Attached files

| file | filename |

|---|---|

| 8-K - SEACUBE CONTAINER LEASING LTD. 8-K - SeaCube Container Leasing Ltd. | a50055063.htm |

| EX-99.1 - EXHIBIT 99.1 - SeaCube Container Leasing Ltd. | a50055063ex99_1.htm |

Exhibit 4.1

CLI FUNDING V LLC

Issuer

and

U.S. BANK NATIONAL ASSOCIATION

Indenture Trustee

______________________________

SERIES 2011-2 SUPPLEMENT

Dated as of November 3, 2011

to

INDENTURE

March 18, 2011

______________________________

FIXED RATE ASSET BACKED NOTES, SERIES 2011-2

TABLE OF CONTENTS

| ARTICLE I Definitions; Calculation Guidelines |

1 |

||

| Section 101. | Definitions | 1 | |

| ARTICLE II Creation of the Series 2011-2 Notes | 5 | ||

| Section 201. | Designation | 5 | |

| Section 202. | Authentication and Delivery | 6 | |

| Section 203. | Interest Payments on the Series 2011-2 Notes | 6 | |

| Section 204. | Principal Payments on the Series 2011-2 Notes | 7 | |

| Section 205. | Prepayment of Principal on the Series 2011-2 Notes | 8 | |

| Section 206. | Payments of Principal and Interest | 9 | |

| Section 207. | Restrictions on Transfer | 9 | |

| ARTICLE III Series 2011-2 Series Account and Allocation and Application of Amounts Therein | 14 | ||

| Section 301. | Series 2011-2 Series Account | 14 | |

| Section 302. | Distributions from Series 2011-2 Series Account | 14 | |

| ARTICLE IV Additional Covenants | 16 | ||

| Section 401. | Other Information | 16 | |

| Section 402. | Use of Proceeds | 16 | |

| ARTICLE V Conditions to Issuance | 17 | ||

| Section 501. | Conditions to Issuance | 17 | |

| ARTICLE VI Representations and Warranties | 17 | ||

| Section 601. | Existence | 17 | |

| Section 602. | Authorization | 17 | |

| Section 603. | No Conflict; Legal Compliance | 17 | |

| Section 604. | Validity and Binding Effect | 18 | |

| Section 605. | Financial Statements | 18 | |

| Section 606. | Place of Business | 18 | |

| Section 607. | No Agreements or Contracts | 18 | |

| Section 608. | Consents and Approvals | 18 | |

| Section 609. | Margin Regulations | 18 | |

| Section 610. | Taxes | 18 | |

| Section 611. | Other Regulations | 19 | |

| Section 612. | Solvency and Separateness | 19 | |

| Section 613. | No Default | 20 | |

| Section 614. | Litigation and Contingent Liabilities | 20 | |

| Section 615. | Title; Liens | 20 | |

| Section 616. | Subsidiaries | 20 | |

| Section 617. | No Partnership | 20 | |

| Section 618. | Pension and Welfare Plans | 20 | |

| Section 619. | Ownership of the Issuer | 20 | |

| Section 620. | Security Interest Representations | 20 | |

| Section 621. | Survival of Representations and Warranties | 22 | |

| Section 622. | ERISA Lien | 22 | |

| ARTICLE VII Miscellaneous Provisions | 22 | ||

| Section 701. | Ratification of Indenture | 22 | |

| Section 702. | Counterparts | 22 | |

| Section 703. | Governing Law | 22 | |

| Section 704. | Notices to Rating Agency | 23 | |

| Section 705. | Statutory References | 23 | |

| Section 706. | Amendments and Modifications | 23 | |

| Section 707. | Consent to Jurisdiction | 23 | |

| Section 708. | Waiver of Jury Trial | 24 | |

EXHIBITS

| EXHIBIT A-1 | Form of 144A Global Notes |

| EXHIBIT A-2 | Form of Regulation S Temporary Global Note |

| EXHIBIT A-3 | Form of Permanent Regulation S Global Note |

| EXHIBIT A-4 | Form of Note Issued to Institutional Accredited Investors |

| EXHIBIT B | Form of Certificate to be Given by Noteholder |

| EXHIBIT C | Form of Certificate to be Given by Euroclear or Clearstream |

| EXHIBIT D | Form of Certificate to be Given by Transferee of Beneficial Interest In a Regulation S Temporary Global Note |

| EXHIBIT E | Form of Transfer Certificate for Exchange or Transfer From 144A Book Entry Note to Regulation S Book Entry Note |

| EXHIBIT F | Form of Transfer Certificate for Exchange or Transfer From Regulations S Book Entry Note to a 144A Book Entry Note |

| EXHIBIT G | Form of Initial Purchaser Exchange Instructions |

| EXHIBIT H | Form of Purchaser Letter |

SCHEDULES

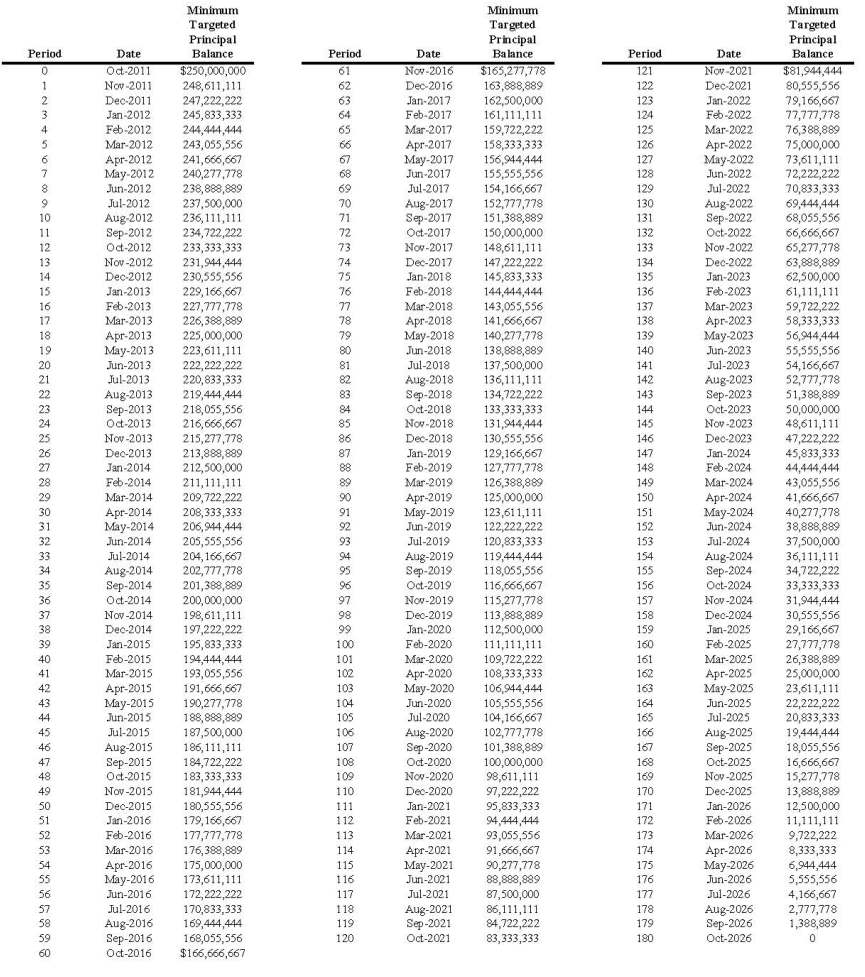

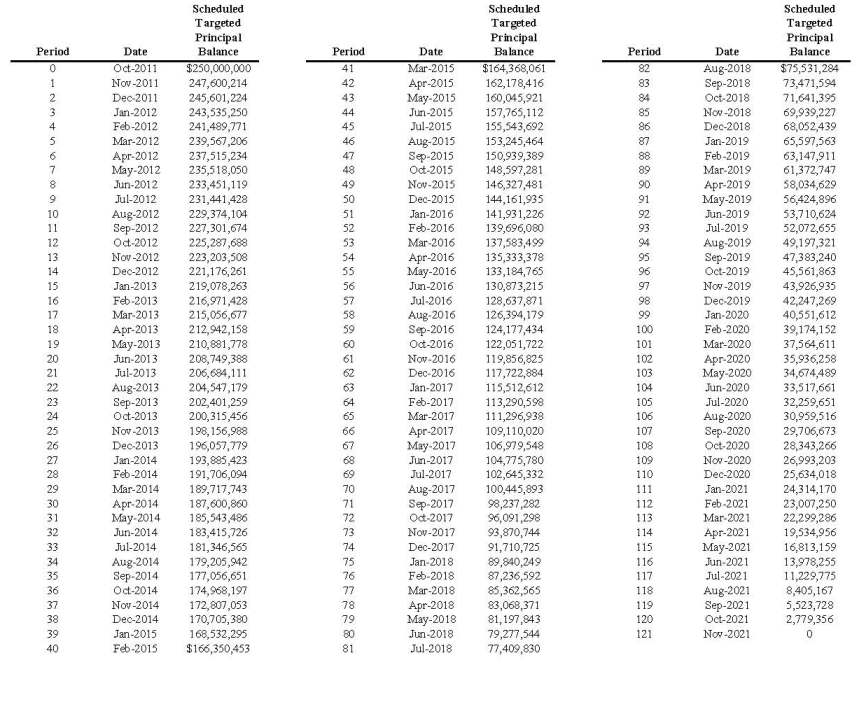

| SCHEDULE 1 | Targeted Principal Balances |

|

SERIES 2011-2 SUPPLEMENT, dated as November 3, 2011 (as amended, modified, and supplemented from time to time in accordance with the terms hereof, this “Supplement”), between CLI Funding V LLC, a limited liability company organized and existing under the laws of the State of Delaware (the “Issuer”), and U.S. Bank National Association, a national banking association, as Indenture Trustee (the “Indenture Trustee”). |

WHEREAS, pursuant to the Indenture, dated as of March 18, 2011 (as amended and supplemented from time to time in accordance with its terms, the “Indenture”), between the Issuer and the Indenture Trustee, the Issuer may from time to time direct the Indenture Trustee to authenticate one or more new Series of Notes. The Principal Terms of any new Series are to be set forth in a Supplement to the Indenture.

