Attached files

| file | filename |

|---|---|

| 8-K - LMI AEROSPACE INC 8-K 9-26-2011 - LMI AEROSPACE INC | form8k.htm |

EXHIBIT 99.1

Management Presentation

September 2011

LMI AEROSPACE PROPRIETARY

1

Safe Harbor Statements

In addition to the Company’s past performance and other historical facts, this presentation

contains certain forward-looking information, such as current expectations as to future

performance and schedules. Such forward-looking information is based on management’s

current assumptions and analysis, which are subject to numerous business risks and

uncertainties, including risk and uncertainties that relate to acquisitions. There can be no

assurance that these assumptions will prove to be accurate in the future. Actual results may

differ from these forward-looking statements as a result of, among other things, the factors

detailed from time to time in the Company’s filings with the Securities and Exchange

Commission. Please refer to the Risk Factors contained in the Company’s annual report on Form

10-K for the year ended December 31, 2010.

contains certain forward-looking information, such as current expectations as to future

performance and schedules. Such forward-looking information is based on management’s

current assumptions and analysis, which are subject to numerous business risks and

uncertainties, including risk and uncertainties that relate to acquisitions. There can be no

assurance that these assumptions will prove to be accurate in the future. Actual results may

differ from these forward-looking statements as a result of, among other things, the factors

detailed from time to time in the Company’s filings with the Securities and Exchange

Commission. Please refer to the Risk Factors contained in the Company’s annual report on Form

10-K for the year ended December 31, 2010.

LMI AEROSPACE PROPRIETARY

2

Senior Management

Lawrence E. Dickinson

CFO & Secretary

Ronald S. Saks

CEO & Director

> Chief Executive Officer of LMI since 1984

> Chief Financial Officer of LMI since 1993

LMI AEROSPACE PROPRIETARY

3

(1) Based on financials for the 12-month period ended December 31, 2010

Investment Highlights

> Leading provider of design engineering services, structural assemblies, kits and components

for aerospace and defense markets

for aerospace and defense markets

> Well-positioned on key programs with leading OEMs and Tier-1 market participants

> Favorable long-term industry trends toward outsourcing engineering, production and

assembly

assembly

> Broad revenue / customer diversification(1)

• 33% services, 67% production and assembly

• 39% large commercial, 24% military, 30% regional and business

> Growth strategy leverages existing programs, disciplined M&A approach and integrated

design-build model

design-build model

> Experienced management team with an average of over 20 years’ experience and strong

