Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PLAINSCAPITAL CORP | d236843d8k.htm |

| EX-4.1 - FORM OF STOCK CERTIFICATE - PLAINSCAPITAL CORP | d236843dex41.htm |

| EX-3.1 - CERTIFICATE OF DESIGNATION OF NON-CUMULATIVE PERPETUAL PREFERRED STOCK, SERIES C - PLAINSCAPITAL CORP | d236843dex31.htm |

| EX-10.2 - REPURCHASE LETTER AGREEMENT, DATED SEPTEMBER 27, 2011 - PLAINSCAPITAL CORP | d236843dex102.htm |

| EX-10.1 - SECURITIES PURCHASE AGREEMENT, DATED SEPTEMBER 27, 2011 - PLAINSCAPITAL CORP | d236843dex101.htm |

Exhibit 99.1

How We Sustain Our

Momentum.

|

How We Sustain Our Momentum

Dallas-based PlainsCapital Corporation has an impressive 23-year track record of growth and success. Founded by Chairman and CEO Alan B. White, PlainsCapital’s family of companies includes PlainsCapital Bank, PrimeLending and FirstSouthwest. Offering a diverse range of financial services, PlainsCapital’s entrepreneurial spirit is the driving force behind its success. With entrepreneurialism at the heart of PlainsCapital’s strategic approach, the Corporation sustains its momentum year after year.

WE EXECUTE THE RIGHT GROWTH STRATEGY

Chairman and CEO Alan B. White is an entrepreneur with strong ties to business leaders across Texas. Those relationships have led to key acquisitions and the hiring of talented bankers making PlainsCapital Corporation what it is today.

The PlainsCapital Bank is the financial foundation of the Corporation and the catalyst for growth. The Bank serves middle market commercial businesses and high net worth individuals. The Bank’s loan and deposit growth, from 1988 to 1999 in its hometown of Lubbock, allowed the Corporation to expand to larger Texas markets. Several strategic moves positioned the Corporation for sustained momentum.

The business models of the three operating companies enable the Corporation to be successful in a variety of economic conditions.

Strategic Highlights

• The Bank opened its first Dallas location in the Turtle Creek neighborhood in 1999.

• Mortgage lender PrimeLending was acquired in 1999.

• From 2000 to 2006, the Bank entered five new Texas markets: Austin, Fort Worth, San Antonio, Weatherford and Arlington. Bankers joining PlainsCapital in these markets brought significant books of business with them.

• FirstSouthwest, a national public finance advisory firm and investment bank, was acquired in 2008.

• Since 1999, PrimeLending has expanded nationwide to more than 240 locations. In 2010, it originated $7.6 billion in home loans.

• The Bank provides the Corporation with a strong capital foundation on which to grow.

• The Bank provides a warehouse line of credit to fund PrimeLending’s mortgage loans.

• PrimeLending sells nearly all the loans it originates into the secondary market.

• FirstSouthwest and PrimeLending contribute fee income to the bottom line.

WE HIRE THE RIGHT PEOPLE

PlainsCapital’s success is the sum of its people. PlainsCapital takes great care to hire talented individuals who will excel in the Corporation’s relationship-based culture. Corporation-wide, PlainsCapital employs more than 3,000 people.

White connects with entrepreneurs like himself—visionary leaders who understand the value of relationships.

Across the three operating companies, branch or office network expansion is typically driven by hiring. A team of bankers is hired, then the companies go to work opening a location. Changes to the competitive landscape over the last decade have allowed PlainsCapital to hire top talent in commercial and private banking, residential mortgage lending, public finance and investment banking.

Bankers in all of the PlainsCapital companies are focused on building long-term relationships with their clients. They are recognized for their expertise, their responsiveness, their straightforward way of doing business and their involvement in the community.

WE DO BUSINESS IN THE RIGHT PLACES

PlainsCapital Corporation companies operate more than 300 locations in 39 states and Washington, D.C.

A commercial bank’s sustained momentum is deeply tied to the economic strength of the communities it serves. As such, PlainsCapital Corporation is fortunate to have all three of its operating companies headquartered in Texas. PlainsCapital companies operate 95 Texas locations in high growth markets such as Austin, Dallas, Fort Worth, San Antonio and Houston.

Over the last decade, Texas has successfully attracted many companies to the state because of its friendly business environment, highly skilled workforce and relatively low cost of living.

In addition, Texas is weathering the recession better than most states. Within this environment, there are opportunities for the PlainsCapital family of companies to grow.

Nationwide, PlainsCapital Corporation seeks to expand the footprints of FirstSouthwest and PrimeLending as opportunities arise.

