Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OCCIDENTAL PETROLEUM CORP /DE/ | form8k-20111027.htm |

| EX-99.3 - EXHIBIT 99.3 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_3-20111027.htm |

| EX-99.1 - EXHIBIT 99.1 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_1-20111027.htm |

| EX-99.2 - EXHIBIT 99.2 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_2-20111027.htm |

| EX-99.5 - EXHIBIT 99.5 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_5-20111027.htm |

EXHIBIT 99.4

Occidental Petroleum Corporation

Third Quarter 2011 Earnings Conference Call

October 27, 2011

Third Quarter 2011 Earnings Conference Call

October 27, 2011

1

2

Third Quarter 2011 Earnings - Highlights

Third Quarter 2011 Earnings - Highlights

• Core Results - $1.8 Billion vs. $1.2 Billion in 3Q10

– Core EPS $2.18 (diluted) vs. $1.48 in 3Q10.

• Net Income - $1.8 Billion vs. $1.2 Billion in 3Q10

– EPS $2.17 (diluted) vs. $1.46 in 3Q10.

• The small difference between net and core income is

due to discontinued operations.

due to discontinued operations.

2

3

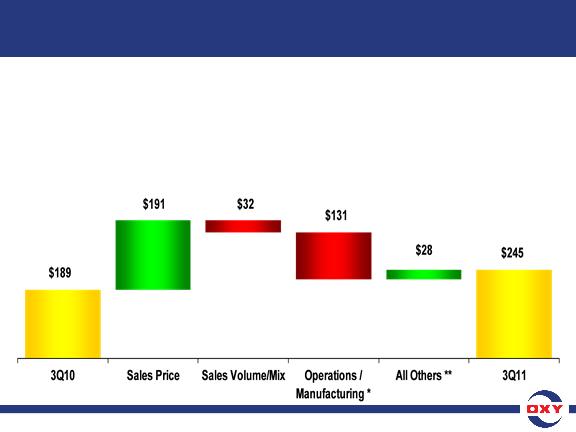

($ in millions)

• Core Results for 3Q11 of $2.6 B vs. $1.8 B in 3Q10 and $2.6 B in 2Q11

– Higher volumes in 3Q11, compared to 2Q11, resulted in flat quarter-to-quarter income despite

lower product prices. The improvement in 3Q11 vs. 3Q10 was driven by higher production and

liquids prices.

lower product prices. The improvement in 3Q11 vs. 3Q10 was driven by higher production and

liquids prices.

Third Quarter 2011 Earnings - Oil & Gas

Segment Variance Analysis - 3Q11 vs. 3Q10

Segment Variance Analysis - 3Q11 vs. 3Q10

3

4

3Q11 3Q10

Reported Segment Earnings ($mm) $2,612 $1,757

WTI Oil Price ($/bbl) $89.76 $76.20

Brent Oil Price ($/bbl) $112.22 $76.41

NYMEX Gas Price ($/mcf) $4.28 $4.53

Oxy’s Realized Prices

Worldwide Oil ($/bbl) $97.24 $72.31

+ 34% year-over-year

Worldwide NGLs ($/bbl) $56.06 $39.70

+ 41% year-over-year

US Natural Gas ($/mcf) $4.23 $4.20

~ flat year-over-year

Third Quarter 2011 Earnings - Oil & Gas Segment

4

5

Third Quarter 2011 Earnings - Oil & Gas Volumes

3Q11 3Q10

Oil and Gas Sales Volumes (mboe/d) 743 713

Oil and Gas Production Volumes (mboe/d) 739 706

– Year-over-year increase of greater than 4.5% (2010 volumes included production

from Libya).

from Libya).

• The year-over-year volume increase reflects our continued focus on

production growth.

production growth.

• 3Q11 production was also more than 3% higher than 2Q11 volumes

of 715 mboe/d.

of 715 mboe/d.

• 3Q11 sales volumes were 743 mboe/d, compared to our guidance of

725 mboe/d.

725 mboe/d.

– The improvement resulted mainly from the higher domestic production and the

timing of liftings.

timing of liftings.

