Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Synthetic Biologics, Inc. | Financial_Report.xls |

| EX-32.1 - EXHIBIT 32.1 - Synthetic Biologics, Inc. | v239387_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Synthetic Biologics, Inc. | v239387_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Synthetic Biologics, Inc. | v239387_ex31-1.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

(Mark One)

|

x

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the quarterly period ended September 30, 2011

|

OR

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES ACT OF 1934

|

|

|

For the transition period from ____________ to ____________

|

Commission File Number: 1-12584

ADEONA PHARMACEUTICALS, INC.

(Name of small business issuer in its charter)

|

Nevada

|

13-3808303

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(IRS Employer Identification Number)

|

|

|

3985 Research Park Drive, Suite 200

|

||

|

Ann Arbor, MI

|

48108

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(734) 332-7800

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, $0.001 par value per share

Securities registered pursuant to Section 12(g) of the Act:

None.

(Title of Class)

Indicate by check mark whether the issuer: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated file, a non-accelerated file, or a smaller reporting company. See the definitions of “large accelerated filer, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

|

|

Non-Accelerated filer o

|

Smaller reporting company x

|

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of November 10, 2011, the registrant had 28,209,126 shares of common stock outstanding.

ADEONA PHARMACEUTICALS, INC.

FORM 10-Q

TABLE OF CONTENTS

|

Page

|

|||

|

PART I. — FINANCIAL INFORMATION

|

|||

|

Item 1.

|

Financial Statements

|

||

|

Consolidated Balance Sheets as of September 30, 2011 (Unaudited) and December 31, 2010

|

3

|

||

|

Consolidated Statements of Operations (Unaudited)

|

4

|

||

|

Consolidated Statements of Cash Flows (Unaudited)

|

5

|

||

|

Notes to Consolidated Financial Statements (Unaudited)

|

6

|

||

|

Item 2.

|

Management’s Discussion and Analysis of Financial Information and Results of Operations

|

15

|

|

|

Item 3.

|

Quantitative and Qualitative Disclosures About Market Risks

|

26

|

|

|

Item 4.

|

Controls and Procedures

|

26

|

|

|

PART II — OTHER INFORMATION

|

|||

|

Item 1.

|

Legal Proceedings

|

27

|

|

|

Item 1A.

|

Risk Factors

|

27

|

|

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

45

|

|

|

Item 3.

|

Defaults Upon Senior Securities

|

45

|

|

|

Item 4.

|

Reserved and Removed

|

45

|

|

|

Item 5.

|

Other Information

|

45

|

|

|

Item 6.

|

Exhibits

|

46

|

|

|

SIGNATURE

|

47

|

||

|

GLOSSARY

|

48

|

||

2

PART I. — FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

Consolidated Balance Sheets

|

September 30, 2011

|

December 31, 2010

|

|||||||

|

(Unaudited)

|

||||||||

|

Assets

|

||||||||

|

Current Assets

|

||||||||

|

Cash and cash equivalents

|

$

|

4,608,607

|

$

|

2,648,853

|

||||

|

Short-term investments

|

2,865,961

|

-

|

||||||

|

Accounts receivable – net

|

494,851

|

338,510

|

||||||

|

Other

|

123,752

|

343,417

|

||||||

|

Total Current Assets

|

8,093,171

|

3,330,780

|

||||||

|

Property and equipment, net

|

371,463

|

511,142

|

||||||

|

Goodwill

|

178,229

|

178,229

|

||||||

|

Deposits and other assets

|

32,300

|

90,848

|

||||||

|

Total Assets

|

$

|

8,675,163

|

$

|

4,110,999

|

||||

|

Liabilities and Stockholders' Equity

|

||||||||

|

Current Liabilities:

|

||||||||

|

Accounts payable

|

$

|

193,015

|

$

|

265,722

|

||||

|

Accrued liabilities

|

41,012

|

210,027

|

||||||

|

Current portion of capital lease

|

-

|

24,400

|

||||||

|

Total Current Liabilities

|

234,027

|

500,149

|

||||||

|

Long Term Liabilities:

|

||||||||

|

Accounts payable

|

2,335

|

32,335

|

||||||

|

Total Liabilities

|

236,362

|

532,484

|

||||||

|

Stockholders' Equity

|

||||||||

|

Preferred stock, $0.001 par value; 10,000,000 shares authorized,

|

||||||||

|

none issued and outstanding

|

-

|

-

|

||||||

|

Common stock, $0.001 par value; 100,000,000 shares authorized,

|

||||||||

|

28,127,644 issued and 28,209,126 outstanding

|

||||||||

|

and 23,420,189 issued and 23,338,707 outstanding

|

28,128

|

23,339

|

||||||

|

Additional paid-in capital

|

57,099,249

|

47,279,416

|

||||||

|

Accumulated deficit

|

(48,688,576

|

)

|

(43,724,240

|

)

|

||||

|

Total Stockholders' Equity

|

8,438,801

|

3,578,515

|

||||||

|

Total Liabilities and Stockholders' Equity

|

$

|

8,675,163

|

$

|

4,110,999

|

||||

See accompanying notes to unaudited consolidated financial statements

3

Consolidated Statements of Operations

(Unaudited)

|

Three months ended

September 30, |

Nine months ended

September 30, |

|||||||||||||||

|

2011

|

2010

|

2011

|

2010

|

|||||||||||||

|

Revenues:

|

||||||||||||||||

|

License revenue, net

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

2,125,000

|

||||||||

|

Laboratory revenues, net

|

293,421

|

289,898

|

972,121

|

419,825

|

||||||||||||

|

Total Revenues

|

293,421

|

289,898

|

972,121

|

2,544,825

|

||||||||||||

|

Operating Costs and Expenses:

|

||||||||||||||||

|

General and administrative

|

681,805

|

601,806

|

2,649,623

|

2,000,262

|

||||||||||||

|

Research and development

|

288,964

|

229,044

|

800,923

|

962,766

|

||||||||||||

|

Costs of laboratory services

|

260,881

|

192,176

|

805,881

|

430,001

|

||||||||||||

|

Total Operating Costs and Expenses

|

1,231,650

|

1,023,026

|

4,256,427

|

3,393,029

|

||||||||||||

|

Loss from Operations

|

(938,229

|

)

|

(733,128

|

)

|

(3,284,306

|

)

|

(848,204

|

)

|

||||||||

|

Other Income (Expense):

|

||||||||||||||||

|

Warrant expense

|

-

|

-

|

(1,491,996

|

)

|

-

|

|||||||||||

|

Change in fair value of warrant liability

|

(164,993

|

)

|

-

|

(242,464

|

)

|

-

|

||||||||||

|

Interest income

|

6,868

|

-

|

6,868

|

|||||||||||||

|

Other income (expense)

|

(1,625

|

)

|

293

|

47,562

|

7,629

|

|||||||||||

|

Total Other Income (Expense), net

|

(159,750

|

)

|

293

|

(1,680,030

|

)

|

7,629

|

||||||||||

|

Net Loss

|

$

|

(1,097,979

|

)

|

$

|

(732,835

|

)

|

$

|

(4,964,336

|

)

|

$

|

(840,575

|

)

|

||||

|

Net Loss Per Share – Basic and Dilutive

|

$

|

(0.04

|

)

|

$

|

(0.03

|

)

|

$

|

(0.18

|

)

|

$

|

(0.04

|

)

