Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Encompass Health Corp | form8k-2011q3.htm |

| EX-99.1 - EXHIBIT 99.1 - Encompass Health Corp | exhibit99-1.htm |

Exhibit 99.2

Third Quarter 2011 Earnings Call

Supplemental Slides

Exhibit 99.2

The information contained in this presentation includes certain estimates, projections and other forward-

looking information that reflect our current outlook, views and plans with respect to future events, including

legislative and regulatory developments, strategy, capital expenditures, financial performance, and

business model. These estimates, projections and other forward-looking information are based on

assumptions that HealthSouth believes, as of the date hereof, are reasonable. Inevitably, there will be

differences between such estimates and actual events or results, and those differences may be material.

looking information that reflect our current outlook, views and plans with respect to future events, including

legislative and regulatory developments, strategy, capital expenditures, financial performance, and

business model. These estimates, projections and other forward-looking information are based on

assumptions that HealthSouth believes, as of the date hereof, are reasonable. Inevitably, there will be

differences between such estimates and actual events or results, and those differences may be material.

There can be no assurance that any estimates, projections or forward-looking information will be realized.

All such estimates, projections and forward-looking information speak only as of the date hereof.

HealthSouth undertakes no duty to publicly update or revise the information contained herein.

HealthSouth undertakes no duty to publicly update or revise the information contained herein.

You are cautioned not to place undue reliance on the estimates, projections and other forward-looking

information in this presentation as they are based on current expectations and general assumptions and

are subject to various risks, uncertainties and other factors, including those set forth in the Form 10-K for the

year ended December 31, 2010, our Form 10-Q for the quarters ended March 31, 2011, June 30, 2011, and

September 30, 2011, when filed, and in other documents we previously filed with the SEC, many of which

are beyond our control, that may cause actual events or results to differ materially from the views, beliefs

and estimates expressed herein.

information in this presentation as they are based on current expectations and general assumptions and

are subject to various risks, uncertainties and other factors, including those set forth in the Form 10-K for the

year ended December 31, 2010, our Form 10-Q for the quarters ended March 31, 2011, June 30, 2011, and

September 30, 2011, when filed, and in other documents we previously filed with the SEC, many of which

are beyond our control, that may cause actual events or results to differ materially from the views, beliefs

and estimates expressed herein.

Note Regarding Presentation of Non-GAAP Financial Measures

The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G

under the Securities Exchange Act of 1934. Schedules are attached that reconcile the non-GAAP financial

measures included in the following presentation to the most directly comparable financial measures

calculated and presented in accordance with Generally Accepted Accounting Principles in the United

States. Our Form 8-K, dated October 27, 2011, to which the following supplemental slides are attached as

Exhibit 99.2, provides further explanation and disclosure regarding our use of non-GAAP financial measures

and should be read in conjunction with these supplemental slides.

The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G

under the Securities Exchange Act of 1934. Schedules are attached that reconcile the non-GAAP financial

measures included in the following presentation to the most directly comparable financial measures

calculated and presented in accordance with Generally Accepted Accounting Principles in the United

States. Our Form 8-K, dated October 27, 2011, to which the following supplemental slides are attached as

Exhibit 99.2, provides further explanation and disclosure regarding our use of non-GAAP financial measures

and should be read in conjunction with these supplemental slides.

Forward-Looking Statements

2

Exhibit 99.2

Table of Contents

3

Exhibit 99.2

Q3 2011 Summary (Q3 2011 vs. Q3 2010)

ü Revenue growth of 8.0%

― Inpatient revenue growth of 8.6%

§ Discharge growth 5.1%

• Strong same-store discharge growth of 4.0%

§ Revenue per discharge increase of 3.3%

ü Disciplined expense management and improved operating leverage

― SWB as a percent of revenue decreased 110 bps.

― Hospital-related expenses as a percent of revenue decreased by 10 bps.

|

Location

|

# of Beds

|

Transaction

|

Date

|

|

Bristol, VA

|

25

|

De Novo

|

Q3 2010

|

|

Houston, TX

|

50

|

Acquired new IRF

|

Q3 2010

|

4

Exhibit 99.2

Q3 2011 Summary (Q3 2011 vs. Q3 2010) (cont.)

