Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - River Rock Entertainment Authority | a2205907z8-k.htm |

| EX-99.1 - EXHIBIT 99.1 - River Rock Entertainment Authority | a2205907zex-99_1.htm |

QuickLinks -- Click here to rapidly navigate through this document

Overview

We own and operate the River Rock Casino, a gaming and entertainment facility located on the Tribe's 93 acres of trust land, located approximately 75 miles north of San Francisco in Sonoma County, California. Our customers consist primarily of residents of Sonoma, Napa and Marin Counties, as well as the San Francisco Bay area, including the major metropolitan cities of San Francisco, Oakland and San Jose. In addition, we attract tourists visiting the region's vineyards. We are the closest and most accessible Class III casino to the San Francisco Bay area. Our casino fully opened in April 2003 and has since had a successful operating history, growing net revenue, income before distributions to the Tribe and EBITDA from $104.5 million, $12.4 million and $36.3 million, respectively, in 2004 to $122.0 million, $24.5 million and $55.1 million, respectively, in the twelve-month period ended June 30, 2011. We believe our casino combines the latest and most popular gaming machines, high quality food and beverage options and excellent guest service to create an exciting entertainment experience that generates repeat visitation and a loyal customer base.

Our 62,000 square-foot casino, which is open 24-hours a day, seven days a week, is located on a scenic elevation above the heart of Sonoma County's beautiful Alexander Valley, with expansive views of the surrounding countryside dominated by renowned vineyards. We recently completed an extensive renovation to rejuvenate the casino with the goal of creating the largest visible impact to visitors. In January 2011, we removed our poker tables to make way for approximately 60 additional penny denomination slot machines. In 2010, we introduced a new high-limit room with premium service designed to appeal to higher end players. These improvements follow a complete redesign of our gaming floor in 2010 to create more open space, improve sightlines and reduce congestion. New carpeting and new slot machine chairs were installed to create an improved gambling experience. We have also expanded and improved our food and beverage offerings to create a more diverse, customized and cost-efficient selection. In addition, in July 2009 we spent approximately $0.6 million to upgrade our slot accounting and player tracking systems. We expect that our upgraded player tracking system will better support our targeted marketing and promotion programs, and should enable us to increase revenues in future periods.

Our casino features approximately 35,500 square feet of gaming space containing 1,285 state-of-the-art slot and video poker gaming machines and 20 table games featuring Blackjack, Three Card Poker, Mini Baccarat and Pai Gow Poker. Our high-limit room features high-limit slot machines and table games, enhanced accommodations, a dedicated host and a high end bar with free food for our top-tier players, all situated in a prime location of the casino with a view of the surrounding Alexander Valley. The Players Club, our comprehensive tiered loyalty program which had over 117,000 members as of June 30, 2011, offers guests incentives for additional play and enables us to perform targeted marketing and maximize per capita revenues. The casino floor includes both smoking and non-smoking gaming rooms in order to satisfy diverse customer preferences.

Our casino was designed to capitalize on the scenic vistas of the surrounding area, with the food and beverage facilities strategically placed to feature the expansive views. Our casino has four high quality food and beverage outlets, including the Quail Run Restaurant with outdoor seating overlooking the Alexander Valley wine region and the Russian River, the Center Stage Bar & Grill which hosts live music and entertainment, the Fortune Café and the Lucky Dogz 24-hour snack shop. We obtained a liquor license in May 2008, and have since been able to serve liquor at our restaurants and bars. We can accommodate parking for approximately 1,584 vehicles in three parking structures and an adjacent parking lot with complimentary valet services and easy and convenient access to the casino floor. We also operate a successful bus program that provides customers from Sonoma County and the San Francisco Bay area with convenient transportation to our casino.

For the twelve-month period ended June 30, 2011, we generated net revenue of $122.0 million, income before distributions to the Tribe of $24.5 million and EBITDA of $55.1 million. During the twelve-month period ended June 30, 2011, our EBITDA margin was 45.2%, which was essentially unchanged from our EBITDA margin of 45.1% during the twelve-month period ended June 30, 2010. See "Summary Financial Data" for reconciliations of EBITDA to net cash from operating activities and to income before distributions to the Tribe. While our operations have been impacted by the general economic challenges that have affected the gaming industry over the past few years, we have mitigated the impact of the economic downturn through our continuous focus on maximizing efficiencies and controlling expenses while maintaining a quality experience for our guests.

Competitive Strengths

We believe the following strengths have contributed and will continue to contribute to our success:

Attractive Location with Convenient Access. Conveniently located in the heart of Sonoma County off of U.S. Highway 101, a four-lane highway through Sonoma County that traverses our local and San Francisco Bay Area markets, our casino is the closest Class III casino to the San Francisco Bay Area. The California Department of Transportation estimates that in 2010 the Average Annual Daily Traffic (AADT) on U.S. Highway 101 at the exit to Dry Creek Road was approximately 65,000 north and south bound vehicles or approximately 24 million vehicles annually. Our casino is easily accessible by car from large population centers throughout the San Francisco Bay Area. In addition, the nearby international airport in Santa Rosa provides easy access for patrons traveling to Sonoma County by air with direct flights to and from Los Angeles, Las Vegas, Seattle, Portland, Canada and Mexico.

Strong Market Demographics. We benefit from visitors to Sonoma County and Napa County (approximately 12 million in 2009), which are known for their world-renowned wineries and related tourist attractions. In addition, according to the U.S. Census Bureau's 2010 American Community Survey, there are approximately 873,000 residents in Sonoma, Napa and Marin Counties, and 7.1 million residents in the San Francisco Bay Area, which includes the major metropolitan cities of San Francisco, Oakland and San Jose. As of 2010, the median household income in the San Francisco Bay area is $73,027, which is well above the national average. We believe that many of our patrons have a propensity to gamble, as evidenced by our loyal customer base and high repeat visitation rates.

Limited Competition and High Barriers to Entry. Class III casino gaming may be conducted in California only by federally recognized Indian tribes on certain tribal lands held in trust by the U.S. government and pursuant to compacts that are negotiated with the State of California and approved by the U.S. Secretary of the Interior. These restrictions significantly limit competition. There are currently only three casinos within 50 miles driving distance of our casino, each of which has less than half of the number of slot machines as our casino and only the Graton Tribe and the Cloverdale Rancheria have announced plans to build a casino within our market.

Emphasis on Gaming Devices. Our casino emphasizes slot and video poker gaming devices, which we believe represent the most consistently profitable and least volatile segment of the gaming business. Our gaming devices feature comprehensive, integrated cashless technology permitting faster wagering and payouts. We offer a wide variety of games not only to attract a broad range of guests, but also to maximize gaming revenue per customer. We believe we also offer the latest and most popular gaming machines with state-of-the-art technology. With a slot denomination and title mix tailored to our patrons we believe that our gaming floor offers an exciting and comfortable gaming atmosphere.

Exceptional Customer Service. We strive to differentiate our casino with exceptional customer service, which is a fundamental component of our business and marketing strategy. We believe a high quality guest experience, which leads to repeat visitations, higher spend per visit and strengthened customer loyalty, begins with exceptional customer service. Our management team is focused on promoting friendly and enthusiastic attitudes among all our team members through our hiring,

2

orientation and ongoing training programs. Our casino also provides our patrons with integrated and convenient access to non-gaming amenities. We believe our focus on exceptional customer service provides a comfortable, fun and positive entertainment experience for our guests.

Strong Financial Performance with Attractive Margins. Our casino has generated strong and stable operating performance since its full opening in 2003, driven by increased gaming revenues resulting from effective marketing. Our financial results have shown resiliency in a challenging economic environment. Our EBITDA has grown from $54.2 million for 2008 to $55.1 million for the twelve-month period ended June 30, 2011, while our EBITDA margins have increased by approximately 1.8% to 45.2%. This success can be partially attributed to our renovation and cost reduction programs and our management team's focus on high return on investment.

Experienced Senior Management Team and Staff. Our casino is managed by seasoned executives who have significant industry experience, leadership and expertise in operations, marketing and finance. Our senior management team has over 40 years of combined gaming industry experience, including experience managing premier local and destination casinos located in competitive markets, for both commercial and tribally-owned properties. We believe that our management team and our experienced staff provide excellent employee and customer care, and understand how to maintain and increase repeat business, which enhances our competitive position.

