Attached files

| file | filename |

|---|---|

| EX-31.01 - EXHIBIT 31.01 - Hondo Minerals Corp | exhibit31-01.htm |

| EX-31.02 - EXHIBIT 31.02 - Hondo Minerals Corp | exhibit31-02.htm |

| EX-32.01 - EXHIBIT 32.01 - Hondo Minerals Corp | exhibit32-01.htm |

| EX-32.02 - EXHIBIT 32.02 - Hondo Minerals Corp | exhibit32-02.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended July 31, 2011

Hondo Minerals Corporation

(Exact name of registrant as specified in its charter)

|

Nevada

|

26-1240056

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Identification No.)

|

15303 N. Dallas Parkway, Suite 1050

Addison, Texas 75001

(Address of principal executive offices, zip code)

(214) 444-7444

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to section 12(g) of the Act:

Common Stock, $.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files) Yes o No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Page - 1

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

Non-accelerated filer o

|

Smaller reporting company x

|

|

(Do not check if a smaller

|

|||

|

reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of July 31, 2011 was NIL based upon the price ($NIL) at which the common stock was last sold as of the last business day of the most recently completed second fiscal quarter, multiplied by the approximate number of shares of common stock held by persons other than executive officers, directors and five percent stockholders of the registrant without conceding that any such person is an “affiliate” of the registrant for purposes of the federal securities laws. Our common stock is traded in the over-the-counter market and quoted on the Over-The-Counter Bulletin Board under the symbol

(“HMNC”).

At July 31, 2011, the end of the Registrant’s most recently completed fiscal year, there were 57,711,390 shares of the Registrant’s common stock, par value $0.001 per share, outstanding.

Explanatory Note to Amendment

This Amendment to the Annual Report on Form 10-K (“Form 10-K”) amends our Annual Report on Form 10-K for the year ended July 31, 2011 which was filed with the Securities and Exchange Commission (“SEC”) on October 31, 2011 . This form 10-K/A is being filed to include Exhibits 31.01 CEO Certification, 31.02 CFO Certification, 32.01-906 Certification and 32.02-906 Certification. That were inadvertently left out due to electronic error.

Page - 2

HONDO MINERALS, INC.

TABLE OF CONTENTS

|

Page No.

|

|||

|

PART I

|

|||

|

Item 1.

|

Business

|

4

|

|

|

Item 1A.

|

Risk Factors

|

11

|

|

|

Item 1B.

|

Unresolved Staff Comments

|

11

|

|

|

Item 2.

|

Properties

|

11

|

|

|

Item 3.

|

Legal Proceedings

|

11

|

|

|

Item 4.

|

(Removed and Reserved)

|

11

|

|

|

PART II

|

|||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

12

|

|

|

Item 6.

|

Selected Financial Data

|

12

|

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

12

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

13

|

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

14

|

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

25

|

|

|

Item 9A.

|

Controls and Procedures

|

25

|

|

|

Item 9B.

|

Other Information

|

27

|

|

|

Part III

|

|||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

27

|

|

|

Item 11.

|

Executive Compensation

|

28

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

29

|

|

|

Certain Relationships and Related Transactions, and Director Independence

|

30

|

||

|

Item 14.

|

Principal Accounting Fees and Services

|

31

|

|

|

Part IV

|

|||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

31 | |

|

Signatures

|

32 |

Page - 3

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K of Hondo Minerals Corp., a Nevada corporation contains “forward-looking statements,” as defined in the United States Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terminology such as “may”, “will”, “should”, “could”, “expects”, “plans”, “intends”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of such terms and other comparable terminology. These forward-looking

statements include, without limitation, statements about our market opportunity, our strategies, competition, expected activities and expenditures as we pursue our business plan, and the adequacy of our available cash resources. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Actual results may differ materially from the predictions discussed in these forward-looking statements. The economic environment within which we operate could materially affect our actual results. Additional factors that could materially affect these forward-looking statements and/or predictions include, among other things: the volatility of minerals prices, the possibility that exploration efforts will not yield economically recoverable quantities of minerals, accidents and

other risks associated with mineral exploration and development operations, the risk that the Company will encounter unanticipated geological factors, the Company’s need for and ability to obtain additional financing, the possibility that the Company may not be able to secure permitting and other governmental clearances necessary to carry out the Company’s exploration and development plans, and other factors discussed in the Company’s filings with the Securities and Exchange Commission (“SEC”).

Our management has included projections and estimates in this Form 10-K, which are based primarily on management’s experience in the industry, assessments of our results of operations, discussions and negotiations with third parties and a review of information filed by our competitors with the SEC or otherwise publicly available. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

All references in this Form 10-K to the ”Company”, “Hondo”, “we”, “us,” or “our” are to Hondo Minerals Corporation.

PART I

|

ITEM 1.

|

BUSINESS

|

On September 25, 2007, the Company was incorporated under the laws of the State of Nevada. We are engaged in the business of acquisition, exploration and development of natural resource properties.

We are authorized to issue 75,000,000 shares of common stock, par value $.001 per share. In October 2007, we issued 2,500,000 shares of common stock to each of our two directors. Said issuances were paid at a purchase price of the par value per share or a total of $5,000.

On February 8, 2011, Tycore Ventures, Inc., closed a transaction pursuant to that certain Share Exchange Agreement (the “Share Exchange Agreement”) with Hondo Minerals, Inc., a Nevada corporation (“HMI”) and the shareholders of HMI (the “HMI Shareholders”), whereby the Company acquired 100% of the outstanding shares of common stock of HMI (the “HMI Stock”) from HMI Shareholders. By agreement and after cancellations, Tycore exchanged 17,783,888 shares of its common stock for all of the issued and outstanding common shares of HMI. As a result of closing the transaction, HMI

Shareholders then held approximately 71.4% of the Company’s issued and outstanding common stock. Tycore Ventures, Inc. also changed its corporate name to Hondo Minerals Corporation.

Page - 4

IN GENERAL

Hondo Minerals Corporation (“Hondo” or “HMC”) has its new corporate headquarters at 15303 N. Dallas Parkway, Suite 1050, Addison, Texas 75001. Hondo is engaged in the acquisition of mines, mining claims and mining real estate in the United States, Canada and Mexico with mineral reserves consisting of precious metals or non-ferrous metals. Hondo owns the Tennessee and Schuylkill Mines in the Wallapai Mining District near

Chloride, Mohave County, Arizona. The Tennessee Mine operated from the late 1800's until 1947 producing lead, zinc, gold and silver. The Tennessee Mine includes a one million ton tailings pile and is adjacent to the Schuylkill Mine. Hondo also owns 24 mining claims in the Cripple Creek, Teller County, Colorado area. However, the properties are not in operation at this time. Additionally, Hondo owns another patented mining claim in Juab County, Utah known as the Sullivan Lode and 9 unpatented mining claims in Iron County, Utah referred to as War Eagle. Again, neither site is in operation at this time.

PRINCIPAL PROJECTS

Hondo is a precious and base metals mining and processing company that operates the Tennessee Mine and has a number of prospective exploration claims in the southwest United States. At the Tennessee Mine, the focus is the processing of the tailings pile at the mouth of the mine. In addition to the Tennessee Mine, Hondo has two properties, which have reported mineralized material and an additional 27 other early stage exploration properties. On an ongoing basis, Hondo will evaluate the exploration portfolio to determine ways to increase

the value of these properties.

