Attached files

| file | filename |

|---|---|

| 8-K - 2011 FISCAL YEAR ANNUAL SHAREHOLDER MEETING PRESENTATION AND RESULTS - Axos Financial, Inc. | a8-kitem701annualpresentat.htm |

presentation

2011 Fiscal Year Annual Shareholder Meeting October 20, 2011 Greg Garrabrants President & Chief Executive Officer

1 Safe Harbor This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). The words “believe,” “expect,” “anticipate,” “estimate,” “project,” or the negation thereof or similar expressions constitute forward-looking statements within the meaning of the Reform Act. These statements may include, but are not limited to, projections of revenues, income or loss, estimates of capital expenditures, plans for future operations, products or services, and financing needs or plans, as well as assumptions relating to these matters. Such statements involve risks, uncertainties and other factors that may cause actual results, performance or achievements of the Company and its subsidiaries to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. For a discussion of these factors, we refer you to the Company's reports filed with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended June 30, 2011. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by the Company or by any other person or entity that the objectives and plans of the Company will be achieved. For all forward-looking statements, the Company claims the protection of the safe-harbor for forward-looking statements contained in the Reform Act.

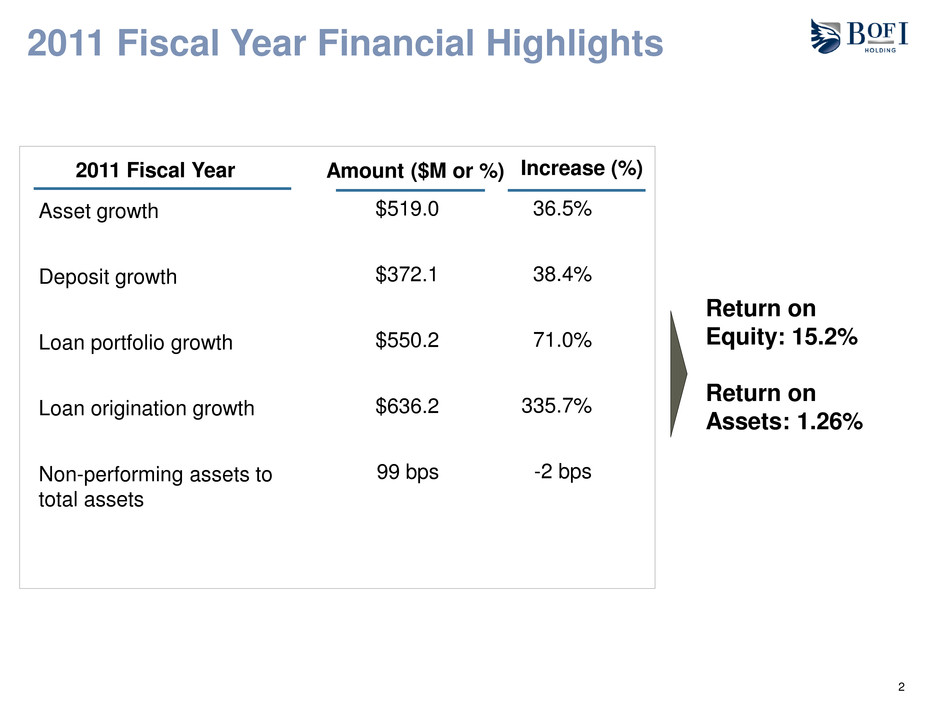

2 2011 Fiscal Year Financial Highlights 2011 Fiscal Year $519.0 $372.1 $550.2 $636.2 99 bps 36.5% 38.4% 71.0% 335.7% -2 bps Asset growth Deposit growth Loan portfolio growth Loan origination growth Non-performing assets to total assets Amount ($M or %) Increase (%) Return on Equity: 15.2% Return on Assets: 1.26%

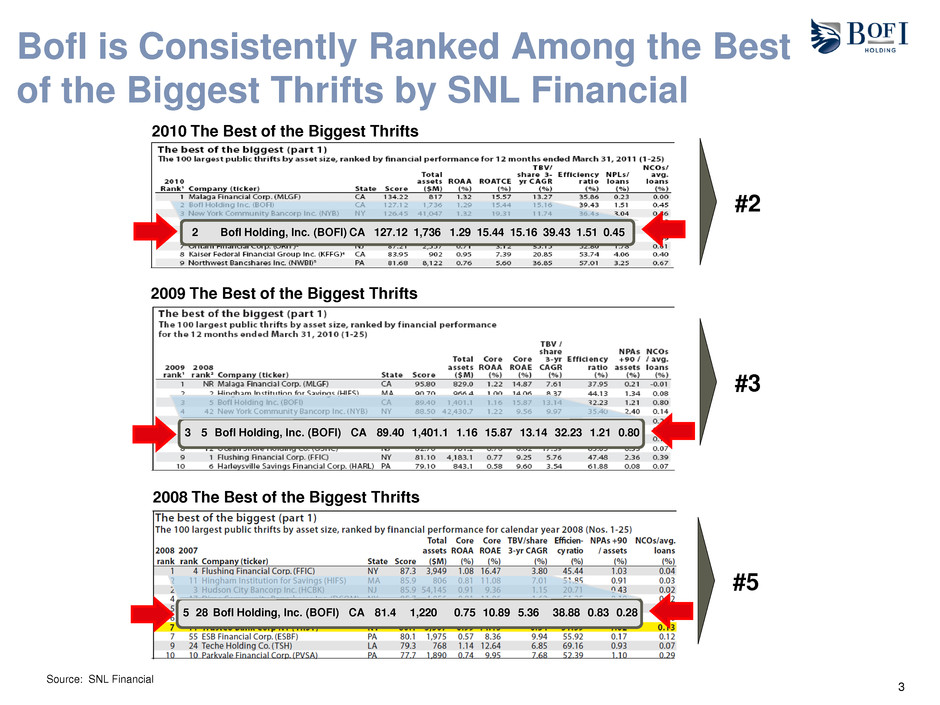

3 BofI is Consistently Ranked Among the Best of the Biggest Thrifts by SNL Financial BofI Holding, Inc. (BOFI) 2 CA 127.12 1,736 1.29 15.44 15.16 39.43 1.51 0.45 BofI Holding, Inc. (BOFI) 3 5 CA 89.40 1,401.1 1.16 15.87 13.14 32.23 1.21 0.80 2010 The Best of the Biggest Thrifts 2009 The Best of the Biggest Thrifts #2 #3 2008 The Best of the Biggest Thrifts BofI Holding, Inc. (BOFI) 5 28 CA 81.4 1,220 0.75 10.89 5.36 38.88 0.83 0.28 #5 Source: SNL Financial