industry relationships

industry relationships

LMI AEROSPACE PROPRIETARY

4

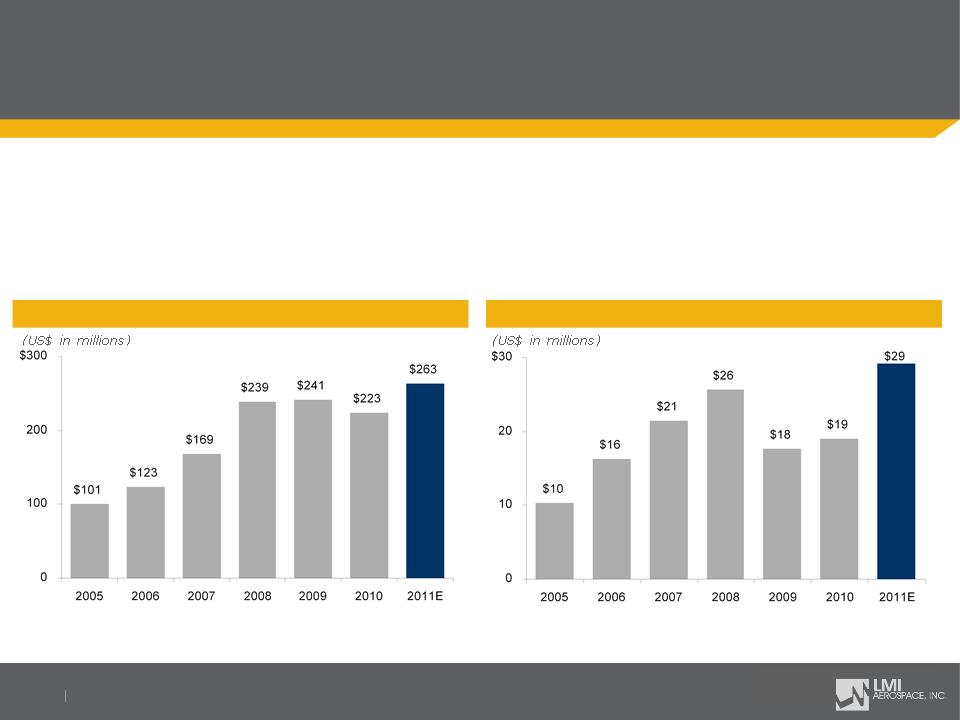

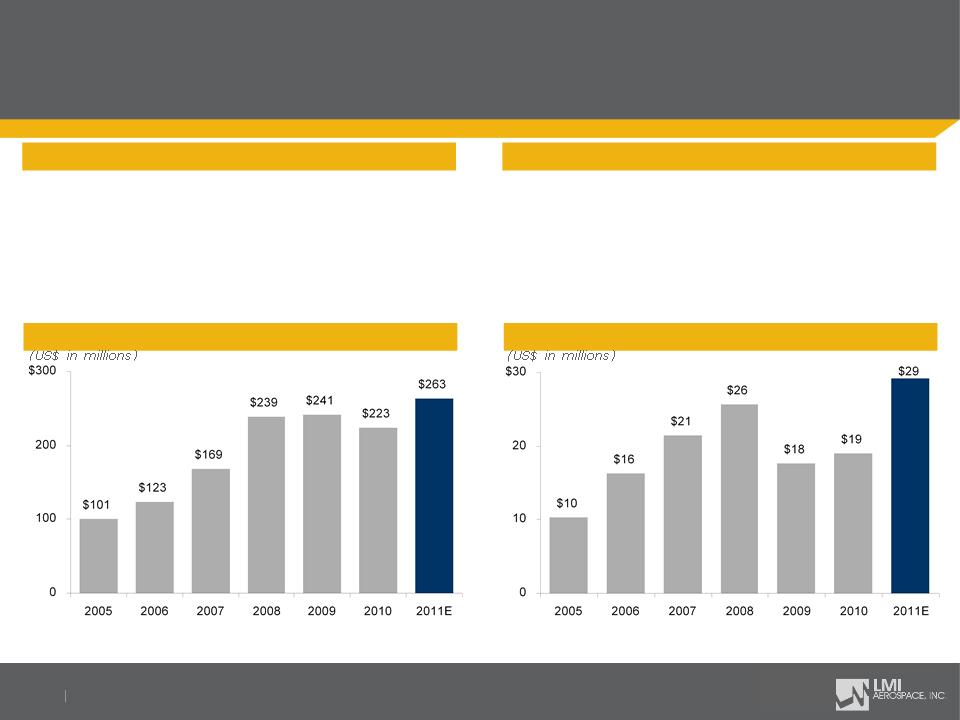

Operating Income(1)

Revenue(1)

Investment Highlights (continued)

