Attached files

| file | filename |

|---|---|

| EX-23.2 - EXHIBIT 23.2 - GENESIS ENERGY LP | ex23_2.htm |

| EX-99.2 - EXHIBIT 99.2 - GENESIS ENERGY LP | ex99_2.htm |

| 8-K - GENESIS ENERGY LP 8-K 9-26-2011 - GENESIS ENERGY LP | form8k.htm |

| EX-99.3 - EXHIBIT 99.3 - GENESIS ENERGY LP | ex99_3.htm |

| EX-99.4 - EXHIBIT 99.4 - GENESIS ENERGY LP | ex99_4.htm |

| EX-23.1 - EXHIBIT 23.1 - GENESIS ENERGY LP | ex23_1.htm |

EXHIBIT 99.1

PART I

Unless the context otherwise requires, references to “Genesis Energy, L.P.,” “Genesis,” “we,” “our,” “us” or like terms refer to Genesis Energy, L.P. and its operating subsidiaries, including Genesis Energy Finance Corporation; “our general partner” refers to Genesis Energy, LLC, the general partner of Genesis; “Free State” refers to Genesis Free State Pipeline, LLC; “NEJD Pipeline” refers to Genesis NEJD Pipeline, LLC; “Cameron Highway” refers to the Cameron Highway Oil Pipeline Company; “Quintana” refers to Quintana Capital Group II, L.P. and its affiliates; “the Robertson Group” refers to Corbin J. Robertson, Jr., members of his family and certain of their affiliates, including Quintana Capital Group, II, L.P.; “Davison family” refers to, collectively, James E. Davison, James E. Davison, Jr., Steven K. Davison and Todd A. Davison and each of their respective families; “DG Marine” refers to DG Marine Transportation, LLC and its subsidiaries; “CO2” means carbon dioxide; “NaHS,” which is commonly pronounced as “nash,” means sodium hydrosulfide; and “NaOH” and “caustic soda” mean sodium hydroxide.

Except to the extent otherwise provided, the information contained in this form is as of December 31, 2010.

General

We are a growth-oriented master limited partnership, or MLP, focused on the midstream segment of the oil and gas industry in the Gulf Coast region of the United States, primarily Texas, Louisiana, Arkansas, Mississippi, Alabama, Florida and in the Gulf of Mexico. Formed in Delaware in 1996, our common units are traded on the New York Stock Exchange under the ticker symbol “GEL.” We have a diverse portfolio of customers, operations and assets, including pipelines, refinery-related plants, storage tanks and terminals, barges and trucks. We provide an integrated suite of services to oil and CO2 producers; refineries; industrial and commercial enterprises that use NaHS and caustic soda; and businesses that use CO2 and other industrial gases. Substantially all of our revenues are derived from providing services to integrated oil companies, large independent oil and gas or refinery companies, and large industrial and commercial enterprises.

We conduct our operations through subsidiaries and joint ventures. We manage our businesses through three divisions that constitute our reportable segments:

Pipeline Transportation—We transport crude oil and CO2 for others for a fee in the Gulf Coast region of the U.S. through approximately 930 miles of pipeline. Our Pipeline Transportation segment owns and operates three onshore crude oil common carrier pipelines and two CO2 pipelines. Additionally, as of November 23, 2010, we own a 50% interest in a joint venture, Cameron Highway, that operates the largest crude oil pipeline system in the Gulf of Mexico. Our 235-mile Mississippi System provides shippers of crude oil in Mississippi indirect access to refineries, pipelines, storage terminals and other crude oil infrastructure located in the Midwest. Our 100-mile Jay System originates in southern Alabama and the panhandle of Florida and provides crude oil shippers access to refineries, pipelines and storage near Mobile, Alabama. Approximately 35 miles of gathering pipelines bring crude oil to the Jay System. Our 90-mile Texas System transports crude oil from West Columbia to several delivery points near Houston. Our crude oil pipeline systems include access to a total of approximately 0.7 million barrels of crude oil storage.

Our Free State Pipeline is an 86-mile, 20” CO2 pipeline that extends from CO2 source fields near Jackson, Mississippi, to oil fields in eastern Mississippi. We have a twenty-year transportation services agreement (through 2028) related to the transportation of CO2 on our Free State Pipeline.

In addition, a subsidiary of Denbury Resources Inc. has leased from us (through 2028) the NEJD Pipeline System, a 183-mile, 20” CO2 pipeline extending from the Jackson Dome, near Jackson, Mississippi, to near Donaldsonville, Louisiana. The NEJD System transports CO2 to tertiary oil recovery operations in southwest Mississippi.

Refinery Services—We primarily (i) provide services to ten refining operations located predominantly in Texas, Louisiana, Arkansas and Utah; (ii) operate significant storage and transportation assets in relation to those services; and (iii) sell NaHS and caustic soda to large industrial and commercial companies. Our refinery services primarily involve processing refiners’ high sulfur (or “sour”) gas streams to remove the sulfur. Our refinery services footprint also includes terminals, and we utilize railcars, ships, barges and trucks to transport product. Our refinery services contracts are typically long-term in nature and have an average remaining term of four years. NaHS is a by-product derived from our refinery services process, and it constitutes the sole consideration we receive for these services. A majority of the NaHS we receive is sourced from refineries owned and operated by large companies, including ConocoPhillips, CITGO, Holly and Ergon. We sell our NaHS to customers in a variety of industries, with the largest customers involved in mining of base metals, primarily copper and molybdenum, and the production of pulp and paper. We believe we are one of the largest marketers of NaHS in North and South America.

1

Supply and Logistics—We provide services primarily to Gulf Coast oil and gas producers and refineries through a combination of purchasing, transporting, storing, blending and marketing of crude oil and refined products, primarily fuel oil. In connection with these services, we utilize our portfolio of logistical assets consisting of trucks, terminals, pipelines and barges. We have access to a suite of more than 250 trucks, 280 trailers and 1.5 million barrels of terminal storage capacity in multiple locations along the Gulf Coast as well as capacity associated with our three common carrier crude oil pipelines. In addition, our wholly-owned marine transportation subsidiary, DG Marine provides us with access to twenty barges which, in the aggregate, include approximately 660,000 barrels of refined product transportation capacity. Usually, our supply and logistics segment experiences limited commodity price risk because it utilizes back-to-back purchases and sales, matching sale and purchase volumes on a monthly basis. Unsold volumes are hedged with NYMEX derivatives to offset the remaining price risk.

On a smaller scale, we also provide CO2 and certain other industrial gases and related services to industrial and commercial enterprises. We (i) supply CO2 to industrial customers under long-term contracts, with an average remaining contract life of six years, and (ii) manufacture and sell syngas (a combination of carbon monoxide and hydrogen) through a small joint venture. Our compensation for supplying CO2 to our industrial customers is the effective difference between the price at which we sell our CO2 under each contract and the price at which we acquired our CO2 pursuant to our volumetric production payments (also known as VPPs), minus transportation costs.

Our Objectives and Strategies

Our primary business objectives are to generate stable cash flows that allow us to make quarterly cash distributions to our unitholders and to increase those distributions over time. We plan to achieve those objectives by executing the following business and financial strategies.

