Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PEABODY ENERGY CORP | btu8k2011118.htm |

Exhibit 99.1

Peabody Energy Australia Overview

Rob Hammond

Acting Group Executive and Managing Director Australian Operations

November 9, 2011

Statement on Forward-Looking Information

Some of the following information contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended, and is intended to come within the safe-harbor protection provided by those sections.

Our forward-looking statements are based on numerous assumptions that the company believes are reasonable, but they are open to a wide range of uncertainties and business risks that may cause actual results to differ materially from expectations as of October 25, 2011. These factors are difficult to accurately predict and may be beyond the company's control. The company does not undertake to update its forward-looking statements. Factors that could affect the company's results include, but are not limited to: demand for coal in the United States and the seaborne thermal and metallurgical coal markets; price volatility and demand, particularly in higher-margin products and in our trading and brokerage businesses; impact of weather and natural disasters on demand, production and transportation; reductions and/or deferrals of purchases by major customers and ability to renew sales contracts; credit and performance risks associated with customers, suppliers, co-shippers, trading, banks and other financial counterparties; geologic, equipment, permitting and operational risks related to mining; transportation availability, performance and costs; availability, timing of delivery and costs of key supplies, capital equipment or commodities such as diesel fuel, steel, explosives and tires; successful implementation of business strategies, including our Btu Conversion and generation development initiatives; negotiation of labor contracts, employee relations and workforce availability; changes in postretirement benefit and pension obligations and funding requirements; replacement and development of coal reserves; availability, access to and the related cost of capital and financial markets; effects of changes in interest rates and currency exchange rates (primarily the Australian dollar); ability to fund, complete, and integrate Macarthur and other acquisitions; economic strength and political stability of countries in which we have operations or serve customers; legislation, regulations and court decisions or other government actions, including new environmental and mine safety requirements, changes in income tax regulations or other regulatory taxes; litigation, including claims not yet asserted; and other risks detailed in the company's reports filed with the Securities and Exchange Commission (SEC). The use of “Peabody,” “the company,” and “our” relate to Peabody, its subsidiaries and majority-owned affiliates.

EBITDA or Adjusted EBITDA is defined as income from continuing operations before deducting net interest expense, income taxes, asset retirement obligation expense, and depreciation, depletion and amortization. EBITDA, which is not calculated identically by all companies, is not a substitute for operating income, net income or cash flow as determined in accordance with United States generally accepted accounting principles. Management uses EBITDA as a key measure of operating performance and also believes it is a useful indicator of the company's ability to meet debt service and capital expenditure requirements.

EPS or Adjusted EPS is defined as diluted earnings per share excluding the impact of the remeasurement of foreign income tax accounts. Management has included this measurement because, in management's opinion, excluding such impact is a better indicator of the company's ongoing effective tax rate and diluted earnings per share, and is therefore more useful in comparing the company's results with prior and future periods.

2

Peabody Energy: Expanding Global Reach to Serve Coal's Supercycle

Australia represents a major cornerstone of Peabody's growth

Unmatched international pipeline with major Australian and Asia projects

Significant upside with earnings growth and multiple expansion

3

2011: Targeting Peabody's Best Year

2011: Targeting Peabody's Best YearYTD 2011 increases:

Revenues +15%

EBITDA +10%

EPS +21%

2011 Targets:

EBITDA of $2.125 - $2.325 billion;

EPS of $3.70 to $4.15

Peabody EBITDA $ in millions

2006 910

2007

2008

2009

2010 1815

2011 Est. Target 2,125-2,325

YTD as of Sept. 30, 2011

4

Peabody's Earnings Now Balanced with Australia

Peabody continues transformation to global coal company

Multiple global initiatives increase earnings leverage to stronger international markets

Peabody's Earnings Now Balanced with Australia

Peabody continues transformation to global coal company

Multiple global initiatives increase earnings leverage to stronger international markets

2003 U.S. > 99%

2007 U.S. 83% Australia 17%

YTD 2011 U.S. 51% Australia 49%

Percentages represent share of Mining EBITDA. YTD information as of Sept. 30, 2011.

