Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - VALLEY NATIONAL BANCORP | d249270d8k.htm |

Investor

Presentation EXHIBIT 99.1 |

2

Forward Looking Statements

The

foregoing

contains

forward-looking

statements

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

Such

statements

are

not

historical

facts

and

include

expressions

about

management’s

confidence

and

strategies

and

management’s

expectations

about

new

and

existing

programs

and

products,

acquisitions,

relationships,

opportunities,

taxation,

technology,

market

conditions

and

economic

expectations.

These

statements

may

be

identified

by

such

forward-looking

terminology

as

“should,”

“expect,”

“believe,”

“view,”

“opportunity,”

“allow,”

“continues,”

“reflects,”

“typically,”

“usually,”

“anticipate,”

or

similar

statements

or

variations

of

such

terms.

Such

forward-looking

statements

involve

certain

risks

and

uncertainties.

Actual

results

may

differ

materially

from

such

forward-looking

statements.

Factors

that

may

cause

actual

results

to

differ

materially

from

those

contemplated

by

such

forward-

looking

statements

include,

but

are

not

limited

to:

a

continued

weakness

or

unexpected

decline

in

the

U.S.

economy,

in

particular

in

New

Jersey

and

the

New

York

Metropolitan

area;

other-than-temporary

impairment

charges

on

our

investment

securities;

higher

than

expected

increases

in

our

allowance

for

loan

losses;

higher

than

expected

increases

in

loan

losses

or

in

the

level

of

nonperforming

loans;

unexpected

changes

in

interest

rates;

higher

than

expected

tax

rates,

including

increases

resulting

from

changes

in

tax

laws,

regulations

and

case

law;

a

continued

or

unexpected

decline

in

real

estate

values

within

our

market

areas;

declines

in

value

in

our

investment

portfolio;

charges

against

earnings

related

to

the

change

in

fair

value

of

our

junior

subordinated

debentures;

higher

than

expected

FDIC

insurance

assessments;

the

failure

of

other

financial

institutions

with

whom

we

have

trading,

clearing,

counterparty

and

other

financial

relationships;

lack

of

liquidity

to

fund

our

various

cash

obligations;

unanticipated

reduction

in

our

deposit

base;

potential

acquisitions

that

may

disrupt

our

business;

government

intervention

in

the

U.S.

financial

system

and

the

effects

of

and

changes

in

trade

and

monetary

and

fiscal

policies

and

laws,

including

the

interest

rate

policies

of

the

Federal

Reserve;

legislative

and

regulatory

actions

(including

the

impact

of

the

Dodd-Frank

Wall

Street

Reform

and

Consumer

Protection

Act

and

related

regulations)

subject

us

to

additional

regulatory

oversight

which

may

result

in

increased

compliance

costs

and/or

require

us

to

change

our

business

model;

changes

in

accounting

policies

or

accounting

standards;

our

inability

to

promptly

adapt

to

technological

changes;

our

internal

controls

and

procedures

may

not

be

adequate

to

prevent

losses;

claims

and

litigation

pertaining

to

fiduciary

responsibility,

environmental

laws

and

other

matters;

the

possibility

that

the

expected

benefits

of

acquisitions

will

not

be

fully

realized,

including

lower

than

expected

cash

flows

from

covered

loan

pools

acquired

in

FDIC-assisted

transactions;

failure

to

obtain

shareholder

approval

for

the

merger

of

State

Bancorp

with

Valley

or

to

satisfy

other

conditions

to

the

merger

on

the

proposed

terms

and

within

the

proposed

timeframe

including,

without

limitation,

the

purchase

from

the

United

States

Department

of

the

Treasury

of

each

share

of

State

Bancorp’s

Series

A

Preferred

Stock

issued

under

the

Treasury’s

Capital

Purchase

Program;

and

other

unexpected

material

adverse

changes

in

our

operations

or

earnings.

A

detailed

discussion

of

factors

that

could

affect

our

results

is

included

in

our

SEC

filings,

including

the

“Risk

Factors”

section

of

our

Annual

Report

on

Form

10-

K

for

the

year

ended

December

31,

2010

and

our

Quarterly

Report

on

Form

10-Q

for

the

quarterly

period

ended

June

30,

2011

and

our

Form

10-Q/A

for

such

period.

We

undertake

no

duty

to

update

any

forward-looking

statement

to

conform

the

statement

to

actual

results

or

changes

in

our

expectations.

Although

we

believe

that

the

expectations

reflected

in

the

forward-looking

statements

are

reasonable,

we

cannot

guarantee

future

results,

levels

of

activity,

performance

or

achievements. |

3

Additional Information and Where to Find it

This

communication

does

not

constitute

an

offer

to

sell

or

the

solicitation

of

an

offer

to

buy

any

securities

or

a

solicitation

of

any

vote

or

approval.

In

connection

with

the

proposed

merger,

Valley

intends

to

file

a

proxy

statement/prospectus

with

the

Securities

and

Exchange

Commission.

INVESTORS

AND

SECURITY

HOLDERS

ARE

ADVISED

TO

READ

THE

PROXY

STATEMENT/PROSPECTUS

WHEN

IT

BECOMES

AVAILABLE,

BECAUSE

IT

WILL

CONTAIN

IMPORTANT

INFORMATION.

Investors

and

security

holders

may

obtain

a

free

copy

of

the

registration

statement

(when

available)

and

other

documents

filed

by

Valley

with

the

Commission

at

the

Commission’s

web

site

at

www.sec.gov.

These

documents

may

be

accessed

and

downloaded

for

free

at

Valley’s

web

site

at

http://www.valleynationalbank.com/filings.html

or

by

directing

a

request

to

Dianne

M.

Grenz,

First

Senior

Vice

President, Valley National Bancorp, at 1455 Valley Road, Wayne, New Jersey 07470, telephone

(973) 305-3380. Participants in the Solicitation

This

communication

is

not

a

solicitation

of

a

proxy

from

any

security

holder

of

State

Bancorp.

However,

Valley,

State

Bancorp,

their

respective

directors

and

executive

officers

and

other

persons

may

be

deemed

to

be

participants

in

the

solicitation

of

proxies

from

State

Bancorp’s

shareholders

in

respect

of

the

proposed

transaction.