Business Strategy

Our primary business strategy is to provide an integrated suite of services to oil and gas producers, refineries and other customers. Successfully executing this strategy should enable us to generate and grow sustainable cash flows. We intend to develop our business by:

|

|

·

|

Identifying and exploiting incremental profit opportunities, including cost synergies, across an increasingly integrated footprint;

|

|

|

·

|

Optimizing our existing assets and creating synergies through additional commercial and operating advancement;

|

|

|

·

|

Leveraging customer relationships across business segments;

|

|

|

·

|

Attracting new customers and expanding our scope of services offered to existing customers;

|

|

|

·

|

Expanding the geographic reach of our refinery services and supply and logistics segments;

|

|

|

·

|

Economically expanding our pipeline and terminal operations; and

|

|

|

·

|

Evaluating internal and third party growth opportunities (including asset and business acquisitions) that leverage our core competencies and strengths and further integrate our businesses.

|

Financial Strategy

2

We believe that preserving financial flexibility is an important factor in our overall strategy and success. Over the long-term, we intend to:

|

|

·

|

Increase the relative contribution of recurring and throughput-based revenues, emphasizing longer-term contractual arrangements;

|

|

|

·

|

Prudently manage our limited commodity price risks;

|

|

|

·

|

Maintain a sound, disciplined capital structure; and

|

|

|

·

|

Create strategic arrangements and share capital costs and risks through joint ventures and strategic alliances.

|

Competitive Strengths

We believe we are well positioned to execute our strategies and ultimately achieve our objectives due primarily to the following competitive strengths:

|

|

·

|

Our businesses encompass a balanced, diversified portfolio of customers, operations and assets. We operate three business segments and own and operate assets that enable us to provide a number of services to oil, and CO2 producers; refinery owners; industrial and commercial enterprises that use NaHS and caustic soda; and businesses that use CO2 and other industrial gases. Our business lines complement each other by allowing us to offer an integrated suite of services to common customers across segments.

|

|

|

·

|

Through our NaHS sales, we have indirect exposure to fast-growing, developing economies outside of the U.S. We sell NaHS — a by-product of our refinery services process — to the mining and pulp and paper industries. Copper and other mined materials as well as paper products are sold in the global market.

|

|

|

·

|

We have lower commodity price risk exposure. The volumes of crude oil, refined products or intermediate feedstocks that we purchase are either subject to back-to-back sales contracts or are hedged with NYMEX derivatives to limit our exposure to movements in the price of the commodity. Our risk management policy requires that we monitor the effectiveness of the hedges to maintain a value at risk of such hedged inventory that does not exceed $2.5 million. In addition, our service contracts with refiners allow us to adjust our processing rates to maintain a balance between NaHS supply and demand.

|

|

|

·

|

Our businesses provide consistent consolidated financial performance. During the adverse economic environment that began in the third quarter of 2008 and continued until early in 2010, our businesses provided consistent performance that, when combined with our conservative capital structure, allowed us to increase our distribution for twenty-two consecutive quarters as of our most recent distribution declaration.

|

|

|

·

|

Our pipeline transportation and related assets are strategically located. Our owned and operated crude oil pipelines, along with Cameron Highway, are located in the Gulf Coast region and provide our customers access to multiple delivery points. In addition, a majority of our terminals are located in areas that can be accessed by truck, rail or barge.

|

|

|

·

|

We believe we are one of the largest marketers of NaHS in North and South America. The scale of our well-established refinery services operations as well as our integrated suite of assets provides us with a unique cost advantage over some of our existing and potential competitors.

|

|

|

·

|

Our expertise and reputation for high performance standards and quality enable us to provide refiners with economic and proven services. Our extensive understanding of the sulfur removal process and refinery services market can provide us with an advantage when evaluating new opportunities and/or markets.

|

|

|

·

|

Our supply and logistics business is operationally flexible. Our portfolio of trucks, barges and terminals affords us flexibility within our existing regional footprint and provides us the capability to enter new markets and expand our customer relationships.

|

3

|

|

·

|

We are financially flexible and have significant liquidity. As of December 31, 2010, we had $160.4 million available under our $525 million credit agreement, including up to $31.1 million of which could be designated as a loan under the $75 million petroleum products inventory loan sublimit, and $95.4 million of which could be used for letters of credit. Our inventory borrowing base was $43.9 million at December 31, 2010.

|

|

|

·

|

We have an experienced, knowledgeable and motivated executive management team with a proven track record. Our executive management team has an average of more than 25 years of experience in the midstream sector. Its members have worked in leadership roles at a number of large, successful public companies, including other publicly-traded partnerships. Through their equity interest in us, our senior executive management team is incentivized to create value by increasing cash flows.

|

2010 Developments

The following is a brief listing of developments since December 31, 2009. Additional information regarding most of these items may be found elsewhere in this report.

Permanent Elimination of IDRs

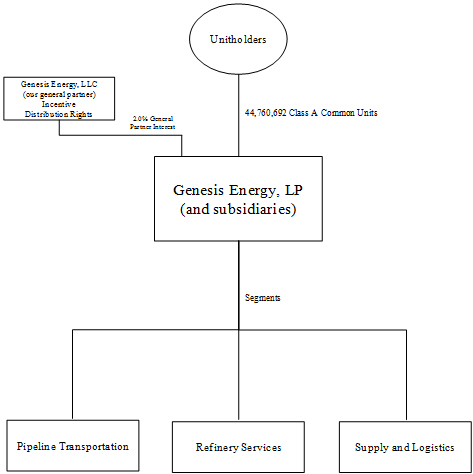

In February 2010, new investors, together with members of our executive management team, acquired our general partner. At that time, our general partner owned all our 2% general partner interest and all of our incentive distribution rights, or IDRs, and consequently was entitled to over 50% of any increased distributions we would pay in respect of our outstanding equity.

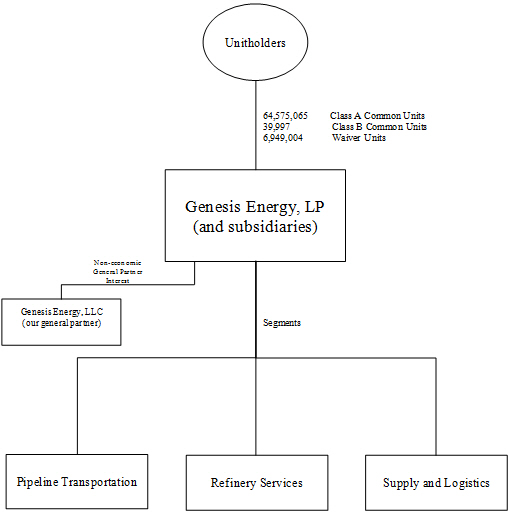

On December 28, 2010, we permanently eliminated our IDRs and converted our two percent general partner interest into a non-economic interest. In exchange for our IDRs and the 2% economic interest attributable to our general partner interest, we issued approximately 20 million common units and 7 million “Waiver Units” to the stakeholders of our general partner, less approximately 145,000 common units and 50,000 Waiver units that have been reserved for a new deferred equity compensation plan for employees. Our Waiver Units have the right to convert into common units in four equal installments in the calendar quarter during which each of our common units receives a quarterly distribution of at least $0.43, $0.46, $0.49 and $0.52, if our distribution coverage ratio (after giving effect to the then convertible Waiver Units) would be at least 1.1 times. Our distribution coverage ratio is computed as the ratio of our Available Cash before Reserves (also known as distributable cash flow) for a quarterly period to the total distribution to be paid with respect to that quarter.

As a result of that transaction, which we refer to as the IDR Restructuring, (i) we now have approximately 64.6 million common units outstanding (with the former stakeholders of the general partner owning approximately 45% of such units, including common units owned prior to the IDR Restructuring), (ii) our general partner has become (by way of merger) one of our wholly-owned subsidiaries, (iii) there has been no change in the composition of our board of directors and (iv) the former stakeholders of our general partner will continue to elect our board of directors in the future.

The IDR Restructuring was unanimously approved by our board of directors based, in part, on the unanimous approval and recommendation of the board’s conflicts committee, which is comprised solely of independent directors. The conflicts committee engaged independent financial and legal advisors and obtained a fairness opinion. The organizational structure resulting from the IDR Restructuring is also shown in the chart below.

