Attached files

| file | filename |

|---|---|

| EX-23 - China Lithium Technologies Inc. | ex23.htm |

| EX-31.2 - China Lithium Technologies Inc. | ex31-2.htm |

| EX-32.1 - China Lithium Technologies Inc. | ex32-1.htm |

| EX-32.2 - China Lithium Technologies Inc. | ex32-2.htm |

| EX-31.1 - China Lithium Technologies Inc. | ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2011

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to ______

Commission File Number 000-53263

CHINA LITHIUM TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

NEVADA

|

41-1559888

|

|

(State or other jurisdiction of

Incorporation or organization)

|

(IRS Employer Identification No.)

|

15 West 39th Street Suite 14B, New York, NY 10018

(Address of principal executive offices)

212-391-2688

(Issuer's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

COMMON STOCK

Securities registered pursuant to Section 12(g) of the Act:

NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

Non-accelerated filer ¨

|

|

Smaller Reporting Company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of September 27, 2011, there were 16,659,811 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

China Lithium Technologies, Inc.

FORM 10-K

For the Year Ended June 30, 2011

TABLE OF CONTENTS

|

Page

No.

|

||||

|

PART I

|

||||

|

ITEM 1.

|

Business

|

1

|

||

|

ITEM 1A.

|

Risk Factors

|

11

|

||

|

ITEM 1B.

|

Unresolved Staff Comments

|

17

|

||

|

ITEM 2.

|

Properties

|

17

|

||

|

ITEM 3.

|

Legal Proceedings

|

18

|

||

|

ITEM 4.

|

Submission of Matters to a Vote of Security Holders

|

18

|

||

|

PART II

|

||||

|

ITEM 5.

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

19

|

||

|

ITEM 6.

|

Selected Financial Data

|

19

|

||

|

ITEM 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

19

|

||

|

ITEM 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

26

|

||

|

ITEM 8.

|

Financial Statements and Supplementary Data

|

26

|

||

|

ITEM 9.

|

Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

|

56

|

||

|

ITEM 9A(T).

|

Controls and Procedures

|

56

|

||

|

ITEM 9B.

|

Other Information

|

57

|

||

|

PART III

|

||||

|

ITEM 10.

|

Directors and Executive Officers of the Registrant and Corporate Governance

|

57

|

||

|

ITEM 11.

|

Executive Compensation

|

60

|

||

|

ITEM 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

62

|

||

|

ITEM 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

63

|

||

|

ITEM 14.

|

Principal Accountant Fees and Services

|

64

|

||

|

PART IV

|

||||

|

ITEM 15.

|

Exhibits, Financial Statement Schedules

|

65

|

||

|

SIGNATURES

|

66

|

|||

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. These statements relate to future events or our future financial performance. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "expect," "plan," "anticipate," "believe," "estimate," "predict," "potential" or "continue," the negative of such terms or other

comparable terminology. These statements are only predictions. Actual events or results may differ materially.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no duty to update any of the forward-looking statements after the date of this report to conform such statements to actual results or to changes in our expectations.

Readers are also urged to carefully review and consider the various disclosures made by us which attempt to advise interested parties of the factors which affect our business, including without limitation the disclosures made in PART I. ITEM 1A. "Risk Factors" and PART II. ITEM 6 "Management's Discussion and Analysis or Plan of Operation" included herein.

PART I.

ITEM 1. Business

Overview

We are holding company incorporated in the State of Nevada. Through our operating entity in China, we design, manufacture and market Polymer lithium-ion battery modules, lithium-ion battery chargers, lithium-ion battery management systems as well as other lithium-ion battery management devices essential to proper power utilization.

Our PLI battery products produce a relatively high average of 3.8 volts per cell, which makes them attractive in terms of both weight and volume. Additionally, they can be manufactured in very thin configurations and with large footprints. PLI cells can be configured in almost any prismatic shape, and can be made thinner than 0.0195 inches (0.5 mm) to fill virtually any shape efficiently. This combination of power and versatility makes rechargeable PLI batteries particularly attractive for use in consumer products such as portable computers, personal digital assistants (PDA's) and cellular telephones. However, one of the bottleneck problems in the existing lithium-ion battery industry is the

battery capacity loss. Through years of efforts in research and development, we developed an efficient battery management system in a way to balance the process of charging and discharging of multiple lithium-ion battery cells and adjust the charging frequency to the change of temperature of the ambient environment. We also incorporated the battery management system in our design of lithium-ion battery module and battery pack.

Research & Development is one of our most important strengths. Our management team is attentive to develop the core technologies to satisfy the needs of our customers. Our R&D researchers are focused on the improvement of lithium battery module groups applicable to vehicle ignition power and wireless charging technology, our manufacturing processes for lithium-ion battery modules, and automated production of lithium-ion battery power systems and chargers. We are proud of our environmentally friendly product line. In order to meet domestic and international market demand, we are constantly upgrading our existing products to expand our market share.

1

Our Corporate History

We were incorporated under the laws of the State of Minnesota on July 7, 1986 as Sweet Little Deal, Inc. The Company was formed to invest in and develop recreational real estate, and to invest in other businesses, particularly medical technology. On October 10, 1991, the Company changed its name to Physicians Insurance Services, Ltd..

On August 1, 2007, the board members appointed new directors, Michael Friess and Chloe DiVita, and then resigned as officers and directors of the Company. The new board members appointed Sanford Schwartz to the board as a Director. On September 30, 2007, the Company issued 245,455 shares of its common stock to two individuals, (Sanford Schwartz and Michael Friess), for a $6,116 cash payment. Additionally, the Company agreed to issue additional shares to these two individuals resulting in 80% control of the Company for an additional cash payment following the proposed increase in the Company's authorized capital. The two individuals were issued 560,902 shares on January 31, 2009 to settle the

agreement.

On January 12, 2009 the Company completed the migratory merger to Nevada. The Company completed the 1 for 5 reverse split of its common stock effective March 20, 2009. Until March 19, 2010, we were defined as a "shell" company, whose sole purpose at this time is to locate and consummate a merger or acquisition with a private entity.

Acquisition of Sky Achieve

On March 19, 2010, we acquired all of the outstanding capital stock of Sky Achieve. As a result of the Acquisition, China Lithium Technologies issued 19,151,827 shares of its common stock to the shareholders of Sky Achieve (the "Share Issuance"). Those shares represent 95 % of the outstanding shares of China Lithium Technologies. Of the 19,151,827 shares issued, 17,236,645 of the shares were issued to Kun Liu, who is the Chief Executive Officer of Sky Achieve and now the Chairman of China Lithium Technologies. The remaining 1,915,183 shares were issued to Youhua Yu, the Chairman of Sky Achieve. Also on

March 19, 2010, Kun Liu (the "Purchaser"), 100% owner of Beijing GuoQiang, purchased from Michael Friess and Sanford Schwartz, the former principal stockholders ("Selling Shareholders") of China Lithium Technologies pursuant to a Stock Purchase Agreement (the "SPA") dated March 4, 2010. As a result of these transactions, persons associated with Beijing Guoqiang now own securities that represent 96% of the equity in China Lithium Technologies. The shares issued have not been registered under the Securities Act of 1933, as amended, in reliance upon an exception under Sections 4(2) of said act.

