Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Energy Future Holdings Corp /TX/ | d248904d8k.htm |

| EX-99.1 - PRESS RELEASE - Energy Future Holdings Corp /TX/ | d248904dex991.htm |

EFH Corp.

Q3 2011 Investor Call

October 28, 2011

Exhibit 99.2 |

1

Safe Harbor Statement

Forward Looking Statements

This

presentation

contains

forward-looking

statements,

which

are

subject

to

various

risks

and

uncertainties.

Discussion

of

risks

and

uncertainties

that

could

cause

actual

results

to

differ

materially

from

management's

current

projections,

forecasts,

estimates

and

expectations

is

contained

in

EFH

Corp.'s

filings

with

the

Securities

and

Exchange

Commission

(SEC).

In

addition

to

the

risks

and

uncertainties

set

forth

in

EFH

Corp.'s

SEC

filings,

the

forward-looking

statements

in

this

presentation

regarding

the

company’s

long-term

hedging

program

could

be

affected

by,

among

other

things:

any

change

in

the

ERCOT

electricity

market,

including

a

regulatory

or

legislative

change,

that

results

in

wholesale

electricity

prices

not

being

largely

correlated

to

natural

gas

prices;

any

decrease

in

market

heat

rates

as

the

long-term

hedging

program

generally

does

not

mitigate

exposure

to

changes

in

market

heat

rates;

the

unwillingness

or

failure

of

any

hedge

counterparty

or

the

lenders

under

the

commodity

collateral

posting

facility

to

perform

their

respective

obligations;

or

any

other

event

that

results

in

the

inability

to

continue

to

use

a

first

lien

on

TCEH’s

assets

to

secure

a

substantial

portion

of

the hedges under the long-term hedging program.

Regulation G

This

presentation

includes

certain

non-GAAP

financial

measures.

A

reconciliation

of

these

measures

to

the

most

directly

comparable

GAAP

measures

is

included

in

the

appendix to this presentation. |

2

Today’s Agenda

Q&A

Financial and Operational

Overview

Q3 2011 Review

Paul Keglevic

Executive Vice President & CFO |

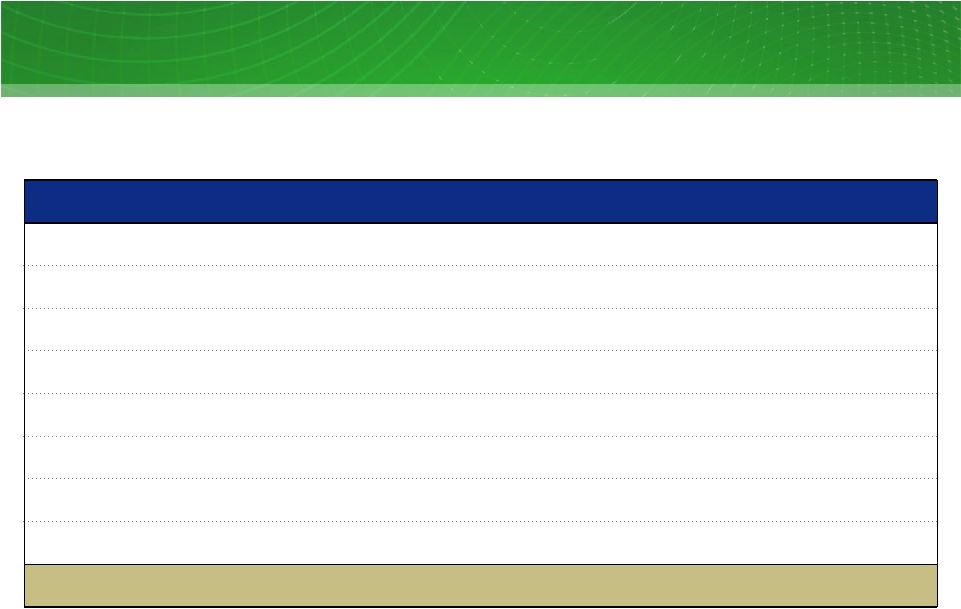

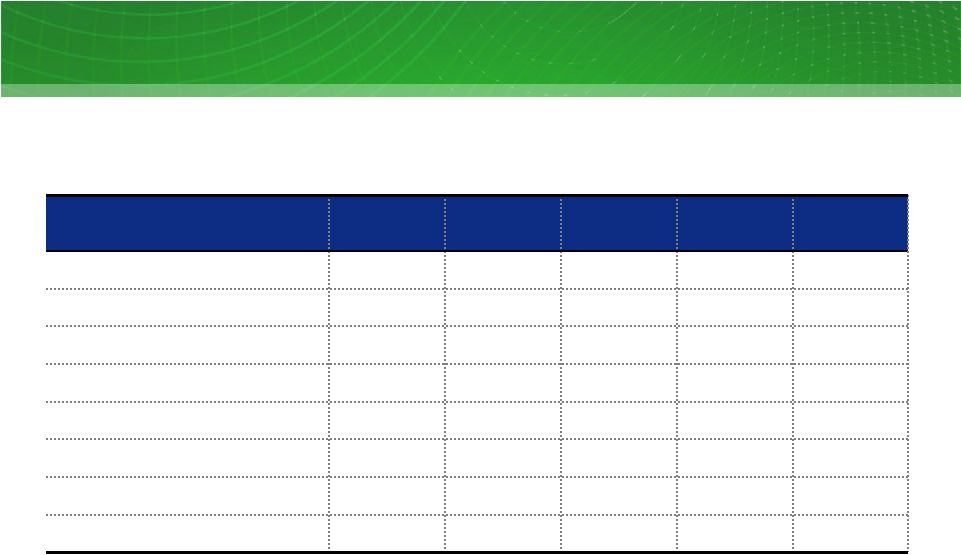

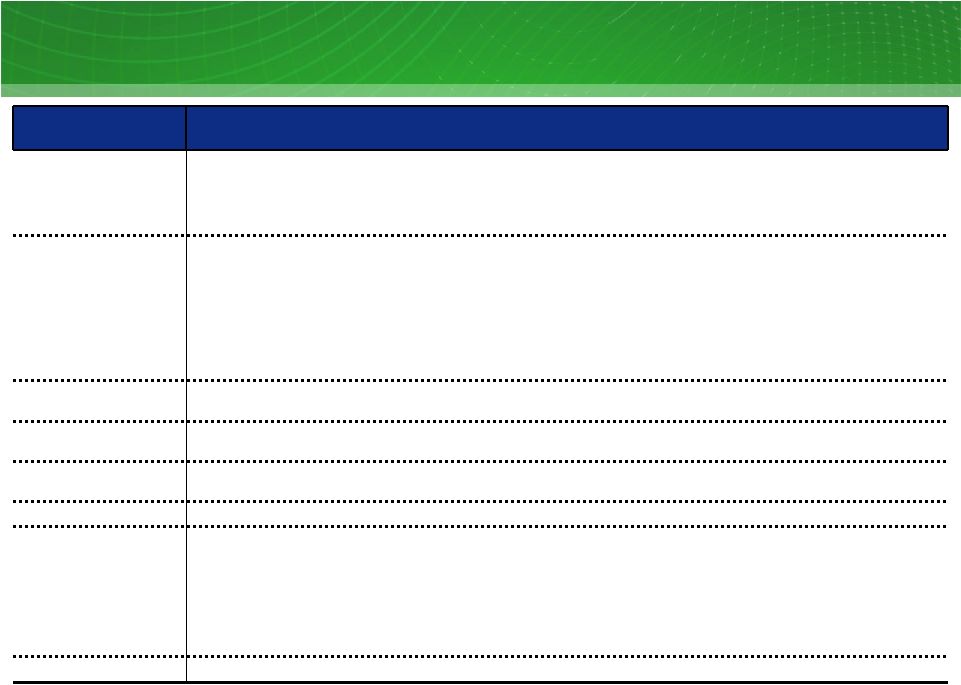

Consolidated: reconciliation of GAAP net income (loss) to adjusted (non-GAAP)

operating results Q3

1

10 vs. Q3 11; $ millions, after tax

EFH Corp.

Adjusted (Non-GAAP) Operating Results -

QTR

1

Three months ended September 30.

2

Items are noncash except for severance related to EPA’s Cross State Air

Pollution Rule (CSAPR). 3

Charges include, net of tax, $269 million of emissions allowances impairments, $32

million of severance accruals, and $6 million of mining asset impairments all recorded in other

deductions and $14 million of incremental depreciation expense.