ü Adjusted EBITDA (1) for the quarter of $110.5 million reflects growth of 15.2%.

ü Adjusted free cash flow (1) for the quarter of $32.4 million:

― Benefited from higher Adjusted EBITDA

― Benefited from the absence of a swap payment ($10.6 million in Q3 2010)

― Offset by approx. $16 million for timing of interest payments

― Offset by approx. $17 million increase in accounts receivable

• Medicare payment deferrals related to legal entity reorganizations

• Increases resulting from revenue growth

ü Earnings per share (2) were negatively impacted by an $18.5 million, or $0.20 per

share, increase in income tax expense mainly attributable to the release of the

valuation allowance in Q4 2010 (see table on slide 11).

share, increase in income tax expense mainly attributable to the release of the

valuation allowance in Q4 2010 (see table on slide 11).

(1) Reconciliation to GAAP provided on slides 31, 32, 34, and 37 - 38.

(2) Earnings per share from continuing operations attributable to HealthSouth

5

Expect full-year adjusted free cash flow to be at least $210 million

reflecting growth over full-year 2010 of at least 16%

reflecting growth over full-year 2010 of at least 16%

Exhibit 99.2

Q3 2011 Summary (Q3 2011 vs. Q3 2010) (cont.)

ü Completed the sale of five long-term acute care hospitals (LTCHs) for approx.

$117.5 million.

$117.5 million.

ü Additional capital structure enhancements

― Completed the retirement of the10.75% senior notes due 2016

ü TeamWorks Care Management implementation completed in all HealthSouth

hospitals

hospitals

ü Clinical information system (CIS) implementation completed in second hospital

― Pilot phase now complete

― System-wide rollout will begin in 2012

6

Leverage ratio reduced to 2.9x (1)

(1) Based on trailing four-quarter Adjusted EBITDA of $455.4 million; reconciliation to GAAP provided on slides 31, 32, 34, and 38.

Exhibit 99.2

HealthSouth Functional Outcomes Continue to Outpace Industry Average

HealthSouth Average

UDS Average*

FIM Gain

LOS Efficiency

* Average = Expected, Risk-adjusted

Source: UDSmr Database - On Demand Report: Q3 2011 Report

FIM Gain

Change in Functional

Independence

Measurement (based

Independence

Measurement (based

on an 18 point

assessment) from

admission to discharge.

assessment) from

admission to discharge.

LOS Efficiency

Functional gain divided

by length of stay.

by length of stay.

High-Quality Care

7

Exhibit 99.2

― Inpatient revenue growth of 8.6%

§ Discharge growth of 5.1%

• Strong same-store discharge growth of 4.0%

• Continued positive contribution from hospitals opened or acquired in the last 12 months

§ Revenue per discharge increased 3.3%

• Medicare (2.25%) and managed care price adjustments

• Q3 2010 impacted by initial Medicare enrollment period (1) at hospitals opened in 2010

• Improved patient outcomes

― Outpatient and other revenue benefited from $1.7 million in state provider taxes.

8

(1) We generally do not receive full reimbursement for the first 30 Medicare patients discharged from a new hospital.

Exhibit 99.2

Expenses (Q3 2011 vs. Q3 2010)

ü Disciplined expense management and improved operating leverage

― SWB as a percent of revenue decreased 110 bps.

§ Q3 2010 results impacted by the ramping up of new hospitals.

― Hospital-related expenses as a percent of revenue decreased 10 bps.

§ Improved operating leverage offset by higher bad debt expense in Q3 2011

9

Exhibit 99.2

Adjusted EBITDA Change

Q3 9 Months

+$14.6M +$45.8M

+15.2% +15.4%

•Revenue growth driven

by higher volumes and

price

by higher volumes and

price

•Disciplined expense

management and

improved operating

leverage

management and

improved operating

leverage

10

Exhibit 99.2

11

(1) Income from continuing operations attributable to HealthSouth

(2) Actual tax provision recorded for the period

(3) Cash income taxes for the 3 and 9 months ended September 30, 2011 were $1.7 million and $5.9 million, respectively.