The Tennessee/Schuylkill Property includes two historic underground mines operated until 1947. The Tennessee Mine was at one time the largest producing silver mine in Arizona and the southwestern United States. The property has been the subject of several exploration programs which have produced an extensive database for current exploration targeting and continuing studies which include mapping of underground tunneling, reports of mineralization in both the extensive vein system and tailings pile located on the property.

TENNESSEE MINE TAILINGS

Certified geologist Howard Metzler of Kayzak Resources, Winnemucca, Nevada, collected samples for the Tennessee Mine tailings. Fourteen (14) total samples were collected from various locations from the Tennessee dump and tailings pile. No samples were collected from the Schuylkill tailings or dump. The samples were dry weight concentration samples run by American Assay Labs at .01 lbs.

The Tennessee tailings pile is not thought to be fully homogenous, as metal concentrations vary at various depths with the highest concentrations of metals in the lower depths. The dump or unprocessed material showed higher precious metal concentrations than shallow samples, while deep samples showed extremely high concentrations of other metals.

Each concentrated sample showed a patterned mix of materials that remain similar to previous samples. Fine crush metals were visible from gravity concentrate that shows a typical mix of gold/silver/copper/lead and ferrous metals. Free gold/silver/copper can be visualized by microscope. Gold bearing sulfides can be seen under microscopic conditions but not fully realized until firing or leaching has occurred.

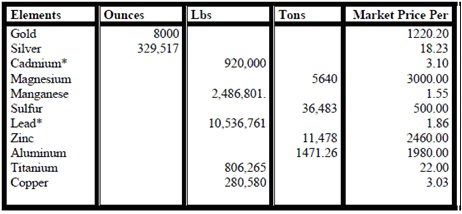

Assays from American Assay Labs, a Canadian certified lab in Reno, Nevada, were returned to the offices of Advanced Natural Technology Services, Inc. on March 18, 2010 via email. Certified Geologist Howard Metzler confirmed number calculations on March 19, 2010. Full assay reports for the 69 elements are available upon request but have been broken down in the following chart to show saleable metals for the Tennessee Mine tailings pile. These numbers are based on 680,000 cubic yards of tailings and dump. It is important to note that dump piles in most instances will carry higher volumes of metal than

previously run tailings piles. Approximately 1/3 of all material on the ground at the Tennessee Mining site is dump material, which consists of unprocessed ore. The 8,000 ounces of gold is considered free gold inside the tailings that have not been put through final concentration which may be done by gravity float with the use of water. Leaching of the tailings will remove the gold carried inside the sulfides and should dramatically increase the number of ounces of gold inside the tailings pile.

Page - 5

* Prices are based on LME for overseas sales

Additional numbers have been added to reflect the changes in results gained by Howard Metzler, Certified Geologist, and backed by his signed report for the increased instances of gold. All other numbers are from American Assay Labs. From that report, the following changes should be made to the gold assays on speculation. The numbers from the certified geologist’s sampling were shown at an approximated rate of 100:1 concentration values under X-ray refraction techniques. Thereby, the free gold and gold from sulfides are final concentrated for further purification leading to a yield of 1.7

oz of gold per ton. The estimated 680,000 cubic yards of material show an initial weight of 2,337 pounds/yard, yielding 798,000 tons of tailings. Current market value for gold at the close of business on June 30, 2010 was $1,220.20 per ounce. These numbers should not be considered 100% indicative of the entire pile as the pile is not fully homogenous and results may vary on final concentration due to production methods, economics and production costs.

Given the large volume of tailings at the Tennessee Mine and gold prices over $l,000 per ounce, it was decided to run gravity concentration tests. The ores at the Tennessee Mine are sulfides and given the fine grind, it would have made gravity concentration difficult in the past, but with modern technology, it was decided to see if a concentrate could be made.

The attempt was rather crude, utilizing an 18-inch spiral concentrator, scales and borrowing water and space from fellow miners. Two samples of approximately 40 pounds were taken by the geologist (accurate weights were not obtained because the samples were damp). One sample was taken from the top of the tailings pile where sulfides were visible and the assay was 0.022 opt gold (Au). The second sample was taken from the base of the pile where the assay was 0.008 opt Au. These samples have remained in the sole possession of the author.

The tests were conducted with difficulty because the fine grind of the tails had the spiral concentrator at its extreme limits as to angle and low flow of water required to get a concentrate. The required low angles and low water volume resulted in considerable problems with balls of clay. Samples will require sufficient agitation prior to getting accurate tests. However, even with these problems, concentrates from both samples were obtained. No accurate weights were possible but concentration was in the vicinity of 100:1. Concentrates were dried and analyzed with a portable XRF unit. The sample from the top of the tails read up to 2 opt Au and the sample from the bottom of

the tails read 20 and 30 opt Au. Microscopic examination of the concentrates showed the top sample consisted mostly of quartz and pyrite/arsenopyrite while the concentrates from the base were darker with more chalcopyrite, darker sulfides and darker silicates.

Two immediate conclusions can be made. A gravity concentrate can be made and significant gold assays are indicated. While these tests were rather crude, the results certainly justify further work utilizing modem concentration technology (Reichert Spirals, centrifuges, and modem jigs, etc.) and controlled weights and assays. Actual concentration ratios and recovery percentages can be calculated. Values of other minerals can also be calculated. With the material already ground and on the surface, the Company envisions a very low cost operation.

After reviewing the results from gravity float concentration and the subsequent projected losses of micro-fine materials, Hondo has begun leaching or Aqua-Regia recovery testing. It is management’s belief this is the way to optimize output from the Tennessee Mine tailings. A description of the proposed processing and well-documented examples of this type of recovery are included below.

Page - 6

Descriptions of the proposed processing of this type of recovery are included below.

Aqua-Regia Processing

Aqua-Regia is the use of chemical corrosives and oxidizers to remove precious metals from ore bodies and suspend them in solution to be processed in final refining. Washed or scrubbed ore is dissolved in a solution of hydrochloric acid (HCL) and nitric acid (HNO3), and heated to dissolve and release gold (Au) and silver (Ag) carried in sulfides.

Solution put through this processing is then filtered and a trade specific mix is then added to remove all Au and Ag content for final refining.

ELeach Processing

ELeach is a process created through the fundamentals of electrochemistry. Using the ability to create a stable medium for continuous oxidation, coupled to the addition of certain halides, the ELeach process provides an environmentally safe and highly efficacious means of oxidizing precious metals.

Once the precious metals are placed into an ionic state, a secondary electrochemistry-based process is selectively utilized to revert the ionic state of the elements back to a metal state.

Tennessee Mine Tailings Application

Gravity float concentration testing of the Tennessee Mine tailings showed light particulates of Ag and Au that amounted to significant losses of recovery during processing. Due to the unique nature of silicates such as clay and heavy Galena concentrations, a plan is under design to switch to a leaching system for the Tennessee tailings. Precious metal recovery during gravity float showed to be around the 45%- 50% levels while leach based recovery is expected to return 93 - 95% of precious metals.

Mineralization

The Tennessee/Schuylkill Property is situated in the Wallapai Mining District of the Cerbat Mountain Range northeast of Kingman, Arizona. The District is about 10 miles long and 4 miles wide, trending NW obliquely across the Cerbat Range. There are about 225 mines, plus an estimated 1,000 shallow pits, shafts, and prospects in the District.

