Attached files

| file | filename |

|---|---|

| 8-K - DEX ONE CORP. 8-K - DEX ONE Corp | a50053063.htm |

| EX-99.1 - EXHIBIT 99.1 - DEX ONE Corp | a50053063ex99_1.htm |

Exhibit 99.2

Third Quarter 2011 Results Information Package November 3, 2011

Third Quarter Highlights Achieved Q3 ad sales guidanceGrew digital sales by double-digits to 16% of total salesBundled solutions increasing sales and customer retentionContinued expansion of digital partnerships and service offeringsGenerated solid EBITDA and free cash flowAffirmed full year guidance

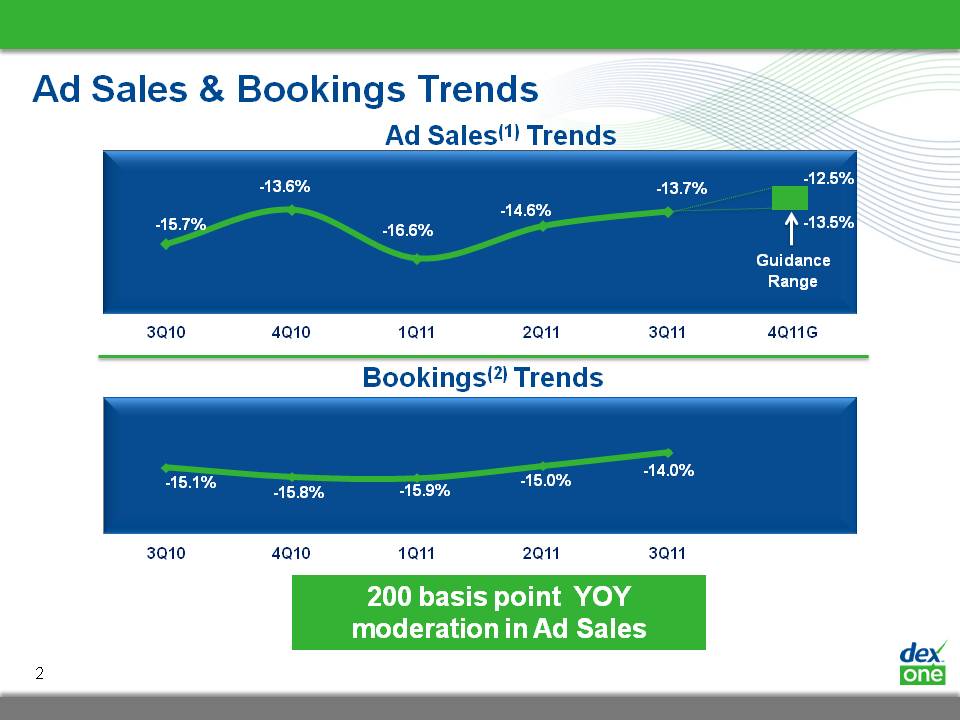

Ad Sales & Bookings Trends Bookings(2) Trends 200 basis point YOY moderation in Ad Sales -12.5% -13.5% Guidance Range Ad Sales(1) Trends

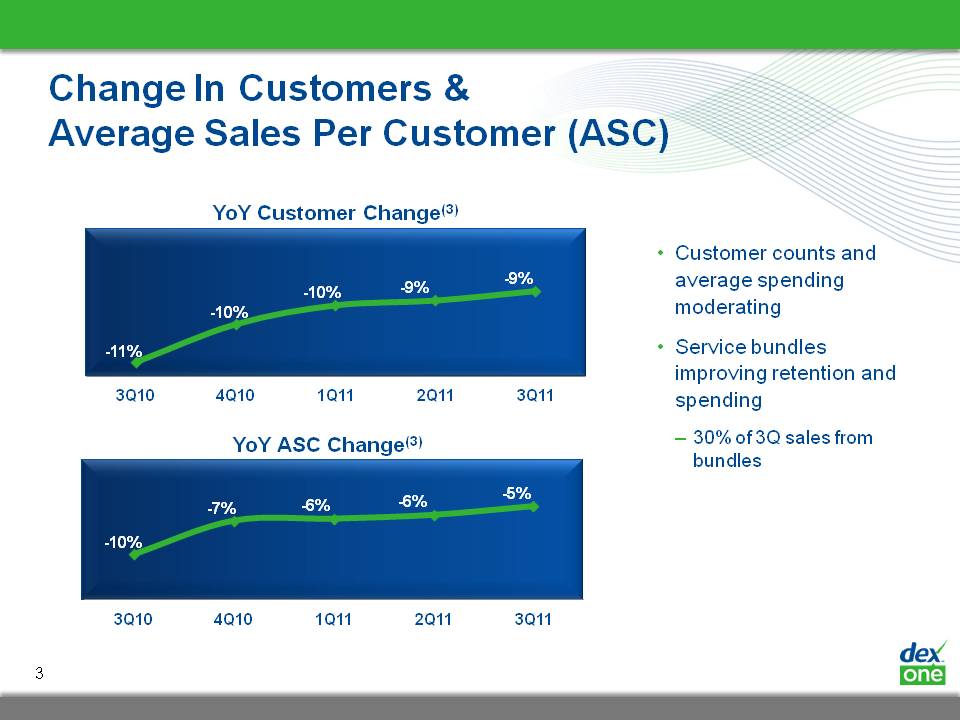

Change In Customers & Average Sales Per Customer (ASC) 3 YoY Customer Change(3) Customer counts and average spending moderatingService bundles improving retention and spending 30% of 3Q sales from bundles YoY ASC Change(3)