Business and Marketing Strategies

We focus on the following business and marketing strategies:

Utilize Effective Targeted Marketing & Promotions. We continue to refine our marketing programs and player development efforts to attract more patrons to our casino and to foster repeat visitation and higher spend per visit. Our focus continues to be on targeted marketing and profitable promotion on a per player basis through extensive analysis of the data generated by our player tracking system. We advertise through direct mail, radio, billboards, TV, newspaper, magazines, online and email blasts, as well as bus billboards, signature shuttles and placement of rack cards at local businesses. We work closely with a reputable marketing, consulting and research firm to optimize our direct mail program and leverage our extensive player database. Our direct mail program includes coupons and information regarding upcoming promotions, food and entertainment. We have been putting more emphasis on direct mail and sending out mailers specifically tailored to our high-end players. Our direct mail program is tiered based on player status and has been enhanced this year as part of our redesigned multi-tiered Players Club to include a greater variety of offers targeted at different player levels.

We strive to tailor promotions to individual patrons based on specific guest demands. We evaluated player demand and have successfully enhanced longtime guest favorite promotions and implemented new events that we believe have resulted in increased revenues. These include our retail promotions, such as Gas and Cash giveaways, Car and Cash giveaways and Cash Wheel spins. We have also achieved longer visits and increased wagering at off-peak demand periods through customized promotions such as player appreciation drawings, gift giveaways, mystery money, bonus point and bonus FreePlay promotions. These promotions offer customers cash rewards on weekday nights and have resulted in an enhanced guest experience and increased net revenue when offered. Along with our ongoing promotions, we are including slot and table games tournaments that we expect will attract additional high-end players and add excitement and action to our casino during off-peak periods.

We partner with local businesses to jointly market our offerings and have created strong community relations with wineries, hotels, restaurants and Chambers of Commerce. We have been working with local businesses to recommend our casino and distribute player incentives and marketing materials to their customers in exchange for nominal fees. We believe that such cross-referrals to local businesses will help to further increase tourism activity in Sonoma County and bring new customers to our casino.

3

Capitalize on Our Prime Location and Appeal of Sonoma County. The picturesque Alexander Valley region in the heart of Sonoma County where our casino is located is a world-renowned tourist destination. We intend to capitalize on its appeal, including its reputation as one of California's premier wine-producing regions, to further expand our customer base. Sonoma County receives approximately 7.5 million tourists annually, and over 4.7 million tourists visit Napa County annually. Our marketing message emphasizes the convenient access to our casino that allows guests to seamlessly combine a visit to our casino with their stay.

Continue to Grow Our Loyalty Programs. We encourage player loyalty and repeat visitation through our Players Club program, our comprehensive tiered loyalty program and player tracking system. We currently have over 117,000 members in our Players Club and approximately 51% of our gaming revenue comes from rated play. We encourage guests to sign up for the Players Club card and collect points while playing for redemption at our casino. Our program is a three-tiered system that provides elevated levels of services and builds loyalty among our higher worth guests. We have recently upgraded the player tracking software which we are using to provide a customized and tailored gaming environment that generates increased time spent on a device and enhances the likelihood of repeat business. Our database and software help us identify our premier players and target their favorite games, while also helping us create a more personal relationship with those patrons. We relied on such data to redesign the gaming floor as part of our recent renovation.

Leverage Our Existing Liquor License. We obtained a liquor license in May 2008, and have since been able to serve liquor at our restaurants and bars. We voluntarily restrict the sale of alcohol to wine and beer between the hours of 11 a.m. and 5 p.m. on weekdays, and we stop serving alcohol at midnight except for Friday and Saturday nights and the nights before holidays. Our guests may bring alcohol onto the gaming floor and may also drink on our open-beamed porte cochere that faces out towards sweeping vistas of Alexander Valley vineyards. We have introduced additional bars to our existing food outlets to increase convenience for our guests.

Optimize Our Bus Program. Our line and charter bus program that provides convenient customer transportation to our casino is an integral part of our business. Our bus program brings guests to our casino from San Francisco, Sonoma, Napa, Marin, Alameda, Contra Costa, Solano, San Mateo, and Santa Clara Counties. We have recently moved our bus program "in-house" which has resulted in lower operating costs, a better experience for our customers and greater route flexibility. There are currently approximately 30 buses arriving at our casino each day. Upon arrival, our bus customers receive player incentives. We believe that this program enables us to maximize our number of guests during off-peak times.

Appeal to a Broad Range of Patrons. In January 2011, we eliminated our Poker Room, replacing it with a dedicated Penny Room with 60 additional penny slots. This offering distinguishes River Rock from its competitors and gives us a distinct advantage in attracting and retaining low denomination play. In addition, we introduced a high-limit room with high-limit slot machines and table games, enhanced accommodations, a dedicated host and a high end bar with free food for our top-tier players, all situated in a prime location of the casino with a view of the surrounding Alexander Valley. We believe this new offering will attract more high-end players to our casino.

Judicious Use of Credit. We plan to introduce a very disciplined extension of credit as a matter of convenience to our casino patrons that we expect will have a positive impact on the average amounts spent by our high-end visitors. The appropriate use of credit is an established concept at comparable casinos that has shown beneficial effects on financial performance, and we expect it will provide us with another attractive business tool to grow our operations. We plan to use it to attract new gaming patrons that currently visit other casinos in the San Francisco Bay area, and expect incremental revenues and greater profitability from the resulting increase in VIP play.

4

Continue to Develop our Appeal to the Asian Market. According to the U.S. Census Bureau's 2010 American Community Survey, Asians constitute 23% of the San Francisco Bay area population and 33% of the City of San Francisco's population. We continue to cultivate our Asian market customer base through our bus program from San Francisco's and Oakland's Chinatowns, our targeted promotions, games catering to the Asian market, such as Pai Gow Poker, and our new Asian-themed restaurant. In an effort to further increase our market exposure, we have increased our Asian-targeted media and we have begun participating in Asian community events.

Memorandum of Agreement between the Tribe and Sonoma County, California

On March 18, 2008, the Tribe and the Sonoma County Board of Supervisors entered into a Memorandum of Agreement that, among other things, settled several long-standing legal disputes between Sonoma County and the Tribe and provides a binding framework for resolving future disputes. The MOA commenced on March 18, 2008 and will terminate when the Tribe's compact with the State of California (the "Compact"), including any amendment, revision or modifications thereto, expires but in any event no earlier than December 31, 2020 (the "Term"). The MOA enabled the Tribe to move forward with various ongoing and proposed development projects. Under the MOA, Sonoma County agreed to drop its opposition to the Tribe's application for a liquor license and we obtained our liquor license for the casino on May 29, 2008.

Under the MOA, the Tribe agreed to restrict the sale of alcohol to wine and beer between the hours of 11 a.m. and 5 p.m. on weekdays, and to stop serving alcohol altogether at midnight except for Friday and Saturday nights and the nights before holidays. The Tribe has also agreed not to serve liquor on the casino floor, although patrons may bring drinks purchased at the restaurant or bar on to the casino floor. The restrictions may be renegotiated after January 1, 2015.

In addition, the MOA commits the Sonoma County Sheriff's Department and Fire Marshall to provide public safety and fire investigation services to the casino and the Tribe's future gaming projects on the Tribe's reservation and provides detailed agreements on off-reservation impact mitigation measures. Pursuant to the MOA, Sonoma County withdrew its opposition to the Tribe's application to take into trust an approximately 18-acre parcel of land adjacent to the Tribe's reservation (the "Dugan Property"), which application was approved by the U.S. Department of the Interior ("DOI") in 2006.

Pursuant to the MOA, the Tribe has agreed to pay Sonoma County $75 million in mitigation fees over a 12 year period, subject to adjustment under certain circumstances described in the MOA, to offset the potential losses and impacts to Sonoma County resulting from the Tribe's various ongoing projects and to support the services being provided by Sonoma County.

