Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - CHINA INFRASTRUCTURE CONSTRUCTION Corp | v235465_ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - CHINA INFRASTRUCTURE CONSTRUCTION Corp | v235465_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - CHINA INFRASTRUCTURE CONSTRUCTION Corp | v235465_ex31-2.htm |

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Fiscal Year Ended May 31, 2011

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ________________ to __________________

Commission File Number 333-146758

CHINA INFRASTRUCTURE CONSTRUCTION CORPORATION

(Exact name of registrant as specified in its charter)

|

Colorado

|

16-1718190

|

|

|

(State or other jurisdiction of

|

(IRS Employer

|

|

|

incorporation or organization)

|

Identification No.)

|

Shidai Caifu Tiandi Suite 1906-1909

1 Hangfeng Road Fengtai District

Beijing, China 100070

(Address of principal executive offices)

Issuer’s telephone number, including area code: 86-10-5809-0217

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No þ

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was Required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. (as defined in Rule 12b-2 of the Exchange Act). Check one:

|

Large accelerated filer

|

¨

|

Non-accelerated filer

|

¨

|

|

|

Accelerated Filer

|

¨

|

Smaller reporting

company

|

þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

As of November 30, 2010, the last day of the Registrant’s most recently completed second fiscal quarter, the aggregate market value of the shares of the Registrant’s common stock held by non-affiliates (based upon the closing stock price of $2.40 as reported on the Over-the-Counter Bulletin Board) was approximately $14,378,424. Shares of the Registrant’s common stock held by each executive officer and director and by each person who owns 10 percent or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates of the Registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of September 21, 2011, there were outstanding 13,180,620 shares of the registrant’s common stock, no par value.

Documents incorporated by reference: None.

China Infrastructure Construction Corporation

Form 10-K

Table of Contents

|

Page

|

||||

|

PART I

|

||||

|

Item 1.

|

Description of Business

|

3 | ||

|

Item 1A.

|

Risk Factors

|

18 | ||

|

Item 2.

|

Description of Property

|

27 | ||

|

Item 3.

|

Legal Proceedings

|

28 | ||

|

PART II

|

||||

|

Item 5.

|

Market for Common Equity and Related Stockholder Matters

|

28 | ||

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

29 | ||

|

Item 8.

|

Financial Statements and Supplementary Data

|

33 | ||

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

34 | ||

|

Item 9A

|

Controls and Procedures

|

34 | ||

|

Item 9B.

|

Other Information

|

35 | ||

|

PART III

|

||||

|

Item 10.

|

Directors and Executive Officers

|

36 | ||

|

Item 11.

|

Executive Compensation

|

38 | ||

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

41 | ||

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

45 | ||

|

Item 14.

|

Principal Accountant Fees and Services

|

46 | ||

|

PART IV

|

||||

|

Item 15.

|

Exhibits

|

47 | ||

|

Signatures

|

50 | |||

|

Financial Statements

|

F-1 | |||

2

PREDICTIVE STATEMENTS AND ASSOCIATED RISK

Certain statements in this Report, and the documents incorporated by reference herein, constitute predictive statements. Such predictive statements involve known and unknown risks, uncertainties and other factors which may cause deviations in actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied. Such factors include, but are not limited to: market and customer acceptance and demand for our products; our ability to market our products; the impact of competitive products and pricing; the ability to develop and launch new products on a timely basis; the regulatory environment, including government regulation in the PRC; our ability to obtain the requisite regulatory approvals to commercialize our products; fluctuations in operating results, including spending for research and development and sales and marketing activities; and other risks detailed from time-to-time in our filings with the U.S. Securities and Exchange Commission (the “SEC”).

The words "believe, expect, anticipate, intend and plan" and similar expressions identify predictive statements. These statements are subject to risks and uncertainties that cannot be known or quantified and, consequently, actual results may differ materially from those expressed or implied by such predictive statements. Readers are cautioned not to place undue reliance on these predictive statements, which speak only as of the date they are made.

Unless otherwise noted, all currency figures in this filing are in U.S. dollars. References to "yuan" or "RMB" are to the Chinese yuan (also known as the renminbi). According to the currency exchange website www.xe.com, as of May 31, 2011, US $1.00 = 6.4939 yuan.

PART I

ITEM 1. BUSINESS

Overview

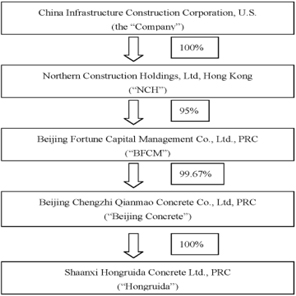

China Infrastructure Construction Corporation (the “Company”) was organized in Colorado on February 28, 2003. The Company, through its subsidiaries in Hong Kong and the People’s Republic of China (“PRC” or “China”), engages in production of ready-mixed concrete for developers and the construction industry in the PRC. The Company primarily operates through its indirect majority-owned subsidiary, Beijing Chengzhi Qianmao Concrete Co., Ltd. (“Beijing Concrete”), a company organized under the laws of the PRC.

Corporate History

The Company was organized in Colorado on February 28, 2003 as a limited liability company under the name “Fidelity Aircraft Partners LLC,” and on December 16, 2004 converted itself into Fidelity Aviation Corporation by filing a Statement of Conversion and Articles of Incorporation with the Colorado Secretary of State. At that time we were engaged in the business of salvaging rotable parts and systems from airframes and selling them to the aviation industry. In 2008, we began to pursue an acquisition strategy, whereby we sought to acquire an undervalued business with a history of operating revenues in markets that provide room for growth.

On October 8, 2008, the Company consummated a share exchange transaction pursuant to that certain Share Exchange Agreement, as a result of which Northern Construction Holdings, Ltd., a Hong Kong limited company (“NCH”) became our wholly-owned subsidiary. Beijing Fortune Capital Management, Ltd., a PRC limited liability company (“BFCM”), a 95% owned subsidiary of NCH, became our indirect majority-owned subsidiary. The remaining 5% equity interest in BFCM is held by Beijing Xingyuqing Tech Co., Ltd., controlled by Mr. Bingchuan Xiao, a former director of the Company. BFCM owned 99.5% of the equity interest in Beijing Chengzhi Qianmao Concrete Co., Ltd. (“Beijing Concrete”), which enabled us to acquire the business and substantially all of the assets of Beijing Concrete. The remaining 0.5% in Beijing Concrete is owned by Mr. Rong Yang, one of the original founders of Beijing Concrete and our current chief executive officer and director. For accounting purposes, the share exchange transaction was treated as a reverse acquisition with NCH as the acquirer and the Company as the acquired party. Following the share exchange, we evaluated the future market for our aircraft parts business and resolved not to pursue this line of business any further.

3

On January 15, 2010, Beijing Concrete increased its registered capital from RMB 15 million (approximately $2.2 million) to RMB 30 million (approximately $4.4 million) and BFCM increased its investment in Beijing Concrete accordingly. Its share capital increased from RMB 10 million (approximately $1.47 million) to RMB 15 million (approximately $2.2 million). As a result, BFCM owns 99.67% of Beijing Concrete from January 15, 2010.

