Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BANCORPSOUTH INC | d249763d8k.htm |

BancorpSouth, Inc.

Investor Presentation

November 2011

Exhibit 99.1 |

Certain

statements

contained

in

this

presentation

and

the

accompanying

slides

may

not

be

based

on

historical

facts

and

are

“forward-looking

statements”

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933,

as

amended,

and

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended.

These

forward-looking

statements

may

be

identified

by

reference

to

a

future

period

or

by

the

use

of

forward-looking

terminology,

such

as

“anticipate,”

“believe,”

“estimate,”

“expect,”

“foresee,”

“may,”

“might,”

“will,”

“intend,”

“could,”

“would”

or

“plan,”

or

future

or

conditional

verb

tenses,

and

variations

or

negatives

of

such

terms.

These

forward-

looking

statements

include,

without

limitation,

statements

about

the

Company’s

strategic

focus,

long-term

prospects

for

shareholder

value,

the

impact

of

the

prevailing

economy,

the

use

of

non-GAAP

financial

measures,

results

of

operations,

and

financial

condition.

We

caution

you

not

to

place

undue

reliance

on

the

forward-looking

statements

contained

in

this

presentation,

in

that

actual

results

could

differ

materially

from

those

indicated

in

such

forward-looking

statements

as

a

result

of

a

variety

of

factors.

These

factors

include,

but

are

not

limited

to,

conditions

in

the

financial

markets

and

economic

conditions

generally,

the

soundness

of

other

financial

institutions,

the

availability

of

capital

on

favorable

terms

if

and

when

needed,

liquidity

risk,

the

credit

risk

associated

with

real

estate

construction,

acquisition

and

development

loans,

estimates

of

costs

and

values

associated

with

real

estate

construction,

acquisition

and

development

loans

in

the

Company’s

loan

portfolio,

the

adequacy

of

the

Company’s

allowance

for

credit

losses

to

cover

actual

credit

losses,

governmental

regulation

and

supervision

of

the

Company’s

operations,

the

impact

of

recent

legislation

on

service

charges

on

core

deposit

accounts,

the

susceptibility

of

the

Company’s

business

to

local

economic

conditions,

changes

in

interest

rates,

the

impact

of

monetary

policies

and

economic

factors

on

the

Company’s

ability

to

attract

deposits

or

make

loans,

volatility

in

capital

and

credit

markets,

the

impact

of

hurricanes

or

other

adverse

weather

events,

risks

in

connection

with

completed

or

potential

acquisitions,

dilution

caused

by

the

Company’s

issuance

of

any

additional

shares

of

its

common

stock

to

raise

capital

or

acquire

other

banks,

bank

holding

companies,

financial

holding

companies

and

insurance

agencies,

restrictions

on

the

Company’s

ability

to

declare

and

pay

dividends,

the

Company’s

growth

strategy,

diversification

in

the

types

of

financial

services

the

Company

offers,

competition

with

other

financial

services

companies,

interruptions

or

breaches

in

security

of

the

Company’s

information

systems,

the

failure

of

certain

third

party

vendors

to

perform,

the

Company’s

ability

to

improve

its

internal

controls

adequately,

any

requirement

that

the

Company

write

down

goodwill

or

other

intangible

assets,

other

factors

generally

understood

to

affect

the

financial

results

of

financial

services

companies,

and

other

factors

detailed

from

time

to

time

in

the

Company’s

press

releases

and

filings

with

the

Securities

and

Exchange

Commission.

Forward-looking

statements

speak

only

as

of

the

date

they

were

made,

and,

except

as

required

by

law,

we

do

not

undertake

any

obligation

to

update

or

revise

forward-looking

statements

to

reflect

events

or

circumstances

after

the

date

of

this

presentation.

Certain

tabular

presentations

may

not

reconcile

because

of

rounding.

Unless

otherwise

noted,

any

statements

in

this

presentation

can

be

attributed

to

company

management.

Forward Looking Information

2 |

This

presentation

contains

financial

information

determined

by

methods

other

than

those

prescribed

by

accounting

principles

generally

accepted

in

the

United

States

("GAAP').

Management

uses

these

"non-GAAP"

financial

measures

in

its

analysis

of

the

Company's

capital

and

performance.

