Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2011

or

o | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________________ to __________________

Commission file number: 000-32581

LOTUS PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

NEVADA |

| 20-0507918 |

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

No. 16 Cheng Zhuang Road, Feng Tai District, Beijing People’s Republic of China |

|

100071 |

(Address of principal executive offices) |

| (Zip Code) |

86-10-63899868

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o |

| Accelerated filer o |

Non-accelerated filer o (Do not check if smaller reporting company) |

| Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act)

Yes o No x

Indicated the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date, 27,816,455 shares of common stock are issued and outstanding as of November 10, 2011.

TABLE OF CONTENTS

|

|

|

| Page No. |

PART I - FINANCIAL INFORMATION | ||||

Item 1. |

| Financial Statements (Unaudited) |

|

|

|

| Condensed Consolidated Balance Sheets as of September 30, 2011 and December 31, 2010 |

| 4 |

|

| Condensed Consolidated Statements of Income and Comprehensive Income for the Three and |

| 5 |

|

| Condensed Consolidated Statements of Cash Flows for the Nine Months Ended September 30, 2011 and 2010 |

| 6 |

|

| Notes to Unaudited Condensed Consolidated Financial Statements |

| 7 |

Item 2. |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

| 30 |

Item 3. |

| Quantitative and Qualitative Disclosures About Market Risk.. |

| 42 |

Item 4T |

| Controls and Procedures. |

| 42 |

PART II - OTHER INFORMATION | ||||

Item 1. |

| Legal Proceedings. |

| 44 |

Item 1A. |

| Risk Factors. |

| 44 |

Item 2. |

| Unregistered Sales of Equity Securities and Use of Proceeds. |

| 44 |

Item 3. |

| Defaults Upon Senior Securities. |

| 44 |

Item 4. |

| (Removed and Reserved) |

| 44 |

Item 5. |

| Other Information. |

| 44 |

Item 6. |

| Exhibits. |

| 44 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Certain statements in this report contain or may contain forward-looking statements that are subject to known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These forward-looking statements were based on various factors and were derived utilizing numerous assumptions and other factors that could cause our actual results to differ materially from those in the forward-looking statements. These factors include, but are not limited to, our ability to enforce the Contractual Arrangements, Lotus East’s strategic initiatives, economic, political and market conditions and fluctuations, U.S. and Chinese government and industry regulation, interest rate risk, U.S., Chinese and global competition, and other factors. Most of these factors are difficult to predict accurately and are generally beyond our control. Readers should consider the areas of risk described in connection with any forward-looking statements that may be made herein. Readers are cautioned not to place substantial reliance on these forward-looking statements and readers should carefully review this report in its entirety together with our Annual Report on Form 10-K for the year ended December 31, 2010 as filed with the SEC, including the risks described in Item 1A. Risk Factors. Except for our ongoing obligations to disclose material information under the Federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. These forward-looking statements speak only as of the date of this report, and readers should not rely on these statements without also considering the risks and uncertainties associated with these statements and our business.

2

OTHER PERTINENT INFORMATION

We maintain a web site at www.lotuspharma.com. Information on this web site is not a part of this report.

CERTAIN DEFINED TERMS USED IN THIS REPORT

Unless specifically set forth to the contrary, when used in this report the terms:

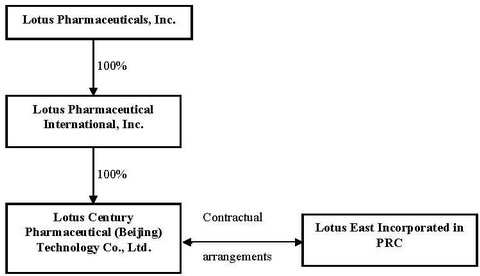

| · | “Lotus,” “we,” “us,” “our,” the “Company,” and similar terms refer to Lotus Pharmaceuticals, Inc., a Nevada corporation and its subsidiaries, |

|

|

|

| · | “Lotus International” refers to Lotus Pharmaceutical International, Inc., a Nevada corporation and a subsidiary of Lotus, |

|

|

|

| · | “Lotus Century” refers to Lotus Century Pharmaceutical (Beijing) Technology Co., Ltd., a wholly foreign-owned enterprise (WFOE) Chinese company which is a subsidiary of Lotus, |

|

|

|

| · | “Liang Fang” refers to Beijing Liang Fang Pharmaceutical Co., Ltd., a Chinese limited liability company formed on June 21, 2000, |

|

|

|

| · | “En Ze Jia Shi” refers to Beijing En Ze Jia Shi Pharmaceutical Co., Ltd., a Chinese limited liability company formed on September 17, 1999 and an affiliate of Liang Fang, |

|

|

|

| · | “Lotus East” collectively refers to Liang Fang and En Ze Jia Shi, |

|

|

|

| · | “Consulting Services Agreements” refers to the Consulting Services Agreements dated September 20, 2006 between Lotus and Lotus East. |

|

|

|

| · | “Operating Agreements” refers to the Operating Agreements dated September 20, 2006 between Lotus, Lotus East and the stockholders of Lotus East, |

|

|

|

| · | “Equity Pledge Agreements” refers to the Equity Pledge Agreements dated September 20, 2006 between Lotus, Lotus East and the stockholders of Lotus East, |

|

|

|

| · | “Option Agreements” refers to the Option Agreements dated September 20, 2006 between Lotus, Lotus East and the stockholders of Lotus East, |

|

|

|

| · | “Proxy Agreements” refers to the Proxy Agreements dated September 20, 2006 between Lotus, Lotus East and the stockholders of Lotus East, |

|

|

|

| · | “Contractual Arrangements” collectively refers to the Consulting Services Agreements, Operating Agreements, Equity Pledge Agreements, Option Agreements and the Proxy Agreements, |

|

|

|

| · | “SFDA” refers to The State Food and Drug Administration, |

|

|

|

| · | “China” or the “PRC” refers to the People’s Republic of China |

|

|

|

| · | “RMB” refers to the renminbi which is the legal currency of mainland PRC of which the yuan is the principal currency, and |

|

|

|

| · | “U.S. dollars”, “dollars” and “$” refer to the legal currency of the United States. |

3

PART 1. - FINANCIAL INFORMATION

Item 1. Financial Statements.