Factor

Q3 10

Q3 11

Change

EFH Corp. GAAP net loss

(2,902)

(710)

2,192

Items

excluded

from

adjusted

(non-GAAP)

operating

results

(after

tax)

2

Unrealized commodity-related mark-to-market net gains

(494)

(89)

405

Unrealized mark-to-market net losses on interest rate swaps

118

402

284

Charges

related

to

EPA

Cross

State

Air

Pollution

Rule

3

-

321

321

Debt extinguishment gains –

2010 debt exchanges and repurchases

(659)

-

659

Goodwill impairment

4,100

-

(4,100)

Reduction of income tax expense due to resolution of IRS tax audit for 1997-2002

(146)

-

146

EFH Corp. adjusted (non-GAAP) operating income (loss)

17

(76)

(93)

3 |

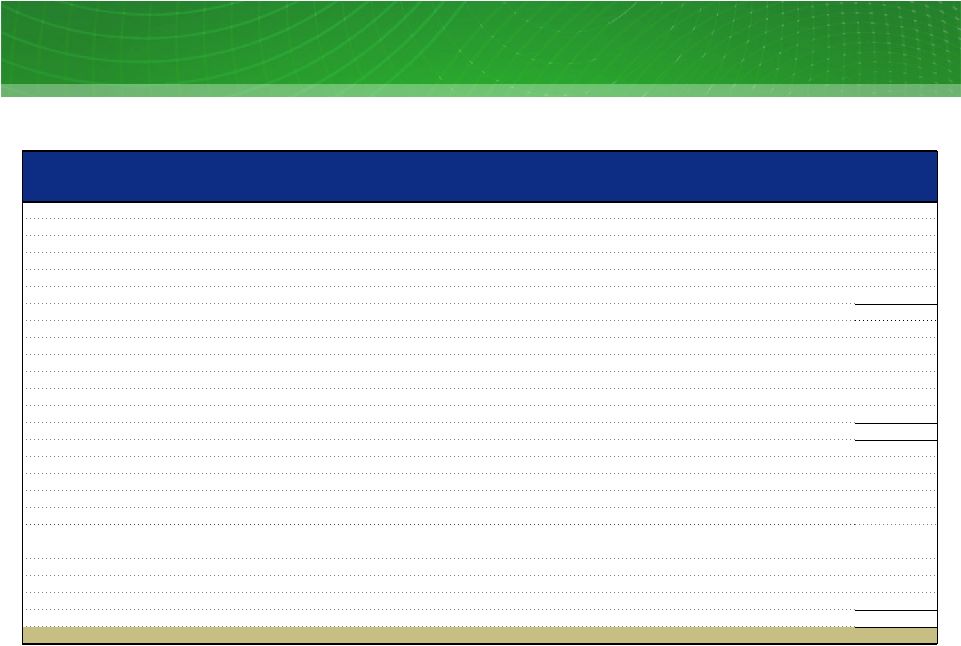

Consolidated key drivers of the change in (non-GAAP) operating results

Q3 10 vs. Q3 11; $ millions, after tax

EFH Corp.

Adjusted (Non-GAAP) Operating Results Key Drivers -

QTR

1

Competitive business consists of Competitive Electric segment and Corp. &

Other. Description/Drivers

Better

(Worse) Than

Q3 10

Competitive business

1

:

Lower retail volumes and commodity hedging offset by favorable weather-driven

consumption and asset management (21)

Lower production from nuclear generation units due to unplanned outages

(12)

Higher fuel costs at legacy generation units reflecting increased costs of purchased

coal and related transportation (7)

Impact of new lignite-fueled generation units

22

Other

(6)

Contribution margin

(24)

Higher net interest expense driven by higher average rates

(44)

Higher SG&A reflecting employee related expenses and information

technology costs

(13)

Higher operating costs reflecting nuclear plant planned maintenance and spending

related to CSAPR (6)

Higher depreciation reflecting ongoing investment in the legacy generation

fleet (3)

Lower retail bad debt expense reflecting improved collections and customer mix

8

All other -

net

(6)

Total change -

Competitive business

(88)

Regulated business:

Higher revenues from increased consumption primarily due to warmer weather

28

Higher net revenues driven by transmission rate and distribution

tariff increases, AMS surcharge and growth in points of delivery

15

Change in income taxes driven by 2010 reduction in interest accrued on uncertain tax

positions (16)

Higher depreciation reflecting infrastructure investment

(9)

Higher operations and maintenance expense due to employee related costs,

transportation and materials costs, vegetation management and advanced

metering expenses (9)

Higher transmission fees

(7)

Higher net interest expense

(3)

All other -

net

(4)

Total change –

Regulated business (~80% owned by EFH Corp.)

(5)

Total change in EFH Corp. adjusted (non-GAAP) operating results

(93)

4 |

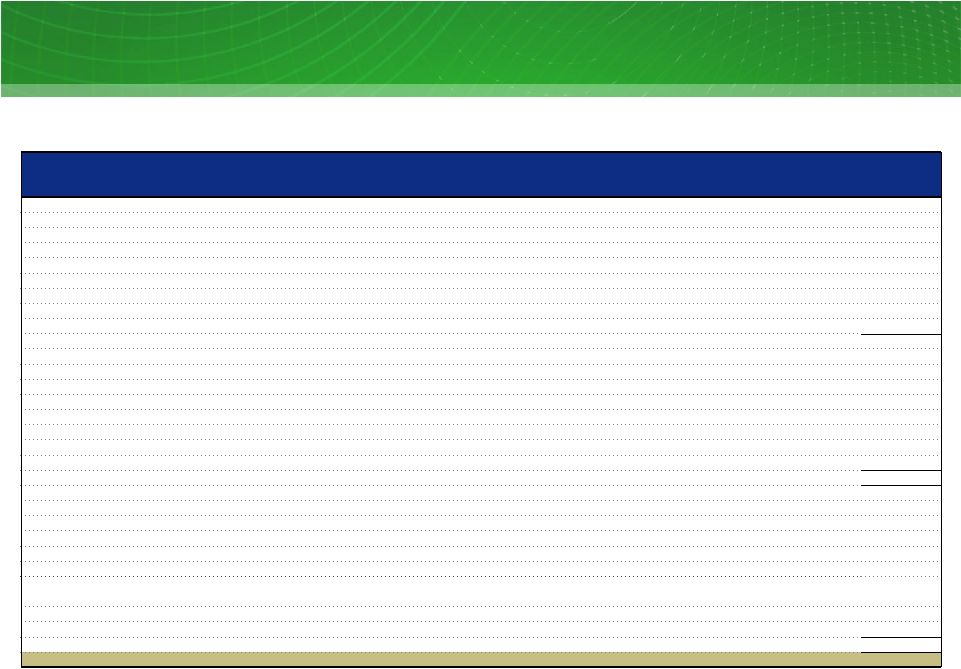

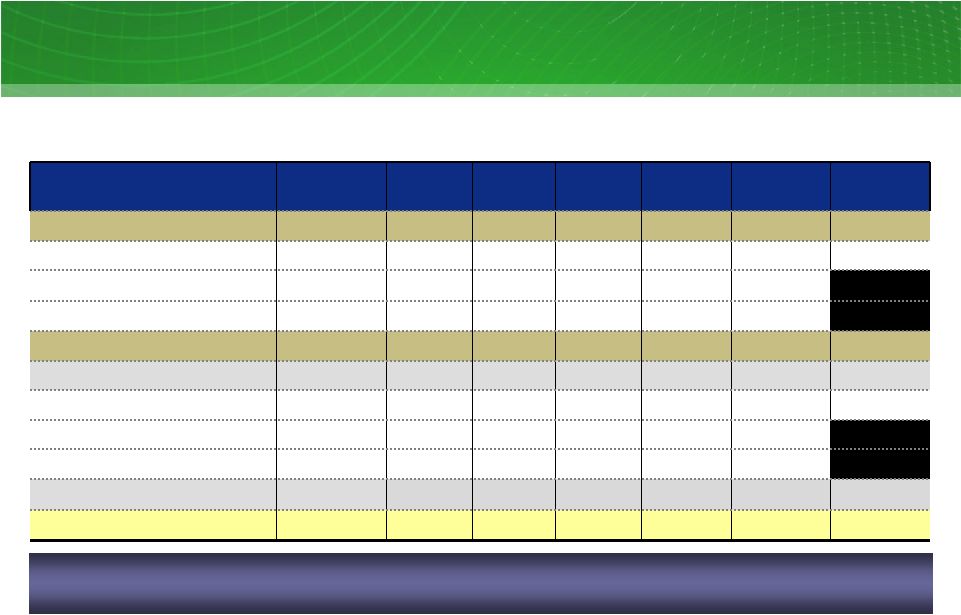

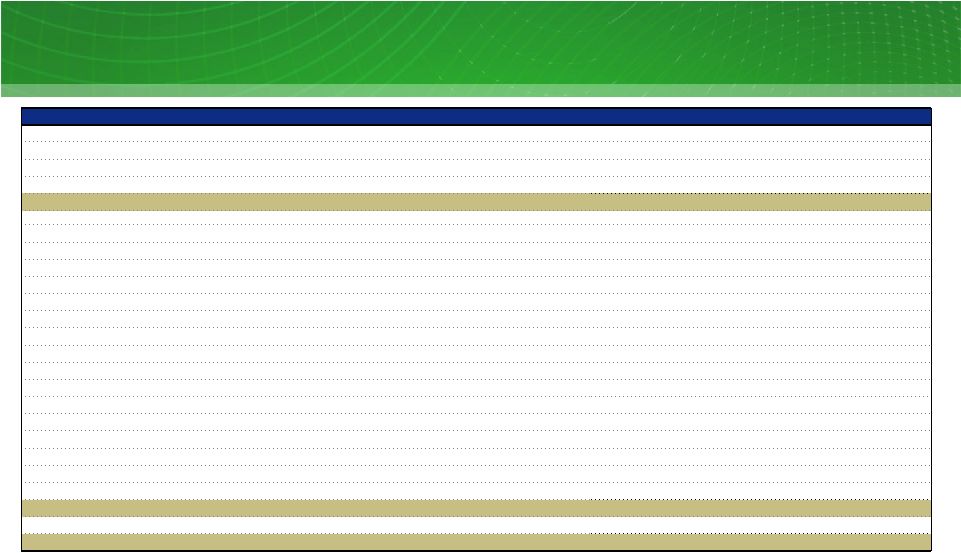

Consolidated: reconciliation of GAAP net income (loss) to adjusted (non-GAAP)

operating results YTD

1

10

vs. YTD 11; $ millions, after tax

EFH Corp.