Management

believes

that

the

ratio

of

tangible

shareholders’

equity

to

tangible

assets

is

important

to

investors

who

are

interested

in

evaluating

the

adequacy

of

the

Company's

capital

levels.

Management

believes

that

tangible

book

value

per

share

is

important

to

investors

who

are

interested

in

changes

from

period

to

period

in

book

value

per

share

exclusive

of

changes

in

tangible

assets.

Management

believes

that

pre-tax,

pre-provision

earnings

is

important

to

investors

as

it

shows

earnings

trends

without

giving

effect

to

provision

for

credit

losses.

You

should

not

view

these

disclosures

as

a

substitute

for

results

determined

in

accordance

with

GAAP,

and

they

are

not

necessarily

comparable

to

non-GAAP

measures

used

by

other

companies.

The

limitations

associated

with

these

measures

are

the

risks

that

persons

might

disagree

as

to

the

appropriateness

of

items

comprising

these

measures

and

that

different

companies

might

calculate

these

measures

differently.

Information

provided

in

the

Appendix

of

this

presentation

reconciles

these

non-GAAP

measures

with

comparable

measures

calculated

in

accordance

with

GAAP.

Non-GAAP Financial Disclaimer

3 |

Strong core capital base

Common

equity

$1.3

billion

(no

preferred)

Tangible

shareholders’

equity

/

tangible

assets:

7.58%

Total

risk-based

capital

ratio:

12.62%

Overview of BancorpSouth, Inc.

4

Data as of September 30, 2011

Insurance ranking from Business Insurance Magazine as of December 31, 2010

$13.2 billion in assets

290 locations with reach throughout an 8-state footprint

Customer-focused business model with comprehensive line of financial products

and banking services for individuals and small to mid-size businesses

Nation’s 26

th

largest insurance agency / brokerage operation

Strong mortgage operations with production totaling $823 million

through the

first three quarters of 2011

Consistent core earnings with YTD pre-tax, pre-provision earnings of $51

million (excluding MSR impairment)

** |

5

Regional Management Structure |

9/30/11

6/30/11

9/30/10

Net interest revenue

$108.1

$109.9

$109.7

(1.5)

%

Provision for credit losses

25.1

32.2

54.9

(54.2)

Noninterest revenue

62.1

75.1

69.8

(11.0)

Noninterest expense

130.7

137.1

123.1

6.2

Income before income taxes

14.3

15.7

1.5

Income tax provision (benefit)

2.4

2.9

(9.8)

Net income

$11.9

$12.8

$11.3

Net income per share: diluted

$0.14

$0.15

$0.13

Three Months Ended,

Q3'11 vs.