(4) During Q3 2010 and 9 months 2010, the Company maintained a valuation allowance against substantially all of its deferred tax assets. A substantial portion of the valuation

allowance was released in Q4 2010.

allowance was released in Q4 2010.

(5) Includes an approx. $28 million, or $0.30 per share, benefit related to the Company’s settlement with the IRS for tax years 2007 and 2008 and a reduction in unrecognized tax

benefits due to the lapse of the statute of limitations for certain federal and state claims.

benefits due to the lapse of the statute of limitations for certain federal and state claims.

(6) The $6.5 million and $19.5 million dividends related to our convertible perpetual preferred stock in the 3 and 9 month periods ended September 30, 2011 and 2010, respectively,

must be subtracted from income from continuing operations when calculating basic earnings per share.

must be subtracted from income from continuing operations when calculating basic earnings per share.

(7) Diluted earnings per share on a GAAP basis are the same as basic earnings per share due to the antidilutive impact in each period presented.

Exhibit 99.2

• Adjusted free cash flow for the quarter was affected by:

– Benefited from higher Adjusted EBITDA

– Benefited from the absence of a swap payment ($10.6 million Q3 2010)

– Offset by approx. $16 million for the timing of interest payments

– Offset by approx. $17 million increase in accounts receivable

§ Medicare payment deferrals related to legal entity reorganizations

§ Increases resulting from revenue growth

12

Expect full-year adjusted free cash flow to be at least $210 million reflecting

growth over full-year 2010 of at least 16%

growth over full-year 2010 of at least 16%

Exhibit 99.2

(1) Based on 2008 and trailing four-quarter Adjusted EBITDA of $322.6 million and $455.4 million, respectively; reconciliation to GAAP provided

on slides 31 - 34 and 38.

on slides 31 - 34 and 38.

Debt and Liquidity

Liquidity

13

Credit Ratings

Exhibit 99.2

Debt Profile

14

$500

Revolver

L+225

September 30 , 2011 (3)

$276

Undrawn

Undrawn

2016

10% of the outstanding principal is

currently callable per annum at $103

currently callable per annum at $103

(1) Based on trailing four-quarter Adjusted EBITDA of $455.4 million; reconciliation to GAAP provided on slides 31, 32, 34, and 38.

(2) The credit agreement has a $200 million restricted payment basket for debt repayment and stock repurchases, which is subject to

an annual grower basket equal to 50% of excess cash flow plus certain other amounts including net cash proceeds from certain

equity issuances.

an annual grower basket equal to 50% of excess cash flow plus certain other amounts including net cash proceeds from certain

equity issuances.

(3) Does not include $387.4 million of convertible perpetual preferred stock and capital leases and other note payables.

Capital Structure Enhancements:

§Completed the retirement of the 10.75% notes due 2016

§Reduced total debt by $131 million during the quarter

§Leverage ratio reduced to 2.9x (1)

Debt Profile:

§Additional debt pre-payment opportunities and flexible covenants (2)

§No near-term maturities and well-spaced debt maturities

§Limited exposure to higher interest rates

Exhibit 99.2

Reinvesting Free Cash Flow

15

• Additional debt prepayment (revolver, term loan

and senior notes)

and senior notes)

• Growth in core business

• Bed expansions

• De novo hospitals

• Hospital acquisitions

• Acute care IRF unit acquisitions/consolidations

• Purchase properties under operating leases

• Lower capital cost

• Greater control of property, CON and/or license

• Share repurchase ($125 million authorization)

− Offset dilution from shares underlying convertible

preferred shares (13.1 million shares), shares issued in

settlement of securities litigation (5.0 million shares),

and shares issued as a result of the Company’s stock

incentive plan

preferred shares (13.1 million shares), shares issued in

settlement of securities litigation (5.0 million shares),

and shares issued as a result of the Company’s stock

incentive plan

• Cash dividends (one time or regular)

Exhibit 99.2

2011 Guidance - Adjusted EBITDA(1)

Original Guidance

Feb. 17, 2011

$440 million to $450

million (Inclusive of

12 months LTCH

Adjusted EBITDA)

million (Inclusive of

12 months LTCH

Adjusted EBITDA)

(1) Reconciliation to GAAP provided on slides 31, 32, 34, and 38.

