Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MARRIOTT VACATIONS WORLDWIDE Corp | d251889d8k.htm |

Marriott

Vacations Worldwide Corporation

November 2011

Exhibit 99.1 |

Forward-Looking Statements

1

This presentation contains “forward-looking statements” within the meaning of

federal securities laws, including statements about future properties and their

anticipated contributions to our operating results; the construction and sales pace

for new properties, upcoming sales of timeshare mortgage notes, and similar statements

concerning anticipated events that are not historical facts. We caution you that

these statements are not guarantees of future performance and are subject to numerous

risks and uncertainties, including volatility in the economy and the credit markets;

supply and demand changes for vacation ownership and residential products; competitive

conditions; the availability of capital to finance growth; and other matters referred

to under the heading “Risk Factors” in our most recent Registration

Statement on Form 10 filed with the U.S Securities and Exchange Commission, any of

which could cause actual results to differ materially from those expressed in or

implied in this presentation. These statements are made as of November 7, 2011

and we undertake no obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events, or otherwise.

Throughout this presentation we report certain financial measures, each identified with the

symbol "†," that are not prescribed or authorized by United States

generally accepted accounting principles (“GAAP”). We discuss our reasons

for reporting these non-GAAP measures and reconcile each to the most directly

comparable GAAP measure at the end of these

slides. |

Introduction

2

Stephen P. Weisz

President and

Chief Executive Officer

John E. Geller, Jr.

