Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HERTZ CORP | a11-29237_18k.htm |

Exhibit 99.1

|

|

3Q 2011 Earnings Call November 2, 2011 10:00 am ET Dial in: (800) 230-1074 (US) (612) 288-0329 (International) Passcode: 220468 Replay available until November 16: (800) 475-6701; (320) 365-3844 international passcode: 220468 |

|

|

Safe Harbor Statement Certain statements made within this presentation contain forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not guarantees of performance and by their nature are subject to inherent uncertainties. Actual results may differ materially. Any forward-looking information relayed in this presentation speaks only as of November 2, 2011, and the Company undertakes no obligation to update that information to reflect changed circumstances. Additional information concerning these statements is contained in the Company’s press release regarding its Third Quarter 2011 results issued on November 1, 2011, and the Risk Factors and Forward-Looking Statements sections of the Company’s 2010 Form 10-K and Quarterly Reports on Form 10-Q. Copies of these filings are available from the SEC, the Hertz web site or the Company’s Investor Relations Department. |

|

|

Definitions and reconciliations of these non-GAAP measures are provided at the end of the presentation. The following non-GAAP measures will be used in the presentation: Non-GAAP Measures EBITDA Corporate EBITDA Adjusted Pre-Tax Income Adjusted Net Income Adjusted Diluted Earnings Per Share (Adjusted EPS) Net Corporate Debt Net Fleet Debt Total Net Debt Adjusted Interest Expense Adjusted Direct Operating Expense Adjusted Selling, General and Administrative Adjusted Depreciation of Revenue Earning Equipment Levered After-Tax Cash-Flow Before Fleet Growth Corporate Cash Flow |

|

|

Third Quarter 2011 Results Mark Frissora, Chairman and CEO Financial Overview Elyse Douglas, Executive VP and CFO Outlook & Guidance Mark Frissora, Chairman and CEO Questions & Answers Session Today’s Agenda |

|

|

Opening Comments |

|

|

C Third Quarter 2011 Snapshot GAAP Q3:11 Results Q3:10 Results YoY Change Revenue $2,432.3 $2,186.3 11.3% Income before income taxes $295.7 $156.1 89.4% Diluted earnings per share $0.47 $0.36 30.6% Diluted shares outstanding 440.9 430.4 2.4% Non-GAAP* Corporate EBITDA $525.7 $435.1 20.8% Adjusted Pre-Tax Income $346.9 $251.4 38.0% Adjusted EPS $0.51 $0.39 30.8% ($ in millions, except per share amounts) * Definitions and reconciliations of these non-GAAP measures are provided at the end of the presentation. Highest revenue quarter of any quarter on record for WW RAC Highest GAAP pre-tax income in company’s history Total company consolidated WW RAC |

|

|

Q3:11 Highlights – WW HERC Corp. EBITDA +20% YoY; margin +210 bps Revenue +14.4% = price +3.4%; volume +9.9% Time utilization +470 basis points At ~75% of planned buy for 2011 YTD Q3:11 HERC Purchases % of Total YTD Buy |

|

|

U.S. RAC adj. pre-tax income +28.4%; incr. revenue flow-through 86% Lean/Six Sigma programs in place at 6 additional airports Unit depreciation -19%: procurement, fleet rotation, mkt values, remarketing EU RAC: won new accounts & re-signed ~70 accounts, of which 90% reflected price increase (2nd consecutive year of contract price increases) 19 Advantage locations in operation across EU ~9% YoY increase in adjusted pre-tax income Global inbound/outbound revenue +7% on tough YoY comp Net Promoter Score - customer satisfaction +460 bps Balance sheet improvement: EU Securitization – extended maturity, reduced spread, increased adv. rate $850 million conduit facility for Donlen - acquisition closed 9/1/11 Q3:11 Highlights |

|

|

EU operations under macro economic pressure Revenue +4%, excl. FX RPD affected by weak leisure demand, longer transactions, mix shift toward Advantage Excl. Advantage, RPD down 2.8% U.S. RAC industry overfleeted Due to Q3:11 fleet order uncertainty; held fleet Q2:11 ~60-90 days to de-fleet w/o diluting used-cars values Negatively impacted summer pricing Hurricane Irene hit U.S. RAC adj. pre-tax income by ~$9M HERC new-fleet purchases still ramping up Prudent capital deployment Q3:11 Headwinds |

|

|

Q3:11 U.S. RAC Total Revenue +5.3% YoY Rev. +$65.2 million Total Revenue ($ in millions) 14.6% 55.2% 30.2% % of total increase Airport Advantage Off-Airport % Change in Total Revenue On-Airport 72.3% of U.S. RAC Revenue Off-Airport 27.7% of U.S. RAC Revenue RPD * $55.74 $38.40 $38.08 Trans Days +8.9% +30.9% +14.8% % of Total U.S. RAC Revenue 68.3% 4.0% 27.7% U.S. RAC Growth Drivers Q3:11 vs. Q3:10 Note: Advantage RAC acquired April 2009 Advantage $9.5 Off Airport $36.0 Airport $19.7 * RPD calculated using Total Revenue |

|

|

U.S. Rent-A-Car RPD Incl. Ancillary Sales Tough YoY Comparison HTZ Peer A Peer B RPD* Q3:10 vs. Q3:09 +2.3% (3.7%) +0.2% *Fully loaded |

|

|

Q3:11 Off-Airport Mix YoY |

|

|

U.S. RAC Monthly Depreciation p/Unit |

|

|

Used-car market’s off-lease supply expected to continue declining through 2013 Tightens used-car supply in 1-3 year old car class Drives residual values higher In Millions of Units Source: Manheim 2011 Used Car Market Report U.S. Off-Lease Volumes 2015 estimate still 13% below 2011 level U.S. RAC Residual Values |

|

|

A 10% shift, wholesale to retail, reduces depreciation expense $12M Q3:11 U.S. Remarketing Strategy Reduces cost of sales, improves sale price, keeps cars on rent longer Growing into Higher-Return Resale Channels (Net Gain vs. Auction) % of Total Hertz Vehicle Sales |

|

|

U.S. RAC Depreciation FY:2011E Sources of Depreciation per Unit Savings 2011E as % of Total |

|

|

Elyse Douglas CFO Financial Results Cash Flow Review Balance Sheet Review |

|

|

* Definitions and reconciliations of these non-GAAP measures are provided at the end of the presentation. Q3:11 Consolidated Financial Results GAAP Q3:11 Q3:10 $ Change YTD Q3:11 YTD Q3:10 $ Change Revenue $2,432.3 $2,186.3 + $246.0 $6,284.6 $5,726.8 + $557.8 Income (loss) before income taxes $295.7 $156.1 + $139.6 $231.5 ($8.6) + $240.1 Net Income (loss) $206.7 $155.3 + $51.4 $129.1 ($20.6) + $149.7 Diluted Earnings (loss) per share $0.47 $0.36 + $0.11 $0.29 ($0.05) + $0.34 Diluted share count 440.9 430.4 447.3 411.6 Non-GAAP* Q3:11 Q3:10 $ Change Margin Expansion YTD Q3:11 YTD Q3:10 $ Change Margin Expansion Corporate EBITDA $525.7 $435.1 + $90.6 170 bps $1,054.2 $832.8 + $221.4 230 bps Adj. Pre-Tax Income $346.9 $251.4 + $95.5 280 bps $515.3 $277.3 + $238.0 340 bps Adj. Net Income $223.2 $161.2 + $62.0 180 bps $325.6 $170.1 + $155.5 220 bps Adjusted EPS $0.51 $0.39 + $0.12 $0.73 $0.41 + $0.32 Adj. share count 440.9 410.0 447.3 410.0 in millions, except per share amounts |

|

|

Q3:11 Consolidated Performance ($ in millions) Q3:11 Q3:10 % chg Revenues $2,432.3 $2,186.3 11.3% Reported DOE: Fleet related $318.5 $284.3 Personnel related $378.4 $353.0 7.2% Other $550.7 $522.3 5.4% Total DOE $1,247.6 $1,159.6 % of revenue 51.2% 53.0% LTM 2011* YoY U.S RAC +2.0% EU RAC +4.5% WW HERC +6.5% Revenue Per Employee (at constant currency) +31.8% since 2006 Personnel related and Other DOE YoY change was significantly less than revenue growth DOE decreased 180 bps as a % of rev. Consolidated revenue per employee is up 3.2% Q3:11 vs. Q3:10 Direct Operating Expenses |

