Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AMEDISYS INC | d254405d8k.htm |

| EX-99.2 - RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES TO GAAP FINANCIAL MEASURES - AMEDISYS INC | d254405dex992.htm |

November

2011 Investor Presentation

clinical

quality

clinical

quality

innovative

care models

innovative

care models

better

communities

better

communities

Leading Home Health & Hospice

Exhibit 99.1 |

Leading Home

Health & Hospice Forward-looking statements

This

presentation

may

include

forward-looking

statements

as

defined

by

the

Private

Securities

Litigation

Reform

Act

of

1995.

These

forward-looking

statements

are

based

upon

current

expectations

and

assumptions

about

our

business

that

are

subject

to

a

variety

of

risks

and

uncertainties

that

could

cause

actual

results

to

differ

materially

from

those

described

in

this

presentation.

You

should

not

rely

on

forward-looking

statements

as

a

prediction

of

future

events.

Additional

information

regarding

factors

that

could

cause

actual

results

to

differ

materially

from

those

discussed

in

any

forward-looking

statements

are

described

in

reports

and

registration

statements

we

file

with

the

SEC,

including

our

Annual

Report

on

Form

10-K

and

subsequent

Quarterly

Reports

on

Form

10-Q

and

Current

Reports

on

Form

8-K,

copies

of

which

are

available

on

the

Amedisys

internet

website

http://www.amedisys.com

or

by

contacting

the

Amedisys

Investor

Relations

department

at

(800)

467-2662.

We

disclaim

any

obligation

to

update

any

forward-looking

statements

or

any

changes

in

events,

conditions

or

circumstances

upon

which

any

forward-looking

statement

may

be

based

except

as

required

by

law.

2

www.amedisys.com

NASDAQ: AMED

We encourage everyone to visit the

Investors Section of our website at

www.amedisys.com, where we

have posted additional important

information such as press releases,

profiles concerning our business

and clinical operations and control

processes, and SEC filings.

We intend to use our website to

expedite public access to time-

critical information regarding the

Company in advance of or in lieu of

distributing a press release or a

filing with the SEC disclosing the

same information. |

Leading Home

Health & Hospice 83%

17%

Home Health

Hospice

Company overview

1

3

•

Founded in 1982, publicly listed 1994

•

572 locations in 45 states

•

Leading provider of home health services

-

Services include skilled nursing and therapy

services

•

Growing hospice business

•

94% of home health revenue is episodic

based (both Medicare & non-Medicare)

17,000 employees

Home Health Division:

-3Q11 admissions of 69,000

-8.4 million annualized visits

Hospice Division:

-

Average daily census = 4,902

-

Average length of stay = 86 days

1

For the quarter ended September 30, 2011

Stats

Revenue Mix |

Leading Home

Health & Hospice Management team

William F. Borne, Chairman and CEO

Founder and CEO since 1982

29 years leading the industry

Ronald LaBorde, President

Board member since 1997; 23 years of executive level

management and financial experience

HR Solutions, Piccadilly Cafeterias

Tim Barfield, Chief Development Officer

16 years of corporate development experience

Gov. Bobby Jindal , Vinson & Elkins, The Shaw Group

Dale E. Redman, CPA, Chief Financial Officer

35 years of senior level financial experience

Winward Capital, United Companies Financial

4

James T. Robinson, Executive VP Home Health

and Hospice

20 years in health care innovation and leadership

American CareSource Holding, VistaCare, St. Jude Medical,

Hewlet Packard Medical, Xerox Corp.

