Attached files

| file | filename |

|---|---|

| EX-99.1 - FINANCIAL STATEMENTS - Yangtze River Port & Logistics Ltd | f8k030111a5ex99i_kirin.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

Amendment No. 5

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): March 1, 2011

KIRIN INTERNATIONAL HOLDING, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

333-166343

|

N/A

|

||

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

Room 1506

South Building of China Overseas Plaza

No. 8 Guanghua Dongli Road

Chaoyang District, Beijing, 100020

People’s Republic of China

(Address of principal executive offices) (Zip Code)

+86 10 6577 2050

(Registrant’s telephone number, including area code)

14001c Saint Germain Dr., Suite 390,

Centreville, VA 20121

(Former name or former address, if changed since last report)

––––––––––––––––

Copies to:

Sichenzia Ross Friedman Ference Anslow LLP

195 Route 9 South, Suite 204Manalapan, New Jersey 07726

Attention: Gregg E. Jaclin, Esq.

(732) 409-1212

––––––––––––––––

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

EXPLANATORY NOTE

This Amendment No. 5 on Form 8-K/A (this “ Fifth Amendment”) is being filed to incorporate changes to the Current Report on Form 8-K filed by Kirin International Holding, Inc., formerly known as Ciglarette, Inc. (the “Company”), on March 7, 2011 (the “Original 8-K”), as amended by Amendment No. 1 on Form 8-K/A filed by the Company on April 28, 2011 (the “First Amendment”), Amendment No. 2 on Form 8-K/A filed by the Company on June 10, 2011 (the “Second Amendment”), Amendment No. 3 on Form 8-K/A filed by the Company on July 25, 2011 (the “Third Amendment”) and Amendment No. 4 on Form 8-K/A filed by the Company on August 26, 2011 (the “Fourth Amendment” and , together with the Original 8-K, the First Amendment, the Second Amendment and the Third Amendment , the “Amended 8-K”) in response to comments received from the Securities and Exchange Commission (the “Commission”) as a result of the Commission’s review of the Amended 8-K. Only Items 2.01 and 9.01 have been amended and restated in this Amendment.

Unless otherwise indicated herein or in the Amended 8-K, the disclosures contained herein have not been updated to reflect events, results or developments that have occurred after the filing of the Original 8-K, the First Amendment, the Second Amendment, Third Amendment or the Fourth Amendment, or to modify or update those disclosures affected by subsequent events. This Fifth Amendment should be read in conjunction with the Amended 8-K and the Company’s other filings made with the Commission subsequent to the Original 8-K, including any amendments to those filings.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This Second Amendment (this “Report”) contains forward looking statements that involve risks and uncertainties, principally in the sections entitled “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” All statements other than statements of historical fact contained in this Report, including statements regarding future events, our future financial performance, business strategy and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” or “will” or the negative of these terms or other comparable terminology. Although we do not make forward looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere in this Report, which may cause our or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time and it is not possible for us to predict all risk factors, nor can we address the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause our actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements included in this document are based on information available to us on the date hereof, and we assumes no obligation to update any such forward-looking statements

You should not place undue reliance on any forward-looking statement, each of which applies only as of the date of this Report. Before you invest in our securities, you should be aware that the occurrence of the events described in the section entitled “Risk Factors” and elsewhere in this Report could negatively affect our business, operating results, financial condition and stock price. Except as required by law, we undertake no obligation to update or revise publicly any of the forward-looking statements after the date of this Report to conform our statements to actual results or changed expectations.

USE OF CERTAIN DEFINED TERMS

Except as otherwise indicated by the context, references in this Report to “Kirin,” “Ciglarette,” “we,” “us,” “our,” “our Company,” or “the Company” are to the combined business of Kirin International Holding, Inc., and its consolidated subsidiaries. In addition, unless the context otherwise requires and for the purposes of this Report only:

|

·

|

“Ciglarette International” refers to Ciglarette International, Inc., a Nevada company;

|

|

·

|

“Commission” refers to the Securities and Exchange Commission;

|

|

·

|

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended;

|

|

·

|

“Hebei Zhongding” refers to Hebei Zhongding Real Estate Development Co., Ltd, a PRC company;

|

|

·

|

“Kirin China” refers to Kirin China Holding Limited, a British Virgin Islands company;

|

|

·

|

“Kirin Development” refers to Kirin Huaxia Development Limited, a Hong Kong company;

|

|

·

|

“Kirin Management” or “PRC Subsidiary” refers to Shijiazhuang Kirin Management Consulting Co., Ltd., a PRC company;

|

|

·

|

“Operating Companies” refers to Hebei Zhongding and Xingtai Zhongding;

|

|

·

|

“PRC” refers to the People’s Republic of China; and

|

|

·

|

“Securities Act” refers to the Securities Act of 1933, as amended.

|

|

·

|

“Xingtai Zhongding” refers to Xingtai Zhongding Jiye Real Estate Development Co., Ltd., a PRC Company.

|

1

INTRODUCTION

On March 1, 2011, the Company entered into a series of transactions pursuant to which the Company acquired Kirin China, spun-out its prior operations to Lisan Rahman, its former principal stockholder, sole director and officer, and consummated a financing transaction in which the Company received gross proceeds of $1,380,000 in a private offering. The following summarizes the foregoing transactions:

|

·

|

Acquisition of Kirin China. We acquired all of the outstanding equity interests in Kirin China in exchange for shares of our common stock pursuant to a share exchange agreement between us, our former principal stockholder, Kirin China and the former principal shareholders of Kirin China (the “Share Exchange”). As a result of the Share Exchange, Kirin China became our wholly-owned subsidiary and the former shareholders of Kirin China became our controlling stockholders. The acquisition was accounted for as a recapitalization effected by a share exchange, wherein Kirin China is considered the acquirer for accounting and financial reporting purposes. For more information on the Share Exchange, see “Item 1.01 — Share Exchange” and “Item 2.01 — Description of Business — Our Corporate History and Background” of this Report.

|

|

·

|

Spin-Out of Ciglarette Business. Immediately prior to the consummation of the Share Exchange, the Company contributed substantially all of our assets to Ciglarette International and, in exchange, Ciglarette International agreed to assume all of our debts and other liabilities. In addition, we transferred all of our ownership interest in Ciglarette International to Lisan Rahman in exchange for the cancellation of 2,500,000 shares of our common stock previously held by Rahman. For more information on these transactions, see “Item 1.01 — Reorganization and Spin-Out” and “Item 2.01 — Description of Business — Our Corporate History and Background” of this Report.

|

|

·

|

Financing Transaction. Immediately following the Share Exchange, we completed an initial closing of a private offering of units, each consisting of four (4) shares of our common stock, a Series A Warrant and a Series B Warrant, for gross proceeds to the Company of $1,380,000. The Company issued an aggregate of 276,000 shares of its common stock and warrants to acquire an aggregate of 138,000 shares of our common stock to the purchasers of the units. For more information on the financing transaction, see “Item 1.01 — The Offering” and “Item 2.01 — Management’s Discussion and Analysis of Financial Condition and Results of Operations —Financing Transaction” of this Report.

|

We are now a holding company, which through certain contractual arrangements with operating companies in the PRC, engages in the development and operation of real estate in the PRC. From inception until we completed the Share Exchange, our operations consisted of marketing and distributing a “smokeless” cigarette. During that time, we had no revenue and our operations were limited to capital formation, organization, and development of our business plan and target customer market. As such, we were a “shell company” (as such term is defined in Rule 12b-2 under the Exchange Act). Accordingly, pursuant to the requirements of Item 2.01(a)(f) of Form 8-K, Item 2.01 of this Report sets forth information that would be required if the Company was required to file a general form for registration of securities on Form 10 under the Exchange Act with respect to its common stock (which is the only class of the Company’s securities subject to the reporting requirements of Section 13 or Section 15(d) of the Exchange Act upon consummation of the Share Exchange).