Change of Name and Reverse Split

Effective on June 2, 2010, we changed our name to China Lithium Technologies, Inc. and effectuated a reverse split of our common stock in the ratio of 1:2.2 (the "Reverse Split").

Corporate Structure

We operate our business in China through Sky Achieve Holdings, Inc, a company under the laws of British Virgin Islands ("Sky Achieve"), and Beijing GuoQiang Global Science & Technology Development Co.,Ltd, a PRC limited liability company ("Beijing Guoqiang"), wholly owned by our Chief Executive Officer, Kun Liu a PRC citizen. Pursuant to our Variable Interest Agreements ("VIE Agreements") with Beijing Guoqiang and its shareholder, we provide consulting and management services to Beijing Guoqiang. We have exclusive control over Beijing Guoqiang's daily operations and financial affairs, appoint its senior executives and approve all matters requiring shareholder approval. As a result of these

contractual arrangements, we are the beneficiary of Beijing Guoqiang. Accordingly, we have consolidated Beijing Guoqiang's financial results, assets and liabilities in our financial statements since the execution of the VIE Agreements.

2

Material Operating Entities

Sky Achieve Holdings, Inc.

Sky Achieve was organized on November 5, 2009 under the laws of British Virgin Islands. It had no business activity from its inception until January 5, 2010. On January 5, 2010, Sky Achieve obtained control over the business of Beijing Guoqiang by entering into five agreements with Beijing Guoqiang and the equity owners of Beijing Guoqiang. The agreements are designed to transfer to Sky Achieve all of the responsibilities for management of the operations of Beijing Guoqiang, as well as all of the benefits and all of the risks that arise from the operations of Beijing Guoqiang. The relationship is purely

contractual, however, so the rights and responsibilities of Sky Achieve with respect to Beijing Guoqiang are ultimately dependent on the willingness of the courts of the PRC to enforce the agreements. We are not aware of any judicial test of similar agreements to date. For accounting purposes, Beijing Guoqiang is deemed to be a variable interest entity with respect to Sky Achieve, and its balance sheet accounts and financial results are consolidated with the accounts and results of Sky Achieve for financial reporting purposes.

The five agreements that define the relationship between Sky Achieve and Beijing Guoqiang each has a term of ten years. In summary, the five agreements contain the following terms:

● Consulting Services Agreement and Operating Agreement. These two agreements provide that Sky Achieve will be fully responsible for the management of Beijing Guoqiang, both financial and operational. Sky Achieve has assumed responsibility for the debts incurred by Beijing Guoqiang and for any shortfall in its registered capital. In exchange for these services and undertakings, Beijing Guoqiang pays a fee to Sky Achieve equal to the net profits of Beijing Guoqiang. In addition, Beijing Guoqiang pledges all of its assets, including accounts receivable, to Sky Achieve. Meanwhile, Beijing

Guoqiang’s shareholders pledged the equity interests of Beijing Guoqiang to Sky Achieve to secure the payment of the Fee.

● Proxy Agreement. In this agreement, the shareholders of Beijing Guoqiang granted an irrevocable proxy to the person designated by Sky Achieve to exercise the voting rights and other rights of shareholder.

● Option Agreement. In this agreement, the shareholders of Beijing Guoqiang granted to Sky Achieve the right to purchase all of their equity interest in the registered capital of Beijing Guoqiang or the assets of Beijing Guoqiang. The option may be exercised whenever the transfer is permitted under the laws of the PRC. The purchase price shall be equal to the original paid-in price of the Purchased Equity Interest by the Transferor, unless the applicable PRC laws and regulations require appraisal of the equity interests or stipulate other restrictions on the purchase price of equity interests. The agreement also contains covenants

designed to prevent any material change occurring in the legal or financial condition of Beijing Guoqiang without the consent of Sky Achieve.

● Equity Pledge Agreement. In this agreement, Beijing Guoqiang shareholders agree to pledge all the equity interest in Beijing Guoqiang to Sky Achieve as security for the performance of the obligation under the Consulting Services Agreement and the payment of Consulting Services Fees under each agreement.

According to the Agreements, Sky Achieve may terminate the agreements at will. Beijing Guoqiang may only terminate the agreements if (a) there is an unremedied breach by Sky Achieve, (b) the operations of Sky Achieve are terminated, (c) Beijing Guoqiang loses its business license, or (d) circumstances arise that materially and adversely affect the performance or objectives of the Agreement. The Consulting Services Agreement, under which all revenues are assigned from Beijing Guoqiang to Sky Achieve, and the Equity Pledge Agreement have no expiration date. The other three agreements terminate on January 5, 2020 unless extended by the parties.

Beijing GuoQiang Global Science & Technology Development Co., Ltd

Beijing Guoqiang is a lithium-ion battery power technology company that was founded on March 27, 2007 under the laws of the PRC with registered capital of 1 million RMB (US$ 147,058). Beijing Guoqiang designs, manufactures and markets Polymer lithium-ion battery modules, lithium-ion battery chargers, lithium-ion battery management systems as well as other lithium-ion battery management devices essential to proper power utilization ("PLI battery products"). Through years of development, Beijing Guoqiang's lithium-ion battery products have been widely used in electric tools, electric bicycles, electric

motorcycles and vehicles, electric bus, electric/hybrid automobiles, golf and tour vehicle, and other electric products.

3

Our Products

We design, manufacture and market Polymer lithium-ion battery modules, lithium-ion battery chargers, lithium-ion battery management systems as well as other lithium-ion battery management devices essential to proper power utilization. We believe that lithium-ion batteries will play an increasingly important role in facilitating a shift toward cleaner forms of energy. Our batteries and battery systems provide a combination of power, safety and life.

A lithium-ion battery (sometimes abbreviated Li-ion battery) is a type of rechargeable battery in which the cathode (positive electrode) contains lithium. The anode (negative electrode) is generally made of a type of porous carbon. During discharging, the current flows within the battery (when the external circuit is connected) from the anode to the cathode, as in any type of battery: the internal process is the movement of electrons from the anode to the cathode, through the non- aqueous electrolyte and separator diaphragm. Lithium-ion batteries are common in portable consumer electronics because of

their high energy-to-weight ratios, lack of memory effect, and slow self-discharge when not in use. In addition to consumer electronics, lithium-ion batteries are increasingly used in defense, automotive, and aerospace applications due to their high energy density.

With its light and self-discharge characteristics, Lithium-ion battery can be formed into a wide variety of shapes and sizes so as to efficiently fill available space in the devices they power. However, such advantages are limited due to the technology difficulties of preserving the energy loss of the battery as a result of the imbalanced charge and discharge of multiple Lithium-ion battery cells. High temperature of the ambient environment will also shorten the life of lithium-ion battery. Through research and development, we developed an efficient battery management system in a way to balance the

process of charging and discharging of multiple lithium-ion battery cells and adjust the charging frequency to the change of temperature of the ambient environment. We also incorporated the battery management system in our design of lithium-ion battery module and battery pack. Our products are widely distributed and used in the electric automobiles, motorcycles and bicycles in China.