5

World in Early Stages of Supercycle for Coal

Asia Represents 90+% of 4 Billion Tonne Coal Demand Growth

+160

+30

+60

+580

+910

+2,320

Coal Demand Growth 2008 - 2035 (Tonnes in Millions)

U.S. growth presented in short tons.

Source: World Energy Outlook 2010, International Energy Agency; Annual Energy Outlook 2011 Early Release, Energy Information Administration; Peabody analysis.

6

Global Supercycle Story Still in Early Chapters

China's 12th Five-Year Plan

~$440 Billion Power Generation Investments

~$400 Billion Electricity Grid Investments

~$185 Billion Urban Subway Investments

55,000 Miles Length of Railroad Tracks

More Than $1 Trillion in Investments in Key Infrastructure Projects

Source: Industry and governmental reports.

7

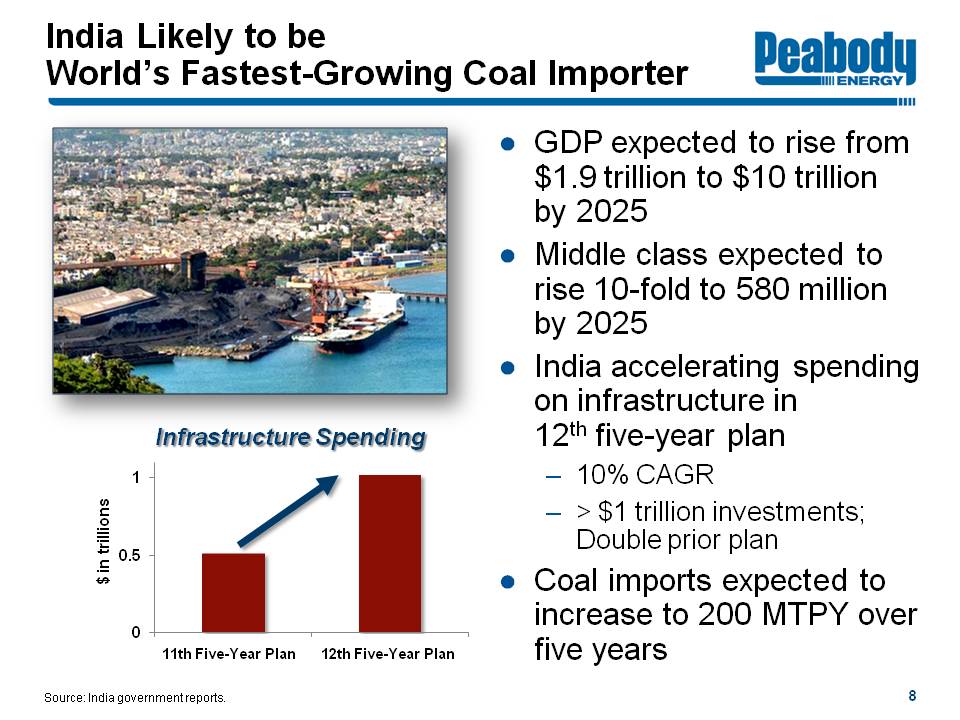

India Like to be World's Fastest-Growing Coal Importer

GDP expected to rise from $1.9 trillion to $10 trillion by 2025

Middle class expected to rise 10-fold to 580 million by 2025

India accelerating spending on infrastructure in 12th five-year plan

10% CAGR

> $1 trillion investments; Double prior plan

Coal imports expected to increase to 200 MTPY over five years

Infrastructure Spending

11th Five-Year Plan

12th Five-Year Plan

Source: India government reports.

8

Peabody Progressing Toward “Asia 100” Goal

Australia exports

China JVs

Tavan Tolgoi

Indonesia supplies

PRB to Asia

9

Australia Platform Expanding Through Organic Growth and Macarthur Acquisition

Expansions are in process at Burton, Wilpinjong, Metropolitan and other operations

Expected Australia Volumes

2010

Domestic Thermal 6

Seaborne Thermal 11

Met 10

Total 27

2011

Domestic Thermal 6.5

Seaborne Thermal 12-13

Met 8.5-9.5

Total 27-29

2014-2015

Domestic Thermal ~8

Seaborne Thermal 15-17

Met 12-15

Macarthur 10

Total 45-50

Macarthur volumes based on Macarthur plans at time of acquisition; ultimate production and timing subject to future investments and other factors.