LOTUS PHARMACEUTICALS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

|

| September 30, 2011 |

| December 31, 2010 |

| ||

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

|

|

|

Cash |

| $ | 158,908 |

| $ | 1,339,972 |

|

Accounts receivable |

|

| 6,000,546 |

|

| 1,973,150 |

|

Inventories |

|

| 1,268,875 |

|

| 634,583 |

|

Prepaid expenses and other current assets |

|

| 128,805 |

|

| 593,759 |

|

|

|

|

|

|

|

|

|

Total Current Assets |

|

| 7,557,134 |

|

| 4,541,464 |

|

|

|

|

|

|

|

|

|

PROPERTY AND EQUIPMENT, net |

|

| 52,280,950 |

|

| 39,337,935 |

|

|

|

|

|

|

|

|

|

OTHER ASSETS |

|

|

|

|

|

|

|

Land use right held for development or sale |

|

| 30,195,957 |

|

| 29,236,891 |

|

Deposits and Installments on intangible assets |

|

| 9,840,982 |

|

| 9,528,419 |

|

Land use rights, net |

|

| 13,111,904 |

|

| 12,932,421 |

|

Other intangible assets, net |

|

| 7,169,988 |

|

| 7,607,485 |

|

|

|

|

|

|

|

|

|

Total Assets |

| $ | 120,156,915 |

| $ | 103,184,615 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

|

|

Accounts payable |

| $ | 2,499 |

| $ | 37,829 |

|

Other payables and accrued liabilities |

|

| 723,557 |

|

| 3,441,466 |

|

Taxes payable |

|

| 10,595,533 |

|

| 2,024,565 |

|

Unearned revenue |

|

| 530,987 |

|

| 504,442 |

|

Dividend payable |

|

| 5,743 |

|

| — |

|

Due to related parties |

|

| 2,342,828 |

|

| 2,042,376 |

|

|

|

|

|

|

|

|

|

Total Current Liabilities |

|

| 14,201,147 |

|

| 8,050,678 |

|

|

|

|

|

|

|

|

|

LONG-TERM LIABILITIES: |

|

|

|

|

|

|

|

Due to related parties |

|

| 1,087,879 |

|

| 869,067 |

|

Notes payable - related parties |

|

| 5,413,778 |

|

| 5,241,829 |

|

|

|

|

|

|

|

|

|

Total Liabilities |

|

| 20,702,804 |

|

| 14,161,574 |

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTIGENCIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY: |

|

|

|

|

|

|

|

Preferred stock ($.001 par value; 10,000,000 shares authorized; |

|

| 620 |

|

| 607 |

|

Common stock ($.001 par value; 100,000,000 shares authorized; |

|

| 27,801 |

|

| 26,763 |

|

Additional paid-in capital |

|

| 23,809,738 |

|

| 21,679,147 |

|

Retained earnings |

|

| 59,170,490 |

|

| 53,925,101 |

|

Statutory reserves |

|

| 6,240,202 |

|

| 6,240,202 |

|

Accumulated other comprehensive income |

|

| 10,205,260 |

|

| 7,151,221 |

|

|

|

|

|

|

|

|

|

Total stockholders’ Equity |

|

| 99,454,111 |

|

| 89,023,041 |

|

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders’ Equity |

| $ | 120,156,915 |

| $ | 103,184,615 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements

4

LOTUS PHARMACEUTICALS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

(UNAUDITED)

|

| For the Three Months Ended |

| For the Nine Months Ended |

| ||||||||

|

| September 30, |

| September 30, |

| ||||||||

|

| 2011 |

| 2010 |

| 2011 |

| 2010 |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET REVENUES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Wholesale |

| $ | 15,276,053 |

| $ | 15,347,372 |

| $ | 38,585,730 |

| $ | 42,309,596 |

|

Retail |

|

| 3,768,485 |

|

| 2,957,488 |

|

| 12,070,485 |

|

| 9,652,235 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Net Revenues |

|

| 19,044,538 |

|

| 18,304,860 |

|

| 50,656,215 |

|

| 51,961,831 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COST OF REVENUES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Wholesale |

|

| 12,855,958 |

|

| 5,791,825 |

|

| 27,287,898 |

|

| 16,318,673 |

|

Retail |

|

| 2,874,778 |

|

| 2,133,906 |

|

| 9,014,537 |

|

| 6,956,438 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Cost of Revenues |

|

| 15,730,736 |

|

| 7,925,731 |

|

| 36,302,435 |

|

| 23,275,111 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GROSS PROFIT |

|

| 3,313,802 |

|

| 10,379,129 |

|

| 14,353,780 |

|

| 28,686,720 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses |

|

| 846,919 |

|

| 2,452,629 |

|

| 2,987,630 |

|

| 6,996,741 |

|

Research and development expenses |

|

| 470,311 |

|

| 21,517 |

|

| 1,889,535 |

|

| 21,517 |

|

General and administrative expenses |

|

| 728,164 |

|

| 1,145,412 |

|

| 4,170,350 |

|

| 3,242,617 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Operating Expenses |

|

| 2,045,394 |

|

| 3,619,558 |

|

| 9,047,515 |

|

| 10,260,875 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME FROM OPERATIONS |

|

| 1,268,408 |

|

| 6,759,571 |

|

| 5,306,265 |

|

| 18,425,845 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSE): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt issuance costs |

|

| — |

|

| — |

|

| — |

|

| (52,226 | ) |

Other income |

|

| 47,717 |

|

| 200,074 |

|

| 141,331 |

|

| 597,016 |

|

Interest income |

|

| 439 |

|

| 525 |

|

| 2,005 |

|

| 2,711 |

|

Interest expense |

|

| (63,223 | ) |

| (59,896 | ) |

| (187,256 | ) |

| (551,726 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Other Income (Expense) |

|

| (15,067 | ) |

| 140,703 |

|

| (43,920 | ) |

| (4,225 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME BEFORE INCOME TAXES |

|

| 1,253,341 |

|

| 6,900,274 |

|

| 5,262,345 |

|

| 18,421,620 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME TAXES |

|

| — |

|

| 200,348 |

|

| 149 |

|

| 470,514 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME |

|

| 1,253,341 |

|

| 6,699,926 |

|

| 5,262,196 |

|

| 17,951,106 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER COMPREHENSIVE INCOME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation gain |

|

| 930,264 |

|

| 1,426,434 |

|

| 3,054,039 |

|

| 1,760,632 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPREHENSIVE INCOME |

| $ | 2,183,605 |

| $ | 8,126,360 |

| $ | 8,316,235 |

| $ | 19,711,738 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME PER COMMON SHARE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

| $ | 0.05 |

| $ | 0.25 |

| $ | 0.19 |

| $ | 0.69 |

|

Diluted |

| $ | 0.04 |

| $ | 0.25 |

| $ | 0.19 |

| $ | 0.67 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

| 27,784,732 |

|

| 26,697,892 |

|

| 27,675,063 |

|

| 26,000,584 |

|

Diluted |

|

| 28,094,644 |

|

| 27,047,556 |

|

| 27,985,245 |

|

| 26,872,434 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements

5

LOTUS PHARMACEUTICALS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

|

| For the Nine Months Ended |

| ||||

|

| September 30, |

| ||||

|

| 2011 |

| 2010 |

| ||

|

|

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

Net income |

| $ | 5,262,196 |

| $ | 17,951,106 |

|

Adjustments to reconcile net income from operations to net cash provided by operating activities: |

|

|

|

|

|

|

|

Depreciation |

|

| 312,176 |

|

| 18,856 |

|

Amortization of intangible assets |

|

| 916,865 |

|

| 1,318,468 |

|

Amortization of deferred debt issuance costs |

|

| — |

|

| 52,226 |

|

Amortization of discount on convertible redeemable preferred stock |

|

| — |

|

| 151,553 |

|

Interest expense attributable to beneficial conversion feature of preferred shares |