2

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

As described in Item 1.01 above, on the Closing Date, we completed the acquisition of Kirin China pursuant to the Exchange Agreement. The acquisition was accounted for as a recapitalization effected by a share exchange, wherein Kirin China is considered the acquirer for accounting and financial reporting purposes. The disclosure in Item 1.01 of this Report regarding the Share Exchange is incorporated herein by reference in its entirety.

As described in Item 1.01 above, on the Closing Date and prior to the consummation of the Share Exchange, we (i) contributed substantially all of our assets to Ciglarette International and, in exchange, Ciglarette International agreed to assume all of our debts and other liabilities and (ii) transferred all of our ownership interest in Ciglarette International to Rahman in exchange for the cancellation of 2,500,000 shares of our common stock previously held by Rahman. The disclosure in Item 1.01 of this Report regarding the Reorganization and Spin-Out is incorporated herein by reference in its entirety.

As a result of the foregoing, we are now a holding company, which through certain contractual arrangements with operating companies in the PRC, engages in the development and operation of real estate in the PRC.

FORM 10 DISCLOSURE

The Company was a “shell company” (as such term is defined in Rule 12b-2 under the Exchange Act) immediately before the completion of the Share Exchange. Accordingly, pursuant to the requirements of Item 2.01(a)(f) of Form 8-K, set forth below is the information that would be required if the Company was required to file a general form for registration of securities on Form 10 under the Exchange Act with respect to its common stock (which is the only class of the Company’s securities subject to the reporting requirements of Section 13 or Section 15(d) of the Exchange Act upon consummation of the Share Exchange). The information provided below relates to the combined operations of the Company after the acquisition of Kirin China, except that information relating to periods prior to the date of the reverse acquisition only relate to Kirin China and its consolidated subsidiaries unless otherwise specifically indicated.

DESCRIPTION OF BUSINESS

Our Corporate History and Background

We were incorporated on December 23, 2009 under the laws of the State of Nevada. From inception until we completed our reverse acquisition of Kirin China, our operations consisted of marketing and distributing a “smokeless” cigarette. During that time, we had no revenue and our operations were limited to capital formation, organization, and development of our business plan and target customer market. As a result of the reverse acquisition of Kirin China on March 1, 2011, we ceased our prior operations and we are now a holding company, which through certain contractual arrangements with operating companies in the PRC, engages in the development and operation of real estate in the PRC.

Reverse Acquisition of Kirin China

On March 1, 2011, we completed a reverse acquisition transaction through a share exchange with Kirin China whereby we acquired all of the issued and outstanding shares of Kirin China in exchange for 18,547,297 shares of our common stock, which represented approximately 98.4% of our total shares outstanding immediately following the closing of the Share Exchange. As a result of the Share Exchange, Kirin China became our wholly-owned subsidiary. We are now a holding company, which through certain contractual arrangements with operating companies in the PRC, engages in the development and operation of real estate in the PRC.

Immediately prior to the Share Exchange, 3,094,297 restricted shares of our common stock then outstanding were cancelled and retired, so that immediately prior to the Offering described in Item 3.02 of this Report, but immediately following the Spin-Out described under the heading “Reorganization and Spin-Out” of Item 1.01 of this Report, we had 18,844,000 shares of common stock outstanding. As a result of the reverse acquisition, Kirin China became our wholly owned subsidiary and the former shareholders of Kirin China became our controlling stockholders. The share exchange transaction with Kirin China was treated as a reverse acquisition, with Kirin China as the acquirer and the Company as the acquired party. Unless the context suggests otherwise, when we refer in this Report to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Kirin China, the Operating Companies and their respective consolidated subsidiaries.

Upon the closing of our reverse acquisition of Kirin China, Lisan Rahman resigned as a director and from all offices that he then held effective immediately. Also upon the closing of our reverse acquisition of Kirin China, our board of directors increased its size from one (1) to three (3) members and appointed Jianfeng Guo, Longlin Hu and Yaojun Liu to fill the vacancies created by the resignation of Mr. Rahman and such increase. In addition, our board of directors appointed Mr. Hu to serve as our President and Chief Executive Officer. On April 26, 2011, Mr. Liu resigned from our board of directors.

3

As a result of our acquisition of Kirin China, Kirin China became our wholly owned subsidiary and we have assumed the business and operations of Kirin China and its subsidiaries.

Overview of Kirin China

Kirin China is a private real estate development company focused on residential and commercial real estate development in “tier-three” cities in the PRC. Tier-three cities are provincial capital cities with ordinary economic development and prefecture cities with relatively strong economic development. Kirin China’s projects are currently concentrated in Hebei Province of the PRC, primarily in the city of Xingtai, and nearby regions. Hebei Province is located in the North Region of the PRC. Kirin China intends to also focus on the Bohai Sea Surrounding Area, which comprises Beijing, Tianjin, Hebei Province, Liaoning Province and Shandong Province.

The Operating Companies’ revenue increased 123.54% for the fiscal year ended December 31, 2010 compared to the fiscal year ended December 31, 2009, mainly due to sales attributable to the Kirin County Project, a building complex of residences, commercial buildings and hotel-style apartments which commenced in September 2009. The Kirin County Project has a total construction area of approximately 180,000 square meters. As of December 31, 2010, we have completed 71.2% of the construction of the Kirin County Project. Kirin China generated approximately $51.34million in sales, and approximately $20.89million in after-tax income for the fiscal year ended December 31, 2010. The net proceeds from the Offering will primarily help to support our expansion strategy.

Organization & Subsidiaries

Our wholly owned subsidiary, Kirin China owns all of the share capital of Kirin Development. Kirin Development owns all of the share capital of Kirin Management, a wholly foreign owned enterprise located in Shijiazhuang City, Hebei Province. In anticipation of the Share Exchange, on December 22, 2010, Kirin Management entered into a series of contractual arrangements, including an Entrusted Management Agreement, a Shareholders’ Voting Proxy Agreement and an Exclusive Option Agreement, with each of Hebei Zhongding and Xingtai Zhongding and their respective shareholders (the “Contractual Arrangements”). As a result of the Contractual Agreements, Kirin Management controls, and is entitled to the economic benefits of, Hebei Zhongding and Xingtai Zhongding. In turn, Iwamatsu Reien, the sole shareholder of the BVI Companies (as defined below), which are our principal stockholders, has entered into the Call Option Agreements with the Option Holders (as defined below) including Mr. Jianfeng Guo, the beneficial owner of Hebei Zhongding and Xingtai Zhongding, granting an option to the Option Holders to purchase all of the shares of the BVI Companies. Other than the parties thereto, the terms and conditions of the Contractual Arrangements entered into with Hebei Zhongding and the terms and conditions of the Contractual Arrangements with Xingtai Zhongding are the same. The following is a summary of each of the Contractual Arrangements:

|

·

|

Entrusted Management Agreement. Pursuant to the Entrusted Management Agreement between Kirin Management, the Operating Companies and the shareholders of the Operating Companies, the Operating Companies and their shareholders agreed to entrust the business operations of the Operating Companies and its management to Kirin Management until Kirin Management acquires all of the assets or equity of the Operating Companies. Kirin Management has the full and exclusive right to manage and control all cash flow and assets of the Operating Companies and to control and administrate the financial affairs and daily operation of the Operating Companies. In exchange, Kirin Management is entitled to the Operating Companies’ earnings before tax as a management fee which depends on the before-tax profit of the Operating Companies and does not have a minimum requirement. No management fee has been paid to date. Kirin Management is also obligated to pay all of the Operating Companies’ debts to the extent the Operating Companies are unable to pay such debts. Specifically, if the Operating Companies do not have sufficient cash to repay their debts when they become due and are unable to obtain any extension of, or borrow new loans to repay, such debts, Kirin Management will be responsible for paying those debts on behalf of the Operating Companies to the extent that the Operating Companies are unable to pay such debts. Likewise, if the Operating Companies’ net assets are lower than their registered capital, Kirin Management will be responsible for funding the deficit. The Entrusted Management Agreement does not specify how Kirin Management and the Operating Companies will determine Operating Company debt and the respective Operating Companies’ ability to pay that debt. There is no existing written or oral arrangement or agreement regarding any aspect of the calculation or payment of the debts of the Operating Companies except the Entrusted Management Agreement. Due to the lack of binding guidance as to such matters, there may be ambiguity in the future regarding Kirin Management’s responsibility to pay the debt obligations of the Operating Companies. To date, Kirin Management has not paid any of the Operating Companies’ respective debts.