10

Peabody Delivering on Organic Growth Projects

Planned Expansions (Tons in Millions)

Mine

Additional MTPY

First Coal

Burton 1 - 2 HCC Late 2012

North Goonyella 1 - 2 HQHCC 2014

Millennium 1 - 2 SH/PCI Late 2011

Wilpinjong 2 - 3 T Q4 2011

Wambo ~3 T 2012 - 2013

Metropolitan 1 HCC Late 2013

Met Coal Mine

Burton

North Goonyella

Eaglefield

Millennium

Metropolitan

Thermal Coal Mine

Wilkie Creek

Wilpinjong

Wambo Underground

Wambo Open Cut

Port

Abbot Point

Dalrymple Bay

Gladstone

Brisbane

PWCS

NCIG

Port Kembla

Queensland

New South Wales

Additional volumes expected to be offset by some mine depletions.

11

Australia Growth Projects: Burton Widening

Project Description

Hard coking coal (HCC) enhances blending with other products from the Burton complex

Burton Widening Project is a fully permitted mine life extension via the reopening of previously mined area

Project engaged in late 2010, entails ancillary works, dams and drains and pit reopening

Additional 1 - 2 million tons starting in second half of 2012

Burton Coal Stockpile - 2011

12

Australia Growth Projects: Burton Widening

Burton Mine, opened in late 1996, was one of the first to use a terrace mining method for extracting steep seams

The Widening Project will expand Burton's terrace mining method to depths approaching 230 meters at the high-wall, an Australian first

Over 62 million cubic meters of material will be moved during development

Terraced Mining at Burton Widening - October 2011

Terraced Mining at Burton Widening - October 2011

13

Australia Growth Projects: Goonyella Top Coal Caving

Project Description

Peabody licensing agreement with Yanzhou Coal Mining Company to deploy Longwall Top Coal Caving (LTCC) mining technology in second half 2012

Created solid relationship for future development opportunities in China while gaining access to technology

LTCC enhances reserve recovery compared to traditional longwall mining through full seam recovery

Lower cost recovery of an additional 4 million tons of highest quality, market recognized “Goonyella” branded product over 2013 - 2017

Longwall Top Coal Caving Technology allows recovery of additional coal typically lost by advancing protective shields providing for improved resource recovery

External view of “Caving Shields” that allow coal to drop to recovery conveyor

14

Australia Growth Projects: Millennium Expansion

Project Description

Semi Hard Coking Coal and Pulverized Coal Injection (PCI) coal to supply increasing Asian demand

Approved expansion and extension project exploits the 165 million ton reserve base

Environmental Impact Statement approved in August; remaining permitting obtained recently

Additional 1 - 2 million tons with first coal expected soon

Full production by 2013 - 2014

Millennium Mine - 2011

Millennium coal being railed to port - 2011

15

Australia Growth Projects: Millennium Expansion

The Millennium Mine, opened in 2006, is located in Bowen Basin

Expansion will increase the life of the mine by approximately 16 years

Optimized mine plans and newest ultra class truck and electric shovel technology to achieve greater efficiencies

Coal product stockpile capacity will also be expanded to support increased production

