Attached files

| file | filename |

|---|---|

| 8-K - ARI NETWORK SERVICES 8-K 9-28-2011 - ARI NETWORK SERVICES INC /WI | form8k.htm |

Exhibit 99.1

Introduction to

ARI Network Services, Inc.

ARI Network Services, Inc.

i A.D. u r e O u P

Safe Harbor Statement

Statements in this news release are "forward-looking statements" within the meaning of the Private Securities

Litigation Reform Act. The forward-looking statements can generally be identified by words such as "believes,"

"anticipates," "expects" or words of similar meaning. Forward-looking statements also include statements relating to

the Company's future performance, such as future prospects, revenues, profits and cash flows. The forward-looking

statements are subject to risks and uncertainties, which may cause actual results to be materially different from any

future performance suggested in the forward-looking statements. Such risks and uncertainties include those factors

described in Part 1A of the Company’s annual report on Form 10-K for fiscal year ended July 31, 2010, filed with the

Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking

statements. The forward-looking statements are made only as of the date hereof, and the Company undertakes no

obligation to publicly release the result of any revisions to these forward-looking statements. For more information,

please refer to the Company’s filings with the Securities and Exchange Commission.

Litigation Reform Act. The forward-looking statements can generally be identified by words such as "believes,"

"anticipates," "expects" or words of similar meaning. Forward-looking statements also include statements relating to

the Company's future performance, such as future prospects, revenues, profits and cash flows. The forward-looking

statements are subject to risks and uncertainties, which may cause actual results to be materially different from any

future performance suggested in the forward-looking statements. Such risks and uncertainties include those factors

described in Part 1A of the Company’s annual report on Form 10-K for fiscal year ended July 31, 2010, filed with the

Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking

statements. The forward-looking statements are made only as of the date hereof, and the Company undertakes no

obligation to publicly release the result of any revisions to these forward-looking statements. For more information,

please refer to the Company’s filings with the Securities and Exchange Commission.

During this presentation, we will discuss GAAP measure such as Net Income, as well as certain non-GAAP measures

such as EBITDA. We have posted on the Investor Relations tab of our website, www.arinet.com, a reconciliation of

these no-GAAP financial measures to the most comparable financial measures under GAAP.

such as EBITDA. We have posted on the Investor Relations tab of our website, www.arinet.com, a reconciliation of

these no-GAAP financial measures to the most comparable financial measures under GAAP.

ARI OVERVIEW

Roy W. Olivier - President and CEO

Who we are…

ARI is the leader in

creating, marketing,

and supporting

solutions that enhance

revenue and reduce

costs for our

customers.

creating, marketing,

and supporting

solutions that enhance

revenue and reduce

costs for our

customers.