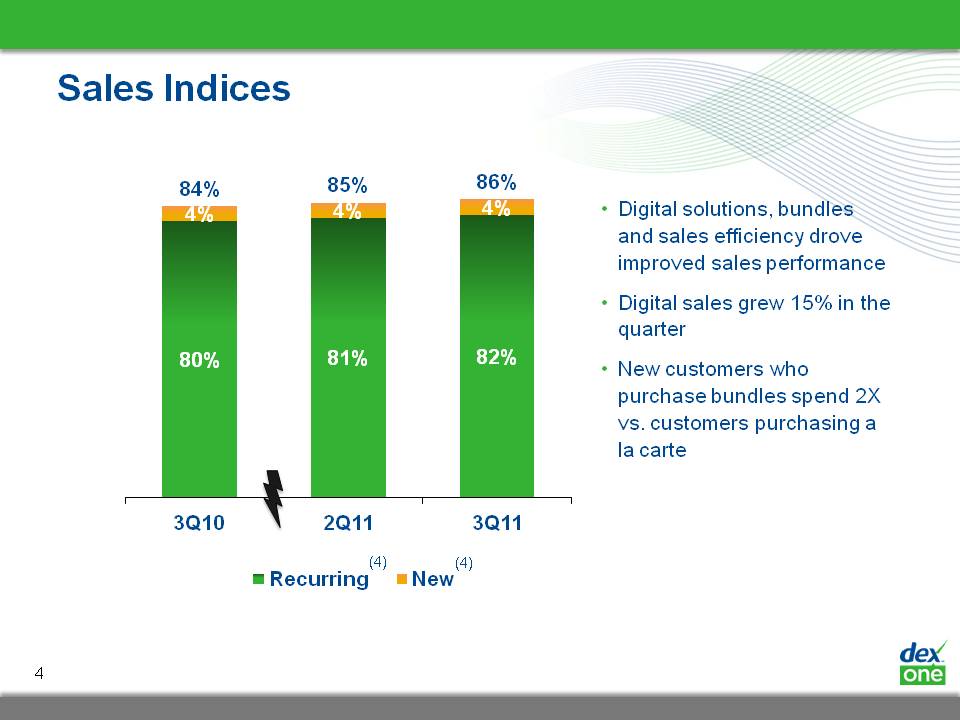

Sales Indices 4 Digital solutions, bundles and sales efficiency drove improved sales performanceDigital sales grew 15% in the quarterNew customers who purchase bundles spend 2X vs. customers purchasing a la carte (4) (4)

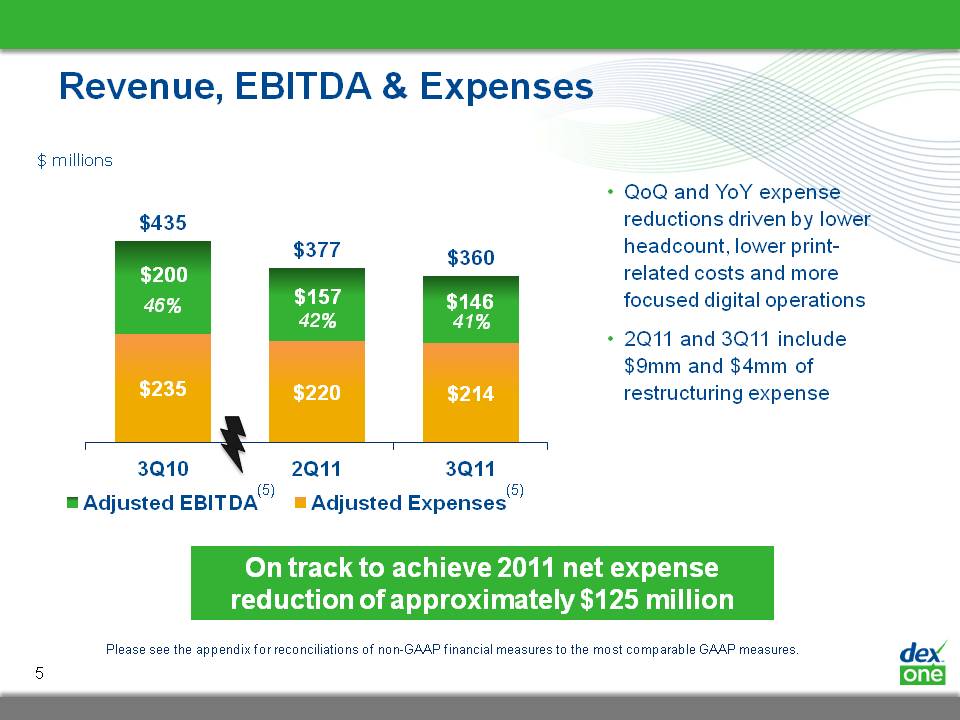

Revenue, EBITDA & Expenses 5 QoQ and YoY expense reductions driven by lower headcount, lower print-related costs and more focused digital operations2Q11 and 3Q11 include $9mm and $4mm of restructuring expense 46% 42% 41% (5) (5) Please see the appendix for reconciliations of non-GAAP financial measures to the most comparable GAAP measures. $ millions On track to achieve 2011 net expense reduction of approximately $125 million