Millennium Expanded Mine Plan - 2011

Millennium Coal handling facility - 2011

16

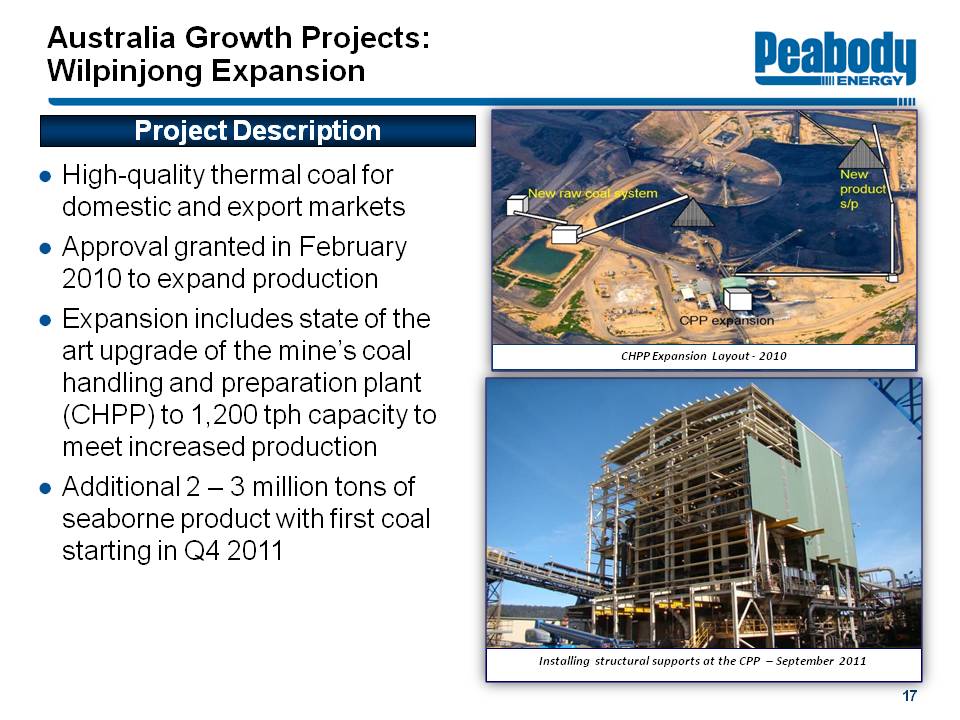

Australia Growth Projects: Wilpinjong Expansion

Project Description

High-quality thermal coal for domestic and export markets

Approval granted in February 2010 to expand production

Expansion includes state of the art upgrade of the mine's coal handling and preparation plant (CHPP) to 1,200 tph capacity to meet increased production

Additional 2 - 3 million tons of seaborne product with first coal starting in Q4 2011

CHPP Expansion Layout - 2010

Installing structural supports at the CPP - September 2011

17

Australia Growth Projects: Wilpinjong Expansion

The $90 million project is nearing completion on time and on budget

The project has an outstanding safety record with 298 thousand construction hours without a lost time injury logged project to date

New high speed conveyors support expanded production - October 2011

New 1200 tph raw coal system and product stockpile - October 2011

100,000 Man Hour Without a Lost Time Injury - early June ,2011

18

Australia Growth Opportunities: Wambo Expansion

Project Description

High quality, low ash thermal and PCI coal

Investigating a range of options for mid-to long-term expansion

Feasibility/Design Stage

Optimizing mine plans for both open cut and underground operations

Exploration drilling ongoing

Targeting additional ~3 million tons of production by 2014 - 2015 with incremental volumes expected later this year

Conceptual Layout

19

Australia Growth Projects: Metropolitan Expansion

Project Description

Fully permitted underground mine expansion and modernization

Quality HCC product shipped from unconstrained Port Kembla to meet expanding overseas sales

CHPP upgrade and new drift excavation is under way

Additional 1 million tons by 2014

Mine Layout

Metropolitan Mine located in the second oldest national park in the world, Royal National Park - 2011

20

Australia Growth Projects: Metropolitan Expansion

The Metropolitan Mine, located 50 kilometres south of Sydney in New South Wales, was founded in 1888 and is Australia's oldest continually operating coal mine

$70 million expansion combined with modernization of mine

Repositions mine in lowest cost quartile

New Metropolitan drift entry - September 2011

Metropolitan CHPP Upgrade - August 2011

Metropolitan CHPP Upgrade - October 2011

21

Australia Growth Opportunities: Denham/Goonyella Corridor Expansion

Project Description

Highest quality, market recognized “Goonyella” branded HCC product

Potential for successful underground extension and/or surface mine

Project feasibility in progress

Construction of new prep plant module and supporting surface facilities

Some environmental approvals in place and others underway

Conceptual Layout

22

Queensland Rail and Peabody Positioning

Expected Rail Improvements

Planning and modeling initiatives to improve capacity continue

Additional train sets added to Pacific National and Queensland Rail networks

Queensland Rail conducting preliminary planning for further expansions

Peabody Positioning

Long-term contracts with Queensland Rail

Flexibility for sourcing between operations

Ability to increase volumes with expansions

23

DBCT and Peabody's Positioning

Expected Rail Improvements

Several versions of total Supply Chain Modelling completed and potential initiatives identified