Q3'10

September 2011 and 2010 numbers reflect $2.1 million and $2.3 million of net

securities gains, respectively. June 2011 numbers reflect $10.0 million

of net securities gains as well as a $9.8 million pre-payment penalty

related to repaying $75.0 million of FHLB borrowings. 6

Recent Operating Results

Dollars in millions, except per share data |

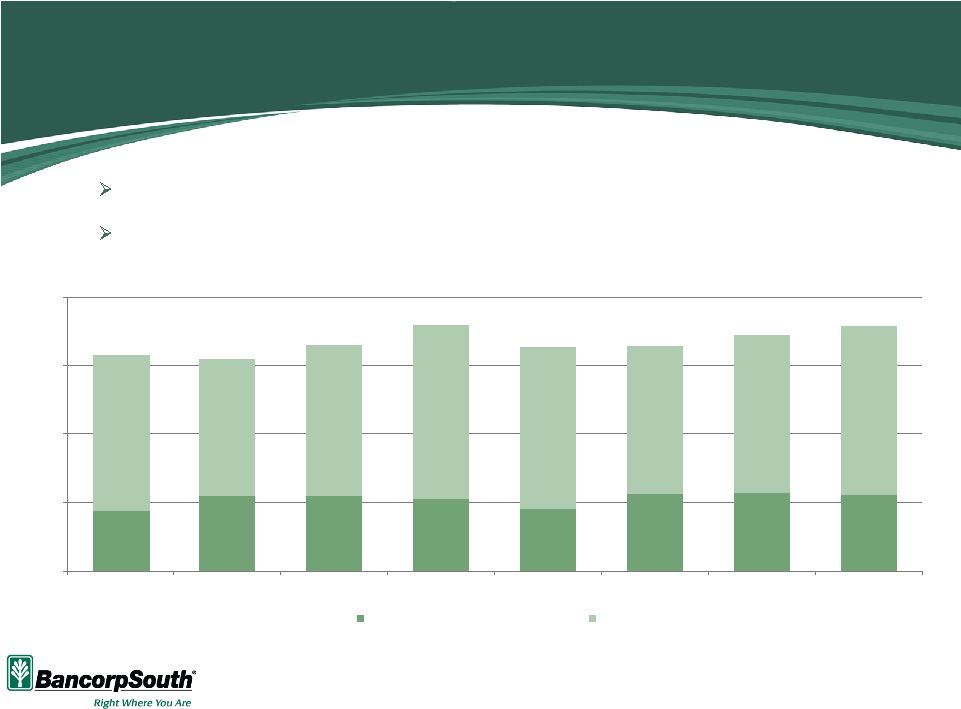

$53

$55

$46

$56

$61

$48

$48

$39

$52

$55

$55

$61

$52

$45

$52

$51

$0

$10

$20

$30

$40

$50

$60

$70

12/31/09

3/31/10

6/30/10

9/30/10

12/31/10

3/31/11

6/30/11

9/30/11

Pre-tax, Pre-provision Earnings

Pre-tax, Pre-Provision Earnings (ex. MSR impairment)

7

Dollars in millions

Data for quarters ended as of dates shown

Stable and Consistent Pre-tax, Pre-provision Earnings

|

Diversified Revenue Stream

8

Percentages based on data for the nine months ended September 30, 2011

Excludes net securities gains of $12.1 million

YTD Noninterest Revenue Composition

Insurance and mortgage businesses

provide significant sources of noninterest

revenue

Historically, over 35% of total revenue

has been derived from noninterest

sources

Insurance commissions were up 5% for

the first nine months of 2011, compared

to the first nine months of 2010

Mortgage production volume totaled

$823 million for 2011 YTD

$193.4M YTD

Mortgage

lending

4%

Card and

merchant fees

18%

Service

charges

25%

Trust income

5%

Insurance

commissions

35%

Other

13% |

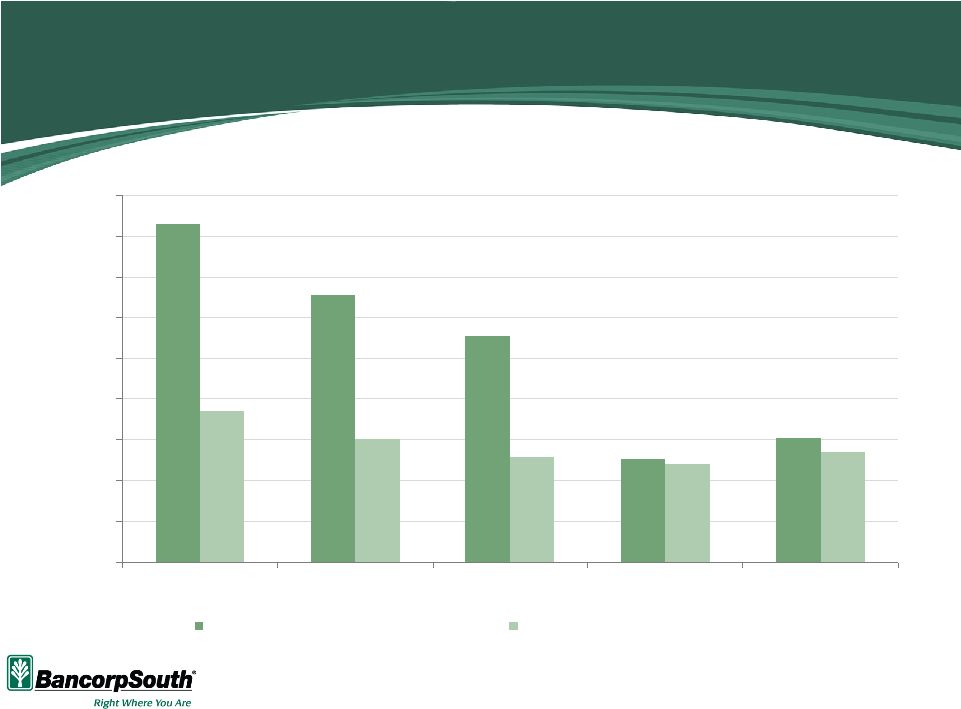

Noninterest revenue continues to be a stable and significant source of

revenue. Insurance

business

continues

to

perform

well

and

typically

makes

up

over

1/3

of

current noninterest revenue.

