UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A-1

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): August 8, 2011

PSM Holdings, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

Nevada

|

333-151807

|

90-0332127

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

1112 N. Main Street, Roswell, NM

|

88201

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (575) 624-4170

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act

|

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

|

Item 9.01 Financial Statements and Exhibits

On August 8, 2011, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Fidelity Mortgage Company, a Colorado corporation (“Fidelity”), the closing of which was affective August 1, 2011. At closing, Fidelity was merged into United Community Mortgage Corporation (“UCMC”) a wholly-owned subsidiary of PrimeSource Mortgage, Inc., which is our wholly-owned subsidiary. The shareholders of Fidelity received 1,785,714 shares of our common stock in exchange for all the outstanding shares of Fidelity. A report on Form 8-K disclosing the transaction was filed with the Commission on August 12, 2011. The following audited financial statements

of Fidelity and pro-forma financial information required pursuant to this item for this transaction are included with this amended report. Pursuant to the terms of the merger agreement and prior to closing, Fidelity spun-off certain of its assets and liabilities into a newly formed entity unrelated to us. The effect of the merger on net income of Fidelity is reflected in the pro-forma adjustments set forth in the pro-forma statement of operations included with this report. Management believes that these changes will result in increased profitability of Fidelity’s operations as a result of this merger.

|

(A)