|

| — |

|

| 184,660 |

|

Common shares issued for service |

|

| 721,127 |

|

| 228,525 |

|

Common shares issued for compensation |

|

| 1,283,101 |

|

| 125,250 |

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

Accounts receivable |

|

| (3,899,198 | ) |

| (110,085 | ) |

Inventories |

|

| (603,649 | ) |

| (133,004 | ) |

Prepaid expenses and other current assets |

|

| 476,647 |

|

| 553,428 |

|

Accounts payable |

|

| (35,985 | ) |

| 36,001 |

|

Other payables and accrued liabilities |

|

| (2,663,379 | ) |

| (584,286 | ) |

Taxes payable |

|

| 8,368,333 |

|

| (1,290,507 | ) |

Unearned revenue |

|

| 9,837 |

|

| 153,160 |

|

Due to related parties |

|

| 424,188 |

|

| 323,264 |

|

|

|

|

|

|

|

|

|

NET CASH PROVIDED BY OPERATING ACTIVITIES |

|

| 10,572,259 |

|

| 18,978,615 |

|

|

|

|

|

|

|

|

|

CASH FLOWS USED IN INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

Purchase of property and equipment |

|

| (11,778,133 | ) |

| (22,054,326 | ) |

|

|

|

|

|

|

|

|

NET CASH USED IN INVESTING ACTIVITIES |

|

| (11,778,133 | ) |

| (22,054,326 | ) |

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET CASH PROVIDED BY FINANCING ACTIVITIES |

|

| — |

|

| — |

|

|

|

|

|

|

|

|

|

EFFECT OF EXCHANGE RATE ON CASH |

|

| 24,810 |

|

| 27,621 |

|

|

|

|

|

|

|

|

|

NET DECREASE IN CASH |

|

| (1,181,064 | ) |

| (3,048,090 | ) |

|

|

|

|

|

|

|

|

CASH - beginning of period |

|

| 1,339,972 |

|

| 3,945,740 |

|

|

|

|

|

|

|

|

|

CASH - end of period |

| $ | 158,908 |

| $ | 897,650 |

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: |

|

|

|

|

|

|

|

Cash paid for: |

|

|

|

|

|

|

|

Interest |

| $ | — |

| $ | — |

|

Income taxes |

| $ | 4,959 |

| $ | 640,897 |

|

|

|

|

|

|

|

|

|

Non-cash investing and financing activities: |

|

|

|

|

|

|

|

Common stock issued for conversion of convertible preferred stock |

| $ | — |

| $ | 4,048,200 |

|

Convertible redeemable preferred stock reclassified to permanent equity |

| $ | — |

| $ | 595,233 |

|

Common stock issued for prior service and compensation |

| $ | 116,350 |

| $ | — |

|

Convertible preferred stock issued for dividend payable |

| $ | 11,064 |

| $ | — |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements

6

LOTUS PHARMACEUTICALS INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of presentation

The accompanying unaudited condensed consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America and reflect the activities of Lotus Pharmaceuticals, Inc., its wholly owned subsidiaries, and its variable interest entities. All material intercompany transactions and balances have been eliminated in the consolidation. Certain information and footnote disclosures normally included in an annual financial statement prepared in accordance with generally accepted accounting principles in the United States have been condensed or omitted pursuant to such rules and regulations. In the opinion of management, the interim condensed consolidated financial statements reflect all adjustments (consisting of normal recurring adjustments) necessary for a fair presentation of the statement of the results for the interim periods presented. These interim condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto, as well as the accompanying Management’s Discussion and Analysis of Financial Condition and Results of Operations for the year ended December 31, 2010 included in the Company’s Annual Report on Form 10-K. Interim financial results are not necessarily indicative of the results that may be expected for a full year.

Reverse stock split

The Company effected a two-for-one reverse split of its common stock on December 31, 2010. Accordingly, all references to number of shares and to per share information in the condensed consolidated financial statements have been adjusted to reflect the reverse stock split on a retroactive basis.

Variable interest entities

Pursuant to Financial Accounting Standards Board Accounting Standards Codification Topic 810 “Consolidation” (“ASC 810”), the Company is required to include in its consolidated financial statements the financial statements of variable interest entity (“VIE”). ASC 810 requires a VIE to be consolidated by a company if that company is subject to a majority of the risk of loss for the VIE or is entitled to receive a majority of the VIE’s residual returns. VIE is the entity in which the Company, through contractual arrangements, bears the risk of, and enjoys the rewards normally associated with ownership of the entity, and therefore the Company is the primary beneficiary of the entity.

Lotus East is considered a VIE and the Company is the primary beneficiary. In September 2006, the Company entered into agreements with Lotus East pursuant to which the Company shall receive 100% of Lotus East’s net income. In accordance with these agreements, Lotus East shall pay consulting fees equal to 100% of its net income to the Company and the Company shall supply business consulting and other general business operation services needed to Lotus East.

The accounts of Lotus East are consolidated in the accompanying consolidated financial statements. As a VIE, Lotus East’s sales are included in the Company’s total sales, Lotus East’s income from operations is consolidated with the Company’s income from operations, and the Company’s net income includes all of Lotus East’s net income, and Lotus East’s assets and liabilities are included in the Company’s consolidated balance sheet. The VIE is entirely controlled by the Company and accordingly, none of the VIE’s net income is subtracted in calculating the net income attributable to the Company. Because of the contractual arrangements, the Company has pecuniary interest in Lotus East that requires consolidation of Lotus East’s financial statements with the Company’s consolidated financial statements. Management makes ongoing assessments of whether the Company is the primary beneficiary of Lotus East.

Use of estimates

The preparation of condensed consolidated financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect certain reported amounts of assets, liabilities, revenues, expenses, and the related disclosures at the date of the financial statements and during the reporting period. Accordingly, actual results could differ from those estimates. Significant estimates include the allowance for doubtful accounts, the allowance for obsolete inventory, the useful life of property and equipment and intangible assets, assumptions used in assessing impairment of long-term assets and valuation of deferred tax assets.

7

LOTUS PHARMACEUTICALS INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Fair value of financial instruments

The Company follows the provisions of ASC 820, “Fair Value Measurement”. ASC 820 clarifies the definition of fair value, prescribes methods for measuring fair value, and establishes a fair value hierarchy to classify the inputs used in measuring fair value as follows:

Level 1-Inputs are unadjusted quoted prices in active markets for identical assets or liabilities available at the measurement date.

Level 2-Inputs are unadjusted quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active, inputs other then quoted prices that are observable, and inputs derived from or corroborated by observable market data.

Level 3-Inputs are unobservable inputs which reflect the reporting entity’s own assumptions on what assumptions the market participants would use in pricing the asset or liability based on the best available information.

The carrying amounts reported in the balance sheets for cash, accounts receivable, inventories, prepaid expenses and other current assets, property and equipment, land use right held for development or sale, deposits and installments on intangible assets, land use rights, other intangible assets, accounts payable, other payable and accrued liabilities, taxes payable, unearned revenue, dividend payable, amounts due to related parties and notes payable approximate their fair market value. The Company did not identify any assets or liabilities that are required to be re-measured at fair value at a recurring basis in accordance with ASC 820.