|

|

Rent-A-Car Metrics: Q3:11 vs. Q3:10 % of WW RAC total revenue Q3:11 vs. Q3:10 Total Revenue Rental Rate Revenue* Revenue Per Day (RPD) Trans. Days Revenue Per Transaction Transactions Trans Length (days) 61% U.S. (Hertz + Advantage) 5.3% 4.9% -6.3% 11.9% -2.0% 7.0% 4.6% U.S. (Hertz Classic) 4.7% 4.4% -6.0% 11.0% -1.9% 6.3% 4.4% 28% Europe 13.7% 2.6% -4.5% 7.4% -1.0% 3.7% 3.6% Worldwide 10.8% 4.6% -5.2% 10.4% -1.5% 6.2% 4.0% *Rental rate revenue exclude the effects of foreign currency. Rental rate revenue consists of all revenue net of discounts, associated with the rental of cars including charges for optional insurance products, but excludes revenue derived from fueling and concession and other expense pass-throughs, NeverLost units in the U.S. and certain ancillary revenue. Adj. pre-tax income: Q3:11 +22.2% YoY; margin 17.8%; +170 bps Corporate EBITDA: Q3:11 +22.3%YoY; margin 19.6%, +190 bps |

|

|

Worldwide Rent A Car Q3:11 WW RAC = 87% of total company revenue Q3:11 WW RAC total revenue: ~$2.1 billion Unit Fleet Mix 9/30/11 9/30/10 U.S. Risk% 70% 64% Europe Risk% 55% 51% WW Risk % 67% 62% Strategically increasing U.S. mix of risk vehicles to capitalize on more profitable resale channels As of: Q3:11Total Revenue by Business U.S. & EU Airport Commercial 20% U.S. & EU Airport Leisure 41% U.S. & EU Off-Airport 29% Other Int’l 10% |

|

|

U.S. Off Airport (OAP) – leisure, local business, monthly, insurance replacement Opened 54 net new locations Total locations = 2,088; +10.5% YoY Total OAP revenue +11.2%; same-store-revenue up 8.6% Low-cost infrastructure, minimum overhead, more economical vehicles, and longer-length rentals Worldwide Advantage brand revenue +60.7% YoY; U.S. rev. +23.7% Added 7 locations Q3:11; WW Total = 75 locations, 15 affiliates Revenue per employee + 12.5% YoY Adjusted pre-tax margin +230 basis points YoY RAC Growth Drivers |

|

|

HERC Growth Initiatives Equipment rental recovery continues to be led by industrial penetration HERC N.A. industrial revenue +16.2% Q3:11 YoY Executing roll-up acquisition strategy to build position in industrial market, expand geographic coverage and develop new revenue streams Acquired WGI Rentals in North Dakota Geographic expansion into the Bakken oil & gas fields Time utilization* +470 bps to 64.5% vs. Q3:10 Adjusted pre-tax income of $55.9M vs. prior year of $33.7M Corporate EBITDA margin improved to 42.1% YoY or +210bps Q3 11 Q3 10 FY 10 FY 09 FY 08 FY 07 Construction 37.5% 38.7% 37.7% 43.5% 47.8% 50.2% Industrial 25.8% 25.7% 27.7% 22.9% 21.6% 19.7% Fragmented 36.7% 35.6% 34.6% 33.6% 30.6% 30.1% North America Revenue Mix *Time utilization: Calculated on unit average vs. weighted fleet cost basis |

|

|

Equipment Rental Pricing Calculations HERTZ Equipment Rental Competitor A Base fleet identified using current calendar year and prior calendar year Normalizes fleet mix & impact Average realized rates for 3 rate segments calculated separately (Month, Week, Day) Weighted average rate index created using base transactions (prior year) Rate segment (day,week,month) weighting applied to the average rate creating a weighted index Price performance based on variance between rate indexes Base fleet identified using current period and prior period Normalizes fleet mix & impact Average rates for 3 rate segments calculated (Month, Week, Day) Current vs. prior variance weighted on current year revenue (Q2:2011) Calculations totaled for each rate segment Rate segment variances blended based on current period revenue against current vs. prior rate variance Using Competitor A price method: N.A. HERC +5.5% Q3:11 |

|

|

Equipment Rental Residual Values Industry residual values improving Retail values 1,130 bps above trough; 350 bps below same-period 2007 HERC sales channels Q3:11= retail 36%; auction 30%; wholesale 22%; manufacturer buyback 12% Fair Market Value (Retail) Fair Liquidation Value (Auction) Source: Rouse |

|

|

Q3:11 HERC Fleet Statistics ($ in millions) WW HERC Fleet – Cash Basis ** ($ in millions) Excludes FX Q3:11 Q3:10 Fleet Expenditures $157.0 $46.7 Disposal Proceeds $52.6 $35.8 Net Capital Expenditures $104.4 $10.9 (cash basis) ** Above amounts are on a cash flow basis, consistent with our GAAP statement of cash flows. Purchases* Disposals 1st Cost* Net Fleet Capital Expenditures* * Includes non-cash purchases and sales. Q3:11 average fleet age ~48 months; 2 months below Q2:11 |

|

|

Interest Expense Q3:11 of $169.3M was $32.9mil below Q3:10 Cash interest down $7.5M– positive impact of refinancing partially offset by expired benefit from ABS buydown Non-cash interest down $25.4M YoY (Q3:11=$21M) primarily due to 2010 expiration of ABS buydown FY:11 cash interest expected to be down $5 to $10M YoY, estimate lowered Restructuring & restructuring-related charges Q3:11 was $1.9M vs. Q3:10 of $14.6M Related cash payments in Q3:11 were $5.6M vs. $10.7M in the prior year FY:11 charges still expected to be $60 to $70M Taxes Q3:11 GAAP tax effective income tax rate was 28.1% vs. (2.5)% in Q3:10 Annual adjusted tax rate normalized = 34% Q2:11 cash taxes paid: $7.2M vs. $10.8M in Q3:10 FY:11 cash taxes estimated to be ~ $50 to $55M Interest | Restructuring | Taxes |

|

|

Q3:11 Changes vs. Q3:10 $177 million Donlen acquisition $ 94 million cash outlays in HERC fleet investment $ 281 million related to RAC fleet, mostly timing of fleet receivables Cash Flow Third Quarter Cash Flow ($ in millions) Q3:11 Q3:10 $ Net Cash Provided by Operating Activities $961.6 $713.3 $248.3 Levered After Tax Cash Flow Before Fleet Growth ($275.9) ($272.0) ($3.9) Corporate Cash Flow ($429.6) ($69.4) ($360.2) Note: The presentation of the Corporate Cash Flow was updated in Q1:11 Conceptually same as Levered After Tax Cash Flow After Fleet Growth Corporate Cash Flow now incorporates changes in FX rates HERC maintenance & growth capex were consolidated |

|

|

Working Capital Days Note: Net working capital days includes non-fleet receivables, HERC fleet receivables, fleet/other payables, inventories, prepaid and accrued liabilities. Receivables include customer receivables, subro receivables, warranty, and other misc. Better Needs update Working Capital Q3:11 receivables DSO improved 9.3% since 2007 Q3:11 Working Capital Days Improved 35.2% since 2007 |

|

|

Capital Structure Improved Closed on European ABS Repricing / Extension (August 2011) Extended facility maturity by 1 year to July 2013 Reduced drawn margin by 87.5 bps and undrawn by 35 bps Increased advance rate by ~10 pts Established $850M 1 year conduit to finance Donlen until permanent financing is executed (closed acquisition September 2011) Refinanced U.S. Fleet Financing Facility (September 2011) $190M 4 year facility Sources Uses Hertz Cash $177 Merger Consideration $248 New Fleet Debt $770 Debt Pay off $699 $947 $947 ($ in millions) |

|

|

Liquidity at $1.2 billion Liquidity & Debt Corporate Liquidity @ 9/30/11 ($ in millions) ABL Availability: $ 786 Unrestricted Cash: 386 Corporate Liquidity: $1,172 Total net corporate debt $4.4 billion Total net fleet debt $7.3 billion |