Q4 2011 Considerations:

üTough discharge volume comps (5.9% discharge growth in Q4 2010)

üBad debt expense was $1.3 million, or 0.3% of revenue, in Q4 2010.

üMedicare pricing in Q4 2011 is expected to increase by approx. 1.6%.

üSWB benefited in Q4 2010 from a $3.3 million favorable adjustment related to workers’

compensation.

compensation.

16

July 27, 2011

$447 million to $453

million

million

May 18, 2011

$440 million to $450

million;

(The high end of, or

greater than)

million;

(The high end of, or

greater than)

Guidance effectively raised by the 2011

expected LTCH Adjusted EBITDA

($17.5 million EBITDA in 2010)

expected LTCH Adjusted EBITDA

($17.5 million EBITDA in 2010)

Reflects 9.9% to 11.1% growth over 2010

Oct. 27, 2011

$450 million to $455

million

million

Raised Guidance

Exhibit 99.2

2011 Guidance - EPS

|

ü The Adjusted EBITDA ($17.5 million in 2010) associated with the Company’s six LTCHs has been

reclassified to discontinued operations. |

Basic Earnings per Share from

Continuing Operations Attributable

to HealthSouth (1)

Continuing Operations Attributable

to HealthSouth (1)

$1.18 to $1.23

Considerations:

ü Includes $38.8 million, or $0.42 per share, loss (pre-tax) on early extinguishment of debt related

to the Company’s retirement of its 10.75% senior notes

to the Company’s retirement of its 10.75% senior notes

ü Includes an approx. $28 million, or $0.30 per share, benefit and assumes provision for income

tax of 38% to 40% for Q4 2011; cash taxes expected to be $5 million to $8 million.

tax of 38% to 40% for Q4 2011; cash taxes expected to be $5 million to $8 million.

ü $10.6 million, or $0.11 per share, gain (pre-tax) in government, class action, and related

settlements

settlements

ü The Company expects interest expense to be approx. $24 million in Q4 2011.

ü Assumes a basic share count of 93.3 million shares

(1) Income from continuing operations attributable to HealthSouth

17

Diluted earnings per share on a GAAP

basis are the same as basic earnings per

share due to the antidilutive impact in

the period.

basis are the same as basic earnings per

share due to the antidilutive impact in

the period.

Exhibit 99.2

|

|

(2) Income from continuing operations attributable to HealthSouth (reclassified for the 6 LTCHs moving to discontinued operations)

(3) Current period amounts in income tax provision; see slides 35 - 36.

(4) Total income tax provision for full-year 2010, including the reversal of a substantial portion of the Company's valuation allowance against deferred tax assets.

(5) Includes an approx. $28 million, or $0.30 per share, benefit related to the Company’s settlement with the IRS for tax years 2007 and 2008, and a reduction in

unrecognized tax benefits due to the lapse of the statute of limitations for certain federal and state claims; assumes 38% to 40% effective tax rate for Q4 2011.

unrecognized tax benefits due to the lapse of the statute of limitations for certain federal and state claims; assumes 38% to 40% effective tax rate for Q4 2011.

(6) The dividends related to our convertible perpetual preferred stock must be subtracted from income from continuing operations when calculating basic

earnings per share.

earnings per share.

18

Exhibit 99.2

(1) Reconciliation to GAAP provided on slide 37.

HealthSouth’s GAAP income statement will be affected by a

number of items that will not affect adjusted free cash flow:

number of items that will not affect adjusted free cash flow:

•Normalized GAAP tax rate resulting from the valuation

allowance reversal in Q4 2010.

allowance reversal in Q4 2010.

•Loss on early extinguishment of debt

Expect full-year adjusted free cash flow to be at least $210 million

reflecting growth over full-year 2010 of at least 16%

reflecting growth over full-year 2010 of at least 16%

19

Exhibit 99.2

Appendix

Exhibit 99.2

(1) Reconciliation to GAAP provided on slides 31 - 38.

(2) Exclusive of any E&Y recovery.

