Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Diamond Resorts Corp | d241064d8k.htm |

October 2011

Exhibit 99.1 |

1

Management Presenter

David F. Palmer

President & Chief Financial Officer |

2

Company Overview

Diamond Resorts is a branded resort management company that operates one of the

largest vacation-ownership networks in the world

Santa Barbara Golf and Ocean

Club –

Canaries, Spain |

3

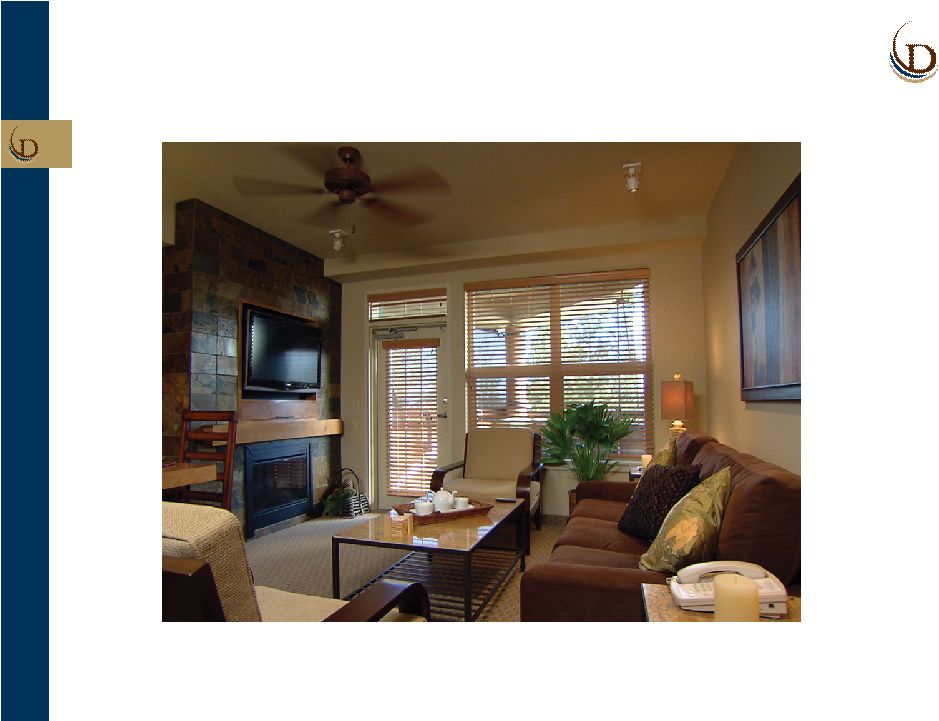

207 Branded and Affiliated Resorts

Lake Tahoe Vacation Resort –

South Lake Tahoe, California |

4

28 Countries

Broome Park Golf and Country

Club –

Kent, United Kingdom |

5

Approximately 27,000 Beds System Wide

Polo Towers Villas –

Las

Vegas, Nevada |

6

Approximately 418,000 Owner-Families |

Diamond’s Global Resort Network

7 |

8

Global Market Leader Measured by Owner-

Families and Number of Resorts

Vacation Ownership Operators by Resorts / Location

Source:

Vacation

Ownership

World

Magazine,

December

2010.

Company

reports

and

industry

websites

Vacation Ownership Operators by Owner-Families

Source:

Company reports and industry websites.

Note:

Metrics are as of year-end 2010 for all operators, except for Starwood and

Hyatt, which are as of year-end 2008 and Diamond Resorts, which are as of

September 2010. |

9

Business Segments

Hospitality and Resort Management Services

Marketing & Sales of Vacation Interests

Consumer Financial Services |

10

Hospitality and Management Services

Manage 71 resort properties globally and provide access to 136 affiliates

Manage members of THE Club

Evergreen management contracts yield highly predictable, contractual cash

flow -

Automatic renewals

-

Management fees are typically cost plus 10%-15%

-

Maintenance CapEx are HOA responsibility and paid by owners

No ADR or occupancy risk associated with management fee income

Since acquisition, Diamond has never been terminated as manager and has added

several new contracts

HOA fees are collected in advance

-

Approximately 78% collected by the end of February each year

-

Cash is held in HOA accounts managed by Diamond reducing collectability risk

A majority of EBITDA contribution with no material overhead or working

capital |

11

Marketing & Sales of Vacation Interests

Diamond markets and sells vacation interests in the form of points

-

Flexibility to use points when and where the owner wants

-

Not tied to fixed interval

-

Members can also utilize their points as currency for services such as airline

tickets, cruises, etc. Diamond sells vacation interests through individual

sales presentations: -

37 sales centers world wide

-

Tour flow based on data driven direct marketing

-

Manage cost per tour

-

Conversion % by tour channel

-

Transaction size

Self-Sustaining Inventory Model

-

Focused

on

selling

recaptured

inventory

–

current

sales

level

supported

without

need

to

build

new

inventory

-

During each of the past two years, we have recovered 3% of our previously sold

VI’s |

12

Consumer Financial Services

Diamond maintains a vertically integrated consumer finance operation

-

Risk-based pricing model based on an obligor's FICO score and credit

report Since October 2008:

-

Consumer receivables generated have had a weighted average FICO score of 759

-

Only approximately 30% of total sales have relied on Diamond’s

financing -

Average combined equity contribution of 40%

Diamond maintains approximately $105 million of non-recourse receivables

financing facilities with more than $70 million of capacity available

As of June 30, 2010, Diamond services a portfolio of approximately 39,000 loans

and approximately $326 million |

13

Company Initiatives

Optimizing sales and marketing platform:

New sales and marketing leadership

Increasing average transaction size

Investment in marketing pipeline and platform

Maximize

operating

leverage

–

approximately

35-40%

contribution

to

EBITDA

per

dollar

of

VI sales growth

Recent and future acquisitions:

ILX acquired October 1, 2010

Tempus acquired July 1, 2011

Soon to announce third acquisition

Minimal balance sheet risk-

operating partner strategy |

Forward-Looking Statements

Important

Note

Regarding

Forward-Looking

Statements:

Statements made in this presentation which are not purely historical are forward-looking

statements, as defined in the Private Securities Litigation Reform Act of 1995. This includes any

statements regarding management’s plans, objectives, or goals for future operations, products

or services, and forecasts of its revenues, earnings, or other measures of performance.

Forward- looking statements are based on current management expectations and, by their nature,

are subject to risks and uncertainties. These statements may be identified by the use of words

such as “believe”, “expect”, “anticipate”, “plan”,

“estimate”, “should”, “will”, “intend”, or similar

expressions. Outcomes related to such statements are subject to numerous risk factors and

uncertainties including those listed in the company’s prospectus filed with the SEC pursuant to

Rule 424(b) of the Securities Act of 1933 on July 8, 2011, and any subsequent Form

10-Q or Form 10-K.

|