Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Howmet Aerospace Inc. | d243716d8k.htm |

| EX-99.1 - TRANSCRIPT OF ALCOA INC. THIRD QUARTER 2011 EARNINGS CALL - Howmet Aerospace Inc. | d243716dex991.htm |

3

rd

Quarter 2011 Earnings Conference

October 11, 2011

Exhibit 99.2

[Alcoa logo] |

Cautionary Statement

2

[Alcoa logo]

rationale

for

the

use

of

the

non-GAAP

financial

measures

can

be

found

in

the

Appendix

to

this

presentation

and

on

our

website

at

www.alcoa.com

under the “Invest”

section. Any reference during the discussion today to EBITDA means adjusted

EBITDA, for which we have provided calculations and reconciliations in the

Appendix and on our website. Forward-Looking Statements

This presentation contains statements that relate to future events and expectations and as such

constitute forward-looking statements. Forward- looking statements include those

containing such words as “anticipates”, “estimates,” “expects,” “forecasts,” “intends,” “outlook,” “plans,” “projects,”

“should,” “targets,” “will,” or other words of similar meaning.

All statements that reflect Alcoa’s expectations, assumptions, or projections about the

future other than statements of historical fact are forward-looking statements, including, without

limitation, forecasts concerning global demand for aluminum, end-market conditions, growth

opportunities for aluminum in automotive, aerospace and other applications or other trend projections,

targeted financial results or operating performance, and statements about Alcoa’s strategies,

outlook, and business and financial prospects. Forward-looking statements are subject

to a number of known and unknown risks, uncertainties, and other factors and are not guarantees of

future performance. Important factors that could cause actual results to differ materially from

those in the forward-looking statements include: (a) material adverse changes in aluminum

industry conditions, including global supply and demand conditions and fluctuations in London Metal

Exchange-based prices for primary aluminum, alumina, and other products, and fluctuations in

indexed-based and spot prices for alumina; (b) global economic and financial market

conditions generally, including the risk of another global economic downturn and uncertainties regarding the

effects of sovereign debt issues or government intervention into the markets to address economic

conditions; (c) unfavorable changes in the markets served by Alcoa, including automotive and

commercial transportation, aerospace, building and construction, distribution, packaging, oil

and gas, defense, and industrial gas turbine; (d) the impact of changes in foreign currency exchange

rates on costs and results, particularly the Australian dollar, Brazilian real, Canadian

dollar, euro, and Norwegian kroner; (e) increases in energy costs, including electricity, natural gas, and

fuel oil, or the unavailability or interruption of energy supplies; (f) increases in the costs of

other raw materials, including caustic soda and carbon products; (g) Alcoa’s inability to

achieve the level of revenue growth, cash generation, cost savings, improvement in profitability and margins, fiscal

discipline, or strengthening of operations (including moving its alumina refining and aluminum

smelting businesses down on the industry cost curve and increasing revenues in its

Flat-Rolled Products and Engineered Products and Solutions segments), anticipated from its productivity

improvement, cash sustainability and other initiatives; (h) Alcoa’s inability to realize expected

benefits from newly constructed, expanded or acquired facilities or from international joint

ventures as planned and by targeted completion dates, including the joint venture in Saudi Arabia; (i)

political, economic, and regulatory risks in the countries in which Alcoa operates or sells products,

including unfavorable changes in laws and governmental policies, civil unrest, or other events

beyond Alcoa’s control; (j) the outcome of contingencies, including legal proceedings,

government investigations, and environmental remediation; (k) the business or financial condition of

key customers, suppliers, and business partners; (l) changes in tax rates or benefits; and (l)

the other risk factors summarized in Alcoa’s Form 10-K for the year ended December 31,

2010, Forms 10-Q for the quarters ended March 31, 2011 and June 30, 2011, and other reports filed

with the Securities and Exchange Commission (SEC). Alcoa disclaims any obligation to

update publicly any forward-looking statements, whether in response to new information,

future events or otherwise, except as required by applicable law. Non-GAAP Financial

Measures Some of the information included in this presentation is derived from

Alcoa’s consolidated financial information but is not presented in Alcoa’s financial

statements prepared in accordance with U.S. generally accepted accounting principles (GAAP). Certain of these data are considered

“non-GAAP financial measures” under SEC rules. These non-GAAP financial

measures supplement our GAAP disclosures and should not be considered an alternative to the

GAAP measure. Reconciliations to the most directly comparable GAAP financial measures and management’s |

Chuck McLane

Executive Vice President and Chief Financial Officer

[Alcoa logo] |

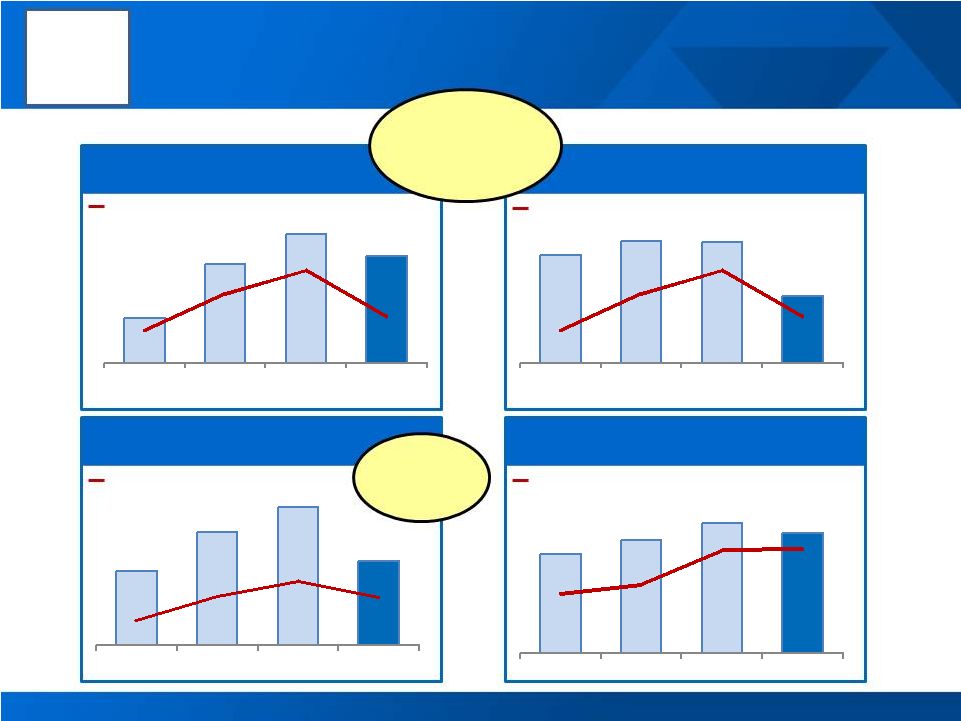

Commodity Price Deflation + European Weakness = Q3 Dip

4

Segment ATOI (US$ Millions)

Alumina

Primary Metals

Flat-Rolled Products

Engineered Products & Solutions

Commodity

Price Deflation

European

market

weakness

Cash LME

Cash LME

Total Shipments

3

rd

Party Revenue

[Alcoa logo]

$53

$81

$99

$60

436

470

491

469

4Q'10

1Q'11

2Q'11

3Q'11

$65

$142

$186

$154

$2,343

$2,500

$2,603

$2,400

4Q'10

1Q'11

2Q'11

3Q'11

$178

$202

$201

$110

$2,343

$2,500

$2,603

$2,400

4Q'10

1Q'11

2Q'11

3Q'11

$113

$130

$149

$138

$1,215

$1,247

$1,370

$1,373

4Q'10

1Q'11

2Q'11

3Q'11 |

3

rd

Quarter

2011

Financial

Overview

Income

from

Continuing

Operations

of

$172

million,

or

$0.15

per

share

Revenue

down

3%

sequentially

and

up

21%

versus

third

quarter

2010

Adjusted

EBITDA

of

$821

million,

down

21%

sequentially

and

up

36%

versus

third

quarter

2010

13%

Adjusted

EBITDA

Margin,

down

300

basis

points

sequentially

and

up

140

basis

points

versus

third

quarter

2010

Free

Cash

Flow

of

$164

million

Days

Working

Capital

5

days

lower

than

third

quarter

2010

Debt

to

Capital

of

33.7%,

200

basis

points

lower

than

third

quarter

2010

Net

debt

balance

reduced

by

$109

million,

Cash

on

hand

of

$1.3

billion

5

See appendix for reconciliations to GAAP and additional information

[Alcoa logo] |

Income Statement Summary

$ Millions

3Q’10

2Q’11

3Q’11

Year

Change

Sequential

Change

Sales

$5,287

$6,585

$6,419

$1,132

($166)

Cost of Goods Sold

$4,413

$5,247

$5,290

$877

$43

COGS % Sales

83.5%

79.7%

82.4%

(1.1 % pts.)

2.7 % pts.

Selling, General Administrative, Other

$232

$253

$261

$29

$8

SGA % Sales

4.4%

3.8%

4.1%

(0.3 % pts.)

0.3 % pts.

Restructuring and Other Charges

$2

$34

$9

$7

($25)

Effective Tax Rate

-81.7%

26.3%

19.6%

101.3 % pts.

(6.7 % pts.)