Information

regarding

the

directors

and

executive

officers

of

Valley

may

be

found

in

its

definitive

proxy

statement

relating

to

its

2011

Annual

Meeting

of

Shareholders,

which

was

filed

with

the

Commission

on

March

11,

2011

and

can

be

obtained

free

of

charge

from

Valley’s

website.

Information

regarding

the

directors

and

executive

officers

of

State

Bancorp

may

be

found

in

its

definitive

proxy

statement

relating

to

its

2011

Annual

Meeting

of

Shareholders,

which

was

filed

with

the

Commission

on

March

25,

2011

and

can

be

obtained

free

of

charge

from

State

Bancorp’s

website.

Other

information

regarding

the

participants

in

the

proxy

solicitation

and

a

description

of

their

direct

and

indirect

interests,

by

security

holdings

or

otherwise,

will

be

contained

in

the

proxy

statement/prospectus and other relevant materials to be filed with the SEC when they become

available. |

Historical

Financial Data (1) (Dollars in millions, except for share data)

9/30/2011

14,231

$

108.8

$

$0.64

1.02

%

11.07

%

$0.52

5/11 -

5%

Stock Dividend

2010

14,144

131.2

0.78

0.93

10.32

0.69

5/10 -

5%

Stock Dividend

2009

14,284

116.1

0.61

0.81

8.64

0.69

5/09 -

5%

Stock Dividend

2008

14,718

93.6

0.61

0.69

8.74

0.69

5/08 -

5%

Stock Dividend

2007

12,749

153.2

1.05

1.25

16.43

0.69

5/07 -

5%

Stock Dividend

2006

12,395

163.7

1.10

1.33

17.24

0.67

5/06 -

5%

Stock Dividend

2005

12,436

163.4

1.12

1.39

19.17

0.65

5/05 -

5%

Stock Dividend

2004

10,763

154.4

1.11

1.51

22.77

0.63

5/04 -

5%

Stock Dividend

2003

9,873

153.4

1.10

1.63

24.21

0.60

5/03 -

5%

Stock Dividend

2002

9,148

154.6

1.06

1.78

23.59

0.57

5/02 -

5:4

Stock Split

2001

8,590

135.2

0.89

1.68

19.70

0.54

5/01 -

5%

Stock Dividend

2000

6,426

106.8

0.86

1.72

20.28

0.50

5/00 -

5%

Stock Dividend

1999

6,360

106.3

0.81

1.75

18.35

0.48

5/99 -

5%

Stock Dividend

1998

5,541

97.3

0.78

1.82

18.47

0.43

5/98 -

5:4

Stock Split

1997

5,091

85.0

0.71

1.67

18.88

0.38

5/97 -

5%

Stock Dividend

1996

4,687

67.5

0.62

1.47

17.23

0.34

5/96 -

5%

Stock Dividend

1995

4,586

62.6

0.57

1.40

16.60

0.32

5/95 -

5%

Stock Dividend

1994

3,744

59.0

0.63

1.60

20.03

0.30

5/94 -

10%

Stock Dividend

1993

3,605

56.4

0.61

1.62

21.42

0.24

4/93 -

5:4

Stock Split

1992

3,357

43.4

0.48

1.36

19.17

0.21

4/92 -

3:2

Stock Split

1991

3,055

31.7

0.35

1.29

15.40

0.20

Period End

Total Assets

Net Income

(2)

Common Stock Splits and Dividends

Diluted

Earnings Per

Common

Share

Return on

Average

Assets

Return on

Average

Equity

Cash Dividends

Declared Per

Common Share

4

Shareholder Returns

(1) All per share amounts have been adjusted retroactively for stock

splits and stock dividends during the periods presented. (2) Net income

includes other-than-temporary impairment charges on investment securities totaling $517 thousand, $2.9 million, $4.0 million,

$49.9 million, and $10.4 million, net of tax benefit, for the period ended

September 30, 2011, December 31, 2010, 2009, 2008, and 2007, respectively. |

Valley

National Bank Today About Valley

Regional Bank Holding Company

Approximately $14.2 Billion in

Assets

Headquartered in Wayne, New

Jersey

40

th

Largest United States

Chartered

Commercial Bank

One of the Largest Chartered

Commercial Banks

Headquartered in

New Jersey

Operates 197 Branches in 135

Communities Serving 14 counties

throughout Northern and Central

New Jersey, Manhattan, Brooklyn

and Queens

Traded on the NYSE (VLY)

Significant Attributes

Consistent Shareholder Returns

Focus on Credit Quality

Conservative Strategies

Affluent and Heavily Populated

Footprint

Strong Customer Service

Experienced Senior and Executive

Management

5 |

6

Management Approach

Large percentage of retail ownership

Long-term investment approach

Focus on cash and stock dividends

Large insider ownership, family members, retired

employees and retired directors

Market Cap of $2.2 Billion

Approximately 275 institutional holders

Source: Bloomberg as of 10/27/2011

Large Bank that Operates and Feels Like a Small Closely Held Company

|

7

Valley’s 3Q 2011 Highlights

Net Income

3Q net income available to common shareholders was $35.4 million

($0.21 Diluted EPS)

Loan Growth

Total non-covered loans increased by $35.1 million linked quarter, or 1.5%

on an annualized basis, to $9.3

billion

Residential Mortgage: 4.7% annualized growth linked quarter

Commercial Real Estate: 4.4% annualized growth linked quarter

Commercial & Industrial: 1.6% annualized growth linked quarter

Consumer Loans: (6.6%) annualized decline linked quarter

Credit Quality

Total 30+ day delinquencies were 1.73% of entire loan portfolio

Total non-accrual loans were 1.12% of total loans

Out of approximately 23,000 residential mortgages and home equity loans, only 269 loans were

past due 30 days

or more at September 30, 2011.

Net charge-offs were $4.8 million or 0.21% of average total non-covered loans during

3Q 2011 on an annualized basis compared with $6.2 million or 0.27% during 2Q

2011. Capital

Strong capital ratios

Merger Agreement with State Bancorp, Inc.

