Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENCORE CAPITAL GROUP INC | d249238d8k.htm |

November 2, 2011

ENCORE CAPITAL GROUP

Exhibit 99.1 |

CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS

2

The statements in this presentation that are not historical facts, including, most

importantly, those statements preceded by, or that include, the words

“may,” “believe,”

“projects,”

“expects,”

“anticipates”

or the negation thereof, or similar

expressions, constitute “forward-looking statements”

within the meaning of the Private

Securities Litigation Reform Act of 1995 (the “Reform Act”).

These statements may

include, but are not limited to, statements regarding our future

operating results and

growth.

For all “forward-looking statements,”

the Company claims the protection of

the safe harbor for forward-looking statements contained in the Reform

Act. Such

forward-looking statements involve risks, uncertainties and other factors which

may cause actual results, performance or achievements of the Company

and its

subsidiaries to be materially different from any future results,

performance or

achievements expressed or implied by such forward-looking statements. These

risks, uncertainties and other factors are discussed in the reports filed by

the Company with the Securities and Exchange Commission, including the most

recent reports on Forms 10-K, 10-Q and 8-K, each as it may be

amended from time to time. The

Company disclaims any intent or obligation to update these forward-looking

statements.

FORWARD-LOOKING STATEMENTS |

INVESTMENT HIGHLIGHTS

3

•

Investments made over the past few years have driven

significant improvements in collections, cash flow and earnings

•

Difficult regulatory environment being managed proactively

•

Demonstrated ability to raise and profitably deploy capital in

favorable and unfavorable business cycles

•

Analytic insights that inform our valuation and operating strategies

allow for a closer partnership with consumers

•

Operational and financial leverage is improving, largely due to the

success of our operating center in India and new strategic initiatives

|

ENCORE

IS A LEADING PLAYER IN THE CONSUMER DEBT BUYING AND RECOVERY INDUSTRY

4

Global Capabilities

St Cloud, MN

Arlington, TX

Phoenix, AZ

Delhi, India

Call Center /

Technology Site

Call Center Site

Ascension

Call Center Site

San Diego, CA

Debt Purchasing & Collections

Bankruptcy Servicing

Headquarters/

Call Center Site

Revenue Composition

As of September 30, 2011

Debt Purchasing & Collections

Bankruptcy Servicing

•

Purchase and collection of

charged-off unsecured

consumer receivables

(primarily credit card)

•

Robust business model

emphasizing consumer

intelligence and

operational

specialization

•

Invested ~$2.1 billion to

acquire receivables with a face

value of ~$63 billion

•

Acquired ~38 million consumer

accounts since

inception

•

Process secured consumer bankruptcy accounts for leading

auto

lenders and other financial institutions

•

Proprietary software dedicated to bankruptcy servicing

•

Operational platform that integrates lenders, trustees,

and

consumers

Call Center

Site 2012

Costa Rica |

ENCORE

HAS GENERATED STRONG RESULTS DESPITE THE MACROECONOMIC DOWNTURN

5

($ millions)