|

||||

|

Weighted average number of common shares outstanding during the period – Basic and Dilutive

|

28,089,492

|

23,003,033

|

27,075,730

|

22,095,349

|

||||||||||||

4

Consolidated Statements of Cash Flows

(Unaudited)

|

Nine months ended September 30,

|

||||||||

|

2011

|

2010

|

|||||||

|

Cash Flows From Operating Activities:

|

||||||||

|

Net loss

|

$

|

(4,964,336

|

)

|

$

|

(840,575

|

)

|

||

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

||||||||

|

Recognition of stock-based compensation

|

483,424

|

324,885

|

||||||

|

Stock option modification expense

|

397,767

|

-

|

||||||

|

Stock issued for consulting fees

|

164,870

|

157,706

|

||||||

|

Stock issued as compensation

|

75,840

|

46,613

|

||||||

|

Warrant expense

|

1,491,996

|

-

|

||||||

|

Change in fair value of warrant liability

|

242,465

|

-

|

||||||

|

Unrealized loss on short term investments

|

205

|

|||||||

|

Depreciation

|

132,787

|

271,076

|

||||||

|

Provision for uncollectible accounts receivable

|

254,298

|

250,427

|

||||||

|

(Gain) loss on sale of equipment

|

5,692

|

(3,390

|

)

|

|||||

|

Gain on settlement of accounts payable

|

(62,996

|

)

|

-

|

|||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Accounts receivable

|

(410,639

|

)

|

(607,225

|

)

|

||||

|

Other current assets

|

219,665

|

163

|

||||||

|

Deposits and other assets

|

58,548

|

-

|

||||||

|

Accounts payable

|

(39,711

|

)

|

(79,034

|

)

|

||||

|

Accrued liabilities

|

(169,015

|

)

|

(434

|

)

|

||||

|

Net Cash Used In Operating Activities

|

(2,119,140

|

)

|

(479,788

|

)

|

||||

|

Cash Flows From Investing Activities:

|

||||||||

|

Purchase of short term investments

|

(2,866,166

|

)

|

||||||

|

Purchase of property and equipment

|

-

|

(2,070

|

)

|

|||||

|

Proceeds from the sale of equipment

|

1,200

|

76,460

|

||||||

|

Net Cash Provided By (Used In) Investing Activities

|

(2,864,966

|

)

|

74,390

|

|||||

|

Cash Flows From Financing Activities:

|

||||||||

|

Repayments under capital lease

|

(24,400

|

)

|

(10,878

|

)

|

||||

|

Proceeds from issuance of common stock for stock option exercises

|

7,650

|

121,878

|

||||||

|

Proceeds from the issuance of common stock, net of offering costs of $539,390 and $115,276

|

6,960,610

|

884,724

|

||||||

|

Net Cash Provided By Financing Activities

|

6,943,860

|

995,724

|

||||||

|

Net increase in cash

|

1,959,754

|

590,326

|

||||||

|

Cash at beginning of period

|

2,648,853

|

2,715,044

|

||||||

|

Cash at end of period

|

$

|

4,608,607

|

$

|

3,305,370

|

||||

|

Supplemental disclosures of cash flow information :

|

||||||||

|

Cash paid for interest

|

$

|

-

|

$

|

2,784

|

||||

|

Cash paid for taxes

|

$

|

-

|

$

|

-

|

||||

|

Supplemental disclosure for non-cash item:

|

||||||||

|

Reclassification of derivative liability to additional paid in capital

|

$

|

1,734,461

|

$

|

-

|

||||

5

Notes to Consolidated Financial Statements

(Unaudited)

1. Organization

Adeona Pharmaceuticals, Inc. (the “Company” or Adeona”) is a pharmaceutical company focused on developing innovative medicines for the treatment of serious central nervous system diseases. The Company’s strategy is to license product candidates that have demonstrated a certain level of clinical efficacy and develop them to a stage that results in a significant commercial collaboration. Adeona is developing, or has partnered the development of, drug product candidates to treat multiple sclerosis, cognitive dysfunction in multiple sclerosis, fibromyalgia, amyotrophic lateral sclerosis (ALS) and Alzheimer’s disease. The Company is currently focused on the commercialization of wellZinTM, a homeopathic over-the-counter zinc acetate lozenge to reduce the duration and symptoms of the common cold. Adeona is also developing reaZinTM as a medical food for the dietary management of zinc deficiency associated with Alzheimer’s disease. Adeona also operates Adeona Clinical Laboratory, a wholly owned clinical reference laboratory that provides a broad array of chemistry and microbiology diagnostic tests.

2. Basis of Presentation

The accompanying unaudited condensed interim financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules and regulations of the United States Securities and Exchange Commission for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X.

The financial information as of December 31, 2010, is derived from the audited financial statements presented in the Company’s Annual Report on Form 10-K for the year ended December 31, 2010. The unaudited condensed interim financial statements should be read in conjunction with the Company’s Annual Report on Form 10-K, which contains the audited financial statements and notes thereto, together with the Management’s Discussion and Analysis, for the year ended December 31, 2010.

Certain information or footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been condensed or omitted, pursuant to the rules and regulations of the Securities and Exchange Commission for interim financial reporting. Accordingly, they do not include all the information and footnotes necessary for a comprehensive presentation of financial position, results of operations, or cash flows. It is management's opinion, however, that all material adjustments (consisting of normal recurring adjustments) have been made which are necessary for a fair financial statement presentation. The interim results for the period ended September 30, 2011, are not necessarily indicative of results for the full year.

The Company has eight subsidiaries, Pipex Therapeutics, Inc. (“Pipex Therapeutics”), Adeona Clinical Laboratory (formerly Hart Lab, LLC), Effective Pharmaceuticals, Inc. (“EPI”), Solovax, Inc. (“Solovax”), CD4 Biosciences, Inc. (“CD4”), Epitope Pharmaceuticals, Inc. (“Epitope”), Healthmine, Inc. (“Healthmine”) and Putney Drug Corp. (“Putney”). As of September 30, 2011, EPI, Adeona Clinical Laboratory, Healthmine and Putney are wholly owned and Pipex Therapeutics, Solovax, CD4 and Epitope are majority-owned.

3. Summary of Significant Accounting Policies

Principles of Consolidation

All significant inter-company accounts and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of consolidated financial statements in conformity with United States generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Such estimates and assumptions impact, among others, the following: the amount allocated to goodwill, the estimated useful lives for intangible assets and for property and equipment, the fair value of warrants and stock options granted for services or compensation, respectively, estimates of the probability and potential magnitude of contingent liabilities and the valuation allowance for deferred tax assets due to continuing operating losses.

Making estimates requires management to exercise significant judgment. It is at least reasonably possible that the estimate of the effect of a condition, situation or set of circumstances that existed at the date of the consolidated financial statements, which management considered in formulating its estimate could change in the near term due to one or more future confirming events. Accordingly, the actual results could differ significantly from our estimates.

6

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable are reported at realizable value, net of allowances for doubtful accounts, which is estimated and recorded in the period the related revenue is recorded. The Company estimates and reviews the collectability of its receivables based on a number of factors, including the period they have been outstanding. Historical collection and payer reimbursement experience is an integral part of the estimation process related to allowances for doubtful accounts associated with Adeona Clinical Laboratory. In addition, the Company regularly assesses the state of its billing operations in order to identify issues that may impact the collectability of these receivables or reserve estimates. Revisions to the allowances for doubtful accounts estimates are recorded as an adjustment to bad debt expense. Receivables deemed uncollectible are charged against the allowance for doubtful accounts. Recoveries of receivables previously written-off are recorded as credits to the allowance for doubtful accounts.

