Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - Altovida Inc. | ex23_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1/A

Amendment No. 2

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

REMMINGTON ENTERPRISES, INC.

(Exact name of Registrant as specified in its charter)

|

Nevada

|

1000

|

45-2759045

|

|

(State or other jurisdiction of incorporation or organization)

|

(Primary Standard Industrial Classification Code Number)

|

(I.R.S. Employer Identification Number)

|

|

7582 Las Vegas Blvd. S., Ste. 236

Las Vegas, Nevada 89123

|

||

|

(address of principal executive offices)

|

||

|

Registrant's telephone number, including area code:

|

(702) 217-3964

|

|

|

Gary A. Scoggins

7582 Las Vegas Blvd. S., Ste. 236

Las Vegas, Nevada 89123

|

||

|

(Name and address of agent for service of process)

|

||

|

Approximate date of commencement of proposed sale to the public:

|

As soon as practicable after the effective date of this Registration Statement.

|

|

If any of the securities being registered on the Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box |X|

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|__|

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|__|

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|__|

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box.|__|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

Large accelerated filer |__| Accelerated filer |__|

Non-accelerated filer |__| Smaller reporting company |X|

COPIES OF COMMUNICATIONS TO:

Puoy K. Premsrirut, Esq.

520. S. Fourth Street, Second Floor

Las Vegas, NV 89101

Ph: (702) 384-5563

|

CALCULATION OF REGISTRATION FEE

|

||||

|

TITLE OF EACH

CLASS OF

SECURITIES

TO BE

REGISTRATION

|

AMOUNT TO BE REGISTERED

|

PROPOSED MAXIMUM OFFERING PRICE PER SHARE(1)

|

PROPOSED MAXIMUM AGGREGATE OFFERING PRICE(2)

|

AMOUNT OF REGISTERED FEE

|

|

Common Stock

|

3,000,000

|

$0.008

|

$24,000.00

|

$2.79

|

|

(1)

|

This price was arbitrarily determined by Remmington Enterprises, Inc.

|

|

(2)

|

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(a) under the Securities Act.

|

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(a), MAY DETERMINE.

PROSPECTUS

REMMINGTON ENTERPRISES, INC.

3,000,000

SHARES OF COMMON STOCK

INITIAL PUBLIC OFFERING

___________________

SUBJECT TO COMPLETION, Dated November 1, 2011

This prospectus relates to our offering of 3,000,000 new shares of our common stock at an offering price of $0.008 per share. The minimum purchase for a single investor is $400 for 50,000 shares. The offering will commence promptly after the date of this prospectus and close no later than 120 days after the date of this prospectus. However, we may extend the offering for up to 90 days following the 120 day offering period. We will pay all expenses incurred in this offering. The shares are being offered by us on a “best efforts” basis and there can be no assurance that all or any of the shares offered will be subscribed. If less than the maximum proceeds are available to us, our planned exploration and prospects could be adversely affected. There is no minimum offering required for this offering to close. All funds received as a result of this offering will be immediately available to us for our general business purposes. The Maximum Offering amount is 3,000,000 shares ($24,000).

The offering is a self-underwritten offering; there will be no underwriter involved in the sale of these securities. We intend to offer the securities through our officer and Director, who will not be paid any commission for such sales.

|

Offering Price

|

Underwriting Discounts

and Commissions

|

Proceeds to Company

|

|

|

Per Share

|

$0.008

|

None

|

$0.008

|

|

Total (maximum offering)

|

$24,000

|

None

|

$24,000

|

Our common stock is presently not traded on any market or securities exchange. The sales price to the public is fixed at $0.008 per share.

The purchase of the securities offered through this prospectus involves a high degree of risk. See section entitled “Risk Factors” starting on page 8.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The Date of This Prospectus is: November 1, 2011

Remmington Enterprises, Inc.

The Company

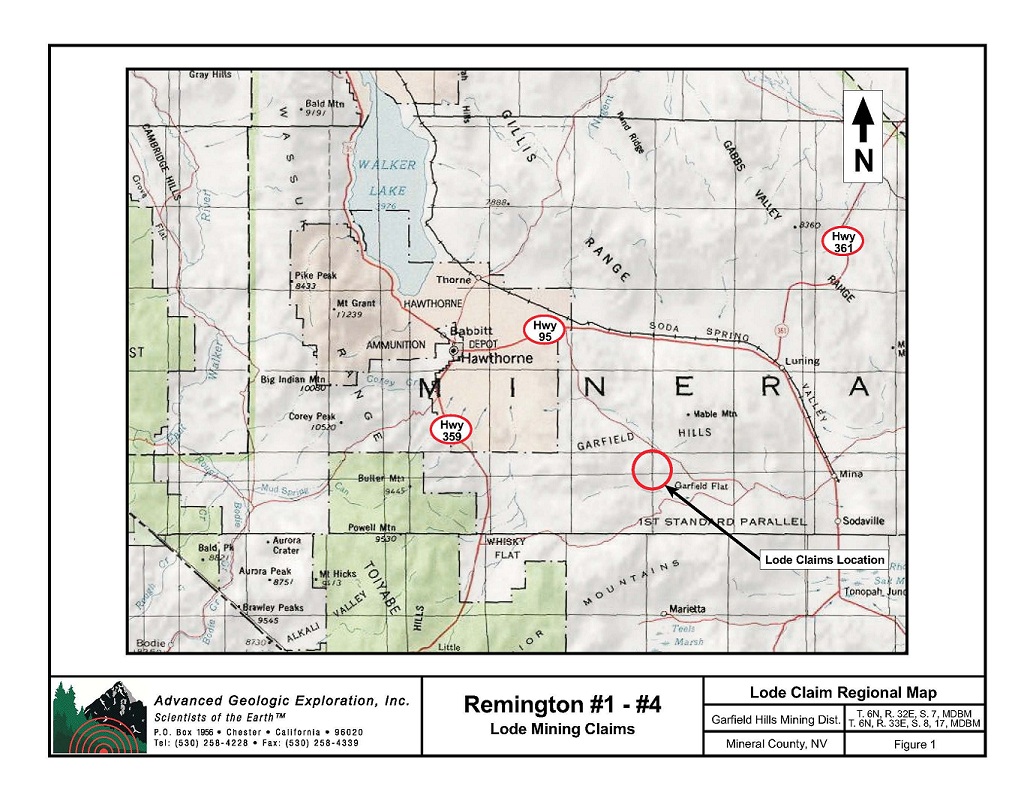

We are an exploration stage mineral exploration company incorporated in Nevada on July 15, 2011. On July 29, 2011, we acquired a 100% ownership interest in the Remington #1 through #4 lode mining claim located in Mineral County, Nevada. The Remington claims are located on federal lands administered by the Bureau of Land Management. Our ownership rights on the claim are limited to the exploration and extraction of mineral deposits subject to applicable regulations. The Remington claims total roughly 100 acres in size and are located in the Garfield Hills approximately 38 miles south of the town of Hawthorne, Nevada.