Adjusted (Non-GAAP) Operating Results -

YTD

1

Nine months ended September 30.

2

Items are noncash except for severance related to CSAPR, fees associated with April

2011 TCEH debt amendment and extension transactions, gain related to counterparty bankruptcy

settlement and 2011 income tax charge.

3

Charges include, net of tax, $269 million of emissions allowances impairments, $32

million of severance accruals, and $6 million of mining asset impairments all recorded in other

deductions and $14 million of incremental depreciation expense.

4

YTD 2010 charges recorded as a result of health care legislation in 2010; YTD 2011

state income tax charges recorded as a result of April 2011 TCEH debt amendment and extension

transactions.

Factor

YTD 10

YTD 11

Change

EFH Corp. GAAP net loss

(2,973)

(1,776)

1,197

Items

excluded

from

adjusted

(non-GAAP)

operating

results

(after

tax)

2

Unrealized mark-to-market net losses on interest rate swaps

352

572

220

Unrealized commodity-related mark-to-market net (gains) losses

(1,040)

159

1,199

Charges

related

to

EPA

Cross

State

Air

Pollution

Rule

3

-

321

321

Third-party fees associated with April 2011 TCEH debt amendment and extension

transactions -

64

64

Debt extinguishment gains

(751)

(16)

735

Gain related to counterparty bankruptcy settlement

-

(14)

(14)

Goodwill impairment

4,100

-

(4,100)

Reduction of income tax expense due to resolution of IRS tax audit for

1997-2002 (146)

-

146

Income

tax

charges

4

8

13

5

EFH Corp. adjusted (non-GAAP) operating loss

(450)

(677)

(227)

5 |

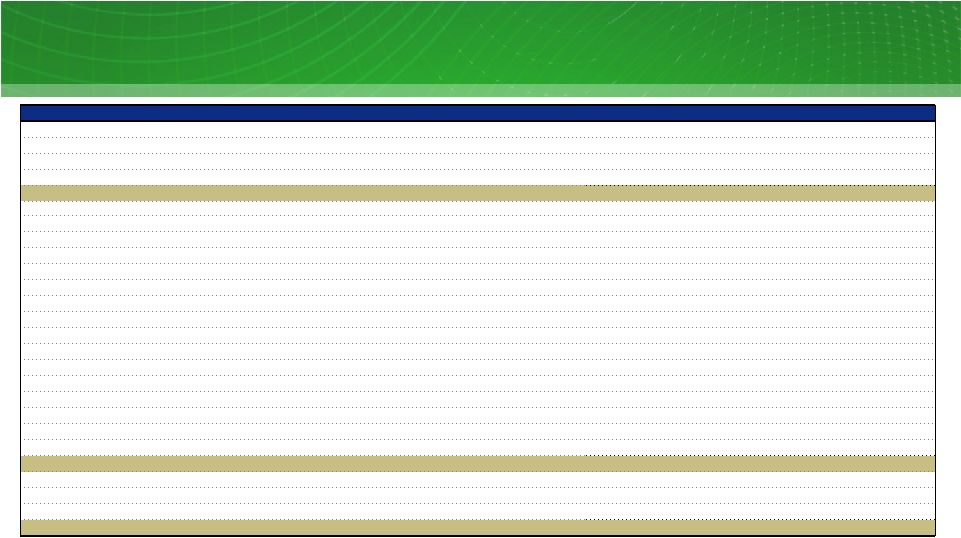

Consolidated key drivers of the change in (non-GAAP) operating results

YTD 10 vs. YTD 11; $ millions, after tax

EFH Corp.

Adjusted (Non-GAAP) Operating Results Key Drivers -

YTD

1

Competitive business consists of Competitive Electric segment and Corp. &

Other. Description/Drivers

Better (Worse)

Than

YTD 10

Competitive business

1

:

Lower retail volumes and commodity hedging offset by favorable weather-driven

consumption and asset management (117)

Higher fuel costs at legacy generation units reflecting increased costs of purchased

coal and related transportation (23)

Impact of winter weather event

(17)

Lower production from nuclear generation units primarily due to unplanned

outages (10)

Lower production from legacy coal-fueled generation units (excludes Sandow 4

generation) (8)

Impact of new lignite-fueled generation units

58

Lower amortization of intangibles arising from purchase accounting

10

All other -

net

(7)

Contribution margin

(114)

Gains in 2010 on sales of assets (reported in other income)

(52)

Higher depreciation reflecting the new lignite-fueled generation units and

ongoing investment in the legacy generation fleet (35)

Higher operating costs reflecting nuclear plant planned maintenance and the impact of

new lignite-fueled generation units (30)

Higher net interest expense driven by higher rates, higher amortization of debt costs

and lower capitalized interest (29)

Higher SG&A reflecting employee related expenses and information

technology costs

(15)

Lower retail bad debt expense reflecting improved collections and customer mix

30

Lower accrued interest on uncertain tax positions

15

All other -

net

8

Total change -

Competitive business

(222)

Regulated business:

Higher net revenues reflecting transmission rate and distribution tariff increases,

AMS surcharge and growth in points of delivery 46

Higher revenues from increased consumption primarily due to warmer weather

33

Higher depreciation reflecting infrastructure investment

(21)

Change in income taxes driven by 2010 reduction in interest accrued on uncertain tax

positions (20)

Higher transmission fees

(16)

Higher operations and maintenance expense due to employee related costs,

transportation and materials costs, and advanced metering and vegetation

management expenses

(11)

Higher net interest expense driven by average rates

(6)

All other –

net

(10)

Change in Regulated business (~80% owned by EFH Corp.)

(5)

Total change in EFH Corp. adjusted (non-GAAP) operating results

(227)

6 |

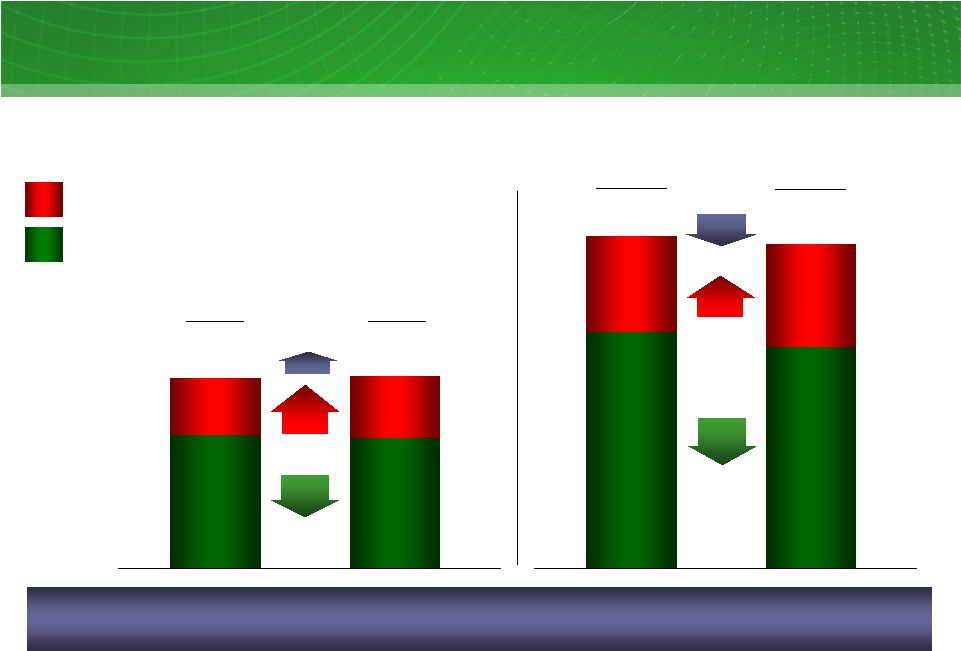

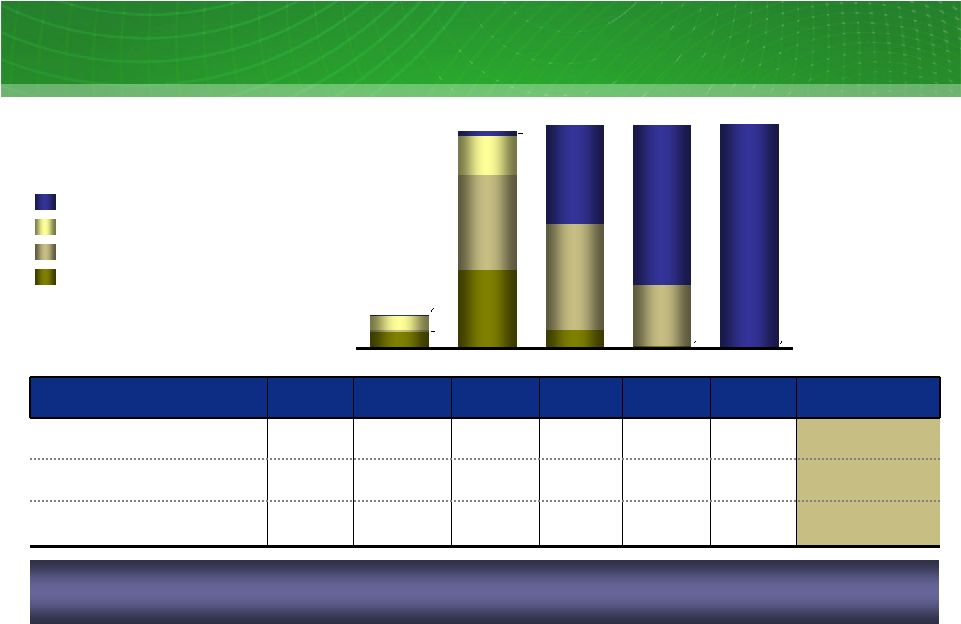

EFH

Corp. Adjusted EBITDA (Non-GAAP) EFH

Corp.