On February 1, 2010, Beijing Concrete formed a subsidiary, Shaanxi Hongruida Concrete Ltd. (“Hongruida”) and contributed RMB 10 million (approximately $1.47 million) to its capital. Beijing Concrete is the sole shareholder of Hongruida. Hongruida was organized to implement the 10-year strategic cooperative agreement with one of the Company’s major clients, China Railway Construction Group Co., Ltd (“CRCG”). Under the Agreement, the Company and CRCG will jointly manage the concrete mixing stations to be operated by Hongruida. CRCG will provide the cement for manufacturing the concrete mix in such concrete mixing stations, and will be able to purchase the concrete mix at discounted prices. Also, in accordance with the Agreement, each party will lease certain equipment to the concrete mixing stations. The Company and CRCG will share 75% and 25% of the annual profits of such concrete mixing stations in Xi’an. Hongruida commenced its operations at the end of March 2010.

Effective August 24, 2009, the Company changed its name from Fidelity Aviation Corporation to China Infrastructure Construction Corporation.

Our current corporate structure is set forth in the following diagram:

Recent Developments

On September 28, 2009, the Company effectuated a 1-for-10 reverse stock split of the Company’s common stock, with no par value (the “Reverse Stock Split”). Upon the Reverse Stock Split, ten (10) shares of the outstanding common stock were automatically converted into one (1) share of common stock. The Reverse Stock Split, however, did not alter the number of shares the Company is authorized to issue, but only reduced the number of shares of its common stock issued and outstanding. Any fractional share issued as a result of the reverse split was rounded up.

4

On October 14, 2009, to provide incentives to the Company’s management and to adjust the Company’s capital structure, the Company issued to Rui Shen, the majority shareholder of the Company, an aggregate of 7,031,344 shares of common stock (after taking into account the 1-for-10 reverse stock split which took effect on September 28, 2009).

On October 16, 2009, the Company entered into and consummated the sale of securities pursuant to a Subscription Agreement with a number of investors, providing for the sale to the investors of an aggregate of approximately 2,564,103 shares of common stock for an aggregate purchase price of approximately $10,000,000 (or $3.90 per Share). In connection with the private placement, the Company issued to the placement agent warrants to purchase 153,846 shares of Common Stock exercisable for a period of five years at an exercise price of $3.90 per share. Additionally, the Company issued to a financial advisor in the PRC 288,963 shares of common stock. Under the Subscription Agreement, the Company agreed to deliver additional shares of common stock to the investors on a pro rata basis for no additional consideration in the event that the Company’s after tax net income for each of the fiscal years ending May 31, 2010 and 2011 is less than $14,000,000 and $18,000,000, respectively, subject to certain adjustments (such as exclusion of non-cash charges and expenses required to be recognized by the Company under the United States generally accepted accounting principles), which number of shares would be calculated using the percentage of variation between the actual net income and the target net income.

On March 5, 2010, the Company and the investors in the October 2009 private placement (the “2009 Investors”) entered into an Amendment to the Subscription Agreement dated October 16, 2009. The Amendment modified certain covenants to which the Company had previously agreed pursuant to the Subscription Agreement, including exemption of the private placement described below from certain restrictions on subsequent offerings.

Under the Amendment, the Company agreed to file a registration statement covering the securities issued in the October 2009 private placement (the “Registrable Shares”), if at anytime after December 31, 2010 not all of the Registrable Shares may be sold without registration pursuant to Rule 144 under the 1933 Act. Such registration statement shall be filed within 45 days after receipt of a written demand from the 2009 Investors representing not less than 50% of the then outstanding Registrable Shares. The 2009 Investors also have piggy-back registration rights exercisable after December 31, 2010 with respect to the Registrable Shares that may not be sold without registration pursuant to Rule 144.

In consideration of the Amendment, the Company agreed to issue to the 2009 Investors warrants to purchase in the aggregate approximately 1,281,083 shares of Common Stock at an exercise price of $6.00 per share. The Company also agreed for the after tax net income target for fiscal year 2011 to be increased to $19.8 million from $18.0 million if the Company does not complete a public offering on or before the date on which it releases its 2011 net income data in a Form 10-K filed with the SEC. Under the Amendment, the Company agreed to deliver additional shares of common stock to the 2010 Investors who invest in the private placement described below ("2010 Private Placement") on a pro rata basis for no additional consideration in the event that the Company’s after tax net income for each of the fiscal years ending May 31, 2010 and 2011 is less than $14,000,000 and $18,000,000 (or $19,800,000 as applicable) respectively subject to certain adjustments (such as exclusion of non-cash charges and expenses required to be recognized by the Company under the United States generally accepted accounting principles), which number of shares should be equal to the percentage of variation between the actual net income and the target net income (the “Adjustment Percentage”). The number of such additional shares shall equal the Adjustment Percentage, times the number of shares of Common Stock acquired by the 2009 Investor in the 2010 Private Placement, minus the Adjustment Percentage times the number of shares acquired by such investor in the October 2009 private placement which have been sold by the investor as of the date on which the Company releases its respective net income data in a Form 10-K filed with the SEC.

On March 11, 2010, the Company consummated a private placement pursuant to a Subscription Agreement dated March 5, 2010 with a number of investors, providing for the sale to the investors of an aggregate of approximately 1,282,091 shares of common stock for an aggregate purchase price of approximately $5,000,000 (or $3.90 per Share). In connection with the private placement, the Company issued to the placement agent a warrant to purchase 46,154 shares of common stock exercisable for a period of five years at an exercise price of $3.90 per share and paid a transaction fee of $240,000. Additionally, the Company issued to a finder a warrant to purchase 23,077 shares of common stock exercisable for a period of five years at an exercise price of $3.90 per share and paid a transaction fee of $120,000.

5

Our Business

Through our indirect subsidiary Beijing Concrete, which has been engaged in the concrete business since January 2002, we are operating as a producer of advanced ready-mix concrete materials headquartered in Beijing, China. The Company specializes in the production of ready-mix concrete and other types of concrete for developers in the construction industry. The Company currently is certified by the Chinese Ministry of Construction to produce certain types of concrete (model C10 to model C60) for residential and commercial developers as well as for industrial companies. The Company currently is applying for certification to produce all types of concrete.

The Company currently owns two stationary factories and two mobile concrete mix stations, which in total have 6 ready-mix concrete batching plants, and two new batching plants are under construction. In addition, it owns 5 concrete transport pumps, 53 truck transit mixers and 3 bulk cement transport vehicles. All pump vehicles and trucks are installed with GPS tracking systems, which ensure the quality control and safe delivery of the concrete mix.

The Company currently has an annual output capacity of approximately 2.76 million cubic meters of concrete. In fiscal years 2011 and 2010, the Company’s revenues amounted to $83.4 million and $73.9 million, respectively. All of the Company’s products have been certified by the ISO9001-2000 Certification Quality System and by the Chinese Ministry of Construction Beijing Branch Certification Center with respect to Integrated Certification System which includes Quality Management System, Environmental Management System and Occupational Health and Safety Management System.