Noninterest Revenue

9

Dollars in millions

Excludes net securities gains and MSR Impairment

Data for quarters ended as of dates shown

$18M

$22M

$22M

$21M

$18M

$23M

$23M

$22M

$0

$20

$40

$60

$80

12/31/09

3/31/10

6/30/10

9/30/10

12/31/10

3/31/11

6/30/11

9/30/11

Insurance Commissions

Other

$63M

$62M

$66M

$72M

$66M

$66M

$69M

$72M |

10

Balance Sheet Summary

Dollars in millions, except per share

Based on period end balances

Q3 ‘11 vs Q3 ‘10

09/30/11

06/30/11

09/30/10

% Change

Total assets

$13,199

$13,367

$13,583

(2.8)

%

Cash and equivalents

500

471

339

47.5

Securities

2,482

2,561

2,274

9.1

Loans, net of unearned income

9,056

9,215

9,515

(4.8)

Allowance for credit losses

(200)

(198)

(205)

(2.4)

Total deposits

11,063

11,308

11,197

(1.2)

Short-term borrowings

451

427

654

(31.0)

Shareholders' equity

1,267

1,247

1,236

2.5

Book value per share

15.17

14.93

14.80

2.5

Tangible book value per share

11.71

11.46

11.32

3.4 |

Non-Interest

Bearing

20%

Interest Bearing

DDA

43%

Time

28%

Savings

9%

Core Deposit Franchise

11

Approximately 72% of total deposits are

non-time

Non-interest bearing deposits have

grown approximately 12% since

September 30, 2010

Cost of total deposits for the quarter

ended September 30, 2011 was 0.75%

Over $1.3 billion in CDs are maturing

over the next two quarters at a weighted

average rate of approximately 1.40%

As of September 30, 2011

$11.1B Total

Deposit Composition |

Stable Net Interest Margin

12

Fiscal Year

Quarter Ended

Shown on a fully taxable equivalent basis |

Building A Stronger Deposit Base

13

De-emphasizing commoditized deposits

Increasing multi-service household accounts

Dollars in millions

Account balances based on quarterly averages

Savings

Noninterest DDAs

Interest Bearing DDAs

CDs |

AL & FL

Panhandle

8%

AR

14%

MS

27%

MO

6%

Greater

Memphis

6%

N.E. TN

8%

TX & LA

18%

Other

13%

Diversified Loan Portfolio

14

Net

loans

and

leases

as

of

September

30,

2011

*”Other”

includes

all

other

geographic

regions

and

lines

of

business

not

managed

by

a

geographic

region

$9.1B Portfolio

Loans By Category

Loans By Geography

*

Commercial &

Industrial

16%

Consumer Mortgages

22%

Home

Equity

6%

Agricultural

3%

C&I Owner-Occupied

15%

Construction,

Acquisition & Dev.

11%

Commercial Real

Estate

19%

Credit Cards

1%

Other

7% |

% Change

Three Months Ended

Linked

YOY

9/30/11

6/30/11

9/30/10

Q3'11 vs. Q2'11

Q3'11 vs. Q3'10

Commercial and industrial

1,503

$

1,527

$

1,438

$

(1.6%)

4.5%

Real estate:

Consumer mortgages

1,966

1,971

1,972

(0.3%)

(0.3%)

Home equity

523

532

552

(1.7%)

(5.3%)

Agricultural

250

255

262

(2.1%)

(4.6%)

Commercial and industrial-owner occupied

1,330

1,367

1,375

(2.7%)

(3.3%)

Construction, acquisition and development

977

1,061

1,336

(7.9%)

(26.9%)

Commercial

1,772

1,765

1,811

0.4%

(2.1%)