Received regulatory approval from the OCC and FRB NY

Closing anticipated for 12/31/2011 effective 1/1/2012 subject to

shareholder approval |

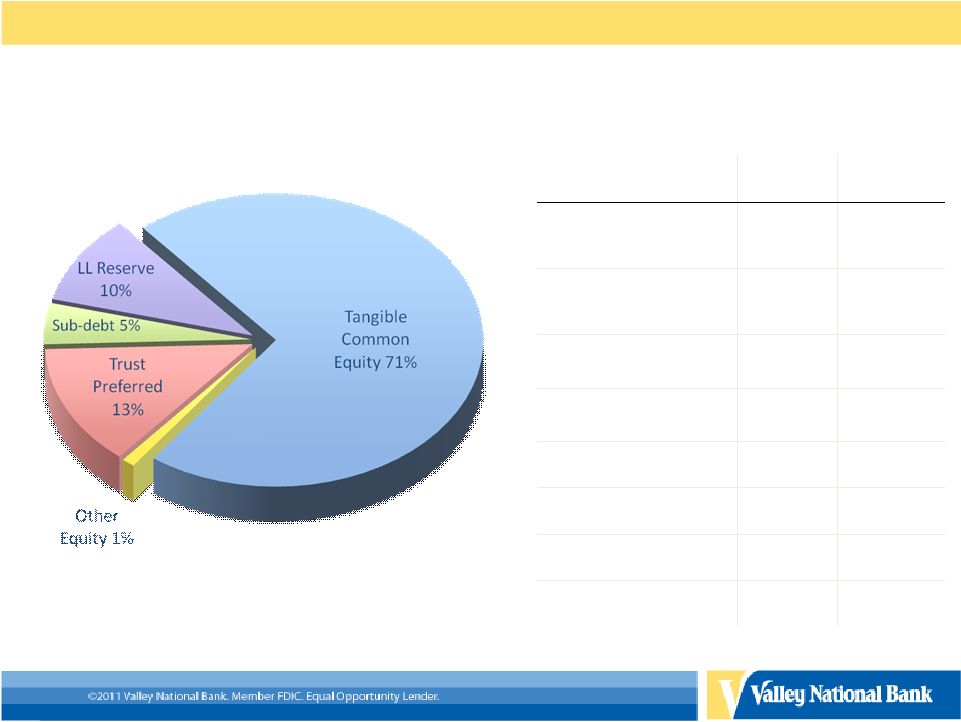

8

Equity Composition / Ratios*

Total Tier II Equity = $1.3 Billion

As of 09/30/11

Significant unrealized gain on facilities, referenced in slide 9,

not incorporated in capital ratios reflected above.

*Non-GAAP reconciliations shown on slide 29-30.

Capital Ratios

As of

09/30/2011

“Well

Capitalized”