Adjusted

EBITDA

(non-GAAP)

1

Q3

10 vs. Q3 11 and YTD 10 vs. YTD 11;

$ millions

Q3 11

Q3 10

1,599

1,592

1,076

1,109

517

476

TCEH

Oncor

Q3 and YTD performance was largely driven by the same key drivers impacting adjusted

(non-GAAP) operating results.

3%

9%

1

See Appendix for Regulation G reconciliations and definition. Includes $7

million, $6 million, $23 million and $22 million in Q3 10, Q3 11, YTD 10 and

YTD 11, respectively, of Corp. & Other Adjusted EBITDA.

YTD 11

YTD 10

4,031

4,157

2,739

2,940

1,270

1,194

3%

7%

6%

7 |

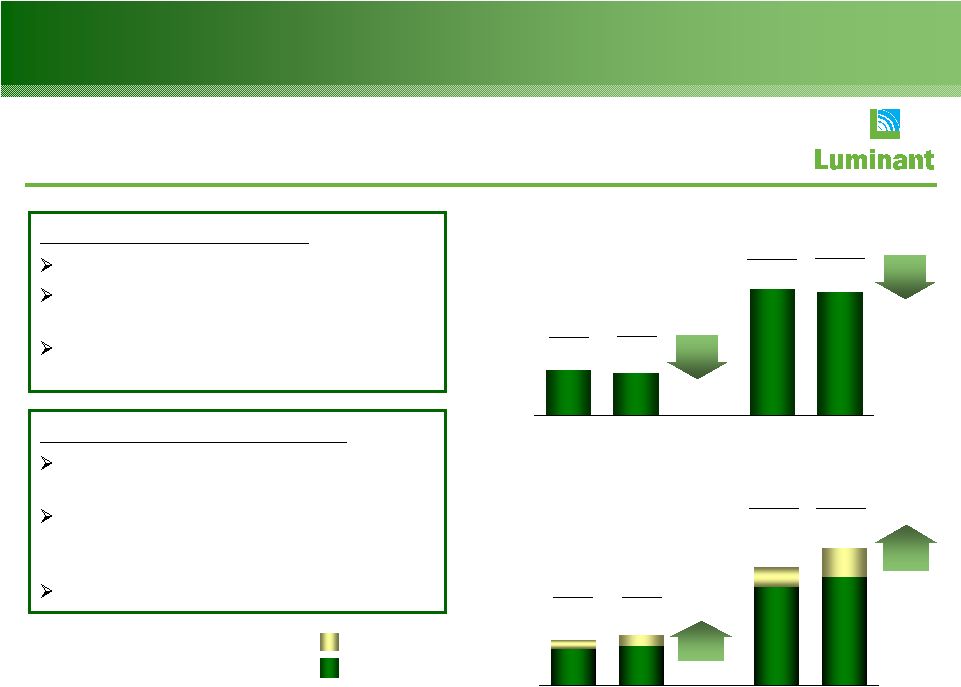

Luminant Operational Results

Coal-fueled generation; GWh

Sandow 5 & Oak Grove

Legacy coal-fueled plants

Q3 2011 Nuclear Plant Results

Solid safety performance

Lower generation due to unplanned

outages

Top decile industry performance for

reliability and cost

Q3 2011 Coal-Fueled Plant Results

New plants operated at ~95% capacity

factor for 0.9 TWh higher generation

Higher legacy coal-fueled generation due

to improved reliability and fewer

unplanned outages

Top quartile industry performance

1

Variance does not include generation from Sandow 5 and Oak Grove

1 & 2.

Q3 11

Q3 10

5,302

14,841

YTD 10

YTD 11

14,546

4,956

7%

QTR

3,691

YTD 11

Q3 10

15,445

16,473

12,100

40,743

45,096

Q3 11

YTD 10

2%

1

YTD

32,996

32,249

11,917

11,754

2%

YTD

Nuclear-fueled generation; GWh

8

1%

1

QTR

4,556

8,494 |

Q3 2011

Results Lower LCI volumes reflect

competitive intensity and TXU Energy

focus on margin discipline

Higher residential sales volumes

driven by warmer weather in Q3 11

compared to Q3 10 partially offset by

lower customer counts

Bad debt expense decreased by 44%

in Q3 11 compared to Q3 10 due to

improved collections initiatives and

customer mix

TXU Energy Operational Results

Total residential customers

End of period, thousands

Retail electricity sales volumes by customer class;

GWh

1,706

1,658

1

SMB –

small business

2

LCI -

large commercial and industrial

3

Last twelve months

YTD 10

SMB

1

LCI

2

Residential

Q3 10

16,184

41,170

Q3 10

Q2 11

8%

LTM

3

22,362

9,473

9,955

4,294

2,417

5,688

Q3 11

Q3 11

1,658

1,800

3%

QTR

23,040

11,738

6,392

9,586

3,445

2,116

38,005

15,147

Q3 11

YTD 11

8%

YTD

6%

QTR

9 |

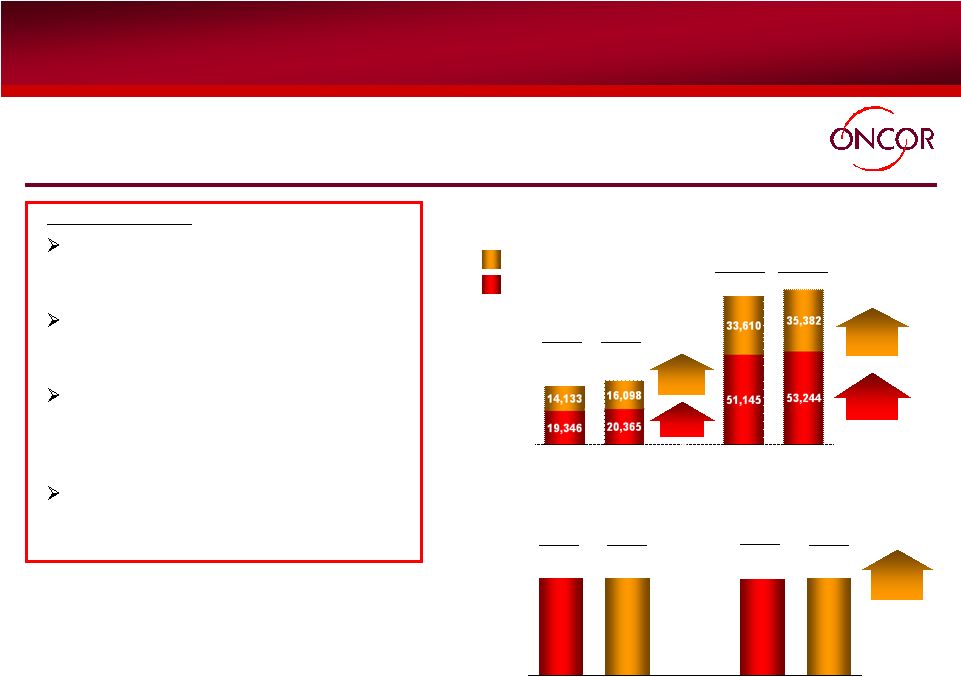

10

Oncor Operational Results

Electric energy billed volumes

4

; GWh

Q3 10

Q3 11

1

SMB –

small business; LCI –

large commercial and industrial

2

AMS –

Advanced Metering System

3

CREZ –

Competitive Renewable Energy Zone

4

On average, billed volumes are on an approximate 17-day calendar lag; therefore,

amounts shown reflect partial impacts from prior quarters

5

Last twelve months

Residential

SMB & LCI

1

3,167

3,196

1%

LTM

5

Electricity distribution points of delivery

End of period, thousands of meters

Q3 11

Q2 11

3,189

3,196

Q3 2011 Results

Higher volumes principally due to

warmer weather in Q3 11 compared

to Q3 10

Higher SMB & LCI

1

energy volumes

due to improved economy and

warmer weather

Execution of AMS

2

plan –

~609,000

advanced meters installed YTD 11;

