Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CLEVELAND-CLIFFS INC. | d248762d8k.htm |

Exhibit 99 (a)

NEWS RELEASE

Cliffs Natural Resources Inc. Reports Third-Quarter 2011 Results

| • | Revenue Increases 59% over Last Year to a Quarterly Record of $2.1 Billion |

| • | Net Income Attributable to Cliffs’ Shareholders Nearly Doubles to a Quarterly Record of $590 Million, or $4.07 Per Diluted Share |

| • | Year-to-Date Cash from Operations Reaches $1.5 Billion |

CLEVELAND—Oct. 27, 2011—Cliffs Natural Resources Inc. (NYSE: CLF) (Paris: CLF) today reported third-quarter results for the period ended Sept. 30, 2011. Consolidated revenues were up 59% to a record $2.1 billion, from $1.3 billion in the same quarter last year. The increase was driven by higher pricing and sales volumes in the Company’s iron ore segments, along with incremental sales from Cliffs’ recently acquired Bloom Lake operations in Eastern Canada.

Joseph Carrabba, Cliffs’ chairman, president and chief executive officer, said: “The execution of our growth and diversification strategy is on track and continues to gain momentum, despite the recent volatility in equity markets. With the combined contributions from our recently acquired Bloom Lake Mine, healthy demand for our products and a favorable pricing environment, we reported the most profitable quarter in our Company’s history. Relatively high seaborne iron ore pricing, increased year-over-year steel production in Asia and a stable market in North America all continue to support our strategically targeted expansion and growth initiatives.”

Third-quarter 2011 operating income was $820 million, an increase of 110% from the comparable quarter in 2010. Net income attributable to Cliffs’ common shareholders was $590 million, or $4.07 per diluted share, up nearly 100% from $297 million, or $2.18 per diluted share, in the third quarter of 2010. Net income attributable to Cliffs’ common shareholders in the quarter included a $17.5 million (net of tax), non-cash loss from discontinued operations related to the Company’s previously disclosed idling of its renewaFUEL biomass production facility in Michigan. Cliffs indicated that, during the quarter, its effective income tax rate was 2%, resulting from the benefits of tax planning and currency effects.

CLIFFS NATURAL RESOURCES INC. — 200 PUBLIC SQUARE — SUITE 3300 — CLEVELAND, OH 44114-2544

1

Also recorded in the quarter, Cliffs’ minority partner’s interest in Empire Mine increased from a negative equity position to a positive equity position due to the mine’s profitability, a direct result of the favorable pricing environment and previously settled price arbitrations. Accordingly, Cliffs, and Cliffs’ U.S. Iron Ore business segment, began to reflect its partner’s share of Empire Mine profits by recording a noncontrolling interest. The net impact of this was an approximately $83.3 million reduction to earnings attributable to Cliffs’ shareholders during the quarter, $67.9 million of which is related to prior-quarter adjustments within 2011 that were recognized in the third quarter.

As indicated above, in 2011, Cliffs no longer reflects Empire Mine as a captive cost entity and fully consolidates this operation, reflecting a noncontrolling interest for its partner’s share of profits. Therefore, volumes associated with mine production and sales to the minority partner in Empire Mine are reflected in the 2011 figures below. A reconciliation of the impact of this is presented as an appendix to today’s news release. The Company noted that reporting Empire Mine on this basis also resulted in offsetting adjustments to revenue and cost of goods sold, which had no impact on U.S. Iron Ore sales margin dollars reported for the quarter.

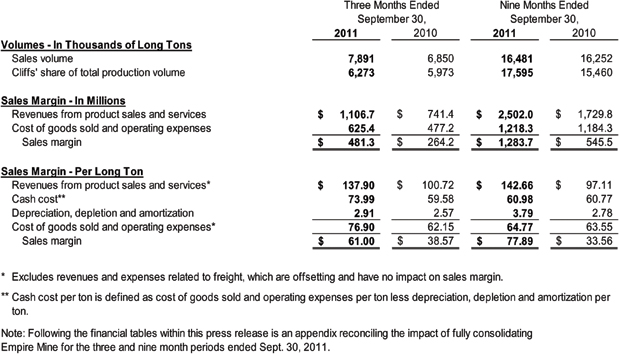

U.S. Iron Ore

Third-quarter 2011 U.S. Iron Ore pellet sales volume increased to 7.9 million tons, compared with 6.9 million tons sold in the third quarter of 2010. Cliffs indicated that full consolidation of Empire Mine added 447,000 tons of additional sales volume reported during the third quarter and year to date, of which 203,000 tons were related to prior quarters in 2011. Such tonnage

CLIFFS NATURAL RESOURCES INC. — 200 PUBLIC SQUARE — SUITE 3300 — CLEVELAND, OH 44114-2544

2

was previously reflected as freight and venture partners’ cost reimbursements. Excluding this adjustment, sales volume increased 9% year over year.