Cameron Highway Acquisition

On November 23, 2010, we acquired a 50% interest in Cameron Highway for approximately $330 million. Cameron Highway, a joint venture with Enterprise Products Partners, L.P. (Enterprise Products), owns and operates the largest (measured by both length and capacity) crude oil pipeline system in the Gulf of Mexico. Constructed in 2004, the Cameron Highway oil pipeline system, or CHOPS, is comprised of 380 miles of 24- and 30- inch diameter pipeline with capacity to deliver up to 500,000 barrels per day of crude oil from developments in the Gulf of Mexico to refining markets along the Texas Gulf Coast located in Port Arthur and Texas City, Texas. When we acquired our interest in Cameron Highway, its assets included CHOPS, approximately $50 million of crude oil linefill and $9 million in pumping equipment (in each case, net to acquired 50% interest). Enterprise Products owns the remaining 50% interest in, and operates, the joint venture. We financed the purchase price for the acquisition primarily with the net proceeds of approximately $119 million from an underwritten public offering of 5.2 million of our common units (including the overallotment option that the underwriters exercised in full and including our general partner’s proportionate capital contribution to maintain its 2% general partner interest) at $23.58 per common unit and net proceeds of approximately $243 million from a private placement of $250 million in aggregate principal amount of 7.875% senior unsecured notes due 2018. We used $23.8 million in excess net proceeds to temporarily reduce the balance outstanding under our revolving credit agreement.

4

Acquisition of Remaining 51% Interest in DG Marine

On July 28, 2010, we acquired the 51% economic interest in DG Marine that we did not already own from TD Marine (a related party) for $25.5 million, resulting in DG Marine becoming our wholly-owned subsidiary. Originally formed in 2008, DG Marine was a joint venture in which we owned a 49% economic interest and TD Marine owned the remaining 51% economic interest. DG Marine provides transportation services of petroleum products by barge, which complements our other supply and logistics operations.

Restructured Credit Agreement

On June 29, 2010, we restructured our credit agreement. Our credit agreement now provides for a $525 million senior secured revolving credit facility, includes an accordion feature whereby the total credit available can be increased up to $650 million under certain circumstances, and matures on June 30, 2015. Among other modifications, our credit agreement now includes a $75 million sublimit tranche designed for more efficient financing of crude oil and petroleum products inventory.

Twenty-Two Consecutive Distribution Rate Increases

We have increased our quarterly distribution rate for twenty-two consecutive quarters. On February 14, 2011, we paid a quarterly cash distribution of $0.40 (or $1.60 annually) per unit to unitholders of record as of February 2, 2011, an increase per unit of $0.0125 (or 3.2%) from the distribution in the prior quarter, and an increase of 11.1% from the distribution in February 2010. As in the past, future increases (if any) in our quarterly distribution rate will depend on our ability to execute critical components of our business strategy.

Organizational Structure

On February 5, 2010, a group of investors acquired all of the equity interest in our general partner (including the interest owned by our executives), although certain of our executives were allowed to participate as members of that investment group to the extent of their prior ownership interest.

On December 28, 2010, pursuant to the IDR Restructuring, the incentive distribution rights held by our general partner were extinguished and the 2% general partner interest in us that our general partner held was converted into a non-economic general partner interest. The former stakeholders of our general partner, which included certain members of executive management team, received approximately 27,000,000 units in us, consisting of: (i) approximately 19,960,000 traditional common units, or Class A Units, (ii) approximately 40,000 Class B common units, or Class B Units, with rights, preferences and privileges of the Class A Units and rights to elect our board of directors and convertible into Class A Units and (iii) approximately 7,000,000 Waiver Units, convertible into Class A Units. The directors of our general partner before the IDR Restructuring remained as directors after the IDR Restructuring. After the IDR Restructuring, through their Class B Units, the former stakeholders of our general partner retained the right to elect our board of directors.

The Class A Units are traditional common units in us. The Class B Units are identical to the Class A Units and, accordingly, have voting and distribution rights equivalent to those of the Class A Units, and, in addition, Class B Units have the right to elect all of our board of directors, subject to the Davison Family’s right to elect up to three directors under certain terms pursuant to a unitholders rights agreement. The Class B Units are convertible into Class A Units under certain circumstances. The Waiver Units are non-voting securities entitled to a minimal preferential quarterly distribution and are comprised of four classes (designated Class 1, Class 2, Class 3 and Class 4) of 1,750,000 authorized units each. The Waiver Units have the right to convert into Class A Units at the rate of one Class A Unit for each Waiver Unit under certain circumstances.

5

The primary benefit realized from the IDR Restructuring was the elimination of our IDRs, which represented the right to receive an increasing percentage of quarterly distributions of available cash after a minimum quarterly distribution and certain target distribution levels had been achieved. Our cost of issuing new units to facilitate our continuing growth included not only the distributions payable to such new unitholders, but also the percent of our aggregate quarterly distributions we pay to our general partner in respect of our general partner interest (2%) and IDRs (approximately 49%). The elimination of our IDRs substantially lowers our cost of equity capital and increases the cash available to be distributed to our common unitholders. Additionally, the elimination of the IDRs enhances our ability to compete for new acquisitions and improves the returns to our unitholders on all future expansion projects.

Below are charts depicting our ownership structure before and after the IDR Restructuring.

Organizational Chart

Existing

After the IDR Restructuring on December 28, 2010:

6

Prior

Before the IDR Restructuring on December 28, 2010:

.

.Description of Segments and Related Assets

We conduct our business through three primary segments: Pipeline Transportation, Refinery Services and Supply and Logistics. These segments are strategic business units that provide a variety of energy-related services. Financial information with respect to each of our segments can be found in Note 12 to our Consolidated Financial Statements.

Pipeline Transportation

We own three onshore crude oil common carrier pipelines, a 50% interest in CHOPS and two CO2 pipelines.

Crude Oil Pipelines

Our core pipeline transportation business is the transportation of crude oil for others for a fee.

Onshore Crude Oil Pipelines. Through the onshore pipeline systems we own and operate, we transport crude oil for our gathering and marketing operations and for other shippers pursuant to tariff rates regulated by FERC or the Railroad Commission of Texas. Accordingly, we offer transportation services to any shipper of crude oil, if the products tendered for transportation satisfy the conditions and specifications contained in the applicable tariff. Pipeline revenues are a function of the level of throughput and the particular point where the crude oil is injected into the pipeline and the delivery point. We also may earn revenue from pipeline loss allowance volumes. In exchange for bearing the risk of pipeline volumetric losses, we deduct volumetric pipeline loss allowances and crude oil quality deductions. Such allowances and deductions are offset by measurement gains and losses. When our actual volume losses are less than the related allowances and deductions, we recognize the difference as income and inventory available for sale valued at the market price for the crude oil.

7

The margins from our onshore crude oil pipeline operations are generated by the difference between the sum of revenues from regulated published tariffs and pipeline loss allowance revenues and the fixed and variable costs of operating and maintaining our pipelines.

