Attached files

| file | filename |

|---|---|

| 8-K - HOUSTON AMERICAN ENERGY CORP 8-K 10-5-2011 - HOUSTON AMERICAN ENERGY CORP | form8k.htm |

Exhibit 99.1

October 2011

Investor Presentation

HOUSTON AMERICAN ENERGY

CORP

CORP

1

Forward-Looking Statements

This presentation contains forward-looking statements, including those relating to our future financial and operational

results, reserves or transactions, that are subject to various risks and uncertainties that could cause the Company’s future

plans, objectives and performance to differ materially from those in the forward-looking statements. Forward-looking

statements can be identified by the use of forward-looking terminology such as “may,” “expect,” “intend,” “plan,” “subject

to,” “anticipate,” “estimate,” “continue,” “present value,” “future,” “reserves,” “appears,” “prospective,” or other variations

thereof or comparable terminology. Factors that could cause or contribute to such differences could include, but are not

limited to, those relating to the results of exploratory drilling activity, the Company’s growth strategy, changes in oil and

natural gas prices, operating risks, availability of drilling equipment, availability of capital, the inherent variability in early

production tests, dependence on weather conditions, seasonality, expansion and other activities of competitors, changes

in federal or state environmental laws and the administration of such laws, the general condition of the economy and its

effect on the securities market, the availability, terms or completion of any strategic alternative or any transaction and

other factors described in “Risk Factors” and elsewhere in the Company’s Form 10-K and other filings with the SEC. While

we believe our forward-looking statements are based upon reasonable assumptions, these are factors that are difficult to

predict and that are influenced by economic and other conditions beyond our control.

results, reserves or transactions, that are subject to various risks and uncertainties that could cause the Company’s future

plans, objectives and performance to differ materially from those in the forward-looking statements. Forward-looking

statements can be identified by the use of forward-looking terminology such as “may,” “expect,” “intend,” “plan,” “subject

to,” “anticipate,” “estimate,” “continue,” “present value,” “future,” “reserves,” “appears,” “prospective,” or other variations

thereof or comparable terminology. Factors that could cause or contribute to such differences could include, but are not

limited to, those relating to the results of exploratory drilling activity, the Company’s growth strategy, changes in oil and

natural gas prices, operating risks, availability of drilling equipment, availability of capital, the inherent variability in early

production tests, dependence on weather conditions, seasonality, expansion and other activities of competitors, changes

in federal or state environmental laws and the administration of such laws, the general condition of the economy and its

effect on the securities market, the availability, terms or completion of any strategic alternative or any transaction and

other factors described in “Risk Factors” and elsewhere in the Company’s Form 10-K and other filings with the SEC. While

we believe our forward-looking statements are based upon reasonable assumptions, these are factors that are difficult to

predict and that are influenced by economic and other conditions beyond our control.

The United States Securities and Exchange Commission permits oil and gas companies, in their filings with the SEC, to

disclose proved, probable and possible reserves. We use certain terms in this document, such as non-proven, resource

potential, Probable, Possible, Exploration and unrisked resource potential. These terms include reserves with substantially

less certainty than proved reserves, and no discount or other adjustment is included in the presentation of such reserve

numbers. The recipient is urged to consider closely the disclosure in our Form 10-K, File No. 001-32955, available from us

at 801 Travis, Suite 1425, Houston, Texas 77002. You can also obtain this form from the SEC by calling 1-800-SEC-0330.

disclose proved, probable and possible reserves. We use certain terms in this document, such as non-proven, resource

potential, Probable, Possible, Exploration and unrisked resource potential. These terms include reserves with substantially

less certainty than proved reserves, and no discount or other adjustment is included in the presentation of such reserve

numbers. The recipient is urged to consider closely the disclosure in our Form 10-K, File No. 001-32955, available from us

at 801 Travis, Suite 1425, Houston, Texas 77002. You can also obtain this form from the SEC by calling 1-800-SEC-0330.

2

Company Overview

§ Houston American Energy Corp (NYSE Amex:HUSA), the “Company”, is a growth-

oriented independent energy company engaged in the exploration, development and

production of crude oil and natural gas resources

oriented independent energy company engaged in the exploration, development and

production of crude oil and natural gas resources

§ Operations focused in Colombia

• Participated in drilling of 125 wells in Colombia to date

• Developing new international projects with a focus on Colombia, Peru and Brazil

§ Significant concessions in Colombia with substantial drilling inventory identified by

advanced 3-D seismic interpretation

advanced 3-D seismic interpretation

• Over 825,000 gross acres with more than 50 currently identified drilling prospects on 3D

seismic data

seismic data

|

Market Cap:

|

$409.8MM

|

Debt Outstanding:

|

$0.0

|

|

Average Volume:

|

216,485

|

Shares Outstanding:

|

31,165,230

|

3

Investment Opportunity

§ Unique portfolio of high impact, large reserve potential projects in Colombia

• Pure-play small cap oil focused investment opportunity with substantial upside potential

• Significant acreage position focused in the Llanos Basin in Colombia

• Favorable government royalties and fiscal terms on existing contracts

§ Significant Technical Partner with SK Energy, a leading Asian integrated oil and gas

company

company

§ Proven Track Record

• Participating in successful drilling program led by Hupecol

• Drilled 125 wells in Colombia with approximately 70% success rate to date

§ Low cost structure

• Non-operator strategy allows for minimal corporate staff

• Colombian properties have lower finding and development costs versus U.S. conventional

and unconventional reserves

and unconventional reserves

§ Experienced management and board of directors with access to proprietary deal flow

§ Simple capitalization structure

6

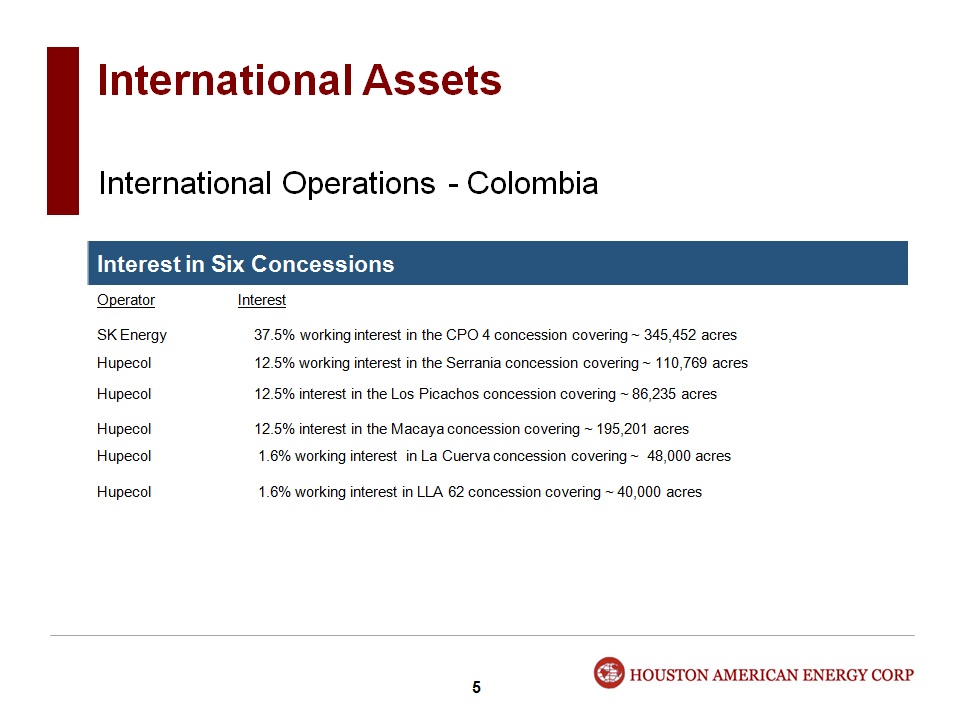

Overview of Colombia

§ President Juan Manuel Santos (elected

August 7, 2010) - Pro Business

August 7, 2010) - Pro Business

§ Main US ally in South America

§ Population: 45,644,023

§ Capital Bogotá: 8,840,116 citizens

§ Exchange rate 2010: 1,807 COP$/US$

§ Gross domestic product, GDP, 2008: US$

395.4 Billion

395.4 Billion

§ GDP / Capita, 2008: $8,800

§ Current Production of 850,000 bbl/day

Source: Wood Mackenzie, IHS, CIA.GOV

7

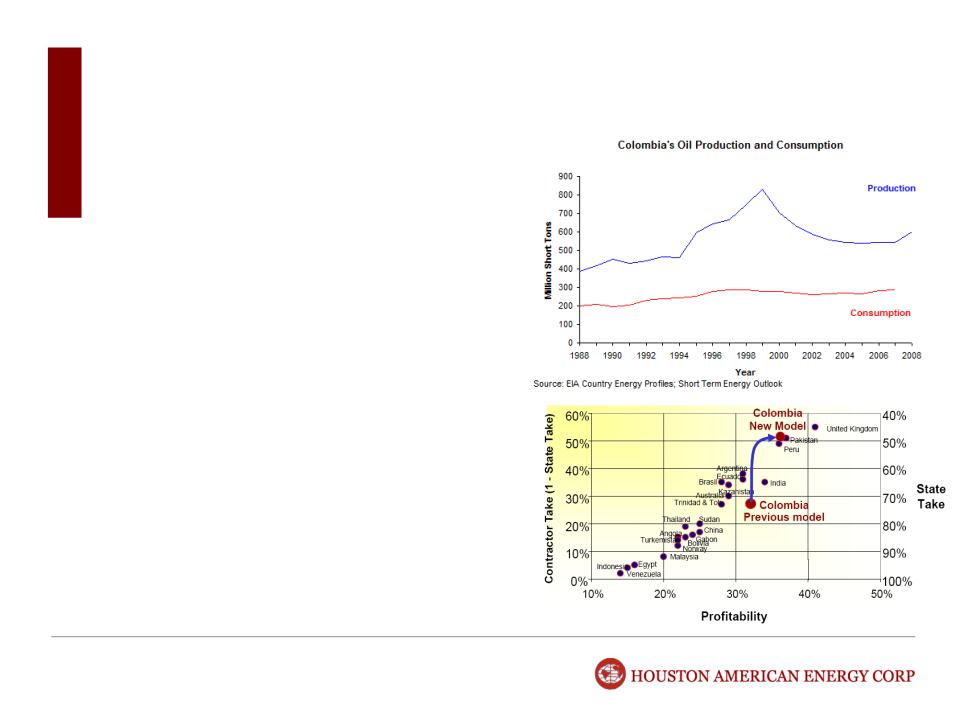

Overview of Colombia

§ Colombia is currently a net exporter (~ 450,000 bbls/d) of crude

oil, but the country's reserves and production had been

declining

oil, but the country's reserves and production had been

declining

§ To combat this decline, the Colombian government enacted a

number of incentives aimed to attract foreign investment:

number of incentives aimed to attract foreign investment:

• Sliding scale royalty rates based on field size, with an

8% royalty rate for most fields

8% royalty rate for most fields

• 100% company ownership of production projects

• Eliminated government back-in rights on new

concessions

concessions

• Vastly improved security environment - President

Santos on offensive with broad popular support

Santos on offensive with broad popular support

• Military increased 273,000 to 370,000 personnel in 2

years. US assistance at US$600 million/year

years. US assistance at US$600 million/year

• Progressive Colombia fiscal changes similar to those in

UK which spurred renewed interest in the North Sea

UK which spurred renewed interest in the North Sea

§ Colombia has a well developed infrastructure system

comprising of over 3,700 miles of crude and product pipelines.

This system is concentrated on transporting crude from the

main producing basins (Llanos and Magdalenas)

comprising of over 3,700 miles of crude and product pipelines.