Jeffrey D. Jeter, Chief Compliance Officer

15 years of health care law and compliance expertise

Former Medicaid prosecutor, LA AG for DOJ

Michael O. Fleming, Chief Medical Officer

29 years as a family physician

Former President of AAFP, first home health industry CMO

G. Patrick Thompson, Chief Information Officer

24 years of corporate administration experience

Arthur Andersen, Turner Industries, The Shaw Group |

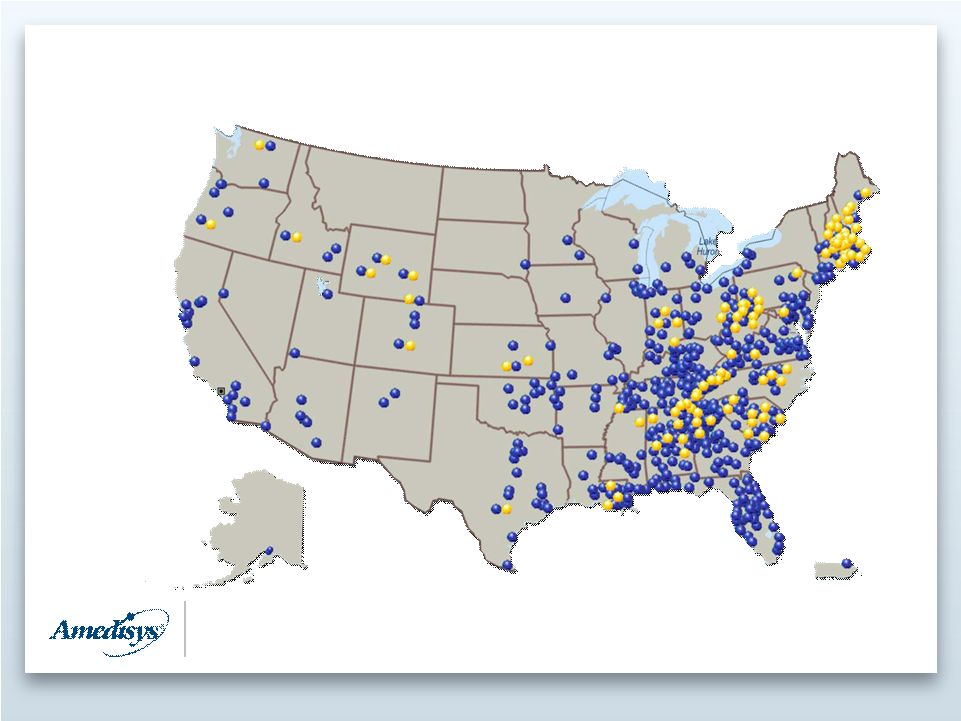

Leading Home

Health & Hospice Agency Locations

5

482 -

Home Health locations

90 -

Hospice locations

*As of September 30, 2011 |

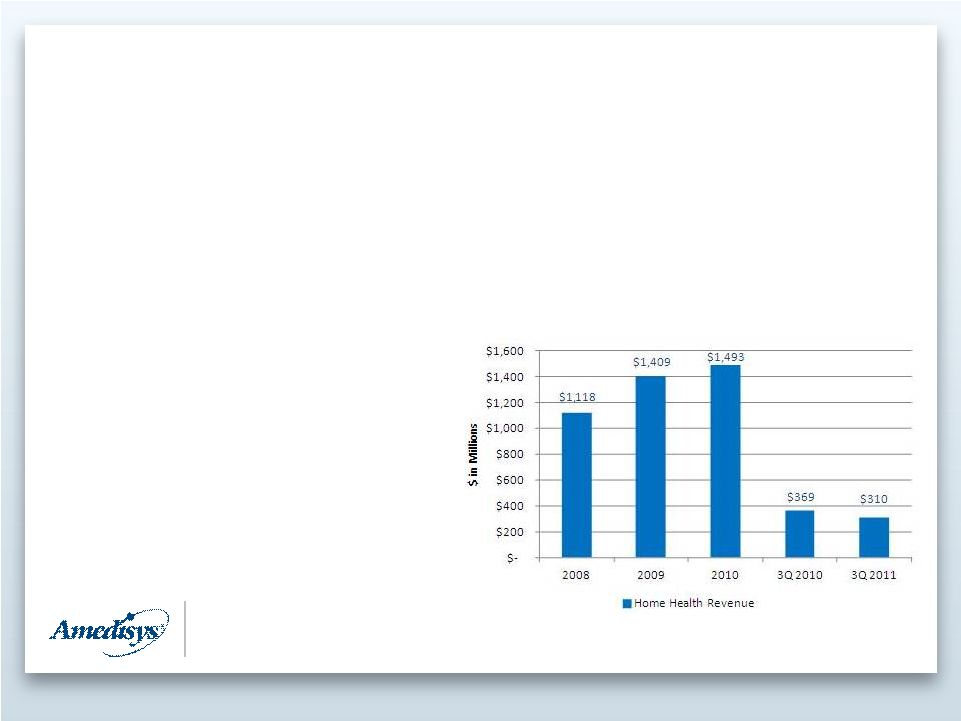

Leading Home

Health & Hospice Home Health Division

6

•

Industry leader

–

Strong national footprint –

482 locations across 45 states

–

$310 million revenue in 3Q 2011

–

83% Medicare revenue in 3Q 2011

