Attached files

| file | filename |

|---|---|

| EX-13 - MAYS J W INC | c66815_ex13.htm |

| EX-21 - MAYS J W INC | c66815_ex21.htm |

| EX-32 - MAYS J W INC | c66815_ex32.htm |

| EX-31.2 - MAYS J W INC | c66815_ex31-2.htm |

| EX-31.1 - MAYS J W INC | c66815_ex31-1.htm |

UNITED STATES OF AMERICA

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

|

|

|

|

S |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) |

|

|

|

|

OR |

|

|

|

£ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) |

|

|

J.W. MAYS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

New York |

11-1059070 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

9 Bond Street, Brooklyn, New York |

11201-5805 |

|

(Address of principal executive offices) |

(Zip Code) |

|

Registrant’s telephone number, including area code: (718) 624-7400 |

||

Securities registered pursuant to Section 12(b) of the Act: |

||

Title of each class |

Name of each exchange on which registered |

|

Common Stock, par value $1 per share |

The NASDAQ Stock Market LLC |

|

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes £ No S

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes £ No S

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes S No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes £ No S

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K is not contained herein and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. S No delinquent filers

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

Large accelerated filer £ |

Accelerated filer £ |

|

Non-accelerated filer £ |

Smaller reporting company S |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes £ No S

The aggregate market value of voting stock held by non-affiliates of the registrant was approximately $7,917,752 as of January 31, 2011 based on the average of the bid and asked price of the stock reported for such date. For the purpose of the foregoing calculation, the shares of common stock held by each officer and director and by each person who owns 5% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares outstanding of the registrant’s common stock as of September 9, 2011 was 2,015,780.

DOCUMENTS INCORPORATED BY REFERENCE

|

|

|

Document |

Part of Form 10-K |

|

Annual Report to Shareholders for Fiscal Year Ended July 31, 2011 |

Parts I and II |

|

Definitive Proxy Statement for the 2011 Annual Meeting of Shareholders |

Part III |

J.W. MAYS, INC.

Page

1

1-2 Item 1B. Unresolved Staff Comments

2

3-7

7

7

8

9

9 Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

10 Item 7A. Quantitative and Qualitative Disclosures About Market Risk

10

10 Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

10

10-11

11 Item 10. Directors, Executive Officers and Corporate Governance

11

11

11 Item 13. Certain Relationships and Related Transactions, and Director Independence

11

11 Item 15. Exhibits, Financial Statement Schedules, and Reports on Form 8-K

12 Signatures

13

FORM 10-K FOR THE FISCAL YEAR ENDED JULY 31, 2011

TABLE OF CONTENTS

PART I J.W. Mays, Inc. (the “Company” or “Registrant”) with executive offices at 9 Bond Street, Brooklyn, New York 11201, operates a number of commercial real estate properties, which are described in Item 2 “Properties”. The Company’s business was founded in 1924 and incorporated under the laws of the State of New York on July

6, 1927. The Company discontinued its department store business which operated under the name of “MAYS”, in the year ended July 31, 1989, and has continued the leasing of real estate. The Company has no foreign operations. The Company employs 30 employees and has a contract, expiring November 30, 2013, with a union covering rates of pay, hours of employment and other conditions of employment for approximately 23% of its employees. The Company considers that its labor relations with its employees and union are good. Cautionary Statement Regarding Forward-Looking Statements This Annual Report on Form 10-K may contain forward-looking statements which include assumptions about future market conditions, operations and financial results. These statements are based on current expectations and are subject to risks and uncertainties. They are made pursuant to safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. The Company’s actual results, performance or achievements in the future could differ significantly from the results, performance or achievements discussed or implied in such forward-looking statements herein and in prior Securities and Exchange Commission filings by the Company. The

Company assumes no obligation to update these forward-looking statements or to advise of changes in the assumptions on which they were based. Factors that could cause or contribute to such differences include, but are not limited to, changes in the competitive environment of the Company, general economic and business conditions, industry trends, changes in government rules and regulations and environmental rules and regulations. Statements concerning interest rates and

other financial instrument fair values and their estimated contribution to the Company’s future results of operations are based upon market information as of a specific date. This market information is often a function of significant judgment and estimation. Further, market interest rates are subject to significant volatility. Risks Relating to Ownership Structure The controlling shareholder group may be able to vote its shares in favor of its interests that may not always coincide with the interests of shareholders not part of such group. This risk may be counter-balanced to a degree by the actions of the Board of Directors whose composition is made up of a majority of independent directors. The controlling shareholder group includes a corporation that owns a significant percentage of the Company’s common stock and which does business with the Company, as further described in the Notes to the Consolidated Financial Statements. In theory, this could result in a conflict of interest; nevertheless, the Company and its

largest shareholder have put in place some controls to reduce the effects of any perceived conflict of interest. Certain conflicts of interest may be perceived by the relationship between the Company and its largest shareholder. Both entities have the same Chief Executive Officer, and certain management personnel work for both entities. Nevertheless, the Company’s Board of Directors is composed of a majority of independent directors. As

recently as 2005, in a case involving both entities, the Delaware Supreme Court in connection with an attempt to obtain books and records of the Company through a proceeding against the Company’s significant shareholder, held that the actions of the Company’s Board were proper. 1

