Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2011

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 1-16735

PENN VIRGINIA RESOURCE PARTNERS, L.P.

(Exact name of registrant as specified in its charter)

| Delaware | 23-3087517 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

FIVE RADNOR CORPORATE CENTER, SUITE 500

100 MATSONFORD ROAD

RADNOR, PA 19087

(Address of principal executive offices) (Zip Code)

(610) 975-8200

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 (“Exchange Act”) during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by a check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

As of October 17, 2011, 70,981,867 common units representing limited partner interests were outstanding.

Table of Contents

PENN VIRGINIA RESOURCE PARTNERS, L.P.

INDEX

Table of Contents

| Item 1 | Financial Statements |

PENN VIRGINIA RESOURCE PARTNERS, L.P. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME – unaudited

(in thousands, except per unit data)

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2011 | 2010 | 2011 | 2010 | |||||||||||||

| Revenues |

||||||||||||||||

| Natural gas midstream |

$ | 259,710 | $ | 180,207 | $ | 722,898 | $ | 497,362 | ||||||||

| Coal royalties |

40,977 | 34,983 | 124,546 | 98,088 | ||||||||||||

| Other |

7,665 | 7,639 | 24,757 | 23,289 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenues |

308,352 | 222,829 | 872,201 | 618,739 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Expenses |

||||||||||||||||

| Cost of gas purchased |

223,762 | 151,657 | 613,295 | 415,111 | ||||||||||||

| Operating |

15,797 | 11,748 | 43,112 | 32,317 | ||||||||||||

| General and administrative |

8,755 | 9,029 | 31,700 | 34,367 | ||||||||||||

| Depreciation, depletion and amortization |

22,463 | 18,702 | 65,357 | 54,783 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total expenses |

270,777 | 191,136 | 753,464 | 536,578 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income |

37,575 | 31,693 | 118,737 | 82,161 | ||||||||||||

| Other income (expense) |

||||||||||||||||

| Interest expense |

(10,528 | ) | (10,639 | ) | (33,806 | ) | (25,368 | ) | ||||||||

| Derivatives |

8,690 | (11,020 | ) | (6,289 | ) | (11,514 | ) | |||||||||

| Other |

120 | 111 | 384 | 654 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income |

$ | 35,857 | $ | 10,145 | $ | 79,026 | $ | 45,933 | ||||||||

| Net loss (income) attributable to noncontrolling interests, pre-merger (Note 1) |

— | (2,864 | ) | 664 | (18,671 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income attributable to Penn Virginia Resource Partners, L.P. |

$ | 35,857 | $ | 7,281 | $ | 79,690 | $ | 27,262 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic net income per limited partner unit |

$ | 0.50 | $ | 0.19 | $ | 1.26 | $ | 0.71 | ||||||||

| Diluted net income per limited partner unit |

$ | 0.50 | $ | 0.19 | $ | 1.26 | $ | 0.71 | ||||||||

| Weighted average number of units outstanding, basic and diluted |

71,197 | 38,293 | 63,019 | 38,293 | ||||||||||||

The accompanying notes are an integral part of these Consolidated Financial Statements.

1

Table of Contents

PENN VIRGINIA RESOURCE PARTNERS, L.P. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS – unaudited

(in thousands)

| September 30, 2011 |

December 31, 2010 |

|||||||

| Assets |

||||||||

| Current assets |

||||||||

| Cash and cash equivalents |

$ | 13,908 | $ | 15,964 | ||||

| Accounts receivable, net of allowance for doubtful accounts |

116,538 | 97,787 | ||||||

| Derivative assets |

1,381 | — | ||||||

| Other current assets |

5,449 | 5,900 | ||||||

|

|

|

|

|

|||||

| Total current assets |

137,276 | 119,651 | ||||||

|

|

|

|

|

|||||

| Property, plant and equipment |

1,555,924 | 1,295,227 | ||||||

| Accumulated depreciation, depletion and amortization |

(384,554 | ) | (324,181 | ) | ||||

|

|

|

|

|

|||||

| Net property, plant and equipment |

1,171,370 | 971,046 | ||||||

|

|

|

|

|

|||||

| Equity investments |

84,487 | 84,327 | ||||||

| Intangible assets (net of accumulated amortization of $37,015 and $32,302) |

72,237 | 76,950 | ||||||

| Derivative assets |

332 | — | ||||||

| Other long-term assets |

44,958 | 52,231 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 1,510,660 | $ | 1,304,205 | ||||

|

|

|

|

|

|||||

| Liabilities and Partners’ Capital |

||||||||

| Current liabilities |

||||||||

| Accounts payable and accrued liabilities |

$ | 118,102 | $ | 103,845 | ||||

| Deferred income |

3,876 | 4,360 | ||||||

| Derivative liabilities |

11,527 | 19,516 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

133,505 | 127,721 | ||||||

|

|

|

|

|

|||||

| Deferred income |

9,646 | 7,874 | ||||||

| Other liabilities |

21,392 | 20,853 | ||||||

| Derivative liabilities |

1,255 | 5,107 | ||||||

| Senior notes |

300,000 | 300,000 | ||||||

| Revolving credit facility |

635,000 | 408,000 | ||||||

| Partners’ capital |

||||||||

| Common unitholders |

409,087 | 213,646 | ||||||

| Accumulated other comprehensive income |

775 | 159 | ||||||

|

|

|

|

|

|||||

| 409,862 | 213,805 | |||||||

| Non-controlling interests, pre-merger (Note 1) |

— | 220,845 | ||||||

|

|

|

|

|

|||||

| Total partners’ capital |

409,862 | 434,650 | ||||||

|

|

|

|

|

|||||

| Total liabilities and partners’ capital |

$ | 1,510,660 | $ | 1,304,205 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these Consolidated Financial Statements.

2

Table of Contents

PENN VIRGINIA RESOURCE PARTNERS, L.P. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS – unaudited

(in thousands)

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2011 | 2010 | 2011 | 2010 | |||||||||||||

| Cash flows from operating activities |

||||||||||||||||

| Net income |

$ | 35,857 | $ | 10,145 | $ | 79,026 | $ | 45,933 | ||||||||

| Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||||||||||

| Depreciation, depletion and amortization |

22,463 | 18,702 | 65,357 | 54,783 | ||||||||||||

| Commodity derivative contracts: |

||||||||||||||||

| Total derivative losses (gains) |

(8,690 | ) | 11,020 | 6,289 | 12,604 | |||||||||||

| Cash payments to settle derivatives |

(6,699 | ) | (2,435 | ) | (19,477 | ) | (6,493 | ) | ||||||||

| Non-cash interest expense |

1,040 | 1,633 | 4,735 | 4,243 | ||||||||||||

| Non-cash unit-based compensation |

966 | 137 | 2,805 | 6,024 | ||||||||||||

| Equity earnings, net of distributions received |

2,818 | 110 | 4,635 | 2,500 | ||||||||||||

| Other |

(127 | ) | (108 | ) | (909 | ) | (722 | ) | ||||||||

| Changes in operating assets and liabilities |

||||||||||||||||

| Accounts receivable |

(2,766 | ) | (9,102 | ) | (18,729 | ) | 1,828 | |||||||||

| Accounts payable and accrued liabilities |

5,345 | 24,492 | 20,335 | 24,517 | ||||||||||||

| Deferred income |

(855 | ) | 4,695 | (730 | ) | 5,423 | ||||||||||

| Other assets and liabilities |

605 | (8,850 | ) | (1,029 | ) | (9,809 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net cash provided by operating activities |

49,957 | 50,439 | 142,308 | 140,831 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cash flows from investing activities |

||||||||||||||||

| Acquisitions |

(95 | ) | (6 | ) | (122,135 | ) | (17,870 | ) | ||||||||

| Additions to property, plant and equipment |

(67,000 | ) | (33,240 | ) | (141,796 | ) | (57,973 | ) | ||||||||

| Other |

347 | 315 | 2,558 | 985 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net cash used in investing activities |