•

Strong clinical quality

•

World-class technology platform

•

Well positioned to capitalize

on organic and consolidation

opportunities |

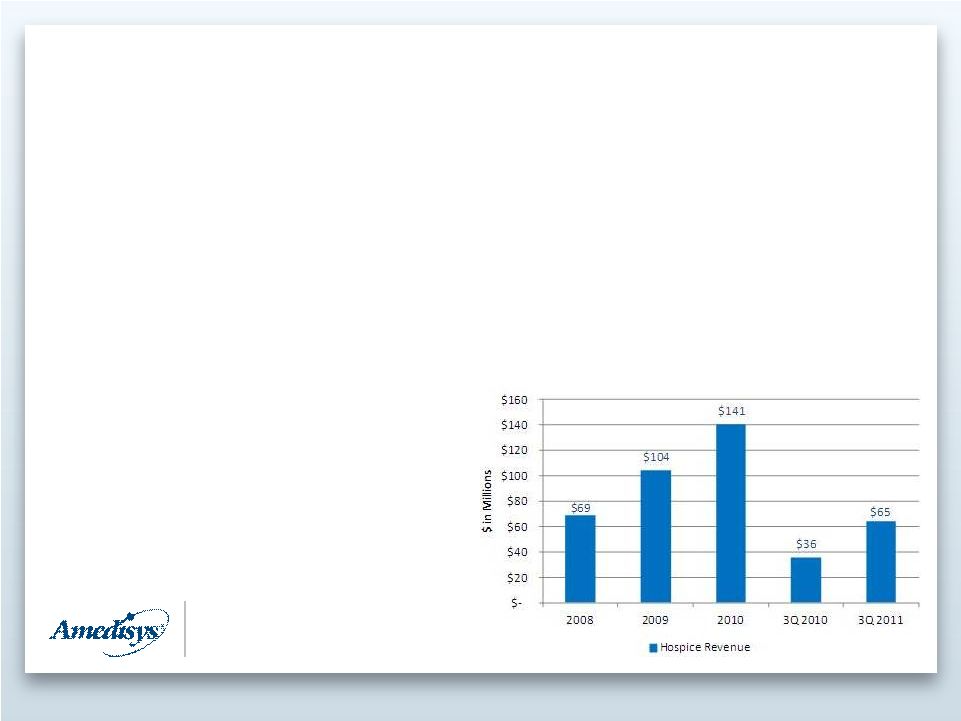

Leading Home

Health & Hospice Hospice Division

7

•

90 locations across 24 states

–

$65 million revenue in 3Q 2011

–

94% Medicare revenue in 3Q 2011

•

Operational efficiencies drive strong margins

•

Quality care drives referral growth

•

Partnered with the country’s largest and leading home health company

–

Offering comprehensive

continuum of at-home care

–

Collective resources to drive

operational and clinical

excellence

–

Cross referral opportunities

to drive growth |

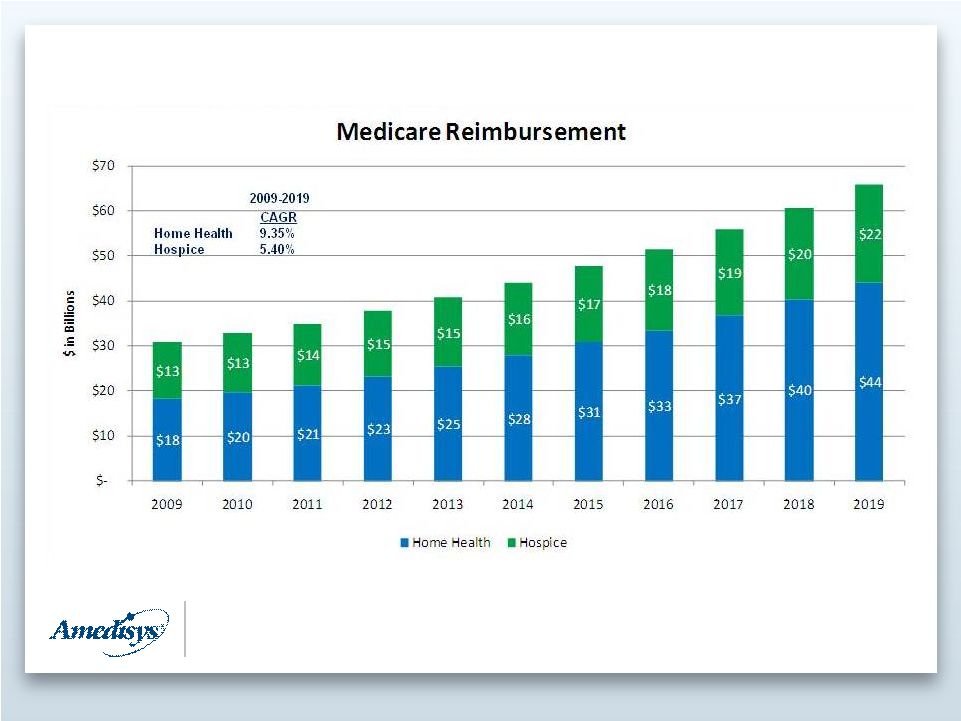

Leading Home

Health & Hospice 8

Source: Congressional Budget Office baseline reports (home health figures from 2010

