Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Xenith Bankshares, Inc. | d253946d8k.htm |

| EX-99.1 - PRESS RELEASE - Xenith Bankshares, Inc. | d253946dex991.htm |

1

1

1

Forward Looking Statements

Certain statements included in this presentation are “forward-looking

statements.” All statements other than statements of historical facts contained in

this presentation, including statements regarding our plans, objectives and goals,

future events or results, our competitive strengths and business strategies, and the

trends in our industry are forward-looking statements. The words

“believe,” “will,” “may,” “could,”

“estimate,” “project,” “predict,” “continue,” “anticipate,” “intend,”

“should,” “plan,” “expect,” “appear,”

“future,” “likely,” “probably,” “suggest,” “goal,” “potential” and

similar expressions, as they relate to us, are intended to identify forward-looking

statements. Forward-looking statements made in this presentation reflect beliefs,

assumptions and expectations of future events or results, taking into account the

information currently available to us. These beliefs, assumptions and expectations may

change as a result of many possible events, circumstances or factors, not all of which

are currently known to us. If a change occurs, our business, financial condition,

liquidity, results of operations and prospects may vary materially from those expressed

in, or implied by, our forward-looking statements. Accordingly, you should not place

undue reliance on these forward-looking statements. Factors that may cause actual results

to differ materially from those contemplated by our forward-looking statements

include the risks outlined in Part 1, Item 1A, “Risk Factors” section of our

Annual Report on Form 10K for the year ended December 31, 2010 filed with Securities

and Exchange Commission. Except as required by applicable law or regulations, we

do not undertake, and specifically disclaim any obligation, to update or revise any

forward-looking statement. Exhibit 99.2 |

2

Corporate Overview

•

Xenith Bankshares, Inc. is the holding company for Xenith Bank, a rapidly

growing commercial bank

•

Business Focus: Xenith targets the banking needs of middle-market and

small businesses, local real estate developers and investors, private

banking clients, and select retail banking clients

•

Market Focus: Virginia markets with the greatest economic activity and

growth, including the MSAs of Washington, D.C., Richmond and Hampton

Roads, which are part of what we refer to as the ‘Golden Crescent’