Tangible Common Equity /

Tangible Assets

6.96%

N/A

Tangible Common Equity /

Risk-Weighted Assets

9.29%

N/A

Tier I Common Ratio

9.13%

N/A

Tier I

10.82%

6.00%

Tier II

12.65%

10.00%

Leverage

8.10%

5.00%

Book Value

$7.69

N/A

Tangible Book Value

$5.69

N/A |

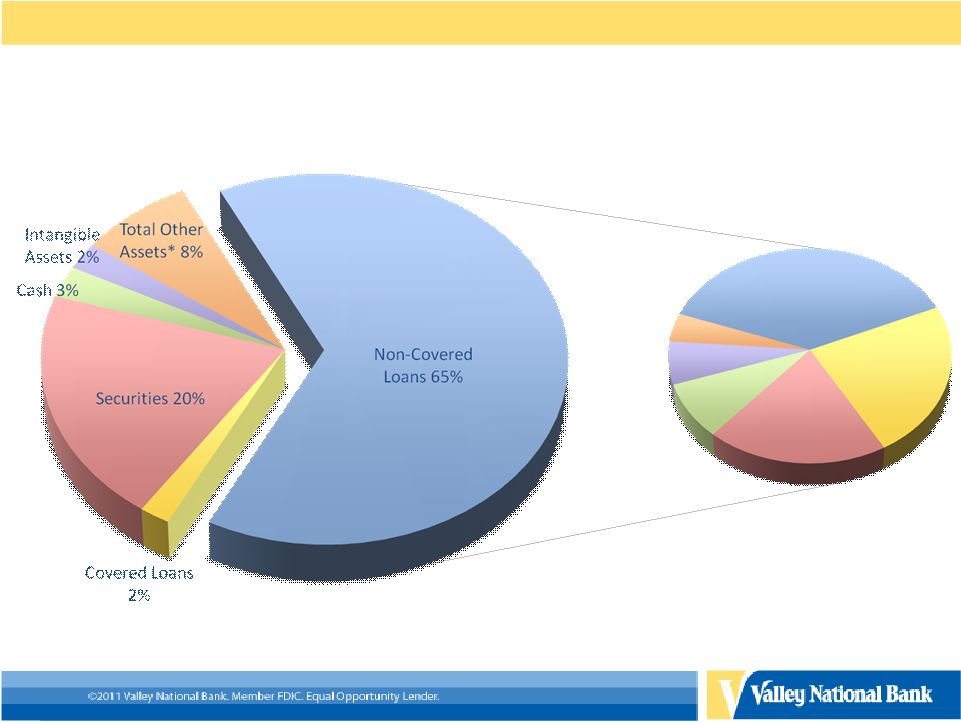

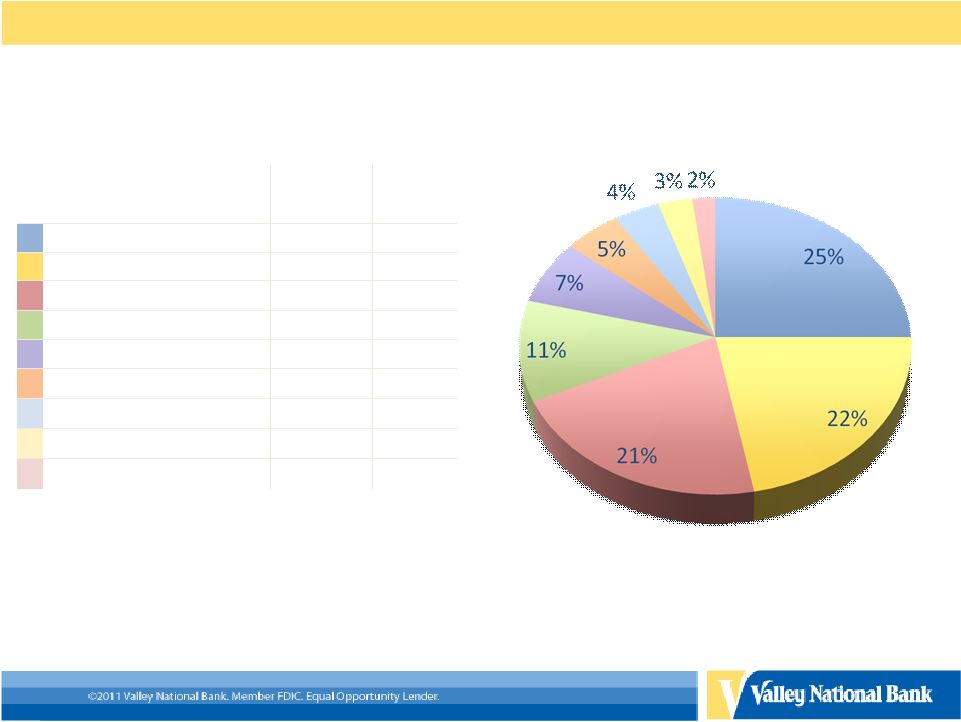

9

Asset and Loan Composition

Total Assets = $14.2 Billion

As of 09/30/2011

Non-Covered Loans (Gross) = $9.3 Billion

*Other Assets includes bank owned branch locations carried at a

cost estimated by management to be significantly less than the

current market value.

Construction

Loans

4%

Commercial

Real Estate

38%

Residential

Mortgages

23%

Commercial

Loans

20%

Auto Loans

8%

Other

Consumer

7% |

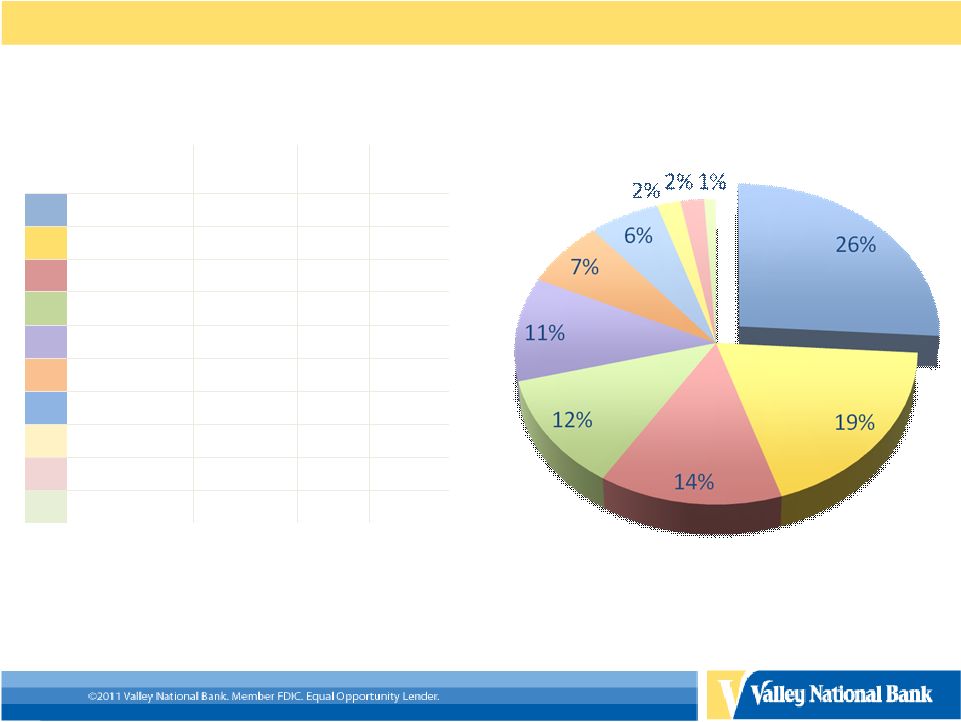

10

Total Commercial Real Estate -

$3.4 Billion

(Non-Covered Loans)

As of 08/31/11

Primary Property

Type

$ Amount

(Millions)

% of

Total

Average

LTV

Retail

895

26%

50%

Industrial

642

19%

52%

Apartments

469

14%

41%

Office

420

12%

53%

Mixed Use

370

11%

45%

Healthcare

236

7%

61%

Specialty

212

6%

50%

Residential

84

2%

49%

Land Loans

64

2%

67%

Other

32

1%

40%

Diversified Commercial Real Estate Portfolio

-Average LTV based on current balances and most recent appraised value

-The total CRE loan balance is based on Valley’s internal loan hierarchy

structure and does not reflect loan classifications reported in Valley’s SEC

and bank regulatory reports.

-The chart above does not include $359 Million in Construction loans.

|

11

Total Retail Property Types -

$895 Million

(Non-Covered Loans)

Retail Property Type

% of

Total

Average

LTV

Multi-Tenanted -

Anchor

25%

52%

Single Tenant

22%

51%

Multi-Tenanted -

No Anchor

21%

53%

Auto Dealership

11%

49%

Private & Public Clubs

7%

33%

Food Establishments

5%

54%

Entertainment Facilities

4%

45%

Private Education Facilities

3%

49%

Auto Servicing

2%

51%

Retail Composition of Commercial Real Estate

-Average LTV based on current balances and most recent appraised value

-The chart above does not include construction loans.

As of 08/31/11 |

12

Construction Loan Composition

Total (Non-Covered) Construction Loans -

$359 Million

Primary Property Type

$ Amount

(Millions)

% of

Total

Residential

140

39%

Retail

40

11%

Land Loans

53

15%

Mixed Use

39

11%

Apartments

33

9%

Other

18

5%

Industrial

14

4%

Specialty

9

3%

Office

8

2%

Healthcare

5

1%

-Construction loan balance is based on Valley’s internal loan hierarchy

structure and does not reflect loan classifications reported in Valley’s SEC

and bank regulatory reports.