This system is concentrated on transporting crude from the

main producing basins (Llanos and Magdalenas)

Source: Wood Mackenzie, IHS, CIA.GOV

8

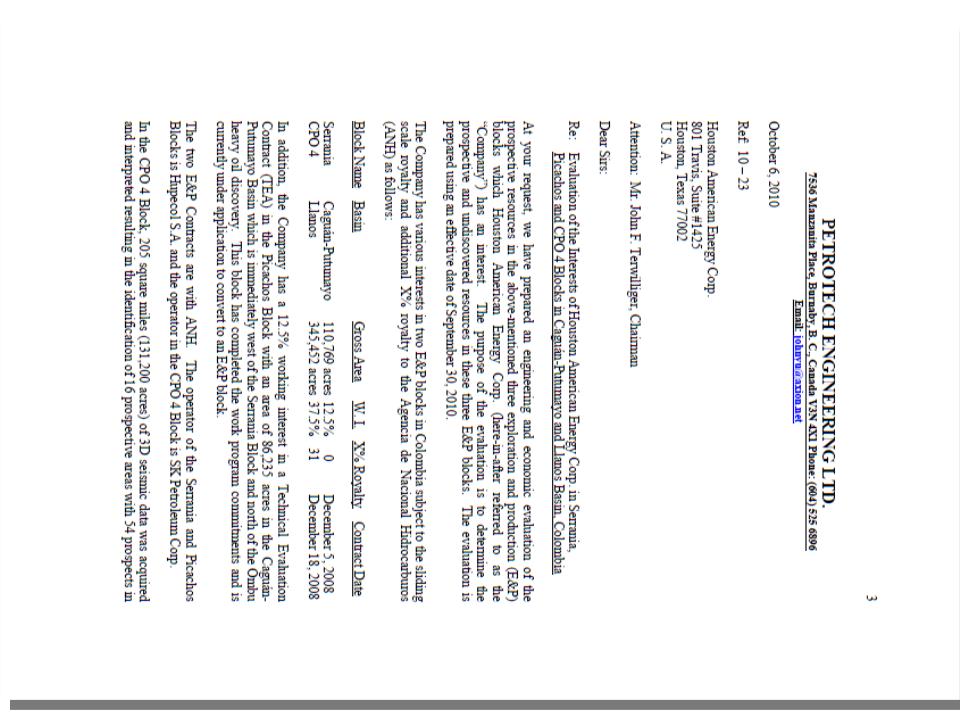

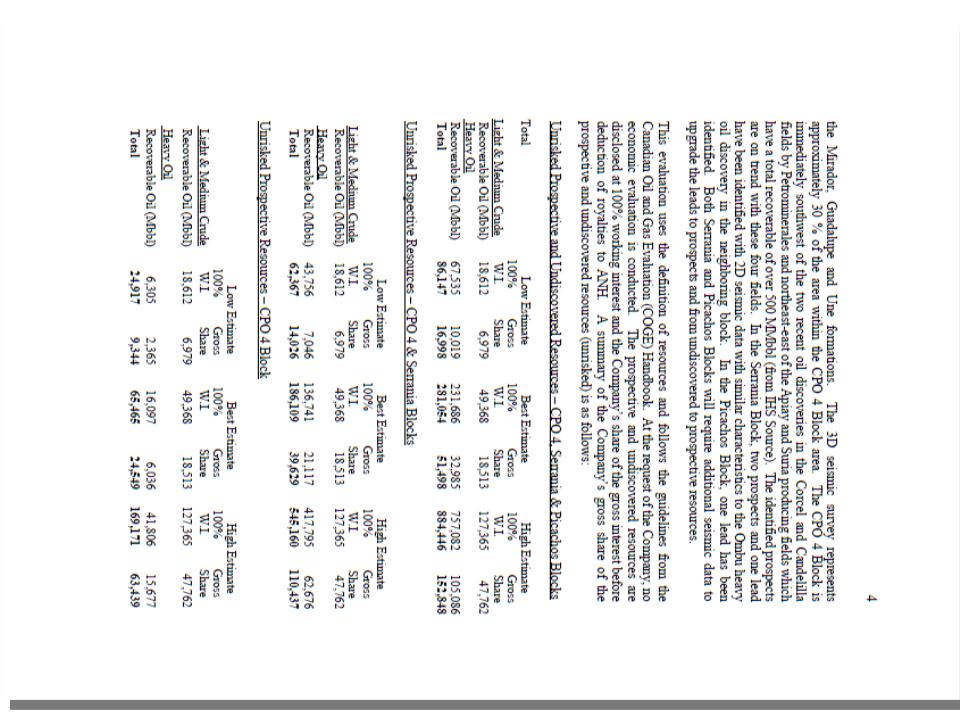

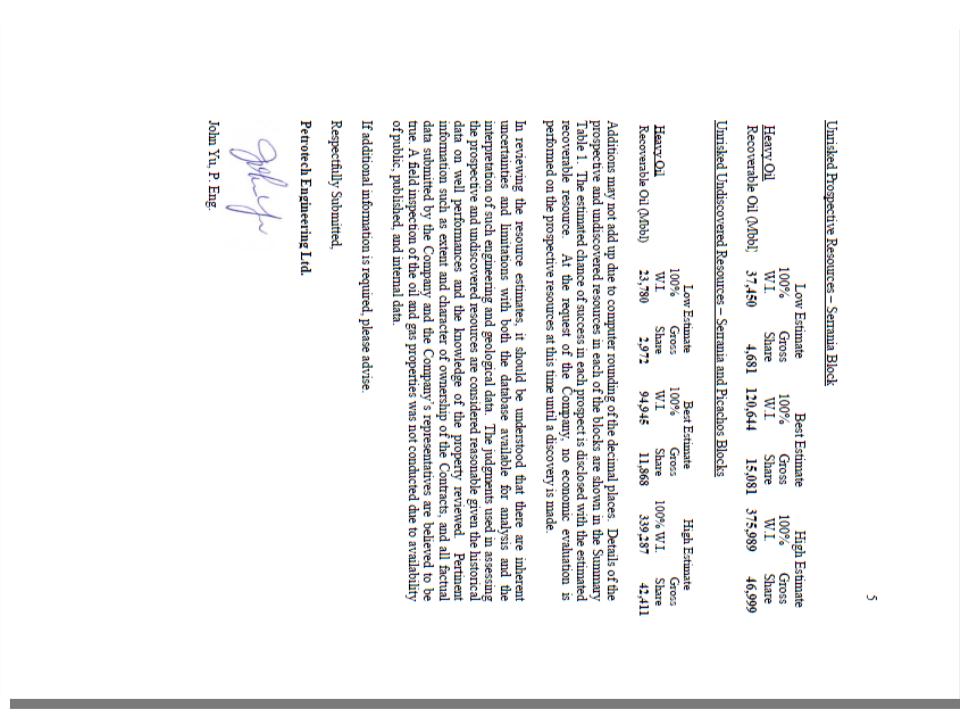

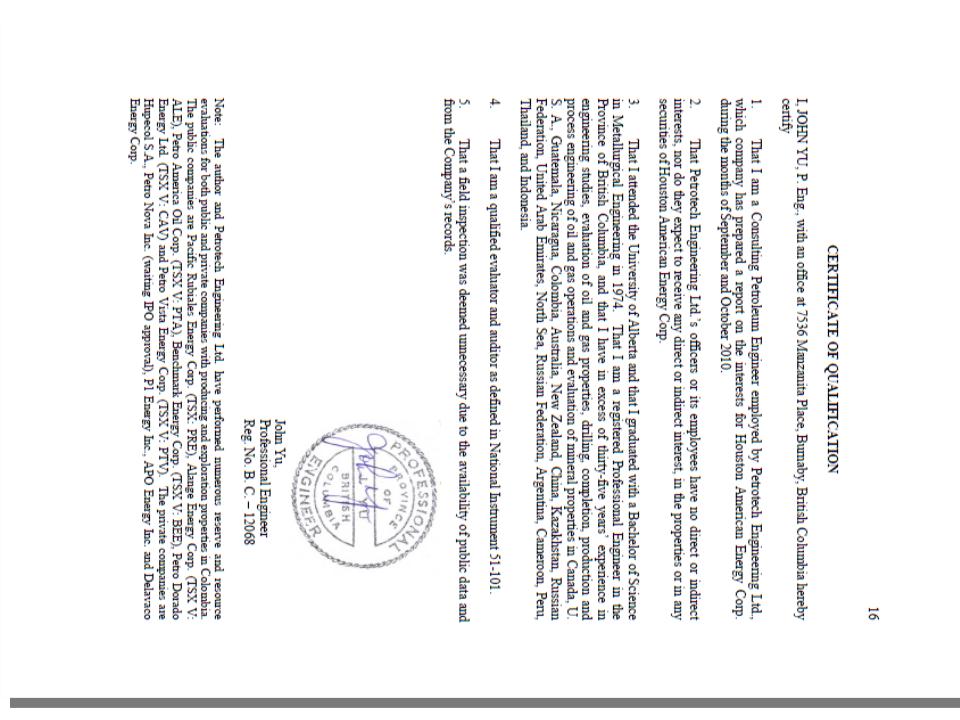

Independent Engineer’s

Recoverable Resource

Evaluation Summary

Recoverable Resource

Evaluation Summary

9

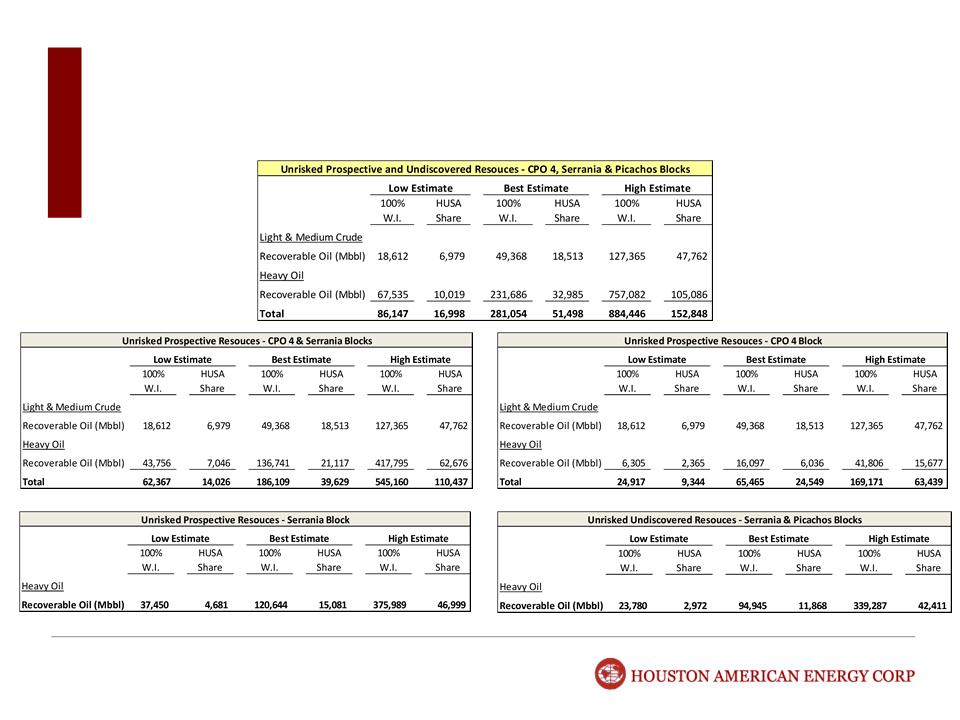

Recoverable Resource Summary

(All figures in thousands of barrels of oil)

14

Hupecol Operated Assets

15

• Operator: Hupecol

• Hupecol has acquired significant

concessions in the Llanos Basin since

Houston American Energy’s inception in April

2001, and has successfully monetized these

properties through two asset sales. Houston

American has participated with Hupecol in its

operations since 2002. The following are

HUSA’s effective working interests in the

Llanos Basin based on its indirect ownership

interests in Hupecol:

concessions in the Llanos Basin since

Houston American Energy’s inception in April

2001, and has successfully monetized these

properties through two asset sales. Houston

American has participated with Hupecol in its

operations since 2002. The following are

HUSA’s effective working interests in the

Llanos Basin based on its indirect ownership

interests in Hupecol:

Hupecol Operations Llanos Basin

|

• La Cuerva

|

1.6% W.I.

|

|

• LLA 62

|

1.6% W.I.