Over the past six years, we have successfully expanded our operations from a single ready-mix concrete factory in Beijing to additional production in the cities of Tangshan and Xi’an. Currently, the Company has four main concrete factories. Of these, one factory has one set of Betomix 3.0A-R/DW series mixing towers, one factory has one set of HZS120 series mixing towers, one factory has two sets of HZS120 series mixing towers, and one factory has two sets of HZS180 series mixing towers. Our facilities are located in Beijing’s Daxing District, Shidu, on the outskirts of Beijing, in the Tangshan Development Zone, about two hundred kilometers east of Beijing, and in Xi’an, central China.

The following summarizes the details of the two factories and two mobile stations as of May 31, 2011:

|

Location

|

Batching Plants

Model

|

Number

of Sets

of

Mixing

Towers

|

Production

capacity (m3)

|

Estimated

Production Capacity

(based on

estimated

utilization

rate)

|

Status

|

||||||||||

|

Beijing (Daxing)

|

1 Betomix 3.0A-R/DW (Stationary)

|

1 | 1,576,800 | 551,880 |

Operating since 2002

|

||||||||||

|

Beijing (Shidu)

|

HZS 120 (Mobile)

|

1 | 1,051,200 | 367,920 |

Operating since February 2010

|

||||||||||

|

Tangshan Caifeidian

|

HZS 120 (Mobile)

|

2 | 2,102,400 | 735,840 |

Operating since November 2009

|

||||||||||

|

Xi’an

|

HZS 180 (Stationary)

|

2 | 3,153,600 | 1,103,760 |

Operating since March 2010

|

||||||||||

6

The Company is building two additional stationary concrete factories with two batching plants of 3.5 million cubic meters production capacity at Beijing factory, which are going to start to operate in September 2011.

Since March 2010 our Caifeidian facility has been providing manufacturing service to our customers. In this business model the customer provides to us raw materials to be used for production of concrete for the customer. Large contractors working on big projects have more bargaining power to negotiate lower prices for raw materials. The Company benefits from this as well because it does not need to advance cash to buy raw materials. Starting from 2011, the Caifeidian facility provides only manufacturing service to its customers. In October 2010, the Shidu facility also switched to providing only manufacturing service to its customers.

The Company is committed to conducting its operations with an emphasis on the efficient production, management and innovation of our concrete products. In particular, we produce “Green Concrete” by extensively using recycled industrial waste and minimizing the energy consumption and the dust and air pollution. We believe that we are able to meet the stringent environmental and technical needs of a rapidly growing market in China. The types of projects for which we provide concrete include large express railways, bridges, tunnels, skyscrapers, and dams. Many competitors are not able to participate in such projects due to technical requirements and the limitations of funding and information.

Our Industry

We believe that as its economy has opened and become more developed and vibrant since the 1990s, China plays a more and more important role in the concrete industry as both a producer and user of concrete and concrete products. China is the world’s largest producer of cement and its output of cement reached up to 1.38 billion tons in 2008, 1.63 billion tons in 2009 and 1.87 billion tons in 2010. Cement production has grown about 10 percent per year over the past two decades and is now growing even faster to keep up with massive urbanization. Today, China produces roughly half of the total cement in the world, whereas the next three largest producers, India, Japan, and the United States altogether produce less than 20 percent. (Source: Chengdu Xinbotelan Technology Inc.; see www.snsqw.com )

Cement consumption in China is forecast to rise by 6% annually through 2012, reaching 1.8 billion tons, according to a new study, "Cement in China", issued by the Freedonia Group. The study also mentioned that construction contractors will remain the largest market for cement in China, accounting for approximately 36% of all cement consumption in 2012. According to the same study, the ready-mix concrete market will see the strongest growth, rising 9.8% per annum through 2012 to 383 million tons. Some of the forecasted growth is projected to result from government regulations banning on-site concrete and mortar mixing as described in more detail under the heading “Business”-“Products and Services” of this report. Demand for cement used in concrete products is expected to grow 5.4% annually through 2012 to 513 million tons, driven by the growing popularity of precast concrete with many construction contractors. The government’s continued efforts to modernize the country’s infrastructure is exemplified by such massive projects as the South-North Water Diversion - designed to redirect water to the northern plains from Central and South China. This project, scheduled for completion in 2050, will result in annual cement consumption of over one million metric tons alone.

China accounts for half of all new building activity in the world and rapid expansion is expected to continue. According to the Report of China Cities Competence, (http://www.ce.cn/cysc/cysczh/200803/31/t20080331_15010675.shtml) up to 1 billion people in China are expected to move into Chinese urban areas by 2030.

Residential and non-residential buildings in China are increasingly requiring much more concrete due to, among other reasons, the short supply of wood. China is currently the largest consumption market of cement worldwide at over $200 billion annually. China’s cement consumption amounted to approximately 54% of global demand in 2010 and was greater than current combined consumption of India, United States, Turkey, Iran, Brazil, Japan, Spain, Vietnam, Russia, Egypt, South Korea, Saudi Arabia, Indonesia, Italy, Mexico, German, Thailand and Pakistan according to the USGS Mineral Program Cement Report. At the present rate, it is presumed that China will continue to be an important player in the global construction materials marketplace for at least the next two decades.

7

China’s concrete market is considered highly competitive, with over 10,000 providers, of which we estimate that approximately 3,000 are ready mix concrete producers. Global Information Inc. reports that ready-mix concrete companies will benefit from an extremely favorable outlook in China, where large-scale construction projects will require significant amounts of ready-mix concrete. In the Beijing concrete market, for example, we estimate that no competitor has greater than a 10% market share according to the Beijing Concrete Association.

According to a recent article in the Economic Observer Newspaper China, the Chinese government has reviewed its investment priorities under the 4-trillion-yuan (USD $586 billion) stimulus package introduced in 2008, with more emphasis given to social welfare projects, rural development, and technology advancement.

China's top economic planner, the National Development and Reform Commission (NDRC), unveiled a breakdown (see chart below) of the revised stimulus package spending during a news conference on March 6, 2009.

Public infrastructure development constitutes the biggest portion – USD $222.7 billion, or nearly 38% of the total Stimulus Package. The projects to be undertaken by the Chinese government include railway, road, irrigation, and airport construction, for which we can provide concrete.

Other than the Chinese Central Government’s USD $586 billion stimulus funds, provincial governments are anticipated to invest another USD $1.5 trillion over the next five years. More than half of the total investment is for infrastructure development.

As part of the Eleventh Fifth Year Plan, the PRC Government had earmarked $730 billion prior to the stimulus plan for the expansion of the rapid railway system. Some of the details include:

|

|

·

|

The national rail network is set to grow by 41,000 km (50%) by 2020.

|

|

|

·

|

RMB 5 trillion (USD $730 billion) government spending plan.

|

|

|

·

|

Expected to consume 120 million tons of cement.

|

8

As a result of the Chinese Government Stimulus Package, the demand for cement and concrete in China is expected to significantly increase in the next several years.

Products and Services

We specialize in “ready-mix concrete”, a concrete mixture made at our production facilities. Ready-mix concrete is mixed on demand and is shipped to worksites by concrete mixer trucks. Currently 20% of the total concrete produced in China is ready-mixed concrete, and 80% is mixed on the construction sites. In developed countries, 80% of the total concrete produced is ready mix concrete. This sector in the concrete market is growing at a fast rate, largely due to the Chinese government’s implementation of Decree #341 in 2004, which bans on-site concrete production in over 200 cities across China, with the goal of reducing environmental damages from on-site cement mixing and improving the quality of cement used in construction. The use of ready-mix concrete minimizes worksite noise, dirt and congestion. Additionally, most additives used in ready-mix concrete are environmentally safe. We use at least 34% recyclable components in our green concrete products.