•

Experienced, highly capable team of seasoned executives and bankers

•

Skilled team of Relationship Managers (‘RM’) with successful track record

in our target markets |

3

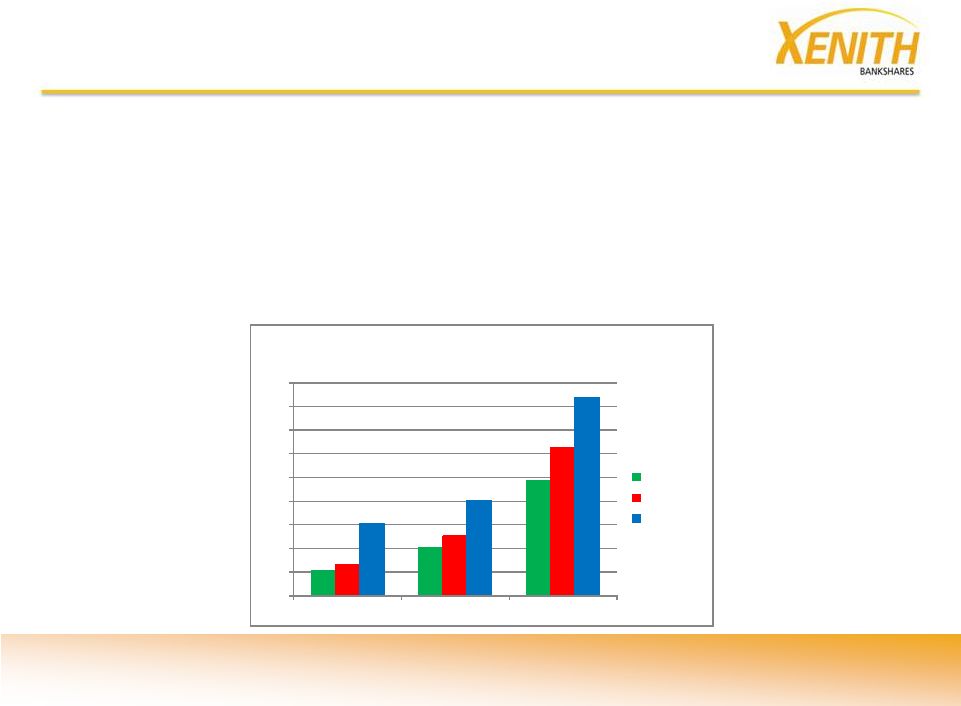

Growth Story

•

Xenith is fueled by organic growth and growth through acquisitions

•

Since 12/31/09, Xenith’s assets, loans and deposits have increased 133%, 187% and

217%, respectively

•

Loan increases have come from 42% organic growth and 58% growth through

acquisitions

•

Deposit increases have come from 55% organic growth and 45% growth through

acquisitions

$50

$100

$150

$200

$250

$300

$350

$400

$450

$500

Dec. 2009

Dec. 2010

Sept. 2011

Xenith Bankshares, Inc.

(In Millions)

Loans (net)

Deposits

Assets |

4

History

•

March 2008 –

Signed agreement with BankCap Partners to create a de novo

Virginia bank

•

May 2009 –

Signed definitive merger agreement with First Bankshares, Inc.,

the

holding company for SuffolkFirst Bank in Suffolk, Virginia (Hampton Roads)

•

June 2009 –

Closed Reg. D common stock offering for $47.5 million

•

December 2009 –

Merger with First Bankshares, name changed to Xenith

Bankshares

•

April 2011 –

Raised $17.7 million (net) in S-1 registered common stock offering

•

July 2011 –

Acquired Richmond branch operations of Paragon Commercial

Bank, and acquired assets and deposits of Virginia Business Bank

in an FDIC

failed bank transaction

•

September 2011 –

Received $8.4 million from U.S. Treasury in SBLF preferred

stock investment |

5

Summary Financial Data at Sept. 30, 2011

•

Total Assets

$470 million

•

Total Loans (net)

$293 million

•

Total Deposits

$362 million

•

Total Common Equity

$80 million

•

Tangible Common Equity

$64 million

•

Shares Outstanding

10.4 million

•

Market Capitalization

$35 million

•

SBLF

$8.4 million

•

Headquarters

Richmond, Virginia

•

Insider Ownership

37% (includes BankCap Partners)

•

Institutional Ownership

25% |

Business

Model Our business model is based on four building

blocks: Seasoned

Seasoned

Team

Team

Vibrant

Vibrant

Markets

Markets

Significant

Significant

Capital

Capital

Resources

Resources

Core

Core

Customers

Customers

6

6 |

•

Previous large regional bank

experience in the Mid-Atlantic

•

Diversified backgrounds in key

disciplines

•

Extensive credit experience

Executive Team

Professional Staff

Knowledgeable Board

7

Relationship Managers

Skilled Team

•

Seasoned bankers with extensive in-

market experience and existing

customer relationships

•

Specific experience in C&I, Small

Business, Commercial Real Estate, &

Private Banking

•

In-depth banking experience in

technology and operations

•

Rigorous analytics & information based

approach

•

Public company / SEC reporting

experience

•

Significant public company board

experience, six with previous bank

board experience

•

Board members with direct experience

overseeing key committees including

Audit, Credit, and Asset & Liability

Management

7 |

Highly

Attractive Highly Attractive

Demographics

Demographics

8

8

Attributes of Our Target Markets

Fragmented Banking

Fragmented Banking

Landscape

Landscape

Economy Built on

Economy Built on

Diverse Industry Base

Diverse Industry Base

Vibrant Local

Vibrant Local

Economies:

Economies:

Golden Crescent makes

Golden Crescent makes

up 75%

up 75%¹

1

of Virginia’s

of Virginia’s

Economic Output

Economic Output

8

1

Source: Bureau of Economic Analysis, 2010 |

Virginia

Demographics: Golden Crescent Highlights

Washington

& N. Va. Region

Hampton

Roads

Region

Richmond

Region

NC

TN

KY

MD

PA

OH

•

The

“Golden

Crescent”

is

made

up of the following MSAs:

-

Washington, DC-MD-VA-WV

-

Richmond-Petersburg, VA

-

Norfolk-Virginia Beach-

Newport News, VA-NC

•

~ 73%

1

of the state’s deposits are

located in Golden Crescent

•

Virginia’s median household

income, $61,347

2

, is higher than

national median household

income of $54,442

2

•

The Golden Crescent represents

an even more attractive market

with a median household income

of the $73,259

2

1

SNL Financial, June 30, 2011

2

SNL Financial, 2010

9 |

Virginia

Demographics: Vibrant Business Environment

•

In 2010, Virginia’s GDP estimated at $424 billion

1

, ranking it 10

th

in the

nation

•

Since 2007, Virginia has ranked 1

st

or 2

nd

in CNBC’s survey of the best state

for business

•

In 2010, Virginia placed 2

nd

in study conducted by Forbes.com evaluating

top states for business

•

The Golden Crescent, represents the Virginia markets with the greatest

economic

activity

and

growth

and

some

of

the

lowest

unemployment

rates

(1.9% lower than national rate

2

)

10

1

Bureau of Economic Analysis, September 2011

2

Bureau of Labor Statistics, September 2011 |

Virginia

Deposits Snapshot Virginia Branch Deposits Concentration

Source: SNL Data, as of 6/30/2011

•

Of 106 banks headquartered in Virginia, 88 were less than $1 billion in assets and 69 had

assets less than $500 million

•

Community

banks

are

typically

constrained

by

capital

and

limited

by

their

focus

on

real

estate lending

•

Mega-banks

are

hampered

by

their

organizational

structure

and

lack

of

consistent

focus

11

0

20

40

60

80

100

120

0

10

20

30

40

50

60

70

Deposit Totals

(Billions)

Number

of

Banks

The Virginia 'Barbell'

Number of Banks

Deposits |

12

12

Target Customers

Stable Funding

Source

Retail

Local Relationships, Centers of

Influence, Deposit rich, low risk

lending

Local Investors &

Developers

Multiple Property Types

Real Estate

C&I, Small Business

Private Banking

Diversified

Self Funding

Profitable

Xenith generates new customers though a focused, targeted prospecting and

marketing effort combined with a risk adjusted return discipline

12 |

Increase

Breadth of Increase Breadth of

Market Served

Market Served

13

13

Attract Talented

Attract Talented

Bankers

Bankers

Provides Regulatory

Provides Regulatory

Flexibility

Flexibility

Raise House & Legal

Raise House & Legal

Lending Limits

Lending Limits

Significant Capital Resources

13 |

Business

Results - Organic Growth

•

In 2010, 50% organic loan growth and 53% organic deposit growth

•

Through nine months ending September 30, 2011;

-

23% organic loan growth (31% annualized)

-

43% organic deposit growth (60% annualized)

•

Organic loan growth balanced between C&I and CRE

•

Organic deposit growth has been focused on building transaction

accounts

•

While the underlying strength of the Virginia economy sustains long

term growth, most recent organic growth is the result of moving

market share from the large banks.