Potential for additional 68 million tonnes of capacity at Dudgeon Point for 2017 commencement

Peabody Positioning

Capacity increasing from 10 million to 12 million tonnes from 2012

Flexible rail contracts support growth platform

Mine expansions to further lift volumes

Tonnes in Millions

Expected DBCT / Hay Point Capacity

Hay Point

DBCT

Port and rail values are estimated nameplate capacity.

24

Newcastle Rail and Peabody's Positioning

Expected Rail Improvements

Industry framework enables alignment of port and rail capacity across Hunter Valley

Boosts certainty and facilitates timely expansion

Long-term contracts promote investment

Numerous projects under way to increase Hunter Valley coal chain capacity

Peabody Positioning

Queensland Rail contract is performance based

Contract expanded to 14 million tonnes per year from 2012

25

Newcastle and Peabody's Positioning

Expected Rail Improvements

PWCS expected to reach 145 MTPA by 2012 and 180 MTPA by 2016

NCIG Stage 1 (30 MTPA) delivered; Stage 2AA being constructed and Stage 2F approved in August 2011

Potential for up to 120 MPTA at the T4 project

Peabody Positioning

Expanding Wilpinjong and Wambo production

Long-term above rail contract with Queensland Rail for both mines

Additional port capacity available for new projects

Expected Newcastle Capacity

Tonnes in Millions

NCIG

PWCS

Port and rail values are estimated nameplate capacity.

26

Acquisition Delivers Value Via Increased Global Access, Earnings Expansion

Macarthur acquisition expands Peabody's presence with quality met product in high-growth region

Provides growth opportunities, large reserve base and significant potential synergies

Continues global buildout and earnings contribution from international assets

27

Macarthur: Active Production Base With Major Growth Pipeline

Queensland

Port

Abbott Point

Dalrymple Bay

Gladstone

Wiggins Island

Peabody Met Coal Mine

Burton

North Goonyella

Eaglefield

Millennium

Macarthur Mine

Coppabella

Moorvale

Macarthur Development

Olive Downs

Codrilla

Vermont East

Middlemount

Peabody Met Coal Mine

Port

Macarthur Mine

Macarthur Development

Producing mines million short tons Coppabella Resources 100% 214 Attributable 157 Reserves 65 48 Production FY 2011 2.3 Moorvale 126 93 47 34 1.9

Announced Projects Middlemount 135 68 106 53 0 Codrilla 88 64 55 40 0

Development Projects Vermont East / Wilunga 541 466 TBD TBD 0 Olive Downs North 140 103 13 9 0 Olive Downs South 300 270 TBD TBD 0

Exploration / Concept Projects

Potential exploration projects provide additional resources of more than 1 billion tons (100% basis) or 720 million tons (attributable basis).

Macarthur data based on June 30, 2011 public filings; Resources and reserves shown on a JORC basis and converted to short tons.