> Proven track record of financial performance

> Overall 2011 Revenues are expected to be $258 - $268 million

• Aerostructures: $172 - $178 million

• Engineering Services: $86 - $90 million

(1) 2011E reflects midpoint of Company guidance as of August 8, 2011

LMI AEROSPACE PROPRIETARY

5

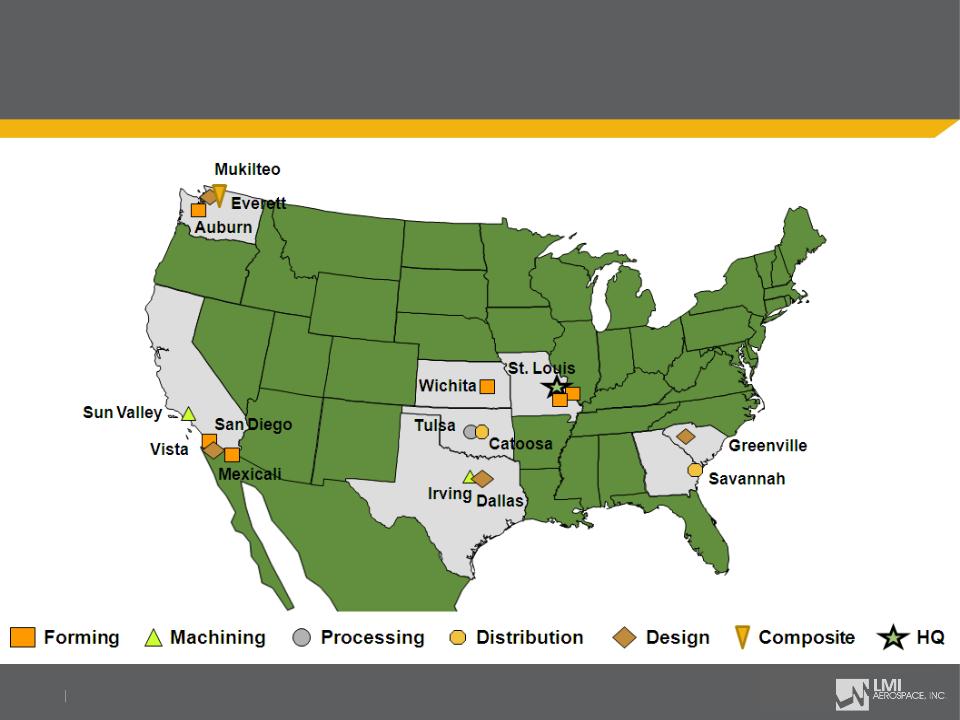

LMI’s Operations In Key Aerospace Markets

LMI AEROSPACE PROPRIETARY

6

Strong Relationships with OEMs & Tier 1s

(1)

(1) Acquired by Triumph Group in 2010

LMI AEROSPACE PROPRIETARY

7

Strategic Initiatives

> Achieve organic growth within our engineering and manufacturing businesses as well as

through new design-build projects

through new design-build projects

> Make project management expertise the cornerstone of our competitive advantage

> Continue to diversify our customers across three major market sectors

> Pursue strategic acquisitions to build critical mass and capabilities to win larger, more

