Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Orexigen Therapeutics, Inc. | d236506d8k.htm |

1

JMP Securities Healthcare Conference

JMP Securities Healthcare Conference

September 28, 2011

September 28, 2011

Exhibit 99.1 |

Forward-Looking Statements

Forward-Looking Statements

2

This presentation contains forward-looking statements about Orexigen Therapeutics, Inc.

Words such as "believes," "anticipates," "plans,"

"expects," "indicates," "will," "intends," "potential," "suggests," "assuming," "designed" and similar expressions are intended

to identify forward-looking statements. These statements are based on the Company's current

beliefs and expectations. These forward-looking

cardiovascular outcomes trial (CVOT); the potential for resubmission and approval of an NDA

based on interim results of the CVOT; the prospects for ultimate approval of an NDA for

Contrave; and the potential to complete a partnership or similar transaction for ex-

North American rights to Contrave and maintain the Company’s existing North American

collaboration with Takeda Pharmaeuticals. The inclusion of forward-looking

statements should not be regarded as a representation by Orexigen that any of its plans will be

achieved. Actual results may differ from those set forth in this presentation due to the risk

and uncertainties inherent in Orexigen’s business, including, without limitation:

Orexigen’s ability to maintain and raise sufficient capital to fund the CVOT and maintain its

other operations; the uncertainty of the FDA approval process, including requirements for

additional clinical and non-clinical studies or other commitments prior to the

submission and approval of an NDA for Contrave; Orexigen's ability to demonstrate that the risk

of major adverse CV events in overweight and obese subjects treated with Contrave does not

adversely affect the product candidate’s benefit-risk profile; the potential

for FDA’s planned 2012 public advisory committee meeting on obesity drug

development to result in additional NDA approval requirements for Contrave as well as

post-approval commitments; Orexigen’s dependence on Takeda Pharmaceuticals for

aspects of the development and commercialization of Contrave; reliance on third parties

to supply Contrave and assist with the development of Contrave and the regulatory submissions

related thereto; the potential for adverse safety findings relating to Contrave; intense

competition in the obesity marketplace and the potential for new products to emerge that

provide different or better therapeutic alternatives for obesity and weight loss compared to Contrave; and other risks

described in the Company's filings with the Securities and Exchange Commission (SEC). You are

cautioned not to place undue reliance on these forward-looking statements, which

speak only as of the date hereof, and Orexigen undertakes no obligation to revise or

update this presentation to reflect events or circumstances after the date hereof. Further information regarding these and

other risks is included under the heading "Risk Factors" in Orexigen’s Quarterly

Report on Form 10-Q, which was filed with the SEC on August 8, 2011 and is available

from the SEC's website (www.sec.gov) and on our website (www.orexigen.com) under the

heading "Investor Relations”. All forward-looking statements are qualified in

their entirety by this cautionary statement. This caution is made under the safe harbor

provisions of Section 21E of the Private Securities Litigation Reform Act of 1995.

statements

include

statements

regarding:

the

study

design

for,

and

the

timing

and

feasibility

of,

the

Contrave

® |

Orexigen

Strategic Summary Orexigen Strategic Summary

Clear path to approval defined by FDA’s OND

Clear path to approval defined by FDA’s OND

Time, cost and probability of success make approval

Time, cost and probability of success make approval

requirements feasible

requirements feasible

Regulatory Path Clarified

Regulatory Path Clarified

Obesity remains a huge market opportunity

Obesity remains a huge market opportunity

Global epidemic with increasing public health concerns

Global epidemic with increasing public health concerns

Obesity Unmet Need

Obesity Unmet Need

Contrave

Contrave

®

®

has blockbuster, global potential

has blockbuster, global potential

Target profile indicates potential first-line pharmacotherapy for

Target profile indicates potential first-line pharmacotherapy for

the majority of patients

the majority of patients

NA partner Takeda has relevant skills and experience

NA partner Takeda has relevant skills and experience

Ex-NA commercial partnership planned

Ex-NA commercial partnership planned

Orexigen Position

Orexigen Position

3 |

Experienced

Management Team with a Strong Balance Sheet

Experienced Management Team with a Strong

Balance Sheet

Michael

Narachi,

President

and

CEO

20-Year

Veteran

of

Amgen

–

Including:

GM of Anemia Business Unit

Global Team Leader, Neupogen

Head of Licensing and Business Development

Mark

Booth,

Chief

Commercial

Officer

President, Takeda

Pharmaceuticals North America Senior Commercial Officer, Immunex and Abbott

Jay

Hagan,

Chief

Business

Officer

Managing Director,

Amgen Ventures

Head

of

Corporate

Development,

Amgen

Preston

Klassen,

M.D.,

SVP,

Head

of

Development

Nephrology Therapeutic Area Head, Amgen Suzanne

McDonald,

Consultant,

Managed

Markets & Government Affairs

VP, Managed Markets and Government Affairs, Takeda Heather

Turner,

SVP,

General

Counsel

Associate General Counsel, Conor Medsystems

Dawn

Viveash,

M.D.,

SVP,

Head

of

Regulatory Affairs

VP, Regulatory Affairs and Safety, Amylin VP,

Regulatory Affairs and Safety, Amgen & Immunex

Global Chief Safety Officer, P&U

4

End of Q2 Cash and Investments Balance of $69.7m

Currently Low Operating Expense Base and No Debt |

5

Regulatory Update

Orexigen Position

Global Need |

Filed

NDA

NDA Accepted

by FDA

Results

Published in

The Lancet

&

Obesity

Signed Takeda

Partnership

Positive Advisory

Committee

Meeting

The Orexigen Story –

Two Years of Successes and

Setbacks, but a Clear Path to Approval Has Emerged

The Orexigen Story –

Two Years of Successes and

Setbacks, but a Clear Path to Approval Has Emerged

2010

2011

CRL

Received

EOR –

Appeal,

Programs Halted &

New Asset Search

Initiated

FDA Feedback on

Feasible Path

Forward –

Development

Restarted

6

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4 |

FDA Has Provided

Guidance on Critical Elements for Feasible Trial

FDA Has Provided Guidance on Critical Elements for

Feasible Trial

Goal of trial is to demonstrate that the risk of CV events is not

unacceptably high

Primary endpoint is major CV events (MACE = CV death, MI, stroke)

Enrolled patient population should have background MACE event rate

of 1.0-1.5% per year

Success criteria at interim analysis to enable approval:

–

Upper bound of 95% CI should exclude a hazard ratio of 2.0

–

Requires ~87 endpoint events and an observed hazard ratio of <1.32

Success criteria at final (post-approval) analysis:

–

Upper bound of 95% CI should exclude a hazard ratio of 1.4

–

Requires ~371 endpoint events and an observed hazard ratio of <1.14

7 |

Trial Focus

Enables Streamlined Approach and Drives Feasible Cost Estimates

Trial Focus Enables Streamlined Approach and Drives

Feasible Cost Estimates

Typical Phase 3 Trial

Approach for Contrave CVOT*

Comprehensive evaluation of efficacy

and general safety

Targeted clinical question allows

focused and streamlined design

Detailed data collection is required

with lengthy CRF (drives site cost)

A CRF focused on primary endpoint

(less data capture)

AE collection is broad

AE collection limited to SAE

Comprehensive labs and ancillary

assessments

Limited labs/ancillary measures

Frequent site visits

Less frequent site visits

Trial activity is focused at sites

Leverages web-based activity

Many enrollment exclusion criteria

Fewer enrollment exclusion criteria

*Trial design and cost assumptions based on current understanding of FDA correspondence. Final

cost projections require FDA agreement on trial protocol.