|

Financial statements of businesses acquired

|

|

Fidelity Mortgage Company

Independent Auditor's Report – June 15, 2011

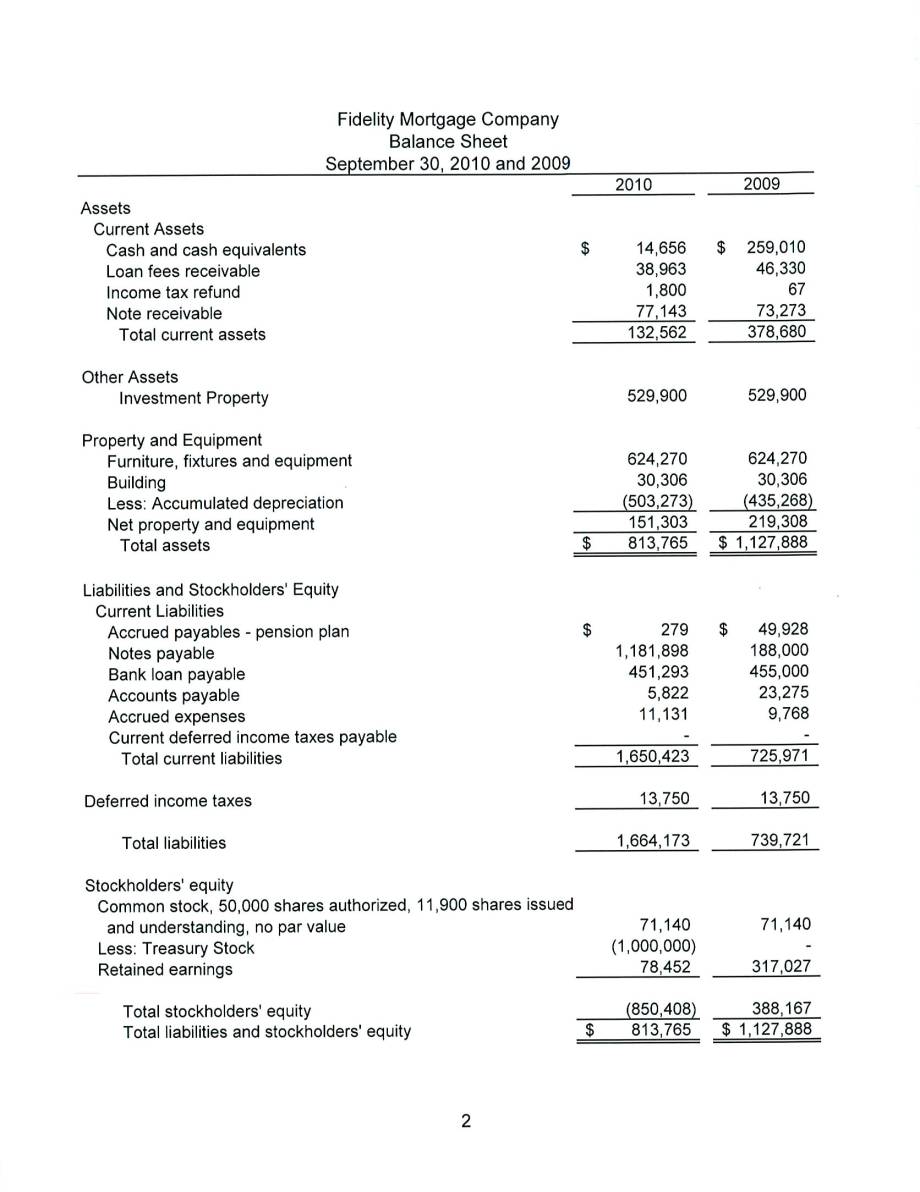

Balance Sheet at September 30, 2010 and 2009

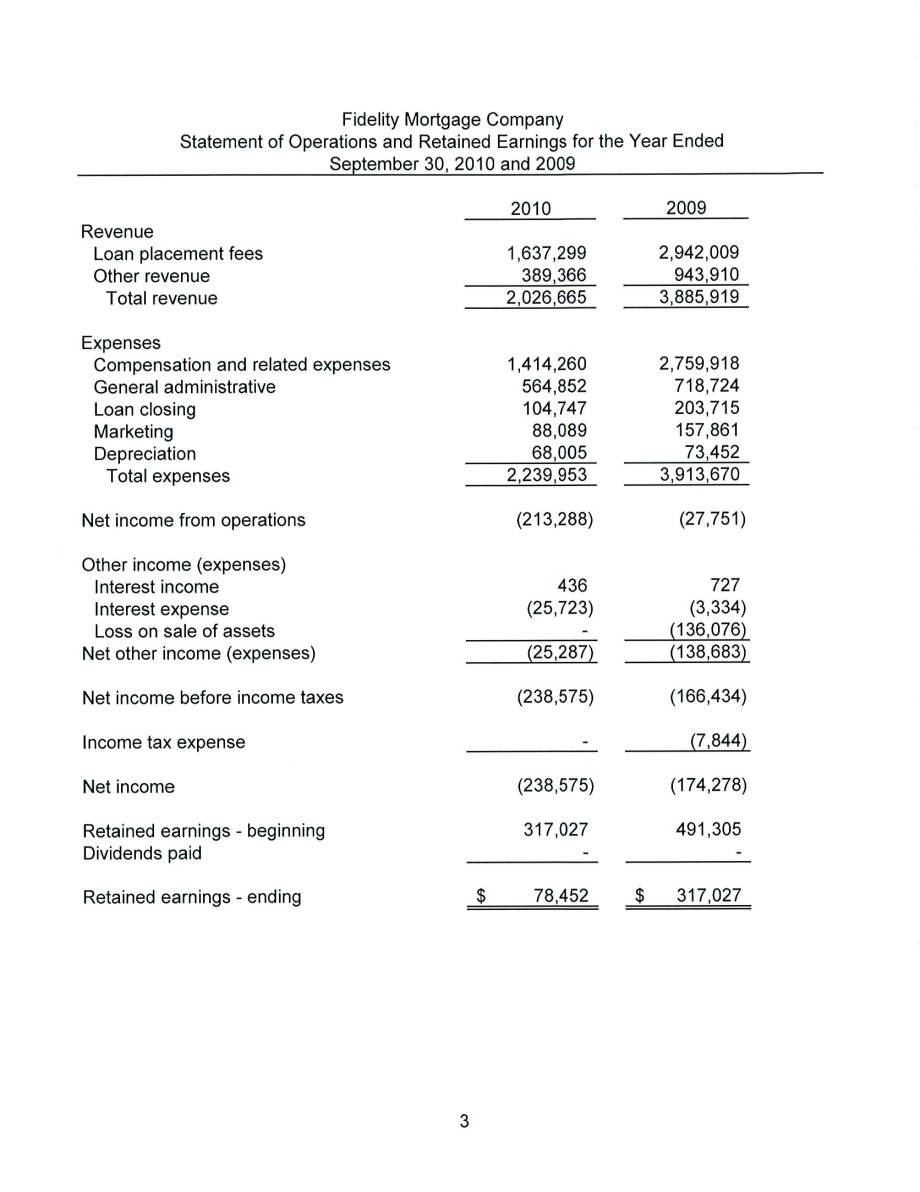

Statement of Operations and Retained Earnings for the years ended September 30, 2010 and 2009

Statements of Cash Flows for the years ended September 30, 2010 and 2009

Notes to Financial Statements

Balance Sheet at June 30, 2011 (Unaudited) and September 30, 2010

Statement of Operations for the nine months ended June 30, 2011 and 2010 (Unaudited)

Statement of Shareholders’ Equity for the nine months ended June 30, 2011 (Unaudited)

Statements of Cash Flows for the nine months ended June 30, 2011 and 2010 (Unaudited)

Notes to Financial Statements (Unaudited)

|

||

|

(B)

|

Pro-forma financial information (page 16)

|

|

Pro-forma financial information required by this item is included in this amended report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this amended report to be signed on its behalf by the undersigned hereunto duly authorized.

|

PSM Holdings, Inc.

|

|||

|

Date: October 20, 2011

|

By:

|

/s/ Ron Hanna

|

|

|

Ron Hanna, President

|

|||

|

(A)

|

Financial statements of businesses acquired

|

Fidelity Mortgage Company

Financial Statements

For the Year Ended

September 30, 2010 and 2009

1

2

3

|

Fidelity Mortgage Company

|

||||||||

|

Statements of Cash Flows for the Year Ended

|

||||||||

|

September 30, 2010 and 2009

|

||||||||

|

2010

|

2009

|

|||||||

|

Cash Flows Operating Activities

|

||||||||

|

Net income (loss)

|

$ | (213,288 | ) | $ | (27,751 | ) | ||

|

Adjustments to reconcile net income to net cash provided by

|

||||||||

|

operating activities:

|

||||||||

|

Depreciation

|

68,005 | 73,452 | ||||||

|

Decrease an advance to employees

|

- | - | ||||||

|

Increase deferred income tax

|

1,961 | |||||||

|

(Increase) decrease in accounts receivable and other

|

5,634 | 95,290 | ||||||

|

Increase (decrease) in accounts payable

|

(17,453 | ) | 31,337 | |||||

|

Increase (decrease) in pension plan

|

(49,649 | ) | (10,987 | ) | ||||

|

(Increase) decrease in income taxes

|

(7,844 | ) | ||||||

|

Increase in accrued expenses

|

1,363 | 7,208 | ||||||

|

Net cash (used) provided by operating activities

|

(205,388 | ) | 162,666 | |||||

|

Cash flows from investing activities

|

||||||||

|

Increase in notes receivable

|

(3,870 | ) | 4,927 | |||||

|

Sale of property

|

- | (136,076 | ) | |||||

|

Investment Income

|

436 | 727 | ||||||

|

Interest expense

|

(25,723 | ) | (3,334 | ) | ||||

|

Loan proceeds

|

- | 455,000 | ||||||

|

Acquisition of property for investment purpose

|

- | (529,900 | ) | |||||

|

Acquisition of property and equipment

|

- | (13,608 | ) | |||||

|

Net cash (used) by investing activities

|

(29,157 | ) | (222,264 | ) | ||||

|

Cash flows from financing activities

|

||||||||

|

Loan proceeds

|

- | 188,000 | ||||||

|

Dividends

|

(9,809 | ) | - | |||||

|

Net cash provided by financing activities

|

(9,809 | ) | 188,000 | |||||

|

Net increase (decrease) in cash and cash equivalents

|

(244,354 | ) | 128,402 | |||||

|

Cash and cash equivalents - beginning

|

259,010 | 130,608 | ||||||

|

Cash and cash equivalents - ending

|

$ | 14,656 | $ | 259,010 | ||||

|

Supplemental cash flow disclosures

|

||||||||

|

Cash paid for:

|

||||||||

|

Interest

|

25,723 | 3,334 | ||||||

|

Income taxes

|

- | 8,146 | ||||||

|

Items not effecting cash flows: Purchase of treasury stock on a note for $1,000,000.