14

14 |

15

Acquisitions

Xenith began by acquiring First Bankshares in Suffolk, Virginia (part of the

Hampton Roads region) through a merger

•

Acquired $110 million in loans at a $7.6 million discount

•

Loan portfolio had approximately 43% in C&I loans

•

Credit problems almost exclusively related to an out-of-market

participations portfolio; have made progress at reducing exposure

•

Acquired $114 million of deposits; balance of deposits in Suffolk market

total $135 million at the end of September 2011

15

15 |

16

Xenith acquired the Richmond branch operations of Paragon Commercial

Bank on July 29, 2011 –

a strategic

acquisition

•

Acquired approximately $58.3 million in performing loans at a $1.8

million discount

•

Hand-picked the loans we purchased

•

Acquired $76.6 million of deposits, an excellent mix of deposits

comprised

primarily

of

transaction

accounts

at

a

deposit

premium

of

approximately $2.5 million

•

Retained the entire Paragon team and integrated them into Xenith’s

headquarters, closing the Paragon branch

16

16

Acquisitions |

17

Acquisitions

Xenith

acquired

all

of

the

deposits

and

substantially

all

of

the

assets

of

Virginia Business Bank on July 29, 2011 in an FDIC failed bank transaction –

a financial

acquisition; the acquisition was completed without any FDIC

loss-share arrangement

•

Acquired approximately $93 million in assets at a $23.8 million

discount, approximately $71 million in loans

•

Acquired

$78

million

in

deposits

(mainly

internet

deposits)

at

a

0%

deposit premium, more than 48% have been redeemed

•

Recorded a pre-tax bargain purchase gain of $8.7 million in Q3

17

17 |

18

•

Our loan mix reflects our business strategy

•

We are focused on lending to

middle-market and small businesses, local

real estate developers and investors

Loan Portfolio

Dec -

2009

Dec -

2010

Sept -

2011

Gross Loan Composition ($)

Consumer

RRE

CRE

C&I

$102 million

$153 million

$297 million

0%

5%

15%

20%

25%

30%

35%

40%

45%

50%

Dec -

2009

Dec -

2010

Sept -

2011

Gross Loan Composition (%)

Consumer

RRE

CRE

C&I

10% |

19

19

Loan Portfolio

•

Over the last seven quarters, we have steadily built Loan Interest & Fee Income

•

In Q3 2011, we increased Loan Interest & Fee Income more than 80% over Q2

2011, reflecting our organic growth and two acquisitions at the end of July 2011

•

Loan Interest Income and Gross Loan Yields reflect the impact of

the accretion of

discount

5.78%

6.95%

7.44%

7.78%

6.89%

6.30%

7.88%

4%

5%

6%

7%

8%

9%

10%

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

Q2 2011

Q3 2011

Quarterly Gross Loan Yields

$1.56

$1.99

$2.37

$2.74

$2.79

$2.83

$5.13

$0

$1

$2

$3

$4

$5

$6

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

Q2 2011

Q3 2011

Loan Interest & Fee Income

(in Millions)

|

20

20

Deposit Portfolio

•

From the outset, we have placed a significant emphasis on core deposits; deposit

gathering is a key factor in calculating our RM incentive pay

•

Since 12/31/2009, we have increased transaction accounts (interest & non-interest

checking and money market accounts) nearly 900% by 9/30/2011

•

Since 12/31/2009, we have reduced time deposits (core plus brokered) as a

percentage of total deposits from nearly 78% to 37% at 9/30/2011

0%

10%

20%

30%

40%

50%

60%

70%

Dec -

2009

Dec -

2010

Sept -

2011

Deposit Composition (%)

Non-Int. Checking

Interest Checking

Money Market / Savings

Brokered CDs

Core Time Deposits

$0

$50

$100

$150

$200

$250

$300

$350

$400

Dec -

2009

Dec -

2010

Sept -

2011

Deposit Composition ($)

Non-Int. Checking

Interest Checking

Money Market / Savings

Brokered CDs

Core Time Deposits

$114 million

$175 million

$362 million |

$0.37

$0.35

$0.43

$0.41

$0.35

$0.36

$0.63

$0.0

$0.1

$0.2

$0.3

$0.4

$0.5

$0.6

$0.7

$0.8

$0.9

$1.0

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

Q2 2011

Q3 2011

Deposit Interest Expense

(in Millions)

21

21

Deposit Portfolio

•

As we have repositioned our mix of deposits, we have also reduced our average

cost

•

Since 12/31/2009, we have reduced the quarterly average cost of deposits

from 1.38% to 0.91%, a reduction of 47 basis points

1.38%

1.20%

1.20%

0.96%

0.92%

0.80%

0.91%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

1.60%

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

Q2 2011

Q3 2011

Quarterly Average Cost of Deposits |

Credit Risk

Management •

Purposeful establishment of credit culture

-

Starts with Board, Credit Policy Committee and Executive Management

-

Close alignment between RMs and Credit Risk Management

-

Explicit understanding of senior debt lender role

-

Risk-adjusted pricing discipline

•

Credit exposure is based on the risk rating of the credit and the type of collateral

