Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - JONES LANG LASALLE INC | d251535d8k.htm |

| EX-99.1 - PRESS RELEASE - JONES LANG LASALLE INC | d251535dex991.htm |

Supplemental Information

Third Quarter

Earnings Call

2011

Exhibit 99.2 |

Market & Financial Overview |

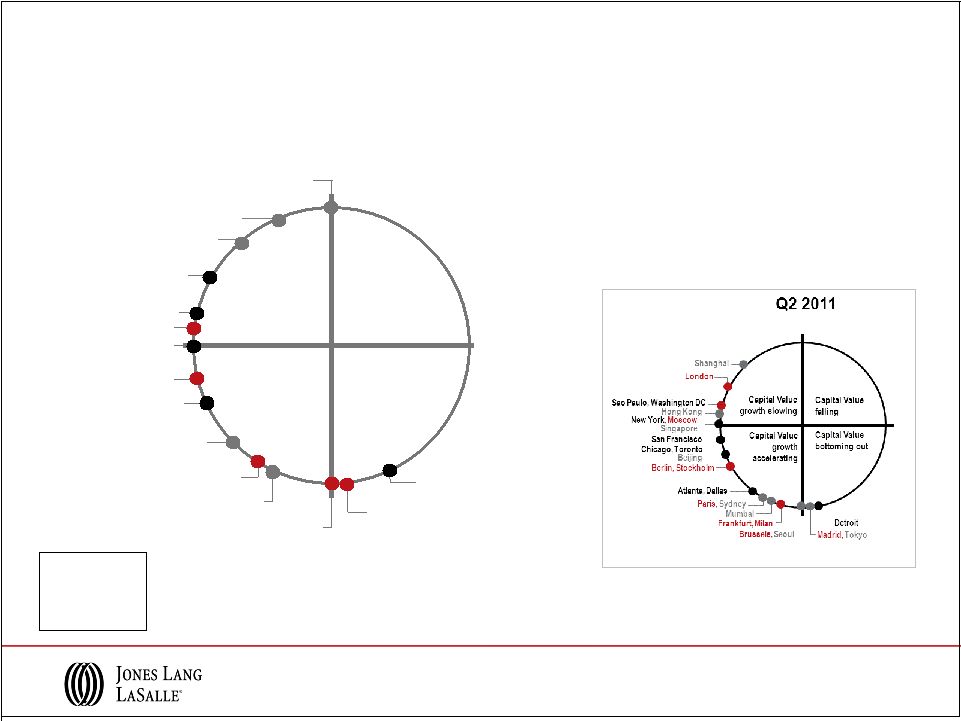

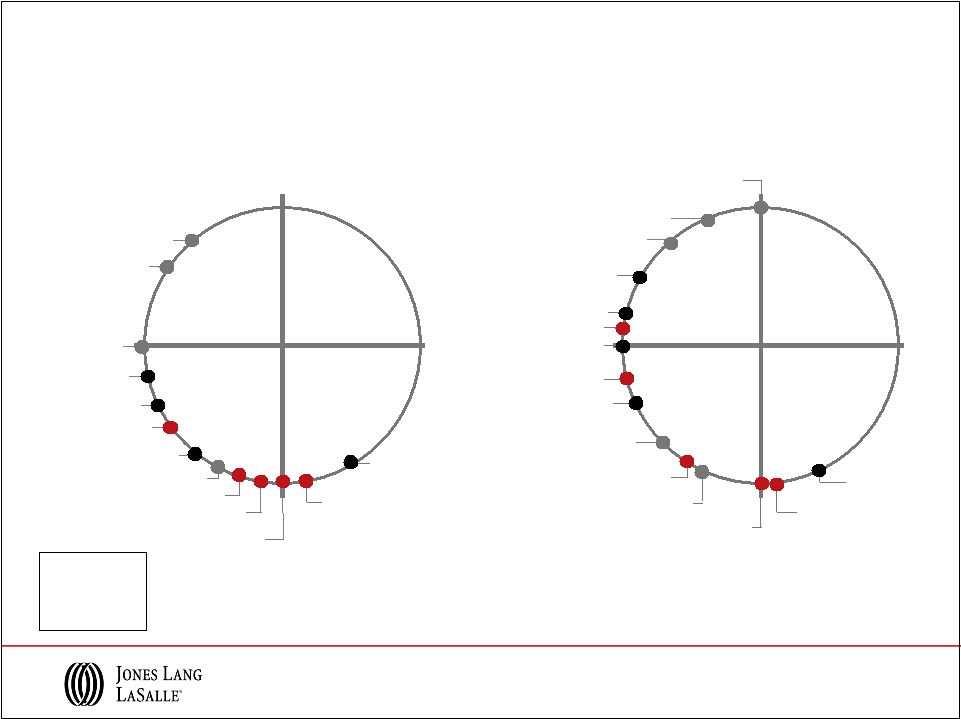

Capital Values

Capital Value

growth slowing

Capital Value

growth

accelerating

Capital Values

bottoming out

Capital Values

falling

Q3 2011

Hong Kong

Washington DC

London

Moscow, Paris

Chicago,

Stockholm

Atlanta, Dallas

Frankfurt, Milan

Brussels

Seoul

Madrid,

Tokyo Detroit

Berlin,

Toronto