We own and operate three onshore common carrier crude oil pipeline systems: the Mississippi System, the Jay System and the Texas System.

|

Mississippi System

|

Jay System

|

Texas System

|

||||

|

Product

|

Crude oil

|

Crude Oil

|

Crude oil

|

|||

|

Interest Owned

|

100%

|

100%

|

100%

|

|||

|

System miles

|

235

|

100

|

90

|

|||

|

Owned and leased tankage storage capacity

|

247,500 Bbls

|

230,000 Bbls

|

220,000 Bbls

|

|||

|

Location

|

Soso, Mississippi to Liberty, Mississippi

|

Southern Alabama/Florida to Mobile, Alabama

|

West Columbia, Texas to Webster, Texas

Webster, Texas to Texas City, Texas

Webster, Texas to Houston, Texas

|

|||

|

Regulated/Unregulated

|

Regulated

|

Regulated

|

Regulated

|

|

|

·

|

Mississippi System Our Mississippi System provides shippers of crude oil in Mississippi indirect access to refineries, pipelines, storage, terminals and other crude oil infrastructure located in the Midwest. The system is adjacent to several oil fields that are in various phases of being produced through tertiary recovery strategy, including CO2 injection and flooding. Increased production from these fields could create increased demand for our crude oil transportation services because of the close proximity of our pipeline. We provide transportation services on our Mississippi pipeline through an “incentive” tariff which provides that the average rate per barrel that we charge during any month decreases as our aggregate throughput for that month increases above specified thresholds.

|

|

|

·

|

Jay System. Our Jay System provides crude oil shippers access to refineries, pipelines and storage near Mobile, Alabama. We completed construction of a gathering pipeline in 2009 extending to producers operating in southern Alabama and providing access to our Jay System. The lateral consists of approximately 33 miles of pipeline originating in the Little Cedar Creek Field in Conecuh County, Alabama to a connection to our Florida Pipeline System in Escambia County, Alabama. The system also includes gathering connections to approximately 35 wells, additional oil storage capacity of 20,000 barrels in the field and a delivery connection to a refinery in Alabama.

|

|

|

·

|

Texas System. Our Texas System transports crude oil from West Columbia to several delivery points near Houston. The Texas System receives all of its volume from connections to other pipeline carriers. We earn a tariff for our transportation services, with the tariff rate per barrel of crude oil varying with the distance from injection point to delivery point. We entered into a joint tariff with TEPPCO, now known as Enterprise Crude Oil Pipeline Company, to receive oil from its system at West Columbia and a joint tariff with TEPPCO and ExxonMobil Pipeline Company to receive oil from their systems at Webster. We also continue to receive barrels from a connection with Blueknight Energy Partners at Webster. We have a tank rental reimbursement agreement with the primary shipper on our Texas System to reimburse us for the lease of 165,000 barrels of storage capacity at Webster.

|

Offshore Crude Oil Pipeline. On November 23, 2010, we acquired a 50% interest in Cameron Highway Oil Pipeline Company, a crude oil pipeline joint venture with Enterprise Products Partners, L.P. The Cameron Highway oil pipeline system is the largest (measured by both length and capacity) crude oil pipeline system in the Gulf of Mexico, which represented approximately 30%, 29% and 23% of U.S. oil production during 2010, 2009 and 2008, respectively.

8

|

CHOPS

|

||

|

Product

|

Crude oil

|

|

|

Interest owned

|

50%

|

|

|

System miles

|

380

|

|

|

Location

|

Gulf of Mexico (primarily offshore of Texas and Louisiana)

|

|

|

Regulated/Unregulated

|

Unregulated

|

|

|

In-service date

|

2004

|

|

|

Capacity (Bbls/day)

|

500,000

|

CHOPS is comprised of 24- and 30- inch diameter pipelines to deliver crude oil from developments in the Gulf of Mexico to refining markets along the Texas Gulf Coast via interconnections with refineries located in Port Arthur and Texas City, Texas. CHOPS also includes two strategically located multi-purpose offshore platforms. Enterprise Products owns the remaining 50% interest in, and operates, the joint venture.

CHOPS was constructed in response to a need for additional pipeline capacity to handle crude oil production from deepwater region discoveries in the Gulf of Mexico, primarily offshore of Texas and Louisiana. Its anchor customers, subsidiaries of BP p.l.c., BHP Billiton Group and Chevron Corporation, dedicated their production from approximately 86,400 acres to CHOPS for the life of the reserves underlying such acreage, which dedications included the prolific Mad Dog and Atlantis fields as well as other deepwater oil discoveries. Those producer agreements include both firm and, to the extent CHOPS has any remaining capacity, interruptible capacity arrangements. Since its formation, Cameron Highway has entered into handling arrangements with numerous other producers pursuant to both firm and interruptible capacity arrangements covering deepwater discoveries, including Constitution, Ticonderoga, K2, Shenzi, Front Runner, Cottonwood and Tahiti.

The pipeline has significant available capacity to accommodate future growth in the fields from which the production is dedicated to the pipeline as well as to transport volumes from non-dedicated fields both currently in production and to be developed in the future. Since we acquired our interest CHOPS has averaged 149,000 barrels per day of revenue volumes.

CO2 Pipelines

We transport CO2 on our Free State Pipeline and the Northeast Jackson Dome Pipeline System, or the NEJD System, for a fee.

|

Free State Pipeline

|

NEJD System *

|

|||

|

Product

|

CO2

|

CO2

|

||

|

Interest owned

|

100%

|

100%

|

||

|

System miles

|

86

|

183

|

||

|

Pipeline diameter

|

20”

|

20”

|

||

|

Location

|

Jackson Dome near Jackson, Mississippi to East Mississippi

|

Jackson Dome near Jackson, Mississippi to Donaldsonville, Louisiana

|

||

|

Regulated/Unregulated

|

Unregulated

|

Unregulated

|

*Subject to fixed payment agreement.

9

Our Free State Pipeline extends from CO2 source fields near Jackson, Mississippi to oil fields in eastern Mississippi. We have a twenty-year transportation services agreement (through 2028) related to the transportation of CO2 on our Free State Pipeline.

Denbury has leased the NEJD System from us through 2028. The NEJD System transports CO2 to tertiary oil recovery operations in southwest Mississippi.

Customers

Currently greater than 90% of the volume on the Mississippi System originates from oil fields operated by Denbury. Denbury is the largest producer (based upon average barrels produced per day) of crude oil in the State of Mississippi. Our Mississippi System is adjacent to several of Denbury’s existing and prospective fields. Our customers on our Mississippi, Jay and Texas systems are primarily large, energy companies. Denbury has exclusive use of the NEJD Pipeline System and is responsible for all operations and maintenance on that system and will bear and assume all obligations and liabilities with respect to that system. Currently, Denbury also has rights to exclusive use of our Free State Pipeline.

Due to the cost of finding, developing and producing oil properties in the deepwater regions of the Gulf of Mexico, most of Cameron Highway’s customers are integrated oil companies and other large producers, and those producers desire to have longer-term arrangements ensuring that their production can access the markets. Usually, Cameron Highway and each of its customers enter into buy-sell arrangements, pursuant to which Cameron Highway acquires from its customer the relevant production at a specified location (often a producer’s platform or at another interconnection with CHOPS) and sells such customer an equivalent volume at one or more specified downstream locations (such as a refinery or an interconnection with another pipeline). Most of the production handled by CHOPS is pursuant to life-of-reserve commitments that include both firm and interruptible capacity arrangements.

Revenues from customers of our pipeline transportation segment did not account for more than ten percent of our consolidated revenues.

Competition

Competition among common carrier pipelines is based primarily on posted tariffs, quality of customer service and proximity to production, refineries and connecting pipelines. We believe that high capital costs, tariff regulation and the cost of acquiring rights-of-way make it unlikely that other competing pipeline systems, comparable in size and scope to our onshore pipelines, will be built in the same geographic areas in the near future.

Cameron Highway’s principal competition includes other crude oil pipeline systems (such as Poseidon) as well as producers who may elect to build or utilize their own production handling facilities. Cameron Highway competes for new production on the basis of geographic proximity to the production, cost of connection, available capacity, transportation rates and access to onshore markets. In addition, the ability of CHOPS to access future reserves will be subject to our ability, or the producers’ ability, to fund the significant capital expenditures required to connect to the new production. In general, CHOPS is not subject to regulatory rate-making authority, and the rates it charges for its services are dependent on the quality of the service required by its customer and the amount and term of the reserve commitment by that customer.