|

||||||||

4

5

6

7

|

FIDELITY MORTGAGE COMPANY

|

||||||||

|

BALANCE SHEET

|

||||||||

|

June 30

|

September 30,

|

|||||||

|

2011

|

2010

|

|||||||

|

(UNAUDITED)

|

||||||||

|

ASSETS

|

||||||||

|

Current Assets:

|

||||||||

|

Cash and cash equivalents

|

$ | 254,980 | $ | 14,656 | ||||

|

Loan fees receivable

|

39,761 | 38,963 | ||||||

|

Income tax refund

|

1,800 | 1,800 | ||||||

|

Notes receivable

|

1,169,812 | 77,143 | ||||||

|

Total Current Assets

|

1,466,353 | 132,562 | ||||||

|

Property and Equipment:

|

||||||||

|

Furniture, fixtures and equipment

|

606,448 | 624,270 | ||||||

|

Building improvements

|

30,306 | 30,306 | ||||||

|

Less - accumulated depreciation

|

(596,456 | ) | (503,273 | ) | ||||

|

Property and Equipment - Net

|

40,298 | 151,303 | ||||||

|

Other Assets

|

||||||||

|

Investment property

|

361,312 | 529,900 | ||||||

|

Total Assets

|

$ | 1,867,963 | $ | 813,765 | ||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

||||||||

|

Current Liabilities:

|

||||||||

|

Accounts payable - pension plan

|

$ | - | $ | 279 | ||||

|

Accounts payable

|

68,481 | 5,822 | ||||||

|

Accrued expenses

|

- | 11,131 | ||||||

|

Bank loan payable

|

451,293 | 451,293 | ||||||

|

Notes payable

|

1,942,136 | 1,181,898 | ||||||

|

Related party advances

|

85,809 | - | ||||||

|

Total Current Liabilities

|

2,547,719 | 1,650,423 | ||||||

|

Deferred income taxes

|

- | 13,750 | ||||||

|

Total Liabilities

|

2,547,719 | 1,664,173 | ||||||

|

Stockholders' Equity

|

||||||||

|

Common stock, 50,000 shares authorized, 11,900 shares issued

and outstanding, no par value

|

71,140 | 71,140 | ||||||

|

Less Treasury stock

|

(1,000,000 | ) | (1,000,000 | ) | ||||

|

Retained earnings

|

249,104 | 78,452 | ||||||

|

Total Stockholders' Equity

|

(679,756 | ) | (850,408 | ) | ||||

|

Total Liabilities and Stockholders' Equity

|

$ | 1,867,963 | $ | 813,765 | ||||

|

The accompanying notes are an integral part of these unaudited financial statements.

|

||||||||

8

|

FIDELITY MORTGAGE COMPANY

|

||||||||

|

STATEMENT OF OPERATIONS

|

||||||||

|

(UNAUDITED)

|

||||||||

|

For the nine months ended June 30,

|

||||||||

|

2011

|

2010

|

|||||||

|

Revenues

|

||||||||

|

Loan placement fees

|

$ | 427,013 | $ | 1,738,767 | ||||

|

Other revenue

|

1,541,464 | - | ||||||

|

Total revenue

|

1,968,477 | 1,738,767 | ||||||

|

Operating expenses

|

||||||||

|

Selling, general & administrative expenses

|

1,672,833 | 1,783,453 | ||||||

|

Depreciation

|

10,863 | 11,227 | ||||||

|

Total operating expenses

|

1,683,696 | 1,794,680 | ||||||

|

Net income (loss) from operations

|

284,781 | (55,913 | ) | |||||

|

Other income (expense)

|

||||||||

|

Interest income

|

193 | 355 | ||||||

|

Interest expense

|

(84,723 | ) | (38,820 | ) | ||||

|

Other

|

(29,599 | ) | 1,067 | |||||

|

Total other income (expense)

|

(114,129 | ) | (37,398 | ) | ||||

|

Provision for income tax

|

- | - | ||||||

|

Net profit (loss)

|

$ | 170,652 | $ | (93,311 | ) | |||

|

The accompanying notes are an integral part of these unaudited financial statements.

|

||||||||

9

|

FIDELITY MORTGAGE COMPANY

|

||||||||||||||||||||

|

STATEMENT OF SHAREHOLDERS' EQUITY

|

||||||||||||||||||||

|

FOR THE NINE MONTHS ENDED JUNE 30, 2011

|

||||||||||||||||||||

|

(UNAUDITED)

|

||||||||||||||||||||

|

Common stock

|

Treasury

|

Retained

|

||||||||||||||||||

|

Shares

|

Amount

|

Stock

|

Earnings

|

Total

|

||||||||||||||||

|

Balance - September 30, 2010

|

11,900 | $ | 71,140 | $ | (1,000,000 | ) | $ | 78,452 | $ | (850,408 | ) | |||||||||

|

Net profit

|

- | - | - | 170,652 | 170,652 | |||||||||||||||

|

Balance - June 30, 2011

|

11,900 | $ | 71,140 | $ | (1,000,000 | ) | $ | 249,104 | $ | (679,756 | ) | |||||||||

|

The accompanying notes are an integral part of these unaudited financial statements.

|

||||||||||||||||||||

10

|

FIDELITY MORTGAGE COMPANY

|

||||||||

|

STATEMENTS OF CASH FLOWS

|

||||||||

|

(UNAUDITED)

|

||||||||

|

For the nine months ended June 30,

|

||||||||

|

2011

|

2010

|

|||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

||||||||

|

Net profit (loss)

|

$ | 170,652 | $ | (93,311 | ) | |||

|

Adjustments to reconcile net profit (loss) to cash cash used by operating activities:

|

||||||||

|

Depreciation

|

10,863 | 11,227 | ||||||

|

Decrease in loan fees receivable

|

(798 | ) | 46,330 | |||||

|

Increase in income tax refund

|

- | (398 | ) | |||||

|

Increase in notes receivable

|

(1,092,669 | ) | (46,447 | ) | ||||

|

Decrease in accounts payable

|

62,380 | (73,203 | ) | |||||

|

Decrease in accrued expenses

|

(11,131 | ) | (7,793 | ) | ||||

|

Decrease in deferred income taxes

|

(13,750 | ) | (13,750 | ) | ||||

|

Net cash used in operating activities

|

(874,454 | ) | (177,345 | ) | ||||

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

||||||||

|

Cash proceeds from sale of property and equipment

|

100,142 | 63,975 | ||||||

|

Proceeds from Investment property

|

168,588 | - | ||||||

|

Net cash provided by investing activities

|

268,730 | 63,975 | ||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

||||||||

|

Cash payments of notes payable

|

760,238 | - | ||||||

|

Cash poceeds frm notes payable

|

- | 2,016 | ||||||

|

Cash proceeds from shareholder

|

85,809 | - | ||||||

|

Net cash provided by financing activities

|

846,048 | 2,016 | ||||||

|

Net increase (decrease) in cash and cash equivalents

|

240,324 | (111,355 | ) | |||||

|

Cash and cash equivalents - beginning of the period

|

14,656 | 259,010 | ||||||

|

Cash and cash equivalents - end of the period

|

$ | 254,980 | $ | 147,655 | ||||

|

SUPPLEMENTAL CASH FLOW DISCLOSURES:

|

||||||||

|

Cash paid for interest

|

$ | 114,322 | $ | 38,820 | ||||

|

Cash paid for income taxes

|

$ | - | $ | - | ||||

|

The accompanying notes are an integral part of these unaudited financial statements.