We have performed an initial reconnaissance sampling program on our mining claim. Our initial sampling program indicated the presence elevated silver mineralization in the rock outcrops which were sampled. Based upon the results of our initial reconnaissance sampling program, our consulting geologist has recommended an additional detailed rock sampling program, together with geological mapping of the claims and a reconnaissance sampling of nearby properties on the boundaries of the Remington claims to determine if the acquisition of neighboring properties would be beneficial. Our planned additional exploration activities will be designed to explore for additional indications that the Remington claims may contain commercially viable quantities of silver. We have not identified commercially exploitable reserves of silver or other precious metals on the Remington claims to date. We are an exploration stage company and there is no assurance that commercially viable silver quantities exist on the Remington mineral claims.

Further exploration activities beyond our currently planned exploration program will be dependent upon a number of factors, including our consulting geologist’s recommendations based upon the exploration program results, and our available funds.

Since we are in the exploration stage of our business plan, we have not yet earned any revenues from our planned operations. As of July 31, 2011, we had $4,370 cash on hand and current liabilities in the amount of $3,249. Accordingly, our working capital position as of July 31, 2011 was $1,121. Since our inception through July 31, 2011, we have incurred a net loss of $8,279. We attribute our net loss to having no revenues to offset our expenses and the professional fees related to the creation and operation of our business. Our management estimates that, until such time that we are able to identify a commercially viable mineral deposit and to generate revenue from the extraction of silver on our mineral claims, we will continue to experience negative cash flow. Our business plan is to pursue exploration of the Remington claims as described in this Prospectus. We do not have any current or future plans to engage in mergers or acquisitions with other companies or entities.

Our fiscal year end is July 31. Our principal offices are located at 7582 Las Vegas Blvd. S., Ste. 236, Las Vegas, Nevada 89123. Our phone number is (702) 217-3964.

|

Securities Being Offered

|

Up to 3,000,000 shares of our common stock.

|

|

Offering Price

|

The offering price of the common stock is $0.008 per share. There is no public market for our common stock. We cannot give any assurance that the shares offered will have a market value, or that they can be resold at the offered price if and when an active secondary market might develop, or that a public market for our securities may be sustained even if developed. The absence of a public market for our stock will make it difficult to sell your shares in our stock.

Upon the effectiveness of the registration statement of which this prospectus is a part, we intend to apply through FINRA to the over-the-counter bulletin board, through a market maker that is a licensed broker dealer, to allow the trading of our common stock upon our becoming a reporting entity under the Securities Exchange Act of 1934. We currently have no market maker who is willing to list quotations for our stock. Further, even assuming we do locate such a market maker, it could take several months before the market maker’s listing application for our shares is approved.

|

|

Minimum Number of Shares

To Be Sold in This Offering

|

n/a

|

|

Maximum Number of Shares

To Be Sold in This Offering

|

3,000,000

|

|

Securities Issued and to be Issued

|

10,000,000 shares of our common stock are issued and outstanding as of the date of this prospectus. Our sole officer and director, Gary A. Scoggins, owns an aggregate of 100% of the common shares of our company and therefore have substantial control. Upon the completion of this offering, our officer and director will own approximately 76.92% of the issued and outstanding shares of our common stock if the maximum number of shares is sold.

|

|

Number of Shares Outstanding After

The Offering If All The Shares Are Sold

|

13,000,000

|

|

Use of Proceeds

|

If we are successful at selling all the shares we are offering, our proceeds from this offering will be approximately $24,000. We intend to use these proceeds to execute our business plan.

|

|

Offering Period

|

The shares are being offered for a period up to 120 days after the date of this Prospectus, unless extended by us for an additional 90 days.

|

|

Summary Financial Information

|

||

|

Balance Sheet Data

|

Fiscal Year Ended

July 31, 2011

(derived from audited

financial information)

|

|

|

Cash

|

$

|

4,370

|

|

Total Assets

|

$

|

24,970

|

|

Liabilities

|

$

|

3,249

|

|

Total Stockholder’s Equity

|

$

|

21,721

|

|

Statement of Operations

|

July 15, 2011

(date of inception) to

July 30, 2011

(derived from audited

financial information)

|

|

|

Revenue

|

$

|

0

|

|

Net Loss for Reporting Period

|

$

|

8,279

|

You should consider each of the following risk factors and any other information set forth herein and in our reports filed with the SEC, including our financial statements and related notes, in evaluating our business and prospects. The risks and uncertainties described below are not the only ones that impact on our operations and business. Additional risks and uncertainties not presently known to us, or that we currently consider immaterial, may also impair our business or operations. If any of the following risks actually occur, our business and financial results or prospects could be harmed. In that case, the value of the Common Stock could decline.

We have not yet commenced active operations and have not generated any revenue to date. Our business plan calls for expenses related to the continued exploration of our mineral claims and basic operating costs. Our cash requirements over the current fiscal year are expected to be approximately $28,000, consisting of approximately $20,000 for planned mineral exploration costs and $8,000 for professional fees. As of July 31, 2011, we had cash on hand in the amount of $4,370 and working capital in the amount of $1,121. Accordingly, our business will likely fail if we are unable to successfully complete this Offering at or near the maximum offering amount.

In the event that we are able to complete this Offering at or near the maximum offering amount, we estimate that our funds will be sufficient to complete Phase II of our planned exploration program and to meet our expected legal and account expenses through the end of the third quarter of our fiscal year beginning August 1, 2011. If significant additional exploration activities beyond the plans outlined in this Prospectus are warranted and recommended by our consulting geologist, we will likely require additional financing in order to move forward with our exploration of the claims. We currently do not have any operations and we have no income. In addition, we will require additional financing to sustain our business operations if we are not successful in earning revenues once exploration is complete. If our exploration programs are successful in discovering commercially exploitable reserves, we will require significant additional funds in order to place the Remington claims into production. We currently do not have any firm arrangements for financing and we may not be able to obtain financing when required. Obtaining additional financing would be subject to a number of factors, including the market prices for gold and other metallic minerals and the costs of exploring for or commercial production of these materials. These factors may make the necessary timing, amount, terms or conditions of additional financing unavailable to us.

We have incurred a net loss of $8,279 for the period from our inception, July 15, 2011, to July 31, 2011, and have no revenues. Our future is dependent upon our ability to obtain financing and upon future profitable operations from the commercial exploitation of our mineral claims. Our auditors have issued a going concern opinion and have raised substantial doubt about our continuance as a going concern. When an auditor issues a going concern opinion, the auditor has substantial doubt that the company will continue to operate indefinitely and not go out of business and liquidate its assets. This is a significant risk to investors who purchase shares of our common stock because there is an increased risk that we may not be able to generate and/or raise enough resources to remain operational for an indefinite period of time. Potential investors should also be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The auditor’s going concern opinion may inhibit our ability to raise financing because we may not remain operational for an indefinite period of time resulting in potential investors failing to receive any return on their investment.

There is no history upon which to base any assumption as to the likelihood that we will prove successful, and it is doubtful that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

We were incorporated on July 15, 2011, and have conducted only an initial reconnaissance sampling program on our mineral claim. We have no significant history of ongoing operations, and additional exploration activities will be required in order to determine whether our mineral claim contains commercially exploitable quantities of silver. As a result, we have no way to evaluate the likelihood that we will be able to operate the business successfully on an ongoing basis. We have not earned any revenues as of the date of this prospectus, and thus face a high risk of business failure.

