Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - tw telecom inc. | Financial_Report.xls |

| EX-31.1 - CERTIFICATION OF CHIEF EXECUTIVE OFFICER - tw telecom inc. | d253952dex311.htm |

| EX-32.1 - CERTIFICATION OF CHIEF EXECUTIVE OFFICER - tw telecom inc. | d253952dex321.htm |

| EX-31.2 - CERTIFICATION OF CHIEF FINANCIAL OFFICER - tw telecom inc. | d253952dex312.htm |

| EX-32.2 - CERTIFICATION OF CHIEF FINANCIAL OFFICER - tw telecom inc. | d253952dex322.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q/A

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-34243

tw telecom inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 84-1500624 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) | |

| 10475 Park Meadows Drive Littleton, Colorado |

80124 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (303) 566-1000

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The number of shares outstanding of tw telecom inc.’s common stock as of April 30, 2011 was 150,669,768 shares.

Table of Contents

tw telecom inc.

Form 10-Q/A

Explanatory Note

This Amendment No. 1 to the quarterly report of tw telecom inc. on Form 10–Q/A (“Form 10–Q/A”) amends our quarterly report on Form 10–Q for the period ended March 31, 2011, which was originally filed on May 10, 2011 (“Original Form 10–Q”). This amendment is being filed for the purpose of restating certain amounts in the Financial Statements in Item 1, Management’s Discussion and Analysis of Financial Condition and Results of Operations in Item 2 and Controls and Procedures in Item 4, as well as for currently dated certifications from our principal executive officer and principal financial officer as required by Section 302 and 906 of the Sarbanes-Oxley Act of 2002. For the convenience of the reader, this Amended Filing sets forth the Original Filing, as modified and superseded where necessary to reflect the restatement. The certifications of our principal executive officer and principal financial officer are attached to this Amended Filing as Exhibits 31.1, 31.2, 32.1 and 32.2.

Our financial statements included in the Original Form 10–Q were prepared reflecting the reliance on a valuation allowance related tax planning strategy for the sale and leaseback of appreciated assets to support the recognition of certain deferred tax assets in periods prior to June 30, 2010. The reliance on this tax planning strategy and related accounting conclusions resulted in a lower valuation allowance against the Company’s historical deferred tax assets in periods prior to June 30, 2010 than would have been recorded without reliance on those conclusions. As a result of a technical re-evaluation of the accounting guidance, the restated financial statements will result in the establishment of a non-cash valuation allowance against a tax asset that was originally recorded in 2001 and the recognition of non-cash tax expense in the periods from the fourth quarter of 2006 until the first quarter of 2010, all of which will be reversed in the second quarter of 2010 resulting in no cumulative net impact to net income across periods from 2001 to 2010.

The restatement increased the tax expense and net loss $2.3 million for the three months ended March 31, 2010. Basic and diluted loss per share were increased by $0.02, respectively, for the three months ended March 31, 2010.

We believe that the restatement does not reflect any economic impact on the Company, any trends in the Company’s business or any current or prospective impact on the Company’s results of operations, the timing of its future ability to use net operating loss carryforwards or the Company’s compliance with its debt covenants. This restatement relates to non-cash entries in the financial statements and has no effect on cash flows or cash balances.

The restatement is more fully described in Note 2 to the Notes to Consolidated Financial Statements.

In connection with the restatements of certain of our financial statements described in more detail elsewhere in this Form 10–Q/A, our management reassessed the effectiveness of the Company’s disclosure controls and procedures. As a result of that reassessment, our management determined that there was a control deficiency in its internal control over financial reporting in the area of accounting for income taxes specific to tax planning strategies related to the need for a valuation allowance against deferred tax assets that constitutes a material weakness. For a discussion of management’s consideration of the Company’s internal control over financial reporting and the material weakness identified, see Part II — Item 9A included in this Amended Filing.

This Form 10–Q/A does not reflect events occurring after the filing of the Original Form 10–Q other than the restatement for the matter discussed above. Such events include, among other things, the events described in our current reports on Form 8–K and Forms 10–Q after the date of the Original Form 10–Q. Concurrent with this filing of Form 10–Q/A, we will file an amended Form 10–Q for the period ended June 30, 2011 and an amended Form 10–K for the year ended December 31, 2010.

2

Table of Contents

| Page | ||||||

| Part I. Financial Information | ||||||

| Item 1. |

||||||

| Condensed Consolidated Balance Sheets at March 31, 2011 (unaudited) and December 31, 2010 |

4 | |||||

| 5 | ||||||

| 6 | ||||||

| 7 | ||||||

| 8 | ||||||

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

22 | ||||

| Item 3. |

34 | |||||

| Item 4. |

34 | |||||

| Part II. Other Information | ||||||

| Item 1. |

Legal Proceedings | 34 | ||||

| Item 1A. |

Risk Factors | 34 | ||||

| Item 2. |

Unregistered Sales of Equity Securities and Use of Proceeds | 35 | ||||

| Item 6. |

Exhibits | 35 | ||||

3

Table of Contents

tw telecom inc.

CONDENSED CONSOLIDATED BALANCE SHEETS

| March 31, 2011 |

December 31, 2010 |

|||||||

| Restated | Restated | |||||||

| (amounts in thousands, except per share amounts) |

||||||||

| ASSETS | ||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 362,215 | $ | 356,922 | ||||

| Investments |

117,547 | 118,672 | ||||||

| Receivables, less allowances of $7,869 and $7,898, respectively |

81,819 | 81,598 | ||||||

| Prepaid expenses and other current assets |

19,468 | 16,935 | ||||||

| Deferred income taxes |

40,428 | 40,428 | ||||||

|

|

|

|

|

|||||

| Total current assets |

621,477 | 614,555 | ||||||

|

|

|

|

|

|||||

| Property, plant and equipment |

3,792,095 | 3,732,050 | ||||||

| Less accumulated depreciation |

(2,422,155 | ) | (2,375,438 | ) | ||||

|

|

|

|

|

|||||

| 1,369,940 | 1,356,612 | |||||||

|

|

|

|

|

|||||

| Deferred income taxes |

215,207 | 224,795 | ||||||

| Goodwill |

412,694 | 412,694 | ||||||

| Intangible assets, net of accumulated amortization |

22,769 | 24,444 | ||||||

| Other assets, net |

16,995 | 17,854 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 2,659,082 | $ | 2,650,954 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | 69,750 | $ | 53,436 | ||||

| Deferred revenue |

38,982 | 37,888 | ||||||

| Accrued taxes, franchise and other fees |

67,610 | 68,663 | ||||||

| Accrued interest |

7,487 | 15,208 | ||||||

| Accrued payroll and benefits |

37,102 | 41,772 | ||||||

| Accrued carrier costs |

29,375 | 35,049 | ||||||

| Current portion debt and capital lease obligations |

6,968 | 7,202 | ||||||

| Other current liabilities |

39,327 | 42,570 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

296,601 | 301,788 | ||||||

|

|

|

|

|

|||||

| Long-term debt and capital lease obligations, net |

1,341,418 | 1,338,297 | ||||||

| Long-term deferred revenue |

14,356 | 14,864 | ||||||

| Other long-term liabilities |

31,021 | 29,364 | ||||||

| Commitments and contingencies (Note 9) |

||||||||

| Stockholders’ equity: |

||||||||

| Preferred stock, $0.01 par value, 20,000 shares authorized, no shares issued and outstanding |

— | — | ||||||

| Common stock, $0.01 par value, 439,800 shares authorized and 151,953 shares issued |

1,520 | 1,520 | ||||||

| Additional paid-in capital |

1,805,126 | 1,802,946 | ||||||

| Treasury stock, 1,481 and 2,707 shares, at cost, respectively |

(25,530 | ) | (45,821 | ) | ||||

| Accumulated deficit |

(804,165 | ) | (790,175 | ) | ||||

| Accumulated other comprehensive loss |

(1,265 | ) | (1,829 | ) | ||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

975,686 | 966,641 | ||||||

|

|

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | 2,659,082 | $ | 2,650,954 | ||||

|

|

|

|

|

|||||

See accompanying notes.

