Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EDIETS COM INC | d258782d8k.htm |

CONFIDENTIAL

Investor Presentation

October 2011

It all starts here with a promise for a future that can be

healthier, better and stronger than today.

Copyright 2011 eDiets.com, Inc. All Rights Reserved

Exhibit 99.1 |

CONFIDENTIAL

2

Forward-Looking Statements

Forward-Looking Statements

Copyright 2011 eDiets.com, Inc. All Rights Reserved

This presentation contains “forward-looking statements”

within the meaning of the federal securities laws and is

intended to qualify for the Safe Harbor from liability established by the Private

Securities Litigation Reform Act of 1995, including statements and

assumptions regarding (i) the size and outlook of the market for our products, (ii) our need

for additional financial support, (iii) our expectation that our

total gross margins and our advertising efficiency will

improve in the future,

(iv) our assumption that we will acquire new customers at an acceptable cost, (v)

our expectation regarding the effectiveness of our advertising and our call

center conversion strategies, (vi) our assumption that we are

well-positioned to compete and capture market share, (vii) our expectation regarding our

ability to comply with regulatory requirements, (viii) our assumptions regarding

market size, projected results and the demand for our products and services.

These statements and assumptions are based on management’s estimates

and projections with respect to future events and financial performance and are

believed to be reasonable, although they are inherently uncertain and

difficult to predict. Actual results could differ materially from those projected as a

result of certain factors, including (i) our ability to raise additional capital,

(ii) our ability to maintain compliance with regulatory requirements, (iii)

our ability to maintain our listing on The Nasdaq Capital Market, (iv) our ability to maintain

or improve meal delivery margins and their effect on total gross

margins, (v) our ability to improve advertising

efficiency, (vi) our ability to manage fluctuations in advertising costs, (vii) our

ability to sufficiently increase revenues and maintain expenses and cash

capital expenditures at appropriate levels, (viii) the state of the credit and capital

markets, including the level of volatility, illiquidity and interest rates and (ix)

our ability to rapidly secure alternate technology infrastructure vendors if

we experience call center or Web site service interruption. A discussion of

factors that could cause results to vary is included in the Company’s filings with the Securities and

Exchange Commission. All forward-looking statements in this presentation speak

only as of the date of this presentation. The Company expressly

disclaims any obligation or undertaking to update or revise any

forward-looking statements.

This presentation also contains non-GAAP financial measures. For a

reconciliation of the non-GAAP measures to the most comparable GAAP

measure, please refer to the eDiets.com website at www.ediets.com, under the Events and

Presentation section of the Investor Relations page. |

CONFIDENTIAL

3

Company Overview

Company Overview

$1.0

billion

market

annually

for

home

delivery

of

diet

food

1

across all price segments

Up

to

$350

million

market

in

our

price

segment

2

fragmented

market

with

approximately

850

competitors

1

we’re number two in the market with less than 10% market share

opportunity to consolidate our segment through aggressive advertising

•

State of the art, online diet membership program including

menus, recipes, shopping lists and tools

Estimated

market

size:

$250

million

annually

2

•

Website hosting for white label corporate wellness sites

focused on diets and diet-related tools

Estimated

market

size:

$50-$100

million

annually

2

Copyright 2011 eDiets.com, Inc. All Rights Reserved

1.

Market size and competitor estimates made by eDiets management based on data from

MarketData January 2011 Survey 2.

Market size estimates made by eDiets management

HOME MEAL DELIVERY BUSINESS

Other Businesses |

CONFIDENTIAL

4

Management Team

Management Team

Copyright 2011 eDiets.com, Inc. All Rights Reserved

Name

Title

Previous Experience

Kevin McGrath

CEO

DIRECTV, Co-Founder

DIRECTV Latin America, Chairman & CEO

Digital Angel, President & CEO

General Motors/Electronic Data Systems/Hughes Comm.