In May 2011, the Sonoma County Board of Supervisors approved a revision to the payment terms of the MOA. Under the amended payment terms, we have agreed to pay to Sonoma County, on behalf of the Tribe, $3.5 million per year commencing June 30, 2011 and continuing each June 30 until the Opening Date of the first phase of an expanded casino and hotel facility. In the event the Opening Date occurs less than one year prior to the end of the Term, on the Opening Date the parties to the MOA shall calculate the difference between $75 million and the sum of all payments made pursuant to the MOA (the "Deferred Amount") through the Opening Date and the Tribe shall be obligated to pay to the County one-half of the Deferred Amount on the Opening Date and the balance at the end of the Term. If more than one year remains between the Opening Date and the end of the Term, the Deferred Amount shall be amortized into equal annual payments over the number of years remaining, plus one if the Opening Date occurs before June 30 of that year, and the Tribe shall be obligated to pay the first annual payment on the Opening Date and the remaining annual payments commencing on the June 30 next following the Opening Date and on each June 30 thereafter through the end of the Term. If the Opening Date does not occur prior to the end of the Term, the Deferred Amount shall be payable by June 30, 2020, unless the MOA is properly reopened as provided for therein and an alternative payment schedule is agreed upon by the parties thereto. As of June 30, 2011, $13.8 million

5

has been paid pursuant to the MOA and the Deferred Amount is $61.2 million. The Tribe has paid $10.3 million of the amounts paid to date. Pursuant to the MOA, the future payment schedule is open to renegotiation by either party due to unforeseen circumstances, including the inability to open the first phase of an expanded resort facility.

Under the amended MOA, we and Sonoma County agreed not to invoke any occurrence in existence in May 2011 as a basis to reopen the MOA. As a result, going forward, we or Sonoma County may request to amend the MOA upon the occurrence of any of the following: (a) the operation by the Tribe of additional Class III slot machines beyond the 2,000 machines allowed under the Compact pursuant to an amendment to the Compact or a new compact entered into for the purpose of allowing the Tribe to operate additional Class III slot machines; (b) more than seven years has elapsed from the Effective Date of the MOA; (c) the Tribe's gross revenues declined by at least 20% over a previous year and remained at or below that Base Year revenue level for a consecutive three-year period; (d) a significant portion of the casino ceases operations for a continuous period of at least seven consecutive days, due to forces entirely beyond the Tribe's control, and the Tribe's annual gross revenues during the year in which that occurred declined by more than 20% from the preceding year; (e) the resort project contemplated in the MOA does not have an alcohol license following the completion of Phase I of the resort project; (f) the Tribe undertakes ongoing project development beyond the projects and infrastructure discussed in the environmental study, environmental assessment, or Exhibit B (relating to the Dugan Projects) referenced in the MOA; or (g) there is a significant adverse impact of an ongoing project beyond that discussed by the Tribe in the environmental study or environmental assessment or which was anticipated or should have been anticipated by Sonoma County.

In addition, the Tribe has agreed to pay a fee in lieu of Sonoma County's Transient Occupancy Tax in the amount of 9% of the rental charges collected on occupied hotel rooms that may be developed by the Tribe. Such fees are required to be paid quarterly until five years after the later to occur of the termination of the MOA, as may be extended, or the Tribe's Compact with the State (which will expire in 2020 at the earliest).

Land Acquisition and Road Construction

To date, access to the Tribe's reservation and our casino has been over a single, two-lane road. Improved safe and direct access to and across the Tribe's reservation is needed to enhance the current gaming operations. Under the MOA, the Tribe covenanted as a condition to the issuance of our liquor license to construct an emergency vehicle access road from the casino. The MOA also requires improvements at the intersection of State Highway 128 and BIA 93, which is currently the principal access road onto the Tribe's reservation and to our casino. The construction of the emergency access road and the improvements to the intersection of State Highway 128 and BIA 93 will ease the flow of traffic and provide a cost effective emergency access route to and from the existing facilities and the Tribe's reservation.

The construction of the emergency access road is managed for us by the Public Works of the Department of the Tribe. The Public Works Department developed in cooperation with us procedures based on recognized industry standards to ensure that the various phases of the project, from initial engineering studies to bidding and execution, are conducted in a manner satisfactory to the Tribe and the Authority. The Public Works Department of the Tribe engaged construction engineers on our behalf to provide estimates for the aggregate cost of constructing an emergency access road. Our studies indicated that the construction of the emergency access road over the Proschold Property with certain adjustments to the grading requirement of the MOA would be $5.0 million as opposed to construction entirely over the Tribe's Reservation which would cost in the range of $18.0 million. The higher cost of constructing over the Tribe's Reservation is due to the difficult terrain, requiring extensive engineering, switchbacks, and retaining walls. In addition, if we were to construct the

6

emergency access road over the Tribe's Reservation we would need to acquire rights of way along State Highway 128 to construct two intersection improvements. It is estimated that the costs of the right of way acquisition and the intersection improvements costs would be approximately $16.0 million. Based on these conclusions, we resolved to focus on acquiring the Easement and building the emergency access road on the Proschold Property.

For that purpose, on August 3, 2011, we acquired the Easement for $9.0 million from the Grantors. The Easement will allow us to construct the emergency vehicle access road required by the MOA. The Easement is effective until July 31, 2016. In a separate agreement, the Tribe acquired the Proschold Property from the Grantors. The Easement Acquisition Price and $3.3 million in deposit funds from the Tribe (of which $0.8 million was reimbursed by us) were credited towards the purchase price for the Proschold Property. The balance of the purchase price for the Proschold Property, or $11.7 million, is payable by the Tribe to the Grantors over five years pursuant to a Mortgage Note from the Tribe that bears interest at 4% per annum and requires a final balloon payment of $10.6 million on the Easement Expiration Date. Upon the closing of this offering, we will lease the Proschold Property from the Tribe for an annual rent of $2.8 million until the Mortgage Note is fully repaid and thereafter for $12,000 per month for the remaining term of the Notes. If the Authority fails to make the annual lease payments of $2.8 million to the Tribe, it is unlikely that the Tribe will have sufficient cash to make payments in full on the Mortgage Note. The Easement will terminate on July 31, 2016. If the Tribe does not pay the Mortgage Note in full, we may not be able to negotiate an extension of the Easement beyond its termination date. The termination of the Easement could result in an interruption of our ability to use the emergency vehicle access road and could result in a breach of the MOA. See "Risk Factors—Risks Related to our Business—Our Easement and our right to use our emergency access road may terminate in 2016 unless the Tribe pays off the Mortgage Note which requires that we make our annual lease payments."

The acquisition of the Proschold Property eliminates the need to acquire rights of way along State Highway 128, as the Proschold Property itself fronts onto that Highway; and the distance between the intersection at State Highway 128 and the access road on the one hand, and State Highway 128 and BIA 93 on the other, is sufficiently small as to allow us to efficiently build a one road widening/intersection improvement project.

We plan to use proceeds from the sale of the Notes to construct the emergency vehicle access road. After receiving four bids following its request for proposal, the Public Works Department has awarded a contract to build the emergency vehicle access road to Ghilotti Bros. Inc., a local construction firm that is not affiliated with us and has worked on projects for us in the past. We expect that construction of the first segment of the road adjacent to the Dugan property to be completed by the end of 2011. The other segments, including the segment that will connect the road to the existing road on the Proschold Property, are still at the environmental review and permitting stage, but we expect that they should be completed in 2012 within the timeframe required by the MOA. See "Risk Factors—Risks Related to Our Business—The construction of the emergency access road as required by the MOA is subject to risks associated with such construction projects and could result in delays and/or cost overruns."

The Tribe and IGRA

The Dry Creek Rancheria Band of Pomo Indians is a federally recognized, self-governing Indian tribe with approximately 1,000 enrolled members and approximately 93-acres of trust land in Sonoma County, California. Pursuant to the Tribe's Articles of Association, the Tribe is governed by a Tribal council (the "Tribal Council"), which is composed of all voting members age 18 and older. As of October 1, 2011, the Tribal Council consists of 597 voting members. Day-to-day authority is delegated to elected Tribal officers who comprise the Tribe's Board of Directors, consisting of a Chairperson, a Vice Chairperson, a Secretary/Treasurer and two members-at-large. Individuals elected to the Tribe's

7

Board of Directors are automatically made members of the Board of Directors of the Authority, and therefore the Board of Directors of the Authority is comprised of the same individuals serving on the Tribe's Board of Directors.

The Authority was formed in 2003 as an unincorporated governmental instrumentality of the Tribe, to own and operate the River Rock Casino on the Tribe's reservation. The casino had previously operated as a wholly-owned economic development project of the Tribe.