San Francisco, Beijing

New York, Sao Paulo

Shanghai

Singapore

Sydney

Mumbai

Americas

EMEA

Asia Pacific

As of Q3 2011

The Jones Lang LaSalle Property Clocks

SM

3 |

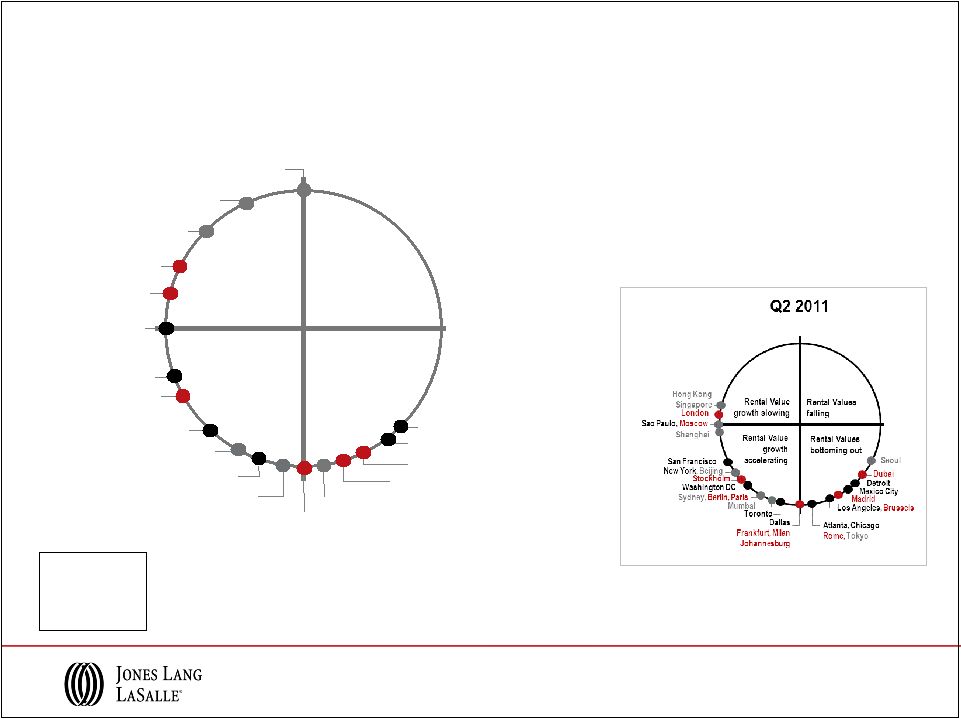

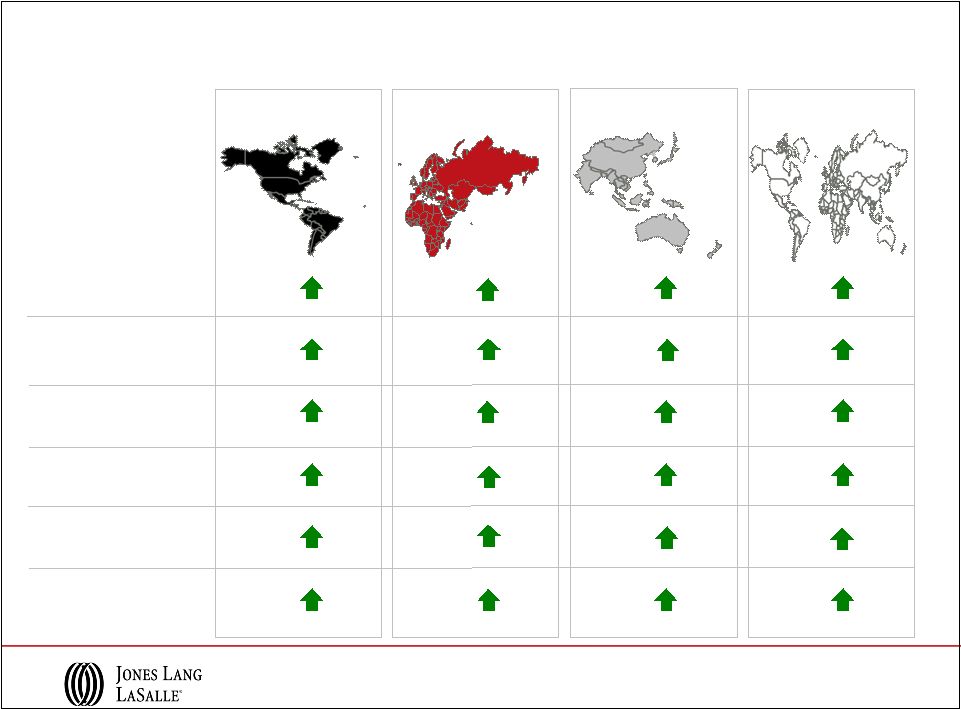

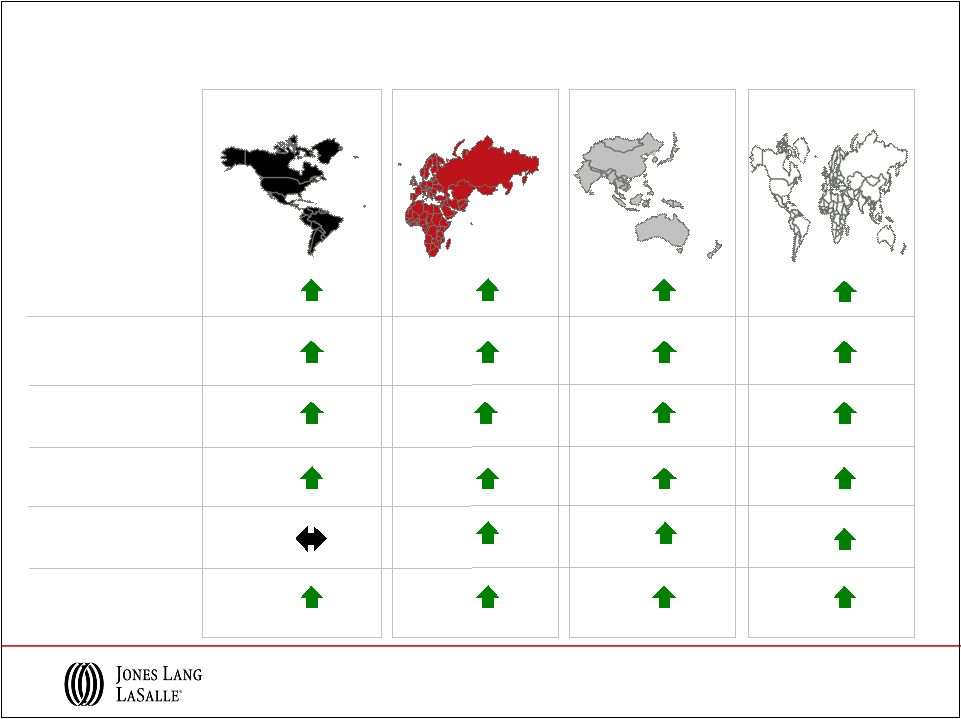

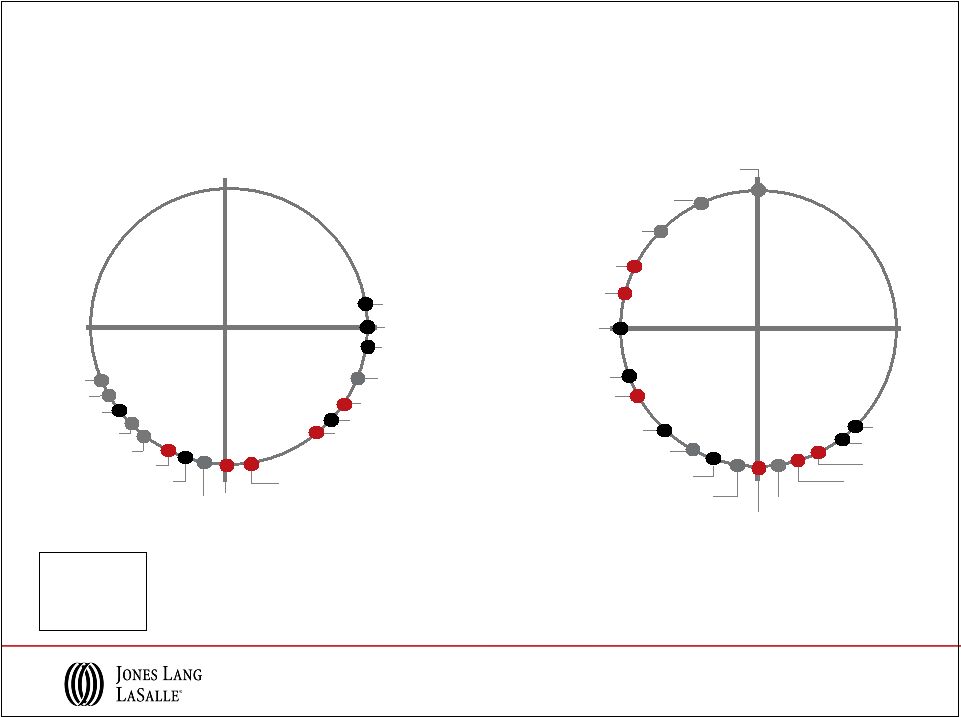

Leasing Market Fundamentals

Q3 2011

As of Q3 2011

The Jones Lang LaSalle Property Clocks

SM

Rental Value

growth slowing

Rental Value

growth

accelerating

Rental Values

bottoming out

Rental Values

falling

Detroit, Dubai

Seoul

San Francisco

New York

Washington DC, Toronto, Milan

Dallas,

Mumbai

Atlanta

Frankfurt

