Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ALLIANCE DATA SYSTEMS CORP | form_8k.htm |

©2011 ADS Alliance Data Systems, Inc.

Confidential and Proprietary

Alliance Data

Company Overview

NYSE: ADS

Company Overview

NYSE: ADS

Fourth Quarter 2011

NYSE: ADS | 4Q2011

2

©2011 ADS Alliance Data Systems, Inc.

Confidential and Proprietary

Three Businesses. One Focus.

The largest and most comprehensive provider of

transaction-based marketing and loyalty solutions.

These solutions are delivered through three businesses:

transaction-based marketing and loyalty solutions.

These solutions are delivered through three businesses:

Designs and executes

ROI-based marketing

programs that deliver

measurable results

ROI-based marketing

programs that deliver

measurable results

Designs, delivers and

manages a suite of loyalty

marketing programs and

services to profitably

change customer behavior

manages a suite of loyalty

marketing programs and

services to profitably

change customer behavior

Drives sales for our clients

by providing marketing

driven branded credit

programs that build

customer loyalty

by providing marketing

driven branded credit

programs that build

customer loyalty

Private Label

Opportunity: ~$380 Billion Addressable Market

Marketing spend is shifting from traditional mass marketing

to data-enabled, multi-channel direct marketing

to data-enabled, multi-channel direct marketing

The digital channel spend directed toward transaction-based, ROI solutions:

Strong double-digit growth market | Still less than 10% of $380+ billion prize

NYSE: ADS | 4Q2011

3

©2011 ADS Alliance Data Systems, Inc.

Confidential and Proprietary

The Alliance Data End-to-End Solution

Three Platforms, One Model

Three Platforms, One Model

Strategy/

Creative

Analytics

and Insights

and Insights

Distribution

Data and

Database

LoyaltyOne | Epsilon | Private Label

Results and

Measurement

Measurement

Mobile

Direct Mail

In-store

Permission-

based Email

based Email

Social Media

On-line

Call Center

NYSE: ADS | 4Q2011

4

©2011 ADS Alliance Data Systems, Inc.

Confidential and Proprietary

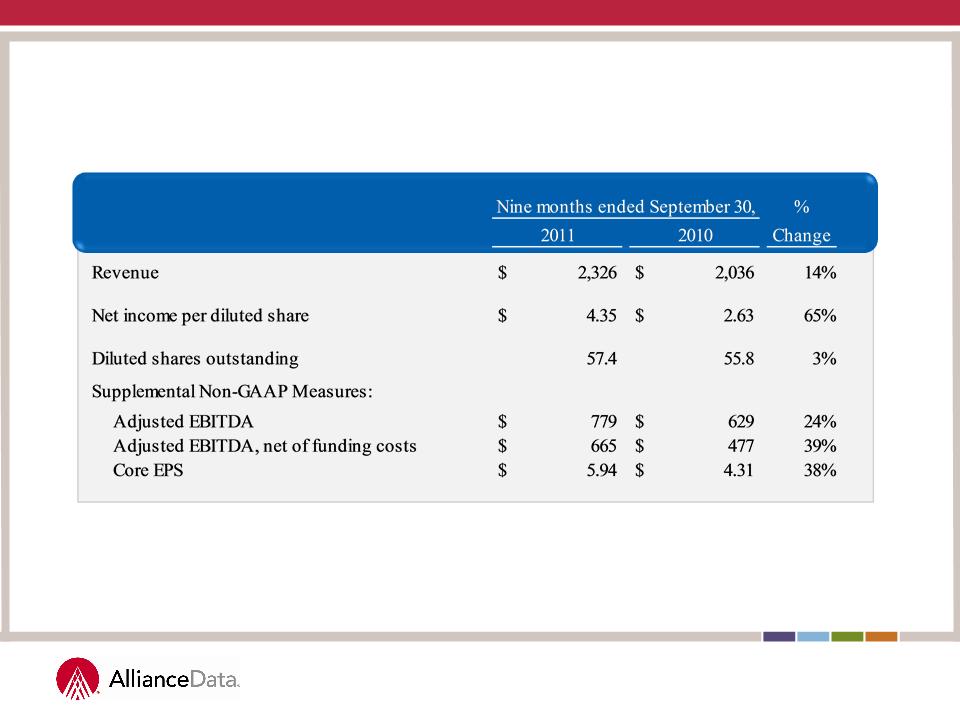

YTD 2011 Operating Results

($MM, except per share data)

($MM, except per share data)

NYSE: ADS | 4Q2011

5

©2011 ADS Alliance Data Systems, Inc.

Confidential and Proprietary

|

|

Actual

2010

|

New

Guidance -

2011

|

%

Increase

|

||

|

Revenue

|

$

|

2.8 bn

|

$

|

3.2 bn

|

+14%

|

|

Adjusted EBITDA

|

$

|

823 mm

|

$

|

997 mm

|

+21%

|

|

EPS

|

$

|

3.48

|

$

|

5.27

|

+51%

|

|

Core EPS

|

$

|

5.86

|

$

|

7.40

|

+26%

|

|

Diluted share count

|

|

55.7 mm

|

|

58.2 mm

|

+5%

|

|

Phantom Shares*

|

|

1.8 mm

|

|

4.4 mm

|

|

|

|

|

|

|

|

|

2011 Updated Guidance

* Shares covered by counterparty hedge agreements, which the Company has no obligation

to settle.

to settle.

NYSE: ADS | 4Q2011

6

©2011 ADS Alliance Data Systems, Inc.