|

4

|

·

|

Shareholders’ Voting Proxy Agreement. Pursuant to the Shareholders’ Voting Proxy Agreement between Kirin Management and the shareholders of the Operating Companies, the Operating Companies’ shareholders irrevocably and exclusively appointed the board of directors of Kirin Management as their proxy to vote on all matters that require the approval of the Operating Companies shareholders. Mr. Guo is the sole member of the board of directors of Kirin Management.

|

|

·

|

Exclusive Option Agreement. Under the Exclusive Option Agreement between Kirin Management, the Operating Companies and the shareholders of the Operating Companies, the Operating Companies’ shareholders granted to Kirin Management an irrevocable exclusive purchase option to purchase all or part of the shares or assets of the Operating Companies to the extent that such purchase does not violate any PRC law or regulations then in effect. If Kirin Management exercises its option, Kirin Management and the Operating Companies’ shareholders shall enter into further agreements regarding the exercise of the option, including the exercise price, which such additional agreements shall take into consideration factors such as the then applicable PRC laws and the then appraisal value of the Operating Companies. The exercise price shall be refunded to Kirin Management or the Operating Companies at no consideration in a manner decided by Kirin Management, in its reasonable discretion. Since Kirin Management controls and receives the economic benefits of the Operating Companies through the Contractual Arrangements, exercising the option at this point will not result in any immediate additional benefit to the Company. Kirin Management will exercise the option when the Company believes that exercising the option would be more beneficial to it. The Exclusive Option Agreement was set up in this manner as currently foreign invested real estate enterprises are strictly controlled and heavily regulated by the PRC authorities. The Company thinks it will be subject to complex procedural requirements if it attempts to obtain approval for the acquisition of share equity or assets of the Operating Companies under the current PRC regulations.

|

The Company does not own any equity interests in the Operating Companies, but controls and receives the economic benefits of their business operations through the Contractual Arrangements. In addition, the Operating Companies are contractually controlled by the Company. Accordingly, the Company is able to consolidate the Operating Companies’ results, assets and liabilities into its financial statements. No dividends have been paid to us to date. We intend to use the profits of the Operating Companies for re-development of planned projects and future procurement of land use rights. We do not anticipate that the Operating Companies will pay any dividends in the near future. Xingtai Zhongding and Hebei Zhongding represent 93.62% and 6.38%, respectively, of the Company’s revenue.

Direct acquisition of the Operating Companies by us would constitute a round-trip investment under the 2006 M&A Rule (please see “Government Regulation and Approvals — Mergers and Acquisitions” below). In addition, the PRC has imposed strict regulations on foreign investment in PRC real estate development enterprises. We believe that complex procedural requirements, including examination by governmental authorities, would likely follow any attempt by the Company to obtain approval for the direct acquisition of the share equity or assets of the Operating Companies under current PRC regulations. Accordingly, we established Kirin Management as our wholly owned subsidiary and adopted the Contractual Arrangements to control and consolidate the Operating Companies for the purpose of obtaining financing from outside the PRC.

We intend to use the proceeds from our private placement and potential future offerings to pay the financial expenditures of our offshore holding companies. As a holding company, neither Kirin International Holding, Inc. nor Kirin Huaxia Development Limited has material expenditures. Kirin Management has not received any cash or assets from the Operating Companies but has the right to obtain management fees equal to the profit of the Operating Companies in 2011. All significant costs and expenses occur in the Operating Companies.

5

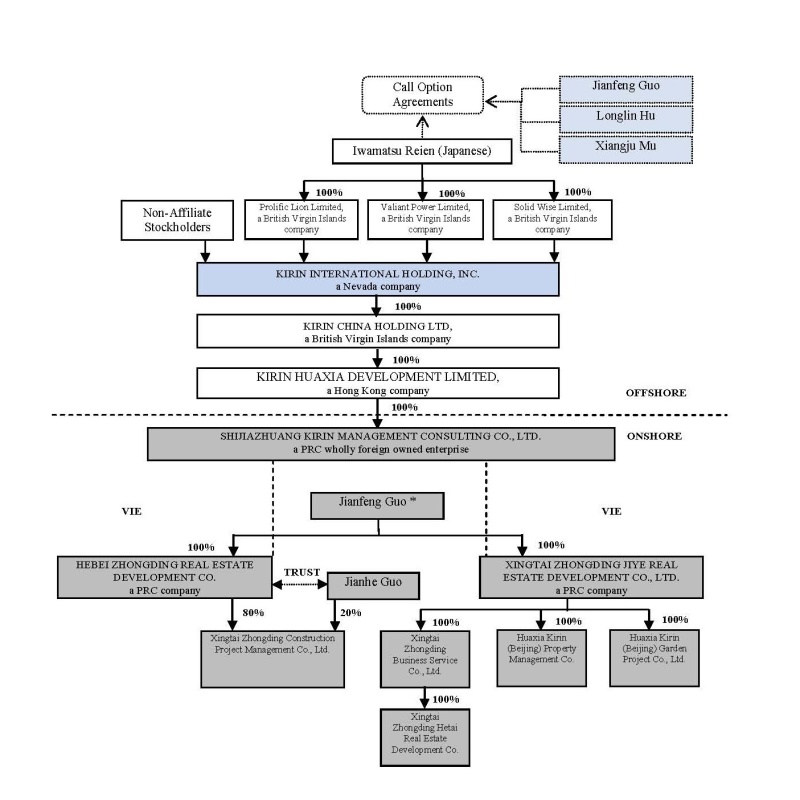

Our corporate structure is as follows:

* Mr. Jianfeng Guo is deemed to be the sole beneficial owner of all of the equity interests in and is the founder of the Operating Companies. Mr. Guo has entered into trust agreements with respect to his holdings in each of the Operating Companies, pursuant to which Mr. Guo is entitled to all rights afforded to a shareholder of the Operating Companies, including the right to manage and operate the Operating Companies, to receive dividends, and bear the risks of a shareholder of the Operating Companies. Without Mr. Guo’s prior written consent, the nominees may not take any action as shareholders of the Operating Companies. Mr. Guo entered into the trust agreements for several reasons. First, when Hebei Zhongding was established in 2004, the then applicable Company Law of the PRC did not allow a company to be wholly owned by a sole shareholder unless it was a state owned company. Consequently, Mr. Guo used Ms. Bi, his wife, and other individuals and entities as the nominal shareholders to hold the equity interest of the Operating Companies. Although the revised Company Law of the PRC, effective as of 2006, permits a company to be owned by a sole shareholder, the registered shareholding structure of Hebei Zhongding was not changed in order to meet the financing requirements by our lenders. Second, the current effective Company Law of the PRC does not allow a domestic company that is owned by a sole individual shareholder to have any wholly owned subsidiaries. However, Xingtai Zhongding has three wholly owned subsidiaries. Consequently, Mr. Guo uses other nominal shareholders to hold part of the shares of Xingtai Zhongding. Third, the Operating Companies from time to time provide guarantees to each other for bank loans and the bank will not accept guarantees from the company if the registered controlling shareholder is also the borrower’s registered controlling shareholder. For all these reasons Mr. Guo entered into the trust agreements with the nominal shareholders. Through these trust agreements, Mr. Guo had the registered shareholders of the Operating Companies enter into Contractual Arrangements with Kirin Management. Mr. Guo did so because he stands to benefit from the Contractual Arrangements due to the option to acquire Prolific Lion, the principle shareholder of the Company. With respect to Hebei Zhongding, Mr. Guo has entered into trust agreements with each of Liping Bi, Jianfei Guo, Li Zhao, Jianhe Guo and Liying Li (collectively, the “Hebei Zhongding Trustees”). The Hebei Zhongding Trustees comprise all of the registered shareholders of Hebei Zhongding. With respect to Xingtai Zhongding, Mr. Guo is the 51% registered shareholder. In addition, Mr. Guo has entered into trust agreements with each of Xie Yuelai and Huaxia Kirin (Tianjin) Equity Investment Fund Management Co., Ltd., a company controlled by Mr. Guo (collectively, the “Xingtai Zhongding Trustees”). The Xingtai Zhongding Trustees are the 49% registered shareholders of Xingtai Zhongding. Among these nominal holders of the Operating Companies, Huaxia Kirin (Tianjin) Equity Investment Fund Management Co., Ltd. is a company controlled by Mr. Guo, while the other individual nominal holders are family members or friends of Mr. Guo, who are willing to hold the shares in a nominal fashion for him. Pursuant to these trust agreements, Mr. Guo is deemed to be the beneficial owner of all the shares of Hebei Zhongding registered in the name of the Hebei Zhongding Trustees and Xingtai Zhongding registered in the names of the Xingtai Zhongding Trustees. Pursuant to the trust agreements, Mr. Guo is entitled to all rights of a shareholder of each of the Operating Companies. Without Mr. Guo’s prior written consent, the nominees may not take any action as shareholders of the Operating Companies. There is no requirement under the PRC laws and regulations to register such trust agreements with any authority.