Mr. Gary A. Scoggins, our sole officer, sole director, and controlling shareholder, does not have any prior mining experience or any technical training as a geologist or an engineer. As a result, our management may lack certain skills that are advantageous in managing an exploration company. In addition, Mr. Scoggin’s decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use. Consequently, our operations, earnings, and ultimate financial success could be impaired due to management’s lack of experience in geology and engineering.

Our sole officer and director, Mr. Scoggins, lacks any prior experience as a company chief executive. In addition, Mr. Scoggins has no experience managing a publicly reporting company. Accordingly, Mr. Scoggins will be less effective than more experienced managers in efficiently managing our ongoing regulatory compliance obligations and in dealing with such matters as public relations, investor relations, and corporate governance.

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The search for valuable minerals also involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. At the present time, we have no coverage to insure against these hazards. The payment of such liabilities may have a material adverse effect on our financial position. In addition, there is no assurance that the expenditures to be made by us in the exploration of the mineral claims will result in the discovery of mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We expect to incur continuing and significant losses into the foreseeable future. As a result of continuing losses, we may exhaust all of our resources and be unable to complete the exploration of the Remington claims. Our accumulated deficit will continue to increase as we continue to incur losses. We may not be able to earn profits or continue operations if we are unable to generate significant revenues from our mineral claim. There is no history upon which to base any assumption as to the likelihood that we will be successful, and we may not be able to generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

The shares are being offered by us on a "best efforts" basis without benefit of a placement agent. We can provide no assurance that this Offering will be completely sold out. If less than the maximum proceeds are available, our business plans and prospects for the current fiscal year could be adversely affected.

Because our president, Mr. Scoggins, currently owns 100% of our outstanding common stock, investors may find that corporate decisions made by Mr. Scoggins are inconsistent with the best interests of other stockholders.

Mr. Scoggins is our president, chief financial officer and sole director. He currently owns 100% of the outstanding shares of our common stock, and, upon completion of this offering, will own 76.92 % of our outstanding common stock if the maximum number of shares is sold. Accordingly, he will have control over the outcome of all corporate transactions or other matters, and also the power to prevent or cause a change in control. The views and interests of Mr. Scoggins, as controlling shareholder, may differ from the interests of the other stockholders.

Mr. Scoggins, our sole officer and director and devotes 5 to 10 hours per week to our business affairs. Currently, we do not have any full or part-time employees and rely upon outside contractors to assist with the performance of our projects on an as-needed basis. If the demands of our business require the full business time of Mr. Scoggins, it is possible that he may not be able to devote sufficient time to the management of our business, as and when needed. If our management is unable to devote a sufficient amount of time to manage our operations, our business will fail.

Upon effectiveness of our Registration Statement for the Offering, we will become a publicly reporting company and will be required to stay current in our filings with the SEC, including, but not limited to, quarterly and annual reports, current reports on materials events, and other filings that may be required from time to time. We believe that, as a public company, our ongoing filings with the SEC will benefit shareholders in the form of greater transparency regarding our business activities and results of operations. In becoming a public company, however, we will incur additional costs in the form of audit and accounting fees and legal fees for the professional services necessary to assist us in remaining current in our reporting obligations. We expect that, during our first year of operations following the effectiveness of our Registration Statement, we will occur additional costs for professional fees in the approximate amount of $10,000. These additional costs will increase our cash needs and may hinder or delay our ability to achieve net profitability even after we have begun to generate revenues from sales of our products.

The mineral exploration business is highly competitive. This industry has a multitude of competitors and no small number of competitors dominates this industry with respect to any of the large volume metallic minerals. Our exploration activities will be focused on attempting to locate commercially viable silver deposits on the Remington claims. Many of our competitors have greater financial resources than us. As a result, we may experience difficulty competing with other businesses when conducting mineral exploration activities on the Remington property. If we are unable to retain qualified personnel to assist us in conducting mineral exploration activities on the Remington claims if a commercially viable deposit is found to exist, we may be unable to enter into production and achieve profitable operations.

Our sole officer and director, Mr. Scoggins, has not yet visited the property. As a result, we may face an enhanced risk that, upon management’s physical examination of the Remington claims, no commercially viable deposits of silver or other minerals will be located. In the event that our continuing exploration of the Remington claims reveals that no commercially viable deposits exist on the site, our business will likely fail.

Even if commercial quantities of reserves are discovered, a ready market may not exist for the sale of the reserves. Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. These factors could inhibit our ability to sell minerals in the event that commercial amounts of minerals are found.

There are several governmental regulations that materially restrict mineral exploration or exploitation. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these regulations. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business, prevent us from carrying out our exploration program, and make compliance with new regulations unduly burdensome.

The land covered by the Remington properties is owned by the United States. The availability to conduct an exploratory program on the properties is subject to the regulatory oversight of the U.S. Bureau of Land Management. In order to keep the Remington claims in good standing with the government, exploration work on the mineral claims valued at certain minimal amounts stipulated by the government must be completed and reported on an annual basis. In the event that these annual work and reporting requirements are not timely satisfied, we could lose our interest in the mineral claims and the mineral claims could then become available again to any party that wishes to stake an interest in these claims. In addition, our ability to use mechanical excavating and processing equipment on the claims will be subject to a federal inspection and permitting process. In the event that we experience unanticipated difficulty in obtaining the necessary permits, our planned exploration activities could be significantly delayed.

Prior to this offering, there has been no public market for our securities and there can be no assurance that an active trading market for the securities offered herein will develop after this offering, or, if developed, be sustained. We anticipate that, upon completion of this offering, the common stock will be eligible for quotation on the OTC Bulletin Board. If for any reason, however, our securities are not eligible for initial or continued quotation on the OTC Bulletin Board or a public trading market does not develop, purchasers of the common stock may have difficulty selling their securities should they desire to do so and purchasers of our common stock may lose their entire investment if they are unable to sell our securities. We currently have no market maker who is willing to list quotations for our stock. Further, even assuming we do locate such a market maker, it could take several months before the market maker’s listing application for our shares is approved.

In addition to the "penny stock" rules described below, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may have the effect of reducing the level of trading activity in our common stock. As a result, fewer broker-dealers may be willing to make a market in our common stock, reducing a stockholder's ability to resell shares of our common stock.

If you purchase shares of our common stock sold in this offering, you may not be able to resell the shares in any state unless and until the shares of our common stock are qualified for secondary trading under the applicable securities laws of such state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in such state. There can be no assurance that we will be successful in registering or qualifying our common stock for secondary trading, or identifying an available exemption for secondary trading in our common stock in every state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, our common stock in any particular state, the shares of common stock could not be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the market for the common stock will be limited which could drive down the market price of our common stock and reduce the liquidity of the shares of our common stock and a stockholder's ability to resell shares of our common stock at all or at current market prices, which could increase a stockholder's risk of losing some or all of his investment.

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future. Our payment of any future dividends will be at the discretion of our board of directors after taking into account various factors, including but not limited to our financial condition, operating results, cash needs, growth plans and the terms of any credit agreements that we may be a party to at the time. Accordingly, investors must rely on sales of their own common stock after price appreciation, which may never occur, as the only way to realize their investment. Investors seeking cash dividends should not purchase our common stock.

Broker-dealer practices in connection with transactions in “penny stocks” are regulated by penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on some national securities exchanges or quoted on Nasdaq). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, broker-dealers who sell these securities to persons other than established customers and “accredited investors” must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. Consequently, these requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security subject to the penny stock rules, and investors in our common stock may find it difficult to sell their shares.

