Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - REGAL BELOIT CORP | c24422e8vk.htm |

Exhibit 99

| John Perino Vice President Investor Relations Chuck Hinrichs Vice President Chief Financial Officer Baird Industrial Conference November 8, 2011 Mark Gliebe President Chief Executive Officer Jon Schlemmer Chief Operating Officer |

| Safe Harbor Statement 1 This presentation contains "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements represent our management's judgment regarding future events. In many cases, you can identify forward-looking statements by terminology such as "may," "will," "plan," "expect," "anticipate," "estimate," "believe," or "continue" or the negative of these terms or other similar words. Actual results and events could differ materially and adversely from those contained in the forward-looking statements due to a number of factors, including: actions taken by our competitors and our ability to effectively compete in the increasingly competitive global electric motor, power generation and mechanical motion control industries; our ability to develop new products based on technological innovation and the marketplace acceptance of new and existing products; fluctuations in commodity prices and raw material costs; our dependence on significant customers; issues and costs arising from the integration of acquired companies and businesses, including the timing and impact of purchase accounting adjustments; our dependence on key suppliers and the potential effects of supply disruptions; infringement of our intellectual property by third parties, challenges to our intellectual property, and claims of infringement by us of third party technologies; increases in our overall debt levels as a result of acquisitions or otherwise and our ability to repay principal and interest on our outstanding debt; product liability and other litigation, or the failure of our products to perform as anticipated, particularly in high volume applications; unanticipated costs or expenses we may incur related to product warranty issues; economic changes in global markets where we do business, such as reduced demand for the products we sell, currency exchange rates, inflation rates, interest rates, recession, foreign government policies and other external factors that we cannot control; unanticipated liabilities of acquired businesses; cyclical downturns affecting the global market for capital goods; difficulties associated with managing foreign operations; and other risks and uncertainties including but not limited to those described in Item 1A-Risk Factors of the Company's Annual Report on Form 10-K filed on March 2, 2011 and from time to time in our reports filed with U.S. Securities and Exchange Commission. All subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by the applicable cautionary statements. The forward-looking statements included in this presentation are made only as of their respective dates, and we undertake no obligation to update these statements to reflect subsequent events or circumstances. |

| Non-GAAP Financial Measures 2 We prepare financial statements in accordance with accounting principles generally accepted in the United States (GAAP). We also disclose adjusted diluted earnings per share (EPS), adjusted gross profit, adjusted gross profit as a percentage of net sales, adjusted operating profit, adjusted operating profit as a percentage of net sales, and free cash flow which are non-GAAP financial measures. We use these measures in our internal performance reporting and for reports to the Board of Directors. We also disclose these measures in our quarterly earnings releases, on investor conference calls, and in investor presentations and similar events. We believe that adjusted diluted EPS, adjusted gross profit, adjusted gross profit as a percentage of net sales and free cash flow are useful measures for providing investors with additional insight into our operating performance. This additional information is not meant to be considered in isolation or as a substitute for our results of operations prepared and presented in accordance with GAAP. Adjusted diluted earnings per share, adjusted gross profit and adjusted gross profit as a percentage of net sales exclude the effects of certain items that are not comparable from one period to the next. Free cash flow is defined as net cash provided by operating activities less additions to property, plant and equipment. e |

| Overview 3 Getting to Know Regal Beloit Best in Class Industrial Performance Growth Catalysts Financial Consistency Building a Premier Global Enterprise |

| Overview 4 Getting to Know Regal Beloit Best in Class Industrial Performance Growth Catalysts Financial Consistency Building a Premier Global Enterprise |