Executive Vice President and

Chief Financial Officer

Jeff Hansen

Vice President, Investor Relations |

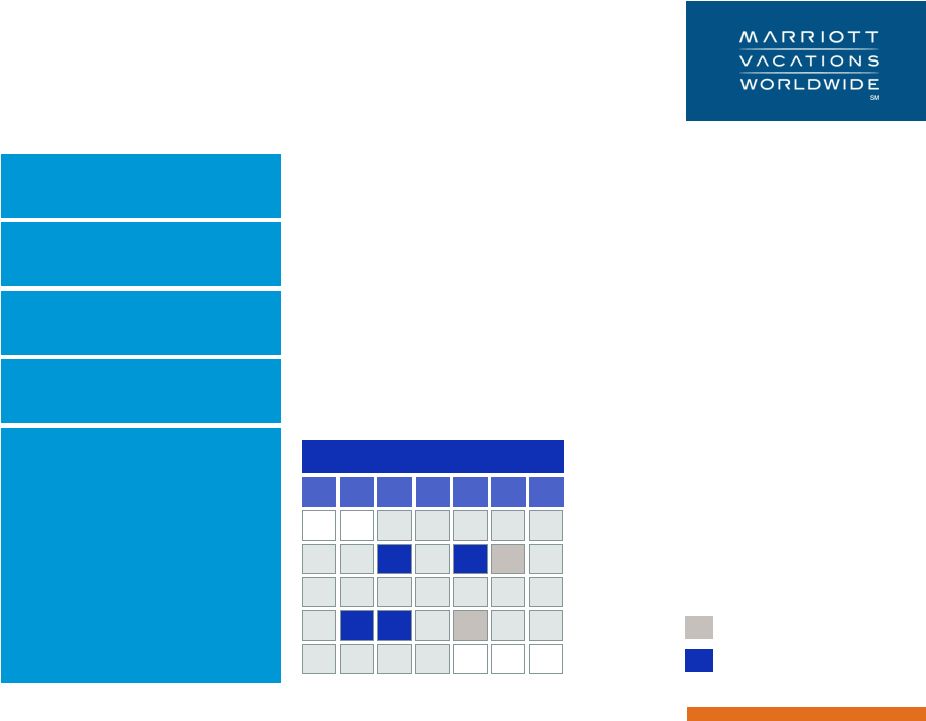

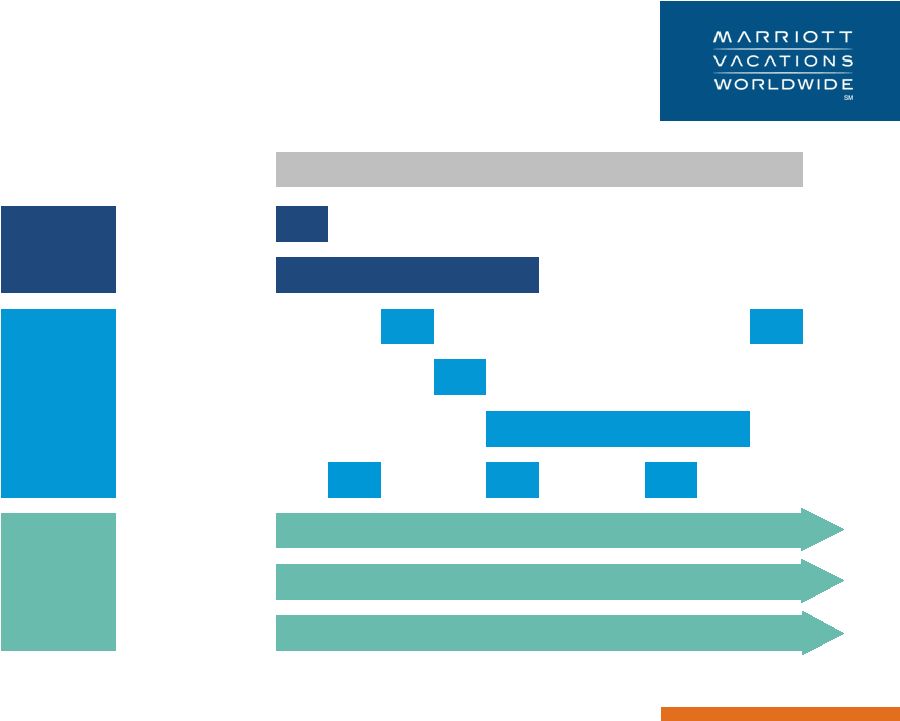

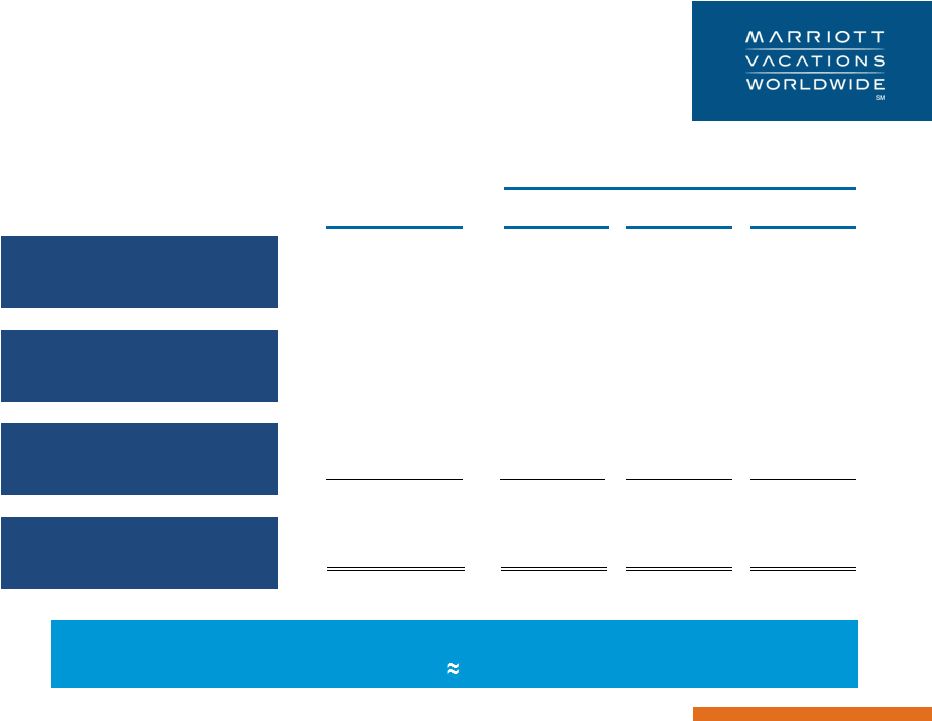

Transaction overview

3

Ticker

NYSE: VAC

Shares outstanding

36.2 million

(1)

Distribution ratio

1 VAC share per 10 MAR shares

Key dates

Issuer

Marriott Vacations Worldwide Corporation

“When-issued”

trading begins

November 8

Road show

November 7 –

17

Record date

November 10

Dividend payment date

November 21

“Regular-way”