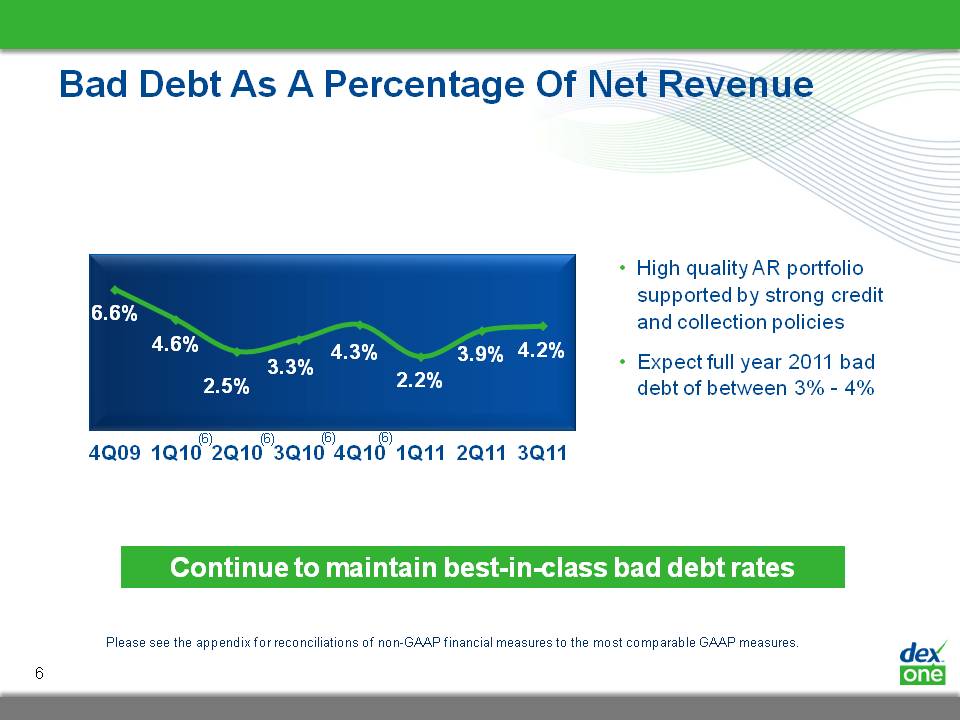

Bad Debt As A Percentage Of Net Revenue High quality AR portfolio supported by strong credit and collection policiesExpect full year 2011 bad debt of between 3% - 4% 6 Please see the appendix for reconciliations of non-GAAP financial measures to the most comparable GAAP measures. (6) (6) (6) (6) Continue to maintain best-in-class bad debt rates

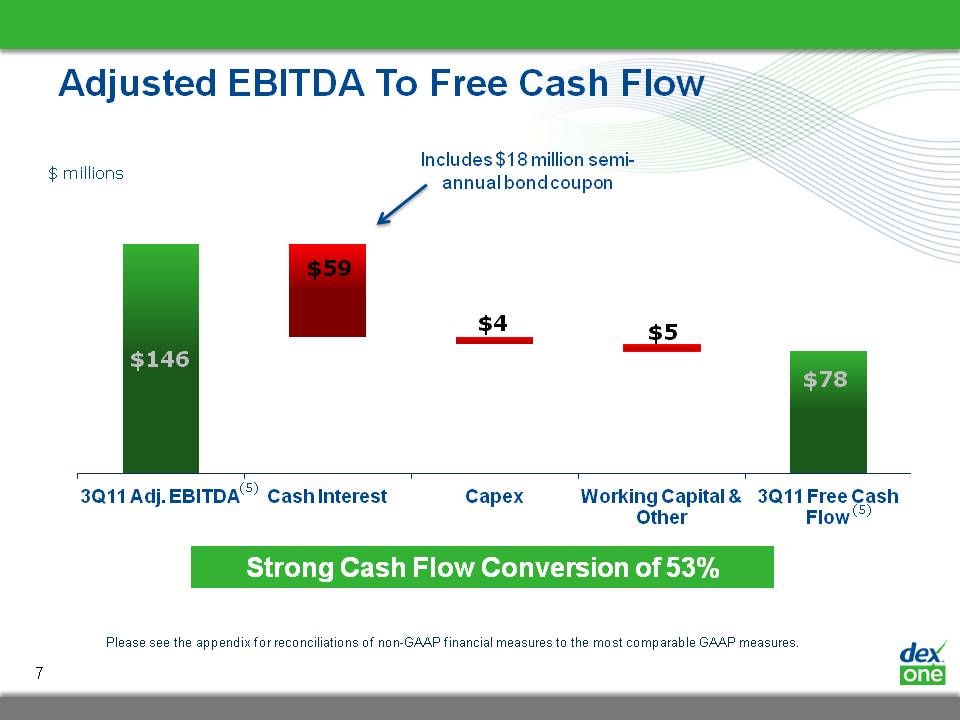

Adjusted EBITDA To Free Cash Flow $ millions (5) (5) Please see the appendix for reconciliations of non-GAAP financial measures to the most comparable GAAP measures. 7 Strong Cash Flow Conversion of 53% Includes $18 million semi-annual bond coupon

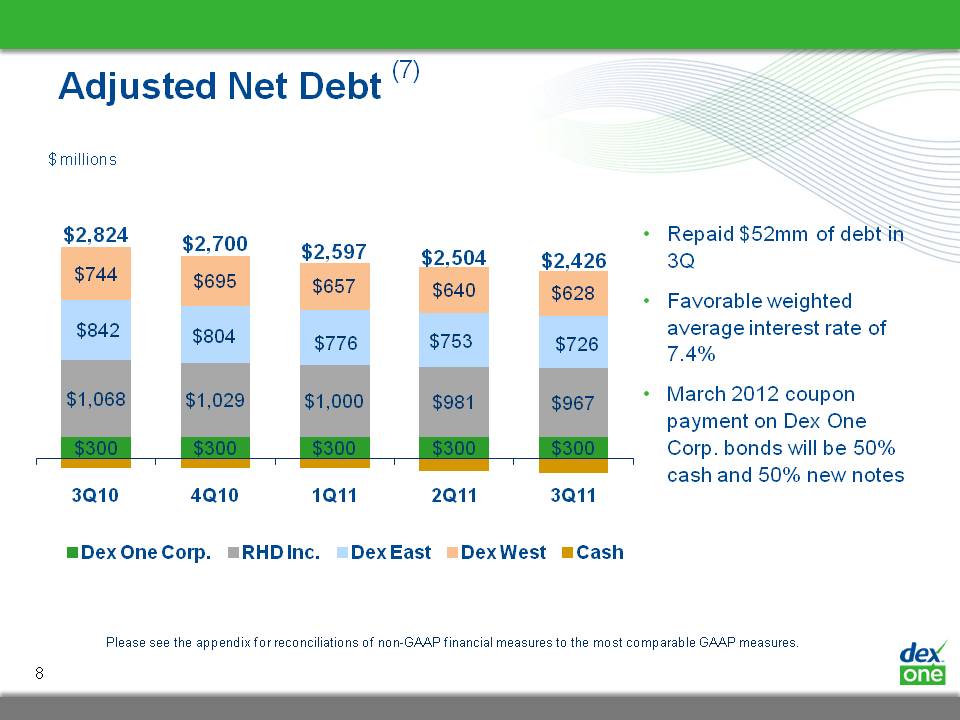

Adjusted Net Debt (7) Repaid $52mm of debt in 3QFavorable weighted average interest rate of 7.4%March 2012 coupon payment on Dex One Corp. bonds will be 50% cash and 50% new notes 8 Please see the appendix for reconciliations of non-GAAP financial measures to the most comparable GAAP measures.