Specifically, our main products include the following:

* Lithium-ion Battery Management System ("BMS")

BMS is the link between rechargeable lithium-ion battery and users. Our BMS is very efficient in monitoring and load balancing battery cells' electricity charging and discharging running or charging, thus extending the life span of the battery pack and battery module we design. We have developed auxiliary battery clamp pressure equalization system, battery maintenance system, and bi-directional current automatic conversion system to address the common battery capacity loss problem in Lion battery industry.

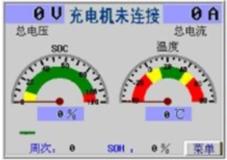

Our BMS has the following functions: real-time detection of the voltage of all single units, multi-point battery temperature and environment temperature, current working status of battery pack, insulation resistance, record of charge and discharge times, assessment over state of charge (SOC) of battery pack, battery malfunction alarm, communication with vehicle-mounted monitoring equipment and transfer battery state to the display, balancing of charge and discharge power, efficiency, electric quantity, AH,WH, dump energy, An WH min Km , flexibly set alarm parameters of upper and lower limits of tension,

electric current, electric quantity, communicating with charger and motor controller and thus improving the battery safety, realizing the optimal combination of different battery packs in the module, and etc.

Currently, our BMS is widely used in electric automobiles, and the picture below is BMS monitor interface on vehicle-mounted display of the electric automobiles.

4

|

|

* Lithium-ion battery module

In 2009, we incorporated our BMS technology into our own lithium-ion battery modules known as" lithium magic cube" series. The series include nominal voltage 12V / 36V / 48V with nominal capacity ranging from 5AH to 60AH, and battery cells of Lithium cobalt(III) oxide /ternary materials/ lithium maganate /lithium iron phosphate. Below is the picture of one type of product in the Series.

Lithium-ion battery module from "lithium magic cube" series

Our 10AH and 20AH products from the "lithium magic cube" series only weigh 1/3 of lead-acid battery of the same mechanical appearance and thus they are very popular in electric bicycles and motorcycles. Our 60AH product from the "lithium magic cube" series can realize high voltage and capacity power easily and they can be used in electric automobiles through parallel connections. The pictures below are the electric car and farm truck powered by our lithium-ion battery modules resulting from our R&D cooperation efforts with a car manufacturer in China.

|

|

|

Small electric passenger car

|

Electric farm truck

|

* High-power Lithium-ion battery charger

Beijing Guoqiang is capable of providing high-power lithium-ion (Plumbous acid /Nickel Cadmium/ silicon energy) battery charger (charger/charging station) products of above 200W 10KW. In June 2009, our lithium-ion battery charger of 12V, 24V, 36V, 48V obtained European CE certification with certificate number of BST09062243003C-1 and BST09062243003C-2.

Our battery charger products are widely used by one hundred standard vehicles. We can also design and produce customer-made chargers to satisfy the special needs of vehicle manufacturers. Specifically, we have the following series of standard charger products:

5

(1) 200W 10KW A~K Full-intelligent charger/battery waterproof charger

(2) Programmed intelligent battery charger

Below are the pictures of some of our charger products.

|

|

|

|

K-type full-intelligent battery charger,

|

D-type full-intelligent battery charger,

|

9KW programmable battery intelligent charger

|

Core Technology and R&D

The lithium-ion battery management technology is the core technology in the field of electric vehicles and electric bicycles, while battery management system (BMS) is the key element in battery management. It is vital in safe application and life-time dilation in bunching use of lithium-ion power battery. Through R&D efforts of our technology teams, we have developed a very competitive battery management system capable of real-time monitoring over battery statement in the process of car running or charging. Our Controller Area Network (“CAN”) system is designed to connect the motor

controller and the charger in such a way as to minimize heat and maximize power output.

We have three patent applications pending in China, which were filed in August 2010. The applications cover the rechargeable battery, lithium ion battery balance charge protection system, and charger system that are elements of our three wire charging system. The three wire charging system invention provides a safe solution to the automobile using lithium-ion battery module. It includes a digital control voltage feedback multilevel current device to resolve an equilibrium problem of connecting large-capacity lithium-ion batteries in series. It also includes a bidirectional current automatic converter to

make a standard automotive two-wire battery charge and discharge system achieve a three-wire system function of lithium-ion battery. We expect that the approval of the patent will give us an impetus to grow in Lithium-ion battery industry in its application in automobile industry.

Because of the light weight, potential long life cycle, energy-efficient and environmental-friendly characteristics, the lithium-ion battery is a good alternative source of power for the automobile industry. On the other hand, energy loss due to the imbalanced charge and discharge of lithium-ion battery pack, the two-wire system used in existing auto charger system prevent the application of lithium-ion battery in automobile industry. However, we use our innovative approaches which provide good solution to the above technical problems.

We have two R&D centers: one in Beijing Zhongguancun S&T Park and the other in Hangzhou. Our first R&D center in Beijing was established in 2007, which is focused on the development of battery modules. In October 2009, we established our second research center in Hangzhou, Zhejiang province in China, which is mainly focused on the research and development of battery protection and management system. Our two R&D centers have a senior R&D team of 38 personnel each of whom has strong academic and technology background in different sections of the Lithium-ion battery industry. Most of our

R&D team members have work experiences of over 5 years and have extensive experience in the lithium-ion battery industry. We have also developed long-term and wide cooperation with institutions with expertise in lithium-ion battery industry including the 19th Institute of Chinese Electronic S&T Group, the 15th institute of Chinese Electronic S&T Group, Beijing University of Aeronautics and Astronautics, and Beijing University of Information Science and Technology, in the field of power lithium-ion battery.

6

Our Lithium-ion Battery Management System (BMS)

Our proprietary Lithium-ion Battery Management System (BMS) solves the energy loss and safety issues in lithium-ion vehicle batteries, optimizes power utilization, and realizes the high power need for ignition of car batteries, especially in low temperatures.

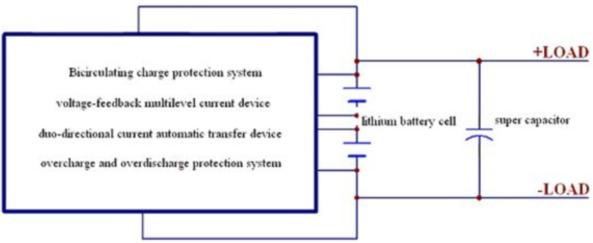

Our lithium-ion BMS as shown in diagram below has the following strength:

(1) Our lithium-ion auto battery design uses a clamp pressure diversion device (i.e to use the technology of voltage-stabilizing bypass circuit diffluence to stabilize cell voltage and convert the surplus electric current from constant current source into bypass heat energy) to realize constant-current charger's function of constant current first and then constant pressure.

(2) Our system adopts a bi-circulating charge protection system in the charge of lithium-ion auto battery to solve the energy loss and safety issues in lithium-ion auto battery.

(3) To solve the equalization problem in connecting high-capacity lithium-ion battery, we use NC voltage-feedback multilevel electric current, which uses single-circuit battery to equalize the unequal battery in the mode of single charge.

(4) Our lithium-ion BMS uses a three-wire system which would automatically shut off charging the control circuit when discharging to reduce power consumption of the system.

(5) Our design also has a charge and discharge protection system in the battery to prevent against the problems of overcharge, over-discharge, over-temperature and overflow.

