Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - WELLS FARGO & COMPANY/MN | d243657d8k.htm |

| EX-99.1 - THE PRESS RELEASE - WELLS FARGO & COMPANY/MN | d243657dex991.htm |

3Q11 Quarterly Supplement

October 17, 2011

Exhibit 99.2 |

Wells Fargo

3Q11 Supplement 1

Appendix

Pages 23-45

-

Non-strategic/liquidating loan portfolio risk reduction

24

-

Purchased credit-impaired (PCI) portfolios

25

-

PCI nonaccretable difference

26

-

PCI accretable yield

27

-

Commercial PCI accretable yield

28

-

Pick-a-Pay PCI accretable yield

29

-

3Q11 Credit quality highlights

30

-

Commercial nonaccrual loans

31

-

Consumer real estate nonaccrual loans

32

-

Commercial real estate (CRE) loan portfolio

33

-

Wholesale Banking CRE loan portfolio

34

-

Pick-a-Pay mortgage portfolio

35

-

Pick-a-Pay credit highlights

36

-

Pick-a-Pay nonaccrual loan composition

37

-

Real estate 1-4 family first mortgage portfolio

38

-

Home equity portfolio

39-40

-

Credit card portfolio

41

-

Auto portfolio

42

Forward-looking statements and

additional information

43

Tier 1 common equity under Basel I

44

Tier 1 common equity under Basel III

(Estimated)

45

Table of contents

3Q11 Results

-

3Q11 Results

Page 2

-

Continued strong diversification

3

-

Balance Sheet overview

4

-

Income Statement overview

5

-

Loans

6

-

Deposits

7

-

Net interest income

8

-

Drivers of net interest income

9

-

Noninterest income

10

-

Noninterest expense

11

-

Noninterest expense target

12

-

Community Banking

13

-

Wholesale Banking

14

-

Wealth, Brokerage and Retirement

15

-

Wachovia merger integration update

16

-

Credit quality

17-18

-

Mortgage servicing

19-20

-

Capital

21

-

Summary

22 |

Wells Fargo

3Q11 Supplement 2

Record earnings of $4.1 billion, up 3% linked

quarter (LQ) and 21% year-over-year (YoY)

$0.72 earnings per share, up 3% LQ and

20% YoY

ROA = 1.26%, up 17 bps from 3Q10

ROE = 11.86%, up from 10.90% in 3Q10

Pre-tax pre-provision profit

(1)

of $8.0 billion, up

$40 million LQ

Total revenue down $758 million from 2Q11

Noninterest expense declined $798 million or 6%

Continued improvement in credit quality

Capital levels continued to grow

-

9.35% Tier 1 common equity ratio under

Basel I and estimated Tier 1 common equity

ratio under Basel III of 7.41%

(2)

3Q11 Results

Wells Fargo Net Income

($ in millions)

3,339

3,414

3,759

3,948

4,055

3Q10

4Q10

1Q11

2Q11

3Q11

(1) Pre-tax pre-provision profit (PTPP) is total revenue less noninterest

expense. Management believes PTPP is a useful financial measure because it enables

investors and others to assess the Company’s ability to generate capital to cover credit

losses through a credit cycle.

(2) Pro forma calculation based on Tier 1 common equity, as adjusted to reflect

management’s interpretation of current Basel III capital proposals. This pro forma

calculation is subject to change depending on final promulgation of Basel III capital rulemaking and interpretations by regulatory authorities. See

pages 44-45 for additional information regarding Tier 1 common equity ratios.

|

Wells Fargo

3Q11 Supplement 3

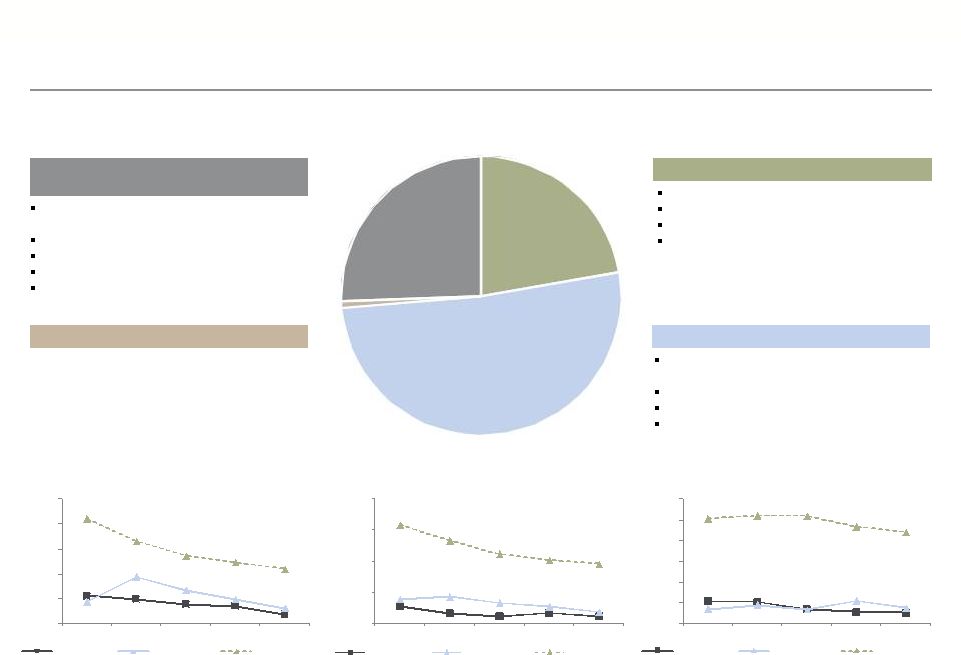

46%

54%

Balanced Spread and

Fee Income

Diversified Fee

Generation

12%

11%

20%

11%

12%

11%

9%

5%

9%

Service Charges

12%

Card Fees

11%

Other Banking Fees

12%

Mortgage Servicing, net

11%

Insurance

5%

Other Noninterest

Income

(1)

9%

Noninterest Income

46%

Net Interest Income

54%

All data is for 3Q11.

(1)

Diversified Loan

Portfolio

Commercial Loans

40%

Consumer Loans

55%

Continued strong diversification

55%

40%

5%

Foreign Loans

5%

Mortgage Orig./Sales, net

9%

Trust, Investment & IRA fees 11%

Commissions & all other fees 20%

Other noninterest income includes net gains (losses) on debt securities available for sale,

net gains from equity investments, net gains (losses) from trading activities, operating

leases and all other noninterest income. |

Wells Fargo

3Q11 Supplement 4

Balance Sheet overview

Period-end balances. All result change references are 3Q11 compared to 2Q11.

(1) See page 24 for additional information regarding the

non-strategic/liquidating portfolio, which comprises the Pick-a-Pay, liquidating home equity, legacy WFF

indirect auto, legacy WFF debt consolidation, Education Finance government guaranteed and

Commercial, legacy Wachovia Commercial Real Estate and other PCI loan portfolios.

Loans

Total period-end loans up $8.2 billion; core loans, which exclude

the $5.3 billion runoff of the non-strategic/liquidating portfolio,

grew $13.5 billion

(1)

Organic loan growth of $12.4 billion

Acquired $1.1 billion of commercial loans in 3Q11

Securities available for sale (AFS)

Balances up $20.9 billion on investment securities purchases

in 3Q11

Deposits

Balances up $41.8 billion on both flight to quality and new account

growth

Primary driver of net interest margin (NIM) compression: 12 bps

out of a 17 bps decline

Long-term debt

Balances down $9.7 billion due to continued maturities

$9.0 billion of maturities in 4Q11

Capital

Called for redemption $5.8 billion of trust preferred securities

in 3Q11

-

Tier 1 Capital reduced in 3Q11, but net interest income and NIM

benefit expected to start in 4Q11 |

Wells Fargo

3Q11 Supplement 5

Income Statement overview

Net interest income

Down $136 million as balance sheet repricing and lower variable

income was partially offset by growth in loans, securities and the

mortgage warehouse as well as one extra day in the quarter

NIM down 17 bps driven primarily by strong deposit flows, 12 bps

impact

Noninterest income

Mortgage banking up $214 million on higher originations

Market-sensitive revenues

(1)

of $202 million

Linked quarter market-sensitive revenues

(1)

down $808 million

-

Equity gains down $380MM from strong 2Q11 equity investment

business results

-

Trading loss included $234MM lower deferred compensation plan

investments (offset in benefits expense, so P&L neutral)

-

Loss and gain on two legacy Wachovia positions partially offset one

another ($377MM trading loss and $271MM debt securities gain)

-

Customer accommodation trading results down $108 million on weaker

market conditions

Insurance revenues down $145 million primarily due to crop insurance

seasonality (partial offset in expense)

Noninterest expense

Deferred compensation down $235 million (offset in trading)

Merger expenses down $108 million

Operating losses down $230 million reflecting lower litigation accruals

All result change references are 3Q11 compared to 2Q11.