complex projects

complex projects

> Provide exemplary customer service

> Target perfect quality and delivery performance

> Implement global sourcing strategy to provide value to our customers

> Continue to invest in training and development of our workforce

Goal: Double our revenue by 2014 and maintain debt to equity ratio less than 1:1

LMI AEROSPACE PROPRIETARY

8

LMI Offers Full Lifecycle Support from Engineering &

Design to Assembly & Manufacturing

Design to Assembly & Manufacturing

> Customer defines

product or project

requirements

product or project

requirements

> Done together with

customer

customer

> Time and materials

billing

billing

> Testing on fixed

price basis

price basis

> Joint input between

LMI and Customer

LMI and Customer

> Quote in

competition with

others

competition with

others

> Build to print

> Long-term

contracts with

customers

contracts with

customers

LMI AEROSPACE PROPRIETARY

9

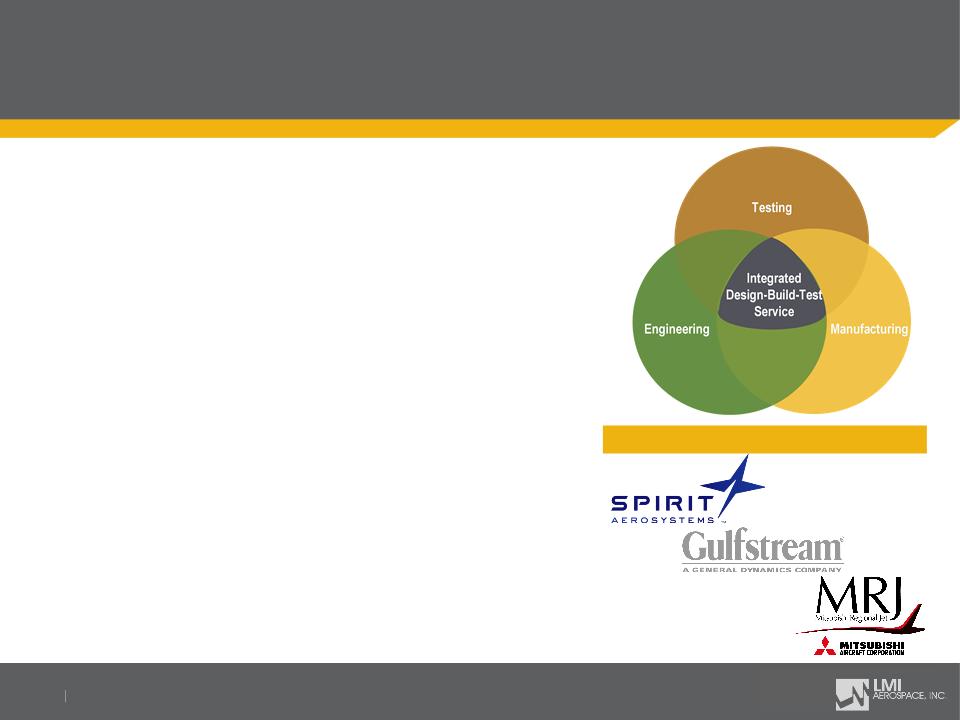

Design-Build Strategy

“We will provide integrated solutions to our

aerospace customers through creative and

value-driven engineering and manufacturing

processes, throughout the product life cycle.”

aerospace customers through creative and

value-driven engineering and manufacturing

processes, throughout the product life cycle.”

> LMI is positioned as a “turnkey” aerospace systems

provider, capitalizing on the accelerating trend of OEMs

outsourcing complex aircraft development projects

provider, capitalizing on the accelerating trend of OEMs

outsourcing complex aircraft development projects

> Technical leadership through over 300 highly skilled D3

engineers and 49 Intec technicians

engineers and 49 Intec technicians

> New programs expected to require substantial annual

investments in engineering and tooling

investments in engineering and tooling

> Continue to seek acquisitions to broaden capabilities

and support production of larger, complex assemblies

and support production of larger, complex assemblies

Select Customers

LMI AEROSPACE PROPRIETARY

10

Mitsubishi Regional Jet Tailcone

> MJET required a supplier with design, tooling and fabrication

capabilities

capabilities

> Critical Design Review held in 4th quarter 2010

> 1st unit to be delivered in 1st quarter 2012

> Engineering and tooling funded through milestone payments

LMI AEROSPACE PROPRIETARY

11

Add New Programs and Market Share Gains

> Pursue new programs with both new and existing customers

• Add new programs across Commercial, Military, Regional and Business Jet sectors