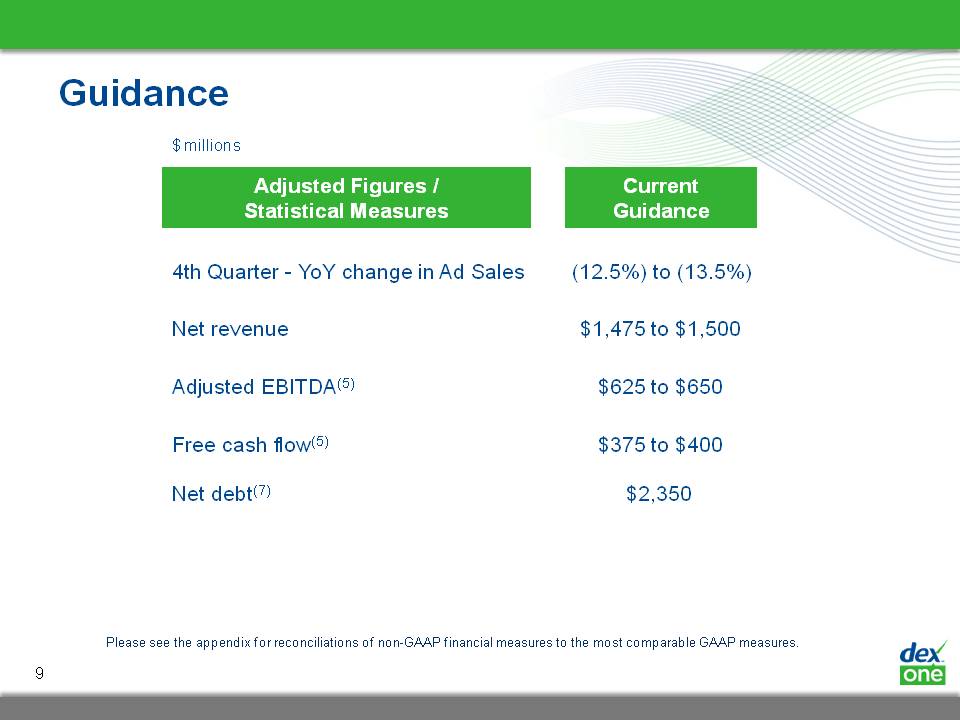

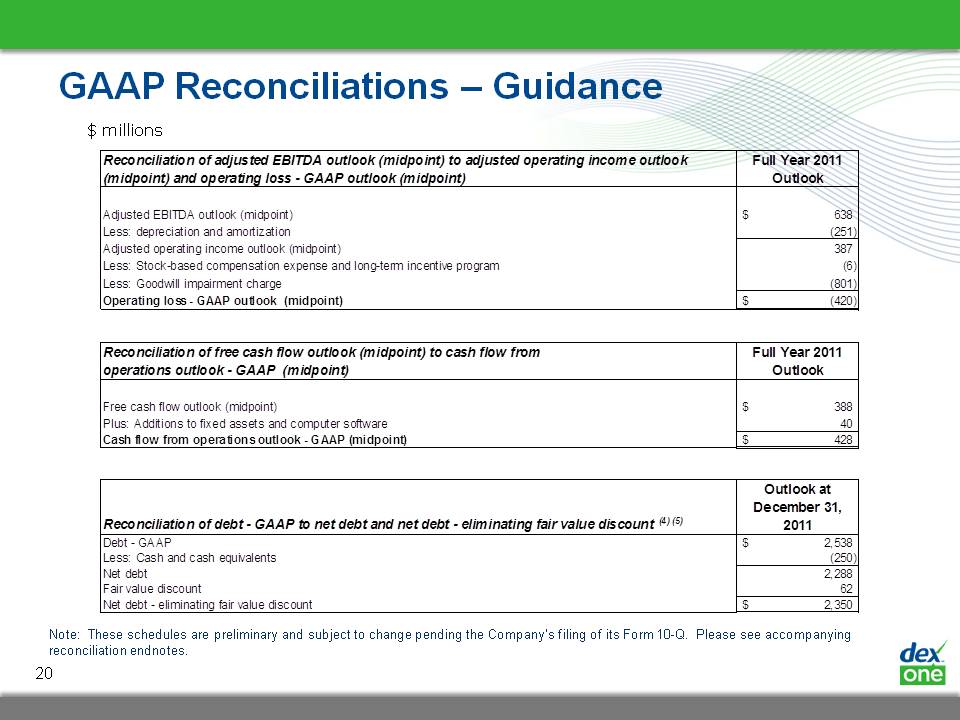

Guidance 4th Quarter - YoY change in Ad Sales (12.5%) to (13.5%)Net revenue $1,475 to $1,500Adjusted EBITDA(5) $625 to $650 Free cash flow(5) $375 to $400 Net debt(7) $2,350 Adjusted Figures / Statistical Measures Current Guidance Please see the appendix for reconciliations of non-GAAP financial measures to the most comparable GAAP measures. 9 $ millions