Johannesburg

Chicago

Rome

Tokyo

Los Angeles

Brussels

Madrid

Berlin,

Sydney

Stockholm

Sao Paulo, Paris

Beijing

London

Moscow

Mexico City

Hong Kong

Singapore

Shanghai

Americas

EMEA

Asia Pacific

4 |

Q3 Selected Business Wins and Expansions

5

Americas

EMEA

Asia Pacific

–

HSBC

–

10M

sf

–

Principal

Financial

–

7M

sf

–

Red

Roof

Inns

Portfolio,

U.S.

-

$151M

–

One

Shell

Square,

New

Orleans

-

$102M

–

1700

Market,

Philadelphia

-

$144M/$123M

–

MetLife,

New

York

–

276K

sf

–

Morris,

Manning

&

Martin,

Atlanta

–

118K

sf

–

Nexen,

Dallas

–

191K

sf

–

HSBC –

4M sf

–

Rolls

Building,

London

-

£305M

–

Friederich

Carre,

Berlin

–

€53M

–

Magnolia

Shopping

Centre,

Poland

–

€220M

–

AXA, Brussels –

538K sf

–

MRSK,

Moscow

–

82K

sf

–

SNS

REEAL,

Amsterdam

–

70K

sf

–

HSBC –

6M sf

–

Pertamina,

Indonesia

–

2M

sf

–

Abacus,

Australia

–

$628M

–

SOHO

China,

Shanghai

–

$296M

–

Crowne

Plaza

Airport,

Singapore

–

$231M

–

AIG

Edison

Life,

Japan

–

2M

sf

–

Agile

Property

Holdings,

Guangzhou

–

130K

sf

–

Australia

Prop.

Growth

Fund

–

3M

sf |

Financial Information |

7

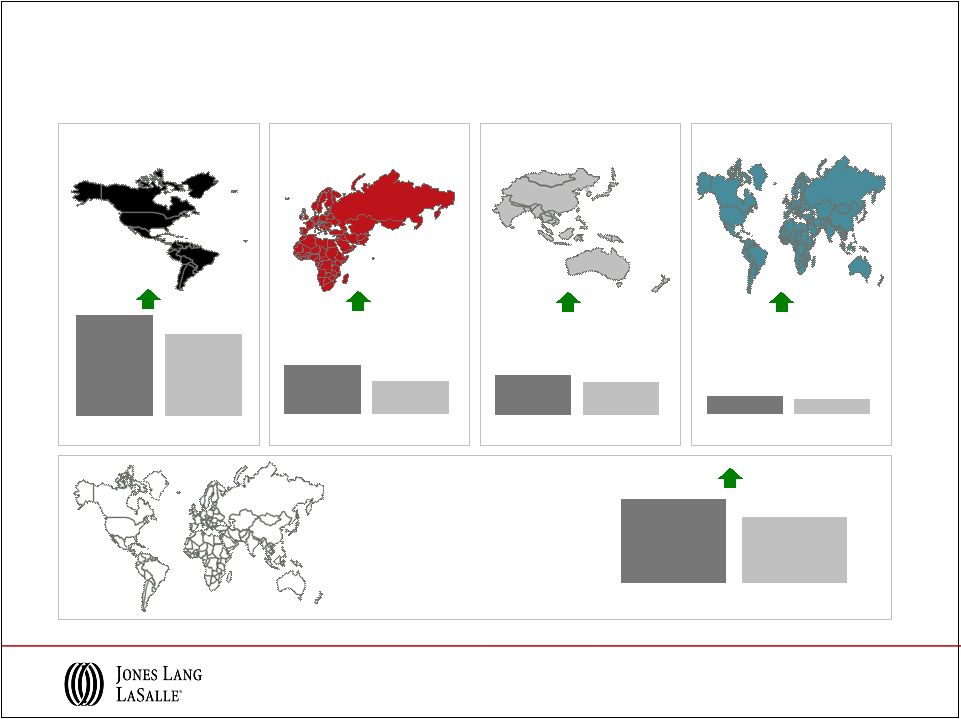

Q3 2011 Revenue Performance

Note: Equity earnings (losses) of $0.5M and ($2.0M) in 2011 and 2010, respectively,