over 2.1 million installed through

September 30, 2011

$689 million spent on CREZ3

through September 30, 2011; $373

million spent YTD 11

4%

YTD

5%

YTD

Q3 11

33,479

36,463

84,755

88,626

14%

QTR

Q3 10

YTD 10

YTD 11

5%

QTR |

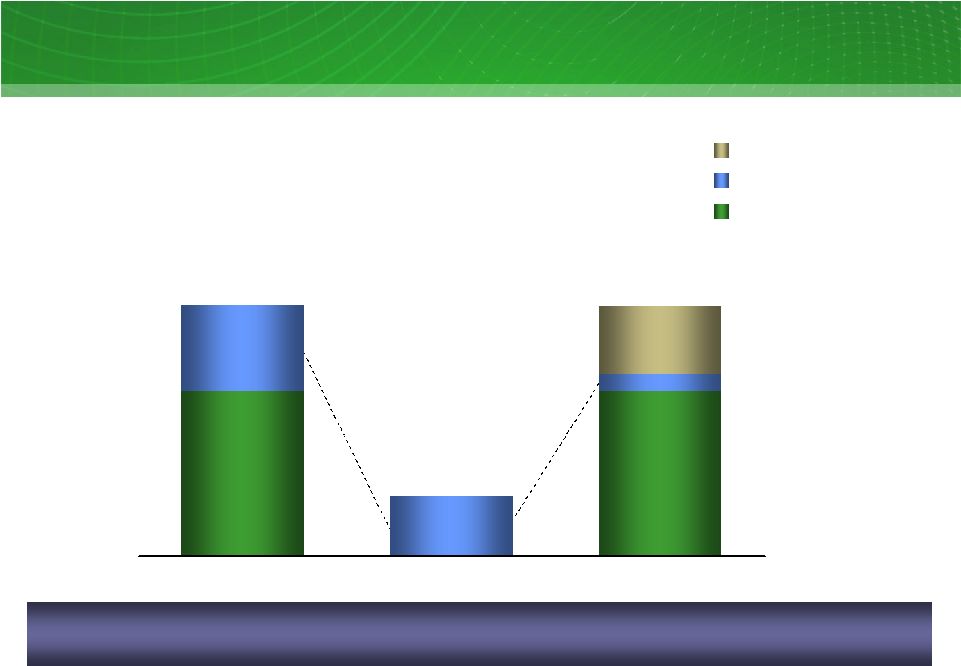

2,054

2,054

1,062

205

742

838

Facilities Limit

LOCs/Cash Borrowings

Availability

EFH Corp. Liquidity Management

As of September 30, 2011

11

Cash and Equivalents

TCEH Letter of Credit Facilities

TCEH Revolving Credit Facilities

742

3,116

EFH Corp. and TCEH continue to monitor capital market conditions

for opportunities to

ensure liquidity needs are met and to improve financial flexibility.

EFH Corp. (excluding Oncor) available liquidity

As of 9/30/11; $ millions

3,097 |

Commodity Prices

Commodity

Units

Q3 11

Actual

Q3 10

Actual

YTD 11

Actual

BOY 11E

1

NYMEX gas price

2

$/MMBtu

$4.13

$4.29

$4.22

$3.80

HSC gas price

$/MMBtu

$4.10

$4.26

$4.17

$3.70

7x24 market heat rate (HSC)

3, 4

MMBtu/MWh

16.70

9.77

11.41

7.94

North Hub 7x24 power price

4

$/MWh

$68.63

$41.62

$47.63

$29.35

TCEH weighted avg. hedge price

5

$/MMBtu

$7.39

$7.67

$7.55

$7.60

Gulf Coast ultra-low sulfur diesel

$/gallon

$3.02

$2.08

$2.97

$2.78

PRB 8400 coal

$/ton

$11.23

$10.03

$11.01

$11.55

LIBOR interest rate

6

percent

0.47%

0.59%

0.45%

0.37%

Commodity prices

Q3 11, Q3 10, YTD 11 and BOY 11E; mixed measures

12

1

BOY 11 estimate based on commodity prices as of 09/30/11 for October 1, 2011

through December 31, 2011 2

Based on NYMEX forward curve

3

Based on ERCOT market clearing price for North Hub power for 2011 and ERCOT

market clearing price for North Zone for 2010 4

The prices in the table are actual prices. Excluding volatile power pricing where

average prices exceeded $100, related to the winter weather event in early February 2011 (

2

nd

and

3

rd

) and the record heat wave during summer 2011, North Hub 7X24 power prices averaged

approximately $35.80 and the 7X24 market heat rate averaged 8.55 MMBtu/MWh during

the first nine months of 2011.

5

Weighted average prices in the TCEH long-term natural gas hedging

program. Based on NYMEX Henry Hub prices of forward natural gas sales positions in the long-term hedging

program

(excluding the impact of offsetting purchases for rebalancing and pricing point

basis transactions). 6

The index for the settled value is a 6-month LIBOR rate.

|

13

Factor

Measure

2011

2012

2013

2014

2015

Total or

Avg.

06/30/11

Natural gas hedges

mm MMBtu

~88

~383

~265

~149

~0

~885

Wtd. avg. hedge price

$/MMBtu

~$7.49

~$7.36

~$7.19

~$7.80

N/A

Natural gas prices

$/MMBtu

~$4.47

~$4.84

~$5.16

~$5.42

~$5.70

Cum. MtM gain at 06/30/11

1

$ billions

~$0.6

~$1.2

~$0.6

~$0.4

~$0

~$2.7

09/30/11

Natural gas hedges

2

mm MMBtu

~57

~331

~259

~149

~0

~796

Wtd. avg. hedge price

3

$/MMBtu

~$7.60

~$7.36

~$7.19

~$7.80

N/A

Natural gas prices

$/MMBtu

~$3.80

~$4.24

~$4.80

~$5.13

~$5.39

Cum. MtM gain at 09/30/11

1

$ billions

~$0.3

~$1.4

~$0.7

~$0.4

~$0

~$2.8

Q3 11 MtM (loss) gain

$ billions

~$(0.3)

~$0.2

~$0.1

~$0

~$0

~$0.1

13

Unrealized Mark-To-Market Impact Of Hedging

Unrealized mark-to-market impact of hedging program

09/30/11 vs. 6/30/11; mixed measures, pre-tax

The overall value of the hedge program remained relatively flat as transactions

maturing during the quarter were offset by increases in value in the forward

years of the program. 1

MtM values include the effects of all transactions in the long-term hedging

program including offsetting purchases (for re-balancing) and natural gas basis deals.

2

As

of

9/30/11,

2011

represents

October

1,

2011

through

December

31,

2011

volumes.

Where

collars

are

reflected,

the

volumes

are

estimated

based

on

the

notional

position

of

the

derivatives

to

provide

protection

against

downward

price

movements.

The

notional

volumes

for

collars

are

approximately

150

million

MMBtu,

which

corresponds

to

a

delta

position

of

approximately 120 million MMBtu in 2014.

3

Weighted

average

prices

are

based

on

NYMEX

Henry

Hub

prices

of

forward

natural

gas

sales

positions

in

the

long-term

hedging

program

(excluding

the

impact

of

offsetting

purchases

for

rebalancing

and

pricing

point

basis

transactions).

Where

collars

are

reflected,

sales

price

represents

the

collar

floor

price.

9/30/11

prices

for

2011

represent

October

1,

2011

through

December 31, 2011 values. |

41

192

48

6

2

7

236

259

149

31

95

3

13

244

395

551

82

536

551

550

553

BAL 11

2012

2013

2014

2015

14

14

TCEH Natural Gas Exposure

TCEH Natural Gas Position

11-15

1

; million MMBtu

Hedges Backed by Asset First Lien

Open Position

Factor

Measure

BAL 11

2012

2013

2014

2015

Total or Average

Natural gas hedging program

million

MMBtu

~38

~331

~259

~149

~0

~777

TXUE and Luminant net positions

million

MMBtu

~41

~192

~48

~6

~2

~289

Overall estimated percent of

total NG position hedged

percent

~97%

~98%

~56%

~28%

~0%

~47%

TXUE and Luminant Net Positions²

TCEH has hedged approximately 47% of its estimated Henry Hub-based natural gas

price exposure from November 1, 2011 through December 31, 2015

3

.

Hedges Backed by CCP

1

As of 09/30/11. Balance of 2011 is from November 1, 2011 to December 31,

2011. Assumes conversion of electricity positions based on a ~8.0 heat rate with natural gas generally

being on the margin ~75-90% of the time (i.e. when other technologies are

forecast to be on the margin, no natural gas position is assumed to be

generated). 2012 - 2015 is inclusive

of the estimated effects of CSAPR as issued in July 2011 on generation.

2

Includes estimated retail/wholesale effects. 2011 position includes ~4 million

MMBtu of short gas positions associated with proprietary trading positions; excluding these positions, 2011

position is ~92% hedged.

3

On an average basis for such period and assuming an 8.0 market heat rate.

|

15

15

15

EFH Corp. Adjusted EBITDA Sensitivities

Commodity

Percent Hedged at

September 30, 2011

Change

BOY 11E

Impact

$ millions

7X24 market heat rate (MMBtu/MWh)

2

~90

0.1 MMBtu/MWh

~1

NYMEX gas price ($/MMBtu)

>95

$1/MMBtu

~3

Texas gas vs. NYMEX Henry Hub price ($/MMBtu)

3,4

~90

$0.10/MMBtu

~1

Diesel ($/gallon)

5

~100

$1/gallon

~1

Base coal ($/ton)

6

~100

$2/ton

~1

Generation operations

Nuclear-

and coal / lignite-fueled generation (TWh)

N/A

1 TWh

~15

Retail operations

BOY 2011

Residential contribution margin ($/MWh)

5 TWh

$1/MWh

~5

Residential consumption

5 TWh

1%

~2

Business markets consumption

4 TWh

1%

~1

Impact on EFH Corp. Adjusted EBITDA

1

11E; mixed measures

The majority of 2011 commodity-related risks are significantly mitigated.

1

2011

estimate

based

on

commodity

positions

as

of

09/30/11,

net

of

long-term

hedges

and

wholesale/retail

effects,

excludes

gains

and

losses

incurred

prior

to

September

30,

2011.

See

Appendix for definition.

2

Simplified

representation

of

heat

rate

position

in

a

single

TWh

position.