6

Iwamatsu Reien, a Japanese citizen, holds 100% of the shares of Prolific Lion Limited, Valiant Power Limited and Solid Wise Limited, each of which were incorporated in the British Virgin Islands (each a “BVI Company” and collectively the “BVI Companies”) and which respectively own 72.3%, 8.7% and 8.7% of the shares of the Company. The Company owns all the share capital of Kirin China. Kirin China owns all of the share capital of Kirin Development which in turn owns all of the share capital of Kirin Management, a wholly foreign owned enterprise in the PRC. Kirin Management controls and receives the economic benefits of Operating Companies’ business operations through the Contractual Arrangements. Through the Call Option Agreements (as defined below) Iwamatsu Reien has granted options to the Option Holders (as defined below) to purchase all of the shares of the BVI Companies. Each Option Holder shall be deemed to be the beneficial owner of the applicable BVI Company.

In order to avoid conflict with SAFE 75 Circular, which has certain restrictions on PRC residents to obtain overseas shares, on December 22, 2010, Iwamatsu Reien entered into Call Option Agreements (collectively, the “Call Option Agreements”) with each of Mr. Guo, Mr. Longlin Hu and Ms. Xiangju Mu (collectively, the “Option Holders”) pursuant to which Mr. Guo is entitled to purchase up to 100% shares of Prolific Lion Limited, Longlin Hu is entitled to purchase up to 100% shares of Valiant Power Limited and Xiangju Mu is entitled to purchase up to 100% of the shares of Solid Wise Limited, each at a nominal price of $0.0001 per share for a period of five years upon satisfaction of certain conditions, which such conditions were designed to be easily met. Specifically, (i) if the Operating Companies and their respective subsidiaries achieved net income of $1 million as calculated and audited in accordance with U.S. GAAP for the fiscal year ended December 31, 2009, each Option Holder will be entitled to purchase 40% of the outstanding shares of the applicable BVI Company; (ii) if the Operating Companies and their respective subsidiaries achieve net income of $2 million as calculated in accordance with U.S. GAAP for the fiscal year ended December 31, 2010, each Option Holder will be entitled to purchase 30% of the outstanding shares of the applicable BVI Company; (iii) if the Operating Companies and their respective subsidiaries achieve net income of $3 million in accordance with U.S. GAAP for the fiscal year ended December 31, 2011, each Option Holder will be entitled to purchase up to 30% of the remaining outstanding shares of the applicable BVI Company. In addition, the Operating Companies and their respective subsidiaries achieve net income of $3 million in fiscal year 2010, each Option Holder shall have the right to purchase all shares of the applicable BVI Company at consideration of $1.00 and the third condition shall be deemed as having been met. The Company has determined that the Operating Companies and their respective subsidiaries achieved net income of $3 million in fiscal year 2010 and therefore Mr. Guo, Mr. Hu and Ms. Mu have the right to purchase all of the shares of the applicable BVI Company.

Ms. Reien is the sole shareholder of the BVI Companies. Ms. Reien also established the BVI entities. Kirin China was established on July 6, 2010 and on July 27, 2010 Kirin China established Kirin Huaxia Development Limited under the laws of Hong Kong. Ms. Reien is a friend of Mr. Guo and established Kirin China for the Option Holders to comply with SAFE Circular 75 in anticipation of share exchange transaction with us. At the time of Kirin China’s formation, it was understood that Ms. Reien would enter into the Call Option Agreements with the Option Holders prior to the share exchange transaction. Under the Call Option Agreements, Ms. Reien acts as the nominee for the Option Holders. Accordingly, Mr. Guo, Mr. Hu and Ms. Mu have the right to direct the vote of the applicable BVI Companies and are deemed to beneficially own the shares of the Company’s common stock owned by the BVI Companies. Mr. Reien and each of the Option Holders serve as the directors of the respective BVI Company. Mr. Guo and Mr. Hu constitute the board of directors of Kirin China and Kirin Huaxia Development Limited. Additionally, Mr. Guo and Mr. Hu are the acting Chairman and CEO, respectively, of the Operating Companies. Ms. Reien does not and will not engage in the management or operation of any of the BVI Companies or Kirin China or any of the subsidiaries of Kirin China. Ms. Reien has not and will not receive any consideration for entering into the Call Option Agreements.

7

Market Area and Projects

Kirin China’s projects are currently concentrated in Hebei Province of the PRC, primarily in the city of Xingtai, and nearby regions. Hebei Province is located in the North Region of the PRC. Kirin China intends to also focus on the Bohai Sea Surrounding Area, which comprises Beijing, Tianjin, Hebei Province, Liaoning Province and Shandong Province. The following map shows the region in which Kirin China currently operates:

Completed Projects

Kirin China has completed the following projects in Xingtai City (denoted by the red star in the map above):

|

·

|

Ming Shi Hua Ting. Ming Shi Hua Ting is a residential center comprised of two residential buildings with between 14 and 19 floors each and eight residential buildings with six floors each. This project was developed in 2002 and targeted homebuyers with middle to high income. The total construction area consisted of 109,260 square meters.

|

|

·

|

Wancheng New World Commercial Center. Wancheng New World Commercial Center is primarily a commercial and business center which includes a shopping center, restaurants, recreation facilities, entertainment and tourist attractions. The project also included over 300 residential properties. The total land area for this project was 57,000 square meters. The project commenced construction in 2007 and has been in service since June 2009. The Company’s Wancheng New World Commercial Center Project is also known as the Xintiandi Project.

|

|

·

|

Kirin County Community. Construction on Kirin County Community commenced in September 2009 and was 71.2% completed by December 31. 2010. This project covers land area of 47,900 square meters. Total construction area is approximately 180,000 square meters and is comprised of residences, commercial buildings and hotel-style apartments.

|

Planned Projects

Kirin China’s project pipeline includes the Kirin Bay and No. 79 Courtyard projects, each of which are located in Xingtai City. Kirin China expects to commence presales for these projects in the first quarter of 2011.

|

·

|

Kirin Bay. Covering a land area of over 660,000 square meters, Kirin China expects that Kirin Bay will be the largest high-end residential community in Xingtai in terms of total construction area upon completion. The project is comprised of three sections of mixed residential and commercial properties. We expect to commence the construction of the Kirin Bay Project in June 2011. The first phase residences are expected to be delivered by the end of 2013 while final phase residences are expected to be delivered in May 2015.

|

|

·

|

No. 79 Courtyard. No. 79 Courtyard Project covers a land area of over 290,000 square meters and a total building area of approximately 450,000 square meters. The project is positioned as a high-end residential development with some mixed commercial use. Construction is expected to start in June 2011 and project completion is planned for the last quarter of 2014. The first phase residences are expected to be delivered by the end of 2012 while the final phase residences are expected to be delivered in January 2015.

|

In addition to its projects in Xingtai, Kirin China has started gaining knowledge on property conditions and related land and development approval procedures in Shijiazhuang of Hebei Province and in Dezhou and Zibo of Shandong Province (as denoted by the blue stars on the map above).