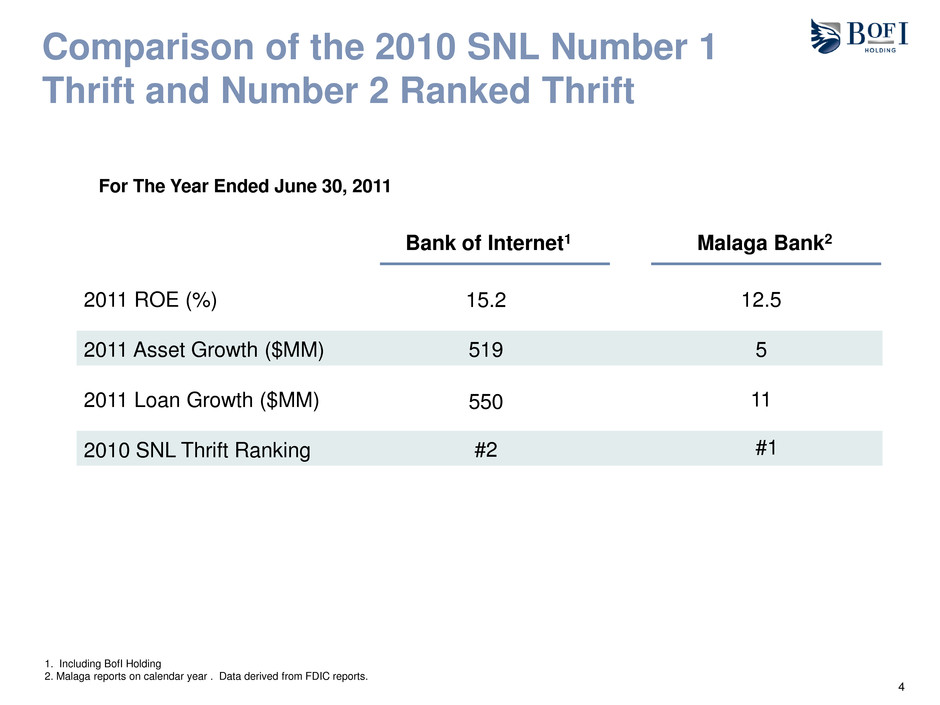

4 2011 ROE (%) 2011 Asset Growth ($MM) 2011 Loan Growth ($MM) 2010 SNL Thrift Ranking Bank of Internet1 Malaga Bank2 15.2 12.5 519 5 550 11 #2 #1 1. Including BofI Holding 2. Malaga reports on calendar year . Data derived from FDIC reports. For The Year Ended June 30, 2011 Comparison of the 2010 SNL Number 1 Thrift and Number 2 Ranked Thrift

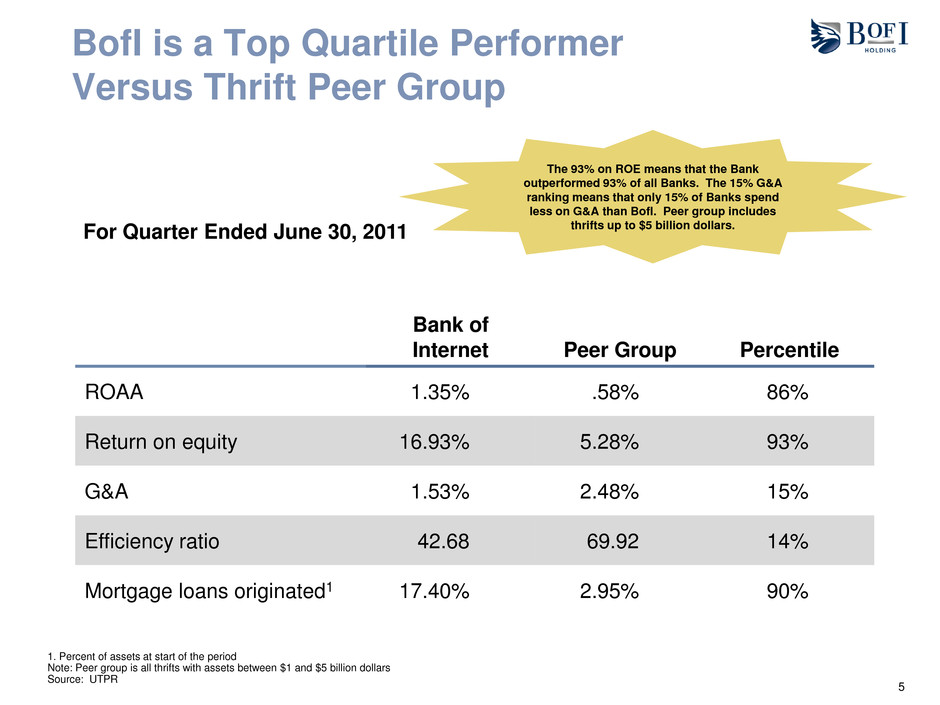

5 BofI is a Top Quartile Performer Versus Thrift Peer Group Bank of Internet Peer Group Percentile ROAA 1.35% .58% 86% Return on equity 16.93% 5.28% 93% G&A 1.53% 2.48% 15% Efficiency ratio 42.68 69.92 14% Mortgage loans originated1 17.40% 2.95% 90% 1. Percent of assets at start of the period Note: Peer group is all thrifts with assets between $1 and $5 billion dollars Source: UTPR The 93% on ROE means that the Bank outperformed 93% of all Banks. The 15% G&A ranking means that only 15% of Banks spend less on G&A than BofI. Peer group includes thrifts up to $5 billion dollars. For Quarter Ended June 30, 2011