WHEREAS, pursuant to Section 1006 of the Indenture, this Supplement is entered into by the Issuer and the Indenture Trustee to create a new Series of Notes (“Series 2011-2”) and to specify the Principal Terms thereof.

NOW THEREFORE, in consideration of the premises and mutual covenants herein contained, the parties hereto agree as follows:

ARTICLE I

Definitions; Calculation

Guidelines

Section 101. Definitions. (a) Whenever used in this Supplement, the following words and phrases shall have the following meanings, and the definitions of such terms are applicable to the singular as well as the plural forms of such terms and to the masculine as well as to the feminine and neuter genders of such terms.

“144A Global Notes” means the 144A Global Notes substantially in the form of Exhibit A-1 hereto.

“Accelerated Principal Payment Amount” means an amount equal to the excess of (i) total principal payments actually paid to the Series 2011-2 Noteholders during the Accelerated Measurement Period, over (ii) the sum of the Minimum Principal Payment Amount, Scheduled Principal Payment Amounts and voluntary Prepayments actually paid to the Series 2011-2 Noteholders during the Accelerated Measurement Period.

“Accelerated Measurement Period” means the period commencing on the date on which an Early Amortization commences and ending on the date on which such Early Amortization Event is cured or waived in accordance with the terms of this Supplement and the Related Documents.

“Aggregate Series 2011-2 Note Principal Balance” means, as of any date of determination, an amount equal to the sum of Unpaid Principal Balances of all Series 2011-2 Notes then Outstanding which, as of the Series 2011-2 Closing Date, shall be Two Hundred Fifty Million Dollars ($250,000,000).

“Control Party” means, with respect to the Series 2011-2 Notes, the holders of Series 2011-2 Notes that are more than 50% of the then Aggregate Series 2011-2 Note Principal Balance of all Series 2011-2 Notes then Outstanding.

“DB” means Deutsche Bank Securities Inc., a corporation organized under the laws of the State of Delaware and its successors and permitted assigns.

“Default Interest” means, the incremental interest specified in Section 203(b) hereof over the amount of interest otherwise payable on such Payment Date pursuant to Section 203(a) hereof, payable by the Issuer resulting from (i) the failure of the Issuer to pay in full on any Payment Date any accrued and unpaid interest, fees, or indemnities on any Series 2011-2 Notes then Outstanding, (ii) the failure of the Issuer to pay in full on the Legal Final Maturity Date the then Unpaid Principal Balance of any Series 2011-2 Notes, or (iii) the failure of the Issuer to pay the Unpaid Principal Balance of any Series 2011-2 Notes upon the occurrence of an Event of Default and the acceleration of the Series 2011-2 Notes in accordance with the provisions of the Indenture.

“Default Rate” means, for any date of determination, an interest rate per annum equal to the sum of (i) two percent (2%) per annum, plus (ii) the interest rate per annum payable on such Note prior to the event giving rise to such Default Interest.

“DTC” shall have the meaning set forth in Section 207.

“Initial Commitment” means Two Hundred Fifty Million Dollars ($250,000,000).

“Initial Purchasers” means each of WFS and DB.

“Institutional Accredited Investors” shall have the meaning set forth in Section 207.

“Legal Final Maturity Date” means, for the Series 2011-2 Notes, the Payment Date occurring in October 2026.

“Letter of Representations” means the Letter of Representations, dated as of November 3, 2011, between the Issuer and DTC.

“Minimum Principal Payment Amount” means, for the Series 2011-2 Notes on each Payment Date, an amount equal to the excess, if any, of (x) the Unpaid Principal Balance of the Series 2011-2 Notes, over (y) the Minimum Targeted Principal Balance for the Series 2011-2 Notes on such Payment Date.

“Minimum Targeted Principal Balance” means, with respect to the Series 2011-2 Notes for each Payment Date, the amount set opposite such Payment Date on Schedule 1 hereto, as such schedule may be adjusted from time to time in accordance with the terms of the Supplement.

“Payment Date” means the eighteenth (18th) calendar day of each month or, if such day is not a Business Day, the next succeeding Business Day, commencing on November 18, 2011.

“Permanent Regulation S Global Notes” means the Permanent Regulation S Global Notes substantially in the form of Exhibit A-3.

“Qualified Institutional Buyers” shall have the meaning set forth in Section 207.

“Rating Agency” means, for Series 2011-2, S&P.

“Regulation S” shall have the meaning set forth in Section 207 hereof.

“Regulation S Global Notes” Collectively, the Regulation S Temporary Global Notes and the Permanent Regulation S Global Notes.

“Regulation S Temporary Global Notes” means the Regulation S Temporary Global Notes substantially in the form of Exhibit A-2.

“Rule 144A” shall have the meaning set forth in Section 207 hereof.

“S&P” means Standard & Poor’s Ratings Service, a Standard & Poor’s financial Services LLC business.

“Scheduled Principal Payment Amount” means, for the Series 2011-2 Notes on each Payment Date, an amount equal to the excess, if any, of (x) the Unpaid Principal Balance of the Series 2011-2 Notes (calculated after giving effect to any payment of the Minimum Principal Payment Amounts for the Series 2011-2 Notes actually paid on such Payment Date), over (y) the Scheduled Targeted Principal Balance for the Series 2011-2 Notes on such Payment Date.

“Scheduled Targeted Principal Balance” means, with respect to the Series 2011-2 Notes for each Payment Date, the amount set forth opposite such Payment Date on Schedule 1 hereto, as such schedule may be adjusted from time to time in accordance with the terms of the Indenture.

“Series 2011-2” means the Series of Notes the terms of which are specified in this Supplement.

“Series 2011-2 Legal Final Maturity Date” means the Payment Date occurring in October 2026.

“Series 2011-2 Note” means any one of the notes issued pursuant to the terms of Section 201(a) of this Supplement, substantially in the form of any of Exhibit A-1, A-2, A-3, or A-4 to this Supplement, and any and all replacements or substitutions of such note.

“Series 2011-2 Note Interest Payment” means, for each Payment Date, an amount equal to the product of (i) the Aggregate Series 2011-2 Note Principal Balance as of the first day of the related Interest Accrual Period, and (ii) an annual rate of interest equal to four and 94/100 of one percent (4.94%) per annum.

“Series 2011-2 Note Principal Balance” means, with respect to any Series 2011-2 Note as of any date of determination, an amount equal to the excess of (x) the Initial Commitment of such Series 2011-2 Note as of the Closing Date, over (y) the cumulative amount of all Minimum Principal Payment Amounts, Scheduled Principal Payment Amounts and any other principal payments actually paid to the Series 2011-2 Noteholders subsequent to the Closing Date.

“Series 2011-2 Note Purchase Agreement” means the Series 2011-2 Note Purchase Agreement, dated as of November 3, 2011, among the Issuer, Carlisle and the Initial Purchasers.

“Series 2011-2 Noteholder” means, at any time of determination for the Series 2011-2 Notes, any Person in whose name a Series 2011-2 Note is registered in the Note Register.

“Series 2011-2 Series Account” means the account of that name established in accordance with Section 301 hereof.

“Series 2011-2 Transaction Documents” shall mean, with respect to this Agreement, any and all of the Indenture, this Supplement, the Series 2011-2 Notes, the Management Agreement, the Contribution and Sale Agreement, the Series 2011-2 Note Purchase Agreement, the Director Services Agreement, the Intercreditor Agreement, the Manager Transition Agreement, any Interest Rate Hedge Agreements, together with any insurance policies related thereto, and any and all other agreements, documents, and instruments executed and delivered by or on behalf or in support of the Issuer with respect to the issuance and sale or administration of the Series 2011-2 Notes, as any of the foregoing may from time to time be amended, modified, supplemented, or renewed.

“Transferor” shall have the meaning set forth in Section 207 hereof.

“U.S. Person” shall have the meaning set forth in Section 207 hereof.

“WFS” means Wells Fargo Securities, LLC, a limited liability company organized under the laws of the State of Delaware and its successors and permitted assigns.

(b) Capitalized terms used herein and not otherwise defined shall have the meaning set forth in the Indenture or, if not defined therein, as defined in the Series 2011-2 Note Purchase Agreement.

ARTICLE II

Creation of the Series 2011-2 Notes

Section 201. Designation

(a) There is hereby created a Series of Notes to be issued in one Class pursuant to the Indenture and this Supplement to be known as “CLI Funding V LLC Fixed Rate Asset Backed Notes, Series 2011-2”. The Series 2011-2 Notes will be issued in the initial principal balance of Two Hundred Fifty Million Dollars ($250,000,000). The Series 2011-2 Notes shall be “Senior Notes” under the Indenture and will not have priority over any other Senior Series of Notes, except to the extent set forth in the Supplement for such other Senior Series of Notes, and will not be subordinate to any other Senior Series of Notes. The issuance date of the Series 2011-2 Notes is November 3, 2011.

(b) The Payment Date with respect to the Series 2011-2 Notes shall be the eighteenth (18th) calendar day of each month, or, if such day is not a Business Day, the immediately following Business Day, commencing November 18, 2011 .

(c) Payments of principal on the Series 2011-2 Notes shall be payable from funds on deposit in the Series 2011-2 Series Account or otherwise at the times and in the amounts set forth in Article III of the Indenture and Article III of this Supplement.

(d) The Series 2011-2 Notes are designated as a “Senior Series” and a Series of “Term Notes”, as each such term is used in the Indenture.

(e) The “Expected Final Maturity Date” for Series 2011-2, as such term is used in the Indenture, is the Payment Date occurring in November 2021.

(f) All of the Early Amortization Events set forth in Article XII of the Indenture are applicable to Series 2011-2.

(g) The “Advance Rate” for Series 2011-2, as such term is used in the Indenture, is eighty-five percent (85%).

(h) The “Related Documents” for Series 2011-2, as such term is used in the Indenture, shall be the Series 2011-2 Transaction Documents.