4

Table of Contents

tw telecom inc.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| Three Months Ended March 31, |

||||||||

| 2011 | 2010 | |||||||

| Restated | ||||||||

| (amounts in thousands, except per share amounts) |

||||||||

| Revenue: |

||||||||

| Data and Internet services |

$ | 152,187 | $ | 129,121 | ||||

| Network services |

89,511 | 89,548 | ||||||

| Voice services |

83,024 | 84,072 | ||||||

| Intercarrier compensation |

7,820 | 8,470 | ||||||

|

|

|

|

|

|||||

| Total revenue |

332,542 | 311,211 | ||||||

|

|

|

|

|

|||||

| Costs and expenses (a): |

||||||||

| Operating (exclusive of depreciation, amortization, and accretion shown separately below) |

139,729 | 128,855 | ||||||

| Selling, general and administrative |

78,815 | 75,102 | ||||||

| Depreciation, amortization, and accretion |

69,736 | 73,387 | ||||||

|

|

|

|

|

|||||

| Total costs and expenses |

288,280 | 277,344 | ||||||

|

|

|

|

|

|||||

| Operating income |

44,262 | 33,867 | ||||||

| Interest expense |

(21,972 | ) | (20,941 | ) | ||||

| Debt extinguishment costs |

— | (17,070 | ) | |||||

| Interest income |

143 | 57 | ||||||

|

|

|

|

|

|||||

| Income (loss) before income taxes |

22,433 | (4,087 | ) | |||||

| Income tax expense |

9,814 | 2,692 | ||||||

|

|

|

|

|

|||||

| Net income (loss) |

$ | 12,619 | $ | (6,779 | ) | |||

|

|

|

|

|

|||||

| Earnings (loss) per share: |

||||||||

| Basic |

$ | 0.08 | $ | (0.05 | ) | |||

|

|

|

|

|

|||||

| Diluted |

$ | 0.08 | $ | (0.05 | ) | |||

|

|

|

|

|

|||||

| Weighted average shares outstanding: |

||||||||

| Basic |

147,565 | 149,296 | ||||||

|

|

|

|

|

|||||

| Diluted |

149,694 | 149,296 | ||||||

|

|

|

|

|

|||||

| (a) Includes non-cash stock-based employee compensation expense (Note 8): |

||||||||

| Operating |

$ | 588 | $ | 758 | ||||

|

|

|

|

|

|||||

| Selling, general and administrative |

$ | 6,860 | $ | 6,219 | ||||

|

|

|

|

|

|||||

See accompanying notes.

5

Table of Contents

tw telecom inc.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| Three Months Ended March 31, |

||||||||

| 2011 | 2010 | |||||||

| Restated | ||||||||

| (amounts in thousands) | ||||||||

| Cash flows from operating activities: |

||||||||

| Net income (loss) |

$ | 12,619 | $ | (6,779 | ) | |||

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: |

||||||||

| Depreciation, amortization, and accretion |

69,736 | 73,387 | ||||||

| Deferred income taxes |

9,486 | 2,317 | ||||||

| Stock-based compensation |

7,448 | 6,977 | ||||||

| Extinguishment costs, amortization of discount on debt and deferred debt issue costs and other |

5,695 | 22,146 | ||||||

| Changes in operating assets and liabilities: |

||||||||

| Receivables, prepaid expenses and other assets |

(2,111 | ) | 3,116 | |||||

| Accounts payable, deferred revenue, and other liabilities |

(3,823 | ) | (3,903 | ) | ||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

99,050 | 97,261 | ||||||

|

|

|

|

|

|||||

| Cash flows from investing activities: |

||||||||

| Capital expenditures |

(79,276 | ) | (80,929 | ) | ||||

| Purchases of investments |

(42,735 | ) | (90,025 | ) | ||||

| Proceeds from sale of investments |

43,286 | 15,075 | ||||||

| Other investing activities, net |

(1,591 | ) | (2,325 | ) | ||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(80,316 | ) | (158,204 | ) | ||||

|

|

|

|

|

|||||

| Cash flows from financing activities: |

||||||||

| Net proceeds (tax withholdings) from issuance of common stock upon exercise of stock options and vesting of restricted stock awards and units |

(2,727 | ) | 167 | |||||

| Purchases of treasury stock |

(8,859 | ) | — | |||||

| Retirement of debt obligations |

— | (413,683 | ) | |||||

| Net proceeds from issuance of debt |

— | 417,477 | ||||||

| Payment of debt and capital lease obligations |

(1,855 | ) | (2,014 | ) | ||||

|

|

|

|

|

|||||

| Net cash (used in) provided by financing activities |

(13,441 | ) | 1,947 | |||||

|

|

|

|

|

|||||

| Increase (decrease) in cash and cash equivalents |

5,293 | (58,996 | ) | |||||

| Cash and cash equivalents at beginning of period |

356,922 | 445,907 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents at end of period |

$ | 362,215 | $ | 386,911 | ||||

|

|

|

|

|

|||||

| Supplemental disclosures of cash flow information: |

||||||||

| Cash paid for interest |

$ | 24,345 | $ | 26,697 | ||||

|

|

|

|

|

|||||

| Cash paid for debt extinguishment costs |

$ | — | $ | 13,677 | ||||

|

|

|

|

|

|||||

See accompanying notes.

6

Table of Contents

tw telecom inc.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY

Three Months Ended March 31, 2011

(Unaudited)

| Additional paid-in capital |

Accumulated deficit |

Accumulated other comprehensive income (loss) |

Total stockholders’ equity |

|||||||||||||||||||||||||||||

| Common Stock | Treasury Stock | |||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||||||||||||||||||

| (amounts in thousands) | ||||||||||||||||||||||||||||||||

| Balance at December 31, 2010 Restated |

151,953 | $ | 1,520 | (2,707 | ) | $ | (45,821 | ) | $ | 1,802,946 | $ | (790,175 | ) | $ | (1,829 | ) | $ | 966,641 | ||||||||||||||

| Net income |

— | — | — | — | — | 12,619 | — | 12,619 | ||||||||||||||||||||||||

| Unrealized gain on cash flow hedging activities, net of tax of $239 |

— | — | — | — | — | — | 519 | 519 | ||||||||||||||||||||||||

| Unrealized gain on available-for-sale securities, net of tax of $17 |

— | — | — | — | — | — | 45 | 45 | ||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||

| Total comprehensive income |

— | — | — | — | — | — | — | 13,183 | ||||||||||||||||||||||||

| Purchases of treasury stock |

— | — | (494 | ) | (8,859 | ) | — | — | — | (8,859 | ) | |||||||||||||||||||||

| Exercise of stock options net of withholdings to satisfy employee tax obligations upon vesting of stock awards |

— | — | 284 | 4,847 | (6,163 | ) | (1,411 | ) | — | (2,727 | ) | |||||||||||||||||||||

| Stock-based compensation |

— | — | 1,436 | 24,303 | 8,343 | (25,198 | ) | — | 7,448 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Balance at March 31, 2011 Restated |

151,953 | $ | 1,520 | (1,481 | ) | $ | (25,530 | ) | $ | 1,805,126 | $ | (804,165 | ) | $ | (1,265 | ) | $ | 975,686 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

See accompanying notes.

