Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Sutor Technology Group LTD | v237167_ex32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - Sutor Technology Group LTD | v237167_ex31-1.htm |

| EX-23.1 - EXHIBIT 23.1 - Sutor Technology Group LTD | v237167_ex23-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Sutor Technology Group LTD | v237167_ex31-2.htm |

| EX-32.2 - EXHIBIT 32.2 - Sutor Technology Group LTD | v237167_ex32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: June 30, 2011

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to _____________

Commission File No. 001-33959

|

SUTOR TECHNOLOGY GROUP LIMITED

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

87-0578370

|

|

(State or other jurisdiction of incorporation or

organization)

|

(I.R.S. Employer Identification No.)

|

|

No 8, Huaye Road

|

|

Dongbang Industrial Park

|

|

Changshu, 215534

|

|

People’s Republic of China

|

|

(Address of principal executive offices)

|

|

(86) 512-52680988

|

|

(Registrant’s telephone number, including area code)

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Common Stock, par value $0.001 per share

|

NASDAQ Capital Market

|

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer o

|

Accelerated Filer ¨

|

|

Non-Accelerated Filer o (Do not check if a smaller reporting company)

|

Smaller reporting company x

|

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

As of December 31, 2010 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the shares of the registrant’s common stock held by non-affiliates (based upon the closing sale price of such shares as reported on the NASDAQ Capital Market) was approximately $22 million. Shares of the registrant’s common stock held by each executive officer and director and by each person who owns 10% or more of the outstanding common stock have been excluded from the calculation in that such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

There were a total of 40,745,602 shares of the registrant’s common stock outstanding as of October 10, 2011.

DOCUMENTS INCORPORATED BY REFERENCE

None.

SUTOR TECHNOLOGY GROUP LIMITED

|

Annual Report on FORM 10-K

|

|

For the Fiscal Year Ended June 30, 2011

|

TABLE OF CONTENTS

|

PART I

|

||||

|

Item 1.

|

Business.

|

2

|

||

|

Item 1A.

|

Risk Factors.

|

11

|

||

|

Item 1B.

|

Unresolved Staff Comments.

|

22

|

||

|

Item 2.

|

Properties.

|

22

|

||

|

Item 3.

|

Legal Proceedings.

|

23

|

||

|

Item 4.

|

(Removed and Reserved).

|

23

|

||

|

PART II

|

||||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

23

|

||

|

Item 6.

|

Selected Financial Data.

|

24

|

||

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

24

|

||

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk.

|

33

|

||

|

Item 8.

|

Financial Statements and Supplementary Data.

|

33

|

||

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

|

33

|

||

|

Item 9A.

|

Controls and Procedures.

|

33

|

||

|

Item 9B.

|

Other Information.

|

34

|

||

|

PART III

|

||||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance.

|

34

|

||

|

Item 11.

|

Executive Compensation.

|

39

|

||

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

41

|

||

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence.

|

43

|

||

|

Item 14.

|

Principal Accounting Fees and Services.

|

45

|

||

|

PART IV

|

||||

|

Item 15.

|

|

Exhibits, Financial Statement Schedules.

|

|

45

|

Special Note Regarding Forward Looking Statements

In addition to historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We use words such as “believe,” “expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,” “aim,” “will” or similar expressions which are intended to identify forward-looking statements. Such statements include, among others, those concerning market and industry segment growth and demand and acceptance of new and existing products; any projections of sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; and any statements regarding future economic conditions or performance, as well as all assumptions, expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, as well as assumptions, which, if they were to ever materialize or prove incorrect, could cause the results of the Company to differ materially from those expressed or implied by such forward-looking statements. Potential risks and uncertainties include, among other things, factors such as:

|

|

·

|

Downturns in the steel industry;

|

|

|

·

|

Competition and competitive factors in the markets in which we compete;

|

|

|

·

|

Our heavy reliance on Shanghai Huaye;

|

|

|

·

|

Market perception of U.S. listed Chinese companies;

|

|

|

·

|

Fluctuations in our raw material costs;

|

|

|

·

|

General economic and business conditions in China and in the local economies in which we regularly conduct business, which can affect demand for our products and services; and

|

|

|

·

|

Changes in laws, rules and regulations governing the business community in China in general and the steel industry in particular.

|

Additional disclosures regarding factors that could cause our results and performance to differ from results or anticipated performance are discussed in Item 1A, “Risk Factors” included herein. All statements other than statements of historical fact are statements that could be deemed forward-looking statements. We assume no obligation and do not intend to update these forward-looking statements, except as required by law.

Use of Terms

Except as otherwise indicated by the context, references in this report to:

|

|

·

|

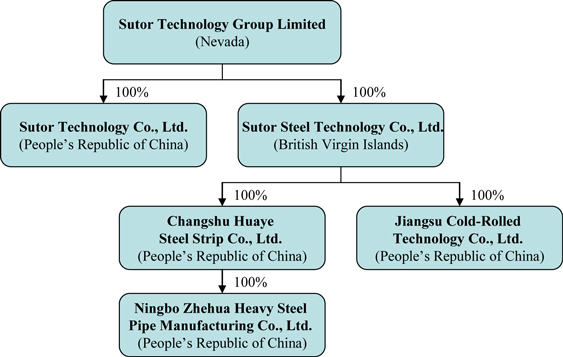

“Company,” “we,” “us” and “our” are to the combined business of Sutor Technology Group Limited, a Nevada corporation, and its subsidiaries: Changshu Huaye, Jiangsu Cold-Rolled, Ningbo Zhehua, Sutor BVI, and Sutor Technology PRC;

|

|

|

·

|

“Changshu Huaye” are to our wholly-owned subsidiary Changshu Huaye Steel Strip Co., Ltd., a PRC company;

|

|

|

·

|

“Jiangsu Cold-Rolled” are to our wholly-owned subsidiary Jiangsu Cold-Rolled Technology Co., Ltd., a PRC company;

|

|

|

·

|

“Ningbo Zhehua” are to our wholly-owned subsidiary Ningbo Zhehua Heavy Steel Pipe Manufacturing Co., Ltd., a PRC company;

|

|

|

·

|

“Shanghai Huaye” are to Shanghai Huaye Iron & Steel Group Co., Ltd., a PRC company of which Lifang Chen, our major shareholder and chief executive officer, and her husband Feng Gao, are 100% owners, and its subsidiaries;

|

|

|

·

|

“Sutor BVI” are to our wholly-owned subsidiary Sutor Steel Technology Co., Ltd., a BVI company;

|

|

|

·

|

“Sutor Technology PRC” are to our wholly-owned subsidiary Sutor Technology Co., Ltd., a PRC company;

|

|

|

·

|

“SEC” are to the United States Securities and Exchange Commission;

|

|

|

·

|

“Securities Act” are to the Securities Act of 1933, as amended;

|

|

|

·

|

“Exchange Act” are to the Securities Exchange Act of 1934, as amended.