(66,748 | ) | (32,931 | ) | (261,373 | ) | (74,858 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cash flows from financing activities |

||||||||||||||||

| Distributions to partners |

(34,887 | ) | (30,619 | ) | (99,696 | ) | (91,403 | ) | ||||||||

| Proceeds from issuance of senior notes |

— | — | — | 300,000 | ||||||||||||

| Proceeds from borrowings |

60,000 | 44,000 | 252,000 | 110,000 | ||||||||||||

| Repayments of borrowings |

(5,000 | ) | (25,490 | ) | (25,000 | ) | (365,100 | ) | ||||||||

| Purchase of PVR limited partner units |

— | — | — | (1,092 | ) | |||||||||||

| Cash paid for debt issuance costs |

— | (10,430 | ) | (3,675 | ) | (19,177 | ) | |||||||||

| Cash paid for merger |

(16 | ) | — | (6,620 | ) | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net cash provided by (used in) financing activities |

20,097 | (22,539 | ) | 117,009 | (66,772 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase (decrease) in cash and cash equivalents |

3,306 | (5,031 | ) | (2,056 | ) | (799 | ) | |||||||||

| Cash and cash equivalents – beginning of period |

10,602 | 23,546 | 15,964 | 19,314 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cash and cash equivalents – end of period |

$ | 13,908 | $ | 18,515 | $ | 13,908 | $ | 18,515 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Supplemental disclosure: |

||||||||||||||||

| Cash paid for interest |

$ | 5,941 | $ | 3,931 | $ | 29,408 | $ | 15,327 | ||||||||

| Noncash investing activities: |

||||||||||||||||

| Other liabilities related to acquisitions |

$ | — | $ | — | $ | 2,084 | $ | — | ||||||||

| Contribution of license agreement to joint venture |

$ | 4,795 | $ | — | $ | 4,795 | $ | — | ||||||||

The accompanying notes are an integral part of these Consolidated Financial Statements.

3

Table of Contents

PENN VIRGINIA RESOURCE PARTNERS, L.P. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF PARTNERS’ CAPITAL AND COMPREHENSIVE INCOME – unaudited

(in thousands)

| Common Units (1) | Accumulated Other Comprehensive Income |

Noncontrolling interests of PVR (2) |

Total | Comprehensive Income |

||||||||||||||||||||

| Balance at December 31, 2010 |

38,293 | $ | 213,646 | $ | 159 | $ | 220,845 | $ | 434,650 | |||||||||||||||

| Unit-based compensation |

24 | 6,756 | 6,756 | |||||||||||||||||||||

| Costs associated with merger |

(11,240 | ) | (11,240 | ) | ||||||||||||||||||||

| Units issued to acquire non-controlling interests |

32,665 | 204,537 | 250 | (204,787 | ) | — | ||||||||||||||||||

| Distributions paid |

(84,302 | ) | (15,394 | ) | (99,696 | ) | ||||||||||||||||||

| Net income (loss) |

79,690 | (664 | ) | 79,026 | $ | 79,026 | ||||||||||||||||||

| Other comprehensive income |

366 | 366 | 366 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance at September 30, 2011 |

70,982 | $ | 409,087 | $ | 775 | $ | — | $ | 409,862 | $ | 79,392 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Common Units (1) | Accumulated Other Comprehensive Income (Loss) |

Noncontrolling interests of PVR |

Total | Comprehensive Income |

||||||||||||||||||||

| Balance at December 31, 2009 |

38,293 | $ | 250,240 | $ | (544 | ) | $ | 235,907 | $ | 485,603 | ||||||||||||||

| Unit-based compensation |

— | 6,024 | 6,024 | |||||||||||||||||||||

| Loss on issuance of subsidiary units |

(1,508 | ) | 1,508 | — | ||||||||||||||||||||

| Purchase of subsidiary units |

(11,665 | ) | 10,573 | (1,092 | ) | |||||||||||||||||||

| Distributions paid |

(45,326 | ) | (46,077 | ) | (91,403 | ) | ||||||||||||||||||

| Net income |

27,262 | 18,671 | 45,933 | $ | 45,933 | |||||||||||||||||||

| Other comprehensive income |

585 | 919 | 1,504 | 1,504 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance at September 30, 2010 |

38,293 | $ | 219,003 | $ | 41 | $ | 227,525 | $ | 446,569 | $ | 47,437 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | The outstanding common units have been adjusted to reflect the effect of the Merger; see Note 1, Organization, and Note 2, Basis of Presentation. PVG unitholders received consideration of 0.98 of a PVR common unit for each PVG common unit. |

| (2) | Effective with the Merger, see Note 1, Organization, and Note 2, Basis of Presentation, noncontrolling interests no longer exist and have become part of common units. |

The accompanying notes are an integral part of these Consolidated Financial Statements.

4

Table of Contents

PENN VIRGINIA RESOURCE PARTNERS, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – unaudited

September 30, 2011

| 1. | Organization |

Penn Virginia Resource Partners, L.P. is a publicly traded Delaware master limited partnership, the limited partner units representing limited partner interests which are listed on the New York Stock Exchange (“NYSE”) under ticker symbol “PVR.” As used in these Notes to Consolidated Financial Statements, the “Partnership,” “PVR,” “we,” “us” or “our” mean Penn Virginia Resource Partners, L.P. and, where the context requires, includes our subsidiaries.

We are principally engaged in the management of coal and natural resource properties and the gathering and processing of natural gas in the United States. We currently conduct operations in two business segments: (i) coal and natural resource management and (ii) natural gas midstream.

Our coal and natural resource management segment primarily involves the management and leasing of coal properties and the subsequent collection of royalties. Our coal reserves are located in Illinois, Indiana, Kentucky, New Mexico, Tennessee, Virginia and West Virginia. We also earn revenues from other land management activities, such as selling standing timber, leasing fee-based coal-related infrastructure facilities to certain lessees and end-user industrial plants, collecting oil and gas royalties and from coal transportation, or wheelage, fees.

Our natural gas midstream segment is engaged in providing natural gas processing, gathering and other related services. We own and operate natural gas midstream assets located in Oklahoma, Texas and Pennsylvania. Our natural gas midstream business derives revenues primarily from gas processing contracts with natural gas producers and from fees charged for gathering natural gas volumes and providing other related services. In addition, we are a partner in several joint ventures that gather and transport natural gas and water. We own a natural gas marketing business, which aggregates third-party volumes and sells those volumes into intrastate pipeline systems and at market hubs accessed by various interstate pipelines.