Risks Related to Our Business We are a part of the communities in which we do business. Accordingly, like other businesses in our communities, we are subject to the following risks:

•

the continued threat of terrorism; • economic downturns, both on a national and on local scales; • loss of key personnel; • the availability, if needed, of additional financing; • the continued availability of insurance (in different types of policies) at reasonably acceptable rates; and • the general burdens of governmental regulation, at the Local, State and Federal levels. Risks Related to Real Estate Operations Our investment in property development may be limited by increasing costs required to “fit up” property to be leased to tenants. Also, as the cost of fitting up properties increases, we may be required to wait and forsake opportunities that would be revenue producing until such time that we obtain the necessary financing of such

ventures. This risk may be mitigated by our obtaining of lines of credit and other financing vehicles, although such have significant limitations on the amounts that may be borrowed at any point in time. We also may be subject to environmental liability as an owner or operator of properties. Many of our properties are old and when we need to fit up a property for a new tenant, we may find materials and the like that could be deemed to contain hazardous elements requiring remediation or encapsulation. We try to lease our properties to tenants with adequate finances, but as a result of the recent economic downturn, even formerly financially strong tenants may be at risk. The Company is trying to mitigate the latter by leasing our properties to multiple tenants where applicable in order to diversify the tenant base. Risks Related to our Investments Excess cash and cash equivalents may be invested from time to time. We seek to earn rates of return that will help us finance our business operations. These investments may be subject to significant uncertainties and may not be successful for many reasons, including, but not limited to the following:

•

fluctuations in interest rates; • worsening of general economic and market conditions; and • adverse legal, financial and regulatory developments that may affect a particular business. Risk Factors Summary These are some of the “Risk Factors” that could affect the Company’s business. The Company endeavors to take actions and do business in a way that reduces these “Risk Factors” or, at least, takes them into account when conducting its business. Nevertheless, some of these “Risk Factors” cannot be avoided so that the Company

must also take actions and do business that negates the adverse effects that these may have on the ongoing business of the Company. Item 1B. Unresolved Staff Comments. There are no unresolved comments from the staff of the Securities and Exchange Commission as of the date of this Annual Report on Form 10-K. 2

The table below sets forth certain information as to each of the properties currently operated by the Company: Location

Approximate

1. Brooklyn, New York

380,000

2. Brooklyn, New York

201,000

3. Jamaica, New York

297,000

4. Fishkill, New York

5. Levittown, New York

6. Massapequa, New York

133,400

7. Circleville, Ohio

8. Brooklyn, New York

17,000

Building-Livingston Street

10,500 Properties leased are under long-term leases for varying periods, the longest of which extends to 2073, and in most instances renewal options are included. Reference is made to Note 6 to the Consolidated Financial Statements contained in the 2011 Annual Report to Shareholders, incorporated herein by reference. The properties

owned which are held subject to mortgage are the Brooklyn Bond Street building, the Jamaica building and the Fishkill property. 1. Brooklyn, New York—Fulton Street at Bond Street 10% of the property is leased by the Company under five separate leases. Expiration dates are as follows: 12/8/2013 (1 lease) which lease has two thirty-year renewal options through 12/8/2073; 4/30/2021 (2 leases), which leases previously had expiration dates of April 30, 2011 and were extended for an additional ten years; and

4/30/31 (2 leases) which leases previously had expiration dates of April 30, 2011 and were extended for an additional twenty years. The Company added two new elevators to its lobby at 9 Bond Street. There are plans to renovate vacant space for office use upon the execution of future leases to tenants, although no assurances can

be made as to when or if such leases will be entered into. The Company is currently renovating 18,218 square feet for office space for a tenant. The property is currently leased to nineteen tenants of which ten are retail tenants, one is a fast food restaurant and eight occupy office space. Two tenants have leased in excess of 10% of the rentable square footage. One tenant is a department store (33.42%) and the other tenant occupies office space (15.06%). 3

Square Feet

Fulton Street at Bond Street

Jowein building at Elm Place

Jamaica Avenue at 169th Street

Route 9 at Interstate Highway 84

203,000

(located on

14.6 acres )

Hempstead Turnpike

10,000

(located on

75,800 square

feet of land )

Sunrise Highway

Tarlton Road

193,350

(located on

11.6 acres )