U.S. Iron Ore third-quarter 2011 revenues per ton were $137.90, including a $12.83 per ton adjustment resulting from full consolidation of Empire Mine. Excluding this adjustment, revenue per ton increased 24% over last year, driven by stronger year-over-year iron ore pricing and pricing mechanisms contained in certain supply contracts that provide more exposure to seaborne iron ore pricing. Last year, Cliffs sold more volume under supply agreements containing formula-based pricing mechanisms that have less exposure to seaborne iron ore pricing.

Cash cost per ton in U.S. Iron Ore was $73.99, including a $16.67 per-ton impact resulting from full consolidation of Empire Mine. As noted above, no longer reflecting Empire Mine as a captive cost entity in 2011 also resulted in recording certain amounts received from the Empire Mine minority partner as product revenue versus adjustments to cost of goods sold and operating expenses. Excluding this impact, cash costs per ton were down 4% from $59.58 in the year-ago quarter, driven by increased leverage over fixed costs compared with the same quarter in 2010.

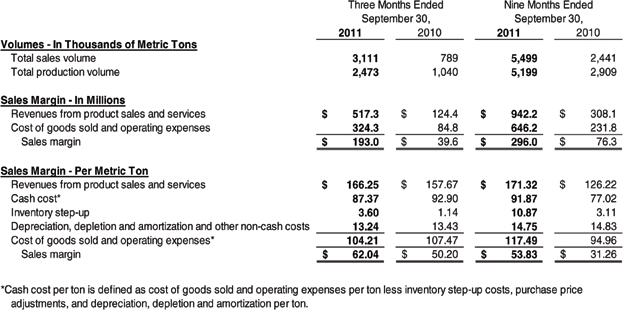

Eastern Canadian Iron Ore

Third-quarter 2011 Eastern Canadian Iron Ore sales volume was 3.1 million tons, a 294% increase from the 789,000 tons sold in the third quarter of 2010. The increase was primarily driven by approximately 1.8 million tons of incremental iron ore concentrate sales volume from the Bloom Lake Mine.

CLIFFS NATURAL RESOURCES INC. — 200 PUBLIC SQUARE — SUITE 3300 — CLEVELAND, OH 44114-2544

3

Eastern Canadian Iron Ore third-quarter 2011 revenues per ton were $166.25, up 5% from $157.67 in the prior year’s third quarter. The revenue-per-ton increase was driven by stronger year-over-year seaborne pricing for iron ore, slightly offset by a sales mix that included iron ore concentrate sales from Bloom Lake Mine.

Cash cost per ton in Eastern Canadian Iron Ore was $87.37, down 6% from $92.90 in the year-ago quarter. The decrease was driven by lower cash costs at Bloom Lake Mine of $74.04 per ton. Third-quarter 2011 cash costs at Wabush Mine were $105.62 per ton, up 14% from the prior year’s comparable quarter, due to higher royalties, transportation rates and higher labor costs.

The Company also incurred a non-cash, non-recurring step-up expense of approximately $11 million related to Bloom Lake Mine’s inventory.

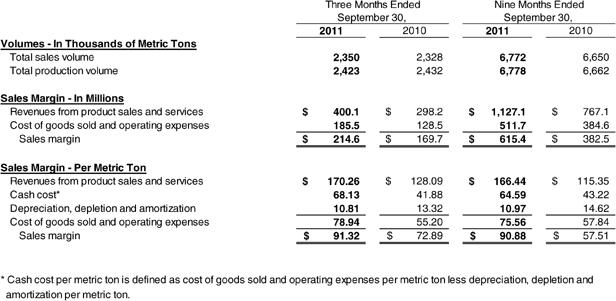

Asia Pacific Iron Ore

Third-quarter 2011 Asia Pacific Iron Ore sales volume was virtually flat at 2.4 million tons, compared with 2010’s third quarter.