In

reality,

heat

rate

impacts

are

differentiated

across

plants

and

respective

pricing

periods:

nuclear

and

coal-fueled

plants generation (linked primarily to changes in North Hub 7x24), natural gas

plants (primarily North Hub 5x16) and wind (primarily West Hub7x8). 3

Assumes

conversion

of

electricity

positions

based

on

a

~8.0

market

heat

rate

with

natural

gas

generally

being

on

the

margin

~75-90%

of

the

time

(i.e.,

when

coal

is

forecast

to

be

on

the

margin, no natural gas position is assumed to be generated).

4

The percentage hedged represents the amount of estimated natural

gas exposure based on Houston Ship Channel (HSC) gas price sensitivity as a proxy

for Texas gas price. 5

Includes positions related to fuel surcharge on rail transportation.

6

Excludes fuel surcharge on rail transportation. |

EFH

Corp. Maturity Profile EFH Corp. debt maturities

1

(excluding Oncor), 2011-2021 and thereafter

As of 9/30/11; $ millions

16

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021+

427

46

100

4,261

3

11

4,510

267

3,343

1,661

15,647

3

5,000

TCEH-1

st

Lien

4

EFH Corp

EFCH

TCEH-LBO

EFIH-1

st

Lien

TCEH-Revolver

4

TCEH-Other /PCRBs

TCEH-2

nd

Lien

EFIH 2

nd

Lien

1

Includes amortization of the $15.4 billion Term Loan/DDTL facility beginning in Q4

2014 and excludes unamortized discounts and premiums. 2

Non-Extended Revolver and Extended Revolver capacities are $645 million due

October 2013 and $1,409 million due October 2016, respectively. 3

Excludes the Deposit Letter of Credit Loans maturing in 2014 and

2017.

4

2016 and 2017 maturity dates under the TCEH Senior Secured Credit Facilities are

subject to a “springing maturity” provision.

3,809

15,044

3,165

1,485

563

2,180

1,750

1,067

1,029

1,494

1,571

406

October 2011 transactions (excluded from chart below):

EFH exchange of $53 million of new EFH 11.25%/12.00%

Toggle Notes due 2017 for $65 million of EFH 5.55%

Series P Senior Notes due 2014

2

2 |

17

Today’s Agenda

Q&A

Financial and Operational

Overview

Q3 2011 Review

John Young

President & CEO |

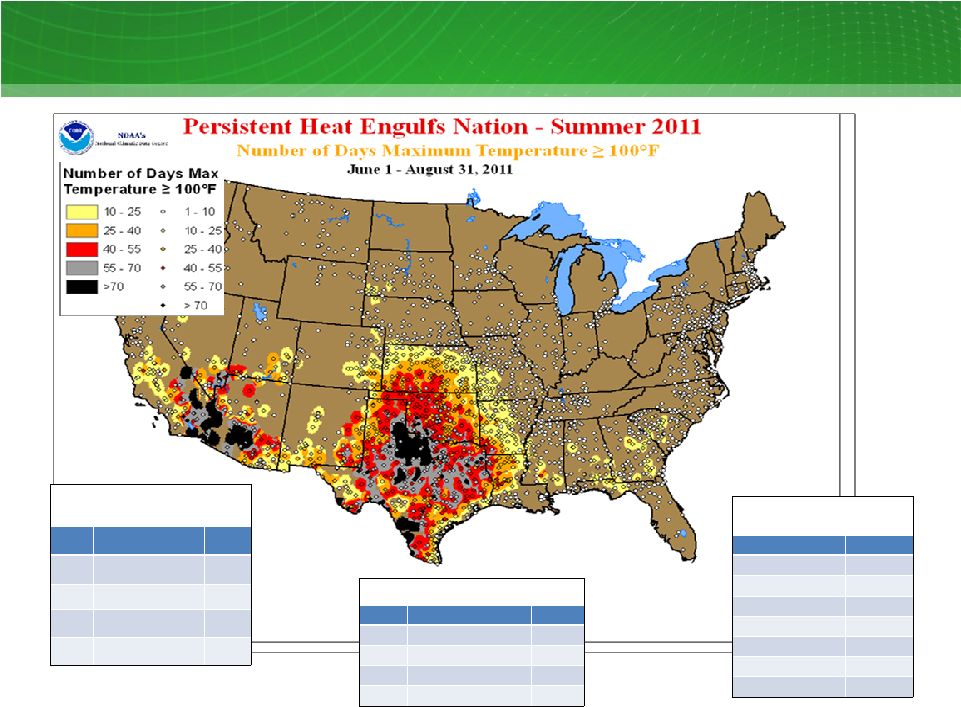

18

18

Summer Heat of 2011

DFW

Days Low >= 80

o

1

2011

55

2

1998

39

3

2008

27

4

2010

24

5

2006

23

DFW

Days>=105

o

Since 1998

2011

19

2000

10

1998

9

2006

6

1999

5

2008

5

2010

3

2003

2

DFW

Days >= 100

o

1

2011

70

2

1980

69

3

1998

56

4

1954

52

5

1956

48 |

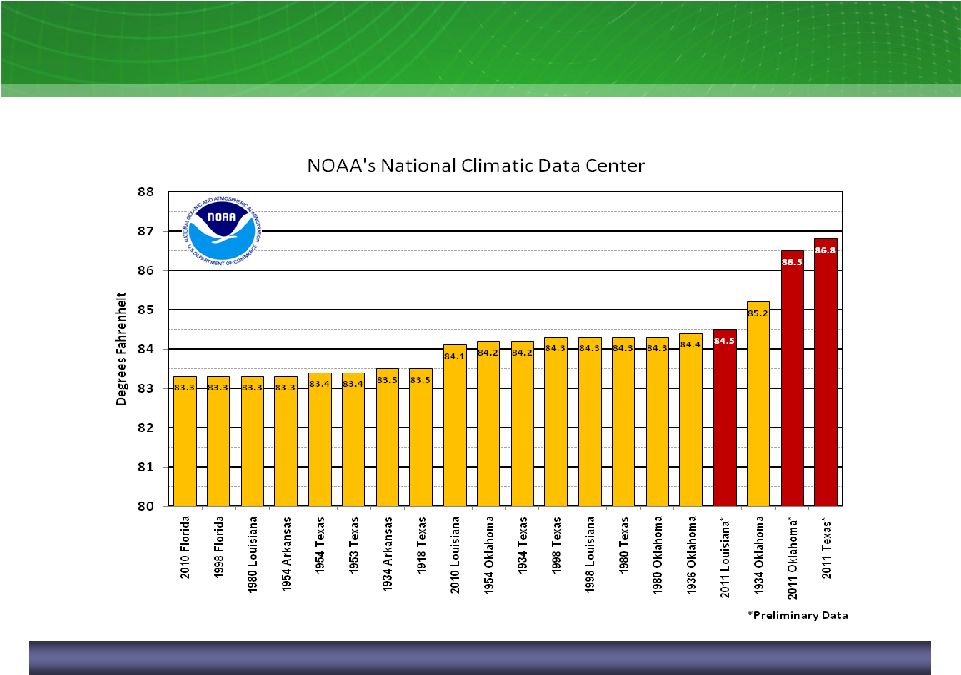

19

19

Warmest Statewide Summer Temperatures: 1895 -

2011

1

NOAA = National Oceanic and Atmospheric Administration

1

The 2011 Texas Summer was the hottest summer on record in the U.S.

|

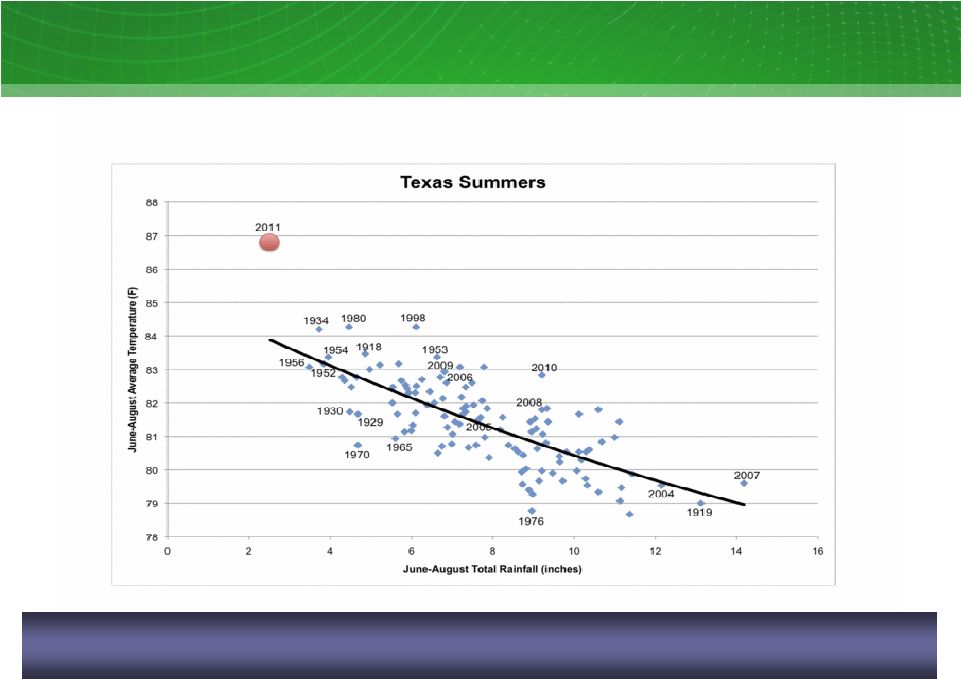

20

20

Historic Heat and Drought in 2011

As measured by both heat and by drought, Texas experienced

its worst summer on record in 2011

Source: John Nielsen-Gammon, Texas State Climatologist and Professor of

Atmospheric Sciences at Texas A&M University |

ERCOT Peak Demand Records

21

ERCOT demand records

MWs

1

Instantaneous peak demand occurred between hours 4 and 5 pm

2

Wind generation totaled ~1,500 MW or 2% during the peak hour per ERCOT; peak demand