(1) Market-sensitive revenues include trading, debt and equity gains (losses).

|

Wells Fargo

3Q11 Supplement 6

614.0

624.1

624.4

630.1

643.6

139.7

133.2

126.8

121.8

116.5

3Q10

4Q10

1Q11

2Q11

3Q11

Core loans

Non-strategic/liquidating loans

5.13%

5.11%

5.03%

5.00%

4.87%

Loans

Growth despite continued reduction in non-strategic/liquidating

portfolio Period-end loans up $8.2 billion from 2Q11

-

Commercial loans up $9.1 billion, or 3%, on

growth in both C&I and CRE driven by new

customer activity and new loans

•

Includes 3Q11 purchase of $1.1 billion in loans

from Bank of Ireland, all U.S.-based and largely

all commercial real estate

-

Consumer loans down $960 million as $4.5

billion in non-strategic loan portfolio runoff

more than offset growth in mortgage, core

auto, credit card and private student lending

Non-strategic/liquidating loans

(1)

down $5.3

billion from 2Q11

Core loans grew $13.5 billion, or 2%, from 2Q11

Total average loan yield of 4.87% down 13 bps

LQ and 26 bps YoY due to runoff of higher-

yielding loans including the non-strategic/

liquidating portfolio

-

Weighted average yield of the non-strategic

portfolio was 5.61% in 3Q11

Period–end Loans Outstanding

($ in billions)

(1)

753.7

757.3

751.2

751.9

Total average loan yield

760.1

Period-end balances.

(1) See page 24 for additional information regarding the

non-strategic/liquidating portfolio, which comprises the Pick-a-Pay, liquidating home equity,

legacy WFF indirect auto, legacy WFF debt consolidation, Education Finance government

guaranteed and Commercial, legacy Wachovia Commercial Real Estate and other PCI loan

portfolios. |

Wells Fargo

3Q11 Supplement 7

631.2

651.5

661.4

184.8

199.3

221.2

3Q10

2Q11

3Q11

Interest-bearing deposits

Noninterest-bearing deposits

0.35%

0.28%

0.25%

Deposits

Strong growth and reduced average cost

Average core deposits of $836.8 billion up $29.4

billion from 2Q11 and up $64.9 billion, or 8%,

from 3Q10

-

111% of average loans

-

Average retail core deposits up 4% annualized

from 2Q11

Average core checking and savings up $33.8

billion, or 5% from 2Q11, and up $82.3 billion, or

12%, from 3Q10

-

92% of average core deposits

Consumer checking accounts up a net 5.6%

from 3Q10

-

7.1% growth in California

-

7.7% growth in Florida

-

8.3% growth in New Jersey

-

9.8% growth in North Carolina

Average deposit cost of 25 bps down 3 bps from

2Q11 and 10 bps from 3Q10

Average Deposits and Rates

($ in billions)

816.0

Average deposit cost

Average Core Checking and Savings

($ in billions)

850.8

686.9

735.4

769.2

3Q10

2Q11

3Q11

882.6 |

Wells Fargo

3Q11 Supplement 8

Net interest income

Net Interest Income (TE)

(1)

($ in millions)

Net interest income (TE)

(1)

Tax-equivalent net interest income declined $137

million from 2Q11

-

Lower income from balance sheet repricing was

partially offset by growth in loans, securities and

the mortgage warehouse

-

Lower income from variable sources including

loan prepayments and resolutions

-

Benefit of one extra day in the quarter

Net interest margin

12 bps of the 17 bps decline in NIM due to $42

billion LQ increase in deposits

11,254

11,224

10,812

10,851

10,714

3Q10

4Q10

1Q11

2Q11

3Q11

4.25%

4.16%

4.05%

4.01%

3.84%

Net Interest Margin (NIM)

(1) Tax equivalent net interest income is based on the federal statutory rate of 35% for the

periods presented. Net interest income was $11,098 million, $11,063 million,

$10,651 million, $10,678 million and $10,542 million for 3Q10, 4Q10, 1Q11, 2Q11 and 3Q11, respectively. |

Wells Fargo

3Q11 Supplement 9

Drivers of net interest income

Net interest income and net interest margin do

not necessarily move in sync

-

Increase in deposits in 3Q11 diluted NIM 12

bps but increased NII by approximately $13

million

Growth in earning assets has helped mitigate

the decline in NII due to repricing

-

AFS portfolio increased by over $39 billion in

the last two quarters

-

Loans outstanding have grown nearly $9

billion in the last two quarters despite the

continued runoff of the liquidating portfolio

•

Core loan portfolio has grown each quarter

this year, including $13.5 billion in 3Q11

-

Mortgage warehouse grew $11.5 billion in

3Q11 on increased refinancing activity

While earning asset growth is the primary

driver, NII is also influenced by our liability mix

-

NII benefit from redemption of $5.8 billion of

TRUPs expected to begin in 4Q11

-

Long-term debt balances down $9.7 billion in

3Q11, with an additional $9 billion maturing

in 4Q11

2011 Period End Balance Sheet Trends

($ in millions)

3Q11

2Q11

1Q11

AFS portfolio

$

207,176

186,298

167,906

change from prior quarter

20,878

18,392

(4,748)

Loans

760,106

751,921

751,155

change from prior quarter

8,185

766

(6,112)

Liquidating loan portfolio

116,509

121,753

126,821

change from prior quarter

(5,244)

(5,068)

(6,483)

Core loan portfolio

643,597

630,168

624,334

change from prior quarter

13,429

5,834

371

Core deposits

849,632

808,970

795,038

change from prior quarter

40,662

13,932

(3,154)

|

Wells Fargo

3Q11 Supplement 10

Noninterest income

Service charges on deposit account fees up 3%

from 2Q11 primarily due to account and volume

growth

Trust and investment fees down 5% LQ on lower

investment banking originations and weaker retail

brokerage transaction activity

Mortgage banking up 13% LQ on higher

originations

-

Larger quarter-end pipeline and timing of revenue

recognition expected to lead to stronger 4Q11

mortgage revenue, but also increased expense

Insurance down 26% LQ substantially all due to

seasonality

Trading gains down $856 million driven by the

loss on resolving one legacy Wachovia position,

lower deferred compensation plan investment

results (P&L neutral) and lower core customer

accommodation trading

Debt securities gains up $428 million LQ, driven

by a $271 million gain on one legacy Wachovia

investment

Equity gains down $380 million LQ from strong

2Q11 equity investment results

Operating lease income up $181 million LQ on

higher lease settlement income

9,776

10,431

9,678

9,708

9,086

3Q10

4Q10

1Q11

2Q11

3Q11

vs

vs

($ in millions)

3Q11

2Q11

3Q10

Noninterest income

Service charges on deposit accounts

$

1,103

3

%

(3)

Trust and investment fees

2,786

(5)

9

Card fees

1,013

1

8

Other fees

1,085

6

8

Mortgage banking

1,833

13

(27)

Insurance

423

(26)

7

Net gains (losses) from trading activities

(442)

nm

nm

300

nm

nm

Net gains from equity investments

344

(52)

nm

Operating leases

284

nm

28

Other

357

(2)

(33)

Total nonterest income

$

9,086

(6)

%

(7)

