Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K DATED OCTOBER 7, 2011 - AmREIT Monthly Income & Growth Fund III Ltd | amreit114812migiii_8k.htm |

Exhibit 10.1

|

|

|

|

|

|

|

|

|

TERM LOAN AGREEMENT |

|

|

|

by and between |

|

|

|

AmREIT LANTERN LANE, LP, |

|

a Texas limited partnership, as |

|

Borrower |

|

|

|

and |

|

|

|

U.S. BANK NATIONAL ASSOCIATION, |

|

a national banking association, |

|

as Lender |

|

|

|

Property: |

|

Lantern Lane Shopping Center |

|

12500 Memorial Drive, Houston, TX |

|

|

|

Dated: Effective as of October 7, 2011 |

|

|

|

|

|

|

|

|

|

|

|

|

ARTICLE 1 DEFINITIONS AND INTERPRETATION |

|

1 |

|||

|

|

|

|

|||

|

|

Section 1.1 |

|

Defined Terms |

|

1 |

|

|

Section 1.2 |

|

Singular and Plural Terms |

|

9 |

|

|

Section 1.3 |

|

Accounting Principles |

|

9 |

|

|

Section 1.4 |

|

Exhibits Incorporated |

|

9 |

|

|

Section 1.5 |

|

References |

|

9 |

|

|

Section 1.6 |

|

Other Terms |

|

10 |

|

|

Section 1.7 |

|

Headings |

|

10 |

|

|

Section 1.8 |

|

Other Documents |

|

10 |

|

|

Section 1.9 |

|

Intention |

|

10 |

|

|

|

|

|

|

|

|

ARTICLE 2 THE LOAN |

|

10 |

|||

|

|

|

|

|||

|

|

Section 2.1 |

|

Purpose of Loan |

|

10 |

|

|

Section 2.2 |

|

Principal |

|

10 |

|

|

Section 2.3 |

|

Interest |

|

11 |

|

|

Section 2.4 |

|

Prepayment |

|

12 |

|

|

Section 2.5 |

|

Regulatory Change; Conversion of Interest Rate |

|

12 |

|

|

Section 2.6 |

|

Payments |

|

13 |

|

|

|

|

|

|

|

|

ARTICLE 3 FEES AND COSTS |

|

14 |

|||

|

|

|

|

|||

|

|

Section 3.1 |

|

Commitment Fee |

|

14 |

|

|

Section 3.2 |

|

Reimbursement of Lender |

|

14 |

|

|

|

|

|

|

|

|

ARTICLE 4 SPECIAL COVENANTS |

|

15 |

|||

|

|

|

|

|||

|

|

Section 4.1 |

|

Voluntary Cleanup Program; Escrow Account |

|

15 |

|

|

Section 4.2 |

|

Deadlines Regarding Environmental Issues; Cash Reserve Account |

|

16 |

|

|

Section 4.3 |

|

CVS Lease; Lease Trigger Event |

|

17 |

|

|

Section 4.4 |

|

Property Condition Report; Repair Reserve |

|

18 |

|

|

Section 4.5 |

|

Rice Lease; Lease Reserve |

|

18 |

|

|

|

|

|

|

|

|

ARTICLE 5 LOAN DOCUMENTS |

|

19 |

|||

|

|

|

|

|||

|

|

Section 5.1 |

|

Security Documents |

|

19 |

|

|

Section 5.2 |

|

Guaranty |

|

20 |

|

|

Section 5.3 |

|

Environmental Indemnity; Environmental Insurance |

|

20 |

|

|

Section 5.4 |

|

Assignment and Subordination of Management Agreement |

|

20 |

|

|

|

|

|

|

|

|

ARTICLE 6 RESERVED |

|

20 |

|||

|

|

|

|

|||

|

ARTICLE 7 RESERVED |

|

20 |

|||

v

|

|

|

|

|

|

|

|

ARTICLE 8 REPRESENTATIONS AND WARRANTIES |

|

20 |

|||

|

|

|

|

|||

|

|

Section 8.1 |

|

Formation, Qualification and Compliance |

|

20 |

|

|

Section 8.2 |

|

Execution and Performance of Loan Documents |

|

20 |

|

|

Section 8.3 |

|

Sole Assets |

|

21 |

|

|

Section 8.4 |

|

Tax Liability |

|

21 |

|

|

Section 8.5 |

|

Government Requirements |

|

21 |

|

|

Section 8.6 |

|

No Adverse Conditions |

|

22 |

|

|

Section 8.7 |

|

Rights of Others |

|

22 |

|

|

Section 8.8 |

|

Reserved |

|

22 |

|

|

Section 8.9 |

|

Litigation |

|

22 |

|

|

Section 8.10 |

|

Reserved |

|

22 |

|

|

Section 8.11 |

|

Condemnation |

|

22 |

|

|

Section 8.12 |

|

Name and Principal Place of Business |

|

22 |

|

|

Section 8.13 |

|

ERISA |

|

22 |

|

|

Section 8.14 |

|

Brokers |

|

22 |

|

|

Section 8.15 |

|

Anti-Terrorism Regulations |

|

22 |

|

|

Section 8.16 |

|

Financial Statements |

|

23 |

|

|

Section 8.17 |

|

Title to the Property |

|

24 |

|

|

Section 8.18 |

|

Governmental Regulations |

|

24 |

|

|

Section 8.19 |

|

Utilities |

|

24 |

|

|

Section 8.20 |

|

Other Lands |

|

24 |

|

|

Section 8.21 |

|

Permits |

|

24 |

|

|

Section 8.22 |

|

Representations and Warranties |

|

25 |

|

|

|

|

|

|

|

|

ARTICLE 9 AFFIRMATIVE COVENANTS |

|

25 |

|||

|

|

|

|

|||

|

|

Section 9.1 |

|

Protection of Liens |

|

25 |

|

|

Section 9.2 |

|

Payment of Taxes, Assessments, Costs and Expenses |

|

25 |

|

|

Section 9.3 |

|

Reserved |

|

25 |

|

|

Section 9.4 |

|

Continued Compliance |

|

25 |

|

|

Section 9.5 |

|

Books and Records |

|

26 |

|

|

Section 9.6 |

|

Maintenance and Security of Property |

|

26 |

|

|

Section 9.7 |

|

Financial Statements |

|

26 |

|

|

Section 9.8 |

|

Notice of Certain Matters |

|

27 |

|

|

Section 9.9 |

|

Notice of Junior Liens |

|

28 |

|

|

Section 9.10 |

|

Additional Reports and Information |

|

28 |

|

|

Section 9.11 |

|

Further Assurances |

|

28 |

|

|

Section 9.12 |

|

Reserved |

|

28 |

|

|

Section 9.13 |

|

Continued Existence |

|

28 |

|

|

Section 9.14 |

|

Guarantor Covenants |

|

28 |

|

|

Section 9.15 |

|

Leases |

|

28 |

|

|

Section 9.16 |

|

Operating Income |

|

29 |

|

|

Section 9.17 |

|

Single Purpose Entity |

|

29 |

|

|

Section 9.18 |

|

Interest Rate Protection |

|

31 |

|

|

Section 9.19 |

|

Appraisals |

|

32 |

vi

|

|

|

|

|

|

|

|

ARTICLE 10 NEGATIVE COVENANTS |

|

32 |

|||

|

|

|

|

|

|

|

|

|

Section 10.1 |

|

Liens on Property |

|

32 |

|

|

Section 10.2 |

|

Liens on Personal Property |

|

32 |

|

|

Section 10.3 |

|

Reserved |

|

33 |

|

|

Section 10.4 |

|

Sale or Lease of Property |

|

33 |

|

|

Section 10.5 |

|

Assignments of Obligations |

|

33 |

|

|

Section 10.6 |

|

Removal of Personal Property |

|

33 |

|

|

Section 10.7 |

|

Transfer of Equity Interests |

|

34 |

|

|

Section 10.8 |

|

ERISA |

|

34 |

|

|

Section 10.9 |

|

Debt |

|

34 |

|

|

Section 10.10 |

|

Distributions |

|

34 |

|

|

Section 10.11 |

|

Management Agreement |

|

34 |

|

|

|

|

|

|

|

|

ARTICLE 11 RESERVED |

|

35 |

|||

|

|

|

|

|

|

|

|

ARTICLE 12 INSURANCE |

|

35 |

|||

|

|

|

|

|

|

|

|

|

Section 12.1 |

|

Policies Required |

|

35 |

|

|

Section 12.2 |

|

Adjustment of Condemnation and Insurance Claims |

|

36 |

|

|

Section 12.3 |

|

Delivery of Proceeds to Lender |

|

36 |

|

|

Section 12.4 |

|

Utilization of Compensation and Proceeds |

|

36 |

|

|

|

|

|

|

|

|

ARTICLE 13 CONDEMNATION |

|

37 |

|||

|

|

|

|

|

|

|

|

ARTICLE 14 DEFAULTS AND REMEDIES |

|

37 |

|||

|

|

|

|

|

|

|

|

|

Section 14.1 |

|

Events of Default |

|

37 |

|

|

Section 14.2 |

|

Remedies Upon Default |

|

39 |

|

|

Section 14.3 |

|

Cumulative Remedies; No Waiver |

|

40 |

|

|

Section 14.4 |

|

Setoff |

|

40 |

|

|

|

|

|

|

|

|

ARTICLE 15 MISCELLANEOUS |

|