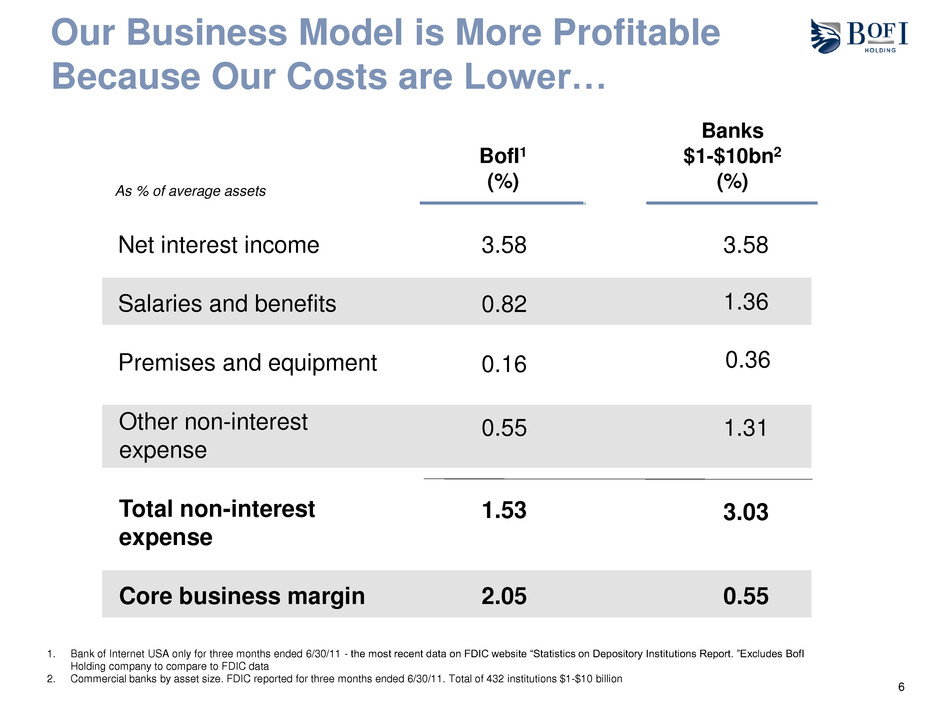

6 Our Business Model is More Profitable Because Our Costs are Lower… Salaries and benefits Premises and equipment BofI1 (%) 0.82 0.16 Other non-interest expense 0.55 Total non-interest expense 1.53 Core business margin 2.05 1.36 0.36 1.31 3.03 0.55 Banks $1-$10bn2 (%) Net interest income 3.58 3.58 As % of average assets 1. Bank of Internet USA only for three months ended 6/30/11 - the most recent data on FDIC website “Statistics on Depository Institutions Report. ”Excludes BofI Holding company to compare to FDIC data 2. Commercial banks by asset size. FDIC reported for three months ended 6/30/11. Total of 432 institutions $1-$10 billion

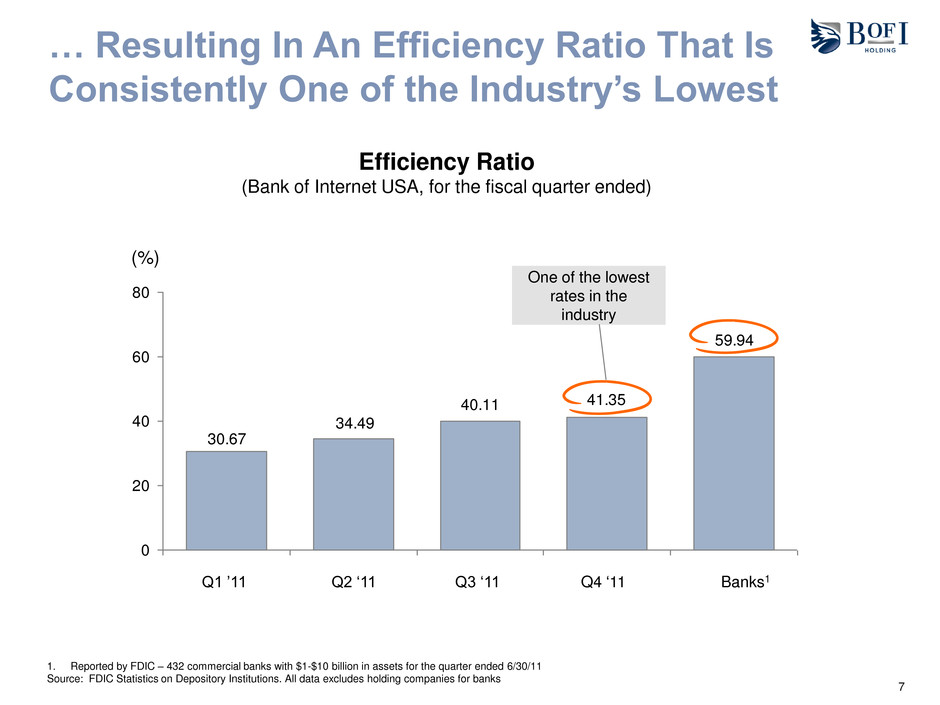

7 Efficiency Ratio (Bank of Internet USA, for the fiscal quarter ended) 59.94 41.3540.11 34.49 30.67 0 20 40 60 80 (%) Banks1 Q4 „11 Q3 „11 Q2 „11 Q1 ‟11 One of the lowest rates in the industry 1. Reported by FDIC – 432 commercial banks with $1-$10 billion in assets for the quarter ended 6/30/11 Source: FDIC Statistics on Depository Institutions. All data excludes holding companies for banks … Resulting In An Efficiency Ratio That Is Consistently One of the Industry’s Lowest

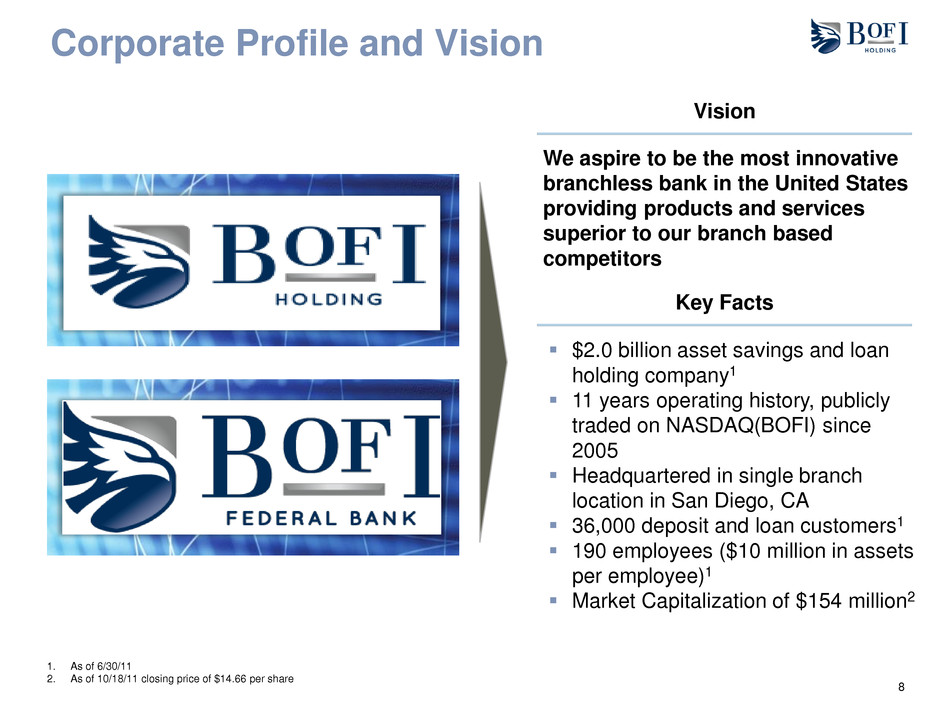

8 Corporate Profile and Vision $2.0 billion asset savings and loan holding company1 11 years operating history, publicly traded on NASDAQ(BOFI) since 2005 Headquartered in single branch location in San Diego, CA 36,000 deposit and loan customers1 190 employees ($10 million in assets per employee)1 Market Capitalization of $154 million2 1. As of 6/30/11 2. As of 10/18/11 closing price of $14.66 per share We aspire to be the most innovative branchless bank in the United States providing products and services superior to our branch based competitors Vision Key Facts