report, hospice figures from 2009 report) Medicare market size

|

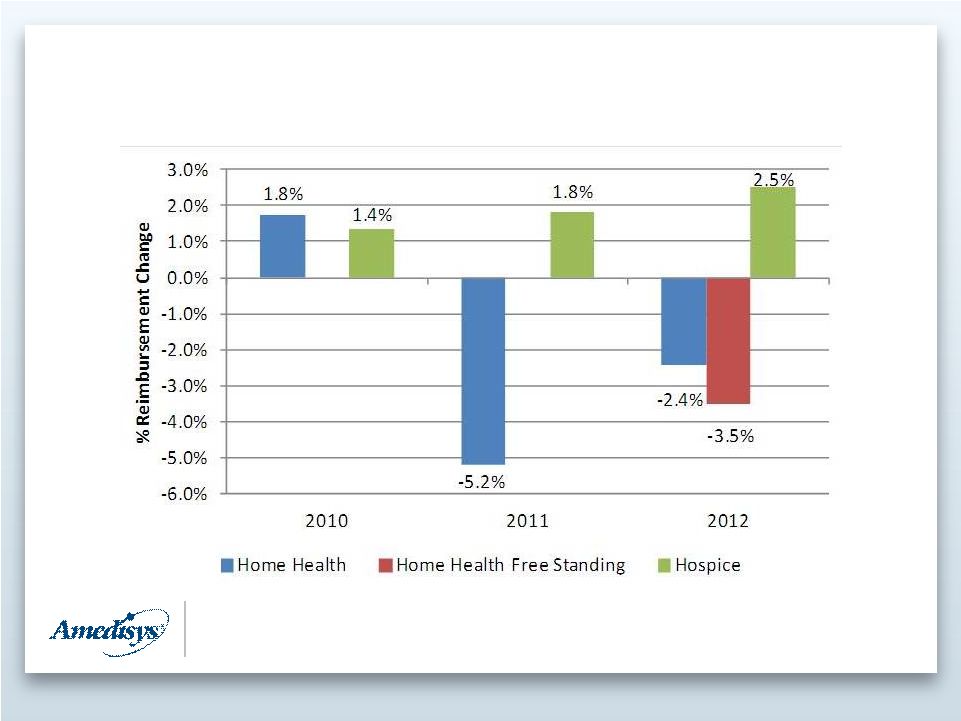

Leading Home

Health & Hospice Medicare Reimbursement

9 |

Leading Home

Health & Hospice Legislative Update

10

Joint Select Committee

•

November 23 committee vote deadline

•

December 23 Congress vote deadline

•

Failure results in sequestration

Industry legislative proposal

•

Targeting fraud and abuse

•

Removing therapy thresholds

•

Promoting value based pricing

•

Meeting deficit reduction goals while minimizing impact to patients

|

Leading Home

Health & Hospice Company Realignment/Executive Changes

11

•

Realignment

–

Disposing of ~50 care centers with annualized revenue of $34 million

and $10 million in contribution losses

–

Reorganizing field into 5 geographic regions

–

Enhanced leadership focus on business development

•

Chief Operating Officer departed

–

Combining leadership of home health and hospice under Jim

Robinson

–

Better capture of home health and hospice synergies

•

Chief Financial Officer retiring in 1Q 2012

–

Ronnie LaBorde appointed President, additionally assuming CFO role