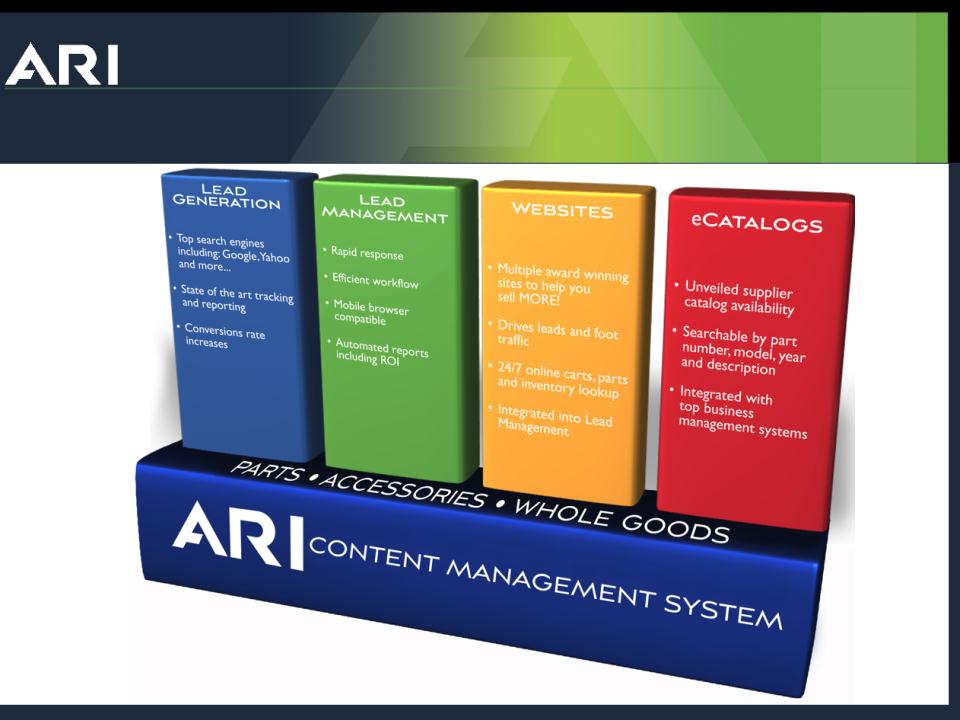

What we do…

• ARI develops multi-industry, multi-brand, SaaS solutions that drive

the sales of whole goods, parts, garments, and accessories in select

vertical markets.

the sales of whole goods, parts, garments, and accessories in select

vertical markets.

• We provide products and services that connect and enable e-

commerce between consumers, dealers, distributors and OEM's in

the markets we serve.

commerce between consumers, dealers, distributors and OEM's in

the markets we serve.

• Revenue sources include subscription fees for the use of our

services & content, transaction fees for sales generated from our e-

commerce solutions, and analytics from customer data resulting in

over 85% of our revenue being recurring.

services & content, transaction fees for sales generated from our e-

commerce solutions, and analytics from customer data resulting in

over 85% of our revenue being recurring.

How we do it…

Headquarters

Milwaukee, Wisconsin

Milwaukee, Wisconsin

Intl. Sales/Support

The Netherlands

The Netherlands

Development & Marketing

Services

Cypress, California

Services

Cypress, California

Marine/RV Sales/Support

Virginia Beach, VA

How we go to market…

• 3 sales channels

– OEM sales

– Dealer inside sales

– International sales

• 2 geographic markets

– Americas

– EMEA

Management Team

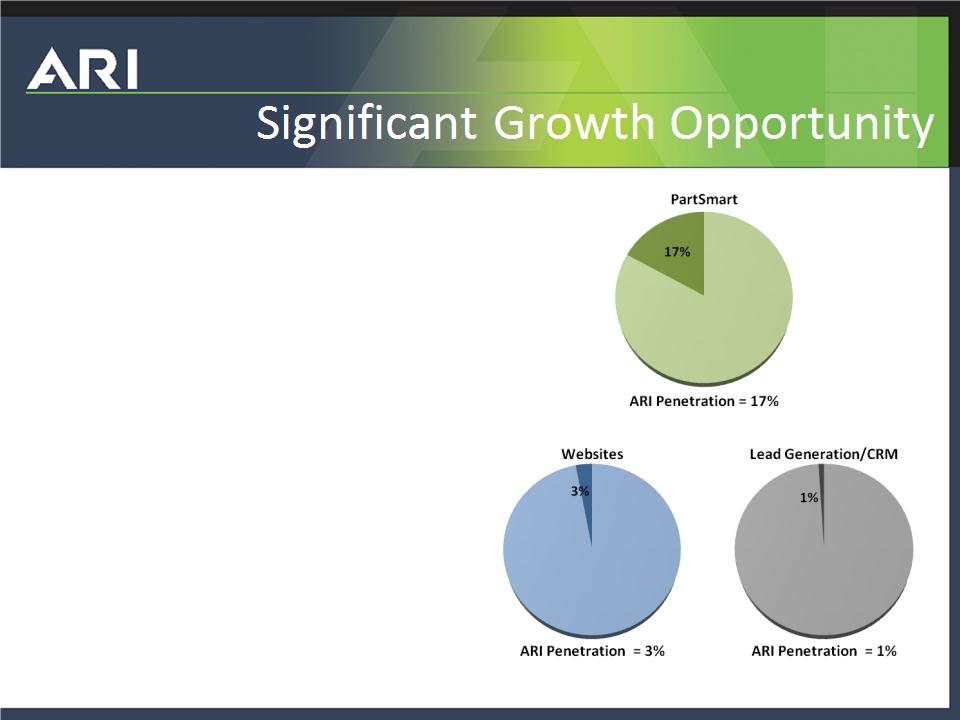

• Significant growth

opportunities in existing

markets

opportunities in existing

markets

• Direct relationships with

over 18,000 OEMs,

dealers, and distributors

over 18,000 OEMs,

dealers, and distributors

• Unmatched knowledge of

the verticals we serve

the verticals we serve

Source: Trade Associations and Internal ARI Data

Growth Strategy

• Organic - Strategic Focus

– Expand market share (new logos)