Net gains (losses) on debt securities

available for sale |

Wells Fargo

3Q11 Supplement 11

Noninterest expense

Noninterest expense down $798 million from

2Q11 driven by lower employee benefits

expense, operating losses and integration costs;

down $576 million from 3Q10

-

Salaries increased $134 million, or 4%, on

higher severance expense and one extra day in

the quarter

-

Employee benefits expense down $384 million

primarily driven by lower deferred compensation

expense

-

$376 million of integration costs in 3Q11, down

$108 million from 2Q11

•

68% of merger integration costs in the quarter

were from outside professional services,

contract services and advertising

-

Other expenses down $474 million and

included:

•

$230 million decline in operating losses on

lower litigation accruals

•

$107 million decline in insurance expense

Currently expect 4Q11 expenses to be higher than

3Q11 driven by costs associated with the strong

mortgage pipeline, higher integration expenses and

seasonally higher expenses at year-end

12,253

13,340

12,733

12,475

11,677

3Q10

4Q10

1Q11

2Q11

3Q11

vs

vs

($ in millions)

3Q11

2Q11

3Q10

Noninterest expense

Salaries

$

3,718

4

%

7

Commission and incentive compensation

2,088

(4)

(8)

Employee benefits

780

(33)

(27)

Equipment

516

(2)

(7)

Net occupancy

751

-

1

Core deposit and other intangibles

466

-

(15)

FDIC and other deposit assessments

332

5

11

Other

3,026

(14)

(8)

Total noninterest expense

$

11,677

(6)

%

(5) |

Wells Fargo

3Q11 Supplement 12

Noninterest expense target

($ in millions)

Actual

2Q11

Actual

3Q11

Merger integration expense

$

484

$

376

$

-

Staff/technology functions

2,238

2,183

2,050-2,150

Loss mitigation and foreclosed asset expense

666

624

600-650

Business optimization

8,659

8,296

8,100-8,450

Operating

losses

(2)

428

198

not targeted

Total NIE

$

12,475

$

11,677

$

10,750-11,250

Targeted

4Q12

(1)

(2) Operating losses includes litigation accruals. (1)

Reflects management’s current targeted noninterest expense in 4Q12, which is subject to

change and may be affected by a variety of factors, including business and economic

cyclicality, seasonality, changes in our business composition and operating environment, growth in our business

and/or acquisitions, and unexpected expenses relating to, among other things, litigation and

regulatory matters. -

The target reflects expense savings initiatives to be executed over the next five quarters,

and reflects a 10-14% decline from 2Q11

-

We will continue to invest in our businesses and add team members and locations where

appropriate as we have done recently, for example, in banking stores in the East

-

Savings initiatives launched in 3Q11 included the consolidation of our consumer lending

businesses (Business optimization), and the consolidation of several business

technology groups and the streamlining of staff functions (Staff/technology

functions) Quarterly expense trends may vary

Noninterest

expense

is

targeted

to

decline

to

$11

billion

in

4Q12

through

Compass

initiatives

and

the

completion of merger integration activities |

Wells Fargo

3Q11 Supplement 13

3Q11

2Q11

3Q10

Regional Banking

Consumer

checking

account

growth

(1)

5.6

%

7.0

7.3

Business

checking

account

growth

(1)

3.8

4.5

5.0

Retail Bank cross-sell

5.91

5.84

5.68

Business

Banking

cross-sell

(2)

4.21

4.17

3.97

Community Banking

Higher segment earnings reflects stronger

mortgage banking revenues

Average loans declined 1% on non-strategic loan

runoff with growth in consumer real estate first

mortgage, core auto, credit card, private student

lending and SBA lending

Regional Banking

Strong combined net checking gains

-

Consumer checking up a net 5.6% from 3Q10

-

Business checking up a net 3.8% from 3Q10

Combined retail bank cross-sell of 5.91 products

per household up from 5.68

in 3Q10

-

West cross-sell = 6.28

-

East cross-sell = 5.39

Core product solutions of 8.80 million in the West,

up 15% from 3Q10

Wells Fargo Home Mortgage

Mortgage originations up $25 billion from 2Q11

while application volumes were up 55%

Managed residential mortgage servicing flat from

3Q10 = $1.8 trillion

(1) Checking account growth is period-ending, 12-month rolling.

(2) Western footprint including Wells Fargo and Wachovia customers.

vs

vs

($ in millions)

3Q11

2Q11

3Q10

Net interest income

$

7,264

(1)

%

(7)

Noninterest income

5,232

-

(7)

Provision for credit losses

1,978

3

(37)

Noninterest expense

6,901

(7)

(6)

Income tax expense

1,217

18

28

Segment earnings

$

2,315

11

%

20

($ in billions)

Avg loans, net

491

(1)

(6)

Avg core deposits

$

556

1

4

vs

vs

($ in billions)

3Q11

2Q11

3Q10

Wells Fargo Home Mortgage

Applications

$

169

55

%

(13)

Application pipeline

84

65

(17)

Originations

89

39

(12)

Managed residential

mortgage servicing

($ in trillions)

$

1.81

-

-

% change |

Wells Fargo

3Q11 Supplement 14

Wholesale Banking

Net interest income down 2% from 2Q11 on

lower PCI resolutions partially offset by strong

loan and deposit growth

-

Average loans up $10.3 billion, or 4%, driven by

both new and existing customer activity while

utilization rates were relatively stable

Noninterest income down 16% LQ as lower sales

and trading results, weaker investment banking

originations, seasonally lower insurance fees and

lower resolution income offset growth in Capital

Finance, International, Real Estate Capital

Markets and Asset Management

Net charge-offs were down $30

million

Expenses down 3% LQ driven by lower insurance

Treasury Management

Commercial card spend volume of $3.31 billion

up 4% LQ and 30% YoY

Investment Banking

U.S. investment banking market share YTD

(2)

of

4.8% up from 4.2% in FY2010

Asset Management

Total AUM down 5% and mutual funds AUM down

7% YoY

(1) Approved and initiated.

(2) Source: Dealogic U.S. investment banking fee market share.

vs

vs

($ in millions)

3Q11

2Q11

3Q10

Net interest income

$

2,910

(2)

%

(1)

Noninterest income

2,240

(16)

(9)

Provision for credit losses

(178)

84

nm

Noninterest expense

2,689

(3)

(1)

Income tax expense

826

(18)

(5)

Segment earnings

$

1,813

(6)

%

20

($ in billions)

Avg loans, net

253

4

11

Avg core deposits

$

209

10

23

vs

vs

($ in billions, except where noted)

3Q11

2Q11

3Q10

Key Metrics:

Commercial card spend

volume

$

3.31

4

%

30

CEO

Mobile

Wire

volume

(in millions)

2,511

89

nm

YTD U.S. investment banking

market

share

%

4.80

%

Total AUM

$

449

(6)

(5)

Advantage Funds AUM

211

(9)

(7)

(1)

(2) |

Wells Fargo

3Q11 Supplement 15

Wealth, Brokerage and Retirement

Net interest income up 3% from 2Q11

-

Average loans down 1% LQ and up 1% YoY

-

Average core deposits up 6% LQ and up 11% YoY

Noninterest income down 9% from 2Q11 primarily

due to losses on deferred compensation plan

investments, as well as lower ARS recoveries and

retail brokerage transaction revenue

-

Brokerage managed account assets down 9% LQ

and up 9% YoY; fees priced at beginning of

quarter, reflecting 6/30/2011 market valuations

Expenses down 5% LQ primarily due to lower

deferred compensation expense and reduced

broker commissions on lower sales revenue

Retail Brokerage

Managed account assets up 9% YoY driven by

strong net flows

Wealth Management

Wealth

Management

client

assets

down

3%

YoY

Retirement

IRA assets down 2% YoY

Institutional Retirement plan assets up 3% YoY

(1) Includes deposits.