(6) To realize high power needed in the ignition of car batteries (especially in low temperatures), we use a super capacitor to ignite the electric automobile and balance the charging to provide the power and balance needed to start an electric automobile.

* Wireless Charging Technology

In addition, we are developing proprietary wireless charging technology for Lithium-ion automobile batteries. Wireless charging increases the convenience and user-friendliness of electric cars using electromagnetic induction to charge the battery of batteries. Our current wireless charging system has 5KW of power and the estimated transmission efficiency is over 85%. We expect to launch the wireless recharge products for 5KW, 20KW in the third quarter of 2010.Our wireless charging system can be shown as the picture below.

7

Industry and Market Opportunity

In 2009, China became the world's largest auto making nation and the largest automobile market. Global trends for the rising cost of oil, stricter environmental standards and regulations, and support for energy sources that environmentally friendly technology are increasing market demand for technologies that can reduce oil dependence. Also, China has one of the world's most aggressive green energy national agendas.

In the transportation market, we believe the high prices of conventional fuel, greater awareness of environmental issues and government regulation are increasing the demand for Hybrid Engineering Vehicle (HEV), Plug-in Bybrid Engine Vehicle (PHEV) and Electric Vehicle (EV). These vehicles offer improved gas mileage and reduced carbon emissions and may ultimately provide an alternative vehicle that eliminates the need for gasoline engines.

We believe these trends are contributing to the growing demand for advanced battery technologies in the transportation, electric grid services and portable power markets.

According to a leader in global research and market analysis, by 2011 the market demand for power lithium-ion battery in China is projected to reach $15.740 billion. The combination of electric automobiles, including electric passenger car and electric highway passenger car, accounts for over 96% of the total market, with the electric bicycle market accounting for 2.4% of the total.

Globally, four types of companies are mainly involved in the lithium-ion battery industry:

|

-

|

Major lithium battery manufacturers (such as Sanyo, LG chemistry, LG Chemical, TOSHIBA)

|

|

|

-

|

Innovative high use rechargeable power technology companies (such as A123)

|

|

-

|

automobile manufacturers (such as Toyota, Daimler), and

|

|

|

-

|

auto parts manufacturers (such as Continental Group, Magna, Bosch)

|

Most are Japanese and South Korean companies.

This is a cutting-edge industry with no dominant players yet. We believe our technology and low cost of research and technology development will enable us to become a leading company in this industry. Also, the Company is based in China and is a leading provider of power systems for in Hybrid and Electric cars and vehicles in China.

Physical Plants and Production

We have two plants: one located in Beijing for the assembly and quality control of battery modules with the production capacity of 1,000 pieces per day,. The plant has three production lines. The address for the plant in Beijing is Er Bo Zi Industrial Region West 88-A, Changping District, Beijing China. The second plant is located in Guangzhou with the production capacity of 10,000 chargers per day and 1,000 units of battery management systems and switching power supply per day. The plant has five production lines to produce charger and battery management systems. The address for the plant in Guangzhou

is Minyin Technology District 1633, Beitai Rd., Baiyun district, Guangzhou China. The total areas for the two plants are approximately 10,000 square meters, and we lease the two spaces. In addition, we also lease two spaces for our R& D centers, one located in Beijing and the other in Hangzhou. The total annual lease payments for the four spaces during the year ended June 30, 2010 was approximately $16,029 (RMB109,000) The leases for the plant in Er Bo Zi, Zhongguancun R&D center, Hangzhou R&D center, and Guangzhou plant will expire in December 2011, November 2011, August 2012, and August 2013, respectively; but we expect to be able to renew these leases.

8

Marketing

At present, we only distribute products to domestic customers within China. With the development of new technologies and new products, we are actively seeking overseas customers and developing overseas market. Upon the request from the potential customers from Australian, France, Germany, and Taiwan we have shipped to them samples of our products for their examinations. We are expecting to develop overseas customers in the near future.

Domestic sales

We sell our products to our customers through the entering of sales contracts. Our customers include hybrid and electric vehicle manufacturers, power tool and consumer electronics manufacturers, E-bikes conversion providers, etc. Through years of cooperation, we have developed good business relationships with these customers. Each year, we entered into sales contracts with each of our customers to provide them our products of lithium-ion battery packs, battery management systems, and chargers. During the year ended June 30, 2011, none of our customers represented 10% or larger of our sales. During the

year ended June 30, 2011, we developed 2 new customers. The two new customers are: Shandong Expressway Co. Ltd (Fujian Branch) and Beijing Lianneng Power Technology Co., Ltd. In aggregate, the revenues from the two new customers contributed to 11.9% of the total revenue of the fiscal year ended June 30, 2011.

Our future marketing strategy includes:

|

•

|

Maintaining our sales contracts with our existing Hybrid and Electric vehicle manufacturers, power tool and consumer electronics manufacturers, and E-bikes conversion providers;

|

|

|

•

|

Extending our sales efforts in three marketing centers of Lithium-ion battery industry in China: the Jingjintang area centered in Beijing area, Zhujiang Delta centered in Guangdong province located in the southeast China, and Changjiang Delta centered in Shanghai area;

|

|

•

|

Developing local sales distributors to sell our own branded lithium-ion battery products;

|

|

|

•

|

Expanding our cooperation with government agency in China, including the efforts to participating government-subsidized projects;

|

China has over 120-million E-bikes on its streets. Since early in 2010 the government of China has had under consideration a regulation titled “Electrical Motorcycle and Electrical Bicycle Safety Regulation.” The regulation, if enacted by the government of China, will classify electric bicycles as motorcycles if they weigh more than 20kg or travel faster than 20km/h. If that regulation is adopted, the demand for lighter E-bikes will increase, because classification of a vehicle as a motorcycle subjects it to all of the regulation applicable to ownership and operation of a motor vehicle,

such as the requirement of an operator license and insutance. Also, motorcycles are banned in many cities in China. A demand for lighter E-bikes is likely to shift market demand from E-bikes carrying heavier lead-acid batteries to E-bikes build with Lithium-ion batteries.

Overseas sales

We intend to expand to overseas markets with our manufacturing partners, particularly in E-bikes, electric scooters, hybrid and electric cars. The Company will expand its lithium-ion battery business as a cost-effective, reliable power solution supplier to hybrid and electronic vehicle manufacturers and consumer electronics manufacturers.

9

We believe that the market demand in the nations of European Union for 60 Ah and 80 Ah large capacity battery module products is likely to increase in the near future. In 2006 the Restriction of Hazardous Substance Directive (2002/95/EC) and the Waste Electrical and Electronic Equipment Directive (2002/96/EC) became effective in the European Union. The directives restrict the use of lead, among other hazardous materials, in the manufacture of equipment. As a result, we expect increased momentum in the replacement of lead batteries by lithium-ion batteries for tour buses and motorcycles,

which primarily use 60AH and 80AH batteries. We have been testing the two types of battery modules in the lab of our research center. We expected to produce a small batch of the two types of products in October, 2010 and planned to market them mainly in the overseas market. Each of the two battery modules consist of three parts: battery, management system and charger. The three parts can be sold as a combined set, or each part can be sold separately. For the combined set, the gross margin could reach 30-40%.