(i) The “Rating Agency” for Series 2011-2, as such term is used in the Indenture, shall be S&P.

(j) The “Record Date” with respect to the initial Payment Date for Series 2011-2 shall be November 3, 2011; and the “Record Date” with respect to each subsequent Payment Date for Series 2011-2 shall be determined in accordance with the definition of “Record Date” as set forth in Section 101 of the Indenture.

(k) In accordance with Section 1006(b)(vii)(B) of the Indenture, the following conditions precedent shall constitute additional conditions precedent to the issuance of any additional Series under the Indenture on or following the date hereof: (A) such additional Series shall have a Legal Final Maturity Date (as defined in the Supplement for such additional Series) that is on or later than the Series 2011-2 Legal Final Maturity Date, (B) such additional Series shall have a Weighted Average Life that is not less than the remaining Weighted Average Life of the Series 2011-2 Notes as of the date of issuance of such additional Series and (C) unless such additional Series is a Subordinate Series, such additional Series shall have an Advance Rate that is equal to or less than the Advance Rate for the Series 2011-2 Notes.

(l) In the event that any term or provision contained herein shall conflict with or be inconsistent with any term or provision contained in the Indenture, the terms and provisions of this Supplement shall govern.

Section 202. Authentication and Delivery.

(a) On the Closing Date, the Issuer shall sign, and shall direct the Indenture Trustee in writing pursuant to Section 201 of the Indenture to duly authenticate, and the Indenture Trustee, upon receiving such direction, shall (i) authenticate, subject to compliance with the conditions precedent set forth in Section 501 hereof, the Series 2011-2 Notes in accordance with such written directions, and (ii) subject to compliance with the conditions precedent set forth in Section 501 hereof, deliver such Series 2011-2 Notes to the Initial Purchasers in accordance with such written directions.

(b) In accordance with Section 202 of the Indenture, the Series 2011-2 Notes sold in reliance on Rule 144A shall be represented by one or more Rule 144A Global Notes. Any Series 2011-2 Notes sold in reliance on Regulation S shall be represented by one or more Regulation S Global Notes. Any Series 2011-2 Notes sold to Institutional Accredited Investors shall be represented by one or more Definitive Notes.

(c) The Series 2011-2 Notes shall be executed by manual or facsimile signature on behalf of the Issuer by any officer of the Issuer and shall be substantially in the forms of Exhibit A-1, A-2, A-3 and A-4 hereto, as applicable.

(d) The Series 2011-2 Notes shall be issued in minimum denominations of $100,000 and in integral multiples of $1,000 thereafter; provided that one Note may be issued in a non-standard denomination.

Section 203. Interest Payments on the Series 2011-2 Notes.

(a) Interest on Series 2011-2 Notes. Interest on each Series 2011-2 Note shall (i) accrue during each Interest Accrual Period at a rate per annum equal to four and 94/100 of one percent (4.94%) per annum, (ii) be calculated on the basis of actual days elapsed during such Interest Accrual Period over a year consisting of 360 days, (iii) be due and payable on each Payment Date, (iv) be calculated based on the Series 2011-2 Note Principal Balance of such Series 2011-2 Note, and (v) be payable from the Series 2011-2 Series Account in accordance with Section 302 hereto. To the extent that the amount of interest which is due and payable on any Payment Date is not paid in full on such date, such shortfall, together with interest thereon at the Default Rate, shall be due and payable on the immediately succeeding Payment Date.

(b) Default Interest on Overdue Amounts. If the Issuer shall default in the payment of (i) the Series 2011-2 Note Principal Balance of any Series 2011-2 Notes on the Series 2011-2 Legal Final Maturity Date, or (ii) the Series 2011-2 Note Interest Payment on any Series 2011-2 Note on any Payment Date, or (iii) any other amount becoming due under this Supplement, the Issuer shall, from time to time, pay Default Interest on such unpaid amounts, to the extent permitted by Applicable Law, at a rate per annum equal to the Default Rate, for the period during which such principal, interest or other amount shall be unpaid from the due date of such payment to, but not including, the date of actual payment thereof (as well as before judgment). Default Interest shall be payable at the times and subject to the priorities set forth in Section 302 of the Indenture and Section 302 of this Supplement.

(c) Maximum Interest Rate. In no event shall the interest charged with respect to a Series 2011-2 Note exceed the maximum amount permitted by Applicable Law. If at any time the interest rate charged with respect to the Series 2011-2 Notes exceeds the maximum rate permitted by Applicable Law, the rate of interest to accrue pursuant to this Supplement and such Series 2011-2 Note shall be limited to the maximum rate permitted by Applicable Law. If the total amount of interest paid or accrued on the Series 2011-2 Note under the foregoing provisions is less than the total amount of interest that would have accrued if the interest rate had at all times been in effect, the Issuer agrees to pay to the Series 2011-2 Noteholders an amount equal to the difference between (a) the lesser of (i) the amount of interest that would have accrued if the maximum rate permitted by Applicable Law had at all times been in effect, or (ii) the amount of interest that would have accrued if the interest rate had at all times been in effect, and (b) the amount of interest accrued in accordance with the other provisions of this Supplement.

Section 204. Principal Payments on the Series 2011-2 Notes. The principal balance of the Series 2011-2 Notes shall be payable on each Payment Date from amounts on deposit in the Series 2011-2 Series Account in an amount equal to (i) so long as no Early Amortization Event nor an Event of Default is continuing, the Minimum Principal Payment Amount, the Scheduled Principal Payment Amount, and the allocable portion of the Supplemental Principal Payment Amount (if any) for such Series 2011-2 Note for such Payment Date to the extent that funds are available for such purpose in accordance with the provisions of Part I of paragraph (c) of Section 302 of the Indenture, (ii) if an Early Amortization Event, but not an Event of Default, has occurred and is continuing, the Minimum Principal Payment Amount, the Scheduled Principal Payment Amount and the Aggregate Series 2011-2 Note Principal Balance on such Payment Date (after giving effect to any payment of the Minimum Principal Payment Amount and the Scheduled Principal Amount for the Series 2011-2 Notes then outstanding actually paid on such Payment Date) to the extent that funds are available for such purposes in accordance with the provisions of Part (II) of paragraph (c) of Section 302 of the Indenture or (iii) if an Event of Default has occurred and is then continuing, the Minimum Principal Payment Amount, the Scheduled Principal Payment Amount and the Aggregate Series 2011-2 Note Principal Balance (after giving effect to any payment of the Minimum Principal Payment Amount and the Scheduled Principal Amount for the Series 2011-2 Notes then outstanding actually paid on such Payment Date) to the extent that funds are available for such purposes in accordance with the provisions of Part (III) of paragraph (c) of Section 302 of the Indenture. Payment of the Supplemental Principal Payment Amount on each Payment Date is subordinated to payment in full on such Payment Date of the Minimum Principal Payment Amount and the Scheduled Principal Payment Amount for the Series 2011-2 Notes and any other Notes then Outstanding. The unpaid principal amount of each Series 2011-2 Note, together with all unpaid interest (including all Default Interest), indemnifications, fees, expenses, costs, and other amounts payable by the Issuer to the Series 2011-2 Noteholders, the Indenture Trustee and any Interest Rate Hedge Provider pursuant to the terms of the Indenture and this Supplement, shall be due and payable in full on the earlier to occur of (x) the date on which an Event of Default shall occur and the Series 2011-2 Notes have been accelerated in accordance with the provisions of Section 802 of the Indenture and (y) the Series 2011-2 Legal Final Maturity Date

.

Section 205. Prepayment of Principal on the Series 2011-2 Notes.

(a) The Issuer will not be permitted to make a voluntary Prepayment of all or a portion of, the principal balance of the Series 2011-2 Notes prior to the 24th Payment Date following the Series 2011-2 Closing Date. On the 25th Payment Date following the Series 2011-2 Closing Date and on each Payment Date thereafter, the Issuer will have the option to prepay without penalty on any Payment Date all, or any portion of, the Principal Balance of the Series 2011-2 Notes in a minimum amount of $100,000, together with accrued interest thereon and any early termination fees owing pursuant to the terms of any Interest Rate Hedge Agreements. The Issuer shall provide prior written notice of any Prepayment to the Indenture Trustee and the Series 2011-2 Noteholders. Nothing contained herein shall prohibit any allocation to the Series 2011-2 Noteholders of Supplemental Principal Payment Amounts in accordance with Section 702(a) of the Indenture on any Payment Date or the mandatory redemption of the Notes on the Final Funding Period Payment Date from amounts on deposit in the Pre-funding Account. Any optional Prepayment of the Series 2011-2 Note Principal Balance shall also include any early termination fees owing pursuant to the terms of any Interest Rate Hedge Agreement and accrued interest to the date of Prepayment on the amount being prepaid. The Issuer may not make such optional Prepayment from funds in the Trust Account, the Series 2011-2 Series Account, the Restricted Cash Account, the Manager Collection Account, the Pre-Funding Account or the Manager Transition Account, except to the extent that funds in any such account would otherwise be payable to the Issuer in accordance with the terms of this Supplement. In the event of any optional Prepayment of the Notes in accordance with this Section 205 or any other provision of the Indenture, the Issuer shall pay any termination, notional reduction, breakage or other fees or costs assessed by any Interest Rate Hedge Provider by reason thereof.

(b) Any Prepayment of less than the Aggregate Series 2011-2 Note Principal Balance of the Series 2011-2 Notes made in accordance with the provisions of Section 205 hereof shall be applied to reduce, by a pro rated portion of the amount of such Prepayment, the Minimum Targeted Principal Balances and Scheduled Targeted Principal Balances in respect of each subsequent Payment Date.

In addition, if an Early Amortization Event has occurred and been subsequently cured and/or waived, the Accelerated Principal Payment Amount shall be applied to reduce, by a pro rated portion of such Accelerated Principal Payment Amount, the Minimum Targeted Principal Balances and Scheduled Targeted Principal Balances in respect of each subsequent Payment Date.

(c) The Issuer shall provide at least three (3) Business Days’ prior written notice of any Prepayment to the Indenture Trustee and the Holders of the Series 2011-2 Notes.