|

||||||||

11

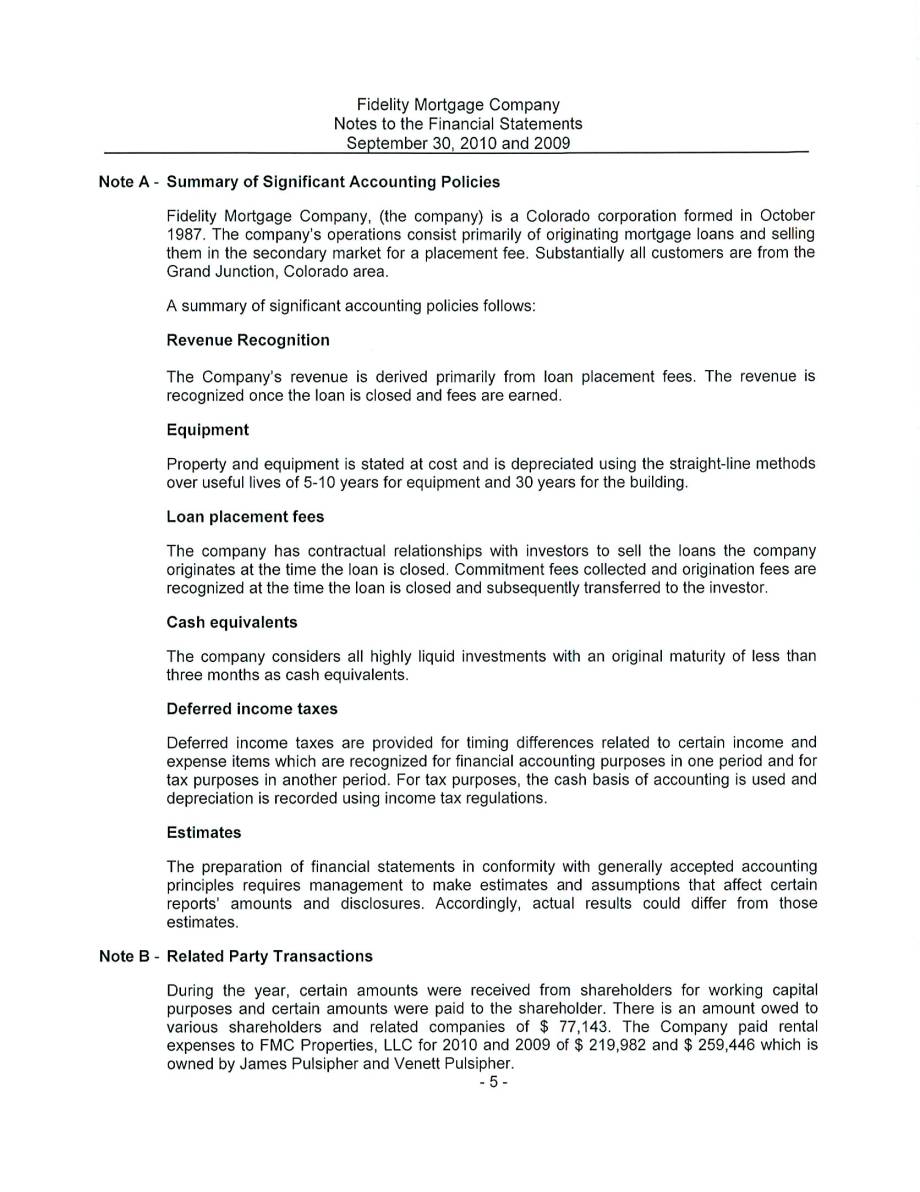

Fidelity Mortgage Company

Notes to the Financial Statements

June 30, 2011

(UNAUDITED)

|

Note A -

|

Summary of Significant Accounting Policies

|

Fidelity Mortgage Company, (the “Company”) is a Colorado corporation formed in October 1987. The Company’s operations consist primarily of originating mortgage loans and selling them in the secondary market for a placement fee. Substantially all customers are from the Grand Junction, Colorado area.

The following summary of significant accounting policies of the Company is presented to assist in the understanding of the Company’s financial statements. The financial statements and notes are the representation of the Company’s management who is responsible for their integrity and objectivity. The financial statements of the Company conform to accounting principles generally accepted in the United States of America (GAAP). The Financial Accounting Standards Board (FASB) is the accepted standard-setting

body for establishing accounting and financial reporting principles.

Use of Estimates

Management uses estimates and assumptions in preparing financial statements. Those estimates and assumptions affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the reported revenues and expenses. Accordingly, actual results could differ from those estimates. Significant estimates include the value of other non-current assets, estimated depreciable lives of property, plant and equipment, estimated valuation of deferred tax

assets due to net operating loss carry-forwards and estimates of uncollectible amounts of loans and notes receivable.

Cash and Cash Equivalents

For the purposes of the statement of cash flows, cash and cash equivalents include cash on hand and cash in checking and savings accounts, and all investment instruments with an original maturity of three months or less.

Loan Fees Receivable

Loan fees receivable represent fees earned on closed loans charged to customers that the Company has not yet received payment. Loan fees receivable are stated at the amount management expects to collect from balances outstanding at period-end. The Company estimates the allowance for doubtful accounts based on an analysis of specific accounts and an assessment of the customer’s ability to pay.

Notes Receivable

Notes receivable are stated at the unpaid principal balance. Interest income is recognized in the period in which it is earned.

Property and equipment

Property and equipment is stated at cost and is depreciated using the straight-line method over useful lives of 5-10 years for equipment and 30 years for the building.

12

Revenue Recognition

The Company’s revenue is derived primarily from loan placement fees. The revenue is recognized once the loan is closed and fees are earned.

Loan placement fees

The Company has contractual relationships with investors to sell the loans the Company originates at the time the loan is closed. Commitment fees collected and origination fees are recognized at the time the loan is closed and subsequently transferred to the investor.