Raw Material and Suppliers

One of our significant costs are of Lithium-ion cells. Heilongjiang ZhongQiang Power-Tech Co., Ltd ("Heilongjiang Zhongqiang") is our major supplier in this regard. Our purchase from Heilongjiang Zhongqiang accounted for 61.43% and 88.54%, respectively of our total purchase during the year ended June 30, 2011 and 2010. Through years of cooperation, we have developed a good business relationship with Heilongjiang Zhongqiang. We have entered into supply contracts with Heilongjiang Zhongqiang since 2007. The contracts are renewable each year. We believe that we are able to access abundant supply of

lithium-ion cells through our relationship with Heilongjiang Zhongqiang. In the event that Heilongjiang Zhongqiang cannot provide a sufficient supply to us, we believe that we can find alternative suppliers in the market with similar pricing. The major lithium-ion cell manufacturers in the market of China include Tianjin Lishen Battery Joint Stock Co., Ltd, China TCL Corporations, and BYD Company Limited.

Our Strategy

Our goal is to utilize our materials, science, expertise, our battery and battery systems engineering expertise and our manufacturing process technologies to provide advanced battery solutions. We intend to pursue the following strategies to attain this goal:

|

•

|

Pursue markets and customers where our technology creates a competitive advantage. We will continue to focus our efforts in markets where customers place a premium on high-quality batteries, innovation and differentiated performance.

|

|

•

|

Partner with industry leaders in China to adapt and commercialize our products to meet the requirements of our target markets. In each of our target markets, our joint development and supply agreements with industry-leading companies in China provide us insight into the performance requirements of that market, allow us to share product development costs and position our products to serve as a key strategic element for our partners' success.

|

|

|

•

|

Remain on the forefront of innovation and commercialization of new battery and system technologies. We believe that our battery design technologies provide us with a competitive advantage, and we intend to continue to innovate in materials science and product design.

|

|

•

|

Reduce costs through assembling improvements, supply chain efficiencies, innovation in materials and battery technologies. We believe that we can lower our battery and battery system costs by improving our assembling performance, lowering our raw material procurement costs, improving our inventory and supply chain management and through further materials science and battery innovation that can help reduce our need for expensive control and electronic components.

|

10

Employees

Beijing Guoqiang has 282 employees, including 22 managerial personnel as well as 35 technology R&D personnel, 50 people in the 57 managerial and technological personnel have bachelor degrees or above, 20 have master's degrees or above.

Environmental Law Compliance

We assemble our products from components. Some of the components are generic off-the-shelf electronic items. Some of the components were designed by our research and development staff, but are manufactured to our order by suppliers. We do not utilize any minerals in their natural state nor engage in any chemical processing. For that reason, our environmental law compliance costs are minimal. In addition, since China does not have additional environmental regulations dealing with climate change that apply to our operations, we have not planned material capital expenditures for environmental control

facilities or changes in our business practices specific to climate change.

Website Access to our SEC Reports

You may obtain a copy of the following reports, free of charge through the SEC's website at www.sec.gov as soon as reasonably practicable after electronically filing them with, or furnishing them to, the SEC: our previous Annual Reports on Form 10-K; our Quarterly Reports on Form 10-Q; our Current Reports on Form 8-K; and amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Our Internet website and the information contained therein or connected thereto are not intended to be incorporated into this Annual

Report on Form 10-K.

The public may also read and copy any materials filed with the SEC at the SEC's Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The Public Reference Room may be contact at (800) SEC-0330. You may also access our other reports via that link to the SEC website.

ITEM 1A. Risk Factors

RISKS RELATED TO OUR BUSINESS

Investing in our common stock involves a significant degree of risk. You should carefully consider the risks described below together with all of the other information contained in this Report, including the financial statements and the related notes, before deciding whether to purchase any shares of our common stock. If any of the following risks occurs, our business, financial condition or operating results could materially suffer. In that event, the trading price of our common stock could decline and you may lose all or part of your investment.

Our business and growth will suffer if we are unable to hire and retain key personnel that are in high demand.

Our future success depends on our ability to attract and retain highly skilled engineers, technical, marketing and customer service personnel, especially qualified personnel for our operations in China. Qualified individuals are in high demand in China, and there are insufficient experienced personnel to fill the demand. Therefore we may not be able to successfully attract or retain the personnel we need to succeed.

We may not be able to adequately protect our intellectual property, which could cause us to be less competitive.

We are designing and developing new technology. We rely on a combination of patent and trade secret laws and restrictions on disclosure to protect our intellectual property rights. Unauthorized use of our technology could damage our ability to compete effectively. In China, monitoring unauthorized use of our products is difficult and costly. In addition, intellectual property law in China is less developed than in the United States and historically China has not protected intellectual property to the same extent as it is protected in other jurisdictions, such as the United States. Any resort to

litigation to enforce our intellectual property rights could result in substantial costs and diversion of our resources, and might be unsuccessful.

11

The demand for batteries in the transportation and other markets depends on the continuation of current trends resulting from dependence on fossil fuels.

We believe that much of the present and projected demand for advanced batteries in the transportation and other markets results from the recent increases in the cost of oil, the dependency of the China on oil from unstable or hostile countries, government regulations and economic incentives promoting fuel efficiency and alternate forms of energy, as well as the belief that climate change results in part from the burning of fossil fuels. If the cost of oil decreased significantly, the outlook for the long-term supply of oil to China improved, the government eliminated or modified its regulations or

economic incentives related to fuel efficiency and alternate forms of energy, or if there is a change in the perception that the burning of fossil fuels negatively impacts the environment, the demand for our batteries could be reduced, and our business and revenue may be harmed.

If we are unable to develop, manufacture and market products that improve upon existing battery technology and gain market acceptance, our business may be adversely affected. In addition, many factors outside of our control may affect the demand for our batteries and battery systems.

We are researching, developing, manufacturing and selling lithium-ion batteries and battery systems. The market for advanced rechargeable batteries is at a relatively early stage of development, and the extent to which our lithium-ion batteries will be able to meet our customers' requirements and achieve significant market acceptance is uncertain. Rapid and ongoing changes in technology and product standards could quickly render our products less competitive, or even obsolete if we fail to continue to improve the performance of our battery chemistry and systems. Other companies that are seeking to

enhance traditional battery technologies have recently introduced or are developing batteries based on nickel metal-hydride, liquid lithium-ion and other emerging and potential technologies. These competitors are engaged in significant development work on these various battery systems. One or more new, higher energy rechargeable battery technologies could be introduced which could be directly competitive with, or superior to, our technology. The capabilities of many of these competing technologies have improved over the past several years. Competing technologies that outperform our batteries could be developed and successfully introduced, and as a result, there is a risk that our products may not be able to compete effectively in our target markets. If our battery technology is not adopted by our customers, or if our battery technology does not meet industry requirements for power and

energy storage capacity in an efficient and safe design our batteries will not gain market acceptance.