21

Business Model

• Adjusted EBITDA CAGR: 5-8% (1)

• Adjusted Free Cash Flow CAGR: 12-17% (1)

Exhibit 99.2

Income Tax Considerations

|

GAAP Considerations:

•As of 9/30/11, the Company had an ending balance of approx. $1.3 billion in federal

NOLs and a remaining valuation allowance of approx. $105 million, primarily related to state NOLs. •Expect effective tax rate of approx. 40% going forward

Future Cash Tax Payments:

•The Company expects to pay approx. $5 million to $8 million per year of income tax.

•The Company does not expect to pay significant federal income taxes for up to 7

years. •HealthSouth is not currently subject to an annual use limitation (“AUL”) under Internal

Revenue Code Section 382 (“Section 382”). A “change of ownership,” as defined by Section 382, would subject us to an AUL, which is equal to the market capitalization of the Company at the time of the “change of ownership” multiplied by the long-term tax exempt rate. |

22

Exhibit 99.2

HealthSouth’s volume growth has outpaced competitors’

(2) Includes consolidated HealthSouth inpatient rehabilitation hospitals classified as same store during that time period.

Our Historic Discharge Growth vs. Industry

4.7%

5.9%

5.9%

5.8%

5.9%

2.7%

2.5%

1.3%

23

• TeamWorks = standardized and

enhanced sales & marketing

enhanced sales & marketing

• Bed additions will help facilitate

continued organic growth

continued organic growth

UDS Industry Sites (1)

HLS Same Store (2)

5.1%

6.1%

7.8%

Yearly

Discharge 6.9% 5.6% 3.1%

Discharge 6.9% 5.6% 3.1%

Growth

2008 vs. 2009 vs. 2010 vs. Q110 vs. Q210 vs. Q310 vs. Q410

vs. Q111 vs. Q211 vs. Q311 vs.

2007 2008 2009 Q109 Q209 Q309 Q409 Q110 Q210 Q310

Quarterly Discharge Growth

Same Store

HealthSouth vs. Industry

Exhibit 99.2

Debt Schedule

(1) Based on 4 quarter trailing and 2010 Adjusted EBITDA of $455.4 million and $409.6 million, respectively; reconciliation to GAAP provided

on slides 31, 32, 34, and 38.

on slides 31, 32, 34, and 38.

24

Exhibit 99.2

Revenues & Expenses (9 Months)

25

Exhibit 99.2

26

Exhibit 99.2

Payment Sources (Percent of Revenue)

(1) Managed Medicare revenues represent ~ 7%, 8%, 7%, 8%, and 8% of total revenues for Q3 2011, Q3 2010, 9 Months 2011, and 9 Months

2010, Full Year 2010, respectively, and are included in “Managed care and other discount plans.”

2010, Full Year 2010, respectively, and are included in “Managed care and other discount plans.”

