Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ALLIANCE RESOURCE PARTNERS LP | d235135d8k.htm |

| EX-99.1 - ALLIANCE RESOURCE PARTNERS, L.P. PRESS RELEASE - ALLIANCE RESOURCE PARTNERS LP | d235135dex991.htm |

Alliance Resource Partners, L.P.

White Oak Transaction

Conference Call

September 23, 2011

Exhibit 99.2 |

2

This presentation contains forward-looking statements and information that are

based on the beliefs of Alliance Resource Partners, L.P. and Alliance

Holdings GP, L.P. (the “Partnerships”) and those of their

respective general partners (the “General Partners”), as well as

assumptions made by and information currently available to them. When

used in this presentation, words such as “anticipate,”

“project,”

“expect,”

“plan,”

“goal,”

“forecast,”

“intend,”

“could,”

“believe,”

“may,”

and similar expressions and statements

regarding the plans and objectives of the Partnerships for future operations, are

intended to identify forward-looking statements.

Although the Partnerships and their General Partners believe that such expectations

reflected in such forward-looking statements are reasonable at the time

such statements are made, neither the Partnerships nor the General Partners

can give assurances that such expectations will prove to be correct. Such

statements are subject to a variety of risks, uncertainties and

assumptions. If one or more of these risks or uncertainties

materialize, or if underlying assumptions prove incorrect, actual results may vary

materially from those the Partnerships anticipated, estimated, projected or

expected. The

Partnerships

have

no

obligation

to

publicly

update

or

revise

any

forward-looking

statement, whether as a result of new information, future events

or otherwise.

Forward-Looking Statements |

The

Alliance Strategy for Success 3

Create Sustainable Growth in Cash Flow and Deliver

Consistent Growth in Unitholder Distributions

Focus on ~

Expanding market opportunities

Low cost producing regions

High return organic development projects

Disciplined acquisitions |

Transaction provides ARLP with sustainable

long-term cash flow growth

Expanding market opportunities

Enhances ARLP’s investment in growing Illinois Basin demand

Provides ARLP exposure to growing export coal markets

Low cost producing regions

Adds a substantial reserve base ideal for low cost longwall operations

Multiple transportation options provides efficient market access

High return organic development projects

Structure provides organic development type returns with lower risk

profile Opportunity to participate in multiple longwall operations

Disciplined acquisitions

Funded with current cash, credit facility and cash flow from existing

operations Structure provides consistent, long term cash flows from

minimum royalty/throughput payments and preferred distributions

White Oak Strategic Rationale

4 |

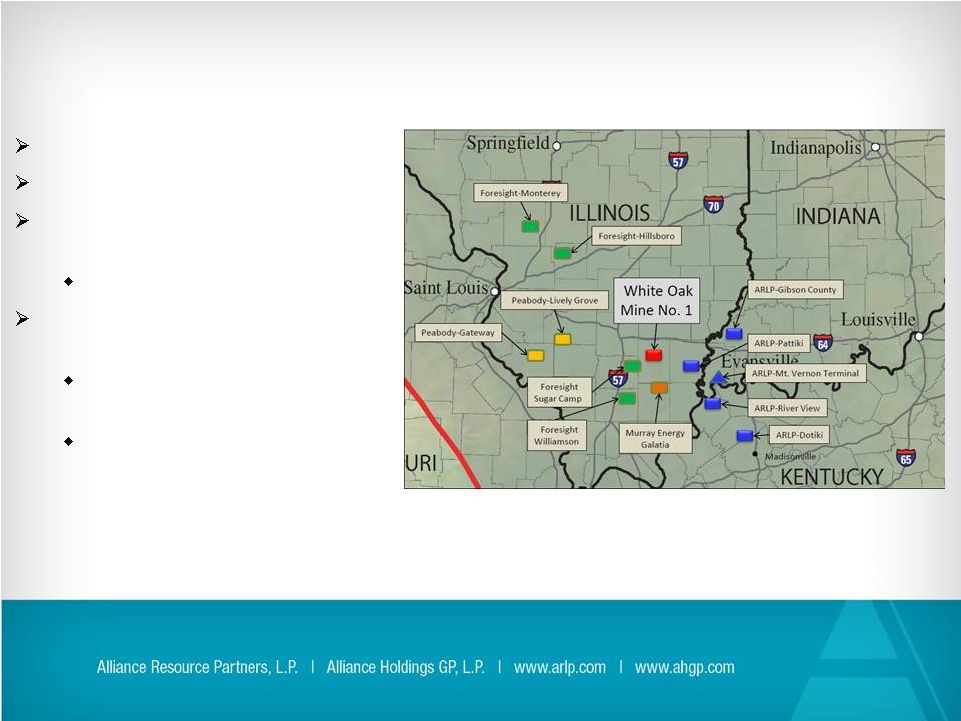

Hamilton County, IL

Herrin #6 coal seam

200 million tons of recoverable

reserves in Mine No. 1

11,800 Btu, 4.5# SO

2

Access to the

Evansville

Western Railway

Connects to ARLP’s Mount

Vernon River Terminal

Connects to CN, CSX and

NS rail carriers

White Oak Reserve Overview

5 |

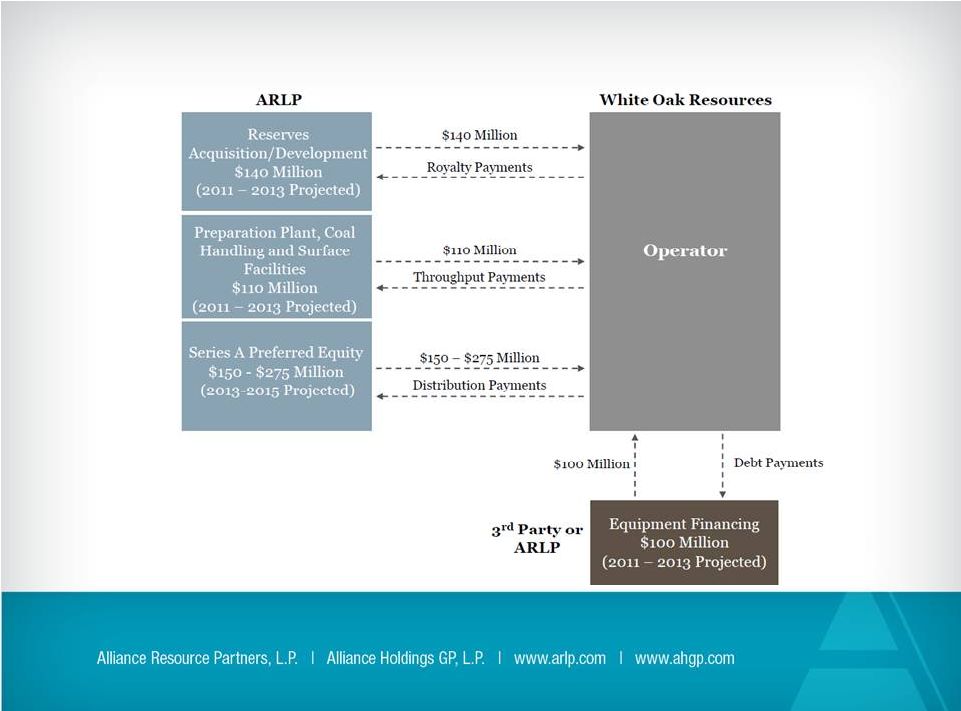

White Oak Transaction Structure

6 |

7

Coal Keeps the Lights On |