Dartmouth, MBA

Princeton, BA

Thomas Hoyer

CFO

Digital Angel, CFO

Nationsrent Companies, CFO

GLOBEquip, CFO

Fluor Corporation

Clemson, MBA, BS

Joseph Leonardo

VP, Meal

Delivery

EPI Breads, VP Operations

Meyers Bakeries, VP Operations & Logistics

Schwan’s Bakery, VP Group Operations

Quaker Oats

Cornell, BS

Jennifer Hartnett

CMO

Parisian Slim, VP Marketing

Nutrisystem, Creative Director

Bon-Ton Stores, David’s Bridal, Macy’s

Bucknell, BA |

CONFIDENTIAL

Key Facts

Key Facts

Copyright 2011 eDiets.com, Inc. All Rights Reserved

Symbol

DIET

Stock Price 11/11/11 || 52-week Range

$1.01 || $1.01 -

$3.95

Shares Outstanding 11/04/11

13,274,751

Market Capitalization 11/04/11

$13,407,499

Volume (daily 30 day average at 11/04/11)

9,000

Insider Ownership

10.7%

1. The stock split 1-for-5 on June 1, 2011

5 |

CONFIDENTIAL

6

Copyright 2011 eDiets.com, Inc. All Rights Reserved

Meal Delivery -

Meal Delivery -

Overview

Overview

•

Healthy, delicious meals delivered to your door

•

Offers both 5-day ($23.60/day) and 7-day plans ($21.14/day)

•

Over 100 different meals freshly

prepared by our chefs

Meal Delivery

TTM 6/30/11

Revenue

$20.0 Million

Shipments Per Week

3,000

Gross Margin

1,2

43%

¹

Excludes depreciation and revenue

share ² The reconciliation for these non-GAAP measures are on our website

Est. $350M Meal

Delivery Market at

our Price Level

Significant Market Opportunity |

CONFIDENTIAL

7

Meal Delivery Model Illustration

Meal Delivery Model Illustration

Target

Average Weekly Selling Price

$131

Average Length of Stay -

# of Weeks

6.9

Average Revenue per Customer

$904

Cost of Goods Sold

$470

Gross Margin

$434

Gross Margin %

48%

Customer Acquisition Cost

$154

Advertising Efficiency (CAC/Revenue)

17%

Call Center Cost

$68

Cash Contribution to Overhead & Profit

$212

Copyright 2010 eDiets.com, Inc. All Rights Reserved

Four

Key

Factors

To

Success

Key Comparative Metrics

Meal Delivery Gross Margin 9-Months 2011: 44%

Meal Delivery Advertising Efficiency 9-Months 2011: 29%

|

CONFIDENTIAL

8

Major 2011/2012 Meal Delivery Initiatives

Major 2011/2012 Meal Delivery Initiatives

•

Upgrading

direct

marketing

and

call

center

capabilities

–

Hired creative director from highly successful competitor to be our chief

marketing officer (February 2011)

–

Added the ex-chief marketing officer from a highly successful competitor to

our Board of Directors (May 2011)

–

Hired call center director from highly successful competitor to be our call center

director (August 2011)

–

Hired media buyer with experience in direct response, including a tenure at a

highly successful competitor (November 2011)

•

Improving

call

center

efficiency:

–

Implemented commission-only compensation structure for sales associates

(September 2011)

–

Continually

modifying

call

scripts

to

be

more

insistent

on

getting

to

“yes”

(Aug-Nov

2011)

–

Upgraded training to include more situational training (Aug-Nov 2011)

–

Changed hiring criteria for sales associates to incorporate a focus on finding

staff that can successfully confront the answer “no”

Copyright 2011 eDiets.com, Inc. All Rights Reserved |

CONFIDENTIAL

9

Major 2011/2012 Meal Delivery Initiatives

Major 2011/2012 Meal Delivery Initiatives

•

Improving

advertising

content:

–

Re-energized testimonial campaign with a casting call for overweight actresses

and models (September 2011)

–

Continually testing television, print and online advertising channels and content

to find optimal mix for driving customers to the call center

economically –

Refreshed existing television commercials (September/October 2011)