8

Total cost of Contrave CVOT to interim analysis

and approval is estimated at <$100M

* |

Probability of

Success at Interim Analysis is High Probability of Success at Interim Analysis is

High Bupropion well characterized in >50M patients over >25 years

–

Large prospective patient registries (up to 10,000 patients) and

examination of AERS have not identified evidence of increased clinical

cardiovascular events

Demonstration of non-inferior CV safety required for approval

–

Interim analysis hurdle for approval is reasonable and analogous

to the

threshold required in Type 2 DM

–

Excluding a HR of 2.0 at interim is possible with a trial result

HR as high

as 1.31

We believe Contrave CV trial is unlikely to produce SCOUT-like results

–

Bupropion is a different drug with different clinical profile

–

Risk Engine modeling of 1-year Contrave Phase 3 data predicts reduced

10-year CV risk compared to placebo

–

Use of a real-world approach to drug utilization will focus therapy on early

responders

9 |

Estimated

Timing of Key Events That Could Deliver a 2014 Approval

Estimated Timing of Key Events That Could Deliver a

2014 Approval

Development Milestone

Estimated Time

Finalize Protocol Details and Begin CVOT

7-9 months

Enroll and Accrue 87 CV Events for Interim Analysis

18-20 months

Time to Prepare resubmission

3-4 months

Regulatory Review

6 months

Potential Approval

H2 2014

10 |

Regulatory

Update Orexigen Position

Global Need

11 |

Obesity

Epidemic Plus Lack of Solutions Have Created a Perfect Storm

Obesity Epidemic Plus Lack of Solutions Have

Created a Perfect Storm

12

T2DM, Driven by Obesity, Is an Epidemic

1

in

3

Adults

in

the

U.S.

May

Have

Diabetes

by

2050

(CDC)

Associated

with

Premature

Death

&

Physical/Psychosocial

Consequences

Weight Loss of 5

10% Confers Significant Benefits

Lifestyle Change is Critical, but Weight Loss Difficult to

Achieve/Maintain

Large Gaps in Current Treatment Paradigm

75M

U.S.

103M

16%

34%

43%

Serious

Disease

Attributable

to

Obesity

Treatment

Options

Needed

Increase

in

Obesity

Source: http://www.cdc.gov; http://www.fightchronicdisease.org;

Flegal KM, et al. 2010 |

World Wide

Obesity Prevalence Projected to Increase Over the Next Decade

World Wide Obesity Prevalence Projected to

Increase Over the Next Decade

n= ~473M people

n= ~473M people

n= ~655M people

n= ~655M people

2010

2010

% Growth

% Growth

81%

81%

17%

17%

38%

38%

20%

20%

41%

41%

Region

Region

Source: EuroMonitor, 2010

Source: EuroMonitor, 2010

2020

2020

13

182

135

117

127

93

Asia Pacific

Europe

Latin America

North America

ROW

101

115

85

106

66 |

Regulatory

Update Orexigen Position

Global Need

14 |

Majority of

Obese are Untreated in an Environment of Limited Treatment Options Contrave

Keys to Commercial Success

Contrave

Keys to Commercial Success

Source: CDC (2009)

103M

US Obesity Rate Growth

Obesity

Rate

Blockbuster Market Size

Blockbuster Market Size

Market Growth

Market Growth

Significant Unmet Need –

Limited Competition

Contrave: Differentiated Profile

Contrave: Differentiated Profile

Takeda: Well Established and Resourced

Takeda: Well Established and Resourced

BMI

Distribution

of US Pop:

Morbidly Obese

Obese

Overweight

~ 113K People

Treated w/ Surgery

~ 2 Million People

Treated w/ Rxs

US Population

~ 1 in 3 People

in the US

are Obese

15

50%

40%

30%

20%

10%

0%

1970s

2009

2018 |

Typical

Response to Weight Loss Therapy is not Uniform

Typical Response to Weight Loss Therapy

is not Uniform

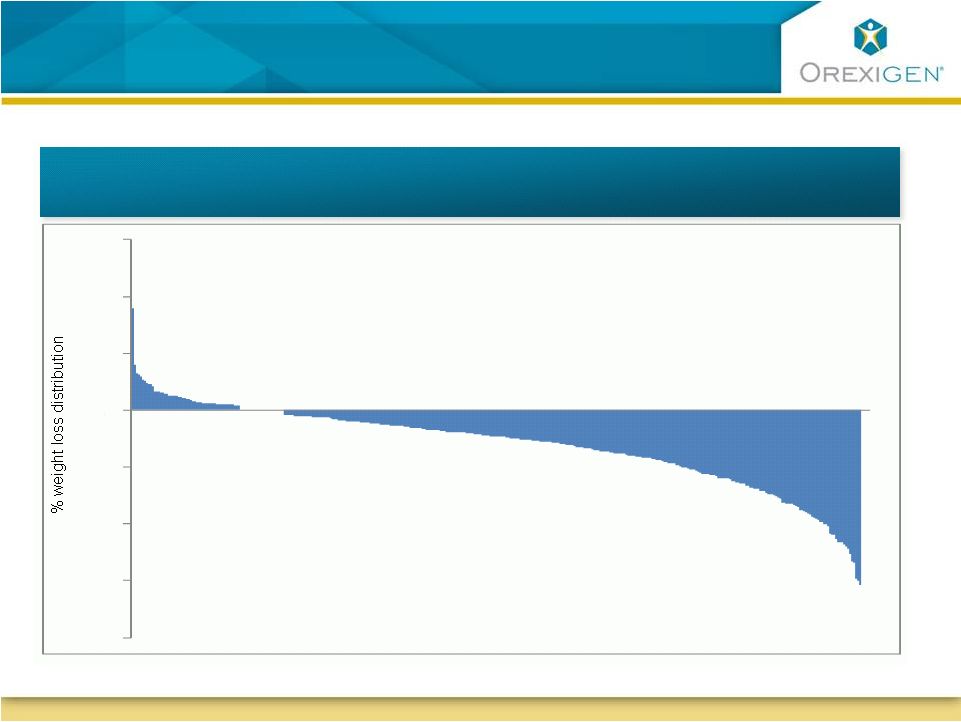

16

COR-I Weight Loss Distribution (Contrave32)

COR-I Weight Loss Distribution (Contrave32)

-

40

-

30

-

20

-

10

0

10

20

30

N=471

N=471

for

COR-I

subjects

treated

with

Contrave

32

32 |

Our Recommended

Treatment Algorithm Focuses on Patients who Achieve a Meaningful Response

Our Recommended Treatment Algorithm Focuses on

Patients who Achieve a Meaningful Response

Our Focus: Patients

Who Lose

5%

<5% weight loss

COR-I Weight Loss Distribution (Contrave32)

N=471 for COR-I subjects treated with Contrave 32

-40

-30

-20

-10

0

10

20

30

17 |

18

Treatment Algorithm: Identify Early Responders

for Continued Long-term Therapy

Treatment Algorithm: Identify Early Responders

for Continued Long-term Therapy

Appropriate BMI

Motivated to Adhere

to Lifestyle Change

Inadequate

Response to Diet &

Exercise

Select Responders

for Continued

Treatment

Reinforce Adherence

to Appropriate Use

Evaluate

Adherence

to

Appropriate

Use

Guidance

Assess

Response

to

Therapy

(

5%)

Screening

16-Week

Therapeutic Trial

Long-Term

Therapy |

19

Contrave Early Responders Go on to Achieve

Substantial Long Term Weight Loss

Contrave Early Responders Go on to Achieve

Substantial Long Term Weight Loss

Weight Loss Distribution

Weight Loss Distribution

0% -

5%

Weight loss

10% -

15%

Weight Loss

Avg Wt Loss =

26.7 lbs

>15% Wt Loss

Avg Wt Loss =

43.9 lbs

Weight Gain

Represents

one

year

data

for

responders

(patients

with

5%

weight

loss

at

week

16

per

recommended

treatment

protocol)

5% -

10%

Weight Loss

Avg Wt Loss =

17.0 lbs |

20

Contrave Responders Achieve Improvement across

Multiple Cardiometabolic Parameters

Contrave Responders Achieve Improvement across

Multiple Cardiometabolic Parameters

Improvement

(Standardized Mean Change from Baseline)