• Aerostructures and Engineering segments have consistently added 4-6 new major

programs per year

programs per year

> New design-build programs expected to require substantial initial investments in engineering

and tooling

and tooling

• Satisfy stringent ROI requirement

> Potential long-term commitment of in-house design resources may be necessary

LMI AEROSPACE PROPRIETARY

12

Growth through Acquisitions

> Plan to acquire businesses with solid management teams and technical capabilities to

continue expanding the complexity of our products

continue expanding the complexity of our products

• Composites and other non-metal products

• High speed machining

> Acquisition program from 1998 through 2009 resulted in 8 successfully acquired and

integrated businesses

integrated businesses

• Broadened our breadth of engineering and manufacturing capabilities

• Diversified our markets and programs served

LMI AEROSPACE PROPRIETARY

13

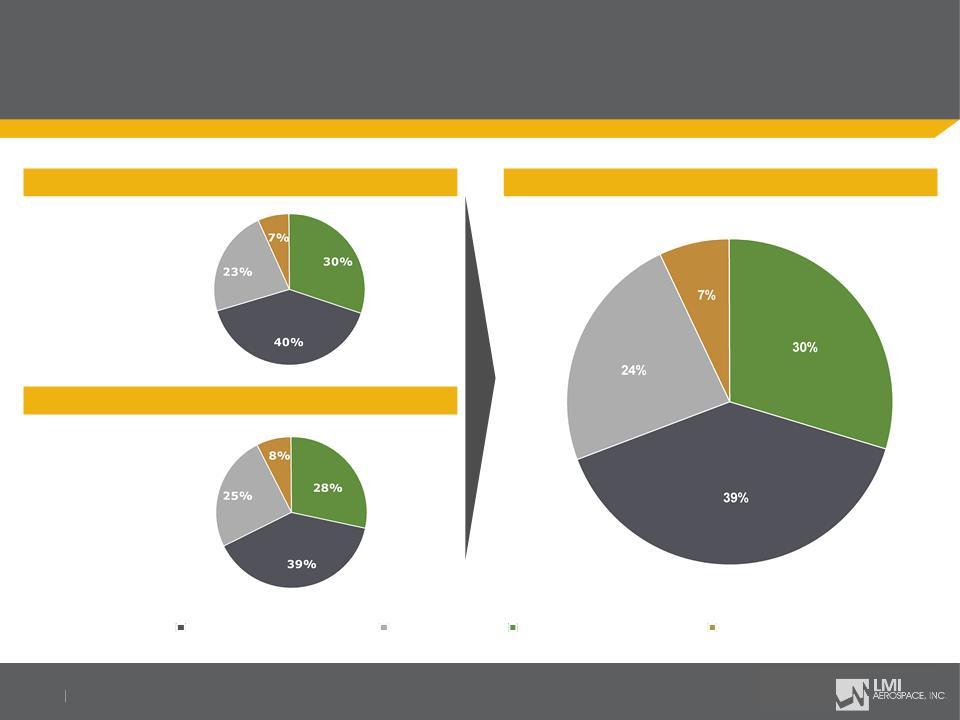

FY 2010 Aerostructures Revenue - $149.0m

Diversified Revenues Across Aerospace Sectors

Disciplined diversification strategy designed to protect LMI from downturns in any single sector

(1) Sector revenue breakdown based on financials for the 12-month period ended December 31, 2010

Eliminations for the 12-month period totaled $0.5 million and spread ratably across sector percentages

FY 2010 Engineering Services Revenue - $74.4m

FY 2010 LMI Revenue - $223.4m

Regional and Business Jet

Large Commercial Aircraft

Military Aircraft

Other

(US$ in millions)

(US$ in millions)

(US$ in millions)