Safe Harbor Statement Certain statements contained in this presentation regarding Dex One Corporation's future operating results, performance, business plans, prospects, guidance and any other statements not constituting historical fact are “forward-looking statements” subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. Where possible, the words “believe,” “expect,” “anticipate,” “intend,” “should,” “will,” “would,” “planned,” “estimated,” “potential,” “goal,” “outlook,” “may,” “predicts,” “could,” or the negative of such terms, or other comparable expressions, as they relate to Dex One Corporation or its management, have been used to identify such forward-looking statements. All forward-looking statements reflect only Dex One Corporation's current beliefs and assumptions with respect to future business plans, prospects, decisions and results, and are based on information currently available to Dex One Corporation. Accordingly, the statements are subject to significant risks, uncertainties and contingencies, which could cause Dex One Corporation's actual operating results, performance or business plans or prospects to differ materially from those expressed in, or implied by, these statements.Factors that could cause actual results to differ materially from current expectations include risks and other factors described in Dex One Corporation's publicly available reports filed with the SEC, which contain a discussion of various factors that may affect Dex One Corporation's business or financial results. Such risks and other factors, which in some instances are beyond Dex One Corporation's control, include: the continuing decline in the use of print directories; increased competition, particularly from existing and emerging online technologies; ongoing weak economic conditions and continued decline in advertising sales; our ability to collect trade receivables from customers to whom we extend credit; our ability to generate sufficient cash to service our debt; our ability to comply with the financial covenants contained in our debt agreements and the potential impact to operations and liquidity as a result of restrictive covenants in such debt agreements; our ability to refinance or restructure our debt on reasonable terms and conditions as might be necessary from time to time; increasing interest rates; changes in the company's and the company's subsidiaries credit ratings; changes in accounting standards; regulatory changes and judicial rulings impacting our business; adverse results from litigation, governmental investigations or tax related proceedings or audits; the effect of labor strikes, lock-outs and negotiations; successful realization of the expected benefits of acquisitions, divestitures and joint ventures; our ability to maintain agreements with CenturyLink and AT&T and other major Internet search and local media companies; our reliance on third-party vendors for various services; and other events beyond our control that may result in unexpected adverse operating results. Dex One Corporation is not responsible for updating the information contained in this presentation beyond the published date, or for changes made to this document by wire services or Internet service providers. This presentation is being furnished to the SEC through a Form 8-K. The Company's Quarterly Report on Form 10-Q for the period ended September 30, 2011 to be filed with the SEC may contain updates to the information included in this presentation.We reference non-GAAP financial measures in this presentation. Please see the appendix for a reconciliation of non-GAAP measures to the most comparable GAAP measures. 10

Endnotes 11

APPENDIX

GAAP Reconciliations – Fresh Start And Other Adjustments The Company adopted fresh start accounting and reporting effective February 1, 2010, the Fresh Start Reporting Date. The financial statements as of the Fresh Start Reporting Date report the results of Dex One with no beginning retained earnings or accumulated deficit. Any presentation of Dex One represents the financial position and results of operations of a new reporting entity and is not comparable to prior periods presented by the Predecessor Company. The financial statements for periods ended prior to the Fresh Start Reporting Date do not include the effect of any changes in the Predecessor Company's capital structure or changes in the fair value of assets and liabilities as a result of fresh start accounting. As a result of the deferral and amortization method of revenue recognition, recognized gross advertising revenues reflect the amortization of advertising sales consummated in prior periods as well as in the current period. The adoption of fresh start accounting had a significant impact on the financial position and results of operations of the Company subsequent to the Fresh Start Reporting Date. Fresh start accounting precluded us from recognizing deferred revenue of $175.8 million and certain deferred expenses of $37.9 million during the three months ended September 30, 2010, associated with advertising sales fulfilled prior to the Fresh Start Reporting Date. Thus, our reported results for the three months ended September 30, 2010 were not indicative of our underlying operating and financial performance and are not comparable to any current period presentation. Accordingly, management has provided a non-GAAP analysis that compares the Company's GAAP results for the three months ended September 30, 2011 to Non-GAAP Adjusted Results for the three months ended September 30, 2010.Management believes that these non-GAAP financial measures are important indicators of our operations because they exclude items that may not be indicative of, or related to, our core operating results, and provide a better baseline for analyzing our underlying business. Non-GAAP Adjusted Results adjusts GAAP results of the Company for the three months ended September 30, 2010 to (i) eliminate the fresh start accounting impact on revenue and certain related expenses noted above and (ii) exclude cost-uplift recorded under fresh start accounting of $3.6 million for the three months ended September 30, 2010. Deferred directory costs, such as print, paper, distribution and commissions, related to directories that have not yet been published and have been recorded at fair value, determined as (a) the estimated billable value of the published directory less (b) the expected costs to complete the directory, plus (c) a normal profit margin. This incremental fresh start accounting adjustment to step up the recorded value of the deferred directory costs to fair value is hereby referred to as “cost-uplift.” Cost-uplift has been amortized over the terms of the applicable directories, not to exceed twelve months. Fresh start accounting had an immaterial impact on our results of operations for the three months ended September 30, 2011 and therefore, we have not adjusted our GAAP results for this period. Management believes that the presentation of Non-GAAP Adjusted Results will help financial statement users better understand the material impact fresh start accounting had on the Company's results of operations for the three months ended September 30, 2010 and also offers a non-GAAP normalized comparison to GAAP results of the Company for the three months ended September 30, 2011. The Non-GAAP Adjusted Results presented below are reconciled to the most comparable GAAP measures. While the Non-GAAP Adjusted Results exclude the effects of fresh start accounting, it must be noted that the Non-GAAP Adjusted Results are not comparable to the Company's GAAP results for the three months ended September 30, 2011 and should not be treated as such. We strongly encourage investors and stockholders to review our financial statements and publicly filed reports in their entirety and not rely on any single financial measure. 13

