Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Bristow Group Inc | d251636d8k.htm |

Second Quarter FY 2012

Earnings Presentation

Bristow Group Inc.

November 8, 2011

Exhibit 99.1 |

2

Second quarter earnings call agenda

Introduction

CEO remarks and operational highlights

Current and future financial performance

-

FY12 Q2 Financial discussion

-

Update on capital return

Closing remarks

Questions and answers

Linda McNeill, Director Investor Relations

Bill Chiles, President and CEO

Jonathan Baliff, SVP and CFO

Bill Chiles, President and CEO |

3

Forward-looking statements

This

presentation

may

contain

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

Forward-looking

statements

include

statements

about

our

future

business,

operations,

capital

expenditures,

fleet

composition,

capabilities

and

results;

modeling

information,

earnings

guidance,

expected

operating

margins

and

other

financial

projections;

future

dividends,

share

repurchase

and

other

uses;

plans,

strategies

and

objectives

of

our

management,

including

our

plans

and

strategies

to

grow

earnings

and

our

business,

our

general

strategy

going

forward

and

our

business

model;

expected

actions

by

us

and

by

third

parties,

including

our

customers,

competitors

and

regulators;

share

repurchase

and

other

uses

of

excess

cash;

the

valuation

of

our

company

and

its

valuation

relative

to

relevant

financial

indices;

assumptions

underlying

or

relating

to

any

of

the

foregoing,

including

assumptions

regarding

factors

impacting

our

business,

financial

results

and

industry;

and

other

matters.

Our

forward-looking

statements

reflect

our

views

and

assumptions

on

the

date

of

this

presentation

regarding

future

events

and

operating

performance.

They

involve

known

and

unknown

risks,

uncertainties

and

other

factors,

many

of

which

may

be

beyond

our

control,

that

may

cause

actual

results

to

differ

materially

from

any

future

results,

performance

or

achievements

expressed

or

implied

by

the

forward-looking

statements.

These

risks,

uncertainties

and

other

factors

include

those

discussed

under

the

captions

“Risk

Factors”

and

“Management’s

Discussion

and

Analysis

of

Financial

Condition

and

Results

of

Operations”

in

our

Annual

Report

on

Form

10-K

for

the

fiscal

year

ended

March

31,

2011

and

our

Quarterly

Report

on

Form

10-Q

for

the

quarter

ended

September

30,

2011.

We

do

not

undertake

any

obligation,

other

than

as

required

by

law,

to

update

or

revise

any

forward-

looking

statements,

whether

as

a

result

of

new

information,

future

events

or

otherwise. |

4

Chief Executive comments

Bill

Chiles,

President

and

CEO |

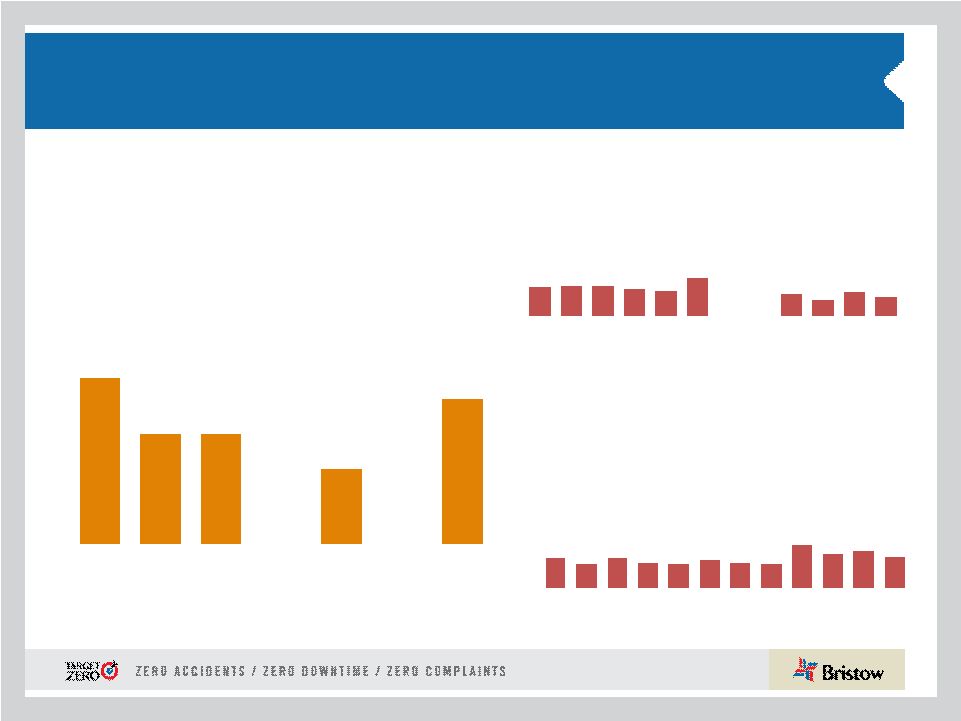

5

Operational safety review

0.33

0.34

0.34

0.31

0.28

0.43

0.00

0.00

0.25

0.18

0.27

0.22

0.00

0.50

1.00

O

N

D

J

F

M

A

M

J

J

A

S

1.17

0.78

0.78

0.00

0.00

1.02

0.54

0.00

1.00

2.00

2006

2007

2008

2009

2010

2011

YTD 2012

* Includes consolidated commercial operations only

0.16

0.13

0.16

0.14

0.13

0.15

0.14

0.13

0.23

0.18

0.20

0.17

0.00

0.10

0.20

0.30

0.40

0.50

O

N

D

J

F

M

A

M

J

J

A

S

Total Reportable Injury Rate per 200,000 man-

hours (cumulative)

Lost Work Case Rate per 200,000

man-hours (cumulative)

Air Accident Rate* per 100,000

Flight Hours (Fiscal Year)

FY11

FY12

FY11

FY12 |

6

Q2 FY12 highlights

•

Quarterly performance was negatively affected by a non-cash inventory write

down, a decrease in earnings from unconsolidated affiliates, an impairment

charge resulting from a base closure, and the loss on the disposal of a fixed

wing aircraft

•

Strong cash flow generation allows us to deliver on commitment to create a

balanced return as evidenced by (up to) $100 million share buyback program

•

Bristow

revises

earnings

per

share

guidance

for

the

full

FY12

to

$3.05

-

$3.30

•

Q2 operating revenue of $297.1M (4% increase from Q2 FY11, 4% increase from Q1

FY12) •

Q2 GAAP EPS of $0.07 (93% decrease from Q2 FY11, 88% decrease from Q1 FY12)

•

Q2 adjusted EPS * of $0.63 (38% decrease from Q2 FY11, 17% increase from Q1

FY12) •

Q2 operating income of $9.6M (82% decrease from Q2 FY11, 74% decrease from Q1

FY12) •

Q2 adjusted operating income * of $38.5M (25% decrease from Q2 FY11, 10% increase

from Q1 FY12) •

Q2 adjusted EBITDA * of $62.1M (15% decrease from Q2 FY11, 7% increase from Q1

FY12) •

Q2 operating cash flow of $64.1M (51% increase from Q2 FY11, 21%

increase from Q1 FY12)

* Adjusted EPS, adjusted operating income and adjusted EBITDA amounts exclude

gains and losses on dispositions of assets and any special items

during

the

period.

