Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Invesco Mortgage Capital Inc. | d236075d8k.htm |

Invesco Mortgage

Capital Inc. JMP Securities Financial Services and

Real Estate Conference

September 2011

Exhibit 99.1 |

1

Past performance is not a guarantee of future results

Forward-looking statements

This presentation, and comments made in the associated Q&A session, may include

“forward-looking statements”

within the meaning of the U.S. securities laws. Forward-looking statements include

statements with respect to our beliefs, plans, objectives, goals, targets,

expectations, anticipations, assumptions, estimates, intentions and future performance.

In addition, words such as “anticipates,” “believes,”

“intends,”

“projects,”

“expects”

and “plans,”

and future or conditional verbs such as “will,”

“may,”

“could,”

“should,”

and “would,”

as well as any other statements that necessarily depends on

future events, are intended to identify forward-looking statements.

Forward-looking statements are not guarantees, and they involve risks, uncertainties and

assumptions. There can be no assurance that actual results will not differ materially

from our expectations. We caution investors not to rely unduly on any

forward-looking statements and urge you to carefully consider the risks described

in our most recent Form 10-K and subsequent Forms 10-Q, filed with the Securities and

Exchange Commission. You may obtain these reports from the SEC’s website at

www.sec.gov. We expressly disclaim any obligation to update the information in any

public disclosure if any forward-looking statement later turns out to be

inaccurate. For all forward-looking statements, we claim the “safe

harbor”

provided by Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934.

All material presented is compiled from sources believed to be reliable and current, but

accuracy cannot be guaranteed.

This is not to be construed as an offer to buy or sell any securities and should not be

relied upon as the sole factor in an investment-making decision. As with all

investments, there are associated inherent risks.

Please obtain and review all financial material carefully before investing. All

data is as of September 23, 2011, unless otherwise noted.

The opinions expressed are based on current market conditions and are subject to change

without notice. |

2

Past performance is not a guarantee of future results

Portfolio Update

Market value as of September 23, 2011

CMBS

9.68%

Non-Agency

18.47%

Agency 15's

16.64%

Agency 30's

44.94%

Agency Hybrids

9.81%

Other

0.46%

IVR Asset Composition |

3

Past performance is not a guarantee of future results

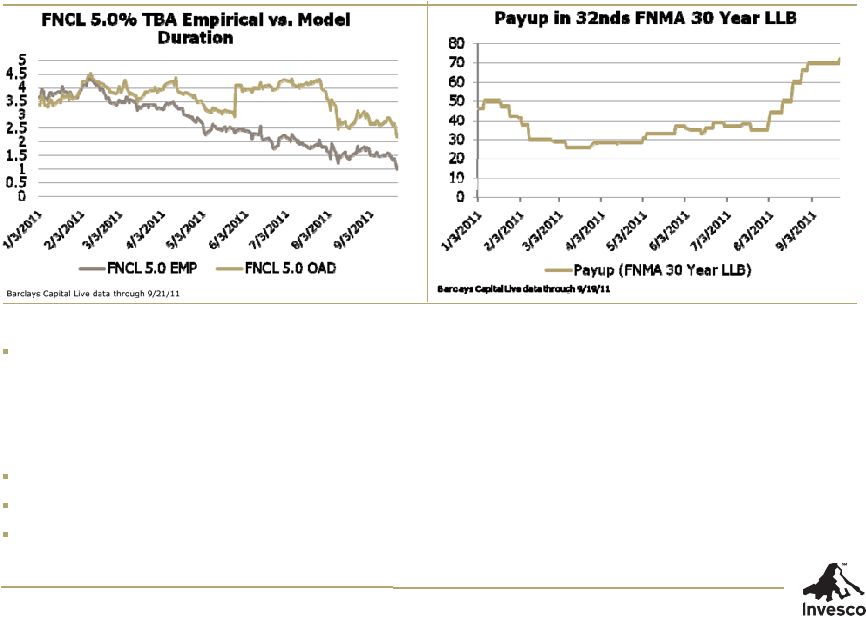

Agency MBS

Comments

Uncertainty

over

future

prepayment

speeds

has

caused

empirical

duration

(over

30

days

minus

10

year

swaps

-EMP)

and

model

option

adjusted

durations

(OAD)

to

de-couple

–

Our

prepayment

history

suggest

durations

that

are

longer

than

empirical

or

model

durations

–

Payups

on

specified

pool

collateral

have

continued

to

expand

which

is

positive

(see

low

loan

balance

example

above)