7

Table of Contents

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. Organization and Summary of Significant Accounting Policies

Description of Business and Capital Structure

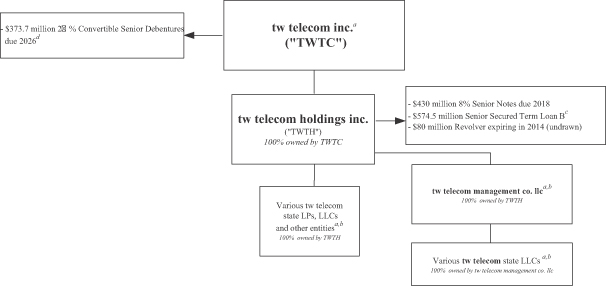

tw telecom inc. (the “Company”) is a leading national provider of managed network services, specializing in data, Internet Protocol (“IP”), voice and network access services to enterprise organizations, including public sector entities, and carriers throughout the United States.

The Company has one class of common stock outstanding with one vote per share. The Company also is authorized to issue shares of preferred stock. The Company’s Board of Directors has the authority to establish voting powers, preferences, and special rights for the preferred stock. No shares of preferred stock have been issued.

Basis of Presentation

The accompanying unaudited interim condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”) for quarterly reports on Form 10-Q and do not include all of the information and note disclosures required by U.S. generally accepted accounting principles (“U.S. GAAP”) for complete financial statements. These condensed consolidated financial statements should therefore be read in conjunction with the consolidated financial statements and notes thereto included in our Annual Report on Form 10-K/A for the year ended December 31, 2010 filed with the SEC. The accompanying unaudited interim condensed consolidated financial statements have been prepared in accordance with U.S. GAAP and include all adjustments of a normal, recurring nature that are, in the opinion of management, necessary to present fairly the financial position and results of operations for the interim periods presented. The results of operations for an interim period are not necessarily indicative of the results of operations for a full fiscal year.

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Recently Adopted Accounting Pronouncements

Effective January 1, 2011, the Company adopted the accounting standard update regarding revenue recognition for multiple deliverable arrangements. The new standard requires an entity to allocate revenue in an arrangement that includes elements with stand-alone value using its best estimate of selling price for each element if neither vendor specific objective evidence nor third party evidence of selling price exists. The adoption of this standard update did not have a material effect on the Company’s condensed consolidated balance sheets or statements of operations for the three months ended March 31, 2011.

Revenue

The Company’s revenue is derived primarily from business communications services, including data, Internet, voice and network access services. Data and Internet services include services that enable customers to connect their internal computer networks and to access external networks, including Internet access at high speeds using Ethernet protocol, metropolitan and wide area Ethernet and virtual private network solutions.

Network services are point-to-point services that transmit voice, data and images as well as enable transmission for storage using state-of-the-art fiber optics, and collocation services which provides secure space with controlled climate and power where customers can locate their equipment to connect to our network in facilities equipped for enterprise information technology environmental requirements. Voice services include traditional and next generation voice capabilities, including voice services from stand alone and bundled products, long distance, toll free services and Voice over IP (“VoIP”). Converged services fully integrate any combination of communication applications including IP Virtual Private Network (“VPN”), voice, Internet, security and managed router service into a single managed IP solution, and the various components of this service are classified into the pertinent service categories in the condensed consolidated statement of operations.

Intercarrier compensation is comprised of switched access services and reciprocal compensation. Switched access represents the compensation from another carrier for the delivery of traffic from a long distance carrier’s point of presence to an end-user’s premises provided through the Company’s switching facilities. The Federal Communications Commission (“FCC”) and state public utility commissions regulate switched access rates in their respective jurisdictions. Reciprocal compensation represents compensation from local exchange carriers (“LECs”) for local exchange traffic originated on another LEC’s facilities and terminated on the Company’s facilities.

8

Table of Contents

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The Company’s customers are principally enterprise organizations from a wide variety of business segments including, among others, financial services, technology and scientific, health care and professional services industries and public sector entities as well as carriers, including incumbent local exchange carriers (“ILECs”), competitive local exchange carriers (“CLECs”), wireless communications companies and Internet service providers (“ISPs”).

Revenue for network, data and Internet, and the majority of voice services is generally billed in advance on a monthly fixed rate basis and recognized over the period the services are provided. Revenue for the majority of intercarrier compensation and certain components of voice services, such as long distance, is generally billed on a transactional basis in arrears based on a customer’s actual usage and estimates are used to recognize revenue in the period earned.

The Company evaluates whether receivables are reasonably assured of collection based on certain factors, including the likelihood of billing being disputed by customers. If there is a billing dispute with a customer, revenue generally is not recognized until the dispute is resolved. The Company does not recognize revenue associated with contract termination charges until cash is received.

The Company classifies certain taxes and fees billed to customers and remitted to government authorities on a gross versus net basis in revenue and expense. In making this determination, the Company assesses, among other things, whether the Company is the primary obligor or principal taxpayer for the taxes and fees assessed in each jurisdiction where the Company does business. In jurisdictions where the Company determines that it is the principal taxpayer, the Company records the taxes and fees on a gross basis, including the taxes and fees in revenue and expense. In jurisdictions where the Company determines that it is merely a collection agent for the government authority, the Company records the taxes on a net basis. The total amounts classified as revenue associated with such taxes and fees were approximately $15.1 million and $12.1 million for the three months ended March 31, 2011 and 2010, respectively.

Significant Customers

The Company has substantial business relationships with a few large customers, including major telecommunications carriers. The Company’s 10 largest customers accounted for an aggregate of 19% and 20% of the Company’s total revenue for the three months ended March 31, 2011 and 2010, respectively. No individual customer accounted for 10% or more of total revenue for the three months ended March 31, 2011 or 2010. Our largest customer (AT&T Inc., a carrier) represented 4% and 5% of our total revenue in the three months ended March 31, 2011 and 2010, respectively.

2. Restatement of Condensed Consolidated Financial Statements

The Company’s financial statements for the three months ended March 31, 2011 and 2010 included in its Original Form 10-Q were prepared reflecting the reliance on a tax planning strategy for the sale and leaseback of appreciated assets to support the recognition of certain deferred tax assets in periods prior to June 30, 2010. The reliance on this tax planning strategy and related accounting conclusions resulted in a lower valuation allowance against the Company’s historical deferred tax assets in periods prior to June 30, 2010. The restated financial statements correct errors in the previously issued financials statements related to the reliance on this tax planning strategy and reflect an increase in accumulated deficit and income tax expense and a reduction to additional paid-in capital to increase the historical valuation allowance against the deferred tax assets followed by a subsequent reversal of the increased valuation allowance reflected in income tax expense and accumulated deficit in the year ended December 31, 2010. The following tables summarize the impacts of these adjustments on the Company’s previously reported results filed on our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2011.