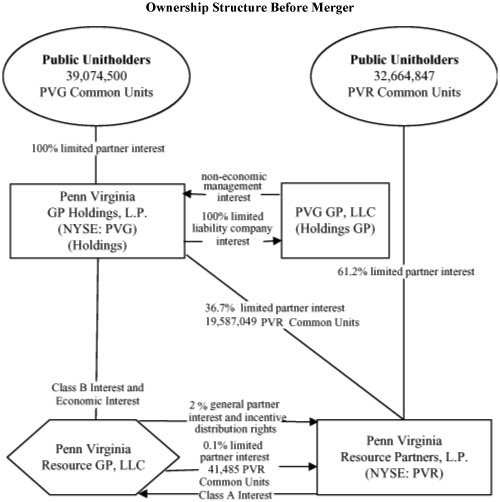

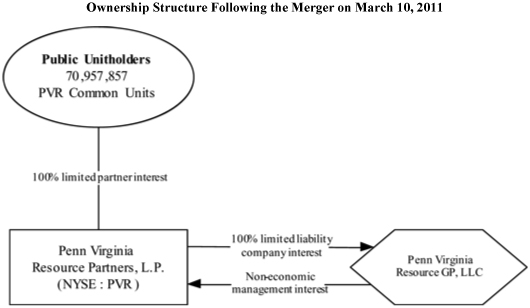

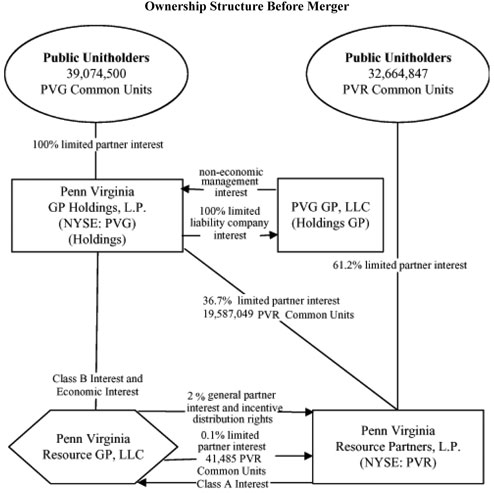

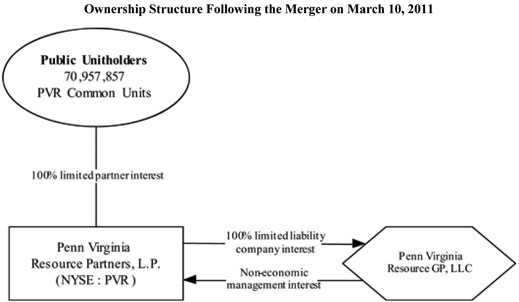

On September 21, 2010, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) by and among PVR, Penn Virginia Resource GP, LLC (“PVR GP”), Penn Virginia GP Holdings, L.P. (“PVG”), PVG GP LLC (“PVG GP”) and PVR Radnor, LLC (“Merger Sub”), a wholly owned subsidiary of PVR. The Merger Agreement received final approval by PVR unitholders on February 16, 2011 and PVG unitholders on March 9, 2011. Pursuant to the Merger Agreement, PVG and PVG GP were merged into Merger Sub, with Merger Sub as the surviving entity (the “Merger”). Merger Sub was subsequently merged into PVR GP, with PVR GP being the surviving entity as a subsidiary of PVR. In the transaction, PVG unitholders received consideration of 0.98 PVR common units for each PVG common unit, representing aggregate consideration of approximately 38.3 million PVR common units. Pursuant to the Merger Agreement and the Fourth Amended and Restated Agreement of Limited Partnership of PVR, the incentive distribution rights held by PVR’s general partner were extinguished, the 2.0% general partner interest in PVR held by PVR’s general partner was converted into a noneconomic management interest and approximately 19.6 million PVR common units owned by PVG were cancelled. The Merger closed on March 10, 2011. After the effective date of the Merger and related transactions, the separate existence of each of PVG, PVG GP and Merger Sub ceased, and PVR GP survives as a wholly-owned subsidiary of PVR.

Historically, PVG’s ownership of PVR’s general partner gave it control of PVR. During the periods that PVG controlled PVR (prior to March 10, 2011), PVG had no substantial assets or liabilities other than those of PVR. PVG’s consolidated financial statements included noncontrolling owners’ interest of consolidated subsidiaries, which reflected the proportion of PVR common units owned by PVR’s unitholders other than PVG. These amounts are reflected in the historical financial balances presented up to consummation of the Merger.

PVG is considered the surviving consolidated entity for accounting purposes, while PVR is the surviving consolidated entity for legal and reporting purposes. The Merger was accounted for as an equity transaction. Therefore, the changes in ownership interests as a result of the Merger did not result in gain or loss recognition.

After the Merger, the board of directors of PVR’s general partner, PVR GP, consisted of nine members, six of whom were existing members of the PVR GP board of directors before the Merger and three of whom were the three existing members of the conflicts committee of the board of directors of PVG GP prior to the Merger. On June 22, 2011, PVR held its annual unitholder meeting and all nine directors were re-elected to serve on the PVR GP board until PVR’s 2012 annual unit holder meeting.

5

Table of Contents

During the nine months ended September 30, 2011 and for the year ended December 31, 2010, we incurred $6.6 million and $4.6 million of direct costs associated with the Merger. The aggregate costs of $11.2 million were charged to partners’ capital upon the effective date of the Merger in 2011. At December 31, 2010, the $4.6 million of costs incurred at that time were included in other long-term assets on the consolidated balance sheet, and were transferred to partners’ capital upon the effective date of the merger. Cumulative costs incurred and paid during the three and nine months ended September 30, 2011 are reported under the caption “Cash paid for merger” in the financing activities section of the consolidated statement of cash flows.

The following diagrams depict the ownership structure of PVR and PVG before and immediately following the Merger:

6

Table of Contents

| 2. | Basis of Presentation |

These financial statements were originally the financial statements of PVG prior to the effective date of the Merger. The Merger was accounted for in accordance with consolidation accounting standards for changes in a parent’s ownership interest in a subsidiary. Under these accounting standards, the exchange of PVG common units for PVR common units was accounted for as a PVG equity issuance and PVG was the surviving entity for accounting purposes. Although PVG was the surviving entity for accounting purposes, PVR is the surviving entity for legal and reporting purposes; consequently, the name on these financial statements was changed from “Penn Virginia GP Holdings, L.P.” to “Penn Virginia Resource Partners, L.P.”

The reconciliation of PVR’s net income, as historically reported, to the net income reported in these financial statements is as follows (in thousands):

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||

| 2010 | 2010 | |||||||

| Net income, as previously reported |

$ | 10,774 | $ | 48,685 | ||||

| Adjustments: |

||||||||

| General and administrative expense (a) |

(637 | ) | (2,791 | ) | ||||

| Interest income |

8 | 39 | ||||||

|

|

|

|

|

|||||

| Net income |

$ | 10,145 | $ | 45,933 | ||||

|

|

|

|

|

|||||

| (a) | PVG incurred general and administrative expenses primarily related to audit fees, board of director fees, insurance and SEC filing expenses. |

Pursuant to the Merger, PVG’s unitholders received 0.98 of a PVR common unit for each PVG common unit they owned, or approximately 38.3 million of PVR common units in the aggregate, in exchange for all outstanding PVG common units. Also pursuant to the Merger, approximately 19.6 million PVR common units that were held by PVG were cancelled. As a result, PVR’s common units outstanding increased from 52.3 million to 71.0 million. However, for historical reporting purposes, the impact of this change was accounted for as a reverse unit split of 0.98 to 1.0. Therefore, since PVG was the surviving entity for accounting purposes, the weighted average common units outstanding used for basic and diluted earnings per unit calculations are PVG’s historical weighted average common units outstanding adjusted for the retrospective application of the reverse unit split. Amounts reflecting historical PVG common unit and per common unit amounts included in this report have been restated for the reverse unit split.

Our Consolidated Financial Statements include the accounts of PVR and all of our wholly owned subsidiaries. Investments in non-controlled entities over which we exercise significant influence are accounted for using the equity method. Intercompany balances and transactions have been eliminated in consolidation. Our Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the United States of America.

7

Table of Contents

These statements involve the use of estimates and judgments where appropriate. In the opinion of management, all adjustments, consisting of normal recurring accruals, considered necessary for a fair presentation of our Consolidated Financial Statements have been included. Our Consolidated Financial Statements should be read in conjunction with our consolidated financial statements and footnotes included in PVR’s and PVG’s Annual Reports on Form 10-K for the year ended December 31, 2010. Operating results for the three and nine months ended September 30, 2011 are not necessarily indicative of the results that may be expected for the year ending December 31, 2011.

Management has evaluated all activities of PVR through the date upon which our Consolidated Financial Statements were issued and concluded that no subsequent events have occurred that would require recognition in the Consolidated Financial Statements, but disclosure is required in the Notes to Consolidated Financial Statements. See Note 13 to the Consolidated Financial Statements.

In June 2011, the Financial Accounting Standards Board (“FASB”) issued an Accounting Standards Update (“ASU”) aimed at increasing the prominence of other comprehensive income in the financial statements by requiring comprehensive income to be reported in either a single statement or in two consecutive statements reporting net income and other comprehensive income. This amendment does not change items that are reported in other comprehensive income or requirements to report reclassification of items from other comprehensive income to net income. This ASU eliminates the option to report other comprehensive income and its components in the statement of changes in partners’ capital. We will be required to adopt the guidance for fiscal years, and interim periods within those years, beginning after December 15, 2011. Management is considering which presentation would be more beneficial to the readers of our financials and will adopt this ASU for interim periods beginning in 2012.

