Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Western Union CO | d245816d8k.htm |

| EX-99.1 - PRESS RELEASE - Western Union CO | d245816dex991.htm |

Western Union

Third Quarter 2011

Earnings Webcast & Conference Call

October 25, 2011

Exhibit 99.2 |

Mike

Salop Senior Vice President, Investor Relations

|

Safe

Harbor 3

This presentation contains certain statements that are forward-looking within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements are not guarantees of future

performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Actual

outcomes and results may differ materially from those expressed in, or implied by, our

forward-looking statements. Words such as “expects,” “intends,”

“anticipates,” “believes,” “estimates,” “guides,”

“provides guidance,” “provides outlook” and other similar expressions or future or conditional verbs such

as “will,” “should,” “would” and “could” are intended to

identify such forward-looking statements. Readers of this presentation by The Western Union

Company (the “Company,” “Western Union,” “we,” “our” or

“us”) should not rely solely on the forward-looking statements and should consider all

uncertainties and risks discussed in the “Risk Factors” section and throughout the Annual

Report on Form 10-K for the year ended December 31, 2010. The statements are only as of the

date they are made, and the Company undertakes no obligation to update any forward-looking statement.

Possible events or factors that could cause results or performance to differ materially from those

expressed in our forward-looking statements include the following: changes in

immigration laws, patterns and other factors related to migrants; our ability to adapt technology in response to changing

industry and consumer needs or trends; our failure to develop and introduce new products, services and

enhancements, and gain market acceptance of such products; the failure by us, our agents or

subagents to comply with our business and technology standards and contract requirements or

applicable laws and regulations, especially laws designed to prevent money laundering, terrorist

financing and anti-competitive behavior, and/or changing regulatory or enforcement

interpretations of those laws; the impact on our business of the Dodd-Frank Wall Street Reform and Consumer

Protection Act and the rules promulgated there-under; changes in United States or foreign laws,

rules and regulations including the Internal Revenue Code and governmental or judicial

interpretations thereof; changes in general economic conditions and economic conditions in the regions and

industries in which we operate; political conditions and related actions in the United States and

abroad which may adversely affect our businesses and economic conditions as a whole;

interruptions of United States government relations with countries in which we have or are implementing material

agent contracts; mergers, acquisitions and integration of acquired businesses and technologies into

our Company, and the realization of anticipated financial benefits from these acquisitions;

changes in, and failure to manage effectively exposure to, foreign exchange rates, including the impact of the

regulation of foreign exchange spreads on money transfers and payment transactions; our ability to

resolve tax matters with the Internal Revenue Service and other tax authorities consistent with

our reserves; failure to comply with the settlement agreement with the State of Arizona; liabilities and

unanticipated developments resulting from litigation and regulatory investigations and similar

matters, including costs, expenses, settlements and judgments; failure to maintain sufficient

amounts or types of regulatory capital to meet the changing requirements of our regulators worldwide;

deterioration in consumers' and clients' confidence in our business, or in money transfer and payment

service providers generally; failure to manage credit and fraud risks presented by our agents,

clients and consumers or non-performance by our banks, lenders, other financial services providers or

insurers; any material breach of security of or interruptions in any of our systems; our ability to

attract and retain qualified key employees and to manage our workforce successfully; our

ability to maintain our agent network and business relationships under terms consistent with or more

advantageous to us than those currently in place; failure to implement agent contracts according to

schedule; adverse rating actions by credit rating agencies; failure to compete effectively in

the money transfer industry with respect to global and niche or corridor money transfer providers, banks and

other money transfer services providers, including telecommunications providers, card associations,

card-based payment providers and electronic and internet providers; our ability to protect

our brands and our other intellectual property rights; our failure to manage the potential both for patent

protection and patent liability in the context of a rapidly developing legal framework for

intellectual property protection; cessation of various services provided to us by

third-party vendors; adverse movements and volatility in capital markets and other events which affect our liquidity, the liquidity of our

agents or clients, or the value of, or our ability to recover our investments or amounts payable to

us; decisions to downsize, sell or close units, or to transition operating activities from one

location to another or to third parties, particularly transitions from the United States to other countries; changes

in industry standards affecting our business; changes in accounting standards, rules and