Truck bays, passage facilities and tunnel-Schermerhorn Street

Occupancy

Lease Expiration Year

Rate

Year

Number of

Area 7/31/2007

61.50

%

7/31/2012

1

260 7/31/2008

53.05

%

7/31/2013

2

3,015 7/31/2009

62.06

%

7/31/2014

5

66,641 7/31/2010

69.74

%

7/31/2016

3

16,009 7/31/2011

69.68

%

7/31/2018

1

3,300

7/31/2019

1

21,121

7/31/2021

5

146,912

7/31/2026

1

7,401

19

264,659 As of July 31, 2011 the federal tax basis is $24,613,648 with accumulated depreciation of $9,045,125 for a net carrying value of $15,568,523. The lives taken for depreciation vary between 18-40 years and the methods used are the straight-line and the declining balance. The real estate taxes for this property are $1,232,757 per year and the rate used is averaged at $11.414 per $100 of assessed valuation. 2. Brooklyn, New York—Jowein building at Elm Place The building is owned. There are plans to renovate vacant space for office use upon the execution of future leases to tenants, although no assurances can be made as to when or if such leases will be entered into. The property is currently leased to thirteen tenants of which two are retail stores, one is a fast food restaurant, two are for

warehouse space, and eight leases are for office space. Occupancy

Lease Expiration Year

Rate

Year

Number of

Area 7/31/2007

61.45

%

7/31/2012

1

305 7/31/2008

68.09

%

7/31/2013

2

31,603 7/31/2009

71.38

%

7/31/2014

1

5,000 7/31/2010

69.85

%

7/31/2015

1

56,547 7/31/2011

76.02

%

7/31/2016

3

9,260

7/31/2017

1

5,500

7/31/2018

2

17,364

7/31/2021

1

8,500

7/31/2059

1

19,437

13

153,516 As of July 31, 2011 the federal tax basis is $10,917,523 with accumulated depreciation of $3,728,836 for a net carrying value of $7,188,687. The lives taken for depreciation vary between 18-40 years and the methods used are the straight-line and the declining balance. The real estate taxes for this property are $490,075 per year and the rate used is averaged at $10.464 per $100 of assessed valuation. 3. Jamaica, New York—Jamaica Avenue at 169th Street The building is owned and the land is leased from an affiliated company. The lease expires July 31, 2027. The property is currently leased to twelve tenants: six are retail tenants and six for office space. Three tenants each occupy in excess of 10% of the rentable square footage: a major retail store occupies 15.86%; and two tenants

occupy office space—one occupies 14.23% and the other 11.07% of the rentable space. Approximately 21,000 square feet of the building are available for lease. There are plans to renovate vacant space for office use upon the execution of future leases to tenants, although no assurances can be made as to when or if such leases will be

entered into. 4

Ended

Ended

Leases

Sq. Ft.

Ended

Ended

Leases

Sq. Ft.

Occupancy

Lease Expiration Year

Rate Year

Year

Number of

Area 7/31/2007

66.03

%

7/31/2012

2

26,625 7/31/2008

79.38

%

7/31/2013

1

2,000 7/31/2009

79.38

%

7/31/2014

3

64,063 7/31/2010

80.99

%

7/31/2015

1

24,109 7/31/2011

81.14

%

7/31/2016

1

6,021

7/31/2017

3

75,907

7/31/2020

1

42,250

12

240,975 As of July 31, 2011 the federal tax basis is $19,352,411 with accumulated depreciation of $9,512,114 for a net carrying value of $9,840,297. The lives taken for depreciation vary between 18-40 years and the methods used are the straight-line and the declining balance. The real estate taxes for this property are $362,447 per year and the rate used is averaged at $11.506 per $100 of assessed valuation. 4. Fishkill, New York—Route 9 at Interstate Highway 84 The Company owns the entire property. There are plans to renovate vacant space to tenants upon the execution of future leases to tenants, although no assurances can be made as to when or if such leases will be entered into. There are approximately 203,000 square feet of the building available for lease. Occupancy

Lease Expiration Year

Rate

Year

Number of

Area 7/31/2007

—

7/31/2008

—

7/31/2009

—

7/31/2010

—

7/31/2011

—

As of July 31, 2011 the federal tax basis is $9,608,448 with accumulated depreciation of $8,057,429 for a net carrying value of $1,551,019. The lives taken for depreciation vary between 18-40 years and the methods used are the straight-line and the declining balance. The real estate taxes for this property are $165,787 per year and the rate used is averaged at $2.30 per $100 of assessed valuation. 5. Levittown, New York—Hempstead Turnpike The Company owns the entire property. In October 2006, the Company entered into a lease agreement with a restaurant. The restaurant constructed a new 10,000 square foot building, which opened in May 2008. Ownership of the building reverts to the Company at the conclusion of the leasing arrangement, currently August 16,

2017. Occupancy

Lease Expiration Year

Rate

Year

Number of

Area 7/31/2007

—

7/31/2018

Building

10,000 7/31/2008

25.00

%

Land

75,800 7/31/2009

100.00

%

1

85,800 7/31/2010

100.00

% 7/31/2011

100.00

% The real estate taxes for this property are $157,362 per year and the rate used is averaged at $659.77 per $100 of assessed valuation. 5

Ended

Ended

Ended

Leases

Sq. Ft.

Ended

Ended

Leases

Sq. Ft.

Ended

Ended

Leases

Sq. Ft.