Revenue Recognition

The Company records revenue when all of the following have occurred: (1) persuasive evidence of an arrangement exists, (2) the service is completed without further obligation, (3) the sales price to the customer is fixed or determinable, and (4) collectability is reasonably assured. The Company recognizes milestone payments or upfront payments that have no contingencies as revenue when payment is received. The Company has two streams of revenue, license revenue and laboratory revenue.

License Revenues

The Company’s licensing agreements may contain multiple elements, such as non-refundable up-front fees, payments related to the achievement of particular milestones and royalties. Fees associated with substantive at risk performance-based milestones are recognized as revenue upon completion of the scientific or regulatory event specified in the agreement. When the Company has substantive continuing performance obligations under an arrangement, revenue is recognized over the performance period of the obligations using a time-based proportional performance approach. Under the time-based method, revenue is recognized over the arrangement’s estimated performance period based on the elapsed time compared to the total estimated performance period. Revenue recognized at any point in time is limited to the amount of non-contingent payments received or due. When the Company has no substantive continuing performance obligations under an arrangement, it recognizes revenue as the related fees become due.

Revenues from royalties on third-party sales of licensed technologies are generally recognized in accordance with the contract terms when the royalties can be reliably determined and collectibility is reasonably assured. To date, the Company has not received any royalty revenues.

Laboratory Revenues

The Company primarily recognizes revenue for services rendered upon completion of the testing process. Billing for services reimbursed by third-party payers, including Medicare and Medicaid, are recorded as revenues, net of allowances for differences between amounts billed and the estimated receipts from such payers.

The Company maintains a sales allowance to compensate for the difference in its billing practices and insurance company reimbursements. In determining this allowance, the Company looks at several factors, the most significant of which is the average difference between the amount charged and the amount reimbursed by insurance carriers over the prior 18 months, otherwise known as the yearly average adjustment amount. The actual sales allowance taken for each period is the averaged yearly average adjustment amount for these prior periods multiplied by the period’s actual gross revenues.

The Company generated reimbursements from 3 significant insurance providers for the nine months ended September 30, 2011 and 2010.

|

Customer

|

2011

|

2010

|

||||||

| A |

69

|

%

|

68

|

%

|

||||

| B |

4

|

%

|

14

|

%

|

||||

| C |

20

|

%

|

10

|

%

|

||||

Risks and Uncertainties

The Company's operations are subject to significant risk and uncertainties including financial, operational, regulatory and other risks, such as the potential risk of business failure. The recent global economic crisis has caused a general tightening in the credit markets, lower levels of liquidity, increases in the rates of default and bankruptcy, and extreme volatility in credit, equity and fixed income markets. These conditions not only limit the Company’s access to capital, but also make it difficult for the Company’s customers, the Company’s vendors and the Company to accurately forecast and plan future business activities.

7

Cash and Cash Equivalents

The Company considers all highly liquid investments with original maturities of three months or less at the time of purchase to be cash equivalents. As of September 30, 2011, and December 31, 2010, respectively, the Company had no cash equivalents.

The Company minimizes credit risk associated with cash by periodically evaluating the credit quality of its primary financial institution. The balance at times may exceed the federally insured limit of $250,000 per depositor, per bank. The Company also held cash in a money market account that is covered by the Securities Investor Protection Corporation (SIPC) for losses up to $500,000. At September 30, 2011 and December 31, 2010, the balance exceeded the federally insured limit by $2.6 million and $2.1 million, respectively.

Classification of Marketable Securities as Held to Maturity, Trading, and Available for Sale

The Company determines the appropriate classification of its investments in debt and equity securities at the time of purchase and reevaluates such determinations at each balance sheet date. Debt securities are classified as held to maturity when the Company has the positive intent and ability to hold the securities to maturity. Debt securities for which the Company does not have the intent or ability to hold to maturity are classified as available for sale. Held to maturity securities are recorded as either short-term or long-term on the balance sheet, based on contractual maturity date and are stated at amortized cost. Marketable securities that are bought and held principally for the purpose of selling them in the near term are classified as trading securities and are reported at fair value, with unrealized gains and losses recognized in earnings. Debt and marketable equity securities not classified as held to maturity or as trading, are classified as available for sale, and are carried at fair market value, with the unrealized gains and losses, net of tax, included in the determination of comprehensive income and reported in shareholders’ equity. All of the Company’s marketable securities at September 30, 2011 are classified as held to maturity.

Fair Value of Financial Instruments

The fair value accounting standards define fair value as the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. As such, fair value is determined based upon assumptions that market participants would use in pricing an asset or liability. Fair value measurements are rated on a three-tier hierarchy as follows:

|

·

|

Level 1 inputs: Quoted prices (unadjusted) for identical assets or liabilities in active markets;

|

|

·

|

Level 2 inputs: Inputs, other than quoted prices included in Level 1 that are observable either directly or indirectly; and

|

|

·

|

Level 3 inputs: Unobservable inputs for which there is little or no market data, which require the reporting entity to develop its own assumptions.

|

In many cases, a valuation technique used to measure fair value includes inputs from multiple levels of the fair value hierarchy described above. The lowest level of significant input determines the placement of the entire fair value measurement in the hierarchy.

The carrying amounts of the Company’s short-term financial instruments approximate fair value due to the relatively short period to maturity for these instruments.

Warrant / Derivative Liabilities

Fair value accounting requires bifurcation of embedded derivative instruments such as conversion features in convertible debt or equity instruments, and measurement of their fair value for accounting purposes. In determining the appropriate fair value, the Company uses the Black-Scholes option-pricing model. In assessing the convertible debt instruments, management determines if the convertible debt host instrument is conventional convertible debt and further if there is a beneficial conversion feature requiring measurement. If the instrument is not considered conventional convertible debt, the Company will continue its evaluation process of these instruments as derivative financial instruments.

Once determined, derivative liabilities are adjusted to reflect fair value at each reporting period end, with any increase or decrease in the fair value being recorded in results of operations as an adjustment to fair value of derivatives. In addition, the fair value of freestanding derivative instruments such as warrants, are also valued using the Black-Scholes option-pricing model.

8

Net Income (Loss) per Share

Net income (loss) per share is computed by dividing net income (loss) less preferred dividends for the period by the weighted average number of common shares outstanding. Diluted income (loss) per share is computed by dividing net income (loss) less preferred dividends by the weighted average number of common shares outstanding including the effect of common share equivalents. Since the Company reported a net loss for the nine months ended September 30, 2011 and 2010, all common equivalent shares would be anti-dilutive; as such there is no separate computation for diluted loss per share. The number of options and warrants for the purchase of common stock, that were excluded from the computations of net loss per common share for the nine months ended September 30, 2011 were 2,823,281 and 3,368,738, respectively, and for the nine months ended September 30, 2010 were 2,455,759 and 1,131,078, respectively.

Research and Development Costs

The Company expenses research and development costs as incurred. Research and development expenses consist primarily of license fees, manufacturing costs, salaries, stock-based compensation and related personnel costs, fees paid to consultants and outside service providers for laboratory development, legal expenses resulting from intellectual property prosecution and other expenses relating to the design, development, testing and enhancement of the Company’s product candidates.