PlainsCapital’s Executive Management Team

Alan B. White PlainsCapital Corporation Founder,

Chairman & CEO

James R. Huffines PlainsCapital Corporation

President & Chief Operating Officer

John A. Martin PlainsCapital Corporation

EVP & Chief Financial Officer

Roseanna McGill PlainsCapital Corporation EVP,

PrimeLending Founder & Chairman

Jerry L. Schaffner PlainsCapital Bank President & CEO

Todd L. Salmans PrimeLending President & CEO

Hill A. Feinberg FirstSouthwest Chairman & CEO

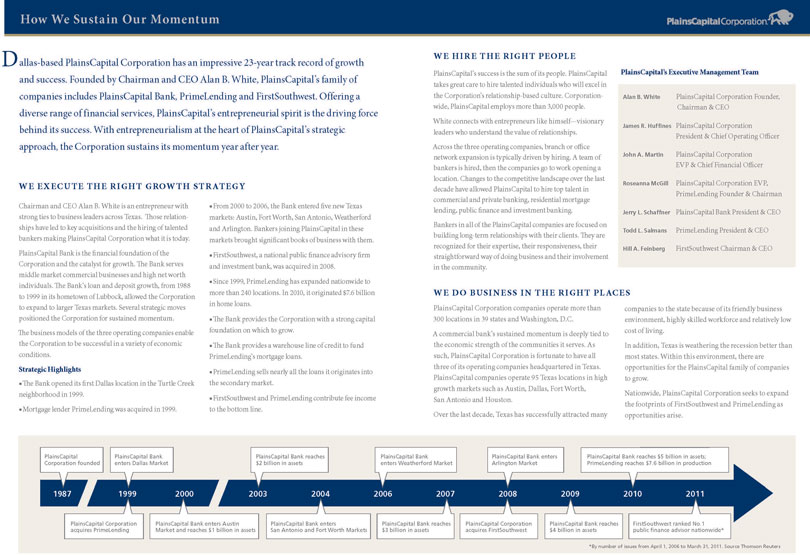

PlainsCapital

Corporation founded

PlainsCapital Bank enters Dallas Market

PlainsCapital Bank reaches $2 billion in assets

PlainsCapital Bank enters Weatherford Market

PlainsCapital Bank enters Arlington Market

PlainsCapital Bank reaches $5 billion in assets; PrimeLending reaches $7.6 billion in production

1987 1999 2000 2003 2004 2006 2007 2008 2009 2010 2011

PlainsCapital Corporation acquires PrimeLending

PlainsCapital Bank enters Austin Market and reaches $1 billion in assets

PlainsCapital Bank enters

San Antonio and Fort Worth Markets

PlainsCapital Bank reaches $3 billion in assets

PlainsCapital Corporation acquires FirstSouthwest

PlainsCapital Bank reaches $4 billion in assets

FirstSouthwest ranked No.1 public finance advisor nationwide*

*By number of issues from April 1, 2006 to March 31, 2011. Source Thomson Reuters

WE DELIVER POSITIVE RESULTS

For more than 23 years, PlainsCapital Corporation has experienced sustained momentum. With a diversified business model, the strong capital base of PlainsCapital Bank, and an experienced management team, the Corporation has grown throughout the last decade even in the midst of the economic downturn.

Financial Highlights as of June 30, 20111

Corporation Total Assets $5.26 billion

Corporation Total Deposits $3.96 billion

Corporation Total Loans $3.7 billion

(Includes loans held for sale)

Corporation Net Interest Income $73.8 million2

Corporation Net Income $23 million2

Bank Tier 1 Capital Risk-Weighted to Assets Ratio 12.94%

(Federal Reserve requires a minimum of 4%)

Bank Assets $5.24 billion

Financial Highlights Over the Last 10 Years3

Asset Growth 15.2%

Net Income Growth 10.0%

Shareholders’ Capital Growth 17.0%

Total Loans & Leases Growth 14.9%

(Includes loans held for sale)

Rankings as of Dec. 31, 2010

PlainsCapital Corporation No. 7 bank holding company based in Texas by asset size4

PlainsCapital Bank No. 8 bank based in Texas by asset size4

PrimeLending No. 3 FHA lender in Texas in 2010; 13th nationwide5

FirstSouthwest No. 1 municipal advisor in the Southwest for 2010 (by issues and par volume)6

$6,000 $5,000

$4,000 $3,000 $2,000 $1,000

88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10

PlainsCapital Corporation Asset Growth Chart amounts in millions

PlainsCapital Bank Expands to Major Texas Markets

HEADQUARTERS

PlainsCapital Corporation

2323 Victory Avenue, Suite 1400 Dallas, TX 75219

214-252-4100

PlainsCapitalCorp.com

Sources: 1.PlainsCapital Corporation June 30, 2011 10-Q 2. For the six months ended June 30, 2011 3.PlainsCapital Corporation regulatory filings compounded annual growth rate from Dec. 31, 2000 to Dec.31, 2010 4.SNL Financial 5.Federal Housing Administration 6.Thomson Reuters © 2011 PlainsCapital Corporation PCCSB091211