The Indian Gaming Regulatory Act of 1988, as amended ("IGRA"), permits federally recognized Indian tribes to conduct casino gaming operations on certain Indian lands, subject to, among other things, the negotiation of a compact with the affected state. The Tribe and the State of California entered into the Compact in September 1999, which became legally effective in May 2000. The Compact authorizes certain forms of Class III casino gaming, including slot machines and house-banked card games. The Tribe enacted a Tribal gaming ordinance in April 1997, which was amended in May 2009 and most recently approved by the NIGC in June 2009 in accordance with IGRA. Among other matters, the gaming ordinance created and established a Tribal gaming agency (the "TGA"), known as the Dry Creek Gaming Commission, as an independent governmental agency of the Tribe. The TGA consists of three commissioners and supporting staff, and is vested with the authority to regulate all gaming activity conducted on the Tribe's lands.

Competition

The gaming industry is very competitive. We face or will face competition from existing and proposed California Indian gaming facilities in the surrounding area and elsewhere in California, and with casino gaming in Nevada, including gaming facilities that could be located closer to the San Francisco Bay area. We also compete with card rooms located in the surrounding area, and other forms of gaming that are legal in California, including on- and off-track wagering and the California State Lottery, as well as with non-gaming leisure activities. The availability of such alternative gaming and non-gaming activities may increase in the future. Many of our competitors have substantially greater resources and name recognition than our casino. In addition, we may also face competition in our market from new facilities that may be built by other Indian tribes in the future. For a discussion of the risks that we face as a result of actual or proposed competition, See "Risk Factors—Risks Related to our Business—We face competition from other California Indian casinos, casinos located in Nevada and elsewhere, and other forms of gaming."

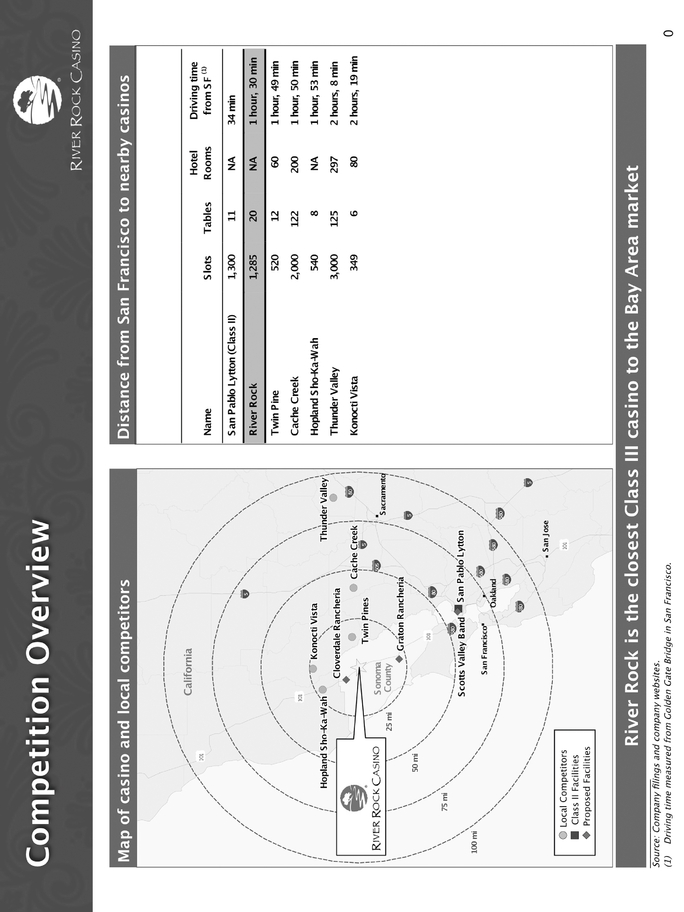

Federal and California law currently permit Class III casino gaming only on certain tribal lands pursuant to compacts negotiated with the State of California and approved by the U.S. Secretary of the Interior. Class II gaming for tribes is permitted only on certain federally recognized tribal lands. There are currently 57 tribes operating 58 compacted gaming facilities in the State of California. The main casinos which we view as our competitors are noted on the map set forth below under "Main Competition Overview." The closest existing tribal competitors are the Hopland Sho-ka-wah Casino, located approximately 31 miles and 40 minutes north of the Tribe's reservation; the Twin Pine Casino and Hotel, located approximately 34 miles and 49 minutes east of the Tribe's reservation; the Konocti Vista Casino, located approximately 47 miles and one hour and ten minutes northeast of the Tribe's reservation; the Cache Creek Indian Casino and Bingo, located approximately 101 miles and two hours and fifteen minutes east of the Tribe's reservation; and the Thunder Valley Casino, located approximately 133 miles and two hours and forty-five minutes east of the Tribe's reservation. In addition, several potential competitors are attempting to develop and open casinos near our casino. Non-tribal card rooms that offer poker and some other games that would be classified as Class II games if conducted by an Indian tribe exist within 50 miles of the Tribe's reservation.

We may face significant competition from the casino-hotel complex that the Graton Tribe plans to build at Rohnert Park. In April 2003, the Graton Tribe, also known as the Coast Miwoks, announced plans to purchase land in Sonoma County near Highway 37 and Lakeville Highway, approximately 35

8

miles south of our casino and closer to San Francisco than the Tribe's reservation. The proposed location would lie directly between our casino and the majority of the seven million population base of the San Francisco Bay area. The announced plans included construction of a casino-hotel complex that would be managed by Station Casinos, Inc., based in Las Vegas, Nevada, and would house approximately 2,000 slot machines, 120 card tables and bingo, as well as a 300-room hotel, five restaurants and a theater with up to 2,000 seats. As a result of environmental opposition to the development of such location, the Graton Tribe announced plans to move the proposed casino-hotel complex to a site near Rohnert Park, California. The Rohnert Park City Council has approved an agreement with the Graton Tribe to share revenues with Rohnert Park and various community groups, approximately $200.0 million over 20 years, to offset the impact of the proposed project.

On October 1, 2010, the U.S. Department of the Interior took the proposed Rohnert Park site into federal trust on behalf of the Graton Tribe. The Department published notice of its intent to take the land into trust in May 2008, but withheld action on the trust acquisition due to a lawsuit filed by a citizens group opposed to the proposed casino. After the U.S. Court of Appeals for the Ninth Circuit upheld the district court's dismissal of the lawsuit on June 3, 2010, the Interior Department moved forward with taking the land into trust. The land's entry into trust represents a significant step toward the development of a casino at Rohnert Park, as do the separate agreements negotiated between the Graton Tribe and Sonoma County and Marin County, whereby the counties pledged not to challenge the land-into-trust decision and the Graton Tribe agreed not to build any additional casinos in Sonoma or Marin Counties.

Also on October 1, 2010, the NIGC approved a management contract between the Graton Tribe and SC Sonoma Management, LLC, an entity owned by Station Casinos, Inc. As part of its approval of the management contract, the NIGC also concluded its environmental review of and approved the environmental impact statement for the proposed casino, but for a reduced project that includes a 317,750 square-foot casino with 65,000 square feet of gaming space and a six-story, 200-room hotel, and that does not include the initially-proposed 2,000-seat theater. A spokesperson for the citizens group that filed the lawsuit challenging the fee-to-trust acquisition has stated publicly that the group will challenge the adequacy of the environmental review and approval, but no lawsuit has yet been filed.

Before the Graton Tribe may conduct gaming at the Rohnert Park site, the NIGC must issue a determination that the lands at the Rohnert Park site are eligible for gaming under the Indian Gaming Regulatory Act. The NIGC approved the Graton Tribe's gaming ordinance in August 2008. In order to operate Class III gaming at the Rohnert Park site, the Graton Tribe will need a tribal-state compact with the State of California, although the Graton Tribe could operate electronic bingo machines at the proposed casino without such a compact. The Graton Tribe must also obtain financing for the proposed Rohnert Park project.