occurred between hours 4 and 5 pm 3

Wind generation totaled ~2,000 MW or 3% during the peak hour per ERCOT; peak demand

occurred between hours 4 and 5 pm 4

Source: May 2011 Report on the Capacity, Demand, and Reserves in the ERCOT Region;

peak demand for integrated hour Record peak demand of 68,379 set on Aug 3, 2011

was 2,613 MW higher than the 2010 record peak demand set Aug 23, 2010

ERCOT 2011 Peak Demand

Estimate: 63,898

4

ERCOT 2012 Peak Demand

Estimate: 65,665

4 |

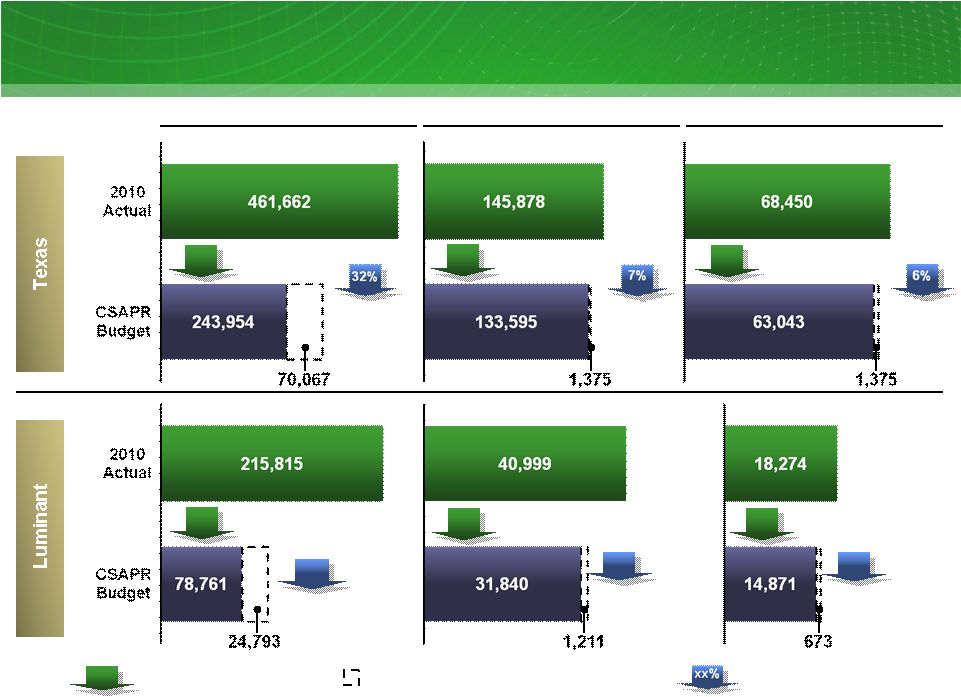

64,418

EPA Emissions Reductions Mandates

Under CSAPR

Annual SO

2

(Tons)

Annual NO

X

(Tons)

Seasonal NO

X

(Tons)

314,021

Increase Included in CSAPR Proposed Revised

% change in July 6 Final CSAPR

134,970

15,544

103,554

33,051

19%

% change in proposed revised

1

October 6, 2011 EPA proposed revisions to the CSAPR.

22

Reduction

of 9,159

Reduction

of 137,054

64%

Reduction

of 3,403

22%

19%

52%

15%

xx%

Reduction

of 112,261

Reduction

of 2,730

Reduction

of 7,948

Reduction

of 217,708

47%

Reduction

of 147,641

Reduction

of 12,283

8%

Reduction

of 10,908

Reduction

of 5,407

8%

Reduction

of 4,032 |

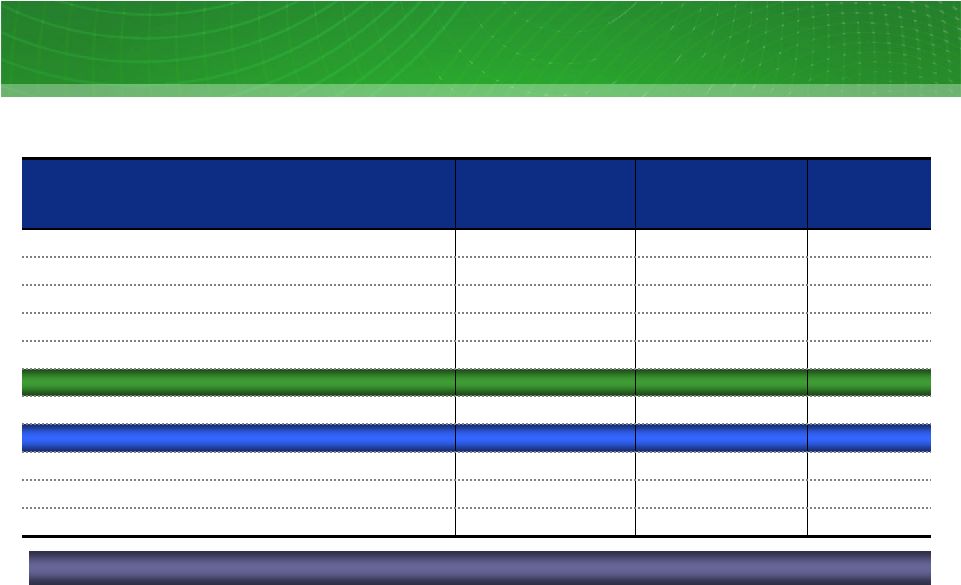

23

Currently Installed

1

Environmental Control Equipment At

Luminant Coal Units

Coal Unit

Capacity

(MW)

FGD

(Scrubber)

2

Activated

Carbon

Injection³

ESP

4

SNCR

5

SCR

5

Bag-

house

4

Fuel Source

Oak Grove 1

800

Lignite

Oak Grove 2

800

Lignite

Sandow 4

557

Lignite

Sandow 5

580

Lignite

Martin Lake 1

750

Lignite/PRB

6

Martin Lake 2

750

Lignite/PRB

Martin Lake 3

750

Lignite/PRB

Monticello 1

565

Lignite/PRB

Monticello 2

565

Lignite/PRB

Monticello 3

750

Lignite/PRB

Big Brown 1

575

Lignite/PRB

Big Brown 2

575

Lignite/PRB

Currently installed

1

There is no assurance that the currently installed control equipment will satisfy

the requirements under any change to applicable law or any future Environmental Protection Agency or

Texas Commission on Environmental Quality regulations.

2

FGD refers to flue gas desulfurization systems that reduce SO2 emissions with

co-benefits of other emissions reductions. 3

Activated carbon injection systems reduce mercury emissions.

4

ESP refers to electro-static precipitation systems. ESP and bag-house

systems reduce particulate emissions with co-benefits of other emissions reductions.

5

SNCR refers to selective non-catalytic reduction systems. SCR refers to

selective catalytic reduction systems. Both systems reduce NOx emissions.

6

PRB refers to Powder River Basin coal transported to plants via

railcar. |

24

Today’s Agenda

Q&A

Financial and Operational

Overview

Q3 2011 Review

EFH Corp. Senior Executive Team |

25

Questions & Answers |

26

Appendix –

Additional Slides and

Regulation G Reconciliations

Appendix |

27

Financial Definitions

Measure

Definition

Adjusted (non-GAAP)

Operating Results

Net

income

(loss)

adjusted

for

items

representing

income

or

losses

that

are

not

reflective

of

underlying

operating

results.

These

items

include

unrealized

mark-to-market

gains

and

losses,

noncash

impairment

charges

and

other

charges,

credits

or

gains

that

are

unusual

or

nonrecurring.

EFH

uses

adjusted

(non-GAAP)

operating

results

as

a

measure

of

performance

and

believes

that

analysis

of

its

business

by

external

users

is

enhanced

by

visibility

to

both

net

income

(loss)

prepared

in

accordance

with

GAAP

and

adjusted

(non-GAAP)

operating

earnings

(losses).

Adjusted EBITDA

(non-GAAP)

EBITDA

adjusted

to

exclude

interest

income,

noncash

items,

unusual

items,

results

of

discontinued

operations

and

other

adjustments

allowable

under

the

EFH

senior

secured

notes

indenture.

Adjusted

EBITDA

plays

an

important

role

in

respect

of

certain

covenants

contained

in

this

indenture.

Adjusted

EBITDA

is

not

intended

to

be

an

alternative

to

GAAP

results

as

a

measure

of

operating

performance

or

an

alternative

to

cash

flows

from

operating

activities

as

a

measure

of

liquidity

or

an

alternative

to

any

other

measure

of

financial

performance

presented

in

accordance

with

GAAP,

nor

is

it

intended

to

be

used

as

a

measure

of

free

cash

flow

available

for

EFH’s

discretionary

use,

as

the

measure

excludes

certain

cash

requirements

such

as

interest

payments,

tax

payments

and

other

debt

service

requirements.