27

Exhibit 99.2

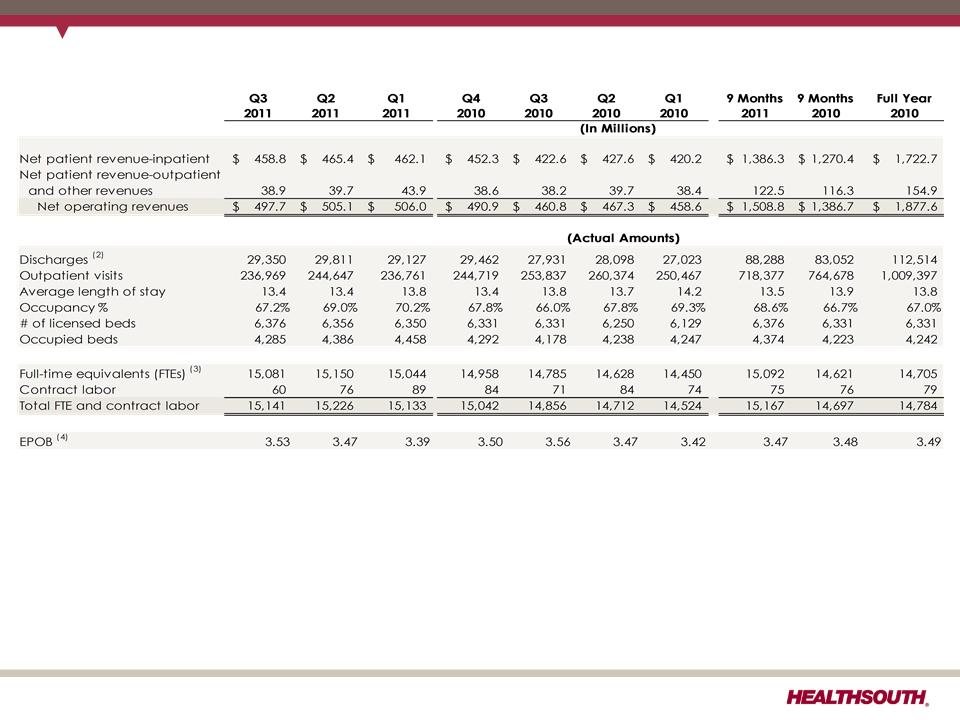

Operational and Labor Metrics (1)

(1) Numbers have been reclassified to reflect current continuing operations.

(2) Represents discharges from HealthSouth’s 94 consolidated hospitals in Q3 2011, Q2 2011, Q1 2011, Q4 2010 and Q3 2010, 92

consolidated hospitals in Q2 2010, and 90 consolidated hospitals prior to Q2 2010.

consolidated hospitals in Q2 2010, and 90 consolidated hospitals prior to Q2 2010.

(3) Excludes approximately 400 full-time equivalents, who are considered part of corporate overhead with their salaries and benefits

included in general and administrative expenses in the Company’s consolidated statements of operations. Full-time equivalents

included in the above table represent HealthSouth employees who participate in or support the operations of the Company’s

hospitals.

included in general and administrative expenses in the Company’s consolidated statements of operations. Full-time equivalents

included in the above table represent HealthSouth employees who participate in or support the operations of the Company’s

hospitals.

(4) Employees per occupied bed, or “EPOB,” is calculated by dividing the number of full-time equivalents, including an estimate of full-

time equivalents from the utilization of contract labor, by the number of occupied beds during each period. The number of

occupied beds is determined by multiplying the number of licensed beds by the Company’s occupancy percentage.

time equivalents from the utilization of contract labor, by the number of occupied beds during each period. The number of

occupied beds is determined by multiplying the number of licensed beds by the Company’s occupancy percentage.

28

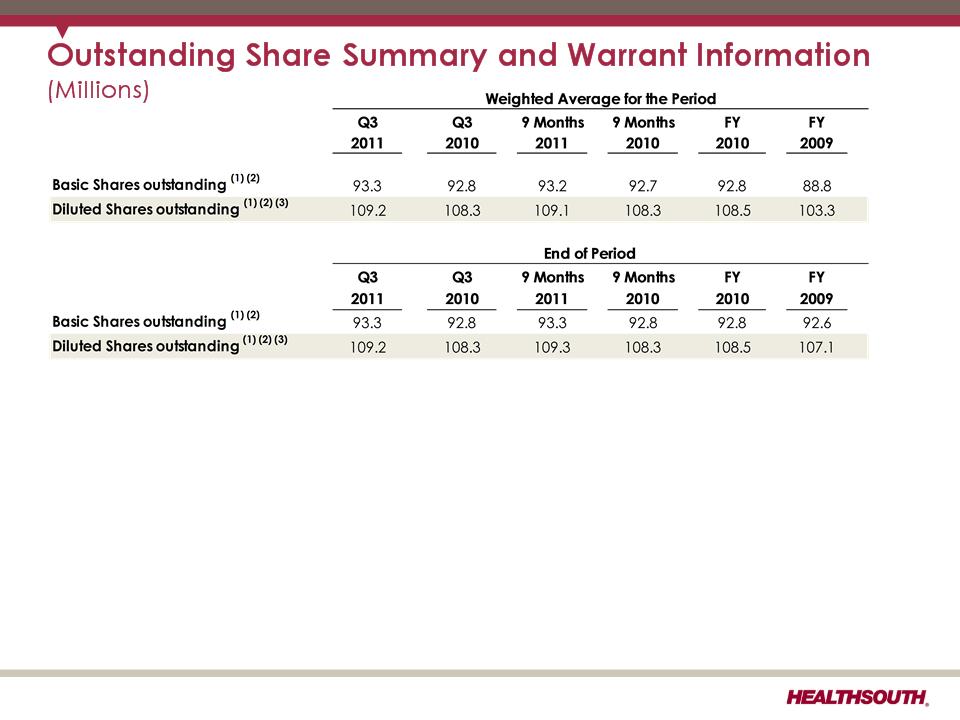

Exhibit 99.2

29

Notes:

(1) Does not include 2.0 million warrants issued in connection with a January 2004 loan repaid to Credit Suisse First Boston. In connection

with this transaction, we issued warrants to the lender to purchase two million shares of our common stock. Each warrant has a term

of ten years from the date of issuance (expire January 16, 2014) and an exercise price of $32.50 per share. The warrants were not

assumed exercised for dilutive shares outstanding because they were antidilutive in the periods presented.

with this transaction, we issued warrants to the lender to purchase two million shares of our common stock. Each warrant has a term

of ten years from the date of issuance (expire January 16, 2014) and an exercise price of $32.50 per share. The warrants were not

assumed exercised for dilutive shares outstanding because they were antidilutive in the periods presented.

(2) The agreement to settle our class action securities litigation received final court approval in January 2007. These shares of common

stock and warrants were issued on September 30, 2009. The 5.0 million of common shares are now included in the outstanding shares.

The warrants to purchase approx. 8.2 million shares of common stock at a strike price of $41.40 (expire January 17, 2017) were not

assumed exercised for the dilutive shares outstanding because they are anti-dilutive in the periods presented.

stock and warrants were issued on September 30, 2009. The 5.0 million of common shares are now included in the outstanding shares.

The warrants to purchase approx. 8.2 million shares of common stock at a strike price of $41.40 (expire January 17, 2017) were not

assumed exercised for the dilutive shares outstanding because they are anti-dilutive in the periods presented.

(3) The difference between the basic and diluted shares outstanding is primarily related to our convertible perpetual preferred stock

(13.1 million shares). The preferred stock is convertible, at the option of the holder, at any time into shares of common stock at an

initial conversion price of $30.50 per share, which is equal to an initial conversion rate of approximately 32.7869 shares of common

stock per share of preferred stock, subject to a specified adjustment. On or after July 20, 2011, we may cause the shares of preferred

stock to be automatically converted into shares of our common stock at the conversion rate then in effect if the closing price of our

common stock for 20 trading days within a period of 30 consecutive trading days ending on the trading day before the date we

give the notice of forced conversion exceeds 150% of the conversion price of the preferred stock.

(13.1 million shares). The preferred stock is convertible, at the option of the holder, at any time into shares of common stock at an

initial conversion price of $30.50 per share, which is equal to an initial conversion rate of approximately 32.7869 shares of common

stock per share of preferred stock, subject to a specified adjustment. On or after July 20, 2011, we may cause the shares of preferred

stock to be automatically converted into shares of our common stock at the conversion rate then in effect if the closing price of our

common stock for 20 trading days within a period of 30 consecutive trading days ending on the trading day before the date we

give the notice of forced conversion exceeds 150% of the conversion price of the preferred stock.

Exhibit 99.2

Adjusted EBITDA (1) History

30

Exhibit 99.2

Reconciliation of Net Income to Adjusted EBITDA (1)(3)

(1) (2) (3) (4) - Notes on page 34

31

Exhibit 99.2

Reconciliation of Net Income to Adjusted EBITDA (1)(3)

(1) (2) (3) (4) - Notes on page 34.

32

Exhibit 99.2

Reconciliation of Net Income to Adjusted EBITDA (1) (3)

(1) (2) (3) (4) - Notes on page 34.