In addition, the market for our products depends upon third parties creating or expanding markets for their end-user products that utilize our batteries and battery systems. If such end-user products are not developed, if we are unable to have our products designed into these end user products, if the cost of these end-user products is too high, or the market for such end-user products contracts or fails to develop, the market for our batteries and battery systems would be expected similarly to contract or collapse. Our customers operate in extremely competitive industries, and competition to

supply their needs focuses on delivering sufficient power and capacity in a cost, size and weight efficient package. The ability of our customers to adopt new battery technologies will depend on many factors outside of our control. For example, in the automotive industry, we depend on our customers' ability to develop HEV, PHEV and EV platforms that gain broad appeal among end users.

Many other factors outside of our control may also affect the demand for our batteries and battery systems and the viability of widespread adoption of advanced battery applications, including:

|

•

|

performance and reliability of battery power products compared to conventional and other non-battery energy sources and products;

|

|

|

•

|

success of alternative battery chemistries, such as nickel-based batteries, lead-acid batteries and conventional lithium-ion batteries and the success of other alternative energy technologies, such as fuel cells and ultra capacitors;

|

12

|

•

|

end-users' perceptions of advanced batteries as relatively safe and reliable energy storage solutions, which could change over time if alternative battery chemistries prove unsafe or become the subject of significant product liability claims and negative publicity is generated on the battery industry as a whole;

|

|

|

•

|

cost-effectiveness of our products compared to products powered by conventional energy sources and alternative battery chemistries;

|

|

•

|

availability of government subsidies and incentives to support the development of the battery power industry;

|

|

|

•

|

fluctuations in economic and market conditions that affect the cost of energy stored by batteries, such as increases or decreases in the prices of electricity;

|

|

•

|

continued investment by the federal government and our customers in the development of battery powered applications;

|

|

|

•

|

heightened awareness of environmental issues and concern about global warming and climate change; and

|

|

•

|

regulation of energy industries.

|

Adverse business or financial conditions affecting the automotive industry may have a material adverse effect on our development and marketing partners and our battery business.

Adverse business or financial conditions affecting individual automotive manufacturers or the automotive industry generally, including potential bankruptcies, as well as market disruption that could result from future consolidation in the automotive industry, could have a material adverse effect on our business. Automotive manufacturers may discontinue or delay their planned introduction of HEVs, PHEVs or EVs as a result of adverse changes in their financial condition or other factors. Automotive manufacturers may also seek alternative battery systems from other suppliers which may be more

cost-effective or require fewer modifications in standard manufacturing processes than our products. We may also experience delays or losses with respect to the collection of payments due from customers in the automotive industry experiencing financial difficulties.

We are dependent on one major supplier for our raw materials. In the event we are no longer able to secure raw materials from this supplier and are unable to find alternative sources of supply at similar or more competitive rates, our operations and profitability will be adversely affected.

For the production of our lithium-ion battery modules and management systems, we rely on our major supplier Heilongjiang Zhongqiang Energy Technology Development Limited ("Heilongjiang Zhongqiang") to provide us the lithium-ion battery cell. The purchase from Heilongjiang Zhongqiang accounted for 88.54% and 92.74%, respectively, of our total purchase of raw materials during the year ended June 30, 2010 and 2009. Although we believe that we are able to find substitute suppliers easily in China such as Tianjin Lishen Battery Joint Stock Co., Ltd, China TCL Corporations, and BYD Company Limited, in

the event that we are unable to find alternative sources of supply at similar or more competitive rates, our business and operations will be adversely affected.

Most of our assets are located in China, any dividends or proceeds from liquidation are subject to the approval of the relevant Chinese government agencies.

Our assets are predominantly located inside China. Under the laws governing Foreign-invested Entities in China, dividend distribution and liquidation are allowed but subject to special procedures under the relevant laws and rules. Any dividend payment will be subject to the decision of the board of directors and subject to foreign exchange rules governing such repatriation. Any liquidation is subject to both the relevant government agency's approval and supervision as well the foreign exchange control. This may generate additional risk for our investors in case of dividend payment or

liquidation.

13

We have limited business insurance coverage.

The insurance industry in China is still at an early stage of development. Insurance companies in China offer limited business insurance products, and do not, to our knowledge, offer business liability insurance. As a result, we do not have any business liability insurance coverage for our operations. Moreover, while business disruption insurance is available, we have determined that the risks of disruption and cost of the insurance are such that we do not require it at this time. Any business disruption, litigation or natural disaster might result in substantial costs and diversion of our

resources.

Our operations are in China, and we are subject to significant political, economic, legal and other uncertainties (including, but not limited to, trade barriers and taxes that may have an adverse effect on our business and operations.

We assemble all of our products in China and substantially all of the net book value of our total fixed assets is located there. However, we plan to sell our products to customers outside of China. As a result, we may experience barriers to conducting business and trade in our targeted markets in the form of delayed customs clearances, customs duties and tariffs. In addition, we may be subject to repatriation taxes levied upon the exchange of income from local currency into foreign currency, as well as substantial taxes of profits, revenues, assets or payroll, as well as value-added tax. The

markets in which we plan to operate may impose onerous and unpredictable duties, tariffs and taxes on our business and products. Any of these barriers and taxes could have an adverse effect on our finances and operations.

We may be required to raise additional financing by issuing new securities with terms or rights superior to those of our shares of common stock, which could adversely affect the market price of our shares of common stock.

We may require additional financing to fund future operations, develop and exploit existing and new products and to expand into new markets. We may not be able to obtain financing on favorable terms, if at all. If we raise additional funds by issuing equity securities, the percentage ownership of our current shareholders will be reduced, and the holders of the new equity securities may have rights superior to those of the holders of shares of common stock, which could adversely affect the market price and the voting power of shares of our common stock. If we raise additional funds by issuing debt

securities, the holders of these debt securities would similarly have some rights senior to those of the holders of shares of common stock, and the terms of these debt securities could impose restrictions on operations and create a significant interest expense for us.

We do not intend to pay any cash dividends on our common stock in the foreseeable future and, therefore, any return on your investment in our common stock must come from increases in the fair market value and trading price of our common stock.

We have never paid a cash dividend on our common stock. We do not intend to pay cash dividends on our common stock in the foreseeable future and, therefore, any return on your investment in our common stock must come from increases in the fair market value and trading price of our common stock.

Our international operations require us to comply with a number of U.S. and international regulations.

We need to comply with a number of international regulations in countries outside of the United States. In addition, we must comply with the Foreign Corrupt Practices Act, or FCPA, which prohibits U.S. companies or their agents and employees from providing anything of value to a foreign official for the purposes of influencing any act or decision of these individuals in their official capacity to help obtain or retain business, direct business to any person or corporate entity or obtain any unfair advantage. Any failure by us to adopt appropriate compliance procedures and ensure that our employees

and agents comply with the FCPA and applicable laws and regulations in foreign jurisdictions could result in substantial penalties or restrictions on our ability to conduct business in certain foreign jurisdictions. The U.S. Department of The Treasury's Office of Foreign Asset Control, or OFAC, administers and enforces economic and trade sanctions against targeted foreign countries, entities and individuals based on U.S. foreign policy and national security goals. As a result, we are restricted from entering into transactions with certain targeted foreign countries, entities and individuals except as permitted by OFAC which may reduce our future growth.

14

Our contractual arrangements with Beijing Guoqiang and its shareholders may not be as effective in providing control over these entities as direct ownership.