Refinery Services

Our refinery services segment primarily (i) provides sulfur-extraction services to ten refining operations predominately located in Texas, Louisiana, Arkansas and Utah, (ii) operate significant storage and transportation assets in relation to our business and (iii) sell NaHS and caustic soda (or NaOH) to large industrial and commercial companies. Our refinery services activities involve processing high sulfur (or “sour”) gas streams that the refineries have generated from crude oil processing operations. Our process applies our proprietary technology, which uses large quantities of caustic soda (the primary raw material used in our process) to act as a scrubbing agent under prescribed temperature and pressure to remove sulfur. Sulfur removal in a refinery is a key factor in optimizing production of refined products such as gasoline, diesel and aviation fuel. Our sulfur removal technology returns a clean (sulfur-free) hydrocarbon stream to the refinery for further processing into refined products, and simultaneously produces NaHS. The resultant NaHS constitutes the sole consideration we receive for our refinery services activities. A majority of the NaHS we receive is sourced from refineries owned and operated by large companies, including ConocoPhillips, CITGO, Holly, and Ergon.

10

Our refinery services footprint also includes terminals, and we utilize railcars, ships, barges and trucks to transport product. In conjunction with our supply and logistics segment, we sell and deliver NaHS and caustic soda to over 100 customers. We believe we are one of the largest marketers of NaHS in North and South America. By minimizing our costs by utilizing our own logistical assets and leased storage sites, we believe we have a competitive advantage over other suppliers of NaHS. Our refinery services contracts are typically long-term in nature and have an average remaining term of four years.

NaHS is used in the specialty chemicals business (plastic additives, dyes and personal care products), in pulp and paper business, and in connection with mining operations (nickel, gold and separating copper from molybdenum) as well as bauxite refining (aluminum). NaHS has also gained acceptance in environmental applications, including waste treatment programs requiring stabilization and reduction of heavy and toxic metals and flue gas scrubbing. Additionally, NaHS can be used for removing hair from hides at the beginning of the tannery process.

Caustic soda is used in many of the same industries as NaHS. Many applications require both chemicals for use in the same process – for example, caustic soda can increase the yields in bauxite refining, pulp manufacturing and in the recovery of copper, gold and nickel. Caustic soda is also used as a cleaning agent (when combined with water and heated) for process equipment and storage tanks at refineries.

We believe that the demand for sulfur removal at U.S. refineries will increase in the years ahead as the quality of the oil supply used by refineries in the U.S. continues to drop (or become more “sour”) and the residual level of sulfur allowed in lubricants and fuels is required to be reduced by regulatory agencies domestically and internationally. As that occurs, we believe more refineries will seek economic and proven sulfur removal processes from reputable service providers that have the scale and logistical capabilities to efficiently perform such services. Because of our existing scale, we believe we will be able to attract some of these refineries as new customers for our sulfur handling/removal services, providing us the capacity to meet any increases in NaHS demand.

Customers

We provided onsite services utilizing NaHS units at ten refining locations, and we managed sulfur removal by exclusive rights to market NaHS produced at three third-party sites. While some of our customers have elected to own the sulfur removal facilities located at their refineries, we operate those facilities. These NaHS facilities are located primarily in the southeastern United States.

We sell our NaHS to customers in a variety of industries, with the largest customers involved in mining of base metals, primarily copper and molybdenum and the production of pulp and paper. We sell to customers in the copper mining industry in the western United States, Canada and Mexico. We also export the NaHS to South America for sale to customers for mining in Peru and Chile. No customer of the refinery services segment is responsible for more than ten percent of our consolidated revenues. Approximately 11% of the revenues of the refinery services segment in 2010 resulted from sales to Kennecott Utah Copper, a subsidiary of Rio Tinto plc. Many of the industries that our NaHS customers are in (such as copper mining and the pulp and paper industry) participate in global markets for their products. As a result, this creates an indirect exposure for NaHS to global demand for the end products of our customers. During 2010, global demand for copper, molybdenum and paper increased, providing increased demand for our NaHS. Provisions in our service contracts with refiners allow us to adjust our sour gas processing rates (sulfur removal) to maintain a balance between NaHS supply and demand.

We sell caustic soda to many of the same customers who purchase NaHS from us, including pulp and paper manufacturers and copper mining. We also supply caustic soda to some of the refineries in which we operate for use in cleaning processing equipment.

Competition

We believe that the U.S. refinery industry’s demand for sulfur extraction services will increase because we believe sour oil will constitute an increasing portion of the total worldwide supply of crude oil and the phase in of stricter passenger vehicle emission standards will require refiners to produce additional quantities of low sulfur fuels. Both of these conditions can be met by refineries installing our sulfur removal technology under refinery service agreements. While other options exist for the removal of sulfur from sour oil, we believe our existing customers are unlikely to change to another method due to the costs involved, our proven reliability and the regulatory permit processes required when changing methods of handling sulfur. NaHS technology is a reliable and cost effective manner to control refinery operating costs regardless of the crude slate being processed. In addition, we have an increasing array of services we can offer to our refinery customers, and we believe our proprietary knowledge, scale, logistics capabilities and safety and service record will encourage these refineries to continue to outsource their existing refinery services functions to us.

11

Our competitors for the supply of NaHS consist primarily of parties who produce NaHS as a by-product of processes involved with agricultural pesticide products, plastic additives and lubricant viscosity. Typically our competitors for the production of NaHS have only one manufacturing location and they do not have the logistical infrastructure that we have to supply customers. Our primary competitor has been AkzoNobel, a chemical manufacturing company that produces NaHS primarily in its pesticide operations.

Our competitors for sales of caustic soda include manufacturers of caustic soda. These competitors supply caustic soda to our refinery services operations and support us in our third-party NaOH sales. By utilizing our storage capabilities and having access to transportation assets, we sell caustic soda to third parties who gain efficiencies from acquiring both NaHS and NaOH from one source.

Supply and Logistics

Through our supply and logistics segment we provide a wide array of services to oil producers and refiners in the Gulf Coast region. In connection with these services, we utilize our portfolio of logistical assets consisting of trucks, terminals, pipelines and barges. Our crude oil related services include gathering crude oil from producers at the wellhead, transporting crude oil by truck to pipeline injection points and marketing crude oil to refiners. Not unlike our crude oil operations, we also gather refined products from refineries, transport refined products via truck, railcar or barge, and sell refined products to customers in wholesale markets. For these services, we generate fee-based income and profit from the difference between the price at which we re-sell the crude oil and petroleum products less the price at which we purchase the oil and products, minus the associated costs of aggregation and transportation. Our industrial gases supply and logistics operations (i) supply CO2 to industrial customers, (ii) process raw CO2 and sell that processed CO2, and (iii) manufacture and sell syngas, a combination of carbon monoxide and hydrogen.