Revenue per ton for the third quarter of 2011 increased 33% to $170.26, from $128.09 in last year’s third quarter. The increase was primarily driven by stronger year-over-year seaborne pricing for iron ore, along with additional higher-revenue sales volume from Cliffs’ Cockatoo Island joint venture, versus last year’s comparable quarter.

CLIFFS NATURAL RESOURCES INC. — 200 PUBLIC SQUARE — SUITE 3300 — CLEVELAND, OH 44114-2544

4

Cash cost per ton in Asia Pacific Iron Ore increased 63% to $68.13 in the quarter of 2011 from $41.88 in last year’s comparable quarter. The increase was primarily due to unfavorable foreign exchange rates, higher mining costs related to the Company’s expansion to 11 million tons per year and higher royalty expenses from the year-ago quarter.

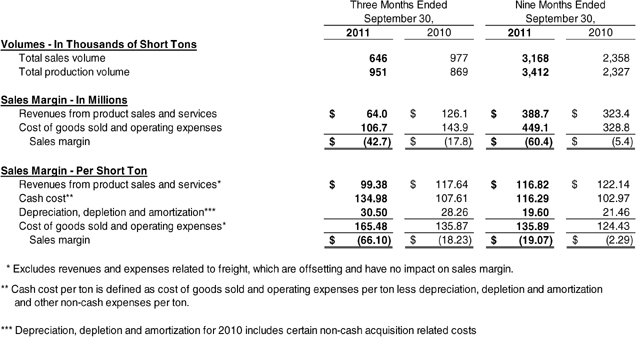

North American Coal

For the third quarter of 2011, North American Coal sales volume was 646,000 tons, a 34% decrease from the 977,000 tons sold in the prior year’s comparable quarter. The decrease was driven by the absence of sales volume from Cliffs’ Oak Grove Mine and lower sales volume from Cliffs’ Pinnacle Mine.

As previously disclosed, Cliffs is in the process of restoring aboveground operations at Oak Grove Mine in Alabama. Earlier this year, these operations were damaged by severe weather. Underground mining operations at Oak Grove Mine continued during the quarter, resulting in the Company stockpiling raw coal in anticipation of a preparation plant restart in December.

Cliffs resumed longwall operations at its Pinnacle Mine in early October. During the third quarter, as a result of previously disclosed detection of carbon monoxide in a section of the mine, Cliffs had suspended underground longwall operations.

North American Coal’s third-quarter 2011 revenue per ton decreased 16% to $99.38, compared with the third quarter of 2010. Cliffs indicated the decline in revenue per ton was driven by a

CLIFFS NATURAL RESOURCES INC. — 200 PUBLIC SQUARE — SUITE 3300 — CLEVELAND, OH 44114-2544

5

product sales mix that included a higher proportion of sales volume from high-volatile metallurgical and thermal coal products versus 2010’s comparable quarter.

Cash cost per ton increased 25% to $134.98 from $107.61 in the comparable quarter last year. The higher cost per ton was primarily attributed to lower fixed-cost leverage as the result of the production challenges indicated above, which resulted in approximately $47 per ton of additional costs during the third quarter of 2011.

Sonoma Coal and Amapá

In the third quarter of 2011, Cliffs’ share of sales volume for its 45% economic interest in Sonoma Coal was 284,000 tons. Revenues and sales margin generated for Cliffs were $53.7 million and $18.2 million, respectively. Revenue per ton at Sonoma was $189.40, with cash costs of $88.03 per ton.

Cliffs has a 30% ownership interest in Amapá, an iron ore operation in Brazil. During the third quarter of 2011, Amapá produced approximately 1.2 million tons and earned equity income of $12.4 million for Cliffs’ share of the operation.

Capital Structure, Cash Flow and Liquidity

At quarter end, Cliffs had $545 million of cash and cash equivalents. During the quarter, Cliffs’ Board of Directors authorized the Company to repurchase up to 4 million of its outstanding common shares under a newly authorized share repurchase plan. Subsequent to the announcement, Cliffs acquired approximately 3 million shares at an average weighted cost of $74 per share and a total investment of approximately $222 million.