Share-Based Payment Arrangements

Generally, all forms of share-based payments, including stock option grants, warrants, restricted stock grants and stock appreciation rights are measured at their fair value on the awards’ grant date, based on the estimated number of awards that are ultimately expected to vest. Share-based compensation awards issued to non-employees for services rendered are recorded at either the fair value of the services rendered or the fair value of the share-based payment, whichever is more readily determinable. The expense resulting from share-based payments are recorded in cost of goods sold, research and development or general and administrative expenses in the consolidated statement of operations, depending on the nature of the services provided.

Recent Accounting Pronouncements

In May 2011, the Financial Accounting Standards Board (FASB) issued guidance in regard to fair value measurement. The new guidance results in a consistent definition of fair value and common requirements for measurement of and disclosure about fair value between GAAP and International Financial Reporting Standards (IFRS). This guidance is effective for interim and annual periods beginning after December 15, 2011. The adoption of this guidance is not expected to have a material impact on the Company’s financial position or results of operations.

In September 2011, the FASB issued guidance in regard to goodwill impairment. The new guidance is intended to reduce the cost and complexity of the annual goodwill impairment test by providing entities with the option of performing a "qualitative" assessment to determine whether further impairment testing is necessary. An entity can choose to perform the qualitative assessment on none, some, or all of its reporting units. Moreover, an entity can bypass the qualitative assessment for any reporting unit in any period and proceed directly to step one of the impairment test, and then perform the qualitative assessment in any subsequent period. The new guidance is effective for annual and interim goodwill impairment tests performed for fiscal years beginning after December 15, 2011, with early adoption permitted. The adoption of this guidance is not expected to have a material impact on the Company’s financial position or results of operations.

Reclassifications

To conform prior period amounts to current year classifications, the Company has reclassified laboratory services, and research and development expenses to general and administrative expenses. These reclassifications had no impact on the Company’s previously reported results of operations or cash flows.

4. Held to Maturity Debt Securities

At September 30, 2011 and December 31, 2010, the Company held investments in marketable securities that were classified as held to maturity and consisted of corporate bonds as follows:

|

September 30, 2011

|

December 31, 2010

|

|||||||

|

Amortized cost

|

$

|

2,366,166

|

$

|

-

|

||||

|

Unrecognized holding gains

|

-

|

-

|

||||||

|

Unrecognized holding losses

|

(13,786)

|

-

|

||||||

|

Fair value

|

$

|

2,352,380

|

$

|

-

|

||||

9

Contractual maturities of held to maturity securities at September 30, 2011 are all short-term due to maturity dates of less than one year. The Company determined that these securities are all level 2 inputs in the fair value hierarchy.

5. Property and Equipment

Property and Equipment consisted of the following at September 30, 2011, and December 31, 2010.

|

September 30, 2011

|

December 31, 2010

|

|||||||

|

Leasehold improvements

|

$

|

2,070

|

$

|

864,429

|

||||

|

Manufacturing equipment

|

400,045

|

410,997

|

||||||

|

Computer and office equipment

|

160,478

|

160,478

|

||||||

|

Laboratory equipment

|

213,908

|

213,908

|

||||||

|

Total

|

776,501

|

1,649,812

|

||||||

|

Less accumulated depreciation

|

(405,038

|

)

|

(1,138,670

|

)

|

||||

|

Property and equipment, net

|

$

|

371,463

|

$

|

511,142

|

||||

The decrease in leasehold improvements during the nine months ended September 30, 2011, reflects the relocation of the Company’s headquarters within Ann Arbor, Michigan. During the nine months ended September 30, 2011, the Company sold equipment, with a net book value of $6,892, for $1,200, resulting in a loss of $5,692.

Depreciation expense for the nine months ended September 30, 2011 and 2010 was $132,787 and $271,076, respectively.

6. Stock-Based Compensation

During 2001, Pipex Therapeutics’ board of directors and stockholders adopted the 2001 Stock Incentive Plan (the “2001 Stock Plan”). This plan was assumed by Pipex in the October 2006 merger with Sheffield. As of the date of the merger, there were 1,489,353 options issued and outstanding under the 2001 plan. The total number of shares of stock with respect to which stock options and stock appreciation rights may be granted to any one employee of the Company or a subsidiary during any one-year period under the 2001 plan shall not exceed 250,000. All awards pursuant to the 2001 Stock Plan shall terminate upon the termination of the grantee’s employment for any reason. Awards include options, restricted shares, stock appreciation rights, performance shares and cash-based awards (the “Awards”). The 2001 Stock Plan contains certain anti-dilution provisions in the event of a stock split, stock dividend or other capital adjustment, as defined in the plan. The 2001 Stock Plan provides for a Committee of the Board to grant awards and to determine the exercise price, vesting term, expiration date and all other terms and conditions of the awards, including acceleration of the vesting of an award at any time. As of September 30, 2011, there were 1,320,354 options issued and outstanding under the 2001 Stock Plan.

On March 20, 2007, the Company’s board of directors approved the Company’s 2007 Stock Incentive Plan (the “2007 Stock Plan”) for the issuance of up to 2,500,000 shares of common stock to be granted through incentive stock options, nonqualified stock options, stock appreciation rights, dividend equivalent rights, restricted stock, restricted stock units and other stock-based awards to officers, other employees, directors and consultants of the Company and its subsidiaries. This plan was approved by stockholders on November 2, 2007. The exercise price of stock options under the 2007 Stock Plan is determined by the compensation committee of the Board of Directors, and may be equal to or greater than the fair market value of the Company’s common stock on the date the option is granted. The total number of shares of stock with respect to which stock options and stock appreciation rights may be granted to any one employee of the Company or a subsidiary during any one-year period under the 2001 plan shall not exceed 250,000. Options become exercisable over various periods from the date of grant, and generally expire ten years after the grant date. As of September 30, 2011, there are 1,225,427 options issued and outstanding under the 2007 Stock Plan.

On November 2, 2010, the board of directors and stockholders adopted the 2010 Stock Incentive Plan (“2010 Stock Plan”) for the issuance of up to 3,000,000 shares of common stock to be granted through incentive stock options, nonqualified stock options, stock appreciation rights, dividend equivalent rights, restricted stock, restricted stock units and other stock-based awards to officers, other employees, directors and consultants of the Company and its subsidiaries. The exercise price of stock options under the 2010 Stock Plan is determined by the compensation committee of the Board of Directors, and may be equal to or greater than the fair market value of the Company’s common stock on the date the option is granted. Options become exercisable over various periods from the date of grant, and generally expire seven years after the grant date. As of September 30, 2011, there are 277,500 options issued and outstanding under the 2010 Stock Plan.

In the event of an employee’s termination, the Company will cease to recognize compensation expense for that employee. There is no deferred compensation recorded upon initial grant date, instead, the fair value of the stock-based payment is recognized ratably over the stated vesting period.