Deferred income taxes

Deferred income taxes are provided for timing differences related to certain income and expense items which are recognized for financial accounting purposes in one period and for tax purposes in another period. For tax purposes, the cash basis of accounting is used and depreciation is recorded using income tax regulations.

|

Note B -

|

Related Party Transactions

|

During the year, certain amounts were received from shareholders for working capital purposes and certain amounts were paid to the shareholder. There is an amount owed from various shareholders and related companies of $85,809, and the Company owed various shareholders and other related companies $954,789. The Company paid rental expenses to the shareholders for the nine months ended June 30, 2011 and 2010 amounting to & $9,000 and $197,462, respectively.

|

Note C -

|

Commitments and Contingencies

|

Loans originated by the company are assigned to another sponsoring mortgage company (sponsor) who provides the funding at closing. The Company has an obligation to repurchase mortgage loans from the sponsor if they do not meet certain criteria. At June 30, 2011, the management of Fidelity Mortgage Company believed they had complied with all the necessary criteria, and were not aware of any claims on those closed loans.

|

Note D -

|

Concentrations of Credit Risk

|

Fidelity Mortgage Company maintains its bank accounts with two financial institutions. Cash in these accounts, are insured up to $250,000. At June 30, 2011, the Company's cash balance in the financial institution was $323,200, all of which was insured under FDIC.

|

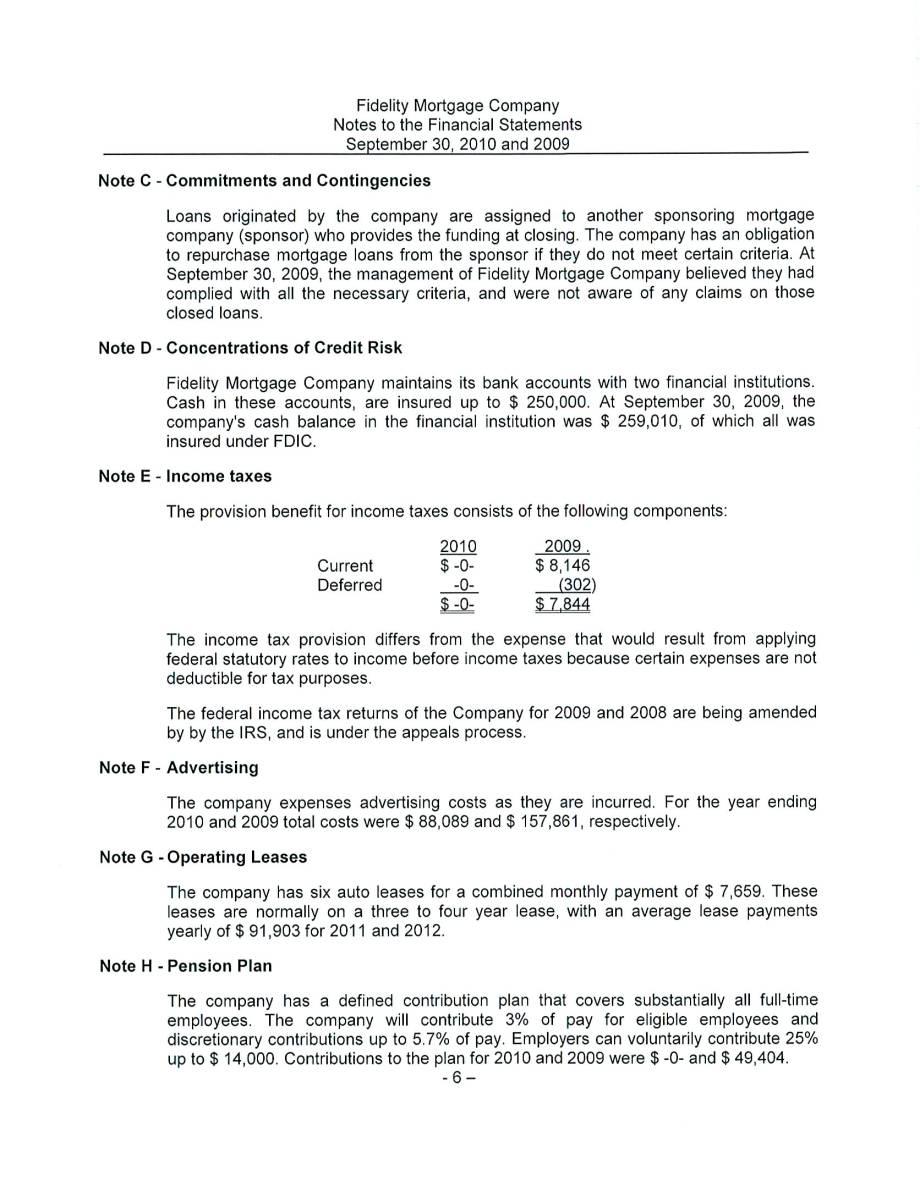

Note E -

|

Income taxes

|

|

Deferred income tax expense consists of the following at June 30, 2011:

|

$ | - | ||

|

Current income tax expense

|

119,823 | |||

|

Deferred income tax expense prior

|

$ | 119,823 | ||

|

Total deferred income tax expense

|

|

Note F -

|

Advertising

|

The Company expenses advertising costs as they are incurred. For the nine months ended June 30, 2011 and 2010, the total costs were $72,916 and $60,423.

13

|

Note G -

|

Operating Leases

|

The Company has six auto leases and an equipment lease for a combined monthly payment of $7,659. These leases are normally on a three to four year lease. The Company recorded an expense for auto leases amounting $64,181 and $81,024 for the nine months ended June 30, 2011 and 2010, respectively.

|

Note H -

|

Notes Receivable

|

There are various notes receivables that interest and principle is due on a monthly basis with interest rates ranging from 6.38% to 16%. These payments are collected monthly and are paid to those individuals or shareholders who hold the note.

|

Note I -

|

Investment Property and Related Obligations

|

The Company purchased an investment property in 2009 for $529,000 which is secured by a bank loan of $451,293 and a loan payable of $188,000. The Company obtained a bank loan of $455,000, secured by investment property, with monthly interest payments of $2,155 at 6.0% interest rate, with a balloon payment of $451,293 due on May 27, 2012. As of June 30, 2011, Note payable to the bank amounted to $451,293.

|

Note J -

|

Notes Payable |

The Company executed several promissory notes payable to investors, bearing monthly payments ranging from $17 to $1,984, annual interest rate ranging from 6.75% to 16%, and note secured by the assets of the Company. The balance due on the promissory notes on June 30, 2011 was $1,942,136. The Company recorded interest expense of $84,723 and $38,820 on the note to investors for the nine months ended June 30, 2011 and 2010, respectively.