– Raise average revenue per dealer (upgrades)

– Reduce churn (add value to products)

– Launch new products

• Leverage large install base of 18K Dealers, Dist. & OEM’s

– Position company for new verticals and markets

• Non-organic - Acquisitions

– Acquire competitors

– Acquire into new markets and products that fit our stratigy

Highlights

• Significant untapped growth opportunity in the markets we serve

• Proven business model

– Recurring Revenue Model

– Direct relationship with over 18,000 OEMs, Distributors, and Dealers

– Unmatched knowledge of the verticals we serve

• “Must have” nature of solutions

• Industry Leader with high barriers to entry:

– Largest content library in the verticals we serve

– Leading technology

– Large install base with leading share of top dealers and top OEMs

• Strong, experienced management team

• Proven acquisition experience

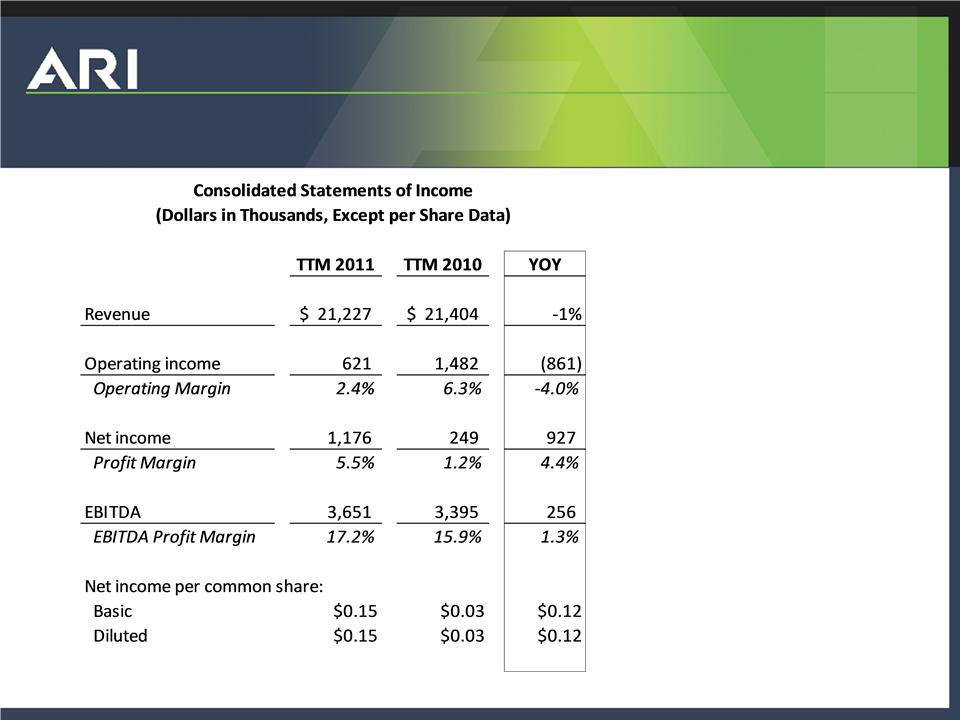

TTM & FY11 YTD Q3 RESULTS

TTM May - April FY11 vs. FY10

2011 Highlights

• Strong operating results

(excluding non-cash revenue)

(excluding non-cash revenue)