are included in segment results, however, are excluded from Consolidated

totals. Americas

EMEA

Asia Pacific

$379.3

$309.1

2011

2010

Consolidated

$903.2

$708.4

2011

2010

($ in millions, % change in USD)

LIM

23%

46%

22%

21%

28%

$247.3

$169.3

2011

2010

$200.6

$165.0

2011

2010

$76.5

$63.0

2011

2010 |

Asia

Pacific 8

Q3 2011 Real Estate Services Revenue

Americas

EMEA

Leasing

Capital Markets &

Hotels

Property & Facility

Management

Project &

Development Services

Advisory, Consulting

& Other

Total RES

Operating Revenue

$186.9

$36.4

$79.4

$46.1

$30.5

$379.3

22%

44%

27%

13%

9%

23%

$57.5

$59.3

$40.2

$46.3

$44.0

$247.3

20%

91%

23%

59%

54%

46%

$44.5

$21.3

$93.1

$21.7

$19.9

$200.5

26%

16%

23%

13%

19%

22%

$288.9

$117.0

$212.7

$114.1

$94.4

$827.1

23%

57%

25%

28%

29%

Total RES

Revenue

29%

Note: Segment and Consolidated Real Estate Services (“RES”) operating

revenue exclude Equity earnings (losses). ($ in millions; % change in USD )

|

9

YTD 2011 Revenue Performance

Note: Equity earnings (losses) of $2.7M and ($10.9M) in 2011 and

2010, respectively, are included in segment results, however,

are excluded from Consolidated totals.

Americas

EMEA

Asia Pacific

LIM

$833.1

$1,015.8

2011

2010

Consolidated

$1,969.4

$2,436.4

2011

2010

24%

($ in millions; % change in USD )

$633.3

$491.4

2011

2010

$580.6

$455.3

2011

2010

$178.7

$209.5

2011

2010

22%

29%

28%

17% |

Asia

Pacific 10

YTD 2011 Real Estate Services Revenue

($ in millions; % change in USD )

Americas

EMEA

Leasing

Capital Markets &

Hotels

Property & Facility

Management

Project &

Development Services

Advisory, Consulting

& Other

Total RES

Operating Revenue

$501.7

$87.9

$220.4

$124.1

$79.1

$1,013.2

22%

79%

21%

12%

(1%)

