Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Polypore International, Inc. | a11-28955_28k.htm |

Exhibit 99.1

|

|

(NYSE Listed: PPO) Third Quarter 2011 Supplemental Financial Information |

|

|

2 These materials include "forward-looking statements." All statements other than statements of historical facts included in these materials that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements including, in particular, the statements about Polypore International's plans, objectives, strategies and prospects regarding, among other things, the financial condition, results of operations and business of Polypore International and its subsidiaries. We have identified some of these forward-looking statements with words like "believe," "may," "will," "should," "expect," "intend," "plan," "predict," "anticipate," "estimate" or "continue" and other words and terms of similar meaning. These forward-looking statements are based on current expectations about future events affecting us and are subject to uncertainties and factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control. Many factors mentioned in our discussion in these materials will be important in determining future results. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we do not know whether our expectations will prove correct. They can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including with respect to Polypore International, the following, among other things: the highly competitive nature of the markets in which we sell our products; the failure to continue to develop innovative products; the loss of our customers; the vertical integration by our customers of the production of our products into their own manufacturing process; increases in prices for raw materials or the loss of key supplier contracts; our substantial indebtedness; interest rate risk related to our variable rate indebtedness; our inability to generate cash; restrictions related to the senior secured credit agreement; employee slowdowns, strikes or similar actions; product liability claims exposure; risks in connection with our operations outside the United States, including compliance with applicable anti-corruption laws; the incurrence of substantial costs to comply with, or as a result of violations of, or liabilities under environmental laws; the failure to protect our intellectual property; the loss of senior management; the incurrence of additional debt, contingent liabilities and expenses in connection with future acquisitions; the failure to effectively integrate newly acquired operations; the absence of expected returns from the intangible assets we have recorded; the adverse impact from legal proceedings on our financial condition; and natural disasters, epidemics, terrorist acts and other events beyond our control. Because our actual results, performance or achievements could differ materially from those expressed in, or implied by, the forward-looking statements, we cannot give any assurance that any of the events anticipated by the forward-looking statements will occur or, if any of them do, what impact they will have on Polypore International's results of operations and financial condition. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of these materials. We do not undertake any obligation to update these forward-looking statements in these materials to reflect new information, future events or otherwise, except as may be required under federal securities laws. Safe Harbor Statement |

|

|

3 Third Quarter Results (1) (unaudited) (in millions, except net income per share) Three Months Ended Adjusted Adjusted October 1, October 2, 2011 2010 (2) Net sales 190.1 $ 151.7 $ Cost of goods sold 113.2 94.4 Gross profit 76.9 57.3 Gross profit margin 40.5% 37.8% Selling, general and administrative expenses 30.5 27.5 Operating income 46.4 29.8 Operating income margin 24.4% 19.6% Interest expense and other, net 8.5 11.5 Income before income taxes 37.9 18.3 Income taxes 12.5 5.1 Net income 25.4 $ 13.2 $ Net income per share - diluted 0.54 $ 0.28 $ Weighted average shares outstanding - diluted 47.2 46.6 (1) The adjusted results on this page represent non-GAAP financial information. Refer to Exhibits A, C and E for reconciliation from GAAP results to adjusted results. (2) During the third quarter of 2011, the adjustments used in calculating the "Adjusted" results included in this presentation were modified to be consistent with the adjustments used in calculating Adjusted EBITDA, as defined in the Company's senior secured credit agreement. The "Adjusted" results exclude certain non-operating items, business restructuring costs and other non-cash or non-recurring charges, consistent with the calculation of Adjusted EBITDA. Amounts previously reported for the "Adjusted" results for the three months ended October 2, 2010 have been conformed to the current year presentation and the impact on the prior period is not significant. |