In the event that our shares are quoted on the over-the-counter bulletin board, we will be required order to remain current in our filings with the SEC in order for shares of our common stock to be eligible for quotation on the over-the-counter bulletin board. In the event that we become delinquent in our required filings with the SEC, quotation of our common stock will be terminated following a 30 day grace period if we do not make our required filing during that time. If our shares are not eligible for quotation on the over-the-counter bulletin board, investors in our common stock may find it difficult to sell their shares.

Purchasers of our securities in this offering will experience immediate and substantial dilution in the net tangible book value of their common stock from the initial public offering price. Dilution in net tangible book value per share represents the difference between the amount per share paid by purchasers of shares of our common stock in this offering and the pro forma net tangible book value per share of our common stock immediately following this offering. The dilution experienced by investors in this offering will result in a net tangible book value per share that is less than the offering price of $0.008 per share. Such dilution may depress the value of the company’s common stock and make it more difficult to recover the value of your investment in a timely manner should you chose sell your shares.

Generally, existing shareholders will experience dilution of their ownership percentage in the company if and when additional shares of common stock are offered and sold. In the future, we may be required to seek additional equity funding in the form of private or public offerings of our common stock. In the event that we undertake subsequent offerings of common stock, your ownership percentage, voting power as a common shareholder, and earnings per share, if any, will be proportionately diluted. This may, in turn, result in a substantial decrease in the per-share value of your common stock.

This prospectus contains forward-looking statements that involve risks and uncertainties. We use words such as anticipate, believe, plan, expect, future, intend and similar expressions to identify such forward-looking statements. The actual results could differ materially from our forward-looking statements. Our actual results are most likely to differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us described in this Risk Factors section and elsewhere in this prospectus.

The net proceeds to us from the sale of up to 3,000,000 shares of common stock offered at a public offering price of $0.008 per share will vary depending upon the total number of shares sold. The following table summarizes, in order of priority the anticipated application of the proceeds we will receive from this Offering if the maximum number of shares is sold:

|

Amount Assuming Maximum Offering

|

Percent of Maximum

|

||||

|

GROSS OFFERING

|

$

|

24,000

|

100.0%

|

||

|

Commission 1

|

$

|

0

|

0.0%

|

||

|

Net Proceeds

|

$

|

24,000

|

100.0%

|

||

|

USE OF NET PROCEEDS

|

|||||

|

Mineral exploration 2

|

$

|

20,000

|

83.33%

|

||

|

Legal and accounting 3

|

$

|

4,000

|

16.67%

|

||

|

TOTAL APPLICATION OF NET PROCEEDS

|

$

|

24,000

|

100.0%

|

||

1 Commissions: Shares will be offered and sold by us without special compensation or other remuneration for such efforts. We do not plan to enter into agreements with finders or securities broker-dealers whereby the finders or broker-dealers would be involved in the sale of the Shares to the investors. Shares will be sold directly by us, and no fee or commission will be paid.

2 Mineral exploration: We intend to use approximately $20,000 of the net proceeds of this Offering to perform Phase II of our mineral exploration plan on the Remington mineral claims.

3 Legal and accounting: A portion of the proceeds will be used to pay legal, accounting, and related compliance costs to be incurred on a periodic basis as a result of our becoming a public company. Our legal expenses incurred in connection with this Offering were accrued in July of 2011 and will be paid from cash currently on hand. Other expenses associated with this Offering will be paid from a combination of cash on hand and funds to be received as-needed from our sole officer and director, Gary Scoggins. Mr. Scoggins has committed to fund our basic legal and accounting compliance expenses through additional infusions of equity or debt capital on an as-needed basis. This commitment is not the subject of a formal written agreement with us, and there are no specific limits as to time or dollar amount.

In the event that less than the maximum number of shares is sold we anticipate application of the proceeds we will receive from this Offering, in order of priority, will be as follows:

|

Amount Assuming

75% of Offering

|

Percent

|

Amount Assuming

50% of Offering

|

Percent

|

Amount Assuming

25% of Offering

|

Percent

|

||||||||||||

|

GROSS OFFERING

|

$

|

18,000

|

100.0%

|

$

|

12,000

|

100.0%

|

$

|

6,000

|

100.0%

|

||||||||

|

Commission

|

$

|

0

|

0.0%

|

$

|

0

|

0.0%

|

$

|

0

|

0.0%

|

||||||||

|

Net Proceeds

|

$

|

18,000

|

100.0%

|

$

|

12,000

|

100.0%

|

$

|

6,000

|

100.0%

|

||||||||

|

USE OF NET PROCEEDS

|

|||||||||||||||||

|

Mineral exploration (1)

|

$

|

15,000

|

83.33%

|

$

|

9,000

|

75.00%

|

$

|

3,000

|

50.00%

|

||||||||

|

Legal and accounting (2)

|

$

|

3,000

|

16.66%

|

$

|

3,000

|

25.00%

|

$

|

3,000

|

50.00%

|

||||||||

|

TOTAL APPLICATION OF NET PROCEEDS

|

$

|

18,000

|

100.0%

|

$

|

12,000

|

100.0%

|

$

|

6,000

|

100.0%

|

||||||||

(1) Our business plan calls for a more extensive rock sampling program on the Remmington property, together with geological mapping, permitting efforts, and reconnaissance of nearby properties. If 75% of the maximum offering is received, we intend to limit our Phase II exploration to the planned rock sampling program only. If 50% or 25% of the maximum offering is received, we intend to limit our exploration activities to a more limited rock sampling program as permitted by our available funds.

(2) These figures reflect the intended use of offering proceeds for legal and accounting expenses, and not our total annual budget for these items, which is disclosed in the section below entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The legal and accounting costs of this Offering, as estimated on Page 46 of this Registration Statement, will be paid from cash on hand and/or through additional infusions of equity or debt capital on an as-needed basis from our sole officer and director, Gary Scoggins.

The $0.008 per share offering price of our common stock was arbitrarily chosen by management. There is no relationship between this price and our assets, earnings, book value or any other objective criteria of value.

Purchasers of our securities in this offering will experience immediate and substantial dilution in the net tangible book value of their common stock from the initial public offering price.

The historical net tangible book value as of July 31, 2011 was $21,721 or approximately $0.0022 per share. Historical net tangible book value per share of common stock is equal to our total tangible assets less total liabilities, divided by the number of shares of common stock outstanding as of July 31, 2011. Adjusted to give effect to the receipt of net proceeds from the sale of the maximum of 3,000,000 shares of common stock for $24,000, net tangible book value will be approximately $0.0035 per share. This will represent an immediate increase of approximately $0.0013 per share to existing stockholders and an immediate and substantial dilution of approximately $0.0045 per share, or approximately 56.25%, to new investors purchasing our securities in this offering. Dilution in pro forma net tangible book value per share represents the difference between the amount per share paid by purchasers of shares of our common stock in this offering and the pro forma net tangible book value per share of our common stock immediately following this offering.