|

Note K -

|

Treasury Stock |

The Company purchased treasury stock from Venette Pulsipher in the amount of $1,000,000 to buy out her ownership interest in the Company. A note payable to Venetta Pulsipher was created with a balance of $1,000,000 at 6% interest and monthly payments of $11,102 for 120 months, maturing in August 2020. Principal and interest payments for the years ended September 30, 2011 are as follows:

|

Year

|

Principal

|

Interest

|

||||||||

|

2011

|

$ | 51,877 | $ | 39,713 | ||||||

|

2012

|

79,915 | 53,310 | ||||||||

|

2013

|

84,844 | 48,431 | ||||||||

|

2014

|

90,077 | 43,148 | ||||||||

|

2015

|

95,633 | 37,592 | ||||||||

| 2016-2020 | 574,260 | 91,863 | ||||||||

| $ | 976,606 | $ | 314,057 | |||||||

14

|

Note L -

|

Subsequent Events |

On August 8, 2011, the Company entered into a merger agreement to merge into United Community Mortgage Corporation (UCMC) effective August 1, 2011. Pursuant to the terms of the merger agreement and prior to closing effective August 1, 2011, the Company spun-off certain of its assets and liabilities into a newly formed entity unrelated to UCMC. The Company merged all of its assets and liabilities at closing, and it’s shareholders received in exchange 1,785,714 shares of common stock of PSM Holdings, Inc. As of October 19, 2011,

no other subsequent events or transactions had occurred that would have materially impacted the financial statements as presented.

15

(B) Pro-forma financial information

PSM Holdings, Inc. and Subsidiaries

Unaudited Pro-forma Financial Information

The following presents our unaudited pro-forma financial information. The pro-forma adjustments to the balance sheet give effect to the acquisitions of Fidelity Mortgage Company as if the transaction occurred on June 30, 2011. The pro-forma statements of operations give effect to the business acquisitions of Fidelity Mortgage Company, as if the acquisitions had occurred at July 1, 2010. The pro-forma adjustments are based upon available information and certain assumptions that we believe are reasonable.

The unaudited pro-forma financial information is for informational purposes only and does not purport to present what our results would actually have been had these transactions actually occurred on the dates presented or to project our results of operations or financial position for any future period. The information set forth below should be read together with the significant notes and assumptions to the pro-forma statements, and the PSM Holdings, Inc. Annual Report on Form 10-K for the fiscal year ended June 30, 2011, and the audited financial statements of Fidelity Mortgage Company for the years ended September 30, 2010 and 2009, including the notes thereto, and the unaudited financial statements of Fidelity

Mortgage Company for the nine months ended June 30, 2011 including the notes thereto, included in this Form 8-K/A.

16

PSM HOLDINGS, INC. AND SUBSIDIARIES

PRO FORMA BALANCE SHEET

(UNAUDITED)

JUNE 30, 2011

|

Historical

|

||||||||||||||||||||||

|

Acquirer

|

Acquiree

|

Pro-forma Adjustments

|

||||||||||||||||||||

|

PSM Holdings

|

Fidelity Mortgage

|

Debit

|

Credit

|

Pro-Forma

|

||||||||||||||||||

|

ASSETS

|

||||||||||||||||||||||

|

Current Assets:

|

||||||||||||||||||||||

|

Cash & cash equivalents

|

$ | 21,470 | $ | 254,980 | A1 | 254,980 | $ | 19,265 | ||||||||||||||

| 7,795 | A2 | |||||||||||||||||||||

| C1 | 10,000 | |||||||||||||||||||||

|

Accounts receivable, net

|

40,768 | 39,761 | A1 | 39,761 | 81,696 | |||||||||||||||||

| 40,928 | A2 | |||||||||||||||||||||

|

Prepaid expenses

|

192,000 | 1,800 | A1 | 1,800 | 192,000 | |||||||||||||||||

|

Mortgage note receivable

|

1,169,812 | A1 | 1,169,812 | |||||||||||||||||||

|

Other assets

|

4,202 | - | 4,202 | |||||||||||||||||||

|

Total current assets

|

258,440 | 1,466,353 | 297,163 | |||||||||||||||||||

|

Property and equipment, net

|

25,321 | 40,298 | A1 | 40,298 | 64,412 | |||||||||||||||||

| 39,091 | A2 | |||||||||||||||||||||

|

Intangible assets, net

|

1,595,576 | 412,186 | A2 | 2,007,762 | ||||||||||||||||||

|

Customer list

|

- | - | 750,000 | A2 | 750,000 | |||||||||||||||||

|

Loan receivable

|

88,898 | 88,898 | ||||||||||||||||||||

|

Employee advances

|

152,155 | 152,155 | ||||||||||||||||||||

|

Note receivable

|

360,000 | 360,000 | ||||||||||||||||||||

|

Investment property

|

- | 361,312 | A1 | 361,312 | - | |||||||||||||||||

|

Security deposits

|

8,375 | - | 8,375 | |||||||||||||||||||

|

Total Assets

|

$ | 2,488,765 | $ | 1,867,963 | $ | 3,728,765 | ||||||||||||||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

||||||||||||||||||||||

|

Current Liabilities:

|

||||||||||||||||||||||

|

Accounts payable

|

$ | 134,797 | $ | 68,481 | 68,481 | A1 | $ | 134,797 | ||||||||||||||

|

Accrued liabilities

|

39,028 | - | 39,028 | |||||||||||||||||||

|

Notes payable

|

- | 1,027,946 | 1,027,946 | A1 | - | |||||||||||||||||

|

Bank loan payable

|

451,293 | 451,293 | A1 | - | ||||||||||||||||||

|

Accrued stock payable

|

778,000 | - | 778,000 | |||||||||||||||||||

|

Total current liabilities

|

951,825 | 1,547,720 | 951,825 | |||||||||||||||||||

|

Long-term Liabilities:

|

||||||||||||||||||||||

|

Due to related party

|

120,000 | - | 120,000 | |||||||||||||||||||

|

Total long-term liabilities

|

120,000 | - | 120,000 | |||||||||||||||||||

|

Total Liabilities

|

1,071,825 | 1,547,720 | 1,071,825 | |||||||||||||||||||

|

Stockholders' Equity:

|

||||||||||||||||||||||

|

Common stock

|

18,614 | 71,140 | 71,140 | A1 | 20,400 | |||||||||||||||||

| A2 | 1,786 | |||||||||||||||||||||

|

Treasury stock

|

(22,747 | ) | - | (22,747 | ) | |||||||||||||||||

|

Additional paid in capital

|

11,281,710 | - | A2 | 1,248,214 | 12,529,924 | |||||||||||||||||

|

Retained earnings (deficit)

|

(9,860,637 | ) | 249,103 | 249,103 | A1 | (9,870,637 | ) | |||||||||||||||

| 10,000 | C1 | |||||||||||||||||||||

|

Total stockholders' equity

|

1,416,940 | 320,243 | 2,656,940 | |||||||||||||||||||

|

Total Liabilities and Stockholders' Equity

|

$ | 2,488,765 | $ | 1,867,963 | $ | 3,127,963 | $ | 3,127,963 | $ | 3,728,765 | ||||||||||||

See Unaudited Significant Notes and Assumptions to Pro Forma Financial Statements.