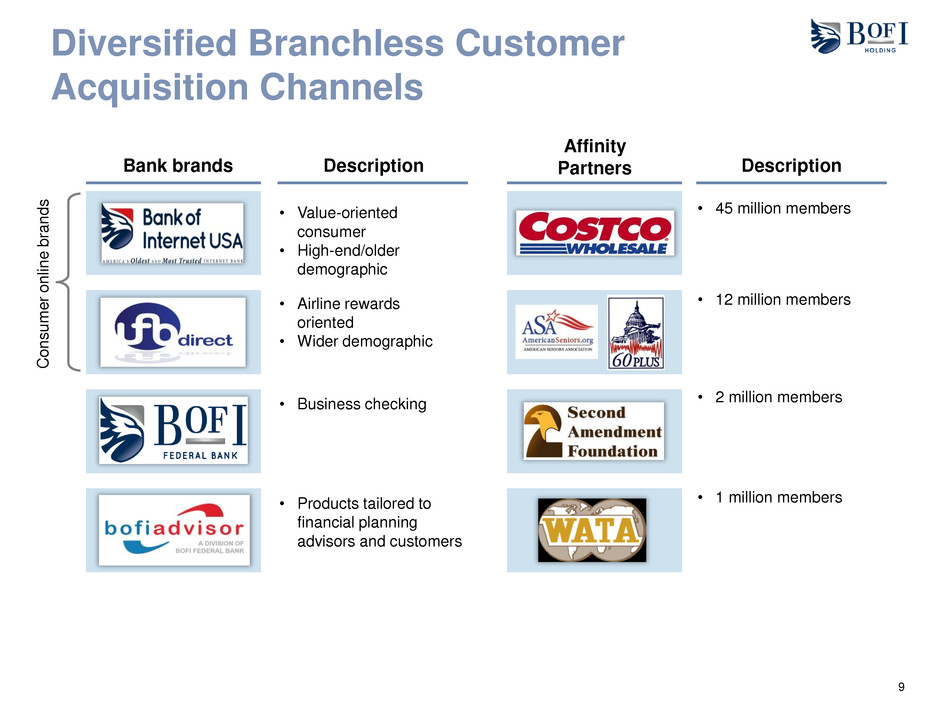

9 Diversified Branchless Customer Acquisition Channels Co n s u m e r o n lin e b ra n d s Description • Value-oriented consumer • High-end/older demographic • Airline rewards oriented • Wider demographic • Business checking • Products tailored to financial planning advisors and customers Bank brands Affinity Partners • 45 million members • 12 million members • 2 million members • 1 million members Description

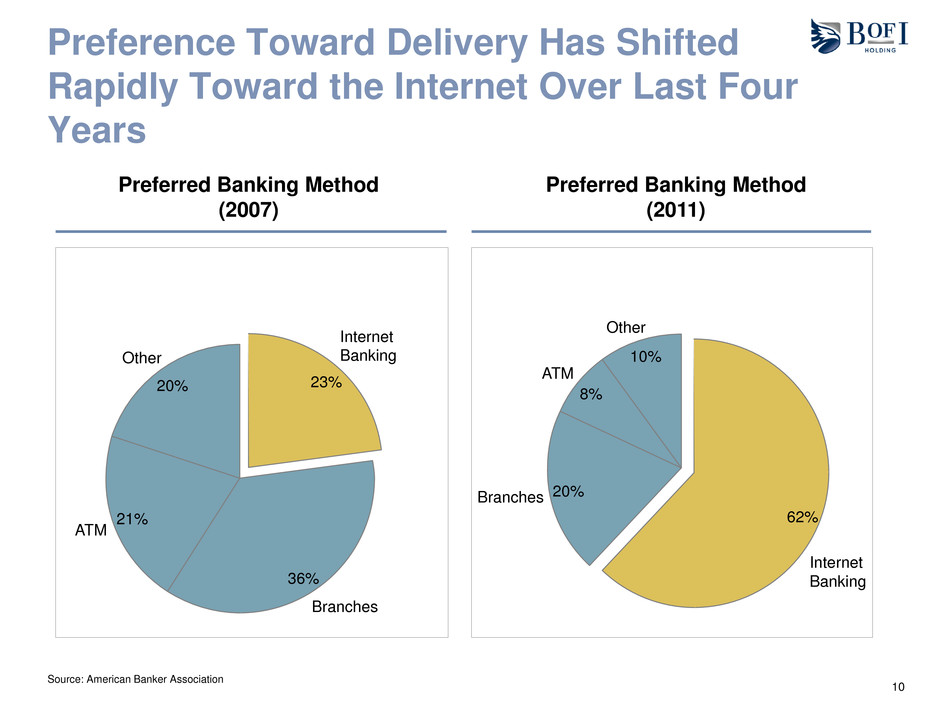

10 Preference Toward Delivery Has Shifted Rapidly Toward the Internet Over Last Four Years Preferred Banking Method (2011) Preferred Banking Method (2007) Other 20% ATM 21% Branches 36% Internet Banking 23% Other 10% ATM 8% Branches 20% Internet Banking 62% Source: American Banker Association

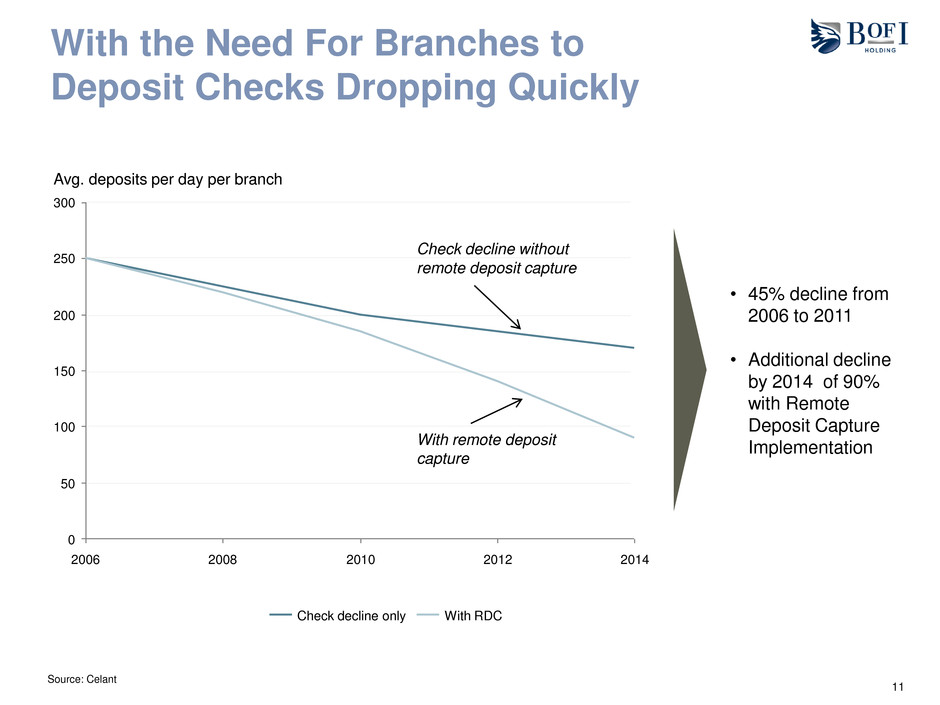

11 With the Need For Branches to Deposit Checks Dropping Quickly Avg. deposits per day per branch 250 50 0 2012 2010 2014 300 100 150 2008 200 2006 Check decline only With RDC • 45% decline from 2006 to 2011 • Additional decline by 2014 of 90% with Remote Deposit Capture Implementation Check decline without remote deposit capture With remote deposit capture Source: Celant