Income from Continuing Operations

$61

$326

$172

$111

($154)

Income Per Diluted Share

$0.06

$0.28

$0.15

$0.09

($0.13)

6

[Alcoa logo] |

Restructuring and Other Special Items

$ Millions

3Q’10

2Q’11

3Q’11

Income from Continuing Operations

$61

$326

$172

Income Per Diluted Share

$0.06

$0.28

$0.15

Restructuring Related

$1

($16)

($5)

Discrete Tax Items

$38

-

$10

Mark-to-Market Energy Contracts

($29)

$10

$13

Debt Tender Offer

($9)

($32)

-

Sao Luis Power Outage

($23)

-

-

Uninsured Losses

($13)

-

($11)

Special Items

($35)

($38)

$7

Income from Continuing Operations excl Special Items

$96

$364

$165

Income per Diluted Share excluding Special Items

$0.09

$0.32

$0.15

7

See appendix for Adjusted Income reconciliation

[Alcoa logo] |

$364

$99

$17

$7

$33

$60

$22

$26

$32

$15

$8

$165

2Q11

LME

Currency

Volume

Price /

Mix

Productivity

Energy

Raw

Materials

Cost

Increases

Repair &

Maint

Equity

Earnings

3Q11

3

rd

Quarter 2011 vs. 2

nd

Quarter 2011 Earnings Bridge

8

See appendix for reconciliation

Income from Continuing Operations excluding Restructuring & Other Special Items ($ millions) [Alcoa logo]

-$116m

+$20m

-$103m |

YTD

2011 vs. YTD 2010 Earnings Bridge 9

See appendix for reconciliation

Income from Continuing Operations excluding Restructuring & Other Special Items ($ millions) 31.8¢

[Alcoa logo]

$336

$645

$241

$210

$196

$411

$167

$240

$304

$846

YTD10

LME

Currency

Volume

Price / Mix

Productivity

Energy

Raw

Materials

Cost

Increases

YTD11

+$404m

+817m

-$711m |

3Q 10

2Q 11

3Q11

Production (kmt)

4,047

4,144

4,140

3

rd

Party Shipments (kmt)

2,423

2,378

2,256

3

rd

Party Revenue ($ Millions)

717

926

879

ATOI ($ Millions)

70

186

154

Alumina

3rd Quarter Results

4

th

Quarter Outlook

3

rd

Quarter Business Highlights

10

Realized

third-party

alumina

price

down

3%

Days

working

capital

down

7

days

from

Q3

2010

Positive

Currency

impact

of

$16

million

as

the

US$ strengthened

Higher

caustic

and

energy

prices

Productivity

and

volume

offset

higher

costs

20%

of

3

rd

party

shipments

on

spot

or

prior-

month indexed basis

Other

pricing

to

follow

two-month

lag

on

LME

Productivity

improvements

to

continue

Caustic

inflation

to

continue,

offset

by

moderating fuel oil costs

3

rd

Quarter Performance Bridge

See appendix for reconciliations to GAAP and additional information

$ Millions

market

performance

cost increases

[Alcoa logo]

-$14m

-$38m

$39m

-$19m

$186

$154

($35)

$16

$12

$24

$3

($9)

($15)

($14)

($14) |

3Q 10

2Q 11

3Q 11

Production (kmt)

891

945

964

3

rd

Party Shipments (kmt)

708

724

754

3

rd

Party Revenue ($ Millions)

1,688

2,145

2,124

3

rd

Party Price ($/MT)

2,261

2,830

2,689

ATOI ($ Millions)

78

201

110

Primary Metals

3

rd

Quarter Highlights

3

rd

Quarter Business Highlights

4

th

Quarter Outlook

11

Realized

pricing

down

5%

sequentially

Days

working

capital

down

5

days

from

Q3

2010

Higher structural energy costs in Europe

Productivity

benefits

offset

raw

material

increases

U.S.

restarts

deliver

profitable

results

Positive

Currency

impact

of

$9

million

as

the

US$

strengthened

Pricing

to

follow

15-day

lag

to

LME

Productivity

benefits to continue

Higher

energy

costs

expected

with

seasonal

price increases and Rockdale planned outage

Carbon

price

inflation

expected

to

continue

3

rd

Quarter Performance Bridge

$ Millions

-$83m

$24m

market

performance

-$14m

-$18m

cost increases

[Alcoa logo] |

12

4

th

Quarter Outlook

3

rd

Quarter Business Highlights

3

rd

Quarter Results

ATOI $ Millions

3Q 10

2Q 11

3Q 11

Flat-Rolled Products,

excl Russia, China & Other

61

86

56

Russia, China & Other

5

13

4

Total ATOI

66

99

60

ATOI down from all-time highs in Q2 driven by

significant market decline in Europe

Total negative impact of $28 million in Europe

due to seasonal summer plant shutdowns and

weakening market conditions

Productivity

improvements

lessen

impact

of

rising costs

Aerospace

and

automotive

demand

remain

strong

Seasonal beverage can packaging decline

European

weakness

expected

to

continue

Productivity

gains

to

mitigate

rising

costs

Progress toward 2013 $2.5 billion incremental

revenue

target,

50

to

60%

during

2011

3

rd

Quarter Performance Bridge

Flat-Rolled Products

See appendix for reconciliations to GAAP and additional information

$ Millions

[Alcoa logo] |

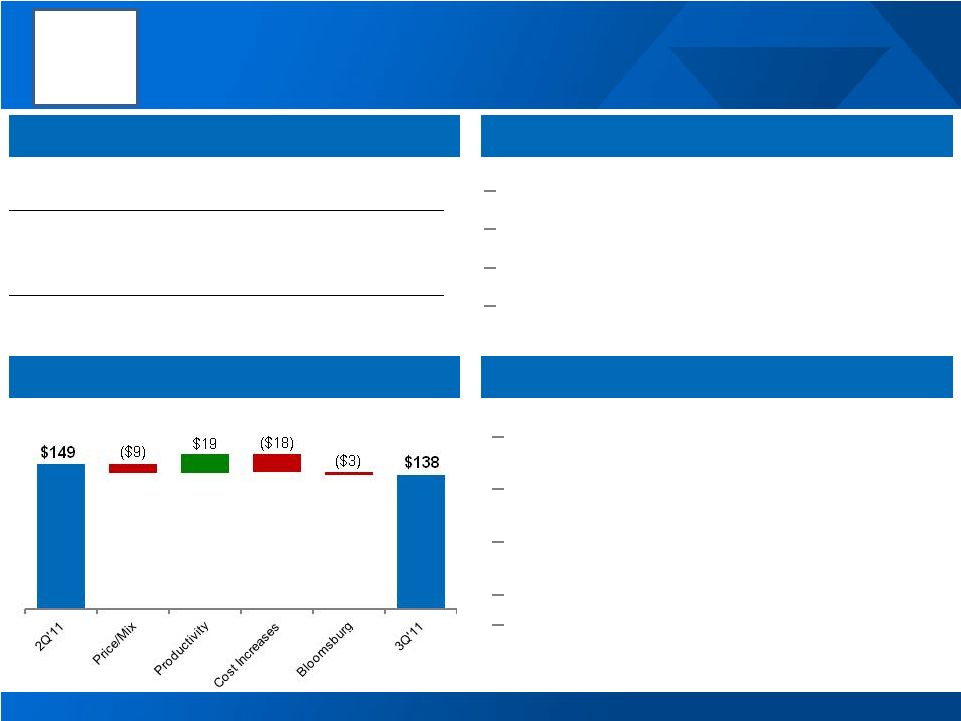

$

Millions 3Q 10

2Q 11

3Q 11

3

rd

Party Revenue

1,173

1,370

1,373

ATOI

114

149

138

Adjusted EBITDA Margin

18%

19%

18%

Engineered Products and Solutions

13

3

rd

Quarter Performance Bridge

$ Millions

3

rd

Quarter Business Highlights

3

rd

Quarter Results

17%

revenue

growth

from

Q3

2010

21%

improvement

in

ATOI

from

Q3

2010

Days

working

capital

down

2

days

from

Q3

2010

$3M

unfavorable

ATOI

impact

due

to

Bloomsburg

flood

4

th

Quarter Outlook

See appendix for reconciliations to GAAP and additional information

Building

&

construction

market

continuing

to

decline

Commercial

transportation

market

weakening

in

Europe

Share

gains

through

innovation

continue

across

all market sectors

Productivity

gains

will

continue

Progress toward 2013 $1.6 billion incremental

revenue

target,

30

to

35%

during

2011

[Alcoa logo] |

($

Millions) 3Q’10

2Q’11

3Q’11

Net Income

$109

$377

$225

DD&A

$358

$375

$377

Change in Working Capital

$213

($110)

($94)

Pension Contributions

($26)

($72)

($114)

Taxes / Other Adjustments

($262)

$228

$95

Cash from Operations

$392

$798

$489

Dividends to Shareholders

($31)

($32)

($33)

Change in Debt

($555)

$30

$72

Distributions to Noncontrolling Interest

($41)

($90)

($66)

Contributions from Noncontrolling Interest

$57

$7

$8

Other Financing Activities

($4)

$0

($8)

Cash from Financing Activities

($574)

($85)

($27)

Capital Expenditures

($216)

($272)

($325)

Other Investing Activities

($128)

($78)

($42)

Cash from Investing Activities

($344)

($350)

($367)

14

3Q’11 FCF

$164 million

$1.3 billion

of cash

Debt-to-Cap

in target

range at

33.7%

DWC better

by 5 Days

from 3Q

2010

See appendix for Free Cash Flow reconciliation

3

rd

Quarter 2011 Cash Flow Overview

[Alcoa logo] |

Sustainable Reductions in Days Working Capital

15

3Q

2009

3Q

2010

3Q

2011

Sustained

historically low

days working

capital

performance

3Q

2009

3Q

2010

3Q

2011

3Q

2009

3Q

2010

3Q

2011

3Q

2009

3Q

2010

3Q

2011

3Q

2009

3Q

2010

3Q

2011

[Alcoa logo] |

2011 Cash Sustainability Operational Targets and Actual Performance

16

Sustaining Capital

Growth Capital

Ma’aden Invest

$400

Debt-to-Cap

$197

$ Millions

$ Millions

%

2010

Actual

2011

Target

2011

YTD

$165

35.0%

34.9%

2010

Actual

2011

Target

2011

YTD

33.7%

$500

$445

2010

Actual

2011

Target

2011

YTD

$262

$570

2010

Actual

2011

Target

2011

YTD

$539

Free Cash Flow

$ Millions

$0

$1,246

$250

2010

Actual

2011

Target *

2011

YTD

30.0%

•Target is to be free cash flow positive. See appendix for Free Cash

Flow reconciliation We Are Focused on Achieving Our 2011 Goals

[Alcoa logo]