$18.6

$5.6

$59.4

$29.1

$45.2

$21.1

$34.6

$9.8

$15.4

$66.3

$88.5

$53.2

LMI AEROSPACE PROPRIETARY

14

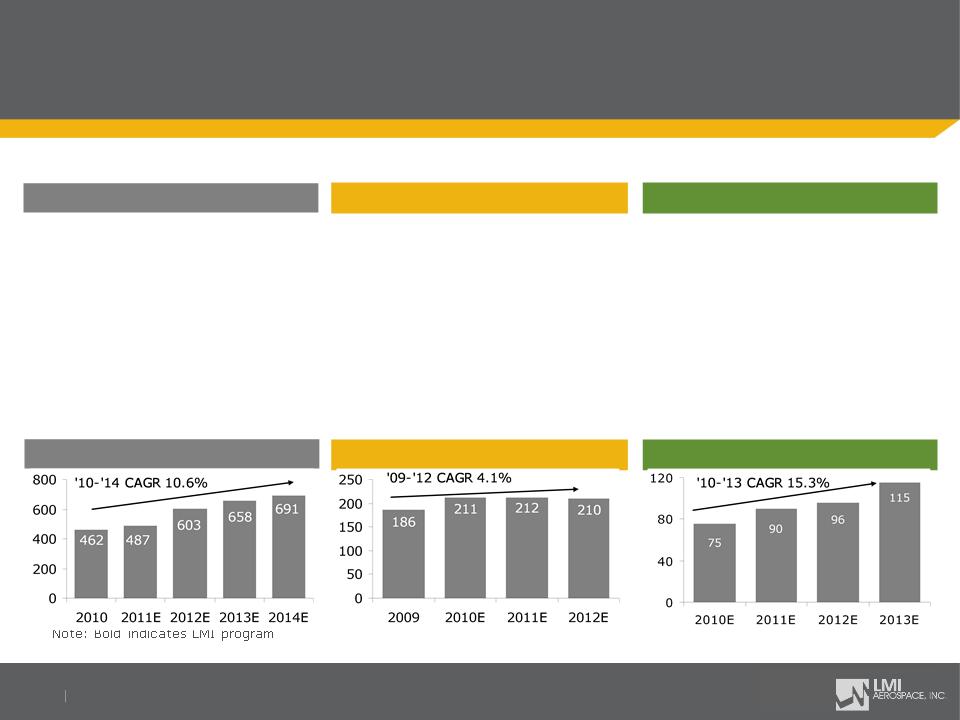

> Global GDP growth leading to

increased air traffic volumes in

domestic and international

markets

increased air traffic volumes in

domestic and international

markets

> OEMs have increased planned

production rates (e.g. 737, 747,

777, 787, A320)

production rates (e.g. 737, 747,

777, 787, A320)