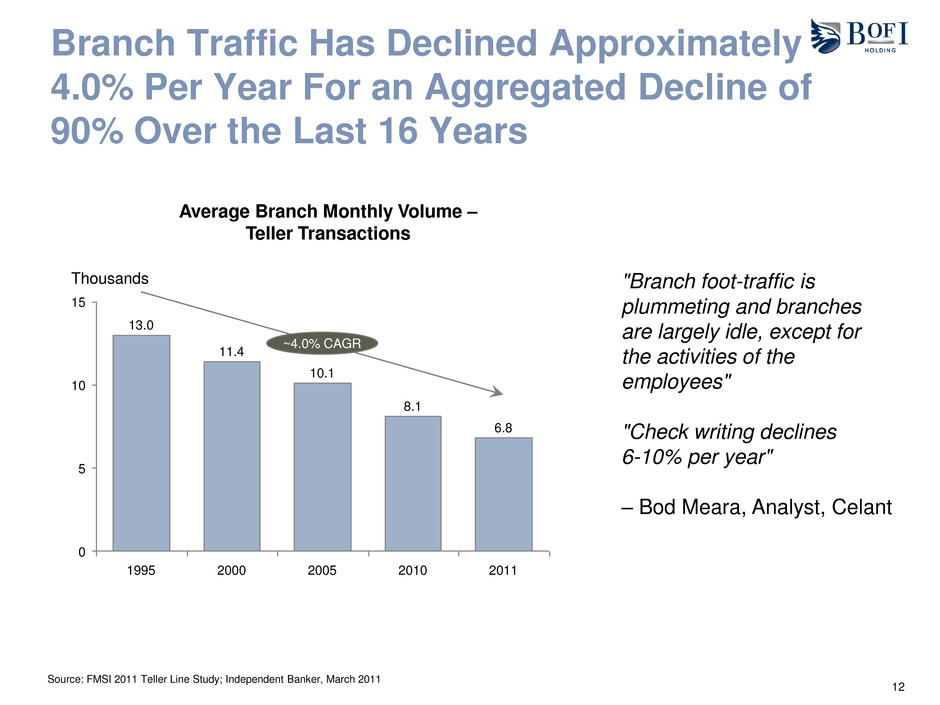

12 Branch Traffic Has Declined Approximately 4.0% Per Year For an Aggregated Decline of 90% Over the Last 16 Years Source: FMSI 2011 Teller Line Study; Independent Banker, March 2011 "Branch foot-traffic is plummeting and branches are largely idle, except for the activities of the employees" "Check writing declines 6-10% per year" – Bod Meara, Analyst, Celant 2010 Thousands 1995 2000 2005 13.0 0 11.4 10.1 15 10 5 6.8 2011 8.1 ~4.0% CAGR Average Branch Monthly Volume – Teller Transactions

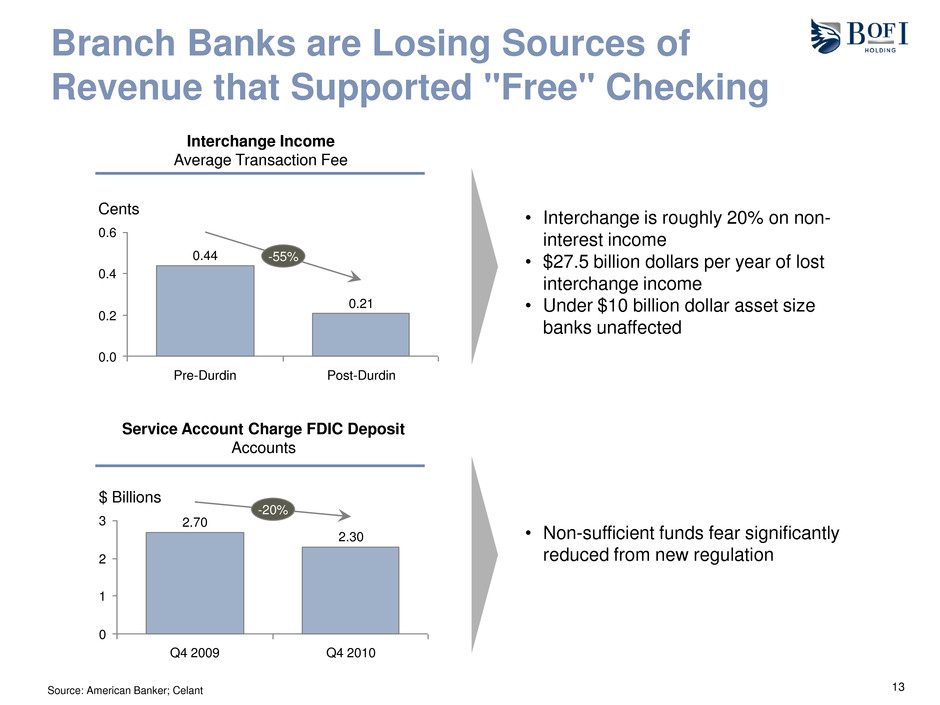

13 Branch Banks are Losing Sources of Revenue that Supported "Free" Checking Interchange Income Average Transaction Fee Service Account Charge FDIC Deposit Accounts 0.4 0.2 0.0 -55% Post-Durdin 0.21 Pre-Durdin 0.44 Cents 0.6 $ Billions 2.70 2 1 Q4 2009 3 0 -20% Q4 2010 2.30 • Interchange is roughly 20% on non- interest income • $27.5 billion dollars per year of lost interchange income • Under $10 billion dollar asset size banks unaffected • Non-sufficient funds fear significantly reduced from new regulation Source: American Banker; Celant