Section 206. Payments of Principal and Interest. All payments of principal and interest on the Series 2011-2 Notes shall be paid to the Series 2011-2 Noteholders reflected in the Note Register as of the related Record Date by wire transfer of immediately available funds for receipt prior to 2:00 p.m. (New York City time) on the related Payment Date. Any payments received by the Series 2011-2 Noteholders after 2:00 p.m. (New York City time) on any day shall be considered to have been received prior to 2:00 p.m. (New York City time) on the next succeeding Business Day.

Section 207. Restrictions on Transfer.

(a) On the Closing Date, the Issuer shall sell the Series 2011-2 Notes to the Initial Purchasers pursuant to the Series 2011-2 Note Purchase Agreement and deliver such Series 2011-2 Notes in accordance herewith and therewith. Thereafter, no Series 2011-2 Note may be sold, transferred, or otherwise disposed of except in compliance with the provisions of the Indenture and except as follows:

(A) to Persons that the transferring Person reasonably believes are Qualified Institutional Buyers in reliance on the exemption from the registration requirements of the Securities Act provided by Rule 144A promulgated thereunder (“Rule 144A”);

(B) not to a U.S. Person in offshore transactions in reliance on Regulation S under the Securities Act (“Regulation S”); or

(C) to institutional “accredited investors” within the meaning of Rule 501(a)(1), (2), (3) or (7) of Regulation D under the Securities Act (“Institutional Accredited Investors”) that take delivery of such Series 2011-2 Note in an amount of at least $100,000 and that deliver an Purchaser Letter substantially in the form of Exhibit H to this Supplement to the Indenture Trustee.

The Indenture Trustee shall have no obligations or duties with respect to determining whether any transfers of the Series 2011-2 Notes are made in accordance with the Securities Act or any other law; provided that with respect to Definitive Notes, the Indenture Trustee shall enforce such transfer restrictions in accordance with the terms set forth in this Supplement.

(b) Each purchaser (other than the Initial Purchasers) of the Series 2011-2 Notes (including any purchaser, other than the Initial Purchasers, of an interest in the Series 2011-2 Notes which are Global Notes) shall be deemed to have acknowledged and agreed as follows:

(i) It is (A) a qualified institutional buyer as defined in Rule 144A (“Qualified Institutional Buyer”) and is acquiring such Series 2011-2 Notes for its own institutional account or for the account or accounts of a Qualified Institutional Buyer, (B) purchasing such Series 2011-2 Notes in a transaction exempt from registration under the Securities Act and in compliance with the provisions of this Supplement and in compliance with the legend set forth in clause (iv) below, or (C) not a U.S. Person as defined in Regulation S (a “U.S. Person”) and is acquiring such Series 2011-2 Notes outside of the United States;

(ii) It represents and warrants to the Initial Purchasers, the Issuer, the Indenture Trustee, and the Manager that (a) either (1) it is not, and is not acting on behalf of, a Plan or a governmental, church or non-U.S. plan which is subject to any federal, state, local, or non-U.S. law that is similar to the prohibited transaction provisions of Section 406 of ERISA or Section 4975 of the Code, and no part of the assets to be used by it to purchase or hold the Notes or any interest therein constitutes the assets of any Plan or such a governmental, church, or non-U.S. plan; or (2) (A) the acquisition, holding, and disposition of the Note will not give rise to a nonexempt prohibited transaction under Section 406 of ERISA or Section 4975 of the Code (or, in the case of a governmental, church, or non-U.S. plan, a violation of any similar federal, state, local, or non-U.S. law) and (B) the Notes are rated investment grade or better and such Person believes that the Notes are properly treated as indebtedness without substantial equity features for purposes of Section 2510.3-101 of the regulations issued by the U.S. Department of Labor, and agrees to so treat the Notes; and (b) it will not sell or otherwise transfer the Notes or any interest therein otherwise than to a purchaser or transferee that represents and agrees with respect to its purchase, holding, and disposition of the Notes to the same effect as the purchaser's representation and agreement set forth in this clause (b)(ii) of Section 207;

(iii) It understands that the Series 2011-2 Notes are being transferred to it in a transaction not involving any public offering within the meaning of the Securities Act, and that, if in the future it decides to resell, pledge, or otherwise transfer any Series 2011-2 Notes, such Series 2011-2 Notes may be resold, pledged or transferred only in accordance with applicable state securities laws and (1) in a transaction meeting the requirements of Rule 144A, to a Person that the seller reasonably believes is a Qualified Institutional Buyer that purchases for its own account (or for the account or accounts of a Qualified Institutional Buyer) and to whom notice is given that the resale, pledge, or transfer is being made in reliance on Rule 144A, (2) to a Person that is an Institutional Accredited Investor, is taking delivery of such Series 2011-2 Notes in an amount of at least $100,000, and delivers a Purchaser Letter to the Indenture Trustee, or (3) in an offshore transaction in accordance with Rule 903 or 904 of Regulation S; and

(iv) It understands that each Series 2011-2 Note shall bear a legend

substantially to the following effect:

[For Book-Entry Notes Only: UNLESS THIS NOTE IS PRESENTED BY AN AUTHORIZED REPRESENTATIVE OF THE DEPOSITORY TRUST COMPANY, A NEW YORK CORPORATION (“DTC”), TO THE TRANSFEROR OF SUCH NOTE (THE “TRANSFEROR”) OR ITS AGENT FOR REGISTRATION OF TRANSFER, EXCHANGE OR PAYMENT, AND ANY NOTE ISSUED IS REGISTERED IN THE NAME OF CEDE & CO. OR IN SUCH OTHER NAME AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC (AND ANY PAYMENT IS MADE TO CEDE & CO. OR TO SUCH OTHER ENTITY AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC), ANY TRANSFER, PLEDGE, OR THE USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL INASMUCH AS THE REGISTERED OWNER HEREOF, CEDE & CO., HAS AN INTEREST HEREIN.

THIS NOTE HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933,

AS AMENDED (THE “SECURITIES ACT”). THE HOLDER HEREOF, BY PURCHASING

THIS NOTE, AGREES THAT SUCH NOTE MAY BE RESOLD, PLEDGED, OR TRANSFERRED

ONLY IN ACCORDANCE WITH ANY APPLICABLE STATE SECURITIES LAWS AND (1) IN

A TRANSACTION MEETING THE REQUIREMENTS OF RULE 144A UNDER THE SECURITIES

ACT (“RULE 144A”), TO A PERSON THAT THE SELLER REASONABLY BELIEVES IS A

QUALIFIED INSTITUTIONAL BUYER THAT PURCHASES FOR ITS OWN ACCOUNT (OR FOR

THE ACCOUNT OR ACCOUNTS OF A QUALIFIED INSTITUTIONAL BUYER) AND TO WHOM

NOTICE IS GIVEN THAT THE RESALE, PLEDGE OR OTHER TRANSFER IS BEING MADE

IN RELIANCE ON RULE 144A, OR (2) IN AN OFFSHORE TRANSACTION COMPLYING

WITH RULE 903 OR RULE 904 OF REGULATION S UNDER THE SECURITIES ACT OR

(3) TO A PERSON THAT IS AN INSTITUTIONAL “ACCREDITED INVESTOR,” WITHIN

THE MEANING OF RULE 501(a)(1), (2), (3), OR (7) OF REGULATION D UNDER

THE SECURITIES ACT, IS TAKING DELIVERY OF SUCH NOTE IN AN AMOUNT OF AT

LEAST $100,000 AND DELIVERS A PURCHASER LETTER TO THE INDENTURE TRUSTEE

IN THE FORM ATTACHED TO THE SUPPLEMENTS.

EACH

PURCHASER OF A NOTE SHALL REPRESENT OR BE DEEMED TO REPRESENT AND

WARRANT TO THE INITIAL PURCHASERS, THE ISSUER, THE INDENTURE TRUSTEE,

AND THE MANAGER THAT (A) EITHER (1) IT IS NOT, AND IS NOT ACTING ON

BEHALF OF, A PLAN OR A GOVERNMENTAL, CHURCH, OR NON-U.S. PLAN WHICH IS

SUBJECT TO ANY FEDERAL, STATE, LOCAL, OR NON-U.S. LAW THAT IS SIMILAR TO

THE PROHIBITED TRANSACTION PROVISIONS OF SECTION 406 OF ERISA OR SECTION

4975 OF THE CODE, AND NO PART OF THE ASSETS TO BE USED BY IT TO PURCHASE

OR HOLD THE NOTES OR ANY INTEREST THEREIN CONSTITUTES THE ASSETS OF ANY

PLAN OR SUCH A GOVERNMENTAL, CHURCH, OR NON-U.S. PLAN; OR (2) (A) THE

ACQUISITION, HOLDING, AND DISPOSITION OF THE NOTE WILL NOT GIVE RISE TO

A NONEXEMPT PROHIBITED TRANSACTION UNDER SECTION 406 OF ERISA OR SECTION

4975 OF THE CODE (OR, IN THE CASE OF A GOVERNMENTAL, CHURCH, OR NON-U.S.

PLAN, A VIOLATION OF ANY SIMILAR FEDERAL, STATE, LOCAL, OR NON-U.S. LAW)

AND (B) THE NOTES ARE RATED INVESTMENT GRADE OR BETTER AND SUCH PERSON

BELIEVES THAT THE SERIES 2011-2 NOTES ARE PROPERLY TREATED AS

INDEBTEDNESS WITHOUT SUBSTANTIAL EQUITY FEATURES FOR PURPOSES OF SECTION

2510.3-101 OF THE REGULATIONS ISSUED BY THE U.S. DEPARTMENT OF LABOR,

AND AGREES TO SO TREAT THE NOTES; AND (B) IT WILL NOT SELL OR OTHERWISE

TRANSFER THE NOTES OR ANY INTEREST THEREIN OTHERWISE THAN TO A PURCHASER

OR TRANSFEREE THAT REPRESENTS AND AGREES WITH RESPECT TO ITS PURCHASE,

HOLDING, AND DISPOSITION OF THE NOTES TO THE SAME EFFECT AS THE

PURCHASER'S REPRESENTATION AND AGREEMENT SET FORTH IN THIS SENTENCE.