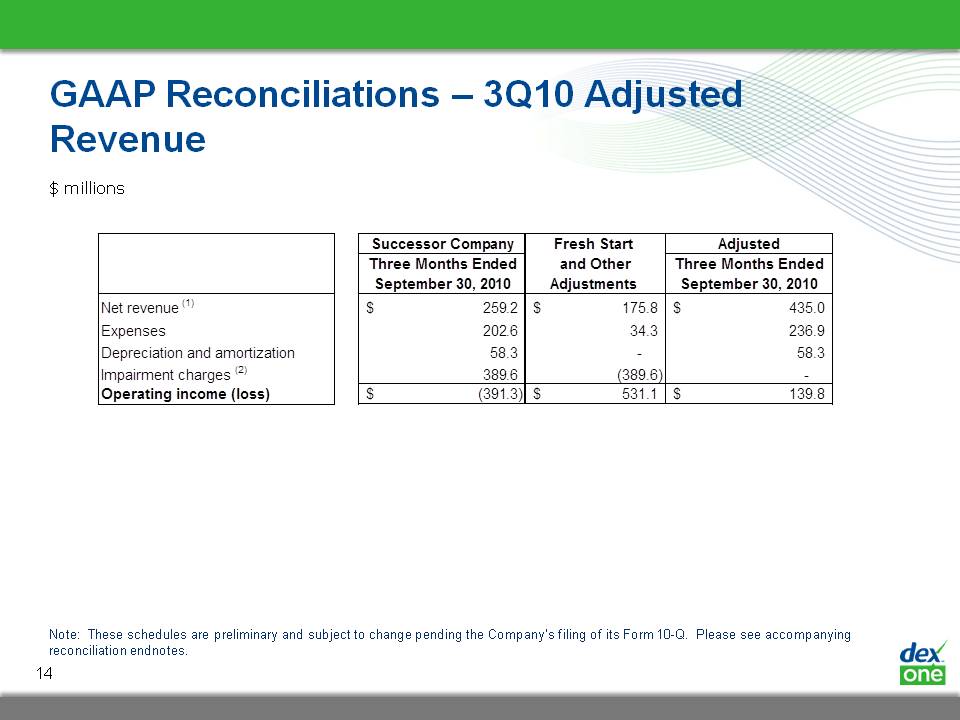

GAAP Reconciliations – 3Q10 Adjusted Revenue $ millions Note: These schedules are preliminary and subject to change pending the Company's filing of its Form 10-Q. Please see accompanying reconciliation endnotes. 14

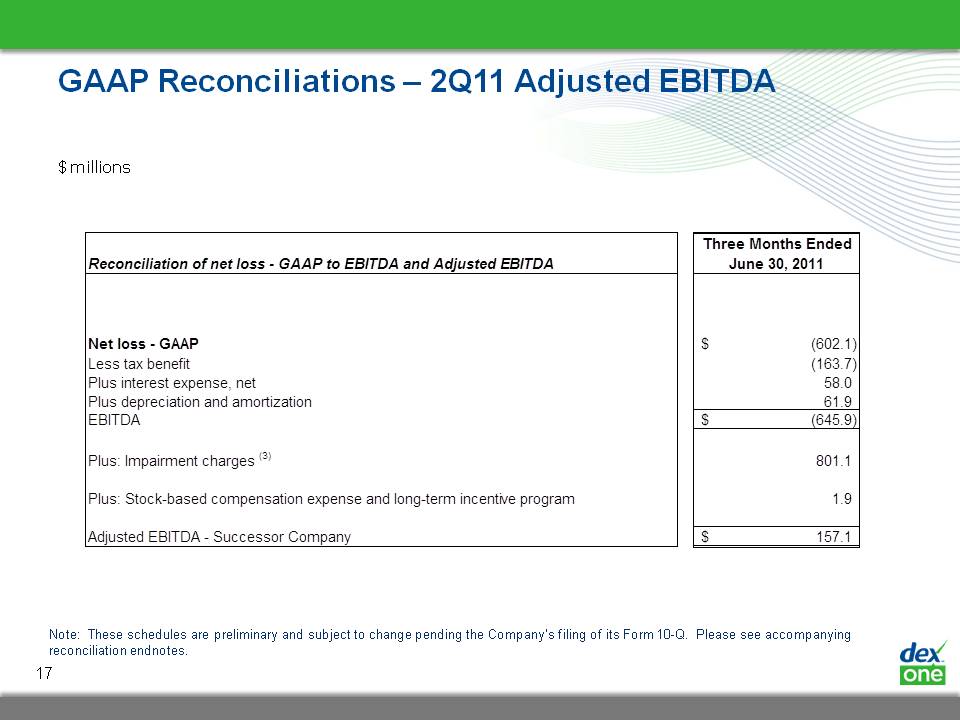

GAAP Reconciliations – 3Q10, 2Q11 & 3Q11 Adjusted EBITDA EBITDA and Adjusted EBITDA are not measurements of operating performance computed in accordance with GAAP and should not be considered as a substitute for net income (loss) prepared in conformity with GAAP. In addition, EBITDA may not be comparable to similarly titled measures of other companies. Management believes that these non-GAAP financial measures are important indicators of our operations because they exclude items that may not be indicative of, or related to, our core operating results, and provide a better baseline for analyzing our underlying business. Adjusted EBITDA of the Successor Company for the three months ended September 30, 2010 is determined by adjusting EBITDA to (i) eliminate the fresh start accounting impact on revenue and certain expenses, (ii) to exclude the impact of cost-uplift recorded under fresh start accounting, (iii) exclude goodwill and non-goodwill intangible asset impairment charges and (iv) adjust for stock-based compensation expense and long-term incentive program. Adjusted EBITDA of the Successor Company for the three months ended June 30, 2011 is determined by adjusting EBITDA for (i) stock-based compensation expense and long-term incentive program and (ii) impairment charges. Adjusted EBITDA of the Successor Company for the three months ended September 30, 2011 is determined by adjusting EBITDA for stock-based compensation expense and long-term incentive program. 15