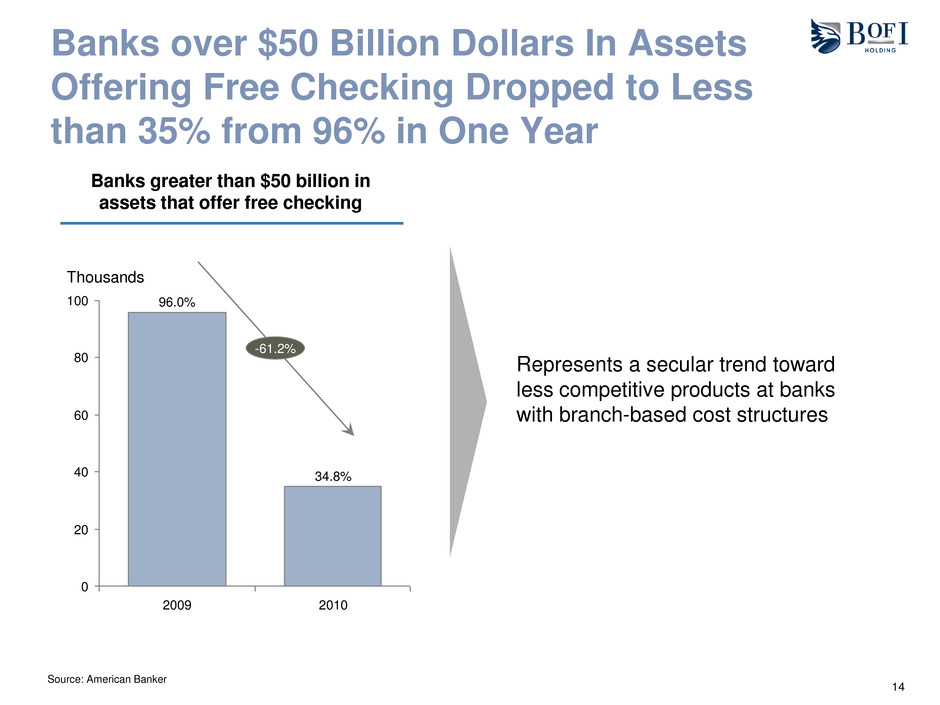

14 Banks over $50 Billion Dollars In Assets Offering Free Checking Dropped to Less than 35% from 96% in One Year Source: American Banker 80 Thousands 60 20 2010 100 40 0 34.8% 2009 96.0% -61.2% Represents a secular trend toward less competitive products at banks with branch-based cost structures Banks greater than $50 billion in assets that offer free checking

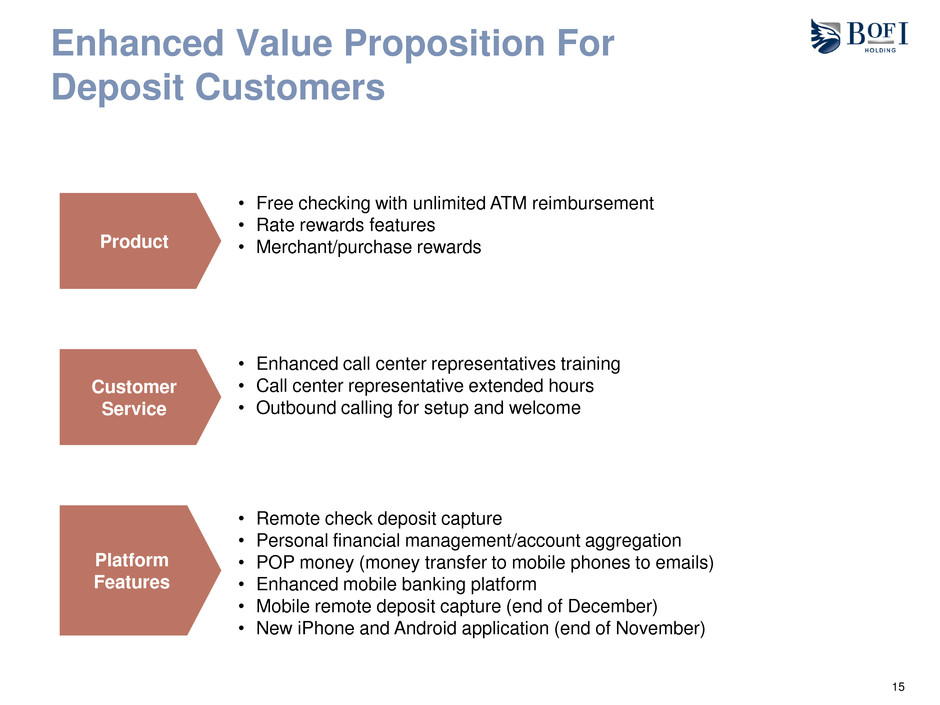

15 Enhanced Value Proposition For Deposit Customers Product Customer Service Platform Features • Free checking with unlimited ATM reimbursement • Rate rewards features • Merchant/purchase rewards • Enhanced call center representatives training • Call center representative extended hours • Outbound calling for setup and welcome • Remote check deposit capture • Personal financial management/account aggregation • POP money (money transfer to mobile phones to emails) • Enhanced mobile banking platform • Mobile remote deposit capture (end of December) • New iPhone and Android application (end of November)

16 CNN Money Recently Highlighted The Bank’s Checking Account In Its Article Describing The Bank As “One of 7 Banks That Is Still Awesome”

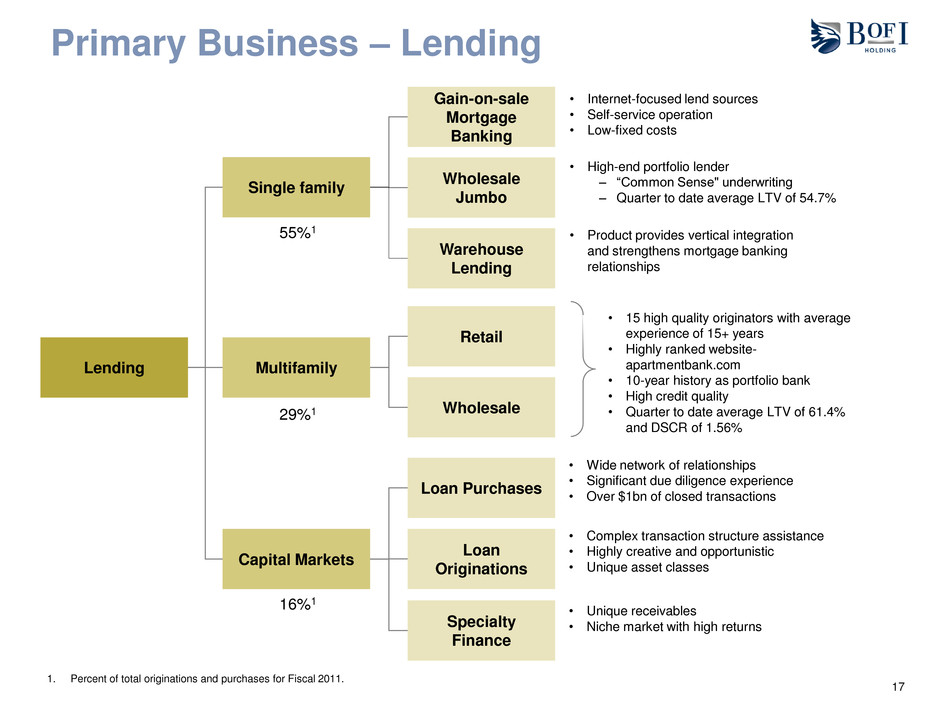

17 Primary Business – Lending 1. Percent of total originations and purchases for Fiscal 2011. Lending Single family Multifamily Capital Markets Gain-on-sale Mortgage Banking Wholesale Jumbo Retail Wholesale Loan Purchases Loan Originations • Internet-focused lend sources • Self-service operation • Low-fixed costs • High-end portfolio lender – “Common Sense" underwriting – Quarter to date average LTV of 54.7% • 15 high quality originators with average experience of 15+ years • Highly ranked website- apartmentbank.com • 10-year history as portfolio bank • High credit quality • Quarter to date average LTV of 61.4% and DSCR of 1.56% • Wide network of relationships • Significant due diligence experience • Over $1bn of closed transactions • Complex transaction structure assistance • Highly creative and opportunistic • Unique asset classes 55%1 29%1 16%1 Warehouse Lending • Product provides vertical integration and strengthens mortgage banking relationships Specialty Finance • Unique receivables • Niche market with high returns