(2) Data as of August 2011.

vs

vs

($ in millions)

3Q11

2Q11

3Q10

Net interest income

$

714

3

%

5

Noninterest income

2,173

(9)

(3)

Provision for credit losses

48

(21)

(38)

Noninterest expense

2,368

(5)

(2)

Income tax expense

178

(13)

13

Segment earnings

$

291

(13)

%

14

($ in billions)

Avg loans, net

43

(1)

1

Avg core deposits

$

133

6

11

vs

vs

($ in billions, except where noted)

3Q11

2Q11

3Q10

Key Metrics:

WBR Clients Assets

(1)

($ in trillions)$

1.3

(8)

%

(3)

Cross-sell

(2)

10.0

8

bps

25

Retail Brokerage

Financial Advisors

15,188

-

%

1

Managed account assets

$

238

(9)

9

Client assets

(1)

($ in trillions)

1.1

(9)

(3)

Wealth Management

Client

assets

(1)

191

(6)

(3)

Retirement

IRA Assets

261

(9)

(2)

Institutional Retirement

Plan Assets

228

(8)

3 |

Wells Fargo

3Q11 Supplement 16

Wachovia merger integration update

Merger integration on track

-

Regional banking store conversions complete following North Carolina conversion the weekend of

October 15-16, 2011; 3,083 store conversions completed

-

Over 45 million banking customers on a single platform

-

Over

38

million

accounts

converted

including

mortgage,

deposits,

trust,

brokerage

and

credit

cards

-

Remaining integration activities expected to be concluded by 1Q12 including deposit and

brokerage catch-up and additional Wholesale banking conversions

Growth opportunities already being realized due to merger revenue synergies:

Community Banking

-

Consumer

checking

account

sales

up

in

the

Eastern

retail

banking

stores

over

20%

from

a

year

ago

-

Credit

card

penetration

in

converted

East

markets

of

15.3%

(1)

,

up

from

13.2%

at

year

end

2010

-

Credit card new account growth in the East up 168% from 3Q10

Wholesale Banking

-

#1

Middle

market

lender

(2)

-

Investment Banking fees from Commercial and Corporate customers up 27% YTD vs. 2010

-

Foreign Exchange revenue from Wholesale customers up 25% YTD compared with 2010

Wealth, Brokerage and Retirement

-

Average deposit balances up 36% since merger

-

10

consecutive

quarter

of

positive

net

flows

into

brokerage

managed

accounts

-

Loans originated through brokers up 67% since merger

th

(1) Household penetration as of August, 2011 and defined as the percentage of retail

banking deposit households that have a credit card with Wells Fargo.

(2) Source: Greenwich Associates. Overall lead banking relationship penetration of

middle market companies (annual revenues of $25-$500 million).

Robust deposit growth during the merger integration; deposits up $114.0 billion since

12/31/08, while average deposit costs have declined 26 bps since 1Q09 |

Wells Fargo

3Q11 Supplement 17

Credit quality

Continued decline in provision expense

$2.6 billion net charge-offs, down $227 million

from 2Q11 and 52% from 4Q09 peak

Provision expense of $1.81 billion, down $27

million from 2Q11, includes an $800 million

reserve release in 3Q11

Allowance for credit losses = $20.4 billion

Remaining PCI nonaccretable = 28.3% of

remaining UPB

(1)

Credit metrics showed continued improvement

-

$1.1 billion LQ decline in NPAs reflects $1.1

billion decline in nonaccrual loans on lower

commercial inflows and an $83 million

increase in foreclosed assets

-

Early stage delinquency balances down

modestly while rates were stable

5.11

5.41

5.33

4.49

4.10

3.84

3.21

2.84

2.61

1.00

0.50

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

Net Charge-offs

Credit Reserve Build

(0.50)

(0.65)

(0.85)

Reserve Release

3.99

3.45

2.99

5.33

5.91

6.11

(1) Unpaid principal balance for PCI loans that have not had a UPB charge-off.

Provision Expense

($ in billions)

2.21

(1.0)

1.84

(1.0)

1.81

(0.8) |

Wells Fargo

3Q11 Supplement 18

($ in billions)

3Q10

4Q10

1Q11

2Q11

3Q11

Commercial

Inflows

2.8

2.3

1.9

1.6

1.2

Outflows

(2.4)

(3.6)

(2.9)

(2.7)

(1.8)

Ending balance

12.6

11.3

10.3

9.2

8.6

Consumer

Inflows

4.9

4.3

4.0

3.4

3.5

Outflows

(4.8)

(5.1)

(4.2)

(4.3)

(4.0)

Ending balance

15.7

14.9

14.7

13.8

13.3

Total

$

28.3

26.2

25.0

23.0

21.9

2.1

2.0

1.7

1.5

1.5

1.1

0.6

0.7

0.3

0.4

3Q10

4Q10

1Q11

2Q11

3Q11

Consumer

Commercial

28.3

26.2

25.0

23.0

21.9

6.1

6.1

5.5

4.9

4.9

3Q10

4Q10

1Q11

2Q11

3Q11

Nonaccrual loans

Foreclosed assets

Credit quality

Credit metrics showed improvement/stabilization

Nonperforming Assets

($ in billions)

2.6

3.2

$10

$15

$20

$25

$30

3Q10

4Q10

1Q11

2Q11

3Q11

Nonaccrual Loan Flows

32.3

34.4

30.5

2.4

Loans

90+

DPD

and

Still

Accruing

($ in billions)

27.9

1.8

26.8

1.9

7.54%

7.14%

6.21%

6.13%

6.13%

(1)

Early

Stage

Delinquencies

–

Retail

Businesses

(30+ days past due -

balances and rates)

(1)

Excludes mortgage loans insured/guaranteed by the FHA or VA and student loans whose repayments

are predominantly guaranteed by guarantee agencies on behalf of the U.S. Department of

Education under the Federal Family Education Loan Program. Also excludes the carrying value of PCI

loans contractually 90 days or more past due of $8.9 billion in 3Q11, $9.8 billion in 2Q11,

$10.8 billion in 1Q11, $11.6 billion in 4Q10 and $13.0 billion in 3Q10. Consumer

includes mortgage loans held for sale 90 days or more past due and still accruing. |

Wells Fargo

3Q11 Supplement 19

69%

19%

6%

6%

Mortgage servicing

Wells Fargo has a high quality servicing portfolio

Residential Mortgage Servicing Portfolio

$1.8 Trillion

(as of September 30, 2011)

Agency

Retained and acquired portfolio

Non-agency securitizations of

WFC originated loans

Non-agency acquired servicing

and private whole loan sales

69% of the portfolio is with the Agencies (FNMA,

FHLMC, and GNMA)

19% are loans that we retained or acquired

-

Loss exposure handled through loan loss

reserves and PCI nonaccretable

6% are private securitizations where Wells Fargo

originated the loan and therefore has some

repurchase risk

-

80% prime at origination

-

58% from pre-2006 vintages

-

Insignificant amount of home equity and no

option ARMs

-

~50% do not have traditional reps and

warranties

6% are non-agency acquired servicing and

private whole loan sales

-

4% is acquired servicing where Wells Fargo

did not underwrite and securitize and has

repurchase recourse with the originator

-

2% are private whole loan sales

•

Less than 2% subprime at origination

•

Loans sold to others and subsequently

securitized are included in private

securitizations above |

Wells Fargo

3Q11 Supplement 20

Mortgage servicing

Delinquency

ratios

lower

than

peers

and

total

repurchase

demands

down

2Q11 delinquency and foreclosure ratio of Wells

Fargo’s servicing portfolio substantially lower

than peers

Wells Fargo’s total delinquency and foreclosure

ratio for 3Q11 was 7.63%, down from a peak of

8.96% in 4Q09

-

Increase from 2Q11 primarily driven by

seasonality

Total repurchase demands down (both number

and balances) for fifth consecutive quarter;

losses of $384 million up from $261 million on

higher loss-content mortgage insurance

rescission repurchase activity

Agency

-

Total agency repurchase demands outstanding

down from 2Q11 on higher repurchase activity

•

Agency new demands for 2006-2008 vintages

up due to an increase in demands from FNMA;

this increase in demands was the primary driver

of the reserve build

•

FHLMC demands as well as newer vintage

demands continued to emerge consistent with

our estimates

-

Demands and losses continued to be concentrated

in the 2006 -

early 2008 vintages

Non-Agency

-

Non-agency repurchase demands outstanding,

which includes non-agency securities, whole loans

sold and acquired servicing, down for the fourth

consecutive quarter

(1) Inside

Mortgage

Finance,

data

as

of

June

30,

2011.

Industry

excluding

WFC

performance calculated based on IMF data.