in 1Q 2012 |

Leading Home

Health & Hospice Value Proposition

•

Home health is the lowest total cost, lowest daily cost, and provides care

over the longest period of time

12

*Source: National Association for Home Health & Hospice, Medpac June 2010 Data

Book Hospital

SNF

Home Health

Average Cost of Stay

$28,191

$14,688

$5,293

Average Length of Stay

4.9 days

27 days

106 days

Per Diem Cost

$5,765

$544

$50 |

Leading Home

Health & Hospice Our Long Term Operating Tenets

13 |

Leading Home

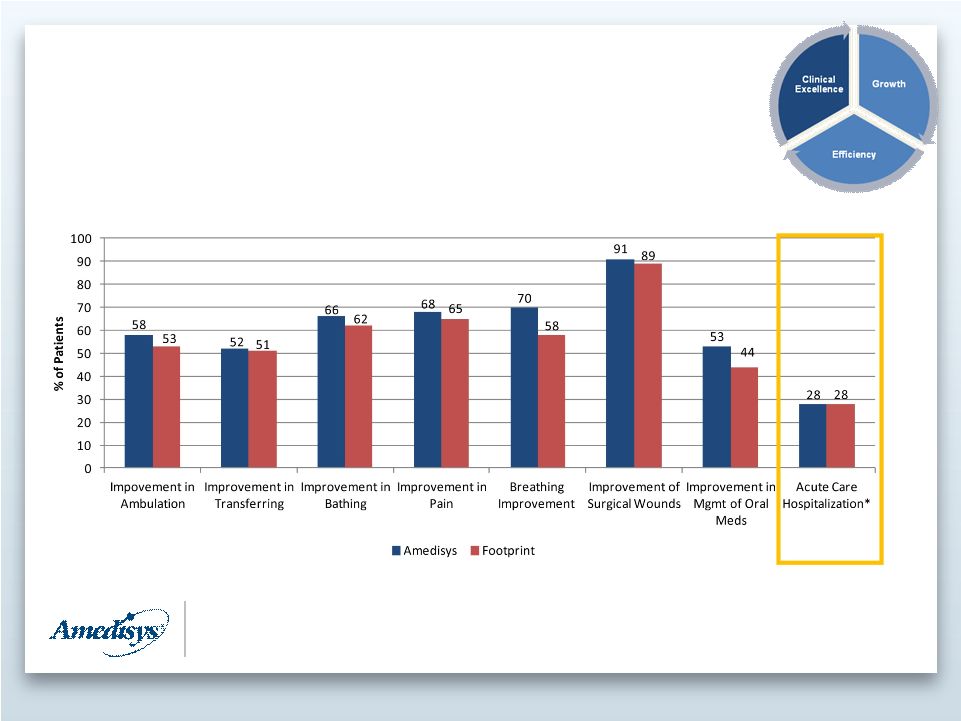

Health & Hospice Focus on Clinical Outcomes

Amedisys vs. Footprint –

Outcomes June 2011

•

Exceeded or met 8 out of 8 outcomes vs. footprint of reported measures

*

Lower % is better

Source: Medicare

14 |

Leading Home

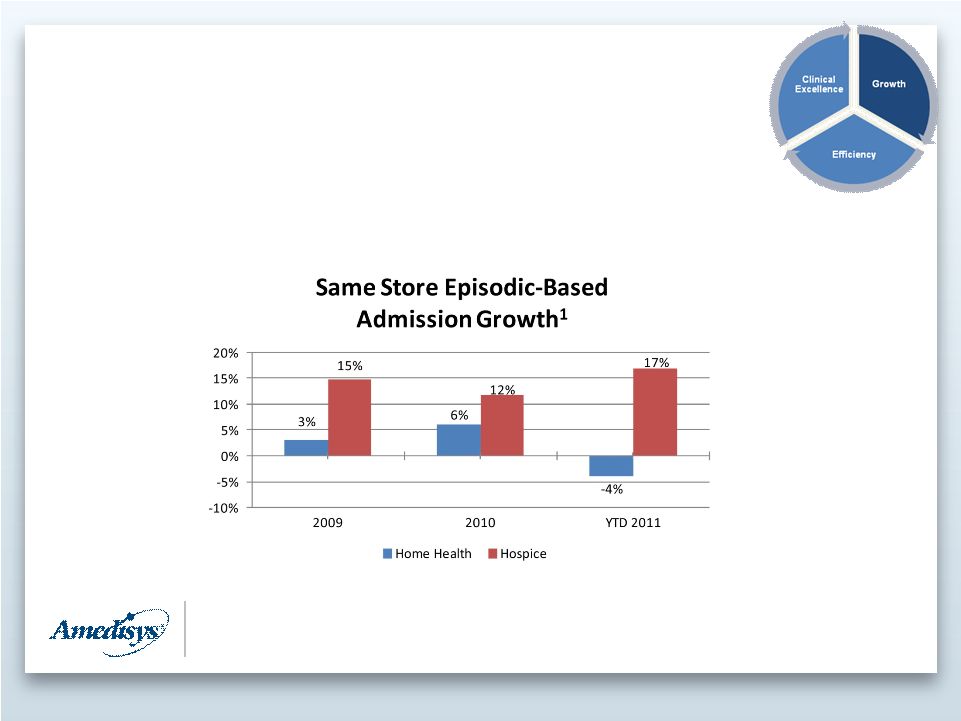

Health & Hospice Growth -

Organic

15

1

Same

store

episodic-based

admission

growth

is

the

percent

increase

in

our

same

store

episodic-based

admissions

for

the

period

as

a

percent

of

the

same

store

episodic-based

admissions

of

the

prior

period.

