Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - UNIFI INC | d255851d8k.htm |

Investor

Presentation November 2011

Exhibit 99.1 |

Presenters

2

Bill Jasper

Roger Berrier

Ron Smith

Chairman and Chief Executive Officer

President and Chief Operating Officer

Vice President and Chief Financial Officer |

Cautionary

Statement 3

Certain statements included herein contain forward-looking statements within the meaning of

federal securities laws about Unifi, Inc.’s (the “Company”) financial

condition and results of operations that are based on management’s current expectations, estimates and projections about

the markets in which the Company operates, as well as management's beliefs and

assumptions. Words such as "expects," "anticipates,"

"believes," "estimates," variations of such words and other similar expressions

are intended to identify such forward-looking statements. These statements are

not guarantees of future performance and involve certain risks, uncertainties and assumptions, which are difficult to

predict. Therefore, actual outcomes and results may differ materially from what is

expressed or forecasted in, or implied by, such forward-looking statements.

Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management's judgment only

as of the date hereof. The Company undertakes no obligation to update publicly any of

these forward-looking statements to reflect new information, future events or

otherwise. Factors that may cause actual outcome and results to differ materially from those expressed in,

or implied by, these forward-looking statements include, but are not necessarily

limited to, availability, sourcing and pricing of raw materials, the success of our subsidiaries, pressures on sales

prices and volumes due to competition and economic conditions, reliance on and financial

viability of significant customers, operating performance of subsidiaries, joint

ventures, alliances and other equity investments, the accurate financial reporting of information from equity method

investees, technological advancements, employee relations, changes in construction spending,

capital expenditures and long-term investments (including those related to

unforeseen acquisition opportunities), continued availability of financial resources through financing arrangements and

operations, outcomes of pending or threatened legal proceedings, negotiations of new or

modifications of existing contracts for asset management and for property construction

and acqusition, regulations governing tax laws, other governmental and authoritative bodies' policies

and legislation, and proceeds received from the sale of assets held for disposal. In

addition to these representative factors, forward-looking statements could be

impacted by general domestic and international economic and industry conditions in the markets where the Company

competes, such as changes in currency exchange rates, interest and inflation rates, recession

and other economic and political factors over which the Company has no control.

Other risks and uncertainties may be described from time to time in the Company’s other reports and filings with

the Securities and Exchange Commission.

|

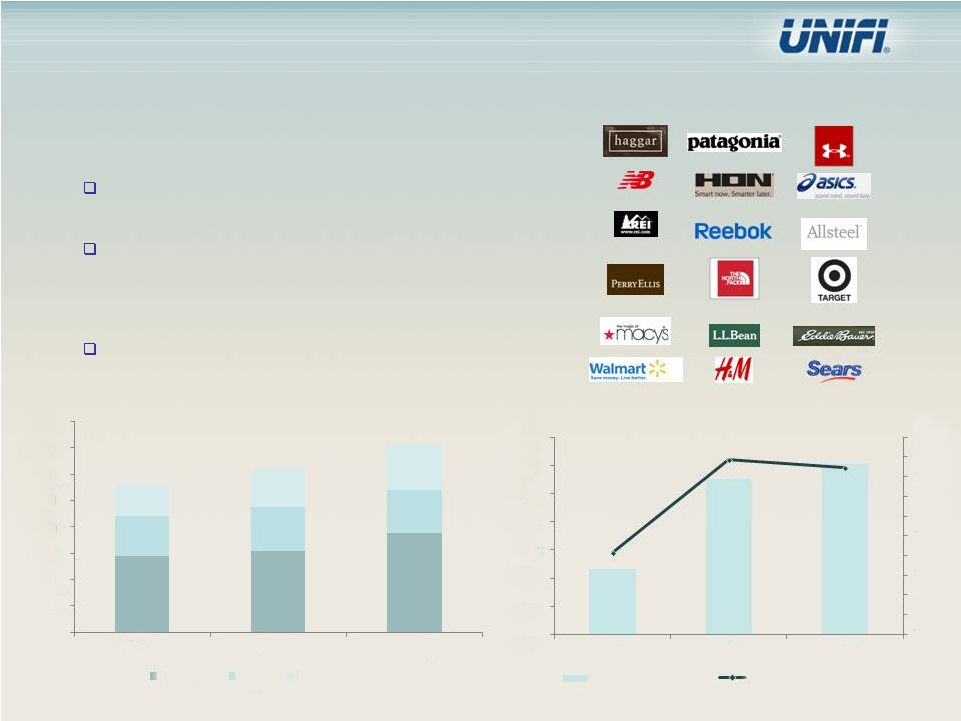

The

Company’s product offerings include specialty and premier value-added yarns

with enhanced performance characteristics

The Company sells to other yarn

manufacturers, knitters and weavers that

produce fabric for the apparel, hosiery,

furnishings, automotive, industrial and

other end-use markets

34% ownership of Parkdale America LLC –

A $1+ billion cotton spinning joint venture

with Parkdale Mills, Inc.