$1,000

$ Millions |

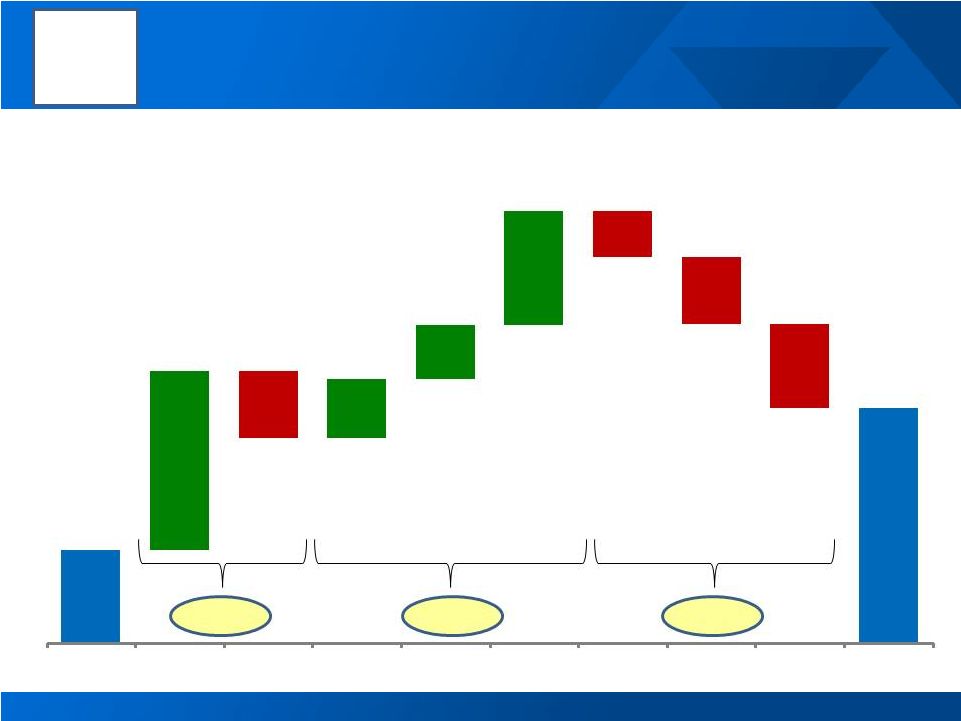

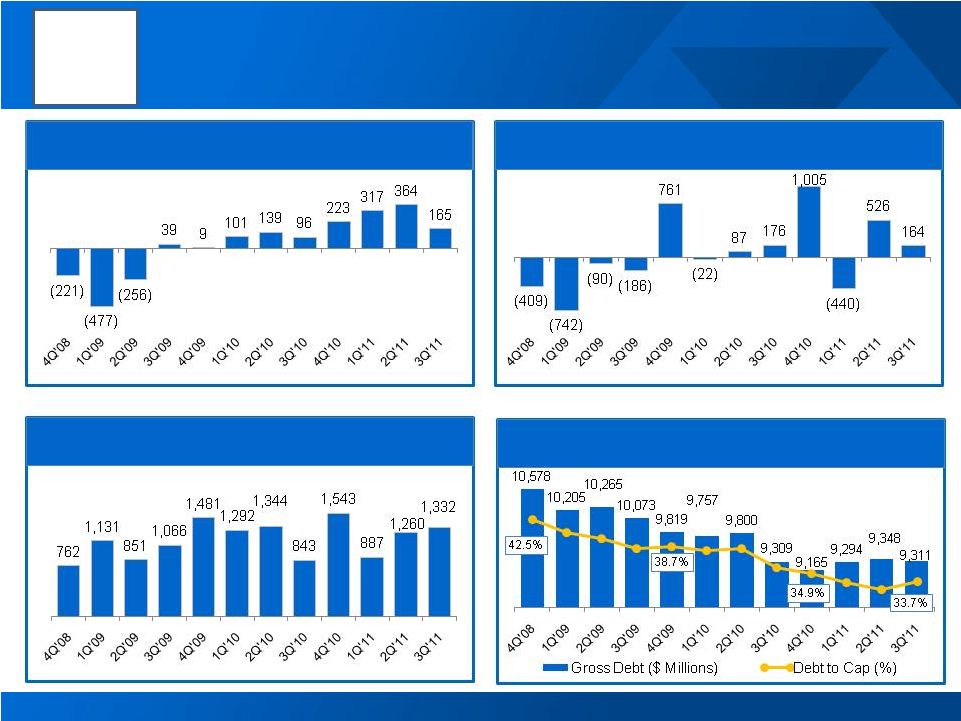

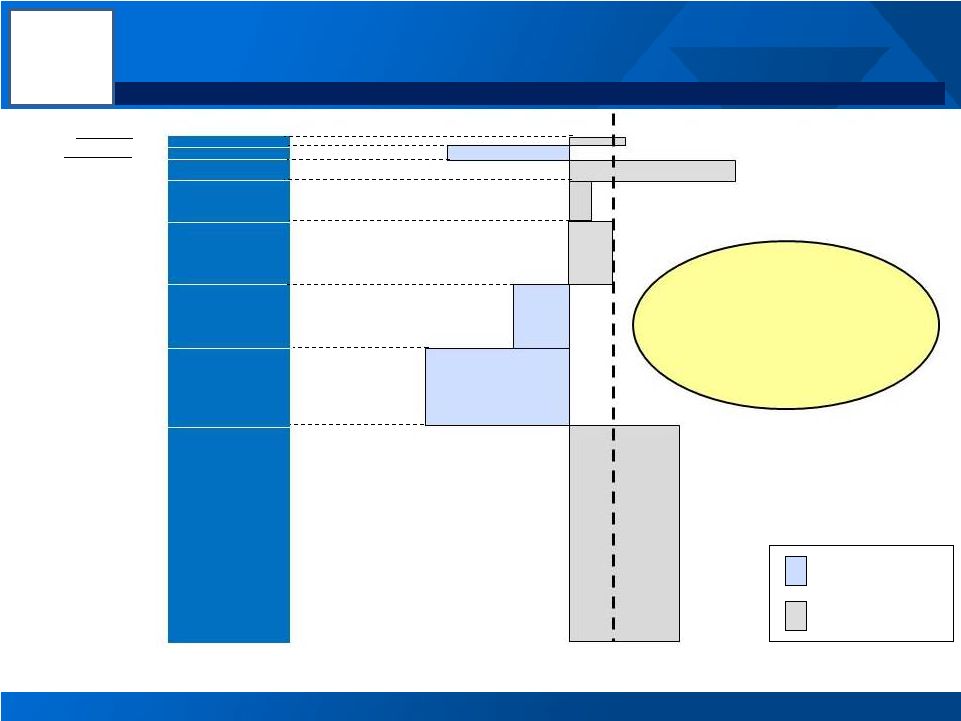

Alcoa Enters Uncertain Times Stronger And More Resilient

17

Improved Performance in our Businesses

Improved Generation of Free Cash Flow

$1b Less Debt and 10% Lower Debt to Cap

Income from Continuing Operations

excluding restructuring and specials

($ Millions)

Free Cash Flow

($ Millions)

Significant Cash on Hand

Cash on Hand

($ Millions)

See appendix for reconciliations to GAAP and additional information

[Alcoa logo] |

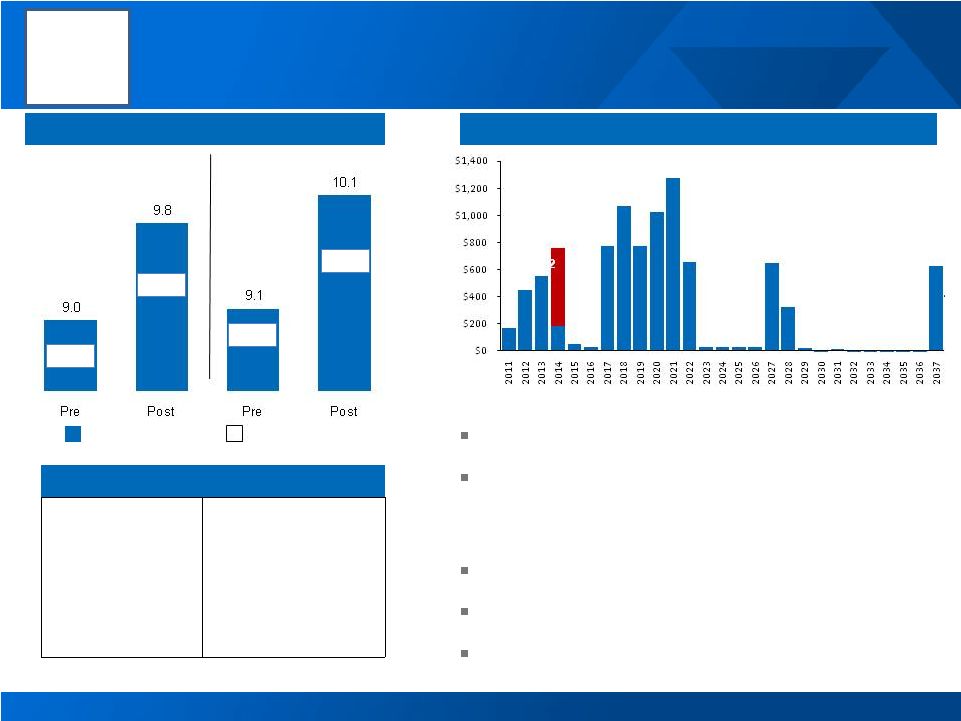

Management Actions Have Led to Improved Liquidity Position

18

Impacts of Refinancing

1

Strong

demand

for

Alcoa

debt

August 2010 and April 2011 issuances

increased

average

debt

maturity

to

10.1

years

Issued

10-year

funds

in

2011

at

5.4%

$1.5B

in

maturities

over

the

next

5

years

1

5-year

credit

facility

completed

successfully

Long-Term

Debt

Maturity

Profile

($millions)