(2) Industry is all large servicers ($7.1 trillion) including WFC, C, JPM and BAC.

(3) Includes mortgage insurance rescissions.

Total

Outstanding

Repurchase

Demands

(3)

and

Agency New Demands for 2006-2008 Vintages

2Q11 Servicing Portfolio Delinquency

Performance

(1) |

Wells Fargo

3Q11 Supplement 21

Capital

Capital remained strong and continued to grow internally

8.01%

8.30%

8.93%

9.15%

9.35%

3Q10

4Q10

1Q11

2Q11

3Q11

Tier 1 common equity ratio +20 bps in 3Q11

Tier 1 common equity ratio under Basel III is

estimated to be 7.41% at 9/30/11

(1)

$5.8 billion of high-cost trust preferred securities

redeemed October 3, 2011

-

Weighted average coupon of 8.45%

-

Redemptions funded with cash on hand

-

Tier 1 capital reduced in 3Q11 with NII and

NIM benefit expected to start in 4Q11

Purchased 22 million common shares in

the quarter and an additional estimated 6 million

shares through a forward repurchase transaction

that will settle in 4Q11

Tier 1 Common Equity Ratio

See Appendix page 44 for additional information on Tier 1 common equity. 3Q11 capital

ratios are preliminary estimates.

(1) Pro forma calculation based on Tier 1 common equity, as adjusted to reflect

management’s interpretation of current Basel III capital proposals. This pro forma

calculation is subject to change depending on final promulgation of Basel III capital

rulemaking and interpretations thereof by regulatory authorities. See page 45 for

additional information. |

Wells Fargo

3Q11 Supplement 22

Summary

Record earnings of $4.1 billion

-

Robust deposit growth

Robust earning asset growth on strong core loan growth and investment securities purchases

Disciplined expense management

Higher pre-tax pre-provision profit

(1)

of $8.0 billion

Continued improvement in credit quality

Strong returns

-

ROA = 1.26%

-

ROE = 11.86%

Capital levels continued to grow

(1) Pre-tax pre-provision profit (PTPP) is total revenue less noninterest

expense. Management believes that PTPP is a useful financial measure because it enables

investors and others to assess the Company’s ability to generate capital to cover credit

losses through a credit cycle. |

Wells Fargo

3Q11 Supplement 23

Appendix |

Wells Fargo

3Q11 Supplement 24

(1) Net of purchase accounting adjustments.

-$27.6

-$8.2

-$8.2

Non-strategic/liquidating loan portfolio risk reduction

-$7.1

-$6.5

-$6.4

-$5.0

-$74.3

-$5.3

($ in billions)

3Q11

2Q11

1Q11

4Q10

3Q10

2Q10

4Q08

Pick-a-Pay mortgage

(1)

$

67.4

69.6

71.5

74.8

77.3

80.2

82.9

85.2

95.3

Liquidating home equity

6.0

6.3

6.6

6.9

7.3

7.6

8.0

8.4

10.3

Legacy WFF indirect auto

3.1

3.9

4.9

6.0

7.1

8.3

9.7

11.3

18.2

Legacy WFF debt consolidation

17.2

17.7

18.4

19.0

19.7

20.4

21.4

22.4

25.3

Education

Finance

-

gov't

guaranteed

15.6

16.3

16.9

17.5

18.0

18.7

19.7

21.2

20.5

Legacy

WB

C&I,

CRE

and

foreign

PCI

loans

(1)

6.3

7.0

7.5

7.9

9.2

10.3

11.8

13.0

18.7

Legacy

WB

other

PCI

loans

(1)

0.9

1.0

1.0

1.1

1.1

1.3

1.5

1.7

2.5

Total

$

116.5

121.8

126.8

133.2

139.7

146.8

155.0

163.2

190.8

4Q09

1Q10 |

Wells Fargo

3Q11 Supplement 25

Purchased credit-impaired (PCI) portfolios

Continued to perform better than originally expected

($ in billions)

Adjusted unpaid principal balance

(1)

December 31, 2008

$

29.2

62.5

6.5

98.2

June 30, 2011

9.1

39.5

2.0

50.6

September 30, 2011

8.3

38.1

1.9

48.3

Nonaccretable difference rollforward

12/31/08 Nonaccretable difference

$

10.4

26.5

4.0

40.9

Losses from loan resolutions and write-downs

(6.7)

(14.5)

(2.6)

(23.8)

Release of nonaccretable difference since merger

(2.7)

(2.4)

(0.7)

(5.8)

(2)

9/30/11 Remaining nonaccretable difference

1.0

9.6

0.7

11.3

Life-to-date net performance

Additional provision since 2008 merger

$

(1.7)

-

(0.1)

(1.8)

Release of nonaccretable difference since 2008 merger

2.7

2.4

0.7

5.8

(2)

Net performance

1.0

2.4

0.6

4.0

Commercial

Pick-a-Pay

Other

consumer

Total

(1) Includes write-downs taken on loans where severe delinquency (normally 180 days)

or other indications of severe borrower financial stress exist that indicate there will

be a loss of contractually due amounts upon final resolution of the loan.

(2) Reflects releases of $1.7 billion for loan resolutions and $4.1 billion from the

reclassification of nonaccretable difference to the accretable yield, which will result

in increasing income over the remaining life of the loan or pool of loans.

|

Wells Fargo

3Q11 Supplement 26

$70

million

nonaccretable

difference

released

in

3Q11

into

income

due

to

loan

resolutions

-

$65 million in net interest income; $5 million in noninterest income

$108

million

reclassified

to

accretable

yield

in

3Q11

$11.3

billion

in

nonaccretable

difference

remains

to

absorb

losses

on

PCI

loans

-

Remaining

nonaccretable

=

28.3%

of

unpaid

principal

balance

(UPB)

(5)

•

Remaining

Pick-a-Pay

nonaccretable

=

29.5%

of

Pick-a-Pay

UPB

(5)

Nonaccretable difference established in purchase accounting for PCI loans absorbs losses

otherwise recorded as charge-offs

PCI nonaccretable difference

Analysis

of

nonaccretable

difference

for

PCI

loans

($ in millions)

Pick-a-Pay

Total

Balance at June 30, 2011

$

1,192

10,136

Release of nonaccretable difference due to:

Loans

resolved

by

settlement

with

borrower

(1)

(65)

-

-

Loans

resolved

by

sales

to

third

parties

(2)

(5)

-

-

Reclassification

to

accretable

yield

for

loans

with

improving

credit-related

cash

flows

(3)

(108)

-

Use of nonaccretable difference due to:

Losses

from

loan

resolutions

and

write-downs

(4)

(56)

(493)

Balance at September 30, 2011

$

958

9,643

-

(47)

(65)

(5)

(108)

(596)

Commercial

733

12,061

Other

consumer

686

11,287

(1) Release of the nonaccretable difference for settlement with borrower, on

individually accounted PCI loans, increases interest income in the period of settlement.

Pick-a-Pay and Other consumer PCI loans do not reflect nonaccretable difference

releases due to pool accounting for those loans, which assumes that the amount received

approximates the pool performance expectations. (2) Release of the

nonaccretable difference as a result of sales to third parties increases noninterest income in the period of the sale.

(3) Reclassification of nonaccretable difference to accretable yield for loans with

increased cash flow estimates will result in increased interest income as a prospective

yield adjustment over the remaining life of the loan or pool of loans. (4)

Write-downs to net realizable value of PCI loans are absorbed by the nonaccretable

difference when severe delinquency (normally 180 days) or other indications of severe

borrower financial stress exist that indicate there will be a loss of contractually due amounts upon final resolution of the loan.