|

Colombia Operations Llanos Basin

16

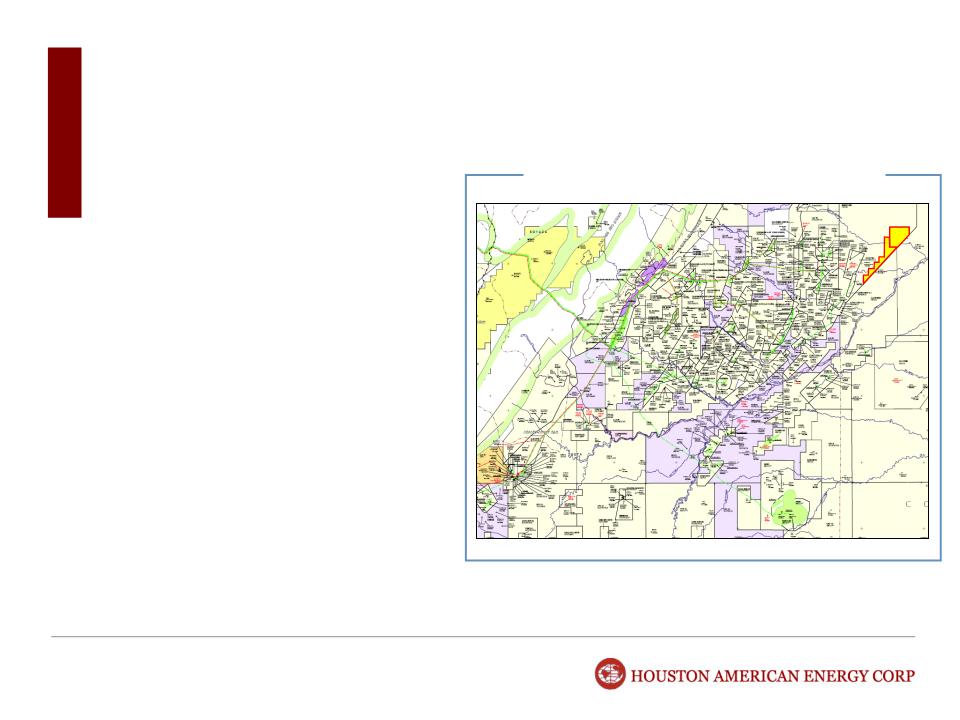

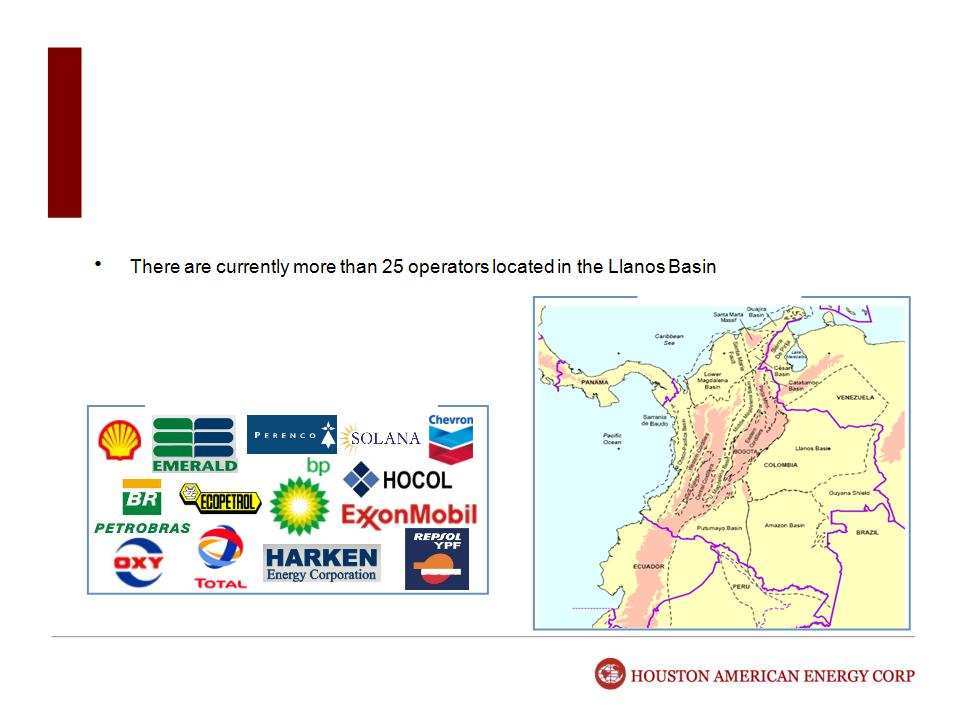

Llanos Basin

• The Llanos Basin covers an area of approximately 125,000 square miles

• Its primary geologic formations are: the Upper Cretaceous, Paleocene and

Eocene

Eocene

• The Llanos Basin is one of the most

active basins in Colombia

Colombia

Other Llanos Basin Operators

Source: Wood Mackenzie, IHS, CIA.GOV

17

Overview of Hupecol (Private Company)

§ Privately held E&P company with offices in Colombia and Texas

• Hupecol’s managing partner currently operates significant production and gathering facilities

domestically in the U.S.

domestically in the U.S.

• Operates with an extensive staff of geologists, petroleum engineers, geophysical and

accounting professionals

accounting professionals

§ One of the more active independents operating in Colombia

• Hupecol sits on the Board of Directors of the Colombian Petroleum Association General

Assembly along with Perenco, Petrobras, ExxonMobil, Hocol, and Terpel

Assembly along with Perenco, Petrobras, ExxonMobil, Hocol, and Terpel

§ Proven track record

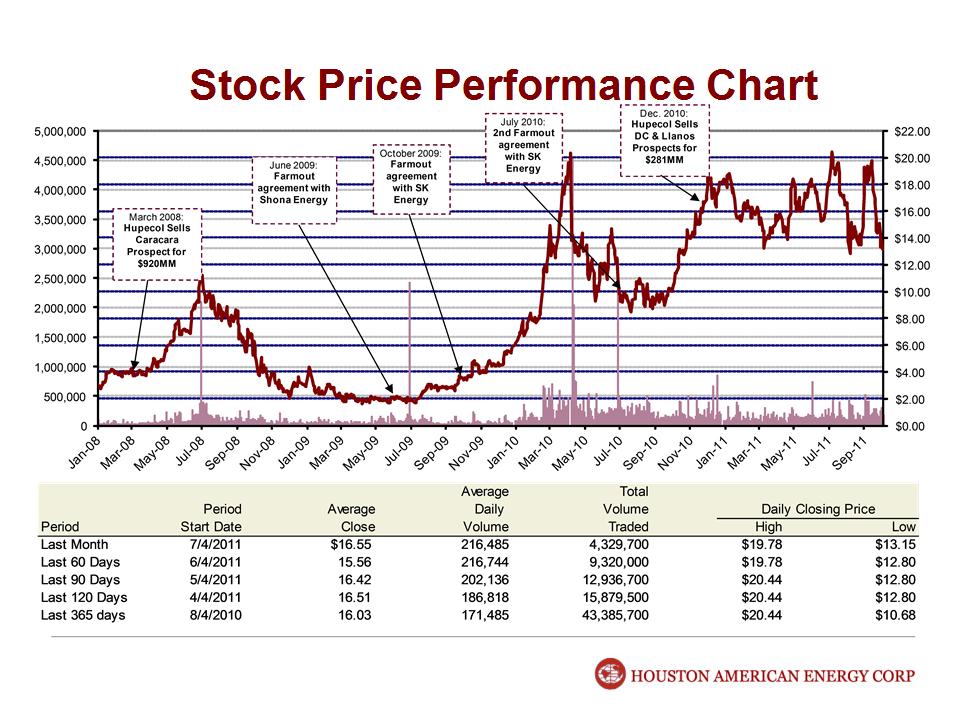

• In June 2008, Hupecol, through Hupecol Caracara LLC as owner/operator, sold all of the

Caracara assets to Cepsa, covering approximately 232,500 acres for USD $920 million

Caracara assets to Cepsa, covering approximately 232,500 acres for USD $920 million

• In December 2010, Hupecol, through Hupecol Dorotea and Cabiona, LLC (“HDC, LLC”) and

Hupecol Llanos, LLC (“HL, LLC”), sold all of the HDC and HL assets, covering

approximately 310,730 acres for USD $281.0 million.

Hupecol Llanos, LLC (“HL, LLC”), sold all of the HDC and HL assets, covering

approximately 310,730 acres for USD $281.0 million.

• Drilled over 125 wells in Colombia to date with a 70% success ratio

18

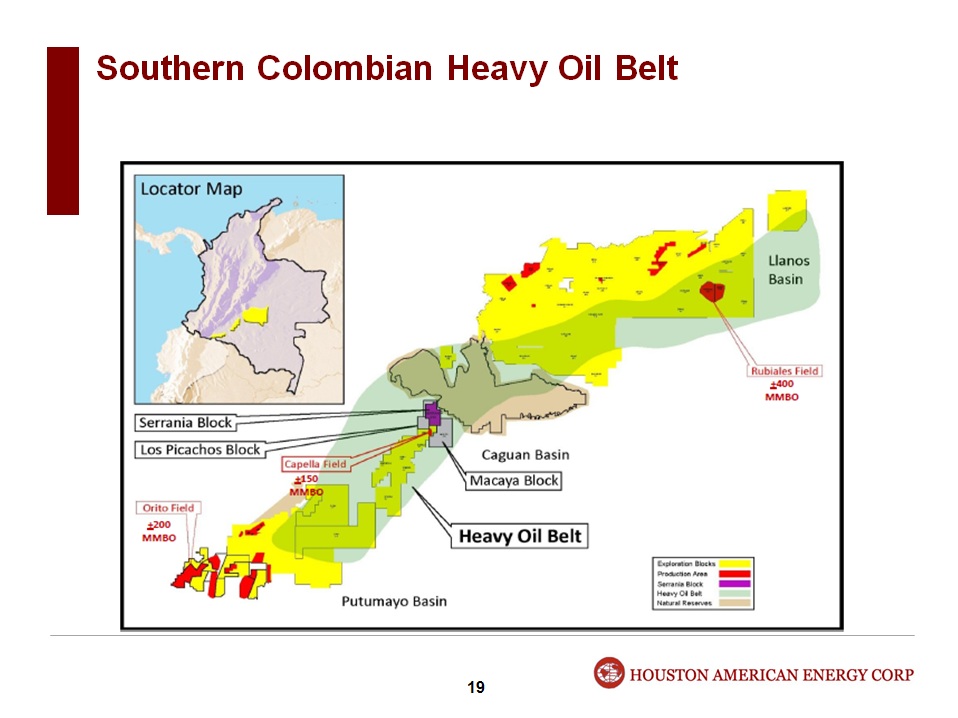

Serrania, Los Picachos

and Macaya Blocks

(Northern Putumayo Basin)

§ The prolific heavy oil belt is the next large play in Colombia

• There is only minimal open acreage that is still available on this trend

• The fields appear to be in large accumulations

20

Serrania Block

§ Contract entered between Shona Energy (Colombia) Limited (major investors of which include

Encap and Nabors) and Houston American Energy on June 24, 2009

Encap and Nabors) and Houston American Energy on June 24, 2009

§ Right to earn an undivided twelve and one half percent (12.5%) of the rights to the Serrania Contract

for Exploration and Production (the Serrania Contract) which covers the Serrania Block located in

the municipalities of Uribe and La Macarena in the Department of Meta

for Exploration and Production (the Serrania Contract) which covers the Serrania Block located in

the municipalities of Uribe and La Macarena in the Department of Meta

§ Serrania Block consists of approximately 110,769 acres

§ Oil Royalty: 8% to 5,000 BOPD and sliding scale to 20% at 125,000 BOPD

§ The Block is located adjacent to the recent Ombu discovery, which is estimated to have potentially

over two billion barrels of oil in place

over two billion barrels of oil in place

§ The Company agreed to pay 25% of Phase 1 Work Program. The Phase 1 work program consisted

of completing a geochemical study, reprocessing existing 2-D seismic data, and the acquisition,

processing and interpretation of 2D seismic program containing approximately 116 kilometers of 2-D

data. Phase 1 work program completed September 2009.

of completing a geochemical study, reprocessing existing 2-D seismic data, and the acquisition,

processing and interpretation of 2D seismic program containing approximately 116 kilometers of 2-D

data. Phase 1 work program completed September 2009.