-

The risk rating of the credit is the result of a disciplined underwriting process

-

The collateral rating related to the expected loss in the event of default

Credit process includes our Management Credit Committee, our Credit Policy

Committee and Watch List meetings

22

22 |

Work-out

Loan Management •

There are currently no loans originated by Xenith in our work-out portfolio

•

Work-out loan portfolio is a predictable by-product of certain acquisitions

•

First Bankshares

-

Non-accrual Loans acquired in December 2009

$4.1 million

-

Balance at end of September 2011

$2.4 million

•

Virginia Business Bank

-

Non-accrual Loans acquired in July 2011

$4.7 million

-

Balance at end of September 2011

$3.2 million

•

Segregated work-out team

-

Professionally managed work-out team reporting to CEO

-

Led by a seasoned banker and staff with extensive work-out experience in the

mid-Atlantic

23

23 |

Criticized

Loans / Non-Performing Assets 24

24

•

All of our criticized loans and non-performing

assets were acquired in the First Bankshares

and Virginia Business Bank acquisitions

•

Criticized loans and non-performing assets are

reviewed monthly

•

Xenith’s ALLL / Loan ratio is 1.15%

•

ALLL calculation does not include the loan

discounts booked to reflect our acquired loans

at fair value

•

As of 9/30/2011, ALLL totaled $3.4 million

•

In addition to the ALLL, we had $16.4 million in

remaining discount related to the acquired

portfolios as of 9/30/2011

•

Our ALLL + Discount totaled $19.8 million as of

9/30/2011

•

The ALLL + Discount / Gross Loans = $19.8

million / $313 million = 6.32%

Sept. 30, 2011

Special Mention Loans

13,565

$

Substandard

19,938

Doubtful

1,545

Total Criticized Loans

35,048

$

Nonaccrual Loans (included above)

5,596

$

Other real estate owned

1,379

Total Non-performing Assets

6,975

$

Non-performing Assets / Gross Loans

2.35%

Non-performing Assets / Total Assets

1.48%

ALLL / Gross Loans

1.15%

ALLL / Non-accrual Loans

61.14%

Net Charge-offs / Average Loans

0.64% |

25

25

Financial Highlights -

Balance Sheet

In Thousands

21-month

Dec 2009

Dec 2010

Sept 2011

Growth

Assets

Cash & Equivalents

35,203

$

12,201

$

83,967

$

139%

Investments

36,847

58,890

60,861

65%

Loans (Net)

102,050

151,380

293,307

187%

Intangible Asset

14,229

14,109

16,445

16%

Other Assets

13,262

14,622

15,375

16%

Total Assets

201,591

$

251,201

$

469,955

$

133%

Liabilities & Equity

Non-Interest Checking

14,646

$

22,800

$

47,127

$

222%

Interest Checking

5,609

5,543

14,504

159%

Money Market & Savings

5,358

45,148

166,914

3015%

Time Deposits

88,535

101,648

133,733

51%

Total Deposits

114,148

175,139

362,278

217%

Borrowed Funds

31,260

25,001

20,000

-36%

Other Liabilities

2,111

2,273

7,270

244%

Total Liabilities

147,519

202,413

389,547

164%

Equity

54,072

48,789

80,408

49%

Total Liabilities & Equity

201,591

$

251,201

$

469,955

$

133% |

26

26

Net Interest Margin

•

GAAP NIM reflects the purchase accounting impact of accretion

Net Interest Margin is defined as the percentage of net interest

income to average-earning assets.