During the quarter, Cliffs entered into an agreement for an amended and restated $1.75 billion revolving credit facility, which amended its existing $600 million revolving credit facility. At quarter end, the Company had $3.9 billion in long-term debt including $250 million drawn on its revolving credit facility.

For the quarter, Cliffs reported depreciation, depletion and amortization of $118 million and generated $821 million in cash from operations.

Outlook

Looking ahead, Cliffs anticipates stagnant to only modest growth in the U.S. economy. However, the Company indicated that the current level of U.S. economic growth should sustain a healthy U.S. business for Cliffs. In Asia, historically high year-over-year crude steel production

CLIFFS NATURAL RESOURCES INC. — 200 PUBLIC SQUARE — SUITE 3300 — CLEVELAND, OH 44114-2544

6

and iron ore imports continue to support demand for Cliffs’ products across the Company’s iron ore segments exposed to the seaborne market.

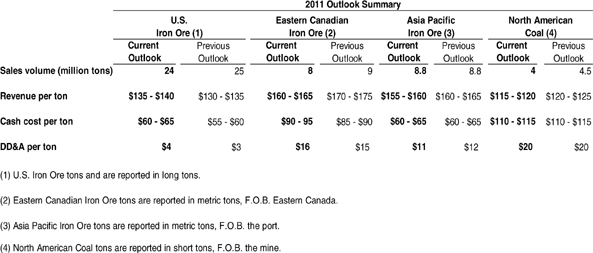

U.S. Iron Ore Outlook (Long tons)

For 2011, the Company is modestly decreasing its expected sales volume in U.S. Iron Ore to approximately 24 million tons from its previous expectation of 25 million tons, driven by vessel availability and adjustments in customer pellet requirements.

U.S. Iron Ore revenue per ton is expected to be approximately $135 - $140, up from the previous expectation of $130—$135, based on the following assumptions:

| • | A Platts 62% iron ore spot price of $140 per ton (C.F.R. China) is maintained for the remainder of 2011; |

| • | 2011 U.S. blast furnace utilization of approximately 70%; |

| • | 2011 average hot rolled steel pricing of $700 - $750 per ton; and |

| • | An approximately $5 per ton increase related to fully consolidating Empire Mine. |

In addition, the revenue-per-ton expectation also considers various contract provisions, lag-year adjustments and pricing caps and floors contained in certain supply agreements. Actual realized revenue per ton for the full year will depend on iron ore price changes, customer mix, production input costs and/or steel prices (all factors contained in certain of Cliffs’ supply agreements).

Cliffs is increasing its U.S. Iron Ore 2011 production volume to approximately 24 million tons. The Company is also increasing its cash cost per ton expectation to approximately $60 - $65, up from its previous expectation of $55 - $60. Both increases are related to fully consolidating Empire Mine. For 2011, depreciation, depletion and amortization is expected to be approximately $4 per ton.

In 2012, Cliffs expects to produce and sell approximately 23 million tons from its U.S. Iron Ore business. This sales volume expectation assumes a 70% - 75% blast furnace utilization rate in 2012.

Eastern Canadian Iron Ore Outlook (Metric Tons, F.O.B. Eastern Canada)

For 2011, the Company is decreasing its Eastern Canadian Iron Ore expected sales and production volume to approximately 8 million tons from a previous expectation of 9 million tons. The decrease was driven by lower than anticipated pellet product available for sale from Cliffs’ Wabush Mine and an adjustment to Bloom Lake’s current shipping plan for the remainder of 2011.

CLIFFS NATURAL RESOURCES INC. — 200 PUBLIC SQUARE — SUITE 3300 — CLEVELAND, OH 44114-2544

7

Cliffs is decreasing its 2011 Eastern Canadian Iron Ore revenue-per-ton outlook to approximately $160 - $165, from its previous expectation of $170 - $175, assuming the following:

| • | A Platts 62% iron ore spot price of $140 per ton (C.F.R. China) is maintained for the remainder of 2011; and |

| • | A product mix of approximately 50% concentrate and 50% pellets. |

Cliffs expects full-year 2011 Eastern Canadian Iron Ore cash cost per ton of approximately $90 - $95, up from a previous range of $85 - $90.

Cliffs also anticipates non-cash inventory step-up costs of approximately $8 per ton and depreciation, depletion and amortization of approximately $16 per ton for full-year 2011.