21

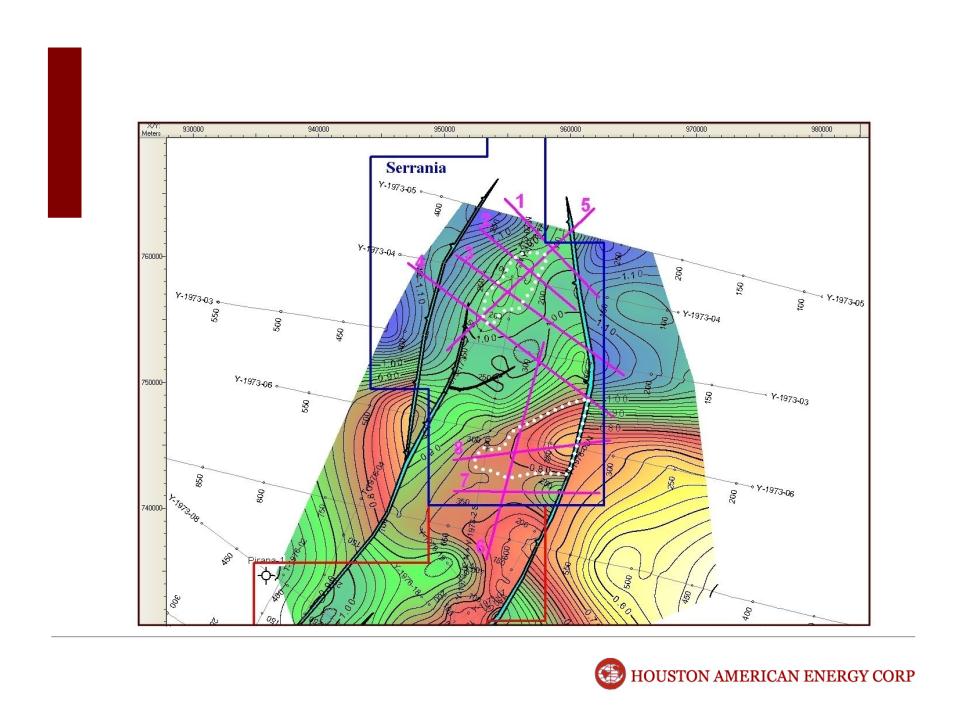

Serrania Phase One Seismic Program

The Phase One Seismic program

was competed in September of

2009.

was competed in September of

2009.

22

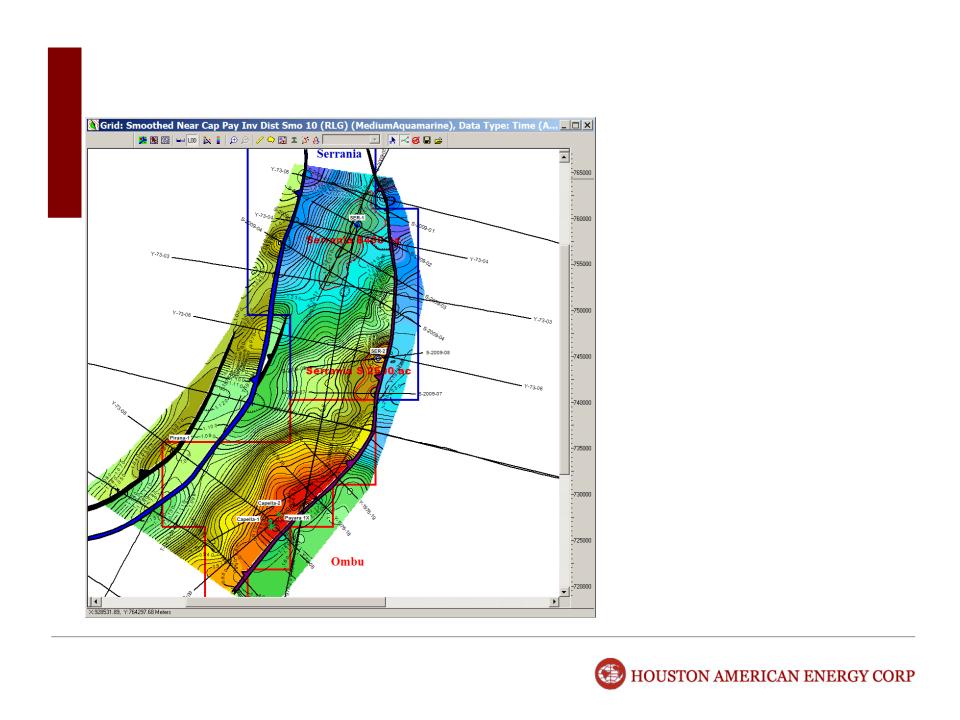

Picture of Ombu field extension onto Serrania

Key Points

Ombu Field

Emerald Energy - 90% owner and operator

of the Ombu field sold to Sinochem

Resources for approximately $836 million

USD. Emerald’s major assets were

located in Syria and Colombia. Emerald’s

major Colombian asset was the Ombu

Field in the Putumayo Basin

of the Ombu field sold to Sinochem

Resources for approximately $836 million

USD. Emerald’s major assets were

located in Syria and Colombia. Emerald’s

major Colombian asset was the Ombu

Field in the Putumayo Basin

Canacol Energy LTD (TSX-V: CNE) - 10%

owner of the Ombu field is estimating that

there is up to 2.4 billion barrels of original

oil in place on the Ombu field

owner of the Ombu field is estimating that

there is up to 2.4 billion barrels of original

oil in place on the Ombu field

In 2009 Emerald Energy after drilling 7

wells on the Ombu field was given potential

recoverable reserves of 220 million barrels

by Netherland, Sewell & Associates, Inc.

Production rates of the 7 wells ranged from

108 to 437 bbl/d

wells on the Ombu field was given potential

recoverable reserves of 220 million barrels

by Netherland, Sewell & Associates, Inc.

Production rates of the 7 wells ranged from

108 to 437 bbl/d

Source: Emeraldenergy.com, Canacolenergy.com

23

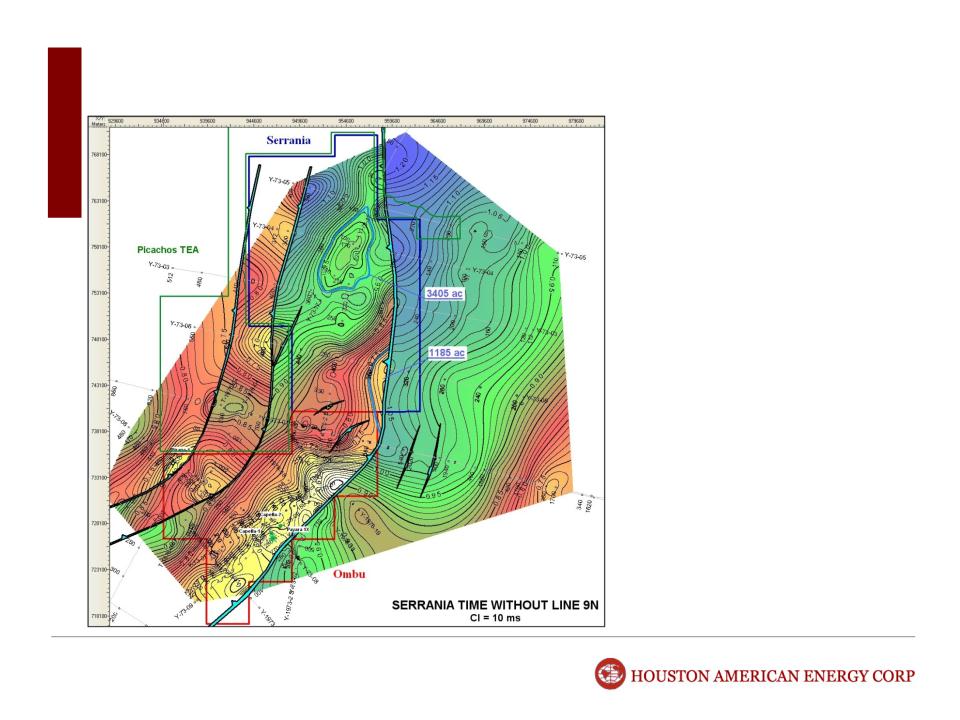

Los Picachos Block

Los Picachos establishes a future

growth area for the Serrania

concession

growth area for the Serrania

concession

Initial 2-D data has identified several

large prospects located on the Los

Picachos Block similar to those

found on the Ombu Block to the

south east

large prospects located on the Los

Picachos Block similar to those

found on the Ombu Block to the

south east

Los Picachos encompasses an

86,235 acre region located to the

west and northwest of the Serrania

block

86,235 acre region located to the

west and northwest of the Serrania

block

24

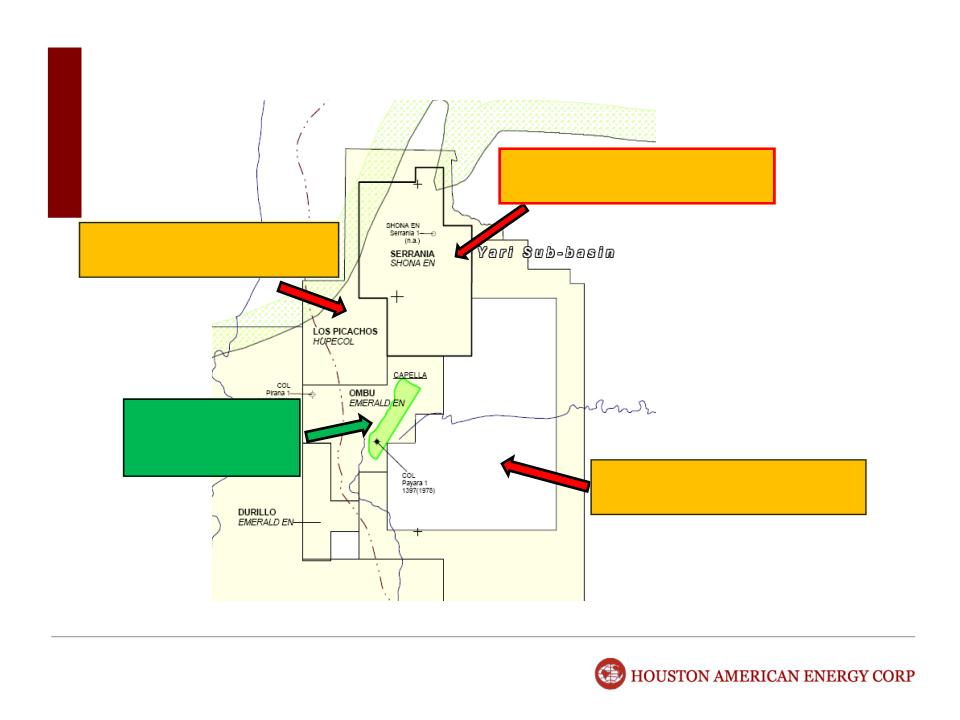

Macaya Block

Macaya establishes a

future growth area for the

Serrania concession

future growth area for the

Serrania concession

Macaya encompasses an

195,201 acre region

located to the east and

southeast of the Serrania

block

195,201 acre region

located to the east and

southeast of the Serrania

block

Los Picachos

349.13Sqkm - 86,249 acres

Ombu Field

63 to 231 MMBOE

Recoverable

Macaya

790.16 Sqkm - 195,201 acres

Serrania

448.47 Sqkm - 110,790 acres

Houston American Energy Corp owns a 12.5 % interest in the Serrania, Los Picachos and Macaya E & P Blocks.