interpretations; significantly slower growth or declines in the money transfer market and other

markets in which we operate; adverse consequences from our spin-off from First Data Corporation; decisions to

change our business mix; catastrophic events; and management's ability to identify and manage these

and other risks. |

Hikmet Ersek

President

& Chief Executive Officer |

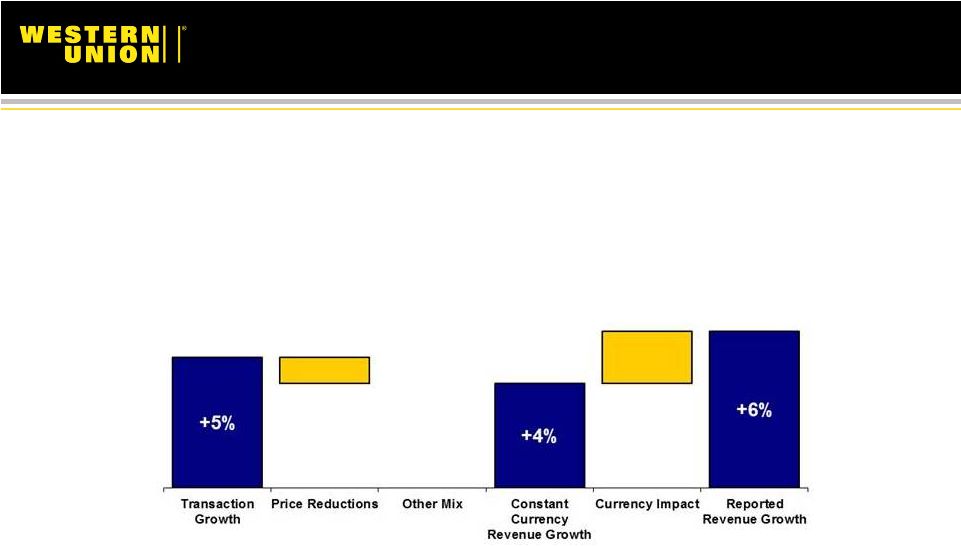

Q3

Highlights Total revenue increased 6% or 5% constant currency

Solid trends continue in C2C

6% reported revenue growth and 4% constant currency

Consumer Bill Payments revenue grew 2%

Business Solutions revenue grew 30%

485,000 agent locations

5

Note: See appendix for reconciliation of Non-GAAP to GAAP measures.