5

6

Third Quarter 2011 Earnings - Oil & Gas Production

Third Quarter 2011 Earnings - Oil & Gas Production

• US production was 436 mboe/d, representing the highest

ever domestic production volumes for the company,

compared to our guidance of 430 to 432 mboe/d.

ever domestic production volumes for the company,

compared to our guidance of 430 to 432 mboe/d.

• Our production in CA rose by 6 mboe/d compared to

2Q11, and contributed a large portion of the sequential

increase in our overall domestic production volumes.

2Q11, and contributed a large portion of the sequential

increase in our overall domestic production volumes.

• Latin America volumes were 30 mboe/d.

– Colombia volumes decreased from 2Q11 due to pipeline interruptions

caused by insurgent activity.

caused by insurgent activity.

6

7

Third Quarter 2011 Earnings - Oil & Gas Production

• In the Middle East region:

– We recorded no production in Libya.

– In Iraq, we produced 4 mboe/d.

– Yemen production was 28 mboe/d, slightly ahead of our

guidance.

guidance.

– In Oman, 3Q11 production was 79 mboe/d, an increase of

3 mboe/d over 2Q11 volumes.

3 mboe/d over 2Q11 volumes.

– In Qatar, 3Q11 production was 73 mboe/d, an increase of

5 mboe/d over 2Q11 volumes.

5 mboe/d over 2Q11 volumes.

• The increase reflected the results of the development program, as well

as maintenance issues that affected the second quarter volumes.

as maintenance issues that affected the second quarter volumes.

– In Dolphin and Bahrain combined, production increased

3 mboe/d from 2Q11 volumes.

3 mboe/d from 2Q11 volumes.

7

8

Third Quarter 2011 Earnings - Oil & Gas

Segment - Realized Prices and Differentials

Segment - Realized Prices and Differentials

Third Quarter 2011 Earnings - Oil & Gas

Segment - Realized Prices and Differentials

Segment - Realized Prices and Differentials

• 3Q11 realized prices declined for all our products from 2Q11:

– Worldwide crude oil realized price was $97.24 p/b, a decrease of 6%.

– Worldwide NGLs were $56.06 p/b, a decline of 3%.

– Domestic natural gas prices were about flat at $4.23 p/mcf.

• Differentials improved in 3Q11, resulting in realized oil prices

representing 108% of the average WTI and 87% of the average

Brent price.

representing 108% of the average WTI and 87% of the average

Brent price.

• About 60% of Oxy’s oil production tracks world oil prices and

40% is indexed to WTI. For example:

40% is indexed to WTI. For example:

– In CA our realized price was 114% of WTI and 91% of Brent in 3Q11.

– In Oman our average price was 117% of WTI and 93% of Brent.

• Price changes at current global prices affect our quarterly

earnings before income taxes by $38 mm for a $1.00 p/b change

in oil prices and $7 mm for a $1.00 p/b change in NGL prices. A

swing of $0.50 per mm BTUs in domestic gas prices affects

quarterly pre-tax earnings by about $34 mm.

earnings before income taxes by $38 mm for a $1.00 p/b change

in oil prices and $7 mm for a $1.00 p/b change in NGL prices. A

swing of $0.50 per mm BTUs in domestic gas prices affects

quarterly pre-tax earnings by about $34 mm.

8

9

Third Quarter 2011 Earnings - Oil & Gas

Segment - Cash Production Costs and Taxes

Segment - Cash Production Costs and Taxes

Third Quarter 2011 Earnings - Oil & Gas

Segment - Cash Production Costs and Taxes

Segment - Cash Production Costs and Taxes

• Oil and gas cash production costs were $12.36 per boe

for the first nine months of 2011, compared with last

year's twelve-month costs of $10.19 per boe.

for the first nine months of 2011, compared with last

year's twelve-month costs of $10.19 per boe.

– The cost increase reflects higher workover and maintenance

activity driven by our program to increase production at these

higher levels of oil prices.

activity driven by our program to increase production at these

higher levels of oil prices.

• Taxes other than on income, which are directly related to

product prices, were $2.29 per boe for the first nine

months of 2011, compared to $1.83 per boe for all of

2010.

product prices, were $2.29 per boe for the first nine

months of 2011, compared to $1.83 per boe for all of

2010.