To examine the impact that the proposed Class III facility at Rohnert Park could have on our casino, we have undertaken internal studies, consulted with advisors and conducted reviews by external consultants, some of whom have concluded that our net revenues and EBITDA could decline by an amount ranging from 32.5% to 35% absent mitigating actions. We estimate that, factoring in certain mitigating actions, within the first year after the opening of the proposed Class III facility our net revenues and EBITDA could decline by an amount ranging from 25% to 28%, from our net revenues and EBITDA for the year ended December 31, 2010. We have identified a number of actions that we would expect to take to mitigate this adverse impact, including a substantial increase in our daily bus service program and our direct mail marketing to our Players Club members, particularly to our most loyal and high-end customers. There can be no assurance, however, that these or other actions that we may take will be successful in mitigating any adverse impact that the proposed Class III facility at Rohnert Park could have on our casino, or that such adverse impact could not be worse than we currently estimate.

9

The Graton Tribe is reportedly also considering the possibility of opening a Class II facility prior to obtaining a compact from the State that would permit it to open a Class III facility at Rohnert Park. Under federal law, tribal-state compacts are not required in order to engage in Class II gaming and cannot restrict or otherwise regulate the operation of Class II gaming. While we believe that Class II gaming is generally seen as less desirable by players and is not as profitable as the Class III gaming we offer, we have not conducted any studies or consulted with advisors to determine the impact of a Class II facility at Rohnert Park on our casino. Given its proximity to San Francisco and technological advances in electronic gaming that are arguably within Class II, a facility at Rohnert Park could also adversely impact our casino. See "Risk Factors—Risks Related to our Business—We face competition from other California Indian casinos, casinos located in Nevada and elsewhere, and other forms of gaming."

The Hopland Sho-ka-wah Casino is located several miles east of U.S. Highway 101 on Route 175, approximately 31 miles from our casino. The facility features a 40,000 square foot casino offering 540 slot machines and eight table games, consisting of poker, Pai Gow, and blackjack. The facility contains a bar and grill offering, a small cafe-type food and beverage area, and a fine-dining steak house. Hopland operates a small bus program but does not operate a hotel.

The Twin Pine Casino and Hotel, owned and operated by the Middletown Rancheria of Pomo Indians, is located on Highway 29 in Lake County, approximately 34 miles from our casino. The Twin Pine Casino and Hotel includes a 60-room hotel, three food areas and a wine tasting room, as well as 50,000 square feet of gaming space with approximately 520 slot machines and 12 table games consisting of blackjack and poker.

The Konocti Vista Casino in Lakeport, California is located approximately 47 miles from our casino with access off Highway 29. The casino currently houses 349 slot machines and six table games. The facility also offers an 80-room hotel and marina with a small pool as well as a 74-space recreational vehicle park. The food and beverage program includes a restaurant and a bar.

The Cache Creek Casino Resort, located approximately 50 miles west of Sacramento and approximately 101 miles from our casino, offers over 2,000 slot machines and has a 14-table poker room with 122 table games including blackjack, Texas Hold'em, Pai Gow and mini-baccarat. The facility also includes a 200-room luxury hotel, nine restaurant outlets, an entertainment pavilion with seating for 600, a spa and outdoor pool, an 18-hole golf course and a 1,883 spot parking structure. In 2007, Cache Creek announced plans to add more shops and parking and expand its gaming floor, and to add a ten-story, 467-room hotel tower, and a 62,500 square-foot convention center capable of seating 2,300 people. These expansion plans were put on hold in early October 2009 but were resumed in January 2010 when the Cache Creek Casino announced plans to resume the expansion, proposing to add over 20,000 square-feet of casino space, a 52,440 square-foot convention center, and a 900-car six-story garage. The construction of the event center and parking garage was halted in September 2010, though the renovation of the existing 200-room hotel was recently completed.

The Thunder Valley Casino Resort is located approximately 133 miles from our casino, at the intersection of Highway 65 and Interstate 80 just outside of Sacramento, California. The Nevada-style property opened in June 2003 and offers approximately 3,000 slot machines and 125 table games that include blackjack, baccarat, and a variety of poker games including Let It Ride and Pai Gow. The facility features a salon, private dining rooms, bars and butler service. In addition, it houses a 500-seat buffet and various fast food options. The facility also features a nightclub. In 2008, the Thunder Valley Casino announced plans to build a new 650-room, 23-story hotel featuring a spa, family center and other amenities. Thunder Valley also planned to construct a 3,000-seat performing arts center, and to expand the casino to include three new restaurants, more gaming space and new poker room, and a parking structure capable of holding 5,000 cars. The expansion began in July 2008 but was halted in November 2008. In May 2009, the casino resumed work on a scaled-down expansion project that includes a 17-story hotel with 297 rooms; a 700-seat, 10,000-square-feet multipurpose entertainment

10

center in place of the performing arts center; and a seven-story parking structure with approximately 3,800 spaces. The hotel opened in June 2010. Thunder Valley also added 40,000 square feet of space to and renovated its casino floor. The casino now has 144,500 square feet of gaming space.

The Lytton Band of Pomo Indians currently operates a 70,000 square-foot casino with over 1,300 Class II electronic bingo machines and 11 table games on a nine-acre site in a card room in San Pablo, near Oakland, California, approximately 77 miles from our casino. The San Pablo site was placed in trust for the tribe through congressional legislation. The Lytton Band signed a compact with the Governor of California for operating Class III casino gaming on the San Pablo site in 2004, but in 2005 the state legislature withheld its approval of this compact. In May 2007, legislation was introduced in the U.S. Senate that would require the Lytton Band to forego any Class III machines at the San Pablo site and limit itself to operating its existing Class II machines. This legislation was passed by the Senate in November 2007 and referred to the U.S. House of Representatives Committee on Natural Resources, but no further action was taken. The legislation was again introduced in the U.S. Senate in January 2009, and the Senate passed the bill in March 2009, but no further action was taken during that session of Congress. The legislation was introduced in the Senate again on May 4, 2011.

Other Indian tribes which have announced their desire to develop gaming projects in the San Francisco Bay area or in other locations that could be competitive with our casino include, among others, the Guidiville Band of Pomo Indians and the Scotts Valley Band of Pomo Indians.

The Guidiville Band's plan was to operate a 240,000 square-foot casino with 124,000 square-feet of gaming space, along with two hotels, a conference center, retail shops, restaurants and two parking structures on land owned by the City of Richmond at the former Point Molate Naval Base in Richmond, California. In 2009, the draft environmental impact study for the proposed project was released, and the Bureau of Indian Affairs held a public hearing on the draft study and took public comments. A final environmental impact report, prepared by the City of Richmond pursuant to the California Environmental Quality Act, was released in February 2011 and certified by the Richmond City Council in March 2011 as being accurate and complete. However, on April 5, 2011, the Richmond City Council voted 5-2 not to continue with plans to develop the proposed casino at Point Molate and directed its staff to begin a 120-day negotiation with the project developer for a non-gaming alternative for the Point Molate site. The City Council must approve any transfer of the Point Molate land to the Guidiville Band. The City Council's vote followed a November 2010 vote on a city-wide advisory measure in which a majority of voters opposed the casino. In addition, on September 1, 2011, the Assistant Secretary—Indian Affairs issued a letter to the Guidiville Band, determining that the Point Molate site would not constitute "restored lands" for the Guidiville Band, and therefore would not be eligible for gaming under Section 20(b)(1)(B)(iii) of IGRA and its implementing regulations.

The Scotts Valley Band hopes to build a 225,000 square-foot casino complex and five-story parking garage on a 30-acre site in unincorporated Contra Costa County, near Richmond, California. In March 2008, the Bureau of Indian Affairs announced the filing of the Final Environmental Impact Statement for the proposed project. A municipal services agreement between the City of Richmond and the Scotts Valley Band was challenged in court on environmental review grounds, and the agreement's validity was upheld in February 2010.

The Cloverdale Rancheria has announced preliminary plans to build a 596,000 square-foot hotel/spa and casino resort approximately ten miles north of our casino on U.S. Highway 101. The Cloverdale Rancheria and its financial partners have purchased land for the casino project and the DOI issued an opinion in 2008 stating that if such land were placed into trust, the Cloverdale Rancheria would be eligible for gaming under the Indian Gaming Regulatory Act. The environmental review process for the proposed Cloverdale Rancheria project began in July 2008. The Draft Environmental Impact Statement for the project was issued August 6, 2010, a public hearing was held on September 15, 2010, and comments were accepted through October 20, 2010.