6. Massapequa, New York—Sunrise Highway The Company is the prime tenant of this leasehold. The lease expired May 14, 2009, and there was one renewal option for twenty-one years, which the Company exercised in April 2008. There are no present plans for additional improvements of this property. The entire leasehold is currently subleased to two tenants; one, to a drive-

in restaurant, which is subject to it receiving the necessary building permits and licenses to construct a new building, and the other for use as a bank. The bank occupies 85.01% of the property and the restaurant will occupy 14.99% of the Property once it receives the building permits and licenses. Both subleases expire in May 2030,

with no renewal options. Occupancy

Lease Expiration Year

Rate

Year

Number of

Area 7/31/2007

100.00

%

7/31/2030

2

133,400 7/31/2008

100.00

% 7/31/2009

96.25

% 7/31/2010

85.01

% 7/31/2011

85.01

% The real estate taxes for this property are $236,672 per year and the rate used is averaged at $639.05 per $100 of assessed valuation. The Company does not own this property. Improvements to the property, if any, are made by tenants. 7. Circleville, Ohio—Tarlton Road The Company owns the entire property. There are plans to renovate vacant space to tenants upon the execution of future leases to tenants, although no assurances can be made as to when or if such leases will be entered into. The property is currently leased to two tenants. The tenants use these premises for warehouse and

distribution facilities. One tenant’s lease agreement was executed for a five year period, with a right to cancel after three years, for 75,000 square feet to November 11, 2010. The tenant is currently on a month to month lease agreement. The other tenant’s lease agreement was executed for a three-year period, with a right to cancel

after one year, for 60,000 square feet to March 31, 2011, which was extended in July 2011 for one year until March 31, 2012. The lease was amended on November 30, 2009, allowing the tenant to have permanent space of 36,000 square feet and revolving space of up to 84,000 square feet with a minimum of 12,000 square feet.

There are approximately 70,000 square feet of the building available for lease. Occupancy

Lease Expiration Year

Rate

Year

Number of

Area 7/31/2007

38.79

%

7/31/2012

2

108,000 7/31/2008

49.13

% 7/31/2009

69.82

% 7/31/2010

67.80

% 7/31/2011

66.11

% As of July 31, 2011 the federal tax basis is $4,388,456 with accumulated depreciation of $2,594,759 for a net carrying value of $1,793,697. The lives taken for depreciation vary between 18-40 years and the methods used are the straight-line and the declining balance. The real estate taxes for this property are $48,656 per year and the rate used is averaged at $4.19 per $100 of assessed valuation. 8. Brooklyn, New York—Livingston Street The City of New York through its Economic Development Administration constructed a municipal garage at Livingston Street opposite the Company’s Brooklyn properties. The Company has a long-term lease with the City of New York and another landlord expiring in 2013 with renewal options, the last of which expires 2073,

under which: (1) Such garage, available to the public, provides truck bays and passage facilities through a tunnel, both for the exclusive use of the Company, to the structure referred to in (2) below. The truck 6

Ended

Ended

Leases

Sq. Ft.

Ended

Ended

Leases

Sq. Ft.

bays, passage facilities and tunnel, totaling approximately 17,000 square feet, are included in the lease from the City of New York and another landlord referred to in the preceding paragraph. (2) The Company constructed a building of six stories and basement on a 20 x 75-foot plot (acquired and made available by the City of New York and leased to the Company for a term expiring in 2013 with renewal options, the last of which expires in 2073). The plot is adjacent to and connected with the Company’s

Brooklyn properties. In the opinion of management, all of the Company’s properties are adequately covered by insurance. See Note 11 to the Consolidated Financial Statements contained in the 2011 Annual Report to Shareholders, which information is incorporated herein by reference, for information concerning the tenants, the rental income from which equals 10% or more of the Company’s rental income. There are various lawsuits and claims pending against the Company. It is the opinion of management that the resolution of these matters will not have a material adverse effect on the Company’s Consolidated Financial Statements. The Company is required to remove the foot bridge over Bond Street in Brooklyn, New York by June 2012. The removal of the foot bridge is anticipated to be completed in October 2011 at a cost of $309,423. If the Company sells, transfers, disposes of or demolishes 25 Elm Place, Brooklyn, New York, then the Company may be liable to create a condominium unit for the loading dock. The necessity of creating the condominium unit and the cost of such condominium unit cannot be determined at this time. Executive Officers of the Registrant The following information is furnished with respect to each Executive Officer of the Registrant (each of whose position is reviewed annually but each of whom has a three-year employment agreement, effective August 1, 2008 and renewed August 1, 2011), whose present term of office will expire upon the election and qualification

of his successor: Name

Age Business Experience During

First Became Lloyd J. Shulman

69 President

November, 1978 Co-Chairman of the Board

and President

June, 1995 Chairman of the Board

November, 1996 Director

November, 1977 Mark S. Greenblatt

57 Vice President

August, 2000 Treasurer

August, 2003 Director

August, 2003 Assistant Treasurer

November, 1987 Ward N. Lyke, Jr.