The following table sets forth as of July 31, 2011, the number of shares of common stock purchased from us and the total consideration paid by our existing stockholders and by new investors in this offering if new investors purchase the maximum offering, assuming a purchase price in this offering of $0.008 per share of common stock.

|

Number

|

Percent

|

Amount

|

||||||

|

Existing Stockholders

|

10,000,000

|

76.92%

|

$

|

30,000

|

||||

|

New Investors

|

3,000,000

|

23.08%

|

$

|

24,000

|

||||

|

Total

|

13,000,000

|

100.00%

|

$

|

54,000

|

||||

There Is No Current Market for Our Shares of Common Stock

There is currently no market for our shares. We cannot give you any assurance that the shares you purchase will ever have a market or that if a market for our shares ever develops, that you will be able to sell your shares. In addition, even if a public market for our shares develops, there is no assurance that a secondary public market will be sustained.

The shares you purchase are not traded or listed on any exchange. After the effective date of the registration statement of which this prospectus forms a part, we intend to have a market maker file an application with the Financial Industry Regulatory Authority to have our common stock quoted on the OTC Bulletin Board. We currently have no market maker who is willing to list quotations for our stock. Further, even assuming we do locate such a market maker, it could take several months before the market maker’s listing application for our shares is approved.

The OTC Bulletin Board is maintained by the Financial Industry Regulatory Authority. The securities traded on the Bulletin Board are not listed or traded on the floor of an organized national or regional stock exchange. Instead, these securities transactions are conducted through a telephone and computer network connecting dealers in stocks. Over-the-counter stocks are traditionally smaller companies that do not meet the financial and other listing requirements of a regional or national stock exchange.

Even if our shares are quoted on the OTC Bulletin Board, a purchaser of our shares may not be able to resell the shares. Broker-dealers may be discouraged from effecting transactions in our shares because they will be considered penny stocks and will be subject to the penny stock rules. Rules 15g-1 through 15g-9 promulgated under the Securities Exchange Act of 1934, as amended, impose sales practice and disclosure requirements on FINRA brokers-dealers who make a market in a "penny stock." A penny stock generally includes any non-NASDAQ equity security that has a market price of less than $5.00 per share. Under the penny stock regulations, a broker-dealer selling penny stock to anyone other than an established customer or "accredited investor" (generally, an individual with net worth in excess of $1,000,000 or an annual income exceeding $200,000, or $300,000 together with his or her spouse) must make a special suitability determination for the purchaser and must receive the purchaser's written consent to the transaction prior to sale, unless the broker-dealer or the transactions is otherwise exempt. In addition, the penny stock regulations require the broker-dealer to deliver, prior to any transaction involving a penny stock, a disclosure schedule prepared by the Commission relating to the penny stock market, unless the broker-dealer or the transaction is otherwise exempt. A broker-dealer is also required to disclose commissions payable to the broker-dealer and the registered representative and current quotations for the securities. Finally, a broker-dealer is required to send monthly statements disclosing recent price information with respect to the penny stock held in a customer's account and information with respect to the limited market in penny stocks.

The additional sales practice and disclosure requirements imposed upon brokers-dealers may discourage broker-dealers from effecting transactions in our shares, which could severely limit the market liquidity of the shares and impede the sale of our shares in the secondary market, assuming one develops.

The Offering will be Sold by Our Officer and Director

We are offering up to a total of 3,000,000 shares of common stock. The offering price is $0.008 per share. The offering will be for a period of 120 days from the effective date and may be extended for an additional 90 days if we choose to do so. In our sole discretion, we have the right to terminate the offering at any time, even before we have sold the 3,000,000 shares. There are no specific events which might trigger our decision to terminate the offering.

The shares are being offered by us on a “best efforts” basis and there can be no assurance that all or any of the shares offered will be subscribed. If less than the maximum proceeds are available to us, our planned exploration prospects could be adversely affected. There is no minimum offering required for this offering to close. All funds received as a result of this offering will be immediately available to us for our general business purposes.

We cannot assure you that all or any of the shares offered under this prospectus will be sold. No one has committed to purchase any of the shares offered. Therefore, we may sell only a nominal amount of shares, in which case our ability to execute our business plan might be negatively impacted. We reserve the right to withdraw or cancel this offering and to accept or reject any subscription in whole or in part, for any reason or for no reason. Subscriptions will be accepted or rejected promptly. All monies from rejected subscriptions will be returned immediately by us to the subscriber, without interest or deductions. Certificates for shares purchased will be issued and distributed by our transfer agent promptly after a subscription is accepted and "good funds" are received in our account.

If it turns out that we have not raised enough money to effectuate our business plan, we will try to raise additional funds from a second public offering, a private placement or loans. At the present time, we have not made any plans to raise additional money and there is no assurance that we would be able to raise additional money in the future. If we need additional money and are not successful, we will have to suspend or cease operations.

We will sell the shares in this offering through our officer and director. The officer and Director engaged in the sale of the securities will receive no commission from the sale of the shares nor will he register as broker-dealers pursuant to Section 15 of the Securities Exchange Act of 1934 in reliance upon Rule 3(a) 4-1. Rule 3(a) 4-1 sets forth those conditions under which a person associated with an issuer may participate in the offering of the issuer's securities and not be deemed to be a broker-dealer. Our officer and director satisfies the requirements of Rule 3(a) 4-1 in that:

|

1.

|

They are not subject to a statutory disqualification, as that term is defined in Section 3(a)(39) of the Act, at the time of his or her participation; and

|

|

|

2.

|

They are not compensated in connection with their participation by the payment of commissions or other remuneration based either directly or indirectly on transactions in securities; and

|

|

|

3.

|

They are not, at the time of their participation, an associated person of a broker- dealer; and

|

|

|

4.

|

They meet the conditions of Paragraph (a)(4)(ii) of Rule 3(a)4-1 of the Exchange Act, in that they (A) primarily perform, or are intended primarily to perform at the end of the offering, substantial duties for or on behalf of the issuer otherwise than in connection with transactions in securities; and (B) are not brokers or dealers, or an associated person of a broker or dealer, within the preceding twelve (12) months; and (C) do not participate in selling and offering of securities for any issuer more than once every twelve (12) months other than in reliance on Paragraphs (a)(4)(i) or (a)(4)(iii).

|

As long as we satisfy all of these conditions, we are comfortable that we will be able to satisfy the requirements of Rule 3(a)4-1 of the Exchange Act.

As our officer and director will sell the shares being offered pursuant to this offering, Regulation M prohibits the Company and its officers and directors from certain types of trading activities during the time of distribution of our securities. Specifically, Regulation M prohibits our officer and director from bidding for or purchasing any common stock or attempting to induce any other person to purchase any common stock, until the distribution of our securities pursuant to this offering has ended.

We have no intention of inviting broker-dealer participation in this offering.

Offering Period and Expiration Date

This offering will commence on the effective date of this prospectus, as determined by the Securities and Exchange Commission and continue for a period of 120 days. We may extend the offering for an additional 90 days unless the offering is completed or otherwise terminated by us. Funds received from investors will be counted towards the minimum subscription amount only if the form of payment, such as a check, clears the banking system and represents immediately available funds held by us prior to the termination of the 120-day subscription period, or prior to the termination of the extended subscription period if extended by our Board of Directors.

Procedures for Subscribing

If you decide to subscribe for any shares in this offering, you must deliver a check or certified funds for acceptance or rejection. The minimum investment amount for a single investor is $400 for 50,000 shares. All checks for subscriptions must be made payable to "Remmington Enterprises, Inc.”