We have no equity ownership interest in Beijing Guoqiang and rely on the contractual arrangements of the VIE Agreements to control and operate Beijing Guoqiang. These contractual arrangements may not be as effective in providing control over Beijing Guoqiang as direct ownership. For example, Beijing Guoqiang could fail to take actions required for our business or fail to pay dividends to Sky Achieve despite its contractual obligation to do so. If Beijing Guoqiang fails to perform its obligation under the VIE Agreements, we may have to rely on legal remedies under PRC law, which may not be

effective. In addition, we cannot assure you that Beijing Guoqiang's shareholders will always act in our best interests.

Our operations are subject to PRC laws and regulations that are sometimes vague and uncertain. Any changes in such PRC laws and regulations, or the interpretations thereof, may have a material and adverse effect on our business.

Our principal operating subsidiary, Sky Achieve Inc., is considered a foreign invested enterprise under PRC laws, and as a result is required to comply with PRC laws and regulations. Unlike the common law system prevalent in the United States, decided legal cases have little value as precedent in China. There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including but not limited to the laws and regulations governing our business and the enforcement and performance of our arrangements with customers in the event of the imposition of

statutory liens, death, bankruptcy or criminal proceedings. The Chinese government has been developing a comprehensive system of commercial laws. However, because these laws and regulations are relatively new, and because of the limited volume of published cases and judicial interpretation and their lack of force as precedents, interpretation and enforcement of these laws and regulations involve significant uncertainties. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. We cannot predict what effect the interpretation of existing or new PRC laws or regulations may have on our businesses. If the relevant authorities find us in violation of PRC laws or regulations, they would have broad discretion in dealing with such a violation.

The capital investments that we plan may result in dilution of the equity of our present shareholders.

We intend to raise a large portion of the funds necessary to implement our business plan by selling equity in our company. At present we have no commitment from any source for those funds. We cannot determine, therefore, the terms on which we will be able to raise the necessary funds. It is possible that we will be required to dilute the value of our current shareholders' equity in order to obtain the funds. If, however, we are unable to raise the necessary funds, our growth will be limited, as will our ability to compete effectively.

We may have difficulty establishing adequate management and financial controls in China.

The PRC has only recently begun to adopt the management and financial reporting concepts and practices that investors in the United States are familiar with. We may have difficulty in hiring and retaining employees in China who have the experience necessary to implement the kind of management and financial controls that are expected of a United States public company. If we cannot establish such controls, we may experience difficulty in collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet U.S.

standards.

15

We may incur significant costs to ensure compliance with U.S. corporate governance and accounting requirements.

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002, or Sarbanes-Oxley, and other rules implemented by the Securities and Exchange Commission. We expect all of these applicable rules and regulations to increase our legal and financial compliance costs and to make some activities more time-consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain

director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors, on committees of our board of directors or as executive officers.

As a public company, we are required to comply with rules and regulations of the SEC, including expanded disclosure, accelerated reporting requirements and more complex accounting rules. This will continue to require additional cost management resources. We will need to continue to implement additional finance and accounting systems, procedures and controls as we grow to satisfy these reporting requirements. In addition, we may need to hire additional legal and accounting staff with appropriate experience and technical knowledge, and we cannot assure you that if additional staffing is necessary

that we will be able to do so in a timely fashion. If we are unable to complete the required annual assessment as to the adequacy of our internal reporting or if our independent registered public accounting firm is unable to provide us with an unqualified report as to the effectiveness of our internal controls over financial reporting in the future, we could incur significant costs to become compliant.

Our financial results may be affected by mandated changes in accounting and financial reporting.

We prepare our financial statements in conformity with accounting principles generally accepted in the United States of America. These principles are subject to interpretation by the Securities and Exchange Commission and other regulatory institutions responsible for the promulgation and interpretation of securities rules and accounting policies. A change in these policies may have a significant effect on our reported results and may even retroactively affect previously reported transactions.

Capital outflow policies in China may hamper our ability to pay dividends to shareholders in the United States.

The PRC has adopted currency and capital transfer regulations. These regulations require that we comply with complex regulations for the movement of capital. Although Chinese governmental policies were introduced in 1996 to allow the convertibility of RMB into foreign currency for current account items, conversion of RMB into foreign exchange for capital items, such as foreign direct investment, loans or securities, requires the approval of the State Administration of Foreign Exchange. We may be unable to obtain all of the required conversion approvals necessary for our operations, and Chinese

regulatory authorities may impose greater restrictions on the convertibility of the RMB in the future. Because most of our future revenues will be in RMB, any inability to obtain the requisite approvals or any future restrictions on currency exchanges will limit our ability to pay dividends to our shareholders.

Currency fluctuations may adversely affect our operating results.

Beijing Guoqiang generates revenues and incurs expenses and liabilities in Renminbi, the currency of the PRC. However, as a Variable Interest Entity ("VIE") of China Lithium Technologies, it will report its financial results in the United States in U.S. Dollars. As a result, our financial results will be subject to the effects of exchange rate fluctuations between these currencies. From time to time, the government of China may take action to stimulate the Chinese economy that will have the effect of reducing the value of Renminbi. In addition, international currency markets may cause significant

adjustments to occur in the value of the Renminbi. Any such events that result in a devaluation of the Renminbi versus the U.S. Dollar will have an adverse effect on our reported results. We have not entered into agreements or purchased instruments to hedge our exchange rate risks.

16

All of our assets are located in China. So any dividends or proceeds from liquidation are subject to the approval of the relevant Chinese government agencies.

Our assets are located inside China. Under the laws governing FIEs in China, dividend distribution and liquidation are allowed but subject to special procedures under the relevant laws and rules. Any dividend payment will be subject to the decision of the board of directors and subject to foreign exchange rules governing such repatriation. Any liquidation is subject to both the relevant government agency's approval and supervision as well the foreign exchange control. This may generate additional risk for our investors in case of dividend payment or liquidation.

We are not likely to hold annual shareholder meetings in the next few years.

Management does not expect to hold annual meetings of shareholders in the next few years, due to the expense involved. The current members of the Board of Directors were appointed to that position by the previous directors. If other directors are added to the Board in the future, it is likely that the current directors will appoint them. As a result, the shareholders of the Company will have no effective means of exercising control over the operations of the Company.

Because our funds are held in banks which do not provide insurance, the failure of any bank in which we deposit our funds could affect our ability to continue in business.

Banks and other financial institutions in the People's Republic of China do not provide insurance for funds held on deposit. As a result, in the event of a bank failure, we may not have access to funds on deposit. Depending upon the amount of money we maintain in a bank that fails, our inability to have access to our cash could impair our operations, and, if we are not able to access funds to pay our suppliers, employees and other creditors, we may be unable to continue in business.

We may be affected by global climate change or by legal, regulatory, or market responses to such change.

Concern over climate change, including global warming, has led to legislative and regulatory initiatives directed at limiting greenhouse gas (GHG) emissions. For example, proposals that would impose mandatory requirements on GHG emissions continue to be considered by policy makers in the territories that we operate. Laws enacted that directly or indirectly affect our production, distribution, packaging, cost of raw materials, fuel, ingredients, and water could all impact our business and financial results.