|

|

OUTLOOK |

|

|

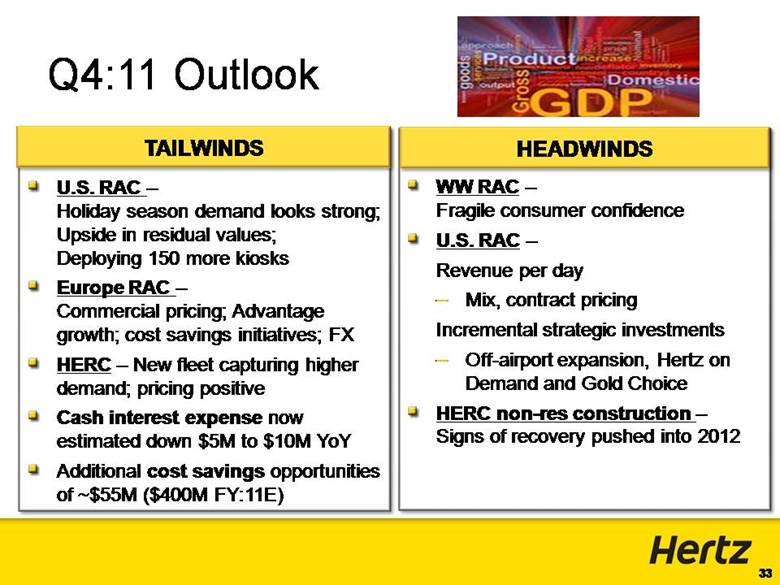

Q4:11 Outlook U.S. RAC – Holiday season demand looks strong; Upside in residual values; Deploying 150 more kiosks Europe RAC – Commercial pricing; Advantage growth; cost savings initiatives; FX HERC – New fleet capturing higher demand; pricing positive Cash interest expense now estimated down $5M to $10M YoY Additional cost savings opportunities of ~$55M ($400M FY:11E) TAILWINDS WW RAC – Fragile consumer confidence U.S. RAC – Revenue per day Mix, contract pricing Incremental strategic investments Off-airport expansion, Hertz on Demand and Gold Choice HERC non-res construction – Signs of recovery pushed into 2012 HEADWINDS |

Table 1

HERTZ GLOBAL HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In millions, except per share amounts)

Unaudited

|

|

|

Three Months Ended |

|

As a Percentage |

| ||||||

|

|

|

2011 |

|

2010* |

|

2011 |

|

2010 |

| ||

|

Total revenues |

|

$ |

2,432.3 |

|

$ |

2,186.3 |

|

100.0 |

% |

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

| ||

|

Expenses: |

|

|

|

|

|

|

|

|

| ||

|

Direct operating |

|

1,247.6 |

|

1,159.6 |

|

51.2 |

% |

53.0 |

% | ||

|

Depreciation of revenue earning equipment and lease charges |

|

523.3 |

|

501.0 |

|

21.5 |

% |

22.9 |

% | ||

|

Selling, general and administrative |

|

197.6 |

|

168.7 |

|

8.1 |

% |

7.7 |

% | ||

|

Interest expense |

|

169.3 |

|

202.2 |

|

7.0 |

% |

9.3 |

% | ||

|

Interest income |

|

(1.2 |

) |

(1.3 |

) |

— |

% |

— |

% | ||

|

Total expenses |

|

2,136.6 |

|

2,030.2 |

|

87.8 |

% |

92.9 |

% | ||

|

Income before income taxes |

|

295.7 |

|

156.1 |

|

12.2 |

% |

7.1 |

% | ||

|

(Provision) benefit for taxes on income |

|

(83.2 |

) |

3.9 |

|

(3.4 |

)% |

0.2 |

% | ||

|

Net income |

|

212.5 |

|

160.0 |

|

8.8 |

% |

7.3 |

% | ||

|

Less: Net income attributable to noncontrolling interest |

|

(5.8 |

) |

(4.7 |

) |

(0.3 |

)% |

(0.2 |

)% | ||

|

Net income attributable to Hertz Global Holdings, Inc. and Subsidiaries’ common stockholders |

|

$ |

206.7 |

|

$ |

155.3 |

|

8.5 |

% |

7.1 |

% |

|

|

|

|

|

|

|

|

|

|

| ||

|

Weighted average number of shares outstanding: |

|

|

|

|

|

|

|

|

| ||

|

Basic |

|

416.6 |

|

412.2 |

|

|

|

|

| ||

|

Diluted |

|

440.9 |

|

430.4 |

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

|

| ||

|

Earnings per share attributable to Hertz Global Holdings, Inc. and Subsidiaries’ common stockholders: |

|

|

|

|

|

|

|

|

| ||

|

Basic |

|

$ |

0.50 |

|

$ |

0.38 |

|

|

|

|

|

|

Diluted |

|

$ |

0.47 |

|

$ |

0.36 |

|

|

|

|

|

|

|

|

Nine Months Ended |

|

As a Percentage |

| ||||||

|

|

|

2011 |

|

2010* |

|

2011 |

|

2010 |

| ||

|

Total revenues |

|

$ |

6,284.6 |

|

$ |

5,726.8 |

|

100.0 |

% |

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

| ||

|

Expenses: |

|

|

|

|

|

|

|

|

| ||

|

Direct operating |

|

3,508.6 |

|

3,248.4 |

|

55.8 |

% |

56.7 |

% | ||

|

Depreciation of revenue earning equipment and lease charges |

|

1,379.0 |

|

1,416.9 |

|

21.9 |

% |

24.8 |

% | ||

|

Selling, general and administrative |

|

575.4 |

|

508.4 |

|

9.2 |

% |

8.9 |

% | ||

|

Interest expense |

|

532.1 |

|

572.1 |

|

8.5 |

% |

10.0 |

% | ||

|

Interest income |

|

(4.7 |

) |

(10.4 |

) |

(0.1 |

)% |

(0.2 |

)% | ||

|

Other (income) expense, net |

|

62.7 |

|

— |

|

1.0 |

% |

— |

% | ||

|

Total expenses |

|

6,053.1 |

|

5,735.4 |

|

96.3 |

% |

100.2 |

% | ||

|

Income (loss) before income taxes |

|

231.5 |

|

(8.6 |

) |

3.7 |

% |

(0.2 |

)% | ||

|

(Provision) benefit for taxes on income |

|

(87.9 |

) |

0.9 |

|

(1.4 |

)% |

— |

% | ||

|

Net loss |

|

143.6 |

|

(7.7 |

) |

2.3 |

% |

(0.2 |

)% | ||

|

Less: Net income attributable to noncontrolling interest |

|

(14.5 |

) |

(12.9 |

) |

(0.2 |

)% |

(0.2 |

)% | ||

|

Net income (loss) attributable to Hertz Global Holdings, Inc. and Subsidiaries’ common stockholders |

|

$ |

129.1 |

|

$ |

(20.6 |

) |

2.1 |

% |

(0.4 |

)% |

|

|

|

|

|

|

|

|

|

|

| ||

|

Weighted average number of shares outstanding: |

|

|

|

|

|

|

|

|

| ||

|

Basic |

|

415.6 |

|

411.6 |

|

|

|

|

| ||

|

Diluted |

|

447.3 |

|

411.6 |

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

|

| ||

|

Earnings (loss) per share attributable to Hertz Global Holdings, Inc. and Subsidiaries’ common stockholders: |

|

|

|

|

|

|

|

|

| ||

|

Basic |

|

$ |

0.31 |

|

$ |

(0.05 |

) |

|

|

|

|

|

Diluted |

|

$ |

0.29 |

|

$ |

(0.05 |

) |

|

|

|

|

* During the third quarter of 2011, we indentified certain adjustments that should have been recorded in our previously prepared consolidated financial statements. Direct operating expenses increased for the three and nine months ended September 30, 2010, by $2.1 million and $2.8 million, respectively, ($1.3 million and $1.7 million, net of tax, respectively).