|

|

|

·

|

“China” and “PRC” are to People’s Republic of China;

|

|

|

·

|

“RMB” are to Renminbi, the legal currency of China; and

|

|

|

·

|

“U.S. dollar,” “$” and “US$” are to the legal currency of the United States.

|

1

PART I

|

ITEM 1.

|

BUSINESS.

|

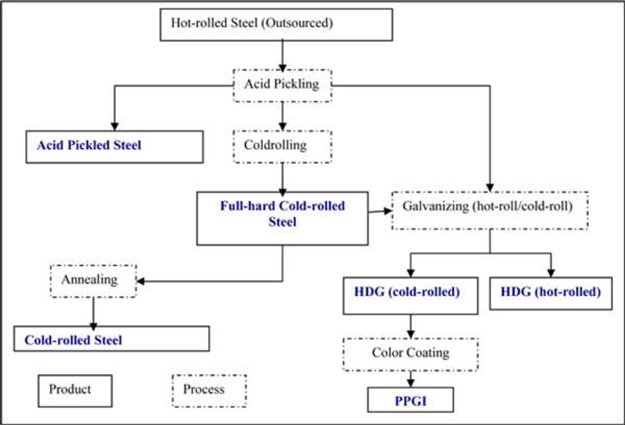

We are one of the leading Chinese non-state-owned manufacturers of fine finished steel products. We utilize a variety of processes and technological methodologies to convert steel manufactured by third parties into fine finished steel products. Our product offerings are focused on higher margin, value-added finished steel products, specifically, hot-dip galvanized steel, or HDG steel, and prepainted galvanized steel, or PPGI. In addition, we produce acid pickled steel, or AP steel, and cold-rolled steel, which represent the least processed of our finished products. Since November 2009, our product offerings have included welded steel pipe products. We use a large portion of our AP steel and cold-rolled steel to produce our HDG steel and PPGI products. Our vertical integration has allowed us to maintain more stable margins for our HDG steel and PPGI products.

We sell most of our products to customers who operate primarily in the solar energy, appliances, automobile, construction, infrastructure, medical equipment and water resource industries. Most of our customers are located in China. Our primary export markets are Europe, the Middle East, Asia, and South America.

Our manufacturing facilities, located in Changshu, China, have three HDG steel production lines, one PPGI production line, one AP steel production line and one cold-rolled steel line. Our current annual production capacity is approximately 700,000 metric tons, or MT, for HDG steel, 200,000 MT for PPGI, 500,000 MT for AP steel and 250,000 MT for cold-rolled steel. Ningbo Zhehua, our subsidiary located in Ningbo, currently has an annual capacity of 400,000 MT for welded steel pipe products.

History and Corporate Structure

We were incorporated on May 1, 1997 in the State of Nevada under the name Bronze Marketing, Inc. and changed our name to Sutor Technology Group Limited effective March 6, 2007 as a result of our reverse acquisition of Sutor BVI in February 2007. From inception until December 31, 2002, we engaged in the business of providing inventory financing to facilitate the marketing and sale of bronze sculptures and other artwork. The business was not successful and we discontinued our active business operations as of December 31, 2002. From December 31, 2002 until the reverse acquisition of Sutor BVI on February 1, 2007, we engaged in no active business operations.

On February 1, 2007, we acquired Sutor BVI through a share exchange transaction pursuant to which the shareholders of Sutor BVI transferred all capital stock of Sutor BVI to us in exchange for 85.2% ownership of our Company. Our acquisition of Sutor BVI was accounted for as a recapitalization effected by a share exchange, wherein Sutor BVI is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of the acquired entity have been brought forward at their book value and no goodwill has been recognized.

In November 2009, our subsidiary Changshu Huaye acquired 100% equity interest in Ningbo Zhehua for the total purchase price of RMB 45.2 million (approximately $6.6 million).

On February 24, 2010, we established Sutor Technology PRC as a wholly-owned subsidiary incorporated in China. We plan to consolidate all R&D activities into this subsidiary in the future.

2

The following chart reflects our organizational structure as of the date of this annual report:

Segment Information

Our three operating segments are categorized according to our three operating subsidiaries:

|

|

·

|

Changshu Huaye, which manufactures and sells HDG steel and PPGI products;

|

|

|

·

|

Jiangsu Cold-Rolled, which manufactures and sells HDG steel, AP steel and cold-rolled steel; and

|

|

|

·

|

Ningbo Zhehua, which manufactures and sells welded steel pipe products.

|

Changshu Huaye and Jiangsu Cold-Rolled are located adjacent to each other in Changshu, China and use largely the same management resources. Ningbo Zhehua is located in Ningbo, China. For additional information about each segment, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Result of Operations” and Note 13, “Segment Information” to the consolidated financial statements included elsewhere in this annual report.

Our Products

Our current products include HDG steel, PPGI, AP steel, cold-rolled steel and welded steel pipe products. Our HDG steel and PPGI products are primarily manufactured by Changshu Huaye and our AP steel and cold-rolled steel products are primarily manufactured by Jiangsu Cold-Rolled. Jiangsu Cold-Rolled added two new HDG steel production lines and has manufactured HDG of both cold-rolled steel and hot-rolled steel since September 2008. Ningbo Zhehua manufactures our welded steel pipe products.

In 2008, we were certified ISO 9001:2008 for our quality management system, ISO 14001:2004 for our environmental management system, and GB/T28001-2001 for our occupational health and safety management system.

The following table set forth sales information about our product mix in last two fiscal years.

3

(All amounts, other than percentages, in millions of U.S. dollars)

|

Fiscal Year Ended June 30, 2011

|

Fiscal Year Ended June 30, 2010

|

|||||||||||||||

|

Product

|

Revenue

|

% of Total

Revenue

|

Revenue

|

% of Total

Revenue

|

||||||||||||

|

HDG Steel

|

$ | 251.9 | 58.4 | % | $ | 228.7 | 47.8 | % | ||||||||

|

PPGI

|

61.8 | 14.3 | % | 78.6 | 16.4 | % | ||||||||||

|

AP Steel

|

34.3 | 8.0 | % | 40.3 | 8.4 | % | ||||||||||

|

Cold-Rolled Steel

|

40.3 | 9.3 | % | 57.8 | 12.1 | % | ||||||||||

|

Welded Steel Pipe Products

|

31.6 | 7.3 | % | 62.4 | 13.0 | % | ||||||||||

|

Other

|

11.8 | 2.7 | % | 10.9 | 2.3 | % | ||||||||||

|

Total

|

$ | 431.7 | 100.0 | % | $ | 478.7 | 100.0 | % | ||||||||

HDG Steel

Using a technology called hot-dip galvanizing, we manufacture corrosion-resistant and zinc-coated HDG steel in different dimensions and using different materials and specifications requested by our customers. HDG steel products are manufactured from steel substrate of cold-rolled or hot-rolled pickled coils by applying zinc to the surface of the material to enhance its corrosion protection. HDG steel products are principally used in the electrical household appliance and construction markets.