28

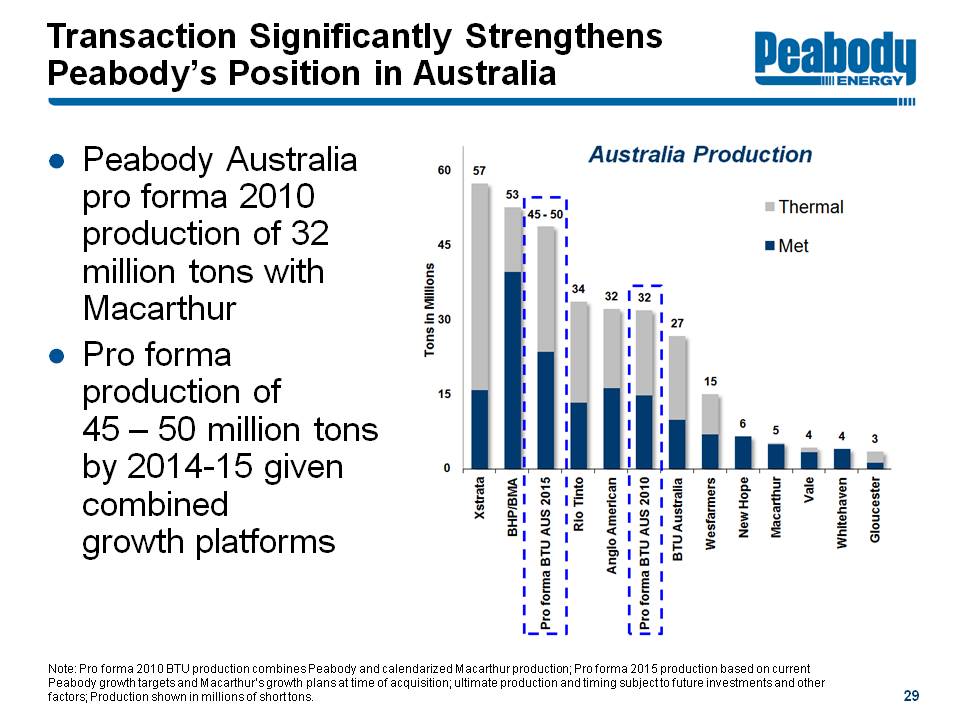

Transaction Significantly Strengthens Peabody's Position in Australia

Peabody Australia pro forma 2010 production of 32 million tons with Macarthur

Pro forma production of 45 - 50 million tons by 2014-15 given combined growth platforms

Australian Production

Thermal

Met

Tons in Millions

Xstrata 57

BHP/BMA 53

ProformaBTU Australia2015 45-50

Rio Tinto 34

Anglo American 32

ProformaBTU Australia2010 32

BTU Australia 27

Wesfarmers 15

New Hope 6

Macarthur 5

Vale 4

Whitehaven 4

Gloucester 3

Note: Pro forma 2010 BTU production combines Peabody and calendarized Macarthur production; Pro forma 2015 production based on current Peabody growth targets and Macarthur's growth plans at time of acquisition; ultimate production and timing subject to future investments and other factors; Production shown in millions of short tons.

29

Macarthur Acquisition: Next Steps

Complete acquisition and implement transition plan

Achieve synergies

Operational performance

Supply chain efficiencies

Marketing/blending potential

Improve mining plan and equipment efficiency at Coppabella Mine in coming months

Advance growth projects to build production pipeline

30

Peabody's Unmatched Growth Pipeline

2011 2012 2013 2014 2015 Beyond

Australia

Millennium 1-2 MTPY SHCC/PCI

Burton 1 - 2 MTPY HCC

Metropolitan 1 MTPY HCC

N. Goonyella LTCC 1 - 2 MTPY HQHCC

Wilpinjong 2 - 3 MTPY Thermal

Wambo ~3 MTPY Thermal/PCI

Goonyella Lower 3-4 MTPY HQHCC

Macarthur

Macarthur Takeover

Macarthur Plans to Increase Production by 5 MTPY by 2014

Asia

Tavan Tolgoi Consortium 15 - 20 MTPY HCC

Xinjiang China MOU 50 MTPY Thermal

Yankuang China MOU 20 MTPY Thermal, 2.0GW Plant

Lu'an China MOU 15 MTPY Thermal

Indonesian Coal Supply Agreements ~6 MT Thermal Over Next Several Years

U.S.

Bear Run Ramp-Up 8 MTPY Thermal

Gateway North 4.5 MTPY Thermal

Gateway Pacific Terminal 24 MTPY Thermal Exports

31

Peabody Positioned for Significant Growth and Value Creation

Industry Leading Reserves and Production Base

Major Cash Flow Generation and Strong Balance Sheet

Expanding in Fastest Growing Global Markets

Significant Organic Growth Capability

Addition of Macarthur Coal

Multiple Expansion to Return to More Traditional Levels

BTU Drivers To Deliver Premium Valuation

32

Peabody Energy Australia Overview

Rob Hammond

Acting Group Executive and Managing Director Australian Operations

November 9, 2011