10

The Company has applied fair value accounting for all stock-based payment awards since inception. The fair value of each option or warrant granted is estimated on the date of grant using the Black-Scholes option-pricing model. The Black-Scholes assumptions used in the nine months ended September 30, 2011 and 2010, are as follows:

|

Three Months Ended September 30,

|

Nine Months Ended September 30,

|

|||||||||||

|

2011

|

2010

|

2011

|

2010

|

|||||||||

|

Exercise price

|

$ 0.64 - $0.87

|

$ 0.80

|

$ 0.64 - $2.22

|

$ 0.80 - $0.87

|

||||||||

|

Expected dividends

|

0%

|

0%

|

0%

|

0%

|

||||||||

|

Expected volatility

|

177% - 180%

|

192%

|

177% - 188%

|

192% - 204%

|

||||||||

|

Risk free interest rates

|

1.40% - 2.17%

|

2.54%

|

1.40% - 3.58%

|

2.54% - 3.63%

|

||||||||

|

Expected life options

|

7 years

|

10 years

|

5 years - 7 years

|

10 years

|

||||||||

|

Expected forfeitures

|

0%

|

0%

|

0%

|

0%

|

||||||||

The Company records stock-based compensation based upon the stated vested provisions in the related agreements, with recognition of expense recorded on the straight line basis over the term of the related agreement. The vesting provisions for these agreements have various terms as follows:

|

·

|

immediate vesting,

|

|

|

·

|

one-half vesting immediately and the remainder over three years

|

|

|

·

|

quarterly over three years,

|

|

|

·

|

annually over three years,

|

|

|

·

|

one-third immediate vesting and remaining annually over two years,

|

|

|

·

|

one-half immediate vesting with remaining vesting over nine months; and

|

|

|

·

|

one quarter immediate vesting with the remaining over three years.

|

During the nine months ended September 30, 2011, the Company granted 377,002 options to employees and consultants having a fair value of $475,003 based upon the Black-Scholes option pricing model. During the same period of 2010, the Company granted 630,000 options to employees having a fair value of $513,750 based upon the Black-Scholes option pricing model.

On January 18, 2011, the Company amended the terms of 228,773 stock options held by a member of the Board of Directors. In connection with the modification, the Company extended the expiration date of the stock options by 5 years. The extension is considered a modification, which in substance is the issuance of a new stock option award. As a result, the Company computed the fair value of this award to be $397,767, using the Black-Scholes valuation model. The fair value was based upon the following management assumptions:

| $ | 0.09 | |||

|

Expected dividends

|

0 | % | ||

|

Expected volatility

|

187.1 | % | ||

|

Expected term

|

5 years

|

|||

|

Risk free interest rate

|

2.03 | % | ||

A summary of stock option activities as of September 30, 2011, and for the year ended December 31, 2010, is as follows:

|

Options

|

Weighted

Average

Exercise

Price

|

Weighted Average

Remaining

Contractual

Life

|

Aggregate

Intrinsic

Value

|

||||||||||||

|

Balance – December 31, 2009

|

2,561,332

|

$

|

1.26

|

||||||||||||

|

Granted

|

743,332

|

0.80

|

|||||||||||||

|

Exercised

|

( 255,954

|

)

|

0.44

|

||||||||||||

|

Forfeited or expired

|

(509,619

|

)

|

0.69

|

||||||||||||

|

Balance – December 31, 2010

|

2,539,091

|

1.32

|

|||||||||||||

|

Granted

|

377,002

|

1.50

|

|||||||||||||

|

Forfeited or expired

|

(82,812

|

)

|

0.57

|

||||||||||||

|

Exercised

|

(10,000

|

)

|

0.56

|

||||||||||||

|

Balance – September 30, 2011 - outstanding

|

2,823,281

|

$

|

1.37

|

6.14 years

|

$

|

233,777

|

|||||||||

|

Balance – September 30, 2011 – exercisable

|

2,366,688

|

$

|

1.48

|

5.77 years

|

$

|

232,827

|

|||||||||

11

The options outstanding and exercisable as of September 30, 2011, are as follows:

|

Options Outstanding

|

Options Exercisable

|

||||||||||||||||

|

Range of

Exercise

Price

|

Number

outstanding

|

Weighted

Average

Exercise

Price

|

Weighted

Average

Remaining

Contractual Life

|

Number

Exercisable

|

Weighted

Average

Exercise

Price

|

Weighted

Average

Remaining

Contractual Life

|

|||||||||||

|

$

|

0.09 - 4.57

|

2,733,282

|

$

|

1.22

|

6.24 years

|

2,276,689

|

$

|

1.30

|

5.88 years

|

||||||||

|

$

|

4.58 - 9.05

|

89,999

|

5.93

|

3.01 years

|

89,999

|

5.93

|

3.01 years

|

||||||||||

|

2,823,281

|

$

|

1.37

|

6.14 years

|

2,366,688

|

$

|

1.48

|

5.77 years

|

||||||||||

The options outstanding and exercisable as of September 30, 2010, are as follows:

|

Options Outstanding

|

Options Exercisable

|

||||||||||||||||

|

Range of

Exercise

Price

|

Number

outstanding

|

Weighted

Average

Exercise

Price

|

Weighted

Average

Remaining

Contractual Life

|

Number

Exercisable

|

Weighted

Average

Exercise

Price

|

Weighted

Average

Remaining

Contractual Life

|

|||||||||||

|

$

|

0.09 - 4.57

|

2,365,760

|

$

|

1.17

|

6.65 years

|

1,809,717

|

$

|

1.30

|

5.80 years

|

||||||||

|

$

|

4.58 - 9.05

|

89,999

|

5.93

|

4.01 years

|

89,062

|

5.93

|

3.97 years

|

||||||||||

|

2,455,759

|

$

|

1.35

|

6.55 years

|

1,898,779

|

$

|

1.52

|

5.72 years

|

||||||||||

7. Stock Purchase Warrants

On July 2, 2010, the Company entered into a Common Stock Purchase Agreement with a single investor. As part of this agreement, the Company issued warrants to purchase 60,606 shares of common stock to the placement agent, or its permitted assigns. The warrants have an exercise price of $1.32 and a life of 5 years. The warrants vested on January 1, 2011 and expire December 31, 2015. Since these warrants were granted as part of an equity raise, the Company has treated them as a direct offering cost. The result of the transaction has a $0 net effect to equity. As of September 30, 2011, 30,303 of these warrants remained outstanding.

On January 28, 2011, the Company entered into a Common Stock Purchase Agreement with three institutional investors. As part of this agreement, the Company issued warrants to purchase 1,428,572 shares of common stock. Each warrant was exercisable for thirteen months at $2.00 per share and subsequently exchanged for new warrants with substantially the same terms as the original warrants except that the expiration date was extended for two months. The original warrants had an anti-dilution price protection feature; if the Company issues securities at a price per share that is less than $2.00 per share, the warrant holders will be ratcheted down to the lower offering price. However, the Company had instituted a floor price of $1.40 per share in connection with the price protection. On April 6, 2011, the Company entered into another Common Stock Purchase Agreement that triggered the ratchet provision and re-set the price of these warrants to $1.40. Due to the re-set to the floor price, the warrant liability was marked-to-market and reclassified to additional paid in capital since it ceased to contain the provisions of a derivative liability.