Table 2

HERTZ GLOBAL HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In millions)

Unaudited

|

|

|

Three Months Ended September 30, 2011 |

|

Three Months Ended September 30, 2010 |

| ||||||||||||||

|

|

|

As |

|

|

|

As |

|

As |

|

|

|

As |

| ||||||

|

|

|

Reported |

|

Adjustments |

|

Adjusted |

|

Reported |

|

Adjustments |

|

Adjusted |

| ||||||

|

Total revenues |

|

$ |

2,432.3 |

|

$ |

— |

|

$ |

2,432.3 |

|

$ |

2,186.3 |

|

$ |

— |

|

$ |

2,186.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Direct operating |

|

1,247.6 |

|

(21.2 |

)(a) |

1,226.4 |

|

1,159.6 |

|

(31.0 |

)(a) |

1,128.6 |

| ||||||

|

Depreciation of revenue earning equipment and lease charges |

|

523.3 |

|

(0.6 |

)(b) |

522.7 |

|

501.0 |

|

(4.9 |

)(b) |

496.1 |

| ||||||

|

Selling, general and administrative |

|

197.6 |

|

(8.4 |

)(c) |

189.2 |

|

168.7 |

|

(13.0 |

)(c) |

155.7 |

| ||||||

|

Interest expense |

|

169.3 |

|

(21.0 |

)(d) |

148.3 |

|

202.2 |

|

(46.4 |

)(d) |

155.8 |

| ||||||

|

Interest income |

|

(1.2 |

) |

— |

|

(1.2 |

) |

(1.3 |

) |

— |

|

(1.3 |

) | ||||||

|

Total expenses |

|

2,136.6 |

|

(51.2 |

) |

2,085.4 |

|

2,030.2 |

|

(95.3 |

) |

1,934.9 |

| ||||||

|

Income before income taxes |

|

295.7 |

|

51.2 |

|

346.9 |

|

156.1 |

|

95.3 |

|

251.4 |

| ||||||

|

(Provision) benefit for taxes on income |

|

(83.2 |

) |

(34.7 |

)(e) |

(117.9 |

) |

3.9 |

|

(89.4 |

)(e) |

(85.5 |

) | ||||||

|

Net income |

|

212.5 |

|

16.5 |

|

229.0 |

|

160.0 |

|

5.9 |

|

165.9 |

| ||||||

|

Less: Net income attributable to noncontrolling interest |

|

(5.8 |

) |

— |

|

(5.8 |

) |

(4.7 |

) |

— |

|

(4.7 |

) | ||||||

|

Net income attributable to Hertz Global Holdings, Inc. and Subsidiaries’ common stockholders |

|

$ |

206.7 |

|

$ |

16.5 |

|

$ |

223.2 |

|

$ |

155.3 |

|

$ |

5.9 |

|

$ |

161.2 |

|

|

|

|

Nine Months Ended September 30, 2011 |

|

Nine Months Ended September 30, 2010 |

| ||||||||||||||

|

|

|

As |

|

|

|

As |

|

As |

|

|

|

As |

| ||||||

|

|

|

Reported |

|

Adjustments |

|

Adjusted |

|

Reported |

|

Adjustments |

|

Adjusted |

| ||||||

|

Total revenues |

|

$ |

6,284.6 |

|

$ |

— |

|

$ |

6,284.6 |

|

$ |

5,726.8 |

|

$ |

— |

|

$ |

5,726.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Direct operating |

|

3,508.6 |

|

(86.8 |

)(a) |

3,421.8 |

|

3,248.4 |

|

(100.8 |

)(a) |

3,147.6 |

| ||||||

|

Depreciation of revenue earning equipment and lease charges |

|

1,379.0 |

|

(6.5 |

)(b) |

1,372.5 |

|

1,416.9 |

|

(10.6 |

)(b) |

1,406.3 |

| ||||||

|

Selling, general and administrative |

|

575.4 |

|

(20.1 |

)(c) |

555.3 |

|

508.4 |

|

(29.6 |

)(c) |

478.8 |

| ||||||

|

Interest expense |

|

532.1 |

|

(108.0 |

)(d) |

424.1 |

|

572.1 |

|

(144.9 |

)(d) |

427.2 |

| ||||||

|

Interest income |

|

(4.7 |

) |

— |

|

(4.7 |

) |

(10.4 |

) |

— |

|

(10.4 |

) | ||||||

|

Other (income) expense, net |

|

62.7 |

|

(62.4 |

)(f) |

0.3 |

|

— |

|

— |

|

— |

| ||||||

|

Total expenses |

|

6,053.1 |

|

(283.8 |

) |

5,769.3 |

|

5,735.4 |

|

(285.9 |

) |

5,449.5 |

| ||||||

|

Income (loss) before income taxes |

|

231.5 |

|

283.8 |

|

515.3 |

|

(8.6 |

) |

285.9 |

|

277.3 |

| ||||||

|

(Provision) benefit for taxes on income |

|

(87.9 |

) |

(87.3 |

)(e) |

(175.2 |

) |

0.9 |

|

(95.2 |

)(e) |

(94.3 |

) | ||||||

|

Net income (loss) |

|

143.6 |

|

196.5 |

|

340.1 |

|

(7.7 |

) |

190.7 |

|

183.0 |

| ||||||

|

Less: Net income attributable to noncontrolling interest |

|

(14.5 |

) |

— |

|

(14.5 |

) |

(12.9 |

) |

— |

|

(12.9 |

) | ||||||

|

Net income (loss) attributable to Hertz Global Holdings, Inc. and Subsidiaries’ common stockholders |

|

$ |

129.1 |

|

$ |

196.5 |

|

$ |

325.6 |

|

$ |

(20.6 |

) |

$ |

190.7 |

|

$ |

170.1 |

|

|

(a) |

Represents the increase in amortization of other intangible assets, depreciation of property and equipment and accretion of certain revalued liabilities relating to purchase accounting. For the three months ended September 30, 2011 and 2010, also includes restructuring and restructuring related charges of $2.8 million and $12.2 million, respectively. For the nine months ended September 30, 2011 and 2010, also includes restructuring and restructuring related charges of $38.1 million and $43.2 million. |

|

(b) |

Represents the increase in depreciation of revenue earning equipment based upon its revaluation relating to purchase accounting. |

|

(c) |

Represents an increase in depreciation of property and equipment relating to purchase accounting. For the three months ended September 30, 2011 and 2010, also includes restructuring and restructuring related charges of $2.2 million and $3.0 million, respectively. For the nine months ended September 30, 2011 and 2010, also includes restructuring and restructuring related charges of $8.7 million and $10.2 million, respectively. For all periods presented, also includes other adjustments which are detailed in Table 5. |

|

(d) |

Represents non-cash debt charges relating to the amortization and write off of deferred debt financing costs and debt discounts. For the three and nine months ended September 30, 2010, also includes $18.0 million and $56.9 million, respectively, associated with the amortization of amounts pertaining to the de-designation of our interest rate swaps as effective hedging instruments. |

|

(e) |

Represents a provision for income taxes derived utilizing a normalized income tax rate (34% for 2011 and 2010). |

|

(f) |

Represents premiums paid to redeem our 10.5% Senior Subordinated Notes and a portion of our 8.875% Senior Notes. |

Table 3

HERTZ GLOBAL HOLDINGS, INC.