(5) Unpaid principal balance of loans without write-downs.

|

Wells Fargo

3Q11 Supplement 27

Cumulative

Accretable yield rollforward

since

($ in millions)

3Q11

2Q11

merger

Total, beginning of period

$

14,871

15,881

10,447

Accretion

into

interest

income

(1)

(553)

(556)

(6,648)

Accretion

into

noninterest

income

due

to

sales

(2)

(3)

(31)

(237)

Reclassification from nonaccretable difference for loans with improving cash flows

108

95

4,158

Changes

in

expected

cash

flows

that

do

not

affect

nonaccretable

difference

(3)

2,473

(518)

9,176

Total, end of period

$

16,896

14,871

16,896

PCI accretable yield

Expected cash flows on all PCI portfolios are recalculated quarterly including the adequacy of

life-of-loan loss marks (nonaccretable difference)

3Q11 increase in expected cash flows of $2.5 billion primarily due to the Pick-a-Pay

portfolio •

Lifetime expected cash flows are updated quarterly and will fluctuate based on estimates and

assumptions •

Cash flow estimates are affected by changes in interest rates, liquidation timing, the pace

of the economic and housing recovery and projected lifetime performance of loan

modification activity •

(1) Includes accretable yield released as a result of settlements with borrowers, which

is included in interest income. (2) Includes accretable yield released as a

result of sales to third parties, which is included in noninterest income. (3)

Represents changes in cash flows expected to be collected due to changes in interest rates on variable rate PCI loans, changes in prepayment assumptions

and the impact of modifications.

The PCI cash flows remained significantly better than estimated at acquisition

–

3Q11 results included accretion of $556 million compared with $587 million in 2Q11

Balance of $16.9 billion expected to accrete to income over the remaining life of the

underlying loans |

Wells Fargo

3Q11 Supplement 28

$1.3 billion remains to be accreted into income over the remaining life of the portfolio

Most of portfolio tied to LIBOR

Weighted

average

life

of

the

portfolio

of

2.7

years

has

extended

over

the

past

couple

of

quarters

as

shorter

duration portfolios have rolled off and period of future cash flow assumptions have been

extended Commercial PCI accretable yield

(1) Increase in accretion and accretable yield percentage is primarily due to

improvements in the expected cash flows. ($ in millions)

3Q11

2Q11

1Q11

PCI interest income

Accretion

(1)

$

220

186

153

Resolution income

65

36

53

Average carrying value

6,672

7,171

7,694

Accretable yield percentage

Accretion

(1)

13.20

%

10.36

7.95

Accretable yield balance

$

1,303

1,357

1,175

Weighted average life (years)

2.7

2.4

2.0

|

Wells Fargo

3Q11 Supplement 29

$15.0 billion remains to be accreted into income over 11 years (estimated remaining life of

portfolio) -

Based on updated cash flow valuations, there was no reclassification of nonaccretable to

accretable in 3Q11 -

Reduction in accretable yield percentage reflects continued industry expectations of extended

foreclosure timelines

and

lengthening

of

portfolio

weighted

average

life

due

to

modification

performance

-

Weighted average life of loans has increased due to loan modification activity and slower

liquidation timing -

Lifetime expected cash flows are updated quarterly and will fluctuate based on estimates and

assumptions •

Cash flow estimates are affected by changes in interest rates, liquidation timing, the pace

of the economic and housing recovery and projected lifetime performance of loan

modification activity Pick-a-Pay PCI accretable yield

($ in millions)

3Q11

2Q11

1Q11

PCI interest income

Accretion

$

310

352

361

Average carrying value

30,168

31,008

31,849

Accretable yield percentage

4.11

%

4.54

4.54

Accretable yield balance

$

14,989

12,884

14,027

Weighted average life (years)

11.0

10.0

9.3

|

Wells Fargo

3Q11 Supplement 30

3Q11 Credit quality highlights

Net charge-offs of $2.6 billion down $227 million

from 2Q11 with declines across all loan categories

except for lease financing and other revolving

credit and installment

-

Commercial

losses

declined

$79

million

-

Consumer

losses

down

$148

million

Total NPAs of $26.8 billion down $1.1 billion

-

Nonaccrual

loans

down

$1.1

billion

-

Foreclosed

assets

up

$83

million

•

60% of the balance are government guaranteed

loans and loans written down through purchase

accounting

$1.3 billion, or 27%, are government

guaranteed

$1.6 billion, or 33%, reflects shift from

PCI loans to REO ($530 million consumer

and $1.1 billion C&I and CRE)

Currently expect future reserve releases absent

significant deterioration in the economy

Total

($ in millions)

Wells Fargo

Commercial loans

6,551

333,283

339,834

Consumer loans

30,662

389,610

420,272

Total period-end loans

37,213

722,893

760,106

Total nonaccrual loans

$

21,900

Total foreclosed assets

4,944

Total NPAs

$

26,844

as % of loans

3.53

%

Provision for credit losses

$

1,810

Net charge-offs

2,611

as % of avg loans

1.37

%

Commercial

0.50

Consumer

2.06

%

Allowance for credit losses

20,039 $

20,372

as % of loans

2.77

2.68

%

as % of nonaccrual loans

93

%

3Q11

PCI loans

Non PCI

loans |

Wells Fargo

3Q11 Supplement 31

Commercial nonaccrual loans

3Q11 Total Commercial nonaccrual loans = $8,611 million

($ change in millions)

Commercial and Industrial & Lease

Financing:

CRE Construction:

CRE Mortgage:

Foreign

Inflows decreased 47%; fourth

consecutive quarterly decrease

92% secured

47% guaranteed

76% current on interest

27% have already been written down

Inflows decreased 31%

58% guaranteed

40% current on interest

38% of NPLs have been written down

Inflows decreased 7%; fourth

consecutive quarterly decline

67% guaranteed

55% current on interest

34% of NPLs have been written

down

-

1,000

2,000

3,000

4,000

5,000

3Q10

4Q10

1Q11

2Q11

3Q11

Commercial and Industrial Loans & Lease

Financing

Total Inflow

Total Outflow

NPL Balances

-

1,000

2,000

3,000

4,000

3Q10

4Q10

1Q11

2Q11

3Q11

CRE Construction

Total Inflow

Total Outflow

NPL Balances

-

1,000

2,000

3,000

4,000

5,000

6,000

3Q10

4Q10

1Q11

2Q11

3Q11

CRE Mortgage

Total Inflow

Total Outflow

NPL Balances

All comparisons are to 2Q11.

$1,915

$4,429

$68

$2,199 |

Wells Fargo

3Q11 Supplement 32

3,000

3,250

3,500

3,750

4,000

1,000

1,500

2,000

2,500

3,000

3Q10

4Q10

1Q11

2Q11

3Q11

Home Equity

Total Inflow

(Left)

Total Outflow

(Left)

RE NPL Balances

(Right)

Consumer real estate nonaccrual loans

Inflows decreased 5%

Outflows decreased 2%

48% are 1-4 family first mortgage

76% is legacy WFF debt consolidation

-

Inflows increased 33%

-

Outflows decreased 14%

-

44% written down; losses taken stable

from prior quarter

12% is WBR

Nonaccrual balances stable

41% written down; losses taken

stable from prior quarter

58% are > 180 DPD

Inflows decreased 5%

Outflows increased 6%

84% of NPLs held at current estimated

recoverable value

23% are TDRs for which impairment

has been recognized

See page 37 for additional information

3Q11 Total residential real estate nonaccrual loans = $13,059 million

Inflows stabilized while outflows slowed reflecting environment and seasonality

All comparisons are to 2Q11.

(1) Includes National Home Equity first and junior lines and loans.

(2) Total

inflows

and

outflows

tracked

on

left

scale

and

RE

NPL

balances

tracked

on

right

scale.