11

Each of these proposed projects faces numerous obstacles in addition to environmental approvals, including the negotiation and approval of a tribal-state gaming compact with the State of California, approval from the DOI to take the land on which the project would be located into federal trust on behalf of the tribe, and, for the Guidiville and Scotts Valley projects, determinations from appropriate federal agencies that the tribes may conduct gaming on these lands pursuant to IGRA.

Another potential competitor may be the Mishewal Wappo Tribe of Alexander Valley, a tribe that claims to have aboriginal lands in Napa County and Sonoma County and a former rancheria located in Sonoma County that was terminated by the federal government under the 1958 California Rancheria Act. In 2009 the tribe filed suit against the United States Secretary of the Interior seeking to have its federally-recognized status restored. The litigation is pending in the United States District Court for the Northern District of California. The Chairman of the Mishewal Wappo Tribe has stated publicly that the tribe has no plans for a casino. However, the tribe could have the right to conduct gaming under IGRA if its federally-recognized status were restored, and it is possible that the tribe might seek to conduct gaming at a site near our casino, as the tribe's former rancheria is claimed to have been located east of the city of Healdsburg and approximately 10 miles southeast of our casino.

We also compete with other forms of gaming such as statewide lotteries, live and simulcast pari-mutuel wagering and card rooms. Initiatives expanding competitive forms of gaming have been proposed and may, from time to time, be approved by state or local authorities in California. Examples include state legislation passed in 2007 expanding off-site betting on horse races through expanded advance deposit wagering and increased satellite wagering sites, state legislation passed in September 2010 allowing for exchange wagering on horse races, a legislative proposal in the California Assembly in February 2007 to amend the California Penal Code to expand permitted bingo games by charitable organizations to include electronic bingo cards, proposals put forth by former Governor Arnold Schwarzenegger in 2007 and 2009, respectively, to authorize the use of instant lottery video terminals at horse racing tracks and card rooms and to dedicate a higher percentage of California State Lottery revenues to player winnings, and bills introduced in the California State Senate in May 2010 and January 2011 to authorize online intrastate poker in California.

In August 2009, a U.S. district court judge issued an order, in ongoing litigation regarding the proper number of total slot machines allowed under the 1999 tribal-state gaming compacts, requiring that the State of California issue an additional 10,549 slot machine licenses. A drawing was held on October 5, 2009, and 3,548 licenses were awarded to eleven different Indian tribes, leaving 7,001 slot machine licenses available in the statewide pool. On August 20, 2010, the U.S. Court of Appeals for the Ninth Circuit reduced the number of additional slot machine licenses from 10,549 to 8,050, and the court denied the State of California's petition for a rehearing on January 28, 2011. The State of California did not appeal the decision, and thus the appeals court's decision is final. As a result, there are 4,502 slot machine licenses not awarded in the October 2009 draw that remain available, and the Tribe or any other Indian tribe(s) could request California to hold a draw for some or all of these licenses.

Following is a map reflecting the above-mentioned tribally-owned existing and announced casinos and illustrating the respective distances of such casinos from the River Rock Casino. Accompanying the map is a table showing the approximate number of slot machines at, and driving time from San Francisco to, each such existing casino.

12

13

Legal Proceedings

We are involved in litigation and disputes from time to time in the ordinary course of business with vendors and patrons. We believe that the aggregate liability, if any, arising from such litigation or disputes will not have a material adverse effect on our results of operations, financial condition or cash flows.

Insurance

We and the Tribe carry $93.8 million of commercial property insurance for buildings and equipment covering, among other things, the existing casino, parking structure and ancillary buildings, and $101.4 million combined business interruption and rental income liability insurance. Additionally, we carry "Difference in Conditions" (DIC) coverage for losses due to earthquake and flood with a policy limit of $25.0 million. The roads on the Tribe's reservation are excluded from existing coverage, although the waste water treatment plant is covered under the Tribe's liability insurance policy.

Employee and Labor Relations

As of June 30, 2011, we had 577 full and part-time employees. Our employees are not covered by any collective bargaining agreements. We believe that our relations with our employees are good. However, as part of the Compact, the Tribe was required to adopt labor ordinance provisions permitting opportunities for unions to attempt to organize our labor force. In addition, a decision by the United States Court of Appeals for the District of Columbia upheld a finding by the National Labor Relations Board that the National Labor Relations Act is applicable to tribal casinos. We have not experienced any unionization activities subsequent to this court decision. We believe that our labor relations with our employees are good, and we are not aware of any unionization activities by our employees.

14

Preliminary Unaudited Financial Data for the three-month period ended September 30, 2011

We currently estimate that our net revenue, income before distributions to the Tribe and EBITDA for the three-month period ended September 30, 2011 will be in the range of approximately $30.5 million to $31.5 million, $7.8 million to $8.3 million and $14.0 million to $14.7 million, compared to $30.4 million, $5.3 million and $13.1 million, respectively for the same period in 2010. Our estimated cash balance as of September 30, 2011 was approximately $37.9 million, excluding approximately $4.3 million in restricted cash. Our final financial results for the three-month period ended September 30, 2011 may vary from present estimates as our quarterly financial statement close process is not complete and additional developments and adjustments may arise between now and the time the financial results for this period are finalized. We currently expect to publish our final results for the three-month period ended September 30, 2011 on or about November 15, 2011. Estimates for any interim period are not necessarily indicative of operating results for any future period. See "Risk Factors—Risks Related to Our Business—Prospective purchasers of the Notes should not place undue reliance on our preliminary financial results."

15

The following summary financial data should be read in conjunction with, and is qualified by reference to the information in "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our financial statements and the related notes. The summary financial data as of December 31, 2009 and 2010 and for each of the three fiscal years in the period ended December 31, 2010 is derived from our audited financial statements that are included in this offering memorandum. The summary financial data as of December 31, 2008 is derived from our audited financial statements that are not included in this offering memorandum. The summary financial data for the six months ended June 30, 2010 and as of and for the six months ended June 30, 2011 is derived from our unaudited financial statements that are included in this offering memorandum. In the opinion of management, the summary financial data as of and for the six months ended June 30, 2010 and 2011 reflects normal and recurring adjustments that are necessary for a fair presentation of the results for such periods. The results of operations for any interim period are not necessarily indicative of the results of operations for a full year. Historical results are not necessarily indicative of results that may be expected for any future period.

The summary unaudited financial data in the tables below for the twelve months ended June 30, 2011 has been derived by taking financial data from our audited financial statements as of and for the year ended December 31, 2010 and adding financial data from our unaudited financial statements for the six months ended June 30, 2011 and subtracting financial data from our unaudited financial statements for the six months ended June 30, 2010, and should be read together with our audited and unaudited financial statements and accompanying notes for the respective periods included in this offering memorandum.

Our financial statements are prepared in accordance with Governmental Accounting Standards Board ("GASB") pronouncements. There are differences between financial statements prepared in accordance with GASB pronouncements and those prepared in accordance with the Accounting Standards Codification (the "Codification") issued by the Financial Accounting Standards Board ("FASB"). The statements of revenues, expenses and changes in net assets (deficit) are a combined statement under GASB pronouncements. FASB Codification allows a statement of income or operations and a separate statement of owners' or shareholders' equity (deficit), which is where distributions to owners would be presented. The amount shown below as income before distributions to the Tribe would be the most comparable amount to net income computed under the FASB Codification. We are a separate enterprise fund of the Tribe, a governmental entity, and as such there is no owners' or shareholders' equity (deficit) as traditionally represented under the FASB Codification.