SEGMENT AND OTHER INFORMATION

(In millions, except per share amounts)

Unaudited

|

|

|

Three Months Ended |

|

Nine Months Ended |

| ||||||||

|

|

|

September 30, |

|

September 30, |

| ||||||||

|

|

|

2011 |

|

2010 |

|

2011 |

|

2010 |

| ||||

|

Revenues: |

|

|

|

|

|

|

|

|

| ||||

|

Car rental |

|

$ |

2,109.1 |

|

$ |

1,903.5 |

|

$ |

5,388.3 |

|

$ |

4,938.2 |

|

|

Equipment rental |

|

321.7 |

|

281.2 |

|

891.6 |

|

784.1 |

| ||||

|

Other reconciling items |

|

1.5 |

|

1.6 |

|

4.7 |

|

4.5 |

| ||||

|

|

|

$ |

2,432.3 |

|

$ |

2,186.3 |

|

$ |

6,284.6 |

|

$ |

5,726.8 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Depreciation of property and equipment: |

|

|

|

|

|

|

|

|

| ||||

|

Car rental |

|

$ |

29.9 |

|

$ |

27.4 |

|

$ |

86.6 |

|

$ |

84.6 |

|

|

Equipment rental |

|

8.8 |

|

8.3 |

|

25.4 |

|

26.0 |

| ||||

|

Other reconciling items |

|

2.0 |

|

2.0 |

|

5.8 |

|

5.6 |

| ||||

|

|

|

$ |

40.7 |

|

$ |

37.7 |

|

$ |

117.8 |

|

$ |

116.2 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Amortization of other intangible assets: |

|

|

|

|

|

|

|

|

| ||||

|

Car rental |

|

$ |

8.2 |

|

$ |

7.6 |

|

$ |

23.3 |

|

$ |

23.3 |

|

|

Equipment rental |

|

8.9 |

|

8.4 |

|

26.8 |

|

24.9 |

| ||||

|

Other reconciling items |

|

0.4 |

|

0.3 |

|

1.1 |

|

0.8 |

| ||||

|

|

|

$ |

17.5 |

|

$ |

16.3 |

|

$ |

51.2 |

|

$ |

49.0 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Income (loss) before income taxes: |

|

|

|

|

|

|

|

|

| ||||

|

Car rental |

|

$ |

352.0 |

|

$ |

259.0 |

|

$ |

625.1 |

|

$ |

352.4 |

|

|

Equipment rental |

|

45.2 |

|

7.6 |

|

24.2 |

|

(31.6 |

) | ||||

|

Other reconciling items |

|

(101.5 |

) |

(110.5 |

) |

(417.8 |

) |

(329.4 |

) | ||||

|

|

|

$ |

295.7 |

|

$ |

156.1 |

|

$ |

231.5 |

|

$ |

(8.6 |

) |

|

|

|

|

|

|

|

|

|

|

| ||||

|

Corporate EBITDA (a): |

|

|

|

|

|

|

|

|

| ||||

|

Car rental |

|

$ |

412.6 |

|

$ |

337.5 |

|

$ |

782.0 |

|

$ |

592.0 |

|

|

Equipment rental |

|

135.5 |

|

112.5 |

|

339.8 |

|

286.9 |

| ||||

|

Other reconciling items |

|

(22.4 |

) |

(14.9 |

) |

(67.6 |

) |

(46.1 |

) | ||||

|

|

|

$ |

525.7 |

|

$ |

435.1 |

|

$ |

1,054.2 |

|

$ |

832.8 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Adjusted pre-tax income (loss) (a): |

|

|

|

|

|

|

|

|

| ||||

|

Car rental |

|

$ |

375.3 |

|

$ |

307.1 |

|

$ |

678.8 |

|

$ |

509.9 |

|

|

Equipment rental |

|

55.9 |

|

33.7 |

|

99.5 |

|

43.0 |

| ||||

|

Other reconciling items |

|

(84.3 |

) |

(89.4 |

) |

(263.0 |

) |

(275.6 |

) | ||||

|

|

|

$ |

346.9 |

|

$ |

251.4 |

|

$ |

515.3 |

|

$ |

277.3 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Adjusted net income (loss) (a): |

|

|

|

|

|

|

|

|

| ||||

|

Car rental |

|

$ |

247.7 |

|

$ |

202.7 |

|

$ |

448.0 |

|

$ |

336.5 |

|

|

Equipment rental |

|

36.9 |

|

22.2 |

|

65.7 |

|

28.4 |

| ||||

|

Other reconciling items |

|

(61.4 |

) |

(63.7 |

) |

(188.1 |

) |

(194.8 |

) | ||||

|

|

|

$ |

223.2 |

|

$ |

161.2 |

|

$ |

325.6 |

|

$ |

170.1 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Adjusted diluted number of shares outstanding (a) |

|

440.9 |

|

410.0 |

|

447.3 |

|

410.0 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Adjusted diluted earnings per share (a) |

|

$ |

0.51 |

|

$ |

0.39 |

|

$ |

0.73 |

|

$ |

0.41 |

|

|

(a) |

Represents a non-GAAP measure, see the accompanying reconciliations and definitions. |

|

Note: |

“Other Reconciling Items” includes general corporate expenses, certain interest expense (including net interest on corporate debt), as well as other business activities such as our third-party claim management services. See Tables 5 and 6. |

Table 4

HERTZ GLOBAL HOLDINGS, INC.

SELECTED OPERATING AND FINANCIAL DATA

Unaudited

|

|

|

Three |

|

Percent |

|

Nine |

|

Percent |

| ||

|

|

|

Months |

|

change |

|

Months |

|

change |

| ||

|

|

|

Ended, or as |

|

from |

|

Ended, or as |

|

from |

| ||

|

|

|

of Sept. 30, |

|

prior year |

|

of Sept. 30, |

|

prior year |

| ||

|

|

|

2011 |

|

period |

|

2011 |

|

period |

| ||

|

|

|

|

|

|

|

|

|

|

| ||

|

Selected Car Rental Operating Data |

|

|

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

|

| ||

|

Worldwide number of transactions (in thousands) |

|

7,401 |

|

6.2 |

% |

20,575 |

|

4.7 |

% | ||

|

Domestic (Hertz) |

|

5,368 |

|

7.0 |

% |

15,102 |

|

4.6 |

% | ||

|

International (Hertz) |

|

2,033 |

|

4.1 |

% |

5,473 |

|

5.0 |

% | ||

|

|

|

|

|

|

|

|

|

|

| ||

|

Worldwide transaction days (in thousands) |

|

40,240 |

|

10.4 |

% |

104,715 |

|

8.2 |

% | ||

|

Domestic (Hertz) |

|

26,452 |

|

11.9 |

% |

71,162 |

|

8.4 |

% | ||

|

International (Hertz) |

|

13,788 |

|

7.7 |

% |

33,553 |

|

7.8 |

% | ||

|

|

|

|

|

|

|

|

|

|

| ||

|

Worldwide rental rate revenue per transaction day (a) |

|

$ |

42.50 |

|

(5.2 |

)% |

$ |

41.98 |

|

(3.6 |

)% |

|

Domestic (Hertz) |

|

$ |

41.44 |

|

(6.3 |

)% |

$ |

40.70 |

|

(4.2 |

)% |

|

International (Hertz) (b) |

|

$ |

44.52 |

|

(3.3 |

)% |

$ |

44.70 |

|

(2.5 |

)% |

|

|

|

|

|

|

|

|

|

|

| ||

|

Worldwide average number of company-operated cars during period |

|

667,800 |

|

37.1 |

% |

613,700 |

|

36.0 |

% | ||

|

Domestic (Hertz) |

|

352,700 |

|

12.9 |

% |

325,500 |

|

7.8 |

% | ||

|

International (Hertz) |

|

186,000 |

|

6.5 |

% |

159,100 |

|

6.7 |

% | ||

|

Donlen |

|

129,100 |

|

N/A |

|

129,100 |

|

N/A |

| ||

|

|

|

|

|

|

|

|

|

|

| ||

|

Worldwide revenue earning equipment, net (in millions) |

|

$ |

9,859.4 |

|

21.7 |

% |

$ |

9,859.4 |

|

21.7 |

% |

|

|

|

|

|

|

|

|

|

|

| ||

|

Selected Worldwide Equipment Rental Operating Data |

|

|

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

|

| ||

|

Rental and rental related revenue (in millions) (a) (b) |

|

$ |

292.3 |

|

12.5 |

% |

$ |

803.2 |

|

12.3 |

% |

|

Same store revenue growth, including initiatives (a) (b) |

|

11.3 |

% |

N/M |

|

10.1 |

% |

N/M |

| ||

|

Average acquisition cost of revenue earning equipment operated during period (in millions) |

|

$ |

2,830.3 |

|

5.1 |

% |

$ |

2,791.7 |

|

2.3 |

% |

|

Worldwide revenue earning equipment, net (in millions) |

|

$ |

1,779.1 |

|

5.8 |

% |

$ |

1,779.1 |

|

5.8 |

% |

|

|

|

|

|

|

|

|

|

|

| ||

|

Other Financial Data (in millions) |

|

|

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

|

| ||

|

Cash flows provided by operating activities |

|

$ |

961.6 |

|

34.8 |

% |

$ |

1,648.5 |

|

(4.7 |

)% |

|

Corporate cash flow (a) |

|

(429.6 |

) |

(519.0 |

)% |

(1,024.7 |

) |

(963.0 |

)% | ||

|

EBITDA (a) |

|

1,040.1 |

|

14.5 |

% |

2,294.2 |

|

7.9 |

% | ||

|

Corporate EBITDA (a) |

|

525.7 |

|

20.8 |

% |

1,054.2 |

|

26.6 |

% | ||

Selected Balance Sheet Data (in millions)