We produce not only common industrial specifications, but also extreme specifications that we believe only a few other large PRC state-owned steel manufacturers can produce. The following table compares our technical manufacturing capabilities for most of our products:

|

Width (mm)

|

Thickness (mm)

|

Galvanized Layer Weight (g/m2 )

|

||||||||||

|

Our Specification Scope

|

700-1250 | 0.18-4.5 | 70-280 | |||||||||

|

Common Industrial Specification Scope

|

700-1250 | 0.3-1.2 | 100-180 | |||||||||

We also are technologically capable of manufacturing more extreme specifications of up to 1300mm wide and 0.16mm thick HDG of cold-rolled steel. As a result, we maintain a competitive advantage in extreme specification technology in terms of thickness and the weight of the galvanized layer of our products. We have the flexibility to adjust production specifications to meet changes in market demand.

Sales of HDG steel products amounted to approximately 342,640 MT in fiscal year 2011, representing approximately 58.4% of our total revenue. Currently, our HDG steel products are manufactured by Changshu Huaye and Jiangsu Cold-Rolled. Changshu Huaye produces only HDG of cold-rolled steel. Jiangsu Cold-Rolled added two new HDG steel production lines which are capable of galvanizing both hot-rolled and cold-rolled steel with both zinc and aluminum. These two new production lines became operational at the end of September 2008. The addition of the new production lines significantly expanded our production capacity of HDG steel, which increased production capacity from 300,000 MT per year to 700,000 MT per year.

With the new production lines, we offer HDG of hot-rolled steel, which we believe is more cost-efficient than production of HDG of cold-rolled steel because production of HDG steel products occurs directly on hot-rolled steel and, therefore, avoids the procedure of cold rolling hot-rolled steel. HDG of hot-rolled steel is generally thicker than HDG of cold-rolled steel with a specification range of 1.5mm to 4.5mm in terms of thickness.

PPGI Products

PPGI products are typically made to order based on customer specifications. Our PPGI products’ specification generally ranges from 700mm to 1250mm in width and from 0.2mm to 1.2mm in thickness. Our PPGI products are used mostly in solar energy, appliances and construction materials. We produce our PPGI by color-coating on HDG of cold-rolled steel and then coating them in various colors, including ivory white, ocean blue, pink and any other color according to customer requirements. Our PPGI production line is equipped with the latest twice baking and coating technology, which together with indirect heating, enhances the color coated layers adhesion to the galvanized zinc layer.

4

Sales of PPGI products amounted to approximately 61,620 MT in fiscal year 2011, representing approximately 14.3% of our total revenue. Through our vertical integration strategy, we currently self-supply approximately 27.0% of HDG of cold-rolled steel to our PPGI production.

AP Steel

Our AP steel production line became operative in September 2006. Acid pickling is a process that removes scales and oxides from the steel surface by pickling, cold rolling and annealing. AP steel products are used mostly as a raw material for cold-rolled steel strip, HDG steel, as well as components of automobile and manufacturing equipment. AP steel products come in several different dimensions and using different materials and different specifications.

Most of our AP steel products are used for our own production of HDG steel and full-hard cold-rolled steel. We also sell a small portion of our AP steel products to the market. In fiscal year 2011, our sales of AP steel products were approximately 112,396 MT, representing approximately 8.0% of our total revenue.

Full-Hard, Cold-rolled Steel Products

We commenced manufacturing of full-hard cold-rolled steel products in January 2007. Full-hard cold-rolled steel strips are treated in an annealing process and are used to produce HDG of cold-rolled steel. We produce full-hard cold-rolled steel strips through a reverse cold rolling mill.

We use most of the full-hard cold-rolled steel strips for our production of HDG of cold-rolled steel. The remaining undergoes the annealing process and is sold to the market. Our sales of full-hard cold-rolled steel products amounted to approximately 62,685 MT in fiscal year 2011, representing approximately 9.3% of our total revenue. In addition, approximately 78.0% of cold-rolled steel products were used for our own production.

Welded Steel Pipe Products

Our subsidiary Ningbo Zhehua has one advanced JCOE production line with characteristics of high forming accuracy and efficiency as well as balanced distribution of forming stress, for large-diameter, double-side, submerged-arc welded steel pipes, three US Lincoln production lines for spiral seam, double-side, submerged-arc welded steel pipes, and two REF production lines for roll-bending, double-side, submerged-arc welded steel pipes. Ningbo Zhehua is specialized in manufacturing large-diameter, double-side, submerged-arc welded steel pipes and spiral seam steel pipes. The finished products are extensively used for oil and gas transmission, municipal water supply projects, sewage treatment projects, and piling. Sales of welded steel pipe products amounted to approximately 40,541 MT in fiscal year 2011, representing approximately 7.3% of our total sales revenue.

Manufacturing

Our manufacturing facilities are located in Changshu and Ningbo, China. Our facilities in Changzhou currently have three HDG steel production lines, one PPGI production line, one AP steel production line and one cold-rolled steel line. Our facilities in Ningbo have six welded steel pipe production lines. Our current annual production capacity is approximately 700,000 MT for HDG steel, 200,000 MT for PPGI, 500,000 MT for AP steels, 250,000 MT for cold-rolled steel and 400,000 MT for welded steel pipe products.

We utilize modern automated production technology which is strictly maintained. There are generally only 15 workers on a continuous cold-rolled galvanizing line and 11 workers on the PPGI production line per shift. The chart below demonstrates our production process.

5

Raw Materials and Suppliers

The principal raw materials used in producing our products are steel coil, zinc, oil paint and acid. We source our raw materials from various suppliers, including our affiliate Shanghai Huaye which supplied approximately 60.0% of our raw materials in fiscal year 2011. We believe that our suppliers are sufficient to meet our present needs.

Steel coil accounted for approximately 90.0% of total production costs in fiscal year 2011. We generally purchase steel coil after receiving orders from customers and are generally able to pass on increased costs to customers. We purchase steel strips from Chinese companies, both state-owned enterprises and private companies. State-owned enterprises can ensure a consistent large supply, but do not react quickly to the fluctuations in prevailing market prices. Private companies normally react quickly to price changes, but are not as reliable as state-owned enterprises in terms of consistent supply. By sourcing raw materials from a combination of state-owned enterprises and private companies, we enjoy both a reliable source of raw materials and competitive prices.

Zinc is an important raw material for HDG of cold-rolled steel and accounted for approximately 2.0% of our total production costs of HDG steel in fiscal year 2011. We have established long-term relationships with several Chinese suppliers. We compare the prevailing domestic prices and choose the lower price and can generally pass price fluctuations onto customers. Zinc prices are closely guided by the London Metal Exchange quotation and are the most volatile among those of all of our raw materials.

Our global sourcing network is designed to ensure the highest quality-to-price ratio of the raw materials we purchase. Our internal specialists collect Chinese domestic and global market information every day and track domestic and global market price fluctuations closely, which allows us to react rapidly to any price changes.

Customers

We sell most of our steel products to customers who operate in the solar energy, appliances, automobile, construction, infrastructure, medical equipment and water resource industries.