|

|

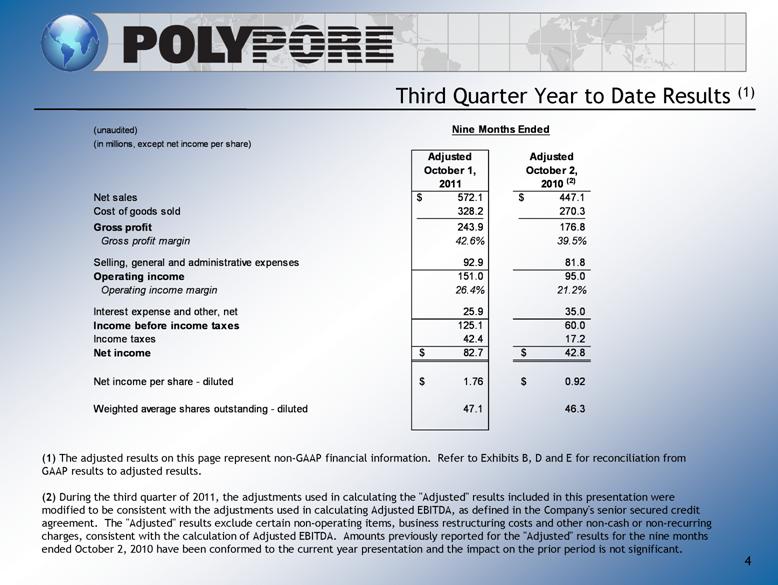

4 Third Quarter Year to Date Results (1) (unaudited) (in millions, except net income per share) Nine Months Ended Adjusted Adjusted October 1, October 2, 2011 2010 (2) Net sales 572.1 $ 447.1 $ Cost of goods sold 328.2 270.3 Gross profit 243.9 176.8 Gross profit margin 42.6% 39.5% Selling, general and administrative expenses 92.9 81.8 Operating income 151.0 95.0 Operating income margin 26.4% 21.2% Interest expense and other, net 25.9 35.0 Income before income taxes 125.1 60.0 Income taxes 42.4 17.2 Net income 82.7 $ 42.8 $ Net income per share - diluted 1.76 $ 0.92 $ Weighted average shares outstanding - diluted 47.1 46.3 (1) The adjusted results on this page represent non-GAAP financial information. Refer to Exhibits B, D and E for reconciliation from GAAP results to adjusted results. (2) During the third quarter of 2011, the adjustments used in calculating the "Adjusted" results included in this presentation were modified to be consistent with the adjustments used in calculating Adjusted EBITDA, as defined in the Company's senior secured credit agreement. The "Adjusted" results exclude certain non-operating items, business restructuring costs and other non-cash or non-recurring charges, consistent with the calculation of Adjusted EBITDA. Amounts previously reported for the "Adjusted" results for the nine months ended October 2, 2010 have been conformed to the current year presentation and the impact on the prior period is not significant. |

|

|

Segment Results (1) (unaudited, in millions) Three Months Ended Nine Months Ended Sales October 1, 2011 October 2, 2010 Change October 1, 2011 October 2, 2010 Change Energy storage Lead-acid battery separators $ 89.9 $ 79.2 13.5% $ 281.3 $ 225.1 25.0% Lithium battery separators 56.1 34.1 64.5% 149.0 97.1 53.5% Total 146.0 113.3 28.9% 430.3 322.2 33.6% Separations media Healthcare 28.0 23.0 21.7% 88.5 77.4 14.3% Filtration and specialty 16.1 15.4 4.5% 53.3 47.5 12.2% Total 44.1 38.4 14.8% 141.8 124.9 13.5% Total $ 190.1 $ 151.7 25.3% $ 572.1 $ 447.1 28.0% Gross Profit Energy storage - $ $ 61.0 $ 42.5 43.5% $ 182.3 $ 120.7 51.0% % sales 41.8% 37.5% 42.4% 37.5% Separations media - $ 15.9 14.8 7.4% 61.6 56.1 9.8% % sales 36.1% 38.5% 43.4% 44.9% Gross profit $ 76.9 $ 57.3 34.2% $ 243.9 $ 176.8 38.0% Gross profit % 40.5% 37.8% 42.6% 39.5% Segment Operating Income (1) Energy storage - $ $ 38.6 $ 23.2 66.4% $ 113.8 $ 63.8 78.4% % sales 26.4% 20.5% 26.4% 19.8% Separations media - $ 7.8 6.6 18.2% 37.2 31.2 19.2% % sales 17.7% 17.2% 26.2% 25.0% Segment operating income $ 46.4 $ 29.8 55.7% $ 151.0 $ 95.0 58.9% Segment operating income % 24.4% 19.6% 26.4% 21.2% (1) See Exhibit F for a reconciliation of Segment Operating Income to Income Before Income Taxes. 5 |

|

|

6 EXHIBITS |

|

|

7 Exhibit A Third Quarter 2011 Results (unaudited) (in millions, except net income per share) Three Months Ended October 1, 2011 As Reported Adjustments As Adjusted Net sales 190.1 $ - $ 190.1 $ Cost of goods sold 113.2 - 113.2 Gross profit 76.9 - 76.9 Selling, general and administrative expenses 33.1 2.6 a,b 30.5 Operating income 43.8 (2.6) 46.4 Other (income) expense: Interest expense, net 8.5 - 8.5 Foreign currency and other (0.4) (0.4) c - 8.1 (0.4) 8.5 Income before income taxes 35.7 (2.2) 37.9 Income taxes 12.1 (0.4) d 12.5 Net income 23.6 $ (1.8) $ 25.4 $ Net income per share - diluted 0.50 $ (0.04) $ 0.54 $ Weighted average shares outstanding - diluted 47.2 47.2 Please see Exhibit E for description of adjustments. |