60 Vice President

February, 1984 Assistant Treasurer

August, 2003 George Silva

61 Vice President

March, 1995 All of the above mentioned officers have been appointed as such by the directors and have been employed as Executive Officers of the Company during the past five years. 7

the Past Five Years

Such Officer

or Director

and President

Common Stock and Dividend Information Effective November 8, 1999, the Company’s common stock commenced trading on The Nasdaq Capital Market tier of The Nasdaq Stock Market under the Symbol: “Mays”. Such shares were previously traded on The Nasdaq National Market. Effective August 1, 2006, NASDAQ became operational as an exchange in NASDAQ-

Listed Securities. It is now known as The NASDAQ Stock Market LLC. The following is the sales price range per share of J. W. Mays, Inc. common stock during the fiscal years ended July 31, 2011 and 2010: Three Months Ended

Sales Price

High

Low October 31, 2010

$

16.89

$

12.60 January

31, 2011

19.91

11.73 April

30, 2011

20.00

17.25 July

31, 2011

20.05

16.50 October

31, 2009

$

15.91

$

12.64 January

31, 2010

21.28

12.50 April

30, 2010

23.55

13.12 July

31, 2010

21.92

13.00 The quotations were obtained for the respective periods from the National Association of Securities Dealers, Inc. There were no dividends declared in either of the two fiscal years. On September 9, 2011, the Company had approximately 1,350 shareholders of record. Recent Sales of Unregistered Securities During the year ended July 31, 2011 we did not sell any unregistered securities. Recent Purchases of Equity Securities During the year ended July 31, 2011 we did not repurchase any of our outstanding equity securities. 8

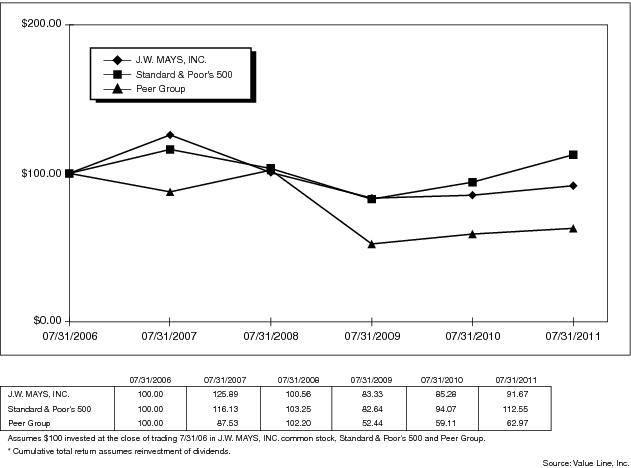

Comparison of Five-Year Cumulative Total Return The following graph sets forth a five-year comparison of cumulative total shareholder return for the Company, the Standard & Poor’s 500 Stock-Index (“S&P 500”), and a Peer Group. The graph assumes the investment of $100 at the close of trading July 31, 2006 in the common stock of the Company, the S&P 500 and the Peer Group,

and the reinvestment of all dividends, although the Company did not pay a dividend during this five-year period. Comparison of Five-Year Cumulative Total Return* Factual material is obtained from sources believed to be reliable, but the publisher is not responsible for any errors or omisions contained herein. The Performance Graph shall not be deemed incorporated by reference by any general statement of incorporation by reference in any filing made under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, and shall not otherwise be deemed filed under such Acts. Item 6. Selected Financial Data. The information appearing under the heading “Summary of Selected Financial Data” on page 2 of the Registrant’s 2011 Annual Report to Shareholders is incorporated herein by reference. 9

J.W. MAYS, INC., Standard & Poor’s 500 and Peer Group

(Five-Year Performance Results Through 07/31/2011)

J.W. MAYS, INC., Standard & Poor’s 500 and Peer Group

(Performance Results Through 07/31/2011)

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations. The information appearing under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of the Registrant’s 2011 Annual Report to Shareholders is incorporated herein by reference. Item 7A. Quantitative and Qualitative Disclosures About Market Risk. The Company uses fixed-rate debt to finance its capital requirements. These transactions do not expose the Company to market risk related to changes in interest rates. The Company does not use derivative financial instruments. At July 31, 2011, the Company had fixed-rate debt of $10,096,526. Item. 8. Financial Statements and Supplementary Data. The Registrant’s Consolidated Financial Statements, together with the report of D’Arcangelo & Co., LLP, independent registered public accounting firm, dated October 6, 2011, appearing on pages 4 through 19 of the Registrant’s 2011 Annual Report to Shareholders is incorporated herein by reference. With the exception of the

aforementioned information and the information incorporated by reference in Items 2, 5, 6, and 7 hereof, the 2011 Annual Report to Shareholders is not to be deemed filed as part of this Form 10-K Annual Report. Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. There are no disagreements between the Company and its accountants relating to accounting or financial disclosures. Item 9A. Controls and Procedures. (a) Evaluation of disclosure controls and procedures. The Company’s management reviewed the Company’s internal controls and procedures and the effectiveness of these controls. As of July 31, 2011, the Company carried out an evaluation, under the supervision and with the participation of the Company’s management, including its Chief Executive Officer and Chief Financial

