Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CAPITAL ONE FINANCIAL CORP | d245193d8k.htm |

| EX-99.1 - EXHIBIT 99.1 - CAPITAL ONE FINANCIAL CORP | d245193dex991.htm |

| EX-99.2 - EXHIBIT 99.2 - CAPITAL ONE FINANCIAL CORP | d245193dex992.htm |

Third Quarter 2011

Results October 20, 2011

Exhibit 99.3 |

| 2

October 20, 2011

Forward-Looking Statements

Please note that the following materials containing information regarding

Capital One’s financial performance speak only as of the particular date or dates indicated in these

materials. Capital One does not undertake any obligation to update or

revise any of the information contained herein whether as a result of new information, future events or

otherwise.

Certain statements in this presentation and other oral and written

statements made by Capital One from time to time are forward-looking statements, including those that

discuss, among other things, strategies, goals, outlook or other

non-historical matters; projections, revenues, income, returns, accruals for claims in litigation and for other

claims against Capital One, earnings per share or other financial

measures for Capital One; future financial and operating results; Capital One’s plans, objectives,

expectations and intentions; the projected impact and benefits of the

pending transactions involving Capital One, HSBC and ING Direct (the “transactions”); and the

assumptions that underlie these matters. To the extent that any

such information is forward-looking, it is intended to fit within the safe harbor for forward-looking

information provided by the Private Securities Litigation Reform Act of

1995. Numerous factors could cause Capital One’s actual results to differ materially from those

described in such forward-looking statements, including, among other

things: general economic and business conditions in the U.S., the U.K., Canada, or Capital One’s local

markets, including conditions affecting employment levels, interest

rates, consumer income and confidence, spending and savings that may affect consumer bankruptcies,

defaults, charge-offs and deposit activity; an increase or decrease

in credit losses (including increases due to a worsening of general economic conditions in the credit

environment); the possibility that regulatory and other approvals and

conditions to either of the transactions are not received or satisfied on a timely basis or at all; the

possibility that modifications to the terms of either of the transactions

may be required in order to obtain or satisfy such approvals or conditions; the possibility that Capital

One will not receive third-party consents necessary to fully realize

the anticipated benefits of the transactions; the possibility that Capital One may not fully realize the

projected cost savings and other projected benefits of the transactions;

changes in the anticipated timing for closing either of the transactions; difficulties and delays in

integrating the assets and businesses acquired in the transactions;

business disruption during the pendency of or following the transactions; the inability to sustain revenue

and earnings growth; diversion of management time on issues related to

the transactions; reputational risks and the reaction of customers and counterparties to the

transactions; disruptions relating to the transactions negatively

impacting Capital One’s ability to maintain relationships with customers, employees and suppliers; changes

in asset quality and credit risk as a result of the transactions;

financial, legal, regulatory, tax or accounting changes or actions, including the impact of the Dodd-Frank Wall

Street Reform and Consumer Protection Act and the regulations promulgated

thereunder; developments, changes or actions relating to any litigation matter involving

Capital One; increases or decreases in interest rates; Capital One’s

ability to access the capital markets at attractive rates and terms to capitalize and fund its operations and

future growth; the success of Capital One’s marketing efforts in

attracting and retaining customers; increases or decreases in Capital One’s aggregate loan balances or the

number of customers and the growth rate and composition thereof,

including increases or decreases resulting from factors such as shifting product mix, amount of actual

marketing expenses Capital One incurs and attrition of loan balances; the

level of future repurchase or indemnification requests Capital One may receive, the actual future

performance of mortgage loans relating to such requests, the success

rates of claimants against Capital One, any developments in litigation and the actual recoveries Capital