9

Table of Contents

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The effects of the restatement on the condensed consolidated balance sheets as of March 31, 2011 and December 31, 2010 are summarized in the following table:

| March 31, 2011 | ||||||||||||

| Previously Reported |

Adjustments | Restated | ||||||||||

| (amounts in thousands, except per share amounts) | ||||||||||||

| Assets: |

||||||||||||

| Deferred income taxes - current |

$ | 42,433 | $ | (2,005 | ) | $ | 40,428 | |||||

| Total current assets |

623,482 | (2,005 | ) | 621,477 | ||||||||

| Deferred income taxes - non current |

231,410 | (16,203 | ) | 215,207 | ||||||||

| Total assets |

2,677,290 | (18,208 | ) | 2,659,082 | ||||||||

| Liabilities and Stockholders’ Equity: |

||||||||||||

| Additional paid-in capital |

1,823,334 | (18,208 | ) | 1,805,126 | ||||||||

| Total stockholders’ equity |

993,894 | (18,208 | ) | 975,686 | ||||||||

| Total liabilities and stockholders’ equity |

2,677,290 | (18,208 | ) | 2,659,082 | ||||||||

| December 31, 2010 | ||||||||||||

| Previously Reported |

Adjustments | Restated | ||||||||||

| (amounts in thousands, except per share amounts) | ||||||||||||

| Assets: |

||||||||||||

| Deferred income taxes - current |

$ | 42,433 | $ | (2,005 | ) | $ | 40,428 | |||||

| Total current assets |

616,560 | (2,005 | ) | 614,555 | ||||||||

| Deferred income taxes - non current |

240,998 | (16,203 | ) | 224,795 | ||||||||

| Total assets |

2,669,162 | (18,208 | ) | 2,650,954 | ||||||||

| Liabilities and Stockholders’ Equity: |

||||||||||||

| Additional paid-in capital |

1,821,154 | (18,208 | ) | 1,802,946 | ||||||||

| Total stockholders’ equity |

984,849 | (18,208 | ) | 966,641 | ||||||||

| Total liabilities and stockholders’ equity |

2,669,162 | (18,208 | ) | 2,650,954 | ||||||||

The effects of the restatement on the condensed consolidated statements of operations for the three months ended March 31, 2010 are summarized in the following table:

| Previously Reported |

Adjustments | Restated | ||||||||||

| (amounts in thousands, except per share amounts) | ||||||||||||

| Income tax expense |

$ | 375 | $ | 2,317 | $ | 2,692 | ||||||

| Net loss |

(4,462 | ) | (2,317 | ) | (6,779 | ) | ||||||

| Earnings per share: |

||||||||||||

| Basic |

$ | (0.03 | ) | $ | (0.02 | ) | $ | (0.05 | ) | |||

| Diluted |

$ | (0.03 | ) | $ | (0.02 | ) | $ | (0.05 | ) | |||

The effects of the restatement on the condensed consolidated statements of cash flows for the three months ended March 31, 2010 are summarized in the following table:

| Previously Reported |

Adjustments | Restated | ||||||||||

| (amounts in thousands) | ||||||||||||

| Cash flow from operating activities: |

||||||||||||

| Net loss |

$ | (4,462 | ) | $ | (2,317 | ) | $ | (6,779 | ) | |||

| Deferred income taxes |

— | 2,317 | 2,317 | |||||||||

| Net cash provided by operating activities |

97,261 | — | 97,261 | |||||||||

3. Earnings (Loss) Per Common Share and Potential Common Share

Basic earnings (loss) per common share (“EPS”) is measured as the income or loss allocated to common stockholders divided by the weighted average outstanding common shares for the period. Diluted EPS is similar to basic EPS but presents the dilutive effect on a per share basis of potential common shares (such as, convertible securities and stock options) as if they had been converted to shares at the beginning of the period presented. Potential common shares that have an anti-dilutive effect (e.g., those that increase income per share or decrease loss per share) are excluded from diluted EPS.

10

Table of Contents

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The following is a reconciliation of the number of shares used in the basic and diluted EPS computations:

| Three months ended March 31, |

||||||||

| 2011 | 2010 | |||||||

| Restated | ||||||||

| (amounts in thousands, except per share amounts) |

||||||||

| Numerator |

||||||||

| Net income (loss) |

$ | 12,619 | $ | (6,779 | ) | |||

| Allocation of net income to unvested restricted stock awards |

(225 | ) | — | |||||

|

|

|

|

|

|||||

| Net income allocated to common stockholders, basic and diluted |

$ | 12,394 | $ | (6,779 | ) | |||

|

|

|

|

|

|||||

| Denominator |

||||||||

| Basic weighted average shares outstanding |

147,565 | 149,296 | ||||||

| Dilutive potential common shares: |

||||||||

| Stock options |

1,624 | — | ||||||

| Unvested restricted stock units |

505 | — | ||||||

|

|

|

|

|

|||||

| Diluted weighted average shares outstanding |

149,694 | 149,296 | ||||||

| Basic earnings (loss) per share |

$ | 0.08 | $ | (0.05 | ) | |||

|

|

|

|

|

|||||

| Diluted earnings (loss) per share |

$ | 0.08 | $ | (0.05 | ) | |||

|

|

|

|

|

|||||

Options to purchase shares of the Company’s common stock, restricted stock awards and restricted stock units to be settled in common stock upon vesting and shares of common stock subject to issuance upon conversion of the Company’s Convertible Debentures due 2026 (“Convertible Debentures”), which were excluded from the computation of diluted weighted average shares outstanding if their inclusion would be anti-dilutive, totaled 28.0 million shares and 34.7 million shares for the three months ended March 31, 2011 and 2010, respectively.

4. Investments

The Company’s investments at March 31, 2011 and December 31, 2010 are summarized as follows:

| March 31, 2011 |

December 31, 2010 |

|||||||

| (amounts in thousands) | ||||||||

| Cash equivalents: |

||||||||

| U.S. Treasury money market mutual funds |

$ | 321,238 | $ | 323,206 | ||||

| Corporate debt securities |

31,895 | 30,495 | ||||||

|

|

|

|

|

|||||

| Total cash equivalents |

353,133 | 353,701 | ||||||

| Investments: |

||||||||

| Corporate debt securities |

82,082 | 88,471 | ||||||

| Debt securities issued by U.S. Government agencies |

35,465 | 30,201 | ||||||

|

|

|

|

|

|||||

| Total investments |

117,547 | 118,672 | ||||||

|

|

|

|

|

|||||

| Total cash equivalents and investments |

$ | 470,680 | $ | 472,373 | ||||

|

|

|

|

|

|||||

At March 31, 2011 and December 31, 2010, the carrying values of investments included in cash and cash equivalents approximated fair value. The aggregate fair value of available-for-sale securities by major security type is included in Note 6. The amortized cost basis of the available-for-sale securities was not materially different from their aggregate fair value. The contractual maturities of the Company’s available-for-sale securities are all within one year.

11

Table of Contents

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Proceeds from the sale and maturity of available-for-sale securities during the three months ended March 31, 2011 and 2010 were $43.3 million and $15.1 million, respectively. Gains and losses on investments are calculated using the specific identification method and are recognized during the period the investment is sold. The Company recognized no material unrealized or realized net gains or losses during the three months ended March 31, 2011 or 2010.