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

Q2 2011

Q3 2011

GAAP NIM

2.99%

4.51%

4.41%

5.84%

4.70%

4.35%

5.01%

2.0%

2.5%

3.0%

3.5%

4.0%

4.5%

5.0%

5.5%

6.0%

GAAP NIM |

27

27

Financial Highlights -

Income Statement

In Thousands

2009

2010

Sept 2011

YTD

Interest Income

8,640

$

10,760

$

12,256

$

Interest Expense

4,195

2,167

1,797

Net Interest Income

4,445

8,593

10,459

Provision For Loan Losses

5,501

1,990

3,100

Net Interest Income after Provision

(1,056)

6,603

7,359

Non-Interest Income

552

483

8,775

Non-Interest Expense

6,022

13,002

11,845

Net Income Before Taxes

(6,526)

(5,916)

4,289

Income Taxes

(2,219)

-

57

Net Income

(4,307)

$

(5,916)

$

4,232

$ |

28

28

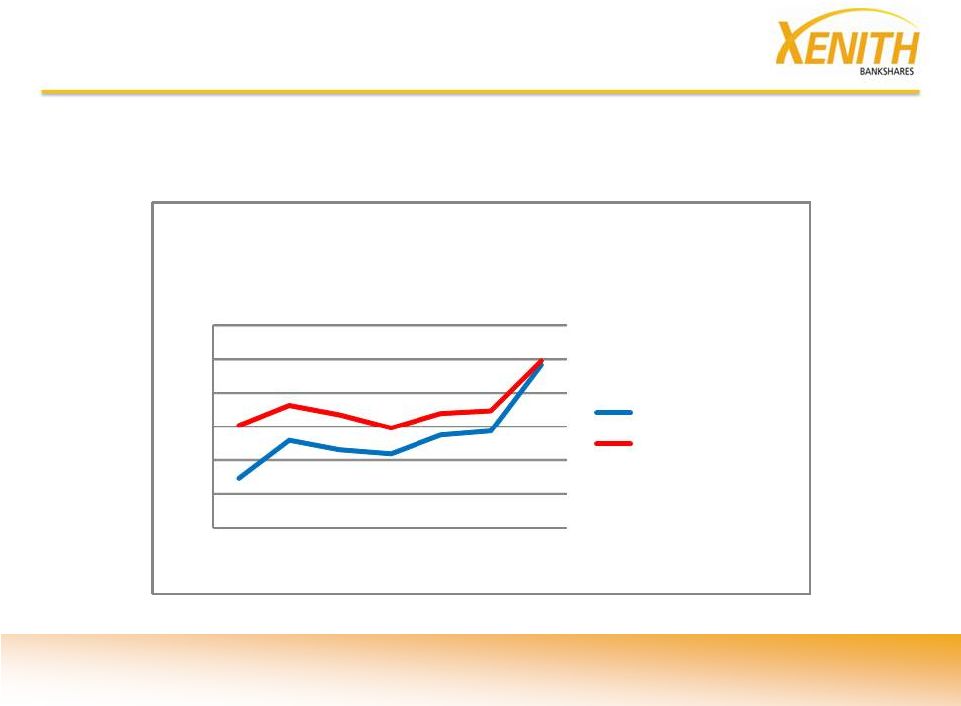

Net Interest Margin

•

Since Q1 2010, the growth in Net Interest Income is 2X the growth in Non-

Interest

Expense (328% vs. 162%).

$-

$1

$2

$3

$4

$5

$6

Q1

2010

Q2

2010

Q3

2010

Q4

2010

Q1

2011

Q2

2011

Q3

2011

Quarterly Net Interest Income &

Non

-

Interest Expense

(in Millions)

Net Interest Income

Non-Interest Expense |

29

Xenith is well capitalized: Proceeds from our S-1 registered public offering, SBLF

preferred stock issuance and the bargain purchase gain from the Virginia Business

Bank acquisition have strengthened our capital position in 2011

29

Capital

Includes proceeds of

$47.5 million related

to initial Xenith Reg

D offering

$54.1

$48.8

$17.7

$8.4

$5.4

$80.4

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

Dec 2009

Dec 2010

Supplemental

Offering

(April 2011)