As of 08/31/11 |

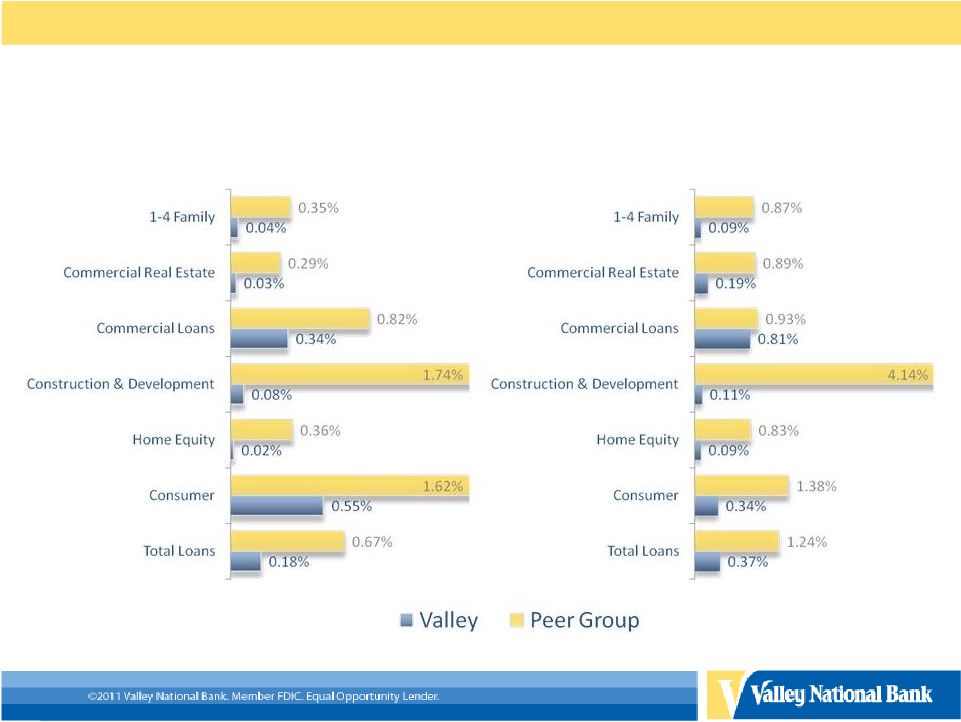

13

Net Charge-offs to Average Loans

Source -

SNL Financial As of 10/27/11

Peer group consists of banks with total assets between $3 billion and $50 billion.

2003 -

2010

2011 YTD |

14

Investment Portfolio

2011

Investment Types

2007

42%

GSE MBS (GNMA)

3%

15%

GSE MBS (FNMA/FHLMC)