Kirin China’s Homebuyers

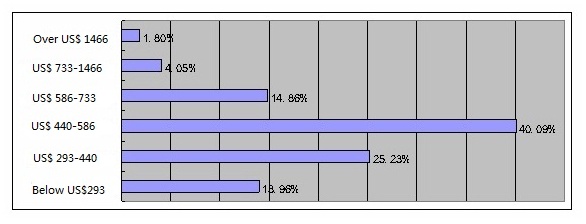

Kirin China markets its residential properties to local PRC homebuyers with $302 to $756 in monthly earnings, which is regarded in the PRC as middle to high income. Kirin China believes that its homebuyers have high expectations about the quality of their residences, the overall community environment and surrounding amenities and developments. Kirin China also believes that its homebuyers’ purchase decisions significantly influence the decisions of others in their same social status. Kirin China’s homebuyers are mainly comprised of young families who are buying due to family growth or increased income.

8

The following chart shows the household monthly incomes of homebuyers who purchased residences from Kirin China between December 2009 and June 2010:

The following chart shows the ages of homebuyers who purchased residences from Kirin China between December 2009 and June 2010:

The following chart shows that first time homebuyers comprised Kirin China’s largest customer segment during the period from December 2009 to June 2010:

Kirin China believes that its homebuyers are primarily motivated by the need for housing condition improvement, or “move-up” housing, from rentals or shared living arrangements with relatives to a place of their own.

9

Commercial Properties

The commercial properties developed by the Company include: Wancheng New World Commercial Center, which achieved sales revenue of approximately $30.16 million, accounting for 65% of total sales of the Company during 2007 and 2008. Profits realized were approximately $4.16 million. The properties include: commercial business center and commercial residence.

Main purchasers of the commercial stores of Wancheng New World Commercial Center are entrepreneurs and investors with substantial purchasing power who live in Xingtai city or a nearby city; government officers, public servants, real estate speculators and a variety of well-known restaurants, banks, and companies in telecommunication, advisory, advertisement, and finance sectors.

Sales and Marketing

Most projects commence sales before construction begins. Typically, the first step in the sales process occurs when the homebuyer visits a sales office and decides to purchase a particular residence. The potential homebuyer then signs a binding agreement of sale for a particular residence and pays a cash down payment, which is generally non-refundable. Cash down payments currently average between 30-50% of the total purchase price of a residence, although, in some cases homebuyers elect to pay the entire purchase price at this point. When construction on the residence is complete and upon payment by the homebuyer of the remaining balance of the purchase price, if any, the residence is delivered to the homebuyer. The sales process for commercial properties is substantially similar, although commercial purchasers typically pay a higher cash down payment.

When demand is particularly high for a project, potential homebuyers seeking to signify their interest in purchasing a residence, but who may not know which particular residence they wish to purchase, will first pay refundable cash deposit typically between $756 and $3,024. If the homebuyer does not elect to purchase a residence, this initial deposit will be refunded. If the homebuyer ultimately selects a particular residence, the initial deposit will be applied to the cash down payment due upon entry into a binding agreement for that residence.

In order to attract homebuyers, Kirin China engages professional design companies to assist with project design and promotion. Dedicated sales offices are also established for each specific project. Promotional flyers, presentation boards, video clips, websites, and 3D photo displays are used to demonstrate the expected construction layout. In addition, the following media are typically utilized to promote real estate projects:

|

·

|

Mainstream newspapers and magazines;

|

|

·

|

SMS text-messaging;

|

|

·

|

Outdoor advertisements;

|

|

·

|

Other promotional activities, which may include real estate exhibitions, outdoor dancing activities, free movies in target communities and residents’ badminton competitions.

|

To help customers choose among the apartment layouts that we offer, we usually create show rooms that demonstrate design possibilities. We pay for the completion of these marketing show rooms. After most of the units in the development have been sold, we sell the show rooms as residences, usually at premium prices.

Sales representatives are encouraged to take a proactive approach after promotions have been launched. Sales representatives usually visit nearby counties or city squares to distribute flyers advertising Kirin China’s communities. They are also encouraged to target and maintain contact with potential groups or organizations who have group purchasing intentions or that provide financial support for their employees to buy residences. Sales representatives receive commissions based on the amount of the purchase price once received by Kirin China. Commissions are paid in installments with 60% of the commission delivered upon execution of the presales agreement, 20% delivered upon execution of the definitive sales agreement and the remaining 20% upon delivery of the properties for occupancy.

10

Kirin China ordinarily launches several phases of sales for each project, but only provides a small proportion of residential units for sale in each phase. Kirin China believes that the sale of residences by phases reduces market risks since prices can be adjusted depending on demand and other economic factors. We have sold all commercial units of the Kirin County Project and approximately 73% of the residential units and 73.2% of the garages (in terms of construction area). We currently have 439 residential units, with a total construction area of about 42,390 square meters, and 95 garage units, with a total construction area of 3,305 square meters, remaining to be sold, representing approximately 25% of the Kirin County Project in terms of the total construction area.

Property Management Services

Kirin China provides property management services to its own communities. The basic services typically provided include security, clean environment preservation, flower and tree planting and community facilities maintenance. Kirin China charges the residence owners a property management fee of $0.18 per square meter per month.

Land Resources Procurement

Kirin China’s ability to continue development activities over the long-term will be dependent upon, among other things, a suitable economic environment and its continued ability to locate and acquire land, obtain governmental approvals for suitable parcels of land, and consummate the acquisition and complete the development of such land. When identifying potential land resources for acquisition, Kirin China first attempts to determine if the target land resource complies with the general municipal plans of the government, whether the surrounding infrastructures are well established, whether there is any existing municipal construction plan, the scale of influence of the project with respect to its neighbors and if the purchasing power of the surrounding population can afford the prices at which Kirin China may expect to sell the properties. Next, Kirin China considers if the initial property development cost is affordable for it, if there is any governmental tax deduction policy and if the project can become a signature project for the local government. Kirin China obtains land resources by participating in public tender, auction, and listing for sales of land. In addition, Kirin China may seek to acquire land rights that are sold in connection with the restructuring of state-owned enterprises or the military. The price and location of land resources that are state-owned or owned by the military are generally superior to private properties.

Regulations in the PRC now provide that all land use rights are granted by way of a public auction held by the land reserve administration of the applicable local government. The auction begins with the local government’s publication of an invitation to bid on a particular parcel of land. Bids must be submitted on or before the bid deadline date. Bids submitted by developers in accordance with bid procedures and deadlines are then evaluated, together with the qualifications of the developers, by the applicable land reserve administration. Bidders who do not meet all of the qualification requirements are disqualified. On the day following the closing date of the auction, an auction winner will be confirmed. The winning bidder and the transferor will enter into a confirmation agreement. Within ten days after the execution of the confirmation agreement, the winning bidder will enter into a “Land Use Rights Transfer Agreement” with the transferor and is required to make a lump sum payment of the transfer fees within two months. The process for acquisition of land resources from state-owned enterprises and the military is similar, except that the governing entities for military-owned properties are the military land management bureaus and their superior supervising authorities.