All dollar and unit amounts presented in the tables to these Notes are in thousands unless otherwise indicated.

| 3. | Acquisitions |

In the following paragraphs, all references to coal, oil and gas interests acquired are unaudited. The factors we used to determine the fair market value of the acquisition include, but are not limited to, discounted future net cash flows on a risk-adjusted basis, geographic location, quality of resources, potential marketability and financial condition of lessees.

Business Combination

Middle Fork

On January 25, 2011, we completed an acquisition to acquire certain mineral rights and associated oil and gas royalty interests in Kentucky and Tennessee for approximately $95.7 million. The results of Middle Fork operations have been included in the consolidated financial statements since that date. The mineral rights include approximately 102 million tons of coal reserves and resources. The coal is primarily steam coal and expands our geographic scope in the Central Appalachia coal region.

We acquired assets of $97.8 million and liabilities of $2.1 million, which primarily represent deferred income. Deferred income represents minimum royalty payments paid by operators of the properties that may be recouped through future production. Funding for the acquisition was provided by borrowings under our revolving credit facility (the “Revolver”).

The Middle Fork acquisition has been accounted for using the purchase method of accounting. Under the purchase method of accounting, the total purchase price has been allocated to the tangible assets acquired and liabilities assumed. Below is the detailed allocation based upon acquisition date fair values:

| Fair value of assets acquired and liabilities assumed: |

||||

| Coal mineral interests |

$ | 94,410 | ||

| Oil and gas interests |

2,857 | |||

| Land |

449 | |||

| Support equipment |

60 | |||

| Deferred income |

(2,018 | ) | ||

| Other liabilities |

(42 | ) | ||

|

|

|

|||

| Fair value of assets acquired and liabilities assumed |

$ | 95,716 | ||

|

|

|

The following pro forma financial information reflects the consolidated results of our operations as if the Middle Fork acquisition had occurred on January 1, 2010. The pro forma information includes adjustments for royalty revenues, operating expenses, general and administrative expenses, depreciation and depletion of the acquired property and equipment, interest

8

Table of Contents

expense for acquisition debt and the change in weighted average common units resulting from the Merger. The pro forma financial information is not necessarily indicative of the results of operations as it would have been had these transactions been effected on the assumed date (in thousands, except per unit data):

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2011 | 2010 | 2011 | 2010 | |||||||||||||

| Revenues |

$ | 308,352 | $ | 226,046 | $ | 873,054 | $ | 627,054 | ||||||||

| Net income attributable to PVR |

$ | 35,857 | $ | 7,937 | $ | 79,853 | $ | 28,890 | ||||||||

| Net income per limited partner unit, basic and diluted |

$ | 0.50 | $ | 0.21 | $ | 1.26 | $ | 0.75 | ||||||||

During the year, we have made other acquisitions that individually and in the aggregate are not material for disclosure purposes. The aggregate cost of all other acquisitions was a net $26.9 million.

| 4. | Fair Value Measurements |

We apply the authoritative accounting provisions for measuring fair value of both our financial and nonfinancial assets and liabilities. Fair value is an exit price representing the expected amount we would receive to sell an asset or pay to transfer a liability in an orderly transaction with market participants at the measurement date. We have followed consistent methods and assumptions to estimate the fair values as more fully described in our Annual Report on Form 10-K for the year ended December 31, 2010.

Our financial instruments that are subject to fair value disclosure consist of cash and cash equivalents, accounts receivable, accounts payable, derivatives and long-term debt. At September 30, 2011, the carrying values of all of these financial instruments, except the long-term debt with fixed interest rates, approximated fair value. The fair value of floating-rate debt approximates the carrying amount because the interest rates paid are based on short-term maturities. The fair value of our fixed-rate long-term debt is estimated based on the published market prices for the same or similar issues (a Level 1 category fair value measurement). As of September 30, 2011, the fair value of our fixed-rate debt was $285.0 million.

Nonrecurring Fair Value Measurements

We completed the Middle Fork acquisition on January 25, 2011. See Note 3, “Acquisitions,” for a description of this acquisition. In connection with our accounting for this acquisition, it was necessary for us to estimate the values of the assets acquired and liabilities assumed, which involved the use of various assumptions. The most significant assumptions, and the ones requiring the most judgment, involved the estimated fair values of coal minerals and oil and gas royalties along with the related pricing and production activities. The coal minerals acquisition included nonfinancial assets and liabilities that were measured at fair value as of the acquisition date. The total purchase price allocation was $95.7 million.

During the year, we have made other acquisitions that individually and in the aggregate are not material for disclosure purposes. The aggregate cost of all other acquisitions was a net $26.9 million.

The following table summarizes the fair value estimates for nonfinancial assets and liabilities measured at fair value on a nonrecurring basis by category as of the acquisition date:

| Fair Value Measurements, Using | ||||||||||||||||

| Description |

Fair Value Measurements at Acquisition Date |

Quoted Prices in Active Markets for Identical Assets (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

||||||||||||

| Middle Fork assets (1) |

$ | 97,776 | $ | — | $ | — | $ | 97,776 | ||||||||

| Middle Fork liabilities (1) |

(2,060 | ) | — | — | (2,060 | ) | ||||||||||

| Other acquisitions, net (2) |

26,919 | — | — | 26,919 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 122,635 | $ | — | $ | — | $ | 122,635 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | The Middle Fork assets and liabilities were acquired on January 25, 2011. |

| (2) | Other acquisitions were completed in the second and third quarters of 2011. |

9

Table of Contents

Recurring Fair Value Measurements

Certain assets and liabilities, including our derivatives, are measured at fair value on a recurring basis in our Consolidated Balance Sheet. The following tables summarize the valuation of these assets and liabilities for the periods presented:

| Fair Value Measurements at September 30, 2011, Using | ||||||||||||||||

| Description |

Fair Value Measurements at September 30, 2011 |

Quoted Prices in Active Markets for Identical Assets (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

||||||||||||

| Interest rate swap liabilities – current |

$ | (3,048 | ) | $ | — | $ | (3,048 | ) | $ | — | ||||||

| Interest rate swap liabilities – noncurrent |

(376 | ) | — | (376 | ) | — | ||||||||||

| Commodity derivative assets – current |

1,381 | — | 1,381 | — | ||||||||||||

| Commodity derivative assets – noncurrent |

332 | — | 332 | — | ||||||||||||

| Commodity derivative liabilities – current |

(8,479 | ) | — | (8,479 | ) | — | ||||||||||

| Commodity derivative liabilities – noncurrent |

(879 | ) | — | (879 | ) | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | (11,069 | ) | $ | — | $ | (11,069 | ) | $ | — | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Fair Value Measurements at December 31, 2010, Using | ||||||||||||||||

| Description |

Fair Value Measurements at December 31, 2010 |

Quoted Prices in Active Markets for Identical Assets (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

||||||||||||

| Interest rate swap liabilities – current |

$ | (7,647 | ) | $ | — | $ | (7,647 | ) | $ | — | ||||||

| Interest rate swap liabilities – noncurrent |

(1,037 | ) | — | (1,037 | ) | — | ||||||||||

| Commodity derivative liabilities – current |

(11,869 | ) | — | (11,869 | ) | — | ||||||||||

| Commodity derivative liabilities – noncurrent |

(4,070 | ) | — | (4,070 | ) | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | (24,623 | ) | $ | — | $ | (24,623 | ) | $ | — | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

We used the following methods and assumptions to estimate the fair values:

| • | Commodity derivatives: We utilize costless collars and swap derivative contracts to hedge against the variability in the fractionation, or frac, spread. We determine the fair values of our commodity derivative agreements based on discounted cash flows based on quoted forward prices for the respective commodities. Each of these is a Level 2 input. We use the income approach, using valuation techniques that convert future cash flows to a single discounted value. |

| • | Interest rate swaps: We have entered into the interest rate swaps (“Interest Rate Swaps”) to establish fixed rates on a portion of the outstanding borrowings under the Revolver. We use an income approach using valuation techniques that connect future cash flows to a single discounted value. We estimate the fair value of the swaps based on published interest rate yield curves as of the date of the estimate. Each of these is a Level 2 input. |