2011 New Issue

2010 New Issue

Close Date

July 25, 2011

Capacity

$3.75B

Tenor

5 years

(July 2016 expiration)

Drawn Amount

$0

Revolving Credit Facility

2

1

Considers convertible debt as equity

2014 Convertible Debt

Weighted life in years

Weighted interest rate

[Alcoa logo]

5.8%

5.5%

5.6%

5.3%

2 |

[Alcoa logo]

Klaus Kleinfeld

Chairman and Chief Executive Officer |

3%

4%

6%

6%

5%

5%

17%

7%

12%

17%

Russia

Brazil

Asia w/o China

North America

Europe

China

2010 vs. 2011

2011 Estimated Consumption

10%

21%

16%

*Other

44.3

2010 Actual

2011 Forecast

20

2010 Global Demand

Growth Rate: 13%

2011 Global Demand

Growth Rate 12%

vs. 2010

(2011 ex China:

8%) India

6%

12%

*Other consists of: Middle East, Latin America ex Brazil, and Rest of World

including unallocated global increase 14%

Global Aluminum Demand in 2011 Remains Strong…

0.9

1.0

[Alcoa logo]

2011 Projected Primary Aluminum Consumption (mmt) and Growth Rates (%) by Region |

Russia

Brazil

Asia w/o China

North America

Europe

China

2H 2011 vs. 1H 2011

2011 Estimated Consumption

*Other

44.3

Decelerating

growth in 2H

Accelerating

growth in 2H

21

India

*Other consists of: Middle East, Latin America ex Brazil, and Rest of World

including unallocated global increase …With

Asia

Compensating

for

Western

Weakness

in

2

nd

Half

0.9

1.0

Net Increase 4%

2H 2011 vs. 1H 2011

Reaffirms 12%

year-on-year

growth 2011 versus 2010

Net Increase = 4%

-13%

-5%

-11%

2%

10%

15%

5%

[Alcoa logo]

19.3

6.8

5.7

5.4

3.4

1.8

4%

2011 Projected Primary Aluminum Consumption (mmt) and 2H vs. 1H 2011 Growth Rates (%)

|

30

10

60

Regional Physical Markets Remain Tight

LME at 38

days

Non-LME at

15 days

53 days of

consumption

22

Regional Premiums Signal Strong Demand

Inventories 6 days Lower Year-on-Year

Global

Inventories

Drop 3 days vs.

2Q’11

$119 /MT

$200 /MT

$181 /MT

Source: Alcoa estimates, LME, SHFE, IAI, Marubeni, Platt’s Metals Week and

Metal Bulletin [Alcoa logo]

0

20

40

50

70

80

LME

China

Japan Port

Producer

0

1

2

3

4

5

6

7

8

9

10

Midwest

Japan

Europe |

Western

World

Annualized Production (May 2011)

25,600

Restarted and Expanded Capacity

400

Total Supply

26,000

Western World Consumption

(24,971)

(Deficit) Surplus

1,029

China

Annualized Production (May 2011)

18,000

Restarted and Expanded Capacity

500

Total Supply

18,500

Consumption

(19,300)

(Deficit) Surplus

(800)

2011 Aluminum: China Deficit Counteracts Western Surplus

23

China

Western World

Production

Demand

Surplus

Source: Alcoa estimates, Brook Hunt, CRU, CNIA, IAI

Deficit

Production

Demand

2011E Primary Aluminum Supply / Demand Balance (in kmt)

229 kmt

global surplus

[Alcoa logo] |

2011 Global Alumina Balance Remains At Equilibrium

24

Source: Alcoa estimates, Brook Hunt, CRU, CNIA, IAI

China

Western World

2011 Annualized Production

34,200

Imports from Western World

1,600

Supply

35,800

Demand

(35,800)

(Deficit) / Surplus

0

2011 Annualized Production

53,800

Exports to China

(1,600)

Supply

52,200

Demand

(52,200)

(Deficit) / Surplus

0

Production

Demand

2011E Alumina Supply / Demand Balance (in kmt)

[Alcoa logo]

Balanced |

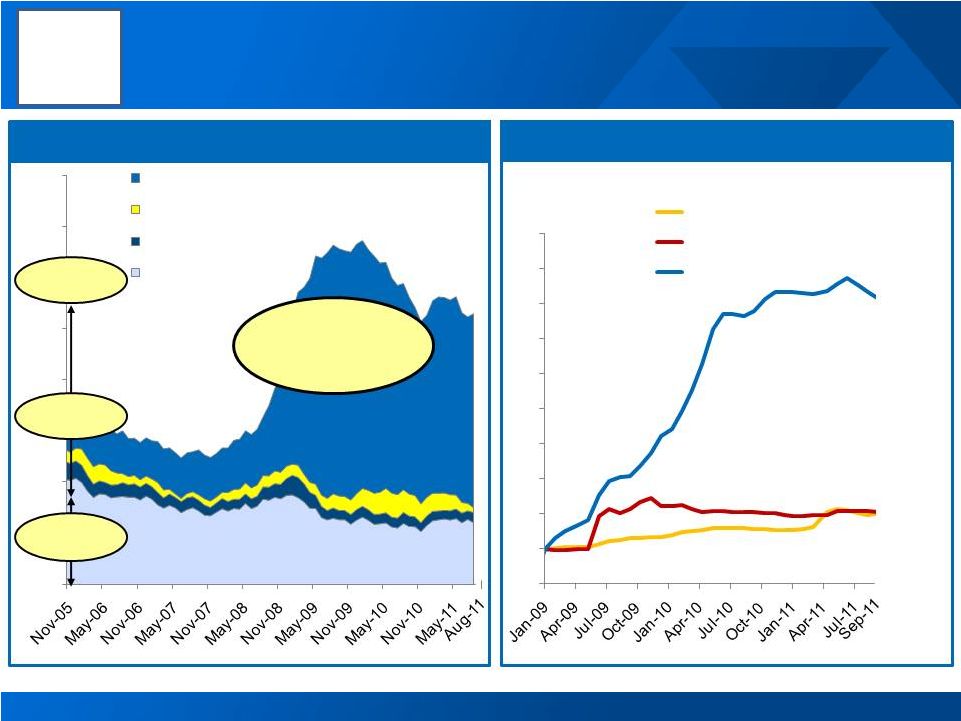

A

Tale of Two Markets…. 25

2008/2009: Best of times (or close to it)…

…worst of times

-232kMT

-3,383kMT

2008

2009

Global Demand

Destruction

Weakening

Physical Markets

Regional Premiums

Europe

Japan

USA

$57

$32

$90

$81

$116

$76

2011: The world is not the same

Open Interest

LME Aluminum

18.2m

$3,323

16.2m

$1,342

Financial

Bias

Bearish

Defensive

Liquidation

16.6m

$2,513

20.1m

$2,243

Financial

Bias

Bearish

Offensive

Short

Selling

But Physical Markets

Remain Strong

$215

$187

$181

$200

$121

$119

Europe

Japan

USA

+5,268kMT

+4,700kMT

2010

2011

Continued

Demand Growth

Open Interest

LME Aluminum

Regional Premiums

Source: Alcoa estimates, CRU, LME, Platt’s Metals Week and Metal Bulletin

[Alcoa logo]

Jan-08

Apr-08

Jul-08

Oct-08

Jan-09

7/10/08

9/10/08

11/10/08

1/10/09

Jun-11

Jul-11

Aug-11

Sep-11

7/19/11

8/19/11

9/19/11 |

Leading Market Indicators Have Softened…

26

Sources: International Monetary Fund; Oxford Economics *Confidence figures set at

100 in January 2011 for comparability 1

EC

Commission

EU

Confidence

National

Bureau

of

Statistics

China

Consumer

Confidence

University

of

Michigan

Consumer

Sentiment

[Alcoa logo]

2

3 |

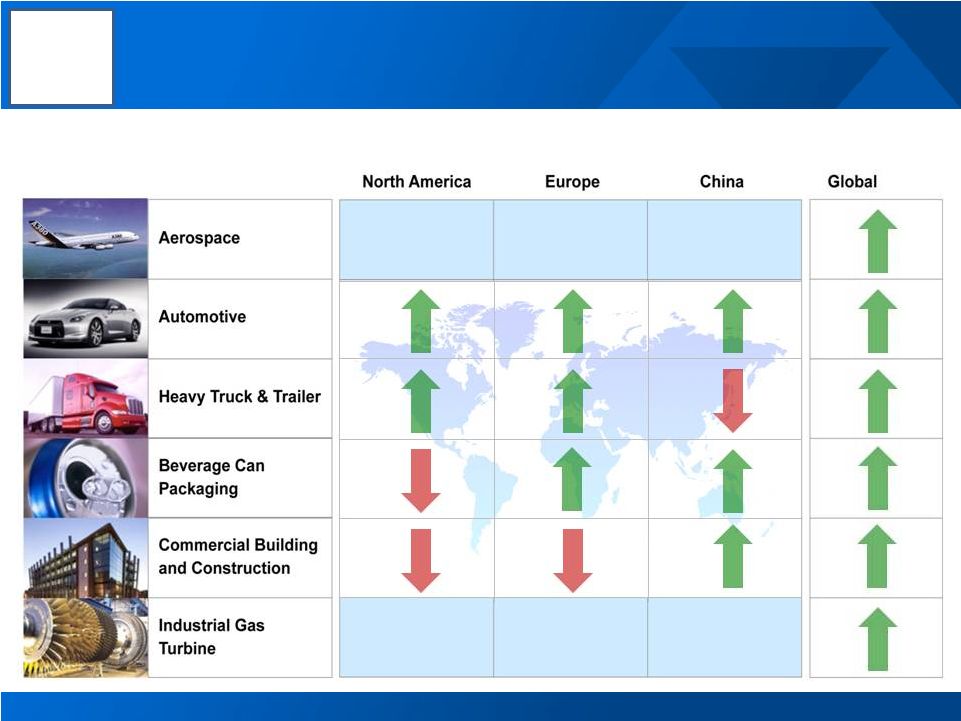

…Still, Growth Continues in 2011…

27

Alcoa End Markets: Current Assessment of 2011 vs. 2010 Conditions

Source: Alcoa analysis

8%-10%

sales growth

1%-2%

sales growth

4%-6%

sales growth

60%-63%

sales growth

26%-29%

sales growth

4%-5%

sales growth

10%-12%

sales growth

10%-12%

sales decline

4%-6%

sales decline

3%-4%

sales decline

10%-16%

sales decline

15%-20%

sales growth

[Alcoa logo]