The warrants were recorded as liabilities at their estimated fair value on the commitment date, which was $716,000 with subsequent changes in estimated fair value recorded as a warrant expense in the Company’s statement of operations at each subsequent reporting period. On April 6, 2011, the fair value of the warrant liability was $1,481,143, which represented an increase in fair value of $765,143. The fair value was measured using the Black Scholes valuation model, which is based, in part, upon unobservable inputs for which there is little or no market data, requiring the Company to develop its own assumptions. The assumptions used by the Company are summarized in the following table:

|

Commitment

Date

|

Remeasurement

Date

April 6, 2011

|

|||||||

|

Closing stock price

|

$

|

1.39

|

$

|

2.08

|

||||

|

Expected dividend rate

|

0

|

%

|

0

|

%

|

||||

|

Expected stock price volatility

|

117.1

|

%

|

104.6

|

%

|

||||

|

Risk free interest rate

|

0.28

|

%

|

0.29

|

%

|

||||

|

Expected life (years)

|

1.08

|

0.85

|

||||||

12

On August 10, 2011, the Company entered into an agreement to exchange the warrants issued in connection with the January 28, 2011 financing for new warrants with substantially the same terms as the original warrants except that in the new warrants the expiration date was extended by two months.

On April 6, 2011, the Company entered into a Common Stock Purchase Agreement with an institutional investor. As part of this agreement, the Company issued a warrant to purchase 844,391 shares of common stock. The warrant was initially exercisable for thirteen months at $2.0725 per share. The warrant had an anti-dilution price protection feature; that provided if the Company issues securities at a price per share that is less than $2.0725 per share, the exercise price of the warrant will be ratcheted down to the lower offering price. On July 28, 2011, the warrant was exchanged for a new warrant with substantially similar terms except that in the new warrant (i) the anti-dilution price protection was eliminated, (ii) the exercise price was lowered to $1.00, (iii) the expiration date was extended for an additional three months to August 12, 2012, and (iv) the warrant’s initial exercise date was changed to January 2012. Due to this warrant exchange, the warrant liability was marked-to-market and reclassified to additional paid in capital since it ceased to contain the provisions of a derivative liability.

The warrant is recorded as a liability at its estimated fair value on the commitment date, which was $775,995 with subsequent changes in estimated fair value recorded as a warrant expense in the Company’s statement of operations at each subsequent period. On July 28, 2011, the fair value of the warrant liability was $253,317, which represented an increase in fair value of $164,994. The fair value is measured using the Black Scholes valuation model, which is based, in part, upon unobservable inputs for which there is little or no market data, requiring the Company to develop its own assumptions. The assumptions used by the Company are summarized in the following table:

|

Commitment

Date

|

Remeasurement

Date

July 28, 2011

|

|||||||

|

Closing stock price

|

$

|

2.08

|

$

|

$0.84

|

||||

|

Expected dividend rate

|

0

|

%

|

0

|

%

|

||||

|

Expected stock price volatility

|

112.1

|

%

|

105.6

|

%

|

||||

|

Risk free interest rate

|

0.29

|

%

|

0.21

|

%

|

||||

|

Expected life (years)

|

1.08

|

1.04

|

||||||

The following table summarizes the estimated fair value of the warrant liabilities:

|

Balance at December 31, 2010

|

$

|

-

|

||

|

Warrant liability

|

1,491,996

|

|||

|

Change in fair value of warrant liability

|

242,465

|

|||

|

Reclassification to additional paid-in capital

|

(1,734,461

|

)

|

||

|

Balance at September 30, 2011

|

$

|

-

|

A summary of warrant activities as of September 30, 2011, and for the year ended December 31, 2010, is as follows:

|

Warrants

|

Weighted

Average

Exercise Price

|

|||||||

|

Balance – December 31, 2009

|

1,070,472

|

$

|

3.27

|

|||||

|

Granted

|

60,606

|

1.32

|

||||||

|

Exercised

|

-

|

-

|

||||||

|

Forfeited or expired

|

-

|

-

|

||||||

|

Balance – December 31, 2010

|

1,131,078

|

3.49

|

||||||

|

Granted

|

4,545,926

|

1.64

|

||||||

|

Forfeited or expired

|

(2,292,651

|

)

|

2.02

|

|||||

|

Exercised

|

(15,615

|

)

|

1.19

|

|||||

|

Balance – September 30, 2011 - outstanding

|

3,368,738

|

$

|

2.00

|

|||||

|

Balance – September 30, 2011 – exercisable

|

3,368,738

|

$

|

2.00

|

|||||

13

The warrants outstanding as of September 30, 2011, are as follows:

|

Range of

Exercise Price

|

Number

outstanding

|

Weighted

Average

Remaining

Contractual Life

|

||||||

|

$

|

1.00

|

844,391

|

|

0.77 years

|

||||

|

$

|

1.32

|

30,303

|

4.25 years

|

|||||

|

$

|

1.40

|

1,428,572

|

0. 58 years

|

|||||

|

$

|

2.22

|

626,809

|

4.76 years

|

|||||

|

$

|

3.30

|

61,207

|

3.67 years

|

|||||

|

$

|

3.75

|

50,000

|

4.38 years

|

|||||

|

$

|

6.36

|

327,456

|

1.11 years

|

|||||

|

3,368,738

|

1.63 years

|

|||||||

8. Stockholders’ Equity

During the nine months ended September 30, 2011, the Company issued 15,000 shares of common stock in connection with the exercise of stock options and warrants for proceeds of $7,650 and 10,615 shares of common stock related to a cashless exercise of warrants. The Company also issued 45,600 shares of common stock for employment service, having a fair value of $75,840 ($1.66 average per share) and 171,796 shares of common stock for consulting services, having a fair value of $164,870 ($0.96 average per share), based on the quoted closing trading prices.

On January 28, 2011, the Company sold 2,857,144 shares of common stock and warrants exercisable for 1,428,572 shares of common stock for $4,000,000. Direct offering costs were approximately $300,000.

On April 6, 2011, the Company sold 1,688,782 shares of common stock and a warrant exercisable for 844,391 shares of common stock for $3,500,000. Direct offering costs were approximately $250,000.

14

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL INFORMATION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with the attached unaudited consolidated financial statements and notes thereto, and with our audited consolidated financial statements and notes thereto for the fiscal year ended December 31, 2010, found in our Annual Report on Form 10-K. In addition to historical information, the following discussion contains forward-looking statements that involve risks, uncertainties and assumptions. Where possible, we have tried to identify these forward looking statements by using words such as “anticipate,” “believe,” “intends,” “plans,” or similar expressions. Our actual results could differ materially from those anticipated by the forward-looking statements due to important factors and risks including, but not limited to, those set forth under “Risk Factors” in this 10-Q and as applicable in Part I, Item 1A of our Annual Report on Form 10-K.

Overview

We are a pharmaceutical company focused on developing innovative medicines for the treatment of serious central nervous system diseases. Our strategy is to license product candidates that have demonstrated a certain level of clinical efficacy and develop them to a stage that results in a significant commercial collaboration. We are developing, or have partnered the development of, drug product candidates to treat multiple sclerosis, cognitive dysfunction in multiple sclerosis, fibromyalgia, amyotrophic lateral sclerosis (ALS) and Alzheimer’s disease. We are currently focused on the commercialization of wellZinTM, a homeopathic over-the-counter zinc acetate lozenge to reduce the duration and symptoms of the common cold. We are also developing reaZinTM as a medical food for the dietary management of zinc deficiency associated with Alzheimer’s disease. We also operate Adeona Clinical Laboratory, a wholly owned clinical reference laboratory that provides a broad array of chemistry and microbiology diagnostic tests.