10

Table of Contents

| 5. | Derivative Instruments |

Natural Gas Midstream Segment Commodity Derivatives

We determine the fair values of our derivative agreements using third-party quoted forward prices for the respective commodities as of the end of the reporting period and discount rates adjusted for the credit risk of our counterparties if the derivative is in an asset position and our own credit risk if the derivative is in a liability position. The following table sets forth our commodity derivative positions as of September 30, 2011:

| Average Volume Per Day |

Swap Price | Weighted Average Price | Fair Value at September 30, 2011 |

|||||||||||||||||

| Put | Call | |||||||||||||||||||

| NGL – natural gasoline collar |

(gallons | ) | (per gallon) | |||||||||||||||||

| Fourth quarter 2011 |

95,000 | $ | 1.57 | $ | 1.94 | $ | (2,492 | ) | ||||||||||||

| NGL – natural gasoline collar |

(gallons | ) | (per gallon) | |||||||||||||||||

| First quarter 2012 through fourth quarter 2012 |

54,000 | $ | 1.75 | $ | 2.02 | (3,138 | ) | |||||||||||||

| Crude oil collar |

(barrels | ) | (per barrel) | |||||||||||||||||

| Fourth quarter 2011 |

400 | $ | 75.00 | $ | 98.50 | 109 | ||||||||||||||

| Crude oil swap |

(barrels | ) | (per barrel | ) | ||||||||||||||||

| First quarter 2012 through fourth quarter 2012 |

600 | $ | 88.62 | 1,604 | ||||||||||||||||

| Natural gas purchase swap |

(MMBtu | ) | (MMBtu | ) | ||||||||||||||||

| Fourth quarter 2011 |

6,500 | $ | 5.80 | (1,193 | ) | |||||||||||||||

| Natural gas purchase swap |

(MMBtu | ) | (MMBtu | ) | ||||||||||||||||

| First quarter 2012 through fourth quarter 2012 |

4,000 | $ | 5.195 | (1,370 | ) | |||||||||||||||

| Settlements to be paid in subsequent period |

(1,165 | ) | ||||||||||||||||||

Interest Rate Swaps

We have entered into the Interest Rate Swaps to establish fixed interest rates on a portion of the outstanding borrowings under the Revolver. The following table sets forth the positions of the Interest Rate Swaps as of September 30, 2011:

| Notional Amounts (in millions) |

Swap Interest Rates (1) | Fair Value

at September 30, 2011 |

||||||||||||||

| Term |

Pay | Receive | ||||||||||||||

| October 2011 – December 2011 |

$ | 250.0 | 3.37 | % | LIBOR | $ | (1,907 | ) | ||||||||

| January 2011 – December 2012 |

$ | 100.0 | 2.09 | % | LIBOR | $ | (1,517 | ) | ||||||||

| (1) | References to LIBOR represent the 3-month rate. |

For the Interest Rate Swaps, we reported a (i) net derivative liability of $3.4 million at September 30, 2011 and (ii) gain in accumulated other comprehensive income (“AOCI”) of $0.8 million as of September 30, 2011. In connection with periodic settlements, we reclassified a total of $0.4 million of net hedging losses on the Interest Rate Swaps from AOCI to the derivatives line on the Consolidated Statements of Income during the nine months ended September 30, 2011. See the following “Financial Statement Impact of Derivatives” section for the impact of the Interest Rate Swaps on our Consolidated Financial Statements.

11

Table of Contents

Financial Statement Impact of Derivatives

The following table summarizes the effects of our derivative activities, as well as the location of gains (losses) on our Consolidated Statements of Income for the periods presented:

| Location

of derivatives recognized in income statement |

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||||

| 2011 | 2010 | 2011 | 2010 | |||||||||||||||

| Derivatives not designated as hedging instruments: |

||||||||||||||||||

| Interest rate contracts (1) |

Interest expense | $ | — | $ | — | $ | — | $ | (1,090 | ) | ||||||||

| Interest rate contracts |

Derivatives | (58 | ) | (2,568 | ) | (956 | ) | (7,739 | ) | |||||||||

| Commodity contracts |

Derivatives | 8,748 | (8,452 | ) | (5,333 | ) | (3,775 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total increase (decrease) in net income resulting from derivatives |

$ | 8,690 | $ | (11,020 | ) | $ | (6,289 | ) | $ | (12,604 | ) | |||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Realized and unrealized derivative impact: |

||||||||||||||||||

| Cash paid for commodity and interest rate contract settlements |

Derivatives | $ | (6,699 | ) | $ | (2,435 | ) | $ | (19,477 | ) | $ | (6,493 | ) | |||||

| Unrealized derivative gains (losses) (2) |

15,389 | (8,585 | ) | 13,188 | (6,111 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total increase (decrease) in net income resulting from derivatives |

$ | 8,690 | $ | (11,020 | ) | $ | (6,289 | ) | $ | (12,604 | ) | |||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | This activity represents Interest Rate Swap amounts reclassified out of AOCI and into interest expense. |

| (2) | This activity represents unrealized gains (losses) in the interest expense and derivatives caption on our Consolidated Statements of Income. |

The following table summarizes the fair value of our derivative instruments, as well as the locations of these instruments, on our Consolidated Balance Sheets for the periods presented:

| Balance Sheet Location | Fair Values as of September 30, 2011 |

Fair Values as of December 31, 2010 |

||||||||||||||||

| Derivative Assets |

Derivative Liabilities |

Derivative Assets |

Derivative Liabilities |

|||||||||||||||

| Derivatives not designated as hedging instruments: |

||||||||||||||||||

| Interest rate contracts |

Derivative assets/liabilities – current |

$ | — | $ | 3,048 | $ | — | $ | 7,647 | |||||||||

| Interest rate contracts |

Derivative assets/liabilities – |

— | 376 | — | 1,037 | |||||||||||||

| Commodity contracts |

Derivative assets/liabilities – |

1,381 | 8,479 | — | 11,869 | |||||||||||||

| Commodity contracts |

Derivative assets/liabilities – |

332 | 879 | — | 4,070 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total derivatives not designated as hedging instruments |

$ | 1,713 | $ | 12,782 | $ | — | $ | 24,623 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total fair value of derivative instruments |

$ | 1,713 | $ | 12,782 | $ | — | $ | 24,623 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

As of September 30, 2011, we were not party to derivative instruments that were classified as fair value hedges or trading securities. In addition, as of September 30, 2011, we were not party to derivative instruments containing credit risk contingencies.

| 6. | Equity Investments |

In September 2011, we entered into a joint venture to construct and operate a pipeline system to supply fresh water to natural gas producers drilling in the Marcellus Shale in Pennsylvania. The 12-inch diameter steel pipeline will largely parallel the trunk line of our existing gathering system in Lycoming County. As of September 30, 2011 our non-cash contribution to the joint venture was $4.8 million.

In accordance with the equity method of accounting, we recognized earnings from all equity investments in the aggregate of $4.3 million and $6.5 million for the nine months ended September 30, 2011 and 2010, with a corresponding increase in the investment. The equity investments generally pay quarterly distributions on their cash flow. We received distributions of $8.9 million and $9.0 million for the nine months ended September 30, 2011 and 2010. Equity earnings related to equity investments are recorded in other revenues on the Consolidated Statements of Income. The equity investments for all joint ventures are included in the equity investments caption on the Consolidated Balance Sheets.