Rocks locally consist of Precambrian crystalline rocks, chiefly of granitic composition, cut by large masses of Mesozoic granite. Dikes are scattered throughout the area. Some are parallel to the prominent northwest-trending system of veins, but others trend in various directions. Remnants of volcanic rocks of probable tertiary and quaternary age are around the margins of the Cerbat Range but are not present in the District proper.

The Precambrian rocks consist of a complex of amphibolite, hornblende schist, biotite schist, chlorite schist, diorite gneiss, granite and associated pegmatitic bodies, granite gneiss, schistose granite, granitic schist, and garnetiferous schist. Granite and amphibolite are the most widespread types, and the granite is predominant.

The amphibolites, which is one of the oldest rocks in the area, is a dark green to black, fine to medium-grained rock commonly epitomized and cut by granite pegmatite intrusions. It is widely distributed throughout the area but is particularly conspicuous near Chloride and in the low hills between Cerbat Canyon and Mineral Park Wash.

The Precambrian granites are represented by many types of bodies. Some of the bodies are distinct and separate intrusions but others are probably differentiation facies. Typically, the rock is light grey, medium-grained, gneissic granite containing a small amount of mafic minerals, chiefly biotite. Weathered surfaces are usually light buff, less commonly reddish-brown.

Chloride, which is in the central part of the District, is where a large granite stock has intruded the Precambrian granites, gneisses, and schists. Its age is tentatively assigned to late Jurassic or early Cretaceus, the same as the batholiths of California and western Nevada. The granite is essentially medium-grained, slightly porphyritic, and intensely altered, although there are many facies of fine or coarse-grained granite, granite porphyry, porphyritic granite, and granite pegmatite. Numerous small stocks and irregular bodies of greenish-black gabbro and associated diabase dikes occur most commonly in the southern part of

the district. These are probably differentiation facies of the granite stock. Mineralizing solutions that formed the veins in the district are believed to be genetically related to the late Mesozoic granite intrusion.

Dikes of many different compositions are widespread. In thickness, they range from a few inches to 300 feet. Some extend along strike for only a hundred feet or less whereas others, notably the rhyolites, extend for long distances. The most abundant dike rocks are granite pegmatites of both Precambrian and late Mesozoic age, and dikes formed from them are usually narrow and of short lateral extent. Aplites are not common. Other dike rocks, some of which are abundant locally, include lamprophyre, andesite, diabase, porphyritic granite, granite porphyry, and rhyolite, and are probably differentiation products of the late Mesozoic intrusion.

Page - 7

The structure of the rocks is complex. Gneissic and schistose structures are common; the prevailing schistosity strikes NE with steep dips either NW or SE. Large and small folds, generally with NE trends, are common. The most predominant fold is near Chloride where the outcrop pattern of the amphibolite indicates a northeast-plunging anticline. Prominent joint systems, sheeting, and small shear zones, commonly with NW strikes, are abundant. Faulting is widespread and is usually well expressed by a prominent system of northwest-trending fault fissures in which many of the later veins are located. The dips of the fissures are generally steep, and NE

dips predominate. In places, the fault fissures are in conjugate systems. The fissures show much branching and in a few places considerable horse-tailing. Gouge and breccia, as well as numerous tear faults in the walls, are present along some fault fissures. The direction of the striations along the walls of the faults is nearly horizontal in places, but a greater number of striations show dips ranging from horizontal to parallel with the dip of the steep fault surface.

Deposits are mesothermal veins of prevailing northwestward strike and steep dip. Their gangue is quartz, in many places shattered and re-cemented by later calcite. The primary minerals are common sulfides of iron, lead, zinc and silver. Gold occurs locally in the sulfide zones. Oxidized zones contain secondary lead minerals, native silver, gold and silver chloride.

Principal Products from the Mines

Hondo anticipate generating revenue from the sale of zinc, gold and silver.

Gold Uses. Gold has two main categories of use: fabrication and investment. Fabricated gold has a variety of end uses, including jewelry, electronics, dentistry, industrial and decorative uses, medals, medallions and official coins. Gold investors buy gold bullion, official coins and jewelry.

Gold Supplies. The supply of gold consists of a combination of current production from mining and the drawdown of existing stocks of gold held by governments, financial institutions, industrial organizations and private individuals.

Gold Price. The following table presents the annual high, low and average afternoon fixing prices for gold over the past ten years, expressed in U.S. dollars per ounce, on the London Bullion Market.

|

Year

|

|

Gold Price (USD) on the

London Bullion Market

|

|||||

|

High

|

|

Low

|

|

Ave

|

|||

|

2000

|

|

313

|

|

264

|

|

279

|

|

|

2001

|

|

293

|

|

256

|

|

271

|

|

|

2002

|

|

349

|

|

278

|

|

310

|

|

|

2003

|

|

416

|

|

320

|

|

363

|

|

|

2004

|

|

454

|

|

375

|

|

410

|

|

|

2005

|

|

536

|

|

411

|

|

444

|

|

|

2006

|

|

725

|

|

525

|

|

604

|

|

|

2007

|

|

841

|

|

608

|

|

695

|

|

|

2008

|

|

1,011

|

|

713

|

|

872

|

|

|

2009

|

|

1,213

|

|

810

|

|

972

|

|

|

2010

|

1,053

|

|

1,421

|

|

1,225

|

||

|

2011 (through July 31)

|

1,890

|

1029

|

1652

|

||||

Source: London Metal Exchange

Page - 8

FULL LIST OF MINING CLAIMS

Listing of current Mining properties:

Patented Claims

|

·

|

Schuylkill

|

|

·

|

Tennessee

|

|

·

|

Tennessee South

|

|

·

|

Molly Gipson

|

|

·

|

Bullion Beck

|

|

·

|

Little Wonder

|

|

·

|

Montana

|

|

·

|

Arizona

|

|

·

|

Great Lead

|

|

·

|

Terminal Mill Site

|

|

·

|

Lucky Boy (Pending)

|

|

·

|

Queen (Pending)

|

|

·

|

Lucky Baldwin (Pending)

|

|

·

|

Samoa (Pending)