National Home Equity

(1)

:

Home Mortgage:

Pick-a-Pay:

Other Businesses:

($ change in millions)

(2)

-

1,000

2,000

3,000

4,000

5,000

-

1,000

2,000

3,000

4,000

3Q10

4Q10

1Q11

2Q11

3Q11

Home

Mortgage

Total Inflow

(Left)

Total Outflow

(Left)

RE NPL Balances

(Right)

2,000

3,000

4,000

5,000

500

1,000

1,500

2,000

2,500

3Q10

4Q10

1Q11

2Q11

3Q11

Pick-a-Pay

Total Inflow

(Left)

Total Outflow

(Left)

RE NPL Balances

(Right)

$3,103

$2,527

$3,900

$3,529 |

Wells Fargo

3Q11 Supplement 33

Commercial real estate (CRE) loan portfolio

Growth in outstandings includes the $948 million

in CRE loans purchased in the quarter partially

offset by real estate construction paydowns

Nonaccruals down $390 million, or 37 bps

Net charge-offs down $49 million, or 16 bps

31% of the portfolio is owner-occupied

($ in millions)

3Q11

2Q11

CRE outstandings

Real estate mortgage

$

104,363

101,458

Real estate construction

19,719

21,374

Total CRE outstandings

124,082

122,832

Nonaccrual loans

Real estate mortgage

4,429

4,691

Real estate construction

1,915

2,043

Total nonaccrual loans

6,344

6,734

as % of loans

5.11

%

5.48

Net charge-offs

Real estate mortgage

$

96

128

Real estate construction

55

72

Total net charge-offs

151

200

as % of avg loans

0.49

%

0.65 |

Wells Fargo 3Q11

Supplement 34

Wholesale Banking CRE loan portfolio

(1)

(1)

Includes $7.1 billion in C&I loans managed by commercial real estate business including

unsecured loans to real estate developers not secured by real estate and loans to

REITs, as well as foreign and consumer loans. Other Wholesale

Total Wholesale

($ in millions)

CRE Division

PCI CRE

Banking CRE

CRE Loans

Loan outstandings

$

65,055

5,295

14,977

85,327

Nonaccrual loans

3,167

-

168

3,335

Foreclosed assets/REO/Other

813

1,022

44

1,879

Total NPAs

3,980

1,022

212

5,214

as a % of loans

6.12

%

19.30

1.42

6.11

Net charge-offs

$

72

35

4

111

as a % of loans

0.44

%

2.62

0.11

0.52

Wholesale Banking Commercial Real Estate

(1)

Growth

reflects

strong

originations

and

the

$1.1

billion

purchase

of

loans

which

was

partially

offset

by

a

decline

in

C&I

loans

managed

by

Wholesale

Banking

CRE

NPAs

decreased

$330

million

from

2Q11

while

losses

declined

$12

million,

or

9

bps,

from

2Q11

3Q11

revenue

included

release

of

nonaccretable

difference

for

commercial

PCI

resolutions

(payoffs/sales)

of

$41

million

vs.

$39

million

in

2Q11

Foreclosed

assets/REO/Other

increased

$57

million

from

2Q11

CRE

loans

originated

through

other

Wholesale

Banking

channels

(both

legacy

Wells

Fargo

and

Wachovia)

=

$15.0

billion

CRE Division portfolio = $65.1 billion, up $758 million from 2Q11 PCI CRE portfolio = $5.3 billion, carrying value

down $911 million, or 15%, from 2Q11

Wholesale

CRE

outstandings

of

$85.3

billion

(1)

up

$974

million

from

2Q11 |

Wells Fargo

3Q11 Supplement 35

Pick-a-Pay mortgage portfolio

Carrying

value

of

$67.4

billion

in

first

lien

loans

outstanding,

down

$2.2

billion

from

2Q11

and

down

$28.0

billion from 4Q08 on paid-in-full loans and loss mitigation efforts

–

Adjusted unpaid principal balance of $75.6 billion, down $2.7 billion from 2Q11 and down $40.1

billion from 4Q08

–

$4.0 billion in modification principal forgiveness since acquisition reflects over 96,000

completed full-term modifications; additional $367 million of conditional

forgiveness that can be earned by borrowers through performance over the next 3 years

–

Pick-a-Pay loans with negative amortization potential decreased $2.8 billion from 2Q11

to 55% of loans Total portfolio deferred interest of $2.1 billion down $161 million from

2Q11 and down $2.2 billion from 4Q08; down for tenth consecutive quarter

Modification redefault rate has been consistently better than the industry average (as

measured by 60+ DPD after 6 months) as we have strived to give customers an affordable,

sustainable payment (1)

Adjusted unpaid principal includes write-downs taken on loans where severe delinquency

(normally 180 days) or other indications of severe borrower financial ($ in millions)

Product type

Adjusted

unpaid

principal

% of total

Adjusted

unpaid

principal

% of total

Adjusted

unpaid

principal

% of total

Option payment loans

(1)

$

41,335

55

%

$

49,958

59

%

$

99,937

86

%

Non-option payment adjustable-rate and

fixed-rate loans

(1)

10,231

13

11,070

13

15,763

14

Full-term loan modifications

(1)

23,990

32

23,132

28

-

-

Total adjusted unpaid principal balance

(1)

$

75,556

100

%

$

84,160

100

%

$

115,700

100

%

Total carrying value

67,361

74,815

95,315

At 12/31/2008

At 12/31/2010

At 9/30/2011

stress exist that indicate there will be a loss of contractually due amounts upon final

resolution of the loan. |

Wells Fargo

3Q11 Supplement 36

Pick-a-Pay credit highlights

Non-PCI portfolio

Loans down 3% driven by loans paid-in-full

85% of portfolio current

Nonaccrual loans down $147 million in 3Q11

-

84% of loans written down to current net

realizable value (See page 37)

-

New inflows of $0.7 billion, down 5% from 2Q11

on stabilizing delinquencies and decline in the

number of TDRs moving to nonaccrual; decreased

for seventh consecutive quarter

-

$223 million of nonaccrual TDRs

reclassified to

accruing TDR status based on borrower payment

performance

$3.9 billion in nonaccruals includes $916 million of

nonaccruing TDRs

Net charge-offs of $220 million in 3Q11,

consistent with expectations and an annualized

loss rate of 2.30%

43% of portfolio with LTV

(2)

80%

PCI portfolio

Carrying value down 3%

68% of portfolio current, consistent with 2Q11

Life-of-loan losses continued to be lower than

originally projected at time of merger

(1)

The carrying value, which does not reflect the allowance for loan losses, includes purchase

accounting adjustments, which, for PCI loans, are the nonaccretable difference

and

the

accretable

yield,

and

for

all

other

loans,

an

adjustment

to

mark

the

loans

to

a

market

yield

at

date

of

merger

less

any

subsequent

charge-offs.

(2) The current loan-to-value (LTV) ratio is calculated as the net carrying

value (defined in (1) above) divided by the collateral value. (3) The adjusted

unpaid principal balance includes write-downs taken on loans where severe delinquency (normally 180 days) or other indications of severe borrower

financial stress exist that indicate there will be a loss of contractually due amounts upon

final resolution of the loan. ($ in millions)

3Q11

2Q11

Non-PCI loans

Carrying value

(1)

$

37,646

38,888

Nonaccrual loans

3,900

4,047

as a % of loans

10.36

%

10.41

Net charge-offs

$

220

224

as % of avg loans

2.30

%

2.27

90+ days past due

as % of loans

9.53

9.41

Current average LTV

(2)

85

%

86

Current average FICO

682

682

Contractual average loan size

$

211,000

213,000

Contractual average age of loans

7.54

years

7.28

% of loans in California

49

%

49

($ in millions)

3Q11

2Q11

PCI loans

Adjusted unpaid principal balance

(3)

$

38,060

39,483

Carrying value

(1)

29,715

30,699

Current average LTV

(2)

89

%

89

Current average FICO

608

606

Contractual average loan size

$

311,000

313,000

Contractual average age of loans

5.50

years

5.25

% of loans in California

67

%

67 |

Wells Fargo

3Q11 Supplement 37

Pick-a-Pay nonaccrual loan composition

84% of Pick-a-Pay nonaccruals held at estimated recoverable value vs. 85% at 2Q11,

reflecting write-downs

and/or

LTV

100%

Allowance

available

for

the

remaining

16%

that

have

not

yet

been

written

down

7% of the nonaccruals are performing modifications

-

Performing modifications move to accruing status after six consecutive payments are made

9/30/11 Total $3,900 million

Charge-offs to date of $670 million

(29% of original balance)

66% of loans have LTV<80%

33%

of

loans

have

LTV

80%

but

<100%

1%

of

loans

have

LTV

100%

(1)

Initial charge-offs usually not taken

until 180 DPD ($39 million taken to

date)

Expected losses included in allowance

Charge-offs/principal forgiveness to

date of $220 million (20% of

original balance)

Additionally, we hold expected life-

of-loan loss reserves in allowance

LTV is considered to be over 100% if the loan balance exceeds current estimated appraised

value based on automated valuation methodology or updated appraisal where available.

