Attached files

Exhibit 10.22

CONVERTIBLE PROMISSORY NOTE

| U.S. $18,000 | Dated: August 6, 2011 |

FOR SERVICES RECEIVED, Minerco Resources Inc., a Nevada corporation (the “Maker”), hereby promises to pay to SE Media Partners Inc. a Georgia professional corporation, or its successors and assigns (the “Payee”), at its address at 2854 Johnson Ferry Road, Suite 200, Marietta, Georgia 30062, or to such other address as Payee shall provide in writing to the Maker for such purpose, a principal sum of Eighteen Thousand Dollars (U.S. $18,000). The aggregate principal amount outstanding under this Note will be conclusively evidenced by the schedule annexed as Exhibit B hereto (the “Loan Schedule”), up to a maximum principal amount of U.S $18,000. The entire principal amount hereunder shall be due and payable on February 6, 2012 (the “Maturity Date”), or on such earlier date as such principal amount may earlier become due and payable pursuant to the terms hereof.

1. Interest Rate. Interest shall accrue on the unpaid principal amount of this Convertible Promissory Note (the “Note”) at the rate of five percent (5%) per annum from the date of the first making of the loan for such principal amount until such unpaid principal amount is paid in full or earlier converted into shares (the “Shares”) of the Maker’s common stock (the “Common Stock”) in accordance with the terms hereof. Interest hereunder shall be paid on such date as the principal amount under this Note becomes due and payable or is converted in accordance with the terms hereof and shall be computed on the basis of a 360-day year for the actual number of days elapsed.

2. Conversion of Principal and Interest. Subject to the terms and conditions hereof, the Payee, at its sole option, may deliver to the Maker a notice in the form attached hereto as Exhibit A (a “Conversion Notice”) and an updated Loan Schedule, at any time and from time to time after the date hereof and prior to the payment of the principal amount and all accrued interest thereon (the date of the delivery of a Conversion Notice shall be referred to herein as a “Conversion Date”), to convert all or any portion of the outstanding principal amount of this Note plus accrued and unpaid interest thereon, for a number of Shares equal to the quotient obtained by dividing the dollar amount of such outstanding principal amount of this Note plus the accrued and unpaid interest thereon being converted by the Conversion Price (as defined in Section 15). Conversions hereunder shall have the effect of lowering the outstanding principal amount of this Note plus all accrued and unpaid interest thereunder in an amount equal to the applicable conversion, which shall be evidenced by entries set forth in the Conversion Notice and the Loan Schedule.

3. Certain Conversion Limitations. The Payee may not convert an outstanding principal amount of this Note or accrued and unpaid interest thereon to the extent such conversion would result in the Payee, together with any affiliate thereof, beneficially owning (as determined in accordance with Section 13(d) of the Exchange Act (as defined in Section 15) and the rules promulgated thereunder) in excess of 9.999% of the then issued and outstanding shares of Common Stock. Since the Payee will not be obligated to report to the Maker the number of shares of Common Stock it may hold at the time of a conversion hereunder, unless the conversion at issue would result in the beneficial ownership in excess of 9.999% of the then outstanding shares of Common Stock (inclusive of any other shares which may be beneficially owned by the Payee or an affiliate thereof), the Payee shall have the authority and obligation to determine whether and the extent to which the restriction contained in this Section will limit any particular conversion hereunder. The Payee may waive the provisions of this Section upon not less than 75 days prior notice to the Maker.

1

4. Deliveries. Not later than five (5) Trading Days (as defined in Section 15) after any Conversion Date, the Maker will deliver to the Payee (i) a certificate or certificates representing the number of Shares being acquired upon the conversion of the principal amount of this Note and any interest accrued thereunder being converted pursuant to the Conversion Notice (subject to the limitations set forth in Section 3 hereof), and (ii) an endorsement by the Maker of the Loan Schedule acknowledging the remaining outstanding principal amount of this Note plus all accrued and unpaid interest thereon not converted (an “Endorsement”). The Maker’s delivery to the Payee of stocks certificates in accordance clause (i) above shall be Maker’s conclusive endorsement of the remaining outstanding principal amount of this Note plus all accrued and unpaid interest thereon not converted as set forth in the Loan Schedule.

5. Prepayment Right. The Maker shall have the right to prepay all or a portion of the outstanding principal amount of this Note plus all accrued and unpaid interest thereon.

6. No Adjustments. If the Maker, at any time while any portion of the principal amount due under this Note is outstanding, (a) shall pay a stock dividend or otherwise make a distribution or distributions on shares of its Common Stock or any other equity or equity equivalent securities payable in shares of Common Stock, (b) subdivide outstanding shares of Common Stock into a larger number of shares, (c) combine (including by way of reverse stock split) outstanding shares of Common Stock into a smaller number of shares, or (d) issue by reclassification of shares of the Common Stock any shares of capital stock of the Maker, then the Conversion Price (as defined in Section 15) shall not be adjusted.