We also participate in government-dominated relocation programs, such as Kong Village Relocation Program to procure land use rights. In relocation programs, the local government takes the land from the local residents as a land reserve for a future auction and bidding process and relocates the residents. We participate in and fund such programs as a partner of the government and obtain the land use right by being invited to the auction and bidding of such land use rights. In the case of Kong Village Relocation Program, the local government did not have enough funds to pay for the relocation and new accommodations for the villagers, therefore the Company funded the local government by building new buildings as accommodation compensation for the villagers as well as bearing the costs incurred by local government compensating villagers and the zoning and developing of vacated land lots. The government will repay our costs when it sells the concerning land use right. In exchange for such financing, we will be invited to bid for the vacated land parcels for residential and commercial use at public auction at market price, and in return for our financing, the proceeds paid by the Company and received by the government the bidding will be refunded to the Company. For more details please refer to “Management Discussion and Analysis—Relocation Program of Kong Village.”

PRC Real Estate Market Overview

Future Development Trends and Regulations of the Real Estate Industry in the PRC

According to the China Daily, the PRC will surpass both the UK and Japan to be the world’s second largest property investment market by 2011, reports international real estate service provider DTZ. Data from real estate consultancy CB Richard Ellis shows that the value of property transactions in 15 Chinese cities hit approximately $7.36 billion during the first six months of 2010. Of this, approximately $2.86 billion came from foreign institutional investors, $1.5 billion from Hong Kong, Taiwan and Macao, and the remaining approximately $2.99 billion from mainland investors.

As reported in the Wall Street Daily, Chinese home-buying activity surged 82% in 2009, and house prices rose 24% nationally. These price increases put the average Beijing apartment at 15 times the typical resident’s annual income and national prices at 10 times the median annual household income. This is far above comparable ratios in the United States where home prices stand at about three and a half times the median annual household income.

11

With the urbanization process, more and more people immigrate to the cities from rural areas of the PRC, such that the boundaries of cities are extending gradually and the urban areas are experiencing rapid development. As the real estate markets in tier-one cities, such as Beijing, have experienced rapid growth in the past five years, Kirin China believes that the development potential for tier-two and tier-three cities is substantial. The Company expects that the real estate markets for tier-two and tier-three cities will expand significantly in the near future due to a variety of factors including the further development of urbanization and the immigration of rural populations into the tier-two and tier-three cities which we believe will result in a growing demand. In addition, China is generally expected to be the second largest real estate investment market by 2011. Since the real estate markets for tier-one cities have almost reached their limits, we believe investment will be directed to tier-two and tier-three cities.

The per capita consumption of a city indicates the purchasing power of its residents. The purchasing power growth in tier-three cities is faster than overall purchasing power. China’s average growth of per capita consumption was 9.09% in 2008 while the growth in tier-one cities such as Beijing and Shanghai was below that average. Many tier-three cities in cities such as Dali in Yunnan, Nanchong in Sichuan, Nanchang in Jiangxi, Taizhou in Zhejiang and Weihai and Dezhou in Shandong exceeded the average, indicating higher real estate purchasing power (from Dongxing Securities Industry Report). We believe this indicates that purchasing power in tier-three cities is growing at a faster rate than it is in tier-one cities.

In 1980, a mere 19.8% of the population in China was urban and by the end of 2008, the urbanization rate had reached 45.7%. According to a report by BNP Paribas (BNPP), China’s urbanization rate should reach 60% by 2020 as shown below:

Similarly, it is predicted that the country’s urbanization rate will hit 52 percent in 2015 and grow to 65 percent by 2030 from the annual report on urban development by the Chinese Academy of Social Sciences (CASS). According to McKinsey in the Preparing for China’s Urban Billion report in March 2008, 350 million people will be added to China’s urban population by 2025—more than the population of today’s United States. One billion people are expected to live in China’s cities by 2030 and 221 Chinese cities are expected to have over one million residents. Five billion square meters of road are expected to be paved, 170 mass transit systems could be built and 40 billion square meters of floor space could be built—in five million buildings. More than half of China’s population today is still rural. With an ongoing flow of workers from the countryside into the cities, officials estimate prospective housing needs for 400 million new urban dwellers over the next 25 years.

The PRC real estate market is strictly controlled by the PRC government and, currently, real estate development companies in tier-one cities are experiencing difficulties as a result. To control the price of real estate, restrict speculation and break the isolated bubbles in the PRC real estate market, the PRC government has tightened its credit loan policies and land right acquisition regulations in tier-one cities. Accordingly, real estate development has begun to focus on tier-two and tier-three cities. Real estate developers in tier-two and tier-three cities are expanding and the PRC’s focus for real estate development has moved on from tier-one cities to tier-two and tier-three cities in response to the urbanization of China and the movement of its population.

The PRC’s Central Economic Conference at the end of 2009 and the “Document No. 1” released by the State Council in 2010 pointed out that the central government was emphasizing the urbanization of medium and small cities and small towns in China, with the purpose to alleviate the over-populated tier-one cities and to resolve the imbalanced development between urban and rural areas. For overall planning, the PRC government has shown its determination to develop small- and medium-sized cities and related authorities have released favorable policies for tier-two and tier-three cities. The PRC’s Ministry of Land and Resources has begun to prioritize the land rights approval processes for real estate projects in tier-two and tier-three cities. The land rights acquired in tier-two and tier-three cities totaled 62.23 million square meters in 2009, compared to 4.83 million square meters in tier-one cities, as indicated by China’s National Bureau of Statistics.

Real estate developers have been finding it difficult to obtain easy financing for their projects due to the recent strict credit loan policies for both developers and buyers. Many of them have subsequently turned to high-cost financing, with interest rates ranging from 12 to 16 percent, compared with the benchmark rate of 5.31 percent for one-year loans as indicated in a report by China Daily.

12

Foreign investors account for a small proportion of the real estate market. According to the National Bureau of Statistics, foreign investors put approximately $4.45 billion into the realty sector during the first seven months of 2010, a 10.6 percent growth over the same period in 2009. UBS Global Asset Management announced in April 2010 that it had successfully concluded the first closing of its joint-venture with Gemdale Corporation, a leading listed real estate developer in China. It will invest in residential development projects in First Tier and selected Second Tier cities in China. In mid-March 2010, China Overseas Land & Investment Ltd., together with ICBC International Investment Management Ltd., set up a $250 million real estate fund to invest in China’s property market.

According to the Wall Street Daily, one-quarter of Chinese homebuyers pay cash, and, on average, mortgages cover only half the property’s value. Household debt in China amounts to approximately 40% of household incomes.

Market Overview of Xingtai

According to a report from the China Daily, the total housing supply in Xingtai was 1.1 million square meters in 2005 and 1.5 million square meters in 2006; due to the macroeconomic control policy specified by the state, the housing supply shrank slightly to 1.1-1.3 million square meters in 2007 and the housing supply in 2008 was 1.5-1.8 million square meters.

With the development of its local economy, since 2006 an increasing number of residents of other regions of China have been immigrating to Xingtai, which has increased housing demand. Kirin China expects this trend in increased immigration to Xingtai to continue in the near future.

As of the end of 2009, the core urban population of Xingtai was 578,700 and its total residential area was approximately 14.06 million square meters. As such, the per capita residential area in Xingtai city was 24 square meters as of the end of 2009. According to the national “well-off” standards published by the PRC’s Department of Construction, by 2020, the average living area for urban population is expected to reach 35 square meters with an average floor area of 100 to 120 square meters for each residence. Kirin China believes the anticipated shortage in average living area per person in Xingtai necessary in order to meet the “well-off” standard indicates significant development potential.

Xingtai can be generally divided into two parts: Qiaodong District (i.e. East of Bridge) and Qiaoxi District (i.e. West of Bridge). The Qiaodong District is the old city area which features transportation, concentrated retail trading areas, aged buildings and a highly polluted environment. Currently, the scale of real estate development in this region is small and scattered due to high relocation costs. The quality of real estate is also low and the buildings are mostly mid-rise. Qiaoxi District, on the contrary, is the region being promoted by the local Xingtai government for development. Qiaoxi District is anticipated to be the center of the new urban area, as planned by the Xingtai government. In the first half of 2007, the price of a residence in Qiaoxi District surged significantly, with $381 to 433 per square meter as the main pricing range. The average price for a residence was $476 per square meter in 2009 with higher prices in the northeast part of Qiaoxi District, at approximately $511 to 614 per square meter.