25

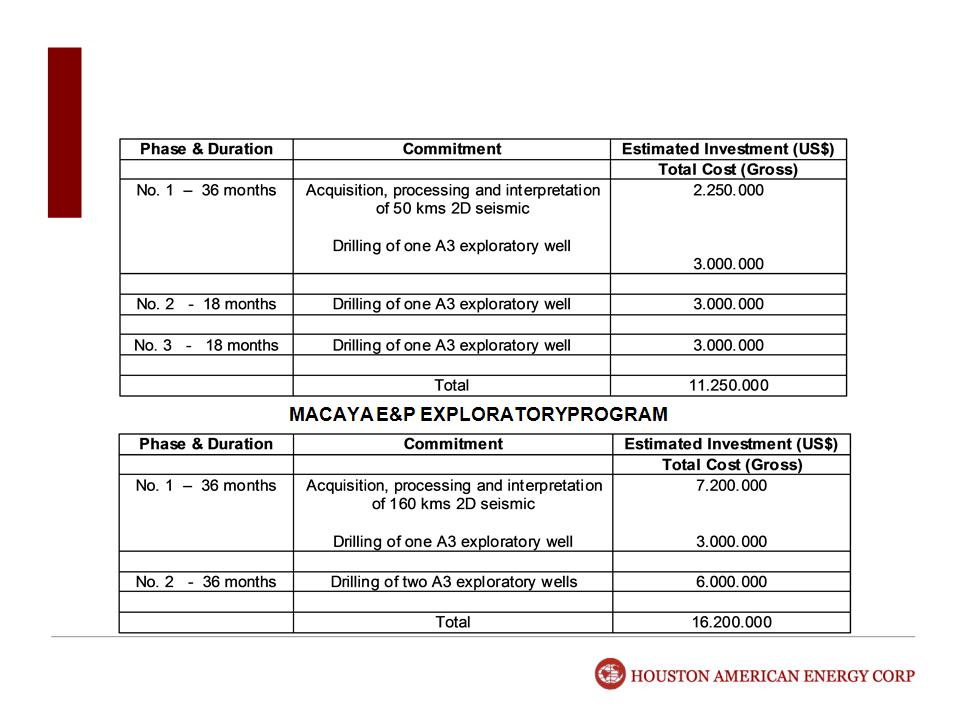

Los Picachos and Macaya Work Commitments

LOS PICACHOS E&P EXPLORATORY PROGRAM

26

SK Innovation - CPO 4 Block

27

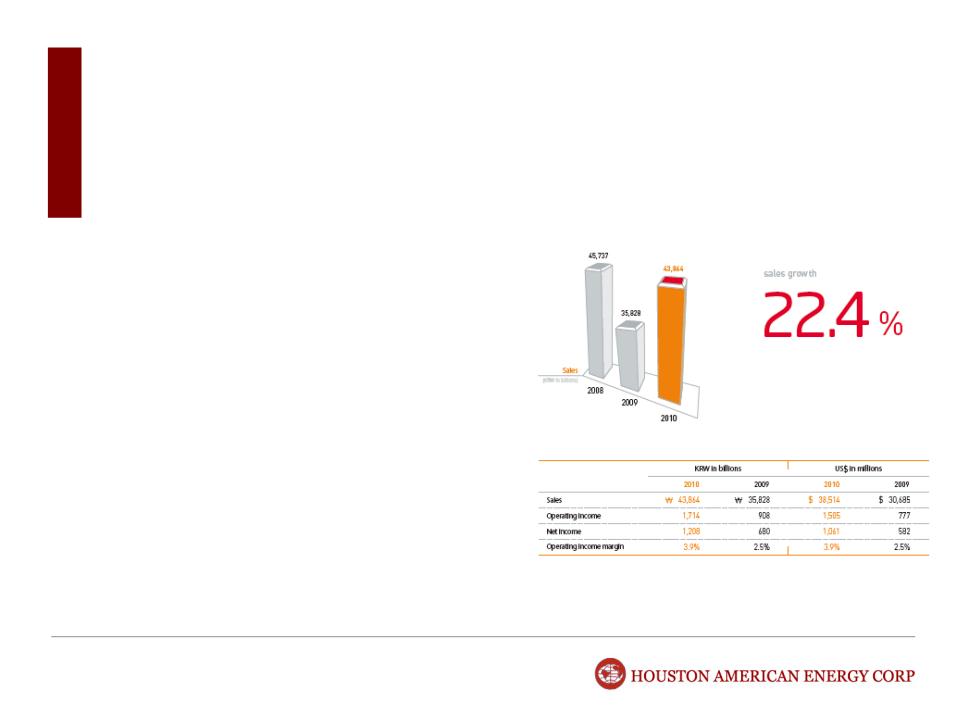

Overview of SK Innovation

Large Asian conglomerate with an integrated business model

Source: SK Energy 2010 Annual Report

1 USD = 1182 KRW

1 USD = 1182 KRW

SK Innovation participates in 29 oil and gas blocks and four LNG

projects in 16 countries, with daily production volume averaging

59,000 barrels of oil equivalent per day in 2010.

projects in 16 countries, with daily production volume averaging

59,000 barrels of oil equivalent per day in 2010.

E&P Business

Petrochemical Business

SK Global Chemical is the undisputed leader in the petrochemical

business in Korea. During 2010 SK sold 1.2 million tons of

petrochemical products for $10.58 billion USD in sales in 2009

business in Korea. During 2010 SK sold 1.2 million tons of

petrochemical products for $10.58 billion USD in sales in 2009

Lubricants Business

SK Lubricants is a leading lubricant manufacturer in Korea. During

2010 SK Lubricants had sales of 1.7 billion and operating income of

252.6 million.

2010 SK Lubricants had sales of 1.7 billion and operating income of

252.6 million.

Refining and Petroleum Business

In 2010, SK Energy had $27.12 billion USD in sales, with refining

capacity of 1.1 million barrels of oil per day. This represents the

largest capacity in Korea, as well as one of the largest in all of Asia

capacity of 1.1 million barrels of oil per day. This represents the

largest capacity in Korea, as well as one of the largest in all of Asia

It should also be noted that SK Innovation has Research and

Development and Technology businesses that are leaders in the

industry.

Development and Technology businesses that are leaders in the

industry.

28

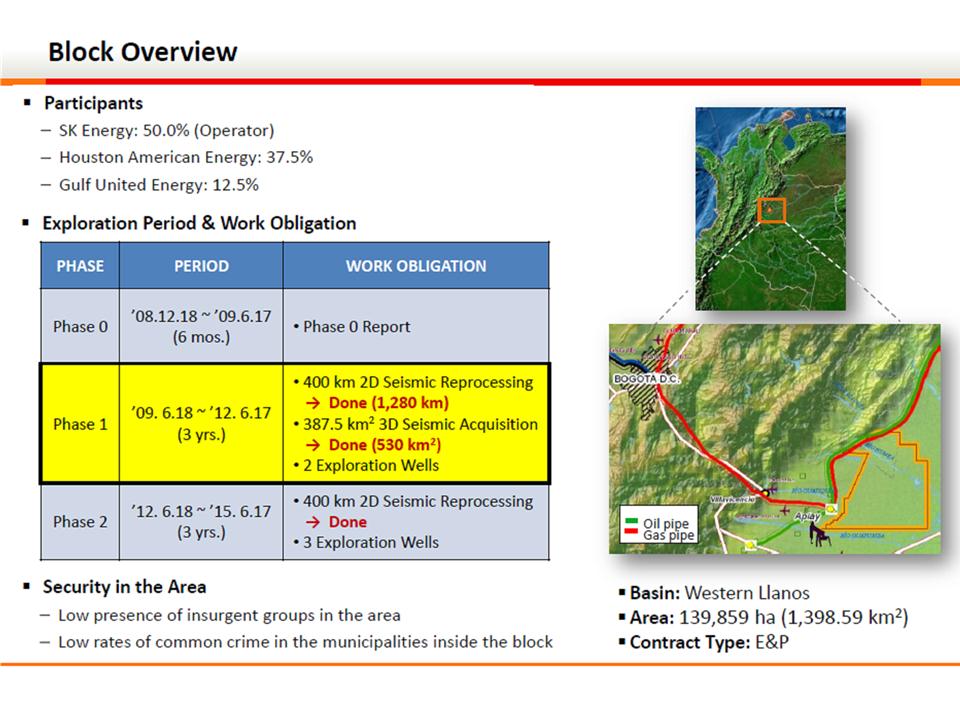

SK Energy - Farmout Agreement and JOA - CPO 4

§ Contract entered between National Hydrocarbon Agency of Colombia and SK Energy

§ Right to earn an undivided 37.5% of the rights of the CPO 4 Contract located in the Western Llanos