3%-5%

sales growth

0%-2%

sales growth

2%-3%

sales growth

5%-10% build

rate growth

6%-7%

sales growth

1%-3%

sales growth |

…with Slowing Growth in 2H

28

Alcoa End Markets: Current Assessment of Market Conditions by Semesters

1H 2011

vs

2H 2010

2H 2011

vs

1H 2011

Key:

Source:

Alcoa

analysis;

**Japanese

earthquake

impact

1H

2011

vs.

2H

2010

[Alcoa logo]

**

10%-12%

1%-3%

5%-10%

4%

0%

28%

23%

0%

-2%-3%

-9%

-3%-4%

14%

-16%

14%

-11%

6%

2%-3%

-4%

-2%-4%

10%-15%

15%-20%

-4%

12%

-4%

4%

10%

-14%

5%

-24%

2%-3%

2%-3%

2%

2% |

Deteriorating European Conditions Impact Flat-Rolled Segment

29

Alcoa Flat-Rolled Product Orders (12 month rolling average)

Indexed to Q1 2010

Europe

China

FRP Orders: Marked Slowdown in Europe

North

America

1.40

1.50

1.30

1.20

1.10

1.00

0.90

0.80

-20%

Q-o-Q

-1%

Q-o-Q

+2%

Q-o-Q

[Alcoa logo]

Q1

2010

Q2

2010

Q3

2010

Q4

2010

Q1

2011

Q2

2011

Q3

2011 |

+$411m vs. 2010

-0.4% pts

vs. 2010

2009: Seven Promises

2011: Prepared for Turbulence

Alcoa Today: Stronger and More Resilient

Operational

•

Productivity

•

Overhead Reductions

•

Capital Expenditures

(including Ma’aden)

•

Working Capital

Financial / Strategic

•

Leading Positions

•

Strong Debt

Maturity Profile

-42% vs. 2007

85% #1 or #2

in their businesses

$1.5b due over

next 5 years

-5 days vs. 2010

30

[Alcoa logo] |

Actively

Managed

Portfolio

Capacity

Optimization

Right-Sized

Workforce

Additional

flexibility

R&D

technology

refocus

Share growth

Procurement

savings

Company-

wide over-

head reduction

Increased

debt capacity

Speedy execution

Focus on cash and bottom line

Capital spend reduction

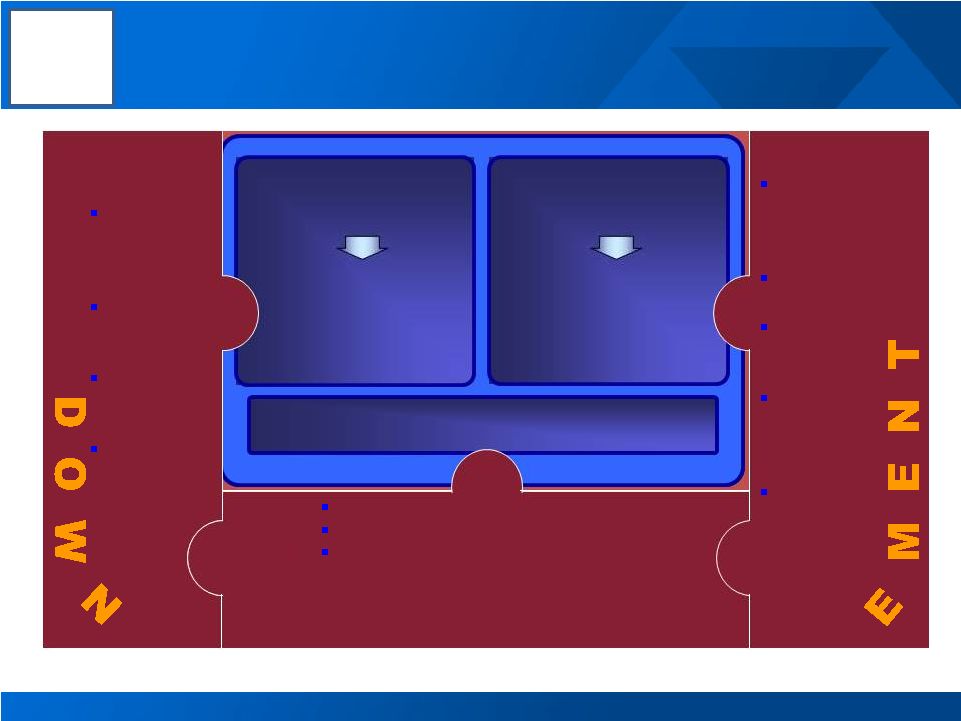

T U R

N M A N A G

Our Crisis Management Toolbox Is Ready for Rapid Deployment

31

[Alcoa logo]

Alcoa Advantage

creating value for

all businesses

–

Talent

–

Technology

–

Customer Intimacy

–

Purchasing

–

Operating System

Profitable Growth

in every business

Business Programs

that

define:

–

3-year aspirations

–

Priority levers

–

Accountability

Alcoa Advantage

creating value for

all businesses

–

Talent

–

Technology

–

Customer Intimacy

–

Purchasing

–

Operating System

in every business

Business Programs

that

define:

–

3-year aspirations

–

Priority levers

–

Accountability

Disciplined Execution

across all activities |

Alcoa Did Not Compromise Its Future In The Last Downturn…

Alcoa

capital

expenditure

on

growth

projects,

2008

–

2009,

in

US$

32

Asset

Swap

$830m

Investment

$130m

Investment

$80m

Investment

$970m

Investment

Mosjoen

&

Lista,

Norway

–

Smelter

São Luis, Brazil –

Alumina Refinery

Bohai,

China

–

Flat

Rolled

Products

Samara, Russia –

End & Tab Line

Juruti,

Brazil

–

Bauxite

Mine

[Alcoa logo] |

…And Has Not Lost True North Of Accelerating Value

Environment

Energy consumption rising

–

Increase of 54% by 2025

–

Driven by developing countries

Personal transport rising

–

Increase of 40% by 2030

Greenhouse gas regulation

Light Weight

High

Strength

Durable

Highly

Conductive

Non-Corrosive

Malleable

Recyclable

Relative

Value

Demographics

Urbanization

…Demanding the Right Solutions…

…Targeting Profitable Growth

The World is Changing…

Global population rising

–

2006: 6.6 billion

–

2025: 7.9 billion

–

2050: 9.1 billion

Population in cities

–

2006: > 50%

–

2030: > 60%

33

Alcoa Innovations

[Alcoa logo] |

Changing Regulations Drive Al Penetration In Automotive

Source: The Aluminum Association, Ducker Research / Alcoa Analysis

Changing Regulations…

…And Drive Substitution

34

US Corporate Average

Fuel Economy (MPG)

Global Auto Body Sheet

Consumption (KMT)

[Alcoa logo]

KMT

…Create Opportunities…

Aluminum Penetration

Opportunities

100%

increase

31%

increase

White House

Proposal

Substitution

potential of

>15MMT

7.5X

increase

27.2

35.5

54.5

2011

2016

2025

0

2,000

4,000

6,000

8,000

10,000

12,000

Currently Aluminum

Aluminum Opportunity

200

800

1,500

2011

2016

2020 |

Aerospace: Vibrant Growth Projected Over Long & Near Terms

35

2030

Replacement

Growth

2020

Existing fleet

…Driven by Travel Demand + Aging Fleet

Commercial Airline Fleet

(thousand units)

Sources: 1) Boeing 2011 Commercial Market Outlook, 2)

The Airline Monitor and OEM websites Notes: All figures include both

Large Commercial Aircraft & Regional Jets; $ Value of deliveries expressed in then-year dollars

Strong Orders and Deliveries…

Commercial Jet Deliveries

16,000

planes

33,000

new planes

Build rate of

1,675 units

per year

[Alcoa logo]

4% CAGR

Units

$B Value

9% CAGR

16% CAGR

Backlog: ~8

years of

production at

2010 rates

21

16

11

5

9

11

24

2010

1,097

1,190

1,360

1,440

1,550

$63

$71

$90

$100

$114

2010

2011

2012

2013

2014 |

Aluminum In The Frame For Years To Come

36

A320Neo

B737-MAX

Improving Performance…

~50%

lower

fuel

use

per

seat

than

last

generation

15

to

16%

lower

fuel

use

per

seat

than

current

generation

Demonstrated

market

appeal

--

1,700+

orders

/

commitments

already

captured

…Great for Aluminum & Alcoa

Aluminum

proprietary

alloys

specified

for

both

models

Meets/exceeds

all

performance

requirements

regarding

weight,

strength

and

maintenance

goals

At

far

less

risk

to

schedules,

budgets

and

technical

complexity

Alcoa

continues

to

grow

per-platform

content

Content

on

nearly

every

major

aircraft

Developed

90%

of

aerospace

alloys

in

use

Best-Selling Aircraft

1

MD-80,

737-Classic

2

A320,

B737-NG

[Alcoa logo]