• Continued investment in product

development

development

• EBITDA growth

• Customer churn improvement

2011 Challenges

• Loss of non-cash revenues

• Increased interest expense

• Restructuring expense

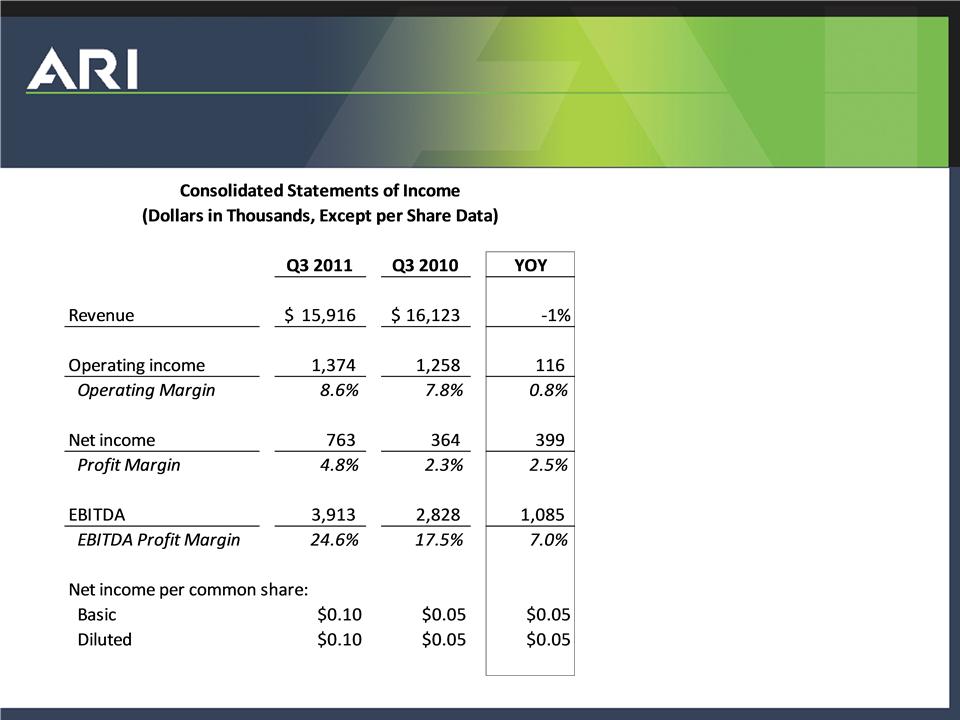

YTD Q3 2011 vs. YTD Q3 2010

Q3’FY11 Highlights

• Strong operating results

(excluding non-cash revenue)

(excluding non-cash revenue)