49%

12%

Trust Preferred

12%

12%

State, County & Municipals

7%

7%

Other

7%

5%

US Treasury

0%

4%

Corporate Debt

17%

3%

Private Label MBS

5%

$2.9 Billion

Investment Portfolio

$3.1 Billion

As of 09/30/11 and 12/31/07

Duration of MBS Securities

2.00 Years

2.64 Years |

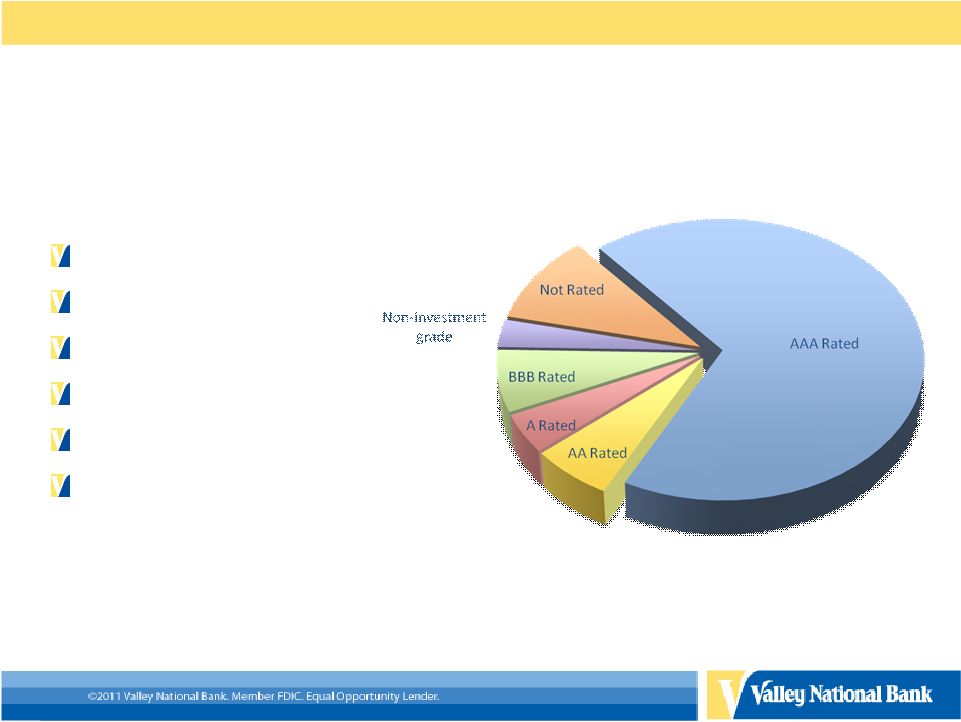

15

Securities by Investment Grade

AAA Rated 69%

AA Rated 6%

A Rated 5%

BBB Rated 7%

Non Investment Grade 3%

Not Rated 10%

As of 09/30/2011 |

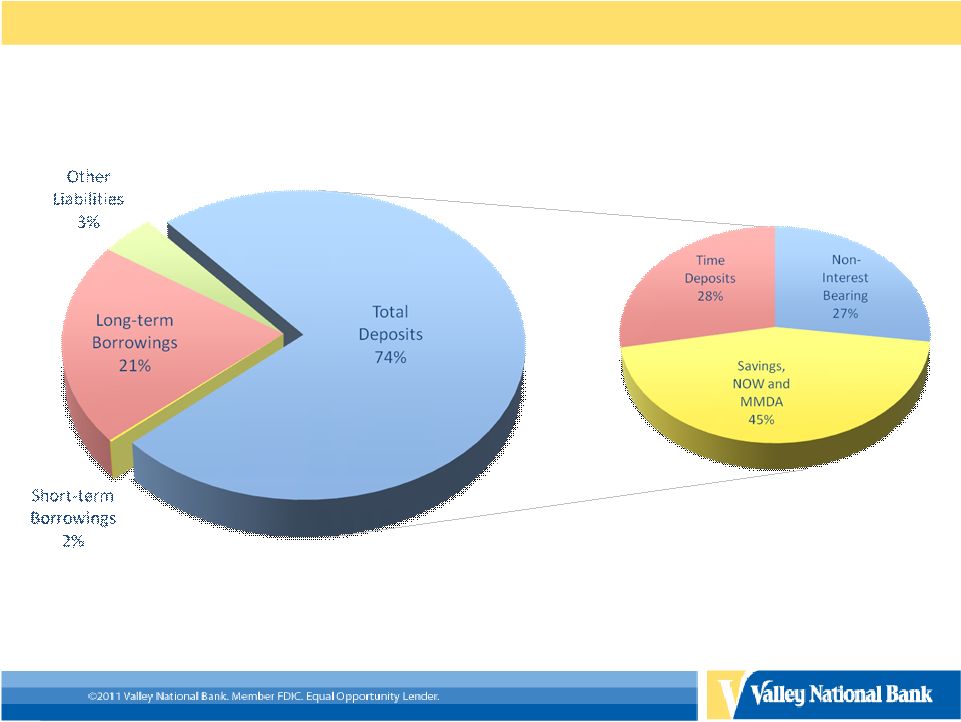

16

Deposits and Borrowings Composition

Total Liabilities = $12.9 Billion

As of 09/30/2011

Total Deposits = $9.6 Billion |

Merger

Overview 17 |

Strategic

Rationale for Transaction •

Powerful Super Community Bank Franchise

–

Strategic eastward geographic extension into a contiguous market

for

Valley

–

Strong middle market commercial lender which matches up with

Valley’s historic strengths

–

Significant core deposit funding franchise

–

Utilizes strong management team with extensive Long Island expertise

–

Clean balance sheet

•

Shared Vision of Banking

–

Relationship bank

–

Conservative management culture

•

Financially Advantageous

–

Commitment to strong capital

–

Accretive to income within one year

18 |

Summary of Key

Terms at Acquisition Price & Structure

Structure

•100% common stock consideration;

fixed 1 for 1 exchange ratio* Transaction Value

•~$222 million

TARP

•Preferred to be repaid &

warrants retired or converted to Valley instruments

Taxable / Non Taxable

•Non-taxable merger transaction

Pricing Multiples**

Price / Tangible Book

•1.85x

Price / 2012 Estimated

EPS

•17.9x (Does not include projected

cost saves, estimated to be 25%)

Price / Deposits

•16.6%

Core Deposit Premium

•8.6%

Assumptions

Loan Mark

•~2.30%

(in addition to ALLL balance as of 3/31/11 of $27.6 million)

Cost Saves

•~25% of 2010 of non-interest expense

Merger –Related Charges

•~$14 million after

tax Closing & Other

Due Diligence

•81% of loan portfolio reviewed by

Valley’s experienced staff

Approvals

•Subject to customary

regulatory and State shareholder approval Management Transitions

•VLY inherits strong seasoned

management team Expected Closing

•4Q 2011

*Adjusted to reflect the 5% stock dividend declared by Valley on

4/13/11

**Calculations based on Valley’s 10 day average closing share price

(4/14/11 – 4/28/11)

19 |

Valley’s

Eastward Expansion •

New York City

–

Acquired Merchants Bank in 2001 (7 branches)

–

Opened 7 De Novo locations

–

Acquired 2 locations with LibertyPointe and Park Avenue acquisitions

•

Brooklyn and Queens

–

Opened 13 De Novo locations since 2007

–

Acquired deposits and lending relationships from LibertyPointe and Park Avenue

acquisitions

•

Long Island

–

Due diligence on Valley’s expansion into Long Island commenced in 2008

•

Continuation of Valley’s eastward franchise expansion, Long Island phase restrained

between 2008 and 2010 due to economic uncertainty and lack of strong acquisition

candidate(s) –

Significant opportunities to fill in franchise

•

Opportunity to grow via De Novo branching

•

Still receptive to grow via acquisition

20 |

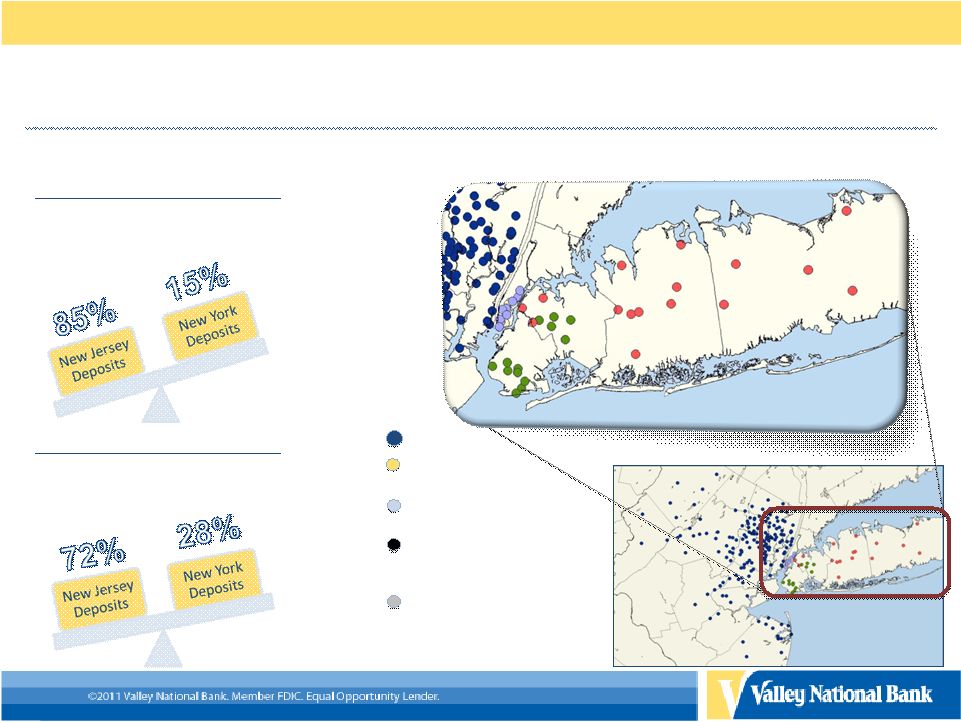

Strategic

Fit Valley’s New York Expansion Continues

2011 Total NY Relationships

•$2.9 billion in NY

deposits •$2.1 billion in

NY loans** * *Pro-forma deposits include State Bancorp;

pro-forma loans are inclusive of VLY C&I and State Bancorp 2001+ De

Novo Branches Manhattan -

9

2007+ Brooklyn/Queens

Brooklyn –

8

Queens -

5

State Bank Branches

Queens –

3

Nassau –

8

Suffolk –

5

Manhattan -

1

VLY NJ Branches -

169

2001 Merchant’s Branches

Manhattan -

7

2001 Total NY Relationships

•$950 million in NY deposits

•$473 million in NY

loans* * NY loans include C&I loans only

21 |

Demographic

Overview •

Familiar & Strong Demographics

–

High net worth marketplace

–

Population density

–

Large average deposits per branch

–

Significant number of businesses within marketplace

Region

Households

(HH) (2010)