|

|

·

|

Silver Monster

|

|

·

|

Golden Gem

|

|

·

|

Exchequer

|

|

·

|

Ra

|

|

·

|

Quaker

|

|

·

|

Red Seal

|

|

·

|

Siwash

|

|

·

|

Sullivan Lode

|

|

·

|

Minnesota

|

|

·

|

Conner

|

|

·

|

Metallic Accident

|

|

·

|

Skyscraper

|

|

·

|

Summit

|

|

·

|

Towne

|

|

·

|

Bryan

|

|

·

|

Wonder

|

|

·

|

Daisy Twins

|

|

·

|

Twins Extension

|

BLM Claims

|

·

|

Tennessee Extension

|

|

·

|

Elkhart

|

|

·

|

Turtle Shell

|

|

·

|

Daisy

|

|

·

|

Miss Maggie

|

|

·

|

Lady

|

|

·

|

Western Extension Great Lead

|

|

·

|

Romeo

|

|

·

|

Randy Bell

|

|

·

|

Sir

|

|

·

|

Stair Step

|

|

·

|

Raven

|

|

·

|

Calamity

|

|

·

|

Temperance

|

|

·

|

North East Bullion

|

|

·

|

St. Louis Claims 1-10 = 100 Acres

|

|

·

|

Gunslinger

|

|

·

|

Old Shoe

|

|

·

|

Gold Toe

|

|

·

|

Silver Ditch

|

|

·

|

Flat Iron

|

|

·

|

Metal Sock

|

|

·

|

Mole Gold

|

|

·

|

Northern Extension Bullion Beck

|

|

·

|

Valero

|

|

·

|

Drunken Mule

|

|

·

|

Hondo Millsite 1-7

|

Page - 9

540 Acres of Mineral Rights only owned in Colorado.

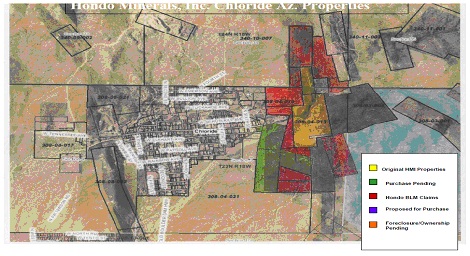

Hondo Minerals’ principal assets are located in the Wallapai Mining District of the Cerbat Mountain Range northeast of Kingman, Arizona. The District is about 10 miles long and 4 miles wide, trending NW obliquely across the Cerbat Range. There are about 225 mines, plus an estimated 1,000 shallow pits, shafts, and prospects in the District. In addition to being located in premier silver regions, both assets possess characteristics that differentiate them from other silver projects:

Recent Developments

On March 7, 2011, the Financial Industry Regulatory Authority (FINRA), approved and processed the Company's name change, and the Company’s common stock was issued the new trading symbol of "HMNCD" to reflect this name change.

On March 23, 2011, the Editorial Board of Standard and Poor's ("S&P"), approved the Company for their Corporation Records Market Access Program. S&P’s Corporation Records are considered the premier source for information on U.S. and international public companies by investors and compliance professionals. As part of the approval, the Company’s corporate profile has recently been published in the Daily News Section of S&P's Corporation Records, a securities manual for secondary trading in 38 States under the Blue Sky Laws.

On April 8, 2011, Hondo completed the superstructure of our processing facility at the Tennessee Mine. With the completion of the superstructure, the Company is now entering the final phase of the construction process of the metal building that will house the processing and extraction equipment. The Company has begun finishing the interior construction which will allow for the installation and placement of the processing equipment.

On April 27, 2011, Hondo began installing equipment that will use a newly developed technology for the abstraction of minerals at the Tennessee Mine. E-Leach, a patent pending technology that creates a leaching process without the use of hazardous chemicals, such as cyanide, has become the technology of choice for the Company’s Tennessee Mine processing facility.

On May 4, 2011, Hondo found a surface vein that runs along the Tennessee and Schuylkill properties. The preliminary measurement showed that the vein is anywhere between 10 and 28 feet wide and runs approximately a half of a mile long. Based on the new discovery, the Company has taken samples and is awaiting the test results. The Company is currently in the process of completing the Mining Safety and Health Administration (MSHA) training, inspection and site review at the Tennessee Mine. The full mineral extraction process onsite will begin immediately following the MSHA regulatory and safety training

certification.

On May 11, 2011, Hondo announced that the Company closed on a major new land acquisition in northwest Arizona. The company will begin to sample the property for future mining and processing in the next six months. Hondo Minerals now controls 1,796 acres of patented and BLM claims in the southwestern United States.

In May 2011, Hondo acquired over $500,000 dollars of additional E-Leach equipment for its Tennessee Mine production facility. On June 9, the Company announced that it paid the remaining balance of $1.9 million on the $2.4 million dollar purchase of additional processing equipment for the Tennessee plant. In July, the company announced that it commenced production at the Tennessee Mine. The company completed all work related to the construction of the plant structure, installed all equipment used for its innovative E-Leach leaching process, and completed all required training and regulatory approvals. The Company is now starting to ramp the

leaching step of its production process. This step produces a water-based solution with suspended metal content. The Company purchased and will soon install the extraction systems which will remove and concentrate the metals suspended in solution.

Page - 10

On June 14, 2011, the Company entered into a Consulting Agreement (the “Consulting Agreement”) with ICR, LLC, a Connecticut limited liability company (“ICR”), pursuant to which ICR shall provide investor relations consulting services to the Company commencing on June 15, 2011 and terminating on July 1, 2012 (the “Term”). In exchange for providing these services, the Company shall pay ICR: (a) a retainer of ten thousand dollars ($10,000) to be held during the Term; (b) five thousand dollars ($5,000) per month; and (c) a fee of one hundred thousand dollars ($100,000) in the event the Company

consummates an offering, private placement of common stock or other transaction in which the Company raises more than two million dollars ($2,000,000) from a financing source that ICR has identified.

EMPLOYEES

As of the date of this report, Hondo has no employees. However, Hondo pays an independent contractor that has 5 full-time employees working at the Tennessee Mine and tailings pile. Hondo may use third-party consultants to assist in the completion of various projects. Third-parties are instrumental to keep the development of projects on time and on budget. Management expects to continue to use consultants, attorneys, and accountants as necessary.

OUR EXECUTIVE OFFICES

Executive offices are located at 15303 N. Dallas Parkway,, Suite 1050 Addison, Texas 75001.

|

ITEM 1A.

|

RISK FACTORS

|

As a “smaller reporting company,” as defined in Rule 12b-2 of the Exchange Act, Hondo is not required to provide the information called for by this Item.

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

None.

|

ITEM 2.

|

PROPERTIES

|

Current business address is 15303 N. Dallas Parkway, Suite 1050, Addison, Texas 75001. Telephone number is (214) 444-7444.

Hondo believe this space is adequate for its current needs. In addition to the business address, there are also interests stated in the mining locations discussed herein.

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

From time to time, the Company may become subject to various legal proceedings that are incidental to the ordinary conduct of its business. Although the Company cannot accurately predict the amount of any liability that may ultimately arise with respect to any of these matters, it makes provision for potential liabilities when it deems them probable and reasonably estimable. These provisions are based on current information and legal advice and may be adjusted from time to time according to developments.

On May 25, 2011, John Theodore Anderson (“Plaintiff”) filed a Complaint against the Company in the United States District Court, District of Nevada. The Plaintiff alleged a breach of contract and was seeking money damages against the Company. On August 9, 2011, Anderson v. Hondo Minerals, Inc. et al. (Case No. 2:11-cv-00850-JCM -RJJ) was dismissed without prejudice.

Other than the foregoing, we know of no material, existing or pending legal proceedings against the Company, nor is Hondo a plaintiff in any material proceeding or pending litigation. There are no proceedings in which the directors, officers, any affiliates, or any registered or beneficial shareholder is an adverse party or has a material interest adverse to our interest.

ITEM 4. (REMOVED AND RESERVED).

Page - 11

PART II

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS MARKET INFORMATION

|

Since March 2011, shares of our common stock have been quoted on the Over-the-Counter Electronic Bulletin Board (“OTC Bulletin Board”) under the stock symbol “HMNC”

|

BID PRICE PER SHARE

|

||||||||

|

HIGH

|

LOW

|

|||||||

|

Three Months Ended April 30, 2011

|

$

|

2.20

|

$

|

0.00

|

||||

|

Three Months Ended July 31, 2011

|

$

|

3.87

|

$

|

2.02

|

||||

HOLDERS

As of the date of this report, there were approximately 1335 holders of record of our common stock.