Affirming 2011 Revenue Outlook and Moving EPS to

High End of Previous Range |

Electronic Channels & Prepaid Q3 Highlights

Account-based money transfer

Approximately 40% transaction growth

Agreements in place with over 70 banks globally

Westernunion.com

Transactions increased by 30%

Approximately 45% transaction growth in international markets

Mobile

19 agreements in place

Over 100,000 locations enabled for cash-to-mobile in 61 countries

Prepaid

Over 1.2 million prepaid cards in force

Approximately $120 million principal loaded through 500,000 loads

6

Electronic Channels Revenue Growth 40% |

Go-To-Market Organization

Global Consumer Financial Services

C2C and Consumer Bill Pay

Western Union Business Solutions

B2B

Western Union Ventures

New products and services

WU.com, Prepaid/Stored Value, Mobile

7 |

Scott Scheirman

Executive Vice President

& Chief Financial Officer |

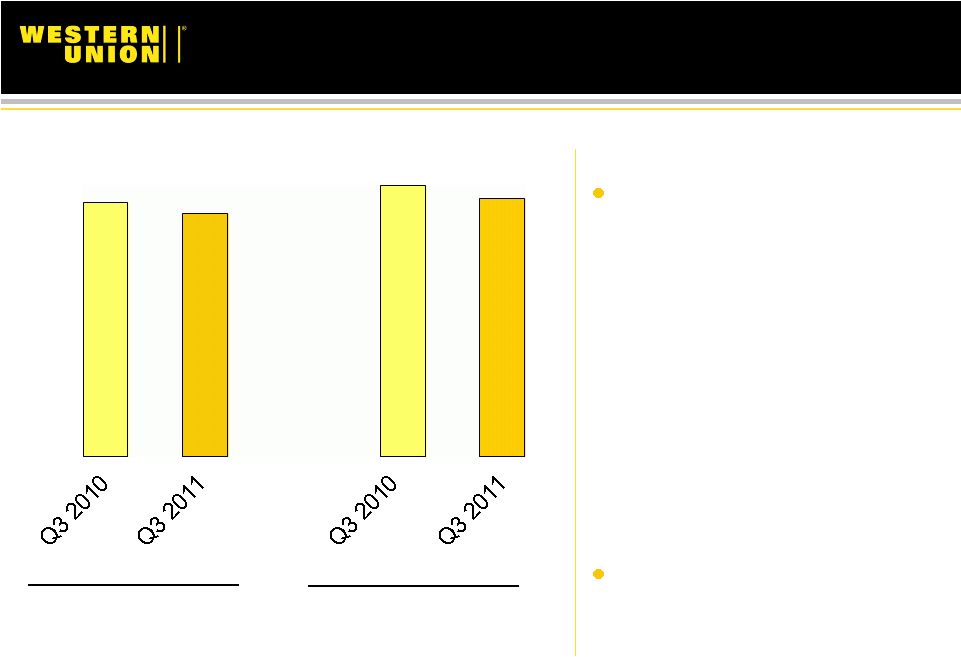

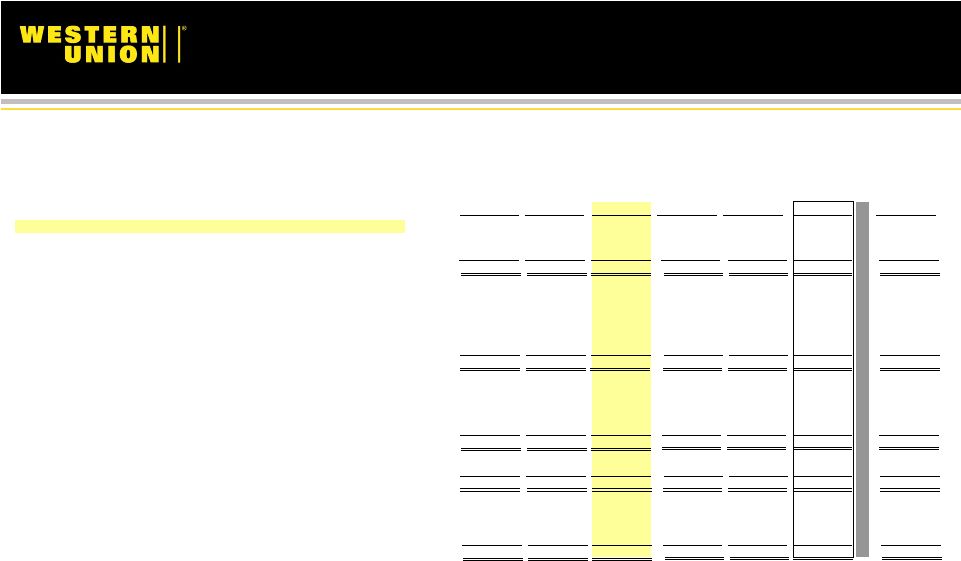

Revenue

9

($ in millions)

$1,330

$1,411

Note: See appendix for reconciliation of Non-GAAP to GAAP measures.

Consolidated revenue up

6%, or up 5% constant

currency adjusted

Transaction fees increased

5%

Foreign exchange revenue

increased 12%

C2C cross-border principal

increased 8%

Strong Western Union

Business Solutions growth

$1,036

$1,083

$263

$294

$31

$34

Q3 2010

Q3 2011

Transaction Fee

Foreign Exchange

Other |

10

+5%

C2C Transactions

(millions)

Note: See appendix for reconciliation of Non-GAAP to GAAP measures.