|

|

|

September 30, |

|

|

|

December 31, |

|

|

| ||

|

|

|

2011 |

|

|

|

2010 |

|

|

| ||

|

Cash and cash equivalents |

|

$ |

385.8 |

|

|

|

$ |

2,374.2 |

|

|

|

|

Total revenue earning equipment, net* |

|

11,638.5 |

|

|

|

8,923.7 |

|

|

| ||

|

Total assets* |

|

19,090.0 |

|

|

|

17,345.0 |

|

|

| ||

|

Total debt |

|

12,506.3 |

|

|

|

11,306.4 |

|

|

| ||

|

Net corporate debt (a) |

|

4,439.4 |

|

|

|

3,364.5 |

|

|

| ||

|

Net fleet debt (a) |

|

7,348.3 |

|

|

|

5,360.1 |

|

|

| ||

|

Total net debt (a) |

|

11,787.7 |

|

|

|

8,724.6 |

|

|

| ||

|

Total equity* |

|

2,265.6 |

|

|

|

2,118.5 |

|

|

| ||

(a) Represents a non-GAAP measure, see the accompanying reconciliations and definitions.

(b) Based on 12/31/10 foreign exchange rates.

N/M Percentage change not meaningful.

* During the third quarter of 2011, we indentified certain adjustments that should have been recorded in our previously prepared consolidated financial statements. Total revenue earning equipment, net decreased as of December 31, 2010 by $15.7 million and total equity as of December 31, 2010 decreased by $12.8 million.

Table 5

HERTZ GLOBAL HOLDINGS, INC.

RECONCILIATION OF GAAP TO NON-GAAP EARNINGS MEASURES

(In millions, except per share amounts)

Unaudited

ADJUSTED PRE-TAX INCOME (LOSS) AND ADJUSTED NET INCOME (LOSS)

|

|

|

Three Months Ended September 30, 2011 |

|

Three Months Ended September 30, 2010 |

| ||||||||||||||||||||

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

Other |

|

|

| ||||||||

|

|

|

Car |

|

Equipment |

|

Reconciling |

|

|

|

Car |

|

Equipment |

|

Reconciling |

|

|

| ||||||||

|

|

|

Rental |

|

Rental |

|

Items |

|

Total |

|

Rental |

|

Rental |

|

Items |

|

Total |

| ||||||||

|

Total revenues: |

|

$ |

2,109.1 |

|

$ |

321.7 |

|

$ |

1.5 |

|

$ |

2,432.3 |

|

$ |

1,903.5 |

|

$ |

281.2 |

|

$ |

1.6 |

|

$ |

2,186.3 |

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Direct operating and selling, general and administrative |

|

1,205.7 |

|

203.9 |

|

35.6 |

|

1,445.2 |

|

1,099.2 |

|

196.1 |

|

33.0 |

|

1,328.3 |

| ||||||||

|

Depreciation of revenue earning equipment and lease charges |

|

461.3 |

|

62.0 |

|

— |

|

523.3 |

|

432.7 |

|

68.3 |

|

— |

|

501.0 |

| ||||||||

|

Interest expense |

|

91.2 |

|

10.7 |

|

67.4 |

|

169.3 |

|

113.7 |

|

9.1 |

|

79.4 |

|

202.2 |

| ||||||||

|

Interest income |

|

(1.1 |

) |

(0.1 |

) |

— |

|

(1.2 |

) |

(1.1 |

) |

0.1 |

|

(0.3 |

) |

(1.3 |

) | ||||||||

|

Total expenses |

|

1,757.1 |

|

276.5 |

|

103.0 |

|

2,136.6 |

|

1,644.5 |

|

273.6 |

|

112.1 |

|

2,030.2 |

| ||||||||

|

Income (loss) before income taxes |

|

352.0 |

|

45.2 |

|

(101.5 |

) |

295.7 |

|

259.0 |

|

7.6 |

|

(110.5 |

) |

156.1 |

| ||||||||

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Purchase accounting (a): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Direct operating and selling, general and administrative |

|

8.0 |

|

9.6 |

|

0.9 |

|

18.5 |

|

9.1 |

|

9.0 |

|

0.8 |

|

18.9 |

| ||||||||

|

Depreciation of revenue earning equipment |

|

— |

|

0.6 |

|

— |

|

0.6 |

|

— |

|

4.9 |

|

— |

|

4.9 |

| ||||||||

|

Non-cash debt charges (b) |

|

11.1 |

|

0.6 |

|

9.3 |

|

21.0 |

|

34.4 |

|

1.6 |

|

10.4 |

|

46.4 |

| ||||||||

|

Restructuring charges (c) |

|

2.8 |

|

(0.9 |

) |

— |

|

1.9 |

|

4.0 |

|

10.6 |

|

— |

|

14.6 |

| ||||||||

|

Restructuring related charges (c) |

|

1.5 |

|

0.8 |

|

0.9 |

|

3.2 |

|

0.6 |

|

— |

|

— |

|

0.6 |

| ||||||||

|

Derivative (gains) losses (c) |

|

(0.1 |

) |

— |

|

— |

|

(0.1 |

) |

— |

|

— |

|

0.2 |

|

0.2 |

| ||||||||

|

Acquisition related costs (d) |

|

— |

|

— |

|

4.6 |

|

4.6 |

|

— |

|

— |

|

9.7 |

|

9.7 |

| ||||||||

|

Management transition costs (d) |

|

— |

|

— |

|

1.5 |

|

1.5 |

|

— |

|

— |

|

— |

|

— |

| ||||||||

|

Adjusted pre-tax income (loss) |

|

375.3 |

|

55.9 |

|

(84.3 |

) |

346.9 |

|

307.1 |

|

33.7 |

|

(89.4 |

) |

251.4 |

| ||||||||

|

Assumed (provision) benefit for income taxes of 34% |

|

(127.6 |

) |

(19.0 |

) |

28.7 |

|

(117.9 |

) |

(104.4 |

) |

(11.5 |

) |

30.4 |

|

(85.5 |

) | ||||||||

|

Noncontrolling interest |

|

— |

|

— |

|

(5.8 |

) |

(5.8 |

) |

— |

|

— |

|

(4.7 |

) |

(4.7 |

) | ||||||||

|

Adjusted net income (loss) |

|

$ |

247.7 |

|

$ |

36.9 |

|

$ |

(61.4 |

) |

$ |

223.2 |

|

$ |

202.7 |

|

$ |

22.2 |

|

$ |

(63.7 |

) |

$ |

161.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Adjusted diluted number of shares outstanding |

|

|

|

|

|

|

|

440.9 |

|

|

|

|

|

|

|

410.0 |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Adjusted diluted earnings per share |

|

|

|

|

|

|

|

$ |

0.51 |

|

|

|

|

|

|

|

$ |

0.39 |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

|

|

Nine Months Ended September 30, 2011 |

|

Nine Months Ended September 30, 2010 |

| ||||||||||||||||||||

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

Other |

|

|

| ||||||||

|

|

|

Car |

|

Equipment |

|

Reconciling |

|

|

|

Car |

|

Equipment |

|

Reconciling |

|

|

| ||||||||

|

|

|

Rental |

|

Rental |

|

Items |

|

Total |

|

Rental |

|

Rental |

|

Items |

|

Total |

| ||||||||

|

Total revenues: |

|

$ |

5,388.3 |

|

$ |

891.6 |

|

$ |

4.7 |

|

$ |

6,284.6 |

|

$ |

4,938.2 |

|

$ |

784.1 |

|

$ |

4.5 |

|

$ |

5,726.8 |

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Direct operating and selling, general and administrative |