Right to Reject Subscriptions

We maintain the right to accept or reject subscriptions in whole or in part, for any reason or for no reason. All monies from rejected subscriptions will be returned immediately by us to the subscriber, without interest or deductions. Subscriptions for securities will be accepted or rejected within 48 hours of our having received them.

Our authorized capital stock consists of 90,000,000 shares of common stock, with a par value of $0.001 per share, and 10,000,000 shares of preferred stock, par value $0.001 per share. As of July 31, 2011, there were 10,000,000 shares of our common stock issued and outstanding. Our shares are currently held by one (1) stockholder of record. We have not issued any shares of preferred stock.

Common Stock

Our common stock is entitled to one vote per share on all matters submitted to a vote of the stockholders, including the election of directors. Except as otherwise required by law or provided in any resolution adopted by our board of directors with respect to any series of preferred stock, the holders of our common stock will possess all voting power. Generally, all matters to be voted on by stockholders must be approved by a majority (or, in the case of election of directors, by a plurality) of the votes entitled to be cast by all shares of our common stock that are present in person or represented by proxy, subject to any voting rights granted to holders of any preferred stock. Holders of our common stock representing fifty percent (50%) of our capital stock issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of our stockholders. A vote by the holders of a majority of our outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to our Articles of Incorporation. Our Articles of Incorporation do not provide for cumulative voting in the election of directors.

Subject to any preferential rights of any outstanding series of preferred stock created by our board of directors from time to time, the holders of shares of our common stock will be entitled to such cash dividends as may be declared from time to time by our board of directors from funds available therefore.

Subject to any preferential rights of any outstanding series of preferred stock created from time to time by our board of directors, upon liquidation, dissolution or winding up, the holders of shares of our common stock will be entitled to receive pro rata all assets available for distribution to such holders.

In the event of any merger or consolidation with or into another company in connection with which shares of our common stock are converted into or exchangeable for shares of stock, other securities or property (including cash), all holders of our common stock will be entitled to receive the same kind and amount of shares of stock and other securities and property (including cash). Holders of our common stock have no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to our common stock.

Preferred Stock

Our board of directors may become authorized to authorize preferred shares of stock and to divide the authorized shares of our preferred stock into one or more series, each of which must be so designated as to distinguish the shares of each series of preferred stock from the shares of all other series and classes. Our board of directors is authorized, within any limitations prescribed by law and our articles of incorporation, to fix and determine the designations, rights, qualifications, preferences, limitations and terms of the shares of any series of preferred stock including, but not limited to, the following:

|

1.

|

The number of shares constituting that series and the distinctive designation of that series, which may be by distinguishing number, letter or title;

|

|

2.

|

The dividend rate on the shares of that series, whether dividends will be cumulative, and if so, from which date(s), and the relative rights of priority, if any, of payment of dividends on shares of that series;

|

|

3.

|

Whether that series will have voting rights, in addition to the voting rights provided by law, and, if so, the terms of such voting rights;

|

|

4.

|

Whether that series will have conversion privileges, and, if so, the terms and conditions of such conversion, including provision for adjustment of the conversion rate in such events as the Board of Directors determines;

|

|

5.

|

Whether or not the shares of that series will be redeemable, and, if so, the terms and conditions of such redemption, including the date or date upon or after which they are redeemable, and the amount per share payable in case of redemption, which amount may vary under different conditions and at different redemption dates;

|

|

6.

|

Whether that series will have a sinking fund for the redemption or purchase of shares of that series, and, if so, the terms and amount of such sinking fund;

|

|

7.

|

The rights of the shares of that series in the event of voluntary or involuntary liquidation, dissolution or winding up of the corporation, and the relative rights of priority, if any, of payment of shares of that series;

|

|

8.

|

Any other relative rights, preferences and limitations of that series

|

Provisions in Our Articles of Incorporation and By-Laws That Would Delay, Defer or Prevent a Change in Control

Our articles of incorporation authorize our board of directors to issue a class of preferred stock commonly known as a "blank check" preferred stock. Specifically, the preferred stock may be issued from time to time by the board of directors as shares of one (1) or more classes or series. Our board of directors, subject to the provisions of our Articles of Incorporation and limitations imposed by law, is authorized to adopt resolutions; to issue the shares; to fix the number of shares; to change the number of shares constituting any series; and to provide for or change the following: the voting powers; designations; preferences; and relative, participating, optional or other special rights, qualifications, limitations or restrictions, including the following: dividend rights, including whether dividends are cumulative; dividend rates; terms of redemption, including sinking fund

provisions; redemption prices; conversion rights and liquidation preferences of the shares constituting any class or series of the preferred stock.

In each such case, we will not need any further action or vote by our shareholders. One of the effects of undesignated preferred stock may be to enable the board of directors to render more difficult or to discourage an attempt to obtain control of us by means of a tender offer, proxy contest, merger or otherwise, and thereby to protect the continuity of our management. The issuance of shares of preferred stock pursuant to the board of director's authority described above may adversely affect the rights of holders of common stock. For example, preferred stock issued by us may rank prior to the common stock as to dividend rights, liquidation preference or both, may have full or limited voting rights and may be convertible into shares of common stock. Accordingly, the issuance of shares of preferred stock may discourage bids for the common stock at a premium or may otherwise adversely affect the market price of the common stock.

Dividend Policy

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future.

Share Purchase Warrants

We have not issued and do not have outstanding any warrants to purchase shares of our common stock.

Options

We have not issued and do not have outstanding any options to purchase shares of our common stock.

Convertible Securities

We have not issued and do not have outstanding any securities convertible into shares of our common stock or any rights convertible or exchangeable into shares of our common stock.

Nevada Anti-Takeover Laws

Nevada Revised Statutes sections 78.378 to 78.379 provide state regulation over the acquisition of a controlling interest in certain Nevada corporations unless the articles of incorporation or bylaws of the corporation provide that the provisions of these sections do not apply. Our articles of incorporation and bylaws do not state that these provisions do not apply. The statute creates a number of restrictions on the ability of a person or entity to acquire control of a Nevada company by setting down certain rules of conduct and voting restrictions in any acquisition attempt, among other things. The statute is limited to corporations that are organized in the state of Nevada and that have 200 or more stockholders, at least 100 of whom are stockholders of record and residents of the State of Nevada; and does business in the State of Nevada directly or through an affiliated corporation. Because of these conditions, the statute currently does not apply to our company.

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

Puoy K. Premsrirut, Esq., our independent legal counsel, has provided an opinion on the validity of our common stock.

Weaver Martin & Samyn, LLC, have audited our financial statements included in this prospectus and registration statement to the extent and for the periods set forth in their audit report. Weaver Martin & Samyn, LLC has presented their report with respect to our audited financial statements. The report of Weaver Martin & Samyn, LLC is included in reliance upon their authority as experts in accounting and auditing.

Principal Place of Business

Our principal offices are located at 7582 Las Vegas Blvd. S., Ste. 236, Las Vegas, Nevada 89123. Our officer and director provides office services free of charge.