*

Adjusted EBITDA is a non-GAAP number. The Company considers Adjusted EBITDA to

be a meaningful indicator of operating performance and uses it as a measure to

assess the operating performance of the Company. See Reconciliation of Adjusted

EBITDA to GAAP Net Income in Appendix B to this presentation **

LTM data as of 09/30/2011

Adjusted EBITDA* and Gross Collections by year |

Metric

Recent trend

•

Payer rates

•

Modestly upward

•

Average payment

size

•

Stable

•

Payment style

•

More payment

plans

•

Broken payer

rates

•

Mild improvement

•

Settlement rates

•

Stable

6

OUR CONSUMERS HAVE SHOWN THAT THEY ARE RESILIENT AS EVIDENCED

BY THE INCREASE OF PAYER RATES

Overall Payer Rate for All Active Inventory |

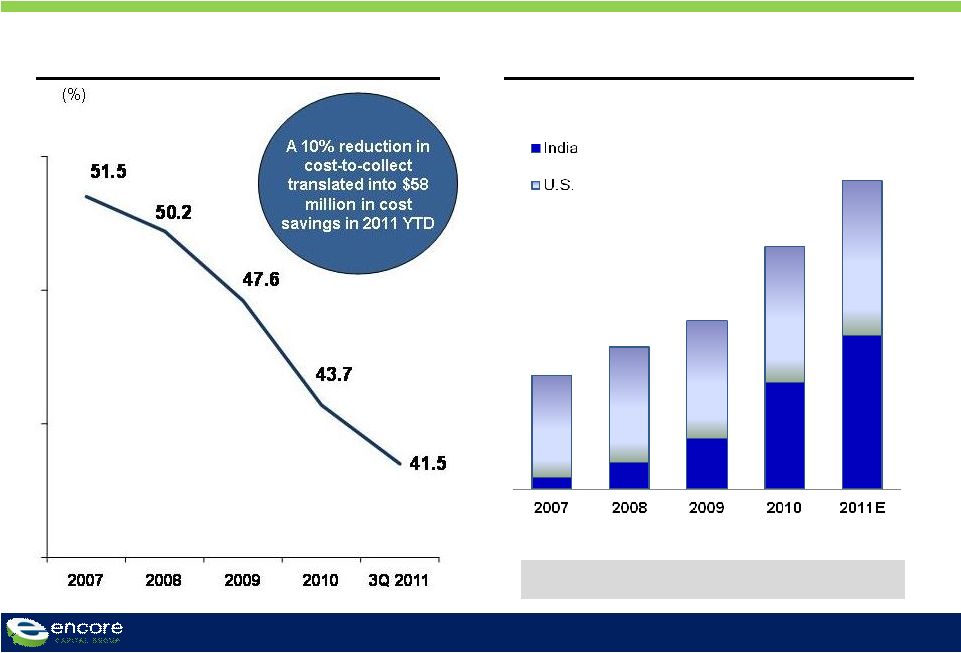

WE HAVE

FUNDAMENTALLY CHANGED THE COST STRUCTURE OF THE COMPANY OVER THE PAST FOUR

YEARS, LED BY OUR INDIA CENTER 7

Overall Cost-to-Collect

Collections from all Call Centers

Percent of Total from India

$126

$157

$186

$268

~$340

10%

19%

30%

44%

50%

($ millions) |

DIVERSIFIED PURCHASE ACTIVITY AND CONSERVATIVE PROJECTIONS HAVE

RESULTED IN A RESERVOIR OF FUTURE COLLECTIONS

8 |

OUR

BUSINESS MODEL IS CRITICALLY IMPORTANT, AS IT PROVIDES THE CONSUMER WITH TIME

TO RECOVER 9

Timeframe

Process and

relationship

with consumers

Outcome

•

Charge-off threshold

extends a maximum of

6 months

Transactional

•

Attempt immediate

resolution during

delinquency cycle

(days 30 –

180)

•

Consumer is “charged-

off”

by issuer on day 181

•

Issuer offers to sell

unsecured, charged-off

debt or service through

3rd party agencies

ORIGINAL

CREDITOR

•

Four-to-six month

collection cycle

Pressured

•

Artificial deadlines

•

Multiple collection

companies

•

Counterproductive

incentive structure

•

Consumer is

confused and

frustrated

CONTINGENCY

COLLECTION

AGENCY

•

Consumer has 84 months

to recover financially

Partnership

•

Create partnership strategy

and set goals

•

Tailor work strategies to

individual circumstances,

giving them time for a

consumer to recover

•

Maximizes likelihood of

repayment, creates

consistency, and ensures

that consumers are treated

fairly |

WE

HAVE TAKEN A LEADERSHIP STANCE BY OUTLINING OUR CORE PRINCIPLES IN AN

INDUSTRY-FIRST CONSUMER BILL OF RIGHTS 10 |

PURCHASING

ACCURACY

AND

OUR

ANALYTIC

OPERATING

MODEL

HAVE

LED

US

TO

CONSISTENTLY

OUTPERFORM

OUR

PEERS

11

Cumulative

Actual

Collection

Multiples

by

Vintage

Year

as

of

June

30,

2011

(Total

Collections

/

Purchase

Price)

Source:

SEC

Filings,

Encore

Capital

Group

Inc.

Since 2000, 95%

of our portfolio

purchases have

been profitable |

WE

HAVE CONSISTENTLY OUTPERFORMED OUR PEERS AND THE S&P 500 12

Source: FactSet (10/28/2011)

Total Return

1-Year (%)

3-Year (%)

5-Year (%) |

WE ARE

WELL POSITIONED TO CAPITALIZE ON A CHANGING ENVIRONMENT 13

•

Diversified purchase model

–

Ability to increase purchases is a result of having capabilities

across asset classes, age and balance

•

New operational initiatives

–

Insourcing of legal function over time will drive increasing margin

contributions in the future

•

Robust consumer-level underwriting

–

Continue to develop new insights about our consumers while

addressing a growing population of Spanish-speaking consumers

•

Lower-cost collection platform

–

Capture incremental value through increased low-cost collection

activities in India and Costa Rica |

APPENDIX |

APPENDIX A: CUMULATIVE COLLECTIONS BY PORTFOLIO VINTAGE

15

Cumulative Collections through September 30, 2011 (000’s)