• Total exploration expense was $39 mm in 3Q11.

9

10

($ in millions)

*Higher feedstock costs

**Power sold to the grid during Texas power shortage

• Core Results for 3Q11 were $245 mm vs. $253 mm in 2Q11 and

$189 mm in 3Q10.

$189 mm in 3Q10.

– The year-over-year improvement reflects higher margins across most product lines. In

addition, during 3Q11, we temporarily idled certain production in our Texas plants and sold

power to the grid during the power shortage, resulting in an increase in the quarter’s earnings.

addition, during 3Q11, we temporarily idled certain production in our Texas plants and sold

power to the grid during the power shortage, resulting in an increase in the quarter’s earnings.

Third Quarter 2011 Earnings - Chemical

Segment Variance Analysis - 3Q11 vs. 3Q10

Segment Variance Analysis - 3Q11 vs. 3Q10

10

11

($ in millions)

• Core Results for 3Q11 were $77 mm vs. $187 mm in 2Q11 and

$163 mm in 3Q10.

$163 mm in 3Q10.

– The decreases from 2Q11 and 3Q10 earnings were due to losses from our Phibro unit both for

the quarter and year-to-date, partially offset by higher pipeline income and increased power

sales to the grid during 3Q11.

the quarter and year-to-date, partially offset by higher pipeline income and increased power

sales to the grid during 3Q11.

Third Quarter 2011 Earnings - Midstream

Segment Variance Analysis - 3Q11 vs. 3Q10

Segment Variance Analysis - 3Q11 vs. 3Q10

11

12

Third Quarter 2011 Earnings - Taxes

• The worldwide effective tax rate was 38% for 3Q11.

– Our higher proportionate domestic income brought us closer to

the US statutory rates.

the US statutory rates.

• Our 3Q11 US and foreign tax rates are included in the

“Investor Relations Supplemental Schedules.”

“Investor Relations Supplemental Schedules.”

12

13

Third Quarter 2011 Earnings -

Nine Months Results & Capital Spending

Nine Months Results & Capital Spending

Third Quarter 2011 Earnings -

Nine Months Results & Capital Spending

Nine Months Results & Capital Spending

YTD2011 YTD2010

• Core Income ($mm) $5,187 $3,377

• Core EPS (diluted) $6.37 $4.14

• Net Income ($mm) $5,137 $3,318

• EPS (diluted) $6.31 $4.07

• Cash flow from operations for 9 months YTD11 was

$8.6 billion.

$8.6 billion.

• Capital spending was $5.0 billion for YTD11 of which

$2.0 billion was spent in 3Q11.

$2.0 billion was spent in 3Q11.

– Year-to-date capital expenditures by segment were 83% in Oil and Gas,

14% in Midstream and the remainder in Chemicals.

14% in Midstream and the remainder in Chemicals.

13

14

Cash Flow

From

Operations

$8,600

From

Operations

$8,600

Beginning

Cash

$2,600

12/31/10

Cash

$2,600

12/31/10

Shah - $500

($ in millions)

Note: See attached GAAP reconciliation.

– Free cash flow from continuing operations after capex and dividends,

but before acquisition and debt activity, was about $2.6 billion.

but before acquisition and debt activity, was about $2.6 billion.

Third Quarter 2011 Earnings -

2011 YTD Cash Flow

2011 YTD Cash Flow

14

15

Third Quarter 2011 Earnings -

Net Acquisition Expenditures

Net Acquisition Expenditures

Third Quarter 2011 Earnings -

Net Acquisition Expenditures

Net Acquisition Expenditures

• Our net acquisition expenditures in the first nine months

were $1.5 billion, which are net of proceeds from the sale

of our Argentina operations.

were $1.5 billion, which are net of proceeds from the sale

of our Argentina operations.

• The acquisitions included the South Texas purchase,

properties in California and the Permian, and a payment

in connection with the signing of the Al Hosn project in

Abu Dhabi, which is the gas development of the Shah

field.

properties in California and the Permian, and a payment

in connection with the signing of the Al Hosn project in

Abu Dhabi, which is the gas development of the Shah

field.

– This payment was for Oxy’s share of development expenditures

incurred by the project prior to the date the final agreement was

signed.

incurred by the project prior to the date the final agreement was

signed.