C2C Revenue growth of 6%, or

4% constant currency

Total Q3 Western Union cross-

border principal of $19 billion

Increased 8% on a reported basis

Increased 5% constant currency

Principal per transaction

Increased 3% on a reported basis

Flat on a constant currency basis

Consumer-to-Consumer

55

58

Q3 2010

Q3 2011 |

Consumer-to-Consumer

11

Revenue

Transactions

Q3 2011

5%

3%

Europe, Middle East, Africa, S. Asia

44% of Western Union revenue

Reported revenue growth moderated from Q2 due to currency and

slowing in Southern Europe and Russia

U.K., France, Germany, and Gulf States remained consistent with Q2

growth

India grew revenue 13% and transactions 11% |

12

Revenue

Transactions

Americas

6%

6%

31% of Western Union revenue

Domestic money transfer grew revenue 9% and transactions 14%

Mexico grew revenue 5% while transactions increased 2%

U.S. outbound revenue growth was consistent with Q2

Q3 2011

Consumer-to-Consumer |

13

Revenue

Transactions

Asia Pacific

11%

7%

9% of Western Union revenue

China grew revenue 5% and transactions 4%

Australia and the Philippines delivered good growth, though not as

strong as Q2

Q3 2011

Consumer-to-Consumer |

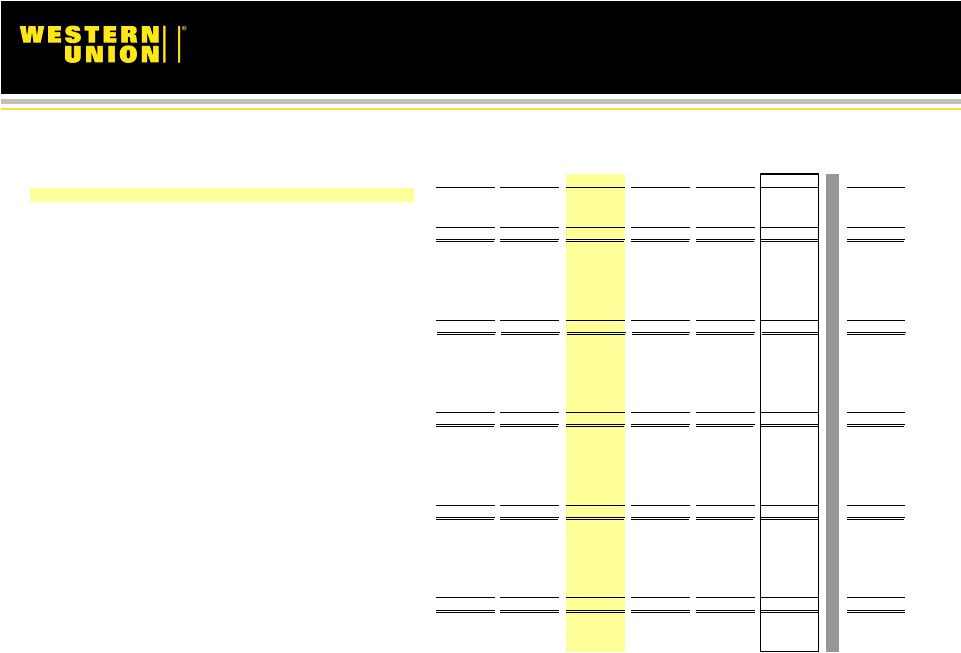

C2C

Transaction and Revenue Growth 14

Note: See appendix for reconciliation of Non-GAAP to GAAP measures.