One may make on any collateral relating to claims against Capital One;

the amount and rate of deposit growth; changes in the reputation of or expectations regarding the

financial services industry or Capital One with respect to practices,

products or financial condition; any significant disruption in Capital One’s operations or technology

platform; Capital One’s ability to maintain a compliance

infrastructure suitable for its size and complexity; Capital One’s ability to control costs; the amount of, and rate of

growth in, Capital One’s expenses as its business develops or

changes or as it expands into new market areas; Capital One’s ability to execute on its strategic and operational

plans; any significant disruption of, or loss of public confidence in,

the United States Mail service affecting Capital One’s response rates and consumer payments; Capital

One’s ability to recruit and retain experienced personnel to assist

in the management and operations of new products and services; changes in the labor and employment

markets; fraud or misconduct by Capital One’s customers, employees

or business partners; competition from providers of products and services that compete with Capital

One’s businesses; and other risk factors set forth from time to time

in reports that Capital One files with the Securities and Exchange Commission (the “SEC”), including,

but not limited to, the Annual Report on Form 10-K for the year ended

December 31, 2010, and Exhibit 99.5 to the Current Report on Form 8-K filed on July 13, 2011.

You should carefully consider the factors discussed above in evaluating

these forward-looking statements. All information in these slides is based on the consolidated results

of Capital One Financial Corporation, unless otherwise noted. A

reconciliation of any non-GAAP financial measures included in this presentation can be found in Capital

One’s most recent Current Report on Form 8-K filed October 20,

2011, available on Capital One’s website at www.capitalone.com under “Investors.”

|

| 3

October 20, 2011

•

Diluted EPS of $1.77, or $813M, compared to $1.97, or $911M, in Q2 2011

•

Ending loan balances increased $987M to $130B on growth in Auto Finance,

Commercial and Revolving Domestic Card balances

•

Net Interest Margin remained strong

•

Asset yields up 13 bps, largely due to credit benefits

•

Cost of funds down 6 bps

•

Pre-provision earnings increased as higher revenue was partially offset by increased

non-interest expense

•

Provision expense increased due to smaller allowance release, partially offset by

lower charge-offs

•

Charge-offs down 39 bps from 2.91% to 2.52%

•

Allowance coverage ratio down 19 bps from 3.48% to 3.29%

•

Capital generation remained strong

•

Basel 1 Tier 1 Common ratio of 10.0%; Basel 3 Tier 1 Common ratio ~10 bps higher

Third quarter 2011 highlights |

4

October 20, 2011

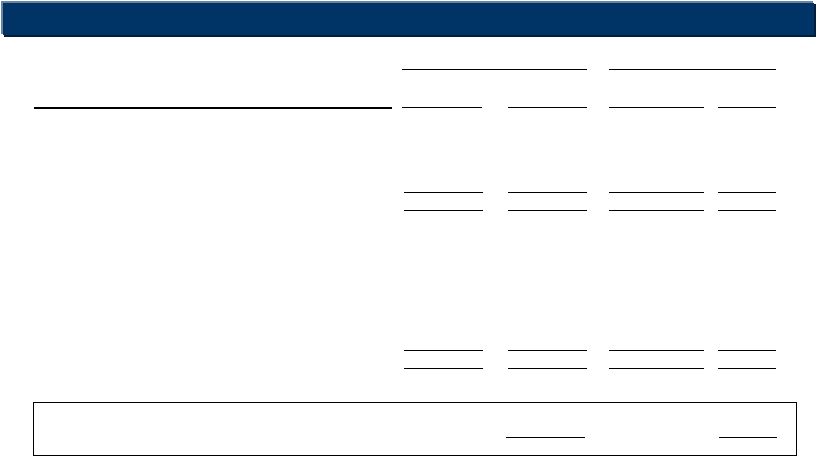

Loan balances increased modestly and margin expanded in the third

quarter

Average Balances & Margin Highlights

Average

Yield/

Average

Yield/

(Dollars in millions)(unaudited)

Balance

Rate

Balance

Rate

Interest-earning assets:

Loans held for investment

129,043

$

11.00

%

127,916

$

10.53

%

Investment securities

37,189

2.84

40,381

3.10

Cash equivalents and other

11,478

0.73

5,846

1.30

Total interest-earning assets

177,710

$

8.63

%

174,143

$

8.50

%

Interest-bearing liabilities:

Total interest-bearing deposits

110,750

$

1.06

%

109,251

$

1.12

%

Securitized debt obligations

18,478

1.93

22,191

2.04

Senior and subordinated notes

10,519

3.19

8,093

3.11

Other borrowings

8,369

4.06

9,167

3.49

Total interest-bearing liabilities

148,116

$

1.49

%

148,702

$

1.51

%

Interest income to average interest-earning assets

8.63

%

8.50

%

Interest expense to average interest-earning assets

1.24

1.30

Net interest margin

7.39

%

7.20

%

Quarter Ended 09/30/11

Quarter Ended 06/30/11 |

5

October 20, 2011

Third quarter 2011 earnings were $1.77 per share

Income Statement

Net interest income

Non-interest income

Revenue

Marketing expense

Operating expense

Pre-Provision Earnings (before tax)

Net charge-offs

Other

Allowance build (release)

Provision Expense

Discontinued operations, net of tax

Total company (after tax)

EPS

Tax expense

Pretax income

$MM

Operating Earnings (after tax)

Non-Interest Expense

3,283

871

4,154

312

1,985

2,297

1,857

812

18

(208)

622

813

865

(52)

$1.77

1,235

370

Q311

3,136

857

3,993

329

1,926

2,255

1,738

931

(9)

(579)

343

911

945

(34)

$1.97

1,395

450

Q211

5%

2%

4%

5%

(3)%

(2)%

7%

13%

400%

(64)%

(81)%

(11)%

(8)%

(53)%

(11)%

18%

(10)%

% Change |

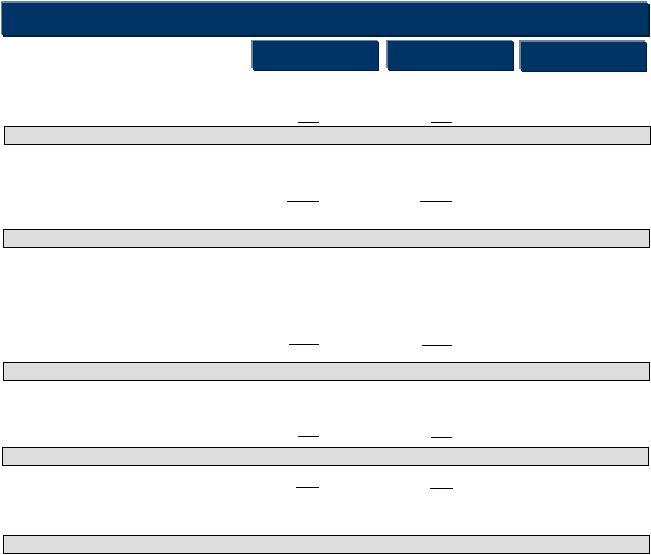

Our capacity to generate

capital remains strong Tier

1

Common

Equity

to

Risk-Weighted

Assets

(Basel

I)

1

8.2%

8.8%

8.4%

9.4%

10.0%

0%

2%

4%

6%

8%

10%

12%

Q310

Q410

Q111

Q211

Q311

Disallowed DTA

RWA

EOP Loans

(1.3)

(1.2)

125

127

126

126

(1.4)

142

124

Tier 1 Common excluding

disallowed DTA

($B)

11.5

12.4

13.4

Tier 1 Common

10.2

11.2

12.0

(0.6)

146

129

14.3

13.7

(0.2)

149

130

15.1

14.9

2

2

1

October 20, 2011

Tier 1 Common ratio is a non-GAAP measure calculated based on Tier 1 common equity divided by

risk-weighted assets. See "Exhibit 99.2—Table 12: Reconciliation of

Non-GAAP Measures and Calculation of Regulatory Capital Measures" for the calculation of this ratio.