|

3,336.0 |

|

639.6 |

|

108.4 |

|

4,084.0 |

|

3,083.7 |

|

579.9 |

|

93.2 |

|

3,756.8 |

| ||||||||

|

Depreciation of revenue earning equipment and lease charges |

|

1,185.3 |

|

193.7 |

|

— |

|

1,379.0 |

|

1,210.7 |

|

206.2 |

|

— |

|

1,416.9 |

| ||||||||

|

Interest expense |

|

245.7 |

|

34.1 |

|

252.3 |

|

532.1 |

|

301.4 |

|

29.6 |

|

241.1 |

|

572.1 |

| ||||||||

|

Interest income |

|

(3.8 |

) |

(0.3 |

) |

(0.6 |

) |

(4.7 |

) |

(10.0 |

) |

— |

|

(0.4 |

) |

(10.4 |

) | ||||||||

|

Other (income) expense, net |

|

— |

|

0.3 |

|

62.4 |

|

62.7 |

|

— |

|

— |

|

— |

|

— |

| ||||||||

|

Total expenses |

|

4,763.2 |

|

867.4 |

|

422.5 |

|

6,053.1 |

|

4,585.8 |

|

815.7 |

|

333.9 |

|

5,735.4 |

| ||||||||

|

Income (loss) before income taxes |

|

625.1 |

|

24.2 |

|

(417.8 |

) |

231.5 |

|

352.4 |

|

(31.6 |

) |

(329.4 |

) |

(8.6 |

) | ||||||||

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Purchase accounting (a): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Direct operating and selling, general and administrative |

|

24.6 |

|

28.4 |

|

2.6 |

|

55.6 |

|

28.6 |

|

26.8 |

|

2.4 |

|

57.8 |

| ||||||||

|

Depreciation of revenue earning equipment |

|

— |

|

6.6 |

|

— |

|

6.6 |

|

— |

|

10.6 |

|

— |

|

10.6 |

| ||||||||

|

Non-cash debt charges (b) |

|

31.9 |

|

4.5 |

|

71.6 |

|

108.0 |

|

107.8 |

|

5.7 |

|

31.4 |

|

144.9 |

| ||||||||

|

Restructuring charges (c) |

|

7.3 |

|

32.7 |

|

0.4 |

|

40.4 |

|

13.4 |

|

31.4 |

|

0.7 |

|

45.5 |

| ||||||||

|

Restructuring related charges (c) |

|

2.4 |

|

3.1 |

|

0.9 |

|

6.4 |

|

7.7 |

|

0.1 |

|

0.1 |

|

7.9 |

| ||||||||

|

Derivative (gains) losses (c) |

|

0.6 |

|

— |

|

(0.7 |

) |

(0.1 |

) |

— |

|

— |

|

2.5 |

|

2.5 |

| ||||||||

|

Pension adjustment (c) |

|

(13.1 |

) |

— |

|

— |

|

(13.1 |

) |

— |

|

— |

|

— |

|

— |

| ||||||||

|

Acquisition related costs (d) |

|

— |

|

— |

|

13.6 |

|

13.6 |

|

— |

|

— |

|

16.7 |

|

16.7 |

| ||||||||

|

Management transition costs (d) |

|

— |

|

— |

|

4.0 |

|

4.0 |

|

— |

|

— |

|

— |

|

— |

| ||||||||

|

Premiums paid on debt (e) |

|

— |

|

— |

|

62.4 |

|

62.4 |

|

— |

|

— |

|

— |

|

— |

| ||||||||

|

Adjusted pre-tax income (loss) |

|

678.8 |

|

99.5 |

|

(263.0 |

) |

515.3 |

|

509.9 |

|

43.0 |

|

(275.6 |

) |

277.3 |

| ||||||||

|

Assumed (provision) benefit for income taxes of 34% |

|

(230.8 |

) |

(33.8 |

) |

89.4 |

|

(175.2 |

) |

(173.4 |

) |

(14.6 |

) |

93.7 |

|

(94.3 |

) | ||||||||

|

Noncontrolling interest |

|

— |

|

— |

|

(14.5 |

) |

(14.5 |

) |

— |

|

— |

|

(12.9 |

) |

(12.9 |

) | ||||||||

|

Adjusted net income (loss) |

|

$ |

448.0 |

|

$ |

65.7 |

|

$ |

(188.1 |

) |

$ |

325.6 |

|

$ |

336.5 |

|

$ |

28.4 |

|

$ |

(194.8 |

) |

$ |

170.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Adjusted diluted number of shares outstanding |

|

|

|

|

|

|

|

447.3 |

|

|

|

|

|

|

|

410.0 |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Adjusted diluted earnings per share |

|

|

|

|

|

|

|

$ |

0.73 |

|

|

|

|

|

|

|

$ |

0.41 |

| ||||||

|

(a) |

Represents the purchase accounting effects of the acquisition of all of Hertz’s common stock on December 21, 2005 on our results of operations relating to increased depreciation and amortization of tangible and intangible assets and accretion of workers’ compensation and public liability and property damage liabilities. Also represents the purchase accounting effects of subsequent acquisitions on our results of operations relating to increased amortization of intangible assets. |

|

(b) |

Represents non-cash debt charges relating to the amortization and write off of deferred debt financing costs and debt discounts. For the three and nine months ended September 30, 2010, also includes $18.0 million and $56.9 million, respectively, associated with the amortization of amounts pertaining to the de-designation of our interest rate swaps as effective hedging instruments. |

|

(c) |

Amounts are included within direct operating and selling, general and administrative expense in our statement of operations. |

|

(d) |

Amounts are included within selling, general and administrative expense in our statement of operations. |

|

(e) |

Represents premiums paid to redeem our 10.5% Senior Subordinated Notes and a portion of our 8.875% Senior Notes. These costs are included within other (income) expense, net in our statement of operations. |

Table 6

HERTZ GLOBAL HOLDINGS, INC.

RECONCILIATION OF GAAP TO NON-GAAP EARNINGS MEASURES

(In millions)

Unaudited

EBITDA, CORPORATE EBITDA, UNLEVERED PRE-TAX CASH FLOW, LEVERED AFTER-TAX CASH FLOW BEFORE FLEET GROWTH AND CORPORATE CASH FLOW

|

|

|

Three Months Ended September 30, 2011 |

|

Three Months Ended September 30, 2010 |

| ||||||||||||||||||||

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

Other |

|

|

| ||||||||

|

|

|

Car |

|

Equipment |

|

Reconciling |

|

|

|

Car |

|

Equipment |

|

Reconciling |

|

|

| ||||||||

|

|

|

Rental |

|

Rental |

|

Items |

|

Total |

|

Rental |

|

Rental |

|

Items |

|

Total |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Income (loss) before income taxes |

|

$ |

352.0 |

|

$ |

45.2 |

|

$ |

(101.5 |

) |

$ |

295.7 |

|

$ |

259.0 |

|

$ |

7.6 |

|

$ |

(110.5 |

) |

$ |

156.1 |

|

|

Depreciation, amortization and other purchase accounting |

|

499.6 |

|

79.8 |

|

2.7 |

|

582.1 |

|

468.6 |

|

85.1 |

|

2.6 |

|

556.3 |

| ||||||||

|

Interest, net of interest income |

|

90.1 |

|

10.6 |

|

67.4 |

|

168.1 |

|

112.6 |

|

9.2 |

|

79.1 |

|

200.9 |

| ||||||||

|

Noncontrolling interest |

|

— |

|

— |

|

(5.8 |

) |

(5.8 |

) |

— |

|

— |

|

(4.7 |

) |

(4.7 |

) | ||||||||

|

EBITDA |

|

941.7 |

|

135.6 |

|

(37.2 |

) |

1,040.1 |

|

840.2 |

|

101.9 |

|

(33.5 |

) |

908.6 |

| ||||||||

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Car rental fleet interest |

|

(83.0 |

) |

— |

|

— |

|

(83.0 |

) |

(108.8 |

) |

— |

|

— |

|

(108.8 |

) | ||||||||

|

Car rental fleet depreciation |

|

(461.3 |

) |

— |

|

— |

|

(461.3 |

) |

(432.7 |

) |

— |

|

— |

|

(432.7 |

) | ||||||||

|

Non-cash expenses and charges (a) |

|

10.9 |

|

— |

|

7.8 |

|

18.7 |

|

34.2 |

|

— |

|

8.9 |

|

43.1 |

| ||||||||

|

Extraordinary, unusual or non-recurring gains and losses (b) |

|

4.3 |

|

(0.1 |

) |

7.0 |

|

11.2 |

|

4.6 |

|

10.6 |

|

9.7 |

|

24.9 |

| ||||||||

|

Corporate EBITDA |

|

$ |

412.6 |

|

$ |

135.5 |

|

$ |

(22.4 |

) |

525.7 |

|

$ |

337.5 |

|

$ |

112.5 |

|

$ |

(14.9 |

) |

435.1 |

| ||

|

Non-fleet capital expenditures, net |

|

|

|

|

|

|

|

(57.1 |

) |

|

|

|

|

|

|

(32.0 |

) | ||||||||

|

Changes in working capital: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Receivables, excluding car rental fleet receivables |