1

2

its |

37

Potlines

Cathode Sealing Plant

Port

Rolling Mill Construction

Refinery Earth Work

Ma’aden Alcoa Project Progresses On Schedule and Budget

[Alcoa logo] |

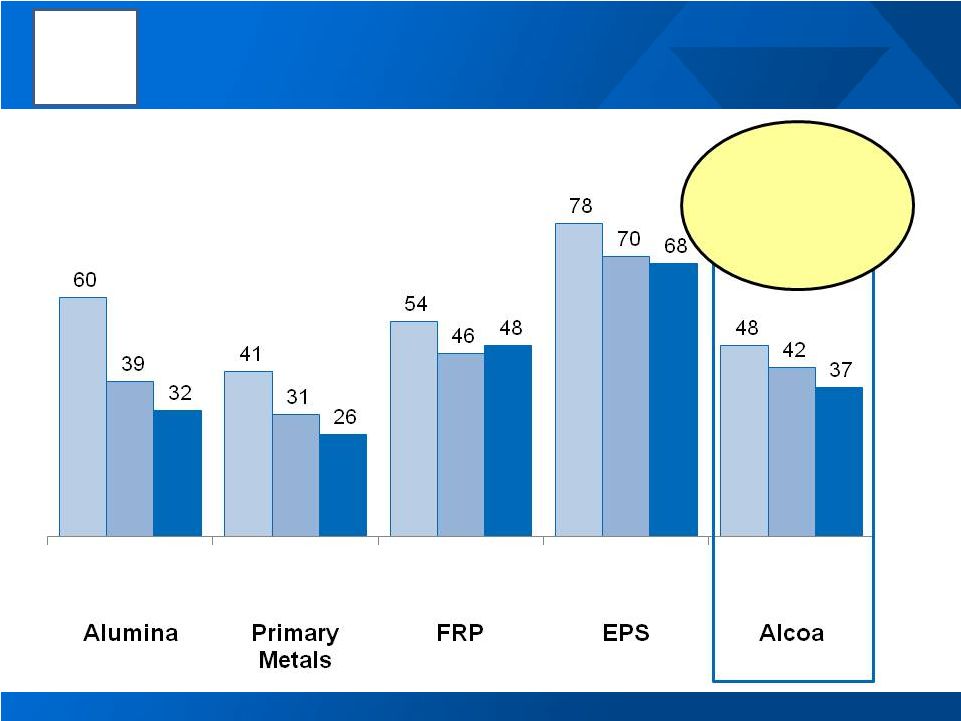

Segment Dashboard: Price & Market Pressure Impact Results

38

See appendix for Adjusted EBITDA reconciliations

LME

Adjusted EBITDA/MT

LME

Adjusted EBITDA/MT

541

495

479

531

620

536

498

254

224

551

173

193

147

Adjusted EBITDA $Millions

Adjusted EBITDA Margin

436

287

356

495

536

676

783

922

630

762

229

261

245

Adjusted EBITDA $Millions

Adjusted EBITDA Margin

460

321

336

418

398

784

626

392

(159)

320

438

422

283

1,447

1,350

1,433

1,719

1,900

2,570

2,641

2,572

1,664

2,173

2,500

2,603

2,400

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

Q1

2011

Q2

2011

Q3

10 YR Average ~

$390/MT

Primary Metals: Margin Compression

11%

8%

9%

12%

11%

12%

13%

15%

13%

17%

18%

19%

18%

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011 2011

Q1

Q2

2011

Q3

Eng. Products & Solutions: Continued Strength

62

44

48

68

75

110

104

81

20

47

71

81

75

1,447

1,350

1,433

1,719

1,900

2,570

2,641

2,572

1,664

2,173

2,500

2,603

2,400

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

Q1

2011

Q2

2011

Q3

10 Yr Average ~ $66/MT

Alumina: Maintaining 2011 Margins

11%

11%

10%

9%

9%

6%

5%

3%

4%

9%

9%

9%

7%

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

Q1

2011

Q2

2011

Q3

Flat-Rolled Products: European Weakness

[Alcoa logo] |

Managing Through Uncertainty –

Focused on True North

Opportunity in the Face of Uncertainty

Meeting our Aggressive Targets

EPS: $1.6b in Revenue Growth by 2013 ($b)

GRP: $2.5b in Revenue Growth by 2013 ($b)

See appendix for reconciliations to GAAP and additional information

$1.1 to $1.2

End Markets Slow

In Second Half

Continued Growth

In Aluminum Demand

Prepared for

Uncertain Times…

…but Focused on

Our True North

[Alcoa logo]

$4.6

$4.0

$6.2

2010

2011

YTD

2013

Target

$6.3

$6.0

$8.8

2010

2011

YTD

2013

Target

$1.6 to $1.8

39 |

40

[Alcoa logo]

[Alcoa logo] |

Roy Harvey

Director, Investor Relations

390 Park Avenue

New York, NY 10022-4608

Telephone: (212) 836-2674

www.alcoa.com

Additional Information

41

[Alcoa logo]

[Alcoa logo] |

Annual Sensitivity Summary

42

Currency Annual Net Income Sensitivity

+/-

$100/ = +/

-

$200

Million

LME Aluminum Annual Net Income Sensitivity

Australian $

+/-

$10 million

per 0.01 change in USD / AUD

Brazilian $

+/-

$ 3 million

per 0.01 change in BRL / USD

Euro €

+/-

$ 2 million

per 0.01 change in USD / EUR

Canadian $

+/-

$ 4 million

per 0.01 change in CAD / USD

Norwegian Kroner

+/-

$ 6 million

per 0.10 change in NOK / USD

[Alcoa logo] |

Revenue Change by Market

3Q’11 Third-Party Revenue

Sequential

Change

Year-Over-Year

Change

43

13%

3%

6%

6%

4%

2%

14%

5%

14%

33%

Aerospace

Automotive

B&C

Comm. Transport

Industrial Products

IGT

Packaging

Distribution/Other

Alumina

Primary Metals

2%

(7%)

(5%)

6%

(6%)

0%

(4%)

(13%)

(5%)

(1%)

20%

26%

9%

44%

1%

11%

21%

14%

23%

26%

[Alcoa logo] |

Reconciliation of ATOI to Consolidated Net (Loss) Income

Attributable to Alcoa

44

[Alcoa logo]

(in millions)

1Q10

2Q10

3Q10

4Q10

201

0

1Q11

2Q11

3Q11

Total

segment ATOI

$ 306

$ 381

$ 328 $

409

$ 1,424

$

555

$

63

5

$

462

Unallocated amounts (net of tax):

Impact of

LIFO

(14)

(3)

(2)

3

(16)

(24)

(27)

2

Interest expense

(77)

(77)

(91)

(76

)

(321)

(72)

(106

)

(81)

Noncontrolling

interests

(22)

(34)

(48)

(34)

(138

)

(58)

(55

)

(53

)

Corporate expense

(67)

(59)

(71)

(94)

(291)

(67)

(76)

(76)

Restructuring and other charges

(122)

(21)

1

8

(134)

(6)

(22

)

(7

)

Discontinued operations

(7)

(1)

–

–

(8)

(1)

(4)

–

Other

(198)

(50)

(56)

42

(262)

(19)

(23

)

(75

)

Consolidated net

(loss) income

attributable to

Alcoa

$ (201)

$ 136

$

61

$

258

$ 254

$ 308

$ 322

$ 172 |

Income (loss) from

continuing operations attributable to Alcoa – as adjusted is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because management reviews the operating results of Alcoa

excluding the impacts of restructuring and other charges, discrete tax items, and other special items

(collectively, “special items”). There can be no assurances that additional special items will not occur in future periods. To compensate for this

limitation, management believes that it is appropriate to consider both Income (loss) from continuing

operations attributable to Alcoa determined under GAAP as well as Income (loss) from continuing operations attributable to Alcoa – as

adjusted.

* Discrete tax items include the following:

for the quarter ended September 30, 2011, a net benefit for adjustments made related to the filing of

2010 tax returns in various jurisdictions ($5) and a net benefit for other miscellaneous items ($5);

for the quarter ended December 31, 2010, a benefit for the reversal of the remaining valuation

allowance related to net operating losses of an international subsidiary ($16) (a portion was initially reversed in the quarter ended September 30, 2010) and a net

benefit for other small items ($2);

for the quarter ended September 30, 2010, a benefit for the reversal of a valuation allowance related

to net operating losses of an international subsidiary that are now realizable due to a settlement with a tax authority ($41), a charge for a tax rate change in

Brazil ($11), and a benefit for the recovery of a portion of the unfavorable impact included in the

quarter ended March 31, 2010 related to unbenefitted losses in Russia, China, and Italy ($8);

for the quarter ended June 30, 2010, a benefit for a change in a Canadian provincial tax law

permitting tax returns to be filed in U.S. dollars ($24), a charge based on settlement discussions of several matters with international taxing authorities ($18), and a

benefit for the recovery of a portion of the unfavorable impact included in the quarter ended March

31, 2010 related to unbenefitted losses in Russia, China, and Italy ($10); and, for the

quarter ended March 31, 2010, charges for a change in the tax treatment of federal subsidies received related to prescription drug benefits provided under certain retiree health benefit plans ($79), unbenefitted losses in Russia, China, and Italy

($22), interest due to the IRS related to a previously deferred gain associated with the 2007

formation of the former soft alloy extrusions joint venture ($6), and a change in the anticipated sale structure of the Transportation Products Europe business ($5).