Our crude oil supply and logistics operations are concentrated in Texas, Louisiana, Alabama, Florida and Mississippi. These operations help to ensure (among other things) a base supply source for our oil pipeline systems and our refinery customers while providing our producer customers with a market outlet for their production. Usually, our supply and logistics segment experiences limited commodity price risk because it involves back-to-back purchases and sales, matching our sale and purchase volumes on a monthly basis. Unsold volumes are hedged with NYMEX derivatives to offset the remaining price risk. By utilizing our network of trucks, terminals and pipelines, we are able to provide transportation related services to crude oil producers and refiners as well as enter into back-to-back gathering and marketing arrangements with these same parties. Additionally, our crude oil gathering and marketing expertise and knowledge base, provides us with an ability to capitalize on opportunities that arise from time to time in our market areas. Given our network of terminals, we have the ability to store crude oil during periods of contango (oil prices for future deliveries are higher than for current deliveries) for delivery in future months. When we purchase and store crude oil during periods of contango, we limit commodity price risk by simultaneously entering into a contract to sell the inventory in the future period, either with a counterparty or in the crude oil futures market. We generally will account for this inventory and the related derivative hedge as a fair value hedge in accordance with generally accepted accounting principles. The most substantial component of the costs we incur while aggregating crude oil and petroleum products relates to operating our fleet of owned and leased trucks.

Our refined products supply and logistics operations are concentrated in the Gulf Coast region, principally Texas and Louisiana. Through our footprint of owned and leased trucks, leased railcars, terminals and barges, we are able to provide Gulf Coast area refineries with transportation services as well as market outlets for their finished refined products. We primarily engage in the transportation and supply of fuel oil, asphalt, diesel and gasoline to our customers in wholesale markets as well as paper mills and utilities. By utilizing our broad network of relationships and logistics assets, including our terminal accessibility, we have the ability to gather, from refineries, various grades of refined products and blend them to meet the requirements of our other market customers. Our refinery customers may choose to manufacture various refined products depending on a number of economic and operating factors, and therefore we cannot predict the timing of contribution margins related to our blending services. However, when we are able to purchase and subsequently blend refined products, our contribution margin as a percentage of the revenues tends to be higher than the same percentage attributable to our recurring operations.

12

We supply CO2 to industrial customers currently under six long-term contracts, with an average remaining contract life of six years. Our compensation for supplying CO2 to our industrial customers, who treat the CO2 and sell it to end users for use in beverage carbonation and chilling and freezing food, is the effective difference between the price at which we sell our CO2 under each contract and the price at which we acquired our CO2 pursuant to our volumetric production payments (also known as VPPs), minus transportation costs. We expect some seasonality in our sales of CO2. The dominant months for beverage carbonation and freezing food are from April to October, when warm weather increases demand for beverages and the approaching holidays increase demand for frozen foods. At December 31, 2010, we had 100.2 Bcf of CO2 remaining under the VPPs.

All of our CO2 supply is currently from our interests—our VPPs—in fields producing naturally occurring CO2. The agreements we executed when we acquired the VPPs provide that we may acquire additional CO2 under terms similar to the original agreements should additional volumes be needed to meet our obligations under the existing customer contracts. These contracts expire between 2011 and 2023. Based on the current volumes being sold to our customers, we believe that we will need to acquire additional volumes pursuant to our VPPs in 2014. When our VPPs expire, we will have to obtain additional CO2 supply if we choose to remain in the CO2 supply business.

We own a 50% interest in Sandhill Group, LLC, or Sandhill, through which we process raw CO2 for sale to other customers for uses ranging from completing oil and natural gas producing wells to food processing. We also own a 50% joint venture interest in T&P Syngas Supply Company, from which we receive distributions earned from fees for manufacturing syngas (a combination of carbon monoxide and hydrogen) by Praxair Hydrogen Supply Inc., or Praxair, our 50% joint venture partner

Within our supply and logistics business segment, to meet our customer needs, we employ many types of logistically flexible assets. These assets include 250 trucks, 280 trailers, 20 barges with approximately 660,000 barrels of refined products transportation capacity, 1.5 million barrels of leased and owned terminal storage capacity in multiple locations along the Gulf Coast, accessible by truck, rail or barge.

Customers

Our supply and logistics business encompasses hundreds of producers and customers, for which we provide transportation related services, as well as gather from and market to crude oil, refined products and CO2. During 2010, more than ten percent of our consolidated revenues were generated from Shell Oil Company. We do not believe that the loss of any one customer for crude oil, petroleum products or CO2 would have a material adverse effect on us as these products are readily marketable commodities.

Competition

In our crude oil supply and logistics operations, we compete with other midstream service providers and regional and local companies who may have significant market share in the areas in which they operate. In our supply and logistics refined products operations, we compete primarily with regional companies. Competitive factors in our supply and logistics business include price, relationships with customers, range and quality of services, knowledge of products and markets, availability of trade credit and capabilities of risk management systems.

Currently, all of our CO2 supply is from our interest—our VPPs—in fields producing naturally occurring sources. In the future, we may have to obtain our CO2 supply from manufactured processes. Naturally-occurring CO2, like that from the Jackson Dome area, occurs infrequently, and only in limited areas east of the Mississippi River. Once our existing VPPs expire, we will have to obtain additional CO2 should we choose to remain in the CO2 supply business, and the competition and pricing issues we will face at that time are uncertain.

Geographic Segments

All of our operations are in the United States. Additionally, we transport and sell NaHS to customers in South America and Canada. Revenues from customers in foreign countries totaled approximately $14.5 million and $9.5 million in 2010 and 2009, respectively. The remainder of our revenues in 2010 and 2009 and all of our revenues in 2008 were generated from sales to customers in the United States.

Credit Exposure

Due to the nature of our operations, a disproportionate percentage of our trade receivables constitute obligations of oil companies, independent refiners, and mining and other industrial companies that purchase NaHS. This energy industry concentration has the potential to impact our overall exposure to credit risk, either positively or negatively, in that our customers could be affected by similar changes in economic, industry or other conditions. However, we believe that the credit risk posed by this industry concentration is offset by the creditworthiness of our customer base. Our portfolio of accounts receivable is comprised in large part of integrated and independent energy companies with stable payment experience. The credit risk related to contracts that are traded on the NYMEX is limited due to the daily cash settlement procedures and other NYMEX requirements.

13

When we market crude oil and petroleum products and NaHS, we must determine the amount, if any, of the line of credit we will extend to any given customer. We have established procedures to manage our credit exposure, including initial credit approvals, credit limits, collateral requirements and rights of offset. Letters of credit, prepayments and guarantees are also utilized to limit credit risk to ensure that our established credit criteria are met. We use similar procedures to manage our exposure to our customers in the pipeline transportation segment.

Some of our customers experienced cash flow difficulties in 2010 and 2009 as a result of the state of the credit markets and the economic recession in the United States. These customers generally purchase petroleum products and NaHS from us. Our credit monitoring procedures includes frequent reviews of our customer base. As a result of cash flow difficulties of some of our customers, we have experienced a delay in collections from these customers and established an allowance for possible uncollectible receivables at December 31, 2010 and 2009 in the amount of $1.3 million and $1.4 million, respectively. During 2010, we charged approximately $0.5 million to bad debt expense in our Consolidated Statements of Operations.

Employees

To carry out our business activities, we employed approximately 690 employees at December 31, 2010. None of our employees are represented by labor unions, and we believe that relationships with our employees are good.

Regulation

Pipeline Rate and Access Regulation

The rates and the terms and conditions of service of our interstate common carrier pipeline operations are subject to regulation by FERC under the Interstate Commerce Act, or ICA. Under the ICA, rates must be “just and reasonable,” and must not be unduly discriminatory or confer any undue preference on any shipper. FERC regulations require that oil pipeline rates and terms and conditions of service be filed with FERC and posted publicly.

Effective January 1, 1995, FERC promulgated rules simplifying and streamlining the ratemaking process. Previously established rates were “grandfathered”, limiting the challenges that could be made to existing tariff rates. Increases from grandfathered rates of interstate oil pipelines are currently regulated by the FERC primarily through an index methodology, whereby a pipeline is allowed to change its rates based on the year-to-year change in an index. Under the FERC regulations, we are able to change our rates within prescribed ceiling levels that are tied to the Producer Price Index for Finished Goods. Rate increases made pursuant to the index will be subject to protest, but such protests must show that the portion of the rate increase resulting from application of the index is substantially in excess of the pipeline's increase in costs.