THIS NOTE IS NOT GUARANTEED OR INSURED BY ANY GOVERNMENTAL AGENCY OR

INSTRUMENTALITY.]

(v) It is not a Competitor.

(vi) Each investor described in Section 207(a)(B) understands that the Series 2011-2 Notes have not and will not be registered under the Securities Act, that any offers, sales, or deliveries of the Series 2011-2 Notes purchased by it in the United States or to U.S. Persons prior to the date that is 40 days after the later of (i) the commencement of the distribution of the Series 2011-2 Notes and (ii) the Closing Date, may constitute a violation of United States law, and that distributions of principal and interest will be made in respect of such Series 2011-2 Notes only following the delivery by the holder of a certification of non-U.S. beneficial ownership or the exchange of beneficial interest in Regulation S Temporary Global Notes for beneficial interests in the related 144A Book-Entry Global Notes (which in each case will itself require a certification of non-U.S. beneficial ownership), at the times and in the manner set forth in this Supplement.

(vii) The Regulation S Temporary Global Notes representing the Series 2011-2 Notes sold to each investor described in Section 207(a)(B) will bear a legend to the following effect, unless the Issuer determines otherwise consistent with Applicable Law:

[FOR REGULATION S TEMPORARY GLOBAL NOTES ONLY:

1. EACH INVESTOR IN AN OFFSHORE TRANSACTION COMPLYING WITH RULE 903 OR RULE 904 OF REGULATION S UNDER THE SECURITIES ACT UNDERSTANDS THAT THE NOTES HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE SECURITIES ACT, THAT ANY OFFERS, SALES, OR DELIVERIES OF THE NOTES PURCHASED BY IT IN THE UNITED STATES OR TO U.S. PERSONS PRIOR TO THE DATE THAT IS 40 DAYS AFTER THE LATER OF (I) THE COMMENCEMENT OF THE DISTRIBUTION OF THE NOTES AND (II) THE CLOSING DATE, MAY CONSTITUTE A VIOLATION OF UNITED STATES LAW, AND THAT DISTRIBUTIONS OF PRINCIPAL AND INTEREST WILL BE MADE IN RESPECT OF SUCH NOTES ONLY FOLLOWING THE DELIVERY BY THE HOLDER OF A CERTIFICATION OF NON-U.S. BENEFICIAL OWNERSHIP OR THE EXCHANGE OF BENEFICIAL INTEREST IN REGULATION S TEMPORARY BOOK-ENTRY NOTES FOR BENEFICIAL INTERESTS IN THE RELATED RULE 144A BOOK-ENTRY NOTES (WHICH IN EACH CASE WILL ITSELF REQUIRE A CERTIFICATION OF NON-U.S. BENEFICIAL OWNERSHIP), AT THE TIMES AND IN THE MANNER SET FORTH IN THE INDENTURE AND THE SUPPLEMENT.

2. THE REGULATION S TEMPORARY BOOK-ENTRY NOTES REPRESENTING THE NOTES SOLD TO EACH INVESTOR IN AN OFFSHORE TRANSACTION COMPLYING WITH RULE 903 OR RULE 904 OF REGULATION S UNDER THE SECURITIES ACT WILL BEAR A LEGEND TO THE FOLLOWING EFFECT, UNLESS THE ISSUER DETERMINES OTHERWISE CONSISTENT WITH APPLICABLE LAW:

THIS NOTE HAS NOT BEEN AND WILL NOT BE REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”) AND, PRIOR TO THE DATE THAT IS 40 DAYS AFTER THE LATER OF (I) THE COMPLETION OF THE DISTRIBUTION OF THE NOTES AND (II) THE CLOSING DATE, MAY NOT BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED IN THE UNITED STATES OR TO A U.S. PERSON EXCEPT PURSUANT TO AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE PROCEDURES SPECIFIED IN THE INDENTURE.]

(viii) It is purchasing one or more Series 2011-2 Notes in an amount of at least $100,000 and it understands that such Series 2011-2 Notes may be resold, pledged, or otherwise transferred only in an amount of at least $100,000.

(ix) The Indenture Trustee shall not permit the transfer of any Series 2011-2 Notes unless such transfer complies with the terms of the foregoing legends and, in the case of a transfer to an Institutional Accredited Investor (other than a Qualified Institutional Buyer), the transferee delivers a completed Purchaser Letter to the Indenture Trustee.

(c) Forms substantially in the form of Exhibit(s) B through G, as appropriate, shall be completed in connection with any transfer of the Series 2011-2 Notes.

Any notice to the Holders of Notes will be validly given (i) by either of (a) the information contained in such notice appearing on the relevant page of the Reuters Screen or such other medium for the electronic display of data as may be approved by the Issuer with notice to Holders of the Notes or (b) publication in the Financial Times and The Wall Street Journal (National Edition) or, if either newspaper will cease to be published or timely publication therein will not be practicable, in such English language newspaper or newspapers as the Issuer will approve having a general circulation in Europe and the United States and (ii) until such time as any Definitive Notes are issued in exchange for the Notes and, so long as such Notes are registered in the name of a nominee for DTC, Euroclear, and/or Clearstream, delivery of the relevant notice to DTC, Euroclear, and/or Clearstream for communication by them to the Holders of the Notes.

ARTICLE III

Series 2011-2 Series Account and

Allocation

and Application of Amounts Therein

Section 301. Series 2011-2 Series Account. The Indenture Trustee shall establish on or prior to the Closing Date and maintain, so long as any Series 2011-2 Note is Outstanding, an Eligible Account which shall be designated as the Series 2011-2 Series Account, which account shall be held in the name of the Indenture Trustee (in its capacity as Securities Intermediary of the Indenture Trustee) for the benefit of the Series 2011-2 Noteholders. In furtherance of the Grant set forth in the Indenture, the Issuer hereby Grants to the Indenture Trustee for the benefit of the Series 2011-2 Noteholders, among other things, a Lien on the Series 2011-2 Series Account. All deposits of funds by or for the benefit of the Series 2011-2 Noteholders from the Trust Account, shall be accumulated in, and withdrawn from, the Series 2011-2 Series Account in accordance with the provisions of the Indenture and this Supplement.

Section 302. Distributions from Series 2011-2 Series Account. On each Payment Date, the Indenture Trustee shall distribute funds then on deposit in the Series 2011-2 Series Account in accordance with the provisions of either subsection (I), (II) or (III) of this Section 302.

(I) If neither an Early Amortization Event nor an Event of Default shall have occurred and be continuing with respect to any Series of Notes:

(1) To each Holder of a Series 2011-2 Note on the immediately preceding Record Date, an amount equal to its pro rata portion of the Series 2011-2 Note Interest Payment (exclusive of Default Interest) then due and payable for such Payment Date;

(2) To each Holder of a Series 2011-2 Note on the immediately preceding Record Date, an amount equal to its pro rata portion of the Minimum Principal Payment Amount then due and payable to the Holders of the Series 2011-2 Notes on such Payment Date;

(3) To each Holder of a Series 2011-2 Note on the immediately preceding Record Date, an amount equal to its pro rata portion of the Scheduled Principal Payment Amount then due and payable to the Holders of the Series 2011-2 Notes on such Payment Date;

(4) To each Holder of a Series 2011-2 Note on the immediately preceding Record Date, an amount equal to its pro rata portion of the Supplemental Principal Payment Amount then due and payable to the Holders of the Series 2011-2 Notes on such Payment Date, if any;

(5) To each Holder of a Series 2011-2 Note on the immediately preceding Record Date, any indemnification, expenses, and any other amounts (including Default Interest) then due and owing, pro rata; and

(6) After application of the amounts required to be paid pursuant to Section 302 of the Indenture, to the Issuer, any remaining Available Distribution Amounts.

(II) If an Early Amortization Event shall have occurred and be continuing with respect to any Series but no Event of Default shall have occurred and be continuing with respect to any Series:

(1) To each Holder of a Series 2011-2 Note on the immediately preceding Record Date, an amount equal to its pro rata portion of the Series 2011-2 Note Interest Payments (exclusive of Default Interest) then due and payable on such Payment Date;

(2) To each Holder of a Series 2011-2 Note on the immediately preceding Record Date, an amount equal to its pro rata portion of the Minimum Principal Payment Amount then due and payable to the Holders of the Series 2011-2 Notes on such Payment Date;

(3) To each Holder of a Series 2011-2 Note on the immediately preceding Record Date, an amount equal to its pro rata portion of the Scheduled Principal Payment Amount then due and payable to the Holders of the Series 2011-2 Notes on such Payment Date;

(4) To each Holder of a Series 2011-2 Note on the immediately preceding Record Date, an amount equal to the Aggregate Series 2011-2 Note Principal Balance, pro rata, based on the then Unpaid Principal Balance for Series 2011-2;

(5) To each Holder of a Series 2011-2 Note on the immediately preceding Record Date, any indemnification, expenses and any other amounts (exclusive of Default Interest) due and owing to each Holder of a Series 2011-2 Note on the immediately preceding Record Date;

(6) To each Holder of a Series 2011-2 Note on the immediately preceding Record Date, an amount equal to the Default Interest then due and payable to the Holders of a Series 2011-2 Note, including accrued and unpaid Default Interest, pro rata; and

(7) After application of the amounts required to be paid pursuant to Section 302 of the Indenture, to the Issuer, any remaining Available Distribution Amounts.