DIVIDENDS

Historically, Hondo has not paid any dividends to the holders of common stock and Hondo does not expect to pay any such dividends in the foreseeable future as Hondo expects to retain our future earnings for use in the operation and expansion of its business.

RECENT SALES OF UNREGISTERED SECURITIES

For recent sales other than previously reported, please see notes to financial statements included herewith in Note 7.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

Hondo has not established any compensation plans under which equity securities are authorized for issuance.

PURCHASES OF EQUITY SECURITIES BY THE REGISTRANT AND AFFILIATED PURCHASERS

Hondo did not purchase any shares of common stock or other securities during the year ended July 31, 2011.

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

As a “smaller reporting company,” as defined in Rule 12b-2 of the Exchange Act, we are not required to provide the information called for by this Item.

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

RESULTS OF OPERATIONS

Hondo has generated no revenues since inception and has incurred $1,768,472 in operating expenses for the year ended July 31, 2011. These expenses were comprised of $761,050 in officers and directors’ fees; $16,031 in property costs; $5,934 filing and claim fees; $314,940 in professional fees and $670,517 in corporate, general and administrative costs for the year ended July 31, 2011. We incurred operating expenses of $1,008,901 for the year ended July 31, 2010. The net loss since inception (September 25, 2007) through July 31, 2011 was $3,391,316. The following table provides selected financial data about the Company for the

years ended July 31, 2011 and 2010.

|

Balance Sheet Data

|

July 31, 2011

|

July 31, 2010

|

|||||||

|

Cash and Cash Equivalents

|

$

|

2,052,048

|

$

|

10,638

|

|||||

|

Total Assets

|

$

|

10,182,646

|

$

|

1,942,946

|

|||||

|

Total Liabilities

|

$

|

308,325

|

$

|

83,024

|

|||||

|

Shareholders’ Equity (Deficit)

|

$

|

9,874,321

|

$

|

1,942,946

|

|||||

LIQUIDITY AND CAPITAL RESOURCES

As of July 31, 2011, the Company’s cash balance was $2,052,048 compared to $10,638 as of July 31, 2010. The increase in cash is attributed to the sale of common stock. Hondo has sufficient cash on hand to commence initial production and to fund ongoing operational expenses beyond 12 months.

Hondo may need to raise funds in the future to fund possible acquisitions or further production. Additional funding will likely come from equity financing from the sale of common stock. If successful in completing an equity financing, existing shareholders will experience dilution of their interest in the Company. Hondo does not have any financing arranged and cannot provide investors with any assurance that we will be able to raise additional funding from the sale of common stock. There are no assurances that Hondo will be able to achieve further sales of common stock or any other form of additional

financing.

Page - 12

PLAN OF OPERATION

In 2011, Hondo has constructed a pilot production plant and completed the installation of lab facilities.

The final months of 2011 will see movement from a construction mode to full production mode.

Hondo will continue to expand upon mining operations and opportunities not only at the Tennessee/Schuylkill facility, but at other properties acquired throughout the year.

Currently, the research and development teams and the construction and installation personnel are finalizing Hondo’s facilities at the Tennessee Mine that will carry the Company into production. Early trial runs of the pilot facility have returned favorable results for production that may exceed previously planned capabilities.

The objectives of our current year end program will be:

(A) Step into full production at the pilot facility

(B) Begin 24 hour operation of tailings processing

(C) Start excavations of known deposits

(D) Begin design of automated facility

(E) Complete testing of all acquired properties

OFF-BALANCE SHEET ARRANGEMENTS

None.

|

ITEM 7A.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

As a “smaller reporting company,” as defined in Rule 12b-2 of the Exchange Act, we are not required to provide the information called for by this Item.

Page - 13

|

ITEM 8.

|

FINANCIAL STATEMENTS

|

HONDO MINERALS CORP.

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

|

Consolidated Financial Statements

|

Page

|

|

|

Report of Independent Registered Public Accounting Firm

|

15

|

|

|

Consolidated Balance Sheets as of July 31, 2011 and July 31, 2010.

|

16

|

|

|

Consolidated Statements of Operations for the years ended July 31, 2011 and 2010

|

17

|

|

|

Consolidated Statements of Stockholders’ Equity for the years ended July 31, 2011 and 2010.

|

18

|

|

|

Consolidated Statements of Cash Flows for the years ended July 31, 2011and 2010.

|

19

|

|

|

Notes to Consolidated Financial Statements (audited).

|

21

|

Page - 14

K W C O, P C

(Formerly Killman, Murrell & Company, P.C.)

Certified Public Accountants

|

1931 East 37th Street, Suite 7

|

2626 Royal Circle

|

|

|

Odessa, Texas 79762

|

Kingwood, Texas 77339

|

|

|

(432) 363-0067

|

(281) 359-7224

|

|

|

Fax (432) 363-0376

|

Fax (281) 359-7112

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors

Hondo Minerals Corporation

Scottsdale, AZ 85259

We have audited the accompanying consolidated balance sheets of Hondo Minerals Corporation as of July 31, 2011 and 2010, and the related consolidated statements of operations, stockholders' equity, and cash flows for each of the years in the two-year period ended July 31, 2011. Hondo Minerals Corporation’s management is responsible for these consolidated financial statements. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. The company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial

reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Hondo Minerals Corporation as of July 31, 2011 and 2010, and the results of its consolidated operations and its consolidated cash flows for the two-year period ended July 31, 2011 in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the consolidated financial statements, the Company has limited cash, no revenues, and limited capital resources raising substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are also discussed in Note 2. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s KWCO, PC

KWCO, PC

Odessa, Texas

October 31, 2011

Page - 15

|

Hondo Minerals Corporation

|

||||||||

|

(Formerly Tycore Ventures, Inc.)

|

||||||||

|

CONSOLIDATED BALANCE SHEETS

|

||||||||

|

July 31,

|

||||||||

|

2011

|

2010

|

|||||||

|

ASSETS

|

||||||||

|

Current Assets:

|

||||||||

|

Cash and cash equivalents

|

$ | 2,052,048 | $ | 10,638 | ||||

|

Receivables - other

|

- | 4,200 | ||||||

|

Prepaid expenses

|

59,386 | - | ||||||

|

Total Current Assets

|

2,111,434 | 14,838 | ||||||

|

Properties, Equipment, and Buildings:

|

||||||||

|

Vehicles

|

67,183 | - | ||||||

|

Office equipment

|

56,428 | - | ||||||

|

Mining equipment

|

4,129,601 | 5,275 | ||||||

|

Plant and buildings

|

1,539,387 | 6,258 | ||||||

|

Land and mineral properties, net of $920,000 allowance for

|

||||||||

|

impairment

|

2,278,513 | 1,916,475 | ||||||

|

Total Properties, Equipment, and Buildings

|

8,071,112 | 1,928,008 | ||||||

|

Other Assets

|

100 | 100 | ||||||

|

TOTAL ASSETS

|

$ | 10,182,646 | $ | 1,942,946 | ||||

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

||||||||

|

Current Liabilities:

|

||||||||

|

Accounts payable

|

$ | 293,066 | $ | - | ||||

|

Accounts payable - related parties

|

15,259 | 83,024 | ||||||

|

Total Current Liabilities

|

308,325 | 83,024 | ||||||

|

Shareholders' Equity:

|

||||||||

|

Common Stock, $0.001 par value, 200,000,000 shares authorized

|

||||||||

|

57,711,390 and 28,509,140 shares issued and outstanding at

|

||||||||

|

July 31, 2011 and 2010, respectively

|

57,711 | 28,509 | ||||||

|

Additional paid-in capital

|

13,220,847 | 3,454,560 | ||||||

|

Treasury stock, at cost

|

(12,921 | ) | (12,921 | ) | ||||

|

Accumulated (deficit)

|

(3,391,316 | ) | (1,610,226 | ) | ||||

|

Total Shareholders' Equity

|

9,874,321 | 1,859,922 | ||||||

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

|

$ | 10,182,646 | $ | 1,942,946 | ||||

|

The accompanying notes are an integral part of these financial statements.