40 |

|||

|

|

|

|

|

|

|

|

|

Section 15.1 |

|

Actions |

|

40 |

|

|

Section 15.2 |

|

Nonliability of Lender |

|

40 |

|

|

Section 15.3 |

|

No Representations by Lender |

|

41 |

|

|

Section 15.4 |

|

Indemnity |

|

41 |

|

|

Section 15.5 |

|

Easements |

|

42 |

|

|

Section 15.6 |

|

Joint and Several; Relationship with Lender |

|

42 |

|

|

Section 15.7 |

|

Survival |

|

42 |

|

|

Section 15.8 |

|

Reserved |

|

42 |

|

|

Section 15.9 |

|

Notices |

|

42 |

|

|

Section 15.10 |

|

No Third Parties Benefited |

|

43 |

|

|

Section 15.11 |

|

Binding Effect |

|

43 |

|

|

Section 15.12 |

|

Counterparts |

|

44 |

|

|

Section 15.13 |

|

Prior Agreements; Amendments; Consents |

|

44 |

vii

|

|

|

|

|

|

|

|

|

Section 15.14 |

|

Governing Law |

|

44 |

|

|

Section 15.15 |

|

Maximum Rate |

|

45 |

|

|

Section 15.16 |

|

Waivers |

|

45 |

|

|

Section 15.17 |

|

Severability of Provisions |

|

46 |

|

|

Section 15.18 |

|

Time of the Essence |

|

46 |

|

|

Section 15.19 |

|

Assignments and Participations |

|

46 |

|

|

Section 15.20 |

|

No Consequential Damages |

|

47 |

|

|

Section 15.21 |

|

Lender Not in Control |

|

47 |

|

|

Section 15.22 |

|

USA Patriot Act Notice |

|

48 |

|

|

Section 15.23 |

|

DTPA Waiver |

|

48 |

viii

|

|

|

|

|

|

|

Exhibits |

|

|

Description |

|

|

|

||||

|

A |

|

Legal Description of the Land |

||

|

B |

|

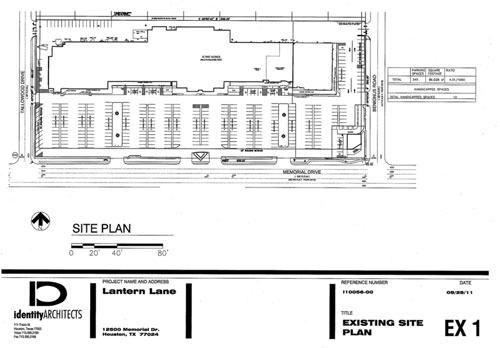

Site Plan of Shopping Center |

||

|

C |

|

Closing Conditions |

||

|

C-1 |

|

Post-Closing Conditions |

||

|

D |

|

Insurance Requirements |

||

|

E |

|

Survey Requirements |

||

|

F |

|

Extension Option |

||

ix

TERM LOAN AGREEMENT

THIS TERM LOAN AGREEMENT is made and entered into effective as of the 7th day of October, 2011, by and between AmREIT LANTERN LANE, LP, a Texas limited partnership (“Borrower”), and U.S. BANK NATIONAL ASSOCIATION, a national banking association (“Lender”).

RECITALS

A. Borrower owns fee title to approximately 6.7 acres of real property located in Harris County, Texas, being more fully described in Exhibit A attached hereto (the “Land”).

B. The Land is improved with a retail shopping center (the “Shopping Center”), as more particularly shown on the site plan of the Shopping Center affixed hereto as Exhibit B, containing approximately 79,462 square feet of retail space, together with applicable parking, amenities, and on-site and off-site improvements and appurtenances located on the Property (or necessary therefor) and/or in such improvements (collectively, the “Improvements”).

C. Borrower has requested that Lender make a term loan (the “Loan”) to Borrower to refinance certain indebtedness encumbering the Shopping Center, which Loan will be evidenced, in part, by this Agreement and by a Promissory Note dated of even date herewith, executed by Borrower and made payable to the order of Lender in the principal face amount of up to $12,800,000.00 (such Promissory Note it may hereafter be renewed, extended, supplemented, increased or modified and in effect from time to time, and all other notes given in substitution therefor, or in modification, renewal, or extension thereof, in whole or in part, is herein called the “Note”).

D. The Loan will be secured by a Deed of Trust, Assignment of Leases and Rents, Security Agreement, Fixture Filing and Financing Statement dated of even date herewith, executed by Borrower and Lender, recorded or to be recorded in the Real Property Records of Harris County, Texas (as amended, restated, modified or supplemented from time to time, is herein called the “Deed of Trust”), and (ii) an Assignment of Leases and Rents dated of even date herewith, executed by Borrower and Lender and recorded or to be recorded in the Real Property Records of Harris County, Texas (as amended, restated, modified or supplemented from time to time, is herein called the “Assignment of Leases”).

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto agree as follows:

ARTICLE 1

DEFINITIONS AND INTERPRETATION

Section 1.1 Defined Terms. As used in this Agreement (and in all other Loan Documents, unless otherwise defined), the following capitalized terms shall have the following meanings:

TERM LOAN AGREEMENT - Page 1

“Accessibility Regulation” means any federal, state or local law, statute, code, ordinance, rule, regulation or requirement including, without limitation, the United States Americans With Disabilities Act of 1991, as amended, (the “ADA”) relating to accessibility to facilities or properties for disabled, handicapped, physically challenged persons or other persons covered by the ADA.

“Adjusted Expenses” means, for any period, the aggregate, actual cash operating expenses of the Property (excluding non-cash expenses such as depreciation and expenses paid from reserves) for such period, but: (a) not including payments of principal or interest on the Loan during such period; and (b) adjusted to include (but without duplication of the above) appropriate monthly accruals for the Property for such period for: (1) a management fee of at least three and one half of one percent (3.50%) per annum, (2) periodic expenses such as property taxes and insurance, and (3) a reserve (not less than $0.25 per square foot of leasable space in the Improvements per annum) for capital repairs and replacements.

“Adjusted Income” means, for any period, all actual recurring cash rental income received by Borrower during such period pursuant to Approved Leases, adjusted for each calendar month during such period as necessary to reflect a vacancy factor/collection loss equal the greater of (i) 5%, or (ii) the actual vacancy factor for each month during such period.

“Adjusted Net Operating Income” means, for any period, (A) the Adjusted Income for such period, adjusted to include only cash rental income received by Borrower under Approved Leases pursuant to which the Tenant under such Approved Lease has (i) accepted and taken occupancy of its respective leased premises in accordance with such Approved Lease, and (ii) commenced the payment of base rent under such Approved Lease, minus (B) the Adjusted Expenses for such period.

“Affiliate” means, as to any Person, any other Person that, directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control with, such Person or any subsidiary of such Person. The term “control” (including the terms “controlled by” or “under common control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through ownership of a Control Percentage, by contract or otherwise.

“Agreement” means this Term Loan Agreement as it may be supplemented, amended, renewed, restated, extended or replaced from time to time.