Cash

The Company maintains cash accounts with various financial institutions mainly in the PRC. Balances at financial institutions of state-owned banks within the PRC are not covered by insurance. The Company has not experienced any losses for amounts in these financial institutions and believes it is not exposed to any significant risks on its cash in bank accounts.

Accounts receivable

The Company presents accounts receivable, net of an allowance for doubtful accounts, if necessary. The Company reviews the accounts receivable on a periodic basis and makes general and specific allowances when there is doubt as to the collectability of individual balances. In evaluating the collectability of individual receivable balances, the Company considers many factors, including the aging of the balance, customer’s historical payment history, its current credit-worthiness, current economic trends and changes in customer payment terms. The amount of the provision, if any, is recognized in the consolidated statement of operations within “General and Administrative Expenses”. Accounts are written off after exhaustive efforts at collection. Because of the Company’s good relationship with its customers and the efforts of the Company’s collection representative to collect outstanding receivables, the majority of the balance of the Company’s accounts receivable is aged less than six months. Management believes that the accounts receivable are fully collectable. Therefore, no allowance for doubtful accounts is deemed to be required as of September 30, 2011 and December 31, 2010.

Inventories

Inventories, consisting of raw materials, packaging materials, work-in-process and finished goods, are stated at the lower of cost or market utilizing the weighted average costing method. An allowance is established when management determines that certain inventories may not be saleable. If inventory costs exceed expected market value due to obsolescence or slow-moving or quantities in excess of expected demand, the Company will record reserves for the difference between the cost and the market value. These reserves are recorded based on estimates and reflected in cost of revenues. The Company did not record any inventory reserve at September 30, 2011 and December 31, 2010.

8

LOTUS PHARMACEUTICALS INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Property and equipment

Property and equipment is stated at cost less accumulated depreciation. The cost of repairs and maintenance is expensed as incurred; major replacements and improvements are generally capitalized. When assets are retired or disposed of, the cost and accumulated depreciation are removed from the accounts, and any resulting gains or losses are included in income in the period of disposition. The Company reviews property and equipment for impairment when events or changes in circumstances indicate the recorded value may not be recoverable.

The construction-in-progress which consists of factories and office buildings under construction in China is included in property and equipment. No provision for depreciation is made on construction-in-progress until such time as the relevant assets are completed and ready for their intended use.

Depreciation is calculated on a straight-line basis over the estimated useful lives of the assets. The useful lives for property and equipment are estimated as follows:

| Useful life |

Manufacturing equipment | 10 to 15 years |

Office equipment and furniture | 3 to 10 years |

Land use rights

Land use rights are carried at cost and charged to expense on a straight-line basis over the estimated useful lives of the assets. Land use rights are amortized over the period the rights are granted, generally over 40 - 50 years.

Other intangible assets

Other intangible assets are carried at cost and charged to expense on a straight-line basis over the estimated useful lives of the assets. Other intangible assets consist of the right to receive revenues from the sale of medical supplies, intellectual right and software. The right to receive revenues from the sale of medical supplies, disclosed in Note 7, is amortized over 20 years, which is the term the Company would benefit from it. Intellectual right is being amortized over 10 years as based on the transfer agreement. Software is amortized over 3 years, its estimated useful life.

Impairment of long-lived assets

In accordance with ASC 360, “Property, Plant and Equipment”, the Company periodically reviews its long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of the assets may not be fully recoverable. The Company recognizes an impairment loss when the sum of expected undiscounted future cash flows is less than the carrying amount of the asset. The amount of impairment is measured as the difference between the asset’s estimated fair value and its book value. Fair value is an estimate using assumptions about future cash flows and may change significantly as time passes. The Company did not record any impairment charges for the three and nine months ended September 30, 2011 and 2010.

Income taxes

Deferred income taxes are recognized for the tax consequences of temporary differences by applying enacted statutory tax rates applicable to future periods to differences between the financial statement carrying amounts and the tax bases of existing assets and liabilities. The effect on deferred income taxes of a change in tax rates is recognized in income in the period that includes the enactment date. A valuation allowance is recognized if it is more likely than not that some portion, or all of, a deferred tax asset will not be realized.

The Company follows United States Generally Accepted Accounting Principles (“US GAAP”) regarding the accounting and disclosure for uncertain tax positions which prescribes a recognition threshold and measurement attribute for recognition and measurement of a tax position taken or expected to be taken in a tax return.

9

LOTUS PHARMACEUTICALS INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Income taxes (continued)

The evaluation of a tax position is a two-step process. The first step is to determine whether it is more-likely-than-not that a tax position will be sustained upon examination, including the resolution of any related appeals or litigation based on the technical merits of that position. The second step is to measure a tax position that meets the more-likely-than-not threshold to determine the amount of benefit to be recognized in the financial statements. A tax position is measured at the largest amount of benefit that is greater than 50 percent likely of being realized upon ultimate settlement. Tax positions that previously failed to meet the more-likely-than-not recognition threshold should be recognized in the first subsequent period in which the threshold is met. Previously recognized tax positions that no longer meet the more-likely-than-not criteria should be de-recognized in the first subsequent financial reporting period in which the threshold is no longer met. Penalties and interest incurred related to underpayment of income tax are classified as income tax expense in the period incurred. The Company did not have any uncertain tax position as of September 30, 2011 and December 31, 2010.

US income tax returns for the years prior to 2008 are no long subject to examination by tax authorities.

Value added tax

The Company is subject to value added tax (“VAT”) for manufacturing products. The applicable VAT rate is 17% for products sold in the PRC. The amount of VAT liability is determined by applying the applicable tax rate to the invoiced amount of goods sold (output VAT) less VAT paid on purchases made with the relevant supporting invoices (input VAT). Sales and purchases are recorded net of VAT collected and paid as the Company acts as an agent for the government.

Revenue recognition

Product sales are recognized when title to the product has transferred to customers in accordance with the terms of the sale. The Company recognizes revenue in accordance with ASC 360. ASC 360 states that revenue should not be recognized until it is realized or realizable and earned. The Company records revenue when persuasive evidence of an arrangement exists, product delivery has occurred, the sales price to the customer is fixed or determinable, and collectability is reasonably assured.

Revenue from sales transactions where the buyer has the right to return the product is recognized at the time of sale only if the seller’s price to the buyer is substantially fixed or determinable at the date of sale, the buyer has paid the seller, or the buyer is obligated to pay the seller and the obligation is not contingent on resale of the product, the buyer’s obligation to the seller would not be changed in the event of theft or physical destruction or damage of the product, the buyer acquiring the product for resale has economic substance apart from that provided by the seller, the seller does not have significant obligations for future performance to directly bring about resale of the product by the buyer, and the amount of future returns can be reasonably estimated. At September 30, 2011 and December 31, 2010, the Company did not have any allowance for returns.

Unearned revenue

Unearned revenue consists of prepayments from customers for merchandise that has not yet been shipped. The Company recognizes the deposits as revenue at the time of shipment. At September 30, 2011 and December 31, 2010, the Company had unearned revenue of $530.987 and $504,442, respectively.