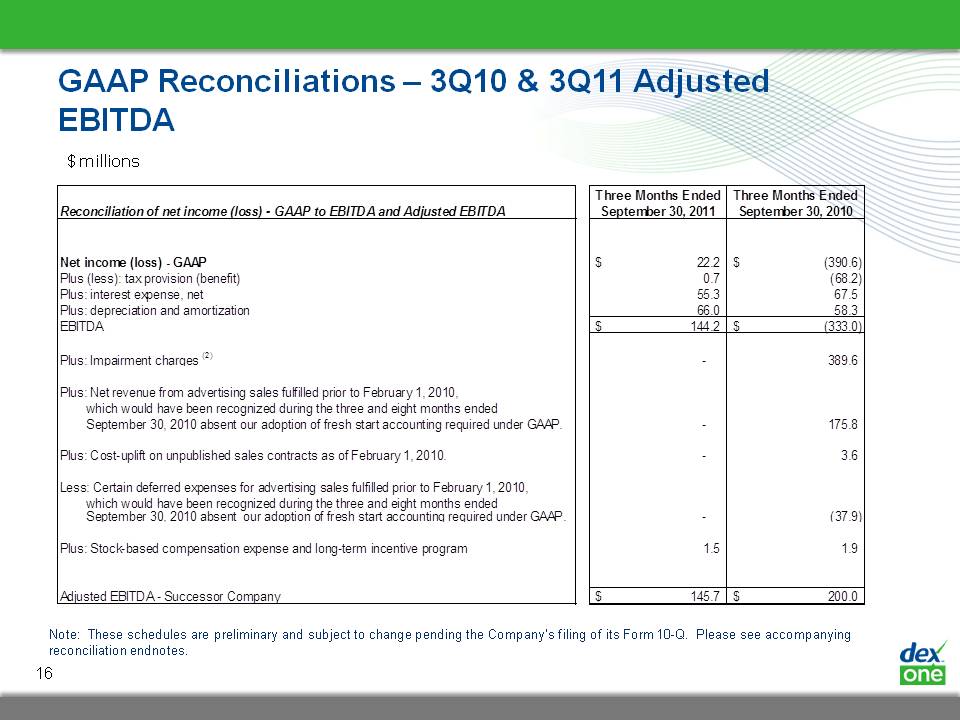

$ millions 16 GAAP Reconciliations – 3Q10 & 3Q11 Adjusted EBITDA Note: These schedules are preliminary and subject to change pending the Company's filing of its Form 10-Q. Please see accompanying reconciliation endnotes.

$ millions 17 GAAP Reconciliations – 2Q11 Adjusted EBITDA Note: These schedules are preliminary and subject to change pending the Company's filing of its Form 10-Q. Please see accompanying reconciliation endnotes.

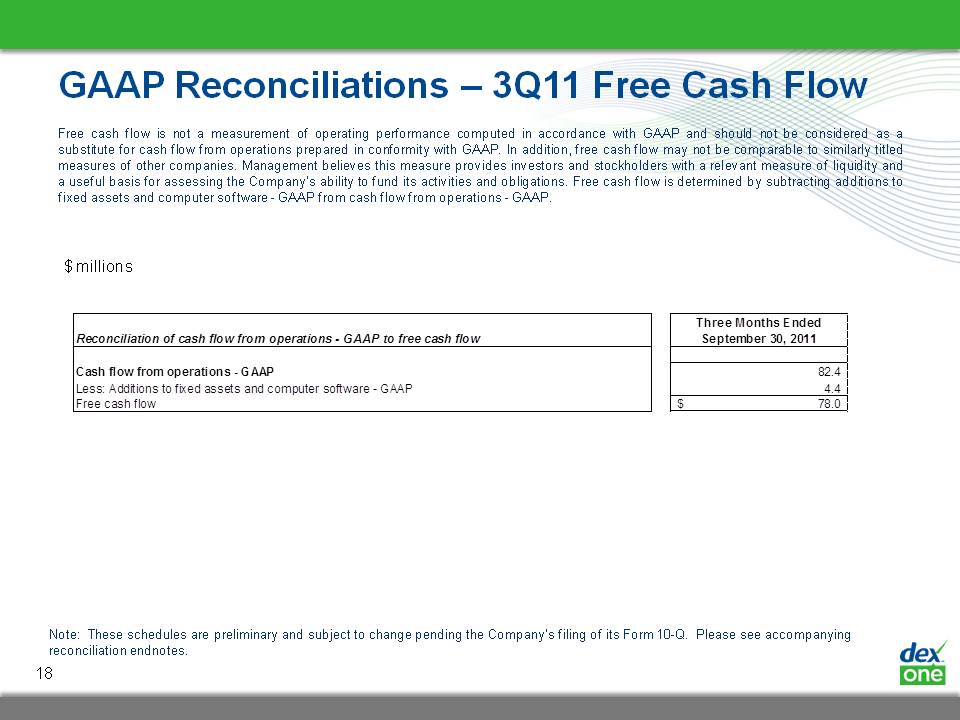

GAAP Reconciliations – 3Q11 Free Cash Flow Free cash flow is not a measurement of operating performance computed in accordance with GAAP and should not be considered as a substitute for cash flow from operations prepared in conformity with GAAP. In addition, free cash flow may not be comparable to similarly titled measures of other companies. Management believes this measure provides investors and stockholders with a relevant measure of liquidity and a useful basis for assessing the Company's ability to fund its activities and obligations. Free cash flow is determined by subtracting additions to fixed assets and computer software - GAAP from cash flow from operations - GAAP. 18 $ millions Note: These schedules are preliminary and subject to change pending the Company's filing of its Form 10-Q. Please see accompanying reconciliation endnotes.