SBLF

(Sept 2011)

YTD

Comprehensive

Income

Sept 2011

Xenith Equity |

30

30

Capital Ratios

Dec 2009

Dec 2010

Sept 2011

Leverage Ratio

26.8%

14.8%

15.4%

Tier 1 RBC Ratio

36.7%

20.3%

18.8%

Total RBC Ratio

36.7%

21.4%

19.9%

0%

5%

10%

15%

20%

25%

30%

35%

40%

Xenith Bank Capital Ratios |

•

We are focused primarily on organic growth in our target markets

–

Disciplined marketing and sales strategies

–

Hire the best of the best bankers who can gain profitable market

share

–

Metrics, reporting and incentives to support objectives

•

We continue to evaluate the competitive landscape for opportunities

–

Virginia is a fragmented banking market

–

Our business model is unique in Virginia

•

Our infrastructure can support significant growth

–

Management team and Board capable of managing a larger institution

31

Looking Forward |

Skilled

Management Team

and

Demonstrated

Model

Significant Capital

Selective In-Market

Consolidation

(Whole bank & select asset

opportunities)

Strong,

Strong,

Substantial &

Substantial &

Independent

Independent

Virginia Bank

Virginia Bank

Organic Growth

(Attractive demographics;

proven market competitor)

•

Focus on the Virginia markets with the greatest economic activity and growth

•

Team of experienced professionals

•

Significant capital

•

Local management and decision-making processes

32

+

+

Investment Considerations |

Appendix

33 |

•

Malcolm S. McDonald –

Chairman of the Board of Directors, Xenith

Bankshares; Retired CEO, Signet

Banking Corporation •

T. Gaylon Layfield, III -

CEO & President, Xenith Bankshares; formerly COO Signet Banking

Corporation

•

Larry L. Felton -

Retired COO of Angus I. Hines, Inc.

•

Palmer P. Garson -

Managing Director of Cary Street Partners, LLC

•

Patrick D. Hanley -

CEO of Gallium Technologies, LLC; former CFO, Overnight Transportation

•

Peter C. Jackson -

President of Jackson Real Estate

•

Brian D. Jones -

Principal and co-founding partner of BankCap Partners

•

Robert J. Merrick -

Retired Chief Credit Officer, Signet Banking Corporation

•

Scott A. Reed -

Principal and co-founding partner of BankCap Partners

•

Mark Sisisky -

Managing Director of Caprin Asset Management

•

James

E.

Turner

-

Retired

President

and

Chief

Operations

Officer

of

General

Dynamics

34

Board of Directors |

•

T.

Gaylon

Layfield,

III:

President,

Chief

Executive

Officer

and

a

director

of

Xenith

Bankshares

–

Previously President and Chief Operating Officer of Signet Banking Corporation

–

Has more than 25 years experience in banking

•

Thomas

W.

Osgood:

EVP,

Chief

Financial

Officer,

Chief

Administrative

Officer

and

Treasurer

–

Held roles in commercial banking, investment banking and risk management at Signet Bank and

Wachovia Bank –

Has more than 20 years experience in banking

•

Wellington

(Chris)

W.

Cottrell,

III:

EVP

and

Chief

Credit

Officer

–

Served as Managing Director of Risk Management in the Corporate and Investment Banking Group

at SunTrust Bank –

Spent entire 30 year career in banking

•

Ronald E. Davis:

EVP and head of Operations and Technology

–

Served as President and CEO of Virginia Heartland Bank and its successor, Second Bank and

Trust –

Spent entire 35 year career in banking

•

W. Jefferson O’Flaherty:

EVP and head of Private Banking

–

Regional Managing Director of Wachovia Wealth Management

–

Spent entire 35 year career in banking in Virginia with broad responsibilities across the

‘Golden Crescent’ •

Edward

H.

Phillips,

Jr.:

EVP

and

Chief

Lending

Officer

–

Corporate Relationship Manager for BB&T in Central Virginia

–

20 years of commercial banking experience, including both relationship management and credit

roles 35

Management Bios |