trading begins

November 22

30

November

S

T

W

T

F

M

S

6

13

27

16

17

18

19

14

23

24

25

26

22

21

29

28

9

10

11

12

8

7

5

1

20

4

2

3

15

Public holidays

Key spin dates

(1) Reflects shares estimated to be outstanding as of the dividend payment

date. |

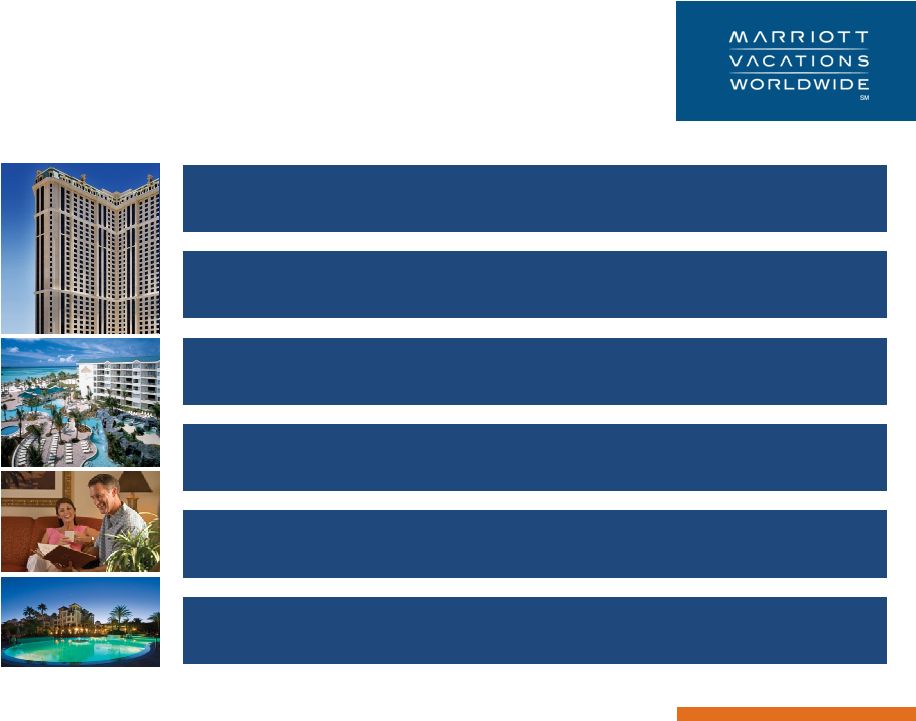

Investment highlights

4

Industry leader with established brands

Experienced management team and distinguished board of directors

Strong cash flow upside from built inventory and land

Diversified revenue streams

Favorable long-term industry dynamics

Optimized capital structure with financial flexibility |

5

Maui Ocean Club

Ka’anapali, Hawaii |

Marriott

Vacations Worldwide Corporation (“VAC”) is an industry leader in the

upscale and luxury vacation ownership segments

–

over 400,000 owners

–

64 vacation and resort destinations,

globally

With the spin-off, VAC will have exclusive

rights to the Marriott and The Ritz-Carlton

brand names as they pertain to the vacation

ownership business

For these exclusive, strategic and long-term

rights, VAC will pay Marriott International an

annual royalty fee

Revenue is derived from diverse sources and

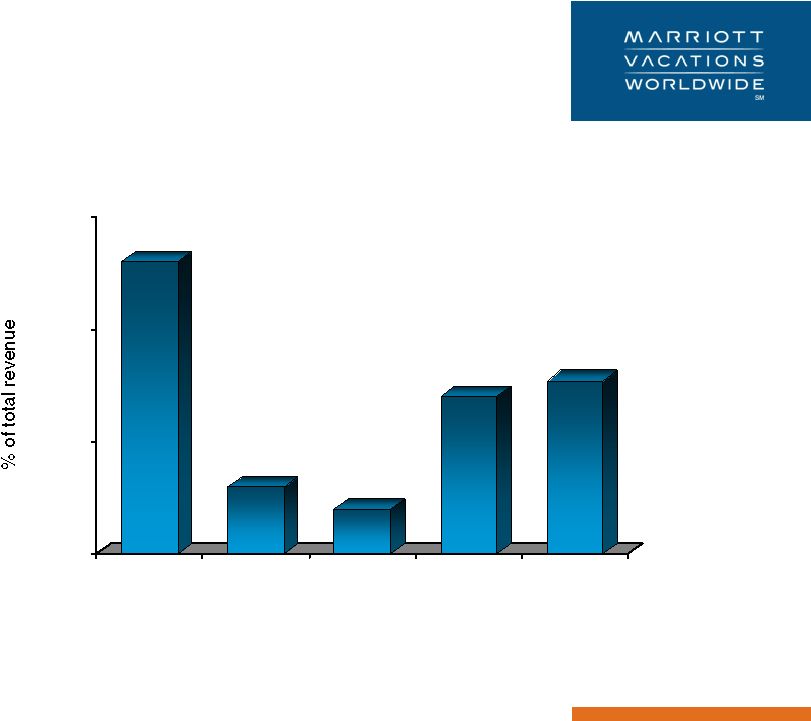

nearly half is recurring and stable

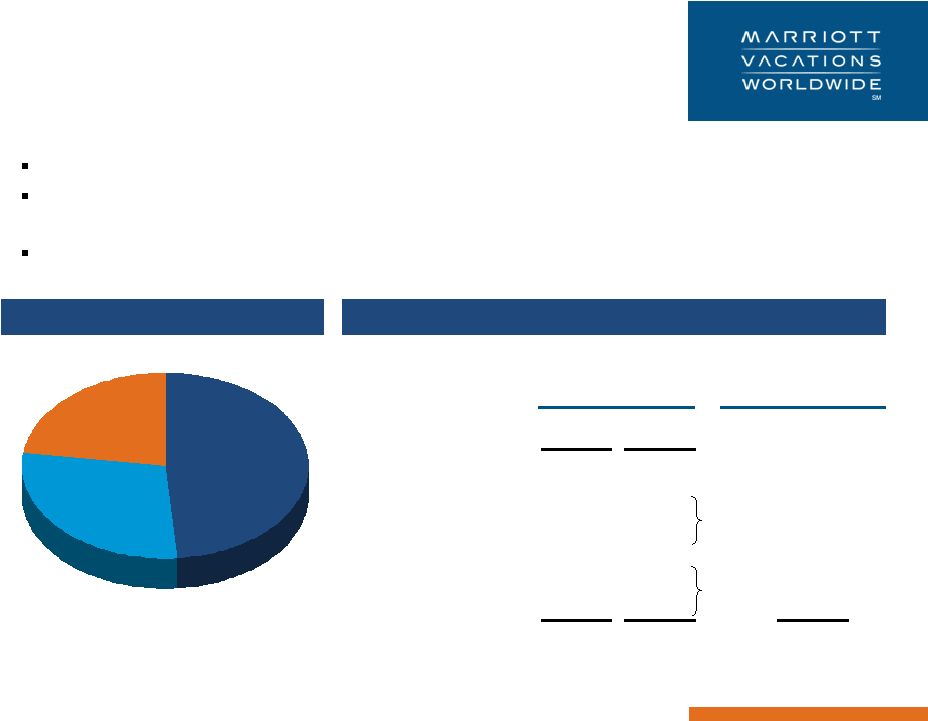

Who we are

6

Total revenue

(1)†

:

$1.3 billion

(1) 2011E revenue, excluding cost reimbursements.

Sales of

vacation

ownership

products, 50%

Resort

management

and other

services, 19%

Financing, 13%

Rental, 16%

Other, 2% |

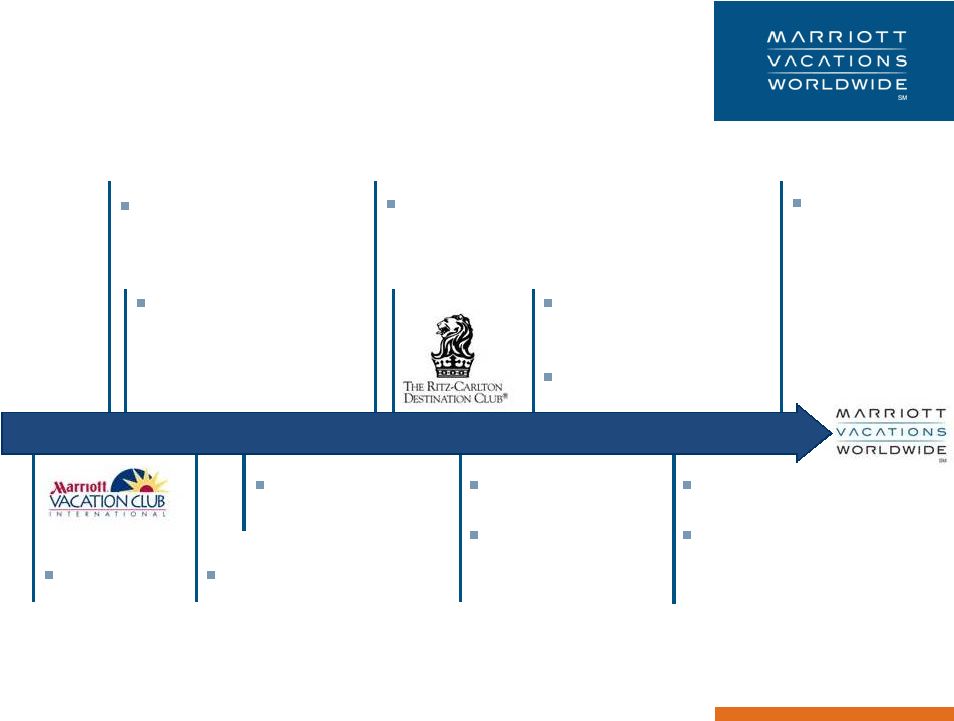

7

Long history of success

20 resorts

100,000 owners

40 resorts

200,000 owners;

Asia expansion

400,000 owners

Introduction of North

America points-based

product

Over $100 million in

annual vacation

ownership sales

Over $500 million in

annual vacation

ownership sales

Introduction of Asia

points product

60 resorts

Announced

spin-off from

Marriott

International

50,000 owners

1984

1993

1997

1999

2001

2009

2010

2011

3 resorts |

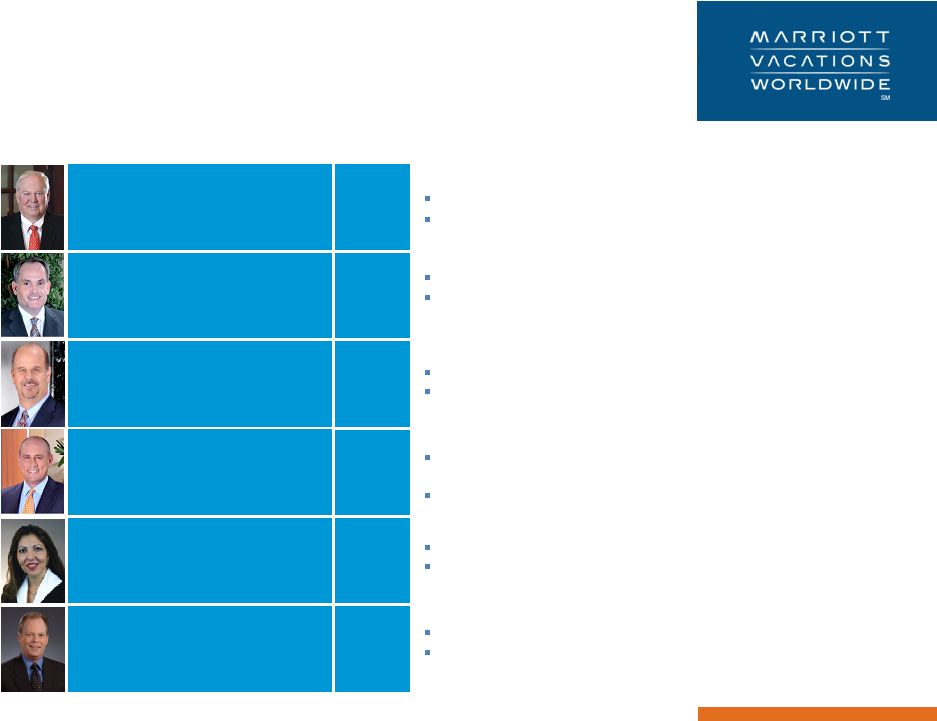

Experienced management team

8

Stephen P. Weisz,

President and CEO

President of VAC since 1996

Serves as trustee of the American Resort Development Association

John E. Geller, Jr.,

Executive Vice President

and CFO

Served in current role since 2009

Previously served as the CFO of AutoStar Realty, and partner at

Ernst & Young

R. Lee Cunningham,

Executive Vice President and COO,

North America & Caribbean

Brian E. Miller

Executive Vice President, Sales,

Marketing and Service Operations

Lani Kane-Hanan

Executive Vice President and Chief

Growth and Inventory Officer

James H. Hunter, IV

Executive Vice President and General

Counsel

Held roles at property, regional and corporate levels

Served in current role since 2007

More than 25 years of vacation ownership marketing and sales

expertise

Served in current role since 2007

Served in current role since 2009

Before joining Marriott, spent 14 years in public accounting and

advisory firms

Served in current role since 2006

Before joining Marriott, Mr. Hunter was an associate at the law firm

of Davis, Graham & Stubbs in Washington, D.C.