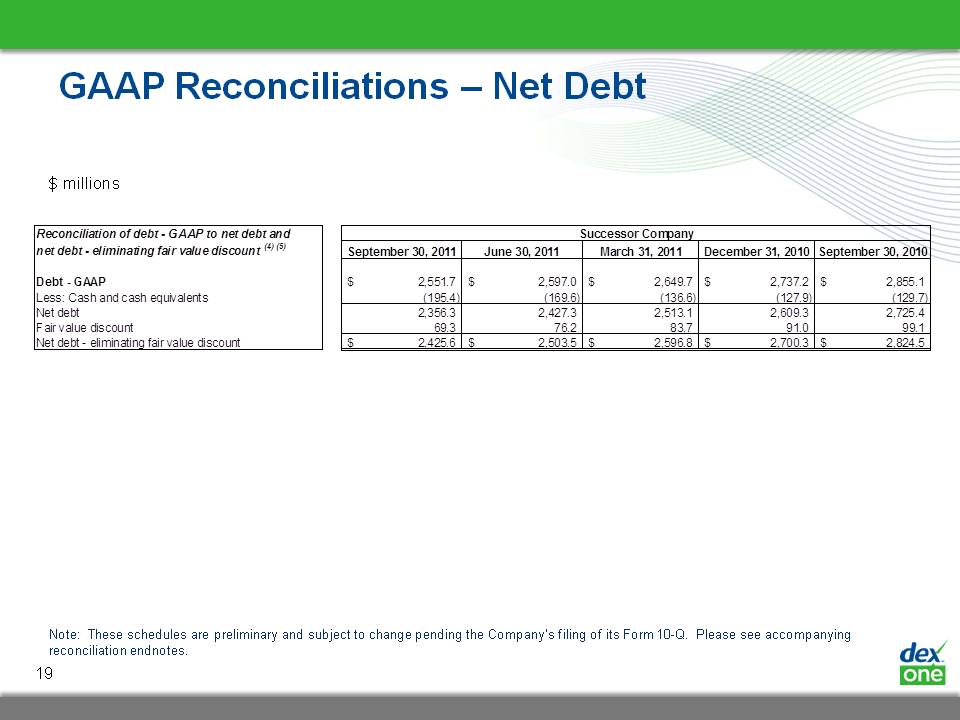

GAAP Reconciliations – Net Debt $ millions 19 Note: These schedules are preliminary and subject to change pending the Company's filing of its Form 10-Q. Please see accompanying reconciliation endnotes.

GAAP Reconciliations – Guidance $ millions 20 Note: These schedules are preliminary and subject to change pending the Company's filing of its Form 10-Q. Please see accompanying reconciliation endnotes.

Reconciliation Endnotes Our advertising revenues are earned primarily from the sale of advertising in yellow pages directories we publish. Advertising revenues also include revenues from our Internet-based marketing solutions including online directories, such as DexKnows.com and DexNet. Advertising revenues are affected by several factors, including changes in the quantity and size of advertisements, acquisition of new clients, renewal rates of existing clients, premium advertisements sold, changes in advertisement pricing, the introduction of new marketing solutions, an increase in competition and more fragmentation in the local business search market and general economic factors. Revenues with respect to print advertising and Internet-based marketing solutions that are sold with print advertising are recognized under the deferral and amortization method whereby revenues are initially deferred when a directory is published, net of sales claims and allowances, and recognized ratably over the directory's life, which is typically 12 months. Revenues with respect to Internet-based marketing solutions that are sold standalone, such as DexNet, are recognized ratably over the life of the contract commencing when they are first delivered or fulfilled. Revenues with respect to our marketing solutions that are non-performance based are recognized ratably over the life of the contract commencing when they are first delivered or fulfilled. Revenues with respect to our marketing solutions that are performance-based are recognized as the service is delivered or fulfilled.Based upon the decline in the trading value of our debt and equity securities during the three months ended September 30, 2010, among other indicators, the Company concluded that there were indicators of impairment during the three months ended September 30, 2010. As a result of identifying indicators of impairment, we performed impairment tests as of September 30, 2010, of our goodwill, definite-lived intangible assets and other long-lived assets in accordance with Accounting Standards Codification ("ASC") 350, Intangibles – Goodwill and Other and ASC 360, Property, Plant and Equipment. The testing results of our definite-lived intangible assets and other long-lived assets resulted in an impairment charge associated with trade names and trademarks, technology, local customer relationships and other from our former Business.com reporting unit of $4.3 million during the three months ended September 30, 2010. The testing results of our goodwill resulted in an impairment charge of $385.3 million during the three months ended September 30, 2010, which has been recorded at each of our reporting units. The Company has excluded the goodwill and intangible asset impairment charges from Adjusted Results three months ended September 30, 2010. Based upon our announcement in May 2011 of the impending departure of our Executive Vice President and Chief Financial Officer, the continued decline in the trading value of our debt and equity securities and revisions made to our long-term forecast, the Company concluded there were indicators of impairment as of May 31, 2011. As a result, we performed impairment tests of our goodwill, definite-lived intangible assets and other long-lived assets as of May 31, 2011. The impairment testing results for recoverability of our definite-lived intangible assets and other long-lived assets indicated they were recoverable and thus no impairment test was required as of May 31, 2011. Based upon the testing results of our goodwill, we determined that the remaining goodwill assigned to each of our reporting units was fully impaired and thus recognized an aggregate goodwill impairment charge of $801.1 million during the three months ended June 30, 2011, which was recorded at each of our reporting units. As of June 30, 2011, the Company has no recorded goodwill at any of its reporting units. We have removed the goodwill impairment charge from GAAP results for the three months ended June 30, 2011. 21 Note: These schedules are preliminary and subject to change pending the Company's filing of its Form 10-Q. Please see accompanying reconciliation endnotes.

Reconciliation Endnotes In conjunction with our adoption of fresh start accounting, an adjustment was established to record our outstanding debt at fair value on the Fresh Start Reporting Date. The Company was required to record our amended and restated credit facilities at a discount as a result of their fair value on the Fresh Start Reporting Date. Therefore, the carrying amount of these debt obligations is lower than the principal amount due at maturity. This fair value adjustment is amortized as an increase to interest expense over the remaining term of the respective debt agreements and does not impact future scheduled interest or principal payments. The unamortized fair value adjustment resulting from fresh start accounting was $69.3 million at September 30, 2011. Net debt represents total debt less cash and cash equivalents on the respective date. Net debt – eliminating fair value discount eliminates the fair value discount as a result of fresh start accounting described in Note 4 and represents principal amounts due at maturity. 22 Note: These schedules are preliminary and subject to change pending the Company's filing of its Form 10-Q. Please see accompanying reconciliation endnotes.