16

The most comparable measure of owners' equity (deficit) is presented on the River Rock Entertainment Authority balance sheet as net assets (deficit).

| |

Year Ended December 31, | Six Months Ended June 30, |

Twelve Months Ended June 30, |

||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2008 | 2009 | 2010 | 2010 | 2011 | 2011 | |||||||||||||||

| |

|

|

|

(unaudited) |

(unaudited) |

||||||||||||||||

| |

(Dollars in thousands) |

||||||||||||||||||||

Statement of Income Data: |

|||||||||||||||||||||

Operating Revenues: |

|||||||||||||||||||||

Casino |

$ | 124,481 | $ | 117,731 | $ | 119,233 | $ | 62,077 | $ | 60,123 | $ | 117,279 | |||||||||

Food, beverage and retail |

6,273 | 5,851 | 5,806 | 2,923 | 3,135 | 6,018 | |||||||||||||||

Other |

598 | 912 | 873 | 507 | 426 | 792 | |||||||||||||||

Gross revenues |

131,352 | 124,494 | 125,912 | 65,507 | 63,684 | 124,089 | |||||||||||||||

Promotional allowances |

(779 | ) | (1,472 | ) | (1,725 | ) | (819 | ) | (1,158 | ) | (2,064 | ) | |||||||||

Net revenues |

130,573 | 123,022 | 124,187 | 64,688 | 62,526 | 122,025 | |||||||||||||||

Operating Expenses: |

|||||||||||||||||||||

Casino |

20,787 | 16,146 | 16,956 | 7,885 | 8,533 | 17,604 | |||||||||||||||

Food, beverage and retail |

7,063 | 7,330 | 6,650 | 3,506 | 3,076 | 6,220 | |||||||||||||||

Selling, general and administrative |

43,506 | 40,295 | 39,773 | 20,703 | 19,628 | 38,698 | |||||||||||||||

Depreciation |

10,025 | 9,554 | 9,849 | 4,794 | 4,953 | 10,008 | |||||||||||||||

Gaming Commission and surveillance expense |

3,695 | 3,791 | 3,187 | 1,535 | 1,429 | 3,081 | |||||||||||||||

Compact revenue sharing trust fund |

1,335 | 1,335 | 1,335 | 668 | 668 | 1,335 | |||||||||||||||

(Gain) Loss on sale of assets |

— | 116 | — | — | (56 | ) | (56 | ) | |||||||||||||

Total operating expenses |

86,411 | 78,567 | 77,750 | 39,091 | 38,231 | 76,890 | |||||||||||||||

Income from Operations |

44,162 | 44,455 | 46,437 | 25,597 | 24,295 | 45,135 | |||||||||||||||

Non-operating Expenses: |

|||||||||||||||||||||

Interest expense |

(20,865 | ) | (20,860 | ) | (20,804 | ) | (10,430 | ) | (10,340 | ) | (20,714 | ) | |||||||||

Interest income |

1,006 | 74 | 58 | 28 | 13 | 43 | |||||||||||||||

Non-operating expenses, net |

(19,859 | ) | (20,786 | ) | (20,746 | ) | (10,402 | ) | (10,327 | ) | (20,671 | ) | |||||||||

Income before Distributions to the Tribe |

$ | 24,303 | $ | 23,669 | $ | 25,691 | $ | 15,195 | $ | 13,968 | $ | 24,464 | |||||||||

17

| |

Year Ended December 31, | Six Months Ended June 30, |

Twelve Months Ended June 30, |

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2008 | 2009 | 2010 | 2010 | 2011 | 2011 | |||||||||||||

| |

|

|

|

(unaudited) |

(unaudited) |

||||||||||||||

| |

(Dollars in thousands) |

||||||||||||||||||

Other Financial Data: |

|||||||||||||||||||

Net cash provided by operating activities |

$ | 54,617 | $ | 53,957 | $ | 54,453 | $ | 30,715 | $ | 26,685 | $ | 50,423 | |||||||

Net cash used in capital and related financing activities |

(60,888 | ) | (36,438 | ) | (35,797 | ) | (19,635 | ) | (19,303 | ) | (35,465 | ) | |||||||

Net cash provided by investing activities |

1,006 | 74 | 58 | 28 | 13 | 43 | |||||||||||||

EBITDA(1) |

54,187 | 54,009 | 56,286 | 30,391 | 29,248 | 55,143 | |||||||||||||

Capital expenditures |

41,698 | 16,768 | 17,895 | 9,363 | 9,513 | 18,045 | |||||||||||||

Ratio of total debt(2) to EBITDA(3) |

3.6x | 3.7x | 3.6x | — | — | 3.6x | |||||||||||||

Distributions to the Tribe |

$ | 13,919 | $ | 13,324 | $ | 13,617 | $ | 6,796 | $ | 6,948 | $ | 13,769 | |||||||

| |

December 31, | June 30, | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2008 | 2009 | 2010 | 2010 | 2011 | |||||||||||

| |

|

|

|

(unaudited) |

||||||||||||

| |

(Dollars in thousands) |

|||||||||||||||

Balance Sheet Data: |

||||||||||||||||

Cash and cash equivalents |

$ | 27,348 | $ | 31,618 | $ | 36,713 | $ | 35,930 | $ | 37,160 | ||||||

Restricted cash(4) |

7,090 | 7,098 | 4,330 | 7,101 | 4,332 | |||||||||||

Total current assets |

28,824 | 33,340 | 38,501 | 37,512 | 41,828 | |||||||||||

Total assets |

194,570 | 208,306 | 222,152 | 224,643 | 224,410 | |||||||||||

Total debt(2) |

199,091 | 199,874 | 199,719 | 199,550 | 199,888 | |||||||||||

Total current liabilities |

11,193 | 14,248 | 215,403 | 22,018 | 210,641 | |||||||||||

Total net assets (deficit) |

(15,669 | ) | (5,324 | ) | 6,749 | 3,075 | 13,769 | |||||||||

Total liabilities and net assets |

$ | 194,570 | $ | 208,306 | $ | 222,152 | $ | 224,643 | $ | 224,410 | ||||||

- (1)

- EBITDA

is defined by us as income before distributions to the Tribe, interest, depreciation and amortization. We are an unincorporated governmental

instrumentality of a federally recognized sovereign Indian Tribe, and, as a result, are not subject to federal or state income tax under current interpretations of tax laws. EBITDA is not a measure of

net income, operating income or other performance metrics derived from, or in accordance with, GAAP, and is subject to important limitations. We have provided this non-GAAP financial

measure because we believe EBITDA is useful to an investor evaluating our operating performance. Other companies in our industry and in other industries may calculate EBITDA differently from the way

that we do, limiting its usefulness as a comparative measure. EBITDA should not be considered as a measure of discretionary cash available to us to invest in the growth of our business. For periods

after June 30, 2011, we will present Adjusted EBITDA which will reflect add backs for our annual MOA payments of $3.5 million and our annual Proschold lease payments. The tables below

provide a reconciliation of EBITDA to net cash provided by operating activities and of EBITDA and Adjusted EBITDA to income before distributions to the Tribe for the periods indicated.

- (2)

- Total

debt consists of the current and long-term portion for all periods presented.

- (3)

- We have included information concerning the ratio of total debt to EBITDA in this offering memorandum as it is used by us and certain investors as a measure of our ability to service our debt.

18

- (4)

- Restricted cash consists of the balance remaining in a restricted account funded with the proceeds of the Existing Notes and pledged to the holders of the Existing Notes. This cash will be released from such restricted account upon the consummation of this offering.

The following table reconciles EBITDA and net cash provided by operating activities for the periods indicated:

| |

Year Ended December 31, | Six Months Ended June 30, |

Twelve Months Ended June 30, |

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2008 | 2009 | 2010 | 2010 | 2011 | 2011 | |||||||||||||

| |

|

|

|

(unaudited) |

(unaudited) |

||||||||||||||

| |

(Dollars in thousands) |

||||||||||||||||||

Net cash provided by operating activities |

$ | 54,617 | $ | 53,957 | $ | 54,453 | $ | 30,715 | $ | 26,685 | $ | 50,423 | |||||||

(Increase) decrease in accounts receivable |

(239 | ) | 198 | 23 | (124 | ) | (258 | ) | (111 | ) | |||||||||

(Increase) decrease in inventories |

16 | (91 | ) | 18 | (14 | ) | (6 | ) | 26 | ||||||||||

(Increase) decrease in prepaid expenses and other current assets |

(190 | ) | 141 | 23 | (3 | ) | 3,144 | 3,170 | |||||||||||

(Increase) decrease in deposits and other assets |

— | — | 88 | 183 | 82 | (13 | ) | ||||||||||||

Increase (decrease) in accounts payable |

518 | (436 | ) | 1,827 | 600 | (37 | ) | 1,190 | |||||||||||

Increase (decrease) in payable to Tribe |

— | — | 136 | — | (452 | ) | (316 | ) | |||||||||||

Increase (decrease) in accrued liabilities |

(535 | ) | 207 | (282 | ) | (966 | ) | 34 | 718 | ||||||||||

Proceeds on sale of assets |

— | 33 | — | — | 56 | 56 | |||||||||||||

EBITDA(1) |

$ | 54,187 | $ | 54,009 | $ | 56,286 | $ | 30,391 | $ | 29,248 | $ | 55,143 | |||||||