See

reconciliation

of

these

items

to

GAAP

measures

in

appendix

and

our

earnings

release

for

the

quarter

ended

September 30, 2011 |

7

•

Brent remains above $100 in the face of weak global economy. OPEC expected

to defend $90/b -

$100/b Brent

•

Momentum continues to build in the U.S. Gulf of Mexico with restart of

deepwater drilling

•

International oil service up-cycle is continuing to steadily unfold; however

costs to fulfill growth are impacting many providers this quarter

•

Strong helicopter activity returning to pre-recession levels with increasing

tender activity and tightening helicopter availability

•

Today we are bidding for contracts requiring 20-25 new large aircraft starting

in 2012 and 2013. Bidding activity over the next six months is expected to

double requiring over 40 new large aircraft

•

81% of our consolidated operating revenue and 94% of our business unit

operating income came from international markets this quarter

Current market environment

Source: Barclays Capital Research and PFC Energy October 2011

|

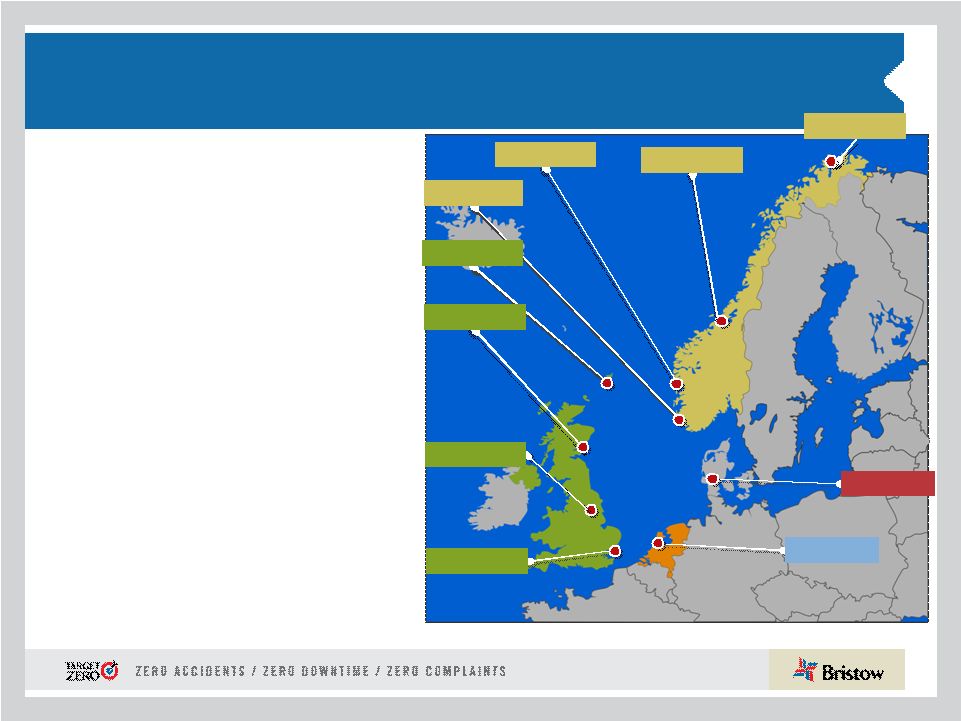

8

•

Europe represents 38% of total Bristow

operating revenue in Q2FY12 and 52% of

operating income

•

Operating margin of 20.7% vs 22.1% in prior

year quarter

•

Increased oil and gas revenue and flying

hours primarily from customers in Southern

North Sea and Aberdeen

•

Higher salary and benefit costs in Norway

and increased maintenance costs

•

Search and Rescue (SAR) UK Gap bid

submitted; Norwegian SAR pre-qualified

Outlook:

•

Continued high tender activity

•

New incremental work starting, including

two large aircraft in Norway continuing

market share gains

•

FBH was awarded Dutch Antilles SAR

contract for two large aircraft

FY12 operating margin expected to

be ~low twenties

Europe (EBU)

UK

Netherlands

Norway

Norwich

Aberdeen

Scasta

Stavanger

Den Helder

Bergen

Hammerfest

Esbjerg

Humberside

Kristiansund |

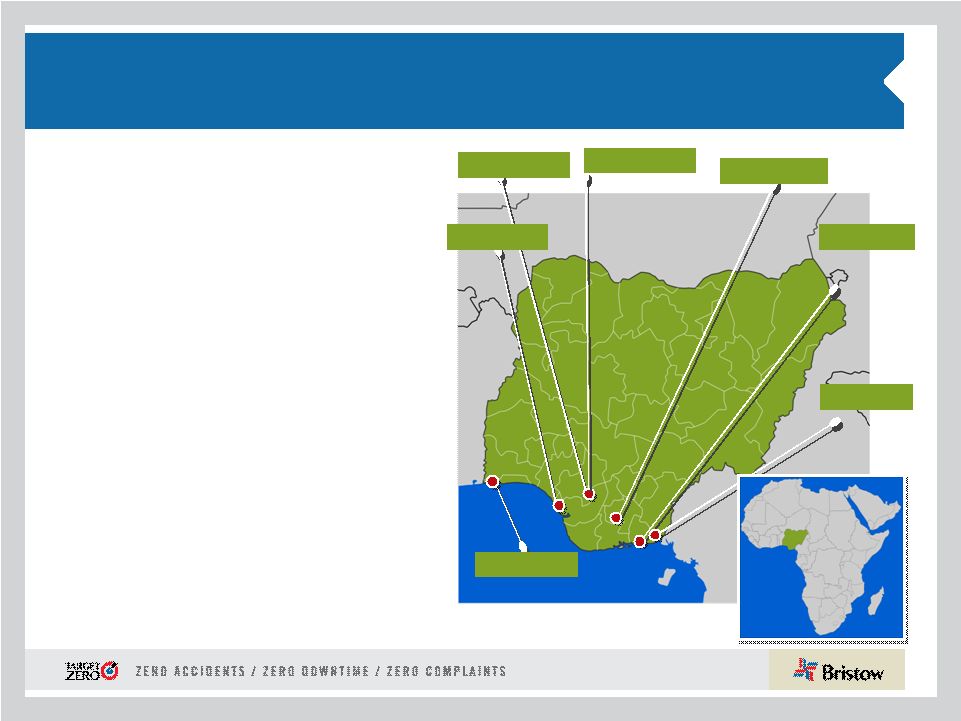

9

West Africa (WASBU)