Green Concrete is the concrete that utilizes industrial waste, or other recycled materials as part of its raw materials, such as the ash reclaimed from the power-plant, the grounded waste steel slag powder, and the waste ore from steel mills. Green Concrete has better performance and properties than regular concrete in terms of endurance and strength, among other things.

Since the Green Concrete uses large amounts of industrial waste, the Company’s products are cost effective and environmentally friendly.

Features of “Green Concrete” include:

|

|

·

|

Reduced cement consumption

|

|

|

·

|

Reduced costs of concrete

|

|

|

·

|

Reduced costs of construction

|

|

|

·

|

Reduced energy consumption

|

|

|

·

|

Improved attributes (i.e. strength, endurance, and bonding)

|

We have a product portfolio that serves the diverse needs of our expanding customer base and its unique construction and infrastructure projects. While we mainly specialize in ready-mix concrete formulations from controlled low-strength material to high-strength concrete, specifically formulated to cater into the respective requirement of each project, we provide both industry standard and highly innovative products, including: Green Concrete, Self-densifying Concrete, Lightweight Aggregate Pumpable Concrete, Heavy Concrete, Macro-void Pervious Concrete, C60 Mass Concrete, Color Concrete, etc.

Manufacturing Process

Introduction

Concrete is a mixture of paste and aggregates (sand & rock). The paste is usually composed of cement and water, coating the surface of the fine sand and coarse aggregates such as rocks and binding them together into a rock-like mass known as concrete.

Aggregates comprise approximately 61 percent of the total volume of concrete. The type and size of the aggregate mixture depends on the thickness and purpose of the final concrete product. A continuous gradation of particle sizes is desirable for efficient use of the paste. In addition, aggregates should be clean and free from any matter that might affect the quality of the concrete.

9

The key to achieving a strong, durable concrete rests on the careful proportioning and mixing of the ingredients. Concrete mixture that does not have enough paste to fill all the voids between the aggregates will be difficult to place and will produce rough, honeycombed surfaces and porous concrete. A mixture with an excess of cement paste will be easy to place and will produce a smooth surface; however, the resulting concrete will be more likely to crack and be uneconomical.

A properly proportioned concrete mixture will possess the desired workability for the fresh concrete and the required durability and strength for the hardened concrete. Typically, a mixture is by volume approximately 16 percent cement, 61 percent aggregates and 18 percent water. Entrained air bubbles in many concrete mixtures may also take up another 3 percent.

The character of concrete is determined by the quality of the paste. The strength of the paste, in turn, depends on the ratio of water to cement. The water-cement ratio is the weight of the mixing water divided by the weight of the cement. High-quality concrete is produced by lowering the water-cement ratio as much as possible without sacrificing the workability of fresh concrete. Generally, using less water produces a higher quality concrete provided the concrete is properly placed, consolidated and cured.

Besides portland cement, the most widely used type of cement around the world, concrete may contain other cementitious materials including (i) fly ash, a waste byproduct from coal burning electric power plants; (ii) ground slag, a byproduct of iron and steel manufacturing; and (iii) silica fume, a waste byproduct from the manufacture of silicon or ferro-silicon metal. The concrete industry uses these materials, which would normally have to be disposed in land-fill sites, to the advantage of concrete. The materials participate in the hydration reaction and significantly improve the strength, permeability and durability of concrete.

Admixtures are generally products used in relatively small quantities to improve the properties of fresh and hardened concrete. They are used to modify the rate of setting and strength development of concrete, especially during hot and cold weather. The most common is an air-entraining agent that develops millions of tiny air bubbles in concrete, which imparts durability to concrete in freezing and thawing exposure. Water reducing admixtures enable concrete to be placed at the required consistency while minimizing the water used in the mixture, thereby increasing strength and improving durability. A variety of fibers are incorporated in concrete to control cracking or improve abrasion and impact resistance. Most common admixtures we use include pumping agent, superplasticizer, and expansive admixtures.

10

Hydration

After the aggregates, water, and the cement are combined, the mixture remains in a fluid condition for about four to six hours during which we use the agitator trucks to transport, place and finish the concrete in its final location. We have around 94 truck drivers to operate and deliver the concrete to customers mainly in the Beijing area, Tangshan, Hebei Province, and Xi’an area. We intend to hire more drivers to accommodate our growing business.

Quality Control Laboratories

The proportioning of a concrete mix design should result in an economical and practical combination of materials to produce concrete with the properties desired for its intended use, such as workability, strength, durability and appearance. We have laboratories on the site of each plant, performing quality control tests throughout our manufacturing process to ensure that our products are accustomed to the needs of the customers. During various stages of the ready-mix concrete manufacturing, the labs inspect the raw materials, such as the sand, rocks and water, and determine the proportion of the ingredients of the concrete in accordance with the specifications received from the customers, before the mixing of aggregates and paste. Right after the mixing process, the labs will also perform tests on the fluid concrete with respect to its minimum cement content, air content, slump, maximum size of aggregate, strength, etc. The Company, over the years, has developed some expertise in selecting the proportions based on previously developed guidelines and experience. We have established methods for selecting the proportions for concrete for each batch and producing environmental friendly concrete with best performance:

|

|

·

|

We utilize fly ash, waste ore, slag or other cementitious materials, which enhance concrete properties, to supplement our cement. We aim to have the least amount of water that can result in a mixture that can be easily placed, consolidated and finished.

|

|

|

·

|

Our labs also make sure the concrete aggregates are required to meet appropriate specifications and in general should be clean, strong and durable.

|

|

|

·

|

We apply some air-entraining and water reducing admixtures into the ready-mix concrete to adjust the rate of setting and strength development of our concrete.

|

The Company tests the absolute volume of the concrete to determine the safety factor, through which the Company reduces the costs of cement while still meeting the criteria of the product specifications. In addition, the Company applies advanced statistical and orthogonal (two perpendicular right angles) design techniques in test and data processing, which is a system design property that facilitates the feasibility and compactness of complex designs. These processes allow the Company to produce a more cost efficient “Green Concrete” while maintaining the product’s quality.

Sales and Marketing

Our marketing efforts are geared towards advancing the Company as the supplier of choice for helping to build China’s most modern and challenging projects. We are constantly seeking ways to raise our profile and leverage additional publicity. To this end, we plan to expand the Company’s presence at leading construction industry events and in periodicals to build on its successful reputation. The primary goal when expanding into new markets is to reinforce the sales effort by promoting positive testimonials and success stories from the Company’s strong base of high profile clients.

The marketing strategy of the Company relies primarily on direct sales and we usually develop our market through the following three means: (i) by our sales department, which consists of 5-6 employees in each station, conducts the market promotion and development and also collects the feedback from the customers on the Company’s products; (ii) by the salesmen, currently around 10 people, with whom we contract to expand our client base; and (iii) by references from our current customers and our raw material suppliers. Due to positive prior experience with the government projects and extensive work with the PRC government on such projects in the past, we believe that we will continue to receive access to such projects in the future.