“Anti-Terrorism Laws” means any laws relating to terrorism or money laundering, including Executive Order No. 13224, the USA Patriot Act, the Laws comprising or implementing the Bank Secrecy Act, and the laws administered by the United States Treasury Department’s Office of Foreign Asset Control (as any of the foregoing laws may from time to time be amended, renewed, extended, or replaced).

“Applicable Rate” is defined in Section 2.3 of this Agreement.

“Appraisal” means an appraisal prepared by an appraiser approved by Lender which appraisal is acceptable to Lender and done in conformity with the following standards:

TERM LOAN AGREEMENT - Page 2

Uniform Standards of Professional Appraisal Practice, the requirements of the Code of Professional Ethics and the Standards of Professional Appraisal Practice of the Appraisal Institute, the appraisal requirements set forth by the office of the Comptroller of the Currency and the Federal Reserve Board, which shall be used for the determination by Lender in its sole and absolute discretion of the Appraised Value.

“Appraised Value” means the value of the Property or portion thereof as determined by Lender based upon Lender’s review of a current Appraisal (or a current update to an Appraisal previously reviewed and approved by Lender) of the Property.

“Approved Lease” is defined in Section 9.15 of this Agreement.

“Approved Lease Form” is defined in Section 9.15 of this Agreement.

“Assignment and Subordination of Management Agreement” means the Assignment of Agreements to be executed and delivered by Borrower, which collaterally assigns to Lender all rights of Borrower under the Management Agreement.

“Assignment of Leases” is defined in the Recitals to this Agreement.

“Borrower” shall have the meaning given such term in the preamble to this Agreement.

“Business Day” means any day other than a Saturday, a Sunday, or a legal holiday on which Lender is not open for business.

“Cash Reserve Account” is defined in Section 4.2 of this Agreement.

“Casualty” means any act or occurrence of any kind or nature that results in damage, loss or destruction to the Property.

“Claim” means any liability, suit, action, claim, demand, loss, expense, penalty, fine, judgment, or other cost of any kind or nature whatsoever, including fees, costs and expenses of attorneys, consultants, contractors and experts.

“Closing Date” means the date of this Agreement.

“Code” means The Internal Revenue Code of 1986, as amended.

“Commitment” means an amount equal to the aggregate maximum unpaid principal amount of the Loan which may from time to time be outstanding hereunder, being the maximum sum of $12,800,000.00, which amount shall be reduced automatically by payments of principal on the Loan made by Borrower to Lender.

“Commitment Fee” is defined in Section 3.1 of this Agreement.

“Compensation” is defined in Article 13.

TERM LOAN AGREEMENT - Page 3

“Condemnation” means any taking of title to, use of, or any other interest in the Property under the exercise of the power of condemnation or eminent domain, whether temporarily or permanently, by any Governmental Agency or by any other Person acting under or for the benefit of a Government Agency.

“Control Percentage” means, with respect to any Person, the percentage of the outstanding capital stock of such Person having ordinary voting power which gives the direct or indirect holder of such stock the power to elect a majority of the Board of Directors of such Person.

“CVS Lease” means that certain Lease dated as of October 3, 2011, executed by Borrower and CVS Pharmacy, Inc. (“CVS”).

“CVS Reletting Requirement” is defined in Section 4.2 of this Agreement.

“DCR Program” is defined in Section 4.1 of this Agreement.

“Debt” means (a) indebtedness for borrowed money; (b) obligations evidenced by bonds, debentures, notes, or other similar instruments; (c) obligations to pay the deferred purchase price of property or services (including trade obligations); (d) obligations as lessee under any lease of any property by such Person as lessee which would, in accordance with generally accepted accounting principles, be required to be classified and accounted for as a capital lease on the balance sheet of such Person; and (e) obligations under guaranties, endorsements, performance bonds, assurances of payment, required investments, assurances against loss, and all other contingent obligations relating to the assurance of another Person against loss.

“Deed of Trust” is defined in the Recitals to this Agreement.

“Default Rate” means an annual rate equal to the lesser of (i) 5% in excess of the Applicable Rate, as such rate may fluctuate from time to time, or (ii) the Maximum Rate.

“Environmental Indemnity” means an Hazardous Substances Indemnity Agreement of even date herewith executed by Borrower and Guarantor in favor of Lender, as now or hereafter amended, modified, supplemented, or restated from time to time with the consent of Lender.

“Environmental Laws” has the meaning assigned to such term in the Environmental Indemnity.

“Environmental Reports” has the meaning assigned to such term in the Environmental Indemnity.

“Environmental Trigger Event” is defined in Section 4.2 of this Agreement.

TERM LOAN AGREEMENT - Page 4

“ERISA” means the Employee Retirement Income Security Act of 1974, as the same may from time to time be amended, and the rules and regulations promulgated thereunder by any Governmental Agency, as from time to time in effect.

“Escrow Account” is defined in Section 4.1 of this Agreement.

“Escrow Deposit” is defined in Section 4.1 of this Agreement.

“Event of Default” means any event so designated in Article 14 hereof.

“Excess Cash Flow” is defined in Section 4.2 of this Agreement.

“Financing Statement” means any Uniform Commercial Code - Financing Statement - Form UCC-1, perfecting the security interest created by the Deed of Trust or any other security interest or assignment relating to the Loan.

“General Partner” means AmREIT Lantern Lane GP, LLC, a Texas limited liability company

“Governmental Agency” means any governmental or quasi-governmental entity, including any court, department, commission, board, bureau, agency, administration, service, district or other instrumentality of any governmental entity.

“Guarantor” means, collectively, AmREIT Monthly Income & Growth Fund III, Ltd., a Texas limited partnership, and any Person who now or hereafter guarantees, in part or in full, the prompt payment and performance of any indebtedness or other obligation to Lender under any of the Loan Documents and the term “Guarantors” means all of such Persons, collectively.

“Guaranty” that certain Limited Payment Guaranty of even date herewith, executed by Guarantor to and for the benefit of Lender, as now or hereafter amended, modified, supplemented, or restated from time to time with the consent of Lender.

“Improvements” is defined in the Recitals to this Agreement.

“Indemnitees” is defined in Section 15.4 of this Agreement.

“Interest Rate Protection” means any agreement, whether or not in writing, relating to any transaction that is a rate swap, basis swap, forward rate transaction, commodity swap, commodity option, equity or equity index swap or option, bond, note or bill option, interest rate option, forward foreign exchange transaction, interest cap, collar or floor transaction, currency swap, cross-currency rate swap, swap option, currency option or any other similar transaction (including any option to enter into the foregoing) or any combination of the foregoing, and, unless the context otherwise clearly requires, any form of master agreement published by the International Swaps and Derivatives Association, Inc., or any other master agreement, entered into between Lender (or its affiliate) and Borrower (or its affiliate) in connection with the Loan, together with any related schedules and confirmations, as amended,

TERM LOAN AGREEMENT - Page 5

supplemented, superseded or replaced from time to time, relating to or governing any or all of the foregoing.

“IRP Counterparty” is defined in Section 9.18 of this Agreement.

“Land” is defined in the Recitals to this Agreement.

“Laws” means, collectively, all international, foreign, federal, state and local statutes, treaties, rules, regulations, ordinances, codes and administrative or judicial decisions or precedents, of or by any Governmental Agency.

“Lease” means any and all present and future ground lease, space lease, sublease or sub-sublease, letting, license, concession or other agreement (whether written or oral and whether now or hereafter in effect), pursuant to which any Person is granted a possessory interest in, or right to use or occupy, all or any portion of any space in the Property, and every modification, amendment or other agreement relating to such lease, sublease, sub-sublease or other agreement entered into in connection with such lease, sublease, sub-sublease or other agreement and every guarantee of the performance and observance of the covenants, conditions and agreements to be performed and observed by the other party thereto, together with any and all extensions or renewals of said leases and agreements.

“Lease Payment” is defined in Section 4.5 of this Agreement.

“Lease Reserve” is defined in Section 4.5 of this Agreement.

“Lease Reserve Account” is defined in Section 4.5 of this Agreement.

“Lease Trigger Event” is defined in Section 4.3 of this Agreement.

“LIBOR Rate” is defined in Section 2.3 of this Agreement.