•

Utilizing CRM tool

•

Training

•

Reorganized business development leadership

•

Managed care |

Leading Home

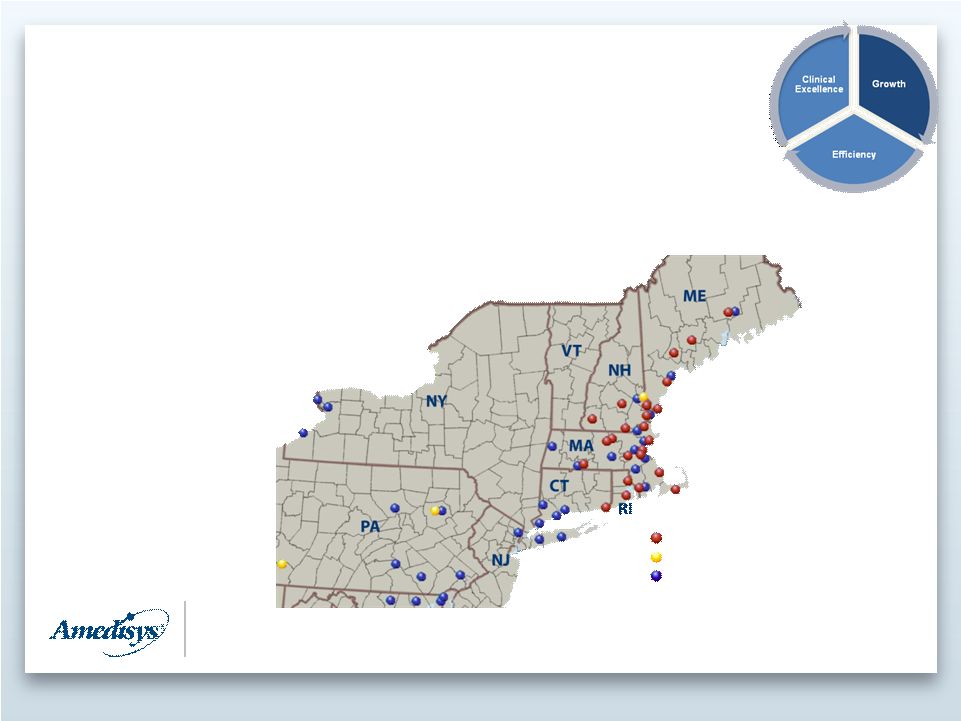

Health & Hospice Beacon Acquisition

•

Premier hospice in Northeast

–

23 locations

–

$80 million in revenue

–

Quality provider

–

Strong leadership and operations

–

Closed acquisition in June 2011

Beacon Hospice Care Centers

Amedisys Hospice Care Centers

Amedisys Home Health Care Centers

16 |

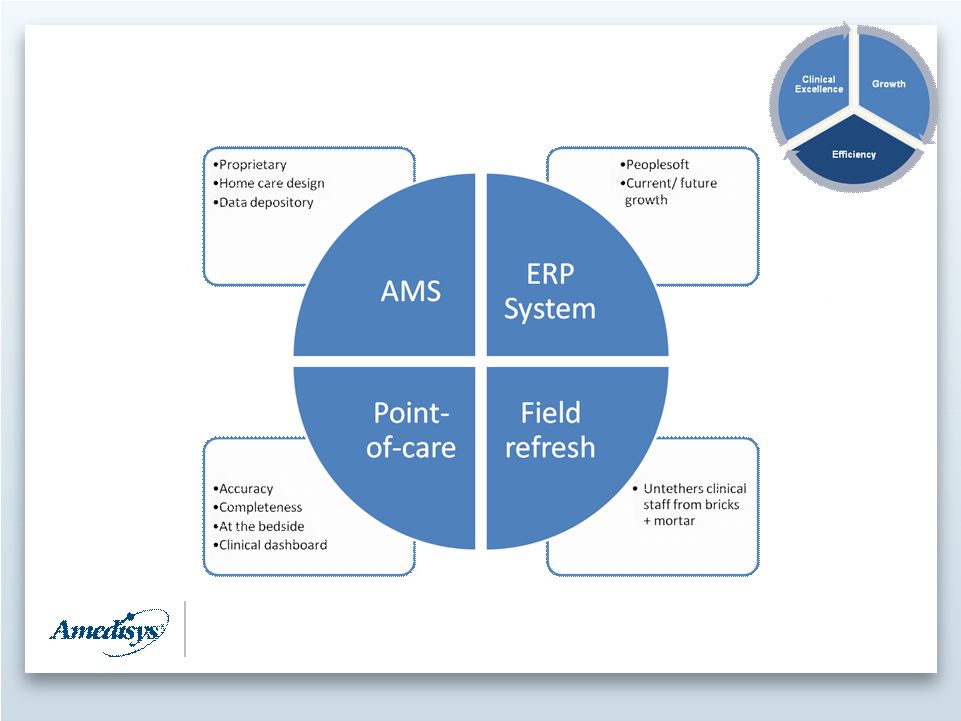

Leading Home

Health & Hospice Efficiency –

Systems Infrastructure

17 |

Leading Home

Health & Hospice Financial Review

18 |

Leading Home

Health & Hospice Goodwill & Other Adjustments

•

3Q11 non-cash goodwill impairment of $574 million

–

Charge associated with home health division

–

Non cash; no impact on liquidity, debt covenants or cash flow

•

Other one-time costs

–

Legal costs

–

Severance, closures and write-offs

–

Medicare quality bonus payments

19 |

Leading Home

Health & Hospice Financial highlights

20 |

Leading Home

Health & Hospice 21

Summary financial results

($ in millions, except per share data and

DSO)

2009

2010

3Q10

3Q11

Net revenue

$1,513.5

$1,634.3

$404.7

$374.9

Gross margin

789.0

813.9

198.4

169.2

CFFO

247.7

206.3

47.2

27.8

Adjusted EBITDA¹

261.8

242.0

51.9

29.4

Adjusted Fully-diluted EPS²

$4.89

$4.29

$0.89

$0.36

Days Sales Outstanding

33.9

32.8

30.8

35.9

1

Adjusted

EBITDA

is

defined

as

net

income

attributable

to

Amedisys,

Inc.

before

provision

for

income

taxes,

net

interest

(income)

expense,

and

depreciation

and

amortization

plus

certain

adjustments (i.e certain items incurred in 2010 and 2011 which are detailed

in our Form 8-K filed with the Securities and Exchange Commission on February 22, 2011 and November 1,

2011,

respectively).