Tier 1 Common ratio as of the quarter end does not reflect any impact from the equity forward sale

agreements executed in July 2011 which have not been settled in whole or in part.

6 |

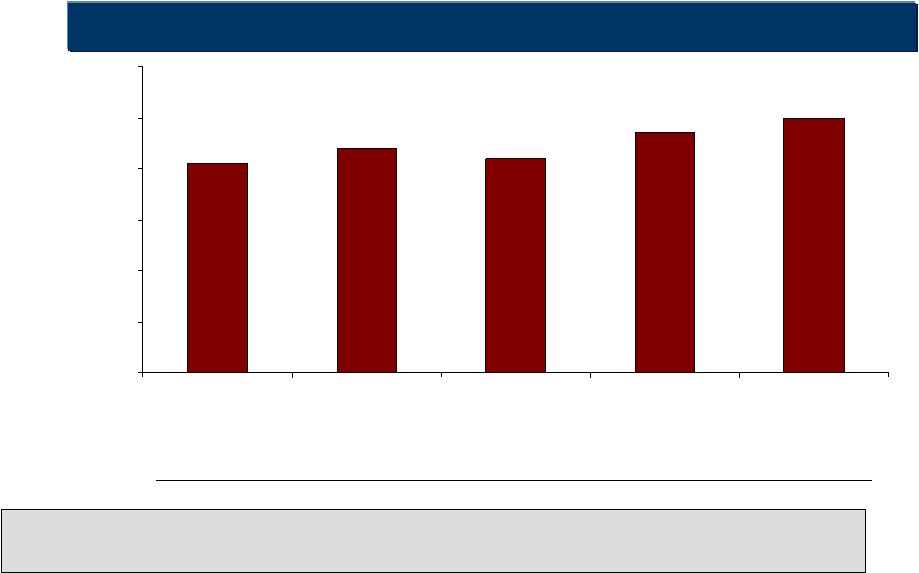

October 20, 2011

Growth in Auto Finance, Commercial Banking and Revolving Domestic

Card resulted in higher ending loan balances in the third quarter

Credit Card (EOP)