7. No Waiver of Payee’s Rights, etc. All payments of principal and interest shall be made without setoff, deduction or counterclaim. No delay or failure on the part of the Payee in exercising any of its options, powers or rights, nor any partial or single exercise of its options, powers or rights shall constitute a waiver thereof or of any other option, power or right, and no waiver on the part of the Payee of any of its options, powers or rights shall constitute a waiver of any other option, power or right. The Maker hereby waives presentment of payment, protest, and notices or demands in connection with the delivery, acceptance, performance, default or endorsement of this Note. Acceptance by the Payee of less than the full amount due and payable hereunder shall in no way limit the right of the Payee to require full payment of all sums due and payable hereunder in accordance with the terms hereof.

8. Modifications. No term or provision contained herein may be modified, amended or waived except by written agreement or consent signed by the party to be bound thereby.

9. Cumulative Rights and Remedies; Usury. The rights and remedies of the Payee expressed herein are cumulative and not exclusive of any rights and remedies otherwise available. If it shall be found that any interest outstanding hereunder shall violate applicable laws governing usury, the applicable rate of interest outstanding hereunder shall be reduced to the maximum permitted rate of interest under such law.

2

10. Collection Expenses. If this obligation is placed in the hands of an attorney for collection after default, and provided the Payee prevails on the merits in respect to its claim of default, the Maker shall pay (and shall indemnify and hold harmless the Payee from and against), all reasonable attorneys’ fees and expenses incurred by the Payee in pursuing collection of this Note.

11. Successors and Assigns. This Note shall be binding upon the Maker and its successors and shall inure to the benefit of the Payee and its successors and assigns. The term “Payee” as used herein, shall also include any endorsee, assignee or other holder of this Note.

12. Lost or Stolen Promissory Note. If this Note is lost, stolen, mutilated or otherwise destroyed, the Maker shall execute and deliver to the Payee a new promissory note containing the same terms, and in the same form, as this Note. In such event, the Maker may require the Payee to deliver to the Maker an affidavit of lost instrument and customary indemnity in respect thereof as a condition to the delivery of any such new promissory note.

13. Due Authorization. This Note has been duly authorized, executed and delivered by the Maker and is the legal obligation of the Maker, enforceable against the Maker in accordance with its terms.

14. Governing Law. This Note shall be governed by and construed and enforced in accordance with the internal laws of the State of Florida without regard to the principles of conflicts of law thereof.

15. Definitions. For the purposes hereof, the following terms shall have the following meanings:

“Business Day” means any day except Saturday, Sunday and any day that is a legal holiday or a day on which banking institutions in the State of New York or State of Nevada are authorized or required by law or other government action to close.

“Conversion Price” shall be 50% of the lowest Per Share Market Value of the five (5) Trading Days immediately preceding a Conversion Date, whichever is lowest.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Trading Day” means (a) a day on which the shares of Common Stock are traded on such Subsequent Market on which the shares of Common Stock are then listed or quoted, or (b) if the shares of Common Stock are not listed on a Subsequent Market, a day on which the shares of Common Stock are traded in the over-the-counter market, as reported by the OTC Bulletin Board, or (c) if the shares of Common Stock are not quoted on the OTC Bulletin Board, a day on which the shares of Common Stock are quoted in the over-the-counter market as reported by the National Quotation Bureau Incorporated (or any similar organization or agency succeeding its functions of reporting prices); provided, however, that in the event that the shares of Common Stock are not listed or quoted as set forth in (a), (b) and (c) hereof, then Trading Day shall mean any day except Saturday, Sunday and any day which shall be a legal holiday or a day on which banking institutions in the State of Texas or State of Georgia are authorized or required by law or other government action to close.

3

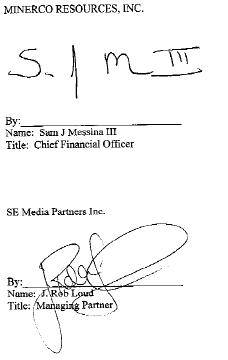

IN WITNESS WHEREOF, the Maker has caused this Convertible Promissory Note to be duly executed and delivered as of the date first set forth above.

(Signature Page of Convertible Promissory Note)

4

EXHIBIT A

NOTICE OF CONVERSION

Dated: _________________

The undersigned hereby elects to convert the principal amount and interest indicated below of the attached Convertible Promissory Note into shares of common stock (the “Common Stock”), of Minerco Resources Inc., according to the conditions hereof, as of the date written below. No fee will be charged to the holder for any conversion.

Exchange calculations: ______________________________________________

Date to Effect Conversion: ___________________________________________

Principal Amount and Interest of

Secured Convertible Note to be Converted: ______________________________

Number of shares of Common Stock to be Issued: _________________________

Applicable Conversion Price:

Signature: __________________________________________

Name:_____________________________________________

Address:____________________________________________

A-1

EXHIBIT B

LOAN SCHEDULE

Convertible Promissory Note Issued by Minerco Resources Inc.

Dated: ___________________

SCHEDULE

OF

CONVERSIONS AND PAYMENTS OF PRINCIPAL

|

Date of Conversion

|

Amount of Conversion

|

Total Amount Due Subsequent

To Conversion

|

B-1