Credit Cards

103

102

103

1.0%

0.3%

Other

632

635

665

(0.5%)

(5.0%)

Total

9,056

$

9,215

$

9,515

$

(1.7%)

(4.8%)

Loan Portfolio Growth

Increase in commercial and industrial lending

Continue to decrease exposure in the CAD portfolio

Excluding

the

impact

of

CAD

portfolio

-

total

loans

declined

1.2%

since

September

2010

15

Dollars

in

millions

Net

loans

and

leases |

Credit Quality Continues to Improve

16

Non-performing loans decreased 4.5% from the previous quarter

48% of non-accrual loans were paying as agreed

Net charge-offs declined $9.9 million, or 30%, from the previous quarter

Both net charge-offs and NPLs have declined for two consecutive quarters

Sales of OREO properties during the quarter totaled $13.1 million,

resulting

in

no

material

net

gain/loss

At and for the three months ended September 30, 2011

“Paying as agreed”

includes

loans < 30 days past due with payments occurring at least quarterly

|

3Q11

NPL Improvement 17

Dollars in millions

As of

9/30/11

6/30/11

Change

Non-accrual loans and leases

$314.5

$331.1

($16.6)

Loans and leases 90+ days past due, still accruing

7.3

4.0

3.3

Restructured loans and leases, still accruing

41.0

44.8

(3.8)

Total non-performing loans and leases

$362.8

$379.8

($17.0)

Allowance for credit losses to net loans and leases

2.21%

2.14%

Allowance for credit losses to non-performing loans and leases

55.04%

52.03%

Non-performing loans and leases to net loans and leases

4.01%

4.12% |

AL & FL

Panhandle

18%

AR

8%

MS

14%

MO

14%

Greater

Memphis

16%

N.E. TN

11%

TX & LA

14%

Other

5%

NPLs By Type & Location

NPLs By Category

NPLs By Geography

As

of

September

30,

2011

NPLs

include

nonaccrual

loans,

loans

90+

days

PD

and

restructured

loans

*“Other”

includes

all

other

geographic

regions

and

lines

of

business

not

managed

by

a

geographic

region

18

* |

Loan

Impairment Analysis 89% of non-accrual loans are impaired and are carried

at 70% of UPB As of September 30, 2011

Dollars in millions

19

Total

Unpaid principal balance of impaired loans

$342.8

Cumulative charge-offs on impaired loans

(62.9)

Allowance for impaired loans

(38.7)

Net book value of impaired loans

$241.2

Net book value / UPB

70% |

20

Newly Identified Non-Accrual Loans

Dollars in millions

$166M

$131M

$111M

$50M

$61M

$74M

$60M

$52M

$48M

$54M

$0

$20

$40

$60

$80

$100

$120

$140

$160

$180

9/30/10

12/31/10

3/31/11

6/30/11

9/30/11

Newly Identified Non-Accrual Loans

Loans 30-89 Days PD, Still Accruing |

$0

$100

$200

$300

$400

9/30/10

12/31/10

3/31/10

6/30/11

9/30/11

Non

-Accrual Lns Paying as Agreed

All Other Non-Accrual Lns

Non-Accrual Loans

21

Dollars in millions

48% of non-accrual loans were paying as agreed as of September 30, 2011

“Paying as Agreed”