Calculation excludes unpaid principal balance of related equity lines of credit that share common collateral. Does not include PCI Pick-a-Pay since they

are considered to be accruing under PCI loan accounting for accretable yield and accrual

status is not based on contractual interest payments. (1) Loans with LTV>100%

are currently in modification trial periods. 180 DPD written down to estimated

recoverable value

0-179 DPD

Loan modifications (TDRs)

180

DPD

updated

LTV

100%

19%

16%

23%

42% |

Wells Fargo

3Q11 Supplement 38

Real estate 1-4 family first mortgage portfolio

First lien mortgage loans up $884 million despite

$2.8 billion decline in runoff portfolios

Pick-a-Pay non-PCI portfolio down 3%

PCI portfolio down 3%

Debt consolidation down 3%

Non runoff first lien up 3%

Core first lien mortgage nonaccruals down $294

million, or 31 bps

Non runoff net charge-offs down $58 million, or

22 bps

(1) Ratios on WFF debt consolidation loan portfolio only.

(2) Ratios on non runoff first lien mortgage loan portfolio only.

($ in millions)

3Q11

2Q11

Total real estate 1-4 family first mortgage

$

223,758

222,874

Less consumer non-strategic/liquidating portfolios:

Pick-a-Pay non-PCI first lien mortgage

37,646

38,888

PCI first lien mortgage

30,446

31,448

WFF debt consolidation portfolio

17,186

17,730

Core first lien mortgage

138,480

134,808

Nonaccrual loans

$

2,334

2,296

as % of loans

13.58 %

12.95

Net charge-offs

$

191

217

as % of average loans

4.37 %

4.81

Nonaccrual loans

$

4,790

5,084

as % of loans

3.46 %

3.77

Net charge-offs

$

410

468

as % of loans

1.17 %

1.39

WFF

debt

consolidation

mortgage

loan

performance

(1)

Core

first

lien

mortgage

loan

performance

(2) |

Wells Fargo

3Q11 Supplement 39

Home equity portfolio

Core Portfolio

(1)

Outstandings

down 1%

-

High quality new originations with weighted

average CLTV of 60%, 777 FICO, and 32% total

debt service ratio

3Q11 losses down $57 million, or 20 bps

2+ delinquencies increased $43 million, or 8 bps

Delinquency rate for loans with a CLTV >100%

increased 8 bps

Liquidating

Portfolio

Outstandings down 5%

3Q11 losses down $9 million, or 25 bps

2+ delinquencies declined $18 million, or 8 bps

Continued decline in delinquency rate for loans

with a CLTV >100%, 22 bps improvement QoQ

Excludes purchased credit-impaired loans.

(1) Includes equity lines of credit and closed-end junior liens associated with the

Pick-a-Pay portfolio totaling $1.5 billion at September 30, 2011 and $1.6 billion at

June 30, 2011.

(2)

CLTV is calculated based on outstanding balance plus unused lines of credit divided by

estimated home value. Unsecured balances, representing the percentage of

outstanding balances above the most recent home value, is a smaller percentage of the portfolio. Estimated home values are determined predominately

based on automated valuation models updated through September 2011.

($ in millions)

3Q11

2Q11

Core Portfolio

(1)

Outstandings

$

103,100

104,417

Net charge-offs

753

810

as % of avg loans

2.88

%

3.08

2+ payments past due

$

3,153

3,110

as % loans

3.07

%

2.99

% CLTV > 100%

(2)

35

36

2+ payments past due

4.40

%

4.32

% 1st lien position

20

20

Liquidating Portfolio

Outstandings

$

5,982

6,266

Net charge-offs

139

148

as % of avg loans

8.97

%

9.22

2+ payments past due

$

281

299

as % loans

4.69

%

4.77

% CLTV > 100%

(2)

73

73

2+ payments past due

5.06

%

5.28

% 1st lien position

4

4 |

Wells Fargo

3Q11 Supplement 40

$109.1 billion home equity portfolio

-

19% in 1

st

lien position

-

41% in junior lien position behind WFC owned or serviced 1

st

lien

-

40% in junior lien position behind third party 1

st

lien

Excludes purchased credit-impaired loans.

(1) Delinquency represents two or more payments past due as of August 2011.

Home equity portfolio

Delinquency Status

(1)

of Junior Liens Behind a Wells Fargo 1

st

Lien

Delinquency Status

Current 1

st

lien, Current junior lien

95.6

%

Current 1

st

lien, Delinquent junior lien

0.9

Delinquent 1

st

lien, Current junior lien

1.6

Delinquent 1

st

lien, Delinquent junior lien

1.9

Outstanding Balance % |

Wells Fargo

3Q11 Supplement 41

Credit card portfolio

$21.7 billion credit card outstandings up 2% from

2Q11 on new customer growth and higher

consumer spending from existing customers

–

New accounts increased 20% in the quarter

with household penetration increasing to

25.8%

(1)

•

East penetration of 14.9%

(1)

–

Purchase dollar volumes increased 4% and

transactions grew 5% from 2Q11

–

Purchase dollar volume increased 12% and

transactions grew 13% from 3Q10

Net charge-offs down $28 million, or 73 bps,

reflecting continued delinquency improvement

driven by previous risk mitigation efforts

($ in millions)

3Q11

2Q11

Credit card outstandings

$

21,650

21,191

Net charge-offs

266

294

as % of avg loans

4.90

%

5.63

(1) Household penetration as of August, 2011 and defined as the percentage of retail

banking deposit households that have a credit card with Wells Fargo. |

Wells Fargo

3Q11 Supplement 42

Auto portfolio

Core Portfolio

Total outstandings up 1% QoQ and up 9% YoY

reflecting market share gains

-

Originations were down 5% from 2Q11 reflecting

increased competition in the marketplace

Net charge-offs increased $35 million, or 32 bps,

on seasonality and modestly weaker used car

values

-

September Manheim index of 122.9, down 4%

from June 2011 and up 3% from September 2010

30+ days past due increased $32 million, or 6

bps, reflecting seasonality

Liquidating

Portfolio

(1)

Legacy Wells Fargo Financial indirect auto

outstandings down 20%, or $780 million, QoQ

driven by paydowns

(1) Legacy Wells Fargo Indirect portfolio.

($ in millions)

3Q11

2Q11

Core

Portfolios

Direct

Auto outstandings

$

2,636

2,762

Nonaccrual loans

75

82

as % of loans

2.84

%

2.97

Net charge-offs

$

11

8

as % of avg loans

1.57

%

1.13

30+ days past due

$

66

87

as % of loans

2.49

%

3.15

Indirect

Auto outstandings

$

39,139

38,420

Nonaccrual loans

12

15

as % of loans

0.03

%

0.04

Net charge-offs

$

69

37

as % of avg loans

0.71

%

0.39

30+ days past due

$

521

468

as % of loans

1.33

%

1.22

Auto outstandings

$

3,101

3,881

Nonaccrual loans

97

113

as % of loans

3.14

%

2.90

Net charge-offs

$

25

16

as % of avg loans

2.85

%

1.43

30+ days past due

$

208

287

as % of loans

6.72

%

7.38

Liquidating

portfolio

(1) |

| Wells Fargo

3Q11 Supplement 43

Forward-looking statements and additional information

Forward-looking statements:

This Quarterly Supplement and management’s related presentation contain

forward-looking statements about our future financial performance.

These

forward-looking

statements

include

statements

using

words

such

as

“believe,”

“expect,”

“anticipate,”

“estimate,”

“target”, “should,”

“may,”

“can,”

“will,”

“outlook,”

“appears”

or similar expressions. These forward-looking statements may include,

among others, statements about: expected or estimated future losses in our loan portfolios,

including our belief that the allowance for loan losses is expected to decline; fourth

quarter 2011 net interest income, noninterest expense, mortgage-related revenues, and

benefits

to

net

interest

income

and

net

interest

margin

from

the

redemption

of

trust

preferred

securities;

expected

or

estimated

loan

loss reserve releases; mortgage repurchase exposure; exposure related to mortgage practices,

including foreclosures and servicing; our

targeted

noninterest

expense

for

fourth