12

Table of Contents

Summarized financial information of unconsolidated equity investments is as follows for the periods presented:

| September 30, 2011 |

December 31, 2010 |

|||||||

| Current assets |

$ | 33,618 | $ | 43,367 | ||||

| Noncurrent assets |

$ | 213,591 | $ | 203,595 | ||||

| Current liabilities |

$ | 13,515 | $ | 6,890 | ||||

| Noncurrent liabilities |

$ | 2,520 | $ | 5,147 | ||||

| Nine Months Ended September 30, | ||||||||

| 2011 | 2010 | |||||||

| Revenues |

$ | 43,074 | $ | 52,722 | ||||

| Expenses |

$ | 26,091 | $ | 25,438 | ||||

| Net income |

$ | 16,983 | $ | 27,284 | ||||

| 7. | Long-term Debt |

Revolver

On April 19, 2011, our wholly-owned subsidiary, PVR Finco LLC, entered into the first amendment to the amended and restated secured credit agreement increasing our borrowing capacity under the Revolver from $850.0 million to $1.0 billion and extending the maturity date to April 19, 2016. PVR Finco LLC has an option to increase the commitments under the Revolver by up to an additional $200.0 million, to a total of $1.2 billion, upon receipt of commitments from one or more lenders. The amendment did not change the collateral provisions of the Revolver which is secured by substantially all of our assets, including recent acquisitions. The interest rate under the Revolver fluctuates based on the ratio of our total indebtedness-to-EBITDA. Interest is payable at the base rate plus an applicable margin ranging from 0.75% to 1.75% if we select the base rate indebtedness option under the Revolver or at a rate derived from LIBOR plus an applicable margin ranging from 1.75% to 2.75% if we select the LIBOR-based indebtedness option. As of September 30, 2011, net of outstanding indebtedness of $635.0 million and letters of credit of $1.6 million, we had remaining borrowing capacity of $363.4 million on the Revolver. The weighted average interest rate on borrowings outstanding under the Revolver during the nine months ended September 30, 2011 was approximately 2.7%. We do not have a public rating for the Revolver. As of September 30, 2011, we were in compliance with all covenants under the Revolver.

| 8. | Partners’ Capital and Distributions |

As of September 30, 2011, partners’ capital consisted of approximately 71.0 million common units. As noted in the Consolidated Statement of Partners’ Capital and Comprehensive Income and described in Note 1, Organization, and Note 2, Basis of Presentation, our outstanding number of units has changed significantly in connection with the Merger.

Net Income per Limited Partner Unit

Basic net income per limited partner unit is computed by dividing net income allocable to limited partners by the weighted average number of limited partner and vested deferred common units outstanding during the period. Diluted net income per limited partner unit is computed by dividing net income allocable to limited partners by the weighted average number of limited partner and vested deferred common units outstanding during the period and, when dilutive, phantom units. For the three and nine months ended September 30, 2011, weighted average awards of 39 thousand and 24 thousand phantom units were excluded from the diluted net income per limited partner unit calculation because the inclusion of these phantom units would have had an antidilutive effect. The three and nine months ended September 30, 2010 computation of net income per limited partner unit relates to the financial statements of PVG prior to the effective date of the Merger. For the three and nine months ended September 30, 2010, PVG did not have any phantom units or other participating securities outstanding, which would affect the computation of net income per limited partner unit.

13

Table of Contents

The following table reconciles the computation of net income to net income allocable to limited partners:

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2011 | 2010 | 2011 | 2010 | |||||||||||||

| Net income |

$ | 35,857 | $ | 10,145 | $ | 79,026 | $ | 45,933 | ||||||||

| Net loss (income) attributable to noncontrolling interests, pre-merger (Note 1) |

— | (2,864 | ) | 664 | (18,671 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income attributable to Penn Virginia Resource Partners, L.P. |

$ | 35,857 | $ | 7,281 | $ | 79,690 | $ | 27,262 | ||||||||

| Adjustments: |

||||||||||||||||

| Distributions to participating securities |

(111 | ) | — | (300 | ) | — | ||||||||||

| Participating securities’ allocable share of net income |

(111 | ) | — | (256 | ) | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income allocable to limited partners, basic |

$ | 35,635 | $ | 7,281 | $ | 79,134 | $ | 27,262 | ||||||||

| Participating securities’ allocable share of net income |

111 | — | 256 | — | ||||||||||||

| Participating securities’ earnings reallocated to unvested securities |

(111 | ) | — | (256 | ) | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income allocable to limited partners, diluted |

$ | 35,635 | $ | 7,281 | $ | 79,134 | $ | 27,262 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income per limited partner unit, basic |

$ | 0.50 | $ | 0.19 | $ | 1.26 | $ | 0.71 | ||||||||

| Net income per limited partner unit, basic and diluted |

$ | 0.50 | $ | 0.19 | $ | 1.26 | $ | 0.71 | ||||||||

| Weighted average limited partner units, basic and diluted |

71,197 | 38,293 | 63,019 | 38,293 | ||||||||||||

Cash Distributions

We distribute 100% of Available Cash (as defined in our partnership agreement) within 45 days after the end of each quarter to unitholders of record and, prior to the Merger, to our general partner. Available Cash is generally defined as all of our cash and cash equivalents on hand at the end of each quarter less reserves established by our general partner for future requirements. Our general partner has the discretion to establish cash reserves that are necessary or appropriate to (i) provide for the proper conduct of our business, (ii) comply with applicable law, any of our debt instruments or any other agreements and (iii) provide funds for distributions to unitholders and our general partner for any one or more of the next four quarters.

The following table reflects the allocation of total cash distributions paid by us during the periods presented:

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2011 | 2010 | 2011 | 2010 | |||||||||||||

| PVG limited partners |

$ | — | $ | 15,239 | $ | 15,239 | $ | 45,326 | ||||||||

| PVR limited partners (1) |

34,777 | 15,347 | 84,188 | 45,671 | ||||||||||||

| PVR phantom units |

110 | 33 | 269 | 406 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total cash distribution paid during period |

$ | 34,887 | $ | 30,619 | $ | 99,696 | $ | 91,403 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | PVR limited partner unit distributions represent distributions paid to public unitholders and not to units owned by PVG prior to the Merger. |

14

Table of Contents

| 9. | Related-Party Transactions |

In June 2010, Penn Virginia Corporation (“PVA”) sold its remaining interest in PVG and as a result, PVA no longer owned any limited or general partner interests in us or PVG. As a result of the divestiture, the related party transactions noted below are now considered arm’s-length and no longer require separate disclosures. Related party transactions included charges from PVA for certain corporate administrative expenses which were allocable to us and our subsidiaries. Other transactions involved subsidiaries of PVA related to the marketing of natural gas, gathering and processing of natural gas, and the purchase and sale of natural gas and NGLs in which we took title to the products. The Consolidated Statements of Income amounts noted below represent related party transactions prior to June 7, 2010 (date of divestiture).

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2011 | 2010 | 2011 | 2010 | |||||||||||||

| Consolidated Statements of Income: |

||||||||||||||||

| Natural gas midstream revenues |

$ | — | $ | — | $ | — | $ | 29,002 | ||||||||

| Other income |

$ | — | $ | — | $ | — | $ | 787 | ||||||||

| Cost of gas purchased |

$ | — | $ | — | $ | — | $ | 27,780 | ||||||||

| General and administrative |

$ | — | $ | — | $ | — | $ | 1,906 | ||||||||

| 10. | Unit-Based Compensation |

The Penn Virginia Resource GP, LLC Sixth Amended and Restated Long-Term Incentive Plan (the “LTIP”) permits the grant of common units, deferred common units, unit options, restricted units and phantom units to employees and directors of our general partner and its affiliates. Common units and deferred common units granted under the LTIP are immediately vested, and we recognize compensation expense related to those grants on the grant date. Restricted units and phantom units granted under the LTIP generally vest over a three-year period, and we recognize compensation expense related to those grants on a straight-line basis over the vesting period. Compensation expense related to these grants is recorded in the general and administrative expenses caption on our Consolidated Statements of Income. During the nine months ended September 30, 2011, we granted 264 thousand phantom units at a weighted average grant-date fair value of $29.16, including 155 thousand time-based phantom units and 109 thousand performance-based phantom units.

Time-based phantom units vest over a three-year period, with one-third vesting in each year. Some of the phantom units vested during the third quarter. A portion of the vested units were withheld for payroll taxes with the recipient receiving the net vested units.