Risks and uncertainties

The Company’s operations are carried out in the PRC. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic and legal environment in the PRC, and by the general state of the PRC’s economy. The Company’s operations in the PRC are subject to specific considerations and significant risks not typically associated with companies in North America. The Company’s results may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things. Although the Company has not experienced any material losses from these risks and believes it is in compliance with existing laws and regulations, this may not necessarily be indicative of future results.

10

LOTUS PHARMACEUTICALS INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Risks and uncertainties (continued)

Financial instruments which potentially subject the Company to concentrations of credit risk consist principally of cash and trade accounts receivable. Substantially all of the Company’s cash is maintained with state-owned banks within the PRC, and no deposits are covered by insurance. The Company has not experienced any losses in such accounts and believes it is not exposed to any risks on its cash in bank accounts. A significant portion of the Company’s sales are credit sales which are primarily to customers whose ability to pay is dependent upon the industry economics prevailing in these areas; however, concentrations of credit risk with respect to trade accounts receivables is limited due to generally short payment terms. The Company also performs ongoing credit evaluations of its customers to help further reduce credit risk.

Stock-based compensation

The Company accounts for stock options and other equity based compensation issued to employees in accordance with ASC 718 “Stock Compensation”. ASC 718 requires companies to recognize an expense in the statement of income at the grant date of stock options and other equity based compensation issued to employees. There were no options outstanding as of September 30, 2011 and December 31, 2010. The Company accounts for non-employee share-based awards in accordance with ASC 505-50 “Equity-based payments to non-employees”.

Shipping

Shipping costs are expensed as incurred and included in selling expenses. For the three and nine months ended September 30, 2011 and 2010, all of the shipping expenses were reimbursed by the Company’s customers.

Employee benefits

The Company’s operations and employees are all located in the PRC. The Company makes mandatory contributions to the PRC government’s health, retirement benefit and unemployment funds in accordance with the relevant Chinese social security laws. The costs of these payments are charged to the same accounts as the related salary costs in the same period as the related salary costs and are not material.

Advertising

Advertising is expensed as incurred and is included in selling expenses. Advertising expenses amounted to $0 for the three and nine months ended September 30, 2011 and 2010.

Research and development

Research and development costs are expensed as incurred. These costs primarily consist of cost of material used and salaries paid for the development of the Company’s products and depreciation related to property and equipment used and fees paid to third parties. Research and development expenses amounted to $470,311 and $21,517 for the three months ended September 30, 2011 and 2010, respectively. Research and development expenses amounted to $1,889,535 and $21,517 for the nine months ended September 30, 2011 and 2010, respectively.

Foreign currency translation

The reporting currency of the Company is the U.S. dollar. The functional currency of the parent company is the U.S. dollar, and the functional currency of the Company’s operating subsidiaries and affiliates is Chinese Renminbi (“RMB”). For the subsidiaries and affiliates whose functional currencies are the RMB, results of operations and cash flows are translated at average exchange rates during the period, assets and liabilities are translated at the unified exchange rate at the end of the period, and equity is translated at historical exchange rates. Translation adjustments resulting from the process of translating the local currency financial statements into

11

LOTUS PHARMACEUTICALS INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Foreign currency translation (continued)

U.S. dollars are included in determining comprehensive income. Transactions denominated in foreign currencies are translated into the functional currency at the exchange rates prevailing on the transaction dates. Assets and liabilities denominated in foreign currencies are translated into the functional currency at the exchange rates prevailing at the balance sheet date with any transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

All of the Company’s revenue transactions are transacted in the functional currency. The Company does not enter any material transaction in foreign currencies and, accordingly, transaction gains or losses have not had, and are not expected to have, a material effect on the results of operations of the Company.

The foreign currency exchange rates were obtained from www.oanda.com. Asset and liability accounts at September 30, 2011 and December 31, 2010 were translated at 6.4018 RMB to $1.00 and at 6.6118 RMB to $1.00, respectively, which were the exchange rates on the balance sheet dates. Equity accounts were stated at their historical rate. The average translation rates applied to the statements of income and cash flows for the nine months ended September 30, 2011 and 2010 were 6.50601 RMB and 6.8164 RMB to $1.00, respectively. As a result, amounts related to assets and liabilities reported on the statement of cash flows will not necessarily agree with changes in the corresponding balances on the balance sheets.

Earnings per common share

Basic earnings per share is computed by dividing net income available to common shareholders by the weighted average number of shares of common stock outstanding during the period. Diluted income per share is computed by dividing net income by the weighted average number of shares of common stock, common stock equivalents and potentially dilutive securities outstanding during each period. Potentially dilutive common shares consist of common shares issuable upon the conversion of series A preferred stock (using the if-converted method) and common stock warrants (using the treasury stock method).

All share and per share amounts used in the Company’s condensed consolidated financial statements and notes thereto have been retroactively restated to reflect the 2-to-1 reverse split, which occurred on December 31, 2010.

The following is a reconciliation of the basic and diluted earnings per share computations for the three months ended September 30, 2011 and 2010:

| 2011 |

| 2010 | ||

Net income | $ | 1,253,341 |

| $ | 6,699,926 |

Deduct: preferred stock dividends |

| (2,435 | ) |

| — |

Net income attributable to common shareholders for basic earnings per share | $ | 1,250,906 |

| $ | 6,699,926 |

|

|

|

|

|

|

Weighted average shares used in basic computation |

| 27,784,732 |

|

| 26,697,892 |

Earnings per share: |

|

|

|

|

|

Basic | $ | 0.05 |

| $ | 0.25 |

Diluted earnings per share

| 2011 |

| 2010 | ||

Net income attributable to common shareholders for basic earnings per share | $ | 1,250,906 |

| $ | 6,699,926 |

Add: preferred stock dividends |

| 2,435 |

|

| — |

Net income attributable to common shareholders for diluted earnings per share | $ | 1,253,341 |

| $ | 6,699,926 |

12

LOTUS PHARMACEUTICALS INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Earnings per common share (continued)

Diluted earnings per share (continued)

| 2011 |

| 2010 | ||

Weighted average shares used in basic computation |

| 27,784,732 |

|

| 26,697,892 |

Diluted effect of warrants |

| — |

|

| 7,576 |

Diluted effect of preferred stock |

| 309,912 |

|

| 342,088 |

Weighted average shares used in diluted computation |

| 28,094,644 |

|

| 27,047,556 |

Earnings per share: |

|

|

|

|

|

Diluted | $ | 0.04 |

| $ | 0.25 |

For the three months ended September 30, 2011 and 2010, a total of 2,001,000 and 1,938,500 warrants, respectively, have not been included in the calculation of diluted earnings per share in order to avoid any anti-dilutive effect.