22%

$155.1

$126.0

$110.3

$130.9

$111.3

$633.6

16%

41%

8%

58%

33%

29%

$123.3

$72.8

$265.8

$60.0

$58.5

$580.4

27%

39%

24%

34%

25%

27%

$780.1

$286.7

$596.5

$315.0

$248.9

$2,227.2

22%

50%

19%

32%

18%

25%

Total RES

Revenue

Note: Segment and Consolidated Real Estate Services (“RES”) operating

revenue exclude Equity earnings (losses). |

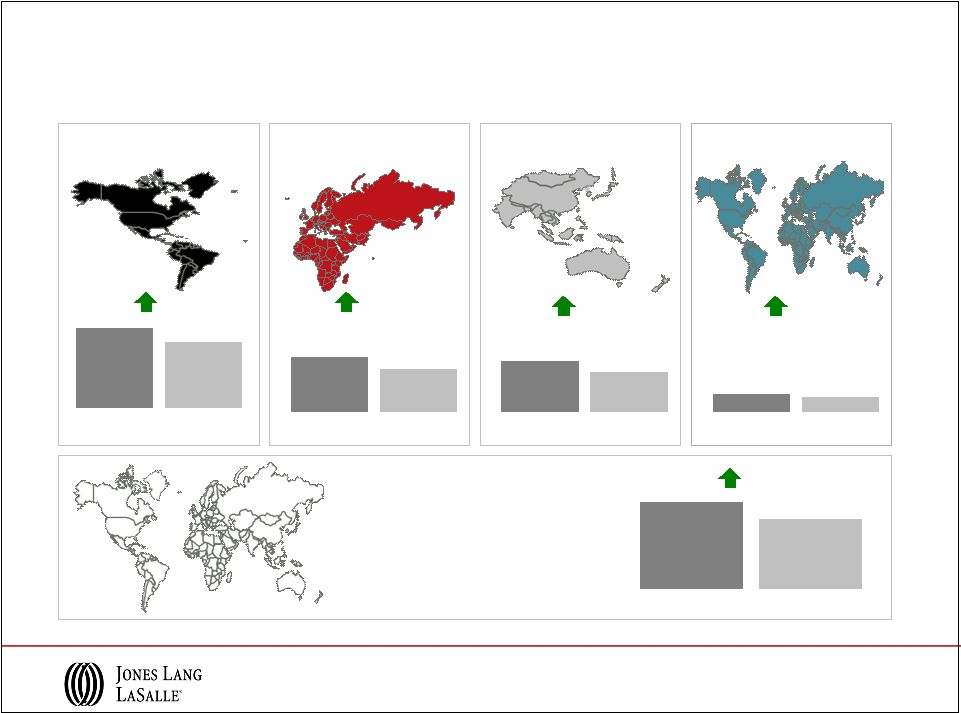

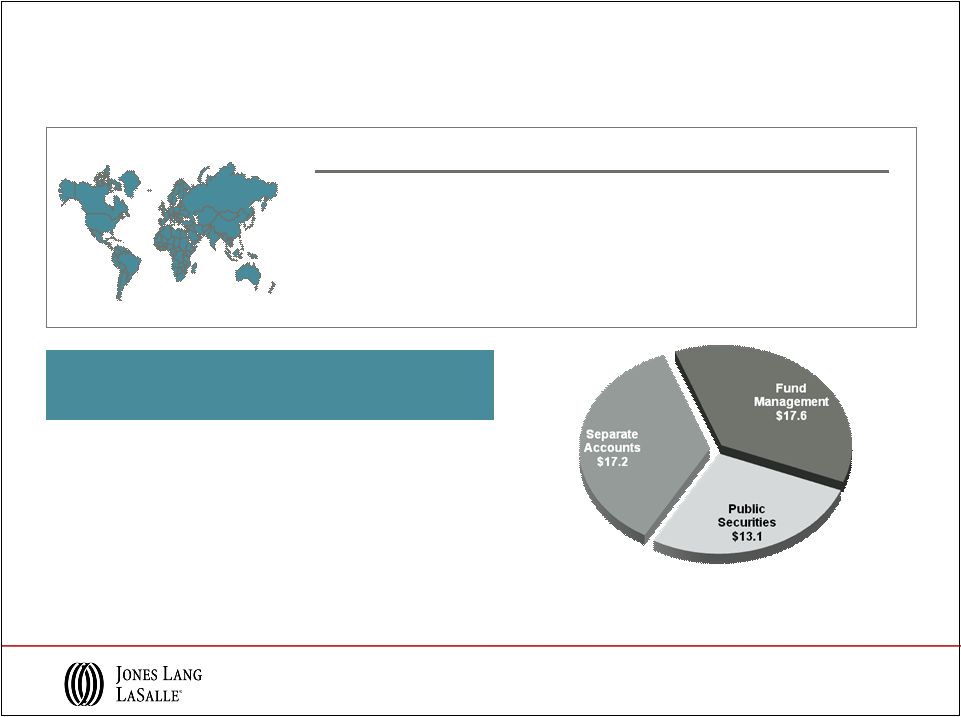

YTD Q3

2011 Highlights LaSalle Investment Management

Product

Assets Under

Management

($ in billions)

Average

Performance

Private Equity

U.K.

$12.0

Above benchmark

Continental Europe

$4.5

Return: >1x equity

North America

$10.1

Above benchmark

Asia Pacific

$8.2

Return: >1x equity

Public Securities

$13.1

Above benchmark

Total Q3 2011 AUM

$47.9 B

AUM by Fund type

Note: AUM data reported on a one-quarter lag

($ in billions)