39 years

6 years

29 years

21 years

11 years

17 years

Marriott

tenure |

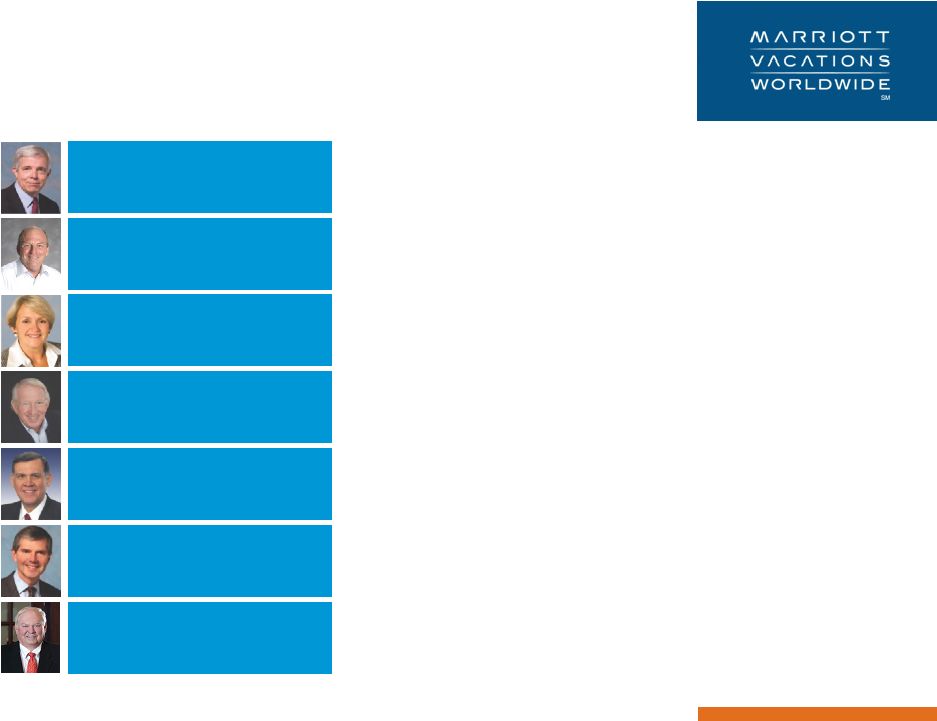

Distinguished Board of Directors

9

Raymond L. "Rip" Gellein, Jr.

Chairman of the Board, Strategic Hotels and Resorts, Inc.; Retired President,

Global Development Group of Starwood Hotels and Resorts Worldwide;

Former Chairman and CEO, Starwood Vacation Ownership, Inc.

Deborah Marriott Harrison

Senior Vice President, Government Affairs, Marriott International, Inc.