Prepayment

speeds

on

our

book

have

remained

very

stable

even

as

rates

have

fallen

We

believe

our

collateral

remains

very

well

positioned

for

this

interest

rate

environment

We

are

predominantly

invested

in

loan

balance

stories

(48%),

with

the

balance

invested

in

pools

backed

by

high

LTV

and

low

FICO

borrowers,

investor

properties

and

seasoned

paper. |

4

Past performance is not a guarantee of future results

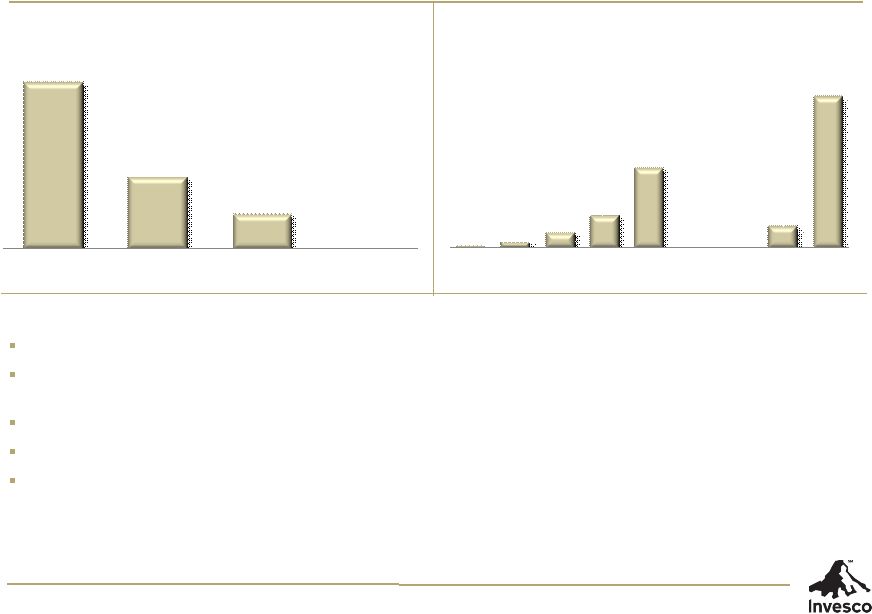

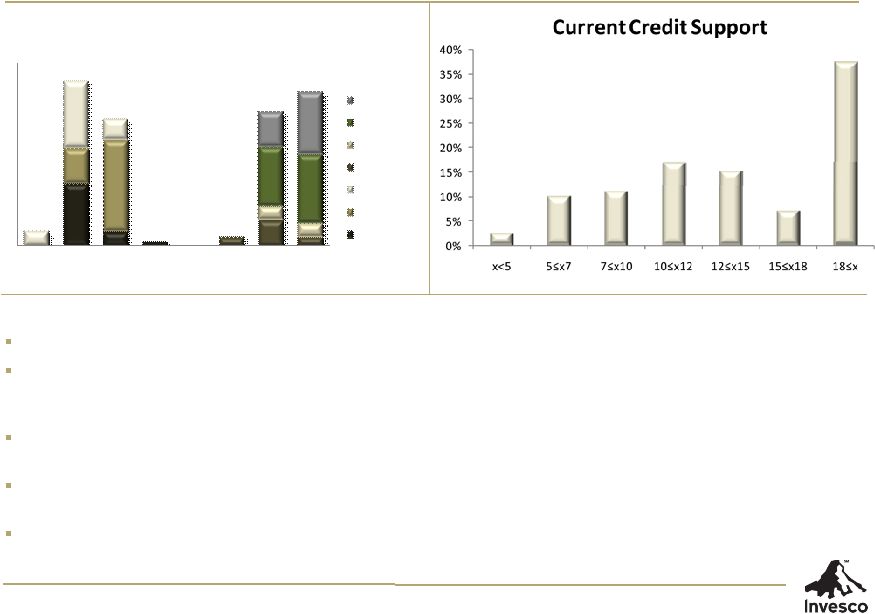

Non-Agency Composition

Comments

Non-Agency RMBS allocations have continued to focus on Senior Re-REMICs

Senior Re-REMIC focus reduces price volatility while improving expected returns and

overall enhancement levels

Legacy non-agency book has declined as a percent of overall exposure

Housing performance to date has been consistent with underwriting assumptions

No OTTI has been recorded in 2011

Vintage reflects year of transaction issuance date

As of September 23, 2011

60.5%

26.3%

12.7%

0.5%

Re-REMIC Senior

Prime

Alt-A

Subprime

Non-Agency Asset Type

1.0%

2.2%

5.1%

10.7%

25.7%

0.0%

0.0%

7.1%

48.3%

2003

2004

2005

2006

2007

2008

2009

2010

2011

Vintage |

5

Past performance is not a guarantee of future results

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

2004

2005

2006

2007

2008

2009

2010

2011

Asset Quality by Vintage

2.0 BBB

2.0 A

2.0 AA

Freddie K MF

AJ

AM

Senior

CMBS Composition

Comments

Commercial real estate fundamentals continue to show signs of stabilization

We believe our CMBS asset selection is concentrated in the highest quality bonds in each

respective sub-sector and vintage -

Our bonds have outperformed their peer group as credit

tiering has become more pronounced

We believe as investors move towards quality, the credit curve will steepen further, causing

our bonds to be among the most resilient during periods of volatility

With low rates and limited growth, we believe our bonds are well

positioned as they offer

attractive yields and positive downside scenarios

2010 and early 2011 CMBS 2.0 investments provide access to newly

originated loans which we

believe benefit from lower leverage and higher debt service coverage ratios than those

underwritten at the peak of the real estate market

Vintage reflects year of underlying loan origination |

6

Past performance is not a guarantee of future results

Repo Market Update

Agency RMBS

Agency haircuts remain at ~5%

Weighted average financing rate is ~28 bps

Non Agency RMBS

Non-Agency haircut is ~19%

Weighted average spread to LIBOR is ~125 bps

CMBS

IVR’s average CMBS haircut is ~18%

Weighted average spread to LIBOR is ~110 bps

As of September 23, 2011 |

7

Past performance is not a guarantee of future results

Interest Rate Hedges

Comments

Average swap ~4.5 years

Hedging strategy has been to maintain a model duration gap of 0.5 to 1.0 years

No additional swaps have been added since 6/30/11

Hedge ratio approximately 55 -

60% of total repo

($ in thousands)

Maturity

Notional

Weighted

Average Pay

Rate

2012

175,000

2.07%

2013

300,000

1.76%

2014

100,000

2.79%

2015

800,000

1.89%

2016

4,700,000

2.27%

2018

450,000

2.96%

2021

400,000

2.99%

6,925,000

$

2.29% |