Basin in the Republic of Colombia

Basin in the Republic of Colombia

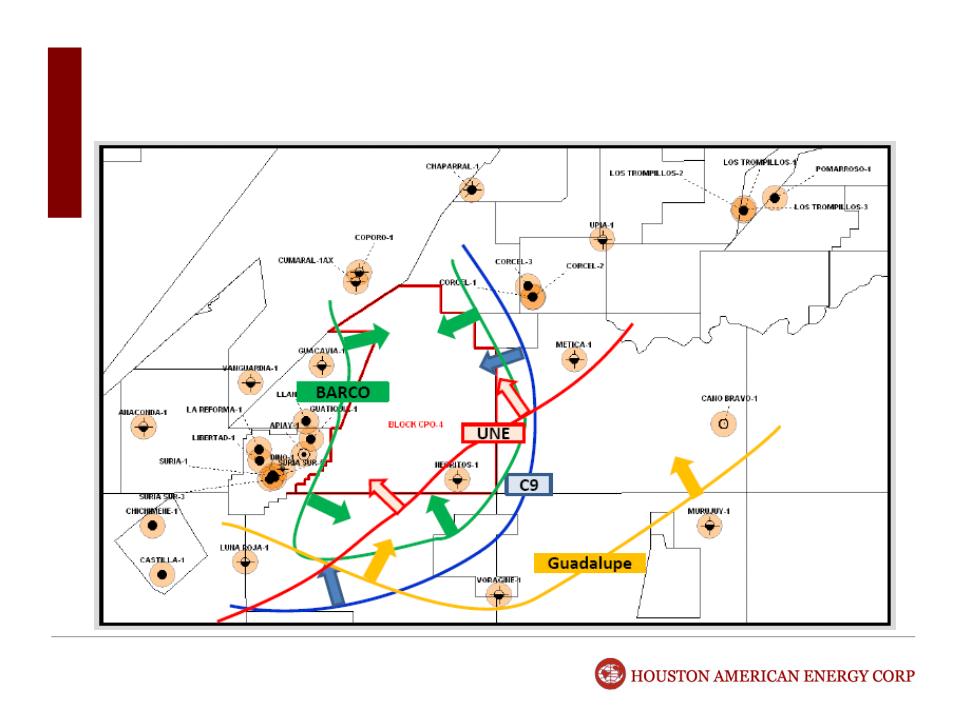

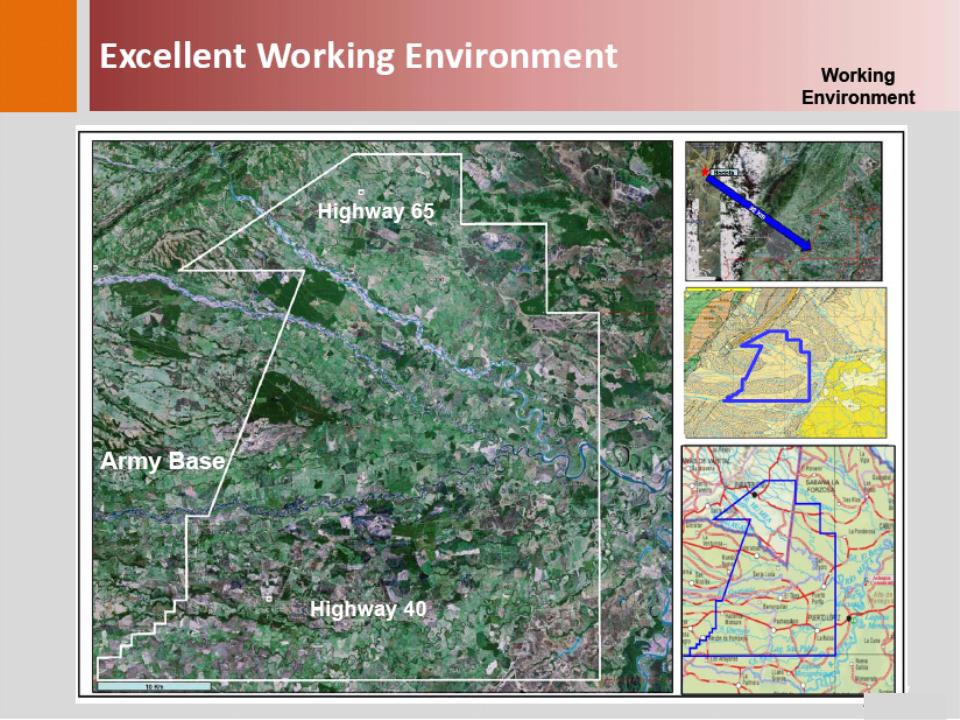

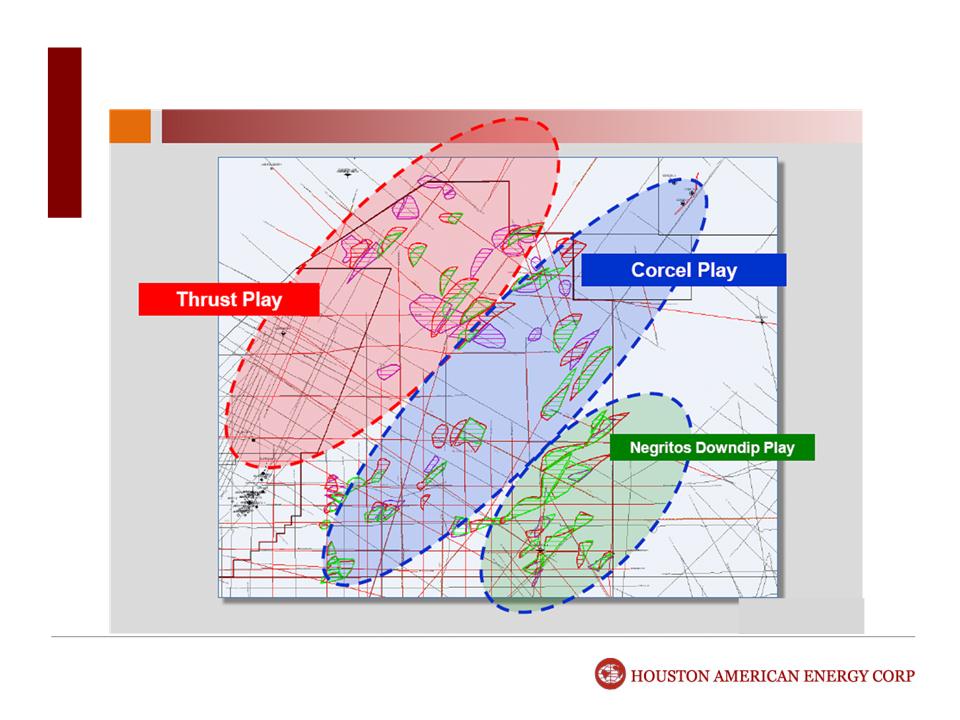

§ CPO 4 Block consists of 345,452 net acres and contains over 50 identified prospects based on 3D

seismic data

seismic data

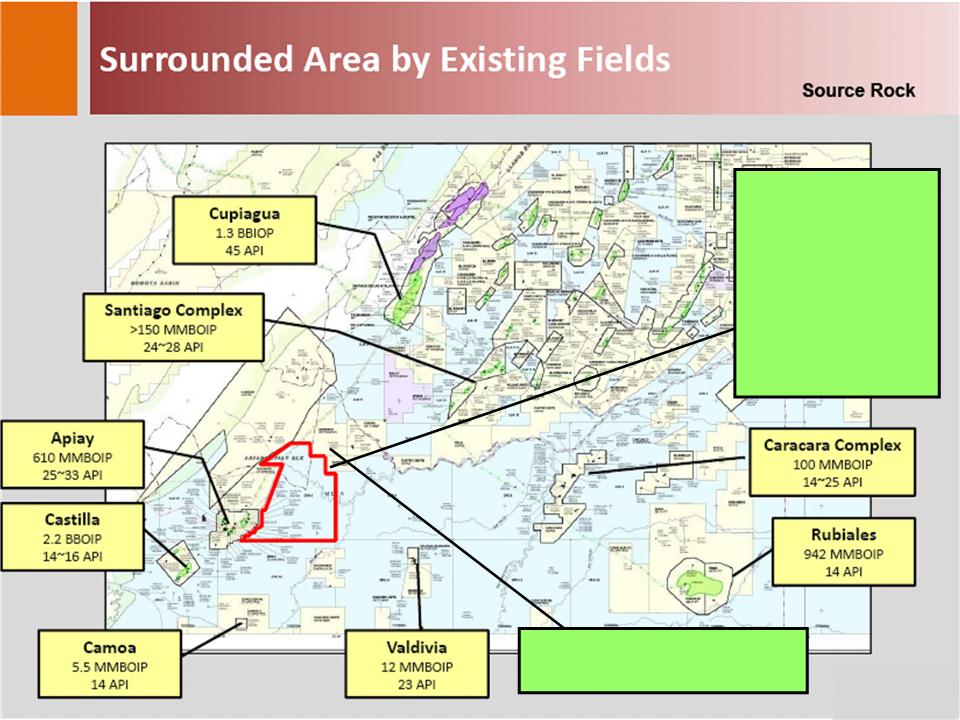

§ The Block is located along the highly productive western margin of the Llanos Basin and is adjacent

to Apiay field which is estimated to have in excess of 610 million barrels of 25-33 API oil in place.

On the CPO 4 Block’s Northeast side lies the Corcel and Guatiquia Blocks where well rates of 2,000

to 15,800 barrels of initial production per day have been announced for recent discoveries.

to Apiay field which is estimated to have in excess of 610 million barrels of 25-33 API oil in place.

On the CPO 4 Block’s Northeast side lies the Corcel and Guatiquia Blocks where well rates of 2,000

to 15,800 barrels of initial production per day have been announced for recent discoveries.

§ In addition, the CPO 4 Block is located nearby oil and gas pipeline infrastructure.

§ The Company has agreed to pay 37.5% of all past and future cost related to the CPO 4 block as

well as an additional 12.5% of the seismic acquisition costs incurred during Phase 1 Work Program

well as an additional 12.5% of the seismic acquisition costs incurred during Phase 1 Work Program

§ All future cost and revenue sharing (excluding the phase 1 seismic cost) will be on a heads up

basis; 50% SK Energy, 37.5% HUSA, and 12.5% Gulf United Energy - no carried interest or other

promoted interest on the block

basis; 50% SK Energy, 37.5% HUSA, and 12.5% Gulf United Energy - no carried interest or other

promoted interest on the block

29

30

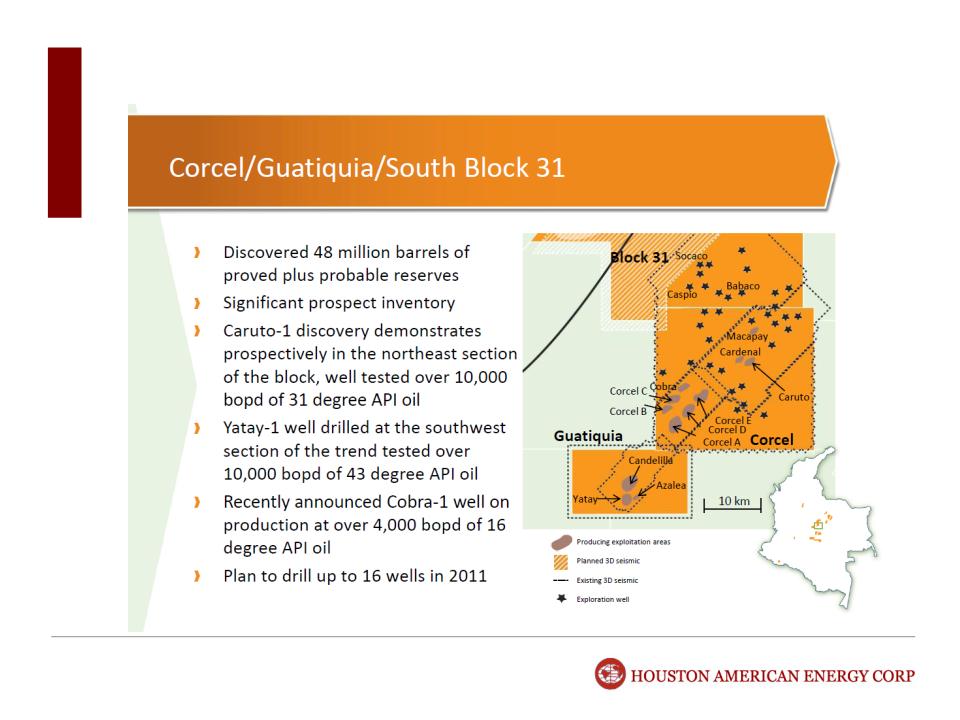

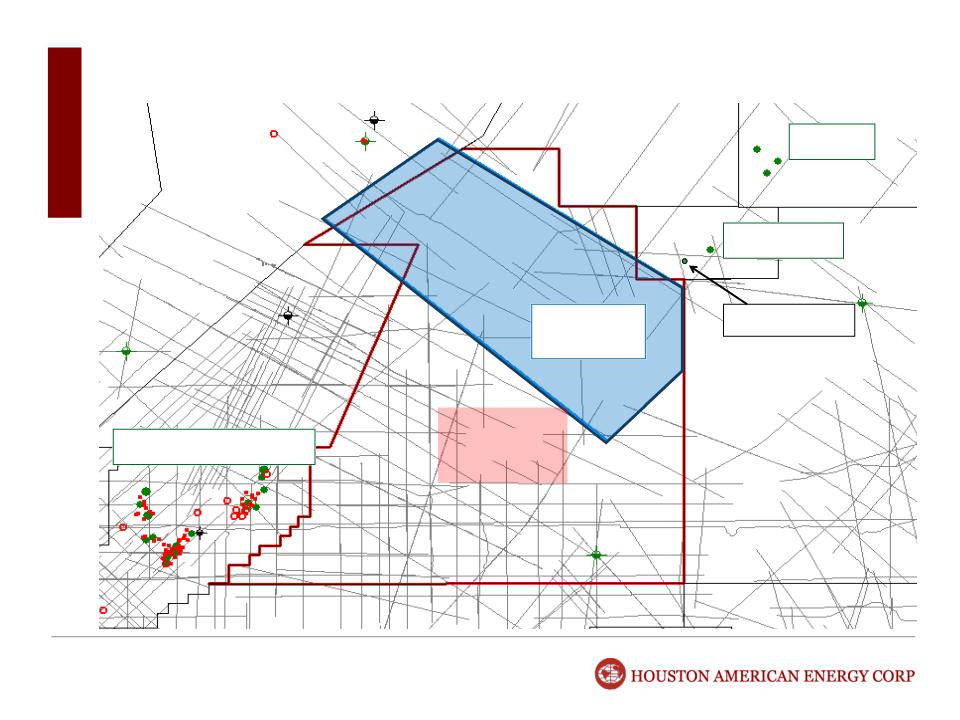

Corcel

Current average production of 10,000 Bbl/d

from 9 wells drilled since July of 2007

from 9 wells drilled since July of 2007

Guatiquia Block

January 5, 2011 - Yatay-1 well

commenced production at over

10,440 barrels of oil per day of

43 degree API, and in its first

four months produced approx.

1.1 million barrels of oil.

commenced production at over

10,440 barrels of oil per day of

43 degree API, and in its first

four months produced approx.

1.1 million barrels of oil.