In addition to the index methodology, FERC allows for rate changes under three other methods—cost-of-service, competitive market showings (“Market-Based Rates”), or agreements between shippers and the oil pipeline company that the rate is acceptable (“Settlement Rates”). The pipeline tariff rates on our Mississippi and Jay Systems are either rates that were grandfathered and have been changed under the index methodology, or Settlement Rates. None of our tariffs have been subjected to a protest or complaint by any shipper or other interested party.

CHOPS is neither an interstate nor a common carrier pipeline. However, it is subject to federal regulation under the Outer Continental Shelf Lands Act, which requires all pipelines operating on or across the outer continental shelf to provide nondiscriminatory transportation service.

Our intrastate common carrier pipeline operations in Texas are subject to regulation by the Railroad Commission of Texas. The applicable Texas statutes require that pipeline rates and practices be reasonable and non-discriminatory and that pipeline rates provide a fair return on the aggregate value of the property of a common carrier, after providing reasonable allowance for depreciation and other factors and for reasonable operating expenses. Most of the volume on our Texas System is now shipped under joint tariffs with TEPPCO and Exxon. Although no assurance can be given that the tariffs we charge would ultimately be upheld if challenged, we believe that the tariffs now in effect can be sustained.

14

Our CO2 pipelines are subject to regulation by the state agencies in the states in which they are located.

Marine Regulations

Maritime Law. The operation of tow boats, barges and marine equipment create maritime obligations involving property, personnel and cargo under General Maritime Law. These obligations can create risks which are varied and include, among other things, the risk of collision and allision, which may precipitate claims for personal injury, cargo, contract, pollution, third-party claims and property damages to vessels and facilities. Routine towage operations can also create risk of personal injury under the Jones Act and General Maritime Law, cargo claims involving the quality of a product and delivery, terminal claims, contractual claims and regulatory issues. Federal regulations also require that all tank barges engaged in the transportation of oil and petroleum in the U.S. be double hulled by 2015. All of our barges are double-hulled.

Jones Act. The Jones Act is a federal law that restricts maritime transportation between locations in the United States to vessels built and registered in the United States and owned and manned by United States citizens. We are responsible for monitoring the ownership of our subsidiary that engages in maritime transportation and for taking any remedial action necessary to insure that no violation of the Jones Act ownership restrictions occurs. Jones Act requirements significantly increase operating costs of United States-flag vessel operations compared to foreign-flag vessel operations. Further, the USCG and American Bureau of Shipping (“ABS”) maintain the most stringent regime of vessel inspection in the world, which tends to result in higher regulatory compliance costs for United States-flag operators than for owners of vessels registered under foreign flags of convenience. The Jones Act and General Maritime Law also provide damage remedies for crew members injured in the service of the vessel arising from employer negligence or vessel unseaworthiness.

Merchant Marine Act of 1936. The Merchant Marine Act of 1936 is a federal law that provides that, upon proclamation by the president of the United States of a national emergency or a threat to the national security, the United States Secretary of Transportation may requisition or purchase any vessel or other watercraft owned by United States citizens (including us, provided that we are considered a United States citizen for this purpose). If one of our tow boats or barges were purchased or requisitioned by the United States government under this law, we would be entitled to be paid the fair market value of the vessel in the case of a purchase or, in the case of a requisition, the fair market value of charter hire. However, if one of our tow boats is requisitioned or purchased and its associated barge or barges are left idle, we would not be entitled to receive any compensation for the lost revenues resulting from the idled barges. We also would not be entitled to be compensated for any consequential damages we suffer as a result of the requisition or purchase of any of our tow boats or barges.

Environmental Regulations

General

We are subject to stringent federal, state and local laws and regulations governing the discharge of materials into the environment or otherwise relating to environmental protection. These laws and regulations may require the acquisition of and compliance with permits for regulated activities, limit or prohibit operations on environmentally sensitive lands such as wetlands or wilderness areas or areas inhabited by endangered or threatened species, result in capital expenditures to limit or prevent emissions or discharges, and place burdensome restrictions on our operations, including the management and disposal of wastes. Failure to comply with these laws and regulations may result in the assessment of administrative, civil and criminal penalties, including the assessment of monetary penalties, the imposition of investigatory and remedial obligations, the suspension or revocation of necessary permits, licenses and authorizations, the requirement that additional pollution controls be installed and the issuance of orders enjoining future operations or imposing additional compliance requirements. Changes in environmental laws and regulations occur frequently, typically increasing in stringency through time, and any changes that result in more stringent and costly operating restrictions, emission control, waste handling, disposal, cleanup, and other environmental requirements have the potential to have a material adverse effect on our operations. While we believe that we are in substantial compliance with current environmental laws and regulations and that continued compliance with existing requirements would not materially affect us, there is no assurance that this trend will continue in the future.

15

Hazardous Substances and Waste

The Comprehensive Environmental Response, Compensation, and Liability Act, as amended, or CERCLA, also known as the “Superfund” law, and analogous state laws impose liability, without regard to fault or the legality of the original conduct, on certain classes of persons. These persons include current owners and operators of the site where a release of hazardous substances occurred, prior owners or operators that owned or operated the site at the time of the release of hazardous substances, and companies that disposed or arranged for the disposal of the hazardous substances found at the site. We currently own or lease, and have in the past owned or leased, properties that have been in use for many years with the gathering and transportation of hydrocarbons including crude oil and other activities that could cause an environmental impact. Persons deemed “responsible persons” under CERCLA may be subject to strict and joint and several liability for the costs of removing or remediating previously disposed wastes (including wastes disposed of or released by prior owners or operators) or property contamination (including groundwater contamination), for damages to natural resources, and for the costs of certain health studies. CERCLA also authorizes the EPA and, in some instances, third parties to act in response to threats to the public health or the environment and to seek to recover the costs they incur from the responsible classes of persons. It is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by hazardous substances or other pollutants released into the environment.

We also may incur liability under the Resource Conservation and Recovery Act, as amended, or RCRA, and analogous state laws which impose requirements and also liability relating to the management and disposal of solid and hazardous wastes. While RCRA regulates both solid and hazardous wastes, it imposes strict requirements on the generation, storage, treatment, transportation and disposal of hazardous wastes. Certain petroleum production wastes are excluded from RCRA’s hazardous waste regulations. However, it is possible that these wastes, which could include wastes currently generated during our operations, will in the future be designated as “hazardous wastes” and, therefore, be subject to more rigorous and costly disposal requirements. Indeed, legislation has been proposed from time to time in Congress to re-categorize certain oil and gas exploration and production wastes as “hazardous wastes.” Any such changes in the laws and regulations could have a material adverse effect on our capital expenditures and operating expenses.

Water

The Federal Water Pollution Control Act, as amended, also known as the “Clean Water Act”, and analogous state laws impose restrictions and strict controls regarding the unauthorized discharge of pollutants, including oil, into navigable waters of the United States, as well as state waters. Permits must be obtained to discharge pollutants into these waters. In addition, the Clean Water Act and analogous state laws require individual permits or coverage under general permits for discharges of storm water runoff from certain types of facilities. These permits may require us to monitor and sample the storm water runoff from certain of our facilities. Some states also maintain groundwater protection programs that require permits for discharges or operations that may impact groundwater conditions. The Oil Pollution Act, or OPA, is the primary federal law for oil spill liability. OPA contains numerous requirements relating to the prevention of and response to oil spills into waters of the United States, including the requirement that operators of offshore facilities and certain onshore facilities near or crossing waterways must maintain certain significant levels of financial assurance to cover potential environmental cleanup and restoration costs. The OPA subjects owners of facilities to strict, joint and several liability for all containment and cleanup costs and certain other damages arising from a spill, including, but not limited to, the costs of responding to a release of oil to surface waters. Noncompliance with the Clean Water Act or OPA may result insubstantial civil and criminal penalties. We believe we are in material compliance with each of these requirements.