•

Stable,

high

margin

advisory

fees

augmented

by

incentive

fees

in

Q3

2011

•

Nearly $5 billion of net new capital commitments raised YTD 2011

•

Trinity Funds Management acquisition added $700 million of assets under

management and increased credibility in Australia

11 |

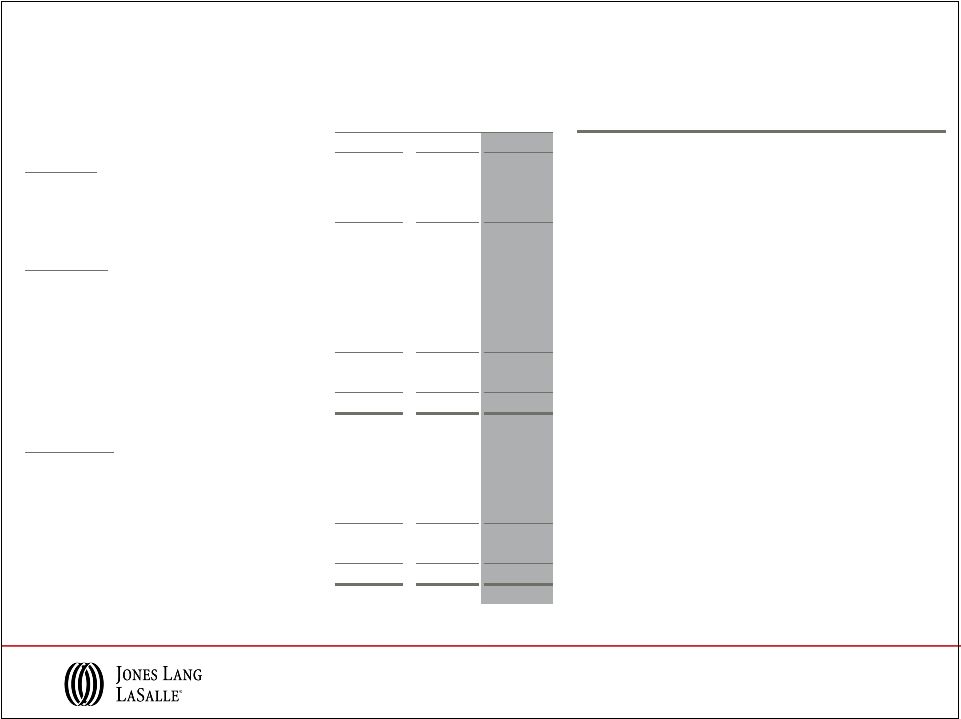

Solid Cash Flows and Balance Sheet Position

•

Steady quarterly improvement in Cash

from Operations

-

$16 million of restructuring charges

included in Q3 2011 Cash from Earnings

•

2011 acquisition activity supplements

organic growth:

-

King Sturge closed in Q2 2011

-

Second

deferred

Staubach

obligation

paid

in Q3 2011

-

Trinity Funds Management acquired in Q3

2011; $23 million of related co-investment

funded in Q3 2011

•

Investment grade ratings

Standard & Poor’s:

BBB-

(Outlook: Stable)

Moody’s Investor Services:

Baa2

(Outlook: Stable)

($ in millions)

YTD Q3 2011 Highlights

2011

Q1

Q2

Q3

Cash Flows

Cash from Earnings

$42

$81

$68

Working Capital

(239)

(20)

27

Cash from / (used in) Operations

($197)

$61

$95

Primary Uses

Capital Expenses

(17)

(19)

(20)

Acquisitions & Deferred Payment Obligations

(25)

(210)

(162)

Co-Investment

(2)

2

(47)

Dividends

-

(7)

-

Net Cash Outflows

($44)

($234)

($228)

Net Share Activity & Other Financing

(4)

(2)

(8)

Net Bank Debt (Borrowings) / Repayments

($245)

($175)

($141)