4

Unifi Overview

Company overview

Historical Consolidated Revenue

Historical Adjusted EBITDA

(1)

Well-established downstream partners

___________________________

(1) Excludes earnings from Parkdale America LLC and other unconsolidated equity

affiliates $290

$309

$376

$152

$165

$163

$117

$149

$174

$-

$100

$200

$300

$400

$500

$600

$700

$800

FY09

FY10

FY11

Polyester

Nylon

International

$23.3

$55.3

$60.5

4.2%

8.9%

8.5%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

10.0%

$-

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

FY09

FY10

FY11

Adjusted EBITDA

Adjusted EBITDA Margin

Unifi, Inc. is a diversified producer and processor of

multi-filament polyester and nylon yarns |

5

Market and Company Overview |

Growing Global

Textile Fibers Market 6

___________________________

Source: PCI Fibers

Global consumption of textile fibers grows based on population and affluence

Global Textile Markets

Approximately 170 billion pounds of textile fibers sold annually

3%+ annual growth in global textile fibers projected from 2011 to 2015

4%+ annual growth in global polyester fibers projected from 2011

to 2015

Polyester fibers’

growth in market share: 22% in 1990, 48% in 2010, projected at 51% in 2015

Cost efficient alternative to functional fibers

Superior functionality compared to commodity fibers like cotton

Man-made fibers allow more acreage for food supply in countries like

China |

U.S. Textile

& Apparel Industry 7

___________________________

Source: NCTO , Textile World, and Fiber Economic Bureau

Remains a large and important component of the U.S. economy

Approximately a $51 billion industry in 2010

Investment of $15 billion in PP&E from 2001 to 2009

3

rd

largest

exporter

of

textile

products

-

$15

billion

Much of the exports utilize regional trade preferences

600,000 domestic employees (fiber to textile to apparel chain), one of the largest

manufacturing employers in the U.S.

45% productivity improvement over the last decade

One of the top industries’

among all U.S. industrial sectors

Modest revival of the regional textile and apparel industry during the last 2 years.

Around 30+ domestic and Central American plant expansions |

U.S. Source of

Synthetic Apparel Supply 8

___________________________

Source: U.S. Dept. of Commerce, OTEXA, O’Rourke Group Partners, Unifi internal

estimates Regional market share has stabilized and is expected to remain flat or slightly

increase in 2011 Regional break-out of 18% share consists of 3.5% U.S. Domestic, 10%

CAFTA, and 4.5% NAFTA / ATPA Brands and retailers see regional supply as vital to their

global sourcing strategy and have indicated holding or increasing regional sourcing

levels during the next 3 years. SME

(Billion)

09

10

11

Est

Region

1.6

1.8

2.0

+16

%

+10

% |

Comparative

Labor Cost Forecast 9

___________________________

Source: The Economist Intelligence Unit, O’Rourke Group Partners, Emerging Textiles, Unifi

Internal Estimates By

2015,

Chinese

labor

wages

are

forecasted

to

be

roughly

equal

to

Mexico

and

higher

than

CAFTA

Indian labor wages also following similar trends |

Comparative

Lead Time 10

___________________________

Source: O’Rourke Group Partners |

Regional Trade

(NAFTA / CAFTA / ATPA) U.S. and regional trading partners provide

competitive advantages

High-quality for critical end-uses

Product innovation

Compressed supply chain/quick turns

Competitive pricing

Duty-free movement among participants

Requires garment to be fully formed in region

Compliant yarn must be extruded in region

Duty free benefit –

28% to 32% on man-made

fiber garments

CAFTA Region

Regional imports dropped in 2009 due to economic

downturn plus the removal of China safeguards

Recovery in 2010, and continuing well into 2011.

Around 15+ companies have announced plant

expansions over the last 1 to 2 years.