In 2012, Cliffs expects to produce and sell approximately 12 million tons from its Eastern Canadian Iron Ore business, comprised of approximately one-third iron ore pellets and two-thirds iron ore concentrate.

Asia Pacific Iron Ore Outlook (Metric tons, F.O.B. the port)

Cliffs is maintaining its full-year 2011 Asia Pacific Iron Ore expected sales volume of approximately 8.8 million tons and production volume of approximately 9 million tons. Cliffs’ 2011 Asia Pacific Iron Ore revenue-per-ton outlook is approximately $155 - $160, decreased from its previous expectation of $160 - $165, assuming the following:

| • | A Platts 62% iron ore spot price of $140 per ton (C.F.R. China) is maintained for the remainder of 2011; and |

| • | A product mix of approximately 50% lump and 50% fines iron ore. |

Full-year 2011 Asia Pacific Iron Ore cash cost per ton is expected to be approximately $60 - $65. Cliffs anticipates depreciation, depletion and amortization to be approximately $11 per ton for full-year 2011.

In 2012, Cliffs expects to produce and sell approximately 11 million tons from its Asia Pacific Iron Ore business, comprised of approximately 50% iron ore lump and 50% iron ore fines. The year-over-year increase in sales and production volume is the result of Cliffs’ ongoing expansion plans at its Asia Pacific Iron Ore operations announced in the year-ago quarter.

North American Coal Outlook (Short tons, F.O.B. the mine)

CLIFFS NATURAL RESOURCES INC. — 200 PUBLIC SQUARE — SUITE 3300 — CLEVELAND, OH 44114-2544

8

Cliffs indicated it is decreasing its 2011 North American Coal sales volume expectation to approximately 4 million tons from its previous expectation of 4.5 million tons. The decrease is primarily related to sales from Oak Grove Mine resuming in January 2012, rather than the Company’s previous estimate of December 2011. Sales volume mix is anticipated to be approximately 1.6 million tons of low-volatile metallurgical coal and 1.4 million tons of high-volatile metallurgical coal, with thermal coal making up the remainder of the expected sales volume. Full-year 2011 production volume is expected to be approximately 4.9 million tons.

Cliffs has revised its North American Coal 2011 revenue-per-ton expectation to approximately $115–$120 and is maintaining its cash-cost-per-ton expectation of approximately $110–$115. Full-year 2011 depreciation, depletion and amortization is expected to be approximately $20 per ton.

In 2012, Cliffs expects to sell approximately 7.2 million tons from its North American Coal business, comprised of approximately 4.3 million tons of low-volatile metallurgical coal, 1.8 million tons of high-volatile metallurgical coal and 1.1 million tons of thermal coal. Full-year 2012 production volume is expected to be approximately 6.6 million tons. As indicated above, Cliffs anticipates having approximately 600,000 tons of low-volatile metallurgical “clean coal equivalent” within its coal inventory stockpile by the end of 2011.

The following table provides a summary of Cliffs’ 2011 guidance for its four business segments:

Outlook for Sonoma Coal and Amapá (Metric tons, F.O.B. the port)

Cliffs has a 45% economic interest in Sonoma Coal. For 2011, the Company is increasing its sales volume expectation to approximately 1.4 million tons from its previous expectation of 1.2 million tons. The approximate product mix is expected to be two-thirds thermal coal and one-

CLIFFS NATURAL RESOURCES INC. — 200 PUBLIC SQUARE — SUITE 3300 — CLEVELAND, OH 44114-2544

9

third metallurgical coal. Cliffs is modestly increasing its full-year 2011 production volume expectation to approximately 1.6 million tons. Cash cost per ton is expected to be approximately $90–$95. For 2011, depreciation, depletion and amortization is expected to be approximately $14 per ton.

In 2012, Cliffs expects to produce and sell approximately 1.6 million tons for the Company’s share of Sonoma Coal. The product mix is expected to be comprised of approximately one-third metallurgical coal and two-thirds thermal coal.

Cliffs expects Amapá to contribute over $35 million in equity income in 2011, with similar profitability in 2012.

SG&A Expenses

Cliffs’ full-year 2011 SG&A expense expectation is approximately $290 million, which includes approximately $35 million related to Sonoma Coal partner profit sharing and approximately $25 million in non-recurring acquisition costs resulting from the Consolidated Thompson acquisition.