In General

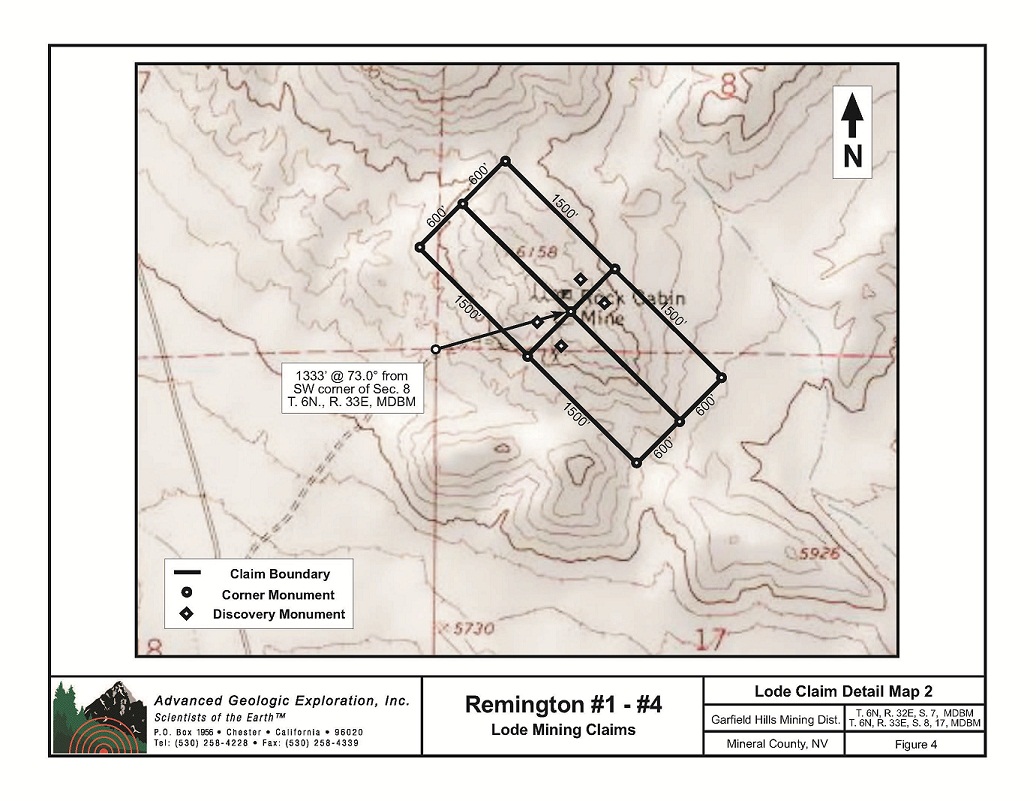

We are an exploration stage company engaged in the exploration of mineral properties. We have acquired a block of mineral claims that we refer to as the Remington claims. The claims are formally designated as Remington #1, Remington #2, Remington #3, and Remington #4. The claims are identified as, Bureau of Land Management Nevada Mining Claim Nos. NMC 1035534, NMC 1035535, NMC 1035536, and NMC 1035537, respectively.

Additional exploration of our mineral claims is required before a final determination as to their viability can be made. The property consists of approximately 100 acres and is located on federal land in Mineral County, Nevada. The Remington claims are a lode mining claims which were located on October 12, 2010. Mining claims on federal land are staked by the placement of a discovery monument on the claim in a conspicuous place. In Nevada, notice of the claim location is then recorded with the county recorder for the county in which the claim is located. The Remington claims were each staked by the placement of discovery monument secured in a mound of stone on the claims. Notices of the claim locations were then recorded with the Mineral County, Nevada recorder on January 10, 2011. The Remington claims are unpatented mining claims and our rights to the property are restricted to the exploration and extraction of a mineral deposit. See generally, “Compliance with Governmental Regulation,” below. We acquired a 100% interest in the Remington mineral claims on July 29, 2011 for a purchase price of $20,600. Our ownership was conveyed from the original locator by way of quitclaim deed which was recorded in Mineral County, Nevada, with copy being furnished to the Bureau of Land Management. We are the sole owner of the Remington claims and there are no royalty agreements or other contractual interests in the claims. Certain conditions must be met in order for our rights in the Remington claims to be maintained. All federal mining claimants must pay an annual maintenance fee per claim or site to the BLM (currently $140 per claim). Because we own an interest in 10 or fewer mining claims nationwide, we have the option of performing assessment work in the minimum amount of $100 in labor or improvements on each claim, and recording evidence of such with the BLM by December 30 of the calendar year in which the assessment year ended. The charge for recording an affidavit of annual labor or representation with BLM is $10 per claim.

Through our consulting geologist, we have performed an initial reconnaissance sampling program on our mining claims. Our initial sampling program indicated the presence elevated silver mineralization in the rock outcrops which were sampled. Based upon the results of our initial reconnaissance sampling program, our consulting geologist has recommended an additional detailed rock sampling program, together with geological mapping of the claims and a reconnaissance sampling of nearby properties on the boundaries of the Remington claims to determine if the acquisition of neighboring properties would be beneficial. Our planned additional exploration activities will be designed to explore for additional indications that the Remington claims may contain commercially viable quantities of silver. We have not identified commercially exploitable reserves of silver or other precious metals on the Remington claims to date. We are an exploration stage company and there is no assurance that commercially viable gold quantities exist on the Remington mineral claims. In addition, our sole officer and director, Mr. Scoggins, has not yet visited the property. As a result, we may face an enhanced risk that, upon management’s physical examination of the Remington property, no commercially viable deposits of gold or other minerals will be located.

The Remington property is without known reserves and our proposed program is exploratory in nature.

Location and Means of Access to the Remington Claims

The Remington #1 - 4 claims consists of four contiguous unpatented lode mining claims covering approximately 100 acres in Township 6 North, Range 32 East (T 6N, R 32E), section 7, and Township 6 North, Range 33 East (T 6N, R 33E), Sections 8 and 17, Mount Diablo Base and Meridian (MDB&M). The mining claims are located on Bureau of Land Management lands in Mineral County, Nevada, near Hawthorne, NV. Access to the claims is predominately on dirt roads that are in good condition. A 4- wheeled drive is recommended, although a 2-wheeled drive would probably access the property in the absence of inclement weather. Directions from the town of Hawthorne, NV are as follows with a GPS point at the end of the route:

|

·

|

From Hawthorne, NV, head East on US 95. Follow US 95 for approximately 8.6 miles.

|

|

·

|

Turn right onto Garfield Flats Road. Follow Garfield Flats Road and Garfield Road for approximately 37.6 miles.

|

|

·

|

Turn right at the fork onto un-named two-track road and follow for 1.5 miles. Go left at the fork, ending GPS point is 38.23262 N., 118.19981 W. (Note: The GPS units are decimal degrees (DD.ddddd) and the datum is NAD27)

|

|

·

|

The two-track road winds up a narrow wash and stops at an elevation of about 5840’. It is a short hike up to the claims. There is no direct vehicle access to the claims.

|

Acquisition and Ownership of the Remington Mineral Claims.