13,475

13,396

13,543

14,035

14,389

10,364

10,484

10,758

11,404

11,924

3,813

4,020

3,936

4,122

4,221

1,890

1,842

1,780

1,642

1,571

0

5

10

15

20

25

30

35

40

Q310

Q410

Q111

Q211

Q311

Commercial Banking

Consumer Banking

Comm’l

& Multi-Family

Middle Market

49,291

49,970

47,298

51,234

51,510

7,487

7,522

8,735

8,711

8,210

4,548

3,879

3,272

2,760

2,310

0

10

20

30

40

50

60

70

80

Q310

Q410

Q111

Q211

Q311

Revolving

Domestic Card

International

17643

17867

18342

19223

20422

12,763

12,103

11,741

11,323

10,916

4,591

4,413

4,223

4,046

4,014

0

5

10

15

20

25

30

35

40

45

50

Q310

Q410

Q111

Q211

Q311

Home Loans

Retail

Banking

Auto

Specialty Lending

Small Ticket CRE

$M

$M

$M

Installment

loans

7 |

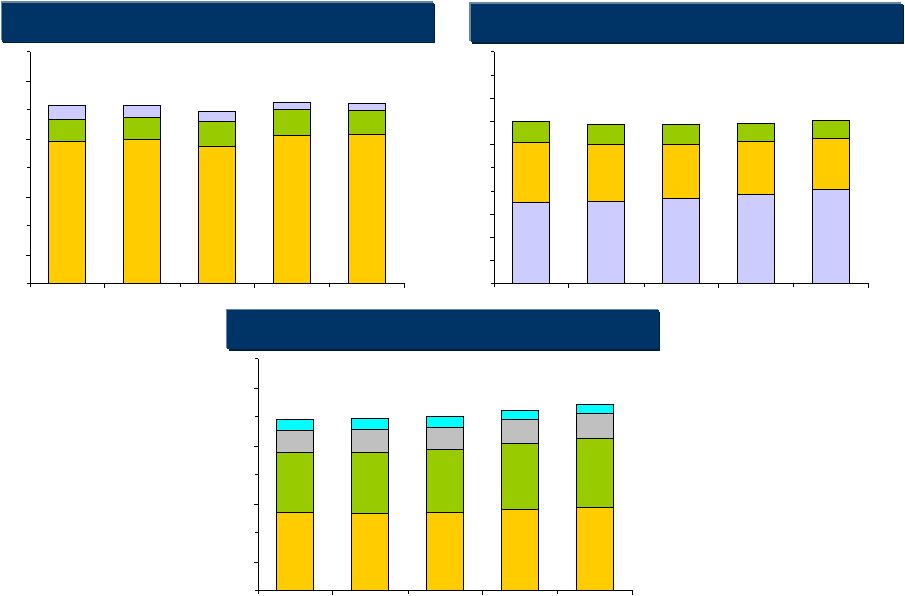

8

October 20, 2011

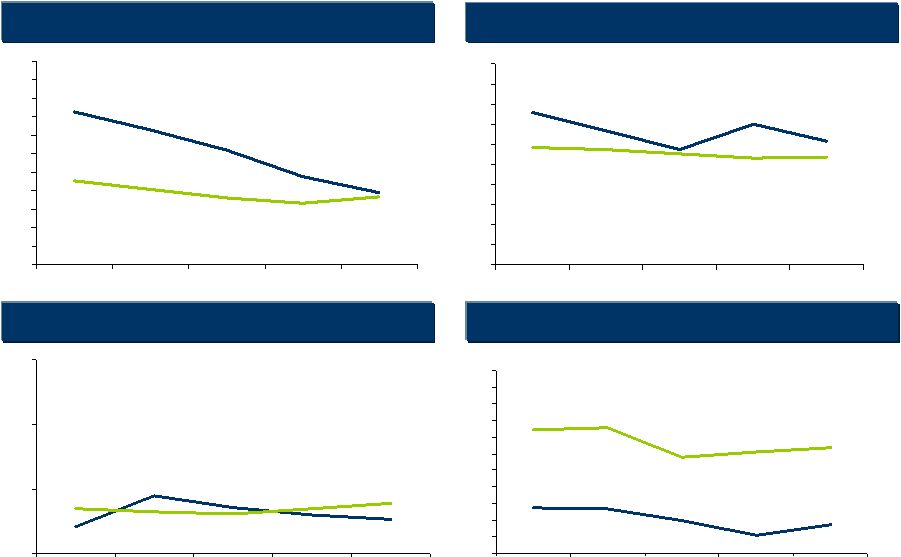

Consumer credit is stabilizing exhibiting expected seasonal patterns

3.92%

8.23%

4.74%

6.20%

7.28%

3.65%

3.33%

3.59%

4.53%

4.09%

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

11%

Q310

Q410

Q111

Q211

Q311

Domestic Credit Card ($53.7B*)

Net Charge-off Rate

30+ Day Delinquency Rate

Home Loan ($11.1B*)

0.71%

0.41%

0.60%

0.89%

0.53%

0.61%

0.70%

0.64%

0.69%

0.78%

0%

1%

2%

3%

Q310

Q410

Q111

Q211

Q311

Auto ($19.8B*)

6.68%

5.74%

7.02%

7.60%

6.15%

5.75%

5.84%

5.55%

5.30%

5.35%

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

Q310

Q410

Q111

Q211

Q311

International Credit Card ($8.7B*)