Officer, of the effectiveness of the design and operation of the Company’s disclosure controls and procedures pursuant to Rules 13a-14(c) and 15d-14(c) of the Securities Exchange Act of 1934. Based upon that evaluation, the Chief Executive Officer and Chief Financial Officer concluded that the Company’s disclosure controls and

procedures are effective in timely alerting them to material information relating to the Company required to be included in its periodic SEC filings. (b) Change to internal controls over financial reporting. There was no change in the Company’s internal controls over financial reporting or in other factors during the Company’s last fiscal quarter that materially affected, or is reasonably likely to materially affect, the Company’s internal controls over financial reporting. There were no significant deficiencies or material weaknesses, and

therefore there were no corrective actions taken. (c) Management’s annual report on internal control over financial reporting. The Company’s management is responsible for establishing and maintaining adequate internal control over financial reporting as such term is defined in Rule 13(a)-15(f). Our internal control system has been designed to provide reasonable assurance to the Company’s management and its Board of Directors regarding the preparation

and fair presentation of published financial statements. All internal control systems, no matter how well designed, have inherent limitations. Even those systems that have been determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. The Company’s management

assessed the effectiveness of our internal control over financial reporting as of July 31, 2011. In making this assessment, the Company’s management used the criteria set forth by the Committee Sponsoring Organizations of the Treadway Commission in Internal Control—Integrated Framework Guidance for Small Public Companies. Based

on the Company’s assessments, we believe that, as of July 31, 2011, its internal control over financial reporting is effective based on these criteria. 10

This Form 10-K Annual Report does not include an attestation report of our independent registered public accounting firm regarding internal controls over financial reporting. Management’s report was not subject to attestation by our independent registered public accounting firm pursuant to the permanent exemption for small reporting

company filers from the internal control audit requirement of Section 404(b) of the Sarbanes-Oxley Act of 2002. Reports on Form 8-K—One report on Form 8-K were filed by the Company during the three months ended July 31, 2011. Item reported—The Company reported its financial results for the three and nine months ended April 30, 2011 Item 10. Directors, Executive Officers and Corporate Governance. The information relating to directors of the Company is contained in the Definitive Proxy Statement for the 2011 Annual Meeting of Shareholders and such information is incorporated herein by reference. The information with respect to Executive Officers of the Company is set forth in Part I hereof. Item 11. Executive Compensation. The information required by this item appears under the heading “Executive Compensation” in the Definitive Proxy Statement for the 2011 Annual Meeting of Shareholders and such information is incorporated herein by reference. The information required by this item appears under the headings “Security Ownership of Certain Beneficial Owners and Management” and “Information Concerning Nominees for Election as Directors” in the Definitive Proxy Statement for the 2011 Annual Meeting of Shareholders and such information is incorporated herein by

reference. Item 13. Certain Relationships and Related Transactions, and Director Independence. The information required by this item appears under the headings “Executive Compensation”, “Certain Transactions,” “Certain Relationships and Related Transactions” and “Board Interlocks and Insider Participation” in the Definitive Proxy Statement for the 2011 Annual Meeting of Shareholders and such information is

incorporated herein by reference. Item 14. Principal Accounting Fees and Services. The following table sets forth the fees paid by the Company to its independent registered public accounting firm, D’Arcangelo & Co., LLP, for the fiscal years 2011 and 2010.

Fiscal Year

Fiscal Year Audit Fees

$

142,725

$

87,676 Tax Fees and Other Fees

35,321

10,218 Total

$

178,046

$

97,894 Audit Fees for fiscal year 2011 and fiscal year 2010 were for professional services rendered for the audits of the consolidated financial statements of the Company, interim quarterly reviews of Form 10-Q information and assistance with the review of documents filed with the Securities and Exchange Commission. Tax Fees and Other Fees for fiscal year 2011 and fiscal year 2010 were for services related to tax compliance and preparation of federal, state and local corporate tax returns and audit of real estate tax matters. The officers of the Company consult with, and receive the approval of, the Audit Committee before engaging accountants for any services. 11

Date of report filed—June 9, 2011

2011

2010

Item 15. Exhibits, Financial Statement Schedules and Reports on Form 8-K.

(a)

The following documents are filed as part of this report:

The Consolidated Financial Statements and report of D’Arcangelo & Co., LLP, independent registered public accounting firm, dated October 6, 2011, set forth on pages 4 through 19 of the Company’s 2011 Annual Report to Shareholders. 2. See accompanying Index to the Company’s Financial Statements and Schedules. 3. Exhibits:

(2)

Plan of acquisition, reorganization, arrangement, liquidation or succession—not applicable. (3) Articles of incorporation and by-laws:

(i)

Certificate of Incorporation, as amended, incorporated by reference to the Company’s Form 8-K dated December 3, 1973. (ii) By-laws, as amended June 1, 1995, incorporated by reference to the Company’s Form 10-K dated October 23, 1995. (iii) Amendment to By-laws, effective November 1, 1999, incorporated by reference to the Company’s Proxy Statement dated October 19, 2000. (iv) Amendment to By-laws, effective November 20, 2007, incorporated by reference to the Company’s Form 8-K dated November 20, 2007.