6

Approximately 38.4% of our revenue was derived from Shanghai Huaye and its affiliates in fiscal year 2011. We currently do not have a long-term written contract with Shanghai Huaye and negotiate the terms of each transaction based on then current market condition. We believe such arrangement will afford us more flexibility and allow us to obtain more favorable prices based on the changing market. We believe we have a good relationship with Shanghai Huaye and expect Shanghai Huaye to remain as our major customer in the foreseeable future. We plan to further expand our sales channel and increase our direct sales to end customers in the future. Other than Shanghai Huaye, none of our customers accounted for more than 10% of our total revenue in fiscal year 2011.

Sales and Marketing

China is our most important market. Domestic sales represented approximately 85.6% of our total revenue in fiscal year 2011. Within China, the biggest market for our products is eastern China, which includes Shanghai, Zhejiang and Jiangsu provinces. Since September 2004, we have exported our products to Europe, the Middle East, Asia, and South America. Our foreign sales accounted for approximately 11.2% and 14.4% of our total revenue in fiscal years 2010 and 2011, respectively.

Our sales network covers most provinces and regions in China. We are developing a diversified sales network which allows us to effectively market products and services to our customers. We sold approximately 61.6% of our products through our own sales and marketing department in fiscal year 2011. Our sales and marketing department consists of approximately 66 employees as of the date of this annual report.

Competition

Competition within the steel industry, both in China and worldwide, is intense. We compete with both large state-owned enterprises and smaller private companies. In addition, we also face competition from international steel manufacturers.

Even though the demand for fine finished steel products has increased in recent years, due to the over expansion of the total production capacity of HDG steel and PPGI products, supply for low-end HDG steel and PPGI products has outpaced demand. Due to the high requirements for production technology and equipment, we believe that demand for high-end HDG steel and PPGI market remains strong. Currently, only we and a few large state-owned enterprises are capable of producing high-end HDG steel and PPGI products in China.

Private steel product manufacturers in China generally focus on low-end products. Many of our competitors are much smaller than us and use older equipment and production techniques. In contrast, our products are aimed at the high-end markets so we attempt to manufacture them with superior quality and broader range of specifications. We use advanced manufacturing equipment that we have purchased from developed countries, such as France and Italy, and employ engineers and researchers who are experienced with different production techniques. This allows us to provide a broad array of products in terms of thickness, zinc layer weight and width of steel coil, which helps us target high-end customers whose manufacturing specifications are extreme. In addition, through cooperation with our strategic partners, we have also established a vertically integrated business model that provides processing, distribution and customized logistic solutions. We believe this business model is difficult to duplicate and very few private companies have this capability.

There are several state-owned steel manufacturers that produce comparable products to our products. As compared with those competitors, we believe we differentiate ourselves by the following:

|

|

·

|

We satisfy customers’ orders with shorter lead times and guarantee lead times for urgent orders, even very small orders, in as short as one or two days;

|

|

|

·

|

We have flexibility in sales arrangements and can take orders in a variety of sizes;

|

|

|

·

|

We operate more efficiently than our state-owned competitors and have lower total labor costs, therefore, lower product prices; and

|

|

|

·

|

We provide more customer-oriented services.

|

7

We also compete with international steel product manufacturers in the global market, such as Mitel Corporation and Posco Steel. As compared to our competitors in Europe, Korea and the United States, we believe we have lower production costs and can offer more competitive pricing. In addition, competitors in developing countries lag behind due to low product quality and limited product specification ranges. We began exporting our products in September 2004 and our products are now sold to Europe, the Middle East, Asia, and South America. Our export sales accounted for approximately 14.4% of our total sales for fiscal year 2011.

Our operating subsidiaries, Changshu Huaye and Jiangsu Cold-Rolled, are both located in Changshu, which provides us a transportation cost advantage. Changshu is situated in the eastern coastal part of China, the largest market for coated steel products in China. In addition, our affiliate Shanghai Huaye has a logistic center in Changshu port, which provides us with convenient and low cost transportation for both raw materials and finished products. Further, our subsidiary Ningbo Zhehua is located in Ningbo which is one of the largest and most important sea port cities in China with easy access to both domestic and international markets.

Research and Development

We believe that the development of new products and production methods is important to our success. We established our high-performance steel sheet research center in 2007 which was recognized as the “Jiangsu Province Foreign Invested Research Center” by the Jiangsu Science and Technology Bureau. As of June 30, 2011, we had approximately 100 research and development personnel and staff.

We recently set up Sutor Technology PRC, a wholly-owned subsidiary incorporated in China, and plan to consolidate all R&D activities into this subsidiary in the future. We plan to build a facility in the new subsidiary to be used solely for research and development of new products and technologies. We expect the new subsidiary will help attract talent and enhance our leading position in the fine processed steel industry in China. The new subsidiary is anticipated to enjoy preferential tax treatment when in full operation.

Intellectual Property

Our success depends, in part, on our ability to maintain and protect our proprietary technology and to conduct our business without infringing on the proprietary rights of others. We rely primarily on a combination of patents, trademarks and trade secrets, as well as employee and third-party confidentiality agreements, to safeguard our intellectual property. As of June 30, 2011, we held 36 patents and had 32 patent applications pending.

All of our products are sold with the trademark of “ ,” which is known by Chinese and international clients. In August 2005, Shanghai Huaye agreed to transfer the trademark of “

,” which is known by Chinese and international clients. In August 2005, Shanghai Huaye agreed to transfer the trademark of “ ” to us without consideration. Such transfer was approved by the Trademark office of the State Administration for Industry and Commerce of China in August 2006. As a result, we have all the legal rights for the trademark, the term of which expires in July 2015.

” to us without consideration. Such transfer was approved by the Trademark office of the State Administration for Industry and Commerce of China in August 2006. As a result, we have all the legal rights for the trademark, the term of which expires in July 2015.

,” which is known by Chinese and international clients. In August 2005, Shanghai Huaye agreed to transfer the trademark of “

,” which is known by Chinese and international clients. In August 2005, Shanghai Huaye agreed to transfer the trademark of “ ” to us without consideration. Such transfer was approved by the Trademark office of the State Administration for Industry and Commerce of China in August 2006. As a result, we have all the legal rights for the trademark, the term of which expires in July 2015.

” to us without consideration. Such transfer was approved by the Trademark office of the State Administration for Industry and Commerce of China in August 2006. As a result, we have all the legal rights for the trademark, the term of which expires in July 2015.All our key employees, especially engineers, have signed confidentiality and non-competition agreements with us. In addition, all our employees are obligated to protect our confidential information. Where appropriate for our business strategy, we will continue to take steps to protect our intellectual property rights.

Employees

As of June 30, 2011, we had approximately 660 full-time employees. Approximately 280 are employees of Changshu Huaye, approximately 170 are employees of Jiangsu Cold-Rolled and approximately 210 are employees of Ningbo Zhehua.

The following table sets forth the number of our full-time employees by function.

|

Function

|

Number of Employees

|

||

|

Manufacturing

|

430 | ||

|

General and administration

|

64 | ||

|

Marketing and sales

|

66 | ||

|

Research and development

|

100 |

8

We believe that we maintain a good working relationship with our employees and we have not experienced any significant labor disputes or any difficulty in recruiting staff for our operations. Our employees are not covered by a collective bargaining agreement. We have not experienced any work stoppages.