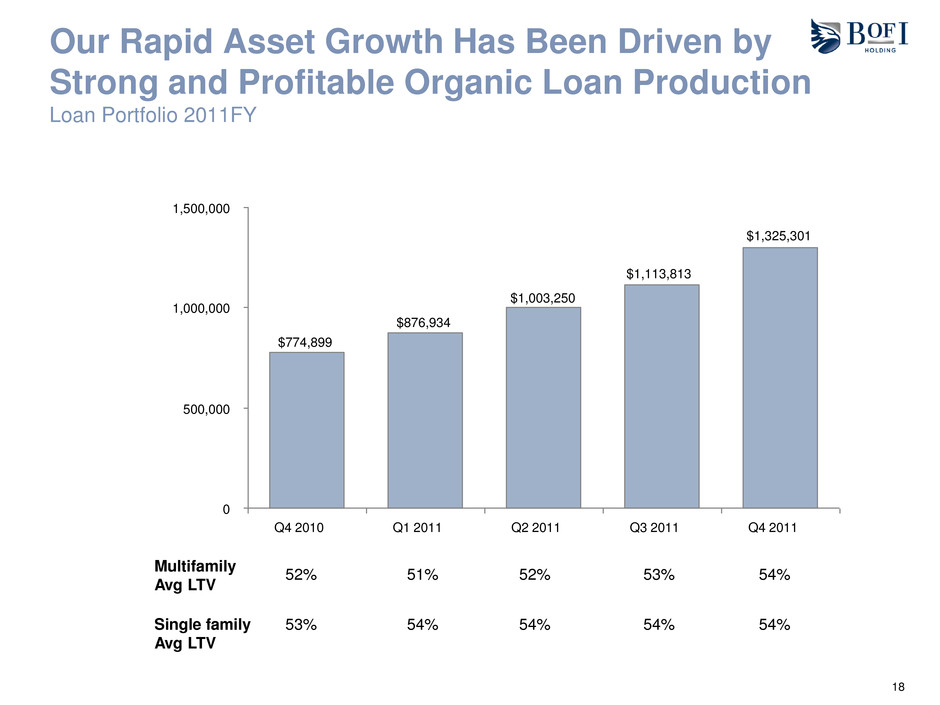

18 Our Rapid Asset Growth Has Been Driven by Strong and Profitable Organic Loan Production Loan Portfolio 2011FY Q4 2010 Q4 2011 0 $1,003,250 Q1 2011 1,000,000 $774,899 $1,113,813 500,000 1,500,000 Q2 2011 $876,934 Q3 2011 Multifamily Avg LTV Single family Avg LTV 52% 51% 52% 53% 54% 53% 54% 54% 54% 54% $1,325,301

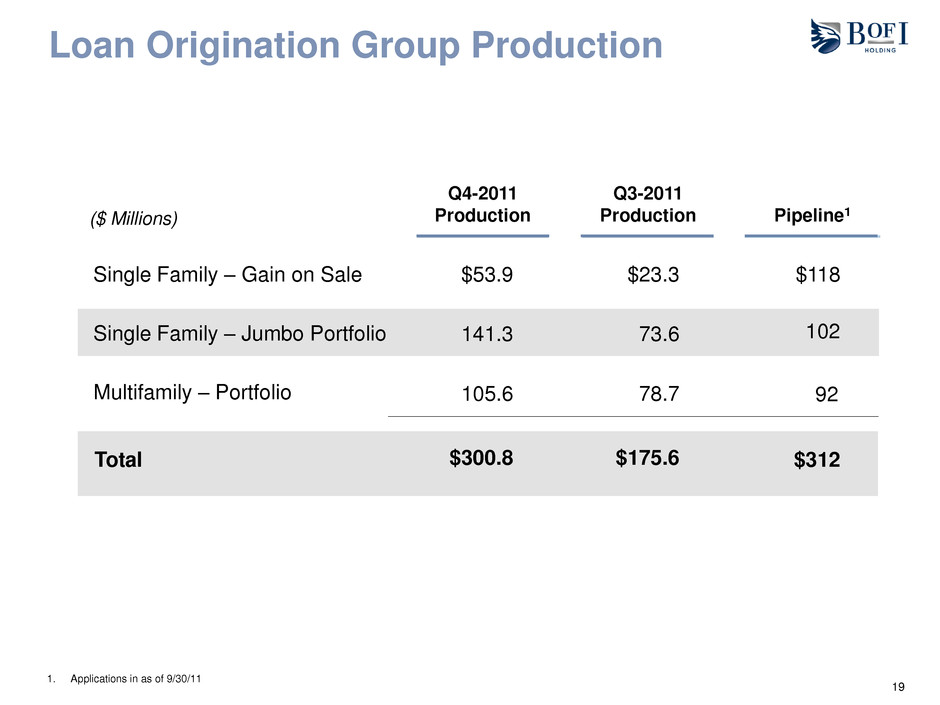

19 Loan Origination Group Production Single Family – Jumbo Portfolio Multifamily – Portfolio 73.6 78.7 Total $175.6 102 92 $312 Pipeline1 Single Family – Gain on Sale $23.3 $118 ($ Millions) Q3-2011 Production 141.3 105.6 $300.8 $53.9 Q4-2011 Production 1. Applications in as of 9/30/11