Q3 2011 |

Global Business Payments

15

Revenue

Transactions

Global Business Payments

7%

4%

14% of Western Union revenue

Consumer Bill Payments revenue increased 2%

Business Solutions revenue growth of 30%

Q3 2011 |

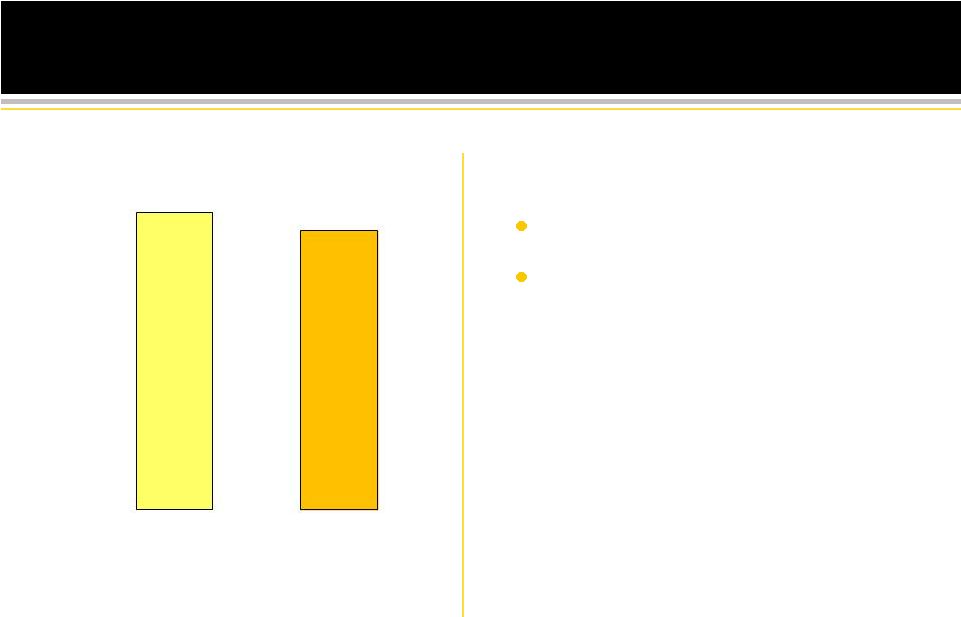

16

Operating Margin

Note: See appendix for reconciliation of Non-GAAP to GAAP measures

GAAP

Excluding

Restructuring

Operating margin excluding

restructuring expense declined

80 basis points

•

Currency translation net of

hedges negatively impacted

margins

•

Higher marketing spending

•

Deal costs related to Travelex

Global Business Payments of

$5 million in 3Q11

•

Benefits from other operating

efficiencies, including

restructuring savings, and

revenue leverage

On a constant currency basis,

operating margins increased

26.4%

25.7%

27.5%

26.7% |

17

C2C Operating Margin

C2C 84% of total company revenue

Operating margin down 90 basis points

from prior year

•

Negative impact of currency net of

hedges and higher marketing offset

other efficiencies, including

restructuring savings, and revenue

leverage

29.9%

29.0%

Q3 2011

Q3 2010 |

18

Global Business Payments

Operating Margin

GBP 14% of total company

revenue

Operating margin improved

Revenue leverage

Restructuring savings

Lower integration and investment

spending in WUBS

15.1%

17.7%

Q3 2010

Q3 2011 |

19

Financial Strength

YTD 2011

Cash Flow from Operations

$883 million

Capital Expenditures

$124 million

Stock Repurchases

$800 million

Dividends Declared

$145 million

Cash Balance, Sept. 30, 2011

$2.7 billion

Debt Outstanding, Sept. 30, 2011

$4.0 billion |

2011

Outlook 20

Note: See appendix for reconciliation of Non-GAAP to GAAP measures.

Constant currency revenue growth in the range of 4% to 5%

GAAP revenue growth 1% higher than constant currency

GAAP EPS of $1.50 to $1.53 (previously $1.48 to $1.53)

EPS excluding restructuring charges of $1.55 to

$1.58 (previously $1.53 to $1.58 )

Restructuring program completed and total expenses of $47 million

recorded for the year

Affirming 2011 Revenue Outlook and Moving EPS to

High End of Previous Range |

2011

Outlook 21

Note: See appendix for reconciliation of Non-GAAP to GAAP measures.

GAAP operating margin range of 25% to 25.5% (including Travelex deal

costs)

Operating margin range of 26% to 26.5%, excluding restructuring

charges

Operating margin on a constant currency basis range of 26.5% to 27%,

excluding restructuring charges (including Travelex deal costs),

compared to 26.2% in 2010, excluding restructuring charges

GAAP

cash

flows

from

operating

activities

to

be

at

the

lower

end

of

the

range of $1.2 billion to $1.3 billion

Affirming 2011 Revenue Outlook and Moving EPS to

High End of Previous Range |

Questions & Answers |

Appendix

Third Quarter 2011 Earnings

Webcast & Conference Call

October 25, 2011

23 |

Non-GAAP Measures

24

Western Union's management believes the non-GAAP measures presented provide

meaningful supplemental information regarding our operating results to

assist management, investors, analysts, and others in understanding our

financial results and to better analyze trends in our underlying business,

because they provide consistency and comparability to prior periods. These

non-GAAP measurements include revenue change constant currency adjusted,

operating income margin and earnings per share excluding restructuring

expenses, effective tax rate restructuring adjusted, consumer-to-consumer

segment revenue change constant currency adjusted, consumer-to-consumer

segment principal per transaction change constant currency adjusted,

consumer-to-consumer cross-border principal change constant

currency adjusted, consumer-to-consumer international revenue change constant currency

adjusted,

consumer-to-consumer

international

principal

per

transaction

change

constant

currency

adjusted, 2011 revenue outlook constant currency adjusted, 2011 operating income

margin outlook restructuring and constant currency adjusted, and 2011

earnings per share outlook excluding restructuring expenses.