The following is a reconciliation of the basic and diluted earnings per share computations for the nine months ended September 30, 2011 and 2010:

| 2011 |

| 2010 | ||

Net income | $ | 5,262,196 |

| $ | 17,951,106 |

Deduct: preferred stock dividends |

| (16,807 | ) |

| — |

Net income attributable for common shareholders for basic earnings per share | $ | 5,245,389 |

| $ | 17,951,106 |

|

|

|

|

|

|

Weighted average shares used in basic computation |

| 27,675,063 |

|

| 26,000,584 |

Earnings per share: |

|

|

|

|

|

Basic | $ | 0.19 |

| $ | 0.69 |

Diluted earnings per share

| 2011 |

| 2010 | ||

Net income attributable to common shareholders for basic earnings per share | $ | 5,245,389 |

| $ | 17,951,106 |

Add: interest expense |

| — |

|

| 24,277 |

Add: preferred stock dividends |

| 16,807 |

|

| — |

Net income attributable to common shareholders for diluted earnings per share | $ | 5,262,196 |

| $ | 17,975,383 |

|

|

|

|

|

|

Weighted average shares used in basic computation |

| 27,675,063 |

|

| 26,000,584 |

Diluted effect of warrants |

| 1,551 |

|

| 43,426 |

Diluted effect of preferred stock |

| 308,631 |

|

| 828,424 |

Weighted average shares used in diluted computation |

| 27,985,245 |

|

| 26,872,434 |

Earnings per share: |

|

|

|

|

|

Diluted | $ | 0.19 |

| $ | 0.67 |

For the nine months ended September 30, 2011 and 2010, a total of 1,938,500 and 200,000 warrants, respectively, have not been included in the calculation of diluted earnings per share in order to avoid any anti-dilutive effect.

13

LOTUS PHARMACEUTICALS INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Accumulated other comprehensive income

The Company follows ASC 220 “Comprehensive Income” to recognize the elements of comprehensive income. Comprehensive income is comprised of net income and all changes to the statements of stockholders’ equity, except those due to investments by stockholders, changes in paid-in capital and distributions to stockholders. For the Company, accumulated other comprehensive income consisted of unrealized gains on foreign currency translation adjustments from the translation of financial statements from Chinese RMB to US dollars.

Segment reporting

ASC 280 requires use of the “management approach” model for segment reporting. The management approach model is based on how a company’s management organizes segments within the company for making operating decisions and assessing performance. Reportable segments are based on products and services, geography, legal structure, management structure, or any other manner in which management disaggregates a company. During the three and nine months ended September 30, 2011 and 2010, the Company operated in two business segments - (1) Wholesales segment and (2) Retail segment.

Recent accounting pronouncements

In May 2011, the FASB (“Financial Accounting Standard Board”) issued ASU (“Accounting Standards Update”) 2011-04, “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRS (International Financial Reporting Standards”)” (“ASU 2011-04”). The amendments in ASU 2011-04 result in common fair value measurement and disclosure requirements in U.S. GAAP and IFRSs. Consequently, ASU 2011-04 changes the wording used to describe many of the requirements in U.S. GAAP for measuring fair value and for disclosing information about fair value measurements. For many of the requirements, the FASB does not intend for the amendments in ASU 2011-04 to result in a change in the application of the requirements in Topic 820. ASU 2011-04 is effective prospectively for interim and annual reporting periods beginning after December 15, 2011. The Company does not expect the adoption of the provisions in ASU 2011-04 will have a significant impact on the Company’s consolidated financial statements.

In June 2011, the FASB issued ASU 2011-05, “Presentation of Comprehensive Income” (“ASU 2011-05”). In accordance with ASU 2011-05, an entity has the option to present the total of comprehensive income, the components of net income, and the components of other comprehensive income either in a single continuous statement of comprehensive income or in two separate but consecutive statements. In both choices, an entity is required to present each component of net income along with total net income, each component of other comprehensive income along with a total for other comprehensive income, and a total amount for comprehensive income. ASU 2011-05 eliminates the option to present the components of other comprehensive income as part of the statement of changes in stockholders’ equity. ASU 2011-05 does not change the items that must be reported in other comprehensive income or when an item of other comprehensive income must be reclassified to net income. ASU 2011-05 is effective retrospectively for fiscal years, and interim periods within those years, beginning after December 15, 2011. The Company does not expect the adoption of this standard will have a significant impact on its consolidated financial statements.

In September 2011, the FASB issued Accounting Standards Update (“ASU”) No. 2011-08, Intangibles — Goodwill and Other (Topic 350). This Accounting Standards Update amends FASB ASC 350. This amendment specifies the change in method for determining the potential impairment of goodwill. It includes examples of circumstances and events that the entity should consider in evaluating whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount. The amendments are effective for annual and interim goodwill impairment tests performed for fiscal years beginning after December 15, 2011. The Company does not expect the adoption of the provisions in ASU 2011-08 will have a significant impact on the Company’s consolidated financial statements.

Other accounting standards that have been issued or proposed by the FASB or other standards-setting bodies that do not require adoption until a future date are not expected to have a material impact on the Company’s consolidated financial statements upon adoption.

14

LOTUS PHARMACEUTICALS INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Reclassifications

Certain prior period amounts have been reclassified to conform to the current period presentation. Leasing income was reclassified from retail revenue into other income. A portion of retail revenue was reclassified into wholesale revenue and a portion of cost of revenues – retail was reclassified into cost of revenues – wholesale. These reclassifications have no material impact on the previously reported financial position, results of operations and cash flows.

NOTE 2 – INVENTORIES

At September 30, 2011 and December 31, 2010, inventories consisted of the following:

|

| 2011 |

| 2010 | ||

Raw materials |

| $ | 280,974 |

| $ | 157,165 |

Packaging materials |

|

| 30,344 |

|

| 4,830 |

Finished goods |

|

| 957,557 |

|

| 472,588 |

Total |

| $ | 1,268,875 |

| $ | 634,583 |

NOTE 3 – PREPAID EXPENSES AND OTHER CURRENT ASSETS

At September 30, 2011 and December 31, 2010, prepaid expenses and other current assets consist of the following:

|

| 2011 |

| 2010 | ||

Advanced payment for research and development expenses |

| $ | — |

| $ | 453,734 |

Prepaid rent expenses |

|

| 126,871 |

|

| 123,343 |

Prepaid service fees |

|

| 1,575 |

|

| — |

Security deposit |

|

| 359 |

|

| 16,682 |

Total |

| $ | 128,805 |

| $ | 593,759 |

NOTE 4 – PROPERTY AND EQUIPMENT

At September 30, 2011 and December 31, 2010, property and equipment consists of the following:

| Useful life |

|

| 2011 |

|

| 2010 |

|

Office equipment and furniture | 3-10 Years |

| $ | 264,867 |

| $ | 254,564 |

|

Manufacturing equipment | 10-15 Years |

|

| 5,969,644 |

|

| 5,780,040 |

|

Construction-in-progress |

|

|

| 56,752,183 |

|

| 43,361,865 |

|

Total |

|

|

| 62,986,694 |

|

| 49,396,469 |

|

Less: accumulated depreciation |

|

|

| (10,705,744 | ) |

| (10,058,534 | ) |

Total |

|

| $ | 52,280,950 |

| $ | 39,337,935 |

|

At September 30, 2011, construction-in-progress amounted to $56,752,183, representing (i) costs incurred on the 1000 MU (approximately 667,000 square meters) of land for construction of a new manufacturing plant of approximately $7.5 million located in Cha Ha Er Industrial Park in Inner Mongolia, China, and (ii) costs incurred for construction of a new complex building of approximately $49.3 million in Beijing, China.