17

PSM HOLDINGS, INC. AND SUBSIDIARIES

PRO FORMA STATEMENT OF OPERATIONS

FOR THE YEAR ENDED JUNE 30, 2011

(UNAUDITED)

|

Historical

|

||||||||||||||||||||||

|

Acquirer

|

Acquiree

|

Pro Forma Adjustments

|

||||||||||||||||||||

|

PSM Holdings

|

Fidelity Mortgage

|

Debit

|

Credit

|

Pro Forma

|

||||||||||||||||||

|

Revenues

|

$ | 3,863,446 | $ | 2,657,575 | $ | 6,521,021 | ||||||||||||||||

|

Operating expenses

|

A3 | 457,358 | ||||||||||||||||||||

|

Selling, general & administrative

|

5,896,999 | 2,497,540 | 10,000 | C1 | 7,947,181 | |||||||||||||||||

|

Depreciation and amortization

|

81,002 | 14,605 | 75,000 | A4 | 170,607 | |||||||||||||||||

|

Total operating expenses

|

5,978,001 | 2,512,145 | 8,117,788 | |||||||||||||||||||

|

Income (loss) from operations

|

(2,114,555 | ) | 145,430 | (1,596,767 | ) | |||||||||||||||||

|

Non-operating income (expense):

|

||||||||||||||||||||||

|

Interest expense

|

(6,896 | ) | (36,355 | ) | (43,251 | ) | ||||||||||||||||

|

Interest and dividend

|

6,945 | - | 6,945 | |||||||||||||||||||

|

Realized gain (loss) on sale of assets

|

5,057 | - | 5,057 | |||||||||||||||||||

|

Other Income (Expense)

|

32,024 | (7,722 | ) | 24,302 | ||||||||||||||||||

|

Total non-operating income (expense)

|

37,130 | (44,077 | ) | (6,947 | ) | |||||||||||||||||

|

Income (loss) from continuing operations before income tax

|

(2,077,425 | ) | 101,353 | (1,603,714 | ) | |||||||||||||||||

|

Provision for income tax

|

- | - | - | |||||||||||||||||||

|

Net income (loss)

|

(2,077,425 | ) | 101,353 | 85,000 | 457,358 | (1,603,714 | ) | |||||||||||||||

|

Other comprehensive income (loss):

|

||||||||||||||||||||||

|

Unrealized gain (loss) on marketable securities

|

(2,666 | ) | - | (2,666 | ) | |||||||||||||||||

|

Comprehensive income (loss)

|

$ | (2,080,091 | ) | $ | 101,353 | $ | 85,000 | $ | 457,358 | $ | (1,606,380 | ) | ||||||||||

|

Net loss per common share and equivalents -

|

||||||||||||||||||||||

|

basic and diluted loss from operations

|

$ | (0.09 | ) | |||||||||||||||||||

|

Weighted average shares of share capital outstanding

|

||||||||||||||||||||||

|

- basic & diluted

|

17,075,538 | |||||||||||||||||||||

|

Weighted average number of shares used to compute basic and diluted loss per share for the year ended June 30, 2011 is the same since the effect of dilutive securities is anti-dilutive.

|

||||||||||||||||||||||

See Unaudited Significant Notes and Assumptions to Pro Forma Financial Statements.

18

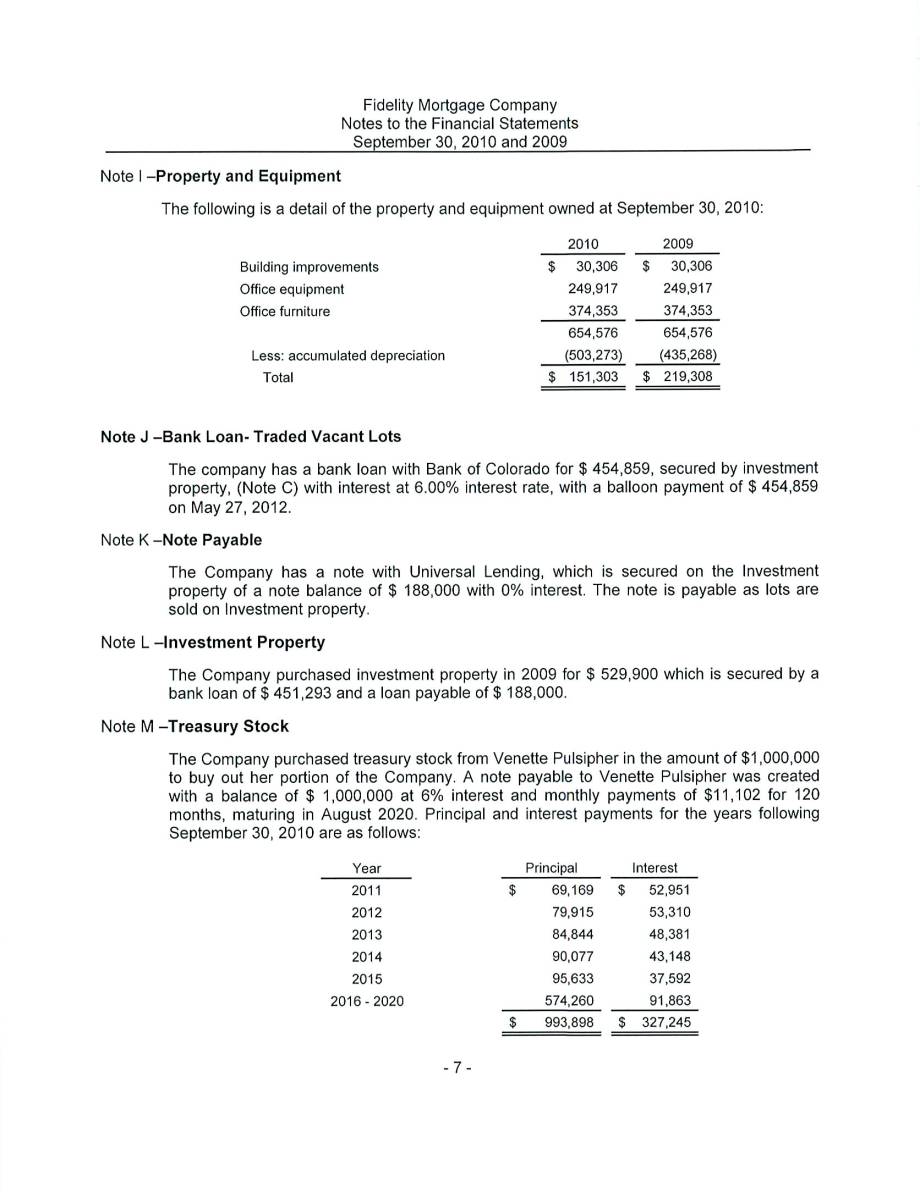

PSM Holdings, Inc. and Subsidiaries

Significant Notes and Assumptions to Pro-Forma Financial Statements

(Unaudited)