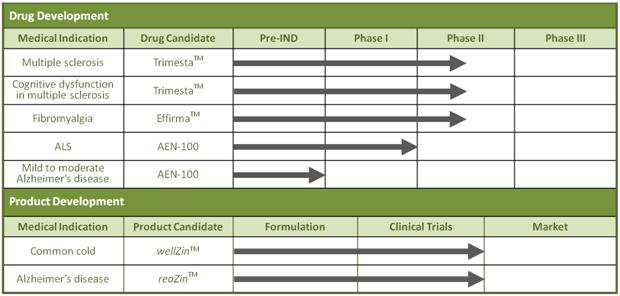

Product Pipeline:

Drug Candidate Development:

|

·

|

TrimestaTM (estriol) is being developed for the treatment of relapsing-remitting multiple sclerosis in women. A randomized, double-blind, placebo-controlled clinical trial is currently underway in the United States. As of September 19, 2011, the 150th patient has been enrolled in this clinical trial, per the original protocol. The Lead Principal Investigator has also received funding to continue enrollment of an additional 10-20 patients at all 15 centers.

|

|

·

|

TrimestaTM (estriol) is being developed for the treatment of cognitive dysfunction in female multiple sclerosis patients. A randomized, double-blind, placebo-controlled Phase II clinical trial is currently screening patients for enrollment.

|

|

|

·

|

EffirmaTM (flupirtine) is being developed for the treatment of fibromyalgia. On May 6, 2010, we and Pipex Therapeutics, Inc. (Pipex), our wholly owned subsidiary, entered into a sublicense agreement with Meda AB, a multi-billion dollar international pharmaceutical company, covering all of our patents’ rights on the use of flupirtine for fibromyalgia in the United States, Canada and Japan. According to Meda’s 2010 Annual Report, flupirtine for fibromyalgia is currently in Phase II development.

|

|

·

|

AEN-100 (zinc) is being developed for the treatment of amyotrophic lateral sclerosis (ALS), or Lou Gehrig’s disease. We intend to sponsor a multi-center, double-blind, placebo-controlled clinical trial in ALS patients. It is anticipated that the clinical trial will enroll at least 60 patients and that patients will be dosed and monitored for up to 9 months.

|

|

·

|

AEN-100 (zinc) is being developed for the treatment of mild to moderate Alzheimer’s disease. We intend to conduct a randomized, double-blind, placebo-controlled clinical study in patients diagnosed with mild to moderate Alzheimer’s disease who are age 70 and over. It is anticipated that the clinical study will enroll over 100 patients and that the patients will be dosed and monitored for at least 12 months.

|

15

Product Candidate Development:

|

·

|

wellZinTM (zinc acetate lozenge) is our near-term product candidate to reduce the duration and symptoms of the common cold. On July 28, 2011, we announced that we acquired exclusive access to two sets of clinical data demonstrating, with statistical significance, the safety and efficacy of a particular oral zinc formulation in reducing the duration and severity of symptoms associated with the common cold. Based on the reduction of the duration and symptoms of the common cold demonstrated by the 13.3 mg zinc acetate formulation, we intend to commercialize wellZin, an oral zinc acetate lozenge, as a homeopathic over-the-counter (OTC) medicine.

|

|

·

|

reaZinTM (zinc cysteine) is being developed as a medical food for the dietary management of zinc deficiency associated with Alzheimer's disease. On April 14, 2011, results from a multi-center, randomized, double-blind, placebo-controlled clinical study showed that the primary outcomes of increasing serum zinc and decreasing serum free copper were effectively demonstrated in patients administered reaZin compared to placebo. In addition, on average, the cognitive function of the placebo group, declined over 6 months in comparison to patients managed with reaZin. The cognitive function trends favoring the patients managed with reaZin were observed in all three standardized cognitive tests utilized in our study and suggest that reaZin may provide an important benefit to the dietary management of zinc deficiency associated with Alzheimer’s disease.

|

Our source of liquidity as of September 30, 2011, is cash, cash equivalents and short-term investments of $7,460,782. Our projected uses of cash include funding further clinical development of our drug candidates and commercialization of our medical food candidate and homeopathic drug, working capital and other general corporate activities. We may also use our cash for the acquisition of businesses, technologies and products that will complement our existing assets.

On January 28, 2011, we entered into a Securities Purchase Agreement with institutional investors, relating to the offering and sale of 2,857,144 shares of common stock, par value $0.001 per share and warrants to purchase 1,428,572 shares of common stock. We raised gross proceeds of $4,000,000, before estimated offering expenses of approximately $300,000, which includes placement agent fees. The offering was made pursuant to t our shelf registration statement on Form S-3 (File No. 333-166750), which was declared effective by the Securities and Exchange Commission (SEC) on June 14, 2010.

On April 6, 2011, we entered into a Securities Purchase Agreement with an institutional investor, relating to the offering and sale of 1,688,782 shares of common stock, par value $0.001 per share and a warrant to purchase 844,391 shares of common stock. We raised gross proceeds of $3,500,000, before estimated offering expenses of approximately $250,000, which includes placement agent fees. The offering was made pursuant to our shelf registration statement on Form S-3 (File No. 333-166750), which was declared effective by the Securities and Exchange Commission (SEC) on June 14, 2010.

We believe that with the additional proceeds of the January and April 2011 equity financings, our cash will be sufficient to fund our planned operations for at least the next 12 months. We will need additional capital to continue the development of our product candidates and clinical programs beyond 12 months. The sale of any equity or debt securities may result in additional dilution to our stockholders, and we cannot be certain that additional financing will be available in amounts or on terms acceptable to us, if at all. If we are unable to obtain financing, we may be required to reduce the scope and timing of the planned clinical and preclinical programs, which could harm our financial condition and operating results.

Clinical Drug Development Programs

Relapsing-Remitting Multiple Sclerosis in Women

Trimesta (estriol)

Disease

Multiple sclerosis is a progressive neurological disease in which the body loses the ability to transmit messages along central nervous system nerve cells, leading to a loss of muscle control, paralysis, cognitive impairment and in some cases death. According to the National Multiple Sclerosis Society, currently, more than 2.5 million people worldwide (approximately 400,000 patients in the United States) have been diagnosed with multiple sclerosis. Young adults, ages 20 to 50, and two to three times as many women than men are predominantly diagnosed with multiple sclerosis. According to the National Multiple Sclerosis Society, approximately 85% of multiple sclerosis patients are initially diagnosed with the relapsing-remitting form, compared to 10-15% with other progressive forms.

16

There are currently 8 Food & Drug Administration (FDA)-approved therapies for the treatment of relapsing-remitting multiple sclerosis: Betaseron®, Rebif®, Avonex®, Novantrone®, Copaxone®, Tysabri®, Gylenya® and AmpyraTM. These therapies provide only a modest benefit for patients with relapsing-remitting multiple sclerosis and therefore serve to only delay progression of the disease. All of these drugs except Gylenya® and Ampyra™ require frequent (daily, weekly & monthly) injections (or infusions) on an ongoing basis and can be associated with unpleasant side effects (such as flu-like symptoms), high rates of non-compliance among users, and eventual loss of efficacy due to the appearance of resistance in approximately 30% of patients. Despite the availability of multiple FDA-approved therapies for the treatment of relapsing-remitting multiple sclerosis, the disease is highly underserved and exacts a heavy economic toll. Multiple sclerosis costs the United States more than $10.6 billion annually in medical care and lost productivity according to the Society for Neuroscience.