Other Expectations

The Company expects to incur cash outflows of approximately $85 million to support future growth, comprised of approximately $40 million related to its global exploration activities and approximately $45 million related to its chromite project in Ontario, Canada.

As a result of the benefits of tax planning and discrete items described above, Cliffs now anticipates a full-year effective tax rate of approximately 18% for 2011, down from its previous expectation of 26%. Cliffs is decreasing its expectation for full-year 2011 depreciation, depletion and amortization to approximately $420 million from its previous expectation of $440 million.

2011 Capital Budget Update and Other Uses of Cash

For 2011, based on the above outlook, Cliffs would generate an anticipated $2.2 billion in cash from operations.

Cliffs is decreasing its 2011 capital expenditures budget to approximately $900 million from its previous estimate of approximately $1 billion. The decrease is driven by an adjustment in timing of capital spending on certain growth projects. Cliffs indicated the revised capital expenditure expectation is comprised of approximately $300 million in sustaining capital and $600 million in growth and expansion capital.

CLIFFS NATURAL RESOURCES INC. — 200 PUBLIC SQUARE — SUITE 3300 — CLEVELAND, OH 44114-2544

10

Cliffs will host a conference call to discuss its third-quarter 2011 results tomorrow, Oct. 28, 2011, at 10 a.m. ET. The call will be broadcast live and archived on Cliffs’ website: www.cliffsnaturalresources.com.

About Cliffs Natural Resources Inc.

Cliffs Natural Resources Inc. is an international mining and natural resources company. A member of the S&P 500 Index, the Company is a major global iron ore producer and a significant producer of high- and low-volatile metallurgical coal. Cliffs’ strategy is to continually achieve greater scale and diversification in the mining industry through a focus on serving the world’s largest and fastest growing steel markets. Driven by the core values of social, environmental and capital stewardship, Cliffs associates across the globe endeavor to provide all stakeholders operating and financial transparency.

The Company is organized through a global commercial group responsible for sales and delivery of Cliffs products and a global operations group responsible for the production of the minerals the Company markets. Cliffs operates iron ore and coal mines in North America and two iron ore mining complexes in Western Australia. The Company also has a 45% economic interest in a coking and thermal coal mine in Queensland, Australia. In addition, Cliffs has a major chromite project, in the pre-feasibility stage of development, located in Ontario, Canada.

News releases and other information on the Company are available on the Internet at: http://www.cliffsnaturalresources.com

‘Safe Harbor’ Statement under the Private Securities Litigation Reform Act of 1995

This news release contains predictive statements that are intended to be made as ‘forward-looking’ within the safe harbor protections of the Private Securities Litigation Reform Act of 1995. Although the Company believes that its forward-looking statements are based on reasonable assumptions, such statements are subject to risk and uncertainties, including that the integration of Consolidated Thompson proceeds without proving to be more difficult, time consuming or costly than expected; production expansions proceed without proving to be more difficult, time consuming or costly than expected; that production increases at Bloom Lake proceed as currently expected and that revenues and costs of production are consistent with current expectations.

Actual results may differ materially from such statements for a variety of reasons, including: the uncertainty or weakness in global economic and/or market conditions, including any related impact on prices; trends affecting our financial condition, results of operations or future prospects, particularly any slowing of the economic growth rate in China for an extended period of time; Cliffs’ ability to achieve the synergies and the strategic and other objectives related to the acquisition of Consolidated Thompson; the outcome of any contractual disputes with our customers or significant suppliers of energy, materials or services; our ability to successfully complete the repair and refurbishment work at the Oak Grove Mine in the expected time frame; the amount and timing of any insurance recovery proceeds with respect to Oak Grove Mine; changes in the sales volumes or mix; the impact of price-adjustment factors on our sales contracts; availability of capital equipment and component parts; the failure of plant, equipment or processes to operate as anticipated; the ability of our customers to meet their obligations to us on a timely basis or at all; events or circumstances that could impair or adversely impact the viability of a mine and the carrying value of associated assets; the business of the acquired companies not being integrated successfully or such integration proving more difficult, time consuming or costly than expected; our ability to obtain any permits, approvals, modifications or other authorization of, or from, any governmental or regulatory entity; the ability to achieve planned production rates or levels; our actual economic ore reserves; reductions in current resource estimates; impacts of increasing governmental regulation, including failure to receive

CLIFFS NATURAL RESOURCES INC. — 200 PUBLIC SQUARE — SUITE 3300 — CLEVELAND, OH 44114-2544

11

or maintain required environmental permits; the ability to maintain adequate liquidity and successfully implement our financing plans; and problems or uncertainties with productivity, third-party contractors, labor disputes, weather conditions, natural disasters, tons mined, changes in cost factors, the supply or price of energy, transportation, mine-closure obligations and employee benefit costs and other risks of the mining industry.