“Loan” means the loan evidenced by the Note to be made by Lender to Borrower in the amount of $12,800,000.

“Loan Documents” means, collectively, this Agreement, the Note, the Security Documents, the Guaranty, the Environmental Indemnity, the Assignment and Subordination of Management Agreement, the Interest Rate Protection, and any other document that Lender requires from time to time to effectuate the purposes of this Agreement.

“Management Agreement” means any contract regarding the management or leasing of the Property now or hereafter executed by Borrower and any Property Manager, as the same may be amended or modified from time to time in accordance with the terms of this Agreement.

“Material Adverse Effect” means any set of circumstances or events which (a) has or could reasonably be expected to have any material adverse effect whatsoever upon the validity or enforceability of any Loan Document, (b) is or could reasonably be expected to be

TERM LOAN AGREEMENT - Page 6

material and adverse to the condition (financial or otherwise), business, assets, or operations of Borrower, Guarantor, or the Property or (c) materially impairs or could reasonably be expected to materially impair the ability of Borrower or Guarantor to perform the Obligations.

“Maturity Date” means the earlier of (i) April 7, 2013, and (ii) any date on which the Loan is required to be paid in full, by acceleration or otherwise, under this Agreement or any of the Loan Documents. The Maturity Date is subject to extension pursuant to the provisions of Exhibit F attached hereto.

“Maximum Rate” is defined in Section 15.15 of this Agreement.

“Money Markets” means one or more wholesale funding markets available to Lender, including negotiable certificates of deposit, commercial paper, eurodollar deposits, bank notes, federal funds, interest rate swaps or others.

“Net Operating Income” means, for any period, the amount, if any, by which the Adjusted Income for such period exceeds the Adjusted Expenses for the Property for the same period.

“New York Banking Day” means any day (other than a Saturday or Sunday) on which commercial banks are open for business in New York, New York.

“Note” is defined in the Recitals to this Agreement.

“Obligations” means all present and future debts, obligations and liabilities of Borrower to Lender arising pursuant to, or on account of, the provisions of this Agreement, the Note, the Security Documents, and any of the other Loan Documents, and all amounts secured by the Security Documents, including the obligation: (a) to pay all principal, interest, late charges, prepayment premiums (if any) and other amounts due at any time under the Note; (b) to pay all fees, charges, costs and expenses, indemnification payments, and other amounts due at any time under the Security Documents and any of the other Loan Documents, together with interest thereon as provided in the Security Documents and such other Loan Documents; (c) to pay and perform all obligations of Borrower under any Interest Rate Protection; and (d) to perform, observe and comply with all of the terms, covenants and conditions, expressed or implied, which Borrower is required to perform, observe or comply with pursuant to the terms of the Security Documents and the other Loan Documents.

“PBGC” means The Pension Benefit Guaranty Corporation or any successor board, authority, agency, officer or official of the United States administering the principal functions assigned on the date hereof to the Pension Benefit Guaranty Corporation under ERISA.

“Permitted Costs” is defined in Section 4.1 of this Agreement.

“Permitted Encumbrances” is defined in the Deed of Trust.

“Permitted Transfer” is defined in Section 10.7 of this Agreement.

TERM LOAN AGREEMENT - Page 7

“Person” means any entity, whether an individual, trustee, corporation, partnership, trust, unincorporated organization, Governmental Agency or otherwise.

“Personal Property” means all of Borrower’s interest in all furniture, furnishings, fixtures, machinery, equipment, inventory and other personal property of every kind, whether now existing or hereafter acquired, tangible and intangible, now or hereafter located on or about the Land, and used or to be used in the future in connection with the operation of the Improvements.

“Proceeds” is defined in Section 12.3.

“Property” means the Land, the Improvements, and all Personal Property related thereto.

“Property Condition Report” means that certain report entitled “Property Review Summary, Lantern Lane Shopping Center, Houston, Texas” dated October 4, 2011, prepared for Lender by AECC, Inc. (AECC, Inc. Project No.: 11281).

“Property Manager” means any leasing agent, broker or property management company providing leasing, brokerage and property management services for the Property, each of which shall be subject to the reasonable approval by Lender.

“Regulation” is defined in Section 2.5 of this Agreement.

“Repair Reserve” is defined in Section 4.4 of this Agreement.

“Repair Reserve Account” is defined in Section 4.4 of this Agreement.

“Required Repairs” is defined in Section 4.4 of this Agreement.

“Rice Lease” means that certain Lease dated as of August 25, 1997, executed by Borrower’s predecessor in title, as landlord, and Rice Food Markets, Inc. (“Rice”), as tenant, as amended.

“Security Agreement” means that certain Security Agreement (Deposit Account), dated of even date herewith, executed by Borrower for the benefit of Lender regarding the Escrow Account, Cash Reserve Account, Lease Reserve Account and Repair Reserve Account, together with any other security agreements, assignments, deposit control agreements or other instruments now or hereafter executed by Borrower in connection with the required pledge and assignment of funds and accounts to Lender under this Agreement.

“Security Documents” means, collectively, the Deed of Trust, the Financing Statement, the Assignment of Leases, the Security Agreement, and any other mortgage, deed of trust, security agreement or assignment now, heretofore or hereafter executed to secure the obligations of Borrower or Guarantor to Lender under any Loan Document.

TERM LOAN AGREEMENT - Page 8

“SNDA” means, with respect to any Approved Lease, a subordination, non-disturbance and attornment agreement in form reasonably acceptable to Lender.

“TCEQ” is defined in Section 4.1 of this Agreement.

“Tenant” means each tenant of the Shopping Center under an Approved Lease.

“Title Company” means Fidelity National Title Insurance Company.

“Title Policy” shall mean a standard TLTA mortgagee title insurance policy in the most current approved form (without modification, revision or amendment) issued by Title Company, insuring Lender that, on the Closing Date, Borrower owns fee simple title to the Property and that the Deed of Trust is a valid first lien on the Property, in the amount of the Loan.

“Treasury Rate” means, as of any date, the rate of interest per annum on U.S. Treasury Notes having a maturity of ten (10) years as shown in the 10-year listing in the “this week” column under the heading “Treasury Constant Maturities,” of the FEDERAL RESERVE statistical release FORM H-15 which has been most recently published (or, if for any reason that published rate as of a date not more than 10 days prior to such first Business Day is not available, another rate determined by Lender to be comparable, in its discretion reasonably exercised, shall be used for this purpose).

“USA Patriot Act” means The Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001, Public Law 107-56, as the same has been, or shall hereafter be, renewed, extended, amended or replaced.

“VCP” is defined in Section 4.1 of this Agreement.

“Water Authority” is defined in Section 4.1 of this Agreement.

Section 1.2 Singular and Plural Terms. Any defined term used in the plural in any Loan Document shall refer to all members of the relevant class and any defined term used in the singular shall refer to any number of the members of the relevant class.

Section 1.3 Accounting Principles. Any accounting term used and not specifically defined in any Loan Document shall be construed in conformity with, and all financial data required to be submitted under any Loan Document shall be prepared in conformity with, generally accepted accounting principles applied on a consistent basis.

Section 1.4 Exhibits Incorporated. All exhibits to this Agreement, as now existing and as the same may from time to time be supplemented and modified, are incorporated herein by this reference.

Section 1.5 References. Any reference to any Loan Document or other document shall include such document both as originally executed and as it may from time to time be supplemented and modified. References herein to Articles, Sections and Exhibits shall be

TERM LOAN AGREEMENT - Page 9

construed as references to this Agreement unless a different document is named. References to subparagraphs shall be construed as references to the same Section in which the reference appears.

Section 1.6 Other Terms. The term “document” is used in its broadest sense and encompasses agreements, certificates, opinions, consents, instruments and other written material of every kind. The terms “including” and “include” mean including (include) without limitation. The requirement that any party “deliver” any item to another party shall be construed to require that the first party “deliver or cause to be delivered” such item to the second party. The term “any” as a modifier to any noun, shall be construed to mean “any and/or all” preceding the same noun in the plural. The terms “herein”, “hereunder” and other similar compounds of the word “here” refer to the entire document in which the term appears and not to any particular provision or section of the document. In all cases where Lender’s approval or consent is required hereunder, such approval or consent may be withheld in Lender’s sole and absolute discretion.