33

Exhibit 99.2

Reconciliation Notes for Slides 31-33

1. Adjusted EBITDA is a non-GAAP financial measure. The Company’s leverage ratio (total

consolidated debt to Adjusted EBITDA for the trailing four quarters) is, likewise, a non-

GAAP financial measure. Management and some members of the investment

community utilize Adjusted EBITDA as a financial measure and the leverage ratio as a

liquidity measure on an ongoing basis. These measures are not recognized in

accordance with GAAP and should not be viewed as an alternative to GAAP

measures of performance or liquidity. In evaluating Adjusted EBITDA, the reader should

be aware that in the future HealthSouth may incur expenses similar to the adjustments

set forth.

consolidated debt to Adjusted EBITDA for the trailing four quarters) is, likewise, a non-

GAAP financial measure. Management and some members of the investment

community utilize Adjusted EBITDA as a financial measure and the leverage ratio as a

liquidity measure on an ongoing basis. These measures are not recognized in

accordance with GAAP and should not be viewed as an alternative to GAAP

measures of performance or liquidity. In evaluating Adjusted EBITDA, the reader should

be aware that in the future HealthSouth may incur expenses similar to the adjustments

set forth.

2. Per share amounts for each period presented are based on diluted weighted average

shares outstanding unless the amounts are antidilutive, in which case the per share

amount is calculated using the basic share count after subtracting the $6.5 million per

quarter dividend on the convertible perpetual preferred stock. The difference in shares

between the basic and diluted shares outstanding is primarily related to our

convertible perpetual preferred stock.

shares outstanding unless the amounts are antidilutive, in which case the per share

amount is calculated using the basic share count after subtracting the $6.5 million per

quarter dividend on the convertible perpetual preferred stock. The difference in shares

between the basic and diluted shares outstanding is primarily related to our

convertible perpetual preferred stock.

3. Adjusted EBITDA is a component of our guidance.

4. The dividends related to our convertible perpetual preferred stock must be subtracted

from income from continuing operations when calculating basic earnings per share.

from income from continuing operations when calculating basic earnings per share.

34

Exhibit 99.2

35

Exhibit 99.2

Reconciliation Notes for Slide 35

1. Adjusted income from continuing operations and Adjusted EBITDA are non-GAAP financial

measures. The Company’s leverage ratio (total consolidated debt to Adjusted EBITDA for the

trailing four quarters) is, likewise, a non-GAAP financial measure. Management and some

members of the investment community utilize adjusted income from continuing operations as

a financial measure and Adjusted EBITDA and the leverage ratio as liquidity measures on an

ongoing basis. These measures are not recognized in accordance with GAAP and should not

be viewed as an alternative to GAAP measures of performance or liquidity. In evaluating

these adjusted measures, the reader should be aware that in the future HealthSouth may

incur expenses similar to the adjustments set forth.

measures. The Company’s leverage ratio (total consolidated debt to Adjusted EBITDA for the

trailing four quarters) is, likewise, a non-GAAP financial measure. Management and some

members of the investment community utilize adjusted income from continuing operations as

a financial measure and Adjusted EBITDA and the leverage ratio as liquidity measures on an

ongoing basis. These measures are not recognized in accordance with GAAP and should not

be viewed as an alternative to GAAP measures of performance or liquidity. In evaluating

these adjusted measures, the reader should be aware that in the future HealthSouth may

incur expenses similar to the adjustments set forth.

2. Per share amounts for each period presented are based on basic weighted average

common shares outstanding for all amounts except adjusted income from continuing

operations per diluted share, which is based on diluted weighted average shares

outstanding. The difference in shares between the basic and diluted shares outstanding is

primarily related to our convertible perpetual preferred stock.

common shares outstanding for all amounts except adjusted income from continuing

operations per diluted share, which is based on diluted weighted average shares

outstanding. The difference in shares between the basic and diluted shares outstanding is

primarily related to our convertible perpetual preferred stock.

3. Adjusted income from continuing operations per diluted share and Adjusted EBITDA are two

components of our historical guidance.

components of our historical guidance.

4. The Company’s credit agreement allows certain other items to be added to arrive at

Adjusted EBITDA, and there may be certain other deductions required.

Adjusted EBITDA, and there may be certain other deductions required.

36

Exhibit 99.2

Adjusted Free Cash Flow

(1) Maintenance capital expenditures are expected to be $10 to $15 million higher in 2011 than in 2010.

(2) Final swap payment of $10.9 million was made in March 2011.

37

Exhibit 99.2

Net Cash Provided by Operating Activities

38