Reference is also made to the detailed explanation of the many factors and risks that may cause such predictive statements to turn out differently, set forth in our Annual Report and Reports on Form 10-K and Form 10-Q and previous news releases filed with the Securities and Exchange Commission, which are publicly available on Cliffs Natural Resources’ website. The information contained in this document speaks as of the date of this news release and may be superseded by subsequent events. Except as may be required by applicable securities laws, we do not undertake any obligation to revise or update any forward-looking statements contained in this press release.

SOURCE: Cliffs Natural Resources Inc.

GLOBAL COMMUNICATIONS AND INVESTOR RELATIONS CONTACTS:

Steve Baisden

Vice President, Investor Relations and Communications

(216) 694-5280

Jessica Moran

Manager, Investor Relations

(216) 694-6532

Patricia Persico

Sr. Manager, Media Relations and Marketing Communications

(216) 694-5316

FINANCIAL TABLES FOLLOW

# # #

CLIFFS NATURAL RESOURCES INC. — 200 PUBLIC SQUARE — SUITE 3300 — CLEVELAND, OH 44114-2544

12

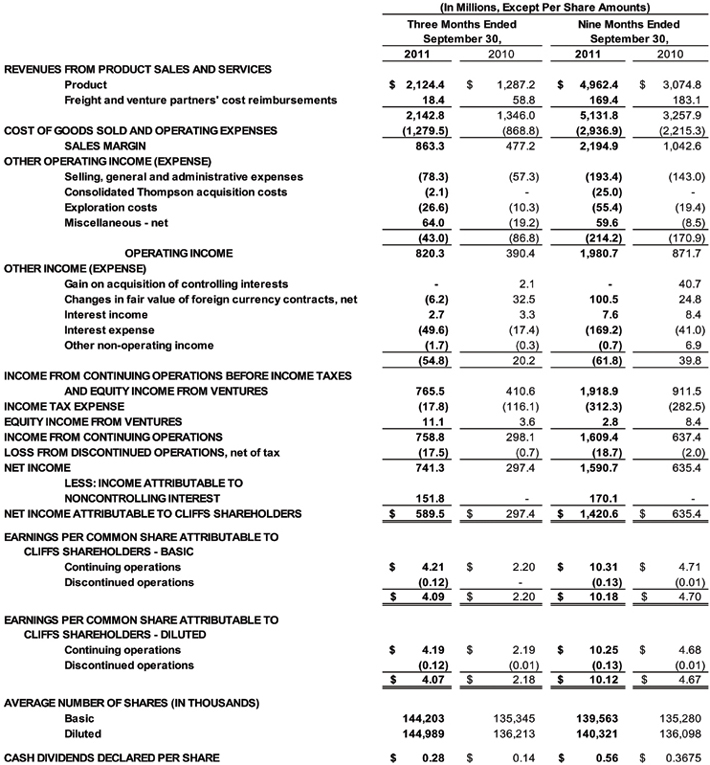

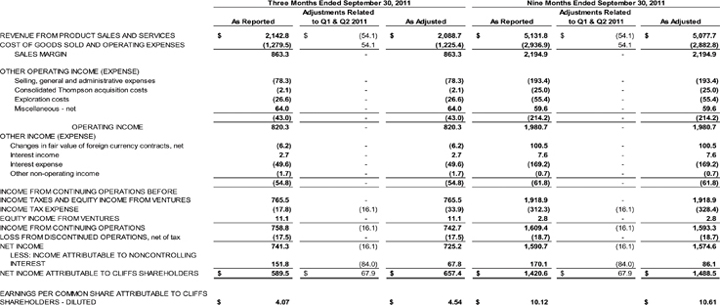

CLIFFS NATURAL RESOURCES INC. AND SUBSIDIARIES

STATEMENTS OF UNAUDITED CONDENSED CONSOLIDATED OPERATIONS

CLIFFS NATURAL RESOURCES INC. — 200 PUBLIC SQUARE — SUITE 3300 — CLEVELAND, OH 44114-2544

13