Background

It has been scientifically documented that pregnant women with certain autoimmune diseases experience a spontaneous reduction of disease symptoms during pregnancy, particularly in the third trimester. The PRIMS (Pregnancy In Multiple Sclerosis) study, a landmark clinical study published in the New England Journal of Medicine followed 254 women with multiple sclerosis during 269 pregnancies and for up to one year after delivery. The PRIMS study demonstrated that relapse rates were significantly reduced by 71 percent (p < 0.001) through the third trimester of pregnancy compared to pre-pregnancy-rates, and that relapse rates increased by 120 percent (p < 0.001) during the first three months after birth (post-partum) before returning to pre-pregnancy rates. It has been hypothesized that the female hormone, estriol, produced by the placenta during pregnancy, plays a role in “fetal immune privilege”, a process that prevents a mother’s immune system from attacking and rejecting her fetus. Maternal levels of estriol increase in a linear fashion through the third trimester of pregnancy until birth, whereupon they abruptly return to low circulating levels. The anti-autoimmune effects of esteriol is thought to be responsible for the therapeutic effects of pregnancy on multiple sclerosis.

Rhonda Voskuhl, M.D., Director, University of California, Los Angeles (UCLA) multiple sclerosis program, UCLA Department of Neurology, has found that pregnancy levels of estriol has potent immunomodulatory effects. She further postulated and tested in pilot clinical studies that oral doses of estriol may have a therapeutic benefit when administered to non-pregnant female multiple sclerosis patients by, in essence, mimicking the spontaneous reduction in relapse rates seen in multiple sclerosis patients during pregnancy.

Estriol has been approved and marketed for over 40 years throughout Europe and Asia for the oral treatment of post-menopausal symptoms. It has never been approved by the United States FDA for any indication.

Clinical Development

Our Trimesta (estriol) drug candidate is for the treatment of relapsing-remitting multiple sclerosis in women. An investigator-initiated, 10-patient, 22-month, single-agent, crossover clinical trial to study the therapeutic effects of 8 mg of oral Trimesta taken daily in non-pregnant female relapsing-remitting multiple sclerosis patients was completed in the United States. The total volume and number of gadolinium-enhancing lesions were measured by brain magnetic resonance imaging (an established neuroimaging measurement of disease activity in multiple sclerosis). Over the next three months of treatment with Trimesta, the median total enhancing lesion volumes decreased by 79% (p = 0.02) and the number of lesions decreased by 82% (p = 0.09). They remained decreased during the next 3 months of treatment, with lesion volumes decreased by 82% (p = 0.01), and numbers decreased by 82% (p =0.02). Following a six-month drug holiday during which the patients were not on any drug therapies, median lesion volumes and numbers returned to near baseline pretreatment levels. Trimesta therapy was reinitiated during a four-month retreatment phase of this clinical trial. The relapsing-remitting multiple sclerosis patients again demonstrated a decrease in enhancing lesion volumes of 88% (p = 0.008) and a decrease in the number of lesions by 48% (p = 0.04) compared with original baseline scores.

A Phase II randomized, double-blind, placebo-controlled clinical trial is currently underway at 15 centers in the United States. The purpose of this clinical trial is to study whether 8 mg of oral Trimesta taken daily over a 2 year period will reduce the rate of relapses in a large population of female patients with relapsing-remitting multiple sclerosis. Investigators are administering either Trimesta or matching placebo, in addition to a standard of care, glatimer acetate (Copaxone®) injections, an FDA-approved therapy for multiple sclerosis, to women between the ages of 18 to 50 who have been recently diagnosed with relapsing-remitting multiple sclerosis. The primary endpoint in this clinical trial being run under an investigator-initiated Investigational New Drug (IND) application, is relapse rates at two years. As of September 19, 2011, the 150th patient has been enrolled in this clinical trial, per the original protocol. Dr. Voskuhl has also received funding to continue enrollment of an additional 10-20 patients at all 15 centers.

With over $8 million in grant funding to date, the ongoing Trimesta clinical trial should be funded to its completion.This clinical trial previously received a $5 million grant from the National Multiple Sclerosis Society (NMSS) in partnership with the NMSS’s Southern California chapter, with support from the National Institutes of Health and $860,440 in grant funding through the American Recovery and Reinvestment Act. In November 2010, the Trimesta multiple sclerosis trial was awarded $244,480 under the Qualifying Therapeutic Discovery Project Program. In March 2011, additional grant funding of $409,426 was received from the NMSS, and in May 2011, grant funding of $1,594,553 was received from the National Institutes of Health/National Institute of Neurological Disorders and Stroke. These recent grants resulted after review of the clinical program.

17

Cognitive Dysfunction in Multiple Sclerosis

Trimesta (estriol)

Disease

According to the National Multiple Sclerosis Society and the Multiple Sclerosis Society of Canada publication, Hold that Thought! Cognition and MS, it is fairly common for people with multiple sclerosis to complain of problems remembering things, finding the right words, concentrating on a task or something they are reading, or following a conversation. These are all cognitive symptoms of multiple sclerosis. Fifty to sixty-five percent of those affected by multiple sclerosis have cognitive dysfunction. Despite the fact that most symptoms are mild to moderate, they can have a significant impact on a person’s ability to normally function. The overall cognitive dysfunction can be described as a reduction in mental “sharpness.”

The major areas of cognition that can be dysfunctional include what are termed complex attention and executive functions. Complex attention involves multitasking, the speed with which information can be processed, learning and memory, and perceptual skills; executive functions include problem solving, organizational skills, the ability to plan, and word finding. Just as the nature, frequency, and severity of multiple sclerosis-related physical problems can widely vary, not all people with multiple sclerosis will display these cognitive issues, and no two people will experience exactly the same types or severity of problems.

Background

In the investigator-initiated, 10-patient, 22-month, single-agent, crossover clinical trial conducted by Dr. Rhonda Voskuhl, a statistically significant 14% improvement from baseline in Paced Auditory Serial Addition Test (PASAT) cognitive testing scores (p = 0.04) was observed in the multiple sclerosis patients after six months of Trimesta therapy. PASAT is a routine cognitive test performed in patients with a wide variety of neuropsychological disorders such as multiple sclerosis. The PASAT scores are expressed as a mean percent change from baseline.

Clinical Development

Our

Trimesta (estriol) drug candidate is also being developed for the treatment of cognitive dysfunction in female

multiple sclerosis patients. On November 11, 2011, we announced our intention to provide financial support and Trimesta drug

supply for a randomized, double-blind, placebo-controlled Phase II clinical trial to evaluate Trimesta’s

potential neuroprotective and therapeutic effect on cognitive dysfunction in female multiple sclerosis patients. This trial

is expected to enroll 64 relapsing-remitting or secondary-progressive female multiple sclerosis patients at University of

California, Los Angeles. Patients between the ages of 18 and 50 will be randomized 1:1 into the treatment and placebo groups.

Dr. Voskuhl will administer either oral Trimesta or a matching placebo, in addition to any FDA-approved multiple sclerosis

treatment. Each patient will be dosed and monitored for one year after being enrolled. The primary endpoint in this clinical

trial being run under an investigator-initiated IND application is expected to be improvement in PASAT cognitive testing

scores versus matching placebo. Patients are currently being screened for enrollment into this trial. On November 11, 2011,

we announced that we and a private foundation have pledged to equally support this new clinical trial. The study also

received contributions from several other supporters.

Fibromyalgia