Performance-based phantom units cliff-vest at the end of a three year period. The number of units that vest could range from 0% to 200% and depends on the outcome of unit market performance compared to peers and key results of operations metrics. Performance-based phantom units are entitled to forfeitable distribution equivalent rights which accumulate over the term of the units and will be paid in cash to the grantees at the date of vesting. The fair value of each performance-based phantom unit was estimated on the date of grant as $30.92 using a Monte Carlo simulation approach that uses the assumptions noted in the following table. Expected volatilities are based on historical changes in the market value of our common units. We base the risk-free interest rate on the U.S. Treasury rate for the week of the grant having a term equal to the expected life of the phantom units, continuously compounded.

| 2011 | ||||

| Expected volatility |

54.53 | % | ||

| Expected life |

2.6 years | |||

| Risk-free interest rate |

0.83 | % | ||

Prior to the Merger, the PVG GP, LLC Amended and Restated Long-Term Incentive Plan (“the PVG LTIP”) likewise permitted the granting of PVG common units, deferred common units, unit options, restricted units and phantom units to employees and directors of the general partner and its affiliates. At the time of the Merger, deferred PVG common units held on account of PVG’s directors were automatically converted to deferred PVR common units at the rate of 0.98 deferred PVR common units for each deferred PVG common unit.

15

Table of Contents

In connection with the normal three-year vesting of phantom and restricted units, as well as common unit and deferred common unit awards, we recognized the following expense during the periods presented: .

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2011 | 2010 | 2011 | 2010 | |||||||||||||

| Restricted units |

$ | — | $ | — | $ | — | $ | 1,172 | ||||||||

| Phantom units |

826 | 130 | 2,186 | 6,017 | ||||||||||||

| Director deferred and common units |

140 | 285 | 619 | 862 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 966 | $ | 415 | $ | 2,805 | $ | 8,051 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 11. | Commitments and Contingencies |

Legal

We are involved, from time to time, in various legal proceedings arising in the ordinary course of business. While the ultimate results of these proceedings cannot be predicted with certainty, our management believes that these claims will not have a material adverse effect on our financial position, results of operations or cash flows.

Environmental Compliance

As of September 30, 2011 and December 31, 2010, our environmental liabilities were $0.8 million and $0.9 million, which represents our best estimate of the liabilities as of those dates. We have reclamation bonding requirements with respect to certain unleased and inactive properties. Given the uncertainty of when a reclamation area will meet regulatory standards, a change in this estimate could occur in the future.

Mine Health and Safety Laws

There are numerous mine health and safety laws and regulations applicable to the coal mining industry. However, since we do not operate any mines and do not employ any coal miners, we are not subject to such laws and regulations. Accordingly, we have not accrued any related liabilities.

Customer Credit Risk

For the nine months ended September 30, 2011, revenues of each of our four largest natural gas midstream segment customers were $124.4 million, $76.5 million, $75.3 million and $72.7 million, for an aggregate of 40% of our total consolidated revenues. At September 30, 2011, 35% of our consolidated accounts receivable related to these customers.

| 12. | Segment Information |

Our reportable segments are as follows:

| • | Coal and Natural Resource Management – Our coal and natural resource management segment primarily involves the management and leasing of coal properties and the subsequent collection of royalties. We also earn revenues from other land management activities, such as selling standing timber, leasing coal-related infrastructure facilities and collecting oil and gas royalties. |

| • | Natural Gas Midstream – Our natural gas midstream segment is engaged in providing natural gas processing, gathering and other related services. In addition, we own member interests in joint ventures that gather and transport natural gas and water. |

| • | The corporate and other caption primarily represents corporate functions. |

16

Table of Contents

The following tables present a summary of certain financial information relating to our segments for the periods presented:

| Revenues | Operating income | |||||||||||||||

| Three Months Ended September 30, | Three Months Ended September 30, | |||||||||||||||

| 2011 | 2010 | 2011 | 2010 | |||||||||||||

| Coal and natural resource management |

$ | 47,456 | $ | 40,408 | $ | 29,831 | $ | 26,374 | ||||||||

| Natural gas midstream |

260,896 | 182,421 | 7,744 | 5,956 | ||||||||||||

| Corporate and other |

— | — | — | (637 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Totals |

$ | 308,352 | $ | 222,829 | $ | 37,575 | $ | 31,693 | ||||||||

|

|

|

|

|

|||||||||||||

| Interest expense |

(10,528 | ) | (10,639 | ) | ||||||||||||

| Derivatives |

8,690 | (11,020 | ) | |||||||||||||

| Other |

120 | 111 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| Net income |

$ | 35,857 | $ | 10,145 | ||||||||||||

|

|

|

|

|

|||||||||||||

| Additions to property and equipment | Depreciation, depletion & amortization | |||||||||||||||

| Three Months Ended September 30, | Three Months Ended September 30, | |||||||||||||||

| 2011 | 2010 | 2011 | 2010 | |||||||||||||

| Coal and natural resource management |

$ | 190 | $ | 169 | $ | 9,572 | $ | 7,440 | ||||||||

| Natural gas midstream |

66,905 | 33,077 | 12,891 | 11,262 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Totals |

$ | 67,095 | $ | 33,246 | $ | 22,463 | $ | 18,702 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Revenues | Operating income | |||||||||||||||

| Nine Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2011 | 2010 | 2011 | 2010 | |||||||||||||

| Coal and natural resource management |

$ | 144,429 | $ | 114,550 | $ | 90,485 | $ | 71,516 | ||||||||

| Natural gas midstream |

727,772 | 504,189 | 28,252 | 13,436 | ||||||||||||

| Corporate and other |

— | — | — | (2,791 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Totals |

$ | 872,201 | $ | 618,739 | $ | 118,737 | $ | 82,161 | ||||||||

|

|

|

|

|

|||||||||||||

| Interest expense |

(33,806 | ) | (25,368 | ) | ||||||||||||

| Derivatives |

(6,289 | ) | (11,514 | ) | ||||||||||||

| Other |

384 | 654 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| Net income |

$ | 79,026 | $ | 45,933 | ||||||||||||

|

|

|

|

|

|||||||||||||

| Additions to property and equipment | Depreciation, depletion & amortization | |||||||||||||||

| Nine Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2011 | 2010 | 2011 | 2010 | |||||||||||||

| Coal and natural resource management |

$ | 110,898 | $ | 18,283 | $ | 27,978 | $ | 22,145 | ||||||||

| Natural gas midstream |

153,033 | 57,560 | 37,379 | 32,638 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Totals |

$ | 263,931 | $ | 75,843 | $ | 65,357 | $ | 54,783 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total assets at | ||||||||||||||||

| September 30, | December 31, | |||||||||||||||

| 2011 | 2010 | |||||||||||||||

| Coal and natural resource management |

$ | 682,307 | $ | 585,559 | ||||||||||||

| Natural gas midstream |

828,353 | 711,942 | ||||||||||||||

| Corporate and other |

— | 6,704 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| Totals |

$ | 1,510,660 | $ | 1,304,205 | ||||||||||||

|

|

|

|

|

|||||||||||||

17

Table of Contents

| 13. | Subsequent Event |

In October 2011, the Coal and Natural Resources segment acquired properties which include coal, timber and oil and gas assets for approximately $21.6 million in West Virginia. We used borrowings under our Revolver to finance this acquisition.