Balance Sheet

Cash

$101

$96

$86

Short Term Borrowings

42

45

54

Credit Facility

278

444

567

Net Bank Debt

$219

$393

$535

Deferred Business Obligations

293

439

292

Total Net Debt

$512

$832

$827

Net Interest Expense

$8.0

$9.6

$9.7

12 |

Appendix |

Capital Values

Capital Value

growth slowing

Capital Value

growth

accelerating

Capital Values

bottoming out

Capital Values

falling

Q3 2010

London

Washington DC

Paris,

Seoul

Beijing

Capital Value

growth slowing

Capital Value

growth

accelerating

Capital Values

bottoming out

Capital Values

falling

Hong Kong

Detroit

Dallas

Brussels, Madrid

Shanghai

Milan,

Mumbai,

Sydney

New York, Sao Paulo

Chicago, San Francisco

Toronto,

Singapore

Berlin, Stockholm, Tokyo

Q3 2011

Hong Kong

Washington DC

London

Moscow, Paris

Chicago,

Stockholm

Atlanta, Dallas

Frankfurt, Milan

Brussels

Seoul

Madrid ,

Tokyo Moscow

Atlanta,

Frankfurt

Detroit

Berlin,

Toronto

San Francisco, Beijing

New York, Sao Paulo

Shanghai

Singapore

Sydney

Mumbai

Americas

EMEA

Asia Pacific

As of Q3 2011

The Jones Lang LaSalle Property Clocks

SM

14 |

Leasing Market Fundamentals

Q3 2011

As of Q3 2011

The Jones Lang LaSalle Property Clocks

SM

Rental Value

growth slowing

Rental Value

growth

accelerating

Rental Values

bottoming out

Rental Values

falling

Paris, Stockholm

Mumbai, Sydney, Tokyo

Hong Kong

London,

Shanghai Milan, Johannesburg

Chicago

Madrid,

Seoul

Rental Value

growth slowing

Rental Values

falling

Rental Value

growth

accelerating

Rental Values

bottoming out

Detroit

Los Angeles

San Francisco

Berlin

Moscow

Q3 2010

Mexico City

Singapore

New York,

Brussels, Frankfurt

Atlanta, Dallas, Toronto, Rome

Dubai

Washington DC

Sao Paulo

Beijing

Detroit,

Dubai

Seoul

San Francisco

New York

Washington DC, Toronto, Milan

Dallas,

Mumbai

Atlanta

Frankfurt

Johannesburg

Chicago

Rome

Tokyo

Los Angeles

Brussels

Madrid

Berlin,

Sydney

Stockholm

Sao Paulo,

Paris

Beijing

London

Moscow

Mexico City

Hong Kong

Singapore

Shanghai

Americas

EMEA

Asia Pacific

15 |

16

Q3 2011 Adjusted EBITDA* Performance

Americas

EMEA

Asia Pacific

LIM

$46.5

$46.0

2011

2010

Consolidated

$93.7

$78.7

2011

2010

* Refer to slide 18 for Reconciliation of GAAP Net Income to adjusted EBITDA for the

three months ended September 30, 2011, and 2010, for details relative to these adjusted

EBITDA calculations. Segment EBITDA is calculated by adding the segment’s

Depreciation and amortization to its reported Operating income, which excludes Restructuring and

acquisition charges. Consolidated adjusted EBITDA is the sum of the EBITDA of the four

segments less net income attributable to non-controlling interests and dividends on

unvested common stock.

($ in millions)

$10.4

$7.4

2011

2010

$17.0

$11.0

2011

2010

$19.8

$13.6

2011

2010 |

17

YTD 2011 Adjusted EBITDA* Performance

Americas

EMEA

Asia Pacific

LIM

$107.1

$105.2

2011

2010

Consolidated

$216.0

$193.7

2011

2010

* Refer to slide 18 for Reconciliation of GAAP Net Income to adjusted EBITDA for the

nine months ended September 30, 2011, and 2010, for details relative to these adjusted

EBITDA calculations. Segment EBITDA is calculated by adding the segment’s

Depreciation and amortization to its reported Operating income, which excludes Restructuring and

acquisition charges. Consolidated adjusted EBITDA is the sum of the EBITDA of the four

segments less net income attributable to non-controlling interest and, dividends on

unvested common stock.

($ in millions)

$12.7

$14.3

2011

2010

$50.2

$33.7

2011

2010

$45.8

$33.0

2011

2010 |

18

($ in millions)

Reconciliation of GAAP Net Income to Adjusted EBITDA

Three Months Ended

September 30,

Nine Months Ended

September 30,

2011

2010

2011

2010

Net income attributable to common

shareholders

$33.9

$37.1

$79.2

$69.1

Add:

Interest expense, net of interest income

9.7

11.5

27.2

35.7

Provision for income taxes

11.3

26.9

20.8

Depreciation and amortization

22.8

17.7

60.5

53.0

EBITDA

$ 77.7

$ 77.4

$ 193.8

$ 178.6

Restructuring and acquisition charges

16.0

0.4

22.2

5.5

Non-cash co-investment charges

-

0.9

-

9.6

Adjusted EBITDA

$ 93.7

$ 78.7

$ 216.0

$ 193.7

11.1 |

19

($ in millions)

Reconciliation of GAAP Net Income to Adjusted Net Income

Three Months Ended

September 30,

Nine Months Ended

September 30,

2011

2010

2011

2010

GAAP Net income attributable to common

shareholders

$ 33.9

$ 37.1

$ 79.2

$ 69.1

Shares (in 000s)

44,355

44,089

44,377

44,064

GAAP earnings per share

$ 0.76

$ 0.84

$ 1.79

$ 1.57

GAAP Net income attributable to common

shareholders

$ 33.9

$ 37.1

$ 79.2

$ 69.1

Restructuring and acquisition charges, net

12.0

0.3

16.6

4.2

Intangible amortization, net

3.7

-

5.0

-

Non-cash co-investment charges, net

-

0.7

-

7.4

Adjusted net income

$ 49.6

$ 38.1

$ 100.8

$ 80.7

Shares (in 000s)

44,355

44,089

44,377

44,064

Adjusted earnings per share

$ 1.12

$ 0.86

$ 2.27

$ 1.83 |