5. Long-Term Debt and Capital Lease Obligations

The components of long-term debt and capital lease obligations at March 31, 2011 and December 31, 2010 were as follows:

| March 31, 2011 |

December 31, 2010 |

|||||||

| (amounts in thousands) | ||||||||

| Term Loan B - January 2013 tranche, due 2013 |

$ | 102,861 | $ | 103,130 | ||||

| Term Loan B - extended tranche, due 2016 |

471,639 | 472,870 | ||||||

| 8% Senior Notes, due 2018 |

430,000 | 430,000 | ||||||

|

2 3/8% Convertible Senior Debentures, due 2026 (1) |

373,744 | 373,744 | ||||||

| Capital lease obligations |

14,786 | 15,260 | ||||||

|

|

|

|

|

|||||

| Total obligations |

1,393,030 | 1,395,004 | ||||||

| Unamortized discounts |

(44,644 | ) | (49,505 | ) | ||||

| Current portion |

(6,968 | ) | (7,202 | ) | ||||

|

|

|

|

|

|||||

| Total long-term debt and capital lease obligations |

$ | 1,341,418 | $ | 1,338,297 | ||||

|

|

|

|

|

|||||

| (1) | The Convertible Debentures are redeemable in whole or in part at the Company’s option at any time on or after April 6, 2013 at a redemption price equal to 100% of the principal amount of the debentures to be redeemed, plus accrued and unpaid interest. Holders of the 2 3/8% Convertible Senior Debentures have the option to require the Company to purchase all or part of the Convertible Debentures on April 1, 2013, April 1, 2016, or April 1, 2021, or at any time prior to April 1, 2026 to convert the debentures into shares of the Company’s common stock. |

As of March 31, 2011, the Company and its wholly-owned subsidiary, tw telecom holdings inc. (“Holdings”), were in compliance with all of their debt covenants.

6. Derivative Instruments

Holdings’ variable rate Term Loan B due 2013 and 2016 (the “Term Loan”) exposes the Company to variability in interest payments due to changes in interest rates. In order to mitigate interest rate fluctuations on the Term Loan, Holdings has entered into an interest rate swap agreement. The interest rate swap agreement effectively converts a portion of Holdings’ floating-rate debt to a fixed-rate basis for the term of the agreement to reduce the impact of interest rate changes on future interest expense. The Company has designated its interest rate swap agreement as a cash flow hedge.

If certain correlation and risk reduction criteria are met, the derivative is deemed to be highly effective in offsetting the changes in cash flows of the hedged item on a retrospective and prospective basis, and may be specifically designated as a hedge of exposure to changes in cash flow. For derivative instruments that are designated and qualify as a cash flow hedge, the effective portion of the gain or loss on the derivative instrument is reported as a component of other comprehensive income or loss. Amounts excluded from the assessment of hedge effectiveness, if any, as well as the ineffective portion of the gain or loss, are reported in results of operations immediately. The Company performs a quarterly assessment to determine whether its derivative instrument is highly effective in offsetting changes in cash flows of the hedged item. If the derivative instrument is determined to be not highly effective as a hedge, or if a derivative instrument ceases to be a highly effective hedge, hedge accounting is discontinued prospectively with respect to that derivative instrument.

The following table reflects the terms of Holdings’ interest rate swap agreement in effect at March 31, 2011:

| Term |

Notional amount |

Fixed rate |

Total weighted average rate, including spread |

|||||||||||

| Beginning |

End | |||||||||||||

| November 28, 2008 |

November 28, 2011 | $ 100 million | 2.96 | % | 5.94 | % | ||||||||

12

Table of Contents

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The following table summarizes the fair value of derivatives reported in the condensed consolidated balance sheets:

| Liability Derivatives |

||||||||||

|

Balance Sheet Location |

March 31, 2011 |

December 31, 2010 |

||||||||

| Derivatives- cash flow hedges |

||||||||||

| (amounts in thousands) | ||||||||||

| Interest rate swap agreement |

Other current liabilities | $ | 1,791 | $ | 2,412 | |||||

|

|

|

|

|

|||||||

| Total fair value of derivatives designated as cash flow hedges |

$ | 1,791 | $ | 2,412 | ||||||

|

|

|

|

|

|||||||

The unrecognized losses for the interest rate swap agreement included in accumulated other comprehensive loss at March 31, 2011 and December 31, 2010 were $1.8 million and $2.4 million, respectively. Based on the fair value of the interest rate swap of $1.8 million at March 31, 2011, the Company expects to recognize in interest expense approximately $1.8 million of net losses on the interest rate swap agreement through the expiration date on November 28, 2011 upon payment of interest associated with the Term Loan. Actual amounts ultimately recognized in interest expense depend on the interest rates in effect when settlements on the interest rate swap agreement occur each month. The variable rate, including the applicable spread, in effect at March 31, 2011 for the Term Loan, excluding the impact of the interest rate swap agreement, was 2.00% on the January 2013 tranche and 3.50% on the extended tranche. The effect of the interest rate swap agreements on the condensed consolidated statements of operations was as follows for the three months ended March 31, 2011 and 2010:

| Three Months Ended March 31, | ||||||||

| 2011 | 2010 | |||||||

| (amounts in thousands) | ||||||||

| Gain/(Loss) recognized in other comprehensive income/(loss) (effective portion) |

$ | (53 | ) | $ | (937 | ) | ||

|

|

|

|

|

|||||

| Gain/(Loss) reclassified from accumulated other comprehensive loss into interest expense (effective portion) |

$ | (674 | ) | $ | (1,429 | ) | ||

|

|

|

|

|

|||||

| Gain/(Loss) recognized in income (ineffective portion and amount excluded from effectiveness testing) |

$ | — | $ | — | ||||

|

|

|

|

|

|||||

7. Fair Value Measurements

Fair value, as defined by relevant accounting standards, is the price that would be received from selling an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. When determining the fair value measurements for assets and liabilities required to be recorded at fair value, the Company considers the principal or most advantageous market in which it would complete a transaction and considers assumptions that market participants would use when pricing the asset or liability, such as inherent risk, transfer restrictions and risk of nonperformance.

Fair Value Hierarchy

Relevant accounting standards set forth a fair value hierarchy that requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. A financial instrument’s categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. Relevant accounting standards establish three levels of inputs that may be used to measure fair value:

| • | Level 1—Quoted prices in active markets for identical assets or liabilities. Level 1 assets that are measured at fair value on a recurring basis consist of the Company’s investment in U.S. Treasury money market mutual funds that are traded in an active market with sufficient volume and frequency of transactions, and are included as a component of cash and cash equivalents in the condensed consolidated balance sheets. |

| • | Level 2—Observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets with insufficient volume or infrequent transactions (less active markets); or model-derived valuations in which all significant inputs are observable or can be derived principally from or corroborated by observable market data for substantially the full term of the assets or liabilities. Level 2 assets that are measured at fair value on a recurring basis consist of the Company’s investments in corporate debt securities and debt securities issued by U.S. government agencies using observable inputs in less active markets and are included as a component of cash equivalents and investments in the condensed consolidated balance sheets. Level 2 liabilities that are measured at fair value on a recurring basis include the Company’s interest rate swap agreement priced using discounted cash flow techniques that use observable market inputs, such as LIBOR-based yield curves, forward rates, and credit ratings, and are included as a component of other current liabilities in the condensed consolidated balance sheets. |

13

Table of Contents

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

| • | Level 3—Unobservable inputs to the valuation methodology that are significant to the measurement of fair value of assets or liabilities. The Company did not have any Level 3 assets that were measured at fair value as of March 31, 2011 and December 31, 2010. |