18

Table of Contents

Certain statements contained herein include “forward-looking statements.” All statements that express beliefs, expectations, estimates or intentions, as well as those that are not statements of historical fact, are forward-looking statements. Words such as “may,” “will,” “could,” “should,” “expect,” “plan,” “project,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursue,” “target,” “continue,” and similar expressions are intended to identify such forward-looking statements. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from those expressed or implied by such forward-looking statements. These risks, uncertainties and contingencies include, but are not limited to, the following:

| • | the volatility of commodity prices for natural gas, natural gas liquids, or NGLs, and coal; |

| • | our ability to access external sources of capital; |

| • | any impairment writedowns of our assets; |

| • | the relationship between natural gas, NGL and coal prices; |

| • | the projected demand for and supply of natural gas, NGLs and coal; |

| • | competition among producers in the coal industry generally and among natural gas midstream companies; |

| • | the extent to which the amount and quality of actual production of our coal differs from estimated recoverable coal reserves; |

| • | our ability to generate sufficient cash from our businesses to maintain and pay the quarterly distribution to our unitholders; |

| • | the experience and financial condition of our coal lessees and natural gas midstream customers, including our lessees’ ability to satisfy their royalty, environmental, reclamation and other obligations to us and others; |

| • | operating risks, including unanticipated geological problems, incidental to our coal and natural resource management or natural gas midstream businesses; |

| • | our ability to acquire new coal reserves or natural gas midstream assets and new sources of natural gas supply and connections to third-party pipelines on satisfactory terms, or at all; |

| • | our ability to retain existing or acquire new natural gas midstream customers and coal lessees; |

| • | the ability of our lessees to produce sufficient quantities of coal on an economic basis from our reserves and obtain favorable contracts for such production; |

| • | the occurrence of unusual weather or operating conditions including force majeure events; |

| • | delays in anticipated start-up dates of our lessees’ mining operations and related coal infrastructure projects and new processing plants in our natural gas midstream business; |

| • | environmental risks affecting the mining of coal reserves or the production, gathering and processing of natural gas; |

| • | the timing of receipt of necessary governmental permits by us or our lessees; |

| • | hedging results; |

| • | accidents; |

| • | changes in governmental regulation or enforcement practices, especially with respect to environmental, health and safety matters, including with respect to emissions levels applicable to coal-burning power generators; |

| • | uncertainties relating to the outcome of current and future litigation regarding mine permitting; |

| • | risks and uncertainties relating to general domestic and international economic (including inflation, interest rates and financial and credit markets) and political conditions (including the impact of potential terrorist attacks); and |

| • | other risks set forth in our Annual Report on Form 10-K for the year ended December 31, 2010. |

Additional information concerning these and other factors can be found in our press releases and public periodic filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2010. Many of the factors that will determine our future results are beyond the ability of management to control or predict. Readers should not place undue reliance on forward-looking statements, which reflect management’s views only as of the date hereof. We undertake no obligation to revise or update any forward-looking statements, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise.

19

Table of Contents

| Item 2 | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion and analysis of the financial condition and results of operations of Penn Virginia Resource Partners, L.P. and its subsidiaries (the “Partnership,” “PVR,” “we,” “us” or “our”) should be read in conjunction with our Consolidated Financial Statements and Notes thereto in Item 1. All dollar amounts presented in the tables that follow are in thousands unless otherwise indicated.

Overview of Business

We are a publicly traded Delaware limited partnership principally engaged in the management of coal and natural resource properties and the gathering and processing of natural gas in the United States.

On September 21, 2010, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) by and among PVR, Penn Virginia Resource GP, LLC (“PVR GP”), Penn Virginia GP Holdings, L.P. (“PVG”), PVG GP LLC (“PVG GP”) and PVR Radnor, LLC (“Merger Sub”), a wholly owned subsidiary of PVR. The Merger Agreement received final approval by PVR unitholders on February 16, 2011 and PVG unitholders on March 9, 2011. Pursuant to the Merger Agreement, PVG and PVG GP were merged into Merger Sub, with Merger Sub as the surviving entity (the “Merger”). Merger Sub was subsequently merged into PVR GP, with PVR GP being the surviving entity as a subsidiary of PVR. In the transaction, PVG unitholders received consideration of 0.98 PVR common units for each PVG common unit, representing aggregate consideration of approximately 38.3 million PVR common units. Pursuant to the Merger Agreement and the Fourth Amended and Restated Agreement of Limited Partnership of PVR, the incentive distribution rights held by PVR’s general partner were extinguished, the 2.0% general partner interest in PVR held by PVR’s general partner was converted into a noneconomic management interest and approximately 19.6 million PVR common units owned by PVG were cancelled. The Merger closed on March 10, 2011. After the effective date of the Merger and related transactions, the separate existence of each of PVG, PVG GP and Merger Sub ceased, and PVR GP survives as a wholly-owned subsidiary of PVR.

Historically, PVG’s ownership of PVR’s general partner gave it control of PVR. During the periods that PVG controlled PVR (prior to March 10, 2011), PVG had no substantial assets or liabilities other than those of PVR. PVG’s consolidated financial statements included noncontrolling owners’ interest of consolidated subsidiaries, which reflected the proportion of PVR common units owned by PVR’s unitholders other than PVG. These amounts are reflected in the historical financial balances presented up to consummation of the Merger.

PVG is considered the surviving consolidated entity for accounting purposes, while PVR is the surviving consolidated entity for legal and reporting purposes. The Merger was accounted for as an equity transaction. Therefore, the changes in ownership interests as a result of the Merger did not result in gain or loss recognition.

After the Merger, the board of directors of PVR’s general partner, PVR GP, consisted of nine members, six of whom were existing members of the PVR GP board of directors before the Merger and three of whom were the three existing members of the conflicts committee of the board of directors of PVG GP prior to the Merger. On June 22, 2011, PVR held its annual meeting and all nine directors were re-elected to serve on the PVR GP board until PVR’s 2012 annual unitholder meeting.

During the nine months ended September 30, 2011 and for the year ended December 31, 2010, we incurred $6.6 million and $4.6 million of direct costs associated with the Merger. The aggregate costs of $11.2 million were charged to partners’ capital upon the effective date of the Merger in 2011. At December 31, 2010, the $4.6 million of costs incurred at that time were included in other long-term assets on the consolidated balance sheet, and were transferred to partners’ capital upon the effective date of the merger. Cumulative costs incurred and paid during the three and nine months ended September 30, 2011 are reported under the caption “Cash paid for merger” in the financing activities section of the consolidated statement of cash flows.

20

Table of Contents

The following diagrams depict the ownership structure of PVR and PVG before and immediately following the Merger:

21

Table of Contents

Key Developments

For the nine months ended September 30, 2011, the following general business developments and corporate actions had an impact, or will have an impact, on our results of operations. A discussion of these key developments follows:

Coal and Natural Resource Management Segment

Middle Fork Acquisition

On January 25, 2011, we completed an acquisition to acquire certain mineral rights and associated oil and gas royalty interests in Kentucky and Tennessee for approximately $95.7 million. The mineral rights include approximately 102 million tons of coal reserves and resources. The coal is primarily steam coal and expands our geographic scope in the Central Appalachia coal region.

Oatsville Reserves

In June 2011, we acquired 26.8 million tons of additional coal reserves in the Illinois Basin for $13.5 million. The Oatsville Reserve properties are deep minable Springfield V seam coal located on approximately 5,875 acres in Gibson and Pike counties in Indiana.

Natural Gas Midstream Segment

Aqua Joint Venture

In September 2011, we entered into a joint venture to construct and operate a pipeline system to supply fresh water to natural gas producers drilling in the Marcellus Shale in Pennsylvania. The 12-inch diameter steel pipeline will largely parallel the trunk line of our existing gathering system in Lycoming County. As of September 30, 2011 our contribution to the joint venture was $4.8 million.

Marcellus Shale Construction

During 2010, we began construction of gathering systems in Wyoming and Lycoming Counties in Pennsylvania. We have completed initial construction of 12-inch gas gathering pipelines in Wyoming County and began gathering natural gas on the system in June 2010. In February 2011, we commenced operations on the first phase of the Lycoming County system. In April 2011, we also began construction on the second phase of the Lycoming County system, which is expected to be operational in the first quarter of 2012. Construction and development to provide gathering, compression and related services in Lycoming and Wyoming Counties is ongoing. These Wyoming and Lycoming Counties gathering and transportation infrastructures are expected to capture anticipated volumes in the Marcellus Shale area, where we have been spending, and expect to continue to spend, a significant portion of our growth capital over the next year, and for the foreseeable future.

Panhandle