The Candelilla structure

produced over 7.3

produced over 7.3

million barrels of light oil in

2010 from the Lower Sand-3

and Guadalupe formations

2010 from the Lower Sand-3

and Guadalupe formations

31

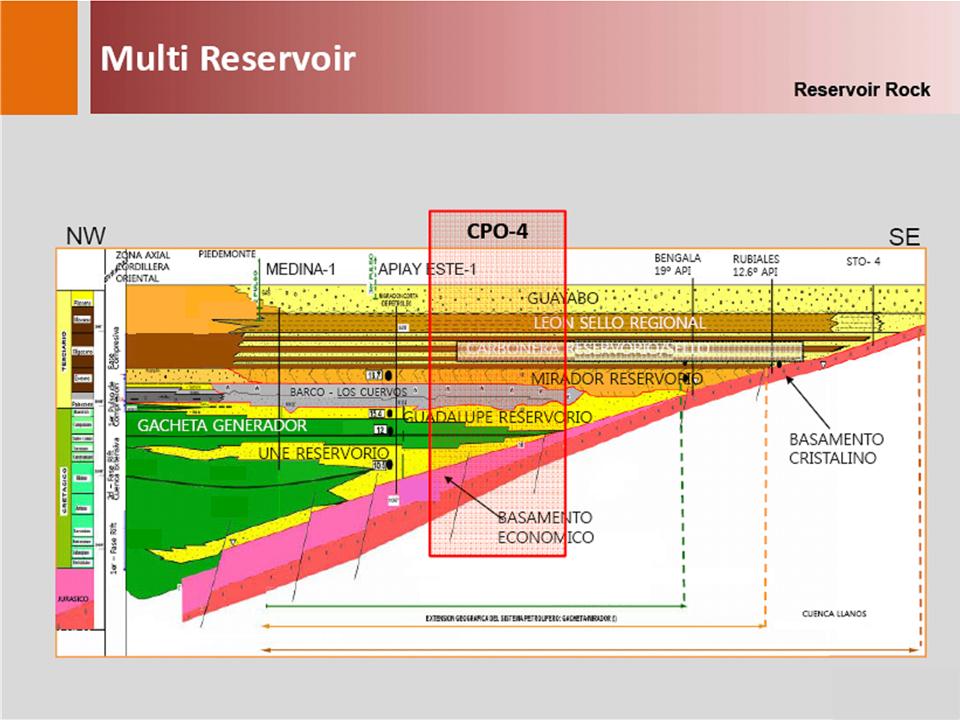

Reservoir Distribution

32

33

34

Multiple Reservoir Plays

35

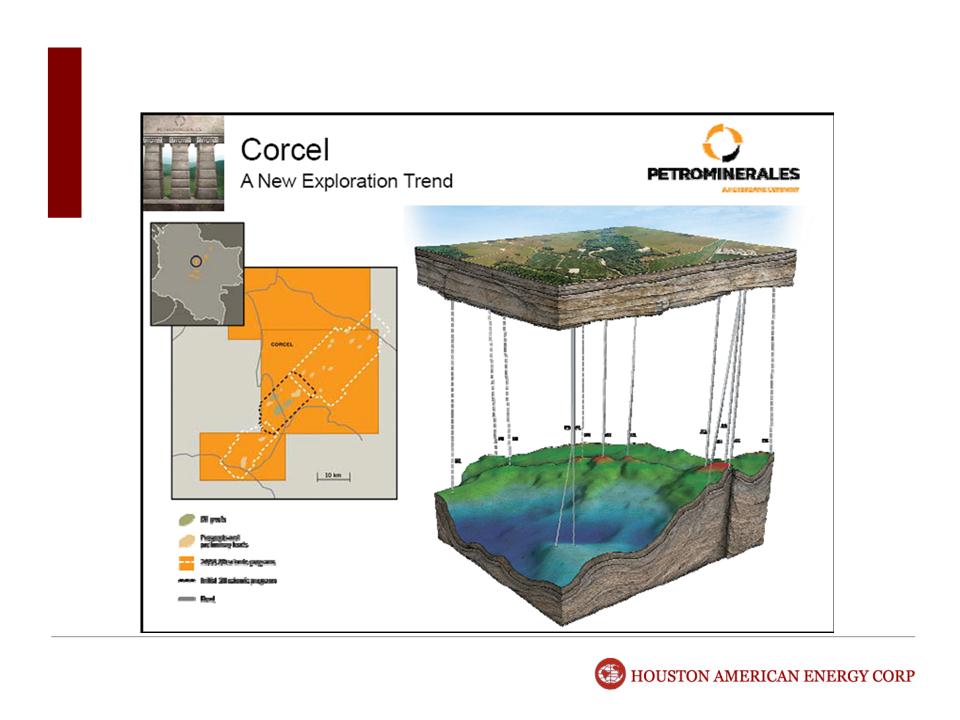

Corcel Overview

Source: Petrominerales.com

36

Corcel Overview

Source: Petrominerales.com

37

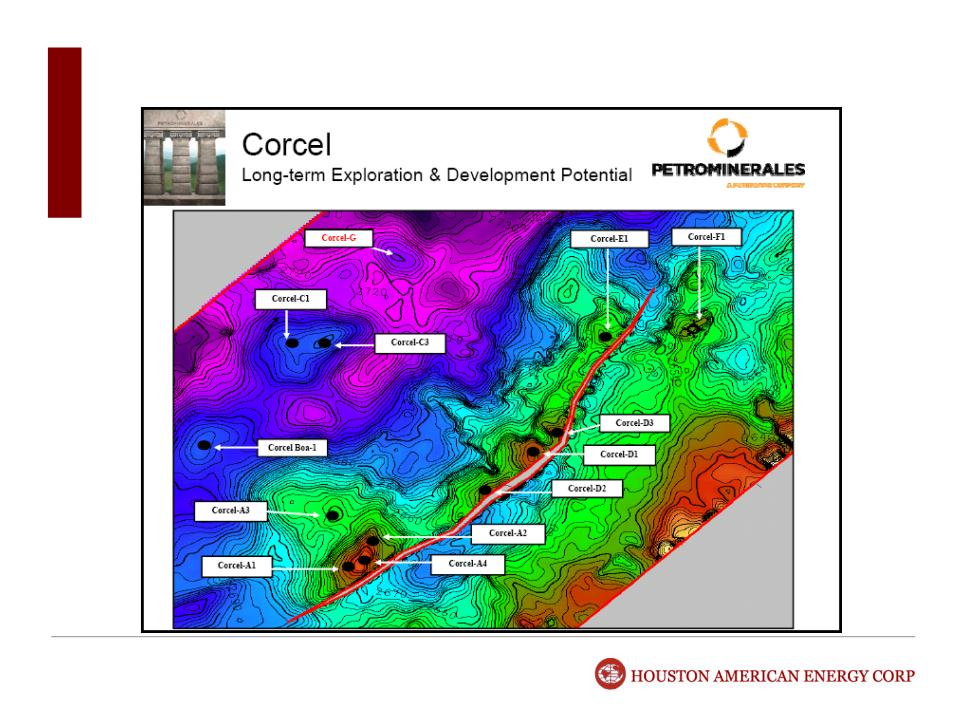

Corcel Overview (continued)

Source: Petrominerales.com

38

Corcel Overview (continued)

Source: Petrominerales.com

39

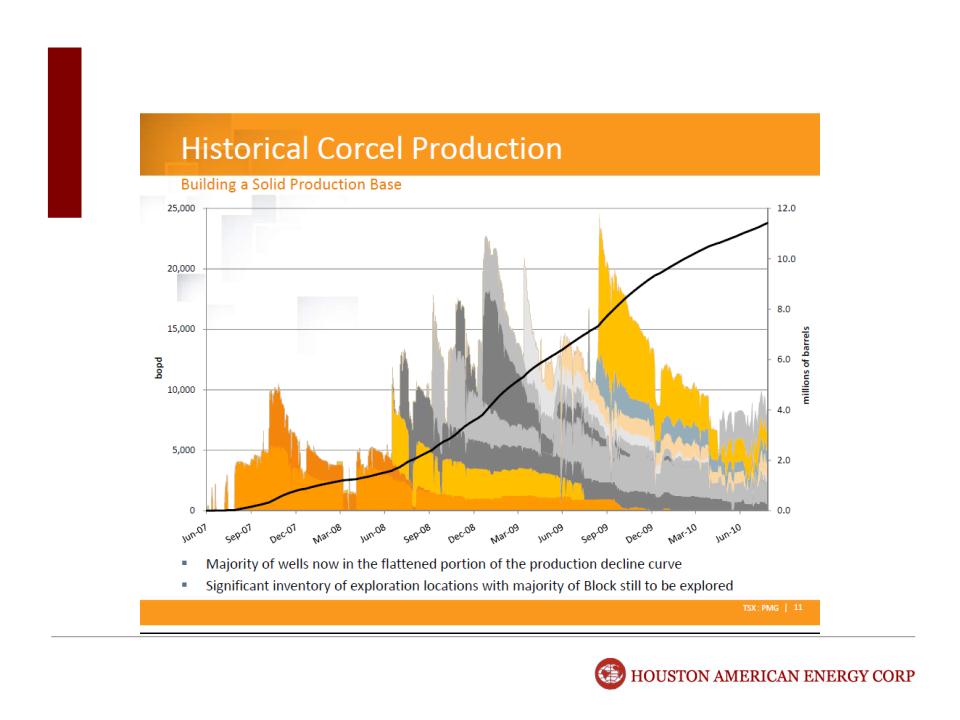

Corcel Overview (continued)

Source: Petrominerales.com; CKCC Research

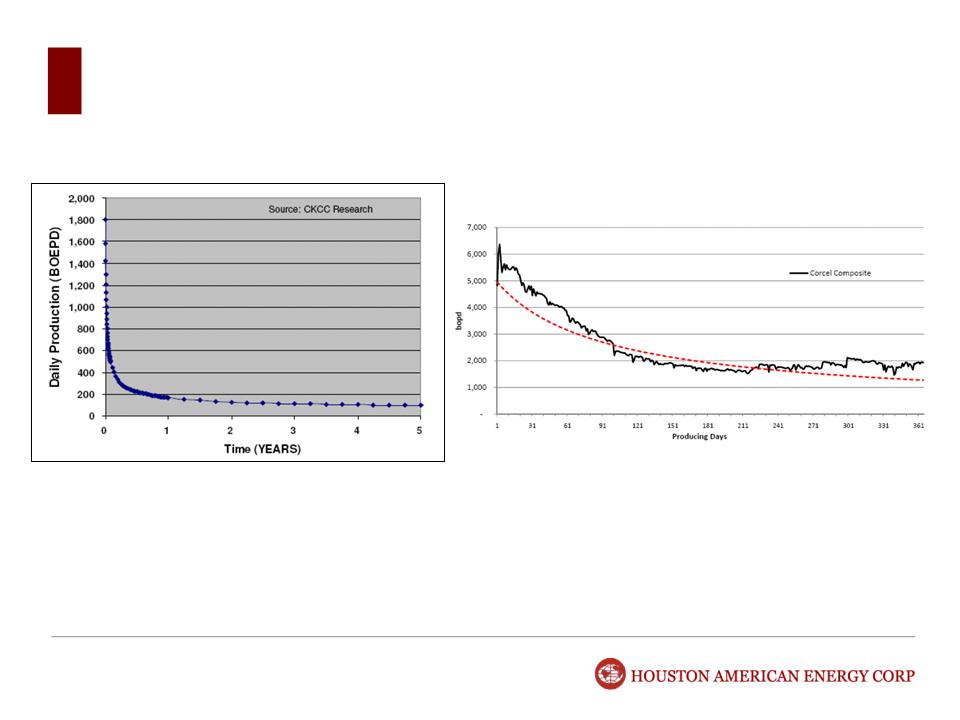

Corcel Production Profile

Bakken/3F Production Profile

§ As can be seen from the two production curves; the Corcel production curve starts at

an average of 6,000 Bbl/d and declines to approximately 2,000 Bbl/d at the end of the

first year; whereas the typical Bakken/Three Forks well starts at 1,800 Bbl/d and

declines to approximately 190 Bbl/d at the end of the first year.

an average of 6,000 Bbl/d and declines to approximately 2,000 Bbl/d at the end of the

first year; whereas the typical Bakken/Three Forks well starts at 1,800 Bbl/d and

declines to approximately 190 Bbl/d at the end of the first year.

40

Corcel Overview (continued)

§ Production from Corcel’s wells have averaged in excess of 5,500 barrels of oil per

day for the first thirty days of production declining to approximately 2,000 barrels of oil

per day after the first year of production.

day for the first thirty days of production declining to approximately 2,000 barrels of oil

per day after the first year of production.

§ Production after the first year of production is expected to decline marginally at 10%

per annum

per annum

§ Multiple stacked pay sands

§ Active water drive is expected to result in high ultimate recoveries

Source: Petrominerales.com

41

Guatiquia Block - Candelilla and Yatay Wells

§ Guatiquia Block is located directly adjacent to the CPO-4 Block, with the Candelilla wells located

approximately 3 kilometers away from the CPO-4 block

approximately 3 kilometers away from the CPO-4 block

§ Candelilla-1 commenced drilling on November 9, 2009 and was drilled to a total vertical depth of

11,681 feet on December 16, 2009. Well logs indicated 97 feet of potential net oil pay in the

Lower Sand 3 formation and 13 feet of potential net oil pay in the Upper Mirador. The well

commenced production at over 11,500 bopd of 44 degree API oil with less then 1% water cut.