Thomas J. Hutchinson III

Chairman, Legacy Hotel Advisors, LLC and Legacy Healthcare Properties,

LLC; Former CEO of CNL Hotels & Resorts

Melquiades R. (Mel) Martinez

Regional Chairman of JPMorgan Chase for Florida, Mexico, Central

America

and the Caribbean; Former United States Senator from Florida; Former

Secretary of HUD

William W. McCarten

Chairman, DiamondRock Hospitality Company; Former CEO of HMS Host

Corporation

Stephen P. Weisz

President and Chief Executive Officer, Marriott Vacations Worldwide

Corporation

William J. Shaw, Chairman

Retired Vice Chairman, Marriott International, Inc.; Former President and

COO, Marriott International, Inc. |

Timber

Lodge South Lake Tahoe, California

10 |

$1

$1

$1

$1

$1

$1

$1

$1

$1

$1

$1

$1

$1

$2

$2

$2

$2

$3

$3

$4

$4

$5

$6

$7

$8

$9

$10

$11

$10

$6

$6

$0

$0

$0

$0

$0

$0

$2

$4

$6

$8

$10

$12

$14

$16

0

1

2

3

4

5

6

7

8

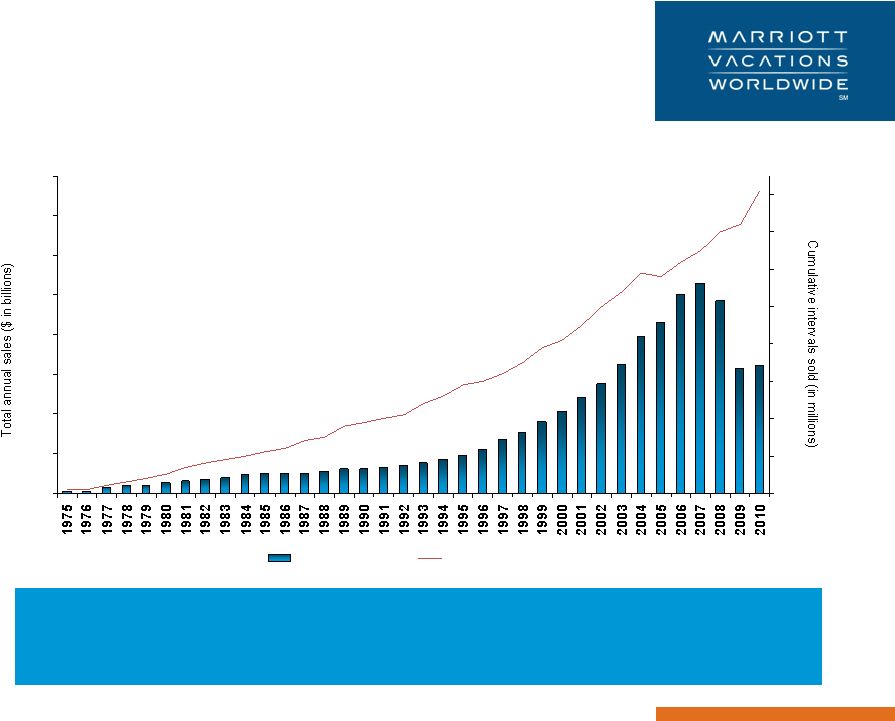

Total annual sales

Cumulative intervals sold

11

Favorable industry dynamics

The size of the target demographic market and current number of

vacation owners would imply an 8% penetration rate with potential

for meaningful upside

Source: ARDA |

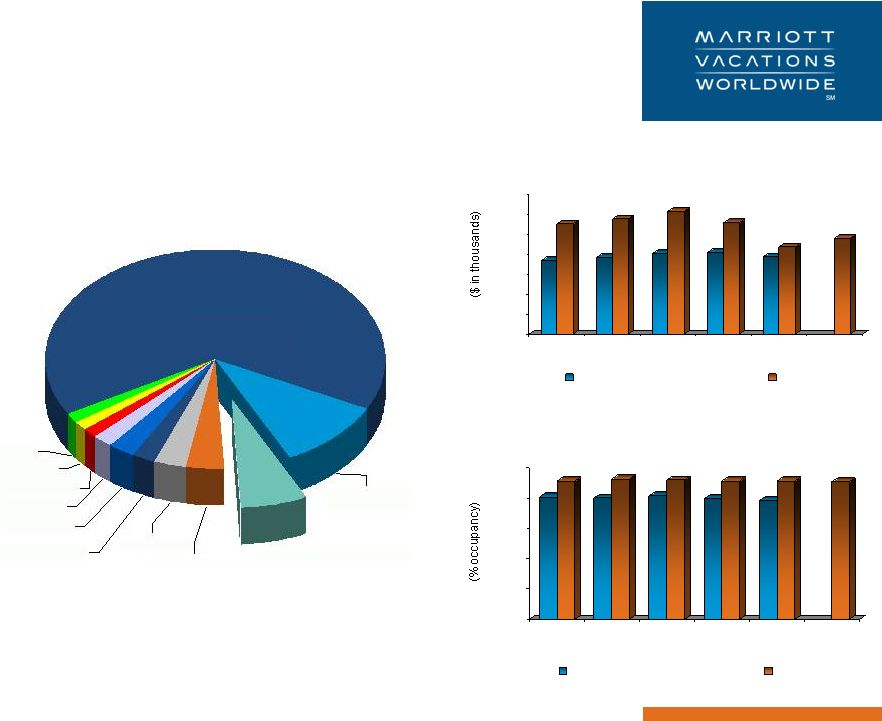

81%

92%

80%

93%

82%

92%

80%

91%

79%

92%

91%

0%

20%

40%

60%

80%

100%

2006

2007

2008

2009

2010

2011

YTD

Industry average

VAC

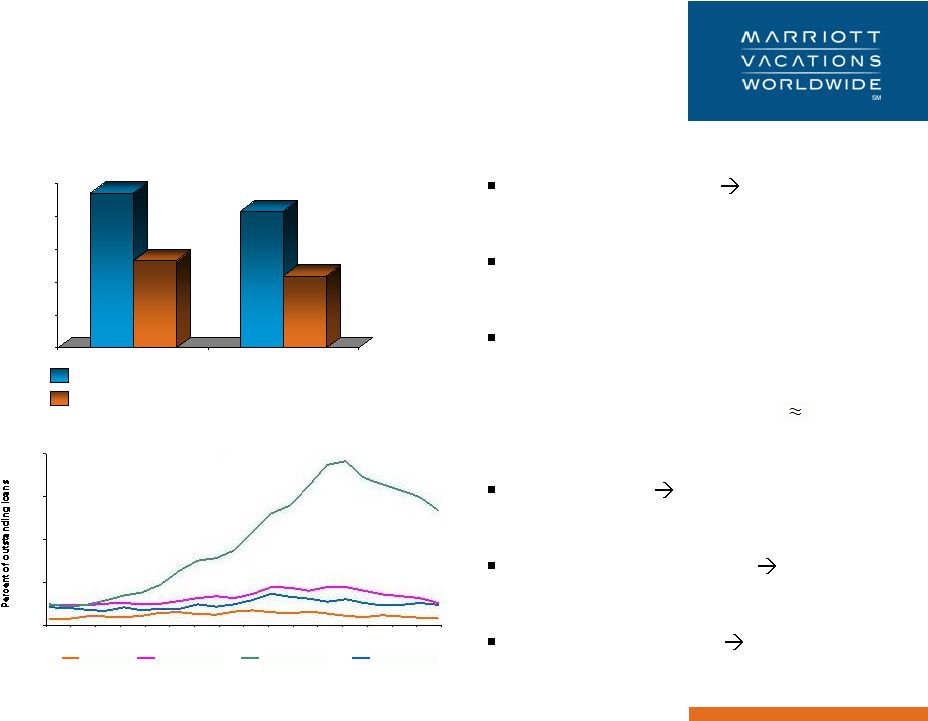

Quality leader in a fragmented

industry

12

2010 timeshare units

Sales price per contract

Occupancy

$19

$28

$19

$29

$20

$31

$20

$28

$19

$22

$24

$0

$5

$10

$15

$20

$25

$30

$35

2006

2007

2008

2009

2010

2011

YTD

Industry average

VAC

Note:

VAC reflects North America sales per contract and occupancy.

2011 YTD industry data for sales per contract and occupancy not currently available.

Disney, 1.8%

Holiday Inn, 1.5%

Silverleaf, 1.4%

Hilton, 2.4%

Hapimag, 2.9%

Starwood

, 2.4%

Wyndham, 10.4%

Marriott Vacations Worldwide,

6.5%

Bluegreen, 3.6%

Villa, 1.4%

Other, 65.7%

Source: Company filings, Vacation Ownership World Magazine – April 2011, ARDA

|

13

Shadow Ridge

Palm Desert, California |

Economics of a timeshare consumer

14

Year

1

Year

20

Initial

sale

Initial sale

Financing income

Incremental

business

opportunities

Rentals

Additional purchases

Financing income

Referrals

Stable

recurring

revenue base

Club dues

Management fee

On-site spending

Note: Case study of hypothetical consumer that finances their purchase through VAC.

|

15

Existing inventory drives growth

Modest near-term inventory spending requirements will allow VAC to harvest cash

flow VAC expects its points-based programs will allow the Company to more

effectively manage

inventory

by

aligning

spending

with

sales

pace

and

future

development

needs

Potential land and bulk inventory sales could also generate meaningful cash proceeds

Future

infrastructure

29%

In-process

23%

Completed

49%

Total inventory: $1.0 billion

Year End 2011E

Estimated Future

Contract Sales

-

-

125

-

1,335

1,460

$

840

930

4,230

6,000

$

$

320

230

-

275

-

825

$

$

Incurred

Potential

Spend

Completed

Under construction

Cost to complete

Future phases

Cost to complete

Total North America

($ in Millions)

Total inventory

North America inventory

Note: As of 9/17/2011. |

16

Capital efficient points product

Consumers buy the system rather than

location

Broader appeal

Ability to sell indefinitely at all galleries

Streamlined sales and marketing process

Over 365,000

owners with 550,000

weeks

Note:

All figures as of third quarter 2011 and include North America owners only.

($ in millions)

Optimization for sale

Note:

Real estate inventory spending does not include non-capitalizable

expenses associated with Cost of Vacation Ownership Products.

Cost of sales reflects real estate inventory costs.