The following table reflects assets and liabilities that are measured and carried at fair value on a recurring basis as of March 31, 2011 and December 31, 2010:

| Fair Value Measurements At March 31, 2011 |

||||||||||||||||

| Level 1 | Level 2 | Level 3 | Assets/Liabilities at Fair Value |

|||||||||||||

| (amounts in thousands) | ||||||||||||||||

| Assets |

||||||||||||||||

| U.S. Treasury money market mutual funds |

$ | 321,238 | $ | — | $ | — | $ | 321,238 | ||||||||

| Corporate debt securities |

— | 31,895 | — | 31,895 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Investments included in cash and cash equivalents |

$ | 321,238 | $ | 31,895 | $ | — | $ | 353,133 | ||||||||

| Corporate debt securities |

— | 82,082 | — | 82,082 | ||||||||||||

| Debt securities issued by U.S. Government agencies |

— | 35,465 | — | 35,465 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Short-term investments |

$ | — | $ | 117,547 | $ | — | $ | 117,547 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total assets |

$ | 321,238 | $ | 149,442 | $ | — | $ | 470,680 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Liabilities |

||||||||||||||||

| Interest rate swap agreement |

$ | — | $ | 1,791 | $ | — | $ | 1,791 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total liabilities. |

$ | — | $ | 1,791 | $ | — | $ | 1,791 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Fair Value Measurements At December 31, 2010 |

||||||||||||||||

| Level 1 | Level 2 | Level 3 | Assets/Liabilities at Fair Value |

|||||||||||||

| (amounts in thousands) | ||||||||||||||||

| Assets |

||||||||||||||||

| U.S. Treasury money market mutual funds |

$ | 323,206 | $ | — | $ | — | $ | 323,206 | ||||||||

| Corporate debt securities |

— | 30,495 | — | 30,495 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Investments included in cash and cash equivalents |

$ | 323,206 | $ | 30,495 | $ | — | $ | 353,701 | ||||||||

| Corporate debt securities |

— | 88,471 | — | 88,471 | ||||||||||||

| Debt securities issued by U.S. Government agencies |

— | 30,201 | — | 30,201 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Short-term investments |

$ | — | $ | 118,672 | $ | — | $ | 118,672 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total assets |

$ | 323,206 | $ | 149,167 | $ | — | $ | 472,373 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Liabilities |

||||||||||||||||

| Interest rate swap agreement |

$ | — | $ | 2,412 | $ | — | $ | 2,412 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total liabilities. |

$ | — | $ | 2,412 | $ | — | $ | 2,412 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

14

Table of Contents

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

While the Company’s long- term debt has not been listed on any securities exchange or inter-dealer automated quotation system, the Company has estimated the fair value of its long-term debt based on indicative pricing published by certain investment banks. While the Company believes these approximations to be reasonably accurate at the time published, indicative pricing can vary widely depending on volume traded by any given investment bank and other factors. The following table summarizes the carrying amounts and estimated fair values of the Company’s long-term debt, including the current portion.

| March 31, 2011 | December 31, 2010 | |||||||||||||||

| Carrying Value |

Fair Value | Carrying Value |

Fair Value | |||||||||||||

| (amounts in thousands) | ||||||||||||||||

| Term Loan B - January 2013 tranche |

$ | 102,861 | $ | 102,475 | $ | 103,130 | $ | 101,841 | ||||||||

| Term Loan B - Extended tranche, due 2016 |

471,639 | 472,818 | 472,870 | 472,870 | ||||||||||||

| 8% Senior Notes, net of discount |

427,324 | 464,400 | 427,227 | 459,025 | ||||||||||||

| 2 3/8% Convertible Senior Debentures, net of discount |

331,776 | 443,821 | 327,012 | 412,987 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total debt |

$ | 1,333,600 | $ | 1,483,514 | $ | 1,330,239 | $ | 1,446,723 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

8. Stock-based Compensation

During the three months ended March 31, 2011, the Company granted restricted stock awards and restricted stock units with respect to 2.1 million shares. There were no stock options granted during the three months ended March 31, 2011. As of March 31, 2011, the Company had 4.3 million restricted stock awards and restricted stock units that were unvested and 8.6 million options outstanding, of which 6.6 million were exercisable.

As of March 31, 2011, there was $10.0 million of total unrecognized compensation expense related to unvested stock options, which is expected to be recognized over a weighted-average period of 1.7 years, and $59.5 million of total unrecognized compensation expense related to unvested restricted stock awards and restricted stock units, which is expected to be recognized over a weighted-average period of 1.8 years.

9. Commitments and Contingencies

Management routinely reviews the Company’s exposure to liabilities incurred in the normal course of its business operations. Where a probable contingency exists and the amount can be reasonably estimated, the Company records the estimated liability. Considerable judgment is required in analyzing and recording such liabilities and actual results may vary from the estimates.

The Company’s pending legal proceedings are limited to litigation incidental to its business. In the opinion of management, the ultimate resolution of these matters will not have a material adverse effect on the Company’s financial statements.

10. Supplemental Guarantor Information

In March 2010, Holdings (“Issuer”) issued 8% Senior Notes due 2018 (the “2018 Notes”) with a principal amount of $430 million. The 2018 Notes are unsecured obligations of the Issuer and are guaranteed by the Company (“Parent Guarantor”) and substantially all of the Issuer’s subsidiaries (“Combined Subsidiary Guarantors”). The guarantees are joint and several. A significant amount of the Issuer’s cash flow is generated by the Combined Subsidiary Guarantors. As a result, funds necessary to meet the Issuer’s debt service obligations are provided in large part by distributions or advances from the Combined Subsidiary Guarantors. The 2018 Notes are governed by an indenture that contains certain restrictive covenants. These restrictions affect, and in many respects significantly limit or prohibit, among other things, the ability of the Parent Guarantor, the Issuer and its subsidiaries to incur indebtedness, make prepayments of certain indebtedness, pay dividends, make investments, engage in transactions with stockholders and affiliates, issue capital stock of subsidiaries, create liens, sell assets, and engage in mergers and consolidations.

The following information sets forth the Company’s Condensed Consolidating Balance Sheets as of March 31, 2011 and December 31, 2010, Condensed Consolidating Statements of Operations for the three months ended March 31, 2011 and 2010, and Condensed Consolidating Statements of Cash Flows for the three months ended March 31, 2011 and 2010.

15

Table of Contents

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

tw telecom inc.

CONDENSED CONSOLIDATING BALANCE SHEET

March 31, 2011

Restated

| Parent Guarantor |

Issuer | Combined Subsidiary Guarantors |

Eliminations | Consolidated | ||||||||||||||||

| (amounts in thousands) | ||||||||||||||||||||

| ASSETS | ||||||||||||||||||||

| Current assets: |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 24,542 | $ | 337,673 | $ | — | $ | — | $ | 362,215 | ||||||||||

| Investments |

— | 117,547 | — | — | 117,547 | |||||||||||||||

| Receivables, net |

— | — | 81,819 | — | 81,819 | |||||||||||||||

| Prepaid expenses and other current assets |

— | 10,664 | 8,804 | — | 19,468 | |||||||||||||||

| Deferred income taxes |

— | 40,408 | 20 | — | 40,428 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total current assets |

24,542 | 506,292 | 90,643 | — | 621,477 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Property, plant and equipment, net |

— | 46,172 | 1,323,768 | — | 1,369,940 | |||||||||||||||

| Deferred income taxes |

— | 214,702 | 505 | — | 215,207 | |||||||||||||||

| Goodwill |

— | — | 412,694 | — | 412,694 | |||||||||||||||

| Intangible and other assets, net |

2,196 | 14,748 | 22,820 | — | 39,764 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