> New fuel-efficient aircraft

programs are gaining traction

(e.g. 787, A350) with significant

backlog

programs are gaining traction

(e.g. 787, A350) with significant

backlog

> Rotorcraft demand driven by high

utilization and aging fleet

utilization and aging fleet

> Engineering services for military

aircraft programs driven by

upgrades, maintenance,

modification and new aircraft

development

aircraft programs driven by

upgrades, maintenance,

modification and new aircraft

development

> Expectations for Sikorsky military

helicopter deliveries to reach 210

units in 2012

helicopter deliveries to reach 210

units in 2012

> Business jet flight operations

experienced double-digit growth

for most of 2010

experienced double-digit growth

for most of 2010

> High end large cabin market is

showing signs of recovery

showing signs of recovery

> Large cabin Gulfstream deliveries

expected to grow to 115 in 2013

from 75 in 2010

expected to grow to 115 in 2013

from 75 in 2010

Military Aircraft

Regional and Business Jet

Focus on Diverse Markets

Large Commercial Aircraft

Gulfstream Large Cabin Deliveries

Sikorsky Military Helicopter Deliveries

Boeing Aircraft Deliveries

Source: DoD, Industry and Wall Street research

LMI AEROSPACE PROPRIETARY

15

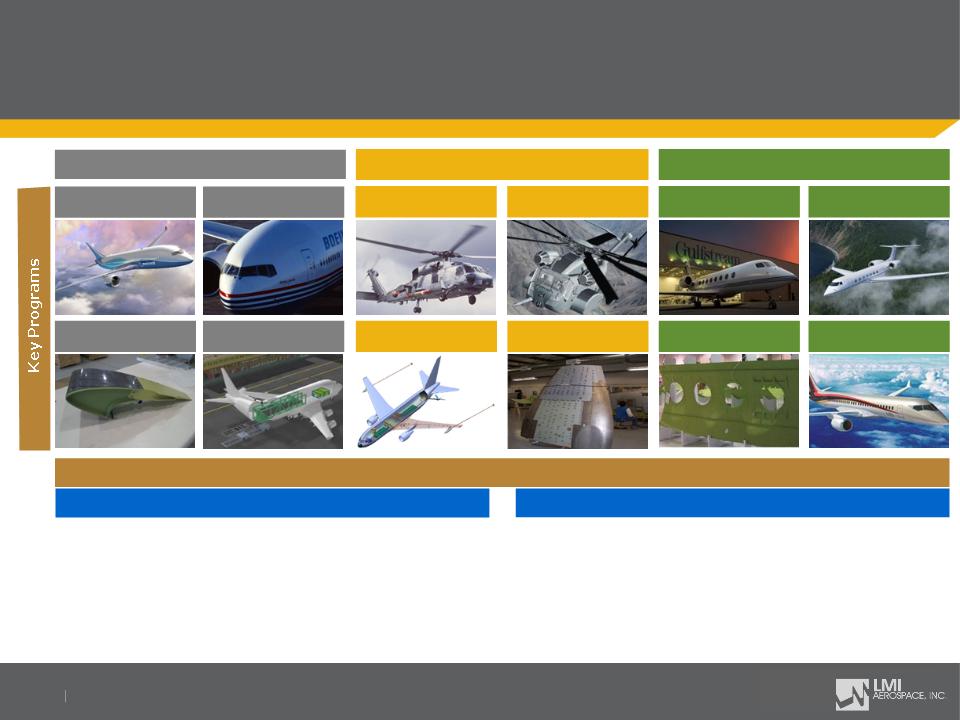

LMI Programs

Large Commercial Aircraft

Military Aircraft

Regional and Business Jet

767 Winglet

Modification

Modification

Boeing Structural

Design

Design

767 Tanker

Sikorsky Cabin

Assembly

Assembly

Fuselage Kit

MJET

> Wing/Wingbox Design

> Fuselage/Empennage Design

> Composite Design Expertise

> Weight Improvement Studies

> Tool Design and Fabrication

> Rapid Prototyping and Test

> Wing Skins and

Components

Components

> Fuselage Skins and

Components

Components

> Leading Edges

> Winglet Leading Edge

and Modification Kit

and Modification Kit

> Structural Sheet Metal and

Extruded Components

Extruded Components

> Detail Interior Components

> Helicopter Components

> Helicopter Assemblies

> Housings and Assemblies

for Gun Turrets

for Gun Turrets

> Avionics and Tactical

Software Development

Software Development

> Winglet Design

> Certification Planning

and Support

and Support

> Design for

Manufacturing Cost

Manufacturing Cost

Aerostructures Products

Engineering Services

G-650

G-550

Blackhawk Models

CH-53K

787

777

LMI Platform

LMI AEROSPACE PROPRIETARY

16

History of Financial Success

|

(US$ in millions)

|

|||

|

Revenue

|

$258.0

|

-

|

$268.0

|

|

Gross Profit Margin

|

24.0%

|

-

|

24.8%

|

|

SG&A

|

$33.8

|

-

|

$35.2

|

|

Interest Expense

|

$1.4

|

-

|

$1.5

|

|

Tax Rate

|

|

|

32.5%

|

|

D&A, Stock Comp.

|

$9.6

|

|

$10.2

|

|

(US$ in millions)

|

Aerostructures

|

Engineering

Services |

|

Revenue

|

$172.0-$178.0

|

$86.0-$90.0

|

|

Gross Profit

Margin |

27.0%-27.8%

|

18.0 % - 18.8%

|

|

SG&A

|

$26.0-$27.0

|

$7.8-$8.2

|

Guidance for 2011

Revenue(1)

Operating Income(1)