Section 1.7 Headings. All headings appearing in this Agreement and article and section headings in the Loan Documents are for convenience of reference only and shall be disregarded in construing this Agreement and the Loan Documents.

Section 1.8 Other Documents. This Agreement shall be deemed a supplement to the other Loan Documents and shall not be construed as a modification thereto. In the event of any conflict between the provisions of this Agreement and those of any other Loan Document, the provisions of this Agreement shall control.

Section 1.9 Intention. The provisions of this Article 1 shall apply in every instance except where a different meaning, construction or reference is clearly specified and intended.

ARTICLE 2

THE LOAN

Section 2.1 Purpose of Loan. Borrower has purchased the Property and has applied to Lender for a loan for the purpose of refinancing the existing indebtedness encumbering the Property. Lender is willing to make such a loan to Borrower on the terms and conditions contained in this Agreement and the other Loan Documents. Subject to the terms and conditions hereof, Lender agrees to lend to Borrower and Borrower agrees to borrow from Lender, the proceeds of the Loan, which proceeds shall be disbursed by Lender to Borrower in a single advance.

Section 2.2 Principal.

(a) From and after the Closing Date to and until April 7, 2013, interest only shall be payable on the Loan. If the Maturity Date of the Loan is extended pursuant to Exhibit F attached hereto, then commencing on May 1, 2013 and continuing on the 1st day of each calendar month thereafter until the final Maturity Date of the Loan, Borrower shall make monthly principal payments on the Loan in an amount per month equal to $16,318.00.

TERM LOAN AGREEMENT - Page 10

(b) The entire principal balance of the Note shall mature and be payable at the Maturity Date.

(c) Lender shall enter in its records the amount of the Loan, the rate of interest borne thereon and the payments of the principal balance received by Lender, and such records shall be conclusive evidence of the subject matter thereof, absent manifest error.

Section 2.3 Interest.

(a) Interest on the outstanding principal balance of the Loan shall accrue at a rate per annum (herein, the “Applicable Rate”) equal to 3.00% plus the one-month LIBOR rate quoted by Lender from Reuters Screen LIBOR01 Page or any successor thereto, which shall be the one-month LIBOR rate in effect and reset each New York Banking Day, adjusted for any reserve requirement and any subsequent costs arising from a change in government regulation, such rate rounded up to the nearest one-sixteenth percent (a “LIBOR Rate”). If Borrower elects to obtain Interest Rate Protection from Lender, the LIBOR Rate shall be modified, by written agreement of Borrower and Lender, to conform to the repayment obligations in respect of such Interest Rate Protection.

(b) If the interest and/or charges in the nature of interest, if any, provided for by this Agreement or by any other Loan Document, shall contravene the Maximum Rate, if any, Borrower shall pay only such amounts as would legally be permitted; provided, however, that if the defense of usury and all similar defenses are unavailable to Borrower, Borrower shall pay all amounts provided for herein. If, for any reason, amounts in excess of the amounts permitted in the foregoing sentence shall have been paid, received, collected or applied hereunder, whether by reason of acceleration or otherwise, then, and in that event, any such excess amounts shall be applied to principal, unless principal has been fully paid, in which event such excess amount shall be refunded to Borrower.

(c) Interest shall accrue on the principal amount of the Loan from and after the date it is made by Lender to Borrower. Interest computed at the Applicable Rate shall be computed on the basis of a 360 day year, but shall be charged for the actual number of days principal is unpaid.

(d) Interest on the Loan computed at the Applicable Rate shall be payable, as accrued, on the first day of each calendar month, commencing on the first day of the next calendar month following the calendar month in which the Loan is funded to Borrower, and all unpaid, accrued interest shall be paid in full at the Maturity Date.

(e) If the Loan has not been repaid on or before the Maturity Date or if an Event of Default occurs pursuant to this Agreement or any other Loan Document, then the entire unpaid balance of the Loan shall (without notice to or demand upon Borrower) become due and payable on said date, together with all unpaid, accrued interest thereon, and with interest computed at the Default Rate from and after that date until the Loan is paid in full. Interest at the Default Rate shall be payable on the first day of each calendar month or on demand, at Lender’s option.

TERM LOAN AGREEMENT - Page 11

(f) If Borrower fails to make any required payment of principal or interest on the Loan (other than the balloon payment at the Maturity Date) on or before the fifth (5th) day following the due date thereof, Borrower shall pay to Lender, if requested by Lender, in addition to interest at the Default Rate, a late payment charge equal to five percent (5%) of the amount of the overdue payment, for the purpose of reimbursing Lender for a portion of the expense incident to handling the overdue payment. This late charge shall apply individually to all payments past due and there will be no daily prorated adjustment. This provision shall not be deemed to excuse a late payment or be deemed a waiver of any other rights Lender may have including the right to declare the entire unpaid principal and/or interest immediately due and payable. Borrower agrees that the “late charge” is a provision for liquidated damages and represents a fair and reasonable estimate of the damages Lender will incur by reason of the late payment considering all circumstances known to Borrower and Lender on the date hereof. Borrower further agrees that proof of actual damages will be difficult or impossible.

Section 2.4 Prepayment. Borrower may prepay all or any portion of the unpaid principal balance of the Note and accrued interest thereon, in full or in part, without premium or penalty (except as provided in Section 2.5 hereof), after at least three (3) Business Days’ prior written notice from Borrower to Lender of the date of prepayment. If Borrower shall fail to provide such three (3) Business Days’ notice when required herein, Lender will charge, and Borrower shall pay, additional interest on the amount prepaid, at the Applicable Rate or the Default Rate whichever is applicable, through the date three (3) Business Days after the date of prepayment, together with any breakage costs or fees incurred by Lender arising out of such prepayment in connection with any Interest Rate Protection relating to the Loan. Lender shall not be obligated hereunder or under any of the other Loan Documents to re-advance to Borrower any sums prepaid by Borrower, whether prepaid voluntarily or involuntarily.

Section 2.5 Regulatory Change; Conversion of Interest Rate.

(a) If there shall occur any adoption or implementation of, or change to, any Regulation, or interpretation or administration thereof, which shall have the effect of imposing on Lender (or Lender’s holding company) any increase or expansion of or any new: tax (excluding taxes on its overall income and franchise taxes), charge, fee, assessment or deduction of any kind whatsoever, or reserve, capital adequacy, special deposits or similar requirements against credit extended by, assets of, or deposits with or for the account of Lender or other conditions affecting the extensions of credit under this Agreement; then Borrower shall pay to Lender such additional amount as Lender deems necessary to compensate Lender for any increased cost to Lender attributable to the extension(s) of credit under this Agreement and/or for any reduction in the rate of return on Lender’s capital and/or Lender’s revenue attributable to such extension(s) of credit. As used above, the term “Regulation” shall include any federal, state or international law, governmental or quasi-governmental rule, regulation, policy, guideline or directive (including but not limited to the Dodd-Frank Wall Street Reform and Consumer Protection Act and enactments, issuances or similar pronouncements by the Bank for International Settlements, the Basel Committee on Banking Regulations and Supervisory Practices or any similar authority and any successor thereto) that applies to Lender. Lender’s determination of the additional amount(s) due under this paragraph shall be binding in the

TERM LOAN AGREEMENT - Page 12

absence of manifest error, and such amount(s) shall be payable within 15 days of demand and, if recurring, as otherwise billed by Lender.

(b) If, on the date for determining the LIBOR Rate, Lender shall determine (which determination shall be conclusive in the absence of manifest error) that, by reason of circumstances affecting the Money Markets, adequate and fair means do not exist for ascertaining the LIBOR Rate, Lender shall promptly give to Borrower telephonic notice (confirmed as soon as practicable in writing) of the nature and effect of such circumstances. After receipt of such notice and during the existence of such circumstances, the Applicable Rate shall be determined based upon an alternate index selected by Lender, in its sole discretion, reasonably comparable to that of LIBOR, intended to generate a return substantially the same as that generated by the LIBOR rate.