Importance of Regional Trade –

Synthetic Apparel

11

Synthetic Apparel Imports from Central America

___________________________

Source: U.S. Dept. of Commerce, OTEXA, O’Rourke Group Partners, Unifi internal

estimates Apparel

Sourcing

Outlook

–

Retailer

/

Brand

Sourcing

Plan based on 70+ Companies

Increase or Hold

Regional Sourcing

Levels

80%

Additional Sourcing

Shift to Asia

20% |

U.S. Market

Segmentation – FY 2011

Diverse product offering sells into the apparel, hosiery, furnishings, automotive and

industrial markets Compliant sales account for approximately 58% of the company’s

total sales Large majority of U.S. customers are domestic weavers and knitters

-

Most free trade benefits come through domestic customers’

shipments of fabrics into region

-

Regional yarn origin required in free trade agreements (NAFTA, CAFTA, ATPA)

Berry and Kissel Amendments require U.S. origin fiber/yarn for Military and Homeland Security

U.S. Sales by Segment

Diverse products and regional requirements

U.S. Sales by Origin Requirement

___________________________

(1) Compliant sales represent those sales to customers who utilize the terms of the NAFTA,

CAFTA, CBI, ATPA, and U.S. Military agreements to produce duty-free finished goods and US origin fiber

requirement. Estimates based on FY 2011 sales by category and division.

U.S. Direct Sales by Region

Commentary

12

Apparel

48%

Hosiery

17%

Furnishings

15%

Industrial

12%

Auto

5%

Other

3%

U.S.

Domestic

81%

NAFTA /

ATPA

8%

CAFTA

9%

Other

2%

Non-

Compliant

41%

Compliant

(1)

59% |

U.S. Customer

& Channel Segmentation – FY 2011

Fiber/yarn demanded by a wide variety of customers

Approximately 600 polyester customers and approximately 200 nylon customers served from U.S.

operations

Top 5 U.S. customers include

Polyester –

Polartec, Milliken, Glen Raven, American & Efird, and International Textile Group

Nylon –

Hanesbrands (HBI), Acme-McCrary, Fruit of the Loom, Kayser Roth Hosiery and Bossong

Top 50 customers in the U.S. represent 65% of net sales

Healthy accounts receivable aging –

approximately 96% of accounts are current within 15 days

U.S. Sales by Customer

Strong diversity of customer base, distribution channels and products

Commentary

___________________________

(1) Sales by customer represent direct shipments from Unifi USA and excludes UCA sales

(2) Estimates for the combined Apparel and Hosiery Segments

(3) PVA Sales represent Unifi global PVA sales as a % of Unifi consolidated sales

Distribution Channel

(2)

13

(1)

Global PVA Sales

(3)

HBI, 9%

Next 4,

16%

Next 10,

17%

Next 35,

23%

Other,

34%

Mass

41%

Department

18%

Other,

15%

Specialty

26%

13%

15%

18%

0%

5%

10%

15%

20%

FY 2009

FY 2010

FY 2011 |

Inventory in

the Apparel Supply Chain 14

___________________________

Source: US Census Bureau and Unifi internal estimates |

15

Company Strategy |

Our Operating

Environment Continued strength of retail apparel, with opportunities for further

improvement

Opportunity for growth in North/Central America region from new

investments across supply chain and realignment of sourcing patterns

Incremental growth in global yarn markets

Raw material pricing at historic high levels; long-term moderation expected

16

___________________________

Source: PCI Fibers, Unifi internal estimates |

Operating

Strategies Further develop expansion opportunities in global growth markets

Central America, China and Brazil

17

Focus on continuous improvement, conversion margin integrity and

mix

enrichment –

with the goal of reducing cyclicality

Maximize growth opportunities developing in North/Central American regional

market

Aggressively grow our Premier Value Added (PVA) products, doubling sales

within 3 years from the start of fiscal 2011

Derive value from sustainability based initiatives, including polyester and nylon

recycling. |

Brazil Market

Dynamics Polyester Textile Filament Market Trends

Skilled and experienced local management team

Market currently serviced by domestic production and imports

Proven market leader in local market

Flexible business model from production to sourcing

Strengthening currency impacts competitiveness of production model

Longer-term risk/opportunity from new market entrant

18

___________________________

Source: ABIT, ABRAFAS, Unifi internal estimates |

China

Polyester Filament Market Dynamics Chinese Polyester Market

Chinese polyester production represents 65% of global market in 2009/2010

Textile filament market projected growth rates for 2010 to 2015 is estimated at 5%

Specialty and PVA yarn segment accounts for around 5% of the total market demand; and growth

is expected to outpace market rates

UTSC (Unifi Textiles (Suzhou) Ltd.)