|

|

8 Exhibit B Third Quarter YTD 2011 Results Nine Months Ended October 1, 2011 (unaudited) (in millions, except net income per share) As Reported Adjustments As Adjusted Net sales 572.1 $ - $ 572.1 $ Cost of goods sold 328.2 - 328.2 Gross profit 243.9 - 243.9 Selling, general and administrative expenses 98.1 5.2 a,b 92.9 Operating income 145.8 (5.2) 151.0 Other (income) expense: Interest expense, net 25.9 - 25.9 Foreign currency and other 0.4 0.4 c - 26.3 0.4 25.9 Income before income taxes 119.5 (5.6) 125.1 Income taxes 40.7 (1.7) d 42.4 Net income 78.8 $ (3.9) $ 82.7 $ Net income per share - diluted 1.67 $ (0.09) $ 1.76 $ Weighted average shares outstanding - diluted 47.1 47.1 Please see Exhibit E for description of adjustments. |

|

|

9 Exhibit C Third Quarter 2010 Results (unaudited) (in millions, except net income per share) Three Months Ended October 2, 2010 As Reported Adjustments As Adjusted Net sales 151.7 $ - $ 151.7 $ Cost of goods sold 94.4 - 94.4 Gross profit 57.3 - 57.3 Selling, general and administrative expenses 28.3 0.8 a,b 27.5 Business restructuring 0.1 0.1 - Operating income 28.9 (0.9) 29.8 Other (income) expense: Interest expense, net 12.1 - 12.1 Foreign currency and other - 0.6 c (0.6) 12.1 0.6 11.5 Income before income taxes 16.8 (1.5) 18.3 Income taxes 4.4 (0.7) d 5.1 Net income 12.4 $ (0.8) $ 13.2 $ Net income per share - diluted 0.27 $ (0.01) $ 0.28 $ Weighted average shares outstanding - diluted 46.6 46.6 Please see Exhibit E for description of adjustments. |

|

|

10 Exhibit D Third Quarter YTD 2010 Results (unaudited) (in millions, except net income per share) Nine Months Ended October 2, 2010 As Reported Adjustments As Adjusted Net sales 447.1 $ - $ 447.1 $ Cost of goods sold 270.3 - 270.3 Gross profit 176.8 - 176.8 Selling, general and administrative expenses 84.3 2.5 a,b 81.8 Business restructuring (0.8) (0.8) - Operating income 93.3 (1.7) 95.0 Other (income) expense: Interest expense, net 35.4 - 35.4 Gain on sale of Italian subsidiary (3.3) (3.3) - Foreign currency and other (0.8) (0.4) c (0.4) 31.3 (3.7) 35.0 Income before income taxes 62.0 2.0 60.0 Income taxes 16.1 (1.1) d 17.2 Net income 45.9 $ 3.1 $ 42.8 $ Net income per share - diluted 0.99 $ 0.07 $ 0.92 $ Weighted average shares outstanding - diluted 46.3 46.3 Please see Exhibit E for description of adjustments. |

|

|

11 Exhibit E Description of adjustments a FTC-related costs incurred due to the ongoing litigation concerning the acquisition of Microporous. b Stock-based compensation. c Foreign currency (gain) loss. d Impact of adjustments on income taxes. |

|

|

12 Exhibit F Reconciliation of Segment Operating Income Reconciliation of Segment Operating Income to Income Before Income Taxes (unaudited, in millions) Three Months Ended Nine Months Ended October 1, 2011 October 2, 2010 October 1, 2011 October 2, 2010 Operating income: Energy storage 38.6 $ 23.2 $ 113.8 $ 63.8 $ Separations media 7.8 6.6 37.2 31.2 Segment operating income 46.4 29.8 151.0 95.0 Stock-based compensation 2.5 0.6 4.6 1.7 Business restructuring - 0.1 - (0.8) Non-recurring and other costs 0.1 0.2 0.6 0.8 Total operating income 43.8 28.9 145.8 93.3 Reconciling items: Interest expense, net 8.5 12.1 25.9 35.4 Gain on sale of Italian subsidiary - - - (3.3) Foreign currency and other (0.4) - 0.4 (0.8) Income before income taxes 35.7 $ 16.8 $ 119.5 $ 62.0 $ |