(c) Notwithstanding anything to the contrary herein contained, if any adoption or implementation of, or change to, any Regulation, or interpretation or administration thereof, shall make it unlawful for Lender to make or maintain the Loan at the LIBOR Rate or to give effect to its obligations as contemplated hereby, then, by written notice to Borrower, Lender may require that the Applicable Rate be converted as described in the preceding paragraph. Borrower shall indemnify Lender against any loss or expense which Lender may sustain or incur (including, without limitation, any loss or expense sustained or incurred in obtaining, liquidating or employing deposits or other funds acquired to effect, fund or maintain the LIBOR Rate) as a consequence of (a) any failure of Borrower to make any payment when due of any amount hereunder, or (b) the occurrence of any Event of Default, including but not limited to any loss or expense sustained or incurred or to be sustained or incurred in liquidating or employing deposits from third parties acquired to effect or maintain the LIBOR Rate. Lender shall provide to Borrower a statement signed by an officer of Lender explaining any such loss or expense and setting forth, if applicable, the computation pursuant to the preceding sentence which, in the absence of manifest error, shall be conclusive and binding on Borrower.

Section 2.6 Payments.

(a) All payments and prepayments of principal of, and interest on, the Note and all fees, expenses and other obligations under the Loan Documents payable to Lender shall be made, without deduction, set off, or counterclaim, in immediately available funds not later than 2:00 o’clock p.m., Dallas, Texas time on the dates due, to Lender at the office specified by it from time to time, except as otherwise specifically provided in this Agreement. Funds received on any day after 2:00 o’clock p.m., Dallas, Texas time shall be deemed to have been received on the next Business Day. Whenever any payment to be made hereunder or on the Note shall be stated to be due on a day which is not a Business Day, such payment shall be made on the next succeeding Business Day and such extension of time shall be included in the computation of any interest or fees. Borrower authorizes Lender to charge any of Borrower’s accounts maintained at Lender for the amount of any payment or prepayment on the Note or other amount owing pursuant to any of the other Loan Documents, which charge may be made by Lender if Borrower fails to make any payment required of Borrower under this Agreement.

TERM LOAN AGREEMENT - Page 13

(b) All payments received by Lender for application to the principal, interest, fees, costs and expenses due to Lender shall be applied in the following order: (i) first, to any fees, costs and expenses due to Lender hereunder; (ii) second, to any unpaid interest then due to Lender hereunder; and (iii) third, to the unpaid principal balance of the Note.

ARTICLE 3

FEES AND COSTS

Section 3.1 Commitment Fee. Borrower agrees to pay to Lender, a one-time, nonrefundable loan commitment fee (“Commitment Fee”) in the amount of $128,000, in consideration of the agreement of Lender to make the Loan to Borrower. Borrower acknowledges and agrees that the Commitment Fee is a bona fide fee and is intended as reasonable compensation to Lender for such purpose and shall be deemed fully earned and nonrefundable on the Closing Date. No termination or reduction of the Commitment shall entitle Borrower to a refund of any portion of the Commitment Fee. Borrower agrees to keep the above described Commitment Fee confidential and not to disclose the Commitment Fee set forth above to any other federal or state savings and loan, national bank or other lending or banking institution; except that such Commitment Fee may be disclosed in tax filings, financial statements, to direct or indirect owners of Borrower or as required by applicable law or court order.

Section 3.2 Reimbursement of Lender. Borrower shall reimburse Lender within fifteen (15) days following receipt of Lender’s demand for all reasonable payments made by Lender and all reasonable costs incurred by Lender (including appraisal fees, inspection fees and the fees and expenses of Lender’s attorneys) in connection with the negotiation, preparation, execution, delivery, construction loan administration, modification, extension, performance and enforcement of the Loan Documents and all related matters, including, but not limited to, the following:

(a) Title insurance premiums, realty tax services, recording fees, filing fees, and release and reconveyance fees.

(b) Funds advanced by Lender pursuant to the Loan Documents following an Event of Default or in connection with the performance by Lender of any Obligation that Borrower has failed or refused to perform.

(c) Lender’s commencement of, appearance in or defense of any action or proceeding purporting to affect the rights or obligations of Lender with respect to the Property or of the parties to any Loan Document.

(d) All claims, demands, causes of action, liabilities, losses, commissions and other costs against which Lender is indemnified hereunder, including specifically under Section 15.4 and under the Environmental Indemnity.

(e) Any expenditures by Lender on behalf of Borrower pursuant to any other Loan Document.

TERM LOAN AGREEMENT - Page 14

Borrower’s reimbursement Obligations shall be part of the Loan and part of the outstanding principal balance of the Note, shall bear interest at the Default Rate following the date reimbursement is due pursuant to this Section 3.2, and shall be secured by the Security Documents, notwithstanding that such Obligations may cause the principal balance of the Note to exceed its face amount. Borrower’s reimbursement Obligations with respect to costs occurred prior to cancellation of the Note shall survive the cancellation of the Note and the release and reconveyance of the Security Documents, provided nothing herein shall be interpreted to release Borrower from any Obligations specified in the Loan Documents for Obligations that occur on or after cancellation of the Note.

ARTICLE 4

SPECIAL COVENANTS

Section 4.1 Voluntary Cleanup Program; Escrow Account.

(a) Borrower hereby represents to and covenants with Lender as follows: The Property is currently enrolled in the Texas Commission on Environmental Quality (“TCEQ”) Voluntary Cleanup Program (“VCP”) due to the prior use of a portion of the Property for the operation of a dry cleaner plant. TCEQ recommended that Borrower’s predecessor in title make application for a Municipal Setting Designation (MSD) for the Property which would permit TCEQ to issue a VCP Certificate of Completion for the Property without requiring treatment of known contaminants resulting from the operation of the dry cleaner plant. Borrower has submitted its application for a MSD and is diligently pursuing (and will continue to diligently pursue) completion of all requirements for approval of the MSD for the Property and issuance of the VCP Certificate of Completion. Borrower has advised Lender that, in order to satisfy all requirements for approval of its application for the MSD, Borrower was required to (and did) provide written notice of its pending application for the MSD to one or more municipal water authorities as required by applicable law (each a “Water Authority”) and either (i) each Water Authority must adopt a resolution objecting to or opposing such application, or (ii) a period of 120 days must elapse after Borrower’s notice to such Water Authority without action by such Water Authority (which failure of such Water Authority to act will be deemed its approval of Borrower’s application). If, within said 120 day period, any Water Authority takes action to indicate its disapproval of Borrower’s application, Borrower will promptly notify Lender and promptly and diligently take such steps as may be necessary to transfer the Property from the VCP into the TCEQ’s Dry Cleaner Remediation Program (the “DCR Program”). If each Water Authority either fails to take action within said 120-day period, Borrower will promptly notify Lender and will diligently pursue issuance of the VCP Certificate of Completion.

(b) Simultaneously with the execution of this Agreement, Borrower shall deposit with Lender an amount in cash equal to $140,000 (the “Escrow Deposit”), which Escrow Deposit is equal to 150% of the estimated costs to be incurred by or on behalf of Borrower to complete the process for obtaining a VCP Certificate of Completion for the Property. The Escrow Deposit shall be deposited into a segregated, Lender-controlled demand deposit account (the “Escrow Account”) established by Borrower with Lender as a reserve for the purpose of paying estimated costs of completing the MSD application process and issuance of the VCP Certificate of Completion. The Escrow Account shall be a “bank directed” account and, until the

TERM LOAN AGREEMENT - Page 15

Obligations have been repaid in full, Borrower shall have no right to withdraw any monies held in the Escrow Account and Lender shall have no obligation to release funds on deposit in the Escrow Account to Borrower or any other Person for any reason, except as provided herein. Funds on deposit in the Escrow Account shall be disbursed by Lender, no more frequently than once each calendar month, to Borrower to pay costs and expenses incurred by Borrower in connection with the completion of the MSD application process and the process for obtaining a VCP Certificate of Completion and approved by Lender and for no other purpose (herein, the “Permitted Costs”). Funds will be disbursed by Lender to Borrower only after receipt by Lender of a written request from Borrower for disbursement of funds in the Escrow Account, which request shall be accompanied by, if required by Lender, copies of invoices and other paid receipts reflecting the Permitted Costs incurred by Borrower. Once Borrower has obtained a VCP Certificate of Completion for the Property or the Property has been transferred into the DCR Program and Borrower has no further obligations under applicable law to monitor or report the scope or extent of any existing contamination resulting from the use of the Property for a dry cleaner plant, then so long as no Event of Default exists, all funds then on deposit in the Escrow Account will be disbursed by Lender to Borrower. If funds on deposit in the Escrow Account are insufficient to pay all Permitted Costs, Borrower shall pay all such Permitted Costs from its own source of funds. Upon the occurrence of an Event of Default under the Loan Documents, Lender may, without notice to Borrower, apply funds in the Escrow Account to pay any amounts owed to Lender under the Loan Documents. As additional security for any and all obligations of Borrower under the Loan Documents, Borrower does hereby irrevocably and unconditionally grant a security interest in, and assign and transfer to Lender, all of its rights, titles and interests in and to the Escrow Account, together with any and all funds on deposit therein, all interest thereon and all proceeds thereof, and any general intangibles and choses in action arising therefrom or related thereto.