F-1

|

||||||||

|

|

||||||||

Page - 16

|

Hondo Minerals Corporation

|

||||||||

|

(Formerly Tycore Ventures, Inc.)

|

||||||||

|

CONSOLIDATED STATEMENTS OF OPERATIONS

|

||||||||

|

For the Years ended July 31, 2011 and 2010

|

||||||||

|

2011

|

2010

|

|||||||

|

Revenue

|

||||||||

|

Mineral Sales

|

$ | - | $ | - | ||||

|

Operating Expenses

|

||||||||

|

Officers' and directors' fees

|

761,050 | 14,000 | ||||||

|

Property costs

|

16,031 | 8,502 | ||||||

|

Filing and claims fees

|

5,934 | 6,308 | ||||||

|

Professional fees

|

314,940 | 1,318 | ||||||

|

Impairment of mining properties

|

- | 920,000 | ||||||

|

Corporate general and administrative

|

670,517 | 58,773 | ||||||

|

Loss from Operations

|

(1,768,472 | ) | (1,008,901 | ) | ||||

|

Other Income (Expense)

|

||||||||

|

Other income

|

15,930 | - | ||||||

|

Interest expense

|

(28,548 | ) | (6,878 | ) | ||||

|

Net (Loss)

|

$ | (1,781,090 | ) | $ | (1,015,779 | ) | ||

|

(Loss) per share

|

||||||||

|

Basic and fully diluted:

|

||||||||

|

Weighted average number of shares outstanding

|

41,352,159 | 28,518,140 | ||||||

|

(Loss) per share

|

$ | (0.04 | ) | $ | (0.04 | ) | ||

|

The accompanying notes are an integral part of these financial statements.

F-2

|

||||||||

Page - 17

|

Hondo Minerals Corporation

|

||||||||||||||||||||||||

|

(Formerly Tycore Ventures, Inc.)

|

||||||||||||||||||||||||

|

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY

|

||||||||||||||||||||||||

|

For the Years Ended July 31, 2011 and 2010

|

||||||||||||||||||||||||

|

Additional

|

||||||||||||||||||||||||

|

Common Stock

|

Treasury

|

Paid in

|

Retained

|

|||||||||||||||||||||

|

Shares

|

Amount

|

Stock

|

Capital

|

(Deficit)

|

Total

|

|||||||||||||||||||

|

Balance, July 31, 2009 - Tycore Ventures, Inc.

|

||||||||||||||||||||||||

|

Historical, as previously reported

|

6,860,000 | $ | 6,860 | $ | - | $ | 59,640 | $ | (24,202 | ) | $ | 42,298 | ||||||||||||

|

Balance, July 31, 2009 - Hondo Minerals, Inc.

|

||||||||||||||||||||||||

|

Historical

|

9,264,090 | 9,264 | (12,921 | ) | 2,292,878 | (510,476 | ) | 1,778,745 | ||||||||||||||||

|

Merger of Tycore Ventures, Inc. and Hondo

|

- | |||||||||||||||||||||||

|

Minerals, Inc.

|

10,640,000 | 10,640 | - | 1,360 | (59,769 | ) | (47,769 | ) | ||||||||||||||||

|

Balance, July 31, 2009 - As restated for merger

|

26,764,090 | 26,764 | (12,921 | ) | 2,353,878 | (594,447 | ) | 1,773,274 | ||||||||||||||||

|

Shares issued for officers' and directors' fees

|

141,000 | 141 | - | 13,959 | - | 14,100 | ||||||||||||||||||

|

Shares issued for services

|

16,500 | 16 | - | 1,634 | - | 1,650 | ||||||||||||||||||

|

Shares issued for interest--related party

|

137,550 | 138 | - | 6,289 | - | 6,427 | ||||||||||||||||||

|

Shares issued for payment of short-term loans--

|

||||||||||||||||||||||||

|

related party

|

1,200,000 | 1,200 | - | 58,800 | - | 60,000 | ||||||||||||||||||

|

Shares issued for purchase of mining interest

|

250,000 | 250 | - | - | - | 250 | ||||||||||||||||||

|

Warrants issued for acquisition of mining

|

||||||||||||||||||||||||

|

properties

|

- | - | - | 1,020,000 | - | 1,020,000 | ||||||||||||||||||

|

Net (loss)

|

- | - | - | - | (1,015,779 | ) | (1,015,779 | ) | ||||||||||||||||

|

Balance, July 31, 2010

|

28,509,140 | 28,509 | (12,921 | ) | 3,454,560 | (1,610,226 | ) | 1,859,922 | ||||||||||||||||

|

Shares issued for officers' and directors' fees

|

2,546,500 | 2,546 | - | 758,504 | - | 761,050 | ||||||||||||||||||

|

Shares issued for services-related party

|

796,750 | 797 | - | 374,278 | - | 375,075 | ||||||||||||||||||

|

Shares issued for services

|

193,000 | 193 | - | 84,807 | - | 85,000 | ||||||||||||||||||

|

Donated management services

|

- | - | - | 3,000 | - | 3,000 | ||||||||||||||||||

|

Shares issued for interest--related party

|

537,250 | 537 | - | 26,325 | - | 26,862 | ||||||||||||||||||

|

Shares issued for payment of short-term loans--

|

||||||||||||||||||||||||

|

related party

|

7,855,000 | 7,855 | - | 384,896 | - | 392,751 | ||||||||||||||||||

|

Shares issued for payment of short-term loans

|

50,000 | 50 | - | 2,450 | - | 2,500 | ||||||||||||||||||

|

Shares issued for acquisition of mining equipment

|

||||||||||||||||||||||||

|

and buildings

|

3,163,500 | 3,164 | - | 1,189,087 | - | 1,192,251 | ||||||||||||||||||

|

Shares issued in private placement

|

14,060,250 | 14,060 | - | 6,942,940 | - | 6,957,000 | ||||||||||||||||||

|

Net (loss)

|

- | - | - | - | (1,781,090 | ) | (1,781,090 | ) | ||||||||||||||||

|

Balance, July 31, 2011

|

57,711,390 | $ | 57,711 | $ | (12,921 | ) | $ | 13,220,847 | $ | (3,391,316 | ) | $ | 9,874,321 | |||||||||||

|

The accompanying notes are an integral part of these financial statements.