We are required under PRC law to make contributions to the employee benefit plans at specified percentages of the after-tax profit. In addition, we are required by the PRC law to cover employees in China with various type of social insurance. We believe that we are in material compliance with the relevant PRC laws.

Regulation

General Regulation of Business

As a producer of steel products in China, we are regulated by the national and local laws of the PRC.

We are subject to various governmental regulations related to environmental protection. The major environmental regulations applicable to us include: the Environmental Protection Law of the PRC, the Law of PRC on the Prevention and Control of Water Pollution, Implementation Rules of the Law of PRC on the Prevention and Control of Water Pollution, the Law of PRC on the Prevention and Control of Air Pollution, Implementation Rules of the Law of PRC on the Prevention and Control of Air Pollution, the Law of PRC on the Prevention and Control of Solid Waste Pollution, and the Law of PRC on the Prevention and Control of Noise Pollution.

We believe that we are in material compliance with all registrations and requirements for the issuance and maintenance of all licenses required by the governing bodies, and that all license fees and filings are current.

Taxation

On March 16, 2007, the National People’s Congress of China passed the Enterprise Income Tax Law, or the EIT Law, and on November 28, 2007, the State Council of China passed its implementing rules, both of which took effect on January 1, 2008. The EIT Law and its implementing rules impose a unified earned income tax, or EIT, rate of 25.0% on all domestic-invested enterprises and foreign invested enterprises, or FIEs, unless they qualify under certain limited exceptions. Changshu Huaye is subject to an EIT of 15% from calendar years 2010 to 2012 because it qualifies as a high-tech enterprise for the calendar years 2010, 2011, 2012. Jiangsu Cold-Rolled’s tax holiday will expire at the end of 2011, and therefore, it is subject to an EIT rate of 12.5% in calendar year 2011 and will be subject to an EIT rate of 25% starting in calendar year 2012. Ningbo Zhehua and Sutor Technology PRC are subject to an EIT of 25% and have no preferential tax treatments.

In addition to the changes to the current tax structure, under the EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a resident enterprise and will normally be subject to an EIT of 25% on its global income. The implementing rules define the term “de facto management bodies” as “an establishment that exercises, in substance, overall management and control over the production, business, personnel, accounting, etc., of a Chinese enterprise.” If the PRC tax authorities subsequently determine that we should be classified as a resident enterprise, then our organization’s global income will be subject to PRC income tax of 25%. For detailed discussion of PRC tax issues related to resident enterprise status, see Item 1A, “Risk Factors – Risks Related to Doing Business in China – Under the New Enterprise Income Tax Law, we may be classified as a “resident enterprise” of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.”

Foreign Currency Exchange

All of our sales revenue and expenses are denominated in RMB. Under the PRC foreign currency exchange regulations applicable to us, RMB is convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions. Currently, our PRC operating subsidiaries may purchase foreign currencies for settlement of current account transactions, including payments of dividends to us, without the approval of the PRC State Administration of Foreign Exchange, or SAFE, by complying with certain procedural requirements. Conversion of RMB for capital account items, such as direct investment, loan, security investment and repatriation of investment, however, is still subject to the approval of SAFE. In particular, if our PRC operating subsidiaries borrow foreign currency through loans from us or other foreign lenders, these loans must be registered with SAFE, and if we finance the subsidiaries by means of additional capital contributions, these capital contributions must be approved by certain government authorities, including the PRC Ministry of Commerce, or MOFCOM, or their respective local branches. These limitations could affect our PRC operating subsidiaries’ ability to obtain foreign exchange through debt or equity financing.

9

Dividend Distributions

Our revenues are earned by our PRC subsidiaries. However, PRC regulations restrict the ability of our PRC subsidiaries to make dividends and other payments to their offshore parent company. PRC legal restrictions permit payments of dividend by our PRC subsidiaries only out of their accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. Each of our PRC subsidiaries is also required under PRC laws and regulations to allocate at least 10% of our annual after-tax profits determined in accordance with PRC GAAP to a statutory general reserve fund until the amounts in such fund reaches 50% of its registered capital. These reserves are not distributable as cash dividends. Our PRC subsidiaries have the discretion to allocate a portion of their after-tax profits to staff welfare and bonus funds, which may not be distributed to equity owners except in the event of liquidation.

In addition, under the EIT Law, the Notice of the State Administration of Taxation on Negotiated Reduction of Dividends and Interest Rates, which was issued on January 29, 2008, and the Notice of the State Administration of Taxation Regarding Interpretation and Recognition of Beneficial Owners under Tax Treaties, which became effective on October 27, 2009, dividends from our PRC operating subsidiaries paid to us through our subsidiaries may be subject to a withholding tax at a rate of 10%. Furthermore, the ultimate tax rate will be determined by treaty between the PRC and the tax residence of the holder of the PRC subsidiary. Dividends declared and paid from before January 1, 2008 on distributable profits are grandfathered under the EIT Law and are not subject to withholding tax.

The Company intends on reinvesting profits, if any, and does not intend on making cash distributions of dividends in the near future.

Environmental Matters

Our manufacturing facilities are subject to various pollution control regulations with respect to noise, water and air pollution and the disposal of waste and hazardous materials. We are also subject to periodic inspections by local environmental protection authorities. Our operating subsidiaries have received certifications from the relevant PRC government agencies in charge of environmental protection indicating that their business operations are in material compliance with the relevant PRC environmental laws and regulations. We are not currently subject to any pending actions alleging any violations of applicable PRC environmental laws.

Seasonality

Our operating results and operating cash flows historically have not been subject to any significant seasonal variations. This pattern may change, however, as a result of new market opportunities or new product introductions.

Available Information

Our Internet website is at www.sutorcn.com. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, including exhibits, and amendments to those reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Exchange Act, are available free of charge on our website as soon as reasonably practicable after such reports are electronically filed with, or furnished to, the SEC. Copies of these reports may also be obtained free of charge by sending written requests to our Secretary, Sutor Technology Group Limited, No 8 Huaye Road, Dongbang Industrial Park, Changshu, China, 215534. The information posted on our website is not part of this or any other report we file with or furnish with the SEC. Investors can also read and copy any materials filed by us with the SEC at the SEC’s Public Reference Room which is located at 100 F Street, NE, Washington, DC 20549. Information about the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. Our filings can also be accessed at the SEC’s website: www.sec.gov.

10

RISKS RELATED TO OUR BUSINESS

We maintain a close business relationship with Shanghai Huaye and any disruption of this relationship or the financial stability of Shanghai Huaye could damage our business.