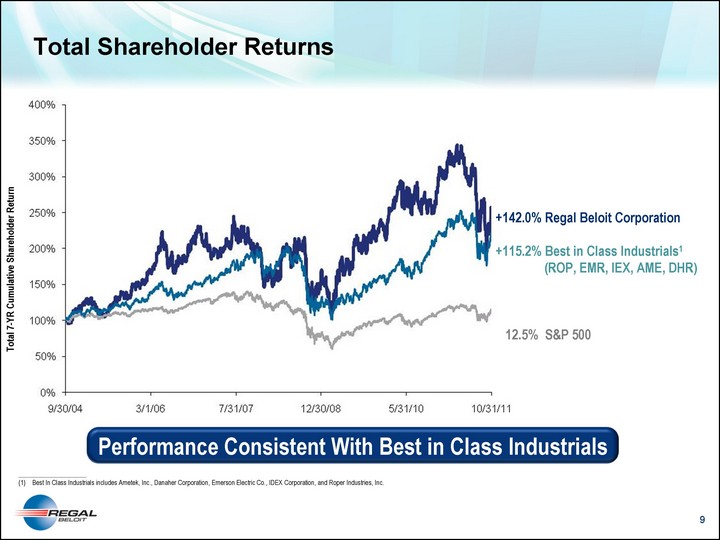

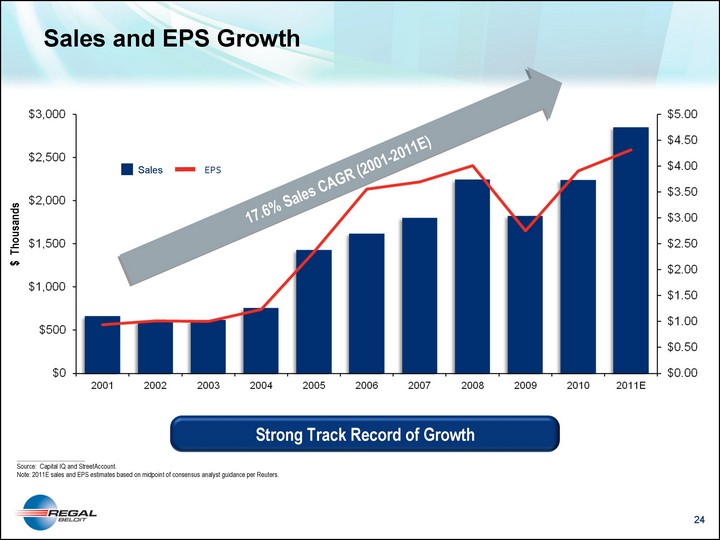

| Transformation Regal Beloit Corporation Overview 5 Revenues (PF) $3B + Employees ~25,800 Total Shareholder Returns 7-Year CAGR 142% Founded 1955 Beloit, WI A Mid Cap Diversified Industrial A Truly Global Manufacturer A Lean Six Sigma Continuous Improvement Culture A Company Innovating Around Energy Efficiency A Consistent and Successful Acquirer A Top Tier Team of Global Industrial Talent Sales by Product/Platform Production by Region Four CEOs Revenue Growth 10-Year CAGR 17.6% |

| Necessary and Innovative Products 6 Electric Motors Power Transmission Electric Generators Custom Electric Drives |

| 7 Well Balanced, Well Diversified Business Model 7 Revenues by Geography Revenues by Channel Cyclicality Revenues by End Markets Late Mid Early _____________________ Management Estimates |

| Overview 8 Getting to Know Regal Beloit Best in Class Industrial Performance Growth Catalysts Financial Consistency Building a Premier Global Enterprise |

| Total Shareholder Returns 9 Performance Consistent With Best in Class Industrials _____________________ Best In Class Industrials includes Ametek, Inc., Danaher Corporation, Emerson Electric Co., IDEX Corporation, and Roper Industries, Inc. +142.0% Regal Beloit Corporation +115.2% Best in Class Industrials1 (ROP, EMR, IEX, AME, DHR) 12.5% S&P 500 Total 7-YR Cumulative Shareholder Return |