•

Improving

meal

delivery

margins

–

Increased price to allow for stronger promotions while maintaining margin (Oct

2011) –

Expect to achieve large volume discounts as business grows

–

Expect to initiate bi-coastal production, which will reduce shipping costs, as

business grows

Copyright 2011 eDiets.com, Inc. All Rights Reserved

9 |

CONFIDENTIAL

10

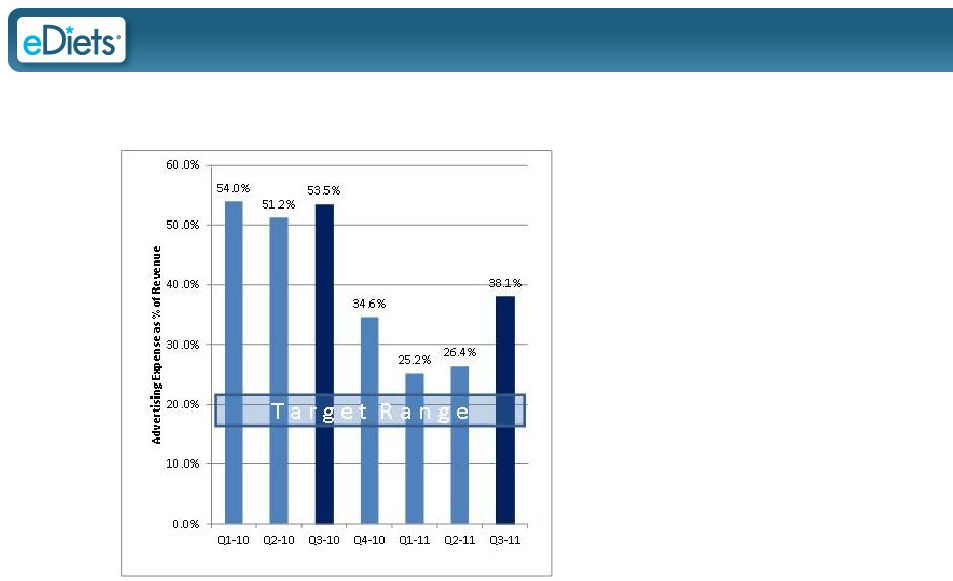

Meal Delivery Advertising Efficiency

Meal Delivery Advertising Efficiency

Advertising

efficiency

=

meal

delivery

advertising

expense

÷

meal

delivery

revenue

Copyright 2011 eDiets.com, Inc. All Rights Reserved

Advertising efficiency has

been improving (percentage

declining) due to better cost

per call and call center

conversion |

CONFIDENTIAL

11

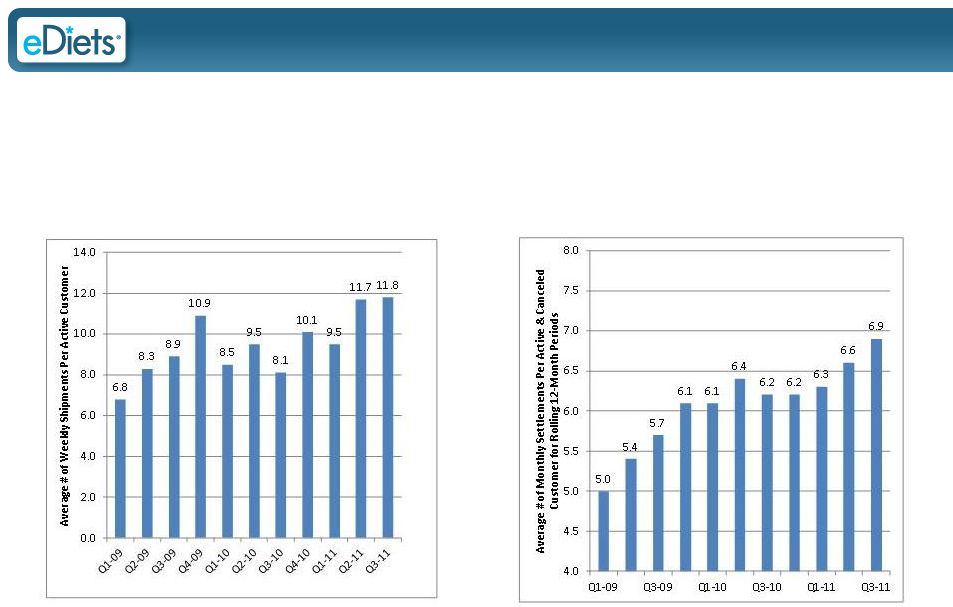

Customer Retention

Customer Retention

Meal Delivery

Average Number of Shipments For Active

Pool of Customers

Measures changes in current customer base

Meal Delivery

Average Number of Shipments For Active

& Canceled Pool of Customers

Measures changes for all customers on a rolling

12-month period

Copyright 2011 eDiets.com, Inc. All Rights Reserved |

CONFIDENTIAL

12

Meal Delivery Gross Margin Before

Depreciation and CAC

(Excludes Revenue Share)