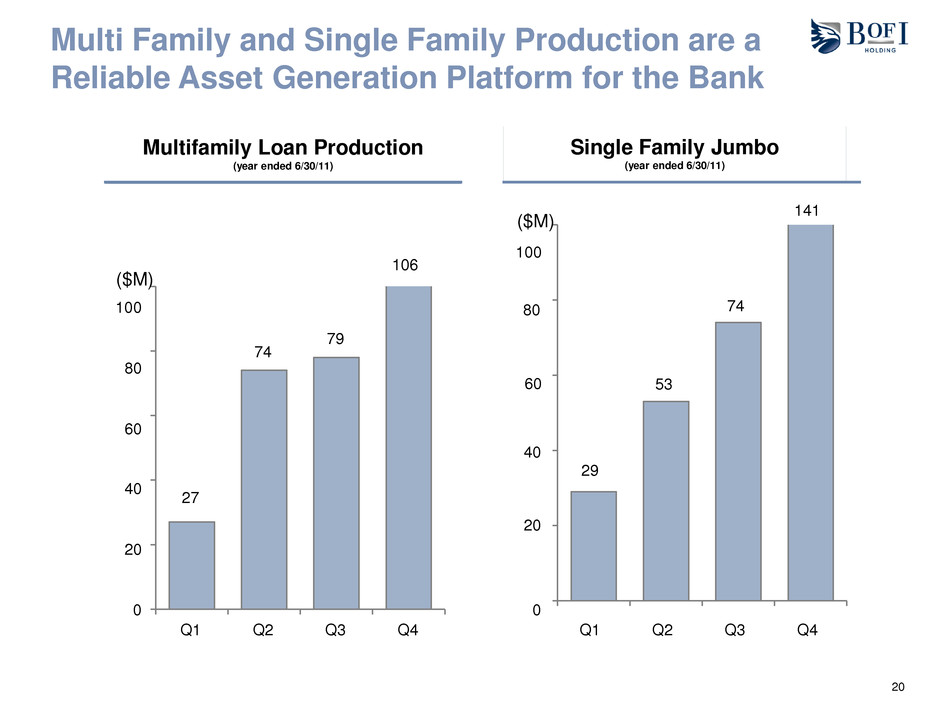

20 Multifamily Loan Production (year ended 6/30/11) Single Family Jumbo (year ended 6/30/11) 0 53 29 80 20 74 141 100 Q4 Q2 Q1 Q3 ($M) 40 60 79 20 Q1 Q2 106 100 0 Q4 74 Q3 27 ($M) 40 60 80 Multi Family and Single Family Production are a Reliable Asset Generation Platform for the Bank

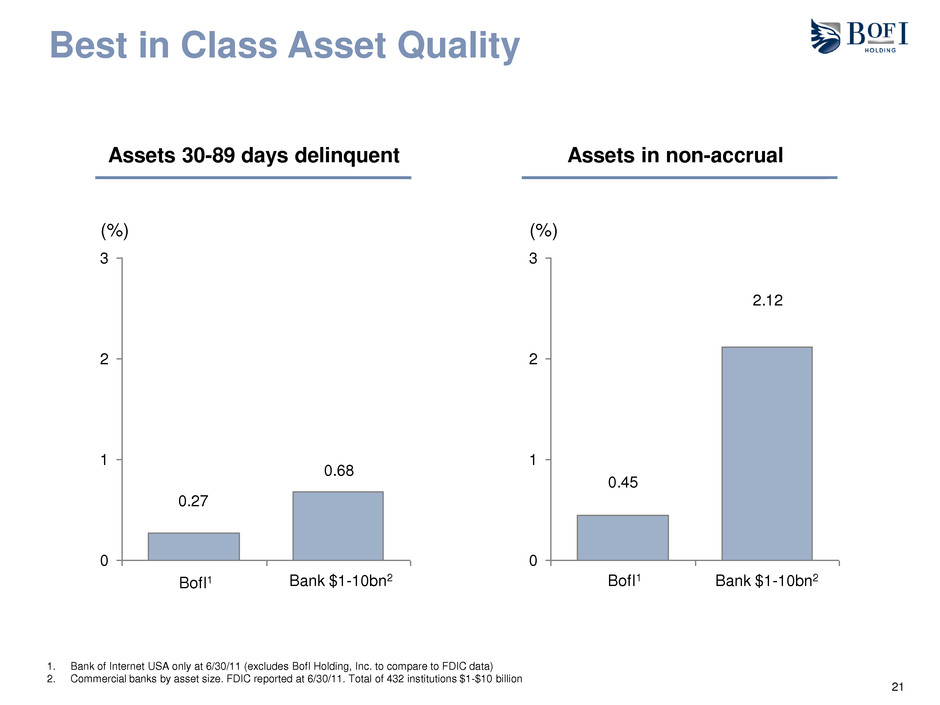

21 0.68 0.27 0 1 2 3 (%) BofI1 Bank $1-10bn2 Assets 30-89 days delinquent Assets in non-accrual 2.12 0.45 0 1 2 3 (%) BofI1 Bank $1-10bn2 1. Bank of Internet USA only at 6/30/11 (excludes BofI Holding, Inc. to compare to FDIC data) 2. Commercial banks by asset size. FDIC reported at 6/30/11. Total of 432 institutions $1-$10 billion Best in Class Asset Quality

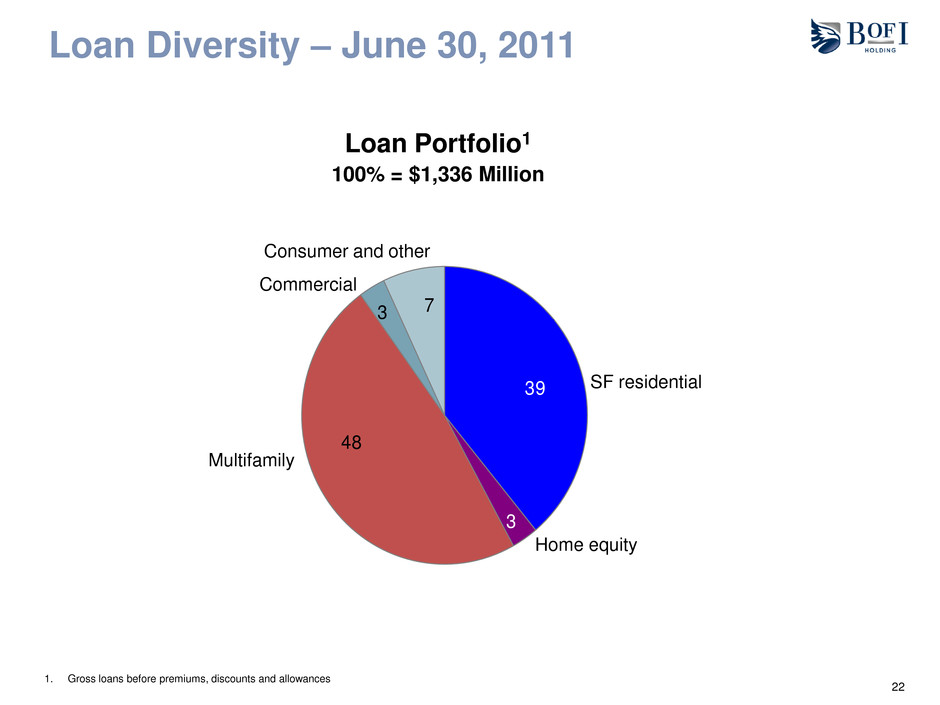

22 Loan Portfolio1 100% = $1,336 Million 39 3 48 3 7 Multifamily SF residential Home equity Commercial Consumer and other 1. Gross loans before premiums, discounts and allowances Loan Diversity – June 30, 2011