A non-GAAP financial measure should not be considered in isolation or as a

substitute for the most comparable GAAP financial measure. A non-GAAP

financial measure reflects an additional way of viewing aspects of our

operations that, when viewed with our GAAP results and the reconciliation to the

corresponding GAAP financial measure, provide a more complete understanding of our

business. Users of the financial statements are encouraged to review our

financial statements and publicly-filed reports in their entirety and

not to rely on any single financial measure. A reconciliation of non-GAAP measures to

the

most

directly

comparable

GAAP

financial

measures

is

included

below. |

Diluted earnings per share ("EPS"), as reported (GAAP) ($ -

dollars)

Diluted EPS, restructuring adjusted ($ - dollars)

Impact from restructuring and related expenses, net of income tax

benefit (b) ($ - dollars)

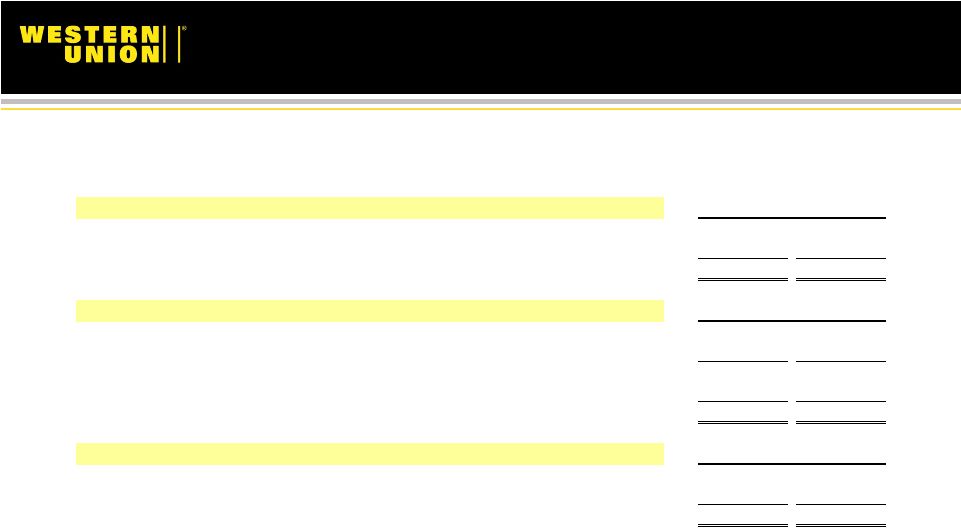

Reconciliation of Non-GAAP Measures

25

3Q10

4Q10

FY2010

1Q11

2Q11

3Q11

YTD 3Q11

Consolidated Metrics

Revenues, as reported (GAAP)

1,329.6

$

1,357.0

$

5,192.7

$

1,283.0

$

1,366.3

$

1,410.8

$

4,060.1

$

Foreign currency translation impact (a)

22.2

18.5

36.8

2.3

(32.5)

(18.2)

(48.4)

Revenues, constant currency adjusted

1,351.8

$

1,375.5

$

5,229.5

$

1,285.3

$

1,333.8

$

1,392.6

$

4,011.7

$

Prior year revenues, as reported (GAAP)

1,314.1

$

1,314.0

$

5,083.6

$

1,232.7

$

1,273.4

$

1,329.6

$

3,835.7

$

Revenue change, as reported (GAAP)

1

%

3

%

2

%

4

%

7

%

6

%

6

%

Revenue change, constant currency adjusted

3

%

5

%

3

%

4

%

5

%

5

%

5

%

Operating income, as reported (GAAP)

351.2

$

322.1

$

1,300.1

$

312.9

$

350.7

$

363.0

$

1,026.6

$

Reversal of restructuring and related expenses (b)