HH per Sq

Mile

Avg. Income

per HH

Avg. Deposits

per Branch

Total

Businesses

NJ Core Market*

1,171,909

1,104

$96,097

$58.4 million

156,071

Brooklyn/Queens/NYC

2,474,719

12,203

$79,390

$239.6 million

291,176

Long Island

956,874

798

$113,739

$71.8 million

127,289

* Core Market Includes Passaic, Morris, Hudson, Essex and Bergen

Counties

22 |

Future

Opportunities •

Ability to lever Valley’s capital to grow Long Island Franchise

–

Opportunity to fill in Nassau and Suffolk county geography

•

Consumer Lending

–

Opportunity to introduce new products (State Bancorp does

not actively pursue consumer lending relationships)

•

Valley’s residential mortgage products

•

Valley’s consumer lending (auto & home equity) products

•

Commercial Lending

–

Opportunity to expand relationships

•

Larger lending limit

23 |

Pro-Forma

Impact Financial Highlights

Valley

03/31/2011

State Bank

03/31/2011

Pro-Forma*

Assets ($ Billion)

$14.4

$1.6

$16.0

Loans ($ Billion)

$9.4

$1.1

$10.5

Deposits ($ Billion)

$9.7

$1.3

$11.0

Branches

198

17

215

Tangible Common Equity /

Tangible Assets

6.88%

7.60%

6.68%

Tangible Book Value /

Share

(1)