(III) If an Event of Default shall have occurred and be continuing with respect to any Series:

(1) To each Holder of a Series 2011-2 Note on the immediately preceding Record Date, an amount equal to its pro rata portion of the Series 2011-2 Note Interest Payments (exclusive of Default Interest) then due and payable on such Payment Date;

(2) To each Holder of a Series 2011-2 Note on the immediately preceding Record Date, an amount equal to the Minimum Principal Payment Amount then due and payable on such Payment Date, pro rata, based on the Unpaid Principal Balance at the time of such Event of Default;

(3) To each Holder of a Series 2011-2 Note on the immediately preceding Record Date, an amount equal to the Scheduled Principal Payment Amount then due and payable on such Payment Date, pro rata, based on the Unpaid Principal Balance at the time of such Event of Default;

(4) To each Holder of a Series 2011-2 Note on the immediately preceding Record Date, an amount equal to the Aggregate Series 2011-2 Note Principal Balance, pro rata, based on the then Unpaid Principal Balance of Series 2011-2 at the time of such Event of Default;

(5) To each Holder of a Series 2011-2 Note on the immediately preceding Record Date, an amount equal to any other amounts (including Default Interest) then due and payable to the Holders of Series 2011-2 Note, including accrued and unpaid Default Interest, pro rata; and

(6) After application of the amounts required to be paid pursuant to Section 302 of the Indenture, to the Issuer, any remaining Available Distribution Amounts.

Any amounts payable to a Noteholder shall be made by wire transfer of immediately available funds to the account that such Noteholder has designated to the Indenture Trustee in writing on or prior to the Business Day immediately preceding the Payment Date.

ARTICLE IV

Additional Covenants

In addition to the covenants set forth in Article VI of the Indenture, the Issuer hereby makes the following additional covenants for the benefit of the Series 2011-2 Noteholders:

Section 401. Other Information. For so long as any of the Series 2011-2 Notes are “restricted securities” within the meaning of Rule 144(a)(3) under the Securities Act and the Issuer is not subject to Section 13 or 15(d) of the Exchange Act, the Issuer will, and shall cause the Manager to (i) provide or cause to be provided to any Series 2011-2 Noteholder, or to any prospective purchaser thereof designated by such Series 2011-2 Noteholder, upon the request of such Noteholder or prospective Series 2011-2 Noteholder, the information required to be provided to such Holder or prospective purchaser by Rule 144A(d)(4) under the Securities Act; and (ii) update such information to prevent such information from becoming materially false and materially misleading in a manner adverse to any Series 2011-2 Noteholder.

Section 402. Use of Proceeds. The proceeds from the issuance of the Series 2011-2 Notes shall be used as follows: (i) to acquire additional Containers, Sold Assets, and other Collateral (ii) to reduce certain outstanding Indebtedness of the Issuer, (iii) to pay the costs of issuance of the Series 2011-2 Notes and (iv) for other general business purposes.

ARTICLE V

Conditions to

Issuance

Section 501. Conditions to Issuance. The Indenture Trustee shall not authenticate the Series 2011-2 Notes unless (i) all conditions to the issuance and purchase of the Series 2011-2 Notes under the Series 2011-2 Note Purchase Agreement shall have been satisfied, and (ii) the Issuer shall have delivered a certificate to the Indenture Trustee to the effect that all conditions set forth in the Series 2011-2 Note Purchase Agreement shall have been satisfied.

ARTICLE VI

Representations

and Warranties

To induce the Series 2011-2 Noteholders to purchase the Series 2011-2 Notes hereunder, the Issuer hereby represents and warrants as of the Closing Date to the Indenture Trustee for the benefit of the Series 2011-2 Noteholders that:

Section 601. Existence. The Issuer is a limited liability company duly organized and validly existing under the laws of the State of Delaware. The Issuer is in good standing and is duly qualified to do business in each jurisdiction where the failure to do so would have a material adverse effect upon the financial condition and business of the Issuer, including, without limitation, its ability to collect payments under the Leases.

Section 602. Authorization. The Issuer has the power and is duly authorized to execute and deliver the Indenture, this Supplement, and the other Related Documents to which it is a party; the Issuer is and will continue to be duly authorized to borrow monies hereunder and under the Indenture; and the Issuer is and will continue to be authorized to perform its obligations under the Indenture, this Supplement, and the other Related Documents. The execution, delivery, and performance by the Issuer of the Indenture, this Supplement, and the other Related Documents to which it is a party and the borrowings hereunder do not and will not require any consent or approval of any Governmental Authority, the Manager, or any other Person which has not already been obtained.

Section 603. No Conflict; Legal Compliance. The execution, delivery, and performance of the Indenture, this Supplement, and each of the other Related Documents and the execution, delivery, and payment of the Series 2011-2 Notes will not: (a) contravene any provision of the Issuer’s constituent or organizational documents; (b) contravene, conflict with, or violate any Applicable Law or regulation, or any order, writ, judgment, injunction, decree, determination, or award of any Governmental Authority; or (c) violate or result in the breach of, or constitute a default under the Indenture, the other Related Documents, any other indenture or other loan or credit agreement, or other agreement or instrument to which the Issuer is a party or by which the Issuer, or its property and assets may be bound or affected. The Issuer is not in violation or breach of or default under any law, rule, regulation, order, writ, judgment, injunction, decree, determination, or award or any contract, agreement, lease, license, indenture, or other instrument to which it is a party.

Section 604. Validity and Binding Effect. Each of this Supplement and each Series 2011-2 Transaction Document to which the Issuer is a party, when duly executed and delivered, will be the legal, valid and binding obligations of the Issuer, enforceable against the Issuer in accordance with its terms, except as enforceability may be limited by bankruptcy, insolvency, or other similar laws of general application affecting the enforcement of creditors’ rights or by general principles of equity limiting the availability of equitable remedies.

Section 605. Financial Statements. Since December 31, 2010, there has been no Material Adverse Change in the financial condition of any of the Seller, the Manager, or the Issuer.

Section 606. Place of Business. The Issuer’s only “place of business” (within the meaning of 9-307 of the UCC) is located at c/o Container Leasing International, LLC, One Maynard Drive, Park Ridge, New Jersey 07656.

Section 607. No Agreements or Contracts. The Issuer is not now and has not been a party to any contract or agreement (whether written or oral) other than the Indenture and the Related Documents.

Section 608. Consents and Approvals. No approval, authorization, or consent of any trustee or holder of any Indebtedness or obligation of the Issuer or of any other Person under any agreement, contract, lease, or license or similar document or instrument to which the Issuer is a party or by which the Issuer is bound, is required to be obtained by the Issuer in order to make or consummate the transactions contemplated under the Indenture and the Related Documents, except for those approvals, authorizations, and consents that have been obtained on or prior to the Closing Date. All consents and approvals of, filings and registrations with, and other actions in respect of, all Governmental Authorities required to be obtained by the Issuer in order to make or consummate the transactions contemplated under the Indenture and the Related Documents have been, or prior to the time when required will have been, obtained, given, filed, or taken and are or will be in full force and effect.

Section 609. Margin Regulations. The Issuer does not own any “margin security”, as that term is defined in Regulation U of the Federal Reserve Board, and the proceeds of the Series 2011-2 Notes issued under this Supplement will be used only for the purposes contemplated hereunder. None of such proceeds will be used, directly, or indirectly, for the purpose of purchasing or carrying any margin security, for the purpose of reducing or retiring any Indebtedness which was originally incurred to purchase or carry any margin security or for any other purpose which might cause any of the loans under this Supplement to be considered a “purpose credit” within the meaning of Regulations T, U, and X. The Issuer will not take or permit any agent acting on its behalf to take any action which might cause this Supplement or any document or instrument delivered pursuant hereto to violate any regulation of the Federal Reserve Board.

Section 610. Taxes. All federal, state, local, and foreign tax returns, reports, and statements required to be filed by the Issuer have been filed with the appropriate Governmental Authorities, and all taxes and other impositions shown thereon to be due and payable by the Issuer have been paid prior to the date on which any fine, penalty, interest, or late charge may be added thereto for nonpayment thereof, or any such fine, penalty, interest, late charge, or loss has been paid, or the Issuer is contesting its liability therefor in good faith and has fully reserved all such amounts according to GAAP in the financial statements provided pursuant to Section 626 of the Indenture. The Issuer has paid when due and payable all material charges upon the books of the Issuer and no Governmental Authority has asserted any Lien against the Issuer with respect to unpaid taxes. Proper and accurate amounts have been withheld by the Issuer from its employees for all periods in full and complete compliance with the tax, social security, and unemployment withholding provisions of applicable federal, state, local, and foreign law and such withholdings have been timely paid to the respective Governmental Authorities.

Section 611. Other Regulations. The Issuer is not an “investment company,” or an “affiliated person” of, or a “promoter” or “principal underwriter” for, an “investment company,” as such terms are defined in the Investment Company Act of 1940, as amended. The issuance of the Series 2011-2 Notes hereunder and the application of the proceeds and repayment thereof by the Issuer and the performance of the transactions contemplated by the Indenture, this Supplement and the other Related Documents will not violate any provision of the Investment Company Act, or any rule, regulation, or order issued by the Securities and Exchange Commission thereunder.

Section 612. Solvency and Separateness.

(i) The capital of the Issuer is adequate for the business and undertakings of the Issuer.

(ii) Other than with respect to the transactions contemplated hereby and by the other Related Documents, the Issuer is not engaged in any business transactions with the Manager, except as permitted by the Management Agreement or with the Seller except as permitted under the Contribution and Sale Agreement.

(iii) At all times, at least two (2) members of the Board of Managers of the Issuer comply with the definition of Independent Person.

(iv) The Issuer’s funds and assets are not, and will not be, commingled with those of the Seller or the Manager, except as permitted by the Management Agreement and the Intercreditor Agreement.

(v) The limited liability company agreement of the Issuer requires it to maintain (A) correct and complete books and records of account, and (B) minutes of the meetings and other proceedings of its members.

(vi) The Issuer has not engaged in any business activities, except as permitted by the present and express terms of the Indenture and the Related Documents and Section 2.3 of its limited liability company agreement.

(vii) The Issuer is not insolvent under the Insolvency Law and will not be rendered insolvent by the transactions contemplated by the Related Documents and after giving effect to such transactions, the Issuer will not be left with an unreasonably small amount of capital with which to engage in its business nor will the Issuer have intended to incur, or believe that it has incurred, debts beyond its ability to pay such debts as they mature. The Issuer does not contemplate the commencement of Insolvency Proceedings or the appointment of a receiver, liquidator, trustee, or similar official in respect of the Issuer or any of its assets.