• Continued investment in product

development

development

• EBITDA growth

• Customer churn improvement

Q3’FY11 Challenges

• Loss of amortized revenues

• Interest expense

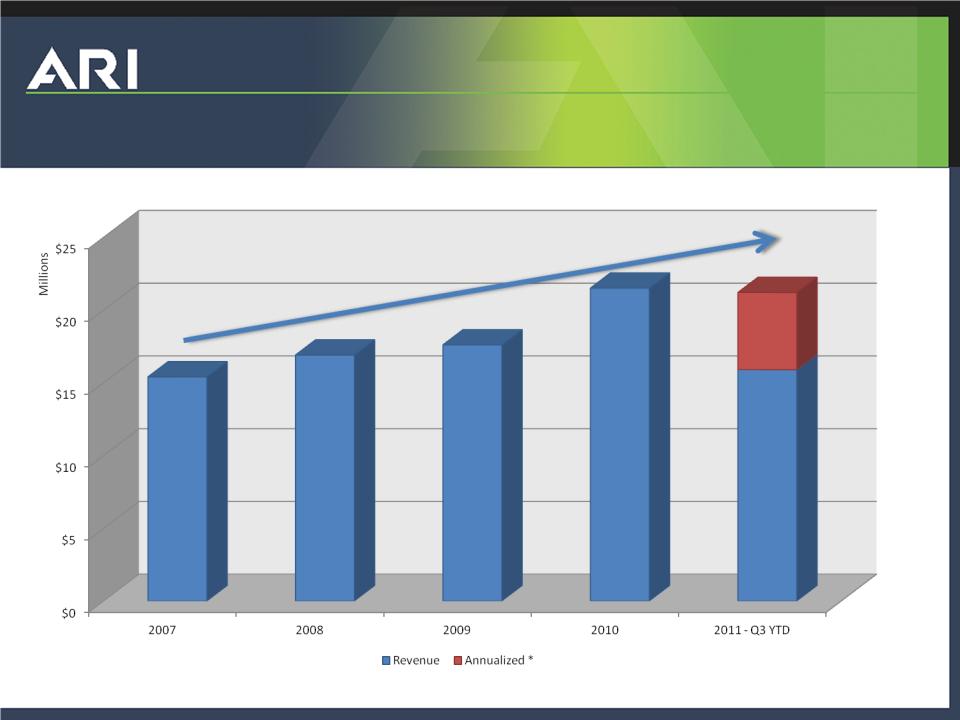

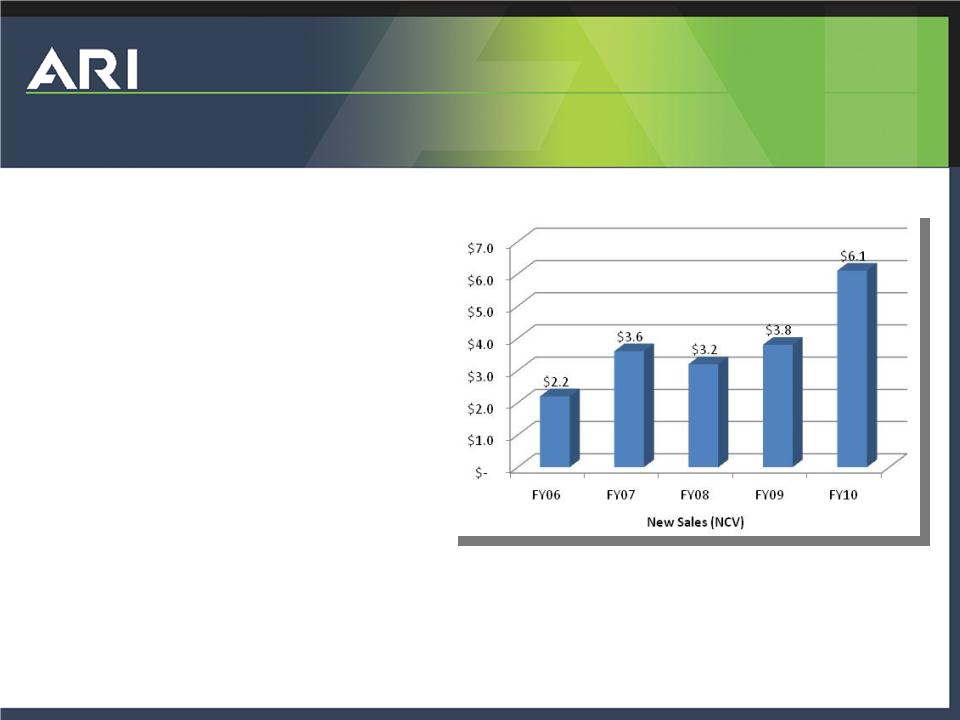

Financial Results: Revenue Growth

CAGR 8.3%

* Does not represent a projection of results, annualized for comparison purposes only.

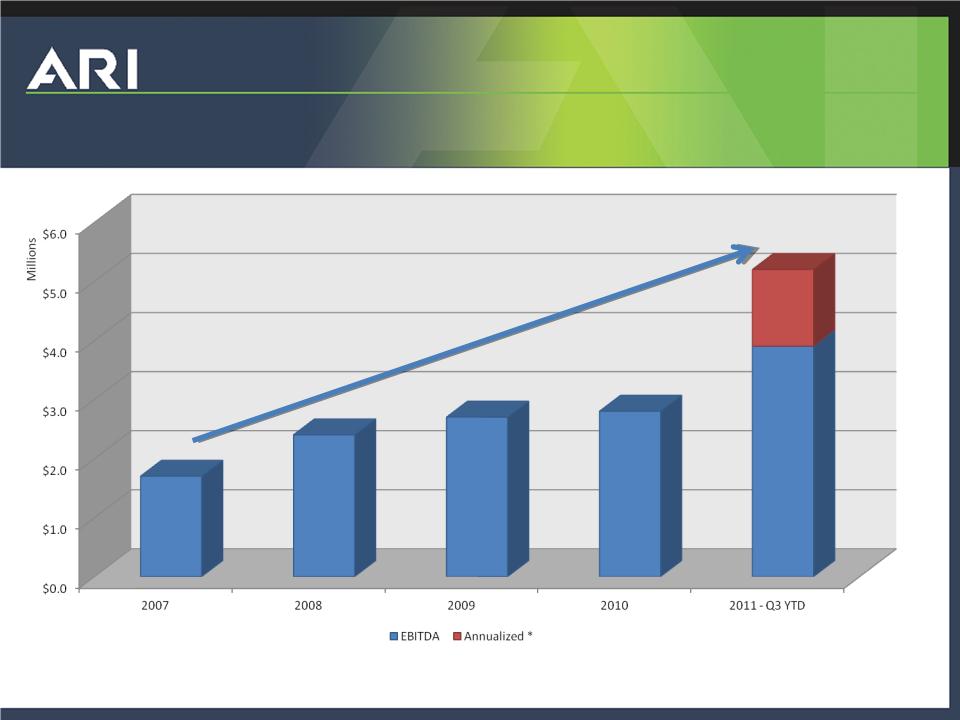

Financial Results: EBITDA

A reconciliation of EBITDA to net income is posted on our website, www.arinet.com, under “Company/Investors”

* Does not represent a projection of results, annualized for comparison purposes only.