The central bank in China is currently reinforcing strict real estate development regulations and emphasizing stringent credit loan policies, which has already had a negative impact on the real estate market. These actions may serve to hinder the development of smaller real estate companies with rigid cash flows and small amounts of capital, leaving growth space for larger, better capitalized companies.

Market Overview of the Bohai Sea Surrounding Area

Kirin China plans to expand its operations to the Bohai Sea Surrounding Area. Located in the center of Northeast Asia economic zone area with abundant resources and convenient transportation, the Company believes that the Bohai Sea surrounding region has great geographical strength. The National Bureau of Statistics data indicated a new trend that home and abroad foreign investment flows from the south to the north of China in recent years. The cities and sub-regions of the Bohai Sea Surrounding Area, such as Beijing, Tianjin Region, the Shandong Peninsula and Northeast regions are considered to be the “growth pole” of China’s next round of development following the development of the Pearl River Delta and Yangtze River Delta region. In the near future, we believe that the Bohai Sea Surrounding Area will enter into a sustainable and rapid growth track.

The cities in Bohai Sea Surrounding Area vary with respect to the economic development degree. The large and well developed cities in this area with mature markets, such as Beijing and Tianjing, have a declination in gross floor area and sale of real estate due to the strict real estate control policies. However, the second and third tier cities in this area still have a rapid growth rate in real estate development. Economic investment and development in this area, which is adjacent to Xingtai, is increasing. Investments in the real estate markets of Qinhuangdao, Tianjin and Tangshan increased by 30%-67% in 2009 according to the PRC’s Ministry of Land and Resources. Commensurate with an increase in investment, the price of residential real estate is has also increased.

13

In recent years, many large national real estate developers have begun to enter the market of Bohai Sea Surrounding Region as increasing land reserves and accelerating development of the market provide more opportunities. Compared with the Pearl River Delta region and Yangtze River Delta region, we believe that the Bohai Sea Surrounding Area has greater market demand and more opportunities. The growth rate of wholesale real estate prices in the Bohai Sea Surrounding Area is stable. As shown in the below chart of land use right procurement costs, in 2009, the land cost in Bohai Sea Surrounding Area is $424 per square meter, which is higher than the national average land cost $388 per square meter, but much lower than the Yangtze River Delta and Pearl River Delta. The cost of land right procurement in the Bohai Sea Surrounding Area is 19% lower than in the Pearl River Delta and 42% lower than in the Yangtze River Delta Regions. The overall growth rate of land right procurement has declined from 6.02% in 2008 to 2.83% in 2009. As depicted in the chart of growth of land use right procurement, the 2009 growth rate was lower than the average annual growth rate of 5.05% of 105 cities in China. We believe that this indicates potential for real estate development and profit generation in this area. The following are the land right procurement costs and growth rates in the Bohai Sea Surrounding Area for 2009.

The scale of residence paying capability (real estate price/household paying capability) demonstrates the ability of consumers to purchase houses. The overall rational scale on an international scope is within the range of 3-6 and the scale in China is higher due to its special housing system, hidden income and solid housing demand, according to Real Estate Bubble and Financial Crisis, authored by Xie Jinglai and Qu Bo in 2002.

As shown in the following chart, except Beijing and Dalian, the house price growth of other cities in the Bohai Sea Surrounding Region is stable, and with the economic development of the Bohai Sea Surrounding Area, the income level has increased and the scale is decreasing gradually. However, most of the sales are over 6 and Beijing and Dalian have shown scales of over 11, which indicate bubbles in their real estate markets.

Price of Private Residence / Private Residence Paying Capability Scale in the Bohai Sea Surrounding Area (US $/multiple)

|

Year

|

Beijing

|

Tianjin

|

Shenyang

|

Dalian

|

Jinan

|

Qingdao

|

Shijiazhuang

|

|||||||||||||||||||||

|

1999

|

682/20.50 | 272/9.81 | 337/12.78 | 281/12.37 | 214/8.24 | 216/8.20 | 232/10.46 | |||||||||||||||||||||

|

2000

|

594/15.84 | 281/9.53 | 324/11.17 | 315/12.67 | 220/7.18 | 221/7.61 | 208/8.92 | |||||||||||||||||||||

|

2001

|

612/14.57 | 287/8.84 | 331/10.47 | 338/12.59 | 240/7.69 | 239/7.54 | 235/9.55 | |||||||||||||||||||||

|

2002

|

576/12.74 | 300/8.88 | 331/10.47 | 343/11.56 | 254/7.80 | 264/8.36 | 219/8.34 | |||||||||||||||||||||

|

2003

|

572/11.37 | 304/8.14 | 352/9.65 | 353/10.70 | 281/7.04 | 291/7.96 | 191/6.81 | |||||||||||||||||||||

|

2004

|

611/10.77 | 376/9.05 | 352/8.75 | 376/10.01 | 369/8.49 | 358/8.92 | 187/5.98 | |||||||||||||||||||||

|

2005

|

841/12.82 | 502/10.69 | 395/8.22 | 464/10.41 | 388/8.48 | 464/9.66 | 232/6.21 | |||||||||||||||||||||

|

2006

|

1060/13.82 | 611/11.14 | 432/7.34 | 579/11.30 | 448/8.38 | 545/9.25 | 261/5.92 | |||||||||||||||||||||

|

2007

|

1582/17.51 | 796/11.84 | 506/6.91 | 762/12.28 | 517/6.99 | 712/9.71 | 336/6.19 | |||||||||||||||||||||

14

Note: Residence Paying Capability Scale = Sales Price Per Square Meter/Disposable Income Per Household. Sales price is assumed as 100 square meters per suite and a household is assumed to comprise three (3) family members.

Features of Real Estate Markets in Tier-Two and Tier-Three Cities

Kirin China believes that the PRC’s tier-three cities have long term earning potential for investment, particularly since tier-one cities have already experienced high growth in the past few years. Kirin China believes that with continued urbanization and improved living standards, the demand in tier-three cities for high quality, high-end buildings is increasing. Kirin China believes that tier-three cities are at the frontier of the continued future urbanization and will benefit from the economic growth in China.

Growth potential of real estate markets in tier-two and tier-three cities

Real estate development potential has shifted to tier-two and tier-three cities and to medium and small cities. The No 1 Documents from the PRC central government pointed out that medium and small cities and towns will be the focus of China’s economic development. The PRC Ministry of Land and Resources indicated that it would prioritize approvals of real estate projects in tier-two and tier-three cities.

Higher profit margins in tier-two and tier-three cities

Kirin China believes that the price growth potential in the tier-two and tier-three segments is high while investment costs, especially land costs, are low. Investment return in tier-two and tier-three cities is no less than 30% and operational costs are comparatively low, according to the “2009 Analysis Report on Real Estate Prices in Major Chinese Cities” as published by the Ministry of Land and Resources of the PRC.

Competition

The real estate development industry in the PRC is highly competitive. In the tier-three cities Kirin China focuses on, local and regional property developers are its major competitors. Many of Kirin China’s competitors are well capitalized and have greater financial, marketing, and other resources than Kirin China has. Some also have larger land banks, greater economies of scale, broader name recognition, and a longer track record in certain markets. In certain markets, we believe our competition benefits from more established relationships, but differences between the Company and our competition’s relationships are divided geographically and vary by city, quality, and scope. As such, these comparisons are limited to specific instances. In addition, the PRC government’s recent measures designed to reduce land supply further increased competition for land among property developers.