Confidential and Proprietary

2012 Initial Guidance

|

|

2011

|

2012

|

%

Increase

|

||

|

Revenue

|

$

|

3.2 bn

|

$

|

3.5 bn

|

+9%

|

|

Adjusted EBITDA

|

$

|

997 mm

|

$

|

1.1 bn

|

+13%

|

|

EPS

|

$

|

5.27

|

$

|

6.00

|

+14%

|

|

Core EPS

|

$

|

7.40

|

$

|

8.30

|

+12%

|

|

Diluted share count

|

|

58.2 mm

|

|

60.5 mm

|

+4%

|

|

Phantom Shares*

|

|

4.4 mm

|

|

6.0 mm

|

|

|

|

|

|

|

|

|

* Shares covered by counterparty hedge agreements, which the Company has no obligation

to settle.

to settle.

NYSE: ADS | 4Q2011

7

©2011 ADS Alliance Data Systems, Inc.

Confidential and Proprietary

Safe Harbor Statement and Forward-Looking Statements

This release may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements may use words such as “anticipate,”

“believe,” “estimate,” “expect,” “intend,” “predict,” “project” and similar expressions as they relate to us or our management. When

we make forward-looking statements, we are basing them on our management’s beliefs and assumptions, using information

currently available to us. Although we believe that the expectations reflected in the forward-looking statements are reasonable, these

forward-looking statements are subject to risks, uncertainties and assumptions, including the anticipated effects of the CARD Act,

potential effects of the Epsilon data theft incident, and those discussed in our filings with the Securities and Exchange Commission.

and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements may use words such as “anticipate,”

“believe,” “estimate,” “expect,” “intend,” “predict,” “project” and similar expressions as they relate to us or our management. When

we make forward-looking statements, we are basing them on our management’s beliefs and assumptions, using information

currently available to us. Although we believe that the expectations reflected in the forward-looking statements are reasonable, these

forward-looking statements are subject to risks, uncertainties and assumptions, including the anticipated effects of the CARD Act,

potential effects of the Epsilon data theft incident, and those discussed in our filings with the Securities and Exchange Commission.

If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual

results may vary materially from what we projected. Any forward-looking statements contained in this presentation reflect our

current views with respect to future events and are subject to these and other risks, uncertainties and assumptions relating to our

operations, results of operations, growth strategy and liquidity. We have no intention, and disclaim any obligation, to update or

revise any forward-looking statements, whether as a result of new information, future results or otherwise.

results may vary materially from what we projected. Any forward-looking statements contained in this presentation reflect our

current views with respect to future events and are subject to these and other risks, uncertainties and assumptions relating to our

operations, results of operations, growth strategy and liquidity. We have no intention, and disclaim any obligation, to update or

revise any forward-looking statements, whether as a result of new information, future results or otherwise.

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995: Statements in this presentation regarding

Alliance Data Systems Corporation’s business which are not historical facts are “forward-looking statements” that involve risks and

uncertainties. For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the

forward-looking statements, see “Risk Factors” in the Company’s Annual Report on Form 10-K for the most recently ended fiscal

year. Risk factors may be updated in Item 1A in each of the Company’s Quarterly Reports on Form 10-Q for each quarterly period

subsequent to the Company’s most recent Form 10-K.

Alliance Data Systems Corporation’s business which are not historical facts are “forward-looking statements” that involve risks and

uncertainties. For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the

forward-looking statements, see “Risk Factors” in the Company’s Annual Report on Form 10-K for the most recently ended fiscal

year. Risk factors may be updated in Item 1A in each of the Company’s Quarterly Reports on Form 10-Q for each quarterly period

subsequent to the Company’s most recent Form 10-K.

NYSE: ADS | 4Q2011

8

©2011 ADS Alliance Data Systems, Inc.

Confidential and Proprietary

Financial Measures

In addition to the results presented in accordance with generally accepted accounting principles, or GAAP, the Company

presents financial measures that are non-GAAP measures, such as constant currency financial measures, adjusted EBITDA,

adjusted EBITDA margin, adjusted EBITDA net of funding costs, core earnings and core earnings per diluted share (core

EPS). The Company believes that these non-GAAP financial measures, viewed in addition to and not in lieu of the

Company’s reported GAAP results, provide useful information to investors regarding the Company’s performance and

overall results of operations. These metrics are an integral part of the Company’s internal reporting to measure the

performance of reportable segments and the overall effectiveness of senior management. Reconciliations to comparable

GAAP financial measures are available in the accompanying schedules and on the Company’s website. The financial

measures presented are consistent with the Company’s historical financial reporting practices. Core earnings and core

earnings per diluted share represent performance measures and are not intended to represent liquidity measures. The non-

GAAP financial measures presented herein may not be comparable to similarly titled measures presented by other companies,

and are not identical to corresponding measures used in other various agreements or public filings.

presents financial measures that are non-GAAP measures, such as constant currency financial measures, adjusted EBITDA,

adjusted EBITDA margin, adjusted EBITDA net of funding costs, core earnings and core earnings per diluted share (core

EPS). The Company believes that these non-GAAP financial measures, viewed in addition to and not in lieu of the

Company’s reported GAAP results, provide useful information to investors regarding the Company’s performance and

overall results of operations. These metrics are an integral part of the Company’s internal reporting to measure the

performance of reportable segments and the overall effectiveness of senior management. Reconciliations to comparable

GAAP financial measures are available in the accompanying schedules and on the Company’s website. The financial

measures presented are consistent with the Company’s historical financial reporting practices. Core earnings and core

earnings per diluted share represent performance measures and are not intended to represent liquidity measures. The non-

GAAP financial measures presented herein may not be comparable to similarly titled measures presented by other companies,

and are not identical to corresponding measures used in other various agreements or public filings.