15

16

Third Quarter 2011 Earnings -

Shares Outstanding, Debt and ROE

Shares Outstanding, Debt and ROE

Shares Outstanding (mm) YTD11 9/30/11

Weighted Average Basic 812.6

Weighted Average Diluted 813.3

Basic Shares Outstanding 811.2

Diluted Shares Outstanding 812.1

9/30/11 12/31/10

Debt/Capital 14% 14%

• During 3Q11, Oxy issued senior notes of $1.3 billion due in 2017 and

$900 million due in 2022 at a weighted average interest rate of 2.3%,

which brought the Company’s average effective borrowing rate

down to 3.2%.

$900 million due in 2022 at a weighted average interest rate of 2.3%,

which brought the Company’s average effective borrowing rate

down to 3.2%.

• Our annualized ROE for YTD11 was 20%.

16

17

Third Quarter 2011 Earnings -

Oxy’s Strategy

Oxy’s Strategy

• Oxy’s overriding goal is to maximize Total Shareholder Return.

• We believe this can be achieved through a combination of:

1. Growing our oil and gas production by 5% to 8% per year on

average over the long term;

average over the long term;

2. Allocating and deploying capital with a focus on achieving

well above cost-of-capital returns; and

well above cost-of-capital returns; and

3. Consistent dividend growth.

17

18

Third Quarter 2011 Earnings -

Oxy’s Strategy - Oil and gas production

Oxy’s Strategy - Oil and gas production

• The impact of our capital program and increase in drilling

activity have started to have a visible impact on our domestic

oil and gas production volumes.

activity have started to have a visible impact on our domestic

oil and gas production volumes.

• Compared to 2Q11, our domestic production increased by

about 6 mboe/d per month, compared to our guidance of

3 to 4 mboe/d.

about 6 mboe/d per month, compared to our guidance of

3 to 4 mboe/d.

– This increase resulted in domestic production of 436 mboe/d for 3Q11,

compared to the 430 to 432 mboe/d guidance we gave you.

compared to the 430 to 432 mboe/d guidance we gave you.

– 3Q11 domestic production is the highest US total production volume in

Oxy’s history, reflecting the highest ever volumes for liquids.

Oxy’s history, reflecting the highest ever volumes for liquids.

• On a year-over-year basis, our domestic production volumes

increased by 15%.

increased by 15%.

18

19

Third Quarter 2011 Earnings -

Oxy’s Strategy - Oil and gas production

Oxy’s Strategy - Oil and gas production

• Compared to the prior year, total company 3Q11 production of

739 mboe/d was affected by a 7% decline in our international

production.

739 mboe/d was affected by a 7% decline in our international

production.

– This reduction was the result of disruptions in the Middle East/North

Africa region, and the impact of higher oil prices on our PSCs.

Africa region, and the impact of higher oil prices on our PSCs.

• In our operations we experience disruptions affecting our

production.

production.

• Without these events our production would have been

10 to 15 mboe/d higher, which is more representative of our

assets’ current theoretical productive capacity.

10 to 15 mboe/d higher, which is more representative of our

assets’ current theoretical productive capacity.

• We believe our capital program will yield higher production

growth and reliability over time.

growth and reliability over time.

19

20

Third Quarter 2011 Earnings -

Oxy’s Strategy - Returns

Oxy’s Strategy - Returns

• ROE - Oxy’s annualized return on equity for the first nine

months of 2011 was 20%.

months of 2011 was 20%.

• ROCE - Oxy’s annualized return on capital employed for

the first nine months of 2011 was 18%.

the first nine months of 2011 was 18%.

• We continue to manage our capital program and

acquisition strategy to yield well above cost-of-capital

returns.

acquisition strategy to yield well above cost-of-capital

returns.

20

21

Third Quarter 2011 Earnings -

Oxy’s Strategy - Dividend growth

Oxy’s Strategy - Dividend growth

• Our ability to pay dividends is indicated by our free cash

flow generation.

flow generation.

• Free cash flow after interest, taxes and capital spending,

but before dividends, acquisitions and debt activity for the

first nine months of the year was $3.7 billion.

but before dividends, acquisitions and debt activity for the

first nine months of the year was $3.7 billion.