Our company and Shanghai Huaye, which is 100% owned by our majority shareholder, Chairperson and CEO, Lifang Chen and her husband Feng Gao, have a close business relationship. Approximately 38.4% of our revenue was derived from Shanghai Huaye and its affiliates in fiscal year 2011, which distribute our products. In addition, a large portion of our raw materials were supplied by Shanghai Huaye in fiscal year 2011. We believe that the larger size of Shanghai Huaye gives it greater bargaining power than us and our arrangement with Shanghai Huaye allows us to leverage its bargaining power and purchase raw materials at relatively lower purchase prices from suppliers. We do not have long-term written contracts with Shanghai Huaye. In the past, Shanghai Huaye also has provided credit support on our behalf and guaranties for our benefit in connection with loans to us from third party lenders.

If our business relationship with Shanghai Huaye changes negatively or Shanghai Huaye’s financial condition deteriorates, this would harm our business in many ways. We would be forced to rely on other third parties for raw materials and product distribution if Shanghai Huaye ceases to be a supplier of our raw materials and/or a distributor of our products at current levels. We may not be able to negotiate terms with these third parties that are as favorable as our arrangements with Shanghai Huaye. If this happens, our revenues could decrease, our production costs could increase and our profit margin could be strained. In addition, a material adverse change in the financial condition and creditworthiness of Shanghai Huaye could impair our existing credit facilities and ability to obtain loans in the future.

Any decrease in the availability, or increase in the cost, of raw materials could materially affect our earnings.

Our operations depend heavily on the availability of various raw materials and energy resources, including steel coil, zinc, oil paint, electricity and natural gas. Steel coil has historically made up approximately 90.0% of our total cost of sales. The availability of raw materials and energy resources may decrease and their prices may fluctuate greatly. We purchase a large portion of our raw materials from our affiliate Shanghai Huaye and we have long-term relationships with several other suppliers. However, if Shanghai Huaye or any other important suppliers are unable or unwilling to provide us with raw materials on terms favorable to us, we may be unable to produce certain products. This could result in a decrease in profit and damage to our reputation in our industry. In the event our raw material and energy costs increase, we may not be able to pass these higher costs on to our customers in full or at all. Any increase in the prices for raw materials or energy resources could materially increase our costs and therefore lower our earnings.

Our industry is highly fragmented and competitive, and increased competition could reduce our operating income.

The steel manufacturing and processing business is highly fragmented and competitive. We compete with a number of other steel manufacturers and processors in China, on a region-by-region basis, and with foreign steel manufacturers on a worldwide basis. Our goal is to market our products to customers who demand the highest quality products and precision in the end product so we compete primarily on the precision and range of achievable tolerances, the quality of our products and the raw materials used in our products. We compete with companies of various sizes, some of which have more established brand names and relationships in certain markets we serve than we do. Increased competition could force us to lower our prices or offer services at a higher cost to us, which could reduce our margins and operating income.

A downturn or negative changes in the highly volatile steel industry will harm our business and profitability.

The steel industry as a whole is cyclical and pricing can be volatile as a result of general economic conditions, energy costs, labor costs, competition, import duties, tariffs and currency exchange rates. These macroeconomic factors have historically resulted in wide fluctuations in the steel industry both in China and globally. In our case, future economic downturns, stagnant economies or currency fluctuations in China or globally could decrease the demand for products or increase the amount of imports of steel into China, which could negatively impact our sales, margins and profitability.

11

We may be exposed to potential risks relating to our internal controls over financial reporting and our ability to have the operating effectiveness of our internal controls attested to by our independent auditors.

As directed by Section 404 of the Sarbanes-Oxley Act of 2002, the SEC adopted rules requiring public companies to include a report of management on the Company’s internal controls over financial reporting in their annual reports and, for companies that are not small reporting companies, the independent registered public accounting firm auditing a company’s financial statements to attest to and report on the operating effectiveness of such company’s internal controls. Our management had previously identified material weaknesses in our internal control over financial reporting in fiscal years 2008 and 2009. Although our management believes that our internal control over financial reporting was effective as of June 30, 2011, we can provide no assurance that we will comply with all of the requirements imposed thereby and we will receive a positive attestation from our independent auditors in the future, when required. In the event we identify significant deficiencies or material weaknesses in our internal controls that we cannot remediate in a timely manner or we are unable to receive a positive attestation from our independent auditors with respect to our internal controls, investors and others may lose confidence in the reliability of our financial statements.

If we become directly subject to the recent scrutiny, criticism and negative publicity involving U.S.-listed Chinese companies, we may have to expend significant resources to investigate and resolve the matter which could harm our business operations, stock price and reputation and could result in a loss of your investment in our stock, especially if such matter cannot be addressed and resolved favorably.

Recently, U.S. public companies that have substantially all of their operations in China, particularly companies like us which have completed so-called reverse merger transactions, have been the subject of intense scrutiny, criticism and negative publicity by investors, financial commentators and regulatory agencies, such as the SEC. Much of the scrutiny, criticism and negative publicity has centered around financial and accounting irregularities and mistakes, a lack of effective internal controls over financial accounting, inadequate corporate governance policies or a lack of adherence thereto and, in many cases, allegations of fraud. As a result of the scrutiny, criticism and negative publicity, the publicly traded stock of many U.S. listed Chinese companies has sharply decreased in value and, in some cases, has become virtually worthless. Many of these companies are now subject to shareholder lawsuits, SEC enforcement actions and are conducting internal and external investigations into the allegations. It is not clear what effect this sector-wide scrutiny, criticism and negative publicity will have on our Company, our business and our stock price. If we become the subject of any unfavorable allegations, whether such allegations are proven to be true or untrue, we will have to expend significant resources to investigate such allegations and/or defend our Company. This situation will be costly and time consuming and distract our management from growing our company. If such allegations are not proven to be groundless, our Company and business operations may be severely and adversely affected and your investment in our stock could be rendered worthless.

We may be unable to fund the substantial ongoing capital and maintenance expenditures that our operations require.

Our operations are capital intensive and our business strategy may require additional substantial capital investment. We require capital for building new production lines, acquiring new equipment, maintaining the condition of our existing equipment and complying with environmental laws and regulations. We plan to fund our capital expenditures from operating cash flow and our credit facilities and may require additional debt or equity financing. We cannot assure you, however, that financing will be available or, if financing is available, it may result in increased interest and amortization expense, increased leverage, dilution and decreased income available to fund further expansion. In addition, future debt financings may limit our ability to withstand competitive pressures and render us more vulnerable to economic downturns. If we are unable to fund our capital requirements, we may be unable to implement our business plan, and our financial performance may suffer.

12

Our level of indebtedness may make it more difficult for us to fulfill all of our debt obligations and may reduce the amount of cash available for maintaining and growing our operations, which could have an adverse effect on our revenues.