(4)

Instruments defining the rights of security holders, including indentures—see Exhibit (3) above.

Voting trust agreement—not applicable. (10) Material contracts:

(i)

The J.W. Mays, Inc. Retirement Plan and Trust, Summary Plan Description, effective August 1, 1991, incorporated by reference to the Company’s Form 10-K dated October 23, 1992 and, as amended, effective August 1, 1993, incorporated by reference to the Company’s Form 10-Q for the Quarter ended October

31, 1993 dated December 2, 1993. (ii) Employment Agreements with Messrs. Shulman, Greenblatt, Lyke and Silva, each dated August 1, 2005, incorporated by reference to the Company’s Form 8-K dated August 1, 2005. Each of these Employment Agreements were extended August 1, 2008 for a period of three years and further extended August 1,

2011 for an additional period of three years.

(11)

Statement re computation of per share earnings—not applicable. (12) Statement re computation of ratios—not applicable. (13) Annual report to security holders. (14) Code of ethics—not applicable.

(16)

Letter re change in certifying auditors—not applicable.

Letter re change in accounting principles—not applicable.

Subsidiaries of the registrant. (22) Published report regarding matters submitted to vote of security holders—not applicable.

(24)

Power of attorney—none.

Information from reports furnished to state insurance regulatory authorities—not applicable.

31.1—Chief Executive Officer 31.2—Chief Financial Officer (32) Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002; 18 U.S.C. Sect 1350. 12

1.

(9)

(18)

(21)

(28)

(31)

Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.

SIGNATURES Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. J.W. MAYS, INC. (REGISTRANT) October 6, 2011

By: LLOYD J. SHULMAN Lloyd J. Shulman October 6, 2011

By: MARK S. GREENBLATT Mark S. Greenblatt October 6, 2011

By: WARD N. LYKE, JR. Ward N. Lyke, Jr. Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the Registrant in the capacities and on the date indicated.

Signature

Title

Date

LLOYD J. SHULMAN Lloyd J. Shulman Chairman of the Board, Chief Executive October 6, 2011 MARK S. GREENBLATT Mark S. Greenblatt Vice President, Treasurer and Director October 6, 2011 DEAN L. RYDER Dean L. Ryder Director October 6, 2011 JACK

SCHWARTZ Jack Schwartz Director October 6, 2011 LEWIS D. SIEGEL Lewis D. Siegel Director October 6, 2011 13

Chairman of the Board

Principal Executive Officer

President

Principal Operating Officer

Vice President and Treasurer

Principal Financial Officer

Vice President

and Assistant Treasurer

Officer, President, Chief Operating

Officer and Director

INDEX TO REGISTRANT’S FINANCIAL STATEMENTS AND SCHEDULES Reference is made to the following sections of the Registrant’s Annual Report to Shareholders for the fiscal year ended July 31, 2011, which are incorporated herein by reference: Report of Independent Registered Public Accounting Firm (page 19) Consolidated Balance Sheets (pages 4 and 5) Consolidated Statements of Income and Retained Earnings (page 6) Consolidated Statements of Comprehensive Income (page 6) Consolidated Statements of Cash Flows (page 7) Notes to Consolidated Financial Statements (pages 8-18)

Page Financial Statement Schedules:

Report of Independent Registered Public Accounting Firm on Financial Statement Schedules

14 II

Valuation and Qualifying Accounts

15 III

Real Estate and Accumulated Depreciation

16 All other schedules for which provision is made in the applicable regulations of the Securities and Exchange Commission are not required under the related instructions or are inapplicable and, accordingly, are omitted. The separate financial statements and schedules of J.W. Mays, Inc. (not consolidated) are omitted because the Company is primarily an operating company and its subsidiaries are wholly-owned. REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM ON To the Board of Directors and Shareholders of We have audited the consolidated financial statements of J.W. Mays, Inc. and subsidiaries as of July 31, 2011 and 2010, and for the three years in the period ended July 31, 2011 and have issued our report thereon dated October 6, 2011; such consolidated financial statements and reports are incorporated by reference in this Form 10-

K Annual Report. Our audits also included the consolidated financial statement schedules of J.W. Mays, Inc. and subsidiaries referred to in Item 15(a)2 of this Form 10-K. These consolidated financial statement schedules are the responsibility of the Company’s management. Our responsibility is to express an opinion based on our audits.

In our opinion, such consolidated financial statement schedules, when considered in relation to the basic consolidated financial statements taken as a whole, present fairly, in all material respects, the information set forth therein. D’ARCANGELO &

CO., LLP 14

FINANCIAL STATEMENT SCHEDULES

J.W. Mays, Inc. and Subsidiaries

Rye Brook, N.Y.

October 6, 2011

SCHEDULE II J.W. MAYS, INC.