11

Raw Materials and Suppliers

We rely on third-party suppliers of the raw materials to manufacture our products. The main components of our products include cement, fly ash, slag, admixture, sand and gravel. Our primary suppliers of each are:

|

Raw Material

|

|

Suppliers

|

|

Cement

|

Tianjin Zhenxing Cement Factory, Hebei Wushan Cement Factory, Hebei Luan Xian Maopai Cement Factory

|

|

|

Fly ash

|

Beijing Xingda Fly Ash Co., Baolu Tongda Co., Zhongxin Shenyuan Fly Ash Co.

|

|

|

Slag

|

Beijing Shenshou Slag Co., Tangshan Slag Co., Beijing Liuhuan Construction Trade Center Co.

|

|

|

Sand

|

Zhuozhou Hongyuan Sand & Gravel Factory, Zhuozhou Shuishang Leyuan Sand & Gravel Factory

|

|

|

Gravel

|

Changqing Sand & Gravel Factory, Zhuozhou Shuishang Leyuan Sand & Gravel Factory

|

We believe we are not dependent on any of these suppliers and will be able to replace them, if necessary, without material difficulties. In particular, we do not expect to experience a shortage of cement, the main material for manufacturing our product, since it is usually readily available and we have long-term contracts with three large cement manufacturers to ensure the constant supply.

Our major supplier of truck transit mixers and concrete transport pumps is Sanyi Zhonggong Ltd. (“Sanyi Zhonggong”), which is the largest concrete production equipment manufacturer in the world. We have purchased over US$5.2 million of equipment from Sanyi Zhonggong. Pursuant to a Strategic Agreement with Sanyi Zhonggong dated December 3, 2009, we agreed to use Sanyi Zhonggong as our preferred equipment supplier, and Sanyi Zhonggong in turn will provide discounts on the purchase prices of the equipment, 24/7 customer service, as well as training services to our employees. For potential construction projects undertaken by Sanyi Zhonggong in China, we will be recommended as their preferred ready-mix concrete provider.

Principal Customers

Our clients are mostly property developers and industrial companies, as well as PRC state-owned companies. Some of them are publicly listed, such as Beijing Capital Steel Group, Tangshan Jiahua Chemical Corporation and Guangzhou Fuli Real Estate Group, a public company listed on the Hong Kong Stock Exchange. Fuli Group’s annual sales are over 1.5 billion US dollars. The PRC state-owned companies, which are our customers, include China Railway Construction Group (“CRCG”), China Construction Group (“China Construction”), Beijing Construction Corporation and Beijing Chemical and Coking.

We had one major customer, China Railway Construction Group, which represented 18% and 14% of the Company’s total sales for the fiscal years ended May 31, 2011 and 2010, respectively.

Two customers, China State Construction Engineering Corporation and Guangzhou Tianli Construction Group accounted for 10% and 8% of the Company’s accounts receivable balance at May 31, 2011. China Railway Construction Group, and Guangzhou Tianli Construction Group, accounted for 26% and 10% of the Company’s accounts receivable balance at May 31, 2010.

The following table summarizes some of the high-end residential and commercial real estate development projects, which are currently under construction or we completed as noted including those completed in fiscal years 2011, 2010 and 2009.

12

|

Project Names

|

|

Start/Duration

(Year)

|

|

Concrete Supplied

|

|

Beijing Zhongxin Semiconductor Company (Completed)

|

2002

|

Supplied total 140,000 cubic meters

|

||

|

400,000 square meters construction space

|

||||

|

Beijing Rainbow City Project (Completed)

|

2003

|

Supplied 100,000 cubic meters

|

||

|

560,000 square meters construction space

|

||||

|

Beijing 5th Generation semiconductor Company (Completed)

|

2004

|

Supplied 70,000 cubic meters

|

||

|

120,000 square meter construction space

|

||||

|

Beijing World Trade CBD project (Completed)

|

2005

|

Supplied 90,000 cubic meters

|

||

|

180,000 square meter construction space

|

||||

|

Beijing Wanjing International Mansion (Completed)

|

2005-2006

|

Supplied 180,000 cubic meters

|

||

|

240,000 square meters construction space

|

||||

|

Tangshan Jiahua Project (project still in progress)

|

2007- 2010

|

434,000 cubic meters in total from September 2007 to November 2009

|

||

|

Douge Zhuang (project still in progress)

|

2007-2010

|

314,000 cubic meters in total from June 2007 to November 2009

|

||

|

Futai Xiangbo Yuan (project still in progress)

|

2007-2010

|

244,000 cubic meters in total from June 2007 to November 2009

|

||

|

Beijing Fuli Real Estate Company

1.1 million square meters of construction space (project still in progress)

|

2009

|

755,000 cubic meters in total from June 2006 to February 2009

|

||

|

Binhai Express Road (in Tangshang)

|

2011

|

412,000 cubic meters in total from Nov. 2009 to May 2011

|

||

|

Fuli City (Beijing)

|

2011

|

347,000 cubic meters

|

Competition

Competitive Environment

Our principal market, Beijing, is considered highly competitive. It has enjoyed stronger economic growth and a higher demand for construction than other regions of China. There are approximately 130 concrete mixture stations in the Beijing area. According to our estimates, no single supplier has greater than a 10% market share, which results in this industry being highly segmented. We currently have an estimated market share of 2% in the ready-mix concrete market in Beijing.

In the Beijing market, we compete with national, regional and local construction companies. Some of our competitors have greater financial and other resources than us. Our main competitors include Beijing Heng Kun Concrete Center, Beijing Jian Gong Group Concrete Center, and Beijing Gaoqing Concrete Company. In 2009, the Beijing government issued a series of policies to encourage concrete manufacturers to upgrade their transportation vehicles to those models that are environmentally friendly. Vehicles that cannot meet the environmentally friendly criteria will be restricted in going into the 5th ring of Beijing. Therefore, concrete manufacturers that cannot afford replacing their truck transit mixers with the environmentally friendly models will be banned from delivering the concrete mix and eventually be eliminated from the concrete industry.

13

We compete primarily on the basis of quality, technological innovation, customer service, and pricing of our products. We win projects which are awarded through a competitive bidding process based on our competitive pricing. Projects are usually awarded to the lowest bidder, if other conditions are the same, although other factors such as shorter delivery schedules are also taken into consideration.

Our Competitive Advantages

Comparing us with other companies in the concrete industry in Beijing and in the Tianjin area, we believe that the Company has the following competitive advantages:

(1) Environmentally friendly products.

We produce all types of concrete products including specialty concrete for varied industry uses. Capitalizing on our research and development, we extensively use recycled materials such as fly ash (from coal fired power plants) and mining waste in our production with the share of these materials of approximately 34% of other raw materials used by us. In doing so, we not only help reduce environmental wastes but we also increase our product quality. Because we successfully apply this technology to our products, we have obtained tax exemptions and other incentives from government organizations. In accordance with a policy by China’s State Development and Reform Commission (the “SDRC”), if the percentage of the industrial wastes components in a company’s concrete mixture exceeds 30%, such company may enjoy the exemptions from income tax and franchise tax in China.