Our major source of liquidity is borrowing through short-term bank and private loans. Our total debt under existing loans as of June 30, 2011 was approximately $119.1 million, of which approximately $95.5 million are short-term loans to non-related third parties. We expect to renew our short-term loans when they become due, our inability to renew these loans upon maturity may cause us working capital constraints. This substantial indebtedness could also impair our financial condition and our ability to fulfill all of our debt obligations, especially during a downturn in our business, in the industry in which we operate or in the general economy. Our indebtedness and the incurrence of any new indebtedness could (i) make it more difficult for us to satisfy our existing obligations, which could in turn result in an event of default on such obligations, (ii) require us to seek other sources of capital to finance cash used in operating activities, thereby reducing the availability of cash for working capital, capital expenditures, acquisitions, general corporate purposes or other purposes, (iii) impair our ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions, general corporate purposes or other purposes; (iv) diminish our ability to withstand a downturn in our business, the industry in which we operate or the economy generally, (v) limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate, or (vi) place us at a competitive disadvantage compared to competitors that have proportionately less debt. If we are unable to meet our debt service obligations, we could be forced to restructure or refinance our indebtedness, seek additional equity capital or sell assets.

We may be unable to obtain financing or sell assets on satisfactory terms, or at all, which could cause us to default on our debt service obligations and be subject to foreclosure on such loans. Additionally, we could incur additional indebtedness in the future and, if new debt is added to our current debt levels, the risks above could intensify.

Unexpected equipment failures may damage our business due to production curtailments or shutdowns.

Our manufacturing processes are extremely specialized and depend on critical pieces of equipment, such as air knife machines, welding tools and apparatus, color-coating machines, roll mills, ABB roll and tension knives. This machinery is highly specialized and cannot be repaired or replaced without significant expense and time delay. On occasion, our equipment may be out of service as a result of unanticipated failures which may result in material plant shutdowns or periods of reduced production. Interruptions in production capabilities will inevitably increase production costs and reduce our sales and earnings. In addition to equipment failures, our facilities are also subject to the risk of catastrophic loss due to unanticipated events such as fires, explosions or adverse weather conditions. Furthermore, any interruption in production capability may require us to make large capital expenditures to remedy the situation, which could have a negative effect on our profitability and cash flows. Although we have business interruption insurance, we cannot provide any assurance that the insurance will cover all losses that we experience as a result of the equipment failures. In addition, longer-term business disruption could result in a loss of customers. If this were to occur, our future sales levels, and therefore our profitability, could be adversely affected.

Our revenue will decrease if there is less demand for construction materials or electrical household appliances.

Our products often serve as important components in construction materials and electrical household appliances. Therefore, we are subject to the general changes in economic conditions affecting the construction and household appliance segments of the economy. Demand for our products is typically affected by a number of economic factors, including, but not limited to, consumer interest rates, consumer confidence, retail trends, sales of existing homes, and the level of mortgage financing. If there is a decline in economic activity in China and the other markets in which we operate or a decrease of sales of construction materials and electrical household appliances, demand for our products and our revenue will likewise decrease.

Environmental regulations impose substantial costs and limitations on our operations.

We are subject to various national and local environmental laws and regulations in China concerning issues such as air emissions, wastewater discharges, and solid waste management and disposal. These laws and regulations can restrict or limit our operations and expose us to liability and penalties for non-compliance. While we believe that our facilities are in material compliance with all applicable environmental laws and regulations, the risks of substantial unanticipated costs and liabilities related to compliance with these laws and regulations are an inherent part of our business. It is possible that future conditions may develop, arise or be discovered that create new environmental compliance or remediation liabilities and costs. While we believe that we can comply with existing environmental legislation and regulatory requirements and that the costs of compliance have been included within budgeted cost estimates, compliance may prove to be more limiting and costly than anticipated.

13

If our customers and/or the ultimate consumers of products that use our products successfully assert product liability claims against us due to defects in our products, our operating results may suffer and our reputation may be harmed.

Our products are widely applied in the manufacturing of many products, including electrical household appliances, medical instruments and large industrial equipment. Significant property damage, personal injuries and even death can result from malfunctioning products. If our products are not properly manufactured or installed and/or if people are injured as a result of our products, we could be subject to claims for damages based on theories of product liability and other legal theories in some jurisdictions in which our products are sold. The costs and resources to defend such claims could be substantial and, if such claims are successful, we could be responsible for paying some or all of the damages. We do not have product liability insurance. The publicity surrounding these sorts of claims is also likely to damage our reputation, regardless of whether such claims are successful. Any of these consequences resulting from defects in our products would hurt our operating results and stockholder value.

We might fail to adequately protect our intellectual property and third parties may claim that our products infringe upon their intellectual property.

As part of our business strategy, we intend to accelerate our investment in new technologies in an effort to strengthen and differentiate our product portfolio and make our manufacturing processes more efficient. As a result, we believe that the protection of our intellectual property will become increasingly important to our business. Currently, we have 36 patents and 32 patent applications pending. We expect to rely on a combination of patents, trade secrets, trademarks and copyrights to provide protection in this regard, but this protection might be inadequate. For example, our pending or future patent applications might not be approved or, if allowed, they might not be of sufficient strength or scope. Conversely, third parties might assert that our technologies infringe their proprietary rights. In either case, litigation could result in substantial costs and diversion of our resources, and whether or not we are ultimately successful, the litigation could hurt our business and financial condition.

Expansion of our business may strain our management and operational infrastructure and impede our ability to meet any increased demand for our fine finished steel products.

Our growth strategy includes growing our operations by meeting the anticipated growth in demand for existing products, introducing new product offerings, and identifying and acquiring or investing in suitable candidates on acceptable terms. In 2009, we acquired a 100% ownership interest in Ningbo Zhehua. In addition, our subsidiary, Jiangsu Cold-Rolled, has recently completed construction of several new production lines and has been put into operation, but lacks a proven operational history. Over time, we may acquire or make investments in other providers of products that complement our business and other companies in our industry. Growth in our business may place a significant strain on our personnel, management, financial systems and other resources. Our business growth also presents numerous risks and challenges, including:

|

|

·

|

our ability to successfully and rapidly expand sales to potential customers in response to potentially increasing demand;

|

|

|

·

|

our ability to integrate and retain key management, sales, research and development, production and other personnel;

|

|

|

·

|

our ability to incorporate the acquired products or capabilities into our offerings from an engineering, sales and marketing perspective;

|

|

|

·

|

integration and support pre-existing supplier, distribution and customer relationships;

|

|

|

·

|

adverse effects on our reported operating results due to possible write-down of goodwill associated with acquisitions;

|

|

|

·

|

potential disputes with sellers of acquired businesses, technologies, services, products and potential liabilities;

|

|

|

·

|

the costs associated with such growth, which are difficult to quantify, but could be significant; and

|

|

·

|

rapid technological change.

|

To accommodate this growth and compete effectively, we may need to obtain additional funding to improve information systems, procedures and controls and expand, train, motivate and manage existing and additional employees. Funding may not be available in a sufficient amount or on favorable terms, if at all. If we are not able to manage these activities and implement these strategies successfully to expand to meet any increased demand, our operating results could suffer.

14

We depend heavily on key personnel, and turnover of key employees and senior management could harm our business.

Our future business and results of operations depend in significant part upon the continued contributions of our key technical and senior management personnel, including Lifang Chen, our Chief Executive Officer, and Yongfei Jiang, our Chief Financial Officer. They also depend in significant part upon our ability to attract and retain additional qualified management, technical, marketing and sales and support personnel for our operations. If we lose a key employee, if a key employee fails to perform in his or her current position, or if we are not able to attract and retain skilled employees as needed, our business could suffer. Significant turnover in our senior management could significantly deplete our institutional knowledge held by our existing senior management team. We depend on the skills and abilities of these key employees in managing the manufacturing, technical, marketing and sales aspects of our business, any part of which could be harmed by turnover in the future.