Air Emissions

The Federal Clean Air Act, as amended, and analogous state and local laws and regulations restrict the emission of air pollutants, and impose permit requirements and other obligations. Regulated emissions occur as a result of our operations, including the handling or storage of crude oil and other petroleum products. Both federal and state laws impose substantial penalties for violation of these applicable requirements. Accordingly, our failure to comply with these requirements could subject us to monetary penalties, injunctions, conditions or restrictions on operations, revocation or suspension of necessary permits and, potentially, criminal enforcement actions.

NEPA

16

Under the National Environmental Policy Act, or NEPA, a federal agency, commonly in conjunction with a current permittee or applicant, may be required to prepare an environmental assessment or a detailed environmental impact statement before taking any major action, including issuing a permit for a pipeline extension or addition that would affect the quality of the environment. Should an environmental impact statement or environmental assessment be required for any proposed pipeline extensions or additions, NEPA may prevent or delay construction or alter the proposed location, design or method of construction.

Climate Change

In June 2009, the U.S. House of Representatives passed the American Clean Energy and Security (ACES) Act that, among other things, would have established a cap-and-trade system to regulate greenhouse gas emissions and would have required an 80% reduction in GHG emissions from sources within the United States between 2012 and 2050. The ACES Act did not pass the Senate, however, and so was not enacted by the 111th Congress. The United States Congress is likely to again consider a climate change bill in the future. Moreover, almost half of the states have already taken legal measures to reduce emissions of GHGs, primarily through the planned development of GHG emission inventories and/or regional GHG cap and trade programs. Most of these cap and trade programs work by requiring major sources of emissions, such as electric power plants, or major producers of fuels, such as refineries and gas processing plants, to acquire and surrender emission allowances corresponding with their annual emissions of GHGs. The number of allowances available for purchase is reduced each year until the overall GHG emission reduction goal is achieved. As the number of GHG emission allowances declines each year, the cost or value of allowances is expected to escalate significantly. Any laws or regulations that may be adopted to restrict or reduce emissions of GHG emissions could require us to incur increased operating costs, and could have an adverse affect on demand for the refined products produced by our refining customers.

On April 2, 2007, the United States Supreme Court found that the EPA has the authority to regulate CO2 emissions from automobiles as “air pollutants” under the Clean Air Act, or the CAA. Thereafter, in December 2009, the EPA determined that emissions of carbon dioxide, methane and other GHGs present an endangerment to human health and the environment, because, according to the EPA, emissions of such gases contribute to warming of the earth’s atmosphere and other climatic changes. These findings by the EPA allowed the agency to proceed with the adoption and implementation of regulations that would restrict emissions of GHGs under existing provisions of the federal Clean Air Act. Subsequently, the EPA recently adopted two sets of related rules, one of which purports to regulate emissions of GHGs from motor vehicles and the other of which would regulate emissions of GHGs from large stationary sources of emissions such as power plants or industrial facilities. The EPA finalized the motor vehicle rule in April 2010 and it became effective January 2011, although it does not require immediate reductions in GHG emissions. The EPA adopted the stationary source rule in May 2010, and it also became effective January 2011, although it remains subject of several pending lawsuits filed by industry groups. Additionally, in September 2009, the EPA issued a final rule requiring the reporting of GHG emissions from specified large GHG emission sources in the U.S., including natural gas liquids fractionators and local natural gas/distribution companies, beginning in 2011 for emissions occurring in 2010.

Safety and Security Regulations

Our crude oil and CO2 pipelines are subject to construction, installation, operation and safety regulation by the U.S. Department of Transportation, or DOT, and various other federal, state and local agencies. Congress has enacted several pipeline safety acts over the years. Currently, the Pipeline and Hazardous Materials Safety Administration under DOT administers pipeline safety requirements for natural gas and hazardous liquid pipelines pursuant to detailed regulations set forth in 49 C.F.R. Parts 190 to 195. These regulations, among other things, address pipeline integrity management and pipeline operator qualification rules. Significant expenses could be incurred in the future if additional safety measures are required or if safety standards are raised and exceed the current pipeline control system capabilities.

We are subject to the DOT Integrity Management, or IM, regulations, which require that we perform baseline assessments of all pipelines that could affect a High Consequence Area, or HCA, including certain populated areas and environmentally sensitive areas. Due to the proximity of all of our pipelines to water crossings and populated areas, we have designated all of our pipelines as affecting HCAs. The integrity of these pipelines must be assessed by internal inspection, pressure test, or equivalent alternative new technology.

The IM regulations required us to prepare an Integrity Management Plan, or IMP, that details the risk assessment factors, the overall risk rating for each segment of pipe, a schedule for completing the integrity assessment, the methods to assess pipeline integrity, and an explanation of the assessment methods selected. The regulations also require periodic review of HCA pipeline segments to ensure that adequate preventative and mitigative measures exist and that companies take prompt action to address pipeline integrity issues. No assurance can be given that the cost of testing and the required rehabilitation identified will not be material costs to us that may not be fully recoverable by tariff increases.

17

We have developed a Risk Management Plan required by the EPA as part of our IMP. This plan is intended to minimize the offsite consequences of catastrophic spills. As part of this program, we have developed a mapping program. This mapping program identified HCAs and unusually sensitive areas along the pipeline right-of-ways in addition to mapping of shorelines to characterize the potential impact of a spill of crude oil on waterways.

Our crude oil, refined products and refinery services operations are also subject to the requirements of OSHA and comparable state statutes. Various other federal and state regulations require that we train all operations employees in HAZCOM and disclose information about the hazardous materials used in our operations. Certain information must be reported to employees, government agencies and local citizens upon request.

States are responsible for enforcing the federal regulations and more stringent state pipeline regulations and inspection with respect to hazardous liquids pipelines, including crude oil, natural gas, and CO2 pipelines. In practice, states vary considerably in their authority and capacity to address pipeline safety. We do not anticipate any significant problems in complying with applicable state laws and regulations in those states in which we operate.

Our trucking operations are licensed to perform both intrastate and interstate motor carrier services. As a motor carrier, we are subject to certain safety regulations issued by the DOT. The trucking regulations cover, among other things, driver operations, log book maintenance, truck manifest preparations, safety placard placement on the trucks and trailer vehicles, drug and alcohol testing, operation and equipment safety, and many other aspects of truck operations. We are also subject to OSHA with respect to our trucking operations.

The USCG regulates occupational health standards related to our marine operations. Shore-side operations are subject to the regulations of OSHA and comparable state statutes. The Maritime Transportation Security Act requires, among other things, submission to and approval of the USCG of vessel security plans.

Since the terrorist attacks of September 11, 2001, the United States Government has issued numerous warnings that energy assets could be the subject of future terrorist attacks. We have instituted security measures and procedures in conformity with federal guidance. We will institute, as appropriate, additional security measures or procedures indicated by the federal government. None of these measures or procedures should be construed as a guarantee that our assets are protected in the event of a terrorist attack.

Website Access to Reports

We make available free of charge on our internet website (www.genesisenergy.com) our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after we electronically file the material with, or furnish it to, the SEC. Additionally, these documents are available at the SEC’s website (www.sec.gov). Information on our website is not incorporated into this Form 10-K or our other securities filings and is not a part of them.

18