• Oxy’s annual dividend rate is currently $1.84 per share or

about $1.1 billion for the nine months of 2011.

about $1.1 billion for the nine months of 2011.

• Oxy has increased its dividends 10 times over the last

9 years, resulting in a compound annual dividend growth

rate of 15.6%.

9 years, resulting in a compound annual dividend growth

rate of 15.6%.

• In keeping with our philosophy to raise the dividend on a

consistent basis, the Board of Directors is expected to

consider a dividend increase at the February meeting.

consistent basis, the Board of Directors is expected to

consider a dividend increase at the February meeting.

21

22

Third Quarter 2011 Earnings -

4Q11 Outlook - US oil and gas production

4Q11 Outlook - US oil and gas production

• We expect 4Q11 oil and gas production to be as follows:

– Domestic volumes are expected to increase by about

3 to 4 mboe/d per month from the current quarterly average

level of 436 mboe/d.

3 to 4 mboe/d per month from the current quarterly average

level of 436 mboe/d.

– This should result in average 4Q11 production of about

442 to 444 mboe/d.

442 to 444 mboe/d.

– This would constitute a year-over-year domestic production

growth rate exceeding 10% and about a 6% per year production

growth rate going forward.

growth rate exceeding 10% and about a 6% per year production

growth rate going forward.

22

23

Third Quarter 2011 Earnings - 4Q11 Outlook

Domestic Asset Review - California

Domestic Asset Review - California

• For the year, we expect to drill and complete 154 shale wells

outside Elk Hills, compared to the 107 wells we had indicated

at the beginning of the year.

outside Elk Hills, compared to the 107 wells we had indicated

at the beginning of the year.

– Including Elk Hills, we expect to drill 195 shale wells for the year.

– We expect to drill and complete a total of 42 shale wells during 4Q11.

• Our experience has been that the 30-day initial production rate

for these wells is between 300 and 400 BOE per day.

for these wells is between 300 and 400 BOE per day.

• With respect to the shale wells outside Elk Hills, about 80% of

the BOE production is a combination of black oil and high-

value condensate.

the BOE production is a combination of black oil and high-

value condensate.

• The cost of drilling and completing the wells has been running

about $3.5 million per well, and we expect this to decline over

time.

about $3.5 million per well, and we expect this to decline over

time.

23

24

Third Quarter 2011 Earnings - 4Q11 Outlook

Domestic Asset Review - California

Domestic Asset Review - California

• Our conventional drilling program is progressing somewhat

better than planned.

better than planned.

• There has been no significant change in the status of

permitting issues in the state since our last call.

permitting issues in the state since our last call.

• We expect the current permitting levels to allow our program

to go forward at these levels and enable us to continue to

grow our production volumes in the state.

to go forward at these levels and enable us to continue to

grow our production volumes in the state.

• We expect the rig count to remain the same at 29.

24

25

Third Quarter 2011 Earnings - 4Q11 Outlook

Domestic Asset Review - Permian & Williston

Domestic Asset Review - Permian & Williston

• In the Permian operations:

– Our CO2 flood production is progressing according to plan.

– We expect our rig count to be about 24 in 4Q11.

– Our non-CO2 operations have stepped up their development

program but will not show significant production growth until

next year.

program but will not show significant production growth until

next year.

• In Williston:

– We are pursuing a development program with about 13 rigs

expected to be running in 4Q11.

expected to be running in 4Q11.

– Our production is growing as a result of the development

program and we expect the growth to continue.

program and we expect the growth to continue.

• Natural gas prices in the US continue to be weak. As a result,

we are considering cutting back our pure gas drilling in the

Midcontinent and possibly elsewhere.

we are considering cutting back our pure gas drilling in the

Midcontinent and possibly elsewhere.

25

26

Third Quarter 2011 Earnings - 4Q11 Outlook

International Oil and Gas

International Oil and Gas

• Internationally, we believe that once the current uncertainties

are behind us, including the resolution of the situation in

Libya and the achievement of a sustained development

program in Iraq, we will achieve production growth similar to

our domestic operations.

are behind us, including the resolution of the situation in

Libya and the achievement of a sustained development

program in Iraq, we will achieve production growth similar to

our domestic operations.