Nigeria

Lagos

Escravos

Port Harcourt

Warri Osubi

Eket

Calabar

•

Nigeria represents 19% of total Bristow operating

revenue in Q2 FY12 and 36% of operating income

•

Operating revenue of $61.1M increased from

$56.2M in Q2 FY11 with operating income

decreased slightly to $16.1M from $17.2M from

prior year quarter

•

Operating margin of 26.4% vs 30.5% in prior year

quarter due to increase in maintenance,

depreciation, training and travel expense

•

$1.1M loss on fixed wing aircraft damaged in

incident

•

Record flight hours due to competitor aircraft

model type grounding; however, not expected to

continue

Outlook:

•

Incremental contracts at attractive rates

•

Focus on Client Promise and reducing working

capital

•

Organizational restructuring continues

FY12 operating margin expected to be

~ low to mid twenties

Warri Texaco |

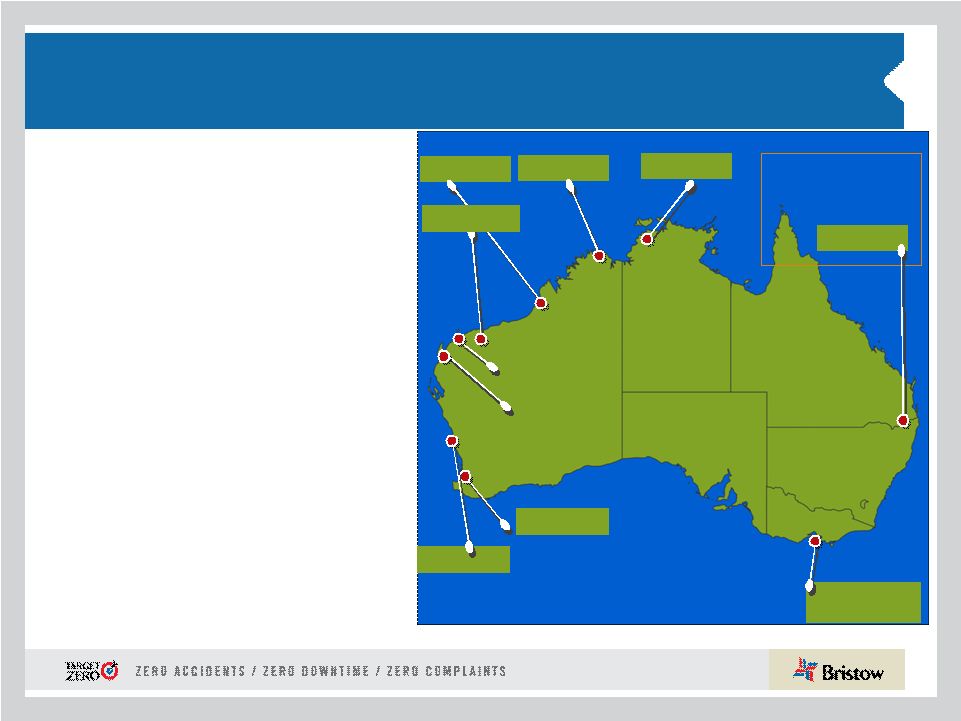

10

Exmouth

Varanus Is

Barrow Is

Australia (AUSBU)

Australia

Perth

Dongara

Essendon

Tooradin

Broome

Truscott

Darwin

BDI provide support

to the Republic of

Singapore Air Force

Oakey

•

Australia represented 12% of total Bristow

operating revenue in Q2 FY12 and 1% of

operating income

•

Operating revenue of $30.5M decreased from

$34.2M Q2 prior year primarily due to

continued delayed activity

•

Operating income decreased from $6.1M in

Q2 FY11 to $0.6M in Q2 FY12 due to

reduced overall volume of work combined

with relatively high overhead

•

Operating margin decreased to 1.9% vs

17.8% for the prior year quarter due to

continued labor costs associated with lost

contract

Outlook:

•

Additional new technology work confirmed in

FY12 with two key operators

•

Other first half work delayed until late FY12,

early FY13

FY12 operating margin expected

to be ~ mid teens

Karratha |

11

Other International (OIBU)

Consolidated in OIBU

Unconsolidated Affiliate

•

OIBU represented 12% of total Bristow operating revenue

and 5% of operating income for Q2 FY12

•

Operating revenue of $35.2M slightly lower than Q2 FY11

of $36M; Operating income, excluding Lider, is $9M same

as Q2 prior year

•

Operating margin, excluding Lider, remained relatively flat

at ~ 25% over the prior year quarter

•

Although operationally on plan, Lider equity earnings had

a negative impact of $6.6M for Q2 due to foreign

exchange impact associated with US GAAP accounting

•

No work in Libya

Outlook:

•

Incremental contracted work for nine helicopters in

Equatorial Guinea, Bangladesh, Trinidad and Brazil is not

reflected in this quarter’s numbers although some costs

have been incurred

•

Lider will have 13 additional helicopters on contract in Q3

•

Q3 will see two large aircraft move from Malaysia back to

Australia

FY12 operating margin expected to be ~ low

twenties |

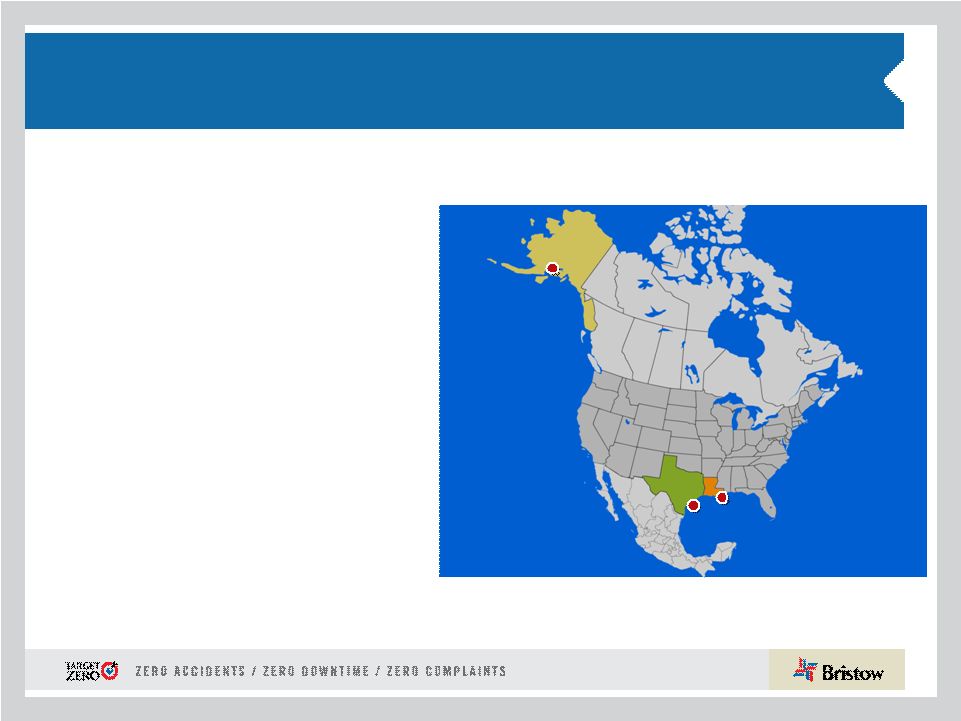

12

North America (NABU)

•

•

Operating revenue of $47.9M represents 16% of

total Bristow operating revenue

•

Operating income decreased to $2.6M vs.

$8.9M in the prior year quarter

•

Operating margin of 5.4% compared to 16.4%

prior year quarter, which was higher due to

increased flying associated with oil spill work

•

Adjusted operating margin, excluding special

items, of 11% compared to 3.6% prior year

quarter, due to better flight hours and focused

cost management

•

Creole base in Louisiana closed

Outlook:

•

GoM drilling permits continue to be issued but at

a slow rate

•

Two new technology large aircraft S-92s to

arrive GoM Q3 for contracted work

FY12 operating margin expected to

be ~ single digit |

13

Financial discussion

Jonathan

Baliff,

SVP

and

CFO |

14

Financial highlights:

Adjusted EPS & EBITDA Summary

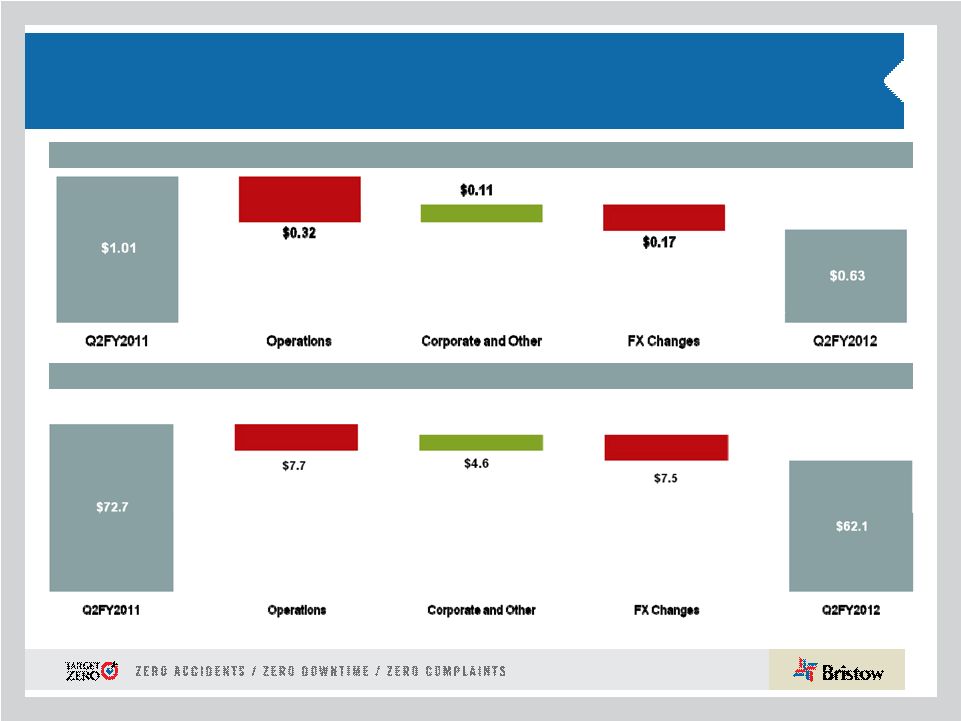

Q2 FY11 to Q2 FY12 adjusted EPS bridge

Q2 FY11 to Q2 FY12 adjusted EBITDA bridge (in millions)

* Adjusted EPS, adjusted operating income and adjusted EBITDA amounts exclude

gains and losses on dispositions of assets and any special items during the period. See

reconciliation of these items to GAAP in our earnings release for the quarter ended

September 30th, 2011. |

15

Financial highlights:

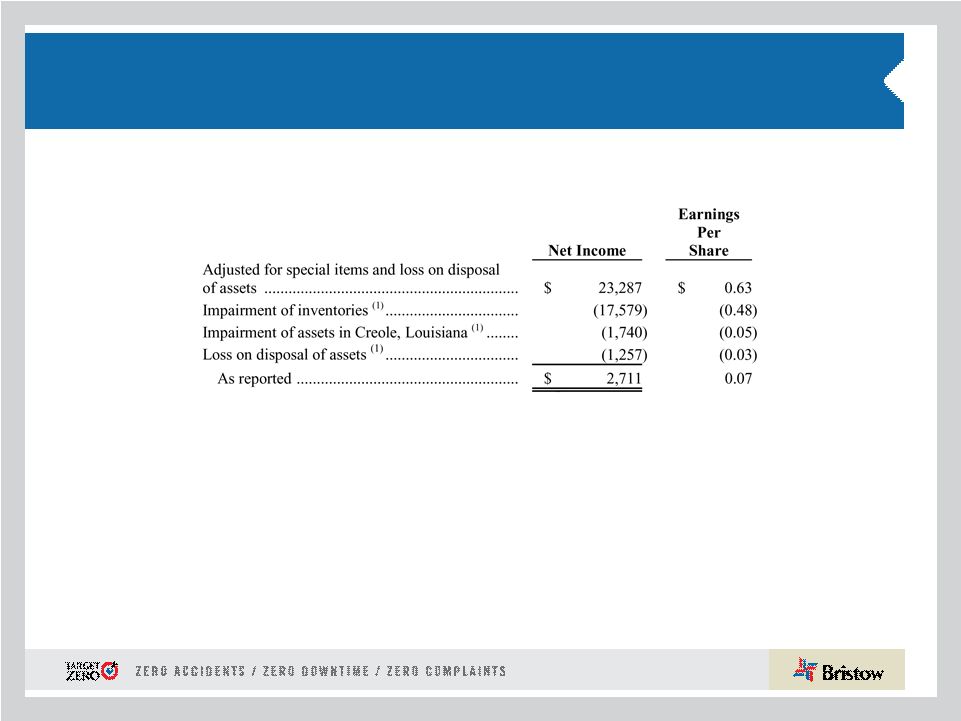

Inventory write-down and special items

•

There has been a marked acceleration in our client’s desire for newer

equipment in FY12 •

Bristow will continue to be proactive with new technology as the

premier service provider

following through on the Client Promise

•

So in 2QFY12, our fleet management led to a shortening of certain aircraft lives

and subsequent inventory write-down

•

Other operational non-cash items lead to adjusted 2Q EPS of $0.63

Reconciliation of Non-GAAP Net Income and

Earnings Per Share September 2011 Quarter

1) These amounts are presented after applying the appropriate tax effect to each

item and dividing earnings per share by the weighted average shares outstanding

during the related period. |

16

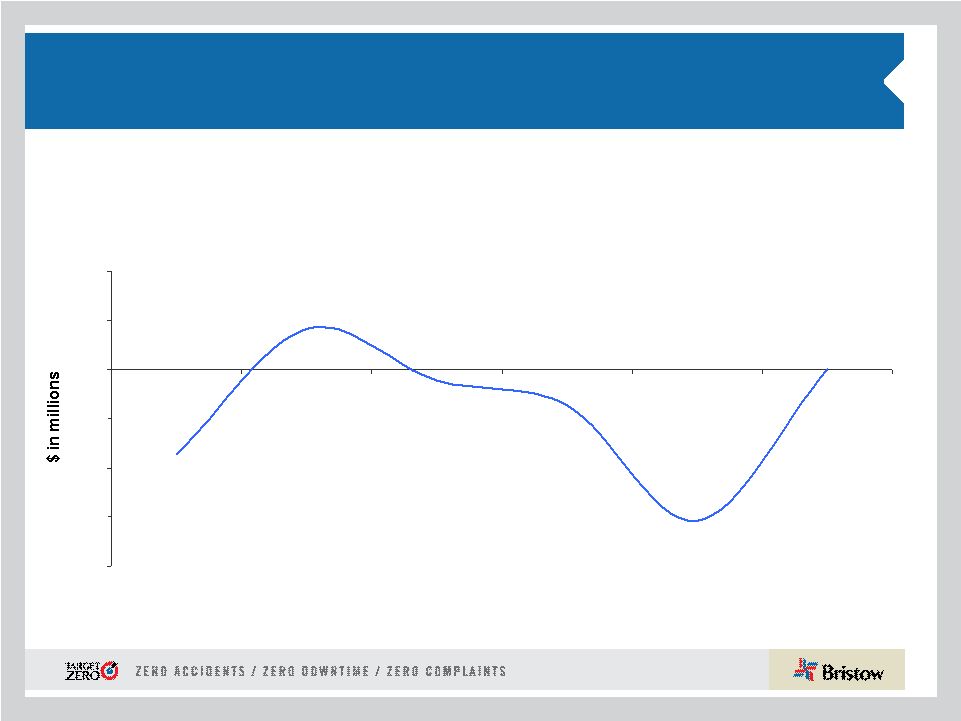

Absolute BVA –

Six Quarters

Sequential quarterly improvement needs to continue

Absolute BVA Q1FY11 - Q2FY12

-15.4

0.0

-3.6

-1.1

+4.2

-8.6

-20

-15

-10

-5

0

5

10

Q1 FY11

Q2 FY11

Q3 FY11

Q4 FY11

Q1 FY12

Q2 FY12 |

17

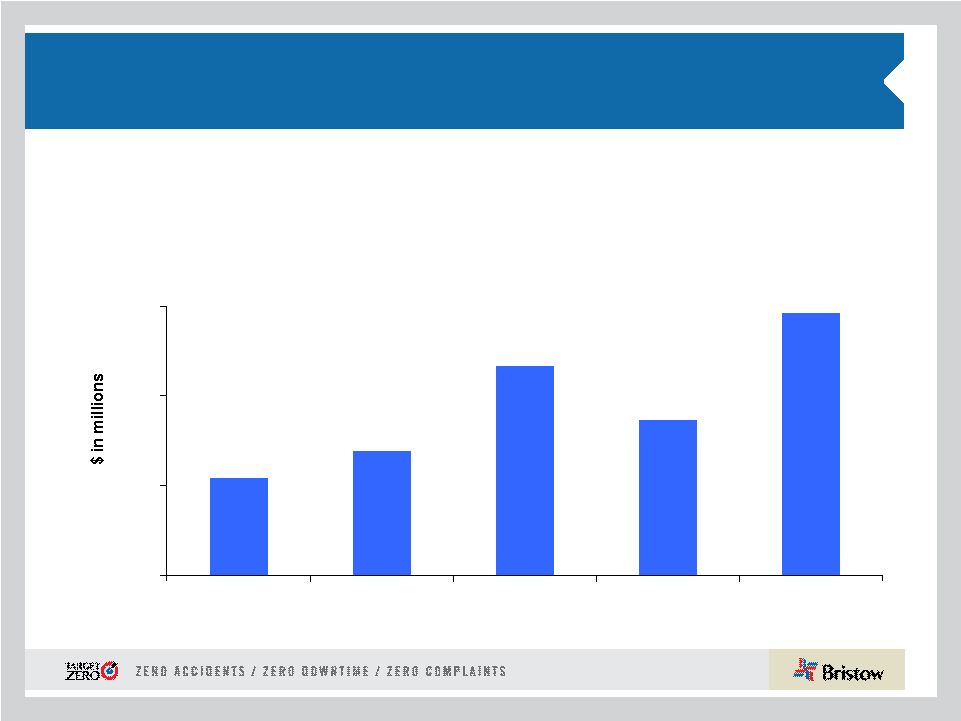

43

55

94

69

117

-

40

80

120

1HFY08

1HFY09

1HFY10

1HFY11

1HFY12

Financial highlights:

Strong operating cash flow generation

We generated 69% more operating cash flow in the first half of

FY12 compared to the same period last year |

18

Commitment to balanced shareholder returns:

Up to $100 million share repurchase authorization

•

We are confident in the underlying ability of Bristow to generate

cash flow while growing the business across the globe and

maintaining a prudent financial profile

•

The $100 million share buyback authorization represents

approximately 5% of today’s outstanding shares based on current

stock price

•

Bristow intends to complete the share repurchase as soon as

practical, depending on conditions discussed in 10Q

•

There are a number of commonly used execution tactics and

Bristow will employ one or a combination to provide the best

value/certainty for our shareholders |

19

Financial highlights:

Revising and narrowing of FY12 guidance

Phase I Revision

•

EPS

guidance

range

(as

of

November

8,

2011)

$3.05

-

$3.30,

excluding aircraft sales and special items

•

Depreciation

and

amortization

expense

~$87

–

$93

million

•

SG & A expense ~ $135 -

$140 million

•

Interest expense ~ $37 -

$42 million

•

Tax ~ 20% -

24% (assuming revenue earned in same regions

and same mix)

Phase II Revision

•

LACE* (Large Aircraft Equivalent) = 158

•

Revenue/LACE Rate* ~ $7.20 -

7.50 million per LACE aircraft

per year

* Excludes Bristow Academy, A/C held for sale, CIP, and reimbursable revenue.

|

20

Conclusions

•

Client Promise is advancing and will have far reaching impacts on

growth, fleet management and our valuable service offerings

•

Operating expenses this quarter were incurred in anticipation of

future revenue growth, and resulted in disappointing 2QFY12

performance

•

We

are

revising

our

annual

FY12

EPS

guidance

to

$3.05

-

$3.30

•

Cash flow generation in FY12 is strong due to continued focus on

BVA enhancing actions

•

Bristow is determined to appropriately balance growth and cash

returns for our shareholders

Analyst Day on November 10, 2011 in New York |

21

Appendix |

22

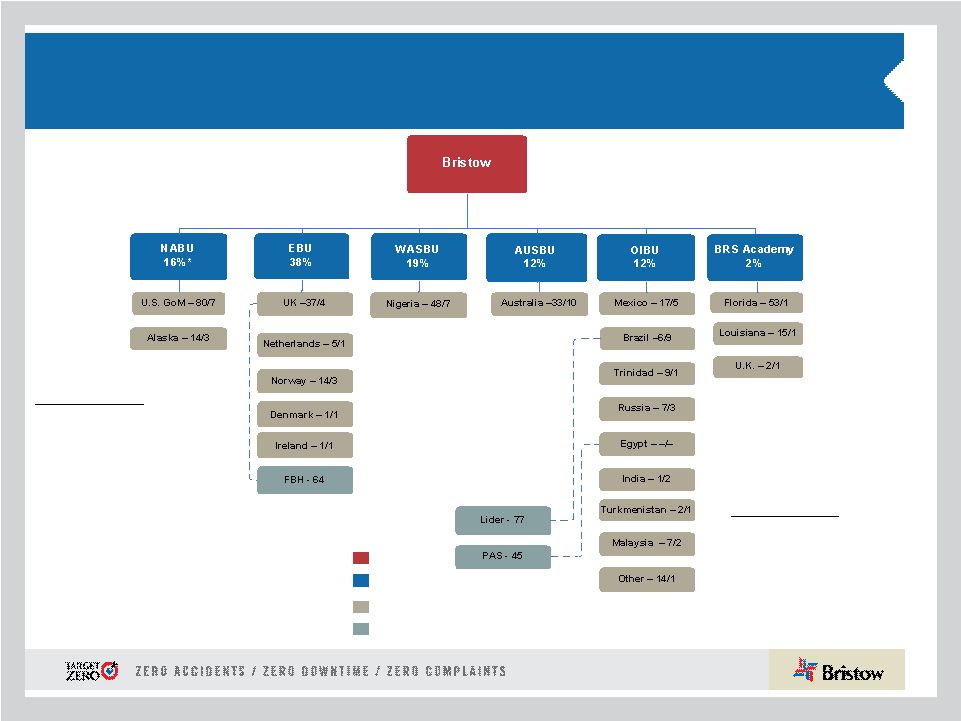

Organizational Chart -

as of September 30, 2011

Business

Unit

(*

%

of

Q2

FY12

Operating

Revenue)

Corporate

Region

(

#

of

Aircraft

/

#

of

Locations)

Joint

Venture

(No.

of

aircraft)

Key

Operated Aircraft

Bristow owns and/or operates 366

aircraft as of September 30, 2011

Affiliated Aircraft

Bristow affiliates and joint

ventures operate 186 aircraft

as of September 30, 2011 |

23

Aircraft Fleet –

Medium and Large

As of September 30, 2011

Next Generation Aircraft

Medium capacity 12-16 passengers

Large capacity 18-25 passengers

Mature Aircraft Models

Aircraft

Type

No. of PAX

Engine

Consl

Unconsl

Total

Ordered

Large Helicopters

AS332L Super Puma

18

Twin Turbine

30

-

30

-

Bell 214ST

18

Twin Turbine

-

-

-

-

EC225

25

Twin Turbine

18

-

18

2

Mil MI 8

20

Twin Turbine

7

-

7

-

Sikorsky S-61

18

Twin Turbine

2

-

2

-

Sikorsky S-92

19

Twin Turbine

25

2

27

8

82

2

84

10

LACE

76

Medium Helicopters

AW139

12

Twin Turbine

7

5

12

-

Bell 212

12

Twin Turbine

3

22

25

-

Bell 412

13

Twin Turbine

36

35

71

-

EC155

13

Twin Turbine

4

-

4

-

Sikorsky S-76 A/A++

12

Twin Turbine

20

6

26

-

Sikorsky S-76 C/C++

12

Twin Turbine

54

28

82

-

124

96

220

-

LACE

57 |

24

Training Helicopters

AS355

4

Twin Turbine

2

-

2

-

Bell 206B

6

Single Engine

8

-

8

-

Robinson R22

2

Piston

11

-

11

-

Robinson R44

2

Piston

2

-

2

-

Sikorsky 300CB/Cbi

2

Piston

46

-

46

-

AS350BB

4

Turbine

-

36

36

-

Fixed Wing

1

-

1

-

70

36

106

-

-

Fixed Wing

3

38

41

-

Total

366

186

552

10

TOTAL LACE (Large Aircraft Equivalent)*

154

10

Aircraft Fleet –

Small, Training and Fixed

As of September 30, 2011 (continued)