19

The following table reconciles EBITDA and Adjusted EBITDA to income before distributions to the Tribe for the periods indicated:

| |

Six Months Ended June 30, 2011 |

Twelve Months Ended June 30, 2011 |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Actual | Pro forma(1) | Actual | Pro forma(1) | |||||||||

| |

(unaudited) |

||||||||||||

Income before distributions to the Tribe |

$ | 13,968 | $ | 10,826 | $ | 24,464 | $ | 18,180 | |||||

Add back net interest |

10,327 | 10,327 | 20,671 | 20,671 | |||||||||

Add back depreciation |

4,953 | 4,953 | 10,008 | 10,008 | |||||||||

EBITDA(2) |

$ | 29,248 | $ | 26,106 | $ | 55,143 | $ | 48,859 | |||||

Add back MOA payments |

— | 1,750 | — | 3,500 | |||||||||

Add back Proschold lease payments |

— | 1,392 | — | 2,784 | |||||||||

Adjusted EBITDA(3) |

$ | 29,248 | $ | 29,248 | $ | 55,143 | $ | 55,143 | |||||

- (1)

- Pro

forma reflects the payment of $3.5 million to Sonoma County pursuant to the MOA and $2.8 million to the Tribe pursuant to the Proschold

lease agreement as if such payments were expensed during such periods.

- (2)

- EBITDA

is defined by us as income before distributions to the Tribe, interest, depreciation and amortization.

- (3)

- Adjusted EBITDA is defined by us as EBITDA before MOA payments and Proschold lease payments. Adjusted EBITDA is not a measure of net income, operating income or other performance metrics derived from, or in accordance with, GAAP, and is subject to important limitations. We have provided this non-GAAP financial measure because we believe Adjusted EBITDA is useful to an investor evaluating our financial performance, as the extent of our obligation to mandatorily redeem Notes with Excess Cash Flow and to make distributions to the Tribe is dependent on the level of our Adjusted EBITDA or its equivalent, Cash Flow.

20

MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following is a discussion of our financial condition and results of operations for the six months ended June 30, 2011 and 2010 and the fiscal years ended December 31, 2010, 2009 and 2008. You should read this section together with the financial statements and related notes for these periods appearing elsewhere in this offering memorandum, and the following discussion is qualified by reference thereto. This discussion includes forward-looking statements based on assumptions about our future business. Our actual results could differ materially from those contained in the forward-looking statements.

Overview

Recent Operational Highlights

While our operations have been impacted by the general economic challenges that have affected the gaming industry over the past few years, we have mitigated the impact of the economic downturn through our continuous focus on maximizing efficiencies and controlling expenses while maintaining a quality experience for our guests. For the twelve month period ended June 30, 2011, we generated net revenue of $122.0 million and EBITDA of $55.1 million. During the twelve months ended June 30, 2011, our EBITDA margin was 45.2%, which was essentially unchanged from our EBITDA margin of 45.1% during the same period in 2010.

Throughout 2011 we continued improving the appearance and appeal of our casino in accordance with our strategic operating plan. We recently completed an extensive renovation to rejuvenate the casino with the goal of creating the largest visible impact to visitors. In January 2011, we removed our poker tables to make way for approximately 60 additional penny denomination slot machines. In 2010, we introduced a new high-limit room with premium service designed to appeal to higher end players. These improvements follow a complete redesign of our gaming floor in 2010 to create more open space, improve sightlines and reduce congestion. New carpeting and new slot machine chairs were installed, which create an improved gambling experience. We have also expanded and improved our food and beverage offerings to create a more diverse, customized and cost-efficient selection. In addition, in July 2009 we spent approximately $0.6 million to upgrade our slot accounting and player tracking systems.

General

We own and operate the River Rock Casino, a gaming and entertainment facility located on the Tribe's 93-acre trust land, approximately 75 miles north of San Francisco in Sonoma County, California. Our customers consist primarily of residents of Sonoma, Napa and Marin Counties, as well as the San Francisco Bay area, including the major metropolitan cities of San Francisco, Oakland and San Jose. In addition, we attract tourists visiting the region's vineyards. We are the closest and most accessible Class III casino to the San Francisco Bay area. Our casino fully opened in April 2003 and has since had a successful operating history, growing net revenue and EBITDA from $104.5 million and $36.3 million, respectively, in 2004 to $122.0 million and $55.1 million, respectively, in the twelve-month period ended June 30, 2011.

Critical Accounting Policies and Estimates

We have identified certain critical accounting policies and estimates that affect our more significant judgments and estimates used in the preparation of our financial statements. The preparation of our financial statements, in conformity with GAAP, requires that we make estimates and judgments that affect the reported amounts of assets and liabilities, revenues and expenses, and related disclosures of contingent assets and liabilities. On an on-going basis, we evaluate those estimates, including those related to asset impairment, accruals for our promotional slot club, compensation and related benefits, revenue recognition, contingencies and litigation. These estimates are based on the information that is

21

currently available to us and on various other assumptions that we believe to be reasonable under the circumstances. Actual results could vary from those estimates under different assumptions or conditions. We believe that the following critical accounting policies affect significant judgments and estimates used in the preparation of our financial statements:

- •

- Casino Revenues—Casino revenue is recognized as the net win from gaming activities, which is the difference

between gaming wins and losses. Casino revenues are net of accruals for anticipated payouts of progressive slot jackpots and certain player incentives, when earned by the customer.

- •

- Capital Assets—Capital assets are stated at cost. Depreciation and amortization are computed using the straight-line method over the estimated useful lives of the assets as follows:

Buildings and improvements: |

5-21 years | |

Furniture, fixtures and equipment: |

5 years |

| We evaluate our capital assets for impairment in accordance with the Accounting pronouncement GASB No. 42, "Accounting and Financial Reporting for Impairment of Capital Assets and for Insurance Recoveries." GASB No. 42 establishes accounting and financial reporting standards for impairment of capital assets. Our capital assets include building and improvements, furniture, fixtures and equipment. A capital asset is considered impaired if both the decline in service utility of the capital asset is large in magnitude and the event or change in circumstances is outside the normal life cycle of the capital asset. We are required to evaluate prominent events or changes in circumstances affecting capital assets to determine whether impairment of a capital asset has occurred. Common indicators of impairment include evidence of physical damage where restoration efforts are needed to restore service utility, enactment or approval of laws or regulations setting standards that the capital asset would not be able to meet, technological development or evidence of obsolescence, a change in the manner or expected duration of use of a capital asset or construction stoppage. GASB No. 42 requires us to report the effects of capital asset impairment in our financial statements when they occur, rather than as part of the ongoing depreciation expense for the capital asset or upon disposal of the capital asset, and to account for insurance recoveries in the same manner. |

- •

- Accrued Progressive Slot Jackpots—Accrued progressive slot jackpots consist of estimates for prizes relating

to various games that have accumulated jackpots. We have recorded the anticipated payouts as a reduction of casino revenues and as a component of accrued liabilities. We do not accrue for the base

jackpot.

- •

- Contingencies—We assess our exposure to loss contingencies, including legal matters, and provide for an exposure if it is judged to be probable and estimable. If the actual loss from a contingency differs from management's estimate, operating results could be materially impacted. As of June 30, 2011, we have determined that no accruals for claims and legal actions are required. If circumstances surrounding claims and legal actions change materially, the addition of accruals for such items in future periods may be required.

There are differences between financial statements prepared in accordance with GASB pronouncements and those prepared in accordance with the Codification issued by the FASB. The statements of revenues, expenses and changes in net assets are a combined statement under GASB pronouncements. The FASB Codification allows a statement of income or operations and a separate statement of owners' or shareholders' equity, which is where distributions to owners would be presented. The amount shown as income before distributions to the Tribe would be the most comparable amount to net income computed under the FASB Codification. We are a separate enterprise fund of the Tribe, a governmental entity, and as such there is no owners' or shareholders'

22

equity as traditionally represented under the FASB Codification. The most comparable measure of owners' equity is presented on our balance sheet as net assets.