(viii) The Issuer is not liable for any unbonded or uninsured final non-appealable judgments or liabilities which in aggregate exceed $50,000.

Section 613. No Default. No Event of Default or Early Amortization Event has occurred and is continuing. No event or condition which with the giving of notice or passage of time (or both) could reasonably be expected to constitute an Event of Default or Early Amortization Event has occurred or is continuing.

Section 614. Litigation and Contingent Liabilities. No claims, litigation, arbitration Proceedings, or governmental Proceedings by any Governmental Authority are pending or, to the Issuer’s knowledge, threatened against the Issuer the results of which might interfere with the consummation of any of the transactions contemplated by the Indenture, this Supplement or any document issued or delivered in connection herewith.

Section 615. Title; Liens. On the Closing Date, the Issuer will have good, legal, and marketable title to each of its respective assets, and none of such assets is subject to any Lien, except for Permitted Encumbrances.

Section 616. Subsidiaries. The Issuer has no Subsidiaries.

Section 617. No Partnership. The Issuer is not a partner or joint venturer in any partnership or joint venture.

Section 618. Pension and Welfare Plans. The Issuer does not maintain or contribute to, and has never maintained or contributed to, any Plan. The Issuer does not have any obligation under any collective bargaining agreement. As of the Closing Date, the Issuer is not an employee benefit plan within the meaning of ERISA or a “plan” within the meaning of section 4975 of the Code and assets of the Issuer do not constitute “plan assets” within the meaning of section 2510.3-101 of the regulations of the United States Department of Labor.

Section 619. Ownership of the Issuer. On the Closing Date, all the equity interests in the Issuer are owned by the Seller.

Section 620. Security Interest Representations.

(a) This Supplement and the Indenture create a valid and continuing security interest (as defined in the UCC) in the Collateral in favor of the Indenture Trustee, for the benefit of the Noteholders and each Interest Rate Hedge Provider, which security interest is prior to all other Liens (subject to Permitted Encumbrances), and is enforceable as such as against creditors of and purchasers from the Issuer.

(b) The Containers constitute “goods” or “inventory” within the meaning of the applicable UCC. The Leases constitute “tangible chattel paper” within the meaning of the UCC. The Lease receivables constitute “accounts” or “proceeds” of the Leases within the meaning of the UCC. The Trust Account, the Restricted Cash Account, the Pre-Funding Account, the Series 2011-2 Series Account and Manager Transition Account constitute “securities accounts” within the meaning of the UCC. The Issuer’s contractual rights under any Interest Rate Hedge Agreements, the Contribution and Sale Agreement, and the Management Agreement constitute “general intangibles” within the meaning of the UCC.

(c) The Issuer owns and has good and marketable title to the Collateral, free and clear of any Lien (whether senior, junior, or pari passu), claim or encumbrance of any Person, except for Permitted Encumbrances.

(d) The Issuer has caused the filing of all appropriate financing statements or documents of similar import in the proper filing office in the appropriate jurisdictions under Applicable Law in order to perfect the security interest in the Collateral granted to the Indenture Trustee in this Supplement and the Indenture. All financing statements filed against the Issuer in favor of the Indenture Trustee in connection herewith describing the Collateral contain a statement to the following effect: “A purchase of or security interest in any collateral described in this financing statement will violate the rights of the Indenture Trustee.”

(e) Other than the security interest granted to the Indenture Trustee pursuant to this Supplement and the Indenture, the Issuer has not pledged, assigned, sold, granted a security interest in, or otherwise conveyed any of the Collateral, except as permitted pursuant to the Indenture. The Issuer has not authorized the filing of, and is not aware of, any financing statements against the Issuer that include a description of collateral covering the Collateral other than any financing statement or document of similar import (i) relating to the security interest granted to the Indenture Trustee in this Supplement or the Indenture or (ii) that has been terminated. The Issuer has no actual knowledge of any judgment or tax lien filings against the Issuer.

(f) The Issuer has received a written acknowledgment from the Manager that the Manager is holding the Leases on behalf of, and for the benefit of, the Indenture Trustee. None of the Leases that constitute or evidence the Collateral have any marks or notations indicating that they have been pledged, assigned, or otherwise conveyed to any Person other than the Indenture Trustee. The Seller has caused the filing of all appropriate financing statements or documents of similar import in the proper filing office in the appropriate jurisdictions under Applicable Law in order to perfect the security interest of the Issuer (and the Indenture Trustee as its assignee) in the Leases (to the extent that such Leases are related to the Containers) granted to the Issuer in the Contribution and Sale Agreement.

(g) The Issuer has received all necessary consents and approvals required by the terms of the Collateral to the pledge to the Indenture Trustee of its interest and rights in such Collateral hereunder or under the Indenture.

(h) The Issuer has taken all steps necessary to cause U.S. Bank National Association (in its capacity as securities intermediary) to identify in its records the Indenture Trustee as the Person having a Security Entitlement in each of the Trust Account, the Restricted Cash Account, the Pre-Funding Account, the Series 2011-2 Series Account, and the Manager Transition Account.

(i) The Trust Account, the Restricted Cash Account, the Pre-Funding Account, Series 2011-2 Series Account and the Manager Transition Account are not in the name of any Person other than the Indenture Trustee. The Issuer has not given its consent to U.S. Bank National Association (as the securities intermediary of the Trust Account, the Restricted Cash Account, the Pre-Funding Account, the Series 2011-2 Series Account, and the Manager Transition Account) to comply with entitlement orders of any Person other than the Indenture Trustee. The Manager Collection Account is subject to a control agreement which has perfected the security interest of the Collateral Agent therein on Gross Revenues for the benefit of the Indenture Trustee as the named party thereunder.

(j) No creditor of the Issuer (other than the Manager in its capacity as Manager under the Management Agreement) has in its possession any goods that constitute or evidence the Collateral.

The representations and warranties set forth in this Section 620 shall survive until this Supplement is terminated in accordance with its terms and the terms of the Indenture. Any breaches of the representations and warranties set forth in this Section 620 may be waived by the Indenture Trustee, only with the prior written consent of the Control Party and with prior written notice to the Rating Agency.

Section 621. Survival of Representations and Warranties. So long as any of the Series 2011-2 Notes shall be Outstanding and until payment and performance in full of the aggregate Outstanding Obligations, the representations and warranties contained herein shall have a continuing effect as having been true when made.

Section 622. ERISA Lien. As of the Closing Date, the Issuer has not received notice that any Lien arising under ERISA has been filed against the assets of the Issuer.

ARTICLE VII

Miscellaneous Provisions

Section 701. Ratification of Indenture. As supplemented by this Supplement, the Indenture is in all respects ratified and confirmed and the Indenture as so supplemented by this Supplement shall be read, taken, and construed as one and the same instrument.

Section 702. Counterparts. This Supplement may be executed in two or more counterparts, and by different parties on separate counterparts, each of which shall be an original, but all of which shall constitute one and the same instrument. Delivery of an executed counterpart of this Supplement by facsimile or by electronic means shall be equally effective as of the delivery of an originally executed counterpart.

Section 703. Governing Law. THIS SUPPLEMENT SHALL BE CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK, INCLUDING SECTIONS 5-1401 AND 5-1402 OF THE GENERAL OBLIGATIONS LAWS BUT OTHERWISE WITHOUT REFERENCE TO ITS CONFLICTS OF LAW PROVISIONS, AND THE OBLIGATIONS, RIGHTS AND REMEDIES OF THE PARTIES HEREUNDER SHALL BE DETERMINED IN ACCORDANCE WITH SUCH LAWS.

Section 704. Notices to Rating Agency. Whenever any notice or other communication is required to be given to the Rating Agency pursuant to the Indenture or this Supplement, such notice or communication shall be delivered Standard & Poor’s Ratings Services, 55 Water Street, 41st Floor, New York, New York 10041, Attention: Asset-Backed Surveillance Group - phone: (212/438-2435), fax: (212/438-2664). Any rights to notices conveyed to the Rating Agency pursuant to the terms of this Supplement shall terminate immediately if the Rating Agency no longer has a rating outstanding with respect to the Series 2011-2 Notes.

Section 705. Statutory References. References in this Supplement and any other Series 2011-2 Transaction Document to any section of the Uniform Commercial Code or the UCC shall mean, on or after the effective date of adoption of any revision to the Uniform Commercial Code or the UCC in the applicable jurisdiction, such revised or successor section thereto.

Section 706. Amendments and Modifications. The terms of the Supplement may be waived, modified, or amended only in a written instrument signed by each of the Issuer, the Control Party, and the Indenture Trustee and, with respect to the matters set forth in (and subject to the terms of) Section 1002(a) of the Indenture, only with the prior written consent of the Requisite Global Majority or, with respect to the matters set forth in Section 1002(b) of the Indenture, the prior written consent of the Holders of all Series 2011-2 Notes then Outstanding affected thereby.