15

LOTUS PHARMACEUTICALS INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 4 – PROPERTY AND EQUIPMENT (Continued)

Upon completion of the construction-in-progress and ready for their intended uses, such assets will be classified to their respective property and equipment categories.

For the three months ended September 30, 2011 and 2010, depreciation expense amounted to $100,879 and $5,936, respectively, of which $0 was included in cost of revenues since the Company did not perform any production during the three months ended September 30, 2011 and 2010. For the nine months ended September 30, 2011 and 2010, depreciation expense amounted to $312,176 and $18,856, respectively, of which $0 was included in cost of revenues since the Company did not perform any production during the nine months ended September 30, 2011 and 2010.

NOTE 5 – LAND USE RIGHT HELD FOR DEVELOPMENT OR SALE

The Company purchased 1,000 MU (approximately 667,000 square meters) of land in Inner Mongolia in 2008 (See Inner Mongolia New Facility under Note 13). The area for Inner Mongolia land which is held for development or sale is 900 MU (approximately 600,000 square meters). The area for the rest of Inner Mongolia land on which the Company expects to build a facility is 100 MU (approximately 67,000 square meters, See note 7).

Land use right held for development or sale is accounted for at the lower of cost or market. It is considered as long-term asset and free of amortization as it is not used in operations. Management intends to co-develop the land with another entity or sell it to a third party, but such partner or buyer has not been found yet. The Company’s management believe that the fair value of the land use right as of September 30, 2011 and concluded that the fair value of the right exceeded the carrying value and no impairment loss is recorded.

As of September 30, 2011 and December 31, 2010, land use right held for development or sale consists of the following:

|

| Lower of cost or market | ||||

|

| 2011 |

| 2010 | ||

Inner Mongolia land use right – 900 MU |

| $ | 30,195,957 |

| $ | 29,236,891 |

Total |

| $ | 30,195,957 |

| $ | 29,236,891 |

NOTE 6 – DEPOSITS AND INSTALLMENTS ON INTANGIBLE ASSETS

Deposit and Installments on a Chinese Class I drug patent-Laevo-Bambuterol

Pursuant to the technology transfer agreement the Company entered into in April 2008 (See Technology Transfer Agreement under Note 13), the Company previously made a deposit for future milestone requirements in order to acquire a Chinese Class I drug patent. Accordingly, $3,124,121 (RMB 20 million) was classified as a deposit on a patent as of September 30, 2011. Such deposit will be returned to the Company after all milestone payments in connection with the technology transfer agreement has been made.

Also, the Company has arranged an installment payment plan on the Chinese Class I drug patent to obtain the patent based on clinic milestones, as stipulated in the signed contract. The Company made $5,779,625 (RMB 37 million) as installment payments on the intangible assets as of September 30, 2011. The Company will need to make additional installment payments of approximately $1.7 million (RMB 11 million) to obtain the patent. The various milestone payments have been recorded as an asset and not expensed because all such payments are fully refundable if the studies are not ratified by the SFDA.

In addition, the Company expects to incur approximately $7.8 million (RMB 50 million) in research and development expense related to the Laevo-Bambuterol drug that has entered in Clinical Trial I in the next two years. The Company recorded $470,311 and $21,517 in research and development expenses for this drug for the three months ended September 30, 2011 and 2010, respectively. The Company recorded $1,889,535 and $21,517 in research and development expenses for this drug for the nine months ended September 30, 2011 and 2010, respectively.

16

LOTUS PHARMACEUTICALS INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 6 – DEPOSITS AND INSTALLMENTS ON INTANGIBLE ASSETS (Continued)

Installments on Gliclazide-Controlled Release Tablets

Pursuant to the new drug patent transfer agreement the Company entered into in February 2009 (See New Drug Patent Transfer Agreement under Note 13), the Company has made the first installment to the transferor to obtain the patent. Hence, the Company recorded $937,236 (RMB 6 million) as installment payment on intangible assets as of September 30, 2011. In order to acquire the patent, the Company needs to make additional installments of approximately $469,000 (RMB 3 million). These payments have been recorded as an asset and not expensed as they are fully refundable if the studies are not ratified by the SFDA.

In addition, the Company expects to incur approximately $1.25 million (RMB 8 million) in research and development expense related to the Gliclazide-Controlled Release Tablets that was accepted by the China SFDA for medicine registration application in the next two years. The Company did not record any research and development expense for the drug for the three and nine months ended September 30, 2011 and 2010.

NOTE 7 – LAND USE RIGHTS AND OTHER INTANGIBLE ASSETS

Land Use Rights

All land in the PRC is owned by the PRC government and cannot be sold to any individual or company. The Company has recorded the amounts paid to acquire long-term interests to utilize land underlying the Company’s facilities as land use rights. This type of arrangement is common for the use of land in the PRC. Land use rights are amortized on the straight-line method over the terms of the land use rights, which range from 40 to 50 years. The Company acquired one parcel of land use right in Beijing and the other parcel of land use right in Inner Mongolia, China. The Company has received land use right certificate on the parcel of land in Beijing. However, as of the filing date of this report, the Company has not received land use right certificate on the parcel of land in Inner Mongolia. The delay is common in China. As described elsewhere in this report, the area for the Inner Mongolia land on which the Company expects to build a facility is 100 MU (approximately 67,000 square meters).The Company acquired the parcel of Beijing land use right in the amount of approximately $10.4 million (RMB 66,769,504) and the 100 MU (approximately 67,000 square meters) Inner Mongolia land use right in the amount of approximately $3.5 million (RMB 22,366,000), which are included in land use rights.

At September 30, 2011 and December 31, 2010, land use rights consist of the following:

|

| 2011 |

| 2010 |

| ||

Beijing land use right |

| $ | 10,429,802 |

| $ | 10,098,537 |

|

Inner Mongolia land use right |

|

| 3,493,705 |

|

| 3,382,740 |

|

Total |

|

| 13,923,507 |

|

| 13,481,277 |

|

Less: accumulated amortization |

|

| (811,603 | ) |

| (548,856 | ) |

Total |

| $ | 13,111,904 |

| $ | 12,932,421 |

|

The projected amortization expense for land use rights attributed to future periods is as follows:

Twelve-month periods ending September 30: |

| Expense | |

2012 |

| $ | 326,324 |

2013 |

|

| 326,324 |

2014 |

|

| 326,324 |

2015 |

|

| 326,324 |

2016 |

|

| 326,324 |

2017 and thereafter |

|

| 11,480,284 |

Total |

| $ | 13,111,904 |

17

LOTUS PHARMACEUTICALS INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 7 – LAND USE RIGHTS AND OTHER INTANGIBLE ASSETS (Continued)

Other Intangible Assets

On October 9, 2006, the Company entered into a five-year loan agreement (the “Loan Agreement”) and a contract with Wu Lan Cha Bu Emergency Hospital (“Wu Lan”), whereby the Company agreed to lend Wu Lan approximately $4.7 million (RMB 30 million) for the construction of a hospital ward in Inner Mongolia, China. In exchange for the loan, Wu Lan agreed to grant the Company an exclusive right to supply all medicines and disposable medical treatment apparatus to Wu Lan for a period of twenty years. In October 2006, the Company’s chief executive officer, Dr. Zhongyi Liu (hereafter, “Dr. Liu”), made this loan to Wu Lan on behalf of the Company. On October 21, 2006, the Company entered into an assignment agreement whereby the Company assigned all of its rights, obligations, and receipts under the Loan Agreement to Dr. Liu, except the rights to receive revenues from the sale of medical and disposable medical treatment apparatus (“Revenue Rights”). Since Dr. Liu accepted the assignment with all the risks and obligations but no right to revenues from the sale of medical and disposable medical treatment apparatus, the Company agreed to pay Dr. Liu compensation of approximately $1.4 million (RMB 9 million) in five (5) equal annual installments of approximately $281,000 (RMB 1.8 million) commencing October 21, 2006. Accordingly, the Company recorded an intangible asset of approximately $1.4 million (RMB 9 million) related to the exclusive rights to provide all medicines and disposable medical treatment apparatus to Wu Lan for a period of twenty (20) years. The Company amortizes this exclusive right over a term of 20 years.