Adjusted

EBITDA

should

not

be

considered

as

an

alternative

to,

or

more

meaningful

than,

income

before

income

taxes,

cash

flow

from

operating

activities,

or

other

traditional

indicators

of

operating

performance.

This

calculation

of

adjusted

EBITDA

may

not

be

comparable

to

a

similarly

titled

measure

reported

by

other

companies,

since

not

all

companies calculate this non-GAAP financial measure in the same manner.

2

Adjusted diluted earnings per share is defined as diluted earnings per share plus

the earnings per share effect of certain adjustments (i.e. certain items incurred in 2010 and 2011 which

are

detailed

in

our

form

8-K

filed

with

the

Securities

and

Exchange

Commission

on

February

22,

2011

and

November

1,

2011,

respectively).

Adjusted

diluted

earnings

per

share

should

not

be

considered

as

an

alternative

to,

or

more

meaningful

than,

income

before

income

taxes,

cash

flow

from

operating

activities,

or

other

traditional

indicators

of

operating

performance.

This

calculation

of

adjusted

diluted

earnings

per

share

may

not

be

comparable

to

a

similarly

titled

measure

reported

by

other

companies,

since

not

all

companies

calculate

this

non-GAAP

financial measure in the same manner. |

Leading Home

Health & Hospice 22

Summary performance results

2009

2010

3Q10

3Q11

Home Health

Agencies at period end

521

486

537

482

Total visits

8,702,146

9,065,549

2,260,608

2,113,413

Episodic-based admissions

231,782

253,763

63,472

58,145

Episodic-based completed

episodes

411,975

424,988

104,997

98,020

Episodic-based revenue

per episode

$3,166

$3,311

$3,294

$2,975

Hospice

Agencies at period end

65

67

72

90

Total admissions

9,002

11,510

2,782

4,608

Hospice days

784,577

1,051,209

273,989

450,956

Daily census

2,150

2,880

2,978

4,902

Average length of stay

82

87

87

86 |

Leading Home

Health & Hospice 23

Summary balance sheet

Dec. 31, 2010

Sep. 30, 2011

Assets

Cash

$ 120.3

$ 29.5

Accounts Receivable, Net

141.5

151.2

Property and Equipment

138.6

146.9

Goodwill

791.4

335.8

Other

108.1

183.4

Total Assets

$ 1,299.9

$ 846.8

Liabilities and Equity

Debt

$ 181.9

$ 153.3

All Other Liabilities

238.3

181.5

Equity

879.7

512.0

Total Liabilities and Equity

$ 1,299.9

$ 846.8

Leverage Ratio

0.8x

0.9x |

Leading Home

Health & Hospice 24

Liquidity

•

Cash balance at 9/30/11 = $29M

•

Available line of credit (LOC): 9/30/11 = $231M

•

2011 estimated CFFO -

Cap Ex = $75M -

$85M |

Leading Home

Health & Hospice 25

Guidance

Calendar Year 2011

Net revenue:

$1.475 -

$1.5 billion

EPS:

$1.90 -

$2.00

Diluted shares:

29.3 million

1

Guidance

excludes

the

effects

of

the

following:

non-cash

impairment

charge,

any

future

acquisitions,

if

any

are

made;

effects

of

any

share

repurchases;

non-recurring

costs

(i.e.

certain

items)

that

may

be

incurred

during

the

year;

or

the

impact

of

the

final

2012

Medicare

rate

changes.

2

Provided

as

of

the

date

of

our

form

8-K

filed

with

the

Securities

and

Exchange

Commission

on

November

1,

2011.

1

2 |

Leading Home

Health & Hospice Investment Rationale

•

Favorable industry growth rates

•

IT infrastructure/scalability

•

Clinical quality and innovation

•

Strong liquidity and capital position

•

Future consolidation opportunities

26 |

Leading Home

Health & Hospice Contact information

Kevin B. LeBlanc

Director of Investor Relations

Amedisys, Inc.

5959 S. Sherwood Forest Boulevard

Baton Rouge, LA 70816

Office: 225.299.3391

Fax: 225.298.6435

kevin.leblanc@amedisys.com

27 |