11,681 feet on December 16, 2009. Well logs indicated 97 feet of potential net oil pay in the

Lower Sand 3 formation and 13 feet of potential net oil pay in the Upper Mirador. The well

commenced production at over 11,500 bopd of 44 degree API oil with less then 1% water cut.

§ Candelilla-2 well commenced drilling on December 26, 2009 and was drilled to a total vertical

depth of 11,740 feet on January 31, 2010. Well logs indicate 88 feet of potential net oil pay in the

Lower Sand 3 formation and 51 feet of potential net oil pay from three separate sands in the

Guadalupe formation. The well commenced production at over 15,800 bopd of 43 degree API

with less then a 1% water cut.

depth of 11,740 feet on January 31, 2010. Well logs indicate 88 feet of potential net oil pay in the

Lower Sand 3 formation and 51 feet of potential net oil pay from three separate sands in the

Guadalupe formation. The well commenced production at over 15,800 bopd of 43 degree API

with less then a 1% water cut.

§ Candelilla-3 well commenced drilling on February 18, 2010 and was drilled to a total measured

depth of 12,162 feet in under 30 days. Well logs indicate 50 feet of potential net oil pay in the

Lower Sand 3 and 46 feet of potential oil pay in two separate intervals in the Guadalupe

formation. The well commenced production at over 15,600 bopd of 43 degree API with less then a

1% water cut.

depth of 12,162 feet in under 30 days. Well logs indicate 50 feet of potential net oil pay in the

Lower Sand 3 and 46 feet of potential oil pay in two separate intervals in the Guadalupe

formation. The well commenced production at over 15,600 bopd of 43 degree API with less then a

1% water cut.

§ Yatay-1 well commenced drilling on November 19, 2010 and was put on production on January 4,

2011. Well logs indicate 114 feet of potential oil pay in the Lower 3 sand. The well commenced

production at over 10,440 bopd of 43 degree API with less then a 1% water cut under natural flow.

The well produced over 1.1 million barrels of oil in its first 4 months of production.

2011. Well logs indicate 114 feet of potential oil pay in the Lower 3 sand. The well commenced

production at over 10,440 bopd of 43 degree API with less then a 1% water cut under natural flow.

The well produced over 1.1 million barrels of oil in its first 4 months of production.

Source: Petrominerales.com

42

Corcel

Candelilla

Apiay / Suria Area

3D Seismic

(205 sm)

CPO 4

(540 sm)

New 3D Areas

Yatay - 1 well

43

Tamandua #1 Well Status

§ The well was spudded on July 12, 2011 with a proposed target depth of 16,300’.

§ The well was drilled to 6,830’and casing was set for the first section of the well.

Upon drilling the Lower Carbonera section of the well, the well encountered a

significant kick from the uppermost pay sand expected in the well (the C-7) between

the interval of approximately 12,200’ to 12,500’.

Upon drilling the Lower Carbonera section of the well, the well encountered a

significant kick from the uppermost pay sand expected in the well (the C-7) between

the interval of approximately 12,200’ to 12,500’.

§ Upon re-entering the hole following a bit change from approximately 13,626’ the drill

pipe got stuck and twisted off below casing. Operator made a decision to sidetrack

the well.

pipe got stuck and twisted off below casing. Operator made a decision to sidetrack

the well.

§ Drilling is underway in the side tracked hole with new modified well program.

§ We believe a significant amount of geologic risk has been reduced in the well and are

encouraged about the prospects of our lower sands due to the tendency of stacked

pay sequences in this area in the Llanos Basin.

encouraged about the prospects of our lower sands due to the tendency of stacked

pay sequences in this area in the Llanos Basin.

Source: Petrominerales.com

44

Appendix

45

46

Management Biography

John F. Terwilliger, President and CEO

John F. Terwilliger has served as the Company's President, Chairman and Chief Executive Officer since its

inception in April 2001. From 1988 to 2001, Mr. Terwilliger served as Chairman of the Board and President of

Moose Oil and Gas Company, a Houston based exploration and production company focused on operations in the

Texas Gulf Coast region. Prior to 1988, Mr. Terwilliger was Chairman of the Board and President of Cambridge Oil

Company, a Texas based exploration and production company. John is a member of the Houston Geological

Society, Houston Producers Forum, Independent Petroleum Association of America and the Society of Petroleum

Engineers.

inception in April 2001. From 1988 to 2001, Mr. Terwilliger served as Chairman of the Board and President of

Moose Oil and Gas Company, a Houston based exploration and production company focused on operations in the

Texas Gulf Coast region. Prior to 1988, Mr. Terwilliger was Chairman of the Board and President of Cambridge Oil

Company, a Texas based exploration and production company. John is a member of the Houston Geological

Society, Houston Producers Forum, Independent Petroleum Association of America and the Society of Petroleum

Engineers.

James J. Jacobs -Chief Financial Officer

James “Jay” Jacobs has served as the Company’s Chief Financial Officer since joining the Company in July 2006.

From April 2003 until joining the Company in July 2006, Mr. Jacobs served as an Associate and as Vice President

in the Energy Investment Banking division at Sanders Morris Harris, Inc., an investment banking firm

headquartered in Houston Texas, where he specialized in energy sector financings and transactions for a wide

variety of energy companies. Prior to joining Sanders Morris Harris, Mr. Jacobs worked as a financial analyst for

Duke Capital Partners where he worked on the execution of senior secured, mezzanine, volumetric production

payment, and equity transactions for exploration and production companies. Prior to joining Duke Capital Partners,

Mr. Jacobs worked in the Corporate Tax Group of Deloitte and Touché LLP. Mr. Jacobs holds a B.B.A. and a

Masters in Professional Accounting from the McCombs School of Business at the University of Texas in Austin and

is a Certified Public Accountant.

From April 2003 until joining the Company in July 2006, Mr. Jacobs served as an Associate and as Vice President

in the Energy Investment Banking division at Sanders Morris Harris, Inc., an investment banking firm

headquartered in Houston Texas, where he specialized in energy sector financings and transactions for a wide

variety of energy companies. Prior to joining Sanders Morris Harris, Mr. Jacobs worked as a financial analyst for

Duke Capital Partners where he worked on the execution of senior secured, mezzanine, volumetric production

payment, and equity transactions for exploration and production companies. Prior to joining Duke Capital Partners,

Mr. Jacobs worked in the Corporate Tax Group of Deloitte and Touché LLP. Mr. Jacobs holds a B.B.A. and a

Masters in Professional Accounting from the McCombs School of Business at the University of Texas in Austin and

is a Certified Public Accountant.

Kenneth A. Jeffers - Senior Vice President of Exploration

Kenneth “Ken” Jeffers brings to Houston American Energy 28 years of oil and gas industry experience. Mr. Jeffers

began his career as an exploration geophysicist with Mobil Oil, later serving as a staff geophysicist and senior

geophysicist with such companies as Anadarko Petroleum, Pennzoil and Hunt Oil and Vice President Geophysics

at Goodrich Petroleum Corp. Prior to his appointment as Senior Vice President of Exploration, Mr. Jeffers worked

with Houston American for six months as a consultant focusing on identification of prospects on the Company’s

large Colombian acreage position.

began his career as an exploration geophysicist with Mobil Oil, later serving as a staff geophysicist and senior

geophysicist with such companies as Anadarko Petroleum, Pennzoil and Hunt Oil and Vice President Geophysics

at Goodrich Petroleum Corp. Prior to his appointment as Senior Vice President of Exploration, Mr. Jeffers worked

with Houston American for six months as a consultant focusing on identification of prospects on the Company’s

large Colombian acreage position.

47

Lee Tawes

Mr. Tawes is Executive Vice President, Head of Investment Banking and a Director of Northeast Securities, Inc. Prior to

joining Northeast Securities, Mr. Tawes held management and research analyst positions with C.E. Unterberg, Towbin,

Oppenheimer & Co. Inc., CIBC World Markets and Goldman Sachs & Co. from 1972 to 2001. Mr. Tawes has served as a

Director of Baywood International, Inc. since 2001 and of GSE Systems, Inc. since 2006. Mr. Tawes is a graduate of Princeton

University and received his MBA from Darden School at the University of Virginia

joining Northeast Securities, Mr. Tawes held management and research analyst positions with C.E. Unterberg, Towbin,

Oppenheimer & Co. Inc., CIBC World Markets and Goldman Sachs & Co. from 1972 to 2001. Mr. Tawes has served as a

Director of Baywood International, Inc. since 2001 and of GSE Systems, Inc. since 2006. Mr. Tawes is a graduate of Princeton

University and received his MBA from Darden School at the University of Virginia

Stephen Hartzell

Since 2003, Mr. Hartzell has been an owner/operator of Southern Star Exploration, LLC, an independent oil and gas

company. From 1986 to 2003, Mr. Hartzell served as an independent consulting geologist. From 1978 to 1986, Mr. Hartzell

served as a petroleum geologist, division geologist and senior geologist with Amoco Production Company, Tesoro Petroleum

Corporation, Moore McCormack Energy and American Hunter Exploration. Mr. Hartzell received his B.S. in Geology from

Western Illinois University and an M.S. in Geology from Northern Illinois University.

company. From 1986 to 2003, Mr. Hartzell served as an independent consulting geologist. From 1978 to 1986, Mr. Hartzell

served as a petroleum geologist, division geologist and senior geologist with Amoco Production Company, Tesoro Petroleum

Corporation, Moore McCormack Energy and American Hunter Exploration. Mr. Hartzell received his B.S. in Geology from

Western Illinois University and an M.S. in Geology from Northern Illinois University.

John Boylan

Mr. Boylan has served as a financial consultant to the oil and gas industry since January 2008. Mr. Boylan served as a

manager of Atasca Resources, an independent oil and gas exploration and production company, from 2003 through 2007.

Previously, Mr. Boylan served in various executive capacities in the energy industry, including both the exploration and

production and oil services sectors. Mr. Boylan’s experience also includes work as a senior auditor for KPMG Peat Marwick

and a senior associate project management consultant for Coopers & Lybrand Consulting. Mr. Boylan holds a B.B.A. with a

major in Accounting from the University of Texas and an M.B.A. with majors in Finance, Economics and International Business

from New York University.

manager of Atasca Resources, an independent oil and gas exploration and production company, from 2003 through 2007.

Previously, Mr. Boylan served in various executive capacities in the energy industry, including both the exploration and

production and oil services sectors. Mr. Boylan’s experience also includes work as a senior auditor for KPMG Peat Marwick

and a senior associate project management consultant for Coopers & Lybrand Consulting. Mr. Boylan holds a B.B.A. with a

major in Accounting from the University of Texas and an M.B.A. with majors in Finance, Economics and International Business

from New York University.

Dr. Richard J. Howe

Dr. Howe began his energy career at Shell Oil Company where he designed and built offshore mobile drilling units and

production platforms. During Dr. Howe’s time with Shell, he was one of the founding Directors of the Offshore Technology

Conference (“OTC”), which is now the world’s foremost event for the development of offshore oil and gas resources. After

leaving Shell Oil Company, Dr. Howe spent 20 years with Exxon where he was responsible for Exxon’s oil production in Lake

Maracaibo, Venezuela. Upon leaving Venezuela, Dr. Howe became General Manager of oil and gas drilling and production

research for Exxon worldwide. His final assignment with Exxon was as Public Relations Manager. Upon leaving Exxon, Dr.

Howe joined Pennzoil where he served as President and Chief Operating Officer until his retirement.

production platforms. During Dr. Howe’s time with Shell, he was one of the founding Directors of the Offshore Technology

Conference (“OTC”), which is now the world’s foremost event for the development of offshore oil and gas resources. After

leaving Shell Oil Company, Dr. Howe spent 20 years with Exxon where he was responsible for Exxon’s oil production in Lake

Maracaibo, Venezuela. Upon leaving Venezuela, Dr. Howe became General Manager of oil and gas drilling and production

research for Exxon worldwide. His final assignment with Exxon was as Public Relations Manager. Upon leaving Exxon, Dr.

Howe joined Pennzoil where he served as President and Chief Operating Officer until his retirement.

Board of Directors