1.69%

2.65%

1.11%

2.71%

1.98%

6.34%

7.42%

7.58%

6.09%

5.79%

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

11%

Q310

Q410

Q111

Q211

Q311

Net Charge-off Rate

30+ Day Delinquency Rate

Net Charge-off Rate

30+ Day Performing

Delinquency Rate

Net Charge-off Rate

30+ Day Performing

Delinquency Rate

* Average Loans |

9

October 20, 2011

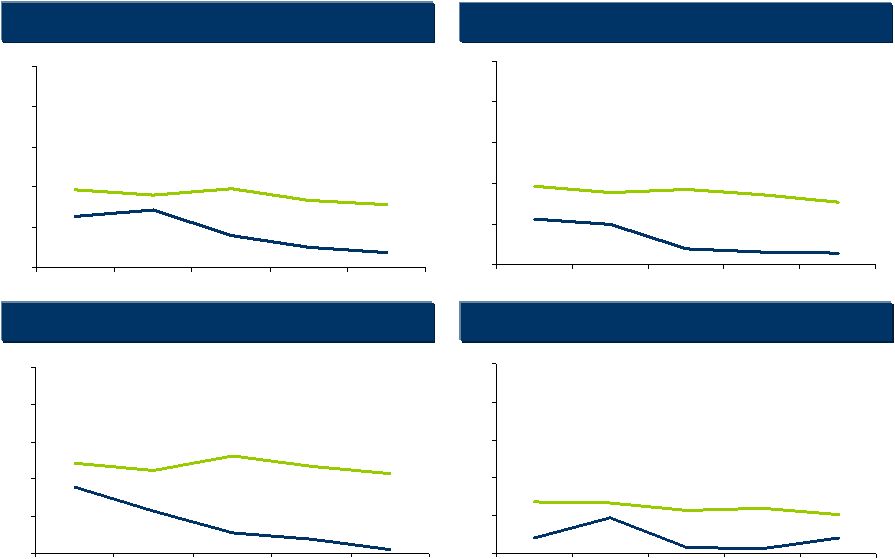

Commercial Banking credit metrics have stabilized and improved

modestly over the last five quarters

1.43%

0.79%

0.50%

1.27%

0.37%

1.80%

1.94%

1.95%

1.66%

1.55%

0%

1%

2%

3%

4%

5%

Q310

Q410

Q111

Q211

Q311

Total Commercial Banking ($31.3B*)

Nonperforming

Asset Rate

Charge-off

Rate

Commercial & Multi-Family Real Estate ($14.0B*)

0.12%

1.15%

0.39%

1.78%

0.56%

2.16%

2.42%

2.23%

2.35%

2.63%

0%

1%

2%

3%

4%

5%

Q310

Q410

Q111

Q211

Q311

Middle Market ($11.6B*)

Nonperforming

Asset Rate

Charge-off

Rate

1.00%

0.38%

0.30%

1.11%

0.28%

1.76%

1.94%

1.86%

1.71%

1.54%

0%

1%

2%

3%

4%

5%

Q310

Q410

Q111

Q211

Q311

Total Commercial Lending

Excluding Small Ticket CRE ($29.7B*)

Nonperforming

Asset Rate

Charge-off

Rate

0.41%

0.94%

0.13%

0.43%

0.18%

1.04%

1.38%

1.33%

1.19%

1.14%

0%

1%

2%

3%

4%

5%

Q310

Q410

Q111

Q211

Q311

Nonperforming

Asset Rate

Charge-off

Rate

* Average Loans |

10

October 20, 2011

We are in a strong position to deliver significant value to customers

and shareholders

Sustainable

economic

advantages

Positioned at

the forefront

of where

banking is

going

End-game

positions

with relevant

scale

Large and

loyal

customer

franchise

Advantaged

access to

both sides of

the balance

sheet

•

Growth potential (off a larger base)

•

Strong returns and capital generation

•

Strong balance sheet and financial resilience

•

National

consumer

assets

•

National brand

•

Digital

leadership and

scale

•

Local banking

in attractive

markets

•

Credit risk

underwriting

•

Direct/digital

distribution |

|