ITEM 1B.Unresolved Staff Comments

ITEM 2. Properties

The Company carries on operations in five locations, each of which is a leasehold. We believe that this assembly of property will be adequate for our operations for the foreseeable future. The lessors of our properties in China are third parties who have no other relationship with the Company. The lessor of our offices in New York City is Advanced Battery Technologies, Inc., which is the parent corporation for our largest supplier of batteries. The properties leased to the Company are:

17

|

Leased

Properties

|

Location

|

Use

|

Lease Term

|

Space

(Square Feet)

|

Annual Rent

|

|||||||||

|

Beijing Plant

|

88A West, North Industry Area, Erbozi Industrial Region West 88-A, Huilongguan, Changping District, Beijing, China

|

Assembly of battery modules

|

1/1/2008-12/31/2012

|

16,146

|

$

|

31,636

|

||||||||

|

Executive Offices

|

34 South Zhongguancun Rd, Suite 1701, Haidian District, Beijing, China.

|

Administrative, sales, R&D

|

11/10/2009-10/09/2014

|

3,186

|

$

|

29,293

|

||||||||

|

Guangzhou Plant

|

Minyin Technology District, 1633 Beitai Rd, Baiyun District, Guangzhou, Guangdong Province, China

|

Assembly of battery modules

|

9/2/2009-9/1/2014

|

19,375

|

$

|

31,636

|

||||||||

|

Hangzhou Center

|

351 Changhe Rd, Suite 4-A201, Binjiang District, Hangzhou, Zhejiang Province, China

|

Research & development

|

9/4/2009-9/3/2012

|

3,229

|

$

|

24,313

|

||||||||

|

New York Office

|

15 West 39th Street Suite 14B, New York, NY 10018

|

Investor Relations

|

Monthly

|

215

|

$

|

12,000

|

||||||||

ITEM 3. Legal Proceedings

We are currently not aware of any pending legal proceedings which involve us or any of our properties or subsidiaries.

ITEM 4. Submission of Matters to a Vote of Security Holders

There were no matters submitted to a vote of security holders from June 30, 2009 to June 30, 2010.

18

PART II.

ITEM 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchase of Equity Securities

MARKET INFORMATION

There is only a very limited market for the Company's securities. Prior to March 20, 2009 there was no marked for the Company’s securities. The Company's securities were listed on the OTC Bulletin Board on March 20, 2009, and are currently listed under the symbol "CLTT". There are no outstanding options or warrants to purchase shares of common stock or securities convertible into shares of the Company's common stock. The Company has no obligations to register any of its shares of common stock under the Securities Act of 1933. The following table shows the high and low prices of our common shares on the OTC Bulletin Board for each quarter during fiscal year of 2011 and

2010.

|

High ($)

|

Low ($)

|

|||||||

|

Year Ended June 30, 2011

|

||||||||

|

First Quarter Ended September 30, 2010

|

4.200 | 0.176 | ||||||

|

Second Quarter Ended December 31, 2010

|

51

|

6

|

||||||

|

Third Quarter Ended March 31, 2011

|

21.95

|

6

|

||||||

|

Fourth Quarter Ended June 30, 2011

|

10.95

|

1.75

|

||||||

|

Year Ended June 30, 2010

|

|

|

||||||

|

First Quarter Ended September 30, 2009

|

0.044

|

0.0002

|

||||||

|

Second Quarter Ended December 31, 2009

|

0.066

|

0.0002

|

||||||

|

Third Quarter Ended March 31, 2010

|

2.596

|

0.066

|

||||||

|

Fourth Quarter Ended June 30, 2010

|

0.176

|

0.176

|

||||||

HOLDERS

As of September 27, 2011, there were 324 holders of record of our common stock.

DIVIDENDS

ITEM 6. Selected Financial Data

N/A

ITEM 7. Management's Discussion and Analysis or Financial Condition and Results of Operation

The accounting effect of the Entrusted Management Agreements entered into on January 05, 2010 is to cause the balance sheets and financial results of Beijing Guoqiang for the years ended June 30, 2010 and 2009 to be consolidated with those of Sky Achieve, with respect to which Beijing Guoqiang is now a Variable Interest Entity ("VIE").

As a wholly-owned subsidiary of China Lithium Technologies, the consolidated financial statements of Sky Achieve, Inc. will be further consolidated with the financial statements of China Lithium Technologies in future filings. For that reason, the financial statements of Beijing Guoqiang and Sky Achieve have been filed with this Report, and the discussion below concerns the financial condition and results of operations of Sky Achieve and Beijing Guoqiang.

19

RESULTS OF OPERATION - Year Ended June 30, 2011 compared to Year Ended June 30, 2010

Total Revenues

The following table shows the revenues attributable to each of our product lines during the past two fiscal years:

|

Year Ended

June 30, 2011

|

Year Ended

June 30, 2010

|

|||||||

|

Battery Management Systems

|

$

|

8,138,013

|

$

|

8,404,660

|

||||

|

Battery Modules

|

$

|

3,410,857

|

$

|

1,470,849

|

||||

|

Battery Packs

|

$

|

202,794

|

$

|

1,632,175

|

||||

|

Electric Vehicle Batteries

|

$

|

1,276,104

|

$

|

1,211,820

|

||||

|

Power Supplies

|

$

|

2,390,477

|

$

|

1,290,470

|

||||

|

Chargers

|

$

|

349,868

|

$

|

79,510

|

||||

Total revenues for the year ended June 30, 2011 were $15,767,978 as compared to total revenues of $14,089,484 for the year ended June 30, 2010, an increase of $1,678,494 or approximately 11.91%. Approximately one fourth of the increase in revenues was due to our success in marketing our products with a higher retail price to our established customers. For example, our largest customer in terms of sales volume, Shandong Expressway Co., Ltd. (Fujian Branch), after two years of experience with our products, increased their purchases of our higher priced battery management systems in fiscal 2011

The remainder of the year-to-year increase in revenue was attributable to our success in developing additional customers during the year ended June 30, 2011. Our new customers included Fuzhou Tongan Electronic, Inc, Anhui Guoxuan Electrical Vehicle, Inc, Zhangzhou Youke Power, Inc, Zhongxing Electrical Vehicle, Inc, Jiangsu Linhai Power Equipment, Co, and Beijing Zhongxinlian Digital Technologies, Inc. In aggregate, the revenues from these six new customers contribute 8.03% of the total revenue of the fiscal year ended June 30, 2011.

Cost of Goods Sold; Gross Profit

Gross profit for the year ended June 30, 2011 was $5,756,385 or 36.51% of revenues, as compared to $4,521,121 or 32.09% of revenues for the year ended June 30, 2010. The increase in our gross margin ratio was primarily attributable to an adjustment in our product offerings that we made at the beginning of the 2011 fiscal year. Shortly into the year we eliminated the sales of battery packs, because they had a low profit margin (10%) and a lower value added. That allowed us to focus our sales effort on battery modules, power supplies and chargers, all of which had higher profit margins, yielding 39%, 50% and 29% respectively. Meanwhile, our largest selling product

line, battery management systems, yielded a profit margin of 32%, enabling us to record the overall increase in profitability. We expect our gross profit margin to remain at its current level, albeit with slight growth in the future.

20