Next Generation Aircraft

Mature Aircraft Models

Small capacity 4-7 passengers

Training capacity 2-6 passengers

•LACE does not include held for sale, training and fixed wing

helicopters Aircraft

Type

No. of PAX

Engine

Consl

Unconsl

Total

Ordered

Small Helicopters

Bell 206B

4

Turbine

2

2

4

-

Bell 206 L-3

6

Turbine

4

6

10

-

Bell 206 L-4

6

Turbine

30

1

31

-

Bell 407

6

Turbine

41

-

41

-

BK 117

7

Twin Turbine

2

-

2

-

BO-105

4

Twin Turbine

2

-

2

-

EC135

7

Twin Turbine

6

3

9

-

Agusta 109

8

Twin Turbine

-

2

2

-

87

14

101

-

LACE

21 |

25

Consolidated Fleet Changes and Aircraft Sales for

Q2 FY12

Q 1 FY12

Q 2 FY12

YTD

Fleet Count Beginning Period

373

372

373

Delivered

EC225

2

2

4

S-92

1

1

Total Delivered

2

3

5

Removed

Sales

(3)

(5)

(8)

Other*

(4)

(4)

Total Removed

(3)

(9)

(12)

372

366

366

* Includes net lease returns and commencements

# of A/C

Sold

Cash

Received*

Gain/ Loss*

Q1 FY 12

3

2,478

1,525

Q2 FY 12

5

13,152

3,004

Totals

8

15,630

4,529

* Amounts stated in thousands

Aircraft held for sale by BU

EBU

WASBU

AUSBU

OIBU

NABU

Total

Large

3

-

3

-

-

6

Medium

2

1

4

2

2

11

Small

-

2

-

-

-

2

Total

5

3

7

2

2

19

|

26

#

Helicopter

Class

Delivery Date

Location

Contracted

#

Helicopter

Class

Delivery Date

Location

2

Large

December 2011

NABU

2 of 2

2

Medium

December 2012

EBU

1

Large

December 2011

EBU

1 of 1

3

Large

December 2012

EBU

1

Large

March 2012

EBU

1 of 1

2

Medium

June 2013

EBU

2

Large

June 2012

EBU

2 of 2

1

Large

September 2013

AUSBU

4

Large

September 2012

EBU

1

Medium

December 2013

OIBU

6 of 10

4

Large

December 2013

EBU

1

Large

December 2013

OIBU

1

Medium

March 2014

OIBU

1

Large

March 2014

OIBU

2

Medium

June 2014

OIBU

1

Large

June 2014

EBU

1

Medium

September 2014

OIBU

1

Medium

September 2014

AUSBU

1

Large

September 2014

AUSBU

2

Medium

December 2014

AUSBU

1

Large

December 2014

AUSBU

1

Large

March 2015

AUSBU

1

Large

June 2015

AUSBU

1

Large

September 2015

EBU

1

Large

December 2015

EBU

1

Large

March 2016

OIBU

1

Large

June 2016

EBU

1

Large

September 2016

OIBU

1

Large

December 2016

EBU

1

Large

March 2017

OIBU

1

Large

June 2017

EBU

1

Large

September 2017

OIBU

1

Large

December 2017

OIBU

37

ORDER BOOK

OPTIONS BOOK

Order and options book as of September 30, 2011

Our order and options book reflects

future contracted and line-of-sight

work for the next five years with 10

large aircraft ordered and 25 large

and 12 medium aircraft on option.

* Subsequent to September 30, 2011, we entered into agreements to purchase or lease

8 new technology large aircraft for approximately $144 million that are not

reflected in the table above. Fair market value of our fleet is ~$1.9

billion as of September 30, 2011. |

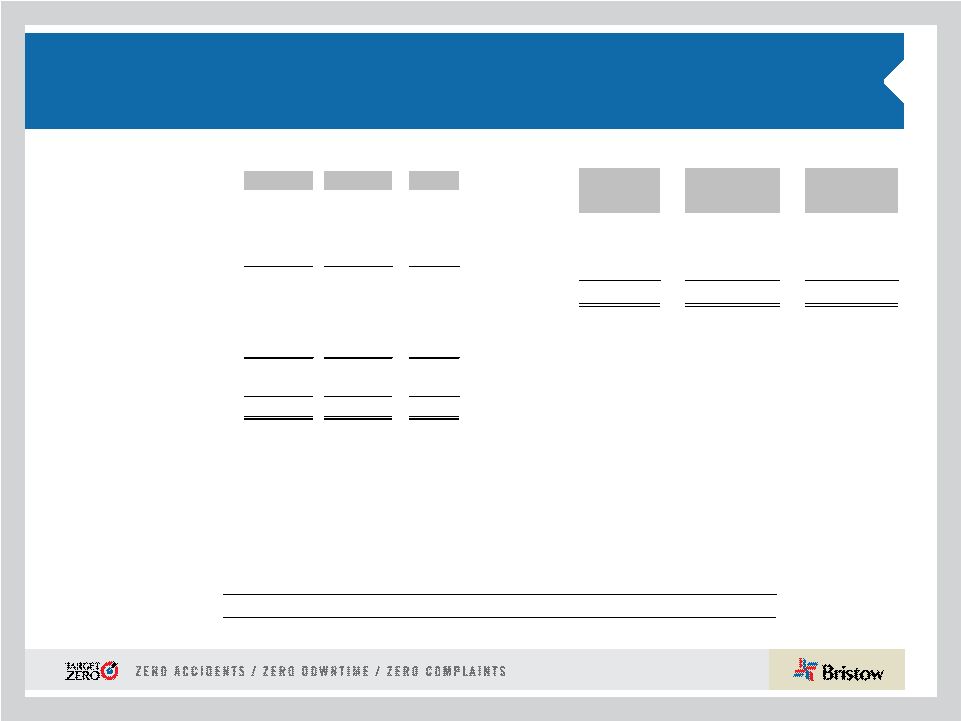

27

Operating margin trend

2008

2009

As Reported

Full Year

Full Year

Q1

Q2

Q3

Q4

FY

Q1

Q2

Q3

Q4

FY

Q1

Q2

EBU

23.6%

19.3%

17.2%

16.7%

16.1%

18.1%

17.0%

18.0%

18.4%

19.6%

18.8%

18.8%

17.3%

16.8%

WASBU

17.9%

21.5%

24.9%

29.3%

25.4%

34.7%

28.5%

26.5%

29.5%

29.8%

24.0%

27.4%

20.6%

25.2%

NABU

14.5%

12.1%

8.9%

9.7%

3.3%

2.2%

6.1%

10.1%

16.1%

4.2%

-4.0%

7.5%

3.6%

5.3%

AUSBU

17.2%

5.9%

20.1%

23.1%

24.5%

24.5%

23.2%

22.5%

16.3%

17.2%

17.4%

18.2%

10.0%

1.7%

OIBU

17.3%

27.0%

21.8%

35.1%

15.5%

1.8%

19.2%

6.9%

30.6%

27.7%

45.8%

28.4%

33.6%

5.8%

Consolidated

16.0%

17.8%

15.4%

18.4%

13.1%

15.2%

15.5%

13.6%

17.1%

14.7%

16.1%

15.4%

11.3%

2.9%

New methodology (operating income/operating revenue)