includes

loans < 30 days past due with payments occurring at least quarterly

42%

36%

37%

47%

48% |

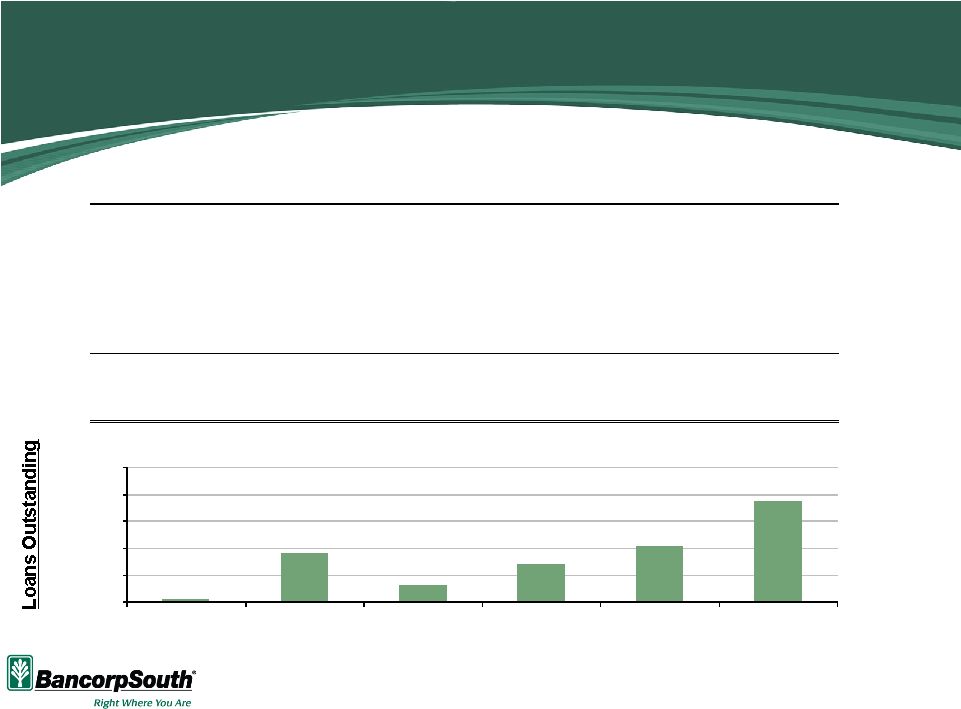

Real

Estate Construction, Acquisition and Development Dollars in millions

As of September 30, 2011

22

$0

$100

$200

$300

$400

$500

Multi

-Family

Construction

1-4 Family

Construction

Recreation & All

Other Loans

Commercial

Construction

Commercial A & D

Residential A & D

Outstanding

NPLs

NPLs as a Percent of

Outstanding

Multi-Family Construction

$10

$0.0

1-4 Family Construction

181

18.5

Recreation and All Other Loans

61

0.7

Commercial Construction

141

10.2

Commercial Acquisition and Development

207

33.3

Residential Acquisition and Development

377

111.4

Real Estate Construction, Acquisition

and Development

$977

$174.0

16.1

29.6

17.8%

0.0%

10.2

1.2

7.2 |

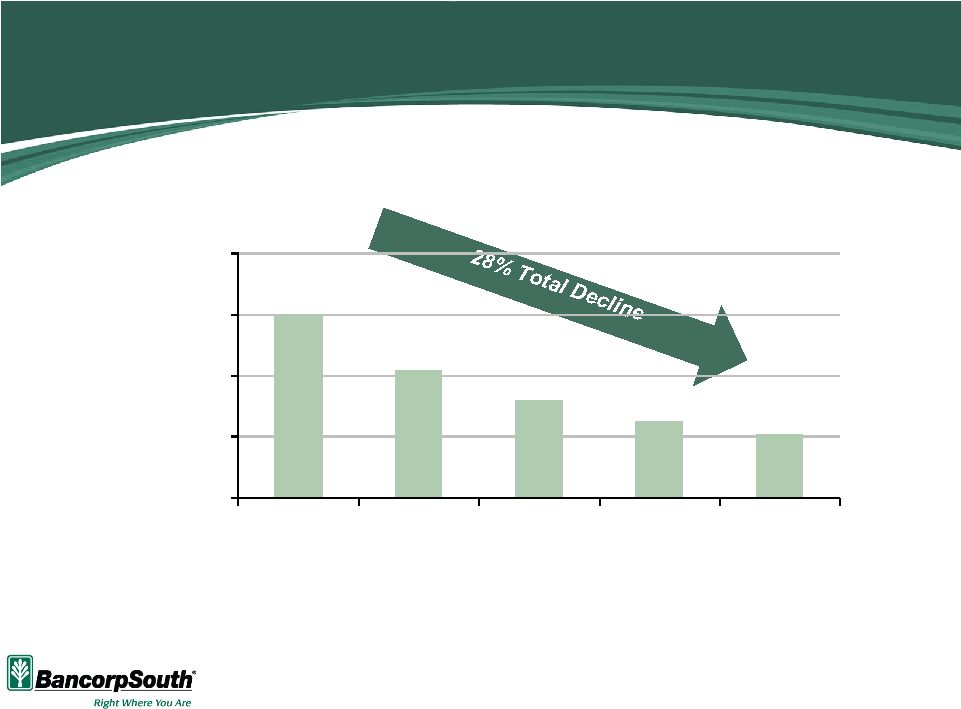

Residential Acquisition and Development

23

Dollars in millions

$523

$456

$420

$393

$377

$300

$375

$450

$525

$600

9/30/10

12/31/10

3/31/11

6/30/11

9/30/11 |

Dollars in millions

24

Net Charge-offs are Improving

% Avg. Loans

$51

$51

$52

$33

$23

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

$0

$10

$20

$30

$40

$50

$60

9/30/10

12/31/10

3/31/11

6/30/11

9/30/11

Net Charge-Offs

Net Charge-offs / Average loans |

Other

Real Estate Owned 25

As of September 30, 2011

Dollars in millions

Total

Unpaid principal balance at time of foreclosure

$288.9

Cumulative charge-offs and writedowns of OREO

(126.2)

Current book value of OREO

$162.7

Current book value / UPB

56%

OREO is carried at 56% of aggregate loan balances at time of foreclosure

|

Strategic Focus

Preserve strong capital and position the Company for economic recovery

Relentless focus on asset quality

Pursue quality loan growth

Take advantage of market disruption

Grow core earnings through margin expansion and revenue growth

Expense control and reduction

26 |

27

Leading Mid-South Regional Bank

Diversified Revenue Stream

Over

35%

of

the

revenue

stream

is

derived

from

noninterest