Competition among property developers may result in increased costs for the acquisition of land for development, increased costs for raw materials, shortages of skilled contractors, oversupply of properties, decrease in property prices in certain parts of the PRC, a slowdown in the rate at which new property developments will be approved and/or reviewed by the relevant government authorities and an increase in administrative costs for hiring or retaining qualified personnel, any of which may adversely affect our business and financial condition. Furthermore, property developers that are better capitalized than Kirin China is may be more competitive in acquiring land through the auction process.

Kirin China considers Royal Real Property Co., Ltd. and Lejiayuan Real Property Co., Ltd. as its major competitors in Xingtai. These two companies have similar financial capacities as Kirin China and engage in projects of similar sizes to those of Kirin China.

With respect to cities in the Bohai Sea Surrounding Area, Kirin China considers Dezhou Real Estate Company and Dezhou Trust Real Estate Development Co., Ltd. as its primary competitors in Dezhou City and Shandong Chuangye Real Estate Development Co. Ltd. and Zhongfang Real Estate Development Company as its primary competitors in Zibo City. Because these competitors have been developing projects in these cities and others in the Bohai Sea Surrounding Area, they have already established relationships with local government and suppliers and have brand recognition among potential customers.

Competitive Advantages

Kirin China believes the following are advantages over its competitors:

|

·

|

Experienced Real Estate Development Team. Kirin China has a professional team with significant experience in real estate development. Members of Kirin China’s membership team have had work experience with well-known real estate development companies in tier-one cities. In addition, Kirin China’s management members are well educated with degrees from top universities such as Tsinghua University, Xi’an Jiaotong University, Zhejiang University and the Communication University of China.

|

|

·

|

R&D and Planning Advantage. Kirin China expends considerable effort on research and development in an effort to identify its target market and understand the needs and wants of potential homebuyers. Kirin China believes that by conducting research and development it can better align project design and pricing with the needs and demands of its target buyers.

|

15

|

·

|

Strong Relationships with Local Government. Kirin China seeks to maintain close ties with the local government in Xingtai City where it has aided the local government in cases such as the Kong Village Relocation Program. Kirin China believes such good relationships with local governments can help in the application of favorable land development policies. We believe that these relationships can better enable Kirin China to successfully bid and execute on projects.

|

|

·

|

Pre-Sales Advantage. Kirin China seeks to ensure high cash flow through presales. Kirin China’s investment costs for a particular project can be covered usually within one year after presales commence. For example, by the end of December 2009, Kirin China recorded $58.47 million in presales of its Kirin County Project, which commenced in April 2009.

|

Growth Strategy

Completion of Pipeline Projects

Kirin China’s project pipeline includes the Kirin Bay and No. 79 Courtyard projects, each of which are located in Xingtai. Kirin China expects to commence presales for these projects in the first quarter of 2011.

The Kirin Bay Project covers a land area of over 660,000 square meters. After completion, Kirin China expects that the project will be the largest high-end residential community in Xingtai in terms of construction area. The project is comprised of three land construction sections, Sections B, C, and D, with total anticipated building area of approximately 1 million square meters. Section B is expected to cover a building area of approximately 240,000 square meters, which is expected to be comprised mainly of malls, hotels, office buildings and apartments. Sections C and D are expected to cover a building area of approximately700,000 square meters. These sections are expected to be comprised of high-rise buildings, villas, kindergartens, primary schools and other commercial buildings.

Preparation for The Kirin Bay Project began in June 2009. Construction is expected to start in June 2011 and project completion is planned for April 2015. The first phase residences are expected to be delivered by the end of 2013 while final phase residences are expected to be delivered in May 2015. The project is planned to include approximately 5,500 residential units consisting of high-rise apartments and single-family houses. The following sets forth the various categories of properties anticipated to be available for sale as part of the Kirin Bay Project and the total area and number of units available for each such category:

|

Kirin Bay Project

Property Resources for Sale

|

||

|

Category

|

Subject

|

Area/Unit Number

|

|

High-floor Apartment

|

Area

|

453,944 sq meters

|

|

Number of Units

|

4,209

|

|

|

Garden Villa

|

Area

|

75,900 sq meters

|

|

Number of Units

|

540

|

|

|

Commercial Residences

|

Area

|

14,700 sq meters

|

|

Number of Units

|

-

|

|

|

Reconstructable Public Facilities

|

Area

|

25,160 sq meters

|

|

Garage

|

Number of Units

|

3,492

|

No. 79 Courtyard Project covers a land area of over 290,000 square meters and a total building area of 440,000 square meters. The project is positioned as a high-end residential development with some mixed commercial use.

No. 79 Courtyard Project started preparation in July 2009. Construction is expected to start in June 2011 and project completion is planned for the last quarter of 2014. The first phase residences are expected to be delivered by the end of 2012 while the final phase residences are expected to be delivered in January 2015. The following sets forth the various categories of properties anticipated to be available for sale as part of the No. 79 Courtyard Project and the total area and number of units available for each such category:

16

|

No. 79 Courtyard Project

Property Resources for Sale

|

||

|

Category

|

Subject

|

Area/Unit Number

|

|

High-floor Apartment

|

Area

|

168,960 sq meters

|

|

Number of Units

|

1,300

|

|

|

Official Mansion

|

Area

|

72,980 sq meters

|

|

Number of Units

|

322

|

|

|

Garden Villa

|

Area

|

88,440 sq meters

|

|

Number of Units

|

436

|

|

|

Penthouse

|

Area

|

81,000 sq meters

|

|

Number of Units

|

270

|

|

|

Multiple-row Townhouse

|

Area

|

17,120 sq meters

|

|

Number of Units

|

64

|

|

|

Double-row Townhouse

|

Area

|

16,200 sq meters

|

|

Number of Units

|

60

|

|

|

Semi-detached House

|

Area

|

3,040 sq meters

|

|

Number of Units

|

8

|

|

|

Commercial Residences

|

Area

|

7,000 sq meters

|

|

Number of Units

|

35

|

|

|

Garage

|

Number of Units

|

2880

|

|

Total

|

Residential

|

2460 units, totaling 447,000 sq meters

|

|

Commercial

|

35 units, approximately 7,000 sq meters

|

|

|

Garage

|

2880 units

|

|

Focusing on Bohai Sea Surrounding Area

For its regional selection strategy, Kirin China intends to focus on the Bohai Sea Surrounding Area. The Bohai Sea Surrounding Area has become the third most active region in the PRC for business investment, just behind the Pearl River Delta and the Yangtze River Delta Regions. The National Development and Reform Commission indicated in September 2010 that the Bohai Sea Surrounding Area, Yangtze River Delta region and Pearl River Delta region are to be prioritized for economic development.

Selecting Tier-Three Cities with Tier-Two Cities as Alternatives

With respect to tier-three cities, Kirin China seeks to select dynamic, highly commercialized cities with the target city acting as the economic driving force of the surrounding area. When selecting target cities, Kirin China generally seeks per capita GDP, economic growth, and citizen purchasing power that is higher than the other surrounding tier-three cities. Cities such as Tianjin, Qingdao, Shenyang, Nanjing, Suzhou, Xuzhou, Hefei, Changshang, and Xi’an satisfy these criteria. Although its primary focus is on tier-three cities, Kirin China may also seek to expand to tier-two cities.

Intellectual Property

Kirin China does not own any patent or registered trademarks.

Environmental Issues

Our business in China is subject to various pollution control regulations in China with respect to noise, water and air pollution and the disposal of waste. Specifically, the major environmental regulations applicable to us include the PRC Environmental Protection Law, the PRC Law on the Prevention and Control of Water Pollution, the PRC Law on the Prevention and Control of Air Pollution, the PRC Law on the Prevention and Control of Solid Waste Pollution, and the PRC Law on the Prevention and Control of Noise Pollution.

The Company is not aware of any investigations, prosecutions, disputes, claims or other proceedings in respect of environmental protection, nor has the Company been punished or can foresee any punishment to be made by any environmental administration authorities of the PRC.

Government Regulation and Approvals

Property and Land Use Rights