$ | 26,738 | $ | 781,914 | $ | 1,850,430 | $ | — | $ | 2,659,082 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) |

||||||||||||||||||||

| Current liabilities: |

||||||||||||||||||||

| Accounts payable |

$ | — | $ | 20,402 | $ | 49,348 | $ | — | $ | 69,750 | ||||||||||

| Other current liabilities |

4,438 | 48,718 | 173,695 | — | 226,851 | |||||||||||||||

| Intercompany payable (receivable) |

(1,851,553 | ) | (600,934 | ) | 2,452,487 | — | — | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total current liabilities |

(1,847,115 | ) | (531,814 | ) | 2,675,530 | — | 296,601 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Losses in subsidiary in excess of investment |

566,391 | 1,035,013 | — | (1,601,404 | ) | — | ||||||||||||||

| Long-term debt and capital lease obligations, net |

331,776 | 995,824 | 13,818 | — | 1,341,418 | |||||||||||||||

| Long-term deferred revenue |

— | — | 14,356 | — | 14,356 | |||||||||||||||

| Other long-term liabilities |

— | 5,291 | 25,730 | — | 31,021 | |||||||||||||||

| Stockholders’ equity (deficit) |

975,686 | (722,400 | ) | (879,004 | ) | 1,601,404 | 975,686 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities and stockholders’ equity (deficit) |

$ | 26,738 | $ | 781,914 | $ | 1,850,430 | $ | — | $ | 2,659,082 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

16

Table of Contents

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

tw telecom inc.

CONDENSED CONSOLIDATING BALANCE SHEET

December 31, 2010

Restated

| Parent Guarantor |

Issuer | Combined Subsidiary Guarantors |

Eliminations | Consolidated | ||||||||||||||||

| (amounts in thousands) | ||||||||||||||||||||

| ASSETS | ||||||||||||||||||||

| Current assets: |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 24,542 | $ | 332,380 | $ | — | $ | — | $ | 356,922 | ||||||||||

| Investments |

— | 118,672 | — | — | 118,672 | |||||||||||||||

| Receivables, net |

— | — | 81,598 | — | 81,598 | |||||||||||||||

| Prepaid expenses and other current assets |

— | 10,002 | 6,933 | — | 16,935 | |||||||||||||||

| Deferred income taxes |

— | 40,408 | 20 | — | 40,428 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total current assets |

24,542 | 501,462 | 88,551 | — | 614,555 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Property, plant and equipment, net |

— | 42,063 | 1,314,549 | — | 1,356,612 | |||||||||||||||

| Deferred income taxes |

— | 224,290 | 505 | — | 224,795 | |||||||||||||||

| Goodwill |

— | — | 412,694 | — | 412,694 | |||||||||||||||

| Intangible and other assets, net |

2,471 | 15,326 | 24,501 | — | 42,298 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

$ | 27,013 | $ | 783,141 | $ | 1,840,800 | $ | — | $ | 2,650,954 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) |

||||||||||||||||||||

| Current liabilities: |

||||||||||||||||||||

| Accounts payable |

$ | — | $ | 6,179 | $ | 47,257 | $ | — | $ | 53,436 | ||||||||||

| Other current liabilities |

2,219 | 65,719 | 180,414 | — | 248,352 | |||||||||||||||

| Intercompany payable (receivable) |

(1,850,975 | ) | (609,054 | ) | 2,460,029 | — | — | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total current liabilities |

(1,848,756 | ) | (537,156 | ) | 2,687,700 | — | 301,788 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Losses in subsidiary in excess of investment |

582,116 | 1,054,580 | — | (1,636,696 | ) | — | ||||||||||||||

| Long-term debt and capital lease obligations, net |

327,012 | 997,227 | 14,058 | — | 1,338,297 | |||||||||||||||

| Long-term deferred revenue |

— | — | 14,864 | — | 14,864 | |||||||||||||||

| Other long-term liabilities |

— | 4,073 | 25,291 | — | 29,364 | |||||||||||||||

| Stockholders’ equity (deficit) |

966,641 | (735,583 | ) | (901,113 | ) | 1,636,696 | 966,641 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities and stockholders’ equity (deficit) |

$ | 27,013 | $ | 783,141 | $ | 1,840,800 | $ | — | $ | 2,650,954 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

17

Table of Contents

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

tw telecom inc.

CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS

Three Months Ended March 31, 2011

| Parent Guarantor |

Issuer | Combined Subsidiary Guarantors |

Eliminations | Consolidated | ||||||||||||||||

| (amounts in thousands) | ||||||||||||||||||||

| Total revenue |

$ | — | $ | — | $ | 332,542 | $ | — | $ | 332,542 | ||||||||||

| Costs and expenses: |

||||||||||||||||||||

| Operating, selling, general and administrative |

— | 46,352 | 172,192 | — | 218,544 | |||||||||||||||

| Depreciation, amortization and accretion |

— | 4,855 | 64,881 | — | 69,736 | |||||||||||||||

| Corporate expense allocation |

— | (51,207 | ) | 51,207 | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total costs and expenses |

— | — | 288,280 | — | 288,280 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income |

— | — | 44,262 | — | 44,262 | |||||||||||||||

| Interest expense, net |

(7,257 | ) | (10,682 | ) | (3,890 | ) | — | (21,829 | ) | |||||||||||

| Interest expense allocation |

7,257 | 10,682 | (17,939 | ) | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before income taxes and equity in undistributed earnings of subsidiaries |

— | — | 22,433 | — | 22,433 | |||||||||||||||

| Income tax expense |

— | 9,489 | 325 | — | 9,814 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) before equity in undistributed earnings of subsidiaries |

— | (9,489 | ) | 22,108 | — | 12,619 | ||||||||||||||

| Equity in undistributed earnings of subsidiaries |

12,619 | 22,108 | — | (34,727 | ) | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

$ | 12,619 | $ | 12,619 | $ | 22,108 | $ | (34,727 | ) | $ | 12,619 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

18

Table of Contents

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

tw telecom inc.

CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS

Three Months Ended March 31, 2010

Restated

| Parent Guarantor |

Issuer | Combined Subsidiary Guarantors |

Eliminations | Consolidated | ||||||||||||||||

| (amounts in thousands) | ||||||||||||||||||||

| Total revenue |

$ | — | $ | — | $ | 311,211 | $ | — | $ | 311,211 | ||||||||||

| Costs and expenses: |

||||||||||||||||||||

| Operating, selling, general and administrative |

— | 45,471 | 158,486 | — | 203,957 | |||||||||||||||

| Depreciation, amortization and accretion |

— | 4,590 | 68,797 | — | 73,387 | |||||||||||||||

| Corporate expense allocation |

— | (50,061 | ) | 50,061 | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total costs and expenses |

— | — | 277,344 | — | 277,344 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income |

— | — | 33,867 | — | 33,867 | |||||||||||||||

| Interest expense, net |

(6,869 | ) | (10,423 | ) | (3,592 | ) | — | (20,884 | ) | |||||||||||

| Debt extinguishment costs |

— | (17,070 | ) | — | — | (17,070 | ) | |||||||||||||

| Interest expense allocation |

6,869 | 27,493 | (34,362 | ) | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before income taxes and equity in undistributed losses of subsidiaries |

— | — | (4,087 | ) | — | (4,087 | ) | |||||||||||||

| Income tax expense |

— | 2,317 | 375 | — | 2,692 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss before equity in undistributed losses of subsidiaries |

— | (2,317 | ) | (4,462 | ) | — | (6,779 | ) | ||||||||||||

| Equity in undistributed losses of subsidiaries |

(6,779 | ) | (4,462 | ) | — | 11,241 | — | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

$ | (6,779 | ) | $ | (6,779 | ) | $ | (4,462 | ) | $ | 11,241 | $ | (6,779 | ) | ||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

19

Table of Contents

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

tw telecom inc.