$5.68

$7.12

$5.57

* Pro-Forma assets, loans and deposits have not been adjusted to reflect

purchase accounting adjustments. (1) Adjusted to reflect Valley’s 5%

stock dividend declared on April 13, 2011 24 |

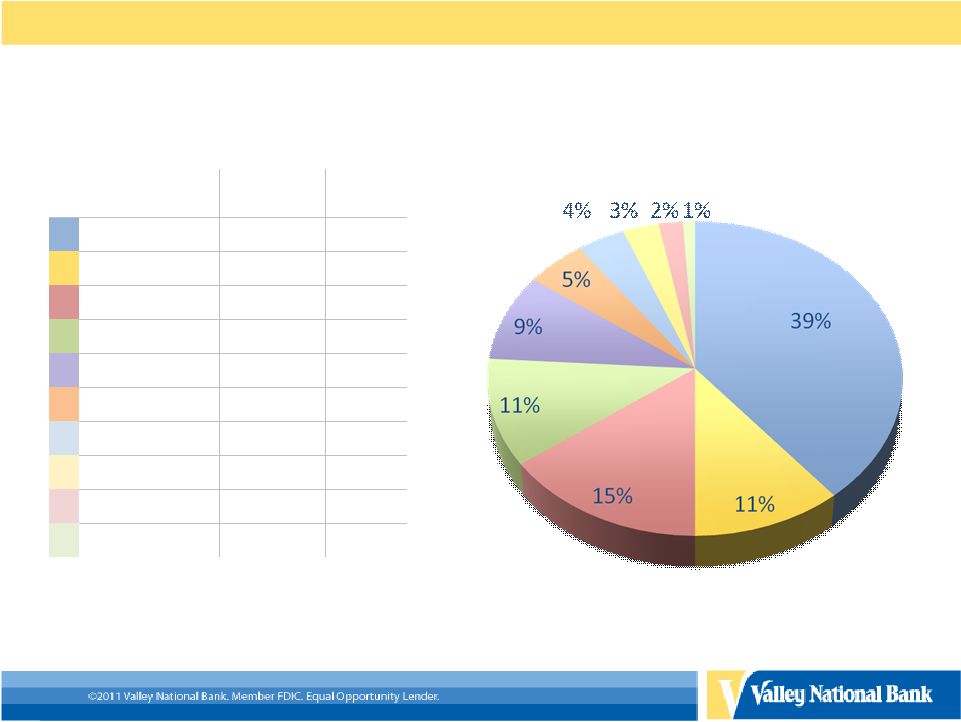

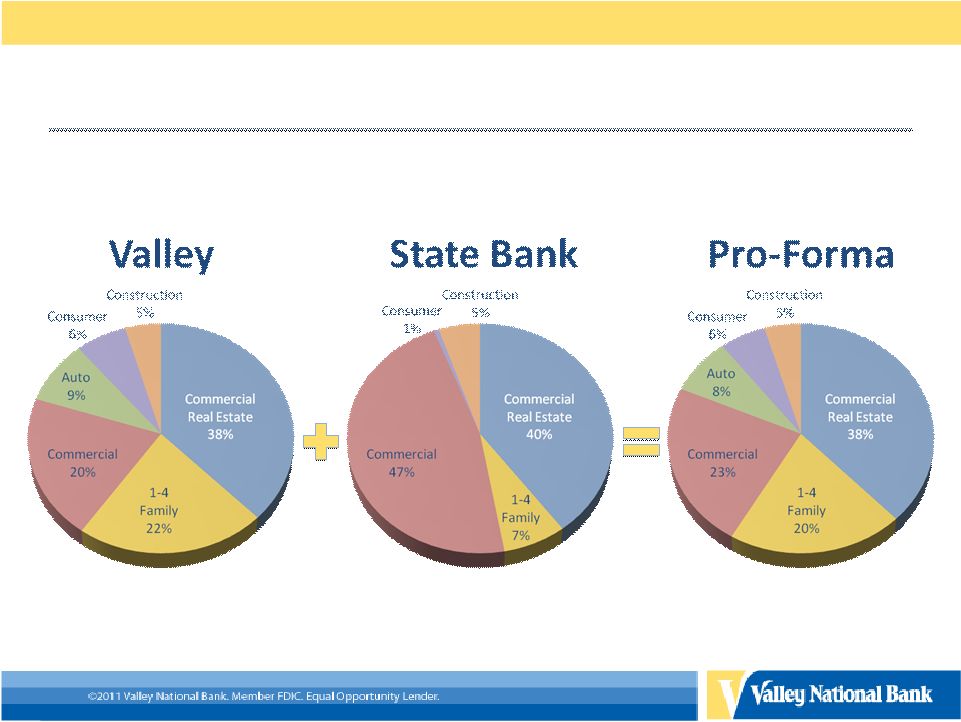

3/31/2011

Loan Mix Pro-Forma Impact

25 |

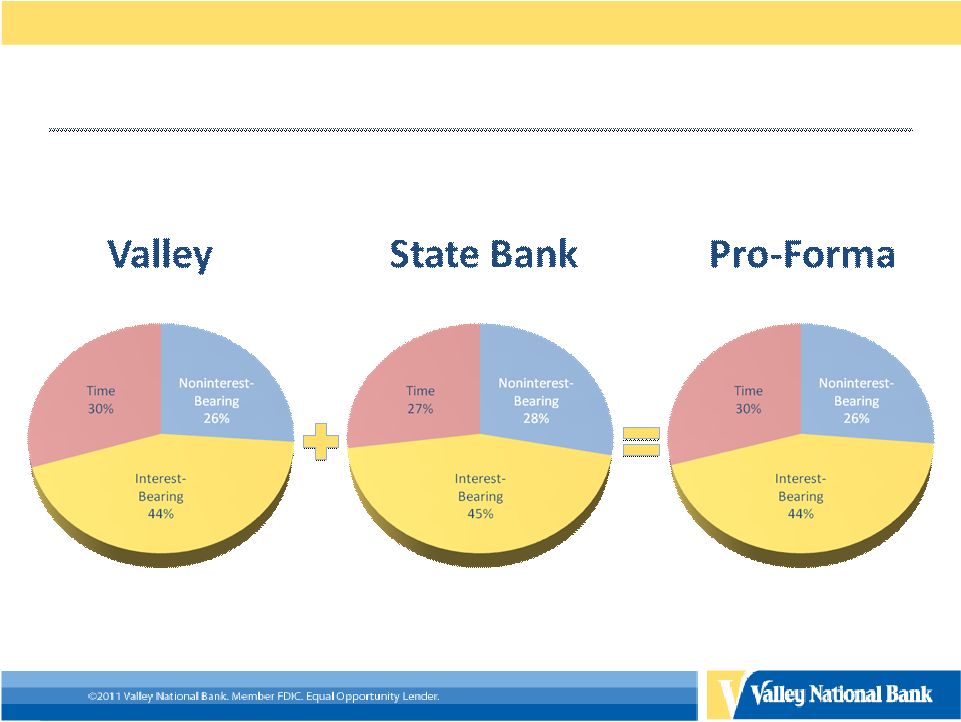

3/31/2011

Deposit Mix Pro-Forma Impact

26 |

Acquisition

History •

Customer Friendly

•

Employee Friendly

•

Seamless Transitions

•

Quick Conversions

Year

Recent Bank Acquisitions

Total Assets

Branches

Data Processing

Conversion

Period (Days)

2011

State Bank of Long Island (Jericho, NY)

$1,580 million

17

2010

The Park Avenue Bank (Manhattan, NY)

$480 million

5

91

2010

LibertyPointe Bank (Manhattan, NY)

$200 million

3

86

2008

Greater Community Bank (Totowa, NJ)

$976 million

16

40

2005

NorCrown Bank (Livingston, NJ)

$622 million

15

50

2005

Shrewsbury State Bank (Shrewsbury, NJ)

$425 million

12

51

2001

Merchants Bank of New York (Manhattan, NY)

$1,369 million

7

103

27 |

28

For More Information

Log onto our web site: www.valleynationalbank.com

E-mail requests to: dgrenz@valleynationalbank.com

Call Shareholder Relations at: (973) 305-3380

Write to: Valley National Bank

1455 Valley Road

Wayne, New Jersey 07470

Attn: Dianne M. Grenz, First Senior Vice President

Director of Marketing, Shareholder & Public Relations

Log onto our website above or www.sec.gov to obtain free copies of

documents filed by Valley with the SEC |

Total

Equity $1,307,102

Total Assets

$14,231,155

Less: Net unrealized gains on securities

available for sale

(7,164)

Less: Goodwill & Other Intangible Assets

(339,850)

Plus: Accumulated net gains (losses) on cash

flow hedges, net of tax

11,811

Total Tangible Assets (TA)

$13,891,305

Plus: Pension liability adjustment, net of tax

17,522

Total Equity

$1,307,102

Less: Goodwill

(317,962)

Less: Goodwill & Other Intangible Assets

(339,850)

Less: Disallowed deferred tax asset

(48,129)

Total Tangible Common Equity (TCE)

$967,252

Less: Disallowed other intangible assets

(12,506)

Tier I Common Capital

$950,674

Ratios

Plus: Trust preferred securities

176,313

TCE / TA

6.96%

Total Tier I Capital

$1,126,987

TCE / RWA

9.29%

Plus: Qualifying allowance for credit losses

$130,039

Plus: Qualifying sub debt

60,000

Tier I (Total Tier I / RWA)

10.82%

Total Tier II Capital

$1,317,026

Tier II (Total Tier II / RWA)

12.65%

Risk Weighted Assets (RWA)

$10,412,788

Tier I Common Capital Ratio

(Tier 1 common /RWA)

9.13%

29

09/30/2011

Non-GAAP Disclosure Reconciliations

($ in Thousands) |

30

09/30/2011

Non-GAAP Disclosure Reconciliations

($ in Thousands)

Common Shares Outstanding

170,025,364

Shareholders’ Equity

$1,307,102

Less: Goodwill and Other

Intangible Assets

(339,850)

Tangible Shareholders’ Equity

$967,252

Tangible Book Value

$5.69 |