F-3

|

||||||||||||||||||||||||

Page - 18

|

Hondo Minerals Corporation

|

|||||||||||

|

(Formerly Tycore Ventures, Inc.)

|

|||||||||||

|

CONSOLIDATED STATEMENTS OF CASH FLOW

|

|||||||||||

|

For the Years Ended July 31, 2011 and 2010

|

|||||||||||

|

2011

|

2010

|

||||||||||

|

Cash flows from operating activities:

|

|||||||||||

|

Net (loss)

|

$ | (1,781,090 | ) | $ | (1,015,779 | ) | |||||

|

Adjustments to reconcile net (loss) to net cash used in

|

|||||||||||

|

operating activities:

|

|||||||||||

|

Allowance for impairment of mining properties

|

- | 920,000 | |||||||||

|

Common stock issued for services--related party

|

375,075 | - | |||||||||

|

Common stock issued for services

|

85,000 | 1,650 | |||||||||

|

Common stock issued for officers' and directors' fees

|

761,050 | 14,100 | |||||||||

|

Common stock issued for interest--related party

|

26,862 | 6,427 | |||||||||

|

Donated management services

|

3,000 | - | |||||||||

|

Changes in current assets and liabilities:

|

|||||||||||

|

Accounts receivable

|

4,200 | (14,502 | ) | ||||||||

|

Prepaid expenses

|

(59,386 | ) | - | ||||||||

|

Accounts payable

|

293,066 | 10,304 | |||||||||

|

Accounts payable - related parties

|

327,487 | 93,454 | |||||||||

|

Net cash (used) in provided by operating activities

|

35,264 | 15,654 | |||||||||

|

Cash flows from investing activities:

|

|||||||||||

|

Purchase of vehicles

|

(67,183 | ) | - | ||||||||

|

Purchase of office equipment

|

(56,428 | ) | - | ||||||||

|

Purchase of mining equipment

|

(3,301,826 | ) | - | ||||||||

|

Purchase of buildings

|

(1,163,379 | ) | (6,258 | ) | |||||||

|

Purchase of land and mining properties

|

(362,038 | ) | |||||||||

|

Net cash (used) in investing activities

|

(4,950,854 | ) | (6,258 | ) | |||||||

|

Cash flows from financing activities

|

|||||||||||

|

Sale of common stock

|

6,957,000 | - | |||||||||

|

Net cash provided by financing activities

|

6,957,000 | - | |||||||||

|

Net increase in cash and cash equivalents

|

2,041,410 | 9,396 | |||||||||

|

Cash and cash equivalents, beginning of year

|

10,638 | 1,242 | |||||||||

|

Cash and cash equivalents, end of year

|

$ | 2,052,048 | $ | 10,638 | |||||||

|

The accompanying notes are an integral part of these financial statements

|

|||||||||||

|

(Continued)

F-4

|

|||||||||||

Page - 19

|

Hondo Minerals Corporation

|

|||||||||||

|

(Formerly Tycore Ventures, Inc.)

|

|||||||||||

|

CONSOLIDATED STATEMENTS OF CASH FLOW

|

|||||||||||

|

For the Years Ended July 31, 2011 and 2010

|

|||||||||||

|

(Continued)

|

|||||||||||

|

2011

|

2010

|

||||||||||

|

Supplemental cash flow disclosures:

|

|||||||||||

|

Cash paid during the year for:

|

|||||||||||

|

Interest

|

$ | 1,686 | $ | - | |||||||

|

Income Taxes

|

$ | - | $ | - | |||||||

|

Non-cash investing and financing activities:

|

|||||||||||

|

Common stock issued for mining equipment

|

$ | 822,500 | $ | - | |||||||

|

Common stock issued for buildings

|

369,750 | - | |||||||||

|

Acquisition of mining equipment

|

(822,500 | ) | - | ||||||||

|

Acquisition of buildings

|

(369,750 | ) | - | ||||||||

|

Common Stock issued for payment of short-term loans

|

2,500 | - | |||||||||

|

Common stock issued for payment of short-term

|

|||||||||||

|

loans--related party

|

392,751 | 60,000 | |||||||||

|

Common stock issued for purchase of mining interest

|

- | 250 | |||||||||

|

Payment of short-term loan

|

(2,500 | ) | - | ||||||||

|

Payment of short-loan loan--related party

|

(392,751 | ) | (60,000 | ) | |||||||

|

Acquisition of mining interest

|

- | (250 | ) | ||||||||

| $ | - | $ | - | ||||||||

|

The accompanying notes are an integral part of these financial statements

F-5

|

|||||||||||

Page - 20

Note 1 – Organization and Business Activity

Hondo Minerals Corporation, formerly Tycore Ventures Inc. (“Tycore”) was incorporated in the State of Nevada on September 25, 2007 to engage in the acquisition, exploration and development of natural resource properties. On February 22, 2011, Tycore changed its name to Hondo Minerals Corporation (the “Company”).

On February 8, 2011, the two controlling shareholders of Tycore and Hondo Minerals, Inc. (“Hondo”) entered into an agreement to merge the two companies into a single entity. By agreement, Tycore exchanged 17,783,888 shares of its common stock for all of the issued and outstanding common shares of Hondo. The two controlling shareholders owned the following percentages of each company:

Company Ownership Percentage

Tycore Ventures Inc. 71.4%

Hondo Minerals, Inc. 58.0%

Due to the common control, the historical basis of accounting of each company was maintained and the accompanying financial statements and historical accounting information represents combined amounts. The Company is primarily engaged in the acquisition, exploration, and development of mining properties. The Company has not yet realized any revenues from its current planned operations.

Note 2 - Summary of Significant Accounting Policies

Basis of Presentation—The Company’s financial statements are prepared using the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America.

Going Concern—As shown in the accompanying financial statements, the Company has limited cash and no revenues and has accumulated a deficit of $3,391,316. These factors raise substantial doubt about the Company’s ability to continue as a going concern. Management intends to seek additional capital from new equity securities offerings that will provide funds needed to increase liquidity and fully implement it business plan. The financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts and classification of

liabilities that might be necessary in the event the Company cannot continue in existence.

Note 2- Summary of Significant Accounting Policies (cont)

Use of Estimates—Preparing the Company’s financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Cash and cash equivalents—Cash and cash equivalents consist of all cash balances and highly liquid investments with an original maturity of three months or less. Because of the short maturity of these investments, the carrying amounts approximate their fair value.

Page - 21

Financial Instruments and Fair Value Measures

ASC 820, “Fair Value Measurements and Disclosures” requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. ASC 820 establishes a fair value hierarchy based on the level of independent, objective evidence surrounding the inputs used to measure fair value. A financial instrument’s categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. ASC 820 prioritizes the inputs into three levels that may be used to measure fair value:

Level 1

Level 1 applies to assets or liabilities for which there are quoted prices in active markets for identical assets or liabilities.

Level 2

Level 2 applies to assets or liabilities for which there are inputs other than quoted prices that are observable for the asset or liability such as quoted prices for similar assets or liabilities in active markets; quoted prices for identical assets or liabilities in markets with insufficient volume or infrequent transactions (less active markets); or model derived valuations in which significant inputs are observable or can be derived principally from, or corroborated by, observable market data.

Level 3

Level 3 applies to assets or liabilities for which there are unobservable inputs to the valuation methodology that are significant to the measurement of the fair value of the assets or liabilities.

Note 2- Summary of Significant Accounting Policies (cont)

The Company’s financial instruments consist principally of cash, prepaid expenses, and accounts payable. Pursuant to ASC 820, the fair value of cash is determined based on “Level 1” inputs, which consist of quoted prices in active markets for identical assts. The recorded values of all other financial instruments approximate their current fair values because of their nature and respective maturity dates or duration.