On August 8, 2011, we entered into an Agreement and Plan of Merger with Fidelity Mortgage Company, a Colorado Corporation. At closing Fidelity merged into United Community Mortgage Corp., a wholly-owned subsidiary of PrimeSource Mortgage, Inc., which is our wholly-owned subsidiary. The merger transaction closed effective August 1, 2011. On August 8, 2011, the closing was held for the Merger Agreement with Fidelity. James Pulsipher and Jared Peterson, as the sole shareholders of Fidelity, received 1,367,210 and 418,504 shares of our common stock, respectively, in the merger transaction in exchange for all the outstanding shares of Fidelity. The common shares issued by us to these shareholders

of Fidelity have not been registered under the Securities Act and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

The accompanying unaudited pro-forma financial information reflects the financial statements of PSM Holdings, Inc., our wholly-owned subsidiaries PrimeSource Mortgage, Inc. and United Community Mortgage Corporation. The pro-forma adjustments to the balance sheet give effect to the acquisitions of Fidelity as if the transaction occurred on June 30, 2011. The pro-forma adjustments to the statements of operations give effect to the acquisitions as if the transaction occurred on July 1, 2010.

Significant assumptions include:

The shares issued to the owners of Fidelity Mortgage were calculated contractually valued at $1,250,000 based on issuance of 1,785,714 shares of our common stock valued at $0.70 per share which was based on the closing price per share on the date of closing the transaction.

We incurred a non-recurring $10,000 of professional fees for legal and accounting related to the acquisition which is reflected as adjustments to accumulated deficit at June 30, 2011.

We assumed that S,G&A (Selling, general and administrative) expenses would have been reduced by $457,359 for the year ended June 30, 2011 as majority of these costs incurred relating to obtaining warehouse line of credit will not be incurred by Fidelity due to PSM Holdings, Inc. has available access to the warehouse lines of credit.

We assumed that the intangible asset “Customer list” will be amortized over a ten year period. We recorded an amortization expense of $75,000 for the year ended June 30, 2011 in the pro-forma financial statements.

The purchase price was allocated first to record identifiable assets and liabilities at their fair value and the remainder to customer list and goodwill based upon the independent valuation of a mortgage expert. The purchase price was allocated as follows:

|

FIDELITY MORTGAGE COMPANY

|

||||||||

|

ACQUISITION BALANCE SHEET

|

||||||||

|

AUGUST 1, 2011

|

||||||||

|

(UNAUDITED)

|

||||||||

|

Cash and cash equivalents

|

$ | 7,795 | ||||||

|

Accounts receivable

|

40,929 | |||||||

|

Property and equipment

|

636,754 | |||||||

|

Less Accumulated depreciation

|

(597,663 | ) | ||||||

|

Property and equipment, net

|

39,091 | |||||||

|

Total assets acquired

|

87,814 | |||||||

|

Liabilities assumed

|

- | |||||||

|

Net assets acquired

|

87,814 | |||||||

|

Goodwill

|

412,186 | |||||||

|

Customer list

|

750,000 | |||||||

|

Total purchase price

|

$ | 1,250,000 | ||||||

|

Common stock - 1,785,714 shares

|

$ | 1,786 | ||||||

|

Paid in Capital

|

1,248,214 | |||||||

|

Total purchase price

|

$ | 1,250,000 | ||||||

Depreciation of property and equipment has been given effect to the acquisitions as if they occurred on July 1, 2010.

19

The following reflect the pro-forma adjustments as at June 30, 2011:

PSM HOLDINGS, INC. AND SUBSIDIARIES

PRO-FORMA ADJUSTMENTS

JUNE 30, 2011

(UNAUDITED)

|

A. Fidelity Mortgage:

|

Debit

|

Credit

|

|||||||||

| A1 |

Cash and cash equivalents

|

$ | 254,980 | ||||||||

|

Accounts receivable

|

39,761 | ||||||||||

|

Prepaid expenses

|

1,800 | ||||||||||

|

Mortgage notes receivable

|

1,169,812 | ||||||||||

|

Property and equipment

|

40,298 | ||||||||||

|

Investment property

|

361,312 | ||||||||||

|

Accounts payable

|

68,481 | ||||||||||

|

Notes payable

|

1,027,946 | ||||||||||

|

Bank loan payable

|

451,293 | ||||||||||

|

Common stock

|

71,140 | ||||||||||

|

Retained earnings

|

249,103 | ||||||||||

|

To remove the book value of assets and liabilities of the acquiree.

|

|||||||||||

| A2 |

Cash and cash equivalents

|

$ | 7,795 | ||||||||

|

Accounts receivable

|

40,928 | ||||||||||

|

Property and equipment

|

39,091 | ||||||||||

|

Goodwill

|

412,186 | ||||||||||

|

Customer list

|

750,000 | ||||||||||

|

Common stock

|

$ | 1,786 | |||||||||

|

Additional paid in capital

|

1,248,214 | ||||||||||

|

To record at fair value of assets acquired and liabilities assumed

pursuant to the purchase agreement.

|

|||||||||||

| A3 |

Accumulated deficit

|

$ | 457,358 | ||||||||

|

Selling, general and administrative expenses

|

$ | 457,358 | |||||||||

|

To record selling, general & administrative expenses incurred by

acquiree that will not be incurred as result of acquisition by acquiror.

|

|||||||||||

| A4 |

Amortization expense

|

$ | 75,000 | ||||||||

|

Accumulated amortization

|

$ | 75,000 | |||||||||

|

To record the amortization of customer list for the year ended

June 30, 2011.

|

|||||||||||

|

C. PSM Holdings, Inc.

|

|||||||||||

| C1 |

Accumulated deficit

|

$ | 10,000 | ||||||||

|

Cash

|

$ | 10,000 | |||||||||

|

To record non-recurring professional fees (acquirer expense)

incurred in the acquisitions for the year ended June 30, 2011.

|

|||||||||||

|

Total

|

$ | 3,660,321 | $ | 3,660,321 | |||||||

See Unaudited Significant Notes and Assumptions to Pro-forma Financial Statements.