Established wholly-owned sales and marketing business focused on the sale of high-end

and branded, premier value added products

Globalized production of key Unifi brands, including REPREVE

Strong downstream activity

Growing contribution to profits in fiscal 2012 and beyond

19

___________________________

Source: PCI Fibers, Unifi internal estimates |

Investing in

the Region 20

November 2010

New 120,000 square feet facility

8 draw texturing & 27 twisting machines

Additional 4 draw texturing machines being

installed

165 new jobs

May 2011

$8 million investment

New 50,000 square feet facility

42 million pounds/year capacity

25 new jobs in North Carolina

Recycle rate of over 900 million PET

plastic bottles |

Premier Value

Added products are key for future growth Branded / PVA Product Success

21

___________________________

Source: Unifi internal estimates

PVA portfolio represents approximately 12% of U.S. sales and 18%

of consolidated sales in fiscal 2011

Products utilized in apparel, contract, home furnishings, military, socks and hospitality

Steady investment in R&D and commercialization of PVA products remains a strategic

priority Sales Revenue –

U.S. PVA

Gross Profit -

U.S. PVA

Target is to double PVA sales and profit in 3 years |

Our PVA

Downstream Partners 22 |

Financial

Overview 23 |

Summary of

Selected Financial Data ($ in millions) Consolidated Operating Results Overview

24

Projection

(2)

($ in millions)

FY12

Adjusted EBITDA

$45

Capital Expenditures

(8)

Cash Interest Expense

(14)

Cash Taxes

(5)

Free Cash Flow

$18

Working Capital source

12

Free Cash Flow Operations

$30

___________________________

(1) Adjusted EBTIDA excludes earnings from Parkdale America LLC and other unconsolidated equity

affiliates (2) FY 12 Projections based on midpoint of management’s publicly disclosed

guidance of low to high $40’s during the October 27, 2011 Earnings Conference call.

$558

$623

$713

Net Sales

Adjusted EBITDA margin

(1)

$290

$309

$376

$152

$165

$163

$117

$149

$174

8.9%

8.5%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

10.0%

$-

$200

$400

$600

$800

$1,000

FY09

FY10

FY11

Polyester

Nylon

International

Adjusted EBITDA Margin |

Parkdale

America, LLC ___________________________

1.

Includes

the

results

of

the

Hanesbrand

transaction,

which

closed

on

October

28,

2009.

2.

PAL

Adjusted

EBITDA

equals

the

sum

of

Income

from

Operations

and

Depreciation

and

Amortization

as

provided

in

our

June

26,

2011

From

10-K.

3.

EAP assistance program was enacted on August 1, 2008 as a part of the 2008 Farm Bill. The

program provides for economic assistance in the amount of 4 cents per pound of cotton consumed

and

the

program

generally

requires

the

economic

assistance

to

be

re-invested

into

qualifying

capital

expenditures.

25

($ in millions)

FY 2008

FY 2009

FY 2010

FY 2011

(1)

Net Sales

$460.5

$408.8

$599.9

$1,110.2

% change

4.6%

(11.2%)

46.7%

Income from Operations

$10.4

$14.1

$37.4

$70.1

Depreciation and Amortization

$17.8

$18.8

$21.2

$31.9

PAL Adjusted EBITDA

$28.2

$32.9

$58.6

$102.0

(2)

% of Net Sales

6.1%

8.0%

9.8%

9.2%

EAP Cotton Rebate Program

(3)

Economic Assitance Received

$0.0

$14.0

$22.3

$28.8

Amount Recognized into Income

$0.0

$5.8

$16.2

$40.2

Deferred Benefit

$0.0

$8.2

$6.1

($11.4)