Improved Gross Margins

Improved Gross Margins

•

Raised price of meal delivery service

•

Moved to lower-cost manufacturer

•

Negotiated lower shipping rates

Copyright 2011 eDiets.com, Inc. All Rights Reserved

30%

35%

37%

35%

40%

39%

41%

40%

46%

44%

42%

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

Q1-09

Q2-09

Q3-09

Q4-09

Q1-10

Q2-10

Q3-10

Q4-10

Q1-11

Q2-11

Q3-11

2

0

1

2

T

a

r

g

e

t

46.5% |

CONFIDENTIAL

13

Financial Overview |

CONFIDENTIAL

14

Capitalization

Capitalization

Copyright 2011 eDiets.com, Inc. All Rights Reserved

The Company completed a 1-for-5 reverse stock split on June 1, 2011

30-Sep-11

Equity (50,000,000 authorized)

Issued Shares

Weighted Avg

Strike Price

Fully Diluted

Common Stock

13,310,534

13,310,534

Warrants

$3.76

719,058

Options

$8.21

1,344,000

Restricted Stock Units

99,800

Total

15,473,392

Debt

Promissory Notes -

Related Party

$ 1,000,000 |

CONFIDENTIAL

15

Quarterly Revenue and EBITDA

Quarterly Revenue and EBITDA

Copyright 2010 eDiets.com, Inc. All Rights Reserved |

CONFIDENTIAL

16

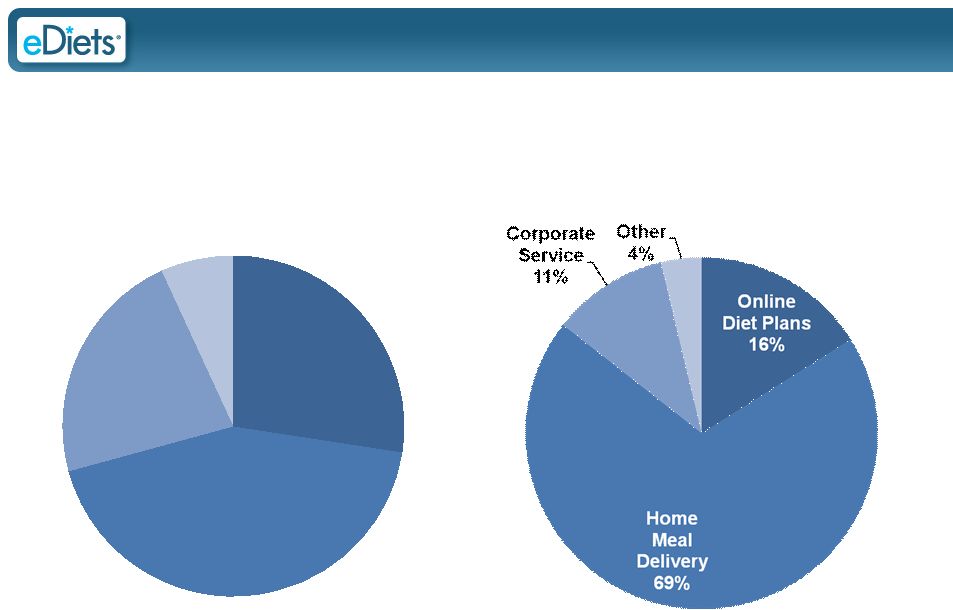

Revenue By Segment

Revenue By Segment

Copyright 2011 eDiets.com, Inc. All Rights Reserved

Online

Diet Plans

28%

Home

Meal

Delivery

43%

Corporate

Services

22%

Other

7%

2010

Actual

2009

Actual

Focus is on growing home meal delivery business |

CONFIDENTIAL

17

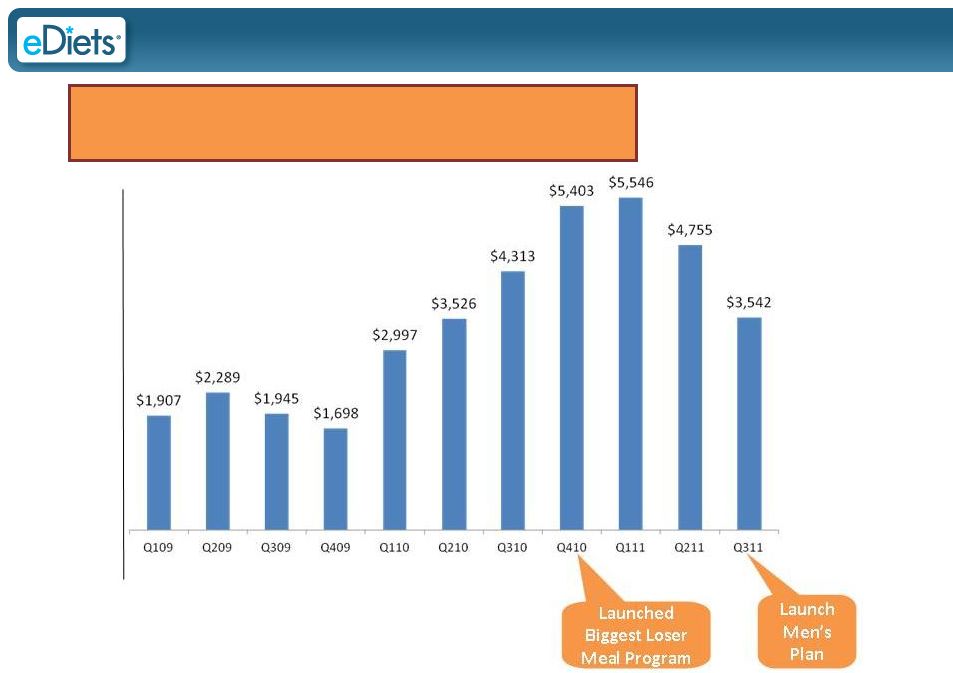

Meal Delivery Revenue By Quarter

Meal Delivery Revenue By Quarter

Copyright 2011 eDiets.com, Inc. All Rights Reserved

Meal delivery revenue declining as a function of less ad spend as

we focus on maintaining customer acquisition costs at levels that

generate positive EBITDA |

CONFIDENTIAL

18