• We expect our 4Q11 international production to be about the

same as 3Q11 production, 4% higher than 2Q11, which

represented the low point of volumes during the year

following the situation in Libya.

same as 3Q11 production, 4% higher than 2Q11, which

represented the low point of volumes during the year

following the situation in Libya.

• Colombia volumes should be modestly higher than 3Q11,

assuming no further pipeline attacks.

assuming no further pipeline attacks.

26

27

Third Quarter 2011 Earnings - 4Q11 Outlook

International Oil and Gas

International Oil and Gas

• The Middle East region production is expected to be as

follows for 4Q11:

follows for 4Q11:

• At this point, we expect no significant production from Libya.

• Our joint venture partnerships are currently in the process of

resuming production, but production ramp-up will be

hampered in the near term by lack of vehicles and personnel

to address operational problems from the prolonged shut-in.

resuming production, but production ramp-up will be

hampered in the near term by lack of vehicles and personnel

to address operational problems from the prolonged shut-in.

• In Iraq, we expect production to be similar to the past quarter.

Going forward, we still are unable to reliably predict spending

levels, which determine production.

Going forward, we still are unable to reliably predict spending

levels, which determine production.

• In the remainder of the Middle East, we expect production to

be comparable to 3Q11 volumes.

be comparable to 3Q11 volumes.

27

28

Third Quarter 2011 Earnings -

4Q11 Outlook - Oil and Gas

4Q11 Outlook - Oil and Gas

• At quarter-end prices, we expect total production to

increase to around 745 mboe/d as a result of the 3 to 4

mboe/d per month coming from domestic production.

increase to around 745 mboe/d as a result of the 3 to 4

mboe/d per month coming from domestic production.

• We expect sales volumes to be around 740 mboe/d due

to the timing of liftings.

to the timing of liftings.

• A $5.00 change in global oil prices would impact our PSC

daily volumes by about 3 mboe/d.

daily volumes by about 3 mboe/d.

• We expect our total year capital expenditures to be about

$7.0 billion.

$7.0 billion.

• We expect exploration expense to be about $100 mm for

seismic and drilling for our exploration programs in

4Q11.

seismic and drilling for our exploration programs in

4Q11.

28

29

Third Quarter 2011 Earnings -

4Q11 Outlook - Chemicals & Taxes

4Q11 Outlook - Chemicals & Taxes

• The chemical segment earnings in 4Q11, historically the

weakest quarter, are expected to be about $100 mm.

weakest quarter, are expected to be about $100 mm.

– This reduction from the third quarter is due to seasonal

slowdowns in many markets such as construction, customers’

efforts to minimize inventories and a slowdown in exports.

slowdowns in many markets such as construction, customers’

efforts to minimize inventories and a slowdown in exports.

• We expect our combined worldwide tax rate in 4Q11 to

remain at about 38%.

remain at about 38%.

29

30

Third Quarter 2011 Earnings - Summary

Third Quarter 2011 Earnings - Summary

• Our 3Q11 core income of $2.18 per share was about

12% higher than the analysts’ consensus estimate.

12% higher than the analysts’ consensus estimate.

• Our 3Q11 oil and gas earnings of $2.6 billion were

essentially unchanged from 2Q11, despite a $6 p/b

decline in our average oil realizations.

essentially unchanged from 2Q11, despite a $6 p/b

decline in our average oil realizations.

• Our annualized return on equity was 20% for the first

nine months of 2011.

nine months of 2011.

• Our total oil and gas production of 739 mboe/d during

3Q11 grew more than 3% compared to 2Q11.

3Q11 grew more than 3% compared to 2Q11.

• Domestic oil and gas production volumes grew to

436 mboe/d in 3Q11 a 3% increase from 2Q11, and

above our earlier guidance of 430 to 432 mboe/d.

436 mboe/d in 3Q11 a 3% increase from 2Q11, and

above our earlier guidance of 430 to 432 mboe/d.

• Domestic volumes are expected to further increase

by about 3 to 4 mboe/d per month in 4Q11.

by about 3 to 4 mboe/d per month in 4Q11.

30

31

31