Year Ended July 31,

2011

2010

2009 Allowance for net unrealized gains (losses) on marketable securities: Balance, beginning of year

$

62,717

$

(88,078

)

$

(204,412

) Additions

127,698

150,795

116,334 Balance, end of year

$

190,415

$

62,717

$

(88,078

) 15

VALUATION AND QUALIFYING ACCOUNTS

SCHEDULE III J.W. MAYS, INC. Col. A

Col. B

Col. C

Col. D

Col. E

Col. F

Col. G

Col. H

Col. I

Initial Cost to Company

Cost Capitalized

Gross Amount at Which Carried

Description

Encum-

Land

Building &

Improvements

Carried

Land

Building &

Total

Accumulated

Date of

Date

Life on Which Office and Rental Buildings Brooklyn, New York

$

4,223,457

$

3,901,349

$

7,403,468

$

18,967,599

$

—

$

3,901,349

$

26,371,067

$

30,272,416

$

9,475,999

Various

Various

(1) (2) Jamaica, New York

3,199,490

—

3,215,699

16,032,589

—

—

19,248,288

19,248,288

9,309,514

1959

1959

(1) (2) Fishkill, New York

1,673,579

594,723

7,212,116

2,438,652

—

594,723

9,650,768

10,245,491

7,744,520

10/74

11/72

(1) Brooklyn, New York

—

1,324,957

728,327

10,189,196

—

1,324,957

10,917,523

12,242,480

3,491,737

1915

1950

(1) (2) Levittown, New York Hempstead

—

125,927

—

—

—

125,927

—

125,927

—

4/69

6/62

(1) Circleville, Ohio

—

120,849

4,388,456

—

—

120,849

4,388,456

4,509,305

2,029,661

9/92

12/92

(1) Total(A)

$

9,096,526

$

6,067,805

$

22,948,066

$

47,628,036

$

—

$

6,067,805

$

70,576,102

$

76,643,907

$

32,051,431

(1)

Building and improvements 18–40 years (2) Improvements to leased property 3–40 years (A) Does not include Office Furniture and Equipment and Transportation Equipment in the amount of $743,205 and Accumulated Depreciation thereon of $644,790 at July 31, 2011.

Year Ended July 31,

2011

2010

2009 Investment in Real Estate Balance at Beginning of Year

$

74,918,445

$

79,477,581

$

78,345,657 Improvements

1,725,462

1,149,943

1,131,924 Deduction – Lease Expiration

—

(5,709,079

)

— Balance at End of Year

$

76,643,907

$

74,918,445

$

79,477,581 Accumulated Depreciation Balance at Beginning of Year

$

30,544,645

$

34,646,428

$

33,069,044 Additions Charged to Costs and Expenses

1,506,786

1,607,296

1,577,384 Deduction – Lease Expiration

—

(5,709,079

)

— Balance at End of Year

$

32,051,431

$

30,544,645

$

34,646,428 16

REAL ESTATE AND ACCUMULATED DEPRECIATION

July 31, 2011

Subsequent to

Acquisition

At Close of Period

brances

Improvements

Cost

Improvements

Depreciation

Construction

Acquired

Depreciation in

Latest Income

Statement is

Computed

Fulton Street at Bond Street

Jamaica Avenue at 169th Street

Route 9 at Interstate

Highway 84

Jowein Building Fulton Street

and Elm Place

Turnpike

Tarlton Road

EXHIBIT INDEX TO FORM 10-K

(2)

Plan of acquisition, reorganization, arrangement, liquidation or succession—not applicable

(3)

(i)

Certificate of incorporation—incorporated by reference

(ii)

By-laws—incorporated by reference

(iii)

Amendment to By-laws, effective November 1, 1999—incorporated by reference

(iv)

Amendment to By-Laws, effective November 20, 2007, incorporated by reference to Registrant’s Form 8-K dated November 20, 2007.

(4)

Instruments defining the rights of security holders, including indentures—see Exhibit (3) above

(9)

Voting trust agreement—not applicable

(10)

Material contracts—

(i)

incorporated by reference

(ii)

Employment Agreements with Messrs. Shulman, Greenblatt, Lyke and Silva, each dated August 1, 2005, incorporated by reference to Registrant’s Form 8-K dated August 1, 2005. Each of these Employment Agreements were extended August 1, 2008 for a period of three years and further

extended August 1, 2011 for an additional period of three years.

(11)

Statement re computation of per share earnings—not applicable

(12)

Statement re computation of ratios—not applicable

(13)

Annual report to security holders

(14)

Code of ethics—not applicable

(16)

Letter re change in certifying auditors—not applicable

(18)

Letter re change in accounting principles—not applicable

(21)

Subsidiaries of the registrant

(22)

Published report regarding matters submitted to vote of security holders—not applicable

(24)

Power of attorney—none

(28)

Information from reports furnished to state insurance regulatory authorities—not applicable

(31)

Certifications Pursuant to Section 302 of the Sarbanes-Oxley Act—1 and 2

(32)

Certification Pursuant to Section 906 of the Sarbanes-Oxley Act 17