The Company entered into an intellectual rights transfer contract with Beijing Yipuan Bio-Medical Technology Co., Ltd. in December 2008 to acquire the drug property right of Yipubishan. The intellectual property right is valued at a fixed amount of RMB 54 million (approximately $8 million). The Company paid the transfer fee in full for the intellectual property right to Yipuan. The intellectual property right has a term of 10 years and will not expire until December 31, 2018. The Company amortizes the intellectual property right over the term of the intellectual property right.

At September 30, 2011 and December 31, 2010, other intangible assets consist of the following:

|

| 2011 |

| 2010 |

| ||

Revenue rights |

| $ | 1,405,855 |

| $ | 1,361,203 |

|

Intellectual rights |

|

| 8,435,128 |

|

| 8,167,216 |

|

Software |

|

| 11,558 |

|

| 11,192 |

|

Total |

|

| 9,852,541 |

|

| 9,539,611 |

|

Less: accumulated amortization |

|

| (2,682,553 | ) |

| (1,932,126 | ) |

Total |

| $ | 7,169,988 |

| $ | 7,607,485 |

|

The projected amortization expense for other intangible assets attributed to future periods is as follows:

Twelve-month periods ending September 30: |

| Expense | |

2012 |

| $ | 913,936 |

2013 |

|

| 913,805 |

2014 |

|

| 913,805 |

2015 |

|

| 913,805 |

2016 |

|

| 913,805 |

2017 and thereafter |

|

| 2,600,832 |

Total |

| $ | 7,169,988 |

Amortization expense amounted to approximately $309,389 and $441,849 for the three months ended September 30, 2011 and 2010, respectively. Amortization expense amounted to approximately $916,865 and $1,318,468 for the nine months ended September 30, 2011 and 2010, respectively.

18

LOTUS PHARMACEUTICALS INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 8 – OTHER PAYABLES AND ACCRUED LIABILITIES

At September 30, 2011 and December 31, 2010, other payables and accrued liabilities consist of the following:

|

| 2011 |

| 2010 | ||

Construction payable |

| $ | — |

| $ | 120,996 |

Refundable deposit |

|

| 158,549 |

|

| 153,513 |

Accrued sales commission |

|

| — |

|

| 1,512,447 |

Accrued payroll and employees benefit |

|

| 392,159 |

|

| 1,280,394 |

Other |

|

| 172,849 |

|

| 374,116 |

Total |

| $ | 723,557 |

| $ | 3,441,466 |

NOTE 9 – TAXES

Income Tax

The Company is subject to income taxes on an entity basis on income arising in or derived from the tax jurisdiction in which each entity is domiciled.

Lotus Pharmaceuticals Inc. was incorporated in the United States and has an aggregate U.S. net operating loss carryforward of approximately $8,241,000 as of September 30, 2011, subject to the Internal Revenue Code Section 382, which places a limitation on the amount of taxable income that can be offset by net operating losses after a change in ownership. The net operating loss carries forward for United States income taxes, which may be available for offsetting against future taxable U.S. income. These carryforwards will expire, if not utilized, through 2031.

Management believes that the realization of the benefits from these loss carryforwards appears uncertain due to the Company’s limited operating history and continuing losses for United States income tax purposes. Accordingly, the Company has provided a 100% valuation allowance on the deferred tax asset to reduce the asset to zero. Management will review this valuation allowance periodically and make adjustments as needed. The valuation allowance at September 30, 2011 and December 31, 2010 was approximately $2,802,000 and $2,036,000, respectively. The net change in the valuation allowance was an increase of approximately $766,000 and $434,000 during the nine months ended September 30, 2011 and 2010, respectively. The consolidated income is earned overseas and will continue to be indefinitely reinvested in overseas operations. Accordingly, no provision has been made for U.S. deferred taxes related to future repatriation of these earnings, nor is it practicable to estimate the amount of income taxes that would have to be provided if we concluded that such earnings will be remitted in the future.

Deferred tax assets and liabilities are provided for significant income and expense items recognized in different years for income tax and financial reporting purposes. Temporary differences, which give rise to a net deferred tax asset for the Company as of September 30, 2011 and December 31, 2010 is as follows:

|

| 2011 |

| 2010 |

| ||

Tax benefit of net operating loss carryforward |

| $ | 2,802,000 |

| $ | 2,036,000 |

|

Valuation allowance |

|

| (2,802,000 | ) |

| (2,036,000 | ) |

Net deferred tax asset |

| $ | — |

| $ | — |

|

Lotus Pharmaceutical International, Inc. was incorporated in the United States and it was an affiliated group of Lotus Pharmaceuticals Inc. for United States income tax purpose and it did not have any business activity. Therefore, no income tax provision was made for Lotus Pharmaceutical International, Inc.

Lotus Century Pharmaceutical (Beijing) Technology Co., Ltd. and Lotus East were incorporated in the PRC and are subject to PRC income tax which is computed according to the relevant laws and regulations in the PRC.

19

LOTUS PHARMACEUTICALS INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 9 – TAXES (Continued)

Income Tax (continued)

Lotus Century Pharmaceutical (Beijing) Technology Co., Ltd. did not have any business activity for PRC income tax purpose. Accordingly, no income tax provision was made for Lotus Century Pharmaceutical (Beijing) Technology Co., Ltd pursuant to the related PRC income tax law.

Beijing Liang Fang was subject to 25% income tax rate since January 1, 2009. Located in Inner Mongolia, Liang Fang’s branch received income tax exemption for its fiscal 2011, 2010 and 2009 taxable income from the Cha You Qian Qi government situated in Inner Mongolia, P.R.C. on June 3, 2008.

The table below summarizes the differences between the U.S. statutory federal rate and the Company’s effective tax rate for the nine months ended September 30, 2011 and 2010:

| 2011 |

| 2010 |

|

US statutory rate | 34.00% |

| 34.00% |

|

Foreign income not recognized in the US | (34.00% | ) | (34.00% | ) |

China statutory rate | 25.00% |

| 25.00% |

|

China income tax exemption | (25.00% | ) | (22.45% | ) |

Effective income tax rate | 0.00% |

| 2.55% |

|