(2) Strict and effective quality management system.

We have developed an effective quality management system that covers all aspects of our operations, including planning, budgeting, purchasing and production. In every step, not only do we have fully trained, experienced and skilled employees that are working in concert to ensure our product’s quality and timely delivery, we also implemented the computer-controlled Concrete Enter Price Management System (CEM 2008 System) to coordinate and oversee the manufacturing, bookkeeping and shipping process. From signing contracts to finishing a project, we have a quality follow up supervising team to make sure that our concrete matches our clients’ engineering designs exactly. All pump vehicles and truck transit mixers are installed with GPS tracking systems, which ensure the quality control and safe delivery of the concrete mix.

Our quality supervisory staff on each construction site is responsible for finished product quality. For every previous project completed, we have earned a 100% pass rate. We believe that this effective management puts us at the top of the industry standard and has allowed the Company to achieve 5% more in profit for every cubic meter of concrete we produce and deliver.

(3) We also have lower production costs by smart outsourcing and quality engineering.

More than 80% of concrete costs come from raw materials, such as cement, sands, fly ash, and gravel. The costs of materials have a direct impact on our production costs. We compare several suppliers’ quotes before we make final purchases. This ensures that we have the lowest prices for all of our raw materials.

In addition, the percentage of each of the raw materials needed to produce concrete is also a big factor that affects our production costs. Our research laboratory led by top professional engineers conducts extensive experiments to ensure that we have excellent mixing formulas while achieving the required quality. We believe the scientific formula of each type of concrete reduces our costs to levels 3% to 5% lower than our competitors.

We believe our tremendous track record in the industry, effective management, solid clientele base, lower production costs and higher than the industry average profit margin puts us at the top in the industry.

14

(4) Maintenance of key relationships

We have successfully built long-term cooperative relationships with China’s top construction companies through our services. Our reputation and good record will help us gain new business from existing customers and new customers.

For instance, on December 3, 2009, the Company entered into a Strategic Agreement with Sanyi Zhonggong Ltd. (“Sanyi Zhonggong”), our major equipment supplier, whereby the Company agreed to choose Sanyi Zhonggong Ltd. as its preferred equipment supplier, and Sanyi Zhonggong in return will provide discounts on the purchase prices of the equipment as well as training services to the Company’s employees. For potential construction projects undertaken by Sanyi Zhonggong in China, we will be recommended by Sanyi Zhonggong as their preferred ready-mix concrete provider.

Growth Strategy

(1) Focus on The Infrastructure Industries and Develop New Relationships. Our sales people will focus on developing relationships with the government, general contractors, architects, engineers, and other potential sources of new business in our target markets. We will actively monitor and analyze China’s infrastructure construction plan to ensure that we direct our resources at the center of the developing area and have the opportunities to bid on the potential business at the earliest time.

(2) Capacity Expansion via Building New Plants. We will add two new stationary batching plants with larger capacity in Beijing during the fiscal year 2012 in order to meet the requirements of existing contracts and anticipated demand. We plan to add more mobile stations in 2012 as part of our long-term expansion plans for highway and high-speed railway projects.

(3) Cooperation with other concrete companies. We will consider cooperating with other concrete companies in certain area or for certain projects. The cooperation will include but not be limited to lease, co-construct a new plant and profit sharing, or an M&A transaction. We believe that by cooperating with local concrete companies, we will save capital and time compared with building a new plant by ourselves. And it will also help us to develop our relationship with local customers and suppliers.

Research and Development

Companies engaged in production of construction materials are under extreme pressure to respond quickly to industry demands with new designs and product innovations that support rapidly changing technical demand and regulatory requirements. We devote a substantial amount of attention to the research and development of advanced construction materials that meet the demands of project specific needs while striving to lead the industry in value, materials and processes. We have sophisticated in-house R&D and testing facilities, a highly technical onsite team, the access to highly specialized market research, the cooperation with a leading research institution, an experienced management and advisory board, and close relationships with leading concrete materials experts. A total of 20 employees are currently working for our R&D department. Our research and development expenses amounted to approximately $14,332 and $55,723 for the years ended May 31, 2011 and 2010, respectively.

Our research laboratory led by a team of 20 engineers and technicians conducts extensive experiments to ensure that we have excellent mixing formulas while achieving the required quality. This includes production of innovative concrete admixtures to supply the company. Admixtures are chemical raw materials used for production of concrete. Admixture is also one of the key materials that affect the quality of concrete. Through technology innovation, our admixture products help the Company produce environmentally friendly and energy-saving concrete.

We intend to conduct research in developing new raw materials. Adoption of new techniques and materials will help us reduce our cost of production and will help improve our product quality.

15

We have dedicated ourselves to testing and research of ready-mix concrete. We have been developing and researching the raw material mixture ratios, which are crucial to the quality of our products, by our advanced testing facilities and the 18 years of testing experience of our technical and engineering staff.

On December 31, 2009, the Company entered into a three-year agreement with the Institute of Building Materials, a subsidiary of the China Academy of Building Research ("CABR") (the “Agreement”). Under the Agreement, the Institute of Building Materials will provide its technical research, development and support exclusively to us for an annual payment of RMB 350,000 (or US$51,000). The Institute of Building Materials will also provide training courses to our employees. We are allowed to list the Institute of Building Materials as our technological partner in our marketing materials, and the Institute of Building Materials has agreed to use its relationships and brand influence in the construction industry to assist us in our business development.

Intellectual Property

We do not have any patents or other registered intellectual property. Currently, we are in the process of applying to register two of our trademarks. To protect our unregistered intellectual property, we enter into confidentiality agreements with our officers and employees in our R&D Department. A confidentiality agreement will cover three years after such officer or employee leaves the Company, and any breach of the agreement will subject such person to liquidated damages of RMB 10,000 and any other losses incurred by the breach.

Environmental Matters

We are required to comply with environmental protection laws and regulations promulgated by the Ministry of Construction and the State Environmental Protection Administration in China. Some specific environmental regulations apply to sealed transportation of dust materials and final products, non-open storage of sand and gravel, as well as reduction of noise and dust pollution on production site and encouraged use of waste materials. In 2009, the Beijing government issued a series of policies to encourage concrete manufacturers to upgrade their transportation vehicles to those models that are environmentally friendly. Vehicles that cannot meet the environment friendly criteria will be restricted in going into the 5th ring of Beijing.

In addition, the governmental regulatory authorities conduct periodic inspections on us. We have met all the requirements in the past inspections. The Company has set up and documented its environment management system according to GB/T24001-2004 Guidance. The Company has also invested: 1) $29,411 for powder silo dust equipment, which reduces the release of dust when delivering the concrete mix; 2) $14,705 for sand and gravel separators, which recycle and reuse the discharged concrete; 3) $14,705 for 3 sedimentation tanks to recycle the water in the manufacturing process; and 4) $294,117 for a warehouse to store sand and gravel to reduce the air pollution. Because of our dedication to be environmentally friendly, we are one of the companies in the industry that have been awarded the honor of “Green Concrete Producer” by the PRC government.