Section 4.2 Deadlines Regarding Environmental Issues; Cash Reserve Account. Borrower covenants with Lender that on or before December 31, 2013, Borrower shall cause (i) TCEQ to issue a VCP Certificate of Completion for the Property, or (ii) the Property to be transferred from the VCP into the DCR Program and Borrower will provide Lender with documents reasonably acceptable to Lender evidencing the issuance of a VCP Certificate of Completion or the Property’s acceptance into the DCR Program, as applicable. As used herein, the term “Environmental Trigger Event” means the occurrence of either or both of the following: (i) any Water Authority takes action, at any time on or before February 1, 2012, to indicate its disapproval of Borrower’s application for a MSD, or (ii) Borrower fails to cause the Property to obtain a VCP Certificate of Completion (or, alternatively, cause the Property to be transferred from the VCP into the DCR Program) on or before December 31, 2013 and Borrower fails to deliver to Lender documents reasonably acceptable to Lender evidencing the issuance of a VCP Certificate of Completion or the Property’s acceptance into the DCR Program. Lender acknowledges that neither an Environmental Trigger Event nor a Lease Trigger Event (as defined in Section 4.3 below) shall constitute an Event of Default under the Loan Documents, however, upon the occurrence of an Environmental Trigger Event or a Lease Trigger Event Borrower shall immediately establish (and hereby directs Lender to establish) with Lender an account (which account may, at the discretion of Lender, be a subaccount of the Escrow Account) (herein, the “Cash Reserve Account”), which Cash Reserve Account shall be a “bank directed” account and, until the Obligations has been repaid in full, Borrower shall have no right

TERM LOAN AGREEMENT - Page 16

to withdraw any monies held in the Cash Reserve Account and Lender shall have no obligation to release funds on deposit in the Cash Reserve Account to Borrower or any other Person for any reason, except as provided herein. Borrower agrees that, commencing on the fifteenth (15th) day of the first calendar month following the Environmental Trigger Event or Lease Trigger Event, as applicable, and on continuing or before the fifteenth (15th) day of each calendar month thereafter, Borrower shall deposit into the Cash Reserve Account all excess cash flow generated by the Property after payment of actual operating expenses incurred for the Property, as approved by Lender, and payment of all scheduled installments of principal and interest of the Loan (“Excess Cash Flow”) for the proceeding calendar month. All funds on deposit in the Cash Reserve Account shall be held by Lender as provided herein as additional collateral for the payment of the Obligations. Borrower’s obligation to deposit Excess Cash Flow into the Cash Reserve Account shall continue until (A) as to an Environmental Trigger Event, the earliest to occur of (i) repayment of the Loan in full, (ii) receipt by Lender of a copy of the VCP Certificate of Completion issued by TCEQ for the Property, or (iii) receipt by Lender of evidence that the Property has been accepted by TCEQ into the DCR Program, or (B) as to a Lease Trigger Event, (i) if the CVS Lease has been terminated, the execution by Borrower of a one or more replacement Lease(s) acceptable to Lender for the entirety of the premises covered by the CVS Lease with Tenant(s) approved by Lender, the acceptance of such Tenant(s) of its/their premises under such replacement Lease(s), and commencement of the payment of base rent by such Tenant(s) under such replacement Lease(s) (the foregoing being referred to herein as the “CVS Reletting Requirement”), or (ii) if Borrower has failed to timely deliver an SNDA for the Rice Lease to Lender, upon delivery of an SNDA signed by Rice reasonably acceptable to Lender. Once Borrower’s obligation to deposit Excess Cash Flow into the Cash Reserve Account terminates as provided above, then so long as no Event of Default exists, all funds then on deposit in the Cash Reserve Account will be disbursed by Lender to Borrower. If Borrower shall fail to pay any principal or interest on the Loan when due or any other amount due to Lender under the Loan Documents, Lender shall be entitled to withdraw, without prior notice to Borrower, available funds then on deposit in the Cash Reserve Account and apply the such funds towards the payment of such principal, interest or other amounts. Nothing contained in this Agreement shall be construed to permit Borrower to defer payment of principal, interest or other amounts payable to Lender under the Loan Documents beyond the date(s) due or to relieve Borrower from its absolute obligation to pay the same in accordance with the Loan Documents. Upon the occurrence of an Event of Default under the Loan Documents, Lender may, without notice to Borrower, apply funds in the Cash Reserve Account to pay any amounts owed to Lender under the Loan Documents. As additional security for any and all obligations of Borrower under the Loan Documents, Borrower does hereby irrevocably and unconditionally grant a security interest in, and assign and transfer to Lender, all of its rights, titles and interests in and to the Cash Reserve Account, together with any and all funds on deposit therein, all interest thereon and all proceeds thereof, and any general intangibles and choses in action arising therefrom or related thereto.

Section 4.3 CVS Lease; Lease Trigger Event. Borrower acknowledges that the CVS Lease provides that CVS will have a period of time within which to conduct due diligence with respect to the Property and its intended use by CVS and to obtain all permits and approvals required for CVS to construct improvements to the leased premises described in the CVS Lease and to operate its business therefrom. As used in this Agreement, the term “Lease Trigger

TERM LOAN AGREEMENT - Page 17

Event” means the occurrence of either or both of the following events: (i) CVS elects to terminate the CVS Lease pursuant to the provisions of Part II, Section 2 of the CVS Lease (in which Borrower shall promptly notify Lender of such termination), or (ii) Borrower fails to deliver to Lender, on or before November 7, 2011, an original SNDA from Rice, in form reasonably acceptable to Lender. Upon the occurrence of a Lease Trigger Event and Borrower shall establish the Cash Reserve Account (if not already established) and commence depositing into the Cash Reserve Account all Excess Cash Flow as required by Section 4.2 above.

Section 4.4 Property Condition Report; Repair Reserve. Borrower acknowledges that Section V of the Property Condition Report identifies deferred maintenance and repairs recommended to be made to the Property (the “Required Repairs”). Borrower agrees that Borrower will, within 120 days after the date of this Agreement, complete all Required Repairs and deliver evidence to Lender of completion by Borrower of all such Required Repairs. Simultaneously with the execution of this Agreement, Borrower shall deposit with Lender an amount in cash equal to $50,000 (the “Repair Reserve”), which Repair Reserve represents an estimate of the costs to be incurred by or on behalf of Borrower to complete all Required Repairs. The Repair Reserve shall be deposited into a segregated, Lender-controlled demand deposit account (the “Repair Reserve Account”) established by Borrower with Lender as a reserve for the purpose of paying estimated costs of completing such application process. The Repair Reserve Account shall be a “bank directed” account and, until the Obligations have been repaid in full, Borrower shall have no right to withdraw any monies held in the Repair Reserve Account and Lender shall have no obligation to release funds on deposit in the Repair Reserve Account to Borrower or any other Person for any reason, except as provided herein. Funds on deposit in the Repair Reserve Account shall be disbursed by Lender to Borrower only upon completion of all of the Required Repairs to pay or reimburse Borrower for costs and expenses incurred by Borrower in connection with the completion of the Required Repairs and for no other purpose. Repair Reserve funds will be disbursed by Lender to Borrower only after receipt by Lender of a written request from Borrower for disbursement of funds in the Repair Reserve Account, which request shall be accompanied by, if required by Lender, copies of invoices and other paid receipts reflecting the costs and expenses incurred by Borrower in completing the Required Repairs. If funds on deposit in the Repair Reserve Account are insufficient to pay all such costs and expenses, Borrower shall pay all such costs and expenses from its own source of funds. Upon the occurrence of an Event of Default under the Loan Documents, Lender may, without notice to Borrower, apply funds in the Repair Reserve Account to pay any amounts owed to Lender under the Loan Documents. As additional security for any and all obligations of Borrower under the Loan Documents, Borrower does hereby irrevocably and unconditionally grant a security interest in, and assign and transfer to Lender, all of its rights, titles and interests in and to the Repair Reserve Account, together with any and all funds on deposit therein, all interest thereon and all proceeds thereof, and any general intangibles and choses in action arising therefrom or related thereto.