** Other special items include the following:

for the quarter ended September 30, 2011, favorable mark-to-market changes in certain power

derivative contracts ($13) and uninsured losses, including costs related to flood damage to a plant in Pennsylvania caused by Hurricane Irene, ($11);

for the quarter ended June 30, 2011, a net charge comprised of expenses for the early repayment of

Notes set to mature in 2013 due to the premiums paid under the tender offers and call option and gains from the termination of related “in-the-money” interest

rate swaps ($32) and favorable mark-to-market changes in certain power derivative contracts

($10); for the quarter ended March 31, 2011, costs related to acquisitions of the

aerospace fastener business of TransDigm Group Inc. and full ownership of carbothermic smelting technology from ORKLA ASA ($8) and favorable mark-to-market changes in certain

power derivative contracts ($5);

for the quarter ended December 31, 2010, favorable mark-to-market changes in certain power

derivative contracts; for the quarter ended September 30, 2010, unfavorable

mark-to-market changes in certain power derivative contracts ($29), recovery costs associated with the São Luís, Brazil facility due to a power outage and failure of a ship unloader in the first half of 2010

($23), restart costs and lost volumes related to a June 2010 flood at the Avilés smelter in Spain

($13), and a net charge comprised of expenses for the early repayment of Notes set to mature in 2011 through 2013 due to the premiums paid under the tender

offers and call option and gains from the termination of related “in-the-money”

interest rate swaps ($9); for the quarter ended June 30, 2010, favorable mark-to-market

changes in certain power derivative contracts ($22), a charge for costs associated with the potential strike and successful execution of a new agreement with the United Steelworkers ($13), and a

charge related to an unfavorable decision in Alcoa’s lawsuit against Luminant related to the

Rockdale, TX facility ($7); and, for the quarter ended March 31, 2010, charges related to

unfavorable mark-to-market changes in certain power derivative contracts ($31), power outages at the Rockdale, TX and São Luís, Brazil facilities ($17), an additional environmental accrual for the Grass

River remediation in Massena, NY ($11), and the write off of inventory related to the permanent

closures of certain U.S. facilities ($5). Reconciliation of Adjusted

Income 45

[Alcoa logo]

(in millions)

Quarter ended

Nine months ended

March 31,

2010

June 30,

2010

September 30,

2010

December 31,

2010

March 31,

2011

June 30,

2011

September 30,

2011

September 30,

2010

September 30,

2011

Net (loss) income

attributable to Alcoa

$ (201)

$ 136

$ 61

$ 258

$ 308

$ 322

$ 172

$ (4)

$ 802

Loss from discontinued

operations

(7)

(1)

–

–

(1)

(4)

–

(8)

(5)

(Loss) income from

continuing

operations

attributable to Alcoa

(194)

137

61

258

309

326

172

4

807

Restructuring and

other charges

119

20

(1)

(8)

5

16

5

138

26

Discrete tax items*

112

(16)

(38)

(18)

–

–

(10)

58

(10)

Other special items**

64

(2)

74

(9)

3

22

(2)

136

23

Income from

continuing

operations

attributable to Alcoa

–

as adjusted

$ 101

$ 139

$ 96

$ 223

$ 317

$ 364

$ 165

$ 336

$ 846 |

Reconciliation of Adjusted Income (continued)

46

[Alcoa logo]

(in millions)

Quarter ended

December 31,

2008

March 31,

2009

June 30,

2009

September 30,

2009

December 31,

2009

Net (loss) income

attributable to Alcoa

$ (1,191)

$ (497)

$ (454)

$ 77

$ (277)

(Loss) income

from

discontinued

operations

(262)

(17)

(142)

4

(11)

(Loss) income from

continuing

operations

attributable to Alcoa

(929)

(480)

(312)

73

(266)

Restructuring and

other charges

614

46

56

1

49

Discrete tax items*

65

(28)

–

–

(82)

Other special items**

29

(15)

–

(35)

308

(Loss) income from

continuing

operations

attributable to Alcoa

–

as adjusted

$ (221)

$ (477)

$ (256)

$ 39

$ 9

Income (loss) from continuing operations attributable to Alcoa – as adjusted is a non-GAAP

financial measure. Management believes that this measure is meaningful to investors because management reviews the

operating results of Alcoa excluding the impacts of restructuring and other charges, discrete tax

items, and other special items (collectively, “special items”). There can be no assurances that additional special items will

not occur in future periods. To compensate for this limitation, management believes that it is

appropriate to consider both Income (loss) from continuing operations attributable to Alcoa determined under GAAP as well as

Income (loss) from continuing operations attributable to Alcoa – as adjusted.

* Discrete tax items include the following:

for the quarter ended December 31, 2009, a benefit for the reorganization of an equity investment in

Canada ($71), a charge for the write-off of deferred tax assets related to operations in Italy ($41), a benefit for a tax

rate change in Iceland ($31), and a benefit for the reversal of a valuation allowance on net operating

losses in Norway ($21); for the quarter ended March 31, 2009, a benefit for a change in a

Canadian national tax law permitting tax returns to be filed in U.S. dollars; and,

for the quarter ended December 31, 2008, a charge for non-cash tax on repatriated

earnings. ** Other special items include the following:

for the quarter ended December 31, 2009, charges related to the European Commission’s ruling on

electricity pricing for smelters in Italy ($250), a tax s ettlement related to an equity investment in Brazil ($24), an

estimated loss on excess power at the Intalco smelter ($19), and an environmental accrual for

smelters in Italy ($15); for the quarter ended September 30, 2009, a gain on an

acquisition in Suriname; for the quarter ended March 31, 2009, a gain on the Elkem/SAPA

AB swap ($133) and a loss on the sale of Shining Prospect ($118); and, for the quarter ended

December 31, 2008, charges for environmental reserve ($26), obsolete inventory ($16), and accounts receivable reserve ($11), and a refund of an indemnification payment ($24). |

Reconciliation of Free Cash Flow

47

(in millions)

Quarter ended

Nine months

ended

March 31,

2011

June 30,

2011

September 30,

2011

September 30,

2011

Cash provided from

operations

$ (236)

$ 798

$ 489

$ 1,051

Capital expenditures

(204)

(272)

(325)

(801)

Free cash flow

$ (440)

$ 526

$ 164

$ 250

Free Cash Flow is a non-GAAP financial measure. Management believes that this measure is

meaningful to investors because management reviews cash flows generated from operations after

taking into consideration capital expenditures due to the fact that these expenditures are

considered necessary to maintain and expand Alcoa’s asset base and are expected to

generate future cash flows from operations. It is important to note that Free Cash Flow does not represent the

residual cash flow available for discretionary expenditures since other non-discretionary

expenditures, such as mandatory debt service requirements, are not deducted from the

measure. [Alcoa logo] |

December 31,

Reconciliation of Free Cash Flow (continued)

48

[Alcoa logo]

(in millions)

Quarter ended

Year ended

December 31,

2008

March 31,

2009

June 30,

2009

September 30,

2009

December 31,

2009

March 31,

2010

June 30,

2010

September 30,

2010

December 31,

2010

2010

Cash

provided

from

operations

$ 608

$ (271)

$ 328

$ 184

$ 1,124

$ 199

$ 300

$ 392

$ 1,370

$ 2,261

Capital

expenditures

(1,017)

(471)

(418)

(370)

(363

)

(221)

(213)

(216)

(365

)

(1,015)

Free cash

flow

$ (409)

$ (742)

$

(90)

$ (186)

$ 761

$ (22)

$ 87

$ 176

$ 1,005

$ 1,246

Free Cash Flow is a non-GAAP financial measure. Management believes that this measure is

meaningful to investors because management reviews cash flows generated from operations after taking into

consideration capital expenditures due to the fact that these expenditures are considered necessary to

maintain and expand Alcoa’s asset base and are expected to generate future cash flows from operations.

It is important to note that Free Cash Flow does not represent the residual cash flow available for

discretionary expenditures since other non-discretionary expenditures, such as mandatory debt service

requirements, are not deducted from the measure.

|

Reconciliation of Alcoa Adjusted EBITDA

49

[Alcoa logo]

($ in millions)

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

3Q10

2Q11

3Q11

Net income (loss)

attributable to

Alcoa

$ 908

$ 420

$ 938

$ 1,310

$ 1,233

$ 2,248

$ 2,564

$ (74)

$ (1,151)

$ 254

$ 61

$ 322

$ 172

Add:

Net income

attributable to

noncontrolling

interests

205

181

212

233

259

436

365

221

61

138

48

55

53

Cumulative effect

of accounting

changes

–

(34)

47

–

2

–

–

–

–

–

–

–

–

Loss (income)

from discontinued

operations

5

101

–

27

50

(22)

250

303

166

8

–

4

–

Provision (benefit)

for income taxes

524

307

367

546

464

853

1,623

342

(574)

148

(49)

136

55

Other (income)

expenses, net

(295)

(175)

(278)

(266)

(478)

(236)

(1,920)

(59)

(161)

5

43

(50)

31

Interest expense

371

350

314

271

339

384

401

407

470

494

139

163

125

Restructuring and

other charges

530

398

(28)

(29)

266

507

268

939

237

207

2

34

9

Provision for

depreciation,

depletion, and

amortization

1,144

1,037

1,110

1,142

1,227

1,252

1,244

1,234

1,311

1,450

358

375

376

Adjusted EBITDA

$ 3,392

$ 2,585

$ 2,682

$ 3,234

$ 3,362

$ 5,422

$ 4,795

$ 3,313

$ 359

$ 2,704

$ 602

$ 1,039

$ 821

Sales

$19,906

$17,691

$18,879

$21,370

$24,149

$28,950

$29,280

$26,901

$18,439

$21,013

$ 5,287

$ 6,585

$ 6,419

Adjusted EBITDA

Margin

17%

15%

14%

15%

14%

19%

16%

12%

2%

13%

11%

16%

13%

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and

amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to

Sales minus the following items: Cost of goods sold; Selling, general administrative, and other

expenses; Research and development expenses; and Provision for depreciation, depletion, and amortization.