†

$0

$100

$200

$300

$400

$500

$600

$700

$800

2008

2009

2010

2011E

Real estate inventory spending

Cost of sales

16 |

Kauai

Beach Club Lihue, Kauai

17 |

Growing margins through a balanced

approach to profitability

18

13%

3%

2%

7%

7% - 8%

0%

5%

10%

15%

2007

2008

2009

2010

2011E

Adjusted EBITDA margins

†

Note: Pro forma for Marriott royalty fees. |

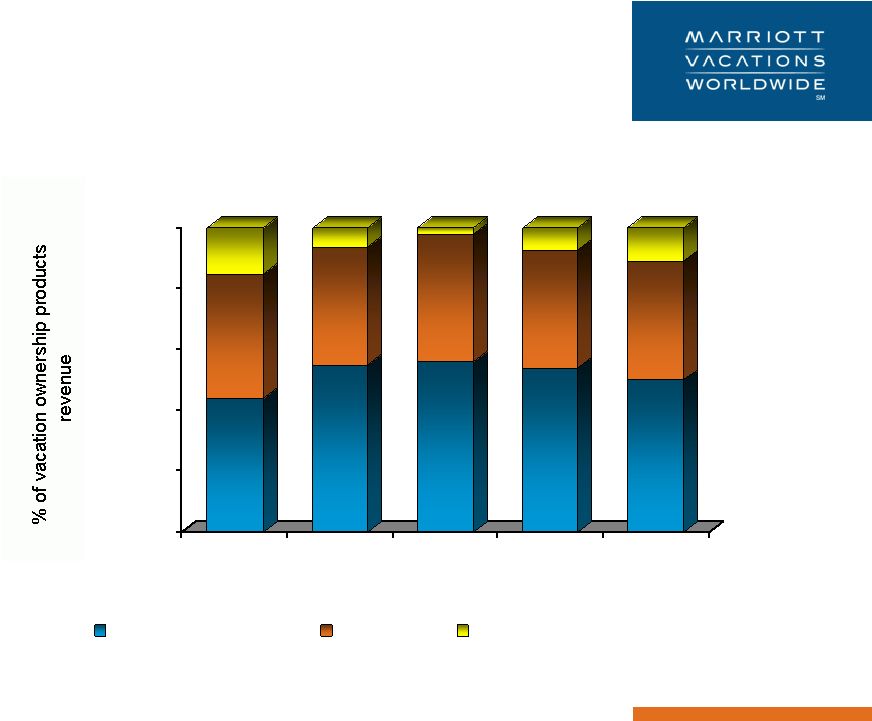

Improving product cost and

marketing and sales margins

19

44%

41%

15%

55%

39%

6%

56%

42%

2%

54%

39%

7%

49%-51%

38%-40%

9%-13%

0%

20%

40%

60%

80%

100%

2007

2008

2009

2010

2011E

Marketing & sales cost

Product cost

Development margin

Development margins

Note: Sales of vacation ownership products revenue, net of expenses is

sales of vacation ownership products revenue less cost of vacation ownership products

expense and

marketing and sales expense. |

Recurring management fee revenue

20

$42

$49

$56

$60

$62 -

$64

$0

$10

$20

$30

$40

$50

$60

$70

2007

2008

2009

2010

2011E

14%

CAGR

from 2001

to 2011

($ in millions) |

Profitable consumer financing

21

Financing

revenue

$0

$40

$80

$120

$160

$200

2010

2011E

$163 -

$168

$188

$106

$85 -

$90

Financing

revenue,

net

of

financing

expenses

and

consumer

financing

interest

expense

Financing activity

Note: +60 Days Delinquency experience.

Source: RBS and Moody’s

Delinquencies

Typical loan coupon

12.5% -

13.5%

No prepayment penalties

Convenient and easy

–

Low monthly payments

$315

Average

term

10

years

Minimum

downpayment

10%

Average

FICO

score

737

($ in millions)

†

0%

5%

10%

15%

20%

Mar-06

Jul-06

Nov-06

Mar-07

Jul-07

Nov-07

Mar-08

Jul-08

Nov-08

Mar-09

Jul-09

Nov-09

Mar-10

Jul-10

Nov-10

Mar-11

Auto

Credit card

Home equity

Timeshare |

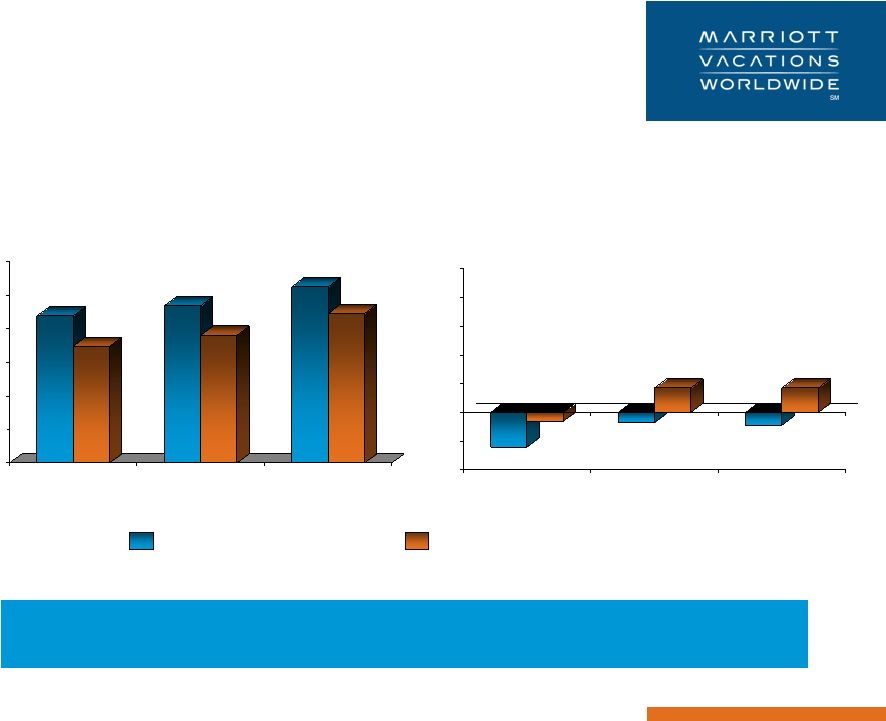

22

Improving rental results

$0

$40

$80

$120

$160

$200

$240

2009

2010

2011E

($40)

($20)

$0

$20

$40

$60

$80

$100

2009

2010

2011E

$205 -

$215

$175

$139

$187

$152

$175 -

$180

$(24)

$(6)

$(7)

$17

$15 -

$20

$(7) -

$(12)

All segments

North America segment

Rental revenue

Rental revenue, net of expenses

($ in millions)