% of Net Sales

0.0%

2.0%

1.0%

(1.0%) |

No

on-going maintenance covenants Limited ability to make restricted payments

Restrictions on use of proceeds from asset

sales

Incurrence of additional indebtedness covenant

of 2 to 1 times fixed charge coverage

Callable by Company at anytime at the

following redemption prices

102.875 from May 2011

Par from May 2012

$124

$124

mm

mm

2014

2014

Senior

Senior

Secured

Secured

Notes

Notes

–

–

11.5%

11.5%

First Amended Revolving Credit Agreement

First Amended Revolving Credit Agreement

$100mm facility, matures September 2015

Secured by eligible working capital

No on-going maintenance covenants, as long as

availability is greater than 15% of facility

Limited restricted payment provisions, as long as

availability is greater than 27.5% of facility

Provisions to facilitate refinance/repayment of

2014 Notes

Interest based on LIBOR+200 bps to 275 bps

Unifi has a stable capital structure with covenant-lite debt instruments and no near-term

maturities 26

Maturity profile at September 2011 ($mm)

Maturity profile at September 2011 ($mm)

Long-term Capital Structure

$40

$124

$60

0

20

40

60

80

100

120

140

2011

2012

2013

2014

2015

2016

RC Balance

11.5% Senior Notes

RC Availability |

Capital

Strategy = Optimizing Cost of Capital 27

Focus on cash generation, across all business process including inventory

management

Fund growth working capital and capital expenditure requirements

required to

develop incremental growth opportunities

Utilize cash flow generated from operations and dividends from PAL to reduce

borrowings under 2015 revolving credit facility.

Reduce cost of capital by utilizing excess availability under revolving credit

facility to redeem 11.5% senior secured notes, due May 2014

Fix LIBOR rate on minimal level of revolving credit borrowings (currently $35

million) through May 2013 |

Summary and

Review Some inflationary pressures, but generally a stable operating environment

Various incremental growth opportunities through increased retail volumes

and re-balancing of sourcing towards North/Central America region

Focus on continuous improvement, margin integrity and mix enrichment

Expansion opportunities in global growth markets

Central America, China and Brazil

Aggressively growing Premier Value-Added products –

especially Repreve

Continued improvement of Balance Sheet and related benefits from

optimizing cost of capital

28 |

29

Questions |

30

Appendix Slides |

Adjusted

EBITDA Reconciliation 31

(Dollars in thousands)

FY 2009

FY 2010

FY 2011

Net income (loss)

(48,996)

$

10,685

$

25,089

$

Provision (benefit) for income taxes

4,301

7,686

7,333

Interest expense, net

20,219

18,764

16,679

Depreciation and amortization expense

31,326

26,312

25,562

EBTIDA

6,850

$

63,447

$

74,663

$

Equity in earnings of unconsolidated affiliates

(3,251)

(11,693)

(24,352)

Consolidated EBTIDA

3,599

$

51,754

$

50,311

$

Goodwill impairment

18,930

100

-

Non-cash compensation, net of distributions

1,500

2,555

1,361

Gain on extinguishment of debt

(251)

(54)

3,337

Restructuring charges (recoveries)

91

739

1,484

Start up costs

-

1,027

3,065

Impairment of investment in unconsolidated affiliates

1,483

-

-

Other

(2,067)

(865)

902

Adjusted EBITDA

23,285

$

55,256

$

60,460

$ |

Non-GAAP

Financial Measures 32

Included in this presentation are certain

non-GAAP financial measures designed to complement the financial information presented in accordance with generally accepted accounting

principles in the United States of America ("GAAP") because management believes such measures

are useful to investors. EBITDA, Consolidated EBITDA and Adjusted EBITDA

EBITDA represents net income or loss before income tax expense, net interest expense, and depreciation

and amortization expense (excluding interest portion of amortization). Consolidated

EBITDA represents EBITDA adjusted to exclude equity in earnings and losses of unconsolidated affiliates. Adjusted EBITDA represents Consolidated EBITDA adjusted to

exclude restructuring charges, startup costs, non-cash compensation expense net of distributions,

gains or losses on extinguishment of debt, and other adjustments. Other adjustments

include gains or losses on sales or disposals of property, plant and equipment and currency and

derivative gains or losses. We present Adjusted EBITDA as a supplemental measure of our

operating performance and ability to service debt. We also present Adjusted EBITDA because we believe such measure is frequently used by securities analysts, investors and other

interested parties in the evaluation of companies in our industry and in measuring the ability of

“high-yield” issuers to meet debt service obligations. EBITDA, Consolidated EBITDA and Adjusted EBITDA are alternative views of performance used by

management and we believe that investors’ understanding of our performance is enhanced by

disclosing these performance measures. Our management uses Adjusted EBITDA: (i) as a measurement of operating performance because it assists us in comparing our

operating performance on a consistent basis as it removes the impact of (a) items directly related to

our asset base (primarily depreciation and amortization) and (b) unusual items that we would

not expect to occur as a part of our normal business on a regular basis; (ii) for planning purposes, including the preparation of our annual operating budget; (iii) as a valuation

measure for evaluating our operating performance and our capacity to incur and service debt, fund

capital expenditures and expand our business; and (iv) as one measure in determining the value

of other acquisitions and dispositions. Adjusted EBITDA is also a key performance metric utilized in the determination of variable compensation.