Adjusted EBITDA is a non-GAAP financial measure. Management believes that this measure is

meaningful to investors because Adjusted EBITDA provides additional information with respect to Alcoa’s

operating performance and the Company’s ability to meet its financial obligations. The

Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies. |

Reconciliation of Alumina Adjusted EBITDA

50

[Alcoa logo]

($ in millions, except

per metric ton

amounts)

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

3Q10

1Q11

2Q11

3Q11

After-tax operating

income (ATOI)

$ 471

$ 315

$ 415

$ 632

$ 682

$ 1,050

$ 956

$ 727

$ 112

$ 301

$ 70

$ 142

$ 186

$ 154

Add:

Depreciation,

depletion, and

amortization

144

139

147

153

172

192

267

268

292

406

100

103

112

117

Equity (income)

loss

(1)

(1)

–

(1)

–

2

(1)

(7)

(8)

(10)

(1)

(3)

(22)

(2)

Income taxes

184

130

161

240

246

428

340

277

(22)

60

(22)

44

60

42

Other

(17)

(14)

(55)

(46)

(8)

(6)

2

(26)

(92)

(5)

(1)

–

(1)

–

Adjusted EBITDA

$ 781

$ 569

$ 668

$ 978

$ 1,092

$ 1,666

$ 1,564

$ 1,239

$ 282

$ 752

$ 146

$ 286

$ 335

$ 311

Production

(thousand metric

tons) (kmt)

12,527

13,027

13,841

14,343

14,598

15,128

15,084

15,256

14,265

15,922

4,047

4,024

4,144

4,140

Adjusted

EBITDA/Production

($ per metric ton)

$ 62

$ 44

$ 48

$ 68

$ 75

$ 110

$ 104

$ 81

$ 20

$ 47

$ 36

$ 71

$ 81

$ 75

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes,

depreciation, and amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales

minus the following items: Cost of goods sold; Selling, general administrative, and

other expenses; Research and development expenses; and Provision for depreciation, depletion, and amortization. The Other line

in

the

table

above

includes

gains/losses

on

asset

sales

and

other

nonoperating

items.

Adjusted

EBITDA

is

a

non-GAAP

financial

measure.

Management

believes

that

this

measure

is

meaningful

to

investors

because

Adjusted

EBITDA

provides

additional

information

with

respect

to

Alcoa’s

operating

performance

and

the

Company’s

ability

to

meet

its

financial

obligations.

The

Adjusted

EBITDA

presented

may

not

be

comparable

to

similarly titled measures of other companies. |

Reconciliation of Primary Metals Adjusted EBITDA

51

[Alcoa logo]

($ in millions, except

per metric ton

amounts

)

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

3Q10

1Q11

2Q11

3Q11

After-tax operating

income (ATOI)

$ 905

$ 650

$ 657

$ 808

$ 822

$ 1,760

$ 1,445

$ 931

$ (612)

$ 488

$ 78

$ 202

$ 201

$ 110

Add:

Depreciation,

depletion, and

amortization

327

300

310

326

368

395

410

503

560

571

142

141

142

137

Equity (income) loss

(52)

(44)

(55)

(58)

12

(82)

(57)

(2)

26

(1)

–

(1)

1

4

Income taxes

434

266

256

314

307

726

542

172

(365)

96

(3)

53

55

21

Other

(8)

(47)

12

20

(96)

(13)

(27)

(32)

(176)

(7)

(7)

1

–

–

Adjusted EBITDA

$ 1,606

$ 1,125

$ 1,180

$ 1,410

$ 1,413

$ 2,786

$ 2,313

$ 1,572

$ (567)

$ 1,147

$ 210

$

396

$ 399

$ 272

Production

(thousand metric

tons) (kmt)

3,488

3,500

3,508

3,376

3,554

3,552

3,693

4,007

3,564

3,586

891

904

945

964

Adjusted

EBITDA/Production

($ per metric ton)

$ 460

$ 321

$ 336

$ 418

$ 398

$ 784

$ 626

$ 392

$ (159)

$ 320

$ 236

$ 438

$ 422

$ 282

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and

amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales minus the following items: Cost of

goods sold; Selling, general administrative, and other expenses; Research and development expenses; and

Provision for depreciation, depletion, and amortization. The Other line in the table above includes gains/losses on asset sales and other

nonoperating items. Adjusted EBITDA is a non-GAAP financial measure. Management believes that this

measure is meaningful to investors because Adjusted EBITDA provides additional information with respect to Alcoa’s operating performance and

the Company’s ability to meet its financial obligations. The Adjusted EBITDA presented may not be

comparable to similarly titled measures of other companies. |

Reconciliation of Flat-Rolled Products Adjusted EBITDA

52

[Alcoa logo]

($ in millions,

except

per metric ton

amounts)

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

3Q10

1Q11

2Q11

3Q11

After-tax

operating income

(ATOI)

$ 253

$ 225

$ 222

$ 254

$

278

$ 233

$ 178

$ (3)

$ (49)

$ 220

$ 66

$ 81

$ 99

$ 60

Add:

Depreciation,

depletion, and

amortization

167

184

190

200

220

223

227

216

227

238

57

58

60

61

Equity loss

2

4

1

1

–

2

–

–

–

–

–

–

–

–

Income taxes

124

90

71

75

121

58

92

35

48

92

26

33

35

26

Other

(5)

(8)

(5)

1

1

20

1

6

(2)

1

–

1

(1)

–

Adjusted EBITDA

$ 541

$ 495

$ 479

$ 531

$ 620

$ 536

$

498

$ 254

$ 224

$ 551

$ 149

$ 173

$ 193

$ 147

Total sales

$ 4,868

$ 4,571

$ 4,768

$ 6,042

$ 7,081

$ 8,610

$ 9,597

$ 9,184

$ 6,182

$ 6,457

$ 1,691

$ 1,961

$ 2,147

$ 2,022

Adjusted EBITDA

Margin

11%

11%

10%

9%

9%

6%

5%

3%

4%

9%

9%

9%

9%

7%

Total shipments

(thousand metric

tons) (kmt)

2,376

2,482

2,361

1,888

1,755

474

470

491

469

Adjusted

EBITDA

/Total

shipments ($ per

metric ton)

$ 226

$ 201

$ 108

$ 119

$ 314

$ 314

$ 368

$ 393

$ 313

-

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and

amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to

Sales minus the following items: Cost of goods sold; Selling, general administrative, and other

expenses; Research and development expenses; and Provision for depreciation, depletion, and amortization. The

Other line in the table above includes gains/losses on asset sales and other nonoperating items.

Adjusted EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to

investors because Adjusted EBITDA provides additional information with respect to Alcoa’s

operating performance and the Company’s ability to meet its financial obligations. The Adjusted EBITDA presented

may not be comparable to similarly titled measures of other companies.

|

Reconciliation of Engineered Products and Solutions

Adjusted EBITDA

53

[Alcoa logo]

($ in millions)

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

3Q10

1Q11

2Q11

3Q11

After-tax operating

income (ATOI)

$ 189

$ 63

$ 124

$ 156

$ 271

$ 365

$ 435

$ 533

$ 315

$ 415

$ 114

$ 130

$ 149

$ 138

Add:

Depreciation,

depletion, and

amortization

186

150

166

168

160

152

163

165

177

154

37

38

41

40

Equity loss

(income)

–

–

–

–

–

6

–

–

(2)

(2)

(1)

(1)

–

–

Income taxes

61

39

55

65

116

155

192

222

139

195

63

62

72

67

Other

–

35

11

106

(11)

(2)

(7)

2

1

–

1

–

(1)

–

Adjusted EBITDA

$ 436

$ 287

$ 356

$ 495

$ 536

$ 676

$ 783

$ 922

$ 630

$ 762

$ 214

$ 229

$ 261

$ 245

Total sales

$ 4,141

$ 3,492

$ 3,905

$ 4,283

$ 4,773

$ 5,428

$ 5,834

$ 6,199

$ 4,689

$ 4,584

$ 1,173

$ 1,247

$ 1,370

$ 1,373

Adjusted EBITDA

Margin

11%

8%

9%

12%

11%

12%

13%

15%

13%

17%

18%

18%

19%

18%

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and

amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to

Sales minus the following items: Cost of goods sold; Selling, general administrative, and other

expenses; Research and development expenses; and Provision for depreciation, depletion, and amortization. The

Other line in the table above includes gains/losses on asset sales and other nonoperating items.

Adjusted EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to

investors because Adjusted EBITDA provides additional information with respect to Alcoa’s

operating performance and the Company’s ability to meet its financial obligations. The Adjusted EBITDA presented

may not be comparable to similarly titled measures of other companies.

|

Reconciliation of Alcoa Net Debt

54

[Alcoa logo]

(in millions)

Quarter ended

December 31,

2008

June 30,

2011

September30,

2011

Short

-

term borrowings

$ 478

$ 65

$ 57

Commercial paper

1,535

–

107

Long

-

term debt due within

one year

56

510

489

Long

-

term debt, less amount

due within one year

8,509

8,773

8,658

Total debt

10,578

9,348

9,311

Less: Cash and cash

equivalents

762

1,260

1,332

Net debt

$ 9,816

$ 8,088

$ 7,979

Net

debt

is

a

non-GAAP

financial

measure.

Management

believes

that

this

measure

is

meaningful

to

investors because management assesses Alcoa’s leverage position after

factoring in available cash that could be used to repay outstanding

debt. |