Maintenance fees from unsold inventory totaled $68 million in 2010

and an estimated $58 million to $61 million in 2011 |

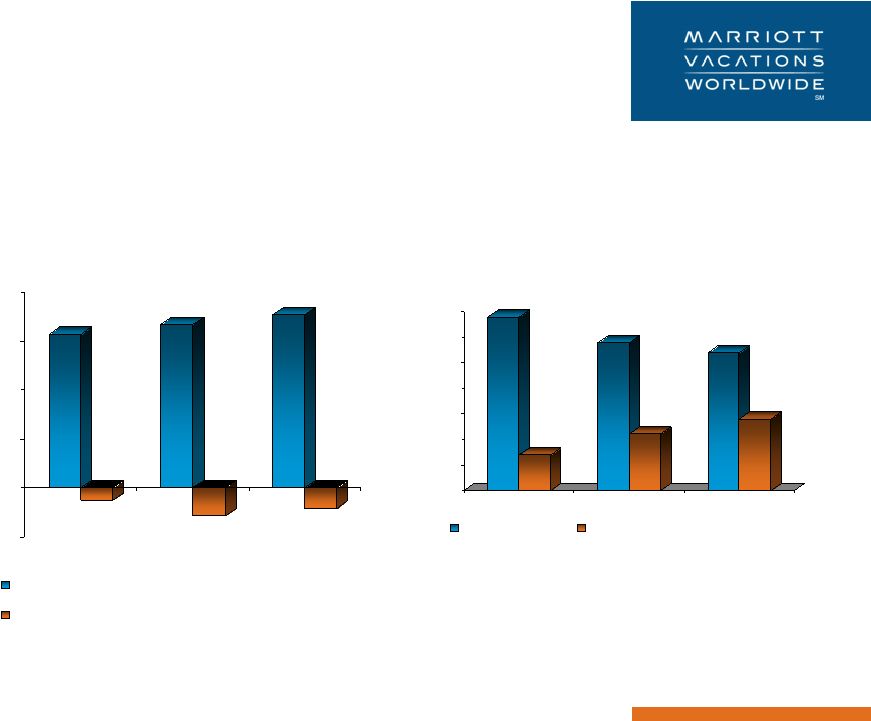

Diversified revenue streams

23

$157

$(13)

$167

$(29)

$175-$180

$(18)-$(23)

($50)

$0

$50

$100

$150

$200

2009

2010

2011E

Resort management and other services revenue

Resort management and other services revenue, net

of expenses

$34

$7

$29

$11

$25-$30

$12-$17

$0

$5

$10

$15

$20

$25

$30

$35

2009

2010

2011E

Other revenue

Other revenue, net of expenses

Resort management and other

services revenue excluding

management fees

†

Other revenue and expenses

($ in millions) |

Pro

forma capital structure 24

Corporate debt:

Revolving credit facility

-

Availability

$200

Other

3

Total corporate debt

$3

Preferred equity

$40

Total corporate debt + preferred

$43

Total debt / 2011E EBITDA

0.4x

Total liquidity

$200

Other non-recourse debt:

Warehouse facility

$125

Securitized vacation ownership debt

830

Total non-recourse debt:

$955

Note: Pro forma for the closing of the $200 million corporate credit facility, the $300

million warehouse facility, and the preferred equity offering. 3Q 2011

($ in millions) |

25

Pro forma adjusted EBITDA

†

$ 62 -

64

170 -

175

(134) -

(137)

$ 95 -

$105

2011E

$ 66

184

(134)

$ 116

2012 contract

sales scenarios

0%

$ 66

196

(135)

$ 127

+5%

$ 66

207

(135)

$ 138

+10%

Management fee revenue

Timeshare

General and

administrative expenses

(1)

Total pro forma adjusted

EBITDA

†

Estimated proceeds of undeveloped land and excess luxury

inventory over next 3 years

$150 million to $200 million

($ in millions)

(1) Includes royalty fee expense. |

Investment highlights

26

Industry leader with established brands

Experienced management team and distinguished board of directors

Strong cash flow upside from built inventory and land

Diversified revenue streams

Favorable long-term industry dynamics

Optimized capital structure with financial flexibility |

27

In our conference materials and related webcast we report certain financial measures that

are not prescribed or authorized by U. S. generally accepted accounting principles

(“GAAP”). We discuss management’s reasons for reporting these non-GAAP measures

below, and the tables on the following pages reconcile the most directly comparable GAAP

measures to the non-GAAP measures (identified by a “†” symbol on

the following pages and in the related materials) that we refer to in our conference materials and

related webcast. Although management evaluates and presents these non-GAAP

measures for the reasons described below, please be aware that these non-GAAP

measures are not alternatives to revenue, net income, or any other comparable operating

measure prescribed by GAAP. In addition, these non-GAAP financial measures may be

calculated and/or presented differently than measures with the same or similar names

that are reported by other companies, and as a result, the non-GAAP measures we report

may not be comparable to those reported by others. Earnings before interest, taxes, depreciation and amortization (EBITDA), reflects earnings

excluding the impact of interest expense, provision for income taxes, depreciation

and amortization. Our management considers EBITDA to be an indicator of operating

performance, and we use it to measure our ability to service debt, fund capital

expenditures, and expand our business. EBITDA is used by analysts, lenders, investors

and others, as well as by us, to evaluate companies because it excludes certain items that can

vary widely across different industries or among companies within the same industry. For

example, interest expense can be dependant on a company’s capital structure,

debt levels and credit ratings. Accordingly, the impact of interest expense on earnings

can vary significantly among companies. The tax positions of companies can also vary

because of their differing abilities to take advantage of tax benefits and because of

the tax policies of the jurisdictions in which they operate. As a result, effective tax rates

and provisions for income taxes can vary considerably among companies. EBITDA also

excludes depreciation and amortization because companies utilize productive assets of

different ages and use different methods of both acquiring and depreciating

productive assets. These differences can result in considerable variability in the relative

costs of productive assets and the depreciation and amortization expense among

companies.

Non-GAAP Financial Measures and

Reconciliations

Non-GAAP Financial Measures

Earnings Before Interest, Taxes, Depreciation and Amortization |

28

Adjusted EBITDA

Management also evaluates Adjusted EBITDA as an indicator of operating performance. Our

Adjusted EBITDA includes the impact of interest expense associated with our

debt from the securitization of our notes receivable and the

utilization of our warehouse facility. We include interest expense related to debt

from securitization of our notes receivable and utilization of our warehouse facility

in determining Adjusted EBITDA as the debt is secured by notes receivable that have

been sold to bankruptcy remote special purposes entities or pledged to the warehouse, and

generally is not recourse to us or to our business. For our estimated fiscal year 2011

Adjusted EBITDA calculation, we also exclude the impact of the impairment charges we

expect to record in the 2011 third quarter. We evaluate Adjusted EBITDA, which

adjusts for these items to allow for period-over-period comparisons of our ongoing core operations

before material charges, and we use it to measure our ability to

service our non-securitized debt. Adjusted EBITA also

facilitates our comparison of results from our ongoing operations with results from other

vacation ownership companies. Total Revenues Excluding Cost Reimbursements

Cost reimbursements revenue includes direct and indirect costs that property

owners’ associations and joint ventures

we participate in reimburse to us, and relates, predominantly, to payroll costs where we are

the employer. As we record cost reimbursements based upon costs incurred with no

added markup, this revenue and related expense has no impact on net income

attributable to us because cost reimbursements revenue net of reimbursed costs expense is

zero. We consider total revenues excluding costs reimbursements to be a meaningful metric as

it represents that portion of revenue that impacts net income attributable to

us. Cost of Sales (Real Estate Inventory Costs)

Cost of sales (Real Estate Inventory Costs) reflects Costs of Vacation Ownership Products

associated with the overall project development process and excludes costs that were

not initially capitalized. Management evaluates Cost of Sales (Real Estate

Inventory Costs), as it represents the direct costs to develop and construct

projects, and it is used in our measurement of our real estate inventory capital

efficiency as we compare the cash outflow for real estate inventory spending in a

given year to the Cost of Sales (Real Estate Inventory Costs) charged to expense for that same

year related to sales of vacation ownership products.