Because

not

all

companies

use

identical

calculations,

Adjusted

EBITDA

may

not

be

comparable

to

similarly

titled

measures

of

other

companies.

See

EFH’s

filings

with

the

SEC

for

a

detailed

reconciliation

of

EFH’s

net income prepared in accordance with GAAP to Adjusted EBITDA.

Competitive Business

Results

Refers to the combined results of the Competitive Electric segment and Corporate

& Other. Contribution Margin (non-

GAAP)

Operating

revenues

less

fuel,

purchased

power

costs,

and

delivery

fees,

plus

or

minus

net

gain

(loss)

from

commodity

hedging

and

trading activities, which on an adjusted (non-GAAP) basis, exclude unrealized

gains and losses. EBITDA

(non-GAAP)

Net income (loss) before interest expense and related charges, income tax expense

(benefit) and depreciation and amortization. GAAP

Generally accepted accounting principles.

Purchase Accounting

The

purchase

method

of

accounting

for

a

business

combination

as

prescribed

by

GAAP,

whereby

the

purchase

price

of

a

business

combination

is

allocated

to

identifiable

assets

and

liabilities

(including

intangible

assets)

based

upon

their

fair

values.

The

excess

of

the

purchase

price

over

the

fair

values

of

assets

and

liabilities

is

recorded

as

goodwill.

Depreciation

and

amortization

due

to

purchase

accounting

represents

the

net

increase

in

such

noncash

expenses

due

to

recording

the

fair

market

values

of

property,

plant

and

equipment,

debt

and

other

assets

and

liabilities,

including

intangible

assets

such

as

emission

allowances,

customer

relationships

and

sales

and

purchase

contracts

with

pricing

favorable

to

market

prices

at

the

date

of

the

Merger.

Amortization

is

reflected

in

revenues,

fuel,

purchased

power

costs

and

delivery

fees,

depreciation

and

amortization

and

interest

expense

in

the

income statement.

Regulated Business Results

Refers to the results of Oncor and the Oncor ring-fenced entities.

|

Table

1: EFH Corp. Adjusted EBITDA Reconciliation Three and Nine Months Ended

September 30, 2010 and 2011 $ millions

Factor

Q3 10

Q3 11

YTD 10

YTD 11

Net loss attributable to EFH Corp.

(2,902)

(710)

(2,973)

(1,776)

Income tax (benefit) expense

370

(443)

336

(1,042)

Interest expense and related charges

1,018

1,523

3,092

3,467

Depreciation and amortization

352

379

1,043

1,119

EBITDA

(1,162)

749

1,498

1,768

Adjustments to EBITDA (pre-tax):

Oncor distributions/dividends

55

32

141

64

Interest income

-

-

(9)

(2)

Amortization of nuclear fuel

38

35

102

104

Purchase accounting adjustments

1

45

44

159

182

Impairment of assets and inventory write-down

2

1

428

3

429

Impairment of goodwill

4,100

-

4,100

-

Net gain on debt exchange offers

(1,023)

-

(1,166)

(25)

Equity in earnings of unconsolidated subsidiary

(118)

(113)

(240)

(235)

Unrealized net (gain) loss resulting from hedging transactions

(767)

(138)

(1,615)

247

Amortization of ”day one”

net loss on Sandow 5 power purchase agreement

(9)

-

(19)

-

Noncash compensation expense

3

-

5

13

8

Severance expense

-

49

3

54

Transition and business optimization costs

4

(1)

16

(2)

30

Transaction and merger expenses

5

13

9

37

27

Restructuring and other

6

(1)

-

(1)

74

Expenses incurred to upgrade or expand a generation station

7

-

-

100

100

EFH Corp. Adjusted EBITDA per Incurrence Covenant

1,171

1,116

3,104

2,825

Add back Oncor adjustments

421

483

1,053

1,206

EFH Corp. Adjusted EBITDA per Restricted Payments Covenant

1,592

1,599

4,157

4,031

1

Includes

amortization

of

the

intangible

net

asset

value

of

retail

and

wholesale

power

sales

agreements,

environmental

credits,

coal

purchase

contracts,

nuclear

fuel

contracts

and

power

purchase agreements and the stepped-up value of nuclear fuel. Also

includes certain credits and gains on asset sales not recognized in net income due to purchase accounting.

2

Impairment

of

assets

includes

impairment

of

emissions

allowances

and

certain

assets

relating

to

mining

operations

due

to

EPA

rule,

impairment

of

land

and

charges

related

to

the

cancelled

development of coal-fueled generation facilities.

3

Represents amounts recorded under stock-based compensation accounting standards

and excludes capitalized amounts.

4

Includes

certain

incentive

compensation

expenses,

systems

development

professional

fees

related

to

major

generation

operations

and

retail

billing

/customer

care

computer

applications and

costs relating to certain growth initiatives.

5

Includes

costs

related

to

the

2007

merger

and

abandoned

strategic

transactions,

the

Sponsor

Group

management

fee,

outsourcing

transition

costs

and

costs

related

to

certain

growth

initiatives.

6

Includes

net

third-party

fees

paid

in

connection

with

the

amendment

and

extension

of

the

TCEH

Senior

Secured

Facilities,

gains

on

termination

of

a

long-term

power

sales

contract

and

settlement of amounts due from a hedging/trading counterparty and reversal of

certain liabilities accrued in purchase accounting. 7

Reflects noncapital outage costs.

28 |

Table

2: TCEH Adjusted EBITDA Reconciliation Three and Nine Months Ended September

30, 2010 and 2011 $ millions

Factor

Q3 10

Q3 11

YTD 10

YTD 11

Net loss

(3,690)

(709)

(3,646)

(1,660)

Income tax expense (benefit)

214

(375)

260

(874)

Interest expense and related charges

852

1,372

2,516

3,020

Depreciation and amortization

345

371

1,027

1,097

EBITDA

(2,279)

659

157

1,583

Adjustments to EBITDA (pre-tax):

Interest income

(23)

(20)

(65)

(66)

Amortization of nuclear fuel

38

35

102

104

Purchase accounting adjustments

1

33

32

124

147

Impairment of assets and inventory write down

2

-

427

1

427

Impairment of goodwill

4,100

-

4,100

-

Unrealized net (gain) loss resulting from hedging transactions

(767)

(138)

(1,615)

247

EBITDA amount attributable to consolidated unrestricted subsidiaries

-

(2)

-

(5)

Amortization of ”day one”

net loss on Sandow 5 power purchase agreement

(9)

-

(19)

-

Corp. depreciation, interest and income tax expense included in SG&A

4

4

9

11

Noncash compensation expense

-

5

11

8

Severance expense

-

50

3

52

Transition and business optimization costs

4

1

18

2

33

Transaction and merger expenses

5

9

9

29

28

Restructuring and other

6

2

(3)

1

70

Expenses incurred to upgrade or expand a generation station

7

-

-

100

100

TCEH Adjusted EBITDA per Incurrence Covenant

1,109

1,076

2,940

2,739

Expenses related to unplanned generation station outages

31

71

122

162

Pro forma adjustment for Oak Grove 2 reaching 70% capacity in Q2

2011

8

-

7

-

32

Other adjustments allowed to determine Adjusted EBITDA per Maintenance Covenant

9

10

-

19

8

TCEH Adjusted EBITDA per Maintenance Covenant

1,150

1,154

3,081

2,941

1

Includes amortization of the intangible net asset value of retail and wholesale

power sales agreements, environmental credits, coal purchase contracts, nuclear fuel contracts and power

purchase agreements and the stepped up value of nuclear fuel. Also includes

certain credits and gains on asset sales not recognized in net income due to purchase accounting.

2

Impairment of assets includes impairment of emissions allowances

and certain assets relating to mining operations due to EPA rule

and impairment of land.

3

Includes

expenses

recorded

under

stock-based

compensation

accounting

standards

and

excludes

capitalized

amounts.

4

Includes certain incentive compensation expenses, systems development professional

fees related to major generation operations and retail billing / customer care computer applications

and costs relating to certain growth initiatives.

5

Includes costs related to the 2007 merger and the Sponsor Group management

fee. 6

Includes net third-party fees paid in connection with the amendment and

extension of the TCEH Senior Secured Facilities, gains on termination of a long-term power sales contract and

settlement of amounts due from a hedging/trading counterparty, and reversal of

certain liabilities accrued in purchase accounting. 7

Reflects noncapital outage costs.

8

Represents the annualization of the of the actual six months ended September 30,

2011 EBITDA results for Oak Grove 2, which achieved the requisite 70% average capacity factor in the

second quarter 2011.

9

Primarily pre-operating expenses related to Oak Grove and Sandow 5 generation

facilities. 29

3 |

Table

3: Oncor Adjusted EBITDA Reconciliation Three and Nine Months Ended September

30, 2010 and 2011 $ millions

Factor

Q3 10

Q3 11

YTD 10

YTD 11

Net income

149

144

304

302

Income tax expense

79

99

174

197

Interest expense and related charges

87

89

259

265

Depreciation and amortization

176

190

507

540

EBITDA

491

522

1,244

1,304

Interest income

(9)

(7)

(29)

(25)

Purchase accounting adjustments

1

(8)

(7)

(26)

(22)

Transition and business optimization costs and other

2

9

5

13

Oncor Adjusted EBITDA

476

517

1,194

1,270

1

Purchase accounting adjustments consist of amounts related to the accretion of an

adjustment (discount) to regulatory assets. 30 |