14.0

11.0

59.5

24.0

8.9

13.9

46.8

Operating income, excluding restructuring

365.2

$

333.1

$

1,359.6

$

336.9

$

359.6

$

376.9

$

1,073.4

$

Operating income margin, as reported (GAAP)

26.4%

23.7%

25.0%

24.4%

25.7%

25.7%

25.3%

Operating income margin, excluding restructuring

27.5%

24.5%

26.2%

26.3%

26.3%

26.7%

26.4%

Net income, as reported (GAAP)

238.4

$

242.6

$

909.9

$

210.2

$

263.2

$

239.7

$

713.1

$

Reversal of restructuring and related expenses, net of income tax

benefit (b) 9.5

7.4

39.3

16.4

5.9

9.7

32.0

Net income, restructuring adjusted, net of income tax

247.9

$

250.0

$

949.2

$

226.6

$

269.1

$

249.4

$

745.1

$

0.36

$

0.37

$

1.36

$

0.32

$

0.41

$

0.38

$

1.12

$

0.01

0.01

0.06

0.03

0.01

0.02

0.05

0.37

$

0.38

$

1.42

$

0.35

$

0.42

$

0.40

$

1.17

$

Diluted weighted-average shares outstanding

661.3

658.4

668.9

652.1

635.8

627.1

638.3

Effective tax rate, as reported (GAAP)

22.7%

15.9%

20.5%

23.5%

21.1%

23.6%

22.7%

Impact from restructuring expenses, net of income tax benefit (b)

0.5%

0.6%

0.7%

0.6

%

0.3%

0.3%

0.4%

Effective tax rate, restructuring adjusted

23.2%

16.5%

21.2%

24.1%

21.4%

23.9%

23.1% |

Reconciliation of Non-GAAP Measures

26

3Q10

4Q10

FY2010

1Q11

2Q11

3Q11

YTD 3Q11

Consumer-to-Consumer Segment

Revenues, as reported (GAAP)

1,128.3

$

1,151.8

$

4,383.4

$

1,078.1

$

1,155.1

$

1,193.3

$

3,426.5

$

Foreign currency translation impact (a)

21.2

18.0

32.3

2.2

(31.4)

(17.9)

(47.1)

Revenues, constant currency adjusted

1,149.5

$

1,169.8

$

4,415.7

$

1,080.3

$

1,123.7

$

1,175.4

$

3,379.4

$

Prior year revenues, as reported (GAAP)

1,117.8

$

1,113.7

$

4,300.7

$

1,030.2

$

1,073.1

$

1,128.3

$

3,231.6

$

Revenue change, as reported (GAAP)

1

%

3

%

2

%

5

%

8

%

6

%

6

%

Revenue change, constant currency adjusted

3

%

5

%

3

%

5

%

5

%

4

%

5

%

Principal

per

transaction,

as

reported

($

-

dollars)

355

$

356

$

355

$

360

$

365

$

366

$

364

$

Foreign

currency

translation

impact

(a)

($

-

dollars)

7

5

1

(1)

(14)

(11)

(9)

Principal

per

transaction,

constant

currency

adjusted

($

-

dollars)

362

$

361

$

356

$

359

$

351

$

355

$

355

$

Prior

year

principal

per

transaction,

as

reported

($

-

dollars)

371

$

365

$

363

$

357

$

351

$

355

$

354

$

Principal per transaction change, as reported

(4)%

(3)%

(2)%

1

%

4

%

3

%

3

%

Principal per transaction change, constant currency adjusted

(3)%

(1)%

(2)%

1

%

0

%

0

%

0

%

Cross-border

principal,

as

reported

($

-

billions)

17.6

$

18.1

$

68.6

$

17.1

$

18.6

$

19.0

$

54.7

$

Foreign

currency

translation

impact

(a)

($

-

billions)

0.4

0.3

0.3

-

(0.8)

(0.6)

(1.4)

Cross-border

principal,

constant

currency

adjusted

($

-

billions)

18.0

$

18.4

$

68.9

$

17.1

$

17.8

$

18.4

$

53.3

$

Prior

year

cross-border

principal,

as

reported

($

-

billions)