Non-GAAP Financial Measures and

Reconciliations |

29

Financing Revenue, Net of Financing Expenses and Consumer Financing Interest Expense

Financing revenues, net of financing expenses and consumer financing interest expense

includes interest income earned on notes receivable as well as fees earned from

servicing the existing loan portfolio, net of direct costs to

support the financing, servicing and securitization processes, as well as consumer financing

interest expense. We believe it is a meaningful measure as it highlights the

overall profitability of our financing business. Resort Management and Other Services

Revenue Excluding Management Fees Resort Management and Other Services Revenues

Excluding Management Fees include revenues we earn from providing ancillary offerings

(including food and beverage, retail, and golf and spa offerings), and for providing other

services to our guests and excludes fees we earn from managing our resorts. We

consider this to be meaningful as it highlights the variable revenue streams we

receive from our ancillary operations. General and Administrative Expenses Including

Royalty Fee Expense General and administrative expenses including royalty fee expense

includes the general and administrative costs to support MVW’s operations as

well as payment of an estimated royalty fee to Marriott International under the Marriott

and Ritz-Carlton license agreements (as if the spin-off had occurred on the first

day of 2007). We believe this combined measure is meaningful as it measures the

total overhead costs in support of the entire development,

financing, resort management and rental businesses.

Non-GAAP Financial Measures and

Reconciliations |

30

Fiscal Year

2007

Fiscal Year

2008

Fiscal Year

2009

Fiscal Year

2010

Fiscal Year

2011E

Total revenue

2,240

$

1,916

$

1,596

$

1,584

$

1,632

$

Less: reimbursed costs

(312)

(304)

(312)

(318)

(325)

Total revenue excluding reimbursed costs

†

1,928

$

1,612

$

1,284

$

1,266

$

1,307

$

†

Denotes non-GAAP financial measures.

($ in millions)

Total Revenue Excluding Cost Reimbursements

Cost of Sales (Real Estate Inventory Costs)

Fiscal Year

2008

Fiscal Year

2009

Fiscal Year

2010

Fiscal Year

2011E

Cost of vacation ownership products

430

$

314

$

247

$

260

$

Less: non-capitalizable expenses

(2)

(9)

(13)

(10)

Cost of sales (real estate inventory costs)

†

428

$

305

$

234

$

250

$

†

Denotes non-GAAP financial measures.

Non-GAAP Financial Measures and

Reconciliations |

31

Financing Revenue, Net of Financing Expenses

and Consumer Financing Interest Expense

Resort Management and Other Services Revenue Excluding Management Fees

($ in millions)

Fiscal Year

2010

Fiscal Year

2011E

Financing revenue

188

$

166

$

Less: financing and other expenses

(44)

(41)

Less: consumer financing interest expense

(56)

(52)

Add back: other expenses

18

14

Financing Revenue, net of financing expenses

and consumer financing interest expense

†

106

$

87

$

†

Denotes non-GAAP financial measures.

Fiscal Year

2009

Fiscal Year

2010

Fiscal Year

2011E

Resort management and other services revenue

213

$

227

$

240

$

Less: management fees

(56)

(60)

(63)

Resort management and other services revenue

excluding management fees

†

157

$

167

$

177

$

†

Denotes non-GAAP financial measures.

Non-GAAP Financial Measures and

Reconciliations |

32

General and Administrative Expenses Including Royalty Fee Expense

($ in millions)

Non-GAAP Financial Measures and

Reconciliations

Fiscal Year

2011E

Fiscal Year

2012E

General and administrative expenses

80

$

78

$

Add: royalty fee expense

1

63

65

General and administrative expenses

including royalty fee expense

†

143

$

143

$

†

Denotes non-GAAP financial measures.

1

All years have been adjusted as if the royalty agreement had been in place for all

years. |

33

Adjusted Pro Forma EBITDA

($ in millions)

Non-GAAP Financial Measures and

Reconciliations

Fiscal Year

2007

Fiscal Year

2008

Fiscal Year

2009

Fiscal Year

2010

Adjusted EBITDA

†

323

$

118

$

85

$

155

$

Less: Royalty fee expense

1

(77)

(75)

(65)

(64)

Adjusted Pro Forma EBITDA

†

246

$

43

$

20

$

91

$

†

Denotes non-GAAP financial measures.

1

All years have been adjusted as if the royalty agreement had been in place for all

years. |

34

EBITDA and Adjusted EBITDA

($ in millions)

Non-GAAP Financial Measures and

Reconciliations

Fiscal Year

2011E

Fiscal Year

2012E (flat)

1

Fiscal Year

2012E (+5%)

1

Fiscal Year

2012E (+10%)

1

Net income (loss)

2

$(162) -

(169)

41

$

48

$

55

$

Interest expense

61

64

64

64

Tax provision (benefit), continuing operations

(99) -

(102)

29

33

37

Depreciation and amortization

33

31

31

31

EBITDA

†

(167) -

(177)

165

$

176

$

187

$

Impairment charge

324

-

-

-

Consumer financing interest expense

(52)

(49)

(49)

(49)

Adjusted EBITDA

†

$ 95 -

105

116

$

127

$

138

$

†

Denotes non-GAAP financial measures.

1

Refers to percentage increase in company owned contract sales from Fiscal Year

2011E. 2

2011E has been adjusted to include a $63 million royalty fee as if the royalty

agreement had been in place for the full year and includes an estimated $12

million of expenses related to being a public company. |

35

EBITDA and Adjusted EBITDA

($ in millions)

Fiscal Year

2007

Fiscal Year

2008

Fiscal Year

2009

Fiscal Year

2010

Net income (loss)

177

$

(16)

$

(532)

$

67

$

Interest expense

-

-

-

56

Tax provision (benefit), continuing operations

107

25

(231)

45

Depreciation and amortization

39

46

43

39

EBITDA

†

323

$

55

$

(720)

$

207

$

Restructuring charges

-

19

44

-

Impairment charge

-

44

761

4

Consumer financing interest expense

-

-

-

(56)

Adjusted EBITDA

†

323

$

118

$

85

$

155

$

†

Denotes non-GAAP financial measures.

Non-GAAP Financial Measures and

Reconciliations |