Segment Guidance for 2011

(1) 2011E reflects midpoint of Company guidance as of August 8 2011

LMI AEROSPACE PROPRIETARY

17

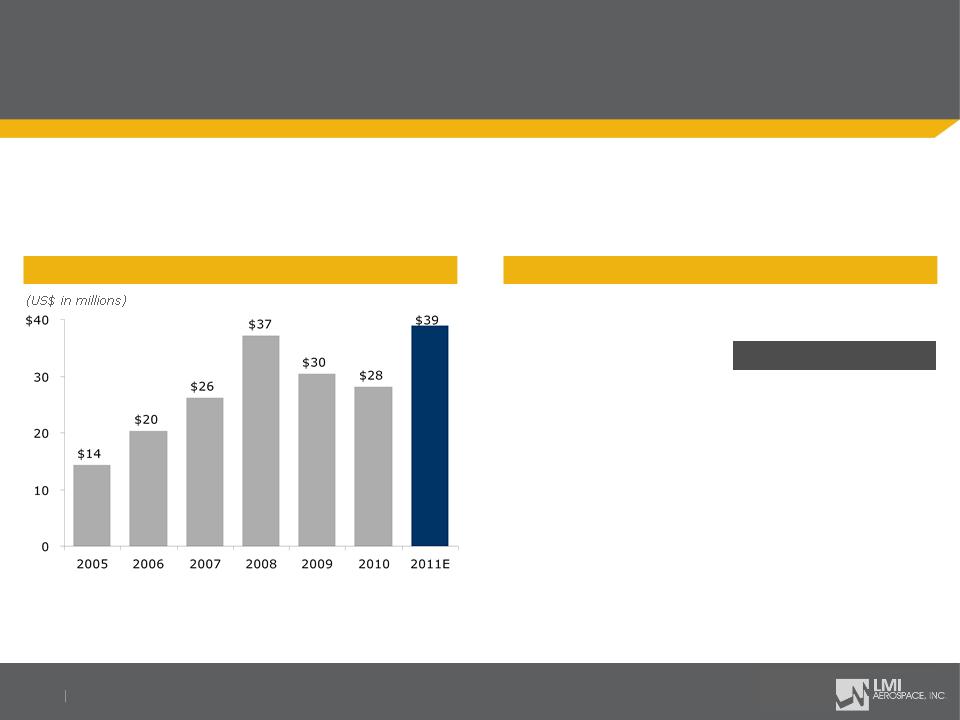

> Significant liquidity

• $125 million revolver with additional $25 million in an accordion feature

• Focus on achieving significant free cash flow

(1) 2011E reflects midpoint of Company guidance as of August 8 2011. EBITDA equals operating income plus depreciation,

amortization, stock compensation expense and goodwill impairment

(2) $125 million capacity

(3) Excludes capital leases and equipment notes

|

|

12/31/10

|

6/30/11

|

|

Cash & Equivalents

|

$1.9

|

$7.5

|

|

Drawn revolver(2)

|

-

|

-

|

|

Net Debt(3)

|

$(1.9)

|

$(7.5)

|

|

Undrawn revolver(2)

|

$80.0

|

$125.0

|

Strong Cash Generation

EBITDA(1)

Current Net Debt and Revolver Capacity

(US$ in millions)

LMI AEROSPACE PROPRIETARY

18

Investment Highlights

> Leading provider of design engineering services, structural assemblies, kits and

components for aerospace and defense markets

components for aerospace and defense markets

> Well-positioned on key programs with leading OEMs and Tier-1 market participants

> Favorable long-term industry trends toward outsourcing engineering, production and

assembly

assembly

> Broad revenue / customer diversification

> Demonstrated track record of strong financial performance

> Growth strategy leverages existing programs, disciplined M&A approach and integrated

design-build model

design-build model

> Experienced management team with an average of over 20 years’ experience and strong

industry relationships

industry relationships