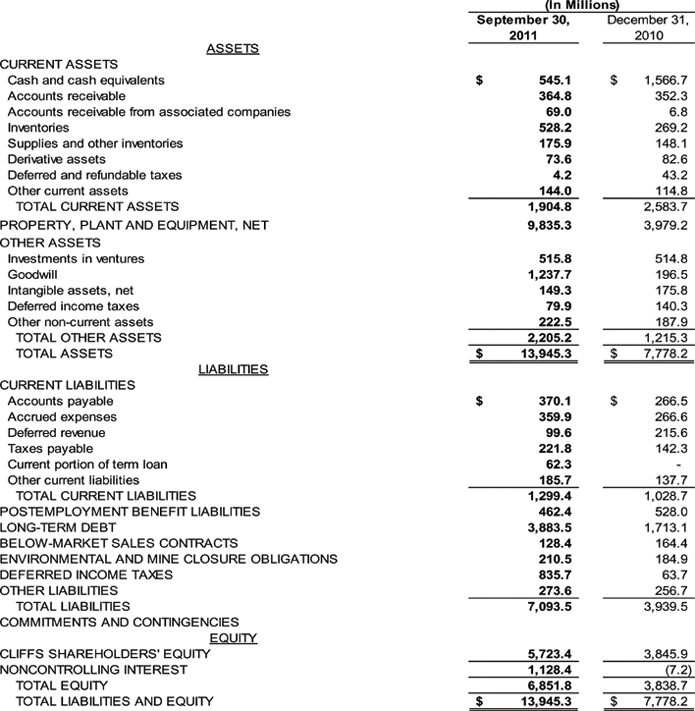

CLIFFS NATURAL RESOURCES INC. AND SUBSIDIARIES

STATEMENTS OF UNAUDITED CONDENSED CONSOLIDATED FINANCIAL POSITION

CLIFFS NATURAL RESOURCES INC. — 200 PUBLIC SQUARE — SUITE 3300 — CLEVELAND, OH 44114-2544

14

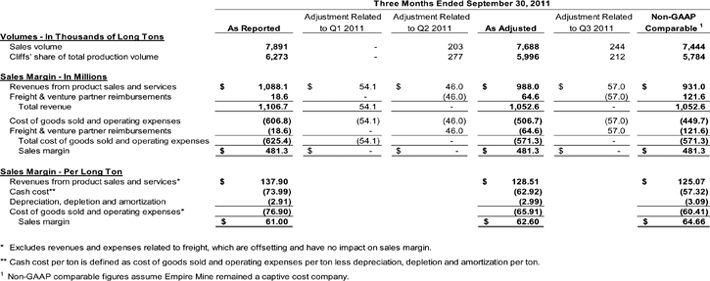

Non-GAAP Presentation of U.S. Iron Ore Business Segment Results

In addition to the consolidated financial statements presented in accordance with U.S. GAAP, the Company uses the following non-GAAP financial measures of its U.S. Iron Ore business segment financial performance. While the Company considers these adjusted figures meaningful to investors in evaluating segment performance, these figures are presented outside of U.S. GAAP. Non-GAAP financial measures should not be considered in isolation from, as a substitute for, or superior to, measures of financial performance prepared in accordance with U.S. GAAP.

APPENDIX A

CLIFFS NATURAL RESOURCES INC.

U.S. IRON ORE BUSINESS SEGMENT

RECONCILIATION OF ACCOUNTING FOR FULLY CONSOLIDATING EMPIRE MINE IN 2011

CLIFFS NATURAL RESOURCES INC. — 200 PUBLIC SQUARE — SUITE 3300 — CLEVELAND, OH 44114-2544

15

APPENDIX B

CLIFFS NATURAL RESOURCES INC. AND SUBSIDIARIES

STATEMENTS OF UNAUDITED CONDENSED CONSOLIDATED OPERATIONS

RECONCILIATION FOR FULLY CONSOLIDATING EMPIRE MINE IN 2011

CLIFFS NATURAL RESOURCES INC. — 200 PUBLIC SQUARE — SUITE 3300 — CLEVELAND, OH 44114-2544

16