Seasonality

Our manufacturing operations are primarily located in northeastern China, which is cold during the winter months. During such time, we are able to manufacture our advanced ready-mix concrete material; however, many construction projects operate on an abbreviated work schedule, if at all.

Regulations

Our products and services are subject to regulation by governmental agencies in the PRC, Beijing City and Hebei Province. Business and company registrations, along with the products, are certified on a regular basis and must be in compliance with the laws and regulations of the PRC and provincial and local governments and industry agencies, which are controlled and monitored through the issuance of licenses. All of the Company’s products have passed the ISO9001-2000 Certification Quality System and Integrated Certification System including Quality Management System Certification, Environmental Management System Certification and Occupational Health and Safety Management System Certification issued by the Beijing Zhong Jian Xie Certification Centre.

16

We have been in compliance with all registrations and requirements for the issuance and maintenance of all licenses and certificates required by the applicable governing authorities, including the Ministry of Construction and the Beijing Administration of Industry & Commerce. The Ministry of Construction awards Level II and Level III qualifications to concrete producers in the PRC construction industry, based on criteria such as production capacity, technical qualification, registered capital and capital equipment, as well as performance on past projects. Level II companies are licensed to produce concrete of all strength levels as well as special concrete, and Level III producers are licensed to produce concrete with strength level C60 and below. We are a Level III concrete producer.

Our Employees

As of September 21, 2011, we had 389 employees. The following table sets forth the number of our full-time employees by department as of September 21, 2011:

|

Department

|

Number of

Employees

|

|||

|

Accounting

|

20 | |||

|

Supply, Purchase & Inventory

|

44 | |||

|

Technical & Engineering Staff

|

35 | |||

|

Production Staff

|

246 | |||

|

Administrative Staff

|

44 | |||

|

Total

|

389 | |||

As required by applicable PRC law, we have entered into employment contracts with most of our officers, managers and employees. We are working towards entering into employment contracts with those employees who do not currently have employment contracts with us. We believe that we maintain a satisfactory working relationship with our employees, and we have not experienced any significant labor disputes or any difficulty in recruiting staff for our operations.

Our employees in China participate in a state pension plan organized by PRC municipal and provincial governments. We are currently required to contribute to the plan at the rate of 20% of the average monthly salary.

In addition, we are required by PRC law to cover employees in China with various types of social insurance, and we believe that we are in material compliance with the relevant PRC laws.

Insurance

We maintain worker's employee insurance for our employees. We provide social welfare insurance for our employees. We also provide life insurance for our officers. Other than the above mentioned, we do not maintain any other business, liability or key employee insurance.

Company Information

Our principal executive offices are located at Room 1906, Shidai Caifu Tiandi Building, 1 Hangfeng Road, Fengtai District, Beijing, China 100070, and our telephone number is 011-86-10-5809-0110.

17

ITEM 1A. RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

Our revenue will decrease if the construction and building material industries experience a downturn, or if the concrete industry in China does not realize an increase in demand at the pace we expect.

Our cement and cement products serve as key components in construction and building projects for a wide range of industries and private and public sector projects. Therefore, we are subject to the general changes in economic conditions affecting many segments of the economy. Demand for concrete is typically affected by a number of economic factors, including, but not limited to, interest rates, market and government confidence, political priorities, level of construction of commercial, government and residential projects, and the level of construction financing available. Also, our revenue is dependent upon the cost and availability of raw materials, the cost of labor, increased taxes, and other costs of doing business. If there is a decline in construction activity in China or a rise in the costs of doing business in China, demand for our concrete products may decline and our revenue will decrease.

Competition in the concrete industry could adversely affect our results of operations.

We operate in local and regional markets in China, and many factors affect the competitive environments we face in any particular market. These factors include the number of competitors in the market, the pricing policies and financial strength of those competitors, the total production capacity serving the market, the barriers to enter the market and the proximity of natural resources, as well as general economic conditions and demand for construction materials within the market. Although we believe our products and quality of service are superior, there is no assurance that existing or new competitors may not receive contracts for which we compete by reason of events and factors beyond our control.

Our growth strategy is capital intensive; without additional capital on favorable terms we may not accomplish our strategic plan.

Our expansion plans are premised upon our raising sufficient capital to timely build or acquire two to three new production plants in the next two to three years to accommodate the increased concrete production needs. Although we believe that, given our current level of revenue and net income, our management team, and our track record of performance, we may be able to raise sufficient capital to carry out our strategic plan, there can be no assurance that we will do so. Our inability to raise sufficient capital or inability to raise capital on acceptable terms to fund these new production plants would negatively impact our projected revenues and our projected growth.

Long-term collection of accounts receivable and potential bad debts may impose a threat to our operations and expansion.

Common among most of the businesses in the concrete industry, we have a large amount of accounts receivable, which accounts for over 70% of the total assets. A substantial majority of our outstanding trade receivables are not secured by any collaterals or credit insurance. While we have procedures to monitor and limit exposure to credit risk on our trade and non-trade receivables, there is no assurance that such procedures will effectively limit our risks of bad debts and avoid losses, which could have a material adverse effect on our financial condition, operating results and business expansion.

18

We depend heavily on key personnel, and turnover of key employees and senior management could harm our business.

Our future business and results of operations depend in significant part upon the continued contributions of our key technical and senior management personnel, including Rong Yang, our Chairman and Chief Executive Officer. They also depend in significant part upon our ability to attract and retain additional qualified management, technical, marketing and sales and support personnel for our operations. If we lose a key employee, or if we are not able to attract and retain skilled employees as needed, our business could suffer. Significant turnover in our senior management could significantly deplete our institutional knowledge held by our existing senior management team. We depend on the skills and abilities of these key employees in managing the manufacturing, technical, marketing and sales aspects of our business, any part of which could be harmed by turnover in the future.

We expect approximately 65% of our sales revenues will be derived from our ten largest customers in 2012 and any reduction in revenues from any of these customers would reduce our revenues and net income.

In fiscal year 2011, we derived 68.69% of our revenue from our ten largest customers. In fiscal year 2010, we derived 72.8% from our ten largest customers.

Leased properties and production lines may be terminated due to unexpected reasons.

We presently have a ten-year lease, signed in 2006, for our Beijing production base and have built our offices and manufacturing facilities on this site. We lease land for our Xi’an production facility. While we believe this lease is secure for us, under our laws, the lease could be terminated for unexpected reasons.

Our intellectual property rights in our proprietary admixture products may be hard to protect, and litigation to protect our intellectual property rights may be costly.

One of our strategies focuses on the development, use and sale of specialty admixture concrete products. We currently use such products in our own operations. These proprietary admixture products are protected by trade secrets only, and are not patented. Accordingly, we cannot ensure that a competitor may not be able to duplicate and commercialize our proprietary products. Litigation may be necessary to enforce our intellectual property rights and given the relative unpredictability of China’s legal system and potential difficulties enforcing a court judgment in China, there is no guarantee litigation would result in an outcome favorable to us. Further, any such litigation could be costly and divert management away from our core business. Our financial results could be negatively affected if we cannot protect or timely develop our admixture products.

Our continuing rapid expansion could significantly strain our resources, management and operational infrastructure which could impair our ability to meet increased demand for our products and hurt our business results.