$3.0 Million Investment in Advertising

$3.0 Million Investment in Advertising

(assume advertising investment turns 8X annually)

(assume advertising investment turns 8X annually)

Copyright 2011 eDiets.com, Inc. All Rights Reserved

Meal Delivery Business Model Illustration

$ Millions

Cash Investment in Advertising

$3.0

$3.0

$3.0

$3.0

Ad Spend Turns (recover cash spent on

advertising in 6.5 weeks)

8X/Year

8X/Year

8X/Year

8X/Year

Leveraged Ad Spend

$24.0

$24.0

$24.0

$24.0

Revenue/Ad Spend Ratio (revenue / advertising)

2.50

3.00

4.00

5.00

Implied Revenue

60.0

72.0

96.0

120.0

Variable Cost of Food and Fulfillment

52.0%

(31.2)

(37.4)

(49.9)

(62.4)

Variable Cost of Acquisition

Call Center, Promotions

7.5%

(4.5)

(5.4)

(7.2)

(9.0)

Advertising Expense

(24.0)

(24.0)

(24.0)

(24.0)

Advertising Efficiency

40.0%

33.3%

25.0%

20.0%

Fixed Cost of Staff and Other Expense

(0.6)

(0.6)

(0.6)

(0.6)

EBITDA

($0.3)

$4.6

$14.3

$24.0

EBITDA Margin

-0.5%

6.3%

14.9%

20.0% |

CONFIDENTIAL

19

Investment Highlights

Investment Highlights

•

Large target market

–

$60

billion

weight

loss

market

1

–

eDiets targeting $350 million of that total

•

Focus on meal delivery

–

Low capital requirements and a relatively quick cash conversion cycle

equals positive ROIC

•

Biggest Loser licensing deal provides exposure

•

Continued improvement in operations will enhance returns

–

Expect meal delivery gross margin to continue increasing due to volume

discounts and shipping cost reductions

–

Expect improved advertising efficiency

Copyright 2011 eDiets.com, Inc. All Rights Reserved

1. Source: MarketData January 2011 Survey |

Copyright 2011 eDiets.com, Inc. All Rights Reserved

*

*

*

*

*

*

*

* |