CONDENSED CONSOLIDATING STATEMENT OF CASH FLOWS

Three Months Ended March 31, 2011

| Parent Guarantor |

Issuer | Combined Subsidiary Guarantors |

Eliminations | Consolidated | ||||||||||||||||

| (amounts in thousands) | ||||||||||||||||||||

| Cash flows from operating activities: |

||||||||||||||||||||

| Net income |

$ | 12,619 | $ | 12,619 | $ | 22,108 | $ | (34,727 | ) | $ | 12,619 | |||||||||

| Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||||||||||||||

| Depreciation, amortization, and accretion |

— | 4,855 | 64,881 | — | 69,736 | |||||||||||||||

| Deferred income taxes |

— | 9,486 | — | — | 9,486 | |||||||||||||||

| Intercompany and equity investment changes |

(8,291 | ) | (11,445 | ) | (14,991 | ) | 34,727 | — | ||||||||||||

| Amortization of discount on debt and deferred debt issue costs and other |

5,039 | 656 | — | — | 5,695 | |||||||||||||||

| Stock-based compensation |

— | — | 7,448 | — | 7,448 | |||||||||||||||

| Changes in operating assets and liabilities |

2,219 | (903 | ) | (7,250 | ) | — | (5,934 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net cash provided by operating activities |

11,586 | 15,268 | 72,196 | — | 99,050 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Cash flows from investing activities: |

||||||||||||||||||||

| Capital expenditures |

— | (9,349 | ) | (69,927 | ) | — | (79,276 | ) | ||||||||||||

| Purchases of investments |

— | (42,735 | ) | — | — | (42,735 | ) | |||||||||||||

| Proceeds from sale of investments |

— | 43,286 | — | — | 43,286 | |||||||||||||||

| Proceeds from sale of assets and other investing activities, net |

— | 385 | (1,976 | ) | — | (1,591 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net cash used in investing activities |

— | (8,413 | ) | (71,903 | ) | — | (80,316 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Cash flows from financing activities: |

||||||||||||||||||||

| Net proceeds (tax withholdings) from issuance of common stock upon exercise of stock options and vesting of restricted stock awards and units |

(2,727 | ) | — | — | — | (2,727 | ) | |||||||||||||

| Purchases of treasury stock |

(8,859 | ) | — | — | — | (8,859 | ) | |||||||||||||

| Payment of debt and capital lease obligations |

— | (1,562 | ) | (293 | ) | — | (1,855 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net cash used in financing activities |

(11,586 | ) | (1,562 | ) | (293 | ) | — | (13,441 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Increase in cash and cash equivalents |

— | 5,293 | — | — | 5,293 | |||||||||||||||

| Cash and cash equivalents at beginning of period |

24,542 | 332,380 | — | — | 356,922 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Cash and cash equivalents at end of period |

$ | 24,542 | $ | 337,673 | $ | — | $ | — | $ | 362,215 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

20

Table of Contents

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

tw telecom inc.

CONDENSED CONSOLIDATING STATEMENT OF CASH FLOWS

Three Months Ended March 31, 2010

Restated

| Parent Guarantor |

Issuer | Combined Subsidiary Guarantors |

Eliminations | Consolidated | ||||||||||||||||

| (amounts in thousands) | ||||||||||||||||||||

| Cash flows from operating activities: |

||||||||||||||||||||

| Net loss |

$ | (6,779 | ) | $ | (6,779 | ) | $ | (4,462 | ) | $ | 11,241 | $ | (6,779 | ) | ||||||

| Adjustments to reconcile net loss to net cash provided by operating activities: |

||||||||||||||||||||

| Depreciation, amortization, and accretion |

— | 4,590 | 68,797 | — | 73,387 | |||||||||||||||

| Deferred income taxes |

— | 2,317 | — | — | 2,317 | |||||||||||||||

| Intercompany and equity investment changes |

(252 | ) | 17,753 | (6,260 | ) | (11,241 | ) | — | ||||||||||||

| Extinguishment costs, discount on debt and deferred debt issue |

4,651 | 17,495 | — | — | 22,146 | |||||||||||||||

| Stock based compensation |

— | — | 6,977 | — | 6,977 | |||||||||||||||

| Changes in operating assets and liabilities |

2,219 | (19,078 | ) | 16,072 | — | (787 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net cash (used in) provided by operating activities |

(161 | ) | 16,298 | 81,124 | — | 97,261 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Cash flows from investing activities: |

||||||||||||||||||||

| Capital expenditures |

— | (2,231 | ) | (78,698 | ) | — | (80,929 | ) | ||||||||||||

| Purchases of investments |

— | (90,025 | ) | — | — | (90,025 | ) | |||||||||||||

| Proceeds from sale of investments |

— | 15,075 | — | — | 15,075 | |||||||||||||||

| Other investing activities |

— | 76 | (2,401 | ) | — | (2,325 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net cash used in investing activities |

— | (77,105 | ) | (81,099 | ) | — | (158,204 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Cash flows from financing activities: |

||||||||||||||||||||

| Net proceeds (tax withholdings) from issuance of common stock upon exercise of stock options and vesting of restricted stock awards and units |

167 | — | — | — | 167 | |||||||||||||||

| Net proceeds from issuance of debt |

— | 417,477 | — | — | 417,477 | |||||||||||||||

| Retirement of debt obligations |

(6 | ) | (413,677 | ) | — | — | (413,683 | ) | ||||||||||||

| Payment of debt and capital lease obligations |

— | (1,989 | ) | (25 | ) | — | (2,014 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net cash provided by (used in) financing activities |

161 | 1,811 | (25 | ) | — | 1,947 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Decrease in cash and cash equivalents |

— | (58,996 | ) | — | — | (58,996 | ) | |||||||||||||

| Cash and cash equivalents at beginning of period |

24,540 | 421,367 | — | — | 445,907 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Cash and cash equivalents at end of period |

$ | 24,540 | $ | 362,371 | $ | — | $ | — | $ | 386,911 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

21

Table of Contents

tw telecom inc.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations has been updated to reflect the restatement of the condensed consolidated statements of operations and cash flows for the three months ended March 31, 2010, and the consolidated balance sheets as of March 31, 2011 and December 31, 2010. The restatement increased the tax expense and net loss $2.3 million for the three months ended March 31, 2010 and approximately $18.2 million of a valuation allowance reducing deferred tax assets on the balance sheets as of March 31, 2011 and December 31, 2010. For a more detailed description of the restatement, see Note 2 – Restatement of Condensed Consolidated Financial Statements.

The following discussion and analysis provides information concerning the results of operations and financial condition of the Company and should be read in conjunction with the accompanying condensed consolidated financial statements and notes thereto. This discussion and analysis also should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations and the consolidated financial statements included in Part II of our Annual Report on Form 10-K/A for the year ended December 31, 2010. References in this item to “we,” “our,” or “us” are to the Company and its subsidiaries on a consolidated basis unless the context otherwise requires.

Cautions Concerning Forward-Looking Statements