To accommodate our anticipated growth and to build additional production plants, we will need to expend capital resources and dedicate personnel to implement and upgrade our accounting, operational and internal management systems and enhance our record keeping and contract tracking system. If we cannot successfully implement these measures efficiently and cost-effectively, we will be unable to satisfy the demand for our products, which will impair our revenue growth and hurt our overall financial performance.

We may lose business to competitors who underbid us, and we may be otherwise unable to compete favorably in our highly competitive industry.

Our competitive position in a given market depends largely on the location and operating costs of our plants and prevailing prices in that market. Generally, our products are price-sensitive. Our prices are subject to changes in response to relatively minor fluctuations in supply and demand, general economic conditions and market conditions, all of which are beyond our control. Because of the fixed-cost nature of our business, our overall profitability is sensitive to minor variations in sales volumes and small shifts in the balance between supply and demand. Price is the primary competitive factor among suppliers for small or simple jobs, principally in residential construction. However, timeliness of delivery and consistency of quality and service, as well as price, are the principal competitive factors among suppliers for large or complex jobs. Concrete manufacturers like us generally obtain customer contracts through local sales and marketing efforts directed at general contractors, developers and homebuilders. As a result, we depend on local relationships. We generally do not have any long-term sales contracts with our customers.

19

Our competitors range from small, owner-operated private companies to subsidiaries or operating units of large, vertically integrated manufacturers of cement and aggregates. Our vertically integrated competitors generally have greater manufacturing, financial and marketing resources than we have, providing them with a competitive advantage. Competitors having lower operating costs than we do or having the financial resources to enable them to accept lower margins than we do will have a competitive advantage over us for projects that are particularly price-sensitive. Competitors having greater financial resources or less financial leverage than us may have a competitive advantage because of their greater financial flexibility to invest in new mixer trucks, build plants in new areas or pay for acquisitions.

Our contracts may require us to perform extra or change order work, which can result in disputes and adversely affect our working capital, profits and cash flows.

Our contracts may require us to perform extra or change order work as directed by the customer even if the customer has not agreed in advance on the scope or price of the work to be performed. This process can result in disputes over whether the work performed is beyond the scope of the work included in the original project plans and specifications or, if the customer agrees that the work performed qualifies as extra work, the price the customer is willing to pay for the extra work. Even when the customer agrees to pay for the extra work, we may be required to fund the costs of such work for a lengthy period of time until the change order is approved and funded by the customer.

We may incur material costs and losses as a result of claims if our products do not meet regulatory requirements or contractual specifications.

Our operations involve providing products that must meet building code or other regulatory requirements and contractual specifications for durability, stress-level capacity, weight-bearing capacity and other characteristics. If we fail or are unable to provide products meeting these requirements and specifications, material claims may arise against us and our reputation could be damaged. We expect that in the future there may be claims of this kind asserted against us. If a significant product-related claim or claims are resolved against us in the future, that resolution may have a material adverse effect on our financial condition, results of operations and cash flows.

Our net sales attributable to public infrastructure projects could be negatively impacted by a decrease or delay in governmental spending.

Our business depends in part on the level of governmental spending on infrastructure projects in our markets. Reduced levels of governmental funding for public works projects or delays in that funding could adversely affect our business, financial condition, results of operations and cash flows. The timing of bid activity may be negatively affected by the economy, municipal budgets and availability of financing.

Severe weather can reduce construction activity and lead to a decrease in demand for the Company’s products in areas affected by adverse weather conditions.

The Company’s operations and the demand for a number of the Company’s products are affected by weather conditions in the markets where the Company operates. Sustained adverse weather conditions such as rain, extreme cold or snow could disrupt or curtail outdoor construction activity which in turn could reduce demand and the quality of our products and have a material adverse effect on our operations, financial performance or prospects.

20

Certain of our existing stockholders have substantial influence over our company, and their interests may not be aligned with the interests of our other stockholders.

Mr. Rui Shen is the owner of approximately 40.2% of our common stock. He has given the voting power of approximately 96.5% of his shares to Mr. Rong Yang, CEO and Chairman of the Company. As a result, Mr. Yang may have significant influence over our business, including decisions regarding mergers, consolidations and the sale of all or substantially all of our assets, election of directors and other significant corporate actions. This concentration of ownership may also have the effect of discouraging, delaying or preventing a future change of control, which could deprive our stockholders of an opportunity to receive a premium for their shares as part of a sale of our company and might reduce the price of our shares.

Environmental claims or failure to comply with any present or future environmental regulations may require us to spend additional funds and may harm our results of operations.

Our business is subject to environmental, health and safety laws and regulations that affect our operations, facilities and products in each of the jurisdictions in which we operate. We believe that we are in compliance with all material environmental, health and safety laws and regulations related to our products, operations and business activities. Although we have not suffered material environmental claims in the past, the failure to comply with any present or future regulations could result in the assessment of damages or imposition of fines against us, suspension of production, cessation of our operations or even criminal sanctions. The enacting of new regulations could also require us to acquire costly equipment or to incur other significant expenses.

We have limited insurance coverage and do not carry any business interruption insurance, third-party liability insurance for our manufacturing facilities or insurance that covers the risk of loss of our products in use.

We presently only carry insurance for the protection of our workers. We do not carry business interruption insurance, third-party liability insurance, or insurance for any other aspect of our business. If we should suffer from natural or other unexpected disaster, business or government litigation, or any uncovered risks of operation, our financial condition may be significantly impaired.

We may be exposed to potential risks relating to our internal controls over financial reporting and our ability to have those controls attested to by our independent auditors.

As directed by Section 404 of the Sarbanes-Oxley Act of 2002 or SOX 404, the SEC adopted rules requiring public companies to include a report of management on the company’s internal controls over financial reporting in their annual reports, including Form 10-K. In addition, the independent registered public accounting firm auditing a company’s financial statements must also attest to and report on the operating effectiveness of the company’s internal controls if the company's public float is over $75 million. These requirements do not currently apply to us with respect to the filing of an auditor’s report. We can provide no assurance that we will comply with all of the requirements imposed thereby. There can be no assurance that we will receive a positive attestation from our independent auditors, if and when the respective regulations become applicable to us. In the event we identify significant deficiencies or material weaknesses in our internal controls that we cannot remediate in a timely manner or we are unable to receive a positive attestation from our independent auditors with respect to our internal controls, investors and others may lose confidence in the reliability of our financial statements.

Our holding company structure may limit the payment of dividends.

We have no direct business operations, other than our ownership of our subsidiaries. While we have no current intention of paying dividends, should we decide in the future to do so, as a holding company, our ability to pay dividends and meet other obligations depends upon the receipt of dividends or other payments from our operating subsidiaries and other holdings and investments. In addition, our operating subsidiaries, from time to time, may be subject to restrictions on their ability to make distributions to us, including as a result of restrictive covenants in loan agreements, restrictions on the conversion of local currency into U.S. dollars or other hard currency and other regulatory restrictions as discussed below. If future dividends are paid in RMB, fluctuations in the exchange rate for the conversion of RMB into U.S. dollars may reduce the amount received by U.S. stockholders upon conversion of the dividend payment into U.S. dollars.

21