Mineral Properties—Mineral property acquisition costs are recorded at cost and are deferred until the viability of the property is determined. When proven and probable reserves are determined for a property, subsequent development costs on the property would be capitalized. If a project were to be put into production, capitalized development costs would be depleted on the units of production basis determined by the proven and probable reserves for that project.

Property and Equipment—Expenditures for new facilities or equipment and expenditures that extend the useful lives or expand the production capacity of existing facilities or equipment are capitalized and depreciated using the straight-line or units of production method at rates sufficient to depreciate such costs over the estimated productive lives of such facilities based on proven and probable reserves. As of July 31, 2011, no property or equipment has been placed in service.

Loss Per Common Share—Basic net loss per share is calculated by dividing net loss by the weighted average number of common shares outstanding during the period, and does not include the impact of any potentially dilutive common stock equivalents. Potential common shares are not included in the computation of loss per share, as their effect is antidilutive.

Impairment of Long-Lived Assets —The Company reviews and evaluates its long-lived assets for impairment annually and at interim periods if events or changes in circumstances indicate that the related carrying amounts may not be recoverable. An impairment is determined to exist if the total estimated future cash flows on an undiscounted basis are less than the carrying amount of the assets. An impairment loss is measured and recorded based on discounted estimated future cash flows. Future cash flows are estimated based on quantities of recoverable minerals, expected gold and other

commodity prices (considering current and historical prices, price trends and related factors), production levels and operating costs of production and capital, all based on life-of-mine plans. The term “recoverable minerals” refers to the estimated amount of gold or other commodities that will be obtained after taking into account losses during ore processing and treatment. Estimates of recoverable minerals from such mineral interests are risk adjusted based on management’s relative confidence in such materials.

Note 2- Summary of Significant Accounting Policies (cont)

In estimating future cash flows, assets are grouped at the lowest level for which there is identifiable cash flows that are largely independent of future cash flows from other asset groups. The Company’s estimates of future cash flows are based on numerous assumptions and it is possible that actual future cash flows will be significantly different than the estimates, as actual future quantities of recoverable minerals, gold and other commodity prices, production levels and operating costs of production and capital are each subject to significant risks and uncertainties.

Page - 22

Mining Development Costs—Mine development costs are amortized using the units of production method based upon projected recoverable ounces in proven and probable reserves. Projected recoverable ounces are determined by the Company based upon its proven and probable reserves and estimated metal recovery associated with those reserves. As of July 31, 2011, no mines are in production therefore none are being amortized.

Revenue Recognition—The Company has not yet achieved any revenues. We will recognizes revenue on gold and silver sales when persuasive evidence of an arrangement exists, the price is fixed or determinable, the metal is delivered, the title has been transferred to the customer, and collectability is reasonably assured.

Treasury Stock—The Company accounts for its treasury stock under the cost method. Under the cost method, the gross cost of the shares reacquired is charged to a contra equity account. The common stock and additional paid-in-capital that were credited for the original share issuance remain intact. If the treasury shares are reissued, proceeds in excess of cost are credited to additional paid-in-capital.

Income Taxes—The Company accounts for income taxes using the liability method, recognizing certain temporary differences between the financial reporting basis of the Company’s liabilities and assets and the related income tax basis for such liabilities and assets. This method generates either a net deferred income tax liability or asset for the Company, as measured by the statutory tax rates in effect. The Company derives its deferred income tax charge or benefit by recording the change in either the net deferred income tax liability or asset balance for the year.

At July 31, 2011 and 2010 the Company recorded a valuation allowance against all of its deferred income tax assets which it believes, based on the weight of available evidence; it is more likely than not that some portion or all of the deferred income tax assets will not be realized.

Note 2- Summary of Significant Accounting Policies (cont)

Recent Accounting Pronouncements—In January 2010, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2010-06, “Fair Value Measurements and Disclosures (Topic 820) — Improving Disclosures about Fair Value Measurements.” This ASU requires some new disclosures and clarifies some existing disclosure requirements about fair value measurement as set forth in Accounting Standards Codification (“ASC”) 820. ASU 2010-06 amends ASC 820 to now require: (1) a reporting entity should disclose separately the amounts of significant

transfers in and out of Level 1 and Level 2 fair value measurements and describe the reasons for the transfers; and (2) in the reconciliation for fair value measurements using significant unobservable inputs, a reporting entity should present separately information about purchases, sales, issuances, and settlements. In addition, ASU 2010-06 clarifies the requirements of existing disclosures. ASU 2010-06 is effective for interim and annual reporting periods beginning after December 15, 2009, except for the disclosures about purchases, sales, issuances, and settlements in the roll forward of activity in Level 3 fair value measurements. Those disclosures are effective for fiscal years beginning after December 15, 2010, and for interim periods within those fiscal years. Early application is permitted. The Company has complied with the additional disclosures

required by this guidance upon its adoption.

In February 2010, the FASB issued updated guidance which amended the subsequent events disclosure requirements to eliminate the requirement for SEC filers to disclose the date through which it has evaluated subsequent events, clarify the period through which conduit bond obligors must evaluate subsequent events and refine the scope of the disclosure requirements for reissued financial statements. The updated guidance was effective upon issuance. Except for the disclosure requirements, the adoption of the guidance had no impact on our consolidated financial statements.

In the opinion of management, these topics have no impact on the financial statements of the Company.

Note 3 – Related Party Transactions

During the years ended July 31, 2011 and 2010, the Company had the following related party transactions:

Page - 23

As of July 31, 2011 and 2010, the Company owed $15,259 and $70,304 respectively to several principal shareholders for cash advances for operations.

Note 4–Concentration of Credit Risk

The Company maintains deposit accounts at financial institutions that are insured by the Federal Deposit Insurance Corporation (“FDIC”) up to $250,000 per financial institution. From time to time the Company’s cash balances may exceed the amount secured by FDIC insurance. At July 31, 2011, the Company had deposits of $2,088,202 that were not insured by the FDIC.

Note 5—Warrants

During the year 2011, equity was raised through a private placement agreement. Per the subscription agreement, each subscriber is entitled to one 3 year warrant at $2.00 and one 3 year warrant at $3.00 per each share bought. As a result of the private placement there were 11,874,000 warrants at $2.00 and 11,874,000 warrants at $3.00 outstanding at July 31, 2011. Total warrants outstanding at July 31, 2011 were 26,748,000. There were 3,000,000 warrants outstanding at July 31, 2010.

Note 6 – Impairment of Mining Property

In May 2010, the company acquired a mining claim in Juab County, Utah for $100 and the granting of 3,000,000 warrants to purchase the Company’s common stock. The warrants were valued at $1,020,000 and the Juab County mining property was valued at $1,020,000. At July 31, 2010 management revised the value of the mining property and determined that an impairment allowance of $920,000 should be reserved on this property based on the estimated net realizable value of the property.

Note 7 – Stock Transactions

The following is a summary of stock transactions for the fiscal year ended July 31, 2011. 2,546,500 shares were issued to the Company’s officers and directors, or $2,546 in common stock and $758,504 in additional paid-in capital, for a total of $761,050 in officers’ and director’s fees. 796,750 shares were issued for related party services, or $797 in common stock and $374,278 in additional paid-in capital, for a total of $375,075 in related party services. 193,000 shares were issued for service, or $193 in common stock and $84,807 in additional paid-in capital, for a total of $85,000 in services. 537,250 shares were issued for interest paid to related