Changes in our effective tax rate or tax liability may have an adverse effect on our results of operations.

Because we are a U.S. company with operating subsidiaries in China and we engage in international sales, we are subject to federal and state tax in the U.S., state and local tax in China and other foreign jurisdictions. Significant judgment is required in determining our worldwide provision for income taxes. In the ordinary course of our business, there are some transactions where the ultimate tax determination is uncertain. Additionally our calculations of income taxes are based on our interpretations of applicable tax laws in the jurisdictions in which we file. Although we believe our tax estimates are appropriate, there is no assurance that the final determination of our income tax liability will not be materially different than what is reflected in our income tax provisions and accruals. We are also subject to the periodic examination of our income tax returns by tax authorities. The outcomes from these examinations may have an adverse effect on our operating results and financial condition. Furthermore, our provision for income tax could increase as we expand our international operations, adopt new products, implement changes to our operating structure or undertake intercompany transactions in light of acquisitions, changing tax laws, and our current and anticipated business and operational requirements. Should additional taxes be assessed as a result of new legislation, an audit or litigation; or if our effective tax rate should change as a result of changes in federal, international or state and local tax laws, there could be a material adverse effect on our income tax provision and results of operations.

Ms. Lifang Chen’s association with Shanghai Huaye could pose a conflict of interest.

Ms. Lifang Chen, our chairman and beneficial owner of 74.5% of our common stock, also beneficially owns 100% of Shanghai Huaye, which is a major distributor of our products and provider of our raw materials. As a result, conflicts of interest may arise from time to time. We will attempt to resolve any such conflicts of interest in our favor. Our officers and directors are accountable to us and our shareholders as fiduciaries, which requires that such officers and directors exercise good faith and integrity in handling our affairs.

We may be exposed to liabilities under the Foreign Corrupt Practices Act, and any determination that we violated the Foreign Corrupt Practices Act could have a material adverse effect on our business.

We are subject to the Foreign Corrupt Practice Act, or FCPA, and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. persons and issuers as defined by the statute for the purpose of obtaining or retaining business. We have operations, agreements with third parties and make sales in China, which may experience corruption. Our activities in China create the risk of unauthorized payments or offers of payments by one of the employees, consultants, sales agents or distributors of our company, because these parties are not always subject to our control. It is our policy to implement safeguards to discourage these practices by our employees. Also, our existing safeguards and any future improvements may prove to be less than effective, and the employees, consultants, sales agents or distributors of our Company may engage in conduct for which we might be held responsible. Violations of the FCPA may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could negatively affect our business, operating results and financial condition. In addition, the government may seek to hold our Company liable for successor liability FCPA violations committed by companies in which we invest or that we acquire.

15

RISKS RELATED TO DOING BUSINESS IN CHINA

Adverse changes in political and economic policies of the PRC government could impede the overall economic growth of China, which could reduce the demand for our products and damage our business.

We conduct substantially all of our operations and generate most of our revenue in China. Accordingly, our business, financial condition, results of operations and prospects are affected significantly by economic, political and legal developments in China. The PRC economy differs from the economies of most developed countries in many respects, including:

|

|

·

|

a higher level of government involvement;

|

|

|

·

|

a early stage of development of the market-oriented sector of the economy;

|

|

|

·

|

a rapid growth rate;

|

|

|

·

|

a higher level of control over foreign exchange; and

|

|

|

·

|

the allocation of resources.

|

As the PRC economy has been transitioning from a planned economy to a more market-oriented economy, the PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. While these measures may benefit the overall PRC economy, they may also have a negative effect on us.

Although the PRC government has in recent years implemented measures emphasizing the utilization of market forces for economic reform, the PRC government continues to exercise significant control over economic growth in China through the allocation of resources, controlling the payment of foreign currency-denominated obligations, setting monetary policy and imposing policies that impact particular industries or companies in different ways.

Any adverse change in economic conditions or government policies in China could have a material adverse effect on the overall economic growth in China, which in turn could lead to a reduction in demand for our services and consequently have a material adverse effect on our business and prospects.

Uncertainties with respect to the PRC legal system could limit the legal protections available to you and us.

We conduct substantially all of our business through our operating subsidiaries in the PRC. Our operating subsidiaries are generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to foreign-invested enterprises. The PRC legal system is based on written statutes, and prior court decisions may be cited for reference but have limited precedential value. Since 1979, a series of new PRC laws and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, since the PRC legal system continues to rapidly evolve, the interpretations of many laws, regulations and rules are not always uniform and enforcement of these laws, regulations and rules involve uncertainties, which may limit legal protections available to you and us. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention. In addition, most of our executive officers and directors are residents of China and not of the United States, and substantially all the assets of these persons are located outside the United States. As a result, it could be difficult for investors to affect service of process in the United States or to enforce a judgment obtained in the United States against our Chinese operations and subsidiaries.

If we are found to have failed to comply with applicable laws, we may incur additional expenditures or be subject to significant fines and penalties.

Our operations are subject to PRC laws and regulations applicable to us. However, many PRC laws and regulations are uncertain in their scope, and the implementation of such laws and regulations in different localities could have significant differences. In certain instances, local implementation rules and/or the actual implementation are not necessarily consistent with the regulations at the national level. Although we strive to comply with all the applicable PRC laws and regulations, we cannot assure you that the relevant PRC government authorities will not later determine that we have not been in compliance with certain laws or regulations.

In addition, our facilities and products are subject to many laws and regulations. Our failure to comply with these and other applicable laws and regulations in China could subject us to administrative penalties and injunctive relief, as well as civil remedies, including fines, injunctions and recalls of our products. It is possible that changes to such laws or more rigorous enforcement of such laws or with respect to our current or past practices could have a material adverse effect on our business, operating results and financial condition. Further, additional environmental, health or safety issues relating to matters that are not currently known to management may result in unanticipated liabilities and expenditures.

16

The PRC government exerts substantial influence over the manner in which we must conduct our business activities.

The PRC government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures.

Restrictions on currency exchange may limit our ability to receive and use our sales effectively.

The majority of our revenues will be settled in RMB and U.S. dollars, and any future restrictions on currency exchanges may limit our ability to use revenue generated in RMB to fund any future business activities outside China or to make dividend or other payments in U.S. dollars. Although the Chinese government introduced regulations in 1996 to allow greater convertibility of the RMB for current account transactions, significant restrictions still remain, including primarily the restriction that foreign-invested enterprises may only buy, sell or remit foreign currencies after providing valid commercial documents, at those banks in China authorized to conduct foreign exchange business. In addition, conversion of RMB for capital account items, including direct investment and loans, is subject to governmental approval in China, and companies are required to open and maintain separate foreign exchange accounts for capital account items. We cannot be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the RMB.