Section 4.5 Rice Lease; Lease Reserve. Borrower acknowledges that the Rice Lease, as amended to date and by that certain Second Lease Amendment dated as of October 6, 2011, requires Borrower to pay to Rice an amount equal to $350,000 (the “Lease Payment”) within five (5) days after the CVS Contingency Satisfaction Date (as defined in said Second Lease Amendment) occurs. Simultaneously with the execution of this Agreement, Borrower shall

TERM LOAN AGREEMENT - Page 18

deposit with Lender an amount in cash equal to $350,000 (the “Lease Reserve”) to secure Borrower’s obligation to make the Lease Payment. The Lease Reserve shall be deposited into a segregated, Lender-controlled demand deposit account (the “Lease Reserve Account”) established by Borrower with Lender. The Lease Reserve Account shall be a “bank directed” account and, until the Obligations have been repaid in full, Borrower shall have no right to withdraw any monies held in the Lease Reserve Account and Lender shall have no obligation to release funds on deposit in the Lease Reserve Account to Borrower or any other Person for any reason, except as provided herein. Funds on deposit in the Lease Reserve Account shall be disbursed by Lender only if and when the Lease Payment is due and payable to Rice (and Lender reserves the right to [and Borrower hereby consents to having Lender] wire transfer the Lease Payment directly to Rice if Lender deems it appropriate to do so to satisfy any obligation or liability of Lender arising under the SNDA hereafter executed by Lender and Rice). If, for any reason, Rice waives its right to receive the Lease Payment or Borrower has no further obligation to make the Lease Payment and CVS terminates the CVS Lease, then Lender shall continue to hold the Lease Reserve until the CVS Reletting Requirement has been satisfied (at which time, so long as no Event of Default exists, Lender will return the funds on deposit in the Lease Reserve Account to Borrower). Upon the occurrence of an Event of Default under the Loan Documents, Lender may, without notice to Borrower, apply funds in the Lease Reserve Account to pay any amounts owed to Lender under the Loan Documents. As additional security for any and all obligations of Borrower under the Loan Documents, Borrower does hereby irrevocably and unconditionally grant a security interest in, and assign and transfer to Lender, all of its rights, titles and interests in and to the Lease Reserve Account, together with any and all funds on deposit therein, all interest thereon and all proceeds thereof, and any general intangibles and choses in action arising therefrom or related thereto.

ARTICLE 5

LOAN DOCUMENTS

Section 5.1 Security Documents. The Loan shall be secured by the Property and the Property and such other collateral as described in the Loan Documents. In consideration of Lender’s execution of this Agreement and as security for (i) the payment of all amounts owing by Borrower to Lender under the Loan Documents, together with all extensions, renewals, supplements and modifications of any of them (including extensions and renewals at different rates of interest and/or evidenced by new or additional promissory notes reciting that such notes are so secured); (ii) the performance of all other Obligations, covenants and agreements of Borrower in the Loan Documents; and (iii) the payment and performance of all other obligations now or hereafter owing to Lender by Borrower, Borrower shall, at its sole expense, deliver to Lender (and cause to be recorded or filed in applicable County and State records, where appropriate) the following documents, each in such form and substance, and executed by such Persons, as Lender in its sole discretion requires: (a) the Deed of Trust; (b) the Assignment of Leases, (c) the Security Agreement, (d) the Financing Statement; and (e) all other documents reasonably required by Lender, necessary to confirm or perfect the rights of Lender under the Loan Documents. Borrower hereby authorizes Lender to record any and all financing statements as Lender may deem necessary to protect or perfect the security interests granted to Lender herein and in the other Loan Documents.

TERM LOAN AGREEMENT - Page 19

Section 5.2 Guaranty. In consideration of Lender’s execution of this Agreement, Guarantor shall deliver to Lender the Payment Guaranty.

Section 5.3 Environmental Indemnity; Environmental Insurance. In consideration of Lender’s execution of this Agreement, Borrower and Guarantor shall execute and deliver to Lender the Environmental Indemnity. Borrower also shall cause to be delivered to Lender a environmental contamination insurance policy covering the Property, in form and substance satisfactory to Lender (the “Environmental Insurance Policy”).

Section 5.4 Assignment and Subordination of Management Agreement. In consideration of Lender’s execution of this Agreement, Borrower shall deliver to Lender the Management Agreement and the Assignment and Subordination of Management Agreement.

ARTICLE 6

RESERVED

ARTICLE 7

RESERVED

ARTICLE 8

REPRESENTATIONS AND WARRANTIES

As a material inducement to Lender’s execution of this Agreement, Borrower represents and warrants to Lender that:

Section 8.1 Formation, Qualification and Compliance. Borrower (a) is validly existing and in good standing under the Laws of the State of its organization; (b) has all requisite authority to conduct its business and own and lease its properties; and (c) is qualified and in good standing in every jurisdiction in which the nature of its business makes qualification necessary or where failure to qualify could have a Material Adverse Effect on its financial condition or the performance of its Obligations under the Loan Documents. Borrower is in compliance in all respects with all Laws and requirements applicable to its business, the violation of which might materially affect its Obligations hereunder, and has obtained all approvals, licenses, exemptions and other authorizations from, and has accomplished all filings, registrations and qualifications with, any Governmental Agency that are necessary for the transaction of its business.

Section 8.2 Execution and Performance of Loan Documents. (a) Borrower and General Partner each has all requisite power and authority to execute and perform its respective Obligations under the Loan Documents, and (b) the execution by Borrower and General Partner and the performance by Borrower and General Partner of their respective Obligations under each Loan Document have been authorized by all necessary action and do not and will not: (i) require any consent or approval not heretofore obtained of any Person having any interest in Borrower or General Partner; (ii) violate any provision of, or require any consent or approval not heretofore obtained under, the operating agreement, articles of organization, bylaws or other governing documents applicable to Borrower or General Partner; (iii) result in or require the creation or imposition of any lien, claim, charge or other right of others of any kind (other than under the Loan Documents) on or with respect to any property or assets owned or leased by Borrower or

TERM LOAN AGREEMENT - Page 20

General Partner; (iv) violate any provision of any Law, order, writ, judgment, injunction, decree, determination or award presently in effect; or (v) conflict with or constitute a breach or default under, or permit the acceleration of obligations owed pursuant to, any contract, loan agreement, lease or other document to which Borrower or General Partner is a party or by which either Borrower or General Partner or any of their respective property is bound; (c) neither Borrower nor General Partner is in default beyond any applicable notice and cure period in any respect under any Law, order, writ, judgment, injunction, decree, determination, award, contract or lease; (d) no approval, license, exemption or other authorization from, or filing, registration or qualification with, any Governmental Agency is required in connection with: (i) the execution by Borrower and General Partner of, and the performance by Borrower and General Partner of their respective obligations under the Loan Documents; and (ii) the creation and perfection of the liens described in the Loan Documents; (e) the Loan Documents, when executed and delivered, will constitute legal, valid and binding obligations of Borrower enforceable in accordance with their respective terms; and (f) the signatories of Borrower and General Partner are fully authorized to execute the Loan Documents to which they are a party.

Section 8.3 Sole Assets. Borrower’s sole asset is the Property. Borrower has no liabilities other than those attributable to the Property.

Section 8.4 Tax Liability. Borrower and General Partner have filed all required federal, state and local tax returns. Borrower and General Partner have paid all federal, state and local taxes due (including any interest and penalties) other than taxes being promptly and actively contested by Borrower or a Manager (as applicable) in good faith and by appropriate proceedings and which have been disclosed to Lender in writing.