| Relative Performance Profile 10 _____________________ Source: Capital IQ and Bloomberg Note: CAGR represents cumulative annual growth rate for the 2006 - 2011E calendar periods. 2011E revenue estimates represent the median analyst estimate per Capital IQ. EBITDA is computed as income from operations plus depreciation and amortization. RBC figures include the EPC transaction. 2011 estimates represent midpoint of Company guidance per StreetAccount. Median analyst estimate as of August 29, 2011. ROIC defined as LTM EBIT divided by the average of the last four quarters total capital. Total Capital equals (Total Assets - Cash) - (Current Liabilities - Current Debt). 5-Year EPS CAGR (2) 5-Year Sales CAGR Total Debt / LTM EBITDA (1) 1.9x 1.7x 2.4x 2.3x 2.4x 1.1x FCF / NI ROIC (3) Performance Consistent With Best In Class Industrials |

| Regal Beloit Compass Operating System 11 Near Term Income Statement Quality Cost Delivery Cap Ex Cash Cycle New Products Long Term Growth Lean Six Sigma Tools Leadership Tools Talent Management Long Range Plans Compliance/Safety Risk Management Customer Care Integrations |

| Overview 12 Getting to Know Regal Beloit Best in Class Industrial Performance Growth Catalysts Financial Consistency Building a Premier Global Enterprise |

| Offers Stronger Global Footprint Strategic Rationale to Acquire EPC 13 Combined Energy Efficient Technology Provides Ability To Deliver Additional Value To Customers Complementary Product Offerings Commercial And Residential Hermetic Strengthens Presence In High Growth Regions Augments Low Cost Manufacturing Locations Talented Global Management Offers New Technology and Products Delivers Value $35 Million Annual Synergies Building Over Four Years Synergies From Facility Rationalization & Material Consolidation Accretive in the First Full Year Tax Benefits Expected To Be Approximately $46 Million EPC Acquisition Consistent With Regal Beloit's Strategic Objectives |

| EPC Broad Product Platform 14 Key Applications Commercial HVAC&R Residential HVAC&R Pump Distribution General Industry 25% 26% 16% 24% 9% _____________________ Management Estimates |

| Integration Summary EPC Leadership Team in Key Management Positions Integration Mechanics Have Gone Smoothly: IT, Payroll, Benefits, Finance, etc Now Focusing on Customers, Products, Markets and Synergies Customer: Face to Face Meetings and Customer Survey Products: New Product Rationalization and Platform Consolidation Markets: Cross Selling and Value Add Opportunities Synergies: Input Materials, Transportation and Rationalization Excellent Team Work With Significant Detail Meeting/Exceeding Integration Expectations 15 |

| 16 Anticipated Gross Synergies1 Anticipated Integration Capital and Expense Explanation of Synergies Procurement Synergies Select Favorable Materials Pricing Materials Specification Consolidation Logistics Synergies Truck Route Consolidation Load Consolidations Manufacturing Synergies Facility Rationalization Design Platform Consolidation Revenue Synergies New Energy Saving Products Existing Products Through New Channels ($ in millions) ($ in millions) Synergies Support Strategic Rationale For EPC Synergy Capture _____________________ 1 A Cumulative Run Rate Excluding Revenue Synergies |

| China Energy Efficiency And Benefit Society Project. Provide Incentives To Promote High Efficiency IE2 And IE3 Motors Energy Efficiency Ratings Required On AC Equipment In Both China and India. Higher Ratings Require Energy Efficient Motors Motor Efficiency Legislation (MEPS) to IE2 California Title 24 Updated Efficiency Regulations for: - Furnaces - Commercial Clothes Washers Global Energy Efficiency Regulations Continuing Catalyst for Growth 17 December 19, 2010: EISA Legislation IE2 Efficiency Required IE3 Efficiency Level Required For Sizes 7.5 Kw - 375 Kw Efficiency Regulations for: - Fractional HP Motors - Water - Unitary Air Conditioners IE3 Efficiency Level Required For Sizes .75 Kw - 375 Kw June 4, 2010 2017 2015 June 16, 2011 December 19, 2010 2013 2012 Canada Adopts Energy Efficiency Measures Already Implemented In US Energy Regulations for: - Commercial Refrigeration Equipment - Vending Machines - Walk-in Coolers & Freezers - Pool Filter Pumps Energy Regulations for: - Commercial Refrigeration Equipment - Commercial Air Conditioners - Furnace Fans 2016 |