Section 707. Consent to Jurisdiction. ANY LEGAL SUIT, ACTION, OR PROCEEDING AGAINST THE ISSUER ARISING OUT OF OR RELATING TO THIS SUPPLEMENT, OR ANY TRANSACTION CONTEMPLATED HEREBY, MAY BE INSTITUTED IN ANY FEDERAL OR STATE COURT IN THE COUNTY OF NEW YORK, STATE OF NEW YORK AND THE ISSUER HEREBY WAIVES ANY OBJECTION WHICH IT MAY NOW OR HEREAFTER HAVE TO THE LAYING OF VENUE OF ANY SUCH SUIT, ACTION, OR PROCEEDING, AND, SOLELY FOR THE PURPOSES OF ENFORCING THIS SUPPLEMENT, THE ISSUER HEREBY IRREVOCABLY SUBMITS TO THE JURISDICTION OF ANY SUCH COURT IN ANY SUCH SUIT, ACTION OR PROCEEDING. THE ISSUER HEREBY IRREVOCABLY APPOINTS AND DESIGNATES CORPORATION SERVICE COMPANY, HAVING AN ADDRESS AT 1133 AVENUE OF THE AMERICAS, SUITE 3100, NEW YORK, NY 10036-6710, ITS TRUE AND LAWFUL ATTORNEY-IN-FACT AND DULY AUTHORIZED AGENT FOR THE LIMITED PURPOSE OF ACCEPTING SERVICING OF LEGAL PROCESS AND THE ISSUER AGREES THAT SERVICE OF PROCESS UPON SUCH PARTY SHALL CONSTITUTE PERSONAL SERVICE OF SUCH PROCESS ON SUCH PERSON. THE ISSUER SHALL MAINTAIN THE DESIGNATION AND APPOINTMENT OF SUCH AUTHORIZED AGENT UNTIL ALL AMOUNTS PAYABLE UNDER THIS SUPPLEMENT SHALL HAVE BEEN PAID IN FULL. IF SUCH AGENT SHALL CEASE TO SO ACT, THE ISSUER SHALL IMMEDIATELY DESIGNATE AND APPOINT ANOTHER SUCH AGENT SATISFACTORY TO THE INDENTURE TRUSTEE AND SHALL PROMPTLY DELIVER TO THE INDENTURE TRUSTEE EVIDENCE IN WRITING OF SUCH OTHER AGENT’S ACCEPTANCE OF SUCH APPOINTMENT.

Section 708. Waiver of Jury Trial. EACH OF THE PARTIES HERETO HEREBY IRREVOCABLY WAIVES, AS AGAINST THE OTHER PARTIES HERETO, ANY RIGHTS IT MAY HAVE TO A JURY TRIAL IN RESPECT OF ANY CIVIL ACTION OR PROCEEDING (WHETHER ARISING IN CONTRACT OR TORT OR OTHERWISE), INCLUDING ANY COUNTERCLAIM, ARISING UNDER OR RELATING TO THIS AGREEMENT OR ANY OTHER OPERATIVE DOCUMENT, INCLUDING IN RESPECT OF THE NEGOTIATION, ADMINISTRATION, OR ENFORCEMENT HEREOF OR THEREOF.

[Signature pages follow]

IN WITNESS WHEREOF, the Issuer and the Indenture Trustee have caused this Supplement to be duly executed and delivered by their respective officers all as of the day and year first above written.

| CLI FUNDING V LLC | ||

| By: | /s/ David F. Doorley | |

| Name: David F. Doorley | ||

| Title: Treasurer | ||

| U.S. BANK NATIONAL ASSOCIATION, as Indenture Trustee | ||

| By: | /s/ Brian J. Hill | |

| Name: Brian J. Hill | ||

| Title: Vice President | ||

EXHIBIT A-1

FORM OF 144A GLOBAL NOTES

UNLESS THIS SERIES 2011-2 NOTE IS PRESENTED BY AN AUTHORIZED REPRESENTATIVE OF THE DEPOSITORY TRUST COMPANY, A NEW YORK CORPORATION (“DTC”), TO THE TRANSFEROR OF SUCH NOTE (THE “TRANSFEROR”) OR ITS AGENT FOR REGISTRATION OF TRANSFER, EXCHANGE OR PAYMENT, AND ANY SERIES 2011-2 NOTE ISSUED IS REGISTERED IN THE NAME OF CEDE & CO. OR IN SUCH OTHER NAME AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC (AND ANY PAYMENT IS MADE TO CEDE & CO. OR TO SUCH OTHER ENTITY AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC), ANY TRANSFER, PLEDGE OR THE USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL INASMUCH AS THE REGISTERED OWNER HEREOF, CEDE & CO., HAS AN INTEREST HEREIN.

THIS SERIES 2011-2 NOTE HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”). THE HOLDER HEREOF, BY PURCHASING THIS SERIES 2011-2 NOTE, AGREES THAT SUCH SERIES 2011-2 NOTE MAY BE RESOLD, PLEDGED OR TRANSFERRED ONLY IN ACCORDANCE WITH ANY APPLICABLE STATE SECURITIES LAWS AND (1) IN A TRANSACTION MEETING THE REQUIREMENTS OF RULE 144A UNDER THE SECURITIES ACT, TO A PERSON THAT THE SELLER REASONABLY BELIEVES IS A QUALIFIED INSTITUTIONAL BUYER THAT PURCHASES FOR ITS OWN ACCOUNT (OR FOR THE ACCOUNT OR ACCOUNTS OF A QUALIFIED INSTITUTIONAL BUYER) AND TO WHOM NOTICE IS GIVEN THAT THE RESALE, PLEDGE OR OTHER TRANSFER IS BEING MADE IN RELIANCE ON RULE 144A, OR (2) IN AN OFFSHORE TRANSACTION COMPLYING WITH RULE 903 OR RULE 904 OF REGULATION S UNDER THE SECURITIES ACT OR (3) TO A PERSON THAT IS AN INSTITUTIONAL “ACCREDITED INVESTOR,” WITHIN THE MEANING OF RULE 501(a)(1), (2), (3) OR (7) OF REGULATION D UNDER THE SECURITIES ACT, IS TAKING DELIVERY OF SUCH SERIES 2011-2 NOTE IN AN AMOUNT OF AT LEAST $100,000 AND DELIVERS A PURCHASER LETTER TO THE INDENTURE TRUSTEE IN THE FORM ATTACHED TO THE SUPPLEMENTS.

EACH PURCHASER OF A SERIES 2011-2 NOTE SHALL REPRESENT OR BE DEEMED TO REPRESENT AND WARRANT TO THE INITIAL PURCHASERS, THE ISSUER, THE INDENTURE TRUSTEE AND THE MANAGER THAT (A) EITHER (1) IT IS NOT, AND IS NOT ACTING ON BEHALF OF, A PLAN OR A GOVERNMENTAL, CHURCH OR NON-U.S. PLAN WHICH IS SUBJECT TO ANY FEDERAL, STATE, LOCAL OR NON-U.S. LAW THAT IS SIMILAR TO THE PROHIBITED TRANSACTION PROVISIONS OF SECTION 406 OF ERISA OR SECTION 4975 OF THE CODE, AND NO PART OF THE ASSETS TO BE USED BY IT TO PURCHASE OR HOLD THE SERIES 2011-2 NOTES OR ANY INTEREST THEREIN CONSTITUTES THE ASSETS OF ANY PLAN OR SUCH A GOVERNMENTAL, CHURCH OR NON-U.S. PLAN; OR (2) (A) THE ACQUISITION, HOLDING AND DISPOSITION OF THE SERIES 2011-2 NOTE WILL NOT GIVE RISE TO A NONEXEMPT PROHIBITED TRANSACTION UNDER SECTION 406 OF ERISA OR SECTION 4975 OF THE CODE (OR, IN THE CASE OF A GOVERNMENTAL, CHURCH OR NON-U.S. PLAN, A VIOLATION OF ANY SIMILAR FEDERAL, STATE, LOCAL OR NON-U.S. LAW) AND (B) THE SERIES 2011-2 NOTES ARE RATED INVESTMENT GRADE OR BETTER AND SUCH PERSON BELIEVES THAT THE SERIES 2011-2 NOTES ARE PROPERLY TREATED AS INDEBTEDNESS WITHOUT SUBSTANTIAL EQUITY FEATURES FOR PURPOSES OF SECTION 2510.3-101 OF THE REGULATIONS ISSUED BY THE U.S. DEPARTMENT OF LABOR, AND AGREES TO SO TREAT THE SERIES 2011-2 NOTES; AND (b) IT WILL NOT SELL OR OTHERWISE TRANSFER THE SERIES 2011-2 NOTES OR ANY INTEREST THEREIN OTHERWISE THAN TO A PURCHASER OR TRANSFEREE THAT REPRESENTS AND AGREES WITH RESPECT TO ITS PURCHASE, HOLDING AND DISPOSITION OF THE SERIES 2011-2 NOTES TO THE SAME EFFECT AS THE PURCHASER’S REPRESENTATION AND AGREEMENT SET FORTH IN THIS SENTENCE.

THIS SERIES 2011-2 NOTE IS NOT GUARANTEED OR INSURED BY ANY GOVERNMENTAL AGENCY OR INSTRUMENTALITY.

| CLI FUNDING V LLC FIXED RATE ASSET BACKED NOTE, SERIES 2011-2 | |

| $[XX] | CUSIP No.: 125634AC9 |

| No. 1 | |

| ___________ __, 20__ | |

KNOW ALL PERSONS BY THESE PRESENTS that CLI FUNDING V LLC, a limited liability company organized and existing under the laws of the State of Delaware (the “Issuer”), for value received, hereby promises to pay to Cede & Co., or registered assigns, at the principal corporate trust office of the Indenture Trustee named below, (i) the principal sum of up to XX Dollars ($xx.00), which sum shall be payable on the dates and in the amounts set forth in the Indenture, dated as of March 18, 2011 (as amended, restated, or otherwise modified from time to time, the “Indenture”) and the Series 2011-2 Supplement, dated as of November 3, 2011 (as amended, restated, or otherwise modified from time to time, the “Series 2011-2 Supplement”), each between the Issuer and U.S. Bank National Association as indenture trustee (the “Indenture Trustee”), and (ii) interest on the outstanding principal amount of this Note on the dates and in the amounts set forth in the Indenture and the Series 2011-2 Supplement. Capitalized terms not otherwise defined herein will have the meaning set forth in the Indenture and the Series 2011-2 Supplement.

Payment of the principal of and interest on this Note shall be made in lawful money of the United States of America which at the time of payment is legal tender for payment of public and private debts. The principal balance of, and interest on this Note is payable at the times and in the amounts set forth in the Indenture and the Series 2011-2 Supplement by wire transfer of immediately available funds to the account designated by the Holder of record on the immediately preceding Record Date.

This Note is one of the authorized notes identified in the title hereto and issued in the aggregate principal amount of up to [XX] Dollars ($XX) pursuant to the Indenture and the Series 2011-2 Supplement.

The Notes shall be an obligation of the Issuer and shall be secured by the Collateral, all as defined in, and subject to limitations set forth in, the Indenture and the Series 2011-2 Supplement.