We have acquired a 100% interest in the Remington mineral claims on July 29, 2011 for a purchase price of $20,600. Our ownership was conveyed from the seller by way of quitclaim deed which was recorded in Mineral County, Nevada, with copy being furnished to the Bureau of Land Management. All federal mining claimants must pay an annual maintenance fee per claim or site to the BLM (currently $140 per claim). Because we own an interest in 10 or fewer mining claims nationwide, we have the option of performing assessment work in the minimum amount of $100 in labor or improvements on each claim, and recording evidence of such with the BLM by December 30 of the calendar year in which the assessment year ended. The charge for recording an affidavit of annual labor or representation with BLM is $10 per claim.

History of Previous Mining Operations on the Remington Claims and Condition of the Property

The Remington lode claims include the historic workings of the Rock Cabin Mine, which is located at the southeastern extent of an extensive northwest / southeast mineralization trend. Historic workings are dotted throughout the claim block and consist of several small digs, shafts and prospects. One particular tunnel had been excavated to more than 60 feet deep and several have been timbered. Many of the historic workings are shallow, however, or were excavated to a few tens of feet below the surface. The small prospects, digs and shafts explore alterations on the Remington claim block. The claims were originally laid out to maximize the coverage of these prospects. The historic Rock Cabin Mine was a producer of gold, silver, lead and tin. Silver production is more prevalent in the southern half of the mining district that includes the Remington lode claims. There are no historical production records available for silver or other metals on the claim.

The Remington #1 - #4 lode claims are located in the Garfield Hills near Garfield Flat. The property occupies a northwest-southeast trending ridge that slopes fairly steeply down in all directions. The elevation ranges from 5920’ to 6158’ amsl. It contains arid, high-elevation vegetation consisting predominantly of sagebrush and various grasses and shrubs. The claims occupy the crest of a north-northwest - south-southeast trending rocky peninsula to the Garfield alkali flats.

There is currently no electrical power available on the Remington claims.

Our consulting geologist, Charles P. Watson, CA Professional Geologist #7818, has performed a reconnaissance-level mineral assessment of the property to outline its potential for an economically viable mineral deposit. The project consisted of the reconnaissance of historic prospects on the property and the collection of five representative rock samples. Sample descriptions were prepared, photographs taken and GPS positioning was determined. The samples were transported under chain of custody to ALS Minerals in Sparks, Nevada, a professional mineral testing and assaying facility. The testing result certificates were sent directly to the professional geologist, whereupon they were evaluated. The specific assay test involved a 35-element suite that used an aqua regia digest followed by an ICP analysis. In addition, a 30-gram sample was fire assayed for gold.

A summary of the results is presented in Table 1, below:

|

Table 1

|

|||||

|

Sample Description

|

Au

ppm

|

Ag

ppm

|

Cu

ppm

|

Pb

ppm

|

Zn

ppm

|

|

RC-1

|

0.033

|

0.3

|

9

|

9

|

68

|

|

RC-2

|

0.109

|

14.4

|

143

|

5,660

|

1,755

|

|

RC-3

|

0.431

|

115

|

3,020

|

28,500

|

34,000

|

|

RC-4

|

0.012

|

6.7

|

286

|

2,980

|

2,030

|

|

RC-5

|

0.612

|

175

|

2,360

|

55,300

|

7,400

|

Laboratory results confirmed field observations of results for high-grade silver and base metal mineralization occurs on the property. Two samples, RC-3 and RC-5 reported over 100 ppm silver with a peak silver assay of 175 ppm (5.6 OPT). The highest silver assays came from samples of the quartz veining mineralization where intense solution boiling was noted. A key item of note was the high silver values are also associated with elevated lead. Zinc appears to be a non-pathfinder mineral as it was high in RC-3 and relatively low in RC-5. Modest amounts of copper were also reported, and these two samples showed the highest values for the five samples collected. Interestingly, gold was also highest in these two samples, showing 0.4 and 0.6 ppm, respectively. Although not impressive, it is noteworthy.

The two perimeter iron oxide mineralization samples collected, RC-1 and RC-2, showed promising silver results in RC-2. Considering that surface leaching of silver is common, it suggests that higher silver values could be found at depth. Proportionally, lead was also elevated in RC-2, which supports the silver-leaching hypothesis. Further reconnaissance of these areas has been recommended by our consulting geologist.

Based on the results of the initial Phase 1 reconnaissance sampling program, our consulting geologist has recommended taking additional steps in an exploration plan to explore for commercial silver deposits on the Remington claims.

Recommendations for additional sampling and testing include:

|

·

|

Additional prospects are observed around the boundaries of the Remington claim block. These prospects should be sampled, assayed and acquired through additional claim staking if positive results are returned.

|

|

·

|

Vicinity and detailed local geological mapping should be conducted with particular attention paid to the alteration suites

|

|

·

|

Conduct a detailed rock sampling program with between 100-200 samples to better define the alteration suites, their spatial distribution and level of surface mineralization.

|

|

·

|

Begin the permitting process for subsurface mineral sampling through exploration test pits or through dozer cuts. Planning should also address the possibility of using the disturbance in the anticipation of a future diamond drill program.

|

The Phase I reconnaissance sampling program was completed at a cost of $5,000. As discussed in more detail under “Management Discussion and Analysis of Financial Condition and Results of Operations,” below, we currently plan to pursue a sampling and mapping program on the property at an approximate cost of $20,000.

Geology and Potential Silver Sources on the Remington Claims

Rocks in the Remington lode claims area consist of a package of Jurassic-age sedimentary rocks of the Dunlap Formation and Triassic-age Gabbs and Sunrise Formations. The Dunlap Formation consists of interstratified sandstones, conglomerate and volcanic flows and tuffaceous sandstones. The Gabbs and Sunrise Formations sandstones consist of limey sandstone, sandy limestone and siltstone, with occasional interbeds of shale. These rock types generally make good host rocks for mineralization. Bedding generally strikes northwest and parallels the ridgeline, and dips to the southwest. The contact between the Triassic and Jurassic rocks is noted in the literature as an unconformity, however, here it is likely faulted. The thickness of the sedimentary package is not well understood at this time but is believed to be on the order of a few thousand feet or more. Tectonic disruption of the sediment units is common. Folding is both local and regional. Drag folds associated regional folding are often sheared and smallscale anticlinal folding forms wide separations between varying rock compositions. Although no large-scale faults were seen on the Remington lode claim block, a short distance away and to the south is a large normal fault that brings sedimentary rocks adjacent to the Tertiary volcanic rocks that cap much of the Garfield Hills.

Rocks of the Garfield Hills show strong alteration halos that suggest plutonic intrusion at relatively shallow depths. The general circular topographic shape of the Garfield Hills suggests that it sits on top of a collapsed plutonic dome. Basaltic-andesitic dikes are scattered on the Remington claims. These intrusions were likely the driving sources for the alterations and mineralizations.

Alterations generally consisted of either: (1) a weak to strong iron oxide veining that is accompanied by some quartz veining and some argillicization, or (2) multiple-phase quartz veining with visible precious and base metal mineralization. The iron oxide alteration occurs in broad aureoles about the property. They seem to be following zones of structural weakness developed by either the folding or faulting. Some iron oxide alteration is intense to a point of becoming gossen-like. The iron oxides alterations are impregnated with thin brown to druzy quartz veinlets and remnant iron sulfides can be seen trapped within the siliceous matrix. Several large siliceous iron oxide alteration haloes were observed on the claims but had no prospect pits. Samples RC-1 and RC-2 were obtained from these perimeter alterations.