17.0

$

17.1

$

65.0

$

16.1

$

16.8

$

17.6

$

50.5

$

Cross-border principal change, as reported

4

%

6

%

6

%

7

%

10

%

8

%

8

%

Cross-border principal change, constant currency adjusted

6

%

7

%

6

%

6

%

6

%

5

%

6

%

International revenues, as reported (GAAP)

944.0

$

972.4

$

3,669.2

$

901.7

$

962.9

$

995.7

$

2,860.3

$

Foreign currency translation impact (a)

21.7

18.4

35.0

2.6

(30.7)

(17.4)

(45.5)

International revenues, constant currency adjusted

965.7

$

990.8

$

3,704.2

$

904.3

$

932.2

$

978.3

$

2,814.8

$

Prior year international revenues, as reported (GAAP)

926.5

$

943.4

$

3,559.7

$

862.0

$

890.8

$

944.0

$

2,696.8

$

International revenue change, as reported (GAAP)

2

%

3

%

3

%

5

%

8

%

5

%

6

%

International revenue change, constant currency adjusted

4

%

5

%

4

%

5

%

5

%

4

%

4

%

International

principal

per

transaction,

as

reported

($

-

dollars)

384

$

386

$

382

$

390

$

399

$

401

$

397

$

Foreign

currency

translation

impact

(a)

($

-

dollars)

8

7

2

(2)

(18)

(13)

(11)

International

principal

per

transaction,

constant

currency

adjusted

($

-

dollars)

392

$

393

$

384

$

388

$

381

$

388

$

386

$

Prior

year

international

principal

per

transaction,

as

reported

($

-

dollars)

395

$

390

$

386

$

381

$

376

$

384

$

380

$

International principal per transaction change, as reported

(3)%

(1)%

(1)%

2

%

6

%

4

%

4

%

International principal per transaction change, constant currency

adjusted (1)%

1

%

(1)%

2

%

1

%

1

%

1

% |

Reconciliation of Non-GAAP Measures

27

2011 Revenue Outlook

Revenue change (GAAP)

5

%

6

%

Foreign currency translation impact (c)

(1)%

(1)%

Revenue change, constant currency adjusted

4

%

5

%

2011 Operating Income Margin Outlook

Operating income margin (GAAP)

25.0

%

25.5

%

Impact from restructuring and related expenses (b)

1.0

%

1.0

%

Operating income margin, restructuring adjusted

26.0

%

26.5

%

Foreign currency translation impact (c)

0.5

%

0.5

%

Operating income margin, restructuring and constant currency

adjusted 26.5

%

27.0

%

2011 EPS Outlook

EPS

guidance

(GAAP)

($

-

dollars)

1.50

$

1.53

$

Impact

from

restructuring

and

related

expenses,

net

of

income

tax

benefit

(b)

($

-

dollars)

0.05

0.05

EPS

guidance,

restructuring

adjusted

($

-

dollars)

1.55

$

1.58

$

Range

Range

Range |

Footnote explanations

28

(a)

Represents the impact from the fluctuation in exchange rates between all foreign

currency denominated amounts and the United States dollar. Constant currency

results exclude any benefit or loss caused by foreign exchange fluctuations

between foreign currencies and the United States dollar, net of foreign currency hedges, which would not

have occurred if there had been a constant exchange rate.

(b)

Restructuring and related expenses consist of direct and incremental expenses

including the impact from fluctuations in exchange rates associated with

restructuring and related activities, consisting of severance, outplacement and

other related benefits; facility closure and migration of the Company's IT

infrastructure; and other expenses related to the relocation of various

operations to new or existing Company facilities and third-party providers, including hiring,

training, relocation, travel, and professional fees. Also included in the facility

closure expenses are non-cash expenses related to fixed asset and

leasehold improvement write-offs and the acceleration of depreciation and

amortization. Restructuring and related expenses were not allocated to the

segments. (c)

Represents

the

estimated

impact

from

the

fluctuation

in

exchange

rates

between

all

foreign

currency

denominated

amounts and the United States dollar. Constant currency results exclude any

estimated benefit or loss caused by foreign

exchange

fluctuations

between

foreign

currencies

and

the

United

States

dollar,

net

of

foreign

currency

hedges, which would not have occurred if there had been a constant exchange

rate. |