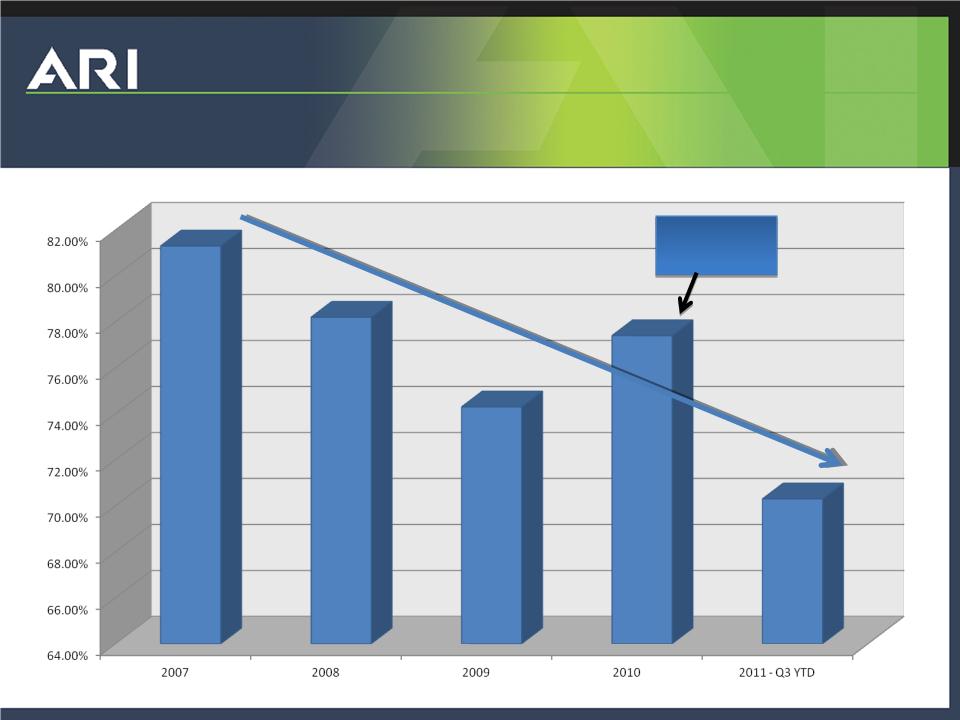

Operating Expenses as % of Revenue

Channel Blade

integration costs

& F&I losses

integration costs

& F&I losses

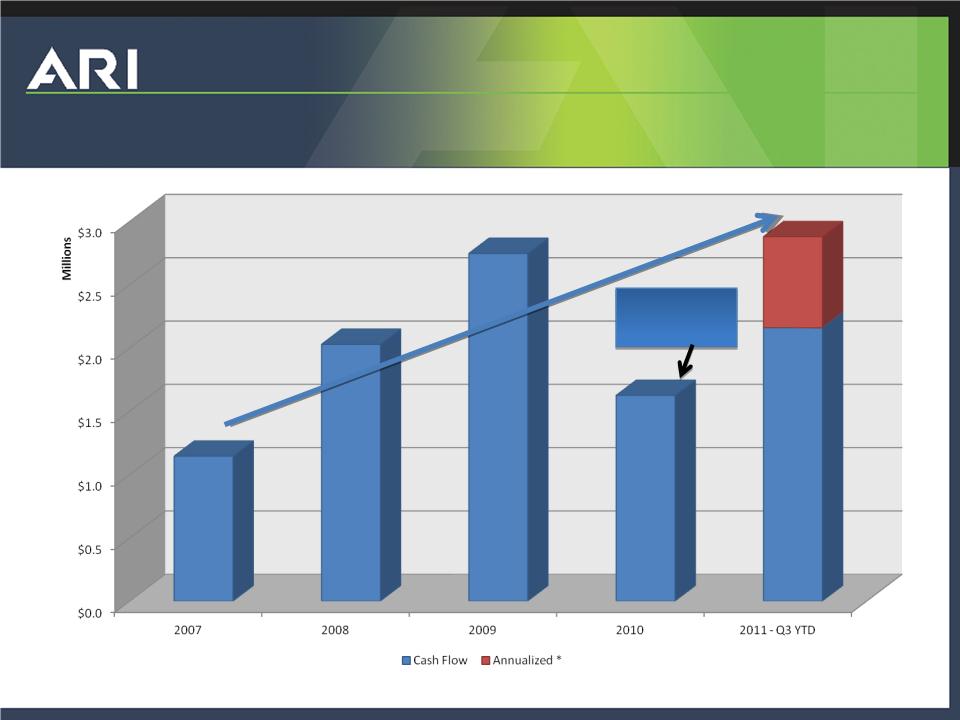

Operating Cash Flow

Channel Blade

integration costs

& F&I losses

integration costs

& F&I losses

* Does not represent a projection of results, annualized for comparison purposes only.

Monthly Recurring Revenue (MRR) & Churn

30.6% year over year MRR improvement

MRR and Churn are non GAAP measures, they are key performance indicators that management uses to gauge the health of the

business.

business.

FY12 Plan Summary

WHO WE ARE

ARI’s broad suite of services, accessible

technology, and ability to deliver tangible

value, equip its customers with every

advantage they need to succeed.

technology, and ability to deliver tangible

value, equip its customers with every

advantage they need to succeed.

MISSION STATEMENT

Be recognized as the leader in creating,

marketing and supporting the best solutions

that enhance revenue or reduce costs for our

customers.

marketing and supporting the best solutions

that enhance revenue or reduce costs for our

customers.

CORE VALUES

People Oriented

Rapid Innovation

Initiative

Delivery and Execution

Embrace the Customer

CRITICAL SUCCESS FACTORS

§ Acquire and retain customers

§ Focused organization that

delivers on commitments and

plans

delivers on commitments and

plans

§ Develop and deploy new

recurring revenue high gross

margin Tech Enabled Svcs

(“TES’s”)

recurring revenue high gross

margin Tech Enabled Svcs

(“TES’s”)

§ Publish the information our

customers need, on time

customers need, on time

§ Develop the systems

infrastructure to support the

company’s growth

infrastructure to support the

company’s growth

§ Acquire, Develop and Retain

High Performing Employees

High Performing Employees

Operating Momentum

Strong New Sales Performance

• 501 New logos (customers) in FY10

• $6.1M in new sales (NCV) in FY10

• 60% increase over FY09

• CAC Ratio is 0.64 (TTM)1

Increased Focus on MRR

• Updating compensation plans