sources

High Quality Deposit Franchise with a Stable Core Deposit Base

20% NIB Deposits / Cost of total deposits of 0.75% (for the quarter ended September

30, 2011) Proven and Experienced Management Team

Positive Asset Quality Trends

4.5%

decline

in

non-performing

loans

in

the

most

recent

quarter

Both

net

charge-offs

and

NPLs

have

declined

for

two

consecutive

quarters

48%

of

nonaccrual

loans

are

paying

as

agreed

Consistent Pre-tax, Pre-Provision Earnings

Summary

At and for the three months ended September 30, 2011

**

**

** |

Appendix |

29

Non-GAAP Financial Reconciliation

Pre-Tax, Pre-Provision Earnings Reconciliation

Q4-09

Q1-10

Q2-10

Q3-10

Q4-10

Q1-11

Q2-11

Q3-11

(Dollars in Thousands)

Net Interest Income Before Provision --> A

$112,347

$111,882

$109,329

$109,678

$110,253

$109,437

$109,912

$108,075

Noninterest Income --> B

64,505

63,332

57,086

69,752

73,974

68,311

75,144

62,055

Noninterest Expense --> C

123,361

120,483

120,016

123,087

123,447

130,010

137,069

130,698

Pre-Tax Pre-Provision Earnings --> D=A+B-C

53,491

54,731

46,399

56,343

60,780

47,738

47,987

39,432

MSR Valuation Adjustment --> E

1,648

8

(8,323)

(4,609)

8,895

2,540

(3,839)

(11,676)

Pre-Tax Pre-Provision Earnings (Excluding MSR Adjustment) -->

F=D-E 51,843

54,723

54,722

60,952

51,885

45,198

51,826

51,108

Tangible Shareholders' Equity / Tangible Assets

As of

As of

As of

9/30/2010

6/30/2011

9/30/2011

(Dollars in Thousands)

Shareholders' Equity --> A

$1,235,705

$1,246,703

$1,266,753

Assets --> B

13,583,016

13,367,050

13,198,518

Intangibles --> C

290,670

289,546

288,723

Tangible Shareholders' Equity --> D=A-C

945,034

957,157

978,030

Tangible Assets --> E=B-C

13,292,346

13,077,504

12,909,795

Tangible Book Value Per Share

Total Equity / Total Assets (%) -- > F=A/B

9.10%

9.33%

9.60%

Tangible Common Equity / Tangible Assets (%) -- > G=D/E

7.11%

7.32%

7.58%

Common Shares Outstanding -- > H

83,482

83,489

83,489

Tangible Book Value Per Share -- > I=D/H

11.32

11.46

11.71 |