|

|

|

|

|

|

|

36.6 |

|

|

|

|

|

|

|

(0.7 |

) | ||||||||

|

Accounts payable and capital leases |

|

|

|

|

|

|

|

(578.6 |

) |

|

|

|

|

|

|

(589.1 |

) | ||||||||

|

Accrued liabilities and other |

|

|

|

|

|

|

|

103.6 |

|

|

|

|

|

|

|

53.1 |

| ||||||||

|

Acquisition and other investing activities |

|

|

|

|

|

|

|

(212.5 |

) |

|

|

|

|

|

|

(11.0 |

) | ||||||||

|

Other financing activities, excluding debt |

|

|

|

|

|

|

|

(4.6 |

) |

|

|

|

|

|

|

(30.0 |

) | ||||||||

|

Foreign exchange impact on cash and cash equivalents |

|

|

|

|

|

|

|

(17.6 |

) |

|

|

|

|

|

|

41.5 |

| ||||||||

|

Unlevered pre-tax cash flow |

|

|

|

|

|

|

|

(204.5 |

) |

|

|

|

|

|

|

(133.1 |

) | ||||||||

|

Corporate net cash interest |

|

|

|

|

|

|

|

(64.2 |

) |

|

|

|

|

|

|

(128.1 |

) | ||||||||

|

Corporate cash taxes |

|

|

|

|

|

|

|

(7.2 |

) |

|

|

|

|

|

|

(10.8 |

) | ||||||||

|

Levered after-tax cash flow before fleet growth |

|

|

|

|

|

|

|

(275.9 |

) |

|

|

|

|

|

|

(272.0 |

) | ||||||||

|

Equipment rental revenue earning equipment expenditures, net of disposal proceeds |

|

|

|

|

|

|

|

(157.7 |

) |

|

|

|

|

|

|

(82.4 |

) | ||||||||

|

Car rental fleet equity requirement |

|

|

|

|

|

|

|

4.0 |

|

|

|

|

|

|

|

285.0 |

| ||||||||

|

Corporate cash flow |

|

|

|

|

|

|

|

$ |

(429.6 |

) |

|

|

|

|

|

|

$ |

(69.4 |

) | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

|

|

Nine Months Ended September 30, 2011 |

|

Nine Months Ended September 30, 2010 |

| ||||||||||||||||||||

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

Other |

|

|

| ||||||||

|

|

|

Car |

|

Equipment |

|

Reconciling |

|

|

|

Car |

|

Equipment |

|

Reconciling |

|

|

| ||||||||

|

|

|

Rental |

|

Rental |

|

Items |

|

Total |

|

Rental |

|

Rental |

|

Items |

|

Total |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Income (loss) before income taxes |

|

$ |

625.1 |

|

$ |

24.2 |

|

$ |

(417.8 |

) |

$ |

231.5 |

|

$ |

352.4 |

|

$ |

(31.6 |

) |

$ |

(329.4 |

) |

$ |

(8.6 |

) |

|

Depreciation, amortization and other purchase accounting |

|

1,295.8 |

|

246.0 |

|

8.0 |

|

1,549.8 |

|

1,321.4 |

|

257.4 |

|

7.4 |

|

1,586.2 |

| ||||||||

|

Interest, net of interest income |

|

241.9 |

|

33.8 |

|

251.7 |

|

527.4 |

|

291.4 |

|

29.6 |

|

240.7 |

|

561.7 |

| ||||||||

|

Noncontrolling interest |

|

— |

|

— |

|

(14.5 |

) |

(14.5 |

) |

— |

|

— |

|

(12.9 |

) |

(12.9 |

) | ||||||||

|

EBITDA |

|

2,162.8 |

|

304.0 |

|

(172.6 |

) |

2,294.2 |

|

1,965.2 |

|

255.4 |

|

(94.2 |

) |

2,126.4 |

| ||||||||

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Car rental fleet interest |

|

(223.9 |

) |

— |

|

— |

|

(223.9 |

) |

(290.8 |

) |

— |

|

— |

|

(290.8 |

) | ||||||||

|

Car rental fleet depreciation |

|

(1,185.3 |

) |

— |

|

— |

|

(1,185.3 |

) |

(1,210.7 |

) |

— |

|

— |

|

(1,210.7 |

) | ||||||||

|

Non-cash expenses and charges (a) |

|

18.7 |

|

— |

|

23.7 |

|

42.4 |

|

107.2 |

|

— |

|

30.6 |

|

137.8 |

| ||||||||

|

Extraordinary, unusual or non-recurring gains and losses (b) |

|

9.7 |

|

35.8 |

|

81.3 |

|

126.8 |

|

21.1 |

|

31.5 |

|

17.5 |

|

70.1 |

| ||||||||

|

Corporate EBITDA |

|

$ |

782.0 |

|

$ |

339.8 |

|

$ |

(67.6 |

) |

1,054.2 |

|

$ |

592.0 |

|

$ |

286.9 |

|

$ |

(46.1 |

) |

832.8 |

| ||

|

Non-fleet capital expenditures, net |

|

|

|

|

|

|

|

(154.1 |

) |

|

|

|

|

|

|

(108.8 |

) | ||||||||

|

Changes in working capital: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Receivables, excluding car rental fleet receivables |

|

|

|

|

|

|

|

(137.1 |

) |

|

|

|

|

|

|

(111.7 |

) | ||||||||

|

Accounts payable and capital leases |

|

|

|

|

|

|

|

45.9 |

|

|

|

|

|

|

|

403.5 |

| ||||||||

|

Accrued liabilities and other |

|

|

|

|

|

|

|

(107.6 |

) |

|

|

|

|

|

|

(25.8 |

) | ||||||||

|

Acquisition and other investing activities |

|

|

|

|

|

|

|

(255.1 |

) |

|

|

|

|

|

|

(7.2 |

) | ||||||||

|

Other financing activities, excluding debt |

|

|

|

|

|

|

|

(94.5 |

) |

|

|

|

|

|

|

(64.7 |

) | ||||||||

|

Foreign exchange impact on cash and cash equivalents |

|

|

|

|

|

|

|

14.0 |

|

|

|

|

|

|

|

(34.3 |

) | ||||||||

|

Unlevered pre-tax cash flow |

|

|

|

|

|

|

|

365.7 |

|

|

|

|

|

|

|

883.8 |

| ||||||||

|

Corporate net cash interest |

|

|

|

|

|

|

|

(294.8 |

) |

|

|

|

|

|

|

(298.3 |

) | ||||||||

|

Corporate cash taxes |

|

|

|

|

|

|

|

(32.5 |

) |

|

|

|

|

|

|

(41.5 |

) | ||||||||

|

Levered after-tax cash flow before fleet growth |

|

|

|

|

|

|

|

38.4 |

|

|

|

|

|

|

|

544.0 |

| ||||||||

|

Equipment rental revenue earning equipment expenditures, net of disposal proceeds |

|

|

|

|

|

|

|

(290.7 |

) |

|

|

|

|

|

|

(68.1 |

) | ||||||||

|

Car rental fleet equity requirement |

|

|

|

|

|

|

|

(772.4 |

) |

|

|

|

|

|

|

(572.3 |

) | ||||||||

|

Corporate cash flow |

|

|

|

|

|

|

|

$ |

(1,024.7 |

) |

|

|

|

|

|

|

$ |

(96.4 |

) | ||||||

Table 6 (pg. 2)

(a) As defined in the credit agreements for the senior credit facilities, Corporate EBITDA excludes the impact of certain non-cash expenses and charges. The adjustments reflect the following:

NON-CASH EXPENSES AND CHARGES

|

|

|