• Updating product pricing

Good progress on controllable churn

• Dedicated team

• Improvements in publishing and software

1 CAC - Customer Acquisition Costs

2 MRR - Monthly Recurring Revenue

Operating Momentum

• Lowered costs

– Staff reductions

– Sold F&I business

• Addressed underperforming products

– Adjusted or are adjusting pricing on all products

– Discontinued two non-core products

– Piloted project to improve one key products gross margin

by almost 2x

by almost 2x

– Sharpened focus on 3 core products (Catalog, Footsteps,

and the Website Platform Products)

and the Website Platform Products)

SUMMARY & CONCLUSION

Roy W. Olivier - President and CEO

Shareholder Value Engine

Performance

Business

Model

Total

Enterprise

Value

1) % Debt

2) # Shares

$$$

Share Price

Communicate to Prospective Shareholders

FY12Plan - I/R program for greater visibility

FY12 Plan

EBITDA

New products

FY12 Plan

SaaS Model

Bessemer metrics

FY12Plan

De-lever

Increasing Shareholder Value

• We run the business to increase shareholder value…

– Grow revenue with fiscal discipline

– Achieve double digit organic sales growth by

• Reducing churn

• Achieving new sales goals

• Increasing average revenue per dealer (ARPD)

• Increasing recurring revenue as a percentage of total revenue

• Launching new products

– Increase ARI visibility

• …but the market sets the price

– Our perspective

• We are undervalued (using industry valuation norms)

• Continued strategic focus and business execution can drive a return to fair value

– We believe that we are doing the right strategic and operational things to

increase shareholder value

increase shareholder value

Outlook

• Expect a slow recovery in several ARI verticals

• Expect revenue growth in FY12

• Expect continued improvement in operating income

& EBITDA

& EBITDA

• Continue to improve cash flow from operations

• Expect to launch a new product to increase ARPD

and drive international growth (BRIC)

and drive international growth (BRIC)

• Expect to reduce churn through increased focus and

product enhancements

product enhancements

Thank You!