Year

of

Purchase

Purchase

Price

<2005

2005

2006

2007

2008

2009

2010

2011

Total

CCM

<2005

$385,474

$749,791

$224,620

$164,211

$85,333

$45,893

$27,708

$19,986

$12,084

$1,329,626

3.4

2005

192,585

66,491

129,809

109,078

67,346

42,387

27,210

14,850

457,171

2.4

2006

141,028

42,354

92,265

70,743

44,553

26,201

14,567

290,683

2.1

2007

204,099

68,048

145,272

111,117

70,572

35,566

430,575

2.1

2008

227,867

69,049

165,164

127,799

70,604

432,616

1.9

2009

253,401

96,529

206,773

131,861

435,163

1.7

2010

358,989

125,853

225,530

351,383

1.0

2011

249,284

70,036

70,036

0.3

Total

$2,012,727

$749,791

$291,111

$336,374

$354,724

$398,303

$487,458

$604,394

$575,098

$3,797,253

1.9 |

APPENDIX B: RECONCILIATION OF ADJUSTED EBITDA

16

Reconciliation of Adjusted EBITDA to GAAP Net Income

(Unaudited, In Thousands)

Three Months Ended

Note:

The

periods

3/31/07

through

12/31/08

have

been

adjusted

to

reflect

the

retrospective

application

of

ASC

470-20

3/31/07

6/30/07

9/30/07

12/31/07

3/31/08

6/30/08

9/30/08

12/31/08

3/31/09

6/30/09

9/30/09

12/31/09

GAAP net income, as reported

4,991

(1,515)

4,568

4,187

6,751

6,162

3,028

(2,095)

8,997

6,641

9,004

8,405

Interest expense

4,042

4,506

4,840

5,260

5,200

4,831

5,140

5,401

4,273

3,958

3,970

3,959

Contingent interest expense

3,235

888

-

-

-

-

-

-

-

-

-

-

Pay-off of future contingent interest

-

11,733

-

-

-

-

-

-

-

-

-

-

Provision for income taxes

3,437

(1,031)

1,315

2,777

4,509

4,225

2,408

(1,442)

5,973

4,166

5,948

4,609

Depreciation and amortization

869

840

833

810

722

766

674

652

623

620

652

697

Amount applied to principal on receivable portfolios

28,259

29,452

26,114

29,498

40,212

35,785

35,140

46,364

42,851

48,303

49,188

47,384

Stock-based compensation expense

801

1,204

1,281

1,001

1,094

1,228

860

382

1,080

994

1,261

1,049

Adjusted EBITDA

45,634

46,077

38,951

43,533

58,488

52,997

47,250

49,262

63,797

64,682

70,023

66,103

3/31/10

6/30/10

9/30/10

12/31/10

3/31/11

6/30/11

9/30/11

GAAP net income, as reported

10,861

11,730

12,290

14,171

13,679

14,775

15,370

Interest expense

4,538

4,880

4,928

5,003

5,593

5,369

5,175

Contingent interest expense

-

-

-

-

-

-

-

Pay-off of future contingent interest

-

-

-

-

-

-

-

Provision for income taxes

6,490

6,749

6,632

9,075

8,601

9,486

9,868

Depreciation and amortization

673

752

816

958

1,053

1,105

1,194

Amount applied to principal on receivable portfolios

58,265

64,901

63,507

53,427

85,709

83,939

73,187

Stock-based compensation expense

1,761

1,446

1,549

1,254

1,765

1,810

2,405

Adjusted EBITDA

82,588

90,458

89,722

83,888

116,400

116,484

107,199

|

APPENDIX C: THE COMPANY’S FINANCIAL RESULTS OVER THE PAST TWO

YEARS HAVE BEEN STRONG

17

2010

2009

YOY Growth

Annual Variance

604.6

116.8

24%

487.8

Collections

381.3

64.9

21%

316.4

Revenue

346.7

82.1

31%

264.6

Adjusted EBITDA*

362.0

105.3

41%

256.6

Purchases

1.95

0.58

42%

1.37

Diluted EPS

($M, except EPS and ratios)

575.2

346.7

340.1

250.1

1.71

YTD

9/30/10

455.4

281.5

262.8

242.9

1.39

YTD

9/30/11 |