Contrave32

N=1038

Placebo

N=254

-11.3%

-8.6%

-9.5 cm

-7.2 cm

5.2 mg/dL

2.9 mg/dL

-2.5 mg/dL

1.7 mg/dL

-16.0%

-9.2%

-38.9%

-36.2%

14.7

12.3

-1.0%

-0.6%

-0.9 mm Hg

-2.8 mm Hg

-1.6 mm Hg

-2.6 mm Hg

0.2 bpm

-2.3 bpm

Proportion w/

5% Wt Loss Wk 16

51%

19%

Contrave32 Standardized Mean

Change from Baseline at 1 Year

Change from Baseline at 1 Year

Body Weight

Waist Circ.

HDL

LDL

Triglycerides

hsCRP

IWQOL

HbA1c

SBP

DBP

Heart Rate

-0.4

0

0.4

0.8

1.2

1.6

2

2.4 |

21

Contrave: Well Characterized Safety Profile

Contrave: Well Characterized Safety Profile

Delivers Safety Experience Consistent with

Delivers Safety Experience Consistent with

20+ Year History of Underlying Agents

20+ Year History of Underlying Agents

Known Areas of Focus for Development Program –

Known Areas of Focus for Development Program –

CV Effects, Seizure, Psychiatric Effects, Creatinine

CV Effects, Seizure, Psychiatric Effects, Creatinine

General Safety Profile Established in >4500 Patients with

General Safety Profile Established in >4500 Patients with

Single Approval Deficiency to Evaluate CV Safety

Single Approval Deficiency to Evaluate CV Safety

Theoretical CV Risk Remains an FDA Concern

Theoretical CV Risk Remains an FDA Concern

OND Outlined a Feasible Plan to Evaluate CV Outcomes

OND Outlined a Feasible Plan to Evaluate CV Outcomes |

22

SUCCESSFUL

BRAND BUILDER

Actos ~$3B in U.S.

Sales in 2009

Prevacid ~$3B in U.S.

Sales in 2009

SCALE

Top 15 Pharma

Significant U.S. Presence

Primary Care Focus

COMMITMENT

TO OBESITY

Partnership

with Amylin

Stated

Strategy

DOMAIN

EXPERIENCE

Leader in

Cardiometabolic

Care

Excellence in

Life Cycle

Management

Takeda is the Ideal Partner for Contrave

Takeda is the Ideal Partner for Contrave |

23

Competitive Product Profile Attractive to Patients

Competitive Product Profile Attractive to Patients

Women Dominate the Market

No Addictive Concerns

Responders Maintained Meaningful

Weight Loss

No Abuse Liability

No DEA Limitations on

Distribution Expected

73%

73%

Sources: Orexigen Quantitative Market Research 2009; IMS NDTI Audit Data, 6

Months Ending 3/09

Female, Many of

Childbearing Age

Represents

one

year

data

for

responders

(patients

with

5%

weight

loss

at

week 16 per recommended treatment protocol) |

24

Orexigen Strategic Summary

Orexigen Strategic Summary

Clear path to approval defined by FDA’s OND

Clear path to approval defined by FDA’s OND

Time, cost and probability of success make approval

Time, cost and probability of success make approval

requirements feasible

requirements feasible

Obesity remains a huge market opportunity

Obesity remains a huge market opportunity

Global epidemic with increasing public health concerns

Global epidemic with increasing public health concerns

Contrave has blockbuster, global potential

Contrave has blockbuster, global potential

Target profile indicates potential broad use for the majority of

Target profile indicates potential broad use for the majority of

patients

patients

NA partner Takeda has relevant skills and experience

NA partner Takeda has relevant skills and experience

Ex-NA commercial partnership planned

Ex-NA commercial partnership planned

Regulatory Path Clarified

Regulatory Path Clarified

Obesity Unmet Need

Obesity Unmet Need

Orexigen Position

Orexigen Position |

25 |