2008

2009

Revised *

Full Year

Full Year

Q1

Q2

Q3

Q4

FY

Q1

Q2

Q3

Q4

FY

Q1

Q2

EBU

29.2%

24.3%

20.9%

20.5%

19.8%

22.4%

20.8%

21.4%

22.1%

25.4%

23.6%

23.6%

21.5%

20.7%

WASBU

19.4%

22.8%

26.8%

30.0%

27.3%

35.7%

29.9%

27.1%

30.5%

30.4%

26.1%

28.6%

21.5%

26.4%

NABU

14.5%

12.2%

8.9%

9.7%

3.3%

2.2%

6.2%

10.2%

16.4%

4.2%

-4.0%

7.6%

3.6%

11.0%

AUSBU

17.9%

6.3%

21.0%

24.5%

25.5%

25.6%

24.3%

23.6%

17.8%

18.8%

19.1%

19.8%

11.1%

1.9%

OIBU

17.4%

27.3%

21.9%

35.9%

15.3%

1.9%

19.4%

6.9%

30.9%

28.2%

47.1%

28.8%

34.5%

5.9%

Consolidated **

16.4%

14.7%

15.9%

17.4%

14.2%

13.9%

15.3%

14.0%

18.0%

15.3%

18.3%

16.4%

12.2%

13.0%

* - All amounts revised to exclude reimbursable revenue from denominator.

** - Revised to exclude aircraft sales from numerator.

2012

2010

2011

2012

2010

2011 |

28

EBIDTAR reconciliation

($ in millions)

2000

2001

2002

2003

2004

Income from continuing operations

$8.8

$27.9

$42.5

$40.3

$49.6

Income tax expense

3.8

13.3

19.1

17.5

18.5

Interest expense

18.5

18.4

15.8

14.9

16.8

Depreciation and amortization

32.0

33.1

33.9

37.5

39.4

EBITDA Subtotal

63.1

92.7

111.4

110.2

124.3

Aircraft rental expense

–

–

–

–

–

EBITDAR

$63.1

$92.7

$111.4

$110.2

$124.3

($ in millions)

2005

2006

2007

2008

2009

Income from continuing operations

$49.2

$54.5

$72.5

$107.7

$125.5

Income tax expense

$20.4

$14.7

$38.8

$44.5

$50.5

Interest expense

$15.7

$14.7

$10.9

$23.8

$35.1

Gain on disposal of assets

($0.1)

($10.6)

($9.4)

($9.1)

Depreciation and amortization

40.5

42.1

42.5

54.1

65.5

EBITDA Subtotal

125.8

125.8

154.1

220.7

267.6

Aircraft rental expense

–

2.1

6.3

6.3

8.2

EBITDAR

$125.8

$127.9

$160.4

$227.0

$275.8

March 31,

March 31, |

29

EBIDTAR reconciliation (continued)

($ in millions)

2010

2011

Income from continuing operations

$113.5

$133.3

Income tax expense

$29.0

$7.1

Interest expense

$42.4

$46.2

Gain on disposal of assets

(18.7)

(10.2)

Depreciation and amortization

74.7

90.9

EBITDA Subtotal

240.9

267.3

Aircraft rental expense

9.1

5.9

EBITDAR

$250.1

$273.2

($ in millions)

YTD FY11

YTD FY12

TTM as of

9/30/2010

9/30/2011

9/30/2011

Income from continuing operations

$59.8

$24.2

$97.7

Income tax expense

11.9

4.7

(0.1)

Interest expense

22.5

18.4

42.1

Gain on disposal of assets

(3.6)

0.2

(6.4)

Depreciation and amortization

40.3

48.1

98.7

EBITDA Subtotal

130.8

95.6

232.1

Aircraft rental expense

3.0

2.8

5.8

EBITDAR

$133.7

$98.4

$237.9

March 31, |

30

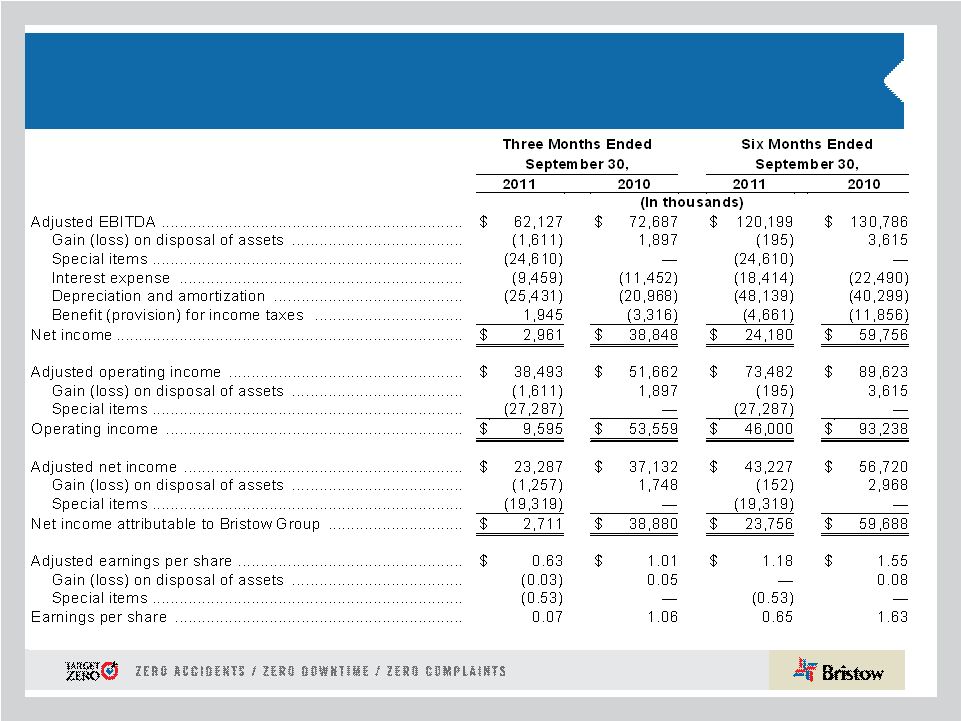

GAAP reconciliation |

31

Bristow Group Inc. (NYSE: BRS)

2000 West Sam Houston Parkway South

Suite 1700, Houston, Texas 77042

t

713.267.7600

f

713.267.7620

bristowgroup.com

Contact Us |