We believe that the use of EBITDA, Consolidated EBITDA and Adjusted EBITDA as operating performance

measures provides investors and analysts with a measure of operating results unaffected by

differences in capital structures, capital investment cycles, and ages of related assets, among otherwise comparable companies. We also believe Adjusted EBITDA is an

appropriate supplemental measure of debt service capacity, because cash expenditures on interest are,

by definition, available to pay interest, and tax expense is inversely correlated to interest

expense because tax expense decreases as deductible interest expense increases; depreciation and amortization are non-cash charges. Equity in earnings and losses of

unconsolidated affiliates is excluded because such earnings or losses do not reflect our operating

performance. The other items excluded from Adjusted EBITDA are excluded in order to

better reflect the performance of our continuing operations.

In evaluating EBITDA, Consolidated EBITDA and Adjusted EBITDA, you should be aware that in the future

we may incur expenses similar to the adjustments in this presentation. Our presentation of

EBITDA, Consolidated EBITDA and Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items.

EBITDA, Consolidated EBITDA, and Adjusted EBITDA are not measurements of our financial performance

under GAAP and should not be considered as alternatives to net income, operating income or any

other performance measures derived in accordance with GAAP or as an alternative to cash flow from operating activities as a measure of our liquidity.

|

Continued

Non-GAAP Financial Measures

33

Our Adjusted EBITDA measure has limitations as an analytical tool, and you should not consider

it in isolation or as a substitute for analysis of our results as reported under GAAP.

Some of these limitations are: • it does not reflect our cash expenditures, future requirements for capital

expenditures or contractual commitments; • it does not reflect changes in, or cash requirements for, our working capital

needs; • it does not reflect the significant interest expense or the cash requirements

necessary to service interest or principal payments on our debt;

• although depreciation and amortization are non-cash charges, the assets being

depreciated and amortized will often have to be replaced in the future, and our Adjusted

EBITDA measure does not reflect any cash requirements for such replacements;

• it is not adjusted for all non-cash income or expense items that are reflected

in our statements of cash flows; • it does not reflect the impact of earnings or charges resulting from matters we

consider not be indicative of our ongoing operations; • it does not reflect limitations on or costs related to transferring earnings from

our subsidiaries to us; and • other companies in our industry may calculate this measure differently than we do,

limiting its usefulness as a comparative measure. Because of these limitations, Adjusted EBITDA should not be considered

as a measure of discretionary cash available to us to invest in the growth of our

business or as a measure of cash that will be available to us to meet our obligations, including those under the notes. You should compensate

for these limitations by relying primarily on our GAAP results and using Adjusted EBITDA only

supplementally. Projected fiscal year 2012 Adjusted EBITDA, Free Cash Flow and Free Cash Flow Operations: With respect to the forward-looking non-GAAP financial measures "Adjusted EBITDA,"

"Free Cash Flow" and "Free Cash Flow Operations" we referenced for fiscal 2012,

the comparable GAAP financial measure "Net Income" is not accessible on a forward-looking basis. For purposes of

reconciling the forward-looking Adjusted EBITDA, we would make adjustments of the type referenced

for prior periods, and we would estimate the material adjustments for interest expense, income

tax, and depreciation and amortization to be $14 million, $5 million, and $27 million, respectively, for

fiscal 2012. For purposes of reconciling the forward-looking Free Cash Flow, we would

estimate the material adjustments for capital expenditures, cash interest expense and

cash taxes to be $8 million, $14 million, and $$5 million, respectively, for fiscal 2012. For purposes of reconciling the

forward-looking Free Cash Flow Operations, we would estimate the material adjustments for working

capital source to be $12 million source for fiscal 2012. The forward-looking

adjustment for equity in (earnings) losses of unconsolidated affiliates cannot be reasonably estimated. |

34

|