| Increasing Global Presence 18 Expanding in Higher Growth Regions 2005 Sales 2011 Proforma Sales Five Year Growth Rate _____________________ Management Estimates |

| Technology Leader 19 Energy Efficient Product Sales Regal Beloit Technology Leadership High Efficiency More Effective Use of Power Variable Speed Broad Variation of Speed During Use Embedded Intelligence Electronic "Smarts" Built Into Products Lower Operating Costs Reduced Lifetime Costs to Operate 21% CAGR New Product Introductions _____________________ Management Estimates $ Millions |

| Successful Acquirer and Integrator 20 Acquisition Strategy Technology and Energy Efficiency Expand Geographic Footprint Synergy Opportunities Acquisition Pipeline Continues to Be Active 2004 - 2009 2010 2011 CMT HARGIL DYNAMICS PTY. LTD. Consistent and Successful Acquirer |

| Record of Strong, Continuous Growth 21 2012 Est Track Record of Consistent Growth and Execution Real Momentum with 10 Recent Acquisitions Energy Efficiency Innovation Tailwind Continuing to Globalize and Simplify Continuous Improvement Headset |

| Overview 22 Getting to Know Regal Beloit Best in Class Industrial Performance Growth Catalysts Financial Consistency Building a Premier Global Enterprise |

| Third Quarter Financial Highlights 23 Strong Third Quarter Performance Adjusted Diluted EPS +17% $1.14 $1.33 $591 $737 Revenue ($M) +25% Adjusted Operating Profit Margin +30 bps Free Cash Flow ($M) +64% 11.8% $37 $68 |

| Sales and EPS Growth 24 EPS Sales 17.6% Sales CAGR (2001-2011E) 2005 _____________________ Source: Capital IQ and StreetAccount. Note: 2011E sales and EPS estimates based on midpoint of consensus analyst guidance per Reuters. Strong Track Record of Growth $ Thousands |

| Consistent Cash Flow While Investing for Growth 25 Cash Div ($M) $14.7 $16.6 $18.1 $19.4 $21.6 $25.1 $26.8 _____________________ Note: 2011E free cash flow, capex and Net Income estimates based on midpoint of consensus analyst guidance per Reuters |

| Balance Sheet Strength 26 _____________________ Note: EBITDA is computed as income from operations plus depreciation and amortization. Q2 2011 total debt / total capital is pro forma for the EPC acquisition. *Includes 8% of hedging activities. 2004 2005 2006 2007 2008 2009 2010 2011 - - - |

| Investment Thesis Well Positioned Global Business Model Performance Consistent with Best in Class Industrials Leadership in Necessary, Innovative Products RBC Operating System Drives Results Accelerating Growth Drivers EPC Adds 2011 Revenue Growth and Longer Term Synergy Opportunities Increasing Global Presence and Alignment with High Growth Economies Energy Efficiency Technology Leadership Consistent and Successful Acquirer and Integrator Consistent Financial Performance Ten Year Sales Growth ^ 17.3%, Continues with EPC Seven Year TSR ^ 142% Consistent Record of Strong Cash Flow 27 |

| Thank you |

| APPENDIX - Non GAAP Measures 29 |

| 30 Appendix Reconciliation of Historic Free Cash Flow (Data in $ Millions) 2005 2006 2007 2008 2009 2010 2011 E1 Cash Flow from Operation $112.2 $93.5 $200.6 $154.2 $314.9 $175.4 $282.0 Capital Expenditures (28.3) (52.5) (36.6) (52.2) (33.6) (45.0) (54.0) Free Cash Flow $83.9 $41.0 $164.0 $102